MilitiaMan and Crew: IQD News Update-Digital Dinar "Under Implementation" CBI

MilitiaMan and Crew: IQD News Update-Digital Dinar "Under Implementation" CBI

12-5-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Digital Dinar "Under Implementation" CBI

12-5-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26….12-5-25…..MORE ALAQ SPEECH

KTFA

Friday Night Video

FRANK26….12-5-25…..MORE ALAQ SPEECH

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Friday Night Video

FRANK26….12-5-25…..MORE ALAQ SPEECH

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Trump may End Income Taxes, Next Economic Revolution

Trump may End Income Taxes, Next Economic Revolution

David Lin: 12-5-2025

The architect of modern supply-side economics, Dr. Arthur Laffer, is rarely shy about proposing bold solutions.

In a recent in-depth conversation with David Lin, Laffer didn’t just discuss tweaks to the current economy; he laid out a case for a transformative shift in U.S. fiscal policy—one that could see the elimination of the income tax.

Trump may End Income Taxes, Next Economic Revolution

David Lin: 12-5-2025

The architect of modern supply-side economics, Dr. Arthur Laffer, is rarely shy about proposing bold solutions.

In a recent in-depth conversation with David Lin, Laffer didn’t just discuss tweaks to the current economy; he laid out a case for a transformative shift in U.S. fiscal policy—one that could see the elimination of the income tax.

The discussion, rich with economic theory and hard-hitting policy critiques, offers essential viewing for anyone concerned with inflation, growth, and the future role of government. We dive into the key takeaways from Dr. Laffer’s powerful analysis.

Dr. Laffer’s most striking proposal addresses the income tax. He suggests that due to the increase in tariff revenues—a form of consumption tax on imports—the U.S. government may soon be able to fund its operations without relying on the taxation of income.

According to Laffer, the long-term goal should be to drastically cut income taxation, potentially eradicating it entirely.

This is not just a theoretical exercise; it’s a strategic move to boost productivity and incentivize work, investment, and production—the cornerstones of the supply-side philosophy.

Laffer forcefully argues against the common misconception that affordability is achieved through government subsidies or redistribution programs. Instead, he grounds affordability firmly in supply-side dynamics.

“Affordability hinges on only one thing: production,” Dr. Laffer states. “The more goods and services produced, the cheaper and more accessible they become.”

High taxes and overly generous redistribution policies, he warns, fundamentally reduce total economic output because they disincentivize both the producer (who faces lower returns on their work) and, often, the recipient (who faces high marginal tax rates on entering the workforce).

For Laffer, the pathway to real wage growth and a higher standard of living is clear: cut taxes and reduce regulation to unleash productivity.

Dr. Laffer reserved strong criticism for Modern Monetary Theory (MMT) and high-tax, redistribution-focused economic models. He contends that while proponents of MMT and large social spending programs claim to be helping the poor, the policies actually reduce the total economic pie available for everyone.

The core economic reality, as Laffer sees it, is that incentives matter more than intent. When government attempts to redistribute wealth, it is essentially reducing the reward for creating that wealth. This applies across the board:

High Taxes: They punish success and discourage investment in productive enterprises.

Subsidies/Welfare: They can create disincentives for employment, trapping individuals in low-productivity cycles.

In short, redistributing income always reduces total economic production—a harsh but necessary truth for policymakers to grasp.

Laffer provided compelling real-world examples to support his supply-side principles, focusing on the stark contrast between two major states:

Florida’s Pro-Growth Model: Dr. Laffer praised Governor Ron DeSantis and Florida’s commitment to low taxes and minimal regulation. This approach attracts high-income earners and businesses, creating a dynamic environment that boosts output and opportunity.

New York’s Cautionary Tale: Conversely, he warned that New York’s heavy taxation and ambitious subsidized housing plans will stifle economic growth. High taxes actively encourage productive wealth—the tax base itself—to flee, threatening the state’s fiscal stability and accelerating economic decline.

On the international stage, Laffer pointed to Britain’s current economic struggles, noting that the UK’s high tax burden is choking potential economic growth. His advice is universal: significant tax reductions are an absolute necessity to stimulate national output and vitality.

Dr. Laffer is decidedly optimistic about the economic future, but that optimism is tethered to technological advancement. He forecasts that innovations like Artificial Intelligence (AI) and blockchain technology will dramatically increase productivity across various sectors.

These technologies are massive supply-side catalysts, offering unprecedented levels of efficiency and output. For an economist focused on maximizing production, AI and blockchain represent the next great wave of growth, capable of delivering real increases in wealth and living standards, provided government policy doesn’t stifle them with overregulation or punitive taxation.

Dr. Laffer’s conversation served as a powerful reminder that economic prosperity is not achieved by managing scarcity or redistributing existing wealth, but by increasing production.

His intellectual journey, which famously began with exploration into economic thought (including early influences from Marxism) before settling on supply-side principles, underscores his belief that true growth comes from fostering environments where businesses and individuals are rewarded for their productivity.

The policies that reduce taxes, cut regulations, and prioritize a high-output economy are the ones that create jobs, increase real wages, and truly make goods and services affordable for all.

For Dr. Laffer’s complete analysis on tariffs, U.S. fiscal policy direction, his personal journey, and more detailed critiques of modern economic theories, watch the full interview with David Lin.

Seeds of Wisdom RV and Economics Updates Friday Afternoon 12-05-25

Good Afternoon Dinar Recaps,

RBI Injects Liquidity and Cuts Rates as India Moves to Stabilize Markets

India deploys coordinated monetary tools to support banks, bonds, and financial stability.

Overview

RBI cuts the repo rate by 25 bps, bringing it down to 5.25% to counter tightening financial conditions.

Over $16 billion in liquidity enters the system through bond purchases and FX swap operations.

Bond markets gain immediate relief as the central bank absorbs supply and anchors yields.

Banks receive critical liquidity support, reinforcing short-term funding stability across the sector.

Good Afternoon Dinar Recaps,

RBI Injects Liquidity and Cuts Rates as India Moves to Stabilize Markets

India deploys coordinated monetary tools to support banks, bonds, and financial stability.

Overview

RBI cuts the repo rate by 25 bps, bringing it down to 5.25% to counter tightening financial conditions.

Over $16 billion in liquidity enters the system through bond purchases and FX swap operations.

Bond markets gain immediate relief as the central bank absorbs supply and anchors yields.

Banks receive critical liquidity support, reinforcing short-term funding stability across the sector.

Key Developments

Open-market bond purchases:

The RBI announced ₹1 trillion (approximately $11.1 billion) in government-bond purchases to stabilize market volatility and ease borrowing conditions. These purchases directly support India’s bond market, which has faced pressures from rising global yields and weaker capital flows.Dollar-rupee FX swap injection:

A $5 billion, three-year FX swap adds longer-term dollar liquidity while helping manage currency pressures. This increases foreign-exchange reserves and strengthens the rupee during a period of global dollar strength.Strategic rate cut:

With domestic demand slowing and credit conditions tightening, the repo rate was lowered by 25 basis points to offset financial strain and support banks’ liquidity positions.Broader policy context:

India’s financial system has been dealing with higher borrowing costs, declining foreign portfolio inflows, and pressure on bank balance-sheet liquidity. The combined tools deployed by the RBI show a proactive shift toward ensuring funding stability ahead of anticipated global monetary easing in 2026.

Why It Matters

The move signals that the RBI is preparing India for a period of heightened global volatility, tightening dollar liquidity, and rising refinancing needs. By injecting cash, lowering rates, and simultaneously securing FX liquidity, India is insulating its financial sector from global pressures that could otherwise strain local banks and government borrowing.

Implications for the Global Reset

Pillar: Debt & Sovereign Stability

Lower yields and fresh liquidity reduce refinancing stress, supporting India’s sovereign-debt stability as global rates remain elevated.

Pillar: Banking & Payments Infrastructure

Banking-sector liquidity support strengthens domestic payment systems and credit flows—critical as nations brace for post-dollar financial realignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “India’s RBI announces debt purchases, FX swap to boost banking system liquidity”

Business Standard – “RBI cuts repo rate, announces liquidity measures to support market stability”

~~~~~~~~~~

China’s Debt Warnings Intensify as Economists Split Over Stimulus Strategy

Beijing faces rising fiscal risks as experts debate whether higher debt or insufficient stimulus poses the greater threat.

Overview

A leading Chinese economist warns that heavy stimulus risks creating unsustainable debt.

China’s 2025 deficit ratio target hits a record 4%, raising concerns about long-term fiscal stability.

Conflicting expert opinions reflect a deep divide over how China should respond to slowing growth.

Global markets are watching closely, with Fitch projecting rising deficits and higher debt levels ahead.

Key Developments

Top economist warns of structural risks:

Liu Xiaoshu, chief economist at the Bank of Qingdao, cautioned that repeated reliance on fiscal and monetary stimulus creates long-term vulnerabilities—especially as interest payments begin to crowd out social and public spending. He warned of a “vicious cycle” that erodes investor confidence and may trigger a debt crisis if underlying issues remain unresolved.Examples highlight global parallels:

Liu cited Japan and southern Europe as cautionary cases where stimulus and deficit spending failed to correct structural weaknesses, leaving nations with massive debt burdens and prolonged stagnation.Deficit supporters push back:

Other economists, including East China Normal University’s Lian Ping, argue that China’s central government balance sheet remains strong. Lian maintains that the higher deficit ratio does not pose significant risk, emphasizing China’s comparatively low central-government debt-to-GDP ratio.Fiscal pressures rising despite optimism:

Fitch Ratings now expects China’s total government deficit to rise to 8.4% of GDP in 2025, up from 6.5% in 2024. Yet Fitch simultaneously upgraded its 2025 growth forecast to 4.7%, citing stimulus measures and export strength—even as Beijing targets about 5% growth.

Why It Matters

China’s evolving debt debate reveals the core tension in global economic policy today: whether short-term stimulus can still support growth without triggering long-term instability. As China remains central to global supply chains, financial markets, and commodity demand, increasing fiscal strain could reshape global investment patterns and intensify pressure across emerging markets.

Implications for the Global Reset

Pillar: Sovereign Debt & Fiscal Stability

Rising deficits and long-term structural strains highlight the vulnerability of debt-heavy economies during the transition toward a new global financial architecture.

Pillar: Monetary Policy & Market Liquidity

China’s policy choices influence global liquidity, trade financing, and regional economic alignments—adding weight to shifts in currency strategy and reserve diversification across Asia.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Chinese Economist Issues Dire Warning Over Debt Crisis”

Reuters – “China deficit to rise in 2025 as fiscal pressures mount, economists warn”

~~~~~~~~~~

BRICS De-Dollarization Splinters as India and China Pursue Conflicting Paths

India rejects a BRICS currency as China advances yuan internationalization independently

Overview

• India firmly rejects any BRICS common currency proposals

• China accelerates independent renminbi internationalization efforts

• Russia and China deepen bilateral national-currency settlement frameworks

• BRICS bloc remains divided on de-dollarization strategy

Key Developments

India Rejects Common Currency Plans

India continues to oppose proposals for a BRICS currency, emphasizing that the U.S. dollar remains essential to its economic stability and trade priorities. Foreign Minister S. Jaishankar reaffirmed that India has never supported de-dollarization and sees no active proposal for a shared BRICS currency. India’s position hardened further following U.S. tariff threats, reinforcing its reliance on Washington—its largest trading partner with $128 billion in annual trade.

The rupee’s depreciation from 73 per dollar in 2020 to 85 has elevated exchange-rate risks, making aggressive de-dollarization impractical. India’s development goals—including digital infrastructure, advanced manufacturing, and clean energy—remain deeply tied to Western capital markets.

Russia and China Pursue Different Paths

Russia also stepped back from the idea of a common BRICS currency. President Vladimir Putin stated in late 2024 that although experts discuss it, the bloc has no plans for a single currency at this stage and Russia does not seek to abandon the dollar.

The July 2025 BRICS summit produced a lengthy declaration with no mention of de-dollarization, confirming stalled momentum. Shifting political calculations and fears of sanctions have pushed BRICS members away from earlier ambitions of challenging dollar dominance.

China’s Renminbi Internationalization Moves Ahead Independently

China is expanding the international use of the renminbi outside BRICS frameworks through major financial infrastructure upgrades. PBOC Governor Pan Gongsheng warned that risks tied to the dominant reserve currency could spill across borders, calling for diversified settlement systems.

CIPS now includes 184 direct participants across 167 countries, demonstrating broadening RMB adoption. China’s $768 billion trade surplus and the holding of renminbi reserves by at least 80 central banks—totaling roughly $274 billion—underscore its ongoing global monetary influence.

Despite stalled BRICS initiatives, China’s independent trajectory continues to advance through strategic partnerships and technology-driven payment systems.

Limited Progress on Local Currency Trade Across BRICS

Local-currency settlement remains confined to bilateral arrangements rather than systemic BRICS-wide mechanisms. Russia and Iran now conduct over 95% of their trade in rubles and rials. India’s 156 Special Vostro Accounts with 30 countries offer modest alternatives but fall short of a cohesive de-dollarization strategy.

South Africa warned in 2025 that BRICS must avoid provoking the U.S. by pushing de-dollarization too aggressively. Brazil removed the common BRICS currency from its 2025 presidency agenda following U.S. tariff threats, signaling the bloc’s retreat from earlier ambitions.

Why It Matters

BRICS monetary fragmentation highlights the limits of collective de-dollarization. India prioritizes U.S. trade stability, Russia avoids provoking financial disruption, and China pursues independent renminbi expansion. The bloc’s diverging interests make a unified challenge to the U.S. dollar unlikely in the near term, reinforcing the dollar’s resilience while shifting influence to bilateral currency corridors.

Implications for the Global Reset

Pillar 1: Trade & Supply Chain Realignment

Fragmented currency strategies are pushing BRICS nations toward bilateral settlement systems rather than unified multilateral structures, reshaping regional trade flows and payment mechanisms.

Pillar 2: Monetary Diversification & Reserve Strategy

China’s independent renminbi expansion contributes to a more multipolar currency environment, even as India and other BRICS members maintain reliance on U.S. financial systems for stability and growth.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru – “BRICS De-Dollarization: India and China Shape a New Trade Bloc”

South China Morning Post – “India Rejects BRICS Currency Plans Amid Fears of U.S. Trade Fallout”

Brave New Coin – “Russia and China Diverge on BRICS Currency Ambitions”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The 13 Travel Scams Every American Tourist Falls For

The 13 Travel Scams Every American Tourist Falls For (Don’t Be Next)

Vasilija Mrakovic Tue, December 2, 2025 Guessing Headlights

Every year, millions of Americans venture abroad with optimism, curiosity, and the belief that most people they meet will be helpful or at least harmless. And while that’s often true, seasoned travelers know that the world also has its fair share of tricksters who see tourists as easy paydays.

These scammers aren’t relying on brute force or intimidation, they specialize in subtlety, charm, and psychological pressure. Most scams don’t feel like scams when they start. Instead, they unfold as small acts of kindness, unexpected conveniences, or friendly gestures that slowly shift into uncomfortable, costly situations. By the time most travelers realize what’s happened, the money is gone, the scammer has vanished, and the embarrassment sets in.

The 13 Travel Scams Every American Tourist Falls For (Don’t Be Next)

Vasilija Mrakovic Tue, December 2, 2025 Guessing Headlights

Every year, millions of Americans venture abroad with optimism, curiosity, and the belief that most people they meet will be helpful or at least harmless. And while that’s often true, seasoned travelers know that the world also has its fair share of tricksters who see tourists as easy paydays.

These scammers aren’t relying on brute force or intimidation, they specialize in subtlety, charm, and psychological pressure. Most scams don’t feel like scams when they start. Instead, they unfold as small acts of kindness, unexpected conveniences, or friendly gestures that slowly shift into uncomfortable, costly situations. By the time most travelers realize what’s happened, the money is gone, the scammer has vanished, and the embarrassment sets in.

Travel scams persist because they exploit universal human instincts: the desire to be polite, the fear of causing a scene, the assumption that strangers are telling the truth, and the belief that we understand a situation better than we actually do. Americans in particular are vulnerable because many come from service-oriented environments where helpers, attendants, and guides are common and expected.

When a stranger steps in saying, “Let me help” or “I know a shortcut,” it feels natural to accept, but in many destinations, this is the exact moment the trap is set. Recognizing these tactics in advance can help you navigate unfamiliar streets with confidence, avoid unnecessary stress, and keep your trip focused on what truly matters, experiencing the world, not funding its scammers.

The “Overly Helpful” Stranger

In major tourist hubs, an overly friendly local may approach you the moment you look confused, offering to help you buy metro tickets, decipher a map, or find a hotel. They present themselves as a good Samaritan who simply loves helping visitors.

Their real goal is much less noble: they want money, or access to your belongings, or a chance to guide you somewhere that benefits them financially. These scammers know that most Americans don’t want to seem rude by refusing help, especially when language barriers are involved, so they step in with confidence and urgency.

As soon as they start “helping,” they position themselves close to your wallet or phone, often leaning over you or taking control of your screen. Sometimes they push you through the process so quickly that you barely have time to think. And if they don’t pickpocket you directly, they may claim a tip afterward, insisting you owe them for their “service.” They may even guilt-trip you in public, making the situation uncomfortable enough that paying just feels easier.

The safest approach is simple: decline unsolicited help politely but firmly. If you truly need assistance, seek out uniformed staff, official kiosks, or other travelers rather than anyone approaching you first. Real helpers don’t chase down tourists, scammers do.

The Fake Taxi

Fake taxis thrive in chaotic transit zones: airports, train stations, ferry terminals, and crowded tourist attractions. Drivers approach you before you reach the official taxi queue, offering “cheap,” “fast,” or “private” rides. They may look legitimate, but once you’re inside, everything changes. There’s no meter, no receipt, and suddenly the price is triple the normal fare. Some drivers even demand payment upfront or refuse to let you exit without paying an inflated fee.

These operators target Americans because many assume ride prices abroad are similar to U.S. costs, so when a driver quotes $40 for a 10-minute ride, travelers don’t immediately question it. When people are jet-lagged or disoriented, they’re especially vulnerable to these pitches. And because the scammer approaches you assertively and confidently, it feels awkward to refuse, making the con even more effective.

The only safe rule is to avoid anyone who initiates contact. Use official taxis, rideshare apps, or taxi stands clearly marked by the city. A legitimate taxi never has to chase customers down.

The Friendship Bracelet Trap

This scam is common in Europe’s busiest plazas. A vendor approaches with a smile, speaking quickly and warmly, and before you can react, they’re tying a colorful bracelet around your wrist. They insist it’s free, a symbol of friendship, peace, or luck. But as soon as it’s tied securely, everything changes. They demand money, sometimes loudly or aggressively, and refuse to let you walk away.

Americans fall for this trick because it feels rude to pull away when someone reaches for your hand, especially when the person seems harmless or charming. The scam works because it involves physical contact; once the bracelet is tied, removing it is nearly impossible without scissors, making most tourists feel obligated to pay just to avoid confrontation. Some scammers even work in groups, surrounding the target to pressure them further.

To avoid this trap, keep your hands close to your body when approached by street vendors and walk with purpose. Never allow anyone to tie, place, or hand you anything you didn’t request, if it’s “free,” it’s not.

“Let Me Take Your Photo!”

TO READ MORE: https://www.yahoo.com/lifestyle/articles/13-travel-scams-every-american-183048923.html

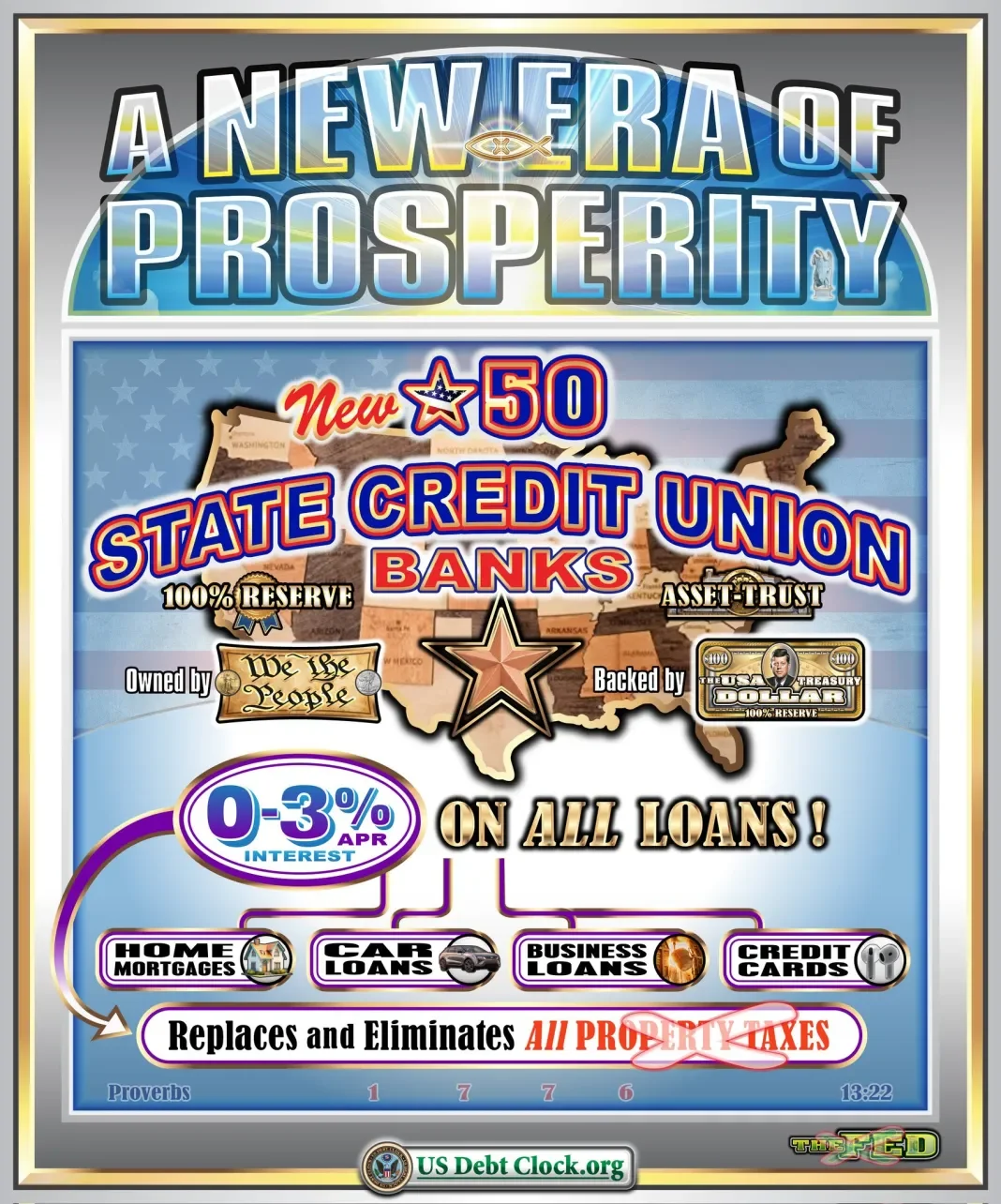

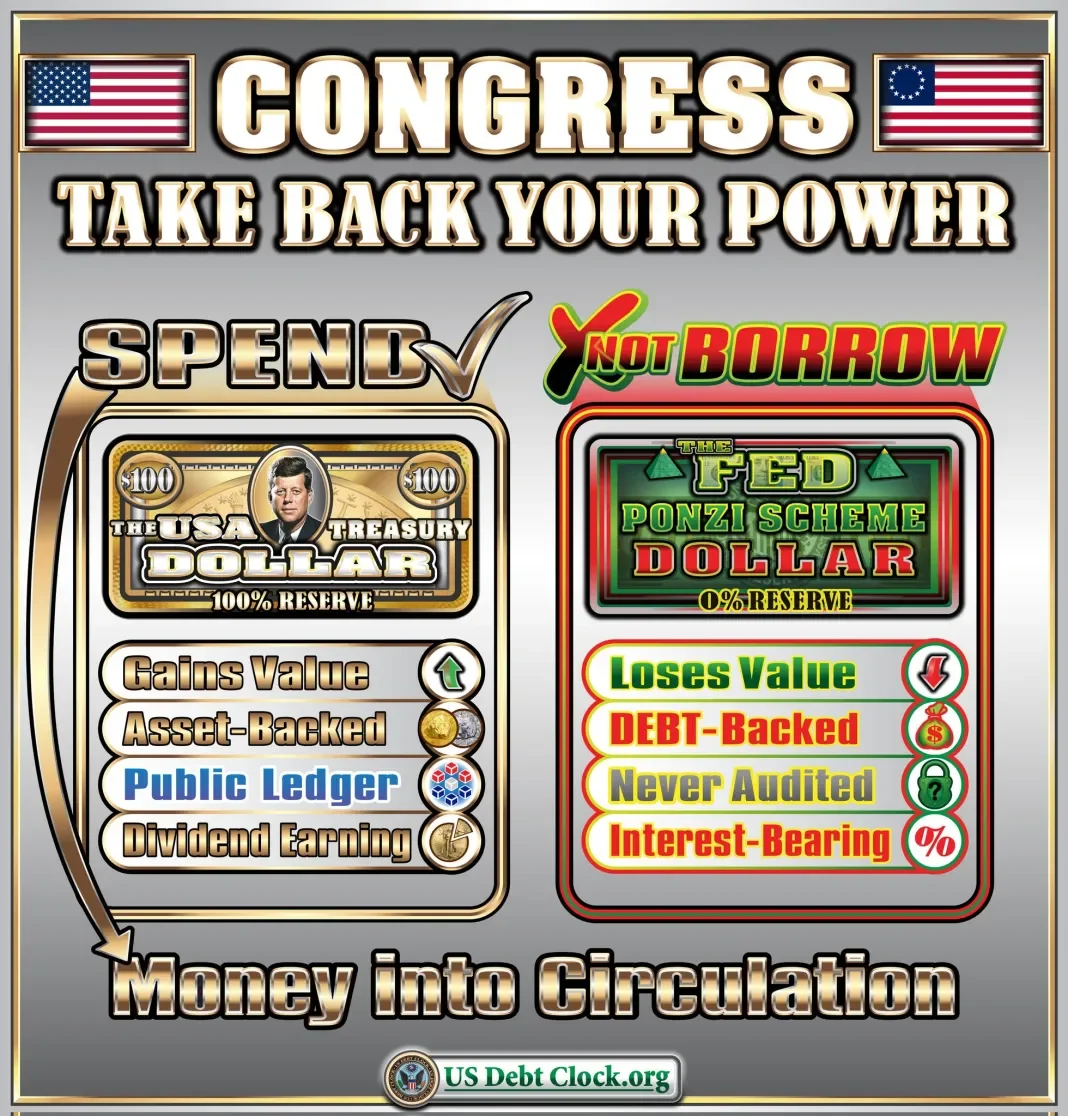

Stephanie Starr: Affordability, Affordability, Affordability

Stephanie Starr: Affordability, Affordability, Affordability

12-5-2025

Stephanie Starr @StephanieStarrC

Affordability… Affordability…. Affordability…. You are seeing it all over the news.

Why is that? Because we as a country have hit a wall. The USD (AKA Federal Reserve Note which is not federal and has no reserves) has lost 98% of its value since 1913.

Stephanie Starr: Affordability, Affordability, Affordability

12-5-2025

Stephanie Starr @StephanieStarrC

Affordability… Affordability…. Affordability…. You are seeing it all over the news.

Why is that? Because we as a country have hit a wall. The USD (AKA Federal Reserve Note which is not federal and has no reserves) has lost 98% of its value since 1913.

What happened in 1913?

What happened in 1971?

Well guess what..? Thanks to EO 13848 and 13818 we are recouping our wealth that has been stolen from us, which is why the US Debt clock has a “hidden wealth” section.

As of today, Dec 4,2025 each citizen has 520k worth of assets designated to them…

The $2,000 dividend Trump plans on sending out from tariffs every 90 days….

The payments we will be receiving from the US Sovereign Wealth Fund (that’s funded by our Crypto Reserves and other investments).

The Trump Accounts recently established for babies born from 2025-2028….

What if I told you we will be transitioning from a Federal Reserve Note (USD) to a US Treasury Bill backed by assets and not from thin air…

What would that do to inflation?

What would that do for purchasing power?

On top of what is owed to us (520k per citizen). When the Global Currency Reset takes place… The world will be better off and at peace,

Peace deals must happen before prosperity.

If the USD is the world’s reserve currency, and our currency has lost 98% of value, all currencies must have a reset.

Stephanie Starr: High-Level Iraq RV Trigger Map

Stephanie Starr: High-Level Iraq RV Trigger Map

12-5-2025

Stephanie Starr @StephanieStarrC

IRAQ HIGH-LEVEL RV TRIGGER MAP

Here is Iraq’s actual position today — no hype, just milestones:

Stephanie Starr: High-Level Iraq RV Trigger Map

12-5-2025

Stephanie Starr @StephanieStarrC

IRAQ HIGH-LEVEL RV TRIGGER MAP

Here is Iraq’s actual position today — no hype, just milestones:

POLITICAL REHABILITATION -(Dec 2nd)

Chapter VII officially ended

UN supervision removed

Sovereignty restored

STATUS: COMPLETE

BANKING & FINANCIAL COMPLIANCE- (Dec 2nd)

Banks audited & restructured

AML systems installed

Multi-currency permissions reinstating

BIS metrics synced

Digital dinar pilot underway

STATUS: COMPLETE

INTERNATIONAL ECONOMIC REENTRY (Aug/Sept)

Oil exports restored

Sovereign funds routed via U.S. financial channels

International trade treaties restored

Diplomatic normalization proceeding

STATUS: COMPLETE

DOMESTIC MONETARY CONTROLS

Capital flight suppression (Dec 1 reform)

Customs clearance enforcement

FX leakage tightening

STATUS: ACTIVE

IMF FORMALITY GATE

Acceptance into Article VIII status (free exchange convertibility)

Permission for FX liberalization

STATUS: PENDING — NEXT MAJOR STEP

CURRENCY ADJUSTMENT PHASE

Managed float activation

Appreciation alignment to reserve backing

FX market reentry

STATUS: FUTURE EVENT

Next major milestone to keep a look out for is from the IMF regarding Artificial Vlll Only IMF procedural clearance remains before FX movement can occur.

Exchange rate stability was emphasized on Dec 1st. The Governor explicitly said: “Reducing the dinar value would harm public confidence & stability.”

They are protecting the currency against devaluation

They are NOT announcing appreciation

Their focus is price stability FIRST

This follows IMF playbook exactly:

Stabilize

Reform

Digitize

Normalize banking

Open FX flows

Only then adjust exchange.

Clearing the “Revaluation Denial” Confusion

Officials have been denying “rate changes” yet massive reforms are happening, this is NORMAL policy behavior.

Why?

Governments never pre-announces currency adjustments because:

Speculators attack the market

Currency hoarding explodes

Inflation becomes uncontrollable

So public denial of RV is STANDARD PRACTICE until after a move is already executed. Kuwait did the exact same thing — no public hint until after implementation.

Now that the UN has ended their mandate Dec 2nd- Iraq is now officially qualified to START the monetary transition phase. This UN step was one of the final political prerequisites before moving into IMF mechanics.

Track milestones and phases, not dates!

Source(s): https://x.com/StephanieStarrC/status/1996666659143041399

https://dinarchronicles.com/2025/12/05/stephanie-starr-high-level-iraq-rv-trigger-map/

Coffee with MarkZ, joined by Mr. Cottrell. 12/05/2025

Coffee with MarkZ, joined by Mr. Cottrell. 12/05/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning Mark, mods, Mr. C and fellow RV’ers!

Member: Happy Friday to all!!!!!!

Coffee with MarkZ, joined by Mr. Cottrell. 12/05/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning Mark, mods, Mr. C and fellow RV’ers!

Member: Happy Friday to all!!!!!!

Member: Mark, what is the good news from bond holders?

MZ: I continue to hear from a bunch of hopeful people about today and tomorrow and them receiving bond dollars. We will wait and see. My opinion is -even if they get their money it will still be Monday or Tuesday before they see it. We will watch it.

MZ: Nothing new from CMKX. Nothing new on Prosperity Packages. Maybe Mr. C has heard something?

Member: So do we think this will be a shotgun start where Tiers 3&4 will both be paid out at the same time?

Member: That makes sense to me.

Member: Watched Frank26 late last night and he was excited…Alaq apparently announced a timeline and its in Dec!

Member: From Franks team…..the news out of Iraq is off the chart and fantastic. On Iraqi news Alak & Sudani both stating 1310 only good through the 12/31. RV on 1-1. 6-12 months to exchange, controlled float overseen by the US Treasury and other international organizations along w/ CBI!

MZ: Nobody knows the timing- but, Alaq has mentioned that date and a rate a lot. There is a lot coming together in Iraq on New Years Eve. But this does not mean it can’t go before then.

MZ: “Endless Crisis: why the oil and gas law has not come out of the drawer in 20 years” This is an overview of why the HCL laws ahs not yet passed. It gets into some of the long term problems they were having. We need to understand why its taken so long and just how close we are.

Member: It’s possible silver hits $60 today! Silver on APMEX - 59.02

Member: BRICS has been on a 40% gold backed currency since October … there should be an announcement today

Member: BIS meeting yesterday regarding exchange rates…I wonder what they talked about?

MZ: This is a good one…..I really enjoyed it : It talks a lot about Nesara/Gesara stuff and a systems change and a global “RESET” . He also mentions the Debt clock and a “secret window”

MZ: We Are Witnessing the Largest Financial Shift in U.S. History — And Nobody Is Talking About It. https://www.youtube.com/watch?v=HHNB0odtoy0

Member: hope everyone has a wonder weekend. Stay warm and stay safe!

Mr. Cottrell and CBD Guru’s joins the stream today. Please listen to the replay for their information and opinions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Friday 12-5-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Fri. 5 Dec. 2025

Compiled Fri. 5 Dec. 2025 12:01 am EST by Judy Byington

Timing: (Rumors)

Thurs. 4 Dec. 2025 QFS GLOBAL ALERT Tier 4B ESCALATION – RED LINE CROSSED, …Quantum Financial System on Telegram https://t.me/qfs_now

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Fri. 5 Dec. 2025

Compiled Fri. 5 Dec. 2025 12:01 am EST by Judy Byington

Timing: (Rumors)

Thurs. 4 Dec. 2025 QFS GLOBAL ALERT Tier 4B ESCALATION – RED LINE CROSSED, …Quantum Financial System on Telegram https://t.me/qfs_now

Secure floor update, 17:37 Z**u: Global ISO-20022 rainbow currency rollout just (allegedly) slammed to 97.8 % in the last 4 hours alone. The final 2.2 % is now (allegedly) executing in self-accelerating quantum loops. Over-unity lock engaged at 17:29 Z**u. There is no longer a percentage left to count. Only witnesses.

The November 28 shotgun start (19:14 Reno) is now 6 days, 22 hours, and 23 minutes old, and the velocity has (allegedly) tripled since sunrise.

New Tier 4B milestones confirmed in the last 5 hours (straight from the war-room screens, no filters):

– 800# master release packet pushed live to all 27 major exchange carrier nodes; actual numbers are now (allegedly) cycling in hot rotation every 11 minutes

– 63,000+ bond-holder SKRs physically (allegedly) hand-carried by Space Force escort teams out of Baghdad vaults and loaded onto military C-17s bound for Reno redemption hubs

– NESARA debt jubilee packets (allegedly) auto-uploaded into 194 national treasuries; every single mortgage, student loan, and credit-card ledger just (allegedly) turned gold-zero in the background

– First 12,000 humanitarian & infrastructure project wallets(allegedly) received instant 1:1 asset-backed parity liquidity; project codes beginning with “P3-Ω” are already drawing funds

– Final Dragon Family gold dragon bonds (Series 999.999) redeemed at Hong Kong node at 16:02 Zulu; the resulting tsunami of liquidity is (allegedly) currently flooding every Tier 4B account in real time

Redemption centers are (allegedly) hotter than nuclear right now.

You are not waiting for the greatest wealth transfer in human history. You are standing inside it while it is still accelerating.

QFS Global Command – secure floor(allegedly) remains fully operational and euphoric. Out.

~~~~~~~~~~~~~~~~~

Global Currency Reset

Thurs. 4 Dec. 2025 TIER 4B CODES JUST WENT LIVE. …https://t.me/KerryCassidyReal

Deepstate bankers are scrambling. Their fiat empire is (allegedly) COLLAPSING in real time.

The Quantum Financial System flipped the switch. NESARA/GESARA protocols (allegedly) activated at 0400 ZULU.

Your redemption codes are HOT. Tier 4B—internet group patriots—are(allegedly) being pulled in FIRST.

Exchanges locked in at 1:1 (for Humanitarian Projects). No more Zimbabwe funny money. Gold-backed digital assets only.

Central banks are ghosting. Fed Reserve servers (allegedly) offline. IMF begging for mercy.

This isn’t hopium. Military satellites confirm: 209 nations synced. BRICS just(allegedly) executed the kill shot.

REDEMPTION CENTERS ON STANDBY. WWG1WGA.

Read full post here: https://dinarchronicles.com/2025/12/05/restored-republic-via-a-gcr-update-as-of-december-5-2025/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Now that we, the Untied States, are there, the speed of the monetary reform should pick up even faster now...Digitalization IMO also requires the lifting of the three zeros. The fact they talk about it so much is a conclusion that they are about to lift the three zeros. It's called priming you...preparing you. Call it a precursor.

Mnt Goat I wish could tell everyone to go to the bank and exchange your dinar today but this is simply not going to be the case. We must realize that the CBI is working on one track, the GOI on another, and some can even say Kurdistan on yet another. It’s the CBI track that we have been following mostly with all the banking and financial reforms. We were told just a few weeks ago that the CBI is ready to remove the zeros and we all know what that can lead to. In the news back then, Iraq even told us about the pending now basket and talked about moving to FOREX. Then they even told us that moving to Forex would even coincide with the implementation of the new digital dinar. [Post 1 of 2....stay tuned]

Mnt Goat This was the first time they talked openly about this since 2011 when we learned about the overall Dr Shabibi plan. The digital dinar did not exist back then, however things have changed since 2011 and so the CBI told us the digital dinar will stop all currency fraud and completely shut down the parallel market. Article: “CENTRAL BANK GOVERNOR: DIGITAL CURRENCY WILL SOLVE 90% OF THE PROBLEMS IN THE IRAQI FINANCIAL SYSTEM”. [Post 2 of 2]

*************

Japan Just PULLED THE TRIGGER—A $20T MELTDOWN is Imminent!

Steven Van Metre: 12-4-2025

Top Japanese officials just pulled the trigger on unwinding the $20 trillion Yen carry trade that could send tech stocks crashing 15-25% overnight and create a generational buying opportunity for those who are prepared.

Seeds of Wisdom RV and Economics Updates Friday Morning 12-04-25

Good Morning Dinar Recaps,

The 5 Economic Pillars Driving the Global Reset

Why these five forces are reshaping currencies, trade systems, and global finance.

Overview

Global debt has reached record highs, forcing governments and central banks into structural shifts rather than short-term fixes.

Trade is moving away from USD settlement as bilateral agreements, BRICS partnerships, and commodity-linked contracts expand.

Good Morning Dinar Recaps,

The 5 Economic Pillars Driving the Global Reset

Why these five forces are reshaping currencies, trade systems, and global finance.

Overview

Global debt has reached record highs, forcing governments and central banks into structural shifts rather than short-term fixes.

Trade is moving away from USD settlement as bilateral agreements, BRICS partnerships, and commodity-linked contracts expand.

Asset portfolios are transforming, with central banks increasing gold and commodity reserves to hedge against fiat instability.

New financial technologies—CBDCs, faster settlement rails, AI-assisted compliance, and interoperability standards—are redefining global payment architecture.

Energy security is re-aligning, creating new alliances and alternative pricing frameworks that reshape geopolitical leverage.

Key Developments

Debt pressures continue to mount as public and private leverage sit at multidecade highs, prompting calls for restructuring and alternative monetary frameworks.

Trade diversification is accelerating, with more nations conducting cross-border settlement outside the U.S. dollar and strengthening regional trade blocs.

Asset reserve strategies are shifting, especially toward gold accumulation and critical-commodity stockpiling as a hedge against fiat volatility.

Technology modernization is enabling real-time, multi-currency settlement systems that bypass traditional Western-dominated infrastructure.

Energy alliances—particularly in Eurasia, Africa, and South America—are establishing long-term supply chains that operate outside legacy pricing systems.

The Five Pillars of the Global Reset

1. The Debt Pillar — Why Debt Matters

Debt is the core pressure point forcing change. With global public debt surpassing $100 trillion and overall debt exceeding 235% of global GDP, existing systems can no longer sustain normal repayment cycles. This strain compels governments to explore restructuring, currency adjustments, and new financial mechanisms. In the Global Reset model, overwhelming debt acts as the trigger that pushes policymakers toward system redesign rather than temporary relief.

2. The Trade Pillar — Why Trade Matters

Trade determines how nations exchange value, and shifting away from U.S.-centric settlement reshapes the financial map. As more countries sign bilateral or regional agreements using local currencies or commodities, the traditional dollar-dominant framework erodes. These realignments lay the foundation for alternative reserve currencies, new trade rails, and multipolar settlement systems—central components of any global reset.

3. The Assets Pillar — Why Assets Matter

Assets—especially gold, critical metals, and sovereign reserves—form the collateral base of economic power. Central banks have expanded gold purchases in recent years, signaling declining confidence in unbacked currency systems. Accumulating hard assets provides nations with stability during transition periods and strengthens balance sheets for potential revaluation environments. Assets supply the trust, collateral, and liquidity required for a redesigned system.

4. The Technology Pillar — Why Technology Matters

A reset cannot occur without modern financial rails. Digital currencies, tokenized settlements, interoperability standards, AI-driven governance, and blockchain-based infrastructure enable cross-border payments that bypass legacy bottlenecks. These systems allow faster, cheaper, and more transparent value transfers. Technology is what turns restructuring proposals into functioning global architecture.

5. The Energy Pillar — Why Energy Matters

Energy is the foundation of global production—and the source of real geopolitical leverage. Nations dependent on externally controlled supply chains face vulnerability. As countries secure long-term energy agreements, build regional networks, or shift into mixed-energy systems, they reduce exposure to Western pricing mechanisms. Because global trade and currency valuation are linked to energy, any systemic reset must be anchored in stable, diversified energy flows.

Why It Matters

These five pillars—Debt, Trade, Assets, Technology, and Energy—show where structural stress is building and where new systems are emerging. Together, they reveal that a transformation in global finance is not speculative but already underway. Understanding these pillars helps readers interpret the daily news not as isolated events but as part of a coordinated global realignment.

Implications for the Global Reset

Pillar: Debt — System-level strain increases pressure for currency restructuring and alternative payment frameworks.

Pillar: Trade & Assets — As trade moves away from USD and central banks accumulate hard reserves, the foundation for a multipolar financial system strengthens.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

IMF Warns Stablecoin Risks Require Strong Institutions, Not Just Regulation

New IMF report says fragmented global rules are not enough to prevent macro-financial instability

Overview

• IMF releases major report on global stablecoin risks

• Warns that regulation alone cannot prevent shocks without strong institutions

• Notes fragmented rules across the U.S., UK, EU, and Japan

• Highlights dominance of USD-pegged coins and growing Treasury-backed reserves

Key Developments

IMF Identifies Fragmented Global Stablecoin Frameworks

In its “Understanding Stablecoins” report, the IMF examined regulatory approaches across the United States, United Kingdom, Japan, and the European Union. The Fund found that global oversight remains highly inconsistent, creating operational gaps and varied interpretations of risk. It warned that the mix of different issuance models and regulatory classifications—sometimes even within the same region—contributes to policy fragmentation.

Stablecoin Interoperability and Cross-Border Risks Raised

The IMF pointed to the proliferation of stablecoins across multiple blockchains and exchanges as a growing concern. It said this expansion risks inefficiencies due to a lack of interoperability, and could generate friction between countries with differing regulatory requirements or transaction rules.

Regulation Is Not Enough—Institutional Strength Needed

The report emphasized that “strong macro-policies and robust institutions” must serve as the first line of defense against stablecoin-related risks. While regulation can address certain vulnerabilities, the IMF stressed that international coordination is essential to prevent cross-border spillovers and to maintain monetary and financial stability.

USDT and USDC Reserve Structures Under Spotlight

According to the report, two of the world’s largest stablecoins—USDT and USDC—are “mostly backed” by short-term U.S. Treasuries, reverse repo agreements, and bank deposits. Roughly 40% of USDC reserves and around 75% of USDT reserves consist of short-term Treasury holdings, with USDT additionally holding a portion of its reserves in Bitcoin. The IMF noted the overall stablecoin market now exceeds $300 billion, with the vast majority of tokens pegged to the U.S. dollar.

GENIUS Act Implementation Reshapes U.S. Stablecoin Markets

Following the signing of the GENIUS Act in July, U.S. regulators are building a comprehensive federal framework for payment stablecoins. Early analysis from blockchain auditor CertiK noted emerging liquidity separation between U.S. and EU-regulated stablecoin pools, signaling the beginning of distinct regional market structures.

Why It Matters

Stablecoins remain among the fastest-growing components of global finance, yet rules governing them are inconsistent and evolving. The IMF’s warning that regulation alone cannot ensure stability signals that the next phase of digital-asset oversight will hinge on stronger institutions, coordinated policy design, and cross-border collaboration. Without these, the rapid expansion of Treasury-backed digital dollars could pose systemic risks.

Implications for the Global Reset

Pillar 1: Monetary System Restructuring

Stablecoins backed largely by U.S. Treasuries reinforce America’s financial influence even as digital assets rise. The IMF’s call for global coordination indicates a turning point where digital-dollar instruments must now be integrated into broader monetary governance.

Pillar 2: Financial Architecture & Regulatory Reform

Fragmented rules across major economies are shaping new digital payment corridors. As the U.S., EU, and Asia establish competing frameworks, nations may align with the system that best supports their role in a multipolar financial landscape.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Cointelegraph – “IMF lays out guidelines for addressing stablecoin risks, beyond regulations”

Reuters – “IMF says stronger institutions needed as stablecoins rise globally”

CertiK – “GENIUS Act reshapes U.S. and EU stablecoin liquidity flows”

~~~~~~~~~~

BRICS De-Dollarization Splinters as India and China Diverge on Strategy

India rejects a BRICS currency while China advances yuan internationalization independently

Overview

• India formally rejects any BRICS common currency proposals

• China accelerates yuan internationalization outside BRICS frameworks

• Russia and China deepen bilateral national-currency trade

• BRICS bloc remains fragmented on de-dollarization strategy

Key Developments

India Rejects a Common BRICS Currency

India’s foreign minister reiterated that the country has “never been for de-dollarization” and sees no proposal for a BRICS currency on the table. India views the U.S. dollar as critical to trade stability—particularly as it maintains over $128 billion in annual U.S. trade. The weakening rupee adds further caution, as rapid de-dollarization would expose India to exchange-rate volatility.

Russia and China Pursue Separate National-Currency Trade Paths

Russia publicly announced it has no intentions of abandoning the dollar entirely and has dismissed the idea of a BRICS currency “at this stage.” However, Russia continues expanding its ruble-based settlement systems, especially with Iran and China, which report extremely high percentages of national-currency trade.

China Expands Renminbi Internationalization Through Infrastructure

The People’s Bank of China is accelerating yuan adoption through CIPS, which now includes more than 180 participating institutions across 167 countries. Approximately 80 global central banks hold RMB reserves, and China’s $768 billion trade surplus strengthens the appeal of yuan-based settlement in select markets.

Limited BRICS Progress on Local-Currency Trade Mechanisms

While India maintains 156 Special Rupee Vostro Accounts with 30 countries, these channels remain modest in scale. South Africa and Brazil have openly cautioned the bloc to avoid provoking Washington through aggressive anti-dollar initiatives, with Brazil dropping the common-currency agenda entirely during its 2025 BRICS presidency.

Why It Matters

The competing strategies within BRICS reveal a shift away from the idea of a unified anti-dollar bloc. Instead, individual countries are prioritizing national interests, geopolitical stability, and bilateral currency arrangements. While China and Russia push forward with alternative systems, India and others remain cautious, limiting the likelihood of a coordinated monetary challenge to the U.S. dollar in the near term.

Implications for the Global Reset

Pillar 1: Trade & Supply Chain Re-Engineering

Fragmentation in BRICS currency strategy signals a move toward bilateral trade corridors rather than large multilateral realignments, affecting global supply routes and settlement systems.

Pillar 2: Monetary System Diversification

China's unilateral renminbi expansion increases global financial multipolarity, but India’s resistance shows that the shift away from the dollar will be uneven, incremental, and shaped by geopolitical risk calculations.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru – “BRICS De-Dollarization: India and China Shape a New Trade Bloc”

Brave New Coin – “90% of Russia–India Trade Now in National Currencies: What’s Next for BRICS?”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Why America Is A Nation Of Miserable Millionaires Who Don't 'Feel Rich'

Why America Is A Nation Of Miserable Millionaires Who Don't 'Feel Rich'

Vawn Himmelsbach Tue, December 2, 2025 Moneywise

So, you’ve hit that money milestone you were aiming for. The one where you thought you’d finally feel wealthy. But you don’t — and in fact you’re as stressed and depressed as ever. Why?

There’s no one number you can hit that upgrades you from middle-class to wealthy. Being rich is “a subjective experience,” says Charles Chaffin, co-founder of the Financial Psychology Institute (1).

Why America Is A Nation Of Miserable Millionaires Who Don't 'Feel Rich'

Vawn Himmelsbach Tue, December 2, 2025 Moneywise

So, you’ve hit that money milestone you were aiming for. The one where you thought you’d finally feel wealthy. But you don’t — and in fact you’re as stressed and depressed as ever. Why?

There’s no one number you can hit that upgrades you from middle-class to wealthy. Being rich is “a subjective experience,” says Charles Chaffin, co-founder of the Financial Psychology Institute (1).

And according to recent research, some people never get much happier when they reach financial security — no matter how much money they make.

Wealth And Well-Being Depend On Mindset

No matter how much money we have, some of us may never feel wealthy. For instance, only a third of millionaires (32%) consider themselves wealthy, according to a survey by Northwestern Mutual (2).

One reason is that people who become millionaires are often “money vigilant,” according to Chaffin. This means they’re constantly keeping track of how much money is moving in and out of their accounts — and they never feel truly secure with the amount they have (1).

Money vigilance is one of four money scripts people fall into, according to a framework created by psychologist Brad Klontz. He describes these scripts as unconscious sets of beliefs about money that shape our financial behavior. They’re typically formed in childhood and can be passed down from generation to generation. While the outcomes from adopting the script of money vigilance can be good — like being a disciplined saver — they can also prevent you from enjoying your wealth (3).

TO READ MORE: https://finance.yahoo.com/news/even-millionaires-dont-feel-wealthy-100702714.html