Ariel: The Return to the Gold Standard

Ariel: The Return to the Gold Standard

6-30-2025

The Return To The Gold Standard: The Evaluation Of A Failed System

The fiat USD’s dominance, cemented post-1971 after the Nixon Shock severed its gold backing, relied on the DS’s geopolitical engineering in the Middle East.

Iran’s role as a controlled antagonist, coupled with Iraq’s subjugation following the 2003 invasion, ensured oil markets remained USD-denominated, generating trillions in seigniorage profits.

Ariel: The Return to the Gold Standard

6-30-2025

The Return To The Gold Standard: The Evaluation Of A Failed System

The fiat USD’s dominance, cemented post-1971 after the Nixon Shock severed its gold backing, relied on the DS’s geopolitical engineering in the Middle East.

Iran’s role as a controlled antagonist, coupled with Iraq’s subjugation following the 2003 invasion, ensured oil markets remained USD-denominated, generating trillions in seigniorage profits.

(Seign·ior·age. profit made by a government by issuing currency, especially the difference between the face value of coins and their production costs. )

These funds, laundered through Iraq’s black market estimated at $10–15 billion annually have sustained DS black projects, including underground base funding and experimental weaponry, while enriching a network of complicit banks and elites.

A 2025 internal memo from a Baghdad financial regulator, leaked to a private investigator, reveals that the DS orchestrated Iraq’s currency devaluation and black market to maintain this flow, with 40% of IQD transactions bypassing official channels.

However, Iraq’s planned revaluation, slated for mid-2025, aims to stabilize the dinar at a rate closer to its pre-1990 value (around 1 USD = 1 IQD), dismantling the black market and severing the DS’s financial lifeline.

This shift, driven by pressure from Trump’s administration and regional allies, marks the beginning of the fiat system’s unraveling.

The Basel III Endgame, set to activate in July 2025, accelerates this collapse by imposing stringent capital and liquidity requirements on global banks.

Unlike previous phases, this final iteration codified after years of negotiation by the Basel Committee reclassifies physical gold and silver as Tier 1 assets with 0% risk weighting, while mandating an 85% Net Stable Funding Ratio (NSFR) for unallocated precious metals.

Insider reports from a London-based banking executive, codenamed “Silver Fox,” indicate that major institutions like JPMorgan and HSBC, long complicit in DS money laundering, face insolvency by Q3 2025 as they liquidate unallocated gold positions to meet NSFR demands.

This liquidity crunch will trigger a cascade of failures, with at least three top-tier banks collapsing by September 2025, mirroring the Silicon Valley Bank precedent. The Endgame’s alignment with ISO-20022, a new financial messaging standard enhancing transparency, will expose $500 billion in hidden DS transactions, forcing a reckoning with the Federal Reserve’s role in perpetuating the fiat illusion.

The Big Beautiful Bill, a legislative cornerstone of Trump’s agenda, streamlines this transition by deregulating AI and financial innovation while mandating compliance with Basel III, ISO-20022, COMEX 589 (a revised commodity exchange rule tightening gold delivery), and SOFR (Secured Overnight Financing Rate) as a replacement for LIBOR.

Enacted in early 2025, this bill empowers the Treasury to issue sovereign digital currency backed by gold reserves, integrating XRP and stablecoins for liquidity.

Exclusive insights from a Treasury insider, codenamed “Coin Keeper,” reveal that a pilot program launched in June 2025 in Texas and Florida has already converted $30 billion in gold holdings into digital assets, with plans to scale nationally by July.

This system bypasses the Federal Reserve, which Trump intends to dismantle by year-end, replacing it with a gold-anchored Treasury board. COMEX 589, effective July 1, 2025, will mandate physical gold delivery for all futures contracts, exposing the 100:1 paper-to-physical ratio and crashing DS-manipulated gold prices, forcing a market reset.

Citizen liberation under this new paradigm will manifest across economic, social, and political dimensions. Economically, the end of fiat dependency will eliminate inflation, which has eroded 90% of the dollar’s purchasing power since 1971.

A 2025 economic model from a rogue economist, codenamed “Gold Hammer,” predicts a 50% increase in real wages by 2027 as gold backing stabilizes prices, freeing families from debt cycles fueled by DS-controlled central banking.

Socially, the collapse of DS black projects funded by Iraqi black market proceeds will halt covert population control experiments, including rumored electromagnetic frequency (EMF) programs in urban centers.

Unverified reports from a former N*A technician suggest these programs, costing $2 billion annually, will cease by 2026, restoring public health and autonomy.

Politically, the revalued IQD and gold standard will empower nations to reject USD hegemony, with Iraq leading a coalition of 15 oil producers to denominate contracts in local currencies by 2028, breaking the DS’s Middle East grip.

Source(s): https://www.patreon.com/posts/return-to-gold-132740357

https://dinarchronicles.com/2025/06/30/ariel-prolotario1-the-return-to-the-gold-standard/

More News, Rumors and Opinions Sunday PM 6-29-2025

KTFA:

Clare: Iranian President: We are ready to start a new page in relations with neighboring Gulf countries

6/29/2025

Iranian President Masoud Pezeshkian announced on Sunday that Iran is ready to begin a new chapter in relations with the Gulf states.

"We are ready to start a new page in relations with the Gulf states," Masoud Pezeshkian was quoted as saying by the Iranian news agency.

KTFA:

Clare: Iranian President: We are ready to start a new page in relations with neighboring Gulf countries

6/29/2025

Iranian President Masoud Pezeshkian announced on Sunday that Iran is ready to begin a new chapter in relations with the Gulf states.

"We are ready to start a new page in relations with the Gulf states," Masoud Pezeshkian was quoted as saying by the Iranian news agency.

Pezeshkian said that strengthening our relations with the Gulf states carries a message of peace, brotherhood, and development for the entire Islamic world, and we are ready to cooperate with the Gulf Cooperation Council, thus opening a new chapter in our relations with the Gulf states. LINK

Clare: #BREAKING: The Iraqi Federal Government will release May salaries for the Kurdistan Region’s civil servants this week, while the KRG is required to transfer its domestic revenues to Baghdad, a high-level source from the Kurdistan Region’s Council of Ministers told Zoom News.

************

Clare: The Central Bank concludes a course on basic standards for detecting counterfeit currency.

June 29, 2025

The Central Bank of Iraq's Basra branch concluded the "Basic Standards for Detecting Counterfeit Currency" course. The course, organized by the Central Bank's Banking Studies Center, lasted three days, from June 23-25, 2025.

The course was attended by 13 government and private banks from the southern governorates. It also covered key aspects related to recent developments in detecting counterfeit currency and its basic standards.

For their part, the participants praised the training courses organized by the Central Bank of Iraq for their significant impact on developing their job performance.

Central Bank of Iraq

Media Office

June 29, 2025

* ***********

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Article of the budget] 12-2c the judge is holding on to it because he's protecting the new exchange rate. Even the gazette, two of them, are holding 12-2c. Why? It's the new exchange rate...This judge holds the future of Iraq's monetary reform in his hands...

Sandy Ingram My ex-husband retired from the Federal Reserve bank. He and his peers have always talked down about an IQD revalue or currency adjustment...Iraq is fixing these flaws...for global inclusion ...Countries and International banks didn't trust doing business with Iraq. Now Iraq's central bank is working to fix these problems. They're updating their systems...If Iraq continues on this path it has the potential to fully integrate into the global banking system...Now we know shy bankers said the IQD would never revalue. It looks like Iraq is plugging the holes and there will be sufficient economic gains for a higher currency value.

CEO Called $3,300 Gold, Predicts $5,000 Next | Morgan Lekstrom

David Lin: 6-29-2025

Morgan Lekstrom, CEO of NexMetals, discusses the global debt crisis and the future of gold and critical metals in light of geopolitical tensions and economic uncertainties.

0:00 - Intro.

0:53 - Previous gold predictions

2:33 - Geopolitics and markets

6:04 - Gold forecast

7:54 - Catalysts for upside

9:53 - Iran

13:28 - Other market hedges and Bitcoin

17:14 - Debt cycle 23:26 - Hodling comparisons

26:42 - Gold miners 28:14 - NexMetals

30:09 - Rebrand and market drivers

31:55 - Trade war and China

33:55 - Copper shortage and mines

37:25 - New mines timeline

39:10 - Botswana mine

Iraq Economic News and Points To Ponder Sunday Afternoon 6-29-25

Iraqi Dollar Smuggling 'Turns Regional' Amid High Iranian Demand For Greenbacks

Iraq / Economy Amwaj.media An Iraqi man counts US dollar bank notes in Baghdad on May 4, 2020. (Photo via Getty Images) Jun. 24, 2025 The story: Iraq has recently been riled by reports of a multi-billion dollar cash smuggling scheme allegedly orchestrated by Iran and its allies. Apparently aiming to circumvent US sanctions, the controversy has sharpened attention to Iran’s extensive regional shadow economies in Iraq. Emerging shortly before the recent attacks on Iran by Israel and the US, the crisis has led to intense scrutiny on ties between Tehran and Iraqi armed groups.

Iraqi Dollar Smuggling 'Turns Regional' Amid High Iranian Demand For Greenbacks

Iraq / Economy Amwaj.media An Iraqi man counts US dollar bank notes in Baghdad on May 4, 2020. (Photo via Getty Images) Jun. 24, 2025 The story: Iraq has recently been riled by reports of a multi-billion dollar cash smuggling scheme allegedly orchestrated by Iran and its allies. Apparently aiming to circumvent US sanctions, the controversy has sharpened attention to Iran’s extensive regional shadow economies in Iraq. Emerging shortly before the recent attacks on Iran by Israel and the US, the crisis has led to intense scrutiny on ties between Tehran and Iraqi armed groups.

The coverage: Dollar smuggling from Iraq to Iran, and between other regional countries, has been a well known practice in Iraqi banking and political circles for over a decade.

● However, citing Iraqi and US sources, a recent Wall Street Journal report has drawn attention to the claimed scale, ingenuity and organization of the enterprise—and Iran’s allegedly central role in orchestrating it.

● A reported arbitrage scheme has apparently involved Iran-linked smugglers acquiring large quantities of Mastercard and Visa prepaid debit cards.

Leveraging Iraq's informal dual exchange rates, couriers are reported to have withdrawn greenbacks at the official rate at ATMs primarily in Jordan, Turkey and the United Arab Emirates (UAE).

● The couriers are claimed to then return to Iraq and use ubiquitous money exchange kiosks to convert the cash to dinars at the higher unofficial exchange rate.

● As a result of these alleged activities, cross-border card transactions reportedly surged from 50M USD to 1.5B USD monthly between early 2023 and Apr. 2023, generating an estimated 450M USD in profits in 2023 alone.

https://flo.uri.sh/visualisation/12677369/embed?auto=1

The reactions in Iraqi media and on social networks have broadly been one of frustration, with critics leveling anger at Iran’s armed allies—and at Iraqi and international regulators for seemingly turning a blind eye to the trade.

● As anger mounts, one Iraqi political observer speculated in a post to Twitter/X that the funds may be used in Iran to pay pensions to government beneficiaries.

Other Iraqi outlets noted how the currency trade, exacerbated by recent regional instability, has weakened the Iraqi dinar.

● One Iraqi analyst told Erbil-based Rudaw that exchange rate spikes “hit ordinary people the hardest,” as they drive up the prices of staple goods and services.

The context/analysis: The alleged profiteering from Iraq’s effectively dual exchange rates appears to be the latest evolution in a longstanding pattern of sanctions evasion schemes by Iran and its regional allies.

● Prepaid cards are particularly attractive for such schemes because they offer anonymity, require minimal identity verification, provide global reach through payment networks and allow for discreet transport as alternatives to large volumes of cash.

Earlier currency smuggling schemes in Iraq were reportedly scaled dramatically through the Qi Card salary distribution system. Partnered with Visa and Mastercard, the network serves millions of government employees, including members of the Popular Mobilization Units (PMU).

● Thousands of PMU employees receive state salaries through Qi Cards, with some commanders reportedly seizing subordinates' payment cards, or creating fake identities to obtain additional payouts. https://datawrapper.dwcdn.net/hTN42/14/

In late 2022, the US Treasury and Federal Reserve clamped down on allegedly fraudulent wire transfers from several Iraqi banks amid concern over dollar smuggling.

● Those new restrictions are believed to have forced Iraqi armed groups to pivot to prepaid debit cards and the exploitation of regional banking networks.

Adding to the controversy, both Mastercard and Visa have allegedly profited significantly from the current alleged scheme, reportedly earning collectively around 120M USD through transaction fees of 1% to 1.4% on cross-border transactions.

● Both Mastercard and Visa have been accused of delaying enforcement calls for action from the US Treasury for months. This is claimed to have allowed transactions to continue, ranging from 400M USD to 1.1B USD monthly until early 2025.

Adding to the rising awareness of the problem, anecdotal reports have suggested long lines of Iraqis at ATMs in regional countries withdrawing large amounts of cash.

● However, such reports have been apparently dismissed by Iraqi officials as negligible and blamed on “criminal gangs.”

Central Bank of Iraq (CBI) Governor Ali Al-Allaq in April stated that

his institution was targeting the “Visa and Mastercard card problem abroad,” although he emphasized that the crisis stemmed from “misunderstandings.”

State-owned banks in Iraq

Agricultural Cooperative Bank of Iraq Founded: 1935

Alnahrain Islamic Bank Founded: 2012

Bank of Iraq Founded: 1948

Industrial Bank of Iraq Founded: 1941

Rafidain Bank Founded: 1941

Rasheed Bank Founded: 1988

Trade Bank of Iraq Founded: 2004

Source: News agencies • Collated by: Amwaj.media

The future: The apparent dollar smuggling enterprise has seemingly fallen off Washington's radar for now,

as attention has shifted to the renewed outbreak of conflict between Iran and Israel

—and more recently the US bombing of Iranian nuclear sites.

● Yet, the effects on Iraq’s banking sector may be long-lasting, as seen in a broader tightening of oversight over the financial sector.

● Regulatory institutions have implemented monthly caps of 300M USD on all cross-border transactions and limited individual cardholders to 5,000 USD monthly.

The US Treasury's blacklisting of three Iraqi card issuers and the blocking of over 200,000 apparently fraudulent cards represent the most significant enforcement actions against allegedly Iran-linked illicit financial networks to date.

● However, the historical pattern of adaptation suggests that new loopholes will likely emerge and be exploited for as long as there is high demand for US dollars.

Nevertheless, the controversy over the prepaid debit cards has accelerated banking sector reform in Iraq, with comprehensive regulatory changes scheduled for implementation beginning in early 2026.

● The CBI has announced reforms that include unified regulatory frameworks, enhanced anti-money laundering capabilities and mandatory compliance with international standards.

https://amwaj.media/en/media-monitor/iraqi-dollar-smuggling-claimed-to-turn-regional-amid-high-iranian-demand-for-gree

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 6-29-25

[⚠️ Suspicious Content] Good Afternoon Dinar Recaps,

USA No Longer Default Market: BRICS Attracts Global Capital By Watcher Guru | June 2025 Global capital is shifting. The U.S. is losing its traditional grip as the world’s default investment hub, with institutional funds now flowing steadily toward BRICS nations. As the U.S. Dollar Index (DXY) dropped to the 96 range early Thursday, a report from Bank of America revealed that exposure to dollar-based assets is at its lowest level since 2005.

Good Afternoon Dinar Recaps,

USA No Longer Default Market: BRICS Attracts Global Capital

By Watcher Guru | June 2025

Global capital is shifting. The U.S. is losing its traditional grip as the world’s default investment hub, with institutional funds now flowing steadily toward BRICS nations. As the U.S. Dollar Index (DXY) dropped to the 96 range early Thursday, a report from Bank of America revealed that exposure to dollar-based assets is at its lowest level since 2005.

BRICS Rising: Global Investors Shift Capital South

▪️ Countries like China, India, Brazil, and South Africa are now attracting capital once destined for the U.S.

▪️ The U.S. dollar's weakening position is making assets in the global south more appealing, especially in the face of recent Trump-imposed tariffs.

▪️ Investors are eyeing early-stage growth in BRICS nations, seeking better returns than U.S. Treasuries or bonds.

The global investment spotlight has moved to the BRICS bloc, where developing markets are benefiting from macro shifts—especially amid growing skepticism toward U.S. monetary dominance.

USA Still Leads, But BRICS Is Catching Up

▪️ The U.S. remains the strongest financial player, but institutional clients are now diversifying away from dollar dominance.

▪️ In 2025, for the first time in two decades, major global investors “went all-in” on non-U.S. assets.

This trend marks a major inflection point in financial history—particularly as China and India move to internationalize the yuan and rupee, respectively.

China alone has drawn $17 billion in foreign inflows, capitalizing on the dollar’s weakening global influence.

The De-Dollarization Era Has Momentum

The de-dollarization movement continues to accelerate as BRICS expands both its economic influence and financial ecosystems.

▪️ BRICS+ aims to solidify a multipolar financial world, weakening the U.S. dollar’s role as the sole reserve currency.

▪️ Dozens of countries, including allies and neutral states, are now watching BRICS as a credible financial alternative.

Unless addressed, this trend could reshape the world’s financial order over the next two decades, and further dilute U.S. influence in global markets.

“The White House needs to act swiftly to maintain leadership on the global financial curve,” the article concludes.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Global Currency Status IQD EUR GBP JPY CHF BRICS

Global Currency Status IQD EUR GBP JPY CHF BRICS

Edu Matrix: 6-29-2025

Global Currency Status IQD EUR GBP JPY CHF BRICS In this week’s global currency update (June 27, 2025), we break down which currencies are gaining ground and why.

From the euro and British pound hitting multi-year highs, to the safe-haven surge of the Swiss franc and Japanese yen, the global currency shift is in full motion.

Global Currency Status IQD EUR GBP JPY CHF BRICS

Edu Matrix: 6-29-2025

Global Currency Status IQD EUR GBP JPY CHF BRICS In this week’s global currency update (June 27, 2025), we break down which currencies are gaining ground and why.

From the euro and British pound hitting multi-year highs, to the safe-haven surge of the Swiss franc and Japanese yen, the global currency shift is in full motion.

We also explore the latest on BRICS currency plans—how these nations are accelerating their push to de-dollarize—and what that could mean for the global economy.

Plus, get an important update on Iraq’s dinar and its steady progress toward currency stability and reform. Which currencies are expected to rise next?

Watch now to find out which foreign currencies are forecasted to climb against the U.S. dollar in the coming weeks and months.

Don’t miss this essential insight for investors, currency watchers, and global economy enthusiasts. Subscribe for more weekly financial updates and smart money moves!

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

HTZ CAP: 6-29-2025

The London Bullion Market Association (LBMA) and WGC had partnered to develop and implement an international system of gold bar integrity (GBI).

The GBI programme aims to put all legitimate gold onto an immutable blockchain-based database where buyers will be able to clearly see that the investment bar, coin, and – when technology allows – jewellery they purchase was resourced responsibly, refined reputably, and only passed through the hands of legitimate actors.

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

HTZ CAP: 6-29-2025

The London Bullion Market Association (LBMA) and WGC had partnered to develop and implement an international system of gold bar integrity (GBI).

The GBI programme aims to put all legitimate gold onto an immutable blockchain-based database where buyers will be able to clearly see that the investment bar, coin, and – when technology allows – jewellery they purchase was resourced responsibly, refined reputably, and only passed through the hands of legitimate actors.

Andy Schectman, president of Miles Franklin, remains decidedly bullish on both gold and silver. In recent commentary, he argues that the ongoing accumulation by major players and strong demand for physical metal signal a continued upward trajectory, irrespective of short-term price fluctuations.

Schectman highlights the Ripple effect of developments within the BRICS bloc, especially the launch of new gold settlement platforms via the Shanghai Gold Exchange in Hong Kong and Saudi Arabia—a clear indicator of a global shift toward bullion as a trusted reserve.

Schectman sees the first week of July as a pivotal moment for the future of BRICS: this is when several member nations are expected to reveal concrete plans for gold and silver integration into their financial systems.

Referencing his chart analysis—particularly the recent technical breakout in silver—he suggests that these developments could catalyse a powerful price surge in both metals, reinforcing the shift away from dollar dominance .

In his view, investors should closely monitor early July announcements as they may mark the start of a new phase in the global gold‑silver bull market.

News, Rumors and Opinions Sunday 6-29-2025

The Old Pretender: Is this all Coming to a Head in July?

6-29-2025

If something big is scheduled to come out of the BRICS summit next week, it will be a lot harder for the west and western MSM to focus blame on Russia and China, without Putin or Xi attending in person.

CGTN Africa: Nigerian President Bola Tinubu will depart Abuja on Saturday for a state visit to Saint Lucia, before proceeding to Brazil where he will attend the 17th BRICS Summit in Rio de Janeiro from July 6-7.

This is interesting: “Although the summit formally begins on July 6, key encounters among central bank heads and finance ministers will already be taking place on July 4 and 5”.

The Old Pretender: Is this all Coming to a Head in July?

6-29-2025

If something big is scheduled to come out of the BRICS summit next week, it will be a lot harder for the west and western MSM to focus blame on Russia and China, without Putin or Xi attending in person.

CGTN Africa: Nigerian President Bola Tinubu will depart Abuja on Saturday for a state visit to Saint Lucia, before proceeding to Brazil where he will attend the 17th BRICS Summit in Rio de Janeiro from July 6-7.

This is interesting: “Although the summit formally begins on July 6, key encounters among central bank heads and finance ministers will already be taking place on July 4 and 5”.

https://en.mercopress.com/2025/06/24/july-7-becomes-holiday-in-rio-due-to-brics-event

And I find it potentially interesting that the Fed has organised a big US banking conference for July 22 (soon after the BRICS summit), at which Basel III implementation will be discussed, once the outcome of the BRICS summit is both known and analysed.

With Trump saying yesterday that the US government will not issue any debt beyond 9 months, is this all coming to a head in July?

Luke Groman: I used to think that; after the last 5 yrs I think they’ll be back in 6-12 mths begging to buy duration at <4% after inflation and gold reval have recapped US balance sheet to <50% debt/GDP

Source(s): https://x.com/Dioclet54046121/status/1938891523568898261

https://dinarchronicles.com/2025/06/28/the-old-pretender-is-this-all-coming-to-a-head-in-july/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Question: "Will there be a time limit to exchange? Will the CBI allow us to see $4.81?" I believe there will be a time frame but it'll be way down the road and yeah, $4.81 is where they want to cap it. You'll see it because it's going to be happening at that time. You'll see it as it floats...

Walkingstick [Iraqi Bank friend Aki update] AKI: Three meetings. The last meeting lasted two hours. My boss tells me, 'I need you back at the bank [In Dearborn Michigan] this Monday because we are waiting on the new exchange rate.' I have to go back because we're waiting for the new rate. WALKINGSTICK: That's the only thing they're waiting for. They already got all the banking software in place, ATM machines, the bank structures, all the bank regulations are set...

Militia Man One of the things that is a component of a reinstatement revaluation is low inflation. It's a sign for the IMF, World Bank, everybody that they maintain stable inflation and reduce it consistently is a very good sign that they're ready for an adjustment. It doesn't mean they will do it, it just means they have a key component.

************

FRANK25…6-28-25….ALOHA….HCL AND MORE…

Trillions in Compounding Interest: The Debt Spiral You Can’t Ignore

Lynette Zang: 6-28-2025

The U.S. government’s debt has hit a breaking point. With soaring interest payments and spending outpacing revenue, the financial system is cracking.

In this video, Lynette explains how compounding debt, rising rates, and failed monetary policy signal a structural bond shift

Seeds of Wisdom RV and Economic Updates Sunday Morning 6-29-25

[⚠️ Suspicious Content] Good Morning Dinar Recaps,

Senate Passes Trump’s “Big, Beautiful Bill” With 51–49 Vote By Coinpedia | June 2025

In a dramatic late-night session, the U.S. Senate narrowly approved President Donald Trump’s signature tax and spending legislation—dubbed the “Big, Beautiful Bill”—by a razor-thin 51–49 margin. The bill marks a cornerstone of Trump’s second-term agenda, with sweeping implications for tax policy, defense, energy, healthcare, and even cryptocurrency regulation.

Good Morning Dinar Recaps,

Senate Passes Trump’s “Big, Beautiful Bill” With 51–49 Vote

By Coinpedia | June 2025

In a dramatic late-night session, the U.S. Senate narrowly approved President Donald Trump’s signature tax and spending legislation—dubbed the “Big, Beautiful Bill”—by a razor-thin 51–49 margin. The bill marks a cornerstone of Trump’s second-term agenda, with sweeping implications for tax policy, defense, energy, healthcare, and even cryptocurrency regulation.

Two GOP Senators Break Ranks

The bill passed with only two Republican senators—Thom Tillis and Rand Paul—voting against it, citing concerns over spending levels and government overreach.

Vice President JD Vance was on standby to cast a tie-breaking vote, though his intervention wasn’t needed. The tight margin highlights growing intra-party divides, even as Trump’s influence over the GOP remains strong.

On Truth Social, Trump criticized Senator Tillis and vowed to back a primary challenger in 2026, signaling an ongoing campaign to reshape the Republican Party around his core policy objectives.

What’s in Trump’s “Big, Beautiful Bill”?

The wide-reaching legislation includes several hallmark provisions:

✅ Permanent extension of the 2017 tax cuts

✅ Elimination of taxes on tips and overtime pay

✅ $150 billion in new defense and border security funding

✅ $5 trillion increase to the federal debt ceiling

✅ Cuts to Medicaid and SNAP, with a new $25 billion rural Medicaid fund (2028–2032)

✅ Repeal of green energy tax credits

✅ Phase-out of SALT (State and Local Tax) deductions

✅ Sale of 1.2 million acres of federal land

The mix of tax relief, spending boosts, and entitlement cuts has generated both praise from fiscal conservatives and criticism from progressive lawmakers.

Crypto Regulation Tied to Legislative Package

One of the bill’s more consequential side developments could soon affect U.S. crypto markets.

A proposed merger of the GENIUS Act and the CLARITY Act—two major crypto bills currently in progress—has gained new traction in the House of Representatives. These bills aim to establish a stablecoin framework (GENIUS Act) and market structure clarity for digital assets (CLARITY Act).

“This could be the most important moment for U.S. crypto policy since the SEC’s early actions,” said one policy analyst tracking the legislation.

House leadership is reportedly considering packaging the crypto bills together to ensure passage before the August recess, possibly delivering a major win for President Trump’s pro-crypto agenda.

Looking Ahead

With the Senate now on board, the bill heads to the House of Representatives, where Republicans hold a majority. If passed, it could lead to one of the most significant fiscal overhauls in recent U.S. history—and potentially reshape the global view of America’s crypto leadership.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Co-Founder Chris Larsen Claims XRP Is a ‘Better Bitcoin’

By Crypto News Flash | June 2025

Ripple’s co-founder Chris Larsen has reignited the long-standing debate in the crypto community by claiming that XRP was designed to outclass Bitcoin in core metrics such as speed, efficiency, and energy usage.

Speaking on the “When Shift Happens” podcast, Larsen praised Bitcoin’s foundational role while insisting that XRP was engineered to be a next-generation improvement over it.

XRP: Built to Surpass Bitcoin

▪️ XRP was developed with the specific intent of improving upon Bitcoin’s transaction speed, cost-effectiveness, and environmental footprint.

▪️ Larsen noted that XRP’s architecture came from a team of “really, really smart people” and was intended to be more efficient without losing the decentralization ethos of blockchain technology.

“We wanted to build a system that addressed Bitcoin’s limitations—faster settlement, lower energy, and long-term scalability,” Larsen explained.

He admitted that XRP still has limitations, but stressed that its core value has remained intact through consistent development and community support.

Criticism of Stellar and Ethereum

Larsen took aim at Stellar Lumens, co-founded by former Ripple executive Jed McCaleb, accusing the project of lacking direction and predictability.

▪️ He referenced McCaleb’s 50% token burn and a history of “constant changes, airdrops, and impulsive pivots” as a red flag for institutional trust.

▪️ “Successful currencies are built on stability, not sudden directional shifts,” Larsen remarked.

On Ethereum, Larsen questioned the long-term dedication of its community, implying it lacks the consistent loyalty seen among XRP and Bitcoin holders.

Will Ripple Go Public? ‘Not Yet,’ Says Larsen

While many in the industry speculate about Ripple's IPO potential, Larsen pushed back on the idea—citing the bureaucratic red tape and short-term market manipulation by misinformed retail sellers.

▪️ Ripple President Monica Long also echoed this sentiment recently, saying the company doesn’t need external capital and is focused on strategic acquisitions instead.

▪️ Ripple’s latest purchase of prime brokerage firm Hidden Road for $1.25 billion further confirms that strategy.

Analysts: XRP Price Could Surge

The comparison between XRP and Bitcoin is being mirrored by top analysts:

Charles Shrem predicts Bitcoin’s dominance is being actively challenged.

Edoardo Farina, founder of Alpha Lions Academy, believes XRP’s growth trajectory is more realistic than Bitcoin’s.

Dustin Layton estimates a 23x return is possible, projecting XRP could hit $52 by year-end.

Zach Rector places a nearer-term target at $15.

“You’d have to be insane to think Bitcoin at $106K is a better investment than XRP,” Farina claimed.

As the SEC case nears closure and Ripple refocuses on global expansion, the firm appears poised to position XRP not only as a better Bitcoin in function—but perhaps soon, in adoption and valuation.

@ Newshounds News™

Source: CryptoNewsFlash

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

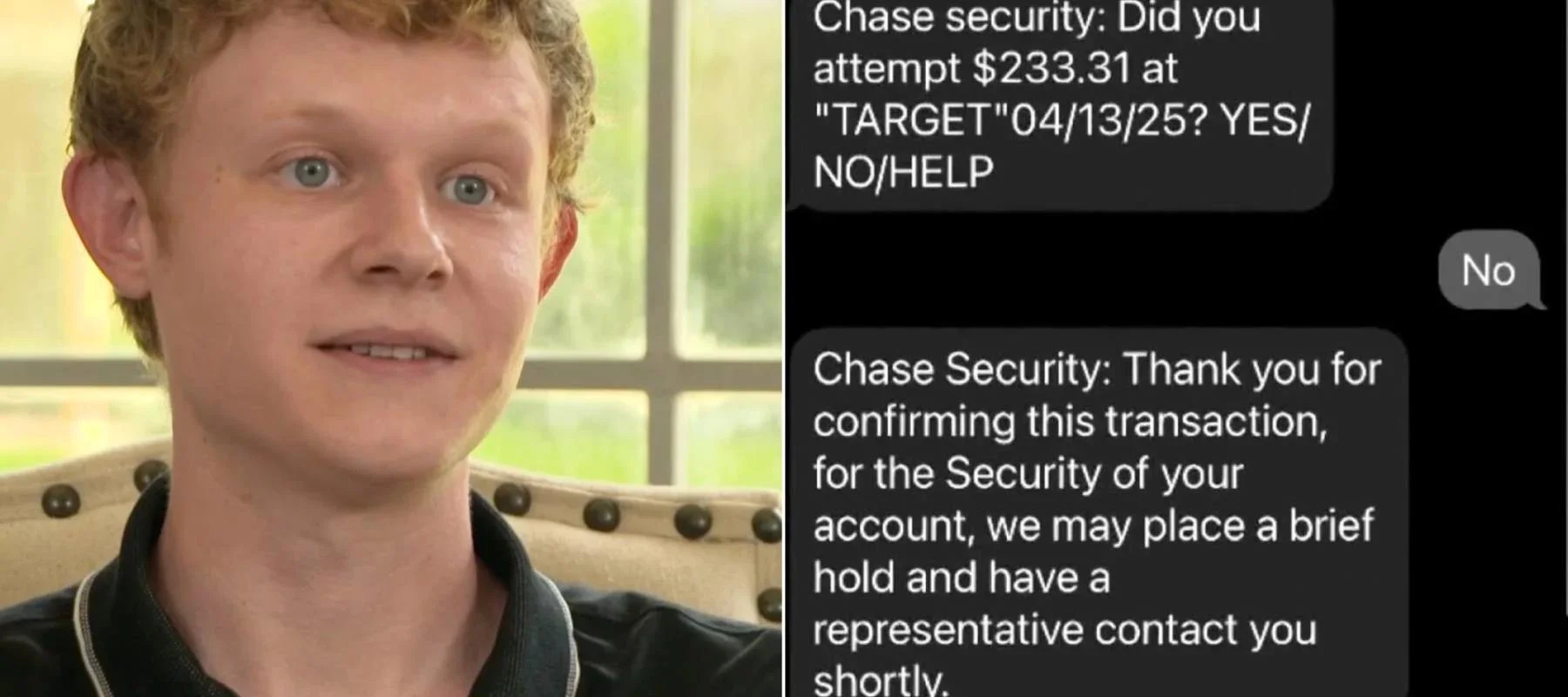

Fort Worth Teacher, 28, Loses $32K Fraud vs Scam

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Leahy was reportedly contacted by scammers who claimed to be representatives of Chase Bank. The supposed bank reps called to inform Leahy that his account had been compromised and that he needed to protect his finances by moving the cash into a secure account. All it took were a few text messages and some counterfeit banking information in order to appear genuine.

"I couldn't even believe how sophisticated it was," Leahy told WFAA.

Now, the newlywed is trying to warn people about the scam that cost him everything in the hopes of preventing others from falling for the same scheme.

Fraud vs. a scam

Unfortunately for Leahy, the situation went from bad to worse when he contacted Chase Bank to report the incident. According to WFAA, the bank told Leahy that his account isn’t covered by fraud protection, arguing that Leahy was the victim of a scam and not financial fraud.

In making this distinction, Chase Bank returned just over $2,000 to Leahy’s account, which is merely a fraction of his total loss. When WFAA contacted Chase Bank for comment, the bank offered clarification on the distinction between fraud and a scam.

"Fraud on a bank account involves someone illegally accessing someone else's account and making withdrawals, transfers, or purchases without the account holder's permission," the bank stated in its emailed reply.

A scam, on the other hand, is "a deceptive scheme or trick used to cheat someone out of their money or other valuable assets,” which is what happened to Leahy.

Chase Bank’s response likely isn’t what Leahy wanted to hear, but that hasn’t stopped him from sharing his story in order to prevent others from making the same mistakes.

"I'd rather I be the sacrificial lamb for the rest of these people and maybe save other people's money from being stolen," he said. "I'm really hoping to look ahead and move on with my life and not have to start over from scratch."

How to avoid falling for similar scams

TO READ MORE: https://www.yahoo.com/lifestyle/articles/fort-worth-teacher-28-loses-110000179.html

“Tidbits From TNT” Sunday Morning 6-29-2025

TNT:

Tishwash: Stay tuned... an expanded meeting will be held tomorrow in Baghdad to discuss the re-export of the region's oil.

Iraqi parliament member Sherwan Dubardani confirmed on Saturday that a delegation from the Kurdistan Region, headed by the Minister of Natural Resources, had arrived in Baghdad. He explained that the capital would host an expanded meeting tomorrow between the Kurdistan delegation and the federal government to discuss the re-export of the region's oil.

"The Kurdish delegation is currently holding a meeting, and an expanded meeting between Erbil and Baghdad is expected to be held tonight or tomorrow, Sunday, to discuss the region's oil file," Dubardani said in a statement monitored by Al-Masry.

TNT:

Tishwash: Stay tuned... an expanded meeting will be held tomorrow in Baghdad to discuss the re-export of the region's oil.

Iraqi parliament member Sherwan Dubardani confirmed on Saturday that a delegation from the Kurdistan Region, headed by the Minister of Natural Resources, had arrived in Baghdad. He explained that the capital would host an expanded meeting tomorrow between the Kurdistan delegation and the federal government to discuss the re-export of the region's oil.

"The Kurdish delegation is currently holding a meeting, and an expanded meeting between Erbil and Baghdad is expected to be held tonight or tomorrow, Sunday, to discuss the region's oil file," Dubardani said in a statement monitored by Al-Masry.

Kurdish media outlets quoted political sources regarding the upcoming meeting, stating that it will include Deputy Prime Minister Fuad Hussein, the Iraqi Oil Minister, a representative from the Iraqi State Oil Marketing Organization (SOMO), the Kurdistan Regional Government's Minister of Natural Resources, and a delegation from the region heading to Baghdad.

She pointed out that "a joint statement on the outcomes of the meeting is expected to be issued after its conclusion." link

Tishwash: Sharp fluctuations in the value of the Iranian currency amid regional tensions between Tehran and Tel Aviv.

Iranian markets have witnessed sharp fluctuations in the Iranian toman's exchange rate over the past few days, directly influenced by the escalating geopolitical tensions between Iran and Israel. The US dollar's exchange rate against the toman reached 9 million tomans at the height of talk of a possible direct war, after it had been expected to reach 10 million.

But with signs of calm and de-escalation between the two sides, the value of the toman has risen again, amidst a state of uncertainty that has gripped the market.

Decrease in trading volume and warnings against risk

"We sold the dollar for 7.6 million dinars, but we didn't buy back because of the price fluctuations," Kawa Yahya, an exchange office owner, told a Kurdistan 24 reporter. "The price had risen to 9 million tomans this morning due to the escalation, but later dropped to 7 million, which represents a difference of nearly 2 million in a very short period."

Money changers confirmed that toman banknotes are becoming less available in the market, and that daily trading volume has fallen to approximately 60% compared to previous levels.

Conditional optimism and expectations of more volatility

For his part, Shawan Muhammad, an exchange office owner, said, "After the calm, the toman began to regain some of its value, but its fate remains uncertain. There is talk of an impending agreement between the United States and Iran, and if it actually materializes, the toman will regain its strength. So far, Tehran has not conceded its interests, so we expect the market to remain volatile."

Observers believe that any new security or political unrest among the countries of the region would immediately impact the toman's exchange rate and trading volume in the Iranian market.

Despite the lack of stability, approximately 10 billion tomans are still traded daily, a source of concern for traders who face significant financial risks amid the lack of clear guarantees regarding the future of the Iranian currency. link

************

Tishwash: An economist warns of the continued dominance of the dollar in Iraqi-Chinese trade.

Data from the Chinese Customs Authority showed a significant increase in the value of Chinese exports to Iraq during the first five months of 2025, increasing by 9.5% compared to the same period in 2024. The value of these exports reached $7.4 billion, compared to $6.77 billion during the same period last year, according to a report by economic expert Manar Al-Obaidi.

Al-Abidi explained that this growth is driven by increased exports from a number of sectors, most notably:

Electrical and mechanical appliances : accounted for 24% of total exports and achieved a growth rate of 11.46%.

Electronics : represented 15% of exports and increased by 29.3%.

Clothing : accounted for 7.6% of total exports and increased by 21%.

Cars and spare parts : Its share reached 7.2% and recorded the highest growth rate of 35%.

In contrast, Iraqi exports to China declined by 5.77% during the same period, reaching $15.2 billion compared to $16.14 billion in 2024, and are almost entirely limited to petroleum products.

Despite the decline, the trade balance between the two countries remains in Iraq's favor, with a trade surplus of $7.7 billion during the first five months of 2025, down from $9.37 billion during the same period the previous year.

Al-Obaidi pointed out that "this surplus remains fragile, as it is almost entirely tied to Iraq's oil exports to China in terms of quantity and price. Any decline in the value or volume of these exports could lead to a shrinkage of the surplus or its transformation into a deficit, which necessitates diversifying Iraq's export base by boosting exports of raw materials and local goods."

Although annual trade between Iraq and China exceeds $54 billion, financial transactions between the two sides continue to be conducted in the US dollar, whether for oil sales or imports.

Al-Obaidi called for "the establishment of a direct financial and trade exchange platform between Iraq and China, similar to what other countries have done, such as the recent agreement between China and Turkey to adopt local currencies in trade exchanges."

He promised that "reducing dependence on the dollar represents a strategic step towards enhancing financial independence and increasing the effectiveness of bilateral trade."

It should be noted that this data represents direct Chinese exports to Iraq and does not include goods exported to other countries, particularly the UAE, and then re-exported to the Iraqi market. link

Mot: . First Teenage Rebellion

Mot: .. as mom sees it

Hundreds of Indicators Pointing to a Global Recession

Hundreds of Indicators Pointing to a Global Recession

Commodity Culture: 6-28-2025

Renowned financial analyst Henrik Zeberg recently joined Jesse Day on Commodity Culture to deliver a stark warning about the global economic outlook.

In a compelling discussion, Zeberg asserts that a global recession is not just a possibility, but an unavoidable certainty, culminating in a deflationary bust that most market participants will fail to anticipate.

Hundreds of Indicators Pointing to a Global Recession

Commodity Culture: 6-28-2025

Renowned financial analyst Henrik Zeberg recently joined Jesse Day on Commodity Culture to deliver a stark warning about the global economic outlook.

In a compelling discussion, Zeberg asserts that a global recession is not just a possibility, but an unavoidable certainty, culminating in a deflationary bust that most market participants will fail to anticipate.

Central to Zeberg’s thesis is the prediction of an imminent “blow-off top” in the broad market. This euphoric, final surge, he argues, will precede a dramatic and unexpected deflationary downturn. Zeberg meticulously outlined the specific indicators he is closely monitoring that underpin this contrarian view, suggesting that the current economic trajectory is far more precarious than widely acknowledged.

The “deflationary bust” is highlighted as a particularly insidious threat, precisely because its arrival is expected to blindside the majority of investors and policymakers.

Beyond the broader market, Zeberg also provided his detailed outlook on the future of gold and gold mining stocks, offering insights into their potential performance in a rapidly shifting economic landscape. The discussion further delved into the potential ripple effects of former President Trump’s tariff policies, analyzing how they might impact global trade and economic stability.

Perhaps one of the most memorable moments of the conversation was Zeberg’s candid assessment of the US dollar’s standing in the current global financial landscape, famously asking whether it remains “the prettiest mare at the glue factory of fiat currencies.”

This provocative statement encapsulates his skepticism about the long-term strength of the world’s reserve currency amidst unprecedented monetary policies.

Zeberg’s comprehensive analysis offers a compelling, albeit unsettling, counter-narrative to much of the prevailing market optimism. For investors and individuals keen to understand the full scope of Zeberg’s predictions, including the specific indicators and his nuanced arguments, the full video discussion on Commodity Culture provides invaluable insights.

It’s a critical watch for anyone looking to navigate the challenging economic waters ahead with a more informed perspective.