Seeds of Wisdom RV and Economic Updates Monday Morning 6-30-25

Good Morning Dinar Recaps,

The End of Bank Branches: How Europe’s Digital Euro and Stablecoins Are Reshaping Finance

The financial world is undergoing a radical digital shift—and physical bank branches are quickly becoming obsolete.

Banking Faces a Digital Reckoning

The slow disappearance of local bank branches across Europe reflects a much deeper transformation. Digitalization, AI, and automation are now reshaping how we work, shop, and save—leaving traditional banking struggling to keep pace.

Good Morning Dinar Recaps,

The End of Bank Branches: How Europe’s Digital Euro and Stablecoins Are Reshaping Finance

The financial world is undergoing a radical digital shift—and physical bank branches are quickly becoming obsolete.

Banking Faces a Digital Reckoning

The slow disappearance of local bank branches across Europe reflects a much deeper transformation. Digitalization, AI, and automation are now reshaping how we work, shop, and save—leaving traditional banking struggling to keep pace.

▪️ In Germany, over 560 branches were closed in 2023 alone, a 2.8% drop.

▪️ This is part of a decades-long contraction: from nearly 60,000 branches in the 1990s to just 18,933 today.

▪️ High rents, shrinking populations, and the dominance of e-commerce have hit brick-and-mortar services hard.

The quiet death of Germany’s bank branches is just one symptom of this evolution—but it's a global story now playing out in real time.

Deutsche Bank: Leading the Downsizing

In March, Deutsche Bank announced a wave of layoffs and branch closures.

“We are witnessing a fundamental transformation in the German banking sector,” said CEO Christian Sewing.

▪️ The bank will cut 2,000 jobs and shutter a “significant number” of branches this year.

▪️ Client consultations are moving to video calls and digital platforms, trading human interaction for efficiency.

This paradigm shift threatens the personal trust built through face-to-face banking—once considered the bedrock of retail finance.

Crushed by Policy, Not Just Progress

Technological change is not the only culprit. The European Central Bank’s (ECB) ultra-loose monetary policy has had devastating effects:

▪️ More than a decade of negative interest rates crushed banks’ ability to earn profit through traditional lending.

▪️ Banks were squeezed by regulatory costs, penalty interest, and flattened yield curves.

▪️ The ECB’s moves helped heavily indebted Eurozone countries like Spain, Italy, and France—but at the expense of private banks and savers.

The branch closures, layoffs, and pivot to digital aren’t just market-driven—they are also policy-driven.

Stablecoins and the Digital Euro: The Final Blow?

The next major disruption comes from stablecoins and the proposed digital euro—two innovations that could sideline banks entirely.

▪️ Stablecoins, pegged to fiat currencies, offer fast, low-cost global payments—no need for banks or wire transfers.

▪️ DeFi (Decentralized Finance) lets users transact via smart contracts, bypassing traditional credit and payment systems.

▪️ As adoption spreads, the need for checking accounts, branches, and bank-issued cards may vanish.

The digital euro, being developed by the ECB, may deliver the final push:

▪️ It’s programmable, blockchain-based, and bypasses commercial banks entirely.

▪️ Retail customers could hold digital euros directly in digital wallets—making bank intermediaries irrelevant.

▪️ Bank branches, long seen as hubs of trust and cash access, could become completely redundant.

A New Financial Era

Europe's digital currency ambitions and the rise of decentralized technologies signal a permanent departure from legacy banking infrastructure. In this new landscape:

Banking becomes faster—but more impersonal.

Traditional financial institutions lose control.

Retail customers migrate to central bank-backed platforms.

The local branch, once a staple of every town square, may soon be no more than a memory.

@ Newshounds News™

Source: ZeroHedge

~~~~~~~~~

US Dollar Faces Historic Stress Test as BIS Issues Dire Warning on Global Fragility

The U.S. dollar, long considered the world’s most reliable safe haven, is facing a historic credibility crisis as global financial trust deteriorates. Amid rising policy turbulence in Washington, the Bank for International Settlements (BIS) has issued a stark warning on the fragility of the global economic order.

BIS: “New Era of Heightened Uncertainty”

At the BIS Annual General Meeting in Basel on June 29, General Manager Agustín Carstens declared that a once-promising recovery is now faltering.

“The global economy has entered a new era of heightened uncertainty,” Carstens warned, noting a reversal from earlier optimism driven by easing inflation and modest growth.

The catalyst: U.S. policy chaos. A sudden pivot toward broad-based tariffs and aggressive fiscal expansion has shocked global markets—undermining confidence and weakening the dollar’s standing.

Dollar Depreciates as Yields Rise—An Alarming Signal

“The US dollar depreciated even as government bond yields rose—an extraordinary, troubling combination,” Carstens stated.

▪️ Typically, rising yields strengthen the dollar.

▪️ This time, however, investors fled the currency, shaken by erratic policy shifts and unpredictable rhetoric from Washington.

▪️ Market volatility soared, and the dollar’s safe-haven image cracked.

Carstens added that discussions about penalizing foreign holders of U.S. securities, challenges to central bank independence, and legal system uncertainty further deepened the crisis.

Structural Risks and Global Fragility

Carstens emphasized that the world’s financial system was already under stress:

Weak productivity growth

Unsustainable fiscal positions

The rise of unregulated non-bank financial institutions (NBFIs)

Now, tariff-driven trade fragmentation is making matters worse, fueling inflation and limiting economic flexibility.

“These measures often fail to achieve intended goals and instead deepen structural challenges,” Carstens warned.

He called for credible reforms aimed at:

▪️ Reducing trade barriers

▪️ Improving regulatory clarity

▪️ Investing in public infrastructure to support sustainable growth

A Call for Financial Reform in the Digital Age

Carstens also turned his focus to emerging technological threats and opportunities:

“Major innovations like the entry of big tech into finance, central bank digital currencies, and artificial intelligence are challenging and reshaping the financial system.”

He warned that unregulated innovation could magnify systemic risk, particularly if NBFIs continue to operate without proper oversight.

To meet this moment, Carstens proposed a new global financial architecture built on:

▪️ Tokenized central bank reserves

▪️ Government bonds integrated into digital ecosystems

▪️ Stronger oversight parity between banks and non-banks

The goal: restore trust, increase transparency, and future-proof global finance.

Conclusion: A Turning Point for the Dollar

As market dynamics shift and investor confidence wanes, the dollar’s status as a global safe haven is being seriously questioned for the first time in decades. The BIS’s warning is clear: without serious reform, the world may be heading into a prolonged era of economic instability and fragmentation.

The dollar isn’t just facing market pressure—it’s confronting a global reckoning of trust.

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Monday Morning 6-30-2025

TNT:

Tishwash: A significant decline in the volume of foreign loans, and Iraq is in the green side in international credit standards.

Iraq's external financial policy has improved its global credit rating, with external debt declining to approximately $10 billion. Despite the rise in domestic debt, economists assert that it poses no risk, thanks to the government's ability to set interest rates and schedule repayments.

The Iraqi government's foreign financial policy appears to be improving, as evidenced by a decline in foreign borrowing rates. This decline raises Iraq's global credit rating, which is based on the size of the debt and the country's ability to repay interest.

TNT:

Tishwash: A significant decline in the volume of foreign loans, and Iraq is in the green side in international credit standards.

Iraq's external financial policy has improved its global credit rating, with external debt declining to approximately $10 billion. Despite the rise in domestic debt, economists assert that it poses no risk, thanks to the government's ability to set interest rates and schedule repayments.

The Iraqi government's foreign financial policy appears to be improving, as evidenced by a decline in foreign borrowing rates. This decline raises Iraq's global credit rating, which is based on the size of the debt and the country's ability to repay interest.

Economist Abdul Rahman Al-Mashhadani says, "The decline in external debt is a positive indicator, and it is not measured in this year, but rather over the past three years, when it fell to less than $30 billion, putting Iraq in the green."

Meanwhile, figures show an increase in the value of domestic debt, which the government has borrowed from financial institutions to finance projects and cover the financial deficit in the annual budgets. However, economic readings confirm that domestic loans do not pose a risk, given that the government determines the interest rate and carefully sets the repayment schedule. However, they remain within the framework of debt that must be repaid. Based on this, the Parliamentary Finance Committee emphasizes the need to deal with the available financial liquidity.

Finance Committee member Moein Al-Kadhimi said, "Based on what the government has at its disposal, it must act within its limits. This way, there is no budget deficit, there is ongoing funding for projects, and no new projects are initiated, while simultaneously funding the operating budget."

The size of foreign loans amounts to approximately $10 billion, which currently places Iraq at a (B-) rating, given that the size of foreign loans for 2023 exceeded $20 billion. This means that this decline is attributed to the government's good handling of foreign loan repayments, placing Iraq at a better credit rating than before. link

************

Tishwash: Kurdistan employees' salaries will be paid within the next two days.

An informed government source revealed, today, Sunday (June 29, 2025), that the federal government will pay May salaries to Kurdistan employees within the next two days.

The source told Baghdad Today, "The federal government will pay the salaries of the region's employees within the next two days, even before the oil agreement is finalized, for humanitarian purposes."

He added, "If an oil agreement is reached between Baghdad and Erbil, the audit and accounting department of the federal Ministry of Finance will review the lists sent by the regional Ministry of Finance, and within days, will release the June salaries."

He pointed out that "the federal government delegation pledged that the region's salaries would be paid monthly, along with those of employees in other Iraqi governorates, without a single day's delay, subject to the oil agreement and the delivery of 50% of domestic revenues, provided they are digitally deposited into the Ministry of Finance's bank account daily." link

************

Tishwash: Iraq's trade landscape: The private sector accounts for the largest share of imports.

The Central Bank of Iraq announced, on Saturday, statistics on the volume of Iraq's imports for the first quarter of 2025.

The bank stated in its statistics that "Iraq's imports amounted to $21 billion and 363 million," indicating that "imports included both the government and private sectors."

He added that "government sector imports amounted to $1.377 billion, while private sector imports amounted to $19.985 billion."

He pointed out that "government imports included consumer imports, capital imports, petroleum product imports, other government imports, and currency printing," while "private sector imports included consumer imports and capital imports." link

Tishwash: You Can Visit between 1 and 5 PM....

Mot: and Another Way to Look at it!!

Ariel: The Return to the Gold Standard

Ariel: The Return to the Gold Standard

6-30-2025

The Return To The Gold Standard: The Evaluation Of A Failed System

The fiat USD’s dominance, cemented post-1971 after the Nixon Shock severed its gold backing, relied on the DS’s geopolitical engineering in the Middle East.

Iran’s role as a controlled antagonist, coupled with Iraq’s subjugation following the 2003 invasion, ensured oil markets remained USD-denominated, generating trillions in seigniorage profits.

Ariel: The Return to the Gold Standard

6-30-2025

The Return To The Gold Standard: The Evaluation Of A Failed System

The fiat USD’s dominance, cemented post-1971 after the Nixon Shock severed its gold backing, relied on the DS’s geopolitical engineering in the Middle East.

Iran’s role as a controlled antagonist, coupled with Iraq’s subjugation following the 2003 invasion, ensured oil markets remained USD-denominated, generating trillions in seigniorage profits.

(Seign·ior·age. profit made by a government by issuing currency, especially the difference between the face value of coins and their production costs. )

These funds, laundered through Iraq’s black market estimated at $10–15 billion annually have sustained DS black projects, including underground base funding and experimental weaponry, while enriching a network of complicit banks and elites.

A 2025 internal memo from a Baghdad financial regulator, leaked to a private investigator, reveals that the DS orchestrated Iraq’s currency devaluation and black market to maintain this flow, with 40% of IQD transactions bypassing official channels.

However, Iraq’s planned revaluation, slated for mid-2025, aims to stabilize the dinar at a rate closer to its pre-1990 value (around 1 USD = 1 IQD), dismantling the black market and severing the DS’s financial lifeline.

This shift, driven by pressure from Trump’s administration and regional allies, marks the beginning of the fiat system’s unraveling.

The Basel III Endgame, set to activate in July 2025, accelerates this collapse by imposing stringent capital and liquidity requirements on global banks.

Unlike previous phases, this final iteration codified after years of negotiation by the Basel Committee reclassifies physical gold and silver as Tier 1 assets with 0% risk weighting, while mandating an 85% Net Stable Funding Ratio (NSFR) for unallocated precious metals.

Insider reports from a London-based banking executive, codenamed “Silver Fox,” indicate that major institutions like JPMorgan and HSBC, long complicit in DS money laundering, face insolvency by Q3 2025 as they liquidate unallocated gold positions to meet NSFR demands.

This liquidity crunch will trigger a cascade of failures, with at least three top-tier banks collapsing by September 2025, mirroring the Silicon Valley Bank precedent. The Endgame’s alignment with ISO-20022, a new financial messaging standard enhancing transparency, will expose $500 billion in hidden DS transactions, forcing a reckoning with the Federal Reserve’s role in perpetuating the fiat illusion.

The Big Beautiful Bill, a legislative cornerstone of Trump’s agenda, streamlines this transition by deregulating AI and financial innovation while mandating compliance with Basel III, ISO-20022, COMEX 589 (a revised commodity exchange rule tightening gold delivery), and SOFR (Secured Overnight Financing Rate) as a replacement for LIBOR.

Enacted in early 2025, this bill empowers the Treasury to issue sovereign digital currency backed by gold reserves, integrating XRP and stablecoins for liquidity.

Exclusive insights from a Treasury insider, codenamed “Coin Keeper,” reveal that a pilot program launched in June 2025 in Texas and Florida has already converted $30 billion in gold holdings into digital assets, with plans to scale nationally by July.

This system bypasses the Federal Reserve, which Trump intends to dismantle by year-end, replacing it with a gold-anchored Treasury board. COMEX 589, effective July 1, 2025, will mandate physical gold delivery for all futures contracts, exposing the 100:1 paper-to-physical ratio and crashing DS-manipulated gold prices, forcing a market reset.

Citizen liberation under this new paradigm will manifest across economic, social, and political dimensions. Economically, the end of fiat dependency will eliminate inflation, which has eroded 90% of the dollar’s purchasing power since 1971.

A 2025 economic model from a rogue economist, codenamed “Gold Hammer,” predicts a 50% increase in real wages by 2027 as gold backing stabilizes prices, freeing families from debt cycles fueled by DS-controlled central banking.

Socially, the collapse of DS black projects funded by Iraqi black market proceeds will halt covert population control experiments, including rumored electromagnetic frequency (EMF) programs in urban centers.

Unverified reports from a former N*A technician suggest these programs, costing $2 billion annually, will cease by 2026, restoring public health and autonomy.

Politically, the revalued IQD and gold standard will empower nations to reject USD hegemony, with Iraq leading a coalition of 15 oil producers to denominate contracts in local currencies by 2028, breaking the DS’s Middle East grip.

Source(s): https://www.patreon.com/posts/return-to-gold-132740357

https://dinarchronicles.com/2025/06/30/ariel-prolotario1-the-return-to-the-gold-standard/

More News, Rumors and Opinions Sunday PM 6-29-2025

KTFA:

Clare: Iranian President: We are ready to start a new page in relations with neighboring Gulf countries

6/29/2025

Iranian President Masoud Pezeshkian announced on Sunday that Iran is ready to begin a new chapter in relations with the Gulf states.

"We are ready to start a new page in relations with the Gulf states," Masoud Pezeshkian was quoted as saying by the Iranian news agency.

KTFA:

Clare: Iranian President: We are ready to start a new page in relations with neighboring Gulf countries

6/29/2025

Iranian President Masoud Pezeshkian announced on Sunday that Iran is ready to begin a new chapter in relations with the Gulf states.

"We are ready to start a new page in relations with the Gulf states," Masoud Pezeshkian was quoted as saying by the Iranian news agency.

Pezeshkian said that strengthening our relations with the Gulf states carries a message of peace, brotherhood, and development for the entire Islamic world, and we are ready to cooperate with the Gulf Cooperation Council, thus opening a new chapter in our relations with the Gulf states. LINK

Clare: #BREAKING: The Iraqi Federal Government will release May salaries for the Kurdistan Region’s civil servants this week, while the KRG is required to transfer its domestic revenues to Baghdad, a high-level source from the Kurdistan Region’s Council of Ministers told Zoom News.

************

Clare: The Central Bank concludes a course on basic standards for detecting counterfeit currency.

June 29, 2025

The Central Bank of Iraq's Basra branch concluded the "Basic Standards for Detecting Counterfeit Currency" course. The course, organized by the Central Bank's Banking Studies Center, lasted three days, from June 23-25, 2025.

The course was attended by 13 government and private banks from the southern governorates. It also covered key aspects related to recent developments in detecting counterfeit currency and its basic standards.

For their part, the participants praised the training courses organized by the Central Bank of Iraq for their significant impact on developing their job performance.

Central Bank of Iraq

Media Office

June 29, 2025

* ***********

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Article of the budget] 12-2c the judge is holding on to it because he's protecting the new exchange rate. Even the gazette, two of them, are holding 12-2c. Why? It's the new exchange rate...This judge holds the future of Iraq's monetary reform in his hands...

Sandy Ingram My ex-husband retired from the Federal Reserve bank. He and his peers have always talked down about an IQD revalue or currency adjustment...Iraq is fixing these flaws...for global inclusion ...Countries and International banks didn't trust doing business with Iraq. Now Iraq's central bank is working to fix these problems. They're updating their systems...If Iraq continues on this path it has the potential to fully integrate into the global banking system...Now we know shy bankers said the IQD would never revalue. It looks like Iraq is plugging the holes and there will be sufficient economic gains for a higher currency value.

CEO Called $3,300 Gold, Predicts $5,000 Next | Morgan Lekstrom

David Lin: 6-29-2025

Morgan Lekstrom, CEO of NexMetals, discusses the global debt crisis and the future of gold and critical metals in light of geopolitical tensions and economic uncertainties.

0:00 - Intro.

0:53 - Previous gold predictions

2:33 - Geopolitics and markets

6:04 - Gold forecast

7:54 - Catalysts for upside

9:53 - Iran

13:28 - Other market hedges and Bitcoin

17:14 - Debt cycle 23:26 - Hodling comparisons

26:42 - Gold miners 28:14 - NexMetals

30:09 - Rebrand and market drivers

31:55 - Trade war and China

33:55 - Copper shortage and mines

37:25 - New mines timeline

39:10 - Botswana mine

Iraq Economic News and Points To Ponder Sunday Afternoon 6-29-25

Iraqi Dollar Smuggling 'Turns Regional' Amid High Iranian Demand For Greenbacks

Iraq / Economy Amwaj.media An Iraqi man counts US dollar bank notes in Baghdad on May 4, 2020. (Photo via Getty Images) Jun. 24, 2025 The story: Iraq has recently been riled by reports of a multi-billion dollar cash smuggling scheme allegedly orchestrated by Iran and its allies. Apparently aiming to circumvent US sanctions, the controversy has sharpened attention to Iran’s extensive regional shadow economies in Iraq. Emerging shortly before the recent attacks on Iran by Israel and the US, the crisis has led to intense scrutiny on ties between Tehran and Iraqi armed groups.

Iraqi Dollar Smuggling 'Turns Regional' Amid High Iranian Demand For Greenbacks

Iraq / Economy Amwaj.media An Iraqi man counts US dollar bank notes in Baghdad on May 4, 2020. (Photo via Getty Images) Jun. 24, 2025 The story: Iraq has recently been riled by reports of a multi-billion dollar cash smuggling scheme allegedly orchestrated by Iran and its allies. Apparently aiming to circumvent US sanctions, the controversy has sharpened attention to Iran’s extensive regional shadow economies in Iraq. Emerging shortly before the recent attacks on Iran by Israel and the US, the crisis has led to intense scrutiny on ties between Tehran and Iraqi armed groups.

The coverage: Dollar smuggling from Iraq to Iran, and between other regional countries, has been a well known practice in Iraqi banking and political circles for over a decade.

● However, citing Iraqi and US sources, a recent Wall Street Journal report has drawn attention to the claimed scale, ingenuity and organization of the enterprise—and Iran’s allegedly central role in orchestrating it.

● A reported arbitrage scheme has apparently involved Iran-linked smugglers acquiring large quantities of Mastercard and Visa prepaid debit cards.

Leveraging Iraq's informal dual exchange rates, couriers are reported to have withdrawn greenbacks at the official rate at ATMs primarily in Jordan, Turkey and the United Arab Emirates (UAE).

● The couriers are claimed to then return to Iraq and use ubiquitous money exchange kiosks to convert the cash to dinars at the higher unofficial exchange rate.

● As a result of these alleged activities, cross-border card transactions reportedly surged from 50M USD to 1.5B USD monthly between early 2023 and Apr. 2023, generating an estimated 450M USD in profits in 2023 alone.

https://flo.uri.sh/visualisation/12677369/embed?auto=1

The reactions in Iraqi media and on social networks have broadly been one of frustration, with critics leveling anger at Iran’s armed allies—and at Iraqi and international regulators for seemingly turning a blind eye to the trade.

● As anger mounts, one Iraqi political observer speculated in a post to Twitter/X that the funds may be used in Iran to pay pensions to government beneficiaries.

Other Iraqi outlets noted how the currency trade, exacerbated by recent regional instability, has weakened the Iraqi dinar.

● One Iraqi analyst told Erbil-based Rudaw that exchange rate spikes “hit ordinary people the hardest,” as they drive up the prices of staple goods and services.

The context/analysis: The alleged profiteering from Iraq’s effectively dual exchange rates appears to be the latest evolution in a longstanding pattern of sanctions evasion schemes by Iran and its regional allies.

● Prepaid cards are particularly attractive for such schemes because they offer anonymity, require minimal identity verification, provide global reach through payment networks and allow for discreet transport as alternatives to large volumes of cash.

Earlier currency smuggling schemes in Iraq were reportedly scaled dramatically through the Qi Card salary distribution system. Partnered with Visa and Mastercard, the network serves millions of government employees, including members of the Popular Mobilization Units (PMU).

● Thousands of PMU employees receive state salaries through Qi Cards, with some commanders reportedly seizing subordinates' payment cards, or creating fake identities to obtain additional payouts. https://datawrapper.dwcdn.net/hTN42/14/

In late 2022, the US Treasury and Federal Reserve clamped down on allegedly fraudulent wire transfers from several Iraqi banks amid concern over dollar smuggling.

● Those new restrictions are believed to have forced Iraqi armed groups to pivot to prepaid debit cards and the exploitation of regional banking networks.

Adding to the controversy, both Mastercard and Visa have allegedly profited significantly from the current alleged scheme, reportedly earning collectively around 120M USD through transaction fees of 1% to 1.4% on cross-border transactions.

● Both Mastercard and Visa have been accused of delaying enforcement calls for action from the US Treasury for months. This is claimed to have allowed transactions to continue, ranging from 400M USD to 1.1B USD monthly until early 2025.

Adding to the rising awareness of the problem, anecdotal reports have suggested long lines of Iraqis at ATMs in regional countries withdrawing large amounts of cash.

● However, such reports have been apparently dismissed by Iraqi officials as negligible and blamed on “criminal gangs.”

Central Bank of Iraq (CBI) Governor Ali Al-Allaq in April stated that

his institution was targeting the “Visa and Mastercard card problem abroad,” although he emphasized that the crisis stemmed from “misunderstandings.”

State-owned banks in Iraq

Agricultural Cooperative Bank of Iraq Founded: 1935

Alnahrain Islamic Bank Founded: 2012

Bank of Iraq Founded: 1948

Industrial Bank of Iraq Founded: 1941

Rafidain Bank Founded: 1941

Rasheed Bank Founded: 1988

Trade Bank of Iraq Founded: 2004

Source: News agencies • Collated by: Amwaj.media

The future: The apparent dollar smuggling enterprise has seemingly fallen off Washington's radar for now,

as attention has shifted to the renewed outbreak of conflict between Iran and Israel

—and more recently the US bombing of Iranian nuclear sites.

● Yet, the effects on Iraq’s banking sector may be long-lasting, as seen in a broader tightening of oversight over the financial sector.

● Regulatory institutions have implemented monthly caps of 300M USD on all cross-border transactions and limited individual cardholders to 5,000 USD monthly.

The US Treasury's blacklisting of three Iraqi card issuers and the blocking of over 200,000 apparently fraudulent cards represent the most significant enforcement actions against allegedly Iran-linked illicit financial networks to date.

● However, the historical pattern of adaptation suggests that new loopholes will likely emerge and be exploited for as long as there is high demand for US dollars.

Nevertheless, the controversy over the prepaid debit cards has accelerated banking sector reform in Iraq, with comprehensive regulatory changes scheduled for implementation beginning in early 2026.

● The CBI has announced reforms that include unified regulatory frameworks, enhanced anti-money laundering capabilities and mandatory compliance with international standards.

https://amwaj.media/en/media-monitor/iraqi-dollar-smuggling-claimed-to-turn-regional-amid-high-iranian-demand-for-gree

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 6-29-25

[⚠️ Suspicious Content] Good Afternoon Dinar Recaps,

USA No Longer Default Market: BRICS Attracts Global Capital By Watcher Guru | June 2025 Global capital is shifting. The U.S. is losing its traditional grip as the world’s default investment hub, with institutional funds now flowing steadily toward BRICS nations. As the U.S. Dollar Index (DXY) dropped to the 96 range early Thursday, a report from Bank of America revealed that exposure to dollar-based assets is at its lowest level since 2005.

Good Afternoon Dinar Recaps,

USA No Longer Default Market: BRICS Attracts Global Capital

By Watcher Guru | June 2025

Global capital is shifting. The U.S. is losing its traditional grip as the world’s default investment hub, with institutional funds now flowing steadily toward BRICS nations. As the U.S. Dollar Index (DXY) dropped to the 96 range early Thursday, a report from Bank of America revealed that exposure to dollar-based assets is at its lowest level since 2005.

BRICS Rising: Global Investors Shift Capital South

▪️ Countries like China, India, Brazil, and South Africa are now attracting capital once destined for the U.S.

▪️ The U.S. dollar's weakening position is making assets in the global south more appealing, especially in the face of recent Trump-imposed tariffs.

▪️ Investors are eyeing early-stage growth in BRICS nations, seeking better returns than U.S. Treasuries or bonds.

The global investment spotlight has moved to the BRICS bloc, where developing markets are benefiting from macro shifts—especially amid growing skepticism toward U.S. monetary dominance.

USA Still Leads, But BRICS Is Catching Up

▪️ The U.S. remains the strongest financial player, but institutional clients are now diversifying away from dollar dominance.

▪️ In 2025, for the first time in two decades, major global investors “went all-in” on non-U.S. assets.

This trend marks a major inflection point in financial history—particularly as China and India move to internationalize the yuan and rupee, respectively.

China alone has drawn $17 billion in foreign inflows, capitalizing on the dollar’s weakening global influence.

The De-Dollarization Era Has Momentum

The de-dollarization movement continues to accelerate as BRICS expands both its economic influence and financial ecosystems.

▪️ BRICS+ aims to solidify a multipolar financial world, weakening the U.S. dollar’s role as the sole reserve currency.

▪️ Dozens of countries, including allies and neutral states, are now watching BRICS as a credible financial alternative.

Unless addressed, this trend could reshape the world’s financial order over the next two decades, and further dilute U.S. influence in global markets.

“The White House needs to act swiftly to maintain leadership on the global financial curve,” the article concludes.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Global Currency Status IQD EUR GBP JPY CHF BRICS

Global Currency Status IQD EUR GBP JPY CHF BRICS

Edu Matrix: 6-29-2025

Global Currency Status IQD EUR GBP JPY CHF BRICS In this week’s global currency update (June 27, 2025), we break down which currencies are gaining ground and why.

From the euro and British pound hitting multi-year highs, to the safe-haven surge of the Swiss franc and Japanese yen, the global currency shift is in full motion.

Global Currency Status IQD EUR GBP JPY CHF BRICS

Edu Matrix: 6-29-2025

Global Currency Status IQD EUR GBP JPY CHF BRICS In this week’s global currency update (June 27, 2025), we break down which currencies are gaining ground and why.

From the euro and British pound hitting multi-year highs, to the safe-haven surge of the Swiss franc and Japanese yen, the global currency shift is in full motion.

We also explore the latest on BRICS currency plans—how these nations are accelerating their push to de-dollarize—and what that could mean for the global economy.

Plus, get an important update on Iraq’s dinar and its steady progress toward currency stability and reform. Which currencies are expected to rise next?

Watch now to find out which foreign currencies are forecasted to climb against the U.S. dollar in the coming weeks and months.

Don’t miss this essential insight for investors, currency watchers, and global economy enthusiasts. Subscribe for more weekly financial updates and smart money moves!

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

HTZ CAP: 6-29-2025

The London Bullion Market Association (LBMA) and WGC had partnered to develop and implement an international system of gold bar integrity (GBI).

The GBI programme aims to put all legitimate gold onto an immutable blockchain-based database where buyers will be able to clearly see that the investment bar, coin, and – when technology allows – jewellery they purchase was resourced responsibly, refined reputably, and only passed through the hands of legitimate actors.

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

HTZ CAP: 6-29-2025

The London Bullion Market Association (LBMA) and WGC had partnered to develop and implement an international system of gold bar integrity (GBI).

The GBI programme aims to put all legitimate gold onto an immutable blockchain-based database where buyers will be able to clearly see that the investment bar, coin, and – when technology allows – jewellery they purchase was resourced responsibly, refined reputably, and only passed through the hands of legitimate actors.

Andy Schectman, president of Miles Franklin, remains decidedly bullish on both gold and silver. In recent commentary, he argues that the ongoing accumulation by major players and strong demand for physical metal signal a continued upward trajectory, irrespective of short-term price fluctuations.

Schectman highlights the Ripple effect of developments within the BRICS bloc, especially the launch of new gold settlement platforms via the Shanghai Gold Exchange in Hong Kong and Saudi Arabia—a clear indicator of a global shift toward bullion as a trusted reserve.

Schectman sees the first week of July as a pivotal moment for the future of BRICS: this is when several member nations are expected to reveal concrete plans for gold and silver integration into their financial systems.

Referencing his chart analysis—particularly the recent technical breakout in silver—he suggests that these developments could catalyse a powerful price surge in both metals, reinforcing the shift away from dollar dominance .

In his view, investors should closely monitor early July announcements as they may mark the start of a new phase in the global gold‑silver bull market.

News, Rumors and Opinions Sunday 6-29-2025

The Old Pretender: Is this all Coming to a Head in July?

6-29-2025

If something big is scheduled to come out of the BRICS summit next week, it will be a lot harder for the west and western MSM to focus blame on Russia and China, without Putin or Xi attending in person.

CGTN Africa: Nigerian President Bola Tinubu will depart Abuja on Saturday for a state visit to Saint Lucia, before proceeding to Brazil where he will attend the 17th BRICS Summit in Rio de Janeiro from July 6-7.

This is interesting: “Although the summit formally begins on July 6, key encounters among central bank heads and finance ministers will already be taking place on July 4 and 5”.

The Old Pretender: Is this all Coming to a Head in July?

6-29-2025

If something big is scheduled to come out of the BRICS summit next week, it will be a lot harder for the west and western MSM to focus blame on Russia and China, without Putin or Xi attending in person.

CGTN Africa: Nigerian President Bola Tinubu will depart Abuja on Saturday for a state visit to Saint Lucia, before proceeding to Brazil where he will attend the 17th BRICS Summit in Rio de Janeiro from July 6-7.

This is interesting: “Although the summit formally begins on July 6, key encounters among central bank heads and finance ministers will already be taking place on July 4 and 5”.

https://en.mercopress.com/2025/06/24/july-7-becomes-holiday-in-rio-due-to-brics-event

And I find it potentially interesting that the Fed has organised a big US banking conference for July 22 (soon after the BRICS summit), at which Basel III implementation will be discussed, once the outcome of the BRICS summit is both known and analysed.

With Trump saying yesterday that the US government will not issue any debt beyond 9 months, is this all coming to a head in July?

Luke Groman: I used to think that; after the last 5 yrs I think they’ll be back in 6-12 mths begging to buy duration at <4% after inflation and gold reval have recapped US balance sheet to <50% debt/GDP

Source(s): https://x.com/Dioclet54046121/status/1938891523568898261

https://dinarchronicles.com/2025/06/28/the-old-pretender-is-this-all-coming-to-a-head-in-july/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Question: "Will there be a time limit to exchange? Will the CBI allow us to see $4.81?" I believe there will be a time frame but it'll be way down the road and yeah, $4.81 is where they want to cap it. You'll see it because it's going to be happening at that time. You'll see it as it floats...

Walkingstick [Iraqi Bank friend Aki update] AKI: Three meetings. The last meeting lasted two hours. My boss tells me, 'I need you back at the bank [In Dearborn Michigan] this Monday because we are waiting on the new exchange rate.' I have to go back because we're waiting for the new rate. WALKINGSTICK: That's the only thing they're waiting for. They already got all the banking software in place, ATM machines, the bank structures, all the bank regulations are set...

Militia Man One of the things that is a component of a reinstatement revaluation is low inflation. It's a sign for the IMF, World Bank, everybody that they maintain stable inflation and reduce it consistently is a very good sign that they're ready for an adjustment. It doesn't mean they will do it, it just means they have a key component.

************

FRANK25…6-28-25….ALOHA….HCL AND MORE…

Trillions in Compounding Interest: The Debt Spiral You Can’t Ignore

Lynette Zang: 6-28-2025

The U.S. government’s debt has hit a breaking point. With soaring interest payments and spending outpacing revenue, the financial system is cracking.

In this video, Lynette explains how compounding debt, rising rates, and failed monetary policy signal a structural bond shift

Seeds of Wisdom RV and Economic Updates Sunday Morning 6-29-25

[⚠️ Suspicious Content] Good Morning Dinar Recaps,

Senate Passes Trump’s “Big, Beautiful Bill” With 51–49 Vote By Coinpedia | June 2025

In a dramatic late-night session, the U.S. Senate narrowly approved President Donald Trump’s signature tax and spending legislation—dubbed the “Big, Beautiful Bill”—by a razor-thin 51–49 margin. The bill marks a cornerstone of Trump’s second-term agenda, with sweeping implications for tax policy, defense, energy, healthcare, and even cryptocurrency regulation.

Good Morning Dinar Recaps,

Senate Passes Trump’s “Big, Beautiful Bill” With 51–49 Vote

By Coinpedia | June 2025

In a dramatic late-night session, the U.S. Senate narrowly approved President Donald Trump’s signature tax and spending legislation—dubbed the “Big, Beautiful Bill”—by a razor-thin 51–49 margin. The bill marks a cornerstone of Trump’s second-term agenda, with sweeping implications for tax policy, defense, energy, healthcare, and even cryptocurrency regulation.

Two GOP Senators Break Ranks

The bill passed with only two Republican senators—Thom Tillis and Rand Paul—voting against it, citing concerns over spending levels and government overreach.

Vice President JD Vance was on standby to cast a tie-breaking vote, though his intervention wasn’t needed. The tight margin highlights growing intra-party divides, even as Trump’s influence over the GOP remains strong.

On Truth Social, Trump criticized Senator Tillis and vowed to back a primary challenger in 2026, signaling an ongoing campaign to reshape the Republican Party around his core policy objectives.

What’s in Trump’s “Big, Beautiful Bill”?

The wide-reaching legislation includes several hallmark provisions:

✅ Permanent extension of the 2017 tax cuts

✅ Elimination of taxes on tips and overtime pay

✅ $150 billion in new defense and border security funding

✅ $5 trillion increase to the federal debt ceiling

✅ Cuts to Medicaid and SNAP, with a new $25 billion rural Medicaid fund (2028–2032)

✅ Repeal of green energy tax credits

✅ Phase-out of SALT (State and Local Tax) deductions

✅ Sale of 1.2 million acres of federal land

The mix of tax relief, spending boosts, and entitlement cuts has generated both praise from fiscal conservatives and criticism from progressive lawmakers.

Crypto Regulation Tied to Legislative Package

One of the bill’s more consequential side developments could soon affect U.S. crypto markets.

A proposed merger of the GENIUS Act and the CLARITY Act—two major crypto bills currently in progress—has gained new traction in the House of Representatives. These bills aim to establish a stablecoin framework (GENIUS Act) and market structure clarity for digital assets (CLARITY Act).

“This could be the most important moment for U.S. crypto policy since the SEC’s early actions,” said one policy analyst tracking the legislation.

House leadership is reportedly considering packaging the crypto bills together to ensure passage before the August recess, possibly delivering a major win for President Trump’s pro-crypto agenda.

Looking Ahead

With the Senate now on board, the bill heads to the House of Representatives, where Republicans hold a majority. If passed, it could lead to one of the most significant fiscal overhauls in recent U.S. history—and potentially reshape the global view of America’s crypto leadership.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Co-Founder Chris Larsen Claims XRP Is a ‘Better Bitcoin’

By Crypto News Flash | June 2025

Ripple’s co-founder Chris Larsen has reignited the long-standing debate in the crypto community by claiming that XRP was designed to outclass Bitcoin in core metrics such as speed, efficiency, and energy usage.

Speaking on the “When Shift Happens” podcast, Larsen praised Bitcoin’s foundational role while insisting that XRP was engineered to be a next-generation improvement over it.

XRP: Built to Surpass Bitcoin

▪️ XRP was developed with the specific intent of improving upon Bitcoin’s transaction speed, cost-effectiveness, and environmental footprint.

▪️ Larsen noted that XRP’s architecture came from a team of “really, really smart people” and was intended to be more efficient without losing the decentralization ethos of blockchain technology.

“We wanted to build a system that addressed Bitcoin’s limitations—faster settlement, lower energy, and long-term scalability,” Larsen explained.

He admitted that XRP still has limitations, but stressed that its core value has remained intact through consistent development and community support.

Criticism of Stellar and Ethereum

Larsen took aim at Stellar Lumens, co-founded by former Ripple executive Jed McCaleb, accusing the project of lacking direction and predictability.

▪️ He referenced McCaleb’s 50% token burn and a history of “constant changes, airdrops, and impulsive pivots” as a red flag for institutional trust.

▪️ “Successful currencies are built on stability, not sudden directional shifts,” Larsen remarked.

On Ethereum, Larsen questioned the long-term dedication of its community, implying it lacks the consistent loyalty seen among XRP and Bitcoin holders.

Will Ripple Go Public? ‘Not Yet,’ Says Larsen

While many in the industry speculate about Ripple's IPO potential, Larsen pushed back on the idea—citing the bureaucratic red tape and short-term market manipulation by misinformed retail sellers.

▪️ Ripple President Monica Long also echoed this sentiment recently, saying the company doesn’t need external capital and is focused on strategic acquisitions instead.

▪️ Ripple’s latest purchase of prime brokerage firm Hidden Road for $1.25 billion further confirms that strategy.

Analysts: XRP Price Could Surge

The comparison between XRP and Bitcoin is being mirrored by top analysts:

Charles Shrem predicts Bitcoin’s dominance is being actively challenged.

Edoardo Farina, founder of Alpha Lions Academy, believes XRP’s growth trajectory is more realistic than Bitcoin’s.

Dustin Layton estimates a 23x return is possible, projecting XRP could hit $52 by year-end.

Zach Rector places a nearer-term target at $15.

“You’d have to be insane to think Bitcoin at $106K is a better investment than XRP,” Farina claimed.

As the SEC case nears closure and Ripple refocuses on global expansion, the firm appears poised to position XRP not only as a better Bitcoin in function—but perhaps soon, in adoption and valuation.

@ Newshounds News™

Source: CryptoNewsFlash

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

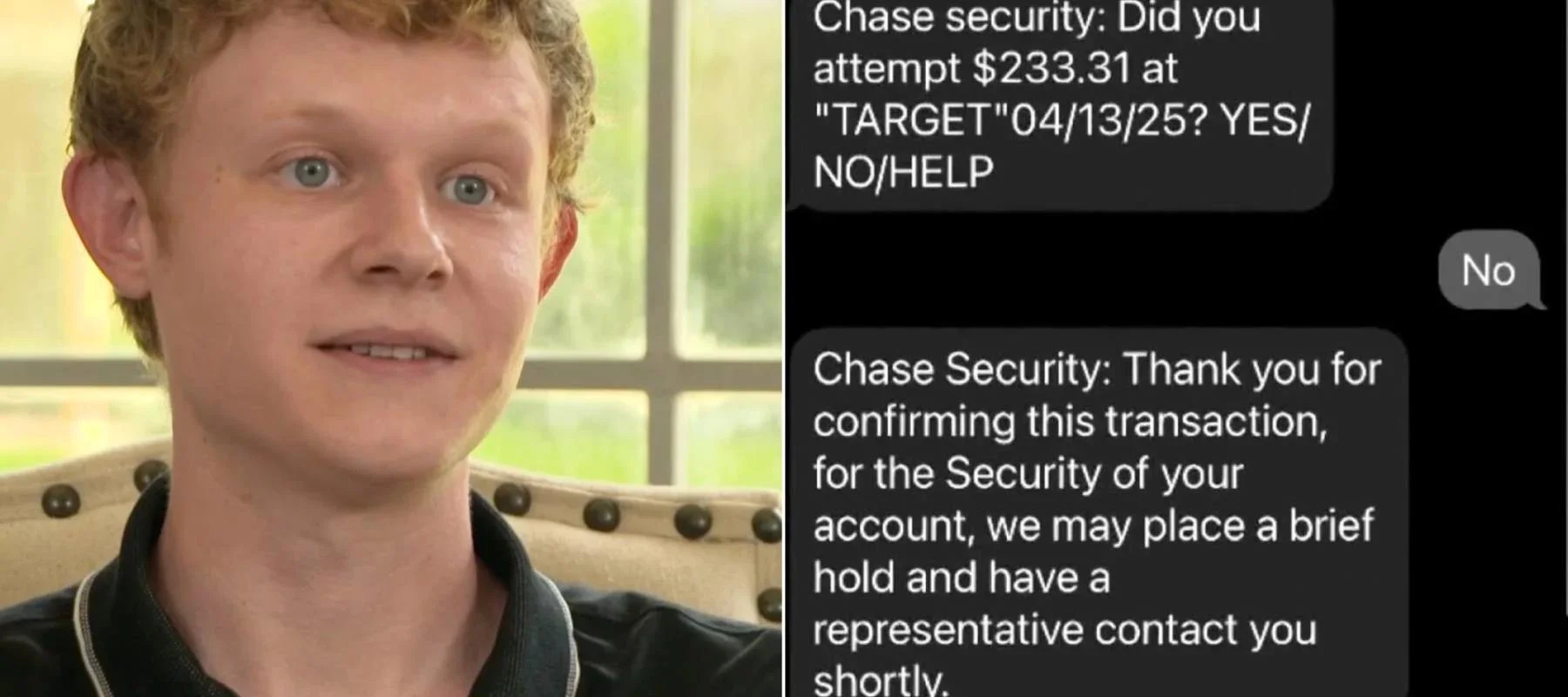

Fort Worth Teacher, 28, Loses $32K Fraud vs Scam

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Leahy was reportedly contacted by scammers who claimed to be representatives of Chase Bank. The supposed bank reps called to inform Leahy that his account had been compromised and that he needed to protect his finances by moving the cash into a secure account. All it took were a few text messages and some counterfeit banking information in order to appear genuine.

"I couldn't even believe how sophisticated it was," Leahy told WFAA.

Now, the newlywed is trying to warn people about the scam that cost him everything in the hopes of preventing others from falling for the same scheme.

Fraud vs. a scam

Unfortunately for Leahy, the situation went from bad to worse when he contacted Chase Bank to report the incident. According to WFAA, the bank told Leahy that his account isn’t covered by fraud protection, arguing that Leahy was the victim of a scam and not financial fraud.

In making this distinction, Chase Bank returned just over $2,000 to Leahy’s account, which is merely a fraction of his total loss. When WFAA contacted Chase Bank for comment, the bank offered clarification on the distinction between fraud and a scam.

"Fraud on a bank account involves someone illegally accessing someone else's account and making withdrawals, transfers, or purchases without the account holder's permission," the bank stated in its emailed reply.

A scam, on the other hand, is "a deceptive scheme or trick used to cheat someone out of their money or other valuable assets,” which is what happened to Leahy.

Chase Bank’s response likely isn’t what Leahy wanted to hear, but that hasn’t stopped him from sharing his story in order to prevent others from making the same mistakes.

"I'd rather I be the sacrificial lamb for the rest of these people and maybe save other people's money from being stolen," he said. "I'm really hoping to look ahead and move on with my life and not have to start over from scratch."

How to avoid falling for similar scams

TO READ MORE: https://www.yahoo.com/lifestyle/articles/fort-worth-teacher-28-loses-110000179.html