Tuesday Coffee with MarkZ,. 10/21/2025

Tuesday Coffee with MarkZ,. 10/21/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning, MarkZ, Mods, and everyone!

Member: What are you hearing from the bond side Mark?

Tuesday Coffee with MarkZ,. 10/21/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning, MarkZ, Mods, and everyone!

Member: What are you hearing from the bond side Mark?

MZ: The bond side is still dead silent. The first check in of the week should be late this evening. I will update then if there is anything fun….If not I will tell you tomorrow.

Member: Mark, Has the full HCL law passed in Iraq.

MZ: Not yet….but we are watching it.

Member: F26 said that part of the HCL was done.

Member: 70% of the articles of the oil and gas law have been agreed upon

Member: 12-2c allegedly became law yesterday now they are possibly waiting on 50000 dollar an ounce gold prices?

Member: Hey Mark, do you believe Iraq will do an in-country rate and then release to an international rate like Kuwait did for 10 days?

MZ: No, I don’t think they can keep is quiet in today’s internet age. Kuwait happened before the widespread adoption of the internet.

MZ: “The Kurdistan region deposits 120 billion dinar in the Federal Finance account” this is for August salaries…so they are still considerably behind. But it seems everything is working like its supposed to….or close enough. Money is moving….which is important for HCL

Member: The Iraqi elections are less than a month away. Sudani better get moving

MZ: The election runoffs start about Oct 26th. Then elections start Nov. 11. There is a lot of pressure to finish this thing before they go on break on the 26th.

Member: what happens if the rv doesnt go before the elections?

Member: Bye- Bye Sudani….IMO no new rate- he is out.

MZ: “Al-Sudani announces it from Baghdad: There is no return to coups. The constitution is a red line” They are now settling things like civilized people now instead of military coups and dictators.

MZ: “Barzani to a senior Iraqi military delegation: We still need the support of the International coalition” He is talking about containing Isis and security and how important this is. Their goal is to lift the purchasing power of all Iraqis.

MZ: “Iraq’s negotiations to join the World Trade Organization continues” They want us to know how awesome and great things are going. But they did not give us an idea on timing…but we know they have completed all the requirements.

Member: Maybe the WTO is waiting on a new rate to let Iraq in? the whole world seems to be waiting on this….sigh.

Member: My bank announced that they would be closed last Monday for training mentioned nothing about indigenous day or Columbus Day… And we weren’t able to use our ATMs through the weekend or Monday

Member: I live in the DC metropolitan area currency exchange said DC types are buying up Iraqi dinars and Vietnamese dongs . Something happening .

Member: Mark, are you still feeling good about this month?

Member: Do we have to register to be in tier 4B?

MZ: You do not need to register. Banks will be screaming from the rooftops to get you into their banks/redemption facilities to exchange.

Member: There are 5 Tiers of folks Exchanging. Tier 1-governments and royalty Tier 2-whales-elite with platforms of currency, corporations, etc. Tier 3-Admirals Group, American Indians, CMKX, large church groups (like the Mormons), etc. Tier 4-all the hundreds of thousands paying attention to intel - internet groups (all of us). Tier 5- those who never paid attn - the general public.

Member: Mark, everyone is concerned about going to the best banking facility that has the best rates

MZ: I am still being told the rates should be the same no matter what banking facility you go to…so they have standardized the rates on purpose to avoid this. I believe this to be accurate and true. If you are worried about this- do not rush to be the first person to exchange.

Member: Thanks everyone…..we appreciate you and have a great day

Lewis Herms joins the stream today. Please listen to the replay for his information and opinions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

Jon Dowling: Cryptos are the Future of Payments, XRP on a Ledger, Wealth Transfer

Jon Dowling: Cryptos are the Future of Payments, XRP on a Ledger, Wealth Transfer

10-20-2025

Are you ready for a financial transformation unlike anything we’ve ever seen?

In a recent podcast episode, former Air Force Captain and cryptocurrency expert, Rob Cunningham, laid out a compelling vision for the overhaul of our global financial system, proposing a monumental shift from the current Federal Reserve model to a new, constitutionally authorized monetary system.

Backed by sound money principles and cutting-edge technology, this isn’t just a financial adjustment – it’s a paradigm shift.

Jon Dowling: Cryptos are the Future of Payments, XRP on a Ledger, Wealth Transfer

10-20-2025

Are you ready for a financial transformation unlike anything we’ve ever seen?

In a recent podcast episode, former Air Force Captain and cryptocurrency expert, Rob Cunningham, laid out a compelling vision for the overhaul of our global financial system, proposing a monumental shift from the current Federal Reserve model to a new, constitutionally authorized monetary system.

Backed by sound money principles and cutting-edge technology, this isn’t just a financial adjustment – it’s a paradigm shift.

Rob’s insights delve deep into the geopolitical and economic forces that are pushing us towards this inevitable reset. From government shutdowns and escalating global conflicts to the looming “currency reset,” he argues that the current “man-made financial and legal systems” have led to a form of control by entities like the Federal Reserve and the city of London corporation.

However, a counter-movement is gaining momentum. Rob highlights ongoing “drain the swamp” efforts within the US government, suggesting a critical turning point in the political landscape.

This, combined with anticipated economic revival in the coming months, sets the stage for a fundamental re-evaluation of how our money works.

So, what does this new system look like? At its core, it’s about transparency, accountability, and real value. Rob emphasizes the vital role of XRP and blockchain technology in enabling this transition.

Imagine a world where financial transactions are not only fast and transparent but also inherently trustworthy, backed by real assets like gold and silver. This move signifies a departure from centralized control towards decentralized, trustless protocols – a financial ecosystem built on integrity, not opacity.

This proposed system aims to restore a republic founded on constitutional principles and divine laws. It promises not just financial stability but an equitable distribution of wealth and resources, potentially unlocking funds and opportunities that have historically been inaccessible, even touching upon concepts like funds tied to birth certificates.

Beyond the economic mechanics, Rob connects these shifts to profound spiritual themes. He references the prophetic insights of the late Kim Clement, who foresaw the fall of corrupt systems and the dawn of a new era marked by abundance and truth.

This isn’t just about money; it’s about a foundational shift in how humanity operates, moving away from systems of control towards liberation and a higher social covenant.

Rob even shared a conceptual diagram, illustrating humanity’s epic journey from financial and spiritual battle to liberation under a new monetary and social framework.

He also tantalizingly announced an upcoming video that will explore a hypothetical monetary system conceptualized by none other than Christ and Nikola Tesla – a fascinating blend of divine principles, advanced technology, and free energy concepts.

Rob Cunningham’s vision challenges us to rethink everything we know about money, power, and our collective future. It’s a call to transparency, decentralization, and a return to sound, constitutional principles, powered by innovation like blockchain.

This is a conversation that touches on some of the most critical questions of our time. To truly grasp the depth of these insights and prepare for the potential shifts ahead, we highly recommend you dive into the full discussion.

Watch the full video from Jon Dowling for further insights and information!

Iraq Economic News and Points To Ponder Tuesday Morning 10-21-25

Iraq's Internal Debt In Numbers: From Currency Printing To The Three-Year Budget

Economy Yesterday, | 1027 Baghdad Today – Baghdad Since 2003, Iraq has been trapped in a vicious financial cycle, marked by recurring crises and changing governments. The only constant, however, is its reliance on domestic debt as a temporary savior during every financial crisis or oil price downturn.

Whenever revenues dwindle, the state resorts to financing through banks or the Central Bank to cover the deficit, pay salaries, and continue spending, without generating new resources or restructuring the economy.

Iraq's Internal Debt In Numbers: From Currency Printing To The Three-Year Budget

Economy Yesterday, | 1027 Baghdad Today – Baghdad Since 2003, Iraq has been trapped in a vicious financial cycle, marked by recurring crises and changing governments. The only constant, however, is its reliance on domestic debt as a temporary savior during every financial crisis or oil price downturn.

Whenever revenues dwindle, the state resorts to financing through banks or the Central Bank to cover the deficit, pay salaries, and continue spending, without generating new resources or restructuring the economy.

This policy, which began as an exceptional option, has over the years become a permanent approach, with domestic debt becoming part of the state's financial structure, rather than a temporary remedy.

From the war on ISIS to the COVID-19 pandemic, to the massive budgets under the government of Mohammed Shia al-Sudani, domestic debt has doubled dramatically, exacerbating the fragility of the economy.

This debt has become a direct reflection of the absence of institutional reform and the weak coordination between fiscal and monetary policy.

Economic expert Nabil Jabbar Al-Tamimi, in a clarification posted on his official Facebook page and followed by Baghdad Today, believes that Iraq's domestic debt has, over the past two decades, been a financial emergency tool used by successive governments in every crisis, given the absence of sustainable economic alternatives.

He points out that the government typically borrows from three main sources: private banks through bonds or limited facilities, national bonds directed to the public, and treasury transfers provided by the Central Bank through liquidity injections or money printing.

Al-Tamimi identifies three stages in which domestic debt rose significantly:

War on ISIS (2014–2017)

During this period, domestic debt jumped from approximately 5 trillion dinars in 2013 to 48 trillion dinars in 2017, before gradually declining to 38 trillion dinars in 2019. According to Al-Tamimi, this is due to the state's need to secure liquidity following the collapse in oil prices and the costs of war.

The central bank was the primary financier, printing money to cover massive operational and military expenses.

This financing facilitated the state's continuity, but it triggered the first real wave of inflation after 2003 and reopened the debate about the limits of central bank independence.

COVID-19 pandemic (2020–2022)

With the outbreak of the pandemic and the decline in demand for oil, domestic debt rose again from 38 to 70 trillion dinars.

Analysis of this period shows that the monetary policies adopted by the government— including adjusting the exchange rate and financing expenditures through domestic debt instruments—provided a temporary respite, but they increased the cost of living and weakened confidence in monetary policy.

Debt here has become not only a means of financing, but a reflection of the fragility of the financial structure that relies on oil as the basis for survival.

Al-Sudani's government and the three-year budget (2023–2025)

Al-Tamimi believes that the domestic debt increased during Al-Sudani's government from 70 to approximately 91 trillion dinars, as a result of financing the deficit in the largest budget in Iraq's history.

Data shows that the bulk of the debt came from the central bank, while borrowing from private banks and national bonds constituted a small percentage.

This financial expansion, despite rising oil prices, reveals the continued reliance on domestic debt to cover operating expenses

rather than stimulate productive sectors, making debt an economically unproductive tool.

According to Al-Tamimi's analysis, the discrepancy between the policies of the Central Bank and the government reflects a lack of institutional coordination.

The former seeks to curb inflation by controlling liquidity, while the latter continues to borrow to secure its monthly obligations.

This contradiction has transformed domestic debt from a means of financial balance into a source of economic pressure that threatens long-term monetary stability.

Most domestic debt is not investment debt that can reproduce wealth or create jobs.

Rather, it represents short-term operational obligations that “pain the pain, not cure the disease,” as economists describe it.

Without genuine institutional reform, domestic debt will remain a closed loop between the treasury and the central ank,expanding with each crisis and temporarily extinguished with each rise in oil prices. https://baghdadtoday.news/285579-.html

Al-Salami: Private Banks Violate The Central Bank's Instructions And Waste Millions Of Dinars Daily.

Economy October 19, Information / Baghdad.. MP Hadi Al-Salami revealed on Sunday that private banks are violating the laws and regulations issued by the Central Bank of Iraq, noting that these violations result in the daily waste of millions of dinars without effective oversight by the relevant authorities.

Al-Salami told Al-Maalouma News Agency that "a number of private banks continue to commit serious financial violations, leading to the waste of public funds," noting that "the Central Bank has not taken decisive action despite the clarity of the violations."

Al-Salami called on regulatory authorities to "open an urgent investigation into the dealings of these banks, hold those involved accountable, and take serious steps to limit the daily financial hemorrhage resulting from fictitious and commercially unsecured transactions." https://almaalomah.me/news/113223/economy/السلامي:-مصارف-أهلية-تخالف-تعليمات-المركزي-وتهدر-ملايين-الدن

An Economist Calls For The Establishment Of A Government Bank To Guarantee Depositors' Funds.

October 20, Information / Baghdad.. Economic expert Basil Al-Obaidi confirmed on Monday that one of the most prominent reasons for the cash shortage in Iraqi banks is citizens' lack of confidence in the security of their deposited funds.

This has led many to store large sums of money, whether in Iraqi dinars or foreign currencies, at home instead of depositing them in banks.

Al-Obaidi told Al-Maalouma News Agency that "citizens' reluctance to deposit their money in banks has led to a decline in the amount of liquidity available to the Central Bank and banking institutions, negatively impacting economic activity and commercial activity in the country."

He added, "Many citizens fear losing their money or being unable to withdraw it when needed, due to the weak safeguards in some banks.

This prompts them to keep their money at home, exposing them to numerous risks, including accidents or theft."

Al-Obaidi called on the Central Bank of Iraq to "establish a government-backed bank whose mission would be to provide full insurance coverage for deposits in banks after they are licensed by the Central Bank, with the aim of reassuring depositors and guaranteeing their rights."

He also called for raising interest rates on fixed and floating deposits, to encourage citizens to deal with the formal banking system instead of keeping money outside the economic cycle.

https://almaalomah.me/news/113327/economy/اقتصادي-يدعو-لتأسيس-مصرف-حكومي-لضمان-أموال-المودعين

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Tuesday Morning 10-21-25

Good Morning Dinar Recaps,

Collateral or Collapse: U.S. Banks Tighten Grip on Argentina’s $20 Billion Lifeline

Emerging-market fragility meets tightening global credit standards

Argentina’s fragile economy faces another hurdle as major U.S. banks — JPMorgan Chase, Bank of America, and Goldman Sachs — demand substantial collateral before releasing a proposed $20 billion rescue loan.

Good Morning Dinar Recaps,

Collateral or Collapse: U.S. Banks Tighten Grip on Argentina’s $20 Billion Lifeline

Emerging-market fragility meets tightening global credit standards

Argentina’s fragile economy faces another hurdle as major U.S. banks — JPMorgan Chase, Bank of America, and Goldman Sachs — demand substantial collateral before releasing a proposed $20 billion rescue loan.

The Deal in Doubt

Argentina’s central bank reserves have fallen to multi-year lows, even as inflation tops 200% year-over-year.

With IMF funds delayed, Buenos Aires is turning to private markets to stabilize its peso and avoid another balance-of-payments crisis.

Lenders, wary after years of defaults, are reportedly seeking export-revenue guarantees or commodity-based collateral to secure repayment.

Market Reaction

Argentine bonds slid as traders questioned whether the loan can close.

Credit-default-swap spreads widened sharply, signaling renewed stress.

Economists warn that without new financing, the government may tighten import controls and deepen recessionary pressures.

Why This Matters

This standoff illustrates how emerging-market borrowing costs are being repriced in a world of higher U.S. interest rates and tighter liquidity.

Private banks are now dictating sovereign terms once reserved for multilateral lenders — a sign of the new credit hierarchy taking shape in global finance.

Argentina’s outcome could define how frontier economies access capital in the post-QE era.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

~~~~~~~~~

Britain’s Debt Crossroads: Borrowing Hits Five-Year High as Fiscal Pressures Mount

Debt costs climb and fiscal headroom narrows ahead of budget season

The U.K. government’s borrowing reached £20.2 billion in September, the highest for that month in five years, bringing total borrowing for 2025’s first half to £99.8 billion.

Key Drivers

Interest-rate impact: higher gilt yields are inflating debt-service costs.

Sluggish revenue: weaker-than-expected tax receipts have widened the deficit.

Energy-subsidy overhang: carry-over spending from prior relief schemes continues to strain the budget.

Fiscal Outlook

Economists warn of limited headroom ahead of the Autumn Budget.

The Office for Budget Responsibility (OBR) projects debt surpassing 100% of GDP by 2026 if growth remains weak.

Treasury officials are reportedly weighing targeted tax increases or spending restraint to stabilize the debt ratio.

Market Impact

Gilt yields remain elevated near multi-year highs.

Sterling softened modestly against the U.S. dollar as investors reassess fiscal risk.

The U.K.’s situation is now a bellwether for how advanced economies manage post-pandemic debt in a high-rate world.

Why This Matters

Britain’s borrowing surge reflects a broader global dilemma — governments are confronting tightening financial conditions with limited fiscal flexibility.

If the U.K. struggles to rein in deficits, it could spark renewed volatility in European bond markets and test investor faith in sovereign credit stability.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

~~~~~~~~~

“From Mediator to Power-Broker: Recep Tayyip Erdoğan & Turkey’s Gaza Gambit”

How Ankara reinvented itself in the Middle East by brokering the Gaza cease-fire

In a dramatic diplomatic shift, Turkey has elevated its role in the Gaza conflict, positioning itself as a central mediator in a cease-fire deal brokered by Donald J. Trump and backed by Hamas. Once viewed skeptically in Washington for its close ties to Hamas, Turkey under President Erdoğan has flipped the script, using its relationship with Hamas to ensure a deal’s delivery—and in doing so, significantly raised its geopolitical standing.

The Deal

Turkey reportedly acted as a key channel between Hamas and the U.S., securing Hamas’s acceptance of a truce and the release of hostages in Gaza.

Ankara then secured the appointment of former disaster-control chief Mehmet Gulluoglu to lead Turkish efforts in Gaza humanitarian operations, signalling Turkey’s deeper involvement.

The arrangement reportedly gives Turkey leverage: in return for mediation, Erdoğan is seeking relief from U.S. sanctions and restoration of defence-ties, including arms purchases.

Regional & Global Impact

Turkey’s successful mediation gives Ankara renewed prestige in the Middle East, enhancing its role beyond the traditional broker states like Qatar and Egypt.

This changes the dynamics for Israel, Hamas and the Arab world: Turkey now has a stake in both stability and influence, altering alignment possibilities.

For the U.S., relying on Turkey as a mediator signals a shift in approach: from multilateral frameworks to transactional deals with regional actors.

Why This Matters

Turkey’s reinvention from outsider to indispensable player in Middle East diplomacy is significant:

It suggests that states once seen as peripheral can now capture key roles through strategic leverage and soft-power mediation.

This could reshape power balances: Turkey may extract concessions—in arms, defence cooperation and regional influence—raising questions about U.S. regional strategy and the role of traditional allies.

Importantly, while the cease-fire is a short-term victory, the absence of a clear pathway toward a two-state solution or durable peace means Turkey’s role may become a long-term one, carrying both risk and reward for Ankara.

This is not just politics — it’s global alliances and global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Reuters – Erdogan turns Trump’s Gaza deal into a power play for Turkey

Modern Diplomacy – From Mediator to Power Broker: Erdogan’s Gaza Gamble

Reuters – Turkey puts ex-disaster chief in charge of Gaza aid

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 10-21-2025

TNT:

Tishwash: Al-Ghariri: Iraq's negotiations to join the World Trade Organization are ongoing.

Minister of Trade Athir Dawood Al-Ghurairi confirmed on Monday that Iraq's negotiations to join the World Trade Organization are ongoing, while pointing out that regional cooperation and integration are the way to achieve peace, stability and sustainable development.

A statement by the Ministry of Trade received by the Iraqi News Agency (INA) stated that "Minister of Trade Athir Dawood Al-Ghurairi participated in the 16th session of the United Nations Conference on Trade and Development (UNCTAD), held in Geneva with the wide participation of representatives of countries and international and regional organizations."

TNT:

Tishwash: Al-Ghariri: Iraq's negotiations to join the World Trade Organization are ongoing.

Minister of Trade Athir Dawood Al-Ghurairi confirmed on Monday that Iraq's negotiations to join the World Trade Organization are ongoing, while pointing out that regional cooperation and integration are the way to achieve peace, stability and sustainable development.

A statement by the Ministry of Trade received by the Iraqi News Agency (INA) stated that "Minister of Trade Athir Dawood Al-Ghurairi participated in the 16th session of the United Nations Conference on Trade and Development (UNCTAD), held in Geneva with the wide participation of representatives of countries and international and regional organizations."

The minister stressed, according to the statement, that "collective action and regional integration represent a fundamental pillar for building a more stable and equitable economic system in light of the transformations and challenges witnessed by the world," stressing that "open regional agreements can support the multilateral trading system and promote sustainable development."

Al-Ghurairi indicated that "Iraq, which continues its negotiations to join the World Trade Organization, sees regional initiatives as an opportunity to enhance its institutional readiness and align its legislative and investment frameworks, enabling it to effectively integrate into the global economy."

He explained that "regional integration represents a pillar for development and reconstruction, and that cooperation in the areas of infrastructure, simplifying customs procedures, encouraging investment, energy, agriculture, and services contributes to enhancing competitiveness and diversifying the national economy."

At the end of his speech, the Minister praised UNCTAD's significant role in supporting Iraq during its accession to the World Trade Organization, stressing that "regional cooperation and integration are the path to achieving peace, stability, and sustainable development." link

************

Tishwash: Energy expert: 70% of the articles of the oil and gas law have been agreed upon

An oil and gas expert says that 70% of the articles of the oil and gas law have been agreed upon and the rest needs political dialogue and negotiations.

The big picture: The oil and gas law was supposed to be completed in 2007 and voted on in the Iraqi parliament, but due to conflict and indifference of Iraqi parties, year after year, the enactment of the law was hampered.

Official Statement: د. Govand Sherwani, a university professor and oil and gas expert, told AVA that the oil export agreement will help to pass the oil and gas law in the sixth session of the Iraqi parliament, provided there is no political interference.

Sherwani said the biggest problem between Erbil and Baghdad on the oil issue is the failure to pass the oil and gas law, which should have been passed in 2007, but fortunately 70% of the articles of the draft law have been agreed.

On the other hand, the expert said that the three-year Iraqi budget law contains many shortcomings and all to the detriment of the Kurdistan Region, if the technical and financial issues are corrected, there is an opportunity in the 2026 budget law. link

************

Tishwash: Central Bank: Iraq's public debt is lower than that of the United States and several other Arab countries.

The Central Bank of Iraq confirmed on Monday that the external debt curve is declining and that Iraq is within safe limits for public debt. The bank noted that Iraq's public debt-to-GDP ratio stands at 31%, a lower percentage than that of developed countries such as the United States and Japan, and other Arab countries such as Egypt, Algeria, and Morocco.

Samir Fakhri, Director General of the Statistics and Research Department at the Central Bank, said, "Total public debt is divided into domestic and external debt. Domestic debt, as of the end of last September, amounted to 90.6 trillion dinars."

He added, "The domestic debt is divided into more than 50% in favor of the Central Bank, and less than 50% in favor of banks, whether private or government-owned," indicating that "the majority of the debt owed to banks is owed to government-owned banks, i.e., from government to government."

He pointed out that "the external debt has reached $54 billion, and is divided into three parts: the largest part, namely $40.5 billion, dates back to before 2003. It is a suspended debt, and we are not currently bearing any burdens on it, whether interest or debt service, from 2003 until today."

He continued, "The second part is the Paris Club debt, which amounted to $120 billion, 80% of which has been written off, leaving $24 billion. With what Iraq has paid, only $3.8 billion remains, which was supposed to be covered until the end of 2028." We note here that the external debt curve is declining.

He pointed out that "the third portion amounts to approximately $10 billion, and is related to investment spending. It is a long-term debt of twenty years, owed to a group of countries and organizations, including Japan's JICA, Germany's Siemens, Spain, and Britain. Thus, the total debt amounts to approximately $10 billion. If we exclude the forty and a half billion, the remaining amount is approximately $13 billion."

He emphasized that "if we convert these debts into dollars multiplied by the current exchange rate and add them to the domestic debt, the total debt-to-GDP ratio would reach approximately 43%. However, if we exclude the suspended debt of $40 billion, the public debt ratio would be around 30 to 31% of GDP."

Regarding financing the three-year budget deficit, Fakhri explained that “the deficit within the budget law was approved by Parliament for a period of three years. It is a planned deficit, not an actual one, of approximately 64 trillion dinars per year, meaning a total of 192 trillion dinars for the three years. What was actually spent as real debt is approximately 35 trillion dinars.” He indicated that “if we divide 35 trillion by the planned deficit, the percentage will be approximately 18.2%,” noting that “the debt was 56 trillion dinars until the end of 2022, and from 2022 until today, 35 trillion has been added to it, bringing the total to approximately 90.6 trillion dinars that we mentioned.”

He added, "One of the most important indicators of monetary policy is the consumer price index (inflation), which is currently close to zero. If we compare it with neighboring countries like Iran and Turkey, we find a clear difference in inflation rates between them and Iraq, in addition to the exchange rate gap."

He stressed that "the focus must be on financing the deficit, so it must be directed towards investment spending, as this leads to growth in non-oil revenues."

Fakhry touched on some of the debt ratios in neighboring countries, noting that "in Egypt, public debt amounts to 90% of GDP, in Algeria: 49%, in Morocco: 70%, in Lebanon: 160-170%, and in Saudi Arabia: 29%, despite being a strong and industrially advanced economy."

He pointed out that "major industrialized countries, such as the United States, have a public debt of 120%, while Japan's debt ratio is 250%." link

Mot: I Did It!!! -- Yeppers!!! I Did It!!!!

Mot: ... and Yet Another Motism frum da Net!!!!

MilitiaMan and Crew: IQD News Update-New Era-Digital Banking

MilitiaMan and Crew: IQD News Update-New Era-Digital Banking

10-20-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-New Era-Digital Banking

10-20-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Monday Evening 10-20-25

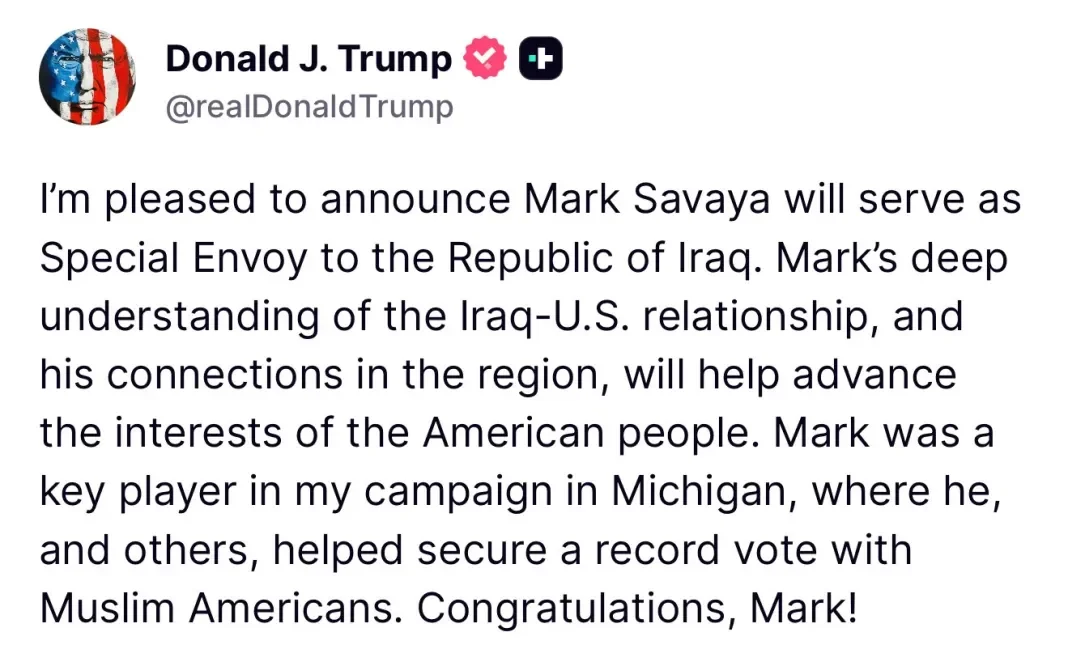

Trump Appoints Mark Savaya As Special Envoy To Iraq

Buratha News Agency2372025-10-20 US President Donald Trump announced on Sunday the appointment of Mark Savaya as his special envoy to Iraq.

"I am pleased to announce that Mark Savaya will serve as Special Envoy to the Republic of Iraq," Trump wrote on Truth Social. The US President said, "Mark's deep understanding of the relationship between Iraq and the United States, and his extensive connections in the region, will contribute to advancing the interests of the American people."

Trump Appoints Mark Savaya As Special Envoy To Iraq

Buratha News Agency2372025-10-20 US President Donald Trump announced on Sunday the appointment of Mark Savaya as his special envoy to Iraq.

"I am pleased to announce that Mark Savaya will serve as Special Envoy to the Republic of Iraq," Trump wrote on Truth Social. The US President said, "Mark's deep understanding of the relationship between Iraq and the United States, and his extensive connections in the region, will contribute to advancing the interests of the American people."

Mark Savaya is a prominent American businessman and pioneer in the cannabis (marijuana) industry in Michigan. He is 40 years old and is known as the founder and CEO of Leaf and Bud, one of the fastest-growing cannabis companies in the state.

Mark Savaya was born to an Iraqi Chaldean family who emigrated from Iraq in the 1990s to escape unrest and settled in the Detroit, Michigan area. This area is known for being home to the largest Chaldean community outside of Iraq.

https://burathanews.com/arabic/news/466703

Oil Falls Due To Oversupply And Global Trade Tensions

Energy Economy News – Baghdad Oil prices fell on Monday amid concerns about a global supply glut and rising trade tensions between the United States and China, raising concerns about a slowing global economy and weak energy demand.

Brent crude futures fell 24 cents, or 0.4%, to $61.05 a barrel by 00:32 GMT, while U.S. West Texas Intermediate crude fell 21 cents, or 0.4%, to $57.33 a barrel, erasing gains from last week's close.

Both benchmark crude oil prices posted weekly losses of more than 2% last week, their third consecutive weekly decline, as the International Energy Agency forecasts a growing supply surplus through 2026.

In a related development, the head of the World Trade Organization called on the United States and China to de-escalate trade tensions, warning that continued decoupling between the world's two largest economies could reduce global economic output by up to 7% over the long term.

The two countries recently renewed their trade war by imposing additional tariffs on ports receiving commercial vessels, moves that could disrupt global shipping traffic.

On the political front, US President Donald Trump and his Russian counterpart Vladimir Putin agreed to hold a new summit to discuss the war in Ukraine, while Washington continues to pressure India and China to halt imports of Russian oil.

Trade sources indicated that these pressures may push India to reduce its imports of Russian oil starting next December, potentially opening the way for China to obtain supplies at lower prices.

On the production front, data from oil services company Baker Hughes indicated that US energy companies added new oil and natural gas rigs last week for the first time in three weeks. https://economy-news.net/content.php?id=61361

Exchange Rate Drops: 141,450 Dinars Per Note

Economy | 10/20/2025 Mawazine News - Baghdad - Local markets in Baghdad recorded a slight decline in the dollar exchange rate against the Iraqi dinar, with the $100 bill reaching 141,450 dinars on the Al-Kifah and Al-Harithiya stock exchanges, after having stabilized at 141,700 dinars during yesterday's trading.

This limited decline comes amid relative stability in buying and selling activity in local markets, while the government and the Central Bank continue to monitor fluctuations in the parallel market within the framework of the current monetary policy. https://www.mawazin.net/Details.aspx?jimare=268798

Gold Recovers After Falling From Record Highs

Monday, October 20, 2025 08:05 | Economic Number of reads: 357 Baghdad / NINA / Gold prices rose slightly on Monday, recovering some of their losses after a sharp decline last week from record levels exceeding $4,300 an ounce following US President Donald Trump's statements that eased trade tensions between the United States and China and pushed investors towards higher-risk assets.

The price of gold in spot transactions rose 0.4% to reach $4,263.59 an ounce, after falling about 1.8% on Friday, the largest decline since mid-May. As for other precious metals, platinum fell 1.1% to $1,591.55 an ounce, and palladium fell 0.5% to $1,467.16 an ounce. / https://ninanews.com/Website/News/Details?key=1257846

The Ministry Of Commerce Launches An "Investment" Plan To Empower The Private Sector As A Key Partner In Development.

Economy | 10/20/2025 Mawazine News - Baghdad - The Ministry of Trade announced the launch of a comprehensive investment plan aimed at developing the private sector and enabling it to play its role as a key partner in the sustainable development process.

The official spokesperson for the Ministry of Trade, Mohammed Hanoun, said in a statement followed by Mawazine News that "this plan comes within the framework of a national strategy aimed at diversifying the Iraqi economy and reducing dependence on oil revenues by creating a stimulating and attractive business environment for local and foreign investments."

Hanoun added that "the ministry is working to update the legislative and regulatory structure of the trade sector in line with World Trade Organization standards," noting that the new procedures include simplifying trade transactions, facilitating investor entry, and enhancing transparency in granting commercial licenses.

He stressed that "the private sector will be an 'effective' partner in implementing investment projects, whether in the field of logistics, warehousing, transportation, or marketing, with the aim of improving the efficiency of the national economy and enhancing its competitiveness."

The official spokesperson explained that "the ministry is proceeding with implementing this plan in cooperation with the Private Sector Development Council and relevant economic entities," noting that "the next phase will witness the launch of joint projects that contribute to employing the workforce and developing national industries."

Hanoun concluded his statement by saying, "The Ministry of Trade believes that the private sector is the true engine of economic growth, and that empowering it represents the cornerstone of building a diversified and sustainable economy capable of facing challenges, providing job opportunities, and enhancing economic stability in Iraq."

https://www.mawazin.net/Details.aspx?jimare=268805

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Monday Evening 10-20-25

Good Evening Dinar Recaps,

BRICS Currency Countdown: Why 2026 Still Looks On the Clock

— And how U.S. tariff threats may be accelerating the very change they aim to block

What’s Going On

The grouping of nations known as BRICS (Brazil, Russia, India, China, South Africa, and newer members) appears to be staying on track for a 2026 launch of a shared-currency framework, despite aggressive efforts by the U.S. to derail the plan. Researchers monitoring the project highlight that digital payment systems, local-currency trade settlement and infrastructure are all advancing.

Good Evening Dinar Recaps,

BRICS Currency Countdown: Why 2026 Still Looks On the Clock

— And how U.S. tariff threats may be accelerating the very change they aim to block

What’s Going On

The grouping of nations known as BRICS (Brazil, Russia, India, China, South Africa, and newer members) appears to be staying on track for a 2026 launch of a shared-currency framework, despite aggressive efforts by the U.S. to derail the plan. Researchers monitoring the project highlight that digital payment systems, local-currency trade settlement and infrastructure are all advancing.

Meanwhile, U.S. President Donald Trump has ramped up threats of tariffs — including warnings of 100 % duties — on countries aligning with what he calls “anti-American policies” via BRICS, or attempting to sideline the U.S. dollar.

Why It Matters

Emerging currency dynamics: A new shared-currency initiative could tilt how global trade is settled and challenge the dominance of the U.S. dollar.

Innovation meets geopolitics: It demonstrates how payment rails, digital currencies, and trade settlement are now central to global strategy, not just finance.

Tariff threats as a double-edged sword: U.S. actions meant to deter may instead accelerate the drive toward alternatives.

What’s Driving the Timeline Toward 2026

Several analysts point to clear progress on infrastructure: cross-border settlement mechanisms, digital-currency research, and local-currency trade arrangements.

For example, central-bank gold accumulation surged in Q2 2025, seen as a hedge by BRICS-member states and sign of serious preparation.

The expansion of the bloc (including nations like Egypt, UAE, Indonesia) increases weight and legitimacy behind the idea of an alternative system.

On the U.S. side, the threat of tariffs and other economic pressure seems to be viewed internally by some BRICS members not just as deterrence, but as a reason to advance alternatives.

Why the U.S. Tariff Strategy May Backfire

Trump has threatened countries with tariffs of up to 100 % if they deviate from the dollar system or join BRICS currency plans.

But such threats can deepen resolve among BRICS nations to reduce dependency on U.S.-dominated systems.

Legal challenges are also pressing in the U.S., which may weaken the long-term enforcement of such tariff powers.

The Big Reality Check

Despite headline talk of a 2026 currency launch, several expert sources caution that a fully unified BRICS currency remains a long shot. For example:

One analysis suggests the first phase likely involves a payment-system platform and local-currency settlement (2025-27), with any full-scale currency much later (2028-2030+).

Key internal challenges remain: aligning fiscal/monetary policy across very different economies (China vs India vs Brazil) and ensuring the infrastructure is trusted and liquid.

At present, trade within BRICS still predominantly uses the U.S. dollar and global reserves remain heavily dollar-weighted.

Our Take

Here’s how this fits with what we track: innovation in finance plus institutional reform.

The financial-technology layer (digital rails, CBDCs, local-currency settlements) is moving ahead.

The institutional/power layer (who issues money, who sets rules) is in flux.

The U.S. tariff strategy highlights the stakes: finance is geopolitics.

In other words: new financial infrastructure is not just about tech; it’s about power, control and strategic autonomy.

What to Watch Next

Announcements from BRICS or its development bank (e.g., New Development Bank) about pilot platforms or settlement systems targeting 2026.

Moves by member-state central banks: digital-coin pilots, gold accumulation, trade denominated in non-dollars.

U.S. policy shifts or legal rulings around tariffs and trade strategy that could reshape how enforceable the “100 % tariff” threat is.

Responses from non-BRICS countries: Will they join or support the alternative rails? Or will they be deterred by U.S. action?

FX/reserve-data signals: Any sizeable shift away from the dollar in reserves, trade settlement or currency-baskets.

Final Word

The “2026 launch” of a BRICS currency isn’t a guaranteed moment in time, but rather a marker of a broader transition — a shift in how large emerging-economy blocs view money, finance and independence. The U.S. threats may slow some actions, but they could also spur others. The real question isn’t whether the effort stops — it’s how fast the contours of a new system take shape, and whether they begin to lean against, rather than around, the dollar-centric world.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

“BRICS Currency Launch Date Unchanged Despite Bold US Move To Stop It” — Watcher.Guru, Oct 19 2025: Watcher Guru

“How Would a New BRICS Currency Affect the US Dollar?” — InvestingNews, Sep 2025: Investing News Network (INN)

“BRICS investment opportunities rise ahead of 2026 common currency launch” — IndonesiaBusinessPost, Sept 30 2025: https://indonesiabusinesspost.com/

“Central bank buys 166 tonnes of gold, BRICS prepares currency for 2026” — IDNFinancials, Aug 17 2025: IDN Financials

“Trump calls BRICS ‘attack’ on US dollar” — EconomicTimes (via PTI), Oct 15 2025:The Economic Times

“Breaking Down the BRICS Tariff” — AmericanActionForum, Jul 15 2025: AAF

“Jim O’Neill: BRICS Currency a Distant Dream Yet Bloc Eyes 2026 Launch” — CryptoRank, Sep 7 2025: CryptoRank

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

More News, Rumors and Opinions Monday PM 10-20-2025

KTFA:

Clare: The "third envoy" to Baghdad: Trump remained in Iraq to play a decisive role.

10/20/2025

The appointment of Iraqi Chaldean Mark Savaya as US President Donald Trump's special envoy to Iraq has generated considerable interest in Iraq, with attempts to understand the US move and the background of this man, known for his closeness to Trump.

However, Savaya now assumes a sensitive position, handling the Iraqi file, despite having never held any official position, either at the state or federal levels.

Mark Savaya is the third US envoy to Iraq, since Paul Bremer in 2003, and after Brett McGurk during the war against ISIS in 2014.

KTFA:

Clare: The "third envoy" to Baghdad: Trump remained in Iraq to play a decisive role.

10/20/2025

The appointment of Iraqi Chaldean Mark Savaya as US President Donald Trump's special envoy to Iraq has generated considerable interest in Iraq, with attempts to understand the US move and the background of this man, known for his closeness to Trump.

However, Savaya now assumes a sensitive position, handling the Iraqi file, despite having never held any official position, either at the state or federal levels.

Mark Savaya is the third US envoy to Iraq, since Paul Bremer in 2003, and after Brett McGurk during the war against ISIS in 2014.

Mark Savaya appears to straddle the worlds of business and politics. His Instagram account, which has over 94,000 followers, features numerous photos of him with Trump, reflecting the personal side of their relationship, including in the White House and other locations, as well as photos of him with numerous prominent political, media, and entertainment figures.

Savaya commented on Trump's appointment as Special Envoy to Iraq in an Instagram post, saying: "I am deeply humbled, honored, and grateful to President Donald Trump for appointing me as Special Envoy to the Republic of Iraq. I am committed to strengthening the US-Iraq partnership under President Trump's leadership and guidance. Thank you, Mr. President. I will work to build bridges of trust and cooperation to achieve sustainable security in Iraq and the region."

Savaya was known for his active involvement in Michigan, demonstrating his ability to influence the masses, particularly in non-traditional communities, which led him to play a pivotal role in increasing voting rates among Michigan's Arab and Muslim communities to record highs.

Savaya is considered a member of the influential MAGA (Make America Great Again) movement, which is believed to have played a key role in Trump's rise and subsequent successful return to the White House, and which includes a diverse group of media figures, politicians, and influential activists.

According to his LinkedIn page, Savaya, a Michigan resident, has no government experience at the local, state, or federal level. He is an active businessman in the Detroit area, where he founded a marijuana retail chain called Leaf & Bud, which sells medical and recreational marijuana. According to The Independent, the company was criticized by Detroit leaders for its bold billboards that promoted the slogan: "Come and get it. Free weed."

However, Trump expressed his great confidence in Savaya's career, saying that he "possesses a deep understanding of regional relations and has direct contact with Iraqi communities, which makes his appointment an important step in advancing America's interests in the Middle East." He added, "We are confident in Mark's ability to advance our agenda and protect our interests in Iraq, especially during this critical period."

The Independent noted that Savaya's Leaf & Pad company conducted an extensive marketing campaign on Detroit roads, prompting city leaders to issue an ordinance restricting such advertising.

According to Reddit, two Liv & Bud branches have closed since January, leaving only three brick-and-mortar stores listed on the company's website. According to The Independent, the website has been updated to remove references to Savaya himself, including "The Mark Savaya Collection."

But Savaya's statement from 2020 says, "It's good to produce cannabis from seed and sell it. It's a process we go through instead of buying it from a different cultivation center. We make it ourselves, and we want to make sure it's a clean product, and that everything we do is monitored."

The Independent noted that it contacted Leaf & Bud to try to confirm Savaya's current role at the company, which had previously identified him on its website as the "visionary" behind the natural cannabis retail chain that marketed itself with the slogan "Come and get it. Free weed."

Trump is known for his personal opposition to drug use, but he has softened his stance in recent years. He supported Florida's referendum to legalize recreational marijuana in 2024, and during his campaign, he called for the execution of drug traffickers. In 2019, he praised China for its use of the death penalty in some serious drug-related cases, and he recently ordered airstrikes targeting boats in the Caribbean, allegedly smuggling drugs. This drew widespread criticism, as the strikes were deemed illegal.

However, Israeli Elizabeth Tzurkov, who was kidnapped in Iraq for more than two years, wrote on the X platform, "I congratulate Mark Savaya on this important appointment. Mark played a pivotal role in freeing me after 903 days of captivity by Kataib Hezbollah, an Iraqi militia working for Iran, without any compensation. This is very bad news for everyone who serves Iran's interests in Iraq and seeks to undermine Iraqi sovereignty."

"This is impossible. He is strongly opposed to the militias," Tsurkov said in response to a comment from an X user who expressed concern that pro-Iranian militias might try to manipulate Savaya. LINK

************

Ariel: Understanding the Implications of this

10-20-2025

We Need To Understand The Implications Of This:

What did Donald Trump mean when he said Mark will advance the Interest of the American people in a foreign country?

What happened a few days ago?

Didn’t Iraqi banks fall under Rafidain Bank and are now subject to the authority of the U.S. Treasury?

What recently happened with their oil a couple of days ago?

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 The only way you're going to see the HCL is if they use the new exchange rate. That's why they told you they're lifting the 3 zeros. You got the new exchange rate and you got the HCL we just need the damn laws...You're about to see a different...value added to your currency which will allow the HCL to be calculated properly and then give the citizens of Iraq a decent oil and gas rights payment to them. At 1310 all they were going to give them was a few pennies. We're walking on very thin ice and at any moment I believe in my heart it's going to crack and put us right through into the monetary reform purchasing power for the citizens and our blessing, our profit.

Jeff They're talking to us out of both sides of their mouth. From one side they keep announcing all the brand new wonderful stuff they're doing/have done, letting us know the rate is about to change. But from the other side of their mouth they won't tell us anything about the budget schedules. They keep hiding that from us.

*****************

"I Believe the Market Top May Be In" Got Gold & Silver?

Mike Maloney: 10-20-2025

Are we seeing the top of the markets now?

In this urgent episode of The Gold Silver Show, Mike Maloney & Alan Hibbard break down why they believe the highest highs may already be behind us—and how gold & silver could become lifeboats in the coming storm.

What you’ll get in this video

• Why the standoff between Trump and Xi could trigger a market collapse

• The importance of real assets when central banks lose control

• How China may secretly own far more gold than reported

• A powerful gold–silver ratio strategy to multiply your gold

• Lessons from Rome: how empires collapse when currencies are debased

The Case For Sound Money: The Most Meaningful 5 Minutes I've Ever Recorded | Judy Shelton

The Case For Sound Money: The Most Meaningful 5 Minutes I've Ever Recorded | Judy Shelton

Adam Taggert/Thoughtful Money: 10-20-2025

Here, former Federal Reserve nominee Judy Shelton makes the most compelling constitutional & moral argument for sound money I've ever heard

I promise it will be the most meaningful 5 minutes you've seen in ages.

The Case For Sound Money: The Most Meaningful 5 Minutes I've Ever Recorded | Judy Shelton

Adam Taggert/Thoughtful Money: 10-20-2025

Here, former Federal Reserve nominee Judy Shelton makes the most compelling constitutional & moral argument for sound money I've ever heard

I promise it will be the most meaningful 5 minutes you've seen in ages.

Iraq Economic News and Points To Ponder Monday Afternoon 10-20-25

Al-Ghariri: Iraq's Negotiations To Join The World Trade Organization Are Ongoing.

Economy | 06:55 - 10/20/2025 Mawazine News - Follow-up: Minister of Trade Athir Dawood Al-Ghariri confirmed on Monday that Iraq is continuing its negotiations to join the World Trade Organization, noting that regional initiatives are an opportunity to enhance institutional readiness and align legislative and investment frameworks.

Al-Ghariri: Iraq's Negotiations To Join The World Trade Organization Are Ongoing.

Economy | 06:55 - 10/20/2025 Mawazine News - Follow-up: Minister of Trade Athir Dawood Al-Ghariri confirmed on Monday that Iraq is continuing its negotiations to join the World Trade Organization, noting that regional initiatives are an opportunity to enhance institutional readiness and align legislative and investment frameworks. https://www.mawazin.net/Details.aspx?jimare=268812

Central Bank: Iraq's Public Debt Is Lower Than That Of The United States And Several Other Arab Countries.

Time: 2025/10/20 19:09:56 Reading: 30 times {Economic: Al Furat News} The Central Bank of Iraq confirmed on Monday that the external debt curve is declining and that Iraq is within safe limits for public debt. The bank noted that Iraq's public debt-to-GDP ratio stands at 31%, a lower percentage than that of developed countries such as the United States and Japan, and other Arab countries such as Egypt, Algeria, and Morocco.

Samir Fakhri, Director General of the Statistics and Research Department at the Central Bank, said, "Total public debt is divided into domestic and external debt. Domestic debt, as of the end of last September, amounted to 90.6 trillion dinars."

He added, "The domestic debt is divided into more than 50% in favor of the Central Bank, and less than 50% in favor of banks, whether private or government-owned," indicating that "the majority of the debt owed to banks is owed to government-owned banks, i.e., from government to government."

He pointed out that "the external debt has reached $54 billion, and is divided into three parts: the largest part, namely $40.5 billion, dates back to before 2003. It is a suspended debt, and we are not currently bearing any burdens on it, whether interest or debt service, from 2003 until today."

He continued, "The second part is the Paris Club debt, which amounted to $120 billion, 80% of which has been written off, leaving $24 billion. With what Iraq has paid, only $3.8 billion remains, which was supposed to be covered until the end of 2028." We note here that the external debt curve is declining.

He pointed out that "the third portion amounts to approximately $10 billion, and is related to investment spending. It is a long-term debt of twenty years, owed to a group of countries and organizations, including Japan's JICA, Germany's Siemens, Spain, and Britain.

Thus, the total debt amounts to approximately $10 billion. If we exclude the forty and a half billion, the remaining amount is approximately $13 billion."

He emphasized that "if we convert these debts into dollars multiplied by the current exchange rate and add them to the domestic debt, the total debt-to-GDP ratio would reach approximately 43%. However, if we exclude the suspended debt of $40 billion, the public debt ratio would be around 30 to 31% of GDP."

Regarding financing the three-year budget deficit, Fakhri explained that “the deficit within the budget law was approved by Parliament for a period of three years. It is a planned deficit, not an actual one, of approximately 64 trillion dinars per year, meaning a total of 192 trillion dinars for the three years. What was actually spent as real debt is approximately 35 trillion dinars.

” He indicated that “if we divide 35 trillion by the planned deficit, the percentage will be approximately 18.2%,” noting that “the debt was 56 trillion dinars until the end of 2022, and from 2022 until today, 35 trillion has been added to it, bringing the total to approximately 90.6 trillion dinars that we mentioned.”

He added, "One of the most important indicators of monetary policy is the consumer price index (inflation), which is currently close to zero. If we compare it with neighboring countries like Iran and Turkey, we find a clear difference in inflation rates between them and Iraq, in addition to the exchange rate gap."

He stressed that "the focus must be on financing the deficit, so it must be directed towards investment spending, as this leads to growth in non-oil revenues."

Fakhry touched on some of the debt ratios in neighboring countries, noting that "in Egypt, public debt amounts to 90% of GDP, in Algeria: 49%, in Morocco: 70%, in Lebanon: 160-170%, and in Saudi Arabia: 29%, despite being a strong and industrially advanced economy."

He pointed out that "major industrialized countries, such as the United States, have a public debt of 120%, while Japan's debt ratio is 250%." LINK

Iraq's Debt Is Within Safe Limits And Does Not Constitute A Burden On The Economy.

October 19, 2025 Baghdad - Qusay Munther The Central Bank of Iraq revealed that Iraq's debt remains within safe limits and does not constitute a burden on the national economy.

A statement received by Al-Zaman yesterday stated that, “Within the framework of financial transparency and to clarify what is included in the public debt and deficit data, the Central Bank would like to clarify what was reported in the media, that the planned deficit in the three-year general budget law approved by the House of Representatives for the three years amounted to 91.5 trillion dinars, while the actual deficit for the three years mentioned amounted to 35 trillion dinars, which was covered internally with bonds and transfers and in accordance with the chapters included in the budget law.

” It added that, “Actual borrowing amounted to 18.2 percent of the planned deficit included in the budget law, reflecting the high level of coordination between the government and the Central Bank in controlling the public debt and its failure to reach the high levels included in the budget law.

” It continued, “The external debts due do not exceed 13 billion dollars after excluding the outstanding and unclaimed debts of the former regime, and Iraq has not defaulted on any obligation, maintaining an excellent financial reputation regionally and internationally in this regard.”

It indicated that, “The internal debt of 91 trillion dinars represents 56 trillion dinars accumulated until the end of 2022.” The added amounts are 35 trillion dinars of debt for the three years, and most of the domestic debt is within the government banking system.

The statement explained that (due to the existence of government accounts and deposits in government banks, specialized committees and international consulting firms are working to convert part of this debt into investment tools within a national fund to manage the domestic debt with the aim of transforming obligations into investment opportunities), stressing that (the ratio of public debt to GDP did not exceed 43 percent, and this ratio, according to internationally recognized classification, is moderate and within safe limits and does not constitute a burden on the economy).

The bank reiterated its confirmation that (it is working to provide an integrated vision of financial sustainability for the coming years that supports the government’s directions in comprehensive reform to diversify the economy and maximize non-oil revenues as an alternative to sole reliance on oil revenues and avoiding a financial deficit).

The bank also warned retirees against dealing with entities and individuals claiming to represent it, with the aim of defrauding them and stealing their data.

The statement said, “The bank warns citizens, especially retirees, against dealing with any entities or individuals impersonating or claiming to represent the Central Bank, and requesting personal data or official documents such as retirement IDs or financial information.

” It stressed that “any licensed financial institution does not request any information from citizens related to their cards, accounts, or financial data, and does not provide loans or request documents via social media or by phone call.” It continued, “Any request of this type is considered an attempt at fraud and deception aimed at exploiting citizens and stealing their data.

” It stressed, “Please do not provide any unofficial entity with any personal or financial information, and immediately report any suspicious contact or message through the official channels of the Central Bank or the competent security authorities.” LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com