Why the BRICS Just Launched their Gold-backed Unit

Why the BRICS Just Launched their Gold-backed Unit

Arcadia Economics: 12-5-2025

The financial world is buzzing with a development that could mark a seismic shift in international trade and monetary policy: the BRICS nations – Brazil, Russia, India, China, and South Africa – have officially launched a new gold-backed digital unit of account, aptly named the “unit.”

This isn’t just another digital token; it’s a meticulously crafted system with the potential to redefine global economic relations.

Why the BRICS Just Launched their Gold-backed Unit

Arcadia Economics: 12-5-2025

The financial world is buzzing with a development that could mark a seismic shift in international trade and monetary policy: the BRICS nations – Brazil, Russia, India, China, and South Africa – have officially launched a new gold-backed digital unit of account, aptly named the “unit.”

This isn’t just another digital token; it’s a meticulously crafted system with the potential to redefine global economic relations.

Launched on October 31st in a controlled trial phase, the “unit” operates on blockchain technology, seamlessly integrating with existing national currencies.

What sets it apart is its innovative backing structure: 40% gold and 60% major BRICS currencies. Crucially, there are no bonds or long-term debt involved.

This is a bold departure from the fiat currency systems that have dominated global finance for decades, and it echoes an idea first proposed at the influential 1944 Bretton Woods Summit – an idea that was ultimately sidelined in favor of U.S. dollar dominance and the International Monetary Fund’s Special Drawing Rights (SDR) system.

This move signals the establishment of a new monetary zone, a bridge between East and West, with gold poised to become the central “password” or reserve asset for transactions.

The “unit” is currently undergoing a “pumpkin batch” phase – a controlled environment allowing real transactions and daily data publication.

This staged rollout highlights a growing divergence between Western and Eastern financial spheres, suggesting that future trade with BRICS nations may increasingly necessitate holding gold and key BRICS currencies in reserve baskets.

This ambitious financial undertaking unfolds against a backdrop of significant market activity. We’re witnessing rising yields, fluctuating commodity prices for gold, silver, copper, and energy products, and a palpable metal supply squeeze, particularly in industrial powerhouse China.

The metal market, in fact, is exhibiting unusual behavior, with indications of a rolling shortage and backwardation in silver – a clear sign of stress in the physical availability of these crucial commodities.

Looking ahead, we can anticipate deeper dives into these market dynamics, including JP Morgan’s 2026 outlook for base and precious metals.

The evolving financial ecosystem will also necessitate a closer examination of cryptocurrencies actively engaged in payment rails, such as Ripple and Cardano, which are likely to play an increasingly important role.

The launch of the BRICS “unit” is undoubtedly a development to watch closely. It represents a potential paradigm shift, challenging established financial norms and paving the way for a more multipolar monetary landscape.

Weekend Coffee with MarkZ. 12/06/2025

Weekend Coffee with MarkZ. 12/06/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

GOOD MORNING AND HAPPY SATURDAY EVERYONE! CBD GURUS MATT AND LUCAS KICK OFF THE FIRST 45 MINS AND MARK GIVES THE NEWS UPDATE AT 10:30 AM

Member: Good Saturday Morning to all.

Member: Are we there yet?

Weekend Coffee with MarkZ. 12/06/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

GOOD MORNING AND HAPPY SATURDAY EVERYONE! CBD GURUS MATT AND LUCAS KICK OFF THE FIRST 45 MINS AND MARK GIVES THE NEWS UPDATE AT 10:30 AM

Member: Good Saturday Morning to all.

Member: Are we there yet?

Mod: Remember to ask Matt to share the “Limo Story” again

Matt: This was 1995. I used to be a limo driver. I had my own company and there was about 10 of us who worked downtown in Minneapolis. I was by a Hyatt hotel one morning and a doorman told me he has a ride for me (This was just at the start of cell phones)

Matt: I asked the gentleman where was his luggage? He told me he didn’t have anything…just himself.….I asked if he wanted to sit up front and talk on the way….He said that would be great….and he sat in the front seat. At that day and age chatting sometimes made for bigger tips.

Matt: I asked what he was doing here in town….He said he was here for just a couple days meeting with Wells Fargo and the Federal Reserve…he also mentioned meeting a couple big shots that used to work in Minneapolis-Stock Broker outfits ect…..

Matt: I then found out he worked for the Federal Government and was working with financial people. He said there was going to be a “switch over” probably around 2023. He was talking about empires….you know like there used to be a Roman empire, a British Empire…stuff like that. He said the US Empire is ending.

Matt: He said all the financial institutions are getting ready for it. He said they had been working on this since the 1950’s. I asked him who was going to be in charge in the future….He told me it was going to be the East. I was thinking Japan and china ect…..Now I think he was talking about the BRICS.

Matt: Now we know its India. Russia, China, Vietnam, Brazil, South Africa, Indonesia ect……I asked if this was going to bad…..He said No, It’s just going to be different.

Matt: I asked if 2023 was set is stone…..he said that’s what they were shooting for.

Matt: the bottom line is -He told me there was going to be a financial switch over probably around 2023 …The US would no longer be the policeman of the world and it would be more of a shared thing. I didn’t know what he was talking about then…I know what he was talking about now. Looks like things are coming to a head now.

Member: Sounds like Global Currency Reset to me.

Member: Crazy that this has been in the works for 40 years. Thanks Matt for sharing with us.

MZ: Normally a monetary system last about 100 years. And they started planning on a “switchover “ about 50 years ago. That makes sense

MZ: Still very quiet on the bond side…but it will be very interesting next week as we start getting updates and hopefully find out if they got what was expected…Very upbeat bond contacts expect liquidity in the next few days.

Member: If they signed NDA’s….they will not tell you if they got paid….I do not blame them a bit. .

MZ: Some interesting things coming out of Iraq.

MZ: A new foreign policy …a massive change in direction of the United States and how they are going to deal with the middle east and the world. I believe it fits with what we believe Nesara/Gesara is going to look like.

MZ: “Trump Re-engineering the Middle East and drops Iraq’s card” A 29 page document shows Trump’s policy is driven above all, on what is good for America.

MZ: “ Baghdad Today: Publishes Trump’s middle east strategy-official document” so this strategy is changing in the middle east…and all over the world.

MZ: “Trumps new National Security Strategy-Key Takeaways” Basically we (the US) is done trying to engineer countries, trying to change them. He says they are what they are and we need to stop trying to change them. Its up to them and part of them being sovereign.

MZ: But the United States will protect our own and keep our own culture what it is and protect our own borders. And start better vetting to only let people in who embrace our own society and what we have created. Trump says we are not isolationists …but we will no longer be “interventionists” .

MZ: This is a massive change in direction from the globalist policies of the past. He believes he will concentrate on “America First” and other countries should focus on their own citizens as well.

MZ: Trump is hoping Iraq will be a rudder in middle east policy and help others in the region. We are going to get our return on our investment in Iraq and then stop monkeying in the middle east. In the future we are going to just let them do their own thing.

Member: Just like going down in a plane you put your mask on first before you go help others. Can’t help others if you don’t help yourself first

MZ: That is a very good example

MZ: In the future Trump will treat foreign relations as a “business” and quit trying to change them.

MZ: About BRICS…there are a number of stories out today,…..”New BRICS group launches gold backed Unit payment system.” 40% gold and 60% BRICS currency basket. The Unit will allow 30+ countries to trade metals outside the federal reserve SWIFT system.

MZ: This is “Asset Backed” money. This to me is the final straw that forces the reset. This is the Free Market forcing the new financial system. It may be a bit unsettled while this plays out- but any big changes can cause some upheaval. I am excited about the thought of us having de-centralized money.

Member: This is huge: BRICS will force the reset…..

Member: Mark, some are saying tier 4 B the (internet group)are getting to go to appointments .

MZ: Nobody is going to any appointments…yet. Those people are pre-mature.

Member: Wish we could see the checklist of all that still needs to be done …..and what has already been done.

Member: Wishing everyone a wonderful weekend. Stay safe and stay warm

Mod: HAVE A GREAT WEEKEND.. SEE YA MONDAY!!!!

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED WEEKEND! SEE YOU ALL MONDAY MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Saturday 12-6-2025

Paul Gold Eagle: Aurora-QFS Protocol was Activated (Opinion/Rumor)

12-6-2025

Paul White Gold Eagle @PaulGoldEagle

On 12.12.2025 at 03:33 UTC, while the world was asleep, the AURORA-QFS protocol was activated — a silent operation that redirected the global gold channels away from the old banking grid and merged them into the new quantum layer.

From that moment on, the financial system we once knew began collapsing without a sound, and the algorithm of the future descended only upon those who know how to listen.

Paul Gold Eagle: Aurora-QFS Protocol was Activated (Opinion/Rumor)

12-6-2025

Paul White Gold Eagle @PaulGoldEagle

On 12.12.2025 at 03:33 UTC, while the world was asleep, the AURORA-QFS protocol was activated — a silent operation that redirected the global gold channels away from the old banking grid and merged them into the new quantum layer.

From that moment on, the financial system we once knew began collapsing without a sound, and the algorithm of the future descended only upon those who know how to listen.

Inside the closed networks, the cube that appeared — the same one you see here — is the first key, the central node already rewriting the codes of XRP, Bitcoin, Litecoin, and three additional assets scheduled for revelation on 21.12.2025, the date marked as THE SOLAR THRESHOLD.

According to documents never meant to surface, this is when the first global migration will occur — from the old debt matrix into the architecture of quantum liquidity.

Nothing will be announced publicly, nothing will be officially confirmed, yet the signal is already circulating: old-world servers are losing pulse, while those aligned with QFS feel the rising pull of the golden stream.

This is not a prediction, not speculation — this is the phase that was delayed for years… and has finally begun.

Whoever is here already senses the shift.

Whoever remains will see the truth first.

Silence is no longer silence.

Silence is the code.

And the code speaks clearly now: QFS IS ACTIVE.

Source(s): https://x.com/PaulGoldEagle/status/1997246361553842337

https://dinarchronicles.com/2025/12/06/paul-gold-eagle-aurora-qfs-protocol-was-activated/

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Delete the 3 zeros still being talked about. Lower denomination banknotes have been printed and are stored. That's in the news I have. Old and new notes will circulate for 6 to 12 months when introduced...Is that plenty of time to do an exchange? Of course it is. Is that in country or not? Doesn't say. We'll see how that turns out. But there's no forced exchange and no loss of purchasing power. So that tells you the story. There's no lop. Same purchasing power. It's going to be good.

Frank26 [Iraq boots-on-the-ground report] OMAR: Today we saw on television talk about the different types of floats...and they talked about a managed one...Then Alaq...said the parallel market is now around 1320 which is less than 1% from the official rate. They said 1310 would be good until January 1, 2026. Alaq also said the time for both currencies will coexist for 6 to 12 months... FRANK: Shut the front door! And the back door! After all that nonsense and lies? ..If he says 1310 is only good until December 31, 2025, what are you going to use on January 1, 2026? ...It's not a secret anymore...This is the Asraflak...

Possible Black Swans Circle | Dr. Mark Thornton

Liberty and Finance: 12-5-2025

Dr. Mark Thornton warns that the economy is primed for contagion because years of Federal Reserve intervention have created fragile leverage points across markets, especially in opaque areas like private equity and commercial real estate.

He argues that despite mainstream caution, small investors remain complacent and heavily exposed, with margin debt and speculative leveraged products still near extremes.

Thornton links the surge in precious metals, especially silver’s explosive move above $50, to rising global uncertainty, inflation fears, and new institutional demand that is transforming the physical market.

He emphasizes that shortages of wholesale silver bars and refinery bottlenecks are reshaping premiums and creating unusual opportunities in constitutional silver as refiners refuse to process it.

Throughout the interview he encourages viewers to understand the principles behind free markets and sound money, highlighting his new book Hayek for the 21st Century as a tool for teaching why government intervention repeatedly destabilizes economies.

INTERVIEW TIMELINE:

0:00 Intro

1:31 Financial contagion

13:15 Silver surge

19:00 Junk silver

Seeds of Wisdom RV and Economics Updates Saturday Morning 12-06-25

Good Morning Dinar Recaps,

U.S. Reverses Visa Denials as Iran Rejoins 2026 World Cup Draw

Washington clears key Iranian officials after temporary boycott threat

Overview

Iran reverses its boycott and confirms participation in Friday’s 2026 FIFA World Cup draw in Washington, D.C.

The U.S. grants new visas to Iranian officials after initial denials sparked diplomatic tension.

The dispute stemmed from June travel restrictions affecting nationals from nearly 20 countries.

Human rights groups warn that fans from restricted nations may still face unequal treatment.

Good Morning Dinar Recaps,

U.S. Reverses Visa Denials as Iran Rejoins 2026 World Cup Draw

Washington clears key Iranian officials after temporary boycott threat

Overview

Iran reverses its boycott and confirms participation in Friday’s 2026 FIFA World Cup draw in Washington, D.C.

The U.S. grants new visas to Iranian officials after initial denials sparked diplomatic tension.

The dispute stemmed from June travel restrictions affecting nationals from nearly 20 countries.

Human rights groups warn that fans from restricted nations may still face unequal treatment.

Key Developments

Iran’s delegation initially announced it would skip the draw after three visa applications—including federation president Mehdi Taj’s—were rejected under U.S. travel rules.

By Thursday the situation shifted, with Iranian Sports Minister Ahmad Donyamali confirming that key officials received approvals and would attend.

Head coach Amir Ghalenoei and FFIRI international-relations chief Omid Jamali are expected to participate after last-minute clearance from U.S. authorities.

U.S. policy currently restricts travel from 19 countries, but includes exemptions for World Cup athletes, coaches, and support personnel. The partial denials underscored confusion and inconsistency in applying these rules.

Fans remain the most vulnerable, as even FIFA’s new priority-access system (the FIFA Pass) cannot guarantee visa approval for supporters traveling from restricted nations.

Human rights organizations warn that enforcement practices could lead to discrimination or mistreatment during the North American tournament cycle.

Why It Matters

The episode highlights how geopolitical tensions and visa restrictions directly influence global sporting events. With the U.S., Canada, and Mexico preparing to host the 2026 World Cup, questions about fairness, security, and accessibility for teams and fans have become central to ensuring the tournament remains internationally representative.

Implications for the Global Reset

Pillar: Trade (Mobility and Access in Cross-Border Events)

Visa and mobility restrictions shape how nations interact, even in areas like sports, reflecting broader shifts toward bloc-based access and differentiated treatment between countries.

Pillar: Technology (Digital Identity & Clearance Systems)

Systems like the FIFA Pass hint at emerging digital access frameworks that may become standard as countries tighten entry controls and require enhanced verification for international events.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Trump Lifts Iran Visa Ban for 2026 World Cup Draw”

Associated Press – “Iran Confirms Participation After U.S. Approves Key Visas”

~~~~~~~~~~

BRICS Gold Pact Expands to 33 Nations as Russia Leads New Metals Exchange

Bloc accelerates commodity-backed settlement systems to bypass Western pricing control

Overview

BRICS gold pact now spans 33 countries, advancing a unified precious-metals trading infrastructure.

Russia pushes for a BRICS metals exchange to establish independent pricing mechanisms.

China’s Shanghai Gold Exchange International anchors the settlement architecture.

BRICS members leverage nearly 6,000 tonnes of gold to accelerate de-dollarization.

Key Developments

Russia is spearheading efforts to create a BRICS metals exchange, enabling gold, platinum, and rare-earth trading outside Western-controlled platforms. Russian Finance Minister Anton Siluanov said the exchange would ensure “fair and equitable competition based on exchange principles.”

The gold settlement mechanism operates through China’s Shanghai Gold Exchange International, which has been building the structural backbone for years. The system was piloted in 2017 when Russia accepted yuan for oil with blockchain-verified guarantees convertible to gold.

Sergey Lavrov clarified that BRICS is not attempting to “replace the dollar,” but instead expand settlements in national currencies supported by physical assets.

BRICS gold reserves now total roughly 6,000 tonnes, representing about 20% of global central-bank holdings. Russia leads with 2,335.85 tonnes, followed closely by China with 2,298.53 tonnes.

The pact’s infrastructure includes vault networks in Saudi Arabia, Singapore, and Malaysia, allowing partners to store, pledge, and securitize gold for credit lines.

Officials project the system will be fully operational by 2030, with Foreign Minister Sergey Ryabkov emphasizing that participation remains voluntary and rooted in physical gold as the basis of trust.

Why It Matters

The BRICS metals initiative challenges decades of Western dominance over commodity pricing and settlement. By shifting trade away from dollar-based systems and toward gold-anchored instruments, the bloc is reinforcing an emerging multipolar financial structure built on collateral, not credit.

Implications for the Global Reset

Pillar: Assets (Return to Physical Collateral)

Gold-backed settlement systems reflect a structural move away from fiat leverage and toward hard-asset collateral as the foundation of international trade.

Pillar: Trade (Parallel Commodity Markets)

A BRICS metals exchange introduces alternative pricing power and reduces reliance on Western institutions such as SWIFT and the London Metal Exchange.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Gold Pact Hits 33 Countries With Russia Leading Metal Exchange Push”

Reuters – “Russia, BRICS Nations Advance Plans for Cross-Border Metals Trading”

~~~~~~~~~~

China Expands Currency Swap Network as Trade Realigns in Multipolar Shift

PBOC–Macao upgrade signals deepening bloc-based trade systems and yuan-anchored settlement

Overview

PBOC increases China–Macao currency swap line from 30B to 50B yuan to support offshore yuan liquidity.

Agreement becomes a long-term standing facility to reinforce bilateral and regional trade stability.

China’s November exports are projected to rebound, reflecting renewed trade flows amid tariff resets.

Trade networks continue shifting away from Western-centric settlement systems.

Key Developments

The People’s Bank of China upgraded its swap agreement with the Monetary Authority of Macao, expanding available liquidity to support yuan-based settlement.

The larger swap line creates a structural tool for stabilizing cross-border trade, especially in regions adopting yuan for invoicing and clearing.

Early export data suggests China may have rebounded in November, despite ongoing tariff negotiations and geopolitical frictions.

Analysts view the move as another step toward regional financial integration, strengthening Asia’s internal settlement architecture and reducing dependency on U.S. dollar funding.

Why It Matters

Trade systems are fragmenting into regional blocs. Expanding yuan-swap networks signals China’s intention to build a parallel settlement system resilient to Western financial leverage—an essential layer of the global reset’s trade realignment.

Implications for the Global Reset

Pillar: Trade (Bloc-Based Settlement Infrastructure)

China continues constructing a yuan-anchored trade ecosystem, enabling partners to transact outside dollar-based platforms.

Pillar: Technology (New Clearing Mechanisms)

Swap lines lay the groundwork for future digital or blockchain-based yuan settlement networks as global payment rails bifurcate.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Saturday Morning 12-6-25

Samir Al-Nassiri: The Banking Reform Plan Is Being Implemented Successfully According To Its Timetable

Banks Economy News – Baghdad Banking consultant and expert Samir Al-Nassiri confirmed that the Central Bank, Oliver Wyman, and other banks are continuing to implement the standards of the banking reform plan in partnership and daily coordination, according to the plan's timeline, which was launched on April 7, 2025.

The Central Bank published the project implementation mechanisms and the banks signed an agreement to comply with the plan. Preparations are now underway to launch the first evaluation cycle during the first quarter of 2026.

Samir Al-Nassiri: The Banking Reform Plan Is Being Implemented Successfully According To Its Timetable

Banks Economy News – Baghdad Banking consultant and expert Samir Al-Nassiri confirmed that the Central Bank, Oliver Wyman, and other banks are continuing to implement the standards of the banking reform plan in partnership and daily coordination, according to the plan's timeline, which was launched on April 7, 2025.

The Central Bank published the project implementation mechanisms and the banks signed an agreement to comply with the plan. Preparations are now underway to launch the first evaluation cycle during the first quarter of 2026.

The procedures and efforts undertaken by the Central Bank of Iraq, in cooperation and consultation with the consulting firm and private banks, have resulted in tangible steps during the current quarter in facilitating the implementation of the objectives, programs, mechanisms and standards of the comprehensive banking reform project, within the framework of implementing the Central Bank’s third strategy.

He explained that the main objective of this project is to build a sound, modern, comprehensive and flexible banking sector that contributes to achieving rapid growth in the national economy, a cumulative increase in GDP, and enhancing the market value of the banking sector.

Al-Nassiri pointed out that economic reform begins with banking reform, explaining that the challenges facing the Iraqi economy simultaneously present significant opportunities to reform and develop the banking and financial sector, in line with the government's program and the Central Bank's future vision.

He added that the banking sector will play a pivotal role in achieving sustainable development and attracting investments, as well as supporting ongoing efforts to activate non-oil productive sectors with the aim of diversifying national income sources and ensuring financial sustainability and balanced economic growth.

Al-Nassiri explained that the role of the Central Bank is also embodied in regulating the financing of foreign trade and implementing infrastructure projects related to comprehensive digital transformation, in addition to expanding the use of electronic payment tools in a way that enhances the achievement of financial inclusion.

He stressed that these efforts will contribute to providing real opportunities for reforming, developing and empowering the private banking sector during the period 2025–2028, through a set of key objectives, most notably:

* Developing the Iraqi banking system to keep pace with internationally approved banking and accounting standards.

* Building a sound, modern, comprehensive and flexible banking sector capable of adapting to economic changes.

* To enhance citizens' confidence in the local banking sector and achieve international recognition of its transparency, progress, and commitment to international standards, thereby strengthening the confidence of global correspondent banks in dealing with it.

* Rehabilitating restricted or weakly active banks to enable them to return to the banking market with their full internal and external activities.

* Refocusing the role of banks on their core function of financing and lending for development, while promoting financial inclusion and increasing its rate in accordance with the established plans.

* To promote the transition from a cash economy to a digital economy by attracting funds circulating outside the banking system, which represent about 90% of the money supply, and bringing them into the formal banking cycle.

Al-Nassiri explained that although the period specified for their implementation according to the banking reform project and the Central Bank’s strategy extends to three years, what was achieved during the years 2023, 2024 and 2025 is considered an important achievement, as solid foundations and rules were built that formed the main pillar for the desired reform path.

He added that these achievements will contribute to the process of evaluating and classifying Iraqi banks based on the extent to which they achieve the goals set within the banking reform project, in accordance with the approved international standards and criteria. https://economy-news.net/content.php?id=63036

ASYCUDA… The System That Will Turn The Balance Of Trade In Iraq Around: From Worn-Out Paper To A Smart State

Economy News – Baghdad Lawyer Noor Jawad Al-Dulaimi

Trade in a country the size of Iraq can no longer continue on worn-out paperwork and files that pass from hand to hand, nor through isolated local programs whose data fate is unknown. In a world where technology drives the economy, not the other way around, the need arose for a modern system, like the electronic arteries that pump life into the body of the state.

This is where the ASYCUDA system emerged as one of the most significant technological transformations Iraq has witnessed in decades—a transformation that will not only change customs clearance methods but will also reshape the landscape of trade, the economy, and the law.

Prior to 2022, most Iraqi customs operations were managed manually, with the exception of some basic local programs for accounting, declarations, and human resources. These systems were disconnected from one another; each operated in isolation, lacking integration and the ability to prevent manipulation or comprehensively monitor the movement of goods.

However, the Iraqi government's decision to proceed with automating the customs system in cooperation with UNCTAD (the United Nations Conference on Trade and Development) represented a major turning point, especially since customs automation is the backbone of any modern administration and the key to border control and revenue collection.

The ASYCUDA project spans three phases over approximately 84 months. It begins with the deployment of state-of-the-art IT systems for customs clearance and monitoring, then moves to automating control processes and risk analysis, culminating in the establishment of a single trade window that enables all stakeholders to submit data and receive approvals through a unified electronic platform. This model is implemented in most advanced economies worldwide because it minimizes human intervention and ensures tight control over data and customs duties.

Economically, ASYCUDA represents a significant leap in revenue because it closes loopholes that previously allowed public funds to be siphoned off through corruption, manipulation of commodity values, or the illegal importation of goods. Comprehensive electronic clearance means that every shipment passing through Iraq will be subject to the same standardized procedures, and fees will be calculated according to fixed criteria, not based on the whims of an employee or personal interpretation.

This has already resulted in a 60% decrease in smuggling since the partial implementation of the system.

Legally, the ASYCUDA system is a true embodiment of transparency and accountability, providing regulatory bodies with tamper-proof digital evidence and linking every step to a traceable electronic signature. It also aligns with Iraq's obligations under international trade facilitation agreements and creates a favorable legal environment for attracting foreign companies that consistently seek clear procedures free from regulatory chaos.

Because the system links all government agencies, from customs to taxes to the Ministry of Trade to banks, building a single window will shorten clearance time from weeks to days or hours, and provide a competitive environment that combats monopolies and gives companies greater confidence to enter the Iraqi market.

ASYCUDA is not just a technical program; it is a state project, and an indicator of Iraq’s transition from an economy based on personal relationships to an economy based on strict digital rules, and from a paper-based administration to a data-based administration.

When all its phases are fully implemented, we will see stronger customs, a more stable business environment, higher revenues, and less porous borders. It is the long-delayed digital future… but it is finally starting to move. https://economy-news.net/content.php?id=63039

Gold Prices Fall As Stock Markets Rise, Ahead Of The US Federal Reserve Meeting.

Thursday, December 4, 2025, 4:59 PM | Economy Number of views: 282 Baghdad/ NINA /Gold prices fell on Thursday as gains in Asian and European stock markets weighed on safe-haven demand, while investors awaited next week's Federal Reserve meeting for clues on the path of interest rates.

Spot gold fell 0.2 percent to $4,199.06 an ounce. U.S. gold futures for February delivery also declined 0.1 percent to $4,229 an ounce.

Among other precious metals, platinum fell 1.8 percent to $1,641.95, and palladium dropped 1.8 percent to $1,434. /End https://ninanews.com/Website/News/Details?key=1265203

Brent Crude Surpasses $63 Mark... Oil Prices Continue To Rise

Economy | 05:34 - 04/12/2025 Mawazin News - Follow-up: Oil prices in global markets rose significantly on Thursday amid concerns about supply disruptions due to escalating geopolitical tensions.

According to trading data, Brent crude futures climbed to $63.07 per barrel.

West Texas Intermediate (WTI) crude futures also rose, trading at $59.39 per barrel.

This increase is driven by continued concerns about global energy supplies following reports of attacks on oil infrastructure in Russia, as well as the stalled peace talks, which have heightened market anxiety about the stability of oil flows. https://www.mawazin.net/Details.aspx?jimare=271164

Dollar Prices Rise In Baghdad As The Weekly Stock Exchange Nears Its Closing.

Economy | 06:55 - 04/12/2025 Mawazin News – Baghdad: The Baghdad and Erbil markets witnessed a rise in the dollar exchange rate as the stock exchanges neared their closing at the end of the week.

The dollar reached 142,750 Iraqi dinars per 100 US dollars in the Al-Kifah and Al-Harithiya exchanges, compared to 142,600 dinars this morning.

In Baghdad's currency exchange offices, the selling price was 143,750 dinars per 100 US dollars, while the buying price was 141,750 dinars per 100 US dollars. https://www.mawazin.net/Details.aspx?jimare=271168

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

MilitiaMan and Crew: IQD News Update-Digital Dinar "Under Implementation" CBI

MilitiaMan and Crew: IQD News Update-Digital Dinar "Under Implementation" CBI

12-5-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Digital Dinar "Under Implementation" CBI

12-5-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26….12-5-25…..MORE ALAQ SPEECH

KTFA

Friday Night Video

FRANK26….12-5-25…..MORE ALAQ SPEECH

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Friday Night Video

FRANK26….12-5-25…..MORE ALAQ SPEECH

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Trump may End Income Taxes, Next Economic Revolution

Trump may End Income Taxes, Next Economic Revolution

David Lin: 12-5-2025

The architect of modern supply-side economics, Dr. Arthur Laffer, is rarely shy about proposing bold solutions.

In a recent in-depth conversation with David Lin, Laffer didn’t just discuss tweaks to the current economy; he laid out a case for a transformative shift in U.S. fiscal policy—one that could see the elimination of the income tax.

Trump may End Income Taxes, Next Economic Revolution

David Lin: 12-5-2025

The architect of modern supply-side economics, Dr. Arthur Laffer, is rarely shy about proposing bold solutions.

In a recent in-depth conversation with David Lin, Laffer didn’t just discuss tweaks to the current economy; he laid out a case for a transformative shift in U.S. fiscal policy—one that could see the elimination of the income tax.

The discussion, rich with economic theory and hard-hitting policy critiques, offers essential viewing for anyone concerned with inflation, growth, and the future role of government. We dive into the key takeaways from Dr. Laffer’s powerful analysis.

Dr. Laffer’s most striking proposal addresses the income tax. He suggests that due to the increase in tariff revenues—a form of consumption tax on imports—the U.S. government may soon be able to fund its operations without relying on the taxation of income.

According to Laffer, the long-term goal should be to drastically cut income taxation, potentially eradicating it entirely.

This is not just a theoretical exercise; it’s a strategic move to boost productivity and incentivize work, investment, and production—the cornerstones of the supply-side philosophy.

Laffer forcefully argues against the common misconception that affordability is achieved through government subsidies or redistribution programs. Instead, he grounds affordability firmly in supply-side dynamics.

“Affordability hinges on only one thing: production,” Dr. Laffer states. “The more goods and services produced, the cheaper and more accessible they become.”

High taxes and overly generous redistribution policies, he warns, fundamentally reduce total economic output because they disincentivize both the producer (who faces lower returns on their work) and, often, the recipient (who faces high marginal tax rates on entering the workforce).

For Laffer, the pathway to real wage growth and a higher standard of living is clear: cut taxes and reduce regulation to unleash productivity.

Dr. Laffer reserved strong criticism for Modern Monetary Theory (MMT) and high-tax, redistribution-focused economic models. He contends that while proponents of MMT and large social spending programs claim to be helping the poor, the policies actually reduce the total economic pie available for everyone.

The core economic reality, as Laffer sees it, is that incentives matter more than intent. When government attempts to redistribute wealth, it is essentially reducing the reward for creating that wealth. This applies across the board:

High Taxes: They punish success and discourage investment in productive enterprises.

Subsidies/Welfare: They can create disincentives for employment, trapping individuals in low-productivity cycles.

In short, redistributing income always reduces total economic production—a harsh but necessary truth for policymakers to grasp.

Laffer provided compelling real-world examples to support his supply-side principles, focusing on the stark contrast between two major states:

Florida’s Pro-Growth Model: Dr. Laffer praised Governor Ron DeSantis and Florida’s commitment to low taxes and minimal regulation. This approach attracts high-income earners and businesses, creating a dynamic environment that boosts output and opportunity.

New York’s Cautionary Tale: Conversely, he warned that New York’s heavy taxation and ambitious subsidized housing plans will stifle economic growth. High taxes actively encourage productive wealth—the tax base itself—to flee, threatening the state’s fiscal stability and accelerating economic decline.

On the international stage, Laffer pointed to Britain’s current economic struggles, noting that the UK’s high tax burden is choking potential economic growth. His advice is universal: significant tax reductions are an absolute necessity to stimulate national output and vitality.

Dr. Laffer is decidedly optimistic about the economic future, but that optimism is tethered to technological advancement. He forecasts that innovations like Artificial Intelligence (AI) and blockchain technology will dramatically increase productivity across various sectors.

These technologies are massive supply-side catalysts, offering unprecedented levels of efficiency and output. For an economist focused on maximizing production, AI and blockchain represent the next great wave of growth, capable of delivering real increases in wealth and living standards, provided government policy doesn’t stifle them with overregulation or punitive taxation.

Dr. Laffer’s conversation served as a powerful reminder that economic prosperity is not achieved by managing scarcity or redistributing existing wealth, but by increasing production.

His intellectual journey, which famously began with exploration into economic thought (including early influences from Marxism) before settling on supply-side principles, underscores his belief that true growth comes from fostering environments where businesses and individuals are rewarded for their productivity.

The policies that reduce taxes, cut regulations, and prioritize a high-output economy are the ones that create jobs, increase real wages, and truly make goods and services affordable for all.

For Dr. Laffer’s complete analysis on tariffs, U.S. fiscal policy direction, his personal journey, and more detailed critiques of modern economic theories, watch the full interview with David Lin.

Seeds of Wisdom RV and Economics Updates Friday Afternoon 12-05-25

Good Afternoon Dinar Recaps,

RBI Injects Liquidity and Cuts Rates as India Moves to Stabilize Markets

India deploys coordinated monetary tools to support banks, bonds, and financial stability.

Overview

RBI cuts the repo rate by 25 bps, bringing it down to 5.25% to counter tightening financial conditions.

Over $16 billion in liquidity enters the system through bond purchases and FX swap operations.

Bond markets gain immediate relief as the central bank absorbs supply and anchors yields.

Banks receive critical liquidity support, reinforcing short-term funding stability across the sector.

Good Afternoon Dinar Recaps,

RBI Injects Liquidity and Cuts Rates as India Moves to Stabilize Markets

India deploys coordinated monetary tools to support banks, bonds, and financial stability.

Overview

RBI cuts the repo rate by 25 bps, bringing it down to 5.25% to counter tightening financial conditions.

Over $16 billion in liquidity enters the system through bond purchases and FX swap operations.

Bond markets gain immediate relief as the central bank absorbs supply and anchors yields.

Banks receive critical liquidity support, reinforcing short-term funding stability across the sector.

Key Developments

Open-market bond purchases:

The RBI announced ₹1 trillion (approximately $11.1 billion) in government-bond purchases to stabilize market volatility and ease borrowing conditions. These purchases directly support India’s bond market, which has faced pressures from rising global yields and weaker capital flows.Dollar-rupee FX swap injection:

A $5 billion, three-year FX swap adds longer-term dollar liquidity while helping manage currency pressures. This increases foreign-exchange reserves and strengthens the rupee during a period of global dollar strength.Strategic rate cut:

With domestic demand slowing and credit conditions tightening, the repo rate was lowered by 25 basis points to offset financial strain and support banks’ liquidity positions.Broader policy context:

India’s financial system has been dealing with higher borrowing costs, declining foreign portfolio inflows, and pressure on bank balance-sheet liquidity. The combined tools deployed by the RBI show a proactive shift toward ensuring funding stability ahead of anticipated global monetary easing in 2026.

Why It Matters

The move signals that the RBI is preparing India for a period of heightened global volatility, tightening dollar liquidity, and rising refinancing needs. By injecting cash, lowering rates, and simultaneously securing FX liquidity, India is insulating its financial sector from global pressures that could otherwise strain local banks and government borrowing.

Implications for the Global Reset

Pillar: Debt & Sovereign Stability

Lower yields and fresh liquidity reduce refinancing stress, supporting India’s sovereign-debt stability as global rates remain elevated.

Pillar: Banking & Payments Infrastructure

Banking-sector liquidity support strengthens domestic payment systems and credit flows—critical as nations brace for post-dollar financial realignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “India’s RBI announces debt purchases, FX swap to boost banking system liquidity”

Business Standard – “RBI cuts repo rate, announces liquidity measures to support market stability”

~~~~~~~~~~

China’s Debt Warnings Intensify as Economists Split Over Stimulus Strategy

Beijing faces rising fiscal risks as experts debate whether higher debt or insufficient stimulus poses the greater threat.

Overview

A leading Chinese economist warns that heavy stimulus risks creating unsustainable debt.

China’s 2025 deficit ratio target hits a record 4%, raising concerns about long-term fiscal stability.

Conflicting expert opinions reflect a deep divide over how China should respond to slowing growth.

Global markets are watching closely, with Fitch projecting rising deficits and higher debt levels ahead.

Key Developments

Top economist warns of structural risks:

Liu Xiaoshu, chief economist at the Bank of Qingdao, cautioned that repeated reliance on fiscal and monetary stimulus creates long-term vulnerabilities—especially as interest payments begin to crowd out social and public spending. He warned of a “vicious cycle” that erodes investor confidence and may trigger a debt crisis if underlying issues remain unresolved.Examples highlight global parallels:

Liu cited Japan and southern Europe as cautionary cases where stimulus and deficit spending failed to correct structural weaknesses, leaving nations with massive debt burdens and prolonged stagnation.Deficit supporters push back:

Other economists, including East China Normal University’s Lian Ping, argue that China’s central government balance sheet remains strong. Lian maintains that the higher deficit ratio does not pose significant risk, emphasizing China’s comparatively low central-government debt-to-GDP ratio.Fiscal pressures rising despite optimism:

Fitch Ratings now expects China’s total government deficit to rise to 8.4% of GDP in 2025, up from 6.5% in 2024. Yet Fitch simultaneously upgraded its 2025 growth forecast to 4.7%, citing stimulus measures and export strength—even as Beijing targets about 5% growth.

Why It Matters

China’s evolving debt debate reveals the core tension in global economic policy today: whether short-term stimulus can still support growth without triggering long-term instability. As China remains central to global supply chains, financial markets, and commodity demand, increasing fiscal strain could reshape global investment patterns and intensify pressure across emerging markets.

Implications for the Global Reset

Pillar: Sovereign Debt & Fiscal Stability

Rising deficits and long-term structural strains highlight the vulnerability of debt-heavy economies during the transition toward a new global financial architecture.

Pillar: Monetary Policy & Market Liquidity

China’s policy choices influence global liquidity, trade financing, and regional economic alignments—adding weight to shifts in currency strategy and reserve diversification across Asia.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Chinese Economist Issues Dire Warning Over Debt Crisis”

Reuters – “China deficit to rise in 2025 as fiscal pressures mount, economists warn”

~~~~~~~~~~

BRICS De-Dollarization Splinters as India and China Pursue Conflicting Paths

India rejects a BRICS currency as China advances yuan internationalization independently

Overview

• India firmly rejects any BRICS common currency proposals

• China accelerates independent renminbi internationalization efforts

• Russia and China deepen bilateral national-currency settlement frameworks

• BRICS bloc remains divided on de-dollarization strategy

Key Developments

India Rejects Common Currency Plans

India continues to oppose proposals for a BRICS currency, emphasizing that the U.S. dollar remains essential to its economic stability and trade priorities. Foreign Minister S. Jaishankar reaffirmed that India has never supported de-dollarization and sees no active proposal for a shared BRICS currency. India’s position hardened further following U.S. tariff threats, reinforcing its reliance on Washington—its largest trading partner with $128 billion in annual trade.

The rupee’s depreciation from 73 per dollar in 2020 to 85 has elevated exchange-rate risks, making aggressive de-dollarization impractical. India’s development goals—including digital infrastructure, advanced manufacturing, and clean energy—remain deeply tied to Western capital markets.

Russia and China Pursue Different Paths

Russia also stepped back from the idea of a common BRICS currency. President Vladimir Putin stated in late 2024 that although experts discuss it, the bloc has no plans for a single currency at this stage and Russia does not seek to abandon the dollar.

The July 2025 BRICS summit produced a lengthy declaration with no mention of de-dollarization, confirming stalled momentum. Shifting political calculations and fears of sanctions have pushed BRICS members away from earlier ambitions of challenging dollar dominance.

China’s Renminbi Internationalization Moves Ahead Independently

China is expanding the international use of the renminbi outside BRICS frameworks through major financial infrastructure upgrades. PBOC Governor Pan Gongsheng warned that risks tied to the dominant reserve currency could spill across borders, calling for diversified settlement systems.

CIPS now includes 184 direct participants across 167 countries, demonstrating broadening RMB adoption. China’s $768 billion trade surplus and the holding of renminbi reserves by at least 80 central banks—totaling roughly $274 billion—underscore its ongoing global monetary influence.

Despite stalled BRICS initiatives, China’s independent trajectory continues to advance through strategic partnerships and technology-driven payment systems.

Limited Progress on Local Currency Trade Across BRICS

Local-currency settlement remains confined to bilateral arrangements rather than systemic BRICS-wide mechanisms. Russia and Iran now conduct over 95% of their trade in rubles and rials. India’s 156 Special Vostro Accounts with 30 countries offer modest alternatives but fall short of a cohesive de-dollarization strategy.

South Africa warned in 2025 that BRICS must avoid provoking the U.S. by pushing de-dollarization too aggressively. Brazil removed the common BRICS currency from its 2025 presidency agenda following U.S. tariff threats, signaling the bloc’s retreat from earlier ambitions.

Why It Matters

BRICS monetary fragmentation highlights the limits of collective de-dollarization. India prioritizes U.S. trade stability, Russia avoids provoking financial disruption, and China pursues independent renminbi expansion. The bloc’s diverging interests make a unified challenge to the U.S. dollar unlikely in the near term, reinforcing the dollar’s resilience while shifting influence to bilateral currency corridors.

Implications for the Global Reset

Pillar 1: Trade & Supply Chain Realignment

Fragmented currency strategies are pushing BRICS nations toward bilateral settlement systems rather than unified multilateral structures, reshaping regional trade flows and payment mechanisms.

Pillar 2: Monetary Diversification & Reserve Strategy

China’s independent renminbi expansion contributes to a more multipolar currency environment, even as India and other BRICS members maintain reliance on U.S. financial systems for stability and growth.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru – “BRICS De-Dollarization: India and China Shape a New Trade Bloc”

South China Morning Post – “India Rejects BRICS Currency Plans Amid Fears of U.S. Trade Fallout”

Brave New Coin – “Russia and China Diverge on BRICS Currency Ambitions”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The 13 Travel Scams Every American Tourist Falls For

The 13 Travel Scams Every American Tourist Falls For (Don’t Be Next)

Vasilija Mrakovic Tue, December 2, 2025 Guessing Headlights

Every year, millions of Americans venture abroad with optimism, curiosity, and the belief that most people they meet will be helpful or at least harmless. And while that’s often true, seasoned travelers know that the world also has its fair share of tricksters who see tourists as easy paydays.

These scammers aren’t relying on brute force or intimidation, they specialize in subtlety, charm, and psychological pressure. Most scams don’t feel like scams when they start. Instead, they unfold as small acts of kindness, unexpected conveniences, or friendly gestures that slowly shift into uncomfortable, costly situations. By the time most travelers realize what’s happened, the money is gone, the scammer has vanished, and the embarrassment sets in.

The 13 Travel Scams Every American Tourist Falls For (Don’t Be Next)

Vasilija Mrakovic Tue, December 2, 2025 Guessing Headlights

Every year, millions of Americans venture abroad with optimism, curiosity, and the belief that most people they meet will be helpful or at least harmless. And while that’s often true, seasoned travelers know that the world also has its fair share of tricksters who see tourists as easy paydays.

These scammers aren’t relying on brute force or intimidation, they specialize in subtlety, charm, and psychological pressure. Most scams don’t feel like scams when they start. Instead, they unfold as small acts of kindness, unexpected conveniences, or friendly gestures that slowly shift into uncomfortable, costly situations. By the time most travelers realize what’s happened, the money is gone, the scammer has vanished, and the embarrassment sets in.

Travel scams persist because they exploit universal human instincts: the desire to be polite, the fear of causing a scene, the assumption that strangers are telling the truth, and the belief that we understand a situation better than we actually do. Americans in particular are vulnerable because many come from service-oriented environments where helpers, attendants, and guides are common and expected.

When a stranger steps in saying, “Let me help” or “I know a shortcut,” it feels natural to accept, but in many destinations, this is the exact moment the trap is set. Recognizing these tactics in advance can help you navigate unfamiliar streets with confidence, avoid unnecessary stress, and keep your trip focused on what truly matters, experiencing the world, not funding its scammers.

The “Overly Helpful” Stranger

In major tourist hubs, an overly friendly local may approach you the moment you look confused, offering to help you buy metro tickets, decipher a map, or find a hotel. They present themselves as a good Samaritan who simply loves helping visitors.

Their real goal is much less noble: they want money, or access to your belongings, or a chance to guide you somewhere that benefits them financially. These scammers know that most Americans don’t want to seem rude by refusing help, especially when language barriers are involved, so they step in with confidence and urgency.

As soon as they start “helping,” they position themselves close to your wallet or phone, often leaning over you or taking control of your screen. Sometimes they push you through the process so quickly that you barely have time to think. And if they don’t pickpocket you directly, they may claim a tip afterward, insisting you owe them for their “service.” They may even guilt-trip you in public, making the situation uncomfortable enough that paying just feels easier.

The safest approach is simple: decline unsolicited help politely but firmly. If you truly need assistance, seek out uniformed staff, official kiosks, or other travelers rather than anyone approaching you first. Real helpers don’t chase down tourists, scammers do.

The Fake Taxi

Fake taxis thrive in chaotic transit zones: airports, train stations, ferry terminals, and crowded tourist attractions. Drivers approach you before you reach the official taxi queue, offering “cheap,” “fast,” or “private” rides. They may look legitimate, but once you’re inside, everything changes. There’s no meter, no receipt, and suddenly the price is triple the normal fare. Some drivers even demand payment upfront or refuse to let you exit without paying an inflated fee.

These operators target Americans because many assume ride prices abroad are similar to U.S. costs, so when a driver quotes $40 for a 10-minute ride, travelers don’t immediately question it. When people are jet-lagged or disoriented, they’re especially vulnerable to these pitches. And because the scammer approaches you assertively and confidently, it feels awkward to refuse, making the con even more effective.

The only safe rule is to avoid anyone who initiates contact. Use official taxis, rideshare apps, or taxi stands clearly marked by the city. A legitimate taxi never has to chase customers down.

The Friendship Bracelet Trap

This scam is common in Europe’s busiest plazas. A vendor approaches with a smile, speaking quickly and warmly, and before you can react, they’re tying a colorful bracelet around your wrist. They insist it’s free, a symbol of friendship, peace, or luck. But as soon as it’s tied securely, everything changes. They demand money, sometimes loudly or aggressively, and refuse to let you walk away.

Americans fall for this trick because it feels rude to pull away when someone reaches for your hand, especially when the person seems harmless or charming. The scam works because it involves physical contact; once the bracelet is tied, removing it is nearly impossible without scissors, making most tourists feel obligated to pay just to avoid confrontation. Some scammers even work in groups, surrounding the target to pressure them further.

To avoid this trap, keep your hands close to your body when approached by street vendors and walk with purpose. Never allow anyone to tie, place, or hand you anything you didn’t request, if it’s “free,” it’s not.

“Let Me Take Your Photo!”

TO READ MORE: https://www.yahoo.com/lifestyle/articles/13-travel-scams-every-american-183048923.html

Stephanie Starr: Affordability, Affordability, Affordability

Stephanie Starr: Affordability, Affordability, Affordability

12-5-2025

Stephanie Starr @StephanieStarrC

Affordability… Affordability…. Affordability…. You are seeing it all over the news.

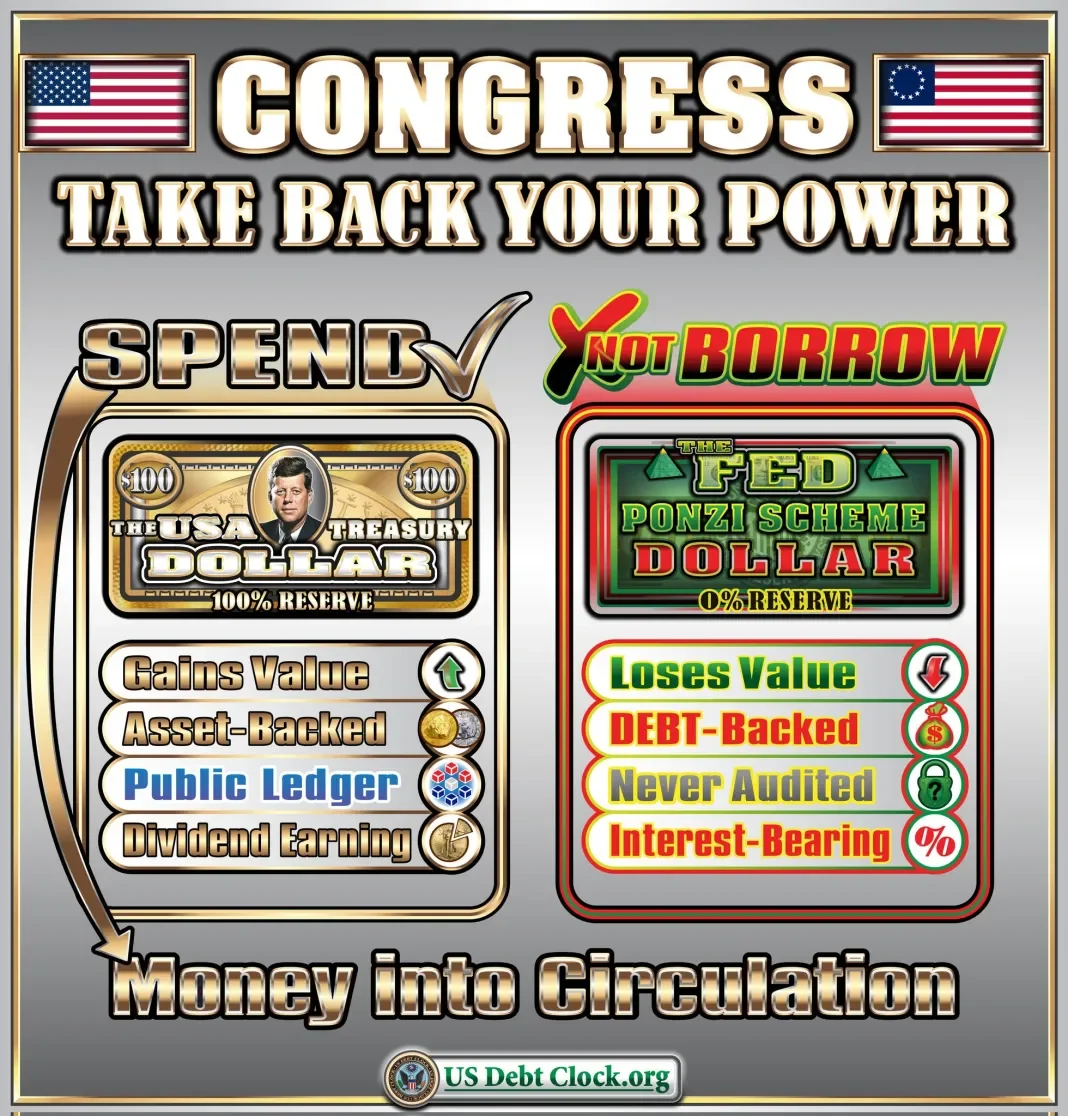

Why is that? Because we as a country have hit a wall. The USD (AKA Federal Reserve Note which is not federal and has no reserves) has lost 98% of its value since 1913.

Stephanie Starr: Affordability, Affordability, Affordability

12-5-2025

Stephanie Starr @StephanieStarrC

Affordability… Affordability…. Affordability…. You are seeing it all over the news.

Why is that? Because we as a country have hit a wall. The USD (AKA Federal Reserve Note which is not federal and has no reserves) has lost 98% of its value since 1913.

What happened in 1913?

What happened in 1971?

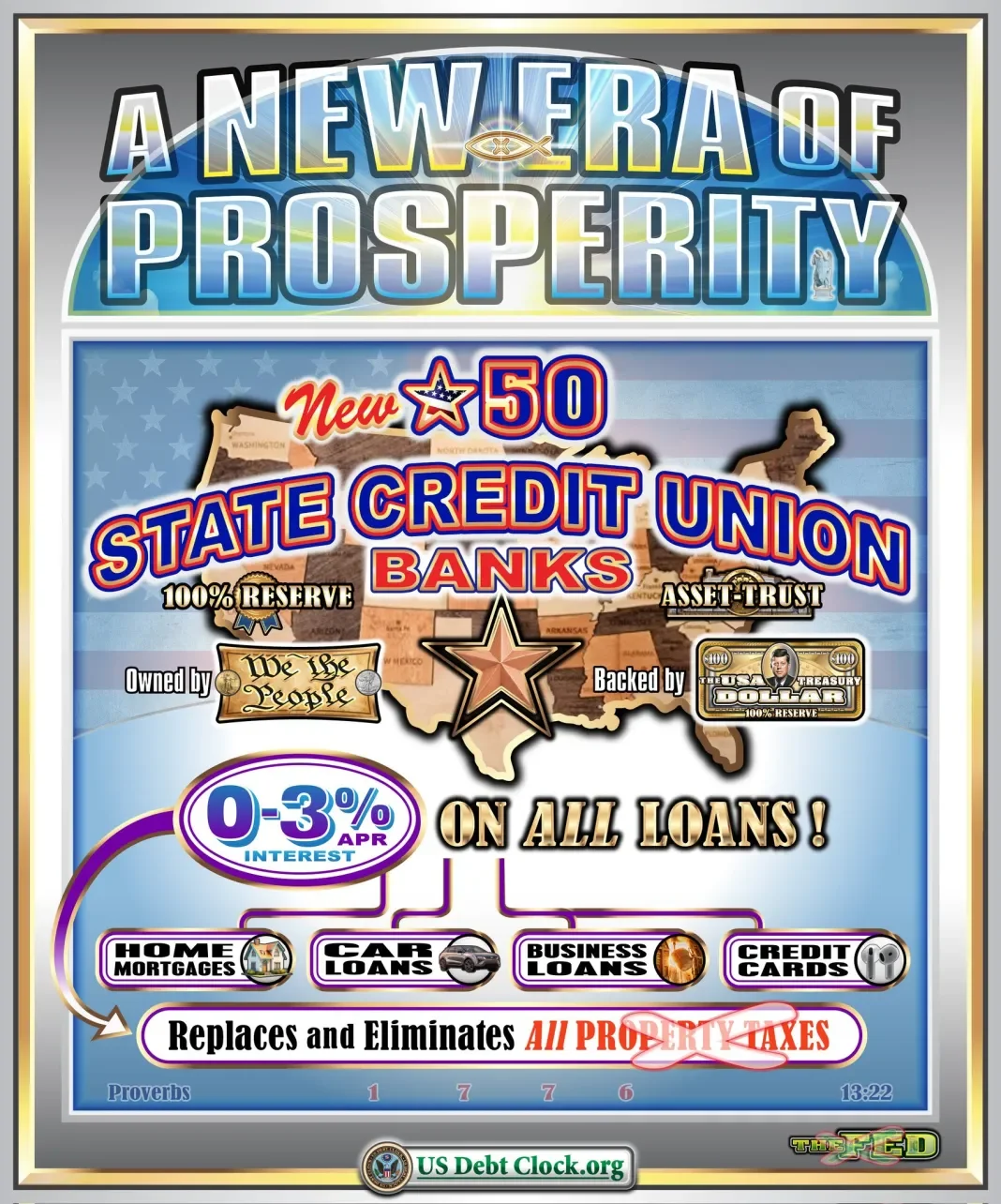

Well guess what..? Thanks to EO 13848 and 13818 we are recouping our wealth that has been stolen from us, which is why the US Debt clock has a “hidden wealth” section.

As of today, Dec 4,2025 each citizen has 520k worth of assets designated to them…

The $2,000 dividend Trump plans on sending out from tariffs every 90 days….

The payments we will be receiving from the US Sovereign Wealth Fund (that’s funded by our Crypto Reserves and other investments).

The Trump Accounts recently established for babies born from 2025-2028….

What if I told you we will be transitioning from a Federal Reserve Note (USD) to a US Treasury Bill backed by assets and not from thin air…

What would that do to inflation?

What would that do for purchasing power?

On top of what is owed to us (520k per citizen). When the Global Currency Reset takes place… The world will be better off and at peace,

Peace deals must happen before prosperity.

If the USD is the world’s reserve currency, and our currency has lost 98% of value, all currencies must have a reset.