Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Social Security Will Run Out Of Money In Nine Years

Social Security Will Run Out Of Money In Nine Years

Notes From the Field by James Hickman/Simon Black May 7, 2024

Social Security’s annual trust fund report was released yesterday… and, no surprise, the report states very clearly that trust fund balances “are projected to become depleted during 2033.”

Allow me to repeat that: Social Security’s most important trust fund will run out of money in nine years.

This is a fact, not some wild conspiracy theory; remember that the annual report is signed by top government officials including the United States Secretaries of the Treasury, Labor, and Health and Human Services… so the projection is about as official as it can get. But if you dive into the report, you quickly notice that even such a grim forecast may, in fact, be too optimistic.

Social Security Will Run Out Of Money In Nine Years

Notes From the Field by James Hickman/Simon Black May 7, 2024

Social Security’s annual trust fund report was released yesterday… and, no surprise, the report states very clearly that trust fund balances “are projected to become depleted during 2033.”

Allow me to repeat that: Social Security’s most important trust fund will run out of money in nine years.

This is a fact, not some wild conspiracy theory; remember that the annual report is signed by top government officials including the United States Secretaries of the Treasury, Labor, and Health and Human Services… so the projection is about as official as it can get. But if you dive into the report, you quickly notice that even such a grim forecast may, in fact, be too optimistic.

Many of the key economic assumptions that they make in the report are wildly inaccurate. They assume, for example, that US fertility rate will be as high as 2.1 (i.e. 2.1 children born per woman). But, in reality, the US fertility rate has been falling for decades, and just hit another all-time low of 1.6 last year.

They’re also way off on other assumptions– like economic productivity. They assume (rather optimistically) that productivity growth will average 2%. Last year it was just 1.3%. And in 2022 productivity actually shrank by 1.9%.

They’re also way off-base in their assumptions about inflation, unemployment, and more.

Plus, just like the Congressional Budget Office’s long-term projections about the US economy, the Social Security trustees don’t account for any kind of future emergency, pandemic, recession, depression, war, financial crisis, or debt crisis.

The really ironic part is that the trustees’ assumptions fail to consider the future economic impact of Social Security going bankrupt.

Think about it– when Social Security’s trust funds suddenly run out of money, it’s going to trigger a major crisis in the United States. Clearly this will be disruptive and throw off their rosy economic assumptions. But they don’t account for this either.

Bottom line, Social Security’s demise is, at best, nine years away. And probably sooner.

So, what will happen when Social Security runs out of money?

Remember that 70 million retirees’ monthly benefits are essentially funded from three different sources.

The first source is payroll tax revenue; people currently in the labor force fork over a portion of their wages to pay Social Security benefits.

For decades, payroll tax revenue exceeded the total benefits that Social Security paid. And this surplus was invested into a special trust fund, which now totals trillions of dollars.

And that’s the second source of funding for the program: investment income from the trust fund, while the third source is the trust fund itself.

Again, for most of Social Security’s history, the trust fund was growing, and its investment income was compounding year after year.

But starting in 2021, Social Security’s annual costs have exceeded combined payroll tax revenue and investment income. So, in order to make ends meet, the program had to start dipping into its trust fund.

The fund’s reserves are now falling. And, again, by 2033, the trust fund will be fully depleted. This also means that there will be no more investment income… leaving payroll tax revenue as the sole source to fund Social Security.

Once this happens, the report states that retirees will have to suffer an immediate, substantial cut (roughly 25%) to their promised benefits. And most likely this cut will continue to become worse over time.

It’s not like there aren’t options to fix Social Security. The government could overhaul the program, raise the retirement age, or start allowing private asset managers to generate higher rates of return for the trust funds (while they still have money).

But everyone in government insists that they are not going to touch Social Security. Joe Biden never misses an opportunity to promise that he will veto any attempt to reform the program.

As a matter of fact, Joe Biden released a statement yesterday (after the trustee report was published) saying– literally in the first sentence– that “Social Security remains strong.”

Come again? What report was this guy reading?

Social Security is, by definition, NOT strong. The trust fund is indisputably going to run out of money in nine years. But this guy is just living on another planet. He refuses to acknowledge reality, he refuses to fix the problem, and he promises to prevent other people from fixing the problem.

Now that’s leadership.

I find it remarkable, though, how many other ‘experts’ are falling in line behind the President.

Even the Wall Street Journal, which is supposed to be a conservative-leaning paper, published an article this morning to say that Social Security’s rapidly depleting trust funds are no big deal… because Congress can always just “choose” to continue funding the program.

Uh… with what money? The budget deficit is already $2 trillion per year. So, if Congress “chooses” to continue paying out 100% of Social Security benefits after 2033, it will all be funded with more debt.

The Journal then suggests that such spending “could also mean the U.S. deficit continues to grow at a pace economists find alarming, potentially weighing on the performance of the economy.”

Could? Potentially? In what reality does multi-trillion-dollar deficit and a fully depleted Social Security trust fund NOT weigh on the US economy?

It’s astonishing how few people want to acknowledge the reality. Social Security will run out of money. Benefits are at risk. And the only way to ‘save’ the program is more debt… which means more inflation, more risk to the dollar’s global reserve status, and more consequences down the road.fmay

That said, Social Security is a perfect example how to think about a Plan B. It is a known and obvious risk: the program will almost certainly run out of money.

But if you know this is going to happen down the road, you can take steps now to secure your retirement– like setting up tax-advantaged retirement accounts to set aside more money in an extremely tax efficient way.

It’s the same with inflation, the national debt, and the dollar; when you can make a very strong case for rising prices and decline in the dollar’s global reserve status in the future, there are ways to mitigate those risks today.

Real assets like gold, energy, uranium, and other critical minerals, plus the companies that produce them, will likely be fantastic investments in a debt-ridden, inflationary environment. And it just so happens that many of them are trading at ridiculously cheap prices right now.

(Subscribers to our premium investment research– check out your most recent edition which features an extremely well-managed, debt-free, highly profitable real asset producer that pays a nearly 9% dividend. Yet its stock sells for a laughably low, single Price/FCF multiple.)

Bottom line, there are completely logical and rational ways to solve these problems and mitigate these risks on your own. Don’t wait for Joe Biden to do it.

https://www.schiffsovereign.com/trends/social-security-will-run-out-of-money-in-nine-years-150811/

News, Rumors and Opinions Tuesday AM 7-9-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 9 July 2024

Compiled Tues. 9 July 2024 12:01 am EST by Judy Byington

Judy Note: What We Think We Know as of Tues. 9 July 2024: (Rumors/Opinions)

The fiat Dollar was no longer accepted by major countries for international trade, while the Global Currency Reset of 209 nations to gold/asset-backed currencies was rolling out.

Mon. 8 July 2024: BRICS intra-bank Payment System has been launched.

Six Countries including Iran have formerly join the BRICS nations of Brazil, Russia, India and South Africa to ditch the fiat US Dollar!

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 9 July 2024

Compiled Tues. 9 July 2024 12:01 am EST by Judy Byington

Judy Note: What We Think We Know as of Tues. 9 July 2024: (Rumors/Opinions)

The fiat Dollar was no longer accepted by major countries for international trade, while the Global Currency Reset of 209 nations to gold/asset-backed currencies was rolling out.

Mon. 8 July 2024: BRICS intra-bank Payment System has been launched.

Six Countries including Iran have formerly join the BRICS nations of Brazil, Russia, India and South Africa to ditch the fiat US Dollar!

Mon. 8 July 2024: The QFS, NESARA, GESARA Redemption Process Has Begun!

There will be an Internet Blackout.

The White Hat Military is in control of the redemption process, which has released funds across the World for the Global Currency Reset.

All banks have signed Non Disclosure Agreements.

The GCR funds come directly from the US Treasury Department of Defense Operations – that go out to Treasury Departments in other countries.

Japan has revalued their currency.

Bond Holders have begun to be paid in Brazil.

Notifications have gone out to Tier 4a, a small group of Tier4b and some Bond Holders.

Sat. 6 July 2024 Wolverine. “It has started. It is a process hopefully completed by the 20th. I’m hoping to get the Green Light in a few days.”

Sat. 6 July 2024 MarkZ: “More and more sources are telling me that serious money movement and us moving towards the banks somewhere around the weekend of Fri. – Mon. 12th-15th. No one knows the exact timing but they are certainly preparing lots of bank contacts for that time period, so I think it may speak well to where we may be on that.”

Fri. 5 July 2024 Banker: “Well folks it’s not like we haven’t heard this before but, I just got off a call from Hong Kong, London, NYC, Reno, and me. They are indicating that certain bond holder groups are having funds disbursed to paymasters over this weekend and that we as currency holders should remain vigilante for notifications this coming week. An FYI only as banker has not suggested same.

~~~~~~~~~~

Mon. 8 July 2024 White Hat Intel:

Iran and Moscow have interconnected local payment systems and fully ditch U S. Dollar. Several African countries and nations. Prepare to get rid of U S. Dollar and Join BRICS with six countries already negotiating.

Zimbabwean President says the new gold-backed currency will become the sole legal tender away from the fiat US Dollar.

Read full post here: https://dinarchronicles.com/2024/07/09/restored-republic-via-a-gcr-update-as-of-july-9-2024/

**************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 What do you get when you have the HCL? Nano seconds later the new exchange rate...The events you're seeing, the things that are happening right now, the alignment of many stars, of many events are only pointing in one direction, that there will be an announcement of a new exchange rate very soon to the Iraqi citizens.

Walkingstick The monetary reform is secured by the reserves. The reserves that back up the currency is the control that the CBI and Saleh is talking about when he says we have a strong exchange rate at 1320 because he can control it and he can change it at any time he wants. He's not just talking about what they know they have...the billions and billions of dinar that were brought back but it also includes all the tapped sources and untapped sources, gold, phosphate, oil, diamonds, etc etc, each one of these categories alone can support the monetary reform.

**********

Iraq: Here's When the IQD RV is Expected

Edu Matrix: 7-8-2024

Iraq: Here's When the IQD RV is Expected—Iraq has never been in a better financial position. People are asking why the country is not increasing the value of its currency. This video answers that question and provides a timeline for when we might expect a currency adjustment of the Iraqi Dinar. Currency

Zimbabwe Is Creating An Artificial Market...

Lynette Zang: 7-8-2024

Why The Dollar Will Lose Its Status As The Global Reserve Currency

Why The Dollar Will Lose Its Status As The Global Reserve Currency

Notes From the Field By James Hickman / Simon Black

By the early 400s, the Roman Empire was coming apart at the seams and in desperate need of strong, competent leadership. In theory, Honorius should have been the right man for the job.

Born into the royal household in Constantinople, Honorius had been groomed to rule, practically since birth, by the finest experts in the realm. So even as a young man, Honorius had already accumulated decades of experience.

Yet Rome’s foreign adversaries rightfully believed Honorius to be weak, out of touch, divisive, and completely inept.

Why The Dollar Will Lose Its Status As The Global Reserve Currency

Notes From the Field By James Hickman / Simon Black

By the early 400s, the Roman Empire was coming apart at the seams and in desperate need of strong, competent leadership. In theory, Honorius should have been the right man for the job.

Born into the royal household in Constantinople, Honorius had been groomed to rule, practically since birth, by the finest experts in the realm. So even as a young man, Honorius had already accumulated decades of experience.

Yet Rome’s foreign adversaries rightfully believed Honorius to be weak, out of touch, divisive, and completely inept.

He had entered into bonehead peace treaties that strengthened Rome’s enemies. He paid vast sums of money to some of their most powerful rivals and received practically nothing in return. He made virtually no attempt to secure Roman borders, leaving the empire open to be ravaged by barbarians.

Inflation was high. Taxes were high. Economic production declined. Roman military power declined. And all of Rome’s foreign adversaries were emboldened.

To a casual observer it would have almost seemed as if Honorius went out of his way to make the Empire weaker.

One of Rome’s biggest threats came in the year 408, when the barbarian king Alaric invaded Italy; imperial defenses were so non-existent at that point that ancient historians described Alaric’s march towards Rome as unopposed and leisurely, as if they were “at some festival” rather than an invasion.

Alaric and his army arrived to the city of Rome in the autumn of 408 AD and immediately positioned their forces to cut off any supplies. No food could enter the city, and before long, its residents began to starve.

Historians have passed down horrific stories of cannibalism– including women eating their own children in order to survive.

Rather than send troops and fight, however, Honorius agreed to pay a massive ransom to Alaric, including 5,000 pounds of gold, 30,000 pounds of silver, and literally tons of other real assets and commodities.

(The equivalent in today’s money, adjusted for population, would be billions of dollars… similar to what the US released to Iran in a prisoner swap last year.)

Naturally Honorius didn’t have such a vast sum in his treasury… so Romans were forced to strip down and melt their shrines and statues in order to pay Alaric’s ransom.

Ironically, one of the statues they melted was a monument to Virtus, the Roman god of bravery and strength… leading the ancient historian Zosimus to conclude that “all which remained of Roman valor and intrepidity was totally extinguished.”

Rome had spent two centuries in the early days of the empire– from the rise of Augustus in 27 BC to the death of Marcus Aurelius in 180 AD– as the clear, unrivaled superpower. Almost no one dared mess with Rome, and few who did ever lived to tell the tale.

Modern scholars typically view the official “fall” of the Western Roman Empire in the year 476. But it’s pretty clear that the collapse of Roman power and prestige took place decades before.

When Rome was ransomed in 408 (then sacked in 410), it was obvious to everyone at the time that the Emperor no longer had a grip on power.

And before long, most of the lands in the West that Rome had once dominated– Italy, Spain, France, Britain, North Africa, etc. were under control of various Barbarian tribes and kingdoms.

The Visigoths, Ostrogoths, Vandals, Franks, Angles, Saxons, Burgundians, Berbers, etc. all established independent kingdoms. And for a while, there was no dominant superpower in western Europe. It was a multi-polar world. And the transition was rather abrupt.

This is what I think is happening now– we’re experiencing a similar transition, and it seems equally abrupt.

The United States has been the world’s dominant superpower for decades. But like Rome in the later stage of its empire, the US is clearly in decline. This should not be a controversial statement.

Let’s not be dramatic; it’s important to stay focused on facts and reality. The US economy is still vast and potent, and the country is blessed with an abundance of natural resources– incredibly fertile farmland, some of the world’s largest freshwater resources, and incalculable reserves of energy and other key commodities.

In fact, it’s amazing the people in charge have managed to screw it up so badly. And yet they have.

The national debt is out of control, rising by trillions of dollars each year. Debt growth, in fact, substantially outpaces US economic growth.

Social Security is insolvent, and the program’s own trustees (including the US Treasury Secretary) admit that its major trust fund will run out of money in just nine years.

The people in charge never seem to miss an opportunity to dismantle capitalism (i.e. the economic system that created so much prosperity to begin with) brick by brick.

Then there are ubiquitous social crises: public prosecutors who refuse to enforce the law; the weaponization of the justice system; the southern border fiasco; declining birth rates; extraordinary social divisions that are most recently evidenced by the anti-Israel protests.

And most of all the US constantly shows off its incredibly dysfunctional government that can’t manage to agree on anything, from the budget to the debt ceiling. The President has obvious cognitive disabilities and makes the most bizarre decisions to enrich America’s enemies.

Are these problems fixable? Yes. Will they be fixed? Maybe. But as we used to say in the military, “hope is not a course of action”.

Plotting this current trajectory to its natural conclusion leads me to believe that the world will enter a new “barbarian kingdom” paradigm in which there is no dominant superpower.

Certainly, there are a number of rising rivals today. But no one is powerful enough to assume the leading role in the world.

China has a massive population and a huge economy. But it too has way too many problems… with the obvious challenge that no one trusts the Communist Party. So, most likely China will not be the dominant superpower.

India’s economy will eventually surpass China’s, and it has an even bigger population. But India isn’t even close to the ballpark of being the world’s superpower.

Then there’s Europe. Combined, it still has a massive economic and trade union. But it has also been in major decline… with multiple social crises like low birth rates and a migrant invasion.

Then there are the energy powers like Russia, Iran, Saudi Arabia, and Indonesia; they are far too small to dominate the world, but they have the power to menace and disrupt it.

The bottom line is that the US is no longer strong enough to lead the world and keep adversarial nations in check. And it’s clear that other countries are already adapting to this reality.

Earlier this month, for example, China successfully launched a rocket to the moon as part of a multi-decade mission to establish an International Lunar Research Station.

By 2045, China hopes to construct a large, city-like base along with several international partners including Russia, Pakistan, Thailand, South Africa, Venezuela, Azerbaijan, Belarus, and Egypt. Turkey and Nicaragua are also interested in joining.

This is pretty remarkable given how many nations are participating, even if just nominally. Yet the US isn’t part of the consortium.

This would have been unthinkable a few decades ago. But today the rest of the world realizes that they no longer need American funding, leadership, or expertise.

We can see similar examples everywhere, most notably in Israel and Ukraine. And I believe one of the next shoes to drop will be the US dollar.

After all, if the rest of the world doesn’t need the US for space exploration, and they can ignore the US when it comes down to World War 3, then why should they need the US dollar anymore?

The dollar was the clear and obvious choice as the global reserve currency back when America was the undisputed superpower. But today it’s a different world.

Foreign nations continuing to rely on the dollar ultimately means governments and central banks buying US government bonds. And why should they take such a risk when the national debt is already 120% of GDP?

In addition, Congress passed a new law a few weeks ago authorizing the Treasury Department to confiscate US dollar assets of any country it deems an “aggressor state.”

While people might think this is a morally righteous idea, the reality is that it will only turn off foreign investors. Why should China, Saudi Arabia, or anyone else buy US government bonds when they can be confiscated in a heartbeat?

All of this ultimately leads to a world in which the US dollar is no longer the dominant reserve currency. We’re already starting to see signs of that shift, and it could be in full swing by the end of the decade.

Schiff Sovereign James Hickman/Simon Black https://www.schiffsovereign.com/about/

Ariel “Breaking News” Monday 7-8-2024

Ariel: Breaking News

On July 18th, 2024, Iraq is slated to go before the World Trade Organization on access and benefits of trading in the modern world.

Their newly developed regulation paper designed to implement and develop an e-commerce facility will incorporate needed changes in digital asset based trading systems.

Watch the water. © Goldilocks

July 12th

July 14th

July 18th

These 3 dates since the inception of this investment opportunity are the most pivotal in the history of this process. No other dates have lined up in this successive manner where each one is it's own historical event and met with two more critical dates just days apart.

Ariel: Breaking News

On July 18th, 2024, Iraq is slated to go before the World Trade Organization on access and benefits of trading in the modern world.

Their newly developed regulation paper designed to implement and develop an e-commerce facility will incorporate needed changes in digital asset based trading systems.

Watch the water. © Goldilocks

July 12th

July 14th

July 18th

These 3 dates since the inception of this investment opportunity are the most pivotal in the history of this process. No other dates have lined up in this successive manner where each one is it's own historical event and met with two more critical dates just days apart.

History is in front of you.

This means a reinstatement can and will occur any time after these dates.

Because all mechanisms fo go international will be implemented on those dates.

Ariel: Clarification: The 3 Dates July 12th Derivative Clearing Organizations DCOs must comply by July 12, 2024.

The completion of these swap dealer compliance issues in the Forex Market comes at a time when Iraq has just completed their requirements on phase one of their economic reforms.

July 14th Central Bank of Iraq will implement a new mechanism for travelers to receive foreign currency (Dollars) which will be exclusively through companies and banks at outlets at "international airports" which will come in effect on July 14th.

On July 18th, 2024, Iraq is slated to go before the World Trade Organization on access and benefits of trading in the modern world.

Their newly developed regulation paper designed to implement and develop an e-commerce facility will incorporate needed changes in digital asset based trading systems.

People, I do not know how you can not be excited about this. You have never experienced dates like these since you have been in this investment.

Please take stock into where you are at this time and realize the life before that you have never lived is extremely close at any moment to come into fruition.

Ariel: Militia Man Article: "Prime Minister's Advisor: Iraq in the process of paying off long-term development loans to the World Bank" It looks like Iraq's financial situation is solid as they get effectively. She has so many revenue streams coming on board now it will only get better

https://x.com/Prolotario1/status/1810346869672882280?t=7zshZaQFp8kfSbPEwCEcKQ&s=19

Seeds of Wisdom RV and Economics Updates Monday Afternoon 7-8-24

Good Afternoon Dinar Recaps,

PRESIDENT TRUMP POSITIONING HIMSELF TO BE A STRONG PROPONENT OF BITCOIN AND TOKENIZED ASSETS

In a Forbes article several lawmakers are described as offering pro-crypto advice to President Trump.

“We want all the remaining Bitcoin to be made in the USA!”

"In a Truth Social post last month, Republican presidential candidate Donald Trump expressed strong support for bitcoin. In the same post, he recognized the geopolitical significance of the world’s largest cryptocurrency, warning that any policy that seeks to hamper bitcoin “only helps China and Russia.” Trump’s statement not only positioned him as the first pro-bitcoin nominee of a major political party—it also put a spotlight on discussions about classifying bitcoin as a strategic reserve asset. "

Good Afternoon Dinar Recaps,

PRESIDENT TRUMP POSITIONING HIMSELF TO BE A STRONG PROPONENT OF BITCOIN AND TOKENIZED ASSETS

In a Forbes article several lawmakers are described as offering pro-crypto advice to President Trump.

“We want all the remaining Bitcoin to be made in the USA!”

"In a Truth Social post last month, Republican presidential candidate Donald Trump expressed strong support for bitcoin. In the same post, he recognized the geopolitical significance of the world’s largest cryptocurrency, warning that any policy that seeks to hamper bitcoin “only helps China and Russia.” Trump’s statement not only positioned him as the first pro-bitcoin nominee of a major political party—it also put a spotlight on discussions about classifying bitcoin as a strategic reserve asset. "

"Former presidential candidate Vivek Ramaswamy, for example, has been advising President Trump on bitcoin and digital assets since January. Ramaswamy staked a unique position in the final weeks of his campaign by proposing that the dollar be backed by a basket of commodities that, in time, could include bitcoin."

"Ramaswamy’s plan echoed a similar proposal from Independent presidential candidate Robert F. Kennedy, Jr., in which a small percentage of US Treasury bills 'would be backed by hard currency, by gold, silver, platinum, or bitcoin."

© Newshounds News™

Read more: Forbes

~~~~~~~~~

AN EXCELLENT INTERVIEW ON "Unchained" WITH SENATOR LUMMIS ON WHY CRYPTO HAS BI-PARTISAN SUPPORT

"Show highlights:"

1. Why the SAB 121 approval was bipartisan

2. Whether President Biden will veto the resolution

3. How it’s a “mystery” to Sen. Lummis why the SEC had a change of heart about Ether ETFs

4. How the SEC’s approach to regulating the industry “is not the American way”

5. Whether there is a bipartisan majority in favor of crypto in Congress

6. How bitcoin has come a long way in terms of adoption

7. Sen. Lummis’ thoughts on how to regulate the stablecoin industry and avoid a Terra Luna situation

8. The differences between the Lummis-Gillibrand bill and FIT21

9. How Sen. Lummis feels about the denial of a master account for Custodia Bank

10. Whether there’s a move against Bitcoin mining companies in the US, given the recent ban of an operation in Wyoming

11. What Sen. Lummis would advise for the industry to accomplish its goals

© Newshounds News™

Read more: Unchained Crypto

~~~~~~~~~

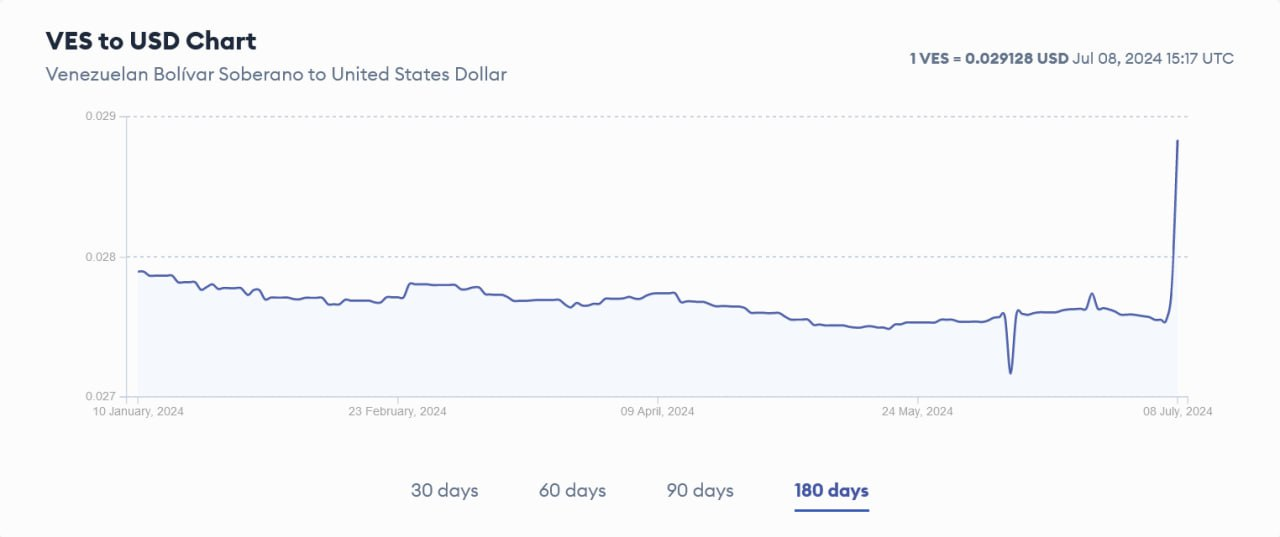

1 VES TO USD

VENEZUELAN BOLIVAR showing a slight strengthening against the US Dollar

Read more: Forbes

~~~~~~~~~

MAJOR DIFFERENCES BETWEEN BASEL CRYPTO RULES AND THE SEC ON BANKS BALANCE SHEETS

The House will seek to overturn the veto possibly later this week with a 2/3rds vote.

"At the end of May President Biden vetoed a bipartisan resolution in the House and Senate that aimed to cancel SEC accounting rule SAB 121, which prevents banks from providing digital asset custody. This week’s House schedule indicates another vote is on the cards.

If lawmakers successfully cancel SAB 121, then the SEC could not provide guidance on crypto custody in the future."

"SAB 121 requires listed firms to show digital assets held in custody as both an asset and liability on their balance sheet, contrary to accounting convention. It particularly impacts banks, because laws require them to set aside risk capital based on their balance sheet. This makes it prohibitively expensive for banks to provide crypto custody and is the reason none provide crypto custody for the Bitcoin ETFs. The SEC did not consult bank regulators before publishing SAB 121.

Firstly, there was the Basel rules for bank treatment of crypto. When the Basel Committee published final rules in late 2022, they did not require crypto held in custody to be shown on the balance sheet. This appeared to be a green light. However, in late March 2022 the SEC had published SAB 121 which meant that international banks could provide custody, but not U.S. ones. The SEC chose not to amend SAB 121 even though it conflicted with the Basel proposals."

Newshounds News will report back on any updates regarding this legislation.

© Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

TAIWAN BUILDS CBDC PROTOTYPE PLATFORM, PLANS HEARINGS FOR NEXT YEAR

"The Block has confirmed that Taiwan’s central bank governor will present a CBDC research report in parliament on Wednesday."

"The central bank started to research a potential central bank digital currency in 2019."

"Taiwan has built a prototype platform for a potential central bank digital currency (CBDC). It plans to hold multiple hearings and forums next year as its central bank continues to study and develop a CBDC."

Taiwan’s Central Bank Governor, Chin-Long Yang, said in a research report on Sunday that building a digital currency isn’t an international competition and that the central bank has yet to set a fixed timeline for CBDC issuance, according to a report from the semi-official Central News Agency.

"The report said the central bank had developed a CBDC prototype platform with a two-tier issuance structure. Initially, the CBDC would be non-interest bearing, and CBDC wallets may come in both anonymous and registered types, according to the report."

"On the retail front, the central bank said that the prototype platform has increased its processing speed to 20,000 transactions per second. The central bank also plans to develop the CBDC at the wholesale level, which could be used as a clearing asset for asset tokenization."

"The central bank stated that cryptocurrency and stablecoins are not part of the CBDC research, as those assets are separate from the digital currency system. The crypto industry remains largely unregulated in Taiwan, with the financial regulator requiring crypto service providers to comply with anti-money laundering laws."

@ Newshounds News™

Source: The Block

~~~~~~~~~

Do US Consumers Underestimate the Potential Of Digital Wallets?

In the United States, digital wallets can be anywhere a smartphone is. In other words, everywhere. Many U.S. consumers are embracing digital wallets, particularly for online shopping. In fact, data shows consumers are 23% more likely to use them for online shopping than in-store purchases. Beyond shopping, PYMNTS Intelligence finds that digital wallets are popular for peer-to-peer payments.

Yet, despite a reputation for tech-savviness, most U.S. consumers are unfamiliar with all these tools could offer. For example, just 8.7% of consumers have used one to store nontransactional credentials. Even fewer have used one of the credentials they have stored.

@ Newshounds News™

Read more: PYMNTS

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Monday PM 7-8-2024

TNT:

Tishwash: Reports: Washington postponed announcement scheduled for this week to reduce its forces in Iraq

Informed sources revealed, today, Monday, July 8, 2024, that the American side has withdrawn from the official announcement of an upcoming schedule that includes reducing the number of its forces in Iraq, during the current week, after it had been preparing for that.

According to the sources, the American side backed down from its decision to announce the reduction of forces during internal deliberations, before meeting with the Iraqi side, within the framework of the Iraqi-American bilateral committee.

She suggested that "there is a link between the decision to postpone the announcement of the reduction in Iraq, after the process of withdrawing American forces from Niger took priority, as the American army completed, yesterday, the withdrawal of all its soldiers from "Air Base 101" in Niamey. link

TNT:

Tishwash: Reports: Washington postponed announcement scheduled for this week to reduce its forces in Iraq

Informed sources revealed, today, Monday, July 8, 2024, that the American side has withdrawn from the official announcement of an upcoming schedule that includes reducing the number of its forces in Iraq, during the current week, after it had been preparing for that.

According to the sources, the American side backed down from its decision to announce the reduction of forces during internal deliberations, before meeting with the Iraqi side, within the framework of the Iraqi-American bilateral committee.

She suggested that "there is a link between the decision to postpone the announcement of the reduction in Iraq, after the process of withdrawing American forces from Niger took priority, as the American army completed, yesterday, the withdrawal of all its soldiers from "Air Base 101" in Niamey. link

************

Tishwash: Al-Sudani and a delegation from the Pentagon discuss the continuation of ending the mission of the international coalition

On Monday, Iraqi Prime Minister Mohammed Shia al-Sudani discussed with a delegation from the US Department of Defense (Pentagon) the procedures for proceeding with ending the mission of the international coalition to fight ISIS.

A statement by Al-Sudani's office received by Shafaq News Agency stated that "the Prime Minister received the US Deputy Assistant Secretary of Defense for Middle Eastern Affairs, Daniel Shapiro, and his accompanying delegation, in the presence of the US Ambassador to Iraq. During the meeting, the procedures for proceeding with ending the mission of the international coalition to fight ISIS and activating bilateral relations between Iraq and the United States were discussed."

The meeting also discussed the situation in the region and the ongoing aggression on Gaza, as Al-Sudani referred to the suffering of the Palestinian people, the difficulty of humanitarian aid and relief supplies in light of the stifling siege, and the failure of the international community to assume its responsibilities in pressuring the Netanyahu government to stop the genocide.

The Iraqi Prime Minister stressed the need for a firm stance against the aggression, and the necessity of preventing escalation that threatens to expand the scope of the conflict.

For his part, the American official pointed out the importance of Iraq's role in reducing tensions in the region, and the inevitability of continuing the approach of communication and cooperation between the two countries in the areas of armament and security and raising the combat level of the Iraqi forces, in a way that supports Iraq's security and sovereignty, economic development and progress at all levels. link

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Saleh has been very vocal about...the exchange rate, inflation, their reserves. His positive tone has been very well accepted because this is his fourth one...the reason there's positivity is because...of where we have been in the past and what has been transpiring ...What is different in the last year and half since Al Sudani arrived is amazing. It's immense. And the totality of it should have everybody pretty pumped because I see it as light at the end of the tunnel.

Mnt Goat ...everything is set to move ahead with the process of currency reform. We are just waiting. We know that the next step must be taken to move ahead and that is to revalue in-country only first just slightly over a dollar, then conduct the Project to Delete the Zeros as the currency swap out takes place. The CBI told us then they plan to monitor for a short time for inflation and then move to reinstate the dinar back to FOREX and when doing so the IMF plans to place the dinar in a new peg as in a basket of currencies and float it. ...this should have already been accomplished in June and is late. It is failure on the part of the US because the US is still stalling it.

************

STOCK MARKET MULTIPLES WILL END IN A NIGHTMARE. Important Updates.

Greg Mannarino: 7-8-2024

News, Rumors and Opinions Monday 7-8-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 8 July 2024

Compiled Mon. 8 July 2024 12:01 am EST by Judy Byington

Judy Note: What we think we know as of Mon. 8 July 2024:

There will be an Internet Blackout.

The White Hat Military is (allegedly) in control of the redemption process, which has released funds across the World for the Global Currency Reset.

All banks have (allegedly) signed Non Disclosure Agreements.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 8 July 2024

Compiled Mon. 8 July 2024 12:01 am EST by Judy Byington

Judy Note: What we think we know as of Mon. 8 July 2024:

There will be an Internet Blackout.

The White Hat Military is (allegedly) in control of the redemption process, which has released funds across the World for the Global Currency Reset.

All banks have (allegedly) signed Non Disclosure Agreements.

The GCR funds (allegedly)come directly from the US Treasury Department of Defense Operations – that go out to Treasury Departments in other countries.

Japan has (allegedly)revalued their currency.

Bond Holders have (allegedly)begun to be paid in Brazil.

Notifications have (allegedly)gone out to Tier 4a, a small group of Tier4b and some Bond Holders.

~~~~~~~~~~

Sat. 6 July 2024 Wolverine. “It has started. It is a process hopefully completed by the 20th. I’m hoping to get the Green Light in a few days.”

Sat. 6 July 2024 MarkZ: “More and more sources are telling me that serious money movement and us moving towards the banks somewhere around the weekend of Fri. – Mon. 12th-15th. No one knows the exact timing but they are certainly preparing lots of bank contacts for that time period, so I think it may speak well to where we may be on that.”

Fri. 5 July 2024 Banker: : “Well folks it’s not like we haven’t heard this before but, I just got off a call from Hong Kong, London, NYC, Reno, and me. They are indicating that certain bond holder groups are having funds disbursed to paymasters over this weekend and that we as currency holders should remain vigilante for notifications this coming week. An FYI only as banker has not suggested same.

~~~~~~~~~~~~

Predicted Timing: (Rumors/Opinions)

Wed. 10 July 2024: Tesla’s birthday; Debt Jubilee, 10 Days of Darkness Begins: BQQQM!!! The Debt Jubilee Begins July 10th! Prepare for the Revolution! – American Media Group (amg-news.com)

Mon. 15 July 2024: Major Event Predicted for Mon. 15 July: Live: New Dick Allgire: July 4th Remote Viewing Special Update 2024 | Prophecy | Before It’s News (beforeitsnews.com)

Fri. 5 July 2024 Important Dates, Derek Johnson: New Derek Johnson Huge Intel- Summer Important Update – July 5, 2024 | Prophecy | Before It’s News (beforeitsnews.com)

Global Currency Reset:

Sun. 7 July 2024: BQQQM!!! The Debt Jubilee Begins July 10th! Prepare for the Revolution! – American Media Group (amg-news.com)

Read full post here: https://dinarchronicles.com/2024/07/08/restored-republic-via-a-gcr-update-as-of-july-8-2024/

****************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 IMO this is an RI. They will reinstate that rate. I thought they would reach it at a cap but now they're talking about coming out right away with a fixed rate and that fixed rate might be $3.22 and then the float. That float should be very very small, very very quick because IMO it's going to reach the cap, boom! Very quickly.

Walkingstick If they float the dinar it will be in a very tight band. If it's a low rate, if it's a dollar then they'll float and it'll drive the rate up. But if they come out at an RI, reinstatement of $3.22 and then the float, then they're going to have some serious very tight banks on the float. It will be monitored very closely. It will only allow it to be a plus or minus of 5%. It cannot go any further than that in the float. For example, don't let it get past maybe $3.50...They will cap it quickly...

************

After Bank Assets Seized, Yellen's Empty Promises, Get FDIC Deposit Insurance NOW!

Atlantis Report: 7-7-2024

The global economy relies heavily on the banking sector, which is currently facing significant challenges. Recent events have sent shockwaves in financial markets and raised doubts about the stability of our banking system.

Statements by Treasury Secretary Janet Yellen have sparked much debate and concern, especially regarding the security of bank assets and the role of FDIC insurance, and the sudden expansion of coverage has left many people questioning the true state of our financial institutions. After bank assets seized, Yellen's makes empty promises, it's time to get FDIC Deposit Insurance NOW!

“Tidbits From TNT” Monday AM 7-8-2024

TNT:

Harambe: Zimbabwe Has $370 Million in Reserves to Back Currency - Bloomberg (7/7/24)

Cash and mineral reserves backing Zimbabwe’s new currency have risen to approximately $370 million from $285 million over the past three months, the state-run Sunday Mail reported citing central bank governor John Mushayavanhu.

The increase in currency and mineral reserves provides a strong “buffer” for the Zimbabwe Gold, or ZiG, against external forces, according to the report.

Mushayavanhu said the central bank has been accumulating reserves from royalties of gold and conversion in kind of other minerals such as diamonds, lithium and platinum.

TNT:

Harambe: Zimbabwe Has $370 Million in Reserves to Back Currency - Bloomberg (7/7/24)

Cash and mineral reserves backing Zimbabwe’s new currency have risen to approximately $370 million from $285 million over the past three months, the state-run Sunday Mail reported citing central bank governor John Mushayavanhu.

The increase in currency and mineral reserves provides a strong “buffer” for the Zimbabwe Gold, or ZiG, against external forces, according to the report.

Mushayavanhu said the central bank has been accumulating reserves from royalties of gold and conversion in kind of other minerals such as diamonds, lithium and platinum.

“As a result, the total reserves have progressively increased about 30% from $285 million as at ” to above $370 million as at the end of June, he said.

The southern African country introduced the ZiG, which began trading It replaced the Zimbabwe dollar, which had lost 80% of its value against the greenback this year.

In September 2022, Zimbabwe introduced regulations to compel mining firms to pay half of their royalties to the government in the commodities themselves, as part of measures to build up mineral reserves. Zimbabwe has the world’s third-largest reserves of platinum, and also mines nickel, chrome, lithium and coal.

***********

For the first time, Google and Facebook pass their bandwidth through Iraq

The Ministry of Communications revealed, on Monday, that Google and Facebook are passing their capacities through Iraqi territory, confirming that this is happening for the first time, while indicating that the transit projects will provide financial returns to the country.

The ministry's spokesman, Omar Al-Amiri, told the Iraqi News Agency (INA): "The ministry has made great strides in strengthening Iraq's geographical position in the matter of transit and passing communications traffic and Internet capacities across Iraqi territory."

Al-Amiri explained that “the Ministry of Communications signed a new contract a few months ago on the transit level, not by sea but by land,” indicating that “this line passes through the south, then the center, reaching the Kurdistan region, and exits to Turkey and connects Asia to Europe via Iraq.”

He added that "the Ministry of Communications fulfilled its promises regarding transit and exploiting Iraq's location after it was disabled in previous sessions," noting that "Iraq's geographical location and its exploitation in international communications traffic and its return to the International Telecommunication Union in a prestigious manner will provide financial returns, in addition to the fact that many international companies will pass their capacities through Iraqi territory."

He referred to the "Road of Civilizations Transit Contract that was signed months ago," noting that "Google and Facebook passed their capacities through Iraqi territory, for the first time in Iraq."

It is worth noting that the Minister of Communications, Hiyam Al-Yasiri, announced on Friday that the threshold of “one tera” had been exceeded in passing international communications through Iraq, confirming that Iraq possesses a safe, attractive and reliable path for transit communications. link

*************

Parliamentary Finance clarifies.. Will selling dollars at the airport limit its smuggling?

The Parliamentary Finance Committee stated that the Central Bank’s decision to restrict the sale of dollars to citizens at the airport aims to combat currency smuggling and reduce corruption, while it indicated that the increase in its prices in local markets is due to smuggling operations to neighboring countries.

Committee member Jamal Koujar said that the decision will prevent corrupt people from exploiting other sales outlets to smuggle currency, stressing that limiting sales to the airport will ensure that the money reaches the actual travelers.

He pointed out that this decision will not negatively affect citizens, but will besiege smugglers and corrupt people, noting that we discovered that millions of dollars are being stolen due to corruption, and the new decision will create a crisis for thieves and corrupt people who were exploiting the currencies that were supposed to go to travelers.

Koger stressed that the stability of the dollar price in the markets requires strong security action on the borders to pursue smugglers, in addition to facilitating the operations of the Central Bank in disbursing it and increasing the quantities available in the currency auction to meet the needs of the market. link

************

Parliamentary Finance Committee talks about a decision that "created a crisis" for the corrupt and thieves

Iraq is preparing to implement the latest decision of the Central Bank in about 6 days from now, which is to limit the delivery of dollars to travelers inside airports, a decision that the Parliamentary Finance Committee described as "a crisis for the corrupt and thieves."

"The decision will prevent corrupt people from exploiting other sales outlets to smuggle currency," said Jamal Koujar, a member of the Finance Committee, stressing that "limiting sales to the airport will ensure that the money reaches the actual travelers."

He pointed out that "this decision will not negatively affect citizens, but will besiege smugglers and corrupt people, as we discovered that millions of dollars are being stolen due to corruption, and the new decision will create a crisis for thieves and corrupt people who were exploiting the currencies that were supposed to go to travelers."

Koger stressed that stabilizing the dollar price in the markets requires strong security action on the borders to pursue smugglers, in addition to facilitating the Central Bank's exchange operations and increasing the quantities available in the currency auction to meet market needs.

Since Eid al-Adha until now, exchange rates have witnessed a "chronic" rise in dollar exchange rates until the selling prices in exchange offices reached 150,000 dinars for every 100 dollars.

The Financial Supervision Bureau revealed in a report that during the first half of 2023, there were more than 150,000 citizens who bought dollars for the purpose of traveling but did not travel, meaning they obtained 600 million dollars and sold them on the black market and benefited from the currency difference. link

*********

Mot: .. Just Love the Internet.. Sumthun fur All occasions!!!

Mot: .. It's World Chocolate Day

Seeds of Wisdom RV and Economics Updates Sunday Evening 7-7-24

Good Evening Dinar Recaps,

BRICS Coalition Eyes Ripple for New Financial Order, Is This the Awaited XRP Price Pump Trigger? ➖

BRICS coalition explores Ripple/crypto strategy to challenge US dollar dominance. ➖RippleNet could replace SWIFT for cross-border transactions. ➖XRP Ledger offers a decentralized platform for asset-backed currency.

The BRICS coalition, composed of Brazil, Russia, India, China, and South Africa, is considering a Ripple/crypto plan to challenge the US dollar’s global supremacy. This action, according to analysts, has the potential to change the present financial situation.

Leaders like Vladimir Putin and Xi Jinping are showing strong interest in cryptocurrency as a means of countering US financial dominance. An entirely new financial order based on real assets and blockchain technology might emerge from such a development, altering the current petrodollar system.

Good Evening Dinar Recaps,

BRICS Coalition Eyes Ripple for New Financial Order, Is This the Awaited XRP Price Pump Trigger?

➖BRICS coalition explores Ripple/crypto strategy to challenge US dollar dominance.

➖RippleNet could replace SWIFT for cross-border transactions.

➖XRP Ledger offers a decentralized platform for asset-backed currency.

The BRICS coalition, composed of Brazil, Russia, India, China, and South Africa, is considering a Ripple/crypto plan to challenge the US dollar’s global supremacy. This action, according to analysts, has the potential to change the present financial situation.

Leaders like Vladimir Putin and Xi Jinping are showing strong interest in cryptocurrency as a means of countering US financial dominance. An entirely new financial order based on real assets and blockchain technology might emerge from such a development, altering the current petrodollar system.

The XRP Ledger (XRPL), in particular, provides a potential decentralized platform for quick, safe transactions as a result of the technology developed by Ripple. These features make XRPL a promising foundation for a new asset-backed currency, decreasing reliance on central banks while increasing financial transparency.

RippleNet, Ripple’s payment network, is also key in this potential change. It allows for real-time, cross-border transactions, potentially replacing the traditional SWIFT system. RippleNet uses XRP in conjunction with On-Demand Liquidity (ODL) to eliminate the requirement for pre-funded accounts, simplifying international payments.

A new, more transparent, efficient, and less reliant on the US dollar global financial system may emerge from the BRICS coalition’s interest in cryptocurrencies and Ripple’s technology. By embracing a crypto/Ripple approach, the BRICS nations have the potential to completely reshape the world financial environment, with major effects on commerce and banking across borders.

The possible adoption of a Ripple/crypto strategy by the BRICS coalition represents a major advancement in global financial services. Ripple’s decentralized technology might serve as the basis for a new asset-backed currency. This change would make the banking system more efficient and put the US dollar under more pressure.

Read more Crypto News Land

~~~~~~~~~

US House Considers Overturning Biden’s Crypto Custody Veto — This Could Spark Wide Market Rally

"The US House of Representatives could overturn President Joe Biden’s veto of the crypto custody bill next week, sparking a bold recovery across the recently battered crypto market."

“In May, the US House voted to overturn the Securities and Exchange Commission SAB 121 rule that requires regulated firms custodying cryptocurrencies to record their holdings on balance sheets.”

“However, President Biden later vetoed the bill, saying it could affect the ability of the SEC to set up the much-needed guardrails in the industry. The President also noted it would affect the well-being of investors and customers.”

“The bill is now back in the House of Representatives and has been classified as “legislation that may be considered.” The US House can overturn or uphold the President’s veto.”

A two-thirds majority vote from both the Senate and the House is needed to overturn the veto.

Could A Recovery for the Crypto Market Be Brewing?

With the recent decline in Bitcoin and the cryptocurrency market, an overturn of the bill could be just what the market needs to recover.

“The market has already recorded a bold recovery in the last 24 hours, with the global market cap up by 4.3%. All the top-ten cryptos by market cap are also trading in the green today.”

“Bitcoin and Ether have gained by 4.5% and 5.3%, respectively, in the last 24 hours. XRP and Cardano are among the top gainers, with an 8% and 7% gain, respectively.”

@ Newshound News™

Read more: ZY Crypto

~~~~~~~~~

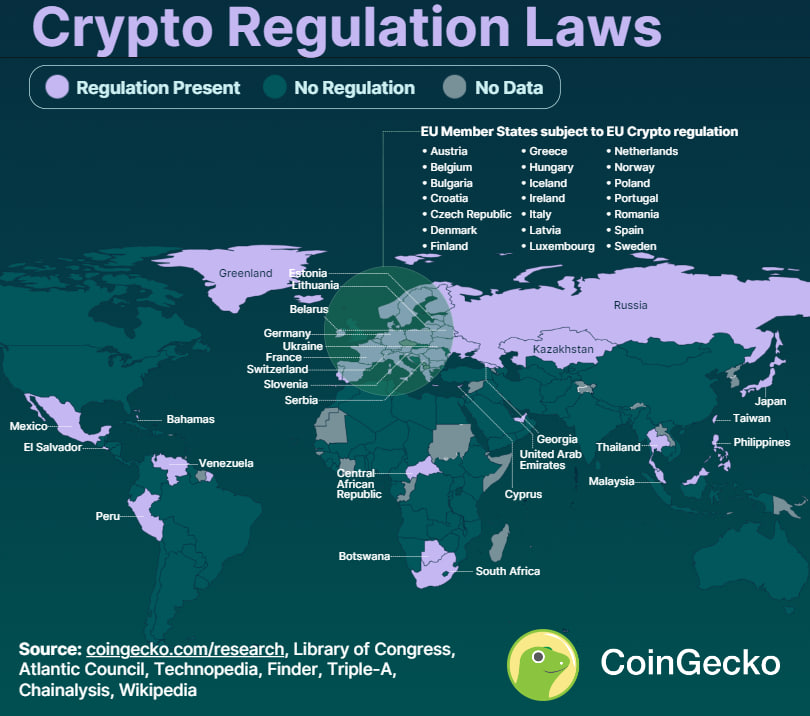

Countries Where Cryptocurrency Is Legal vs Illegal

Where Is Cryptocurrency Legal?

Cryptocurrency is currently legal in 119 countries and four British Overseas Territories. This means more than half of the world's countries have legalized cryptocurrency. 64.7% of countries that have legalized crypto are emerging and developing countries from the Asian and African continents. However, out of the 119 countries that legalized cryptocurrency, 20 (16.8%) have imposed bank bans. These bans restrict financial institutions from interacting with cryptocurrency exchanges or users.

Europe Leads With 39 Countries Recognizing Crypto’s Legitimacy

Europe is at the forefront of global cryptocurrency legalization, with 39 (95.1%) out of 41 analyzed countries acknowledging its legitimacy. North Macedonia is the only European country where cryptocurrency is illegal, while Moldova's status remains unclear.

Out of 31 countries in the Americas, 24 (77.4%) countries recognize cryptocurrency as legal. Bolivia stands as the sole exception, deeming cryptocurrency illegal. Six American countries - Guatemala, Guyana, Haiti, Nicaragua, Paraguay, and Uruguay - have yet to establish their official stance on cryptocurrency.

In Africa, only 17 out of 44 (38.6%) countries have legalized cryptocurrency, while 35 (77.7%) out of 45 countries in Asia recognize cryptocurrency as legal.

How Many Countries Have Defined Crypto Laws?

Only 62 (52.1%) of the 119 countries where cryptocurrency is legal have comprehensive regulations. This number has gone up by 53.2% since 2018 when only 33 jurisdictions had cryptocurrency regulations.

Among the 62 countries with established regulations, 36 (58.0%) are individual countries, 22 (35.5%) are part of the European Union (EU), and 4 (6.5%) are British Overseas Territories. Notably, half of these countries are advanced economies, while the remaining half are emerging and developing economies.

Half of the countries that have legalized cryptocurrency have yet to implement robust regulatory frameworks. This gap between legalization and full regulation raises potential concerns about investor protection and clarity for businesses operating in the cryptocurrency space in those countries.

Instead, several countries have taken the approach of adapting existing regulatory frameworks to encompass cryptocurrencies, rather than establishing entirely new regulations. This approach often involves applying established tax laws and anti-money laundering and counter-financing of terrorism (AML/CFT) laws to cryptocurrency transactions and activities.

Major advanced economies, including France, Japan, and Germany, have successfully established regulatory frameworks for cryptocurrencies.

In contrast, other major advanced economies, such as Italy, the United States, Canada, and the United Kingdom, face challenges in implementing comprehensive cryptocurrency regulations. Multiple governments and financial regulatory bodies in these countries contribute to the complexity of the regulatory process.

EU member states, on the other hand, adhere to EU-wide regulations regarding crypto assets. These regulations provide a more harmonized approach to cryptocurrency regulation within the bloc.

Which Countries Use Cryptocurrency as Legal Tender?

Only two countries, El Salvador and the Central African Republic (CAR), have adopted cryptocurrency as legal tender. Of which, El Salvador remains the only country actively using cryptocurrency as legal tender today.

El Salvador made history in August 2021 by legalizing Bitcoin through the Bitcoin Law. This landmark legislation cemented Bitcoin's acceptance as legal tender with automatic conversion to US dollars. In January 2023, El Salvador took another step towards embracing Bitcoin by passing the Digital Securities Law. This law classifies Bitcoin as a "digital commodity" and all other crypto assets as "securities."

@ Newshound News™

Read more: CoinGecko

~~~~~~~~~

THE UK COULD BE THE FIRST COUNTRY TO DESIGN CBDCs TO HELP THE PEOPLE, NOT THE BANKS

Labour's plan acknowledges the growing case for a state-backed digital pound and emphasizes the need for financial products to reach underserved communities.

"The landslide victory of the UK’s Labour Party in the general election saw little to no mention of Bitcoin, blockchain, or digital assets. However, Labour’s previous statements and plans suggest a cautious yet open stance toward blockchain technology. "

Labour backs Digital Pound, but what could it look like?

“Labour’s financial services plan, “Financing Growth,” acknowledges the growing case for a state-backed digital pound and emphasizes the need for “financial products to reach underserved communities.

“Embrace innovation and fintech as the future of financial services by becoming a global standard-setter for the use of AI in FS, delivering the next phase of Open Banking, defining a roadmap for Open Finance, embracing securities tokenisation and a central bank digital currency, and establishing a regulatory sandbox for financial products to reach underserved communities.”

“The party has fully supported the Bank of England’s ongoing work in this area, indicating a commitment to continue exploring and developing a CBDC.”

The Labour party has “highlighted the importance of addressing key concerns such as privacy, financial inclusion, and stability in designing any potential CBDC.” This indicates Labour “prioritizes public interest and economic stability.”

“Labour’s plan also emphasizes the importance of making the UK a global hub for securities tokenization” and exploring the tokenization of securities. "

"Labour has expressed intentions to advance open banking initiatives, explore the potential of open finance, and establish regulatory sandboxes to test financial products aimed at underserved communities. "

Healthy Skepticism for CBDCs

"As with any attempt to deliver a CBDC, it’s important to remain skeptical due to its potential for governmental overreach and abuse." However, "as one of the few ‘Left Wing’ governments to oversee a CBDC, Labour could offer a unique take on its design."

“Labour’s support for CBDC exploration does not equate to an immediate implementation plan. The party has emphasized the need for thorough consultation and careful consideration of potential impacts” such as privacy concerns associated with CBDCs. “It is clear that FIAT, in its current form, is failing.”

A positive CBDC design would include:

More transparency over government spending

More accessible access to finance for the unbanked

Cheaper and faster international transfers

Reduced costs of Central Bank printing

Increased privacy

A reduction in financial crime

“However, designing a CBDC to offer all these things without the more Orwellian alternatives may require too much of a leap of faith for most. A party with socialist origins, with a forward-thinking and modern technology focus, in the 2024 United Kingdom could theoretically adopt the best of what blockchain offers without overreaching if app priately advised by those in the digital assets industry.”

“We would have one shot at this, and it would have to be designed so that a future government could not alter it to take advantage of its citizens.”

"The coming months and years will be critical in determining whether the UK under Labour leadership can successfully navigate the complex landscape of digital currencies, balancing innovation with stability and public interest. If successful, the UK could emerge as a global leader in the responsible development and implementation of CBDCs, setting a precedent for other nations to follow."

@ Newshound News™

Read more: CryptoSlate

~~~~~~~~~

STABLECOINS AND NATIONAL SECURITY: LEARNING THE LESSONS OF EURODOLLARS

"As Congress struggles to resolve big issues like funding for Ukraine and Israel, the debate over legislation to regulate stablecoins seems like small potatoes. But there is a connection, which is that stablecoins could have national security implications: Unless we strengthen their regulation, they could undermine our ability to use sanctions to advance our national interests.

This was illustrated recently by news that Russian smugglers have used Tether, the largest stablecoin, to avoid Western sanctions and purchase billions of dollars worth of weapons."

"Stablecoins are a type of cryptocurrency that is far more useful as a means of payment than Bitcoin. 1 That is because stablecoins are designed to maintain a constant price in terms of another asset. 2 Stablecoins pegged to the U.S. dollar are more “money-like” than other cryptocurrencies.

They can be used to move value across borders without going through banks, and it is the banking system—and in particular the role of U.S. banks—that is key to the implementation and efficacy of sanctions."

"Stablecoins are in some respects similar to Eurodollars, a financial innovation that helped to create the financial plumbing used to implement sanctions. Both stablecoins and Eurodollars are U.S. dollar-based liabilities that had their origins outside the regulated banking system...

It is the global dominance of the dollar, coupled with the role of U.S. banks in facilitating dollar payments, that gives the U.S. its tremendous financial leverage."

"Could stablecoins undermine that leverage? As with the early days of the Eurodollar market, stablecoin use is minimal today, and so their national security risk may also be minimal. But just as Eurodollar use grew quickly and unexpectedly, stablecoins could also grow.

While they are used principally to trade other crypto assets today, they could become a more widespread means of payment. They have also become popular as a means for people in countries with weak currencies to acquire a dollar substitute.

Moreover, that growth could come even if the U.S. does not take action. That is because many other jurisdictions are creating frameworks to license stablecoins, including Europe, the U.K., Japan, Singapore and the U.A.E. While those frameworks may lead to stablecoins in native currencies, they could also give rise to new dollar-based stablecoins.

@ Newshound News™

Read more: BrookingsEdu

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

BRICS Intra-bank Payment System Launched: What next?

BRICS Intra-bank Payment System Launched: What next?

Fastepo: 7-7-2024

Russia and Iran, as two BRICS members, have finalized the integration of their national payment systems, a significant step toward enhancing their economic cooperation and circumventing U.S. sanctions.

The heads of the central banks from both nations have been working closely to link Iran's SEPAM system with Russia's System for Transfer of Financial Messages (SPFS).

This integration will allow the two countries to conduct trade and financial transactions using their national currencies, the ruble and rial, reducing their reliance on the U.S. dollar and the Western-dominated SWIFT system.

The new system will enable Iranian and Russian banks to issue and accept each other's bank cards, facilitating smoother transactions for businesses and individuals in both countries.

BRICS Intra-bank Payment System Launched: What next?

Fastepo: 7-7-2024

Russia and Iran, as two BRICS members, have finalized the integration of their national payment systems, a significant step toward enhancing their economic cooperation and circumventing U.S. sanctions.

The heads of the central banks from both nations have been working closely to link Iran's SEPAM system with Russia's System for Transfer of Financial Messages (SPFS).

This integration will allow the two countries to conduct trade and financial transactions using their national currencies, the ruble and rial, reducing their reliance on the U.S. dollar and the Western-dominated SWIFT system.

The new system will enable Iranian and Russian banks to issue and accept each other's bank cards, facilitating smoother transactions for businesses and individuals in both countries.

This move is seen as a strategic effort by both nations to mitigate the impact of international sanctions and strengthen their economic ties.

Russia, heavily sanctioned due to its invasion of Ukraine, and Iran, facing long-standing sanctions related to its nuclear program and other issues, are increasingly collaborating to build financial infrastructure independent of Western influence.

The first trade transactions using this new system have already taken place, and both countries are optimistic about the potential to significantly increase their annual bilateral trade, aiming to double it from $4 billion to $8 billion.

This integration is part of a broader effort to create a more resilient and self-sufficient economic partnership between Russia and Iran, further solidifying their alliance against Western economic pressures.

More News, Rumors and Opinions Sunday PM 7-7-2024

TNT:

Tishwash: Central Bank hosts meeting to regulate e-commerce in Iraq

His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, chaired the meeting of the Diwani Order Committee (24079) to regulate e-commerce in Iraq with the participation of the concerned authorities.

During the meeting, the draft e-commerce and consumer protection system was discussed through the controls discussed by the attendees, through the registration procedures and obtaining a license to practice this trade.

The committee contributed to defining the service provider and granting him a license through an electronic platform established by the Ministry of Trade. The committee members stressed the need to establish controls for granting a license to those wishing to practice e-commerce in a manner that preserves the rights of all parties.

The attendees agreed to submit the "system paper" to the Council of Ministers for review and approval to proceed with work on it.

TNT:

Tishwash: Central Bank hosts meeting to regulate e-commerce in Iraq

His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, chaired the meeting of the Diwani Order Committee (24079) to regulate e-commerce in Iraq with the participation of the concerned authorities.

During the meeting, the draft e-commerce and consumer protection system was discussed through the controls discussed by the attendees, through the registration procedures and obtaining a license to practice this trade.

The committee contributed to defining the service provider and granting him a license through an electronic platform established by the Ministry of Trade. The committee members stressed the need to establish controls for granting a license to those wishing to practice e-commerce in a manner that preserves the rights of all parties.

The attendees agreed to submit the "system paper" to the Council of Ministers for review and approval to proceed with work on it.

Central Bank of Iraq

Media Office

July 7, 2024 link

**************

Clare: Economist explains why the dollar fluctuates

Economic researcher Alaa Al-Fahd diagnosed, today, Saturday, a factor that caused the dollar price to rise against the Iraqi dinar in the parallel market.

Al-Fahd said in a press interview that "the fluctuations in the dollar exchange rate in the parallel market came as a result of the Central Bank of Iraq taking new measures regarding selling currency to travelers and delivering amounts from the airport exclusively."

He added, "When there are new measures, there are fluctuations in exchange rates," noting that "there are those who try to raise concerns with any new measures taken by the Central Bank in order to benefit some speculators."

The economic researcher pointed out that "the Central Bank has reassured more than once that it will continue to sell the currency and cover all needs, whether for imports or travel, and there are no concerns." link

************

Tishwash: Investment shows the importance of the Singapore Agreement.. What are its details?

The National Investment Commission confirmed, today, Sunday, that the Singapore agreement will accelerate the increase in Iraq's international classification, while clarifying regarding financing projects of local, Arab and foreign investors in Iraq.

The head of the commission, Haider Makiya, said: “The investment classification of emerging countries in 2024, conducted by FDI Intelligence, ranked Iraq fourth, indicating the confidence provided by investment in Iraq, specifically the National Investment Commission, in providing a safe legislative environment for the investor to settle in Iraq and return large capital to implement infrastructure projects and achieve sustainable development.”

He added, "The Singapore Agreement will accelerate and speed up the increase in Iraq's international rating, which is a sovereign rating for the whole world, and thus Iraq's rating will be known when it is good."

He pointed out that "all investors in the world will come without any restrictions or conditions as long as the legislative environment exists and governs their work in Iraq, and thus the process of attracting money to enter it will proceed easily and smoothly."

He pointed out that "project financing may be internal or external. If Iraq joins the international agreements, the process regarding foreign investors will be governed by the agreements. However, if the investor is local or Arab and wants to take financing, he will be subject to Iraqi laws regarding financing." link

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Article: "Prime Minister's Advisor: Iraq in the process of paying off long-term development loans to the World Bank" It looks like Iraq's financial situation is solid as they get effectively. She has so many revenue streams coming on board now it will only get better and the World Bank, the IMF, the UST, etc all know it. Hence, the view of Iraq will bring confidence to the largest Banks and Financial Entities in the world. That was broadcasted globally too.

Frank26 Question: "Do you think they're letting the dinar float into its cap before they release the new rate?" No. You have to release the rate first. Once the rate is released internationally then it can be acquired by the international community. It'll be used in banks...Once the dinar is out there officially in the international market the friction that the Iraqi dinar is going to cause in the financial market will only cause it to get bigger and bigger and bigger in its value/rate internationally. Inside Iraq it doesn't affect it - a dinar is a dinar. The rate inside does not move, only the rate outside.

*************

Iraqi Trade Bank's Progress on Debt Collection

Nader: 7-7-2024

MARKETS A LOOK AHEAD: A NEW PHASE OF HYPER-DEBT HAS ALREADY BEGUN.

Greg Mannarino: 7-7-2024

Some Thoughts On America For Her 248th Birthday

Some Thoughts On America For Her 248th Birthday

Notes From The Field by James Hickman (Simon Black Sovereign Man) July 3, 2024

When the 56 delegates to the Second Continental Congress ratified the Declaration of Independence 248 years ago tomorrow, they were creating much more than a nation. They were giving birth to an idea.

America, at its core, is an idea. And it’s one that ranks as one of the greatest innovations in the history of human civilization, right up there with the wheel, the steam engine, the printing press, and the Internet.

The idea of America wasn’t born in 1776, however. By then it had already evolved over thousands of years.

Some Thoughts On America For Her 248th Birthday

Notes From The Field by James Hickman (Simon Black Sovereign Man) July 3, 2024

When the 56 delegates to the Second Continental Congress ratified the Declaration of Independence 248 years ago tomorrow, they were creating much more than a nation. They were giving birth to an idea.

America, at its core, is an idea. And it’s one that ranks as one of the greatest innovations in the history of human civilization, right up there with the wheel, the steam engine, the printing press, and the Internet.

The idea of America wasn’t born in 1776, however. By then it had already evolved over thousands of years.

The ancient Greeks embraced individual liberty, direct democracy, and a respect for the rule of law.

The Roman republic further refined Greek democracy and developed a more professional legal code. The early Roman Empire embodied peace through strength, ushering in nearly two centuries of geopolitical stability and economic prosperity under the Pax Romana.

The later Byzantine Empire fused Greek and Roman ideas with Judeo-Christian values. And by 1000 AD, the Republic of Venice– borrowing from Rome’s republican form of government– infused an early form of capitalism to this model.

The Dutch republic of the 1600s refined the concept of a powerful, free, capitalist society even further, as did philosophers like Rousseau, Montesquieu, John Locke, and Adam Smith.

So, when the Founding Fathers wrote the Declaration of Independence (and subsequently the US Constitution), they didn’t have to start from scratch; they drew from a rich, 2,000-year intellectual heritage of the giants who came before them.