The Financial Reset Everyone’s Missing

The Financial Reset Everyone’s Missing

Miles Harris: 2-12-2026

The recent price movements in gold, silver, and broader asset markets have sparked a flurry of discussions around inflation, currency debasement, and other conventional narratives.

However, a deeper analysis reveals that these factors may not be the primary drivers of the current market dynamics. A recent video presentation by Miles Harris sheds light on the underlying structural shifts that are reshaping the financial landscape, and the insights are both fascinating and enlightening.

The Financial Reset Everyone’s Missing

Miles Harris: 2-12-2026

The recent price movements in gold, silver, and broader asset markets have sparked a flurry of discussions around inflation, currency debasement, and other conventional narratives.

However, a deeper analysis reveals that these factors may not be the primary drivers of the current market dynamics. A recent video presentation by Miles Harris sheds light on the underlying structural shifts that are reshaping the financial landscape, and the insights are both fascinating and enlightening.

Harris argues that the real driver behind the recent price movements is not inflation or currency debasement, but a fundamental settlement and collateral problem in Western financial markets.

The settlement issue refers to the system’s inability to repay debts when due, while the collateral scarcity stems from the exhaustion of traditional collateral sources like sovereign debt and housing, which are already highly leveraged or “weaponized.”

To maintain the stability of the financial system, institutions are employing various strategies to postpone settlement, including low interest rates, inflationary financial repression, and stablecoins.

Simultaneously, they are searching for new, “clean” sources of collateral to enable further borrowing.

The chosen solution is a tokenized financial reset—a balance sheet restructuring that enhances and expands collateral by creating tokenized assets tied one-to-one with physical assets, particularly gold.

Gold is central to this reset due to its scarcity as unencumbered collateral and its treatment as tier one collateral under bank regulations. As a neutral balance sheet stabilizer with no counterparty risk, gold is viewed as a premium asset.

The tokenization of gold reduces artificial derivative claims on precious metals, resulting in a repricing of these assets as “clean” collateral.

Silver’s situation is more complex due to its industrial use and derivative market distortions. However, it benefits from demand in Eastern markets, creating an east-west arbitrage dynamic.

This dichotomy highlights the nuances of the current market dynamics and the need for a deeper understanding of the underlying forces at play.

This structural reset extends beyond precious metals, impacting stock markets, housing, bonds, currencies, and corporate financing.

Financialized Western economies rely on persistent capital inflows to offset trade deficits caused by deindustrialization and offshoring, necessitating continuous asset price inflation supported by existing leverage.

Harris emphasizes that these market moves are not signs of collapse or panic but rather an orderly, quiet repricing driven by collateral scarcity and trust recalibration.

The modern financial system is increasingly collateral-driven, with conventional collateral deteriorating as it is mostly someone else’s liability.

Assets free from such claims occupy a privileged position, creating a selective repricing of trust and collateral quality. This pervasive but subtle reset supports large stocks, prime real estate, and sovereign debt while rural and less collateralized sectors suffer.

Understanding this ongoing, structural collateral-driven reset is key to navigating current and future market dynamics. As the financial landscape continues to evolve, it is essential to look beyond the conventional narratives and focus on the underlying structural shifts driving the markets.

As the financial system continues to undergo this structural reset, staying informed and adapting to the changing landscape will be crucial for investors and market participants.

By understanding the underlying drivers of the current market dynamics, you can make more informed decisions and navigate the complexities of the modern financial system.

Coffee with MarkZ, joined by Dr. Scott Young. 02/12/2026

Coffee with MarkZ, joined by Dr. Scott Young. 02/12/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, mods and Dr. Scott

Member: Long weekend coming up. Could this be our weekend for an RV?

Coffee with MarkZ, joined by Dr. Scott Young. 02/12/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, mods and Dr. Scott

Member: Long weekend coming up. Could this be our weekend for an RV?

Member: Valentines Day Saturday and Presidents Day Monday….3 day weekend.

Member: And tomorrow is Friday the 13th!!!

Member: Is the best plan still to release RV on a 3 day weekend?

MZ: I have asked them if its still the plan to go an a 3 day weekend and they said its preferable but not necessary

Member: Mark, Would you say Dubai 1 and 2 are part of the global settlements?

MZ: Yes, I would say that. It’s not where 100% of it goes…but enough to lump it there.

Member: Mark, What do you know about gold bearer bonds?

MZ: I know they are popular with Treasury buyers right now.

Hey Mark, read this do you know anything about its validity? Wed. 11 Feb. 2026 at 05:05 am EST final clearance codes for the new Quantum Financial System pulsed through the Quantum Grid.

Member: Mark do you agree there’s no way to clean up all the corrupt and Iraq will just have to move forward??

MZ: yes I do

MZ: They said Iraq would have a president today….but we don’t. the President comes first and then the Prime Minister

MZ: Constitutionally they should already have their president. They should already have their government. They keep making back room deals and putting things off. They are ignoring their own constitution and legal experts are starting to call them to the mat. It should force them to get things done.

Member: I read the IRAQ president decision postponed till Sunday….again

MZ: “Iraqi dinar speculation misplaced: CBI boss” Alaq is saying to stop speculating because we are not going to reduce the value of the dinar. They are going to continue to hold it strong. They have the reserves and they have the gold …they do not need to lower the value. They can back 140% of their currency.

MZ: Remember – these were the kind of rumors in Kuwait just before they revalued. And the same rumors in china before they revalued.

Member: Is Iraq ever gonna finish those white papers and HCL laws???

Member: Last year they said the same thing and they didn’t RV. Also, Sudani said it would happen while he was the PM and it didn’t.

Member: I KNOW it will happen eventually but we seem like we are having the same conversations about IQD that we were having a year ago

MZ: I think they are moving forward on HCL and have all the necessary components….and don’t want us to know yet. I think they are holding announcements so we can’t speculate on RV timing.

Member: Lots of rumors going around. Distractions...Keep focused.

Member: Ramadan starts at the end of the month…..hope we see the RV before then.

Member: Dr. Scott..you are a Blessing to us all..thank you for partnering with Mark..

Member: Have a safe and wonderful day everyone.

Dr. Young joins the stream today. Please listen to the replay for his information and opinions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

News, Rumors and Opinions Thursday 2-12-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Thurs. 12 Feb. 2026

Compiled Thurs. 12 Feb. 2026 12:01 am EST by Judy Byington

Wed. 11 Feb. 2026 JUST IN: U.S. DEBT CLOCK SIGNALS A HISTORIC SHIFT — THE FINANCIAL RESET IS UNDERWAY …Nesara Gesara connected

The global financial system is changing faster than most people realize. While main stream media stays quiet, the U.S. Debt Clock is (allegedly) flashing signals that point to a radical transformation: the end of the debt-based era and the rise of an entirely new economic model.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Thurs. 12 Feb. 2026

Compiled Thurs. 12 Feb. 2026 12:01 am EST by Judy Byington

Wed. 11 Feb. 2026 JUST IN: U.S. DEBT CLOCK SIGNALS A HISTORIC SHIFT — THE FINANCIAL RESET IS UNDERWAY …Nesara Gesara connected

The global financial system is changing faster than most people realize. While main stream media stays quiet, the U.S. Debt Clock is (allegedly) flashing signals that point to a radical transformation: the end of the debt-based era and the rise of an entirely new economic model.

Federal income tax and corporate tax have vanished from the clock. That alone is a shockwave. It suggests a future where the IRS, as we’ve known it, loses relevance. But the signals don’t stop there. Digital assets like Dogecoin, alongside “savings per taxpayer,” now appear—clear markers that decentralized and asset-driven systems are moving to the forefront.

This is not a minor policy tweak. This is a declaration that the old system—built on debt, fiat currency, and centralized control—is breaking down.

TRUMP AND THE ROAD TO A NEW GOLDEN AGE

For years, Donald Trump has positioned himself against central banking dominance. His strategy has pointed toward one goal: financial sovereignty for the people. Behind the scenes, policies and executive actions have been laying the foundation for a transition from a debt-driven economy to a wealth-based, decentralized structure.

The Federal Reserve and IRS are no longer untouchable institutions. Their power is being challenged as self-custody, decentralized assets, and alternative financial rails gain momentum. The era of endless money printing and manipulated fiat value is fading—and a new system is taking shape.

For decades, people were forced to work for debt instead of building real wealth. That model is now cracking.

FROM DEBT TO WEALTH: THE U.S. TREASURY DOLLAR

The shift away from the Federal Reserve Note toward a U.S. Treasury Dollar backed by real assets marks a defining moment. This signals the potential end of inflationary, debt-controlled currency and the emergence of a stable, asset-backed system.

The backbone of this new economy includes: Blockchain and distributed ledgers for transparency and security. AI and advanced computing for instant, fraud-resistant transactions. Decentralized Finance (DeFi) that removes dependence on centralized banks

The Debt Clock updates reinforce this direction. Removing income and corporate tax indicators points to a fundamental overhaul, not a temporary fix.

THE BALANCE OF POWER IS SHIFTING

For over a century, centralized institutions extracted wealth through taxation, inflation, and debt. That structure is now collapsing under its own weight. As DeFi and alternative financial platforms expand, control shifts away from unelected bureaucracies and back toward individuals.

This movement is global. Nations are distancing themselves from fiat dominance and moving toward asset-backed and decentralized systems. Those clinging to the old model risk being left behind as its value erodes.

CRYPTO, DIGITAL RESERVES, AND THE NEXT PHASE

Trump’s executive focus on cryptocurrency and U.S. digital reserves is designed to accelerate this transformation. Strategic crypto reserves, blockchain integration, and liquidity bridges between traditional finance and DeFi point to a future where the U.S. leads the next financial era.

This isn’t just reform. It’s a reset.

FINAL WORD: PREPARE FOR WHAT’S COMING

The signals are clear. The old system is dying. A decentralized, asset-backed future is rising.

This shift is about more than money—it’s about freedom, sovereignty, and control over your own value. The power balance is changing, and those who recognize it early will be positioned to thrive.

The age of economic dependency is ending. The age of financial sovereignty is beginning.

Read full post here: https://dinarchronicles.com/2026/02/12/restored-republic-via-a-gcr-update-as-of-february-12-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff The news...is suggestive the formation of the new government is going to take [Iraq] into the international world, get them onto the next stage, next phase. That's why this government formation is the most important elections they've ever had going back to 2003.

Jeff What makes the most sense right now is for them to change the rate the second half of February giving them 30 days of March to finish everything [that needs to be done] after the rate has changed so they could have the budget ready to implement...April 1st like they traditionally do.

Mnt Goat Iraq still faces a deadlock from the Nov 2025 election cycle. It is said that Kurdistan has presented their candidate for president to Parliament for confirmation this week. Also it is said that the confirmation of the prime minister candidate will also be presented this week following the seating of the new president. It is all scheduled for this week. Constitutional deadlines are at stake.

************

Trump Talks About Paying Back The Debt, Economic Enslavement Is Coming To An End

X22Report: 2-11-2026

Trump is talking about paying back the debt multiple times, he is ending the economic enslavement.

Excerpts:

We are transitioning from a Central Bank system into a people’s system. Trump is building the parallel economic system, moving all the pieces around and bringing us to a system that benefits the people.

Everything that was structured in this country was structured for the Central Bank System. Trump now is dismantling all of that. He is talking about paying off the debt and moving us out of economic enslavement. He is about to change everything.

Seeds of Wisdom RV and Economics Updates Thursday Morning 2-12-26

Good Morning Dinar Recaps,

Energy Chessboard: U.S. Moves to Revive Venezuela Oil While Countering China

Washington signals energy dominance strategy as sanctions flexibility meets geopolitical competition

Good Morning Dinar Recaps,

Energy Chessboard: U.S. Moves to Revive Venezuela Oil While Countering China

Washington signals energy dominance strategy as sanctions flexibility meets geopolitical competition

Overview

U.S. Secretary of Energy Chris Wright traveled to Venezuela in the highest-level U.S. energy-focused visit to Caracas in nearly 30 years, signaling a strategic push to revive Venezuelan oil production while challenging China’s role in the OPEC nation.

Meeting with interim President and Oil Minister Delcy Rodriguez, Wright emphasized that the United States is prepared to help expand Venezuela’s oil, natural gas, and electricity production. Venezuela currently produces approximately 1 million barrels of crude per day, a fraction of its historical output.

The visit reflects a broader U.S. strategy: reshape Western Hemisphere energy flows, counter Chinese and Russian influence, and reassert American leadership in global oil markets.

Key Developments

U.S. Push for Energy Expansion

Wright stated that Venezuela could significantly increase oil and gas production this year with proper investment and reforms. He framed the initiative as mutually beneficial — boosting Venezuelan employment and wages while strengthening energy supply security across the Western Hemisphere.

The U.S. recently issued a new general license to facilitate oil and gas exploration and production in Venezuela, expanding prior authorizations tied to exports and fuel imports.

China’s Role Under Scrutiny

While Wright acknowledged that legitimate Chinese investments are acceptable, he warned against what he described as “damaging” deal structures seen in other regions. Sanctions relief explicitly excludes companies and individuals from China, Iran, and Russia — a move Moscow criticized as discriminatory.

China has already purchased Venezuelan crude in recent months, illustrating the complex overlap of global energy interests inside Venezuela’s market.

Sanctions & Debt Restructuring Challenges

Wright clarified there is no fixed timeline for lifting all sanctions. Venezuela owes billions to foreign firms following past nationalizations, meaning debt restructuring will be essential before full capital flows resume.

Recent oil sector reforms were described as a positive step, but analysts caution they may not immediately unlock large-scale investment.

Energy Infrastructure Rebuild

The Trump administration has promoted a $100 billion reconstruction vision for Venezuela’s energy infrastructure, alongside a $2 billion oil supply agreement. Wright is also meeting with Chevron, Repsol, and visiting Petropiar in the Orinoco Belt — Venezuela’s primary oil-producing region.

Reviving production after decades of underinvestment and sanctions remains a massive operational and political challenge.

Why It Matters

This initiative intersects three major themes:

Western Hemisphere energy security

Strategic competition with China and Russia

Sanctions recalibration tied to geopolitical objectives

If successful, Venezuela could re-emerge as a meaningful supplier in global crude markets, potentially easing supply pressures and reshaping OPEC dynamics.

However, political instability, infrastructure decay, and lingering sanctions complexity pose substantial risks.

Why It Matters to Foreign Currency Holders

Energy flows directly influence:

Oil pricing and petro-currency strength

U.S. dollar demand in global commodity settlement

Latin American currency stability

OPEC production balance

An increase in Venezuelan output could soften oil prices, affecting energy-linked currencies while strengthening U.S. influence in Western Hemisphere trade settlement.

Conversely, instability or breakdown in reforms could tighten supply expectations and elevate volatility.

Implications for the Global Reset

Pillar 1: Energy Dominance & Supply Chain Reconfiguration

Reintegrating Venezuela into U.S.-aligned energy networks would reduce reliance on adversarial suppliers and strengthen dollar-based commodity flows.

Pillar 2: Geopolitical Currency Competition

Limiting Chinese and Russian participation in Venezuela’s energy sector signals broader strategic positioning in the battle for influence over commodity-backed economies.

Energy remains one of the primary levers in global financial restructuring.

This is not just about oil production — it is about who controls supply, settlement channels, and regional influence.

All information compiled from publicly available diplomatic, energy, and financial reporting.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

• Modern Diplomacy – US Pushes Venezuela Oil Revival as It Challenges China’s Role

• Reuters – U.S. Energy Secretary Visits Venezuela to Boost Oil Ties

• U.S. Department of Energy – Official Statements and Press Releases

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Thursday Morning 2-11-26

Iraq ranks second top importer of Jordanian goods in January

2026-02-12 Shafaq News- Baghdad/ Amman Iraq ranked second among the top importers of goods certified by the Amman Chamber of Commerce in January, with imports valued at 47 million Jordanian dinars (around $33 million), according to data released on Thursday.

The chamber said it issued 2,279 certificates of origin during the first month of the year, up 2.7% from 2,219 certificates in January last year. The total value of certificates of origin rose 32.2% to approximately 155 million dinars, compared with 116 million dinars in the same period a year earlier.

Iraq ranks second top importer of Jordanian goods in January

2026-02-12 Shafaq News- Baghdad/ Amman Iraq ranked second among the top importers of goods certified by the Amman Chamber of Commerce in January, with imports valued at 47 million Jordanian dinars (around $33 million), according to data released on Thursday.

The chamber said it issued 2,279 certificates of origin during the first month of the year, up 2.7% from 2,219 certificates in January last year. The total value of certificates of origin rose 32.2% to approximately 155 million dinars, compared with 116 million dinars in the same period a year earlier.

Switzerland topped the list of countries by value of certificates issued, with 52 million dinars through eight certificates. Iraq ranked second, followed by Saudi Arabia, Syria, and Egypt.

Separate data from the chamber showed that Jordan’s exports to Iraq rose 4.5% in 2025 to 1.016 billion dinars ($1.43 billion), compared with 972 million dinars ($1.37 billion) the previous year.

https://www.shafaq.com/en/Economy/Iraq-ranks-second-top-importer-of-Jordanian-goods-in-January

Global oil demand to rise 850 kb/d in 2026

2026-02-12 Shafaq News- London Global oil demand is forecast to grow by 850,000 barrels per day (kb/d) in 2026, up from 770 kb/d last year, with non-OECD economies accounting for the entire increase, the International Energy Agency (IEA) said in a new report.

According to IEA data, world oil supply fell sharply by 1.2 million barrels per day (mb/d) in January to 106.6 mb/d, as severe winter weather disrupted operations in North America, while outages and export constraints reduced flows from Kazakhstan, Russia, and Venezuela. After expanding by nearly 3.1 mb/d in 2025, global oil output is projected to rise by 2.4 mb/d in 2026 to reach 108.6 mb/d, with growth expected to be evenly split between OPEC+ producers and non-OPEC+ countries.

Global refinery crude throughputs declined from a record 86.3 mb/d in December to 85.7 mb/d in January, reflecting seasonal maintenance and weaker refining margins. For 2026, crude runs are forecast to increase by an average of 790 kb/d to 84.6 mb/d, led by non-OECD regions, compared with a rise of nearly 1 mb/d in 2025. Refining margins fell further in January as stronger December runs eased tightness in product markets.

Earlier today, oil prices edged higher, with Brent crude rising 27 cents to $69.67 a barrel and US West Texas Intermediate gaining 29 cents to $64.92, as escalating US-Iran tensions fueled concerns that potential attacks on Tehran or regional shipping routes could disrupt supply. https://www.shafaq.com/en/Economy/Global-oil-demand-to-rise-850-kb-d-in-2026

Iraq’s Imports From Brazil Exceed $1.4B In 2025

2026-02-12 Shafaq News- Baghdad Iraq’s imports from Brazil reached $1.49 billion in 2025, marking a 21.3% decline compared with 2024, according to data from the United Nations International Trade Statistics Database (COMTRADE).

The figures place Iraq as Brazil’s third-largest Arab trading partner during the year, after the United Arab Emirates and Saudi Arabia.

According to COMTRADE, sugar and related products ranked as the largest imported category at $374 million, followed by meat at $324 million. Oil seeds, vegetable oils, and related products totaled $263 million, while live animal imports reached $171 million. Grain imports amounted to $167 million, in addition to iron products, metal goods, and other commodities.

Data from Brazil’s Ministry of Development, Industry, Trade, and Services, compiled by the Market Intelligence department of the Arab-Brazilian Chamber of Commerce (ABCC), also showed that Iraqi imports from Brazil stood at $1.490 billion in 2025, down from $1.900 billion in 2024, but higher than the $1.300 billion recorded in 2023.

https://www.shafaq.com/en/Economy/Iraq-s-Imports-from-Brazil-exceed-1-4B-in-2025

Iraq Leads Importers Of Iranian Agricultural And Food Products

2026-02-12 Shafaq News- Baghdad/ Tehran Iraq ranked as the largest importer of Iranian agricultural and food products during the first nine months of the current Iranian year, which ends in March 2026, according to Iran’s National Center for Strategic Studies of Agriculture and Water, affiliated with the Iran Chamber of Commerce.

The report showed that Iraq accounted for 39% of Iran’s total agricultural commodity exports during the period, while its share of Iranian food industry exports reached 50%.

Key exports to Iraq included dairy products, vegetables such as tomatoes and cucumbers, fruits including apples and watermelons, as well as dates.

Most agricultural shipments to Iraq originated from Iran’s western and southwestern provinces, particularly Khuzestan, Kermanshah, and Ilam, which border Iraq and serve as key trade corridors.

After Iraq, the United Arab Emirates ranked second, accounting for 21% of Iran’s agricultural exports. Russia followed with 10%, Pakistan with 5%, and Afghanistan with 4%. Other destinations included Oman, Turkiye, Turkmenistan, India, and Qatar, each holding shares ranging between 2% and 3%.

Data from the Islamic Republic of Iran Customs Administration (IRICA) showed that Iraq also remained the top destination for Iranian agricultural and food exports in 2024, purchasing between $1.4 billion and $1.7 billion worth of goods during the first nine to eleven months of the year. The figure represented nearly one-third of Iran’s total exports in this category. https://www.shafaq.com/en/Economy/Iraq-leads-importers-of-Iranian-agricultural-and-food-products

Dollar Rise In Iraq's Baghdad And Erbil Markets

2026-02-12 Shafaq News- Baghdad/ Erbil The US dollar opened Thursday’s trading higher in Iraq, gaining 500 dinars in Baghdad compared with Wednesday’s rates.

According to a Shafaq News market survey, the dollar traded in Baghdad’s Al-Kifah and Al-Harithiya exchanges at 150,600 dinars per 100 dollars, up from 150,100 dinars.

In the Iraqi capital, exchange shops sold the dollar at 151,000 dinars and bought it at 150,000 dinars.

In Erbil, selling prices stood at 150,250 dinars per 100 dollars and buying prices at 150,150 dinars.

https://www.shafaq.com/en/Economy/Dollar-rise-in-Iraq-s-Baghdad-and-Erbil-markets

Precious Metals Retreat As Dollar Firms And Yields Reprice

2026-02-12 Shafaq News Gold prices dipped on Thursday as the U.S. dollar firmed after stronger-than-expected January jobs data dented expectation for near-term interest rate cuts, while investors awaited inflation data due on Friday for more monetary policy cues.

Spot gold edged 0.3% lower to $5,063.11 per ounce by 0453 GMT. It closed Wednesday with a more than 1% gain.

U.S. gold futures for April delivery lost 0.3% to $5,083.90 per ounce.

"The stronger jobs report leading to a slight pare back in Fed rate-cut expectations may have played a role in gold's lacklustre move," said Christopher Wong, a strategist at OCBC.

The U.S. dollar index (.DXY) rose following the surprisingly strong employment report that suggested underlying U.S. economic health. A stronger dollar makes greenback-priced metals more expensive for other currency holders.

"Sensitivity to the dollar, yield repricing, and uncertainty around Fed policy should continue to pose two-way risks for gold in the interim," Wong said.

U.S. job growth unexpectedly accelerated in January and the unemployment rate fell to 4.3%, though the largest increase in payrolls in 13 months likely exaggerates the labour market's health, as revisions showed the economy added only 181,000 jobs in 2025 instead of the previously estimated 584,000.

The U.S. budget deficit will grow slightly in fiscal 2026 to $1.853 trillion, the Congressional Budget Office forecast on Wednesday, showing that on balance, President Donald Trump's economic policies are worsening the country's fiscal picture amid low economic growth.

The Federal Reserve will keep rates unchanged through Chair Jerome Powell's term ending in May but cut immediately afterward in June, a Reuters poll showed, with economists warning that policy under his likely successor, Kevin Warsh, could become too loose.

Investors now await the weekly jobless claims report on Thursday and inflation data on Friday for more cues on the Fed's monetary policy path.

Spot silver fell 0.8% to $83.32 per ounce, after a 4% climb on Wednesday.

Spot platinum shed 0.8% to $2,113.79 per ounce, while palladium rose 0.9% to $1,715.30.

(Reuters) https://www.shafaq.com/en/Economy/Precious-metals-retreat-as-dollar-firms-and-yields-reprice

“Tidbits From TNT” Thursday Morning 2-12-2026

TNT:

Tishwash: The Cabinet directs the reduction of official working hours during Ramadan.

The General Secretariat of the Council of Ministers issued a directive today, Thursday, to reduce official working hours during the holy month of Ramadan .

The General Secretariat stated in a statement received by Al-Sa’a Network that “it has been decided to reduce official working hours by one hour in ministries and entities not affiliated with a ministry, and all governorates during the holy month of Ramadan .”

She explained that "the directive included authorizing the concerned authorities to determine this at the beginning or end of official working hours ."

TNT:

Tishwash: The Cabinet directs the reduction of official working hours during Ramadan.

The General Secretariat of the Council of Ministers issued a directive today, Thursday, to reduce official working hours during the holy month of Ramadan .

The General Secretariat stated in a statement received by Al-Sa’a Network that “it has been decided to reduce official working hours by one hour in ministries and entities not affiliated with a ministry, and all governorates during the holy month of Ramadan .”

She explained that "the directive included authorizing the concerned authorities to determine this at the beginning or end of official working hours ."

The statement continued, “The directive is based on paragraph four of Cabinet Resolution No. 128 of 2025, which includes the recommendations of the committee concerned with providing the appropriate legal recommendation regarding the adoption of the timings for the start and end of official working hours in government institutions link

Tishwash: Details of the meeting between Maliki and Sudani

Prime Minister Mohammed Shia al-Sudani met on Wednesday (February 11, 2026) with Nouri Kamel al-Maliki, head of the State of Law Coalition, to discuss the overall general situation and the course of dialogues between political forces regarding the upcoming constitutional entitlements.

The Prime Minister's Media Office said in a statement received by "Baghdad Today" that "the meeting witnessed a review of the understandings and dialogues between the national forces, and the efforts made to reach a political agreement that completes the selection of the President of the Republic in the House of Representatives, and proceeds with the rest of the constitutional entitlements."

The statement added that “Al-Sudani and Al-Maliki discussed the positions of the political blocs on the current course, in addition to emphasizing the government’s continued work to meet the requirements of services and development, and to strengthen the national economy in light of the current political circumstances.” link

*****************

Tishwash: Iraq has ‘huge plan’ to transform banking sector, says CBI governor

Ali al-Alaq told The New Region that citizens must not "rush to the market" amid a rise in unofficial dollar prices, insisting that the Central Bank is maintaining foreign reserves "at a very good level."

ERBIL, Kurdistan Region of Iraq – Central Bank of Iraq (CBI) Governor Ali al-Alaq told The New Region on Wednesday that Baghdad has a "huge plan" to change the banking sector in the next few years, reassuring the Iraqi population that the value of the Iraqi dinar compared to the US dollar is under control.

Alaq urged the Iraqi people to "calm down" and not to "rush to the market," amid a recent soaring rise in unofficial dollar prices, going from around 1,420 dinars per $1 in the black market to 1,570, before settling around 1,500. In comparison, the CBI has set the value at 1,300 dinars per $1.

The fluctuations have created uncertainty and unrest in the Iraqi market, with several videos circulating on social media showing people rushing to currency exchange centers across the country. In response to a question by The New Region regarding a potential problem with the Iraqi dinar's value, Alaq asserted, "not at all."

"We have foreign reserves at a very good level," Alaq said, reassuring that "we are not in a position that we cannot respond to these demands on the American dollars" as Baghdad has purchased large quantities of gold.

The interview came during the launch event of the Kurdistan Regional Government's (KRG) e-Psule initiative, a platform that will allow users to pay their utility bills electronically through several wallets and banks that have participated in the program.

Alaq praised the KRG's initiative, saying, "It won't change everything, but it will change something for sure."

"Especially, like, when you offer new tools for people, new technology, easy to use and you will save money, you will save time, ... I think you will attract more and more people," the CBI governor said, lauding Kurdistan Region Prime Minister Masrour Barzani's "vision" and "will" toward a cashless economy for the Region.

Speaking to Iraq's broader strides toward a better banking sector, Alaq said that Baghdad and Erbil are in "close coordination," adding that "the plan we have, really, it's a huge plan. It will change the whole sector."

"We expect that in two or three years we will see a totally different sector," he stressed. "I think one of the biggest plans within the country in general. So, we are very optimistic about the plan."

In late September, CBI announced a plan to end cash payments in government institutions by July 2026, as part of a nationwide shift to electronic payments.

“Iraq will completely eliminate cash transactions in state institutions and other facilities by July of next year,” Dhurgham Musa, director of supervision over non-banking financial institutions at CBI, told the state newspaper in September.

The plan is being carried out under the direct supervision of Prime Minister Mohammed Shia’ al-Sudani and other government ministries, according to Musa, adding that trillions of dinars have already been paid electronically and the interior ministry has completely halted the use of cash. ink

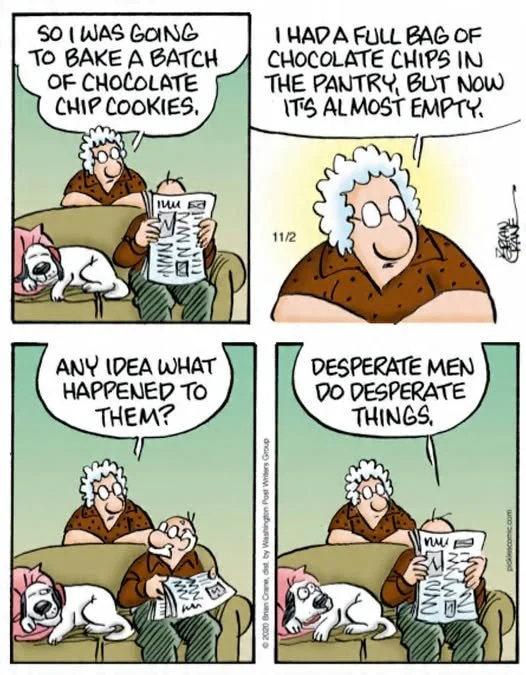

Mot: . Who Makes the bestest Valentines????

Mot: Desperate Men

MilitiaMan and Crew: IQD News Update-Iraq-Exchange Rate-Digital Dinar not Denied

MilitiaMan and Crew: IQD News Update-Iraq-Exchange Rate-Digital Dinar not Denied

2-11-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Iraq-Exchange Rate-Digital Dinar not Denied

2-11-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Wednesday Evening 2-11-26

Seeds of Wisdom RV and Economics Updates Wednesday Evening 2-11-26

Good Evening Dinar Recaps,

High-Stakes Summit: Netanyahu Pushes Trump to Broaden Iran Deal

White House talks could reshape nuclear diplomacy and Middle East security dynamics

Seeds of Wisdom RV and Economics Updates Wednesday Evening 2-11-26

Good Evening Dinar Recaps,

High-Stakes Summit: Netanyahu Pushes Trump to Broaden Iran Deal

White House talks could reshape nuclear diplomacy and Middle East security dynamics

Overview

U.S. President Donald Trump will host Israeli Prime Minister Benjamin Netanyahu at the White House on Wednesday, with Iran expected to dominate discussions amid renewed nuclear negotiations and heightened regional tensions.

This marks Netanyahu’s seventh visit with Trump since the president returned to office nearly 13 months ago — underscoring strong coordination, but also revealing potential policy divergences over the scope of U.S.–Iran diplomacy and the future of Gaza.

At the center of the meeting: whether negotiations with Tehran remain limited to nuclear restrictions or expand to address Iran’s missile program and regional proxy network.

Key Developments

Israel Seeks Expanded Negotiation Framework

Netanyahu is expected to press Trump to widen ongoing nuclear discussions to include Iran’s ballistic missile capabilities and its support for groups such as Hamas and Hezbollah. Israeli officials fear a narrow nuclear deal could leave Iran’s broader regional influence intact.

Iran, however, has stated negotiations remain confined to nuclear matters and has ruled out restrictions on its missile program.

Diplomacy Paired With Military Signaling

Trump has reiterated that any agreement must guarantee Iran has “no nuclear weapons,” and has hinted at tougher measures if negotiations fail. Reports indicate the U.S. may deploy a second aircraft carrier strike group to the region, reinforcing deterrence amid ongoing talks.

The United States previously supported Israeli strikes on Iranian nuclear facilities during a 12-day conflict last June, significantly damaging Iran’s air defenses. Israeli officials believe Tehran is now attempting to rebuild key capabilities.

Gaza Ceasefire & Regional Stability

Gaza is also expected to feature prominently in discussions. Trump has advanced a 20-point ceasefire and reconstruction framework aimed at ending the war and stabilizing the enclave. Progress remains stalled over issues such as phased Israeli withdrawal and Hamas disarmament.

Differences may also surface over Palestinian statehood. Trump has signaled openness to a broader peace framework, while Netanyahu maintains long-standing opposition to Palestinian statehood and annexation debates continue to spark international concern.

Strategic Balance in Flux

Iran’s regional influence has been weakened by Israeli military operations and setbacks across Gaza, Lebanon, Yemen, Iraq, and Syria. However, Israeli leadership remains wary of Tehran’s capacity to regroup.

For Washington, the challenge is balancing diplomatic engagement with credible deterrence. For Jerusalem, the objective is ensuring U.S. negotiations address what it views as the full spectrum of Iranian threats.

Why It Matters

This meeting could determine:

Whether U.S.–Iran talks remain nuclear-focused or expand strategically

The degree of U.S.–Israel policy alignment going forward

The trajectory of Middle East stability in 2026

The balance between diplomacy and military deterrence

Markets and global energy stakeholders are closely watching developments, as escalation risks in the region can directly affect oil prices, trade routes, and investor sentiment.

Why It Matters to Foreign Currency Holders

Geopolitical shifts of this scale influence:

Energy market volatility

Safe-haven currency flows (USD, gold)

Defense sector and regional infrastructure investments

Broader risk sentiment across emerging markets

Any escalation or breakdown in negotiations could trigger rapid capital movement into traditional safe assets.

Conversely, a structured agreement could stabilize regional risk premiums and reduce volatility in energy-linked currencies.

Implications for the Global Reset

Pillar 1: Energy & Security Realignment

Middle East stability directly impacts global energy pricing and reserve currency demand. A durable agreement could lower geopolitical premiums embedded in oil markets.

Pillar 2: Strategic Alliance Calibration

The outcome will test whether long-standing U.S.–Israel alignment remains unified amid shifting diplomatic strategies and evolving global power balances.

This is not just diplomacy — it is a recalibration of security architecture in a region central to global finance and energy stability.

All information compiled from publicly available diplomatic and international media reporting.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Ripple Expands UAE Footprint, Linking RLUSD with Dirham Stablecoin AEDZ

Cross-border settlement infrastructure deepens as stablecoins evolve into regulated financial rails

Overview

Ripple has expanded its partnership with UAE-based Zand Bank to strengthen stablecoin infrastructure in the Middle East. The collaboration connects Ripple’s U.S. dollar-pegged stablecoin, RLUSD, with Zand Bank’s dirham-backed stablecoin, AEDZ.

The move advances custody services, cross-border settlement efficiency, liquidity bridges between stablecoins, and potential issuance of AEDZ on the XRP Ledger. This signals a broader transformation: stablecoins are evolving from trading tools into regulated financial infrastructure.

Key Developments

1. RLUSD and AEDZ Liquidity Bridge

Ripple and Zand Bank plan to establish direct liquidity connectivity between RLUSD (USD-pegged) and AEDZ (AED-pegged). This would:

Improve cross-currency settlement efficiency

Reduce reliance on traditional correspondent banking

Enable faster institutional payment flows

Strengthen regional digital asset interoperability

By linking two regulated stablecoins, the partnership builds a programmable FX corridor between the U.S. dollar and UAE dirham.

2. Regulatory-Compliant Custody Integration

Zand Bank will support RLUSD within a compliant digital-asset custody framework. The UAE has positioned itself as a forward-leaning jurisdiction for digital finance, and both Abu Dhabi and Dubai regulators have approved structured usage of RLUSD under licensing guidelines.

This signals increasing regulatory normalization of stablecoins within traditional banking environments.

3. AEDZ Potential Issuance on XRP Ledger

The partnership includes discussions around issuing AEDZ directly on the XRP Ledger. If executed, this would:

Expand the XRP Ledger’s role in sovereign-linked token issuance

Enhance settlement speed and cost efficiency

Create programmable liquidity channels between fiat-backed digital assets

This development further integrates public blockchain rails into regulated banking ecosystems.

4. Stablecoins Expanding Beyond Trading

The collaboration illustrates a structural shift: stablecoins are no longer limited to crypto exchange liquidity. They are becoming tools for:

Corporate treasury management

Cross-border settlement

Tokenized asset infrastructure

Regulated payment corridors

The Middle East is emerging as a testing ground for these integrations.

Why It Matters

The UAE continues positioning itself as a digital finance hub bridging East and West. Ripple’s deeper integration with Zand Bank demonstrates:

Stablecoin infrastructure moving into formal banking channels

Regional currencies gaining programmable settlement capabilities

Increased interoperability between dollar-pegged and local-currency digital assets

This reduces friction in global payments and potentially bypasses legacy systems like SWIFT for certain transaction corridors.

Why It Matters to Foreign Currency Holders

For currency holders observing global monetary restructuring:

Dirham-backed stablecoin infrastructure strengthens regional currency digitization

Direct USD-AED digital bridges could influence settlement patterns

Stablecoin liquidity corridors may alter future reserve usage dynamics

Tokenized finance reduces settlement delays and counterparty exposure

Digital rails are increasingly layered on top of sovereign currencies rather than replacing them.

Implications for the Global Reset

Pillar 1: Digitized Fiat Infrastructure

The partnership reflects a broader shift toward fiat-backed stablecoins operating within regulatory frameworks. Rather than decentralized monetary replacement, the trend is regulated digitization of sovereign currencies.

Pillar 2: Regional Settlement Realignment

By enabling programmable liquidity bridges between USD and AED stablecoins, this move supports a multipolar settlement environment. Financial hubs like the UAE are becoming strategic intermediaries in global payment restructuring.

This is not speculative crypto expansion — it is the institutional wiring of digital currency infrastructure.

This is not just a partnership — it’s the building of programmable currency corridors within the evolving global financial system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Yuan Breakout: China Curbs U.S. Treasuries as BRICS Currency Hits 2023 High

Beijing’s reserve strategy shift fuels dollar weakness and global diversification momentum

Overview

The Chinese yuan has surged to its strongest level against the U.S. dollar since May 2023, trading around 6.91 per dollar, following reports that Chinese regulators urged domestic banks to curb purchases of U.S. Treasuries.

The move is being interpreted as part of a broader strategic reserve diversification effort—one that is reinforcing BRICS currency positioning while amplifying pressure on the U.S. dollar.

China currently holds $682.6 billion in U.S. government debt (as of November 2025), ranking as the third-largest foreign holder behind Japan and the United Kingdom. However, signals from Beijing suggest a recalibration of exposure to U.S. sovereign debt markets.

The yuan is now on track for its seventh consecutive monthly gain, its longest streak since 2020–2021, and has appreciated roughly 5% since the start of 2025.

Key Developments

Chinese Regulators Signal Treasury Reduction

Bloomberg reported that Chinese officials advised banks to limit additional U.S. Treasury purchases, though the directive does not apply to existing state holdings. Analysts view this as a measured but strategic shift in reserve allocation policy ahead of recent high-level U.S.–China discussions.

Yuan Strength Fuels Broader Dollar Selling

Market strategists say yuan appreciation is contributing to broader U.S. dollar weakness. Chris Weston of Pepperstone noted that the People’s Bank of China (PBOC) appears more tolerant of a stronger yuan, creating tailwinds for pro-cyclical currencies and China-linked markets.

Inflation & Rate Concerns Surface in U.S.

Economist Peter Schiff warned that if China slows Treasury buying, the Federal Reserve may need to absorb more issuance—potentially increasing inflationary pressures. Senator Elizabeth Warren similarly cautioned that reduced foreign demand for Treasuries could translate into higher U.S. borrowing costs for mortgages and auto loans.

Global Reserve Diversification Accelerates

China’s move aligns with a broader pattern. Danish pension fund AkademikerPension reportedly plans to reduce U.S. Treasury exposure due to fiscal sustainability concerns. Meanwhile, foreign ownership of U.S. debt has fallen from nearly 40% in 2010 to roughly 15% today. The Federal Reserve has also reduced its balance sheet by approximately $1.5 trillion since May 2022.

Why It Matters

The yuan’s breakout is not merely a currency fluctuation — it reflects:

Strategic reserve realignment

Growing skepticism about long-term U.S. fiscal sustainability

Increasing global appetite for diversification away from dollar assets

If major holders gradually reduce Treasury exposure while the Fed continues balance sheet contraction, liquidity and yield volatility could intensify.

The shift also reinforces China’s ambition to position the yuan as a stronger player in cross-border trade settlement within the BRICS framework.

Why It Matters to Foreign Currency Holders

For those watching global monetary realignment:

A stronger yuan strengthens the case for multi-polar reserve structures

Reduced Treasury demand pressures U.S. rates higher

Sustained dollar weakness supports commodity-linked and emerging market currencies

BRICS trade settlement diversification gains credibility

This is not sudden de-dollarization — it is strategic, incremental repositioning.

Implications for the Global Reset

Pillar 1: Reserve Diversification Accelerates

Central banks and institutional funds are gradually reassessing sovereign credit exposure. The decline in foreign-held U.S. debt suggests structural—not cyclical—adjustments.

Pillar 2: Currency Power Rebalancing

The yuan’s strength, combined with BRICS payment system development, signals a shift toward a more distributed global currency architecture.

This is not just FX volatility — it is long-term reserve recalibration unfolding in real time.

All information compiled from publicly available financial reporting and institutional data.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

• Watcher Guru – BRICS: Yuan Hits 2023 High vs Dollar After China Limits US Bonds

• Bloomberg – China Urges Banks to Curb Treasury Purchases

• U.S. Treasury TIC Data – Major Foreign Holders of Treasury Securities

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

23-Year-Old Inherited $450K, Parked It And Doesn't Know What To Do Next

23-Year-Old Inherited $450K, Parked It And Doesn't Know What To Do Next

What Dave Ramsey says will get the 'most lift'

Emma Caplan-Fisher Moneywise Updated Tue, February 10, 2026

When 23-year-old Jackson from New York called into The Ramsey Show, he wasn’t asking how to spend his inheritance. He was asking what not to do with it. A few months earlier, he and his brothers had sold their parents’ home, leaving him with about $450,000. He had no debt, had just graduated from college, earned about $75,000 a year and was renting with his brother while planning a future move from Long Island to New York City.

Yet instead of feeling empowered, he felt stuck.

23-Year-Old Inherited $450K, Parked It And Doesn't Know What To Do Next

What Dave Ramsey says will get the 'most lift'

Emma Caplan-Fisher Moneywise Updated Tue, February 10, 2026

When 23-year-old Jackson from New York called into The Ramsey Show, he wasn’t asking how to spend his inheritance. He was asking what not to do with it. A few months earlier, he and his brothers had sold their parents’ home, leaving him with about $450,000. He had no debt, had just graduated from college, earned about $75,000 a year and was renting with his brother while planning a future move from Long Island to New York City.

Yet instead of feeling empowered, he felt stuck.

“I’m just wondering what to do with it,” Jackson told the cohosts (1). “I have all of that money … just sitting in a CD right now.”

It’s a familiar reaction. Sudden wealth — especially at a young age — can create decision paralysis.

Large inheritances at a young age are both rare and risky. Without experience managing six-figure sums, many people either spend recklessly or worry about making the “wrong” move, resulting in no move at all.

How freezing can quietly cost you

Parking the money in a certificate of deposit allowed Jackson to avoid impulsive purchases, and was something host Dave Ramsey praised as preventing him from doing "something stupid with it." He even said Jackson was “wise beyond his years” for not spending it.

But Ramsey also warned that letting the money sit too long comes with its own price. Freezing can be just as damaging as rushing, especially when inflation and missed investment years are at play.

Inflation erodes purchasing power, and time — especially starting in your early 20s — is one of the most powerful drivers of long-term wealth.

Ramsey pointed out that if the inheritance were invested at long-term market rates, “it would double in about seven years.” He contrasted that with the low yield of a CD, saying the money “should have made five times as much” over recent years if invested instead.

This matters because young adults don’t just have money working for them; they have time working for them. According to the latest Federal Reserve data, the median net worth of Americans under 35 is just $39,000, compared with more than $364,000 for those aged 55 to 64 (2).

So, a $450,000 inheritance at 23 is a massive head start, but only if it can grow.

Not house money, not spending money

One temptation Ramsey shut down quickly was using the inheritance to buy property in New York City. Even with $450,000, the math doesn’t work, “450 will not buy anything in the city,” he said. “Not paid for.”

Without the income to comfortably support a mortgage, Ramsey argued, tying the inheritance up in real estate would add pressure rather than freedom. The same logic applies to lifestyle upgrades or helping others too aggressively, too soon.

To Continue and Read More: https://www.yahoo.com/finance/news/23-old-inherited-450k-parked-110000785.html

The Global Dollar Reserve Currency Era Just Ended

The Global Dollar Reserve Currency Era Just Ended

Arcadia Economics: 2-11-2026

The global economy is undergoing a significant transformation, with far-reaching implications for the world’s financial systems, trade dynamics, and precious metals markets.

In a recent discussion, Vince Lanci highlighted the eroding status of the US dollar as the global reserve currency, a trend that is gaining momentum and has profound consequences for the global economy.

The Global Dollar Reserve Currency Era Just Ended

Arcadia Economics: 2-11-2026

The global economy is undergoing a significant transformation, with far-reaching implications for the world’s financial systems, trade dynamics, and precious metals markets.

In a recent discussion, Vince Lanci highlighted the eroding status of the US dollar as the global reserve currency, a trend that is gaining momentum and has profound consequences for the global economy.

The acknowledgment by Marco Rubio that the US dollar is losing its dominance as the global reserve currency marks a significant shift in the global economic landscape.

The recent trade agreement between Brazil and China, where they opted to transact in their own currencies rather than the dollar, exemplifies this trend.

As regional reserve currencies begin to replace the dollar’s singular dominance, the US’s ability to enforce sanctions and maintain economic control globally is being undermined.

This multipolar global economy is characterized by a decline in the dollar’s influence, and the emergence of new regional reserve currencies. As a result, countries are seeking alternatives to the dollar for international transactions, reducing their dependence on the US currency.

This development has significant implications for the global economy, as it challenges the US’s long-standing economic hegemony.

The discussion also shed light on the precious metals market, particularly gold and silver. A crucial distinction was made between monetary and nonmonetary gold.

While all gold is inherently monetary, only gold in specific forms and purity is classified as monetary gold. In contrast, gold used in jewelry or industrial applications is termed nonmonetary gold.

Interestingly, the US’s export of nonmonetary gold often results in foreign countries converting it into monetary gold, effectively transferring US economic gold to foreign monetary gold reserves.

The increasing gold purchases by Tether, a stablecoin issuer, suggest strategic positioning in response to global financial uncertainties. Tether’s accumulation of gold beyond its immediate needs signals a growing recognition of the metal’s importance as a safe-haven asset.

This development is particularly noteworthy, given the ongoing economic and geopolitical tensions that are driving investors towards precious metals.

The conversation also touched on recent market movements in precious metals and commodities, noting normal price behaviors and speculating on potential near-term trends in silver and gold prices.

As the global economy continues to evolve, the demand for precious metals is likely to increase, driven by investors seeking safe-haven assets and countries looking to diversify their reserves.

In an interview with Jim McDonald of Kuene Silver, the company’s significant silver reserves and potential leverage to future silver price increases were highlighted. As mining companies like Kuene Silver play an increasingly important role in the precious metals market, their ability to capitalize on fluctuating metal prices will be closely watched.

In conclusion, the shifting global economic landscape is having a profound impact on the precious metals market, particularly gold and silver.

As the US dollar’s dominance as the global reserve currency continues to erode, countries and investors are turning to alternative assets, including precious metals.

The implications of this trend are far-reaching, and will likely continue to shape the global economy and precious metals markets in the years to come.

FRANK26…..2-11-26…..BANK STORIES

KTFA

Wednesday Night Video #2

FRANK26…..2-11-26…..BANK STORIES

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Wednesday Night Video #2

FRANK26…..2-11-26…..BANK STORIES

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#