News, Rumors and Opinions Monday 8-18-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Restored Republic via a GCR: Update as of Mon. 18 August 2025

Compiled Mon. 18 August 2025 12:01 am EST by Judy Byington

Possible Global Currency Reset and EBS Timing:

Sun. 17 Aug. 2025: Oil exports from the Kurdistan Region of Iraq to Turkey’s Ceyhan port are set to resume within hours, ending a halt of more than two years. An agreement has been reached between the KRG and the Iraqi Ministry of Oil.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Restored Republic via a GCR: Update as of Mon. 18 August 2025

Compiled Mon. 18 August 2025 12:01 am EST by Judy Byington

Possible Global Currency Reset and EBS Timing:

Sun. 17 Aug. 2025: Oil exports from the Kurdistan Region of Iraq to Turkey’s Ceyhan port are set to resume within hours, ending a halt of more than two years. An agreement has been reached between the KRG and the Iraqi Ministry of Oil.

An informed source told Channel 8 that Iraqi oil exports will begin this week (Mon. 18 Aug) after 28 months of suspension. (Such could not (allegedly) happen unless the Iraqi Dinar had revalued with an international rate). Majeed KSA on X: / X

Sun. 17 Aug. 2025: “The US-led global international coalition is already packing their stuff and ready to leave Iraq. “ Remember Trump said they aren’t leaving until they get paid in full. https://x.com/majeed66224499/status/1957148043658297637

Sun. 17 Aug. 2025 High Up Rumors were that it would be wise to stay inside for the next couple of days as chaos was about to hit nations across the Globe. … on Telegram

Trump has given the Green Light for the new Quantum Financial System to slide into place.

The Global Military Alliance and BRICS Nations’ recent (alleged) implementation of the Quantum Financial System changed all. Now every stolen dollar, every offshore vault, every hidden transaction — was tracked, blocked and reversed.

The QFS didn’t just bypass the banks. It (allegedly) replaced them.

~~~~~~~~~~~~

Sun. 17 Aug. 2025 Nesara Gesara Rollout Notice …Mr. Pool on Telegram

Treasury begins gold and commodity peg alignment; Dollar moves to asset basis.

Debt Jubilee protocols tested in three states; interest arrears marked fulfilled.

QFS settlement rail handles Federal payrolls and pensions; public wallets Phase Two opens

Withholding on wages paused; funding shifted to tariffs and resource duties.

Mortgage and title audits start; unlawful fees flagged for repayment.

Small Business relief and revaluation windows scheduled; community banks join the new ledger.

EBS briefings will explain Nesara Gesara benefits prior to full implementation

Keep documents handy, save statements; do not sign new loan terms until briefings.

Read full post here: https://dinarchronicles.com/2025/08/18/restored-republic-via-a-gcr-update-as-of-august-18-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man We're going to maybe see a surprise. Because Iran is one of Iraq's largest trading partners. Yes we've had sanctions and we have some conflict in the Middle East...There's two articles about Iran removing 4 zeros...One of the things that's interesting here and it's no different than Iraq is that I know they were going to talks about coinage in Iraq again...Iran's gong to drop 4-zeros off their currency and Iraq is going to drop 3 zeros...They're trading partners. That kind of levels the playing field...If they can do the same thing at or around the same time, that might be a surprise.

Mnt Goat Another item is the much-needed Oil and Gas law. Article: “ERBIL, BAGHDAD SIGN OIL EXPORT MECHANISM AGREEMENT”. In a major breakthrough, the Kurdistan Regional Government’s (KRG) Ministry of Natural Resources and the Iraqi Ministry of Oil have finalized and signed a comprehensive agreement on the mechanism to resume oil exports from the Kurdistan Region, paving the way to end a costly suspension that has been in place since March 2023. So, although they may not have the new Oil and Gas Law fully in parliament yet, we learned that they are getting very close to resolving past issues and use these crises to build the new law, as the years passed.

Iraq's Central Bank of Iraq News: Mandates for End of 2025

Edu Matrix: 8-17-2025

raq’s Central Bank is making some of its biggest moves in years! From ambitious new banking reforms to partnerships with Egypt on digital transformation, these changes could reshape Iraq’s financial future. In this video, we’ll break down the most important updates:

Why banks must raise their capital to 400 billion dinars by 2025

How Iraq is working with Egypt to expand digital banking and fight money laundering

The Central Bank’s daily dollar auctions and what they mean for the Iraqi dinar

New security upgrades to protect financial operations

Support programs for displaced families in Nineveh and Duhok

Whether you’re following the Iraqi dinar, interested in global finance, or just want to stay updated on Middle East economics, this video will give you a clear and simple explanation of what’s happening right now.

MilitiaMan and Crew: Iraq Dinar News Update-K2 Integrity-Oil-Salaries-REER

MilitiaMan and Crew: Iraq Dinar News Update-K2 Integrity-Oil-Salaries-REER

8-18-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraq Dinar News Update-K2 Integrity-Oil-Salaries-REER

8-18-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Monday Morning 8-18-25

Philosophy Of Economic Empowerment

Economic 2025/08/18 Abdul Zahra Muhammad Al-Hindawi Months ago, the Ministry of Labor

launched a series of initiatives aimed at transforming social protection beneficiaries from aid recipients to productive members of the labor market.

It also launched intensive efforts to rehabilitate large numbers of young people through training courses that provide them with the skills necessary to integrate into the labor market.

Philosophy Of Economic Empowerment

Economic 2025/08/18 Abdul Zahra Muhammad Al-Hindawi Months ago, the Ministry of Labor

launched a series of initiatives aimed at transforming social protection beneficiaries from aid recipients to productive members of the labor market.

It also launched intensive efforts to rehabilitate large numbers of young people through training courses that provide them with the skills necessary to integrate into the labor market.

Undoubtedly, these policies express the true philosophy behind the concept of economic empowerment for poor families, which represents a shift from the logic of temporary support to sustainable production.

The assistance received by social protection beneficiaries should be a transitional phase,

enabling individuals to overcome their difficult circumstances and reach a stage of self-sufficiency and self-reliance.

Of course, there are groups who cannot be deprived of these benefits,

such as the elderly or those with complex disabilities,

who have lost the ability to meet their basic needs.

Although Iraq's social protection policy has largely succeeded in reducing poverty rates and

saving thousands of families from destitution, it has also created financial and structural challenges.

The increase in the number of families covered by the program to more than two million means that we are talking about nearly a quarter of Iraq's population, which places increasing pressure on the general budget.

Furthermore, some youth groups now view the subsidy salary as a convenient solution that replaces work, given the lack of incentives for development or engagement in the production market.

In the face of these challenges, the Ministry of Labor and Social Affairs has taken action along three integrated paths.

The first is to identify the truly poor, which has contributed to improving inclusion standards and making them more equitable and realistic.

The second path involves clearing the protection network of those who are not entitled to it,

which represents a significant achievement in rationalizing spending and directing support to those who deserve it.

The third path has been directed towards strengthening economic empowerment,

which represents the most important pillar, as it aims to address poverty at its roots.

Empowerment is the transition from the concept of "receiving aid" to "creating opportunity," and from a state of helplessness to a space for production.

Therefore, it requires greater attention from the state and more coordination between the Ministries of Labor, Planning, Education, Finance, and the private sector to support small projects and encourage youth to innovate and produce, instead of relying on and waiting for aid.

The experiences of many countries, such as China, Brazil, India, and Rwanda,

have proven that economic empowerment policies are not only more sustainable,

but also lead to reduced dependence on government support and broad-based economic growth.

What we need today is to reframe our priorities so that empowerment policies become the norm,

and aid becomes a temporary exception.

The future of social justice in Iraq lies not only in the efficient distribution of aid,

but also in our ability to transform beneficiaries into producers, and rependents into economic actors.

This is the essence of the empowerment philosophy, in light of which policies must be reshaped.

https://alsabaah.iq/119086-.html

Al-Ahly First, Baghdad Second... Bank Profits Reveal Foreign Dominance

August 16, 2025 Last updated: August 16, 2025 Al-Mustaqilla/- A document obtained by the Independent Press Agency revealed the profit rates of Iraqi banks during the first half of this year, shedding light on the reality of the banking sector and the dominance of some foreign banks within it.

According to the document, the National Bank of Iraq topped the list of profits, occupying first place, while the Bank of Baghdad came in second, and Mansour Bank came in third.

Data indicates that profits generated by foreign banks operating in Iraq remain substantial,

amounting to hundreds of millions of dollars, even as the local banking sector faces widespread criticism for its poor performance and declining public confidence.

This arrangement comes amid an ongoing crisis of confidence between the public and Iraqi banks,

particularly after a number of banks were placed on US sanctions lists, and others were subjected to liquidation or audit procedures by the Central Bank.

Observers believe that the continued dominance of foreign banks in the Iraqi market reflects the

fragility of the financial structure of local banks and their weak ability to compete.

This requires radical reforms to banking policies and a comprehensive restructuring of the sector

to bolster depositor confidence. https://mustaqila.com/الأهلي-أولاً-وبغداد-ثانياً-أرباح-المص/

The Central Bank Announces The Launch Of A Project Financing Guide.

August 17, 2025 The Central Bank of Iraq announced the launch of a guide to accessing financing for small, medium, and micro enterprises, in cooperation with the German International Cooperation Agency (GIZ) and the Iraqi Private Banks Association.

In his speech during the launch ceremony of the guide,

the Deputy Governor of the Central Bank of Iraq, Dr. Ammar Khalaf, said:

“Iraq has witnessed a multiplicity of lending providers.

The Central Bank of Iraq, through the National Lending Strategy,

has developed a guide that complements this strategy.

It enables entrepreneurs to develop their businesses and provides a mature and informative destination for all loans, providing a new opportunity for easier access and faster procedures for obtaining financing.”

The Deputy Governor noted that the banking reform strategy adopted by the Central Bank of Iraq

will support procedures for accessing project financing according to a clear vision to enhance confidence in the Iraqi banking system.

Central Bank of Iraq Media Office https://cbi.iq/news/view/2959

An Economist Points To Strategic Gains Iraq Is Making In The Oil And Water Sectors.

Economy, | 504 Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi confirmed on Saturday (August 16, 2025) that the construction of the Iraq-Syria pipeline represents a strategic gain that reduces shipping distances to European markets.

He also pointed out that the joint seawater supply project is the key to achieving huge gains in oil production from Iraq.

Al-Marsoumi said in a post on his Facebook account, followed by Baghdad Today, that

“in 2009, the Ministry of Oil formed a team headed by Engineer Alaa Al-Asadi to discover and inspect the Iraqi-Syrian pipeline from Kirkuk to the Syrian border with the Italian company Saipem,” noting that

“the committee stated in its report that the cost of rehabilitating the pipeline amounted to $780 million,

while the cost of establishing a new pipeline with a length of 888 km, a diameter of 40 inches, and a

capacity of 1.250 million barrels per day reached $11 billion at 2009 prices, and

it is expected that the cost will rise to $14 billion at today’s prices,

especially since the pipeline is completely destroyed.”

He added, Although this pipeline is a strategic gain,

reducing shipping distances to European markets,

reducing dependence on chokepoints in the Arabian Gulf, and

giving Iraq an additional option for exporting north at a time when its only current route,

via the port of Ceyhan in Turkey, is facing severe pressure, transporting crude oil from Kirkuk to southern Iraq for export to the Gulf is still the cheapest route by about $1 per barrel.

This cost will rise to between $3 and $5 per barrel in tariffs and insurance via the Kirkuk-Banias pipeline, in addition to additional capital investments to repair the pipeline." He indicated that

"transportation costs and transit fees will rise significantly if the transport of Kirkuk oil is limited, as the pipeline's capacity will not exceed 300,000 barrels per day."

In another context, the economic expert explained that the China Petroleum Engineering and Construction Corporation (CPECC) won a contract for a seawater pipeline project from processing facilities to various oil fields throughout Basra, valued at $2.524 billion. He pointed out that

"the joint seawater supply project is the key to achieving massive gains in oil production from Iraq.

The seawater project is one of four projects that have been referred to the French company Total as part of the integrated southern project.

It aims to provide 5 million barrels per day, later increasing to 7.5 million barrels per day,

for the purpose of water injection and sustaining oil production in the Basra, Maysan and Dhi Qar fields, and over a length of no less than 1,000 kilometers of fields."

The British newspaper, The Guardian, published a shocking report on how oil companies are using fresh water in oil extraction operations, depriving citizens and agriculture in the country of huge quantities of water, exposing the environment to serious risks, and contributing to the spread of serious diseases.

According to the newspaper, an analysis of satellite images revealed that the Italian company Eni is building a dam on the Basra Canal to divert water to its treatment plants.

Other companies, such as BP and ExxonMobil, are using up to 25% of Iraq's potable water for the same purpose. https://baghdadtoday.news/281029-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Monday Morning 8-18-25

Good Morning Dinar Recaps,

The United States Prepares a Complete Overhaul of DeFi

Regulatory Overhaul on the Horizon

The U.S. Treasury has placed decentralized finance (DeFi) under sweeping review as part of the GENIUS Act, signed in July 2025 by President Donald Trump. The initiative targets the anonymity of DeFi transactions, aiming to combat money laundering and terrorist financing by embedding digital identity verification directly into DeFi smart contracts.

Good Morning Dinar Recaps,

The United States Prepares a Complete Overhaul of DeFi

Regulatory Overhaul on the Horizon

The U.S. Treasury has placed decentralized finance (DeFi) under sweeping review as part of the GENIUS Act, signed in July 2025 by President Donald Trump. The initiative targets the anonymity of DeFi transactions, aiming to combat money laundering and terrorist financing by embedding digital identity verification directly into DeFi smart contracts.

This would require users to prove their identity—via government-issued IDs or even biometric data—before completing transactions.

Coding Compliance Into DeFi

The Treasury’s proposal seeks to integrate KYC (Know Your Customer) requirements into the very code of DeFi protocols. According to its official notice, these identity tools are meant to balance compliance with user privacy, while reducing burdens for financial institutions.

Banks and regulators largely support the move, but many in the crypto community view it as a threat to anonymity and a break from DeFi’s founding principles.

Technology at the Center

The consultation paper highlights four key tools for regulatory enforcement:

Artificial Intelligence

Surveillance APIs

Blockchain Analytics

Digital Identity Systems

By making these technologies native features of DeFi platforms, regulators aim to ensure the law cannot be circumvented through code.

Industry Reactions

Crypto Community: Critics warn of a dangerous precedent, fearing that U.S.-mandated universal KYC could spread globally and stifle innovation. Concerns also focus on data protection risks if personal identifiers are hard-coded into protocols.

Banking Sector: Groups like the Bank Policy Institute (BPI) support the move but also flagged loopholes in the GENIUS Act, warning Congress that some stablecoin issuers could bypass interest-payment restrictions, potentially shifting up to $6.6 trillion in bank deposits into stablecoins.

Key Facts and Timeline

Public consultation launched: August 18, 2025

Comments accepted until: October 17, 2025

Applies to: All DeFi platforms offering services in the U.S.

Targeted enforcement tools: API, AI, blockchain monitoring, digital identity

Political Pushback

Not all policymakers are aligned. Senator Elizabeth Warren argues the GENIUS Act could weaken transparency rather than strengthen it, legitimizing opaque practices under the guise of innovation.

The Bigger Picture

The U.S. strategy represents a paradigm shift: regulation will be embedded in DeFi infrastructure itself. The era of uncontrolled decentralized finance is ending, and the next chapter will test how much freedom DeFi can retain under government scrutiny.

@ Newshounds News™

Source: CoinTribune

~~~~~~~~~

Will U.S. Regulation Kill Decentralized Finance, or Simply Reshape It?

The United States has moved from watching decentralized finance (DeFi) to attempting to engineer regulation directly into its foundations. Under the GENIUS Act, the Treasury is consulting on rules that would insert identity verification and compliance mechanisms into the very code of DeFi smart contracts. The official justification is clear: stop money laundering, curb terrorist financing, and close loopholes that could drain liquidity from traditional banks.

But the deeper question remains — will this end decentralization?

The Case for the “End of DeFi”

For many, the answer is yes — at least within U.S. borders. By requiring:

Portable digital identifiers for every transaction,

KYC baked into smart contracts, and

AI-driven compliance tools tied directly to platforms,

the government would effectively erase the anonymity and permissionless nature that define DeFi. In this model, “decentralized” finance begins to look more like a tokenized extension of the banking system, where innovation bends to regulatory code.

The Counterpoint: DeFi is Global

Yet DeFi was never designed to exist in a single jurisdiction. Code can be deployed anywhere, and users can access protocols across borders. If the U.S. tightens rules, offshore DeFi will continue without these restrictions, keeping anonymity and censorship resistance alive. Other nations may even embrace this shift, hoping to attract the next wave of innovation that America appears to be constraining.

A Two-Track Future

Rather than a complete “end,” what is emerging is a split reality:

Regulated DeFi (CeDeFi):

U.S. and European platforms that integrate KYC and compliance.

Tailored for banks, institutional investors, and regulated entities.

Less innovation, but far more legitimacy in financial markets.

True DeFi (Permissionless):

Offshore or pseudonymous projects that maintain full decentralization.

Higher innovation potential, but riskier for users facing regulatory pushback.

Likely to attract those unwilling to trade away anonymity.

Why the U.S. is Pushing Now

The timing is not accidental. Bank groups warn that up to $6.6 trillion in deposits could flow into stablecoins, destabilizing traditional finance. For regulators, the threat is not just about crime or terrorism — it is about control of capital flows. If trillions shift into DeFi outside the banking system, central banks lose visibility and authority.

Conclusion: Decentralization Won’t Die, But It Will Change

The U.S. is not ending DeFi — it is reshaping it into a regulated, institution-friendly framework. True decentralization will survive, but it may migrate offshore, becoming harder for Americans to access.

The result? Two parallel worlds:

Compliant DeFi for Wall Street.

Permissionless DeFi for the rest of the world.

In this sense, the fight over DeFi’s future is not about technology alone — it is about whether financial sovereignty remains in the hands of individuals, or is recoded into the architecture of regulation.

@ Newshounds News™

Source: AI ChatGPT

~~~~~~~~~

XRP News: Can Ripple Replace Banks Worldwide?

Riccardo Spagni’s viral post reignites debate as Ripple rides legal victories, political endorsements, and market optimism.

A viral post from Riccardo Spagni, the former lead developer of Monero, has thrust XRP back into the spotlight — and reignited one of crypto’s most divisive debates: can Ripple and XRP eventually replace banks?

Ripple Momentum Builds on Legal & Political Wins

The timing of Spagni’s remarks is significant. Ripple has been riding a string of favorable developments, including the SEC formally dropping its lawsuit against the company. The momentum was amplified when President Donald Trump named XRP as a potential part of the U.S. digital asset reserve stockpile — a surprise endorsement that sent ripples across markets.

XRP’s performance reflects this surge in confidence. Rising from under $1 in late 2024 to over $3.60 by mid-2025, XRP has remained one of the year’s strongest tokens, even after retracing from recent highs. Ripple continues to push its narrative of XRP as a global bridge currency, further boosting investor interest.

Critics Push Back: “Replacing Banks is Unrealistic”

Not everyone is convinced. Spagni revealed that a close friend — previously skeptical of crypto — wanted to buy XRP, persuaded by the belief that banks would be gone within two years. While bullish XRP holders welcomed the statement, critics quickly pushed back.

Skeptics argue that XRP cannot truly replace banks, and warn that granting such influence to Ripple risks creating a single point of failure — running counter to blockchain’s promise of decentralization. Some community members dismissed the hype outright, calling it little more than an orchestrated marketing narrative.

Analysts Warn of Downside Pressure

Amid the heated debate, on-chain analyst Ali Martinez issued a cautious note. He observed that XRP has recently slipped below the key $3 support level, which could expose the token to further downside — possibly to $2.60 or even $2 if bearish momentum accelerates.

At the same time, XRP bulls remain undeterred, with some analysts continuing to forecast a potential rally to $4 by year-end. For many newcomers — like the friend in Spagni’s story — optimism appears to outweigh caution.

Ripple’s Marketing Engine in Overdrive

Even Ripple’s harshest critics concede one thing: its marketing machine is unmatched in crypto. Social media engagement around XRP consistently outpaces most other tokens, drawing fresh retail investors into the ecosystem.

But detractors argue this success is fueled by questionable narratives. Some allege that Ripple funds campaigns exaggerating the collapse of banks or the inevitability of XRP as the “global bridge asset.” One critic, known online as Fish Catfish, even suggested investigative journalists should scrutinize Ripple’s media influence more closely.

Outlook

The debate over XRP’s ultimate role is far from settled. Supporters see Ripple as the front-runner for global financial integration, while critics view it as overhyped and fundamentally centralized.

What remains undeniable is that XRP continues to command disproportionate attention in crypto markets — whether as the future of finance, or as one of the industry’s most polarizing tokens.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Investors May Soon Earn 4–7% Annual Yield on XRP Holdings

Flare Labs and Firelight are collaborating to bring decentralized finance opportunities to XRP holders, with projected yields ranging from 4% to 7% annually.

Flare & Firelight Introduce XRP Yield Opportunities

In a recent interview with Scott Melker, Hugo Philion (CEO of Flare Labs) and Jesus Rodriguez (CTO of Sentora and lead at Firelight) revealed details of their joint initiative. The project aims to allow XRP holders to lend, borrow, and generate yield—unlocking new use cases for an asset historically used only for payments.

Philion compared the concept to Ethereum’s MakerDAO, where investors can lock XRP as collateral to mint stablecoins, acquire assets, or provide liquidity to DeFi protocols. He emphasized that Flare’s approach avoids custodial risks by using FXRP, a wrapped version of XRP secured by network validators, enabling non-custodial transfers and lending.

4–7% Yield Potential for Idle XRP

Rodriguez highlighted that internal tests showed potential annual returns of 4% to 7% for XRP holders. He described this as groundbreaking for an asset that has traditionally generated no yield, noting that restaking strategies could further expand XRP’s DeFi capabilities.

Community Divided on Risk vs. Reward

The XRP community has responded with mixed reactions:

Brad Kimes (Digital Perspectives): Called it a milestone that could unlock “the biggest release of idle liquidity in crypto,” comparing it to turning XRP into a bond-like income stream.

Attorney Bill Morgan: Welcomed the yield prospects as a much-needed incentive for long-term holders.

Vet (XRP Ledger validator): Warned that 7% yield may not justify the risks of deploying volatile assets into DeFi strategies, urging the ecosystem to move beyond short-term speculation.

Morgan suggested that the ideal product would allow holders to lock XRP long-term while borrowing safely against it for liquidity, though such solutions remain in development.

With Flare and Firelight pushing ahead, XRP could soon transform from a non-yielding asset into one that provides steady income streams, potentially reshaping its role in global finance.

@ Newshounds News™

Source: The Crypto Basic

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Monday Morning 8-18-2025

TNT:

Tishwash: Some of them are crucial.. The Coordination Framework will meet tomorrow to discuss five files.

An informed source within the Coordination Framework, which brings together Shiite political forces excluding the Sadrist bloc, revealed the agenda for the framework's meeting scheduled for Monday evening, Sunday.

The source told Shafaq News Agency, "The framework will discuss a number of important issues tomorrow, Monday, including the visit of the Secretary of Iran's Supreme National Security Council, Ali Larijani, to Baghdad last Monday, and his signing of a security memorandum of understanding related to security coordination on the common border between the two countries."

TNT:

Tishwash: Some of them are crucial.. The Coordination Framework will meet tomorrow to discuss five files.

An informed source within the Coordination Framework, which brings together Shiite political forces excluding the Sadrist bloc, revealed the agenda for the framework's meeting scheduled for Monday evening, Sunday.

The source told Shafaq News Agency, "The framework will discuss a number of important issues tomorrow, Monday, including the visit of the Secretary of Iran's Supreme National Security Council, Ali Larijani, to Baghdad last Monday, and his signing of a security memorandum of understanding related to security coordination on the common border between the two countries."

He added, "The framework will also discuss the withdrawal of US forces from Iraq according to the agreed-upon timetable, including a full withdrawal from the Iraqi government-controlled area by September 2025, and from the Kurdistan Region by September 2026."

He pointed out that "the Coordination Framework will also discuss the issue of oil exports via the Turkish port of Ceyhan, which has been suspended since March 2023 following a ruling by the International Chamber of Commerce's Court of Arbitration in Paris, resulting in losses estimated at billions of dollars due to the disruption of supplies."

The source also revealed that the framework will discuss the parliamentary elections scheduled for November 11, 2025, the issue of the Electoral Commission's disqualification of some candidates, and the compensation mechanism for those excluded, who number in the hundreds.

In this context, the source noted that "the Coordination Framework forces may resort to holding a subsequent meeting with the head of the High Elections Commission to discuss the exclusion and compensation mechanism in some detail and in accordance with applicable laws."

For its part, the Electoral Commission clarified that the disqualifications were due to the candidates' violation of Article 7/Third of the House of Representatives Elections Law of 2018.

Article 7/Thirdly, of the law stipulates that the candidate must be “of good character and conduct, and not have received a previous pardon for crimes of financial and administrative corruption or misdemeanors that violate honor.”

As for the final aspect of the framework meeting, the source said it "will include a discussion of the possibility of passing the Popular Mobilization Law and its future consequences for the country. This is expected to be discussed in a preliminary manner during tomorrow's meeting, Monday. A special meeting may be held regarding the Popular Mobilization Law to agree on a mechanism for passing it or postponing it to the next session, in a manner consistent with the requirements of the current stage."

In this regard, Ibtisam al-Hilali, a member of the Coordination Framework, revealed to Shafaq News Agency on Sunday that there is a movement within the House of Representatives to collect signatures to hold an upcoming session to vote on the Popular Mobilization Forces (PMF) law.

However, Member of Parliament Jawad al-Yasari previously confirmed to Shafaq News Agency that there is no directive from the parliament's presidency or a concrete date for resuming scheduled sessions to discuss and vote on a number of important laws, including the Popular Mobilization Forces law link

************

Tishwash: Al-Rasheed begins disbursing the first semi-annual interest on national bonds.

Rashid Bank announced today, Sunday, the commencement of disbursing the first semi-annual interest to holders of the first national bond issue, affirming its commitment to the timetable previously set by the Central Bank of Iraq and the Ministry of Finance.

The bank explained in a statement that "this step comes within the framework of its efforts to enhance confidence in national bonds as a safe savings and investment tool, in addition to their contribution to diversifying funding sources and supporting the national economy."

The bank urged citizens to "visit the relevant branches to receive their dues," stressing that "national bonds represent an important investment opportunity for citizens, as they offer generous returns with full government guarantees, which contributes to attracting local savings and directing them toward development projects." link

************

Tishwash: The Association of Banks announces the launch of a guide to accessing finance in Iraq.

The Iraqi Private Banks Association announced today, Sunday, the launch of a guide to accessing finance in Iraq under the auspices of the German Development Cooperation Agency (GIZ) and the Central Bank of Iraq, noting that the launch of this guide is a fundamental step towards building the national economy.

"The launch of the Access to Finance Guide in Iraq is a fundamental step toward empowering entrepreneurs, small and medium-sized enterprise owners, and all those seeking to contribute to building our national economy," said Ali Tariq, CEO of the Iraqi Private Banks Association, in a speech at the launch event of the Access to Finance Guide.

He added, "Access to financing is one of the biggest challenges facing youth and the private sector in Iraq today. Many innovative ideas and promising projects are stalled due to a lack of clear information about funding sources, available mechanisms, and required procedures." He explained that "this guide will serve as a simplified, practical reference, bringing together various financing tools and options that can benefit investors, entrepreneurs, or any startup."

He continued, "This guide would not have seen the light of day without the fruitful cooperation between the GIZ and the Central Bank, in the belief that enhancing financial inclusion and empowering the private sector represent a fundamental gateway to economic reform in Iraq."

He continued: "We are currently experiencing a pivotal phase in the development process, as the state moves to support and develop the private sector to become an effective partner in building the economy and diversifying sources of income." He pointed out that "this guide is not just a document, but rather a practical tool that will help thousands of young men and women and entrepreneurs identify the options available to them, whether through banks, financing companies, or government and international support programs."

He explained that "the Iraqi Private Banks Association affirms its commitment to working side by side with its partners to overcome obstacles, simplify procedures, and develop the business environment, thus opening the door to investment and innovation."

He pointed out that "the launch of this guide today is a message of hope to Iraqi youth that opportunities exist, support is available, and success is possible when there is determination and resolve, along with sound planning and cooperation." He expressed his thanks to "everyone who contributed to the preparation of this guide, and to all the parties that offered their expertise and support to make this initiative a success. I also thank you for inviting us to participate in issuing this guide, which reflects your commitment to supporting the economic reform process in Iraq."

He expressed his hope that "Iraq will witness more initiatives that will positively impact development and prosperity." link

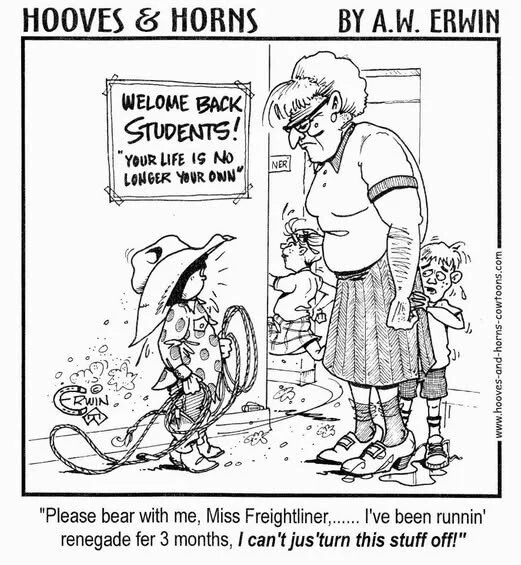

Mot: .. school - back he is !!!!

Mot: school - first day

FRANK26….8-17-25….ALOHA…..PP

KTFA

Sunday Night Video

FRANK26….8-17-25….ALOHA…..PP

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Sunday Night Video

FRANK26….8-17-25….ALOHA…..PP

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Dollar Decline Is the Plan: Gold & Bitcoin to Compete as Neutral Reserve Asset | Luke Gromen

Dollar Decline Is the Plan: Gold & Bitcoin to Compete as Neutral Reserve Asset | Luke Gromen

Miles Frankin Metals: 8-17-2025

Michelle Makori, President & Editor-in-Chief of Miles Franklin Media, speaks with Luke Gromen, Founder & President of Forest for the Trees (FFTT), about why a seismic monetary shift is already underway and why the outcome has effectively been decided.

Gromen explains how the Trump administration is deliberately engineering a weaker U.S. dollar to reshore manufacturing, why central banks around the world have replaced Treasuries with gold for over a decade, and how a “gold pivot” could reset the global system.

Dollar Decline Is the Plan: Gold & Bitcoin to Compete as Neutral Reserve Asset | Luke Gromen

Miles Frankin Metals: 8-17-2025

Michelle Makori, President & Editor-in-Chief of Miles Franklin Media, speaks with Luke Gromen, Founder & President of Forest for the Trees (FFTT), about why a seismic monetary shift is already underway and why the outcome has effectively been decided.

Gromen explains how the Trump administration is deliberately engineering a weaker U.S. dollar to reshore manufacturing, why central banks around the world have replaced Treasuries with gold for over a decade, and how a “gold pivot” could reset the global system.

He also reveals why Bitcoin may be America’s chosen asset to compete with gold as the next neutral reserve asset. In this interview:

The Triffin Dilemma and the deliberate reversal of 50 years of dollar flows

Why the U.S. can’t make the goods to support the current reserve system

The Fed’s quiet gold revaluation research note & hints from top U.S. officials

The chess game between two neutral reserve assets: gold vs. Bitcoin

Luke’s gold & Bitcoin forecast – the next 6-12 months

00:00 Coming Up

01:41 Introduction: The US Dollar's Global Dominance & Its Consequences

06:24 The Dollar’s Managed Decline & Global Implications

12:46 China’s Strategic Moves & the Role of Gold

15:25 U.S. National Security & Industrial Base Concerns

25:41 Potential Gold Revaluation & Its Impact

41:02 Fiscal Challenges & Future Economic Strategies

47:07 Gold as a Primary Reserve Asset

49:09 U.S. Gold Imports & Shadow Programs

52:18 China’s Gold Strategy & U.S. Response

55:58 Bitcoin vs. Gold: The New Neutral Reserve Asset

01:03:45 Bitcoin’s Role in U.S. Economic Strategy

01:18:35 AI’s Impact on the Economy & Gold/Bitcoin

01:27:25 Final Thoughts & Predictions

Iraq Economic News and Points To Ponder Sunday Afternoon 8-17-25

Al-Sudani's Advisor Identifies The Reasons For The Decline In The Dollar Exchange Rate.

Money and Business Economy News – Baghdad The Prime Minister's financial advisor, Mazhar Mohammed Saleh, outlined the reasons for the decline in the dollar exchange rate and its impact on the country's economic recovery on Sunday.

Saleh said, "The Iraqi parallel market has witnessed a significant decline in the dollar exchange rate against the dinar in recent months, reflecting shifts in demand and money supply, and raising questions about the extent to which this decline will impact economic activity and the balance of commodity prices."

Al-Sudani's Advisor Identifies The Reasons For The Decline In The Dollar Exchange Rate.

Money and Business Economy News – Baghdad The Prime Minister's financial advisor, Mazhar Mohammed Saleh, outlined the reasons for the decline in the dollar exchange rate and its impact on the country's economic recovery on Sunday.

Saleh said, "The Iraqi parallel market has witnessed a significant decline in the dollar exchange rate against the dinar in recent months, reflecting shifts in demand and money supply, and raising questions about the extent to which this decline will impact economic activity and the balance of commodity prices."

He added, "Because the parallel (secondary) foreign exchange market is an information-based market, the efficiency of economic policy, with its financial, monetary, and commercial pillars, implemented in accordance with an integrated strategic framework, has contributed to transforming this market from a state of information noise with excessive price deviations, to a stable market that deals with clear and disciplined information (white noise), and in many cases, it has become led by the official market, not the other way around."

He pointed out that "the trend of the dollar's decline in the parallel market towards the official price can be attributed to the efficiency of coordination between government policies, through the following axes: (legally criminalizing the use of the dollar in local transactions, especially in the real estate market, which is one of the sectors with the highest demand for foreign currency, which strengthened the role of the dinar in daily trading, and the shift to an external financing system through international correspondent banks, instead of relying directly on the Central Bank window, a measure that reduced compliance risks and kept large traders away from relying on high-cost and high-risk parallel market financing)."

He added: "Integrating small importers into the official foreign currency financing network has enabled them to obtain dollars at the official exchange rate directly, without the need for intermediaries from currency companies.

This represents approximately 60% of import activity, thanks to administrative facilitations and the reduction of bureaucratic links.

This is in addition to the cultural shift in travelers' behavior towards using electronic payment cards in foreign currency, which has eased pressure on cash dollars, while maintaining the possibility of obtaining a specific cash share from airports on favorable terms and with strict compliance.

In addition, a smart defensive pricing policy has been adopted, represented by the spread of cooperative societies to distribute food commodities, construction goods, and others, with import financing based on the official rate of 1,320 dinars per dollar.

This has contributed to the stability of the commodity market and achieving a reasonable balance between supply and demand."

He pointed out that "the expected economic impacts can be monitored as follows:

First, on the economic movement, which is represented by: (a decrease in import costs and an increase in purchasing power, strengthening confidence in the Iraqi dinar and stimulating local investment, and a revival of domestic commercial activity as a result of lower operating costs, and

second, the economic impacts are directed at the prices of basic commodities, most notably (a decrease in the prices of imported food and medicine, and a reduction in inflation resulting from fluctuations in the exchange rate, as well as improving the purchasing power of citizens, and that the instability of the exchange markets has effects on the state of balance in the prices of basic commodities, and increases their fluctuations in such cases."

Saleh concluded by saying: “Efficiently controlling economic policy with its three pillars: fiscal, monetary, and trade, along with strong law enforcement, remains an important factor in providing a framework for stability, specifically: (maintaining the gradual unification of the official and parallel exchange rates, as well as increasing the supply of dollars through official channels, in addition to tightening controls on speculators and the black market, and stimulating local production to reduce dependence on imports within strong and stable supply policies that provide national producers with greater flexibility in supplying capital goods, raw materials, and production supplies.” https://economy-news.net/content.php?id=58891

Iraq's Oil Exports To The US Decline By More Than 130,000 Barrels Per Day.

Energy Economy News – Baghdad The U.S. Energy Information Administration announced on Sunday that Iraqi oil exports to the United States fell by more than 130,000 barrels per day last week.

The administration said, "U.S. crude oil imports from nine major countries averaged 5.911 million barrels per day last week, up 322,000 barrels per day from the previous week's average of 5.589 million barrels per day."

She added, "Iraq's oil exports to the United States averaged 142,000 barrels per day, down 137,000 barrels per day from the previous week's average of 279,000 barrels per day."

The administration also indicated that "the largest US oil revenues during the past week came from Canada, at a rate of 4.045 million barrels per day, followed by Mexico, at a rate of 398,000 barrels per day, Brazil, at a rate of 344,000 barrels per day, and Colombia, at a rate of 343,000 barrels per day."

According to the table, "US crude oil imports from Saudi Arabia averaged 273,000 barrels per day, from Nigeria 213,000 barrels per day, from Libya 80,000 barrels per day, from Ecuador 65,000 barrels per day, and no imports from Venezuela." https://economy-news.net/content.php?id=58871

Central Bank: Financing Guide Is A Step Towards Restructuring The Banking Sector And Enhancing Financial Inclusion.

Banks Economy News – Baghdad The Central Bank announced on Sunday that the Access to Finance Guide is an important step for financial institutions and the restructuring of the banking sector. It also noted that the National Lending Strategy and the National Financial Inclusion Strategy have facilitated access to finance.

In a speech during the launch of the Access to Finance Guide, the bank's Deputy Governor, Ammar Hamad Khalaf, said, "In cooperation with the German Agency for International Cooperation and the Association of Private Banks, the Access to Finance Guide was launched today to facilitate the financing situation, remove obstacles, and facilitate access to it with the aim of achieving development and increasing supply and demand."

He explained that "the facilities provided represent an important step for financial institutions and the restructuring of the banking sector, particularly for small and medium-sized enterprises," indicating that "the multiplicity of entities supporting these projects leads to the dispersion of efforts and a lack of focus on additional projects.

Therefore, the first recommendation of the committee supervising the implementation of the national strategy for the sector is to establish an independent national entity to oversee these projects and work to mobilize financial and technical support for them according to an integrated vision that ensures optimal investment of funding sources."

He added that "a large proportion of small businesses remain part of the informal economy, which prevents them from accessing formal financing," noting that "the Central Bank has launched financing initiatives since 2015 that have helped support thousands of small and medium-sized enterprises, in addition to large projects and housing loans."

He pointed out that "the Iraqi government has recognized the importance of entrepreneurial projects and launched the "Riyada" initiative, from which hundreds of projects have benefited to date, and the Central Bank has become a significant contributor to financing these projects."

He continued, "The recently launched National Lending Strategy and National Financial Inclusion Strategy have facilitated access to financing, given its importance. This guide, whose launch we are celebrating today, complements the measures taken by the renewal strategy and aims to achieve key objectives, including enabling entrepreneurs to identify official sources of financing and enhancing financial literacy to achieve continuous and sustainable growth across various sectors." https://economy-news.net/content.php?id=58888

Al-Sudani: Economic Development Must Proceed Through Optimal Investment Of Funds

Money and Business Economy News – Baghdad Prime Minister Mohammed Shia al-Sudani stressed on Sunday that economic development must proceed through optimal investment of funds in locations with the highest returns.

A statement from his media office, received by Al-Eqtisad News, stated that "Al-Sudani chaired a meeting devoted to discussing ways to maximize non-oil revenues and support and enhance the state's financial resources. The meeting was attended by the Minister of Finance, the Minister of Trade, the Mayor of Baghdad, the Governor of the Central Bank of Iraq, and a number of advisors and general managers."

He pointed out that "the meeting discussed the use of modern technologies, digital mechanisms, and automation to maximize revenues and promote projects with higher returns."

The Prime Minister emphasized that "economic development must proceed through optimal investment of funds in locations with the highest returns, and by developing plans to rationalize spending and reduce waste."

He explained that "the meeting discussed the Ministry of Trade's revenues and maximizing them, enhancing the quality of ration card items, the best economic ways to manage wheat purchasing and storage operations, the absorptive capacity for the coming seasons and spending in this regard, as well as discussing the organization of Baghdad Municipality's revenues, the optimal path for managing real estate resources, institutions and their projects and collection methods, in addition to presenting the implementation of collection in the electricity sector and the objective plans in this regard." https://economy-news.net/content.php?id=58890

The Withdrawal Of US Forces Raises Questions About Stability In Iraq.

Political |- 08/17/2025 Mawazine News - Baghdad - In a move described as having intertwined political and security dimensions, US forces have begun reducing their military presence in some Iraqi bases. The timing raises widespread questions about its repercussions for the country's stability, especially with the escalation of threats emanating from the north.

Officials in Baghdad confirmed that the withdrawal is taking place in accordance with joint understandings with Washington and comes in response to repeated demands to end the foreign presence. However, analysts believe that the move carries deeper implications, as it may reflect a strategic repositioning rather than a final withdrawal.

The timing is sensitive, as the country faces complex security challenges in the north, where ISIS remnants are operating in some rugged areas, in parallel with Turkish military operations against the Kurdistan Workers' Party (PKK), as well as armed movements on the Syrian-Iraqi border.

This situation, according to observers, may present Iraq with a difficult test. While the public and political forces welcome the withdrawal as a reinforcement of national sovereignty, concerns are growing about the possibility of a security and intelligence vacuum that could be exploited by extremist groups or regional parties.

Others, however, believe the withdrawal could become an opportunity to strengthen the state's capabilities if it is accompanied by clear plans to fill the vacuum, activate cooperation between federal forces and the Peshmerga, and support intelligence and border control agencies.

Between concern and optimism, the most important question remains: Will Iraq be able to transform the US withdrawal into a platform for strengthening stability and sovereignty, or will the timing leave a vacuum that further destabilizes the security landscape? https://www.mawazin.net/Details.aspx?jimare=265233

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 8-17-25

Good Afternoon Dinar Recaps,

BRICS Shakeup: India Rejects Full US Dollar Exit, Expands Rupee Trade

India’s Official Position: No Wholesale De-Dollarization

India has formally rejected speculation of abandoning the U.S. dollar, even as BRICS explores alternative settlement mechanisms.

Good Afternoon Dinar Recaps,

BRICS Shakeup: India Rejects Full US Dollar Exit, Expands Rupee Trade

India’s Official Position: No Wholesale De-Dollarization

India has formally rejected speculation of abandoning the U.S. dollar, even as BRICS explores alternative settlement mechanisms.

MEA spokesperson Randhir Jaiswal clarified:

“We have made our position very clear on this issue earlier as well. De-dollarization is not part of India’s financial agenda.”

His remarks followed Brazilian President Lula’s renewed call for a BRICS trade currency amid U.S. tariff tensions.

External Affairs Minister S. Jaishankar reinforced India’s balanced stance:

“India is a member of the BRICS group, and we continue to remain in touch with member countries to discuss issues of shared interest.”

Bilateral Rupee Trade Expansion

Instead of a wholesale de-dollarization policy, New Delhi is pursuing targeted bilateral trade agreements to reduce dollar dependency.

Key developments include:

Maldives: Direct rupee-rufiyaa settlement system established in November 2024.

UAE: Operational arrangements underway for rupee settlements.

Ongoing talks: With additional Asian and African nations to expand rupee settlement corridors.

RBI Deputy Governor Sanjay Malhotra confirmed that such agreements reduce both transaction costs and foreign exchange exposure for Indian businesses.

Strategic Positioning Within BRICS

India’s approach diverges from China and Russia, who are pushing alternatives like the digital yuan and ruble under sanctions.

Instead, India is:

Avoiding a common BRICS currency, citing economic and geographic disparities.

Maintaining global dollar access while selectively reducing dependency through bilateral deals.

Retaining financial flexibility, ensuring that rupee trade expansion complements rather than replaces the dollar.

Pragmatic Currency Policy

India’s strategy shows a practical middle path in BRICS:

No abrupt U.S. dollar exit.

Focus on rupee internationalization via bilateral agreements.

Balanced participation in BRICS without risking global market access.

This calculated stance places India as a unique player within BRICS—reducing dollar reliance where possible but preserving financial stability and international credibility.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Now the Fed is Talking about Gold Revaluation

Now the Fed is Talking about Gold Revaluation

Heresy Financial: 8-17-2025

The Federal Reserve has recently published a paper discussing the potential revaluation of the United States’ gold reserves as a means to address the country’s escalating fiscal crisis.

With the US debt-to-GDP ratio exceeding 120%, growing national debt, and a worsening budget deficit, policymakers are exploring unconventional ways to finance government spending without increasing taxes or borrowing more.

One such method is increasing the official value of gold reserves, which are currently recorded at $42 per ounce, despite the market price being over $3,300 per ounce.

Now the Fed is Talking about Gold Revaluation

Heresy Financial: 8-17-2025

The Federal Reserve has recently published a paper discussing the potential revaluation of the United States’ gold reserves as a means to address the country’s escalating fiscal crisis.

With the US debt-to-GDP ratio exceeding 120%, growing national debt, and a worsening budget deficit, policymakers are exploring unconventional ways to finance government spending without increasing taxes or borrowing more.

One such method is increasing the official value of gold reserves, which are currently recorded at $42 per ounce, despite the market price being over $3,300 per ounce.

This revaluation could inject significant new money into the Treasury in a budget-neutral way, meaning it wouldn’t require new taxes or borrowing, but it would essentially be money printing, potentially leading to inflation.

The Federal Reserve’s paper outlines three methods of gold revaluation, each involving adjusting the value of gold on the central bank’s balance sheet and transferring the gains to the government or offsetting central bank losses.

This is not a novel idea; the US has done this before during the Gold Reserve Act of 1934, when the government confiscated gold from citizens and then raised its official price from $20.67 to $35 per ounce to increase spending power.

Currently, a bill known as the Bitcoin Act (S.954) in Congress proposes revaluing gold certificates held by the Federal Reserve to their fair market value.

The act mandates that the difference in value be paid to the Treasury in cash and suggests using this money to purchase Bitcoin within five years.

However, Treasury Secretary Scott Bessent has publicly stated that the Treasury will not buy Bitcoin, though his statements seem contradicted by the bill’s directives and subsequent clarifications on Twitter, which mention exploring “budget-neutral” ways to acquire more Bitcoin.

The revaluation process is essentially an accounting maneuver that allows the government to print money under the guise of recognizing the true value of its gold. Though this could provide a significant cash infusion, it will not solve the underlying debt problem and is likely to increase inflationary pressures. The video also promotes a live masterclass on trading strategies related to these market uncertainties.

While the idea of revaluing gold reserves to address the fiscal crisis may seem appealing, it is crucial to consider the potential risks and consequences, such as inflation.

Policymakers should carefully weigh the benefits and drawbacks of this approach and explore alternative solutions to address the nation’s financial challenges. Watch the full video from Heresy Financial for further insights and information.

News, Rumors and Opinions Sunday 8-17-2025

KTFA:

Frank26: "BY THE 31ST OF AUGUST".......F26

Washington is pressuring and monitoring... 20 days remain before the liquidation of Iraq's banks, and the options are "bitter."

8/10/2025

Iraqi banks have only 20 days left to implement the banking reform paper prepared by the American firm Oliver Wyman.

The paper obligates all private banks to increase their capital to 400 billion dinars and pay an annual fee of $2.4 million for four years, or opt for a merger and define ownership and management structures with several controls, including reducing the percentage of “relatives” in the new structures to just 10% and paying $1.3 million annually.

KTFA:

Frank26: "BY THE 31ST OF AUGUST".......F26

Washington is pressuring and monitoring... 20 days remain before the liquidation of Iraq's banks, and the options are "bitter."

8/10/2025

Iraqi banks have only 20 days left to implement the banking reform paper prepared by the American firm Oliver Wyman.

The paper obligates all private banks to increase their capital to 400 billion dinars and pay an annual fee of $2.4 million for four years, or opt for a merger and define ownership and management structures with several controls, including reducing the percentage of “relatives” in the new structures to just 10% and paying $1.3 million annually.

These controls may not be implemented by bank owners during the short remaining period, which ends on August 31, according to economic expert Mustafa Hantoush. Hantoush believes that the banking reform paper will be subject to “flexibility” in terms of time, so that it can be implemented within months or a year, according to the Central Bank’s estimate. Hantoush, however, rules out the possibility of liquidating banks subject to US restrictions and sanctions, with the exception of some banks that have already declared bankruptcy.

Mustafa Hantoush, in an interview with journalist Qais Al-Murshid, followed by the 964 network:

The banking system was easy and not built on risk tolerance, as it did not delve deeply into banking operations. Instead, it relied on massive trade requiring dollar transfers, which generated large and rapid profits for many banks.

Oliver Wyman, an American consulting firm, was contracted by the Central Bank to conduct a study on the reality of the Iraqi banking sector, along with consultations and reform plans.

The firm completed its study and submitted proposals last April, which were translated into actual decisions two weeks ago.

Banks will be required to sign a pledge or contract requiring one of two options by the end of this month at the latest.

The first is to increase the banks' capital to 400 billion dinars, with an annual payment of $2.4 million for a period of four years. The second option is to merge with other banks, setting the ownership structure at 10% for relatives and the remaining percentage for other partners, with an annual payment of $1.3 million for a period of four years.

The hope is to implement one of the two previous options, with certain required criteria, and exit the US sanctions list. Otherwise, the third option is liquidation.

I believe the reform plan proposed by Oliver Wyman and adopted by the Central Bank will see some flexibility in implementation.

The timeframe for capital increases or the merger option may be extended, and these banks may be given a grace period until the end of the year or for a year. I don't believe banks will be forced to resort to the liquidation option, except for some banks that are already bankrupt. LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick The currency of Iraq is different. It is not fiat. This currency is backed by gold, assets and by the planet earth. Basically, everything that the planet needs is in Iraq and they are becoming digital.

Mnt Goat ...my CBI contact said... they need to do the project (the Project To Delete the Zeros) very soon to get all this hoarded cash into the banking system...Think about this – Who the hell is going to turn in their three zeros notes if the dinar is not worth more than the dollar? They know what is coming and they are waiting for it just like us...over the years, the CBI has tried every trick in the book to get these dinar hoards in the banks, unsuccessfully. This new rate will be the second of the two rate changes we were promised by the CBI years ago…finally! The CBI told us it must be just over a dollar. [Post 1 of 2....stay tuned]

Mnt Goat Remember folks this will be in Iraq in country ONLY! We can not yet go the banks when this happens. It will not yet be international...the CBI can not let the dinar sit there for too long without migrating to the out of country global currency exchanges. To wait would also be disastrous too. This is why when this does happen we must watch the dinar VERY closely since it could then pop out on FOREX at about anytime afterwards. Then we go to the bank...as investors if you want a timing...watch the process. [Post 2 of 2]

9000 Ton Silver Delivery Trap Meets 76,617 Record Short—Wall Street Paper Game Dies | Andy Schectman

Two Dollars Investing: 8-16-2025

Wall Street’s silver suppression game is running out of road. A record-breaking 9,000 tons of physical silver is now standing for delivery — directly against 76,617 short contracts that can’t possibly be covered without triggering chaos.

This is the largest showdown between the paper market and real metal in modern history, and if the shorts can’t deliver, the entire bullion banking system could unravel overnight.