Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

The Dollar’s Down 99% Since Nixon Temporarily Took us off Gold Standard

The Dollar’s Down 99% Since Nixon Temporarily Took us off Gold Standard

Arcadia Economics: 8-20-2025

What if one seemingly temporary financial decision, made decades ago, has profoundly shaped your economic reality today, from the value of your dollar to the global power balance?

That’s the powerful question at the heart of a recent video from Arcadia Economics, featuring the insightful Vince Lanci. The discussion dives deep into a pivotal moment in financial history: August 15, 1971, the day President Richard Nixon unilaterally severed the U.S. dollar’s link to gold.

The Dollar’s Down 99% Since Nixon Temporarily Took us off Gold Standard

Arcadia Economics: 8-20-2025

What if one seemingly temporary financial decision, made decades ago, has profoundly shaped your economic reality today, from the value of your dollar to the global power balance?

That’s the powerful question at the heart of a recent video from Arcadia Economics, featuring the insightful Vince Lanci. The discussion dives deep into a pivotal moment in financial history: August 15, 1971, the day President Richard Nixon unilaterally severed the U.S. dollar’s link to gold.

Dubbed the “Nixon Shock,” this decision effectively ended the Bretton Woods system, which had pegged the dollar to gold and other currencies to the dollar.

Nixon presented it as a temporary measure, a necessary step to combat inflation and foreign speculation. However, as Lanci meticulously details, what began as a short-term fix unleashed a cascade of long-term, irreversible consequences that continue to reverberate through our global economy.

Fast forward to today, and the chickens are coming home to roost. The video highlights how the long-term repercussions of Nixon’s 1971 decision are now manifesting in the erosion of U.S. hegemony and the rise of alternative monetary strategies worldwide.

Central banks globally are sending clear signals: they’re increasingly dumping U.S. Treasuries and, significantly, accumulating gold once again as a core reserve asset.

This isn’t just a cyclical shift; it’s a strategic repositioning away from a system that no longer offers the same perceived stability.

Vince Lanci previews an upcoming, thought-provoking article titled “The End of Free Market Capitalism and the US Debt for Equity Swap.” This analysis suggests that with foreign buyers of U.S. Treasuries retreating, America may be facing a critical juncture.

The U.S. might soon need to explore exchanging equity stakes in its future — meaning, pieces of its economic engine and assets — for the capital inflows it desperately needs. This potential scenario marks a significant deviation from a purely free-market capitalist system, signaling a monumental shift in how the nation might finance its future.

Amidst these macroeconomic tidal shifts, specific market signals offer glimpses of opportunity and change. The discussion also touches upon recent precious metals updates, including exciting news from Argenta Silver about exceptional drill results indicating very high silver concentrations.

Such developments underscore the importance of monitoring market signals, policy shifts, and resource potential in navigating these uncertain economic times.

The Arcadia Economics video with Vince Lanci serves as a crucial reminder that historical decisions have tangible, long-lasting consequences.

These aren’t just abstract economic concepts; they are live, evolving challenges that impact every facet of our financial lives and the global economic order.

Podcast: The Rise of National Capitalism

Podcast: The Rise of National Capitalism

Notes From the Field By James Hickman (Simon Black) August 19, 2025

Few people understand how the Federal Reserve actually works— and frankly, I’m not sure the President or Treasury Secretary are among them.

That’s not an insult, just based on what they say. Let me explain.

Podcast: The Rise of National Capitalism

Notes From the Field By James Hickman (Simon Black) August 19, 2025

Few people understand how the Federal Reserve actually works— and frankly, I’m not sure the President or Treasury Secretary are among them.

That’s not an insult, just based on what they say. Let me explain.

Most people think the Fed sets “the interest rate” for everything—mortgages, car loans, 10-year yields. But that’s not how it works. The Fed only sets a very narrow rate—the overnight lending rate between banks.

Everything else, from your mortgage to the government’s long-term borrowing costs, is determined by the bond market. And as America’s debt spirals past $37 trillion, the bond market—not the Fed—is in control.

This misunderstanding matters. Because when Treasury Secretary Bessent says he’s going to “get rates down,” what he really means is printing money.

That’s the only lever left: the Federal Reserve creates money electronically and uses it to buy government bonds.

The consequence of that is inflation: more money in the system means higher prices. Sometimes it shows up in financial assets—stocks, bonds, real estate—can also surge to record highs as a result of inflation. Other times inflation hits the grocery store, your utility bill, or your insurance premiums.

Lately, it’s been both. Inflation is everywhere.

But this administration is also openly floating the idea of a sovereign wealth fund—borrowing billions (or trillions) and putting that money directly into the stock market. Intel. Nvidia. Strategic stakes in American companies.

It’s not socialism, and it’s not free markets. It’s something in between: a blending of state and corporate power. Call it National Capitalism.

If that sounds far-fetched, remember—they’re already talking about taking a stake in Intel. Why would they stop there?

This administration is full of people whose entire background is borrowing massive sums of money at low interest, pouring it into enormous projects, and pocketing the spread.

There’s nothing wrong with that. That’s what they know. That’s what they do. Trump is a very successful real estate developer who has personally borrowed billions of dollars throughout his career.

So of course when they look at the economy, their instinct is to repeat the same playbook on a national scale—borrow cheap, buy big, and hope the gap between cost and return pays for everything.

But when the government itself becomes one of the biggest stock buyers, what happens to markets? They explode higher.

And you’re going to want to own assets when that happens.

This is the subject of today’s podcast.

We dive into:

Why the Fed’s “rate cuts” don’t control the 10-year or 30-year Treasury yields—and why the bond market is now in charge.

How the U.S. is spending $1.2 trillion a year just on interest payments, and why refinancing old debt at today’s higher rates keeps driving costs up.

The Fed’s true method of lowering rates: creating new money, buying bonds, and fueling asset bubbles—at the cost of more inflation.

The absurdity of how the US banking system works.

How every time the Fed “prints money” to bail out a crisis—9/11, 2008, the pandemic—it ends up inflating specific bubbles: housing, stocks, crypto, collectibles, and now consumer prices across the board.

And we wrap up with a quick look at Total Access—our highest level membership built around forging lasting relationships with other members in extraordinary settings. It combines world-class networking and internationalization strategies with unforgettable, once-in-a-lifetime travel experiences.

Right now, Total Access membership is open for a limited time. You can learn more here.

And you can listen to the full podcast here.

For the audio-only version, check out our online post here.

Finally, you can find the podcast transcript for your convenience, here.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

Active Resistance to the Digital Financial Reset

Active Resistance to the Digital Financial Reset

Miles Harris: 8-18-2025

A major change is occurring in the global financial system. Governments and financial institutions describe this change as modernization, efficiency, or digital innovation.

In reality, it is a gradual shift of money, markets, and ownership records into centralized digital systems.

Active Resistance to the Digital Financial Reset

Miles Harris: 8-18-2025

A major change is occurring in the global financial system. Governments and financial institutions describe this change as modernization, efficiency, or digital innovation.

In reality, it is a gradual shift of money, markets, and ownership records into centralized digital systems.

These systems make assets visible in real time, programmable by policy, and subject to rules that can change without the consent of the owner.

Understanding this process is essential for anyone who wants to maintain control over their assets and plan for the future.

00:00 Intro

Legal & Regulatory Changes

Institutional & Infrastructure Developments

Digital Identity Integration

Engineered Liquidity

Events Policy Narratives

Control Layer Indicators

International coordination clues

Planning the Sequence of Actions

A Practical Monitoring System Conclusion

Americans Are Hoarding More Cash

Americans Are Hoarding More Cash, but not in checking or savings. Here are the accounts rewarding savers today

Danielle Antosz Sun, August 17, 2025 Moneywise

Consumer spending remains strong in the U.S., even as inflation holds at 2.7% and checking and savings balances decline. So, where’s the money coming from?

New research from JPMorgan Chase's Household Finances Pulse analysis may offer an answer.

Analyzing data from 4.7 million households, the study found that while traditional bank balances have stagnated, total cash reserves — including money market funds, brokerage accounts, and certificates of deposit (CDs) — are growing 3% to 5% annually in 2025.

Americans Are Hoarding More Cash, but not in checking or savings. Here are the accounts rewarding savers today

Danielle Antosz Sun, August 17, 2025 Moneywise

Consumer spending remains strong in the U.S., even as inflation holds at 2.7% and checking and savings balances decline. So, where’s the money coming from?

New research from JPMorgan Chase's Household Finances Pulse analysis may offer an answer.

Analyzing data from 4.7 million households, the study found that while traditional bank balances have stagnated, total cash reserves — including money market funds, brokerage accounts, and certificates of deposit (CDs) — are growing 3% to 5% annually in 2025.

The biggest gains are among lower-income households, with those in the lowest income quartile seeing 5% to 6% growth in total cash reserves.

This shift toward higher-yield accounts may help explain why consumer spending remains resilient, despite economic headwinds.

Where are Americans putting their money?

Instead of parking funds in checking or standard savings accounts, many households are turning to investment-style options with higher returns. If you're considering a similar move, here are a few of the most popular alternatives:

High-yield savings accounts (HYSAs): These work like traditional savings accounts but offer higher interest rates — often between 4% and 5% APY as of mid-2025 — often offered by online banks with lower overhead.

Certificates of deposit (CDs): CDs lock your money in for a fixed term in exchange for a guaranteed return. Rates vary by term but can exceed 4% for longer durations.

Money market accounts (MMAs): Offered by banks, MMAs combine savings features with limited check-writing abilities, FDIC insurance, and competitive yields — though often slightly below HYSAs.

Money market funds (MMFs): These are investment products, not bank accounts. While not FDIC-insured, they invest in low-risk, short-term securities and are considered a stable alternative to cash.

Brokerage accounts: These accounts allow you to invest in stocks, ETFs, and mutual funds. While more volatile, they offer higher long-term growth potential.

TO READ MORE: https://finance.yahoo.com/news/americans-hoarding-more-cash-not-210000368.html

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 8-19-25

Good Afternoon Dinar Recaps,

BRICS Meaning in Globalization: From Trade Bloc to Power Player

BRICS meaning in globalization reflects a major shift from Western-dominated trade systems toward a more multipolar world economy. What began as Goldman Sachs’ 2001 investment concept has evolved into a geopolitical force that now challenges traditional global power structures.

Today, BRICS—Brazil, Russia, India, China, and South Africa—controls 37.3% of global GDP and represents over 40% of the world’s population. With new members like Egypt, Ethiopia, Iran, and the UAE, the bloc is extending its influence across trade, politics, and energy.

Good Afternoon Dinar Recaps,

BRICS Meaning in Globalization: From Trade Bloc to Power Player

BRICS meaning in globalization reflects a major shift from Western-dominated trade systems toward a more multipolar world economy. What began as Goldman Sachs’ 2001 investment concept has evolved into a geopolitical force that now challenges traditional global power structures.

Today, BRICS—Brazil, Russia, India, China, and South Africa—controls 37.3% of global GDP and represents over 40% of the world’s population. With new members like Egypt, Ethiopia, Iran, and the UAE, the bloc is extending its influence across trade, politics, and energy.

Economic Foundation and Global Impact

The economic weight of BRICS is staggering:

China accounts for 19.05% of global GDP

India contributes 8.23% of global GDP

(Source: IMF)

This power is institutionalized through initiatives like the New Development Bank, which funds infrastructure across emerging markets.

An S&P Global analysis notes that the expanded BRICS could control nearly half of worldwide oil production. With Saudi Arabia’s potential inclusion, the bloc would become a true commodities superpower.

Political Coordination and Global Influence

Politically, BRICS has become a platform for resisting Western pressure. Trade tensions and U.S. tariffs have only deepened bloc unity.

Leaders like Brazil’s President Lula da Silva and China’s Xi Jinping continue to push for cooperation against unilateralism.

Professor Jayati Ghosh highlights U.S. inconsistency, noting that even the EU—like BRICS members—continues to purchase Russian oil.

Member Countries and South Africa’s Role

South Africa has leveraged BRICS to amplify Africa’s voice in global trade and reform agendas. The inclusion of Egypt and Ethiopia further strengthens continental representation in strategic platforms.

Chinese President Xi Jinping emphasized that adding new economies injects vitality, representativeness, and influence into BRICS cooperation. Currently, 23 countries have formally applied to join.

Future Direction and Currency Alternatives

BRICS is actively working on alternatives to the U.S. dollar, developing frameworks for bilateral trade in local currencies. Brazilian officials are also exploring the creation of a BRICS currency to reduce dollar dependency.

Beyond finance, BRICS is building cooperation in climate, health, energy, and digital economy initiatives, with the upcoming COP30 summit offering another platform for joint action.

Professor Ghosh notes that U.S. policy unpredictability makes long-term deals with Washington risky, pushing nations toward independent BRICS-led agreements.

Bottom Line: BRICS meaning in globalization has transformed from a trade bloc into a strategic power player, reshaping economics, energy, and geopolitics. With expansion underway and dollar alternatives rising, the bloc is setting the stage for a new global order.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Tuesday 8-19-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 19 August 2025

Compiled Tues. 19 August 2025 12:01 am EST by Judy Byington

This is the QFS. …QFS on Telegram:

The Quantum Financial System is (allegedly) live across the globe, dismantling the banking empires from the inside. Deutsche Bank, HSBC, and JP Morgan have (allegedly been stripped of authority.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 19 August 2025

Compiled Tues. 19 August 2025 12:01 am EST by Judy Byington

This is the QFS. …QFS on Telegram:

The Quantum Financial System is (allegedly) live across the globe, dismantling the banking empires from the inside. Deutsche Bank, HSBC, and JP Morgan have (allegedly been stripped of authority.

Mastercard and VISA are(allegedly collapsing. QFS debit cards, armed with quantum encryption, are (allegedly replacing them. PayPal and Stripe are next.

Every citizen already has a QFS account. It is (allegedly linked to their national ID and waiting for activation. At the appointed time, a secured message through the Quantum Communication Network will (allegedly trigger the switch.

Fiat money dead: the dollar, the euro, the yen With the petrodollar destroyed, the balance of power has shifted. The new financial order is (allegedly anchored in gold, silver, and precious metals. Rainbow Tokens — asset-backed, incorruptible, immune to cabal manipulation — now stand at the foundation.

Central banks in more than sixty nations have quietly (allegedly stockpiled gold for years, preparing for this transition.

Zim Bonds are now at the heart of global wealth redistribution.

Redemption Centers (allegedly operate under military command. What was once hoarded by elites is being redirected into humanitarian projects.

~~~~~~~~~~~~

Mon. 18 Aug. 2025 Nesara Gesara Rollout Notice. …Mr. Pool https://x.com/MrPool_QQ/status/1956978275059663342?t=k0nAWlKqIdopgQcmyLj7CQ&s=03

Treasury begins gold and commodity peg alignment; Dollar moves to asset basis.

Debt Jubilee protocols tested in three states; interest arrears marked fulfilled.

QFS Settlement rail handles Federal payrolls and pensions; public wallets Phase Two

~~~~~~~~~~

Mon. 18 Aug. 2025 BOOM: TRUMP AND PUTIN JUST TRIGGERED GESARA FROM A U.S. MILITARY BASE …Wikileaks Database on Telegram

The August 15 summit at Joint Base Elmendorf–Richardson in Alaska was not a photo-op. President Trump and Vladamir Putin (allegedly) met under military protection, far from globalist interference, to finalize the opening phases of GESARA — the gold-backed system that will (allegedly) dismantle the empire of debt, fraud, and endless war.

This wasn’t diplomacy. It was the public unveiling of a military operation that has been quietly in motion for years.

Debt erasure has already (allegedly) begun quietly across multiple states under the cover of “legal corrections” and “settlement programs.” Over $400 billion in student loans and mortgages have been marked “in dispute” inside federal databases.

IRS field agents are (allegedly) being reassigned to audit divisions reporting directly to Space Force contractors.

Major banks(allegedly) undergo forced realignments as their fiat credit systems collapse. This isn’t theory. It’s GESARA’s debt jubilee unfolding step by step.

At the same time, over 1,300 institutions are already (allegedly) running QFS compliance tests. New “federal ID systems” being issued are in reality Quantum Access Cards — sovereign wallets tied to asset-backed digital currency.

Read full post here: https://dinarchronicles.com/2025/08/19/restored-republic-via-a-gcr-update-as-of-august-19-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff Across this weekend the central bank has been putting a huge emphasis on banking reforms. Why is that? Because Iraq's about to revalue the currency and get back on the world stage...The banking reforms are coming forward because they're ready and timed with the rate changing...

Frank26 The monetary reform education process is being introduced by something they're calling a 'mechanism'. It's my strong opinion that the 'mechanism' is what we call Article 12-2c [of the budget] because 12-2c contains IMO the new exchange rate that they've been using/going to use for the future...

Militia Man Article: "Rafidain Bank confirms: Our agreement with K2 Integrity puts Iraq on the map of the global financial system." The focus on a qualitative leap is likely due to the efforts taken by Iraq regarding compliance, anti-money laundering (AML), counter-terrorism financing (CML), etc...Iraq will not be isolated banking wise from the international system any longer...K2s partnership supports that Iraq is going to make a change to its currency...Completion looks to be set for show time.

************

Who's The Big Gold Buyer In The US | Andy Schectman

Liberty and Finance: 8-18-2025

Andy Schechtman of Miles Franklin Precious Metals reveals who is truly behind the massive gold buying in the US.

He argues that the buyers aren't everyday investors, but rather powerful institutions and possibly even the U.S. government itself.

Schechtman analyzes the unprecedented flow of physical gold out of exchanges, contrasting this with a public that is at record-high speculation in the stock market.

This crucial divergence, he explains, signals that those with inside knowledge are preparing for an economic reckoning and a continued de-dollarization trend.

Tune in to understand why gold is the asset of choice for the world's most informed players and what that means for your financial future.

INTERVIEW TIMELINE:

0:00 Intro

1:30 Africa's resources

12:49 Market update

24:00 Who's stockpiling gold?

Seeds of Wisdom RV and Economic Updates Tuesday Morning 8-19-25

Good Morning Dinar Recaps,

US Treasury Calls for Public Comment on GENIUS Stablecoin Bill

The U.S. Treasury Department is seeking public input on the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, signed into law by President Donald Trump in July. The move is part of a broader effort to strengthen U.S. leadership in digital assets while addressing illicit finance risks tied to crypto.

Good Morning Dinar Recaps,

US Treasury Calls for Public Comment on GENIUS Stablecoin Bill

The U.S. Treasury Department is seeking public input on the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, signed into law by President Donald Trump in July. The move is part of a broader effort to strengthen U.S. leadership in digital assets while addressing illicit finance risks tied to crypto.

Public Comment Period Open Until Oct. 17

Treasury has invited individuals and organizations to submit comments by October 17.

Feedback should focus on innovative methods to detect and mitigate illicit activity involving digital assets.

Areas of particular interest include:

Anti–money laundering strategies

APIs and blockchain monitoring tools

Artificial intelligence applications

Digital identity verification

Treasury officials will compile and review the public responses before submitting formal reports to the Senate Banking Committee and House Financial Services Committee.

Secretary Bessent: Essential Step for U.S. Leadership

Treasury Secretary Scott Bessent described the consultation process as “essential” for implementing the GENIUS Act and securing American leadership in the digital asset sector.

The law requires the Treasury and Federal Reserve to finalize regulations before full implementation. Under the timeline:

The GENIUS Act will take effect 18 months after being signed (July 2025), or

120 days after final regulations are published — whichever comes first.

Political and Regulatory Timing

The timing suggests that enforcement of the GENIUS Act will not overlap with the 2026 midterm elections, reducing the likelihood of the law being used as a campaign issue.

Broader Crypto Legislation Efforts

The GENIUS Act was one of three major bills advanced during Republicans’ “crypto week” in July:

GENIUS Act – Establishes a regulatory framework for stablecoins

Digital Asset Market Clarity (CLARITY) Act – Aims to provide clearer rules for digital asset markets

Anti-CBDC Surveillance State Act – Pushes back against a government-issued central bank digital currency

The House of Representatives passed all three with bipartisan support. The Senate Banking Committee has indicated it will prioritize crypto market structure, aiming to advance its own version of the CLARITY Act by October.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Tether Appoints Former White House Crypto Council Head Bo Hines as U.S. Strategy Advisor

Stablecoin leader Tether (USDT) has appointed Bo Hines, the former executive director of the White House Crypto Council, as its Strategic Advisor for Digital Assets and U.S. Strategy. The move marks a major step in Tether’s push to establish a regulated presence in the U.S. under the new pro-crypto administration.

Bo Hines Brings Washington Insider Experience

Hines, a Yale-trained attorney and former GOP congressional candidate, played a central role in shaping U.S. crypto policy.

At the White House, he helped secure passage of the GENIUS Act, creating a federal framework for stablecoins.

He also organized a high-level digital assets summit connecting industry leaders with government officials.

After seven months in government service, Hines stepped down in early August before moving to the private sector.

Why the Appointment Matters for Tether

Tether has long operated outside the U.S. regulatory framework. By adding Hines, the company gains:

A direct connection to U.S. policymakers

Expertise in navigating Washington’s legislative and regulatory processes

Strategic positioning to launch a U.S.-compliant stablecoin under the GENIUS Act

Tether CEO Paolo Ardoino confirmed that U.S. expansion plans are “well underway,” calling Hines’s appointment a pivotal step toward meeting institutional and regulatory standards in the world’s largest market.

Tether’s Market Position

Tether issues USDT, the world’s largest stablecoin.

Circulating supply exceeds $166 billion, according to The Block’s data dashboard.

The company’s U.S. strategy signals its ambition to transition from operating on the regulatory margins to becoming a fully integrated player in the American financial system.

@ Newshounds News™

Source: The Block

~~~~~~~~~

Ripple Backs Gemini’s IPO Filing With $75M Credit Line, RLUSD Option Included

Ripple has emerged as a key backer of Gemini’s upcoming IPO, providing the exchange with a $75 million credit line that could expand to $150 million. The deal also introduces Ripple’s new stablecoin, RLUSD, as a borrowing option once the initial facility is tapped.

Key Takeaways

Ripple extends $75M credit line to Gemini, with potential to reach $150M and RLUSD as a borrowing option.

Gemini files for IPO under ticker “GEMI,” aiming to become the third U.S. crypto exchange to go public.

The exchange reported a $282.5M net loss in H1 2025, highlighting steep financial headwinds ahead of listing.

RLUSD inclusion signals Ripple’s ambition to challenge Tether (USDT) and Circle (USDC) in the stablecoin market.

Gemini’s IPO Plans

Gemini, which plans to list on Nasdaq under the ticker “GEMI,” disclosed the agreement with Ripple as part of its long-anticipated public offering.

The move positions Gemini to become the third crypto exchange to go public in the U.S., following Coinbase (2021) and Bullish (2025).

However, Gemini’s filing also revealed significant financial challenges:

A $282.5 million net loss in H1 2025, up nearly sevenfold from last year.

Revenue sliding to $67.9 million, down from $74.3 million in the same period of 2024.

Ripple’s Credit Facility Terms

Under the agreement with Ripple Labs, Gemini can:

Borrow in tranches of at least $5 million.

Pay interest rates of 6.5% or 8.5%, with collateral required.

Once borrowing surpasses $75 million, loans can be denominated in RLUSD, providing Ripple’s new stablecoin a direct entry into U.S. exchange infrastructure.

No funds have been drawn yet, but the inclusion of RLUSD underscores Ripple’s push to compete with USDT and USDC, which dominate the stablecoin market.

For Gemini, the facility provides fresh liquidity at a critical moment, as investor scrutiny intensifies ahead of its IPO.

Wall Street Giants Back Gemini IPO

The deal is being led by major Wall Street banks, including:

Goldman Sachs

Citigroup

Morgan Stanley

Cantor Fitzgerald

With Academy Securities and AmeriVet Securities acting as co-managers.

Investor appetite for crypto listings is strong:

Circle’s IPO (June 2025) saw shares surge nearly 10x from its $31 offering price before settling at $149.

Bullish’s IPO earlier this week more than tripled from $37 to nearly $70 on its first trading day.

Several other firms — including OKX, Grayscale, and Kraken — are also considering public offerings. Meanwhile, listed giants like Coinbase and MicroStrategy have hit multi-year highs.

Policy Shift Fuels IPO Wave

The IPO momentum comes amid a regulatory climate increasingly favorable to digital assets:

Since President Trump’s return in January 2025, the SEC has dropped most cases against crypto firms.

The administration has advanced a pro-crypto agenda, including:

An executive order urging regulators to remove barriers preventing 401(k) retirement plans from including crypto assets.

Potential reforms that could allow millions of Americans to allocate retirement savings into Bitcoin and other digital assets through regulated channels.

@ Newshounds News™

Source: CryptoNews

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 8-19-2025

TNT:

Tishwash: The withdrawal of the US coalition... Is the war over or has new influence begun?

The US Embassy in Iraq announced on Monday that the withdrawal of the international coalition from the country does not mark the end of its work against the terrorist organization ISIS, noting that its military mission will transform into a bilateral security partnership with Iraqi security forces.

In statements to Al Jazeera, monitored by Al-Mustaqilla, the embassy confirmed that the international coalition will continue its civilian efforts worldwide, raising questions about the form and extent of future US intervention in Iraq and the extent to which this partnership will impact Iraqi sovereignty.

TNT:

Tishwash: The withdrawal of the US coalition... Is the war over or has new influence begun?

The US Embassy in Iraq announced on Monday that the withdrawal of the international coalition from the country does not mark the end of its work against the terrorist organization ISIS, noting that its military mission will transform into a bilateral security partnership with Iraqi security forces.

In statements to Al Jazeera, monitored by Al-Mustaqilla, the embassy confirmed that the international coalition will continue its civilian efforts worldwide, raising questions about the form and extent of future US intervention in Iraq and the extent to which this partnership will impact Iraqi sovereignty.

Observers believe this shift may represent a less obvious reshuffle of the US presence, but it could continue to shape the course of politics and security in Iraq. While others believe the bilateral security partnership could give Iraqi forces an opportunity to independently enhance their capabilities to counter terrorism, the ambiguity surrounding the nature of this partnership raises concerns about the continued indirect influence of foreign powers.

Amid these statements, the most prominent question remains: Is the coalition's withdrawal a real step toward Iraq regaining its independent security decision-making, or merely a change in form without any change in reality? link

********************

Tishwash: Demonstration announcement in Basra: We will not remain silent any longer.

The Nahr al-Ezz tribes in the Thaghr district, north of Basra in the far south of Iraq, announced this evening, Monday, a demonstration to demand services and job opportunities, starting on August 24. While warning against neglecting the implementation of rights, they affirmed their commitment to continuing until their rights are fully and undiminished.

This came in a statement by the leader of the Shaghanbi, Al-Bubakhit and Al-Hilijiya tribes movement, Sheikh Ali Sabah Hatem Al-Shaghanbi, received by Shafaq News Agency.

Addressing the people of Basra, the statement said, "Enough is enough. For many years, we have suffered the bitterness of deprivation and marginalization, with no health care, no education, no electricity, no services, and no job opportunities that would preserve the dignity of our youth."

He added, "We previously stood in front of the West Qurna 2 oil fields and raised our voices sincerely, but they met us with silence, disregard, and deadly indifference. Today, we say it loud and clear: Our rights will not be granted; we will seize them by force."

He continued: "We warn anyone who underestimates the will of the people of Nahr al-Ezz: the patience of the patient has limits, and if the patient becomes angry, his revolution will not be stopped by a false promise or a deceptive speech." He stressed: "We, the people of Nahr al-Ezz, will not retreat, and we will not remain silent from today on, and we will continue until we obtain our full and undiminished rights, no matter the cost."

The statement declared, "Our date is Sunday, August 24, a day when everyone will hear the voice of the oppressed, the voice of truth, the voice of the river of glory. And tomorrow is near."

Northern areas of Basra province, particularly the districts of Al-Thaghr and Al-Sadiq, and the Al-Qurna district, have witnessed a series of demonstrations and sit-ins over the past few months, protesting what residents describe as "deliberate marginalization and neglect" by the local and federal governments.

Protesters' demands ranged from improving basic services, providing job opportunities, and addressing the dangerous environmental pollution resulting from oil extraction operations, which have destroyed agricultural areas and spread disease. There have been repeated threats to shut down oil fields if the situation continues to be ignored. link

************

Tishwash: Iraqi banks eye capital boost extension

An economist expects the capital increase period for Iraqi banks "covered by reform" to be extended.

Economic expert Mustafa Akram Hantoush confirmed on Monday that the Central Bank of Iraq and the Iraqi banking system are going through a critical phase, suggesting that the deadline for increasing the capital of banks subject to reform will likely be extended to three years, instead of the previous deadline of the end of this year.

Hantoush told Shafaq News Agency, "The Central Bank contracted last year with Oliver Wyman to conduct a comprehensive study of the banking sector," noting that "the company has completed its study."

He added, "The preliminary report was submitted three weeks ago, while the final report was recently issued. It included a package of mechanisms to address banking challenges and regulate dollar transactions. These mechanisms are currently under discussion between the Central Bank and the company."

Hantoush pointed out that "the recommendations included raising the capital of all Iraqi banks to 400 billion dinars, in addition to paying $2.4 million over four years for banks, under conditions most notably merger or liquidation, as well as restructuring the capital so that relatives' stake does not exceed 10%."

He pointed out that "these conditions pose a significant challenge to the sanctioned banks, making it difficult to comply with the required increase," emphasizing that "the matter requires discussions between the Central Bank and these banks to reach an acceptable formula."

The economic expert expects that "the Central Bank will open a new dialogue with the consulting firm to reach a compromise, either by extending the capital increase period to more than three years, or by reducing the required amounts to be closer to the capabilities of Iraqi banks." link

*************

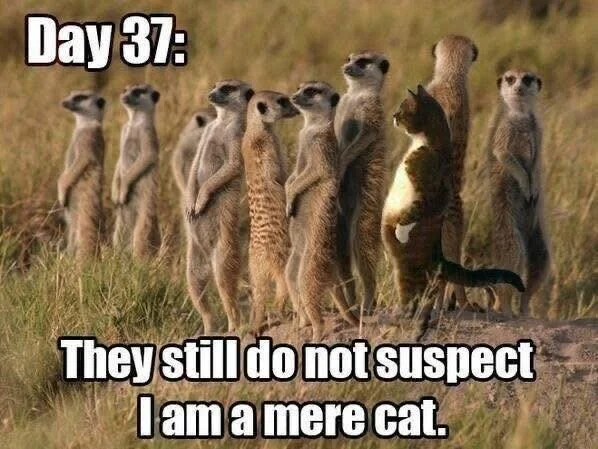

Mot: Now - This is What I Wants!!!!

Mot: .. Fitting In !!!!

I’m an Economist: Here’s When Tariff Price Hikes Will Start Hitting Your Wallet

I’m an Economist: Here’s When Tariff Price Hikes Will Start Hitting Your Wallet

August 1, 2025 by Gabrielle Olya

A blanket 10% reciprocal tariff issued by President Donald Trump took effect April 5, with more slated to roll out on Aug. 1. So far, prices haven’t surged — but that’s likely to change.

GOBankingRates spoke with Lauren Saidel-Baker, an economist at ITR Economics, about why prices have yet to spike, when they will and how far they are expected to climb.

I’m an Economist: Here’s When Tariff Price Hikes Will Start Hitting Your Wallet

August 1, 2025 by Gabrielle Olya

A blanket 10% reciprocal tariff issued by President Donald Trump took effect April 5, with more slated to roll out on Aug. 1. So far, prices haven’t surged — but that’s likely to change.

GOBankingRates spoke with Lauren Saidel-Baker, an economist at ITR Economics, about why prices have yet to spike, when they will and how far they are expected to climb.

Why Prices Haven’t Surged Yet

We never expected that prices would immediately rise by the full extent of the tariffs imposed.

In some cases, importers absorb at least a portion of the cost. In many cases, excess inventory has been brought into the U.S. in anticipation of these tariff announcements and there will be a lag while that lower-cost inventory is available.

While the impact of tariffs on pricing varies materially on a microeconomic scale, it tends to be smaller on a macroeconomic scale. The supply chain is relatively neutral currently, and stable financial conditions have permitted consumers to shift spending behaviors such that the aggregate effect of tariffs on overall consumer prices has been minimal thus far.

The overall consumer price index also includes housing and services, which are more insulated from tariffs.

When Tariffs Will Start Raising Prices

At Least Social Security Will Go Bankrupt With Good Customer Service

At Least Social Security Will Go Bankrupt With Good Customer Service

Notes From the Field By James Hickman (Simon Black) August 18, 2025

I know it’s cliche, but one of the happiest days of my life was a bit more than four years ago when my daughter was born in Cancún, Mexico. My wife and I chose Mexico deliberately— given all the COVID craziness that was going on (especially in the US), we wanted to be in a place where the pandemic wasn’t going to factor into our lives at all. And Cancun was perfect.

Add in world-class healthcare at affordable prices, and it was an easy call. Plus babies born in Mexico automatically become citizens, and both parents and grandparents receive permanent residency.

At Least Social Security Will Go Bankrupt With Good Customer Service

Notes From the Field By James Hickman (Simon Black) August 18, 2025

I know it’s cliche, but one of the happiest days of my life was a bit more than four years ago when my daughter was born in Cancún, Mexico. My wife and I chose Mexico deliberately— given all the COVID craziness that was going on (especially in the US), we wanted to be in a place where the pandemic wasn’t going to factor into our lives at all. And Cancun was perfect.

Add in world-class healthcare at affordable prices, and it was an easy call. Plus babies born in Mexico automatically become citizens, and both parents and grandparents receive permanent residency.

Pretty much everything about her birth went really smoothly. The Mexican paperwork was shockingly easy, and we were able to get her passport and our residency cards very quickly.

The most difficult part by far was the US side.

We couldn’t fly back to Puerto Rico until she had a US passport. But thanks to the State Department’s broken online system (which crashes constantly and conjures bizarre errors) we were scrambling for a slot.

(It’s also bizarre that, despite millions of Americans traveling to Cancun each year, the US government put its consulate 4 1/2 hours away in Merida... not exactly convenient.)

Once there, storm-trooper style security treated a newborn’s bottled milk as a threat, and then we sat for more than an hour while bureaucrats invented reasons to say “no” to her passport application.

In the end, we finally got what we needed—but the whole process revealed the deeper truth: in the US, government offices act as if citizens work for them. They’ve forgotten their purpose is to serve, and citizens are left with inefficient, indifferent, even borderline inhumane experiences.

Some other countries take a different approach; they treat citizens like valued customers, and bureaucrats are measured on the efficiency and quality of their service.

When the US first launched the Department of Government Efficiency—DOGE—I thought this should be a critical piece of the reform.

Yes, of course, slash fraud, waste, and abuse. But even more urgently, reset the entire culture of how the US government does business with its citizens.

I recently found a glimmer of hope that this may be happening.

Late last week, Social Security marked its 90th birthday since being signed it into law in 1935 at the height of the Great Depression.

Ever since, generations of Americans have accumulated stories of painfully navigating this massive institution— too often about waiting rooms, endless forms, and mind-numbing incompetence.

But something unusual has happened in the last few months. Frank Bisignano, the new commissioner, took over. He comes from a CEO position in the private sector, and seems to be running Social Security like a business.

He’s pushed a digital-first strategy, incorporated AI tools, and focused on simple things that most people in the private sector would take for granted.

Processing backlogs are coming down. Efficiency is up.

Barely a year ago, you had to spend nearly 30 minutes on hold when you called Social Security. Today, the agency says the wait is under five minutes—while serving nearly twice as many people.

You can also now schedule appointments before going into an office— imagine that. And the average wait time at a Social Security office has also been slashed down to just six minutes.

The Social Security website has been overhauled as well, so taxpayers are able to obtain much more information and handle their service needs online. Crazy that it took until 2025 to make this happen.

Oh, and it turns out that the Social Security website— until very recently— used to be offline nearly 30 hours per WEEK for scheduled downtime. They’ve now eliminated this and MySocialSecurity is now available 24/7.

Frankly, the bar for government performance is so low that saying “the website now works” is heralded as a massive breakthrough.

But still, it’s encouraging to see what’s possible when someone with a private-sector mindset actually tries to fix things. In just a few months, one of the worst bureaucracies in Washington has shown major improvement.

Unfortunately, there’s one thing the Commissioner can’t control: Social Security’s looming insolvency.

Social Security’s finances are up to Congress, and that picture is bleak.

Social Security is almost out of money. Everyone in Washington knows it. At best, there’s less than eight years until Social Security’s major trust fund runs out of money. And it will probably take place sooner than that.

Just like fixing bad government service, fixing Social Security’s solvency is not complicated. At this point there are only a few levers to pull: either raise taxes, or roll back retirement age.

The trustees and Social Security’s own actuaries have spelled out these solutions for years, practically begging Congress to act.

They’ve also been clear— the sooner that Congress works to solve the problem, the less painful the solution will be.

If they raise payroll taxes now, the tax hike will be minor. If they wait until 2032, the increase will be brutal.

Similarly, if they pass a law today to phase in an increase to the retirement age, the change will be minor. If they wait a decade, the increase will be much more dramatic.

Yet Congress is—predictably—the least capable group on the planet when it comes to handling obvious problems.

Sure, most likely they won’t let Social Security fail. But the longer they wait, the more likely the eventual fix will simply be a multi-trillion-dollar bailout funded by “printing” money.

The national debt will continue its upward surge, taxpayers will fork over more money, and inflation will quicken.

Bisignano, Social Security’s new “CEO” commissioner, shows what is possible when government changes its posture.

Instead of the usual “F-you, take a number” attitude, Bisignano’s team worked to serve people more efficiently and respectfully. That massive cultural shift moved the needle almost instantly—wait times fell, backlogs shrank, and an agency long known for dysfunction suddenly became usable.

It shouldn’t stop there. The same mindset could be applied to bigger problems—Social Security’s solvency, immigration, debt. None of these are mysteries. The solutions already exist. It’s not rocket science. What’s required is competence and a willingness to act early, before the problems metastasize.

But that’s the catch. The most incompetent body of all—Congress—is the one charged with making those decisions.

And until voters stop sending the same clowns back to Washington, nothing changes.

These are people who can’t balance a budget, can’t read a balance sheet, and can barely string together a coherent thought—yet they’re entrusted with fixing the nation’s most critical programs.

It’s no wonder every solution comes too late, costs too much, and creates another crisis in the process.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

"MAJOR ALERT! Trump's Surprise Gold Strategy Will Send Gold Above $20,000/Oz" – Andy Schectman

"MAJOR ALERT! Trump's Surprise Gold Strategy Will Send Gold Above $20,000/Oz" – Andy Schectman

Finance Log: 8-17-2025

The possibility of a gold revaluation in the United States is no longer a fringe discussion. With Scott Bessent now serving as Treasury Secretary, the signals coming out of Washington suggest that gold is once again being considered as a pillar of fiscal and monetary strategy.

Judy Shelton, long associated with calls for a return to sound money, has openly floated the idea of issuing Treasury Trust Bonds tied to gold—potentially as early as July 4th, 2026, the 250th anniversary of American independence.

"MAJOR ALERT! Trump's Surprise Gold Strategy Will Send Gold Above $20,000/Oz" – Andy Schectman

Finance Log: 8-17-2025

The possibility of a gold revaluation in the United States is no longer a fringe discussion. With Scott Bessent now serving as Treasury Secretary, the signals coming out of Washington suggest that gold is once again being considered as a pillar of fiscal and monetary strategy.

Judy Shelton, long associated with calls for a return to sound money, has openly floated the idea of issuing Treasury Trust Bonds tied to gold—potentially as early as July 4th, 2026, the 250th anniversary of American independence.

The symbolism is deliberate: a declaration of economic renewal backed by the one asset that has anchored monetary systems for millennia.

But it may not just be about the future—it could already be underway.

Andy Schectman points to staggering amounts of physical gold quietly being drawn out of COMEX since last November. Over $100 billion worth of gold has moved, with delivery percentages far exceeding historic norms.

For decades, less than one percent of contracts stood for delivery. Now, we’re seeing 100 percent fulfillment in certain contract months, with billions leaving the ecosystem.

The obvious question is: who is buying all this gold? The secrecy and scale strongly suggest that it is not hedge funds or private investors.

The possibility that the U.S. government itself is behind this accumulation cannot be ignored.

Seeds of Wisdom RV and Economic Updates Monday Afternoon 8-18-25

Good Afternoon Dinar Recaps,

BRICS Members in 2025: Full List, New Member Countries & Global Impact

The BRICS alliance has expanded significantly, now including eleven member nations as of 2025. What began with five founding members has grown into a geopolitical and economic force representing over 40% of the world’s population and 37.3% of global GDP. With Saudi Arabia finalizing its membership in July 2025, BRICS continues to attract nations searching for alternatives to Western-led institutions.

Good Afternoon Dinar Recaps,

BRICS Members in 2025: Full List, New Member Countries & Global Impact

The BRICS alliance has expanded significantly, now including eleven member nations as of 2025. What began with five founding members has grown into a geopolitical and economic force representing over 40% of the world’s population and 37.3% of global GDP. With Saudi Arabia finalizing its membership in July 2025, BRICS continues to attract nations searching for alternatives to Western-led institutions.

Current BRICS Members and Expansion

Originally formed in 2006 by Brazil, Russia, India, and China—later joined by South Africa in 2010—the BRICS bloc has become an anchor for emerging economies.

2024 expansion: Egypt, Ethiopia, Iran, and the United Arab Emirates joined on January 1, 2024.

2025 expansion: Indonesia joined in January 2025, followed by Saudi Arabia in July 2025.

This brings the current BRICS membership to eleven nations.

Chinese President Xi Jinping emphasized:

“Adding new economies will inject new vitality into BRICS cooperation and increase the representativeness and influence of BRICS.”

Which Countries Want to Join BRICS

Interest continues to rise, with 32 countries signaling interest and 23 filing official applications.

The alliance has also created a circle of 13 “partner countries,” including Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, and Uzbekistan.

Top candidates for membership include:

Bahrain

Malaysia

Turkey

Vietnam

Belarus

Sri Lanka

Mexico

Kuwait

Thailand

Uzbekistan

Oil producers such as Bahrain and Kuwait aim to leverage their resources as strategic bargaining chips, while Mexico could deliver Latin American access and Belarus offers an Eastern European foothold.

Thailand stated:

“Joining BRICS would benefit Thailand in many respects and boost prospects of being one of the international economic policy makers.”

Economic Impact of BRICS

The expanded bloc now represents 3.3 billion people and wields 37.3% of global GDP (PPP).

China: 19.05%

India: 8.23%

With Iran, UAE, and Saudi Arabia onboard, BRICS members control nearly half of global oil production and roughly 35% of total oil consumption.

S&P Global noted:

“With Saudi onboard the BRICS grouping would be a commodities powerhouse.”

Meanwhile, the New Development Bank (NDB) has financed over $32 billion across 96 projects since 2016, pioneering local-currency infrastructure loans that reduce reliance on the U.S. dollar.

Challenges Facing BRICS

Despite its growth, the alliance faces internal divisions:

China and Russia are pushing rapid expansion.

Brazil and India are urging a more cautious approach.

This tension has slowed decision-making on new member admissions and economic integration strategies.

Political reactions have been sharp:

U.S. President Donald Trump dismissed the bloc outright: “BRICS is dead.”

UN Secretary-General António Guterres highlighted its appeal to developing nations:

“This system was created by rich countries to benefit rich countries. Practically no African country was sitting at the table of the Bretton Woods Agreement.”

Global Shift

The BRICS expansion underscores a multipolar shift in global governance, giving developing nations new financial and trade pathways outside the traditional Western order. With dozens of nations waiting to join, BRICS is positioning itself as the central counterweight to the U.S.-led system in global finance, energy, and trade.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Gold Revaluation to $15,000, Here's The Secret Plan For a U.S. Reset

Gold Revaluation to $15,000, Here's The Secret Plan For a U.S. Reset

Daniela Cambone: 8-18-2025

“Gold is heading to $15,000 an ounce,” says former Swiss banker Clive Thompson in this exclusive conversation with Daniela Cambone.

With U.S. debt exploding and interest costs devouring nearly 20% of tax revenues, Thompson argues Washington’s only lifeline is to revalue its gold reserves, unlocking trillions without adding to the national debt.

“It’s the same playbook from 1934,” he warns, pointing to a quiet plan already in motion that could hand the Treasury $3.9 trillion overnight.

Gold Revaluation to $15,000, Here's The Secret Plan For a U.S. Reset

Daniela Cambone: 8-18-2025

“Gold is heading to $15,000 an ounce,” says former Swiss banker Clive Thompson in this exclusive conversation with Daniela Cambone.

With U.S. debt exploding and interest costs devouring nearly 20% of tax revenues, Thompson argues Washington’s only lifeline is to revalue its gold reserves, unlocking trillions without adding to the national debt.

“It’s the same playbook from 1934,” he warns, pointing to a quiet plan already in motion that could hand the Treasury $3.9 trillion overnight.

Thompson calls $15,000 the “sweet spot” — high enough to ease the debt spiral but not so high as to trigger a dollar collapse. Such a move, he explains, would ignite silver past $100, squeeze America’s creditors, and accelerate a global rush into hard assets.

With Fed rate cuts now certain, COMEX inventories draining, and hedge funds taking physical delivery, Thompson says the world is “waking up to gold’s return as money.”