Global Currency Status IQD EUR GBP JPY CHF BRICS

Global Currency Status IQD EUR GBP JPY CHF BRICS

Edu Matrix: 6-29-2025

Global Currency Status IQD EUR GBP JPY CHF BRICS In this week’s global currency update (June 27, 2025), we break down which currencies are gaining ground and why.

From the euro and British pound hitting multi-year highs, to the safe-haven surge of the Swiss franc and Japanese yen, the global currency shift is in full motion.

Global Currency Status IQD EUR GBP JPY CHF BRICS

Edu Matrix: 6-29-2025

Global Currency Status IQD EUR GBP JPY CHF BRICS In this week’s global currency update (June 27, 2025), we break down which currencies are gaining ground and why.

From the euro and British pound hitting multi-year highs, to the safe-haven surge of the Swiss franc and Japanese yen, the global currency shift is in full motion.

We also explore the latest on BRICS currency plans—how these nations are accelerating their push to de-dollarize—and what that could mean for the global economy.

Plus, get an important update on Iraq’s dinar and its steady progress toward currency stability and reform. Which currencies are expected to rise next?

Watch now to find out which foreign currencies are forecasted to climb against the U.S. dollar in the coming weeks and months.

Don’t miss this essential insight for investors, currency watchers, and global economy enthusiasts. Subscribe for more weekly financial updates and smart money moves!

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

HTZ CAP: 6-29-2025

The London Bullion Market Association (LBMA) and WGC had partnered to develop and implement an international system of gold bar integrity (GBI).

The GBI programme aims to put all legitimate gold onto an immutable blockchain-based database where buyers will be able to clearly see that the investment bar, coin, and – when technology allows – jewellery they purchase was resourced responsibly, refined reputably, and only passed through the hands of legitimate actors.

IT IS NOT STOPPING! This Is The Biggest Bullish News I've Heard From The BRICS Ever - Andy Schectman

HTZ CAP: 6-29-2025

The London Bullion Market Association (LBMA) and WGC had partnered to develop and implement an international system of gold bar integrity (GBI).

The GBI programme aims to put all legitimate gold onto an immutable blockchain-based database where buyers will be able to clearly see that the investment bar, coin, and – when technology allows – jewellery they purchase was resourced responsibly, refined reputably, and only passed through the hands of legitimate actors.

Andy Schectman, president of Miles Franklin, remains decidedly bullish on both gold and silver. In recent commentary, he argues that the ongoing accumulation by major players and strong demand for physical metal signal a continued upward trajectory, irrespective of short-term price fluctuations.

Schectman highlights the Ripple effect of developments within the BRICS bloc, especially the launch of new gold settlement platforms via the Shanghai Gold Exchange in Hong Kong and Saudi Arabia—a clear indicator of a global shift toward bullion as a trusted reserve.

Schectman sees the first week of July as a pivotal moment for the future of BRICS: this is when several member nations are expected to reveal concrete plans for gold and silver integration into their financial systems.

Referencing his chart analysis—particularly the recent technical breakout in silver—he suggests that these developments could catalyse a powerful price surge in both metals, reinforcing the shift away from dollar dominance .

In his view, investors should closely monitor early July announcements as they may mark the start of a new phase in the global gold‑silver bull market.

News, Rumors and Opinions Sunday 6-29-2025

The Old Pretender: Is this all Coming to a Head in July?

6-29-2025

If something big is scheduled to come out of the BRICS summit next week, it will be a lot harder for the west and western MSM to focus blame on Russia and China, without Putin or Xi attending in person.

CGTN Africa: Nigerian President Bola Tinubu will depart Abuja on Saturday for a state visit to Saint Lucia, before proceeding to Brazil where he will attend the 17th BRICS Summit in Rio de Janeiro from July 6-7.

This is interesting: “Although the summit formally begins on July 6, key encounters among central bank heads and finance ministers will already be taking place on July 4 and 5”.

The Old Pretender: Is this all Coming to a Head in July?

6-29-2025

If something big is scheduled to come out of the BRICS summit next week, it will be a lot harder for the west and western MSM to focus blame on Russia and China, without Putin or Xi attending in person.

CGTN Africa: Nigerian President Bola Tinubu will depart Abuja on Saturday for a state visit to Saint Lucia, before proceeding to Brazil where he will attend the 17th BRICS Summit in Rio de Janeiro from July 6-7.

This is interesting: “Although the summit formally begins on July 6, key encounters among central bank heads and finance ministers will already be taking place on July 4 and 5”.

https://en.mercopress.com/2025/06/24/july-7-becomes-holiday-in-rio-due-to-brics-event

And I find it potentially interesting that the Fed has organised a big US banking conference for July 22 (soon after the BRICS summit), at which Basel III implementation will be discussed, once the outcome of the BRICS summit is both known and analysed.

With Trump saying yesterday that the US government will not issue any debt beyond 9 months, is this all coming to a head in July?

Luke Groman: I used to think that; after the last 5 yrs I think they’ll be back in 6-12 mths begging to buy duration at <4% after inflation and gold reval have recapped US balance sheet to <50% debt/GDP

Source(s): https://x.com/Dioclet54046121/status/1938891523568898261

https://dinarchronicles.com/2025/06/28/the-old-pretender-is-this-all-coming-to-a-head-in-july/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Question: "Will there be a time limit to exchange? Will the CBI allow us to see $4.81?" I believe there will be a time frame but it'll be way down the road and yeah, $4.81 is where they want to cap it. You'll see it because it's going to be happening at that time. You'll see it as it floats...

Walkingstick [Iraqi Bank friend Aki update] AKI: Three meetings. The last meeting lasted two hours. My boss tells me, 'I need you back at the bank [In Dearborn Michigan] this Monday because we are waiting on the new exchange rate.' I have to go back because we're waiting for the new rate. WALKINGSTICK: That's the only thing they're waiting for. They already got all the banking software in place, ATM machines, the bank structures, all the bank regulations are set...

Militia Man One of the things that is a component of a reinstatement revaluation is low inflation. It's a sign for the IMF, World Bank, everybody that they maintain stable inflation and reduce it consistently is a very good sign that they're ready for an adjustment. It doesn't mean they will do it, it just means they have a key component.

************

FRANK25…6-28-25….ALOHA….HCL AND MORE…

Trillions in Compounding Interest: The Debt Spiral You Can’t Ignore

Lynette Zang: 6-28-2025

The U.S. government’s debt has hit a breaking point. With soaring interest payments and spending outpacing revenue, the financial system is cracking.

In this video, Lynette explains how compounding debt, rising rates, and failed monetary policy signal a structural bond shift

Seeds of Wisdom RV and Economic Updates Sunday Morning 6-29-25

[⚠️ Suspicious Content] Good Morning Dinar Recaps,

Senate Passes Trump’s “Big, Beautiful Bill” With 51–49 Vote By Coinpedia | June 2025

In a dramatic late-night session, the U.S. Senate narrowly approved President Donald Trump’s signature tax and spending legislation—dubbed the “Big, Beautiful Bill”—by a razor-thin 51–49 margin. The bill marks a cornerstone of Trump’s second-term agenda, with sweeping implications for tax policy, defense, energy, healthcare, and even cryptocurrency regulation.

Good Morning Dinar Recaps,

Senate Passes Trump’s “Big, Beautiful Bill” With 51–49 Vote

By Coinpedia | June 2025

In a dramatic late-night session, the U.S. Senate narrowly approved President Donald Trump’s signature tax and spending legislation—dubbed the “Big, Beautiful Bill”—by a razor-thin 51–49 margin. The bill marks a cornerstone of Trump’s second-term agenda, with sweeping implications for tax policy, defense, energy, healthcare, and even cryptocurrency regulation.

Two GOP Senators Break Ranks

The bill passed with only two Republican senators—Thom Tillis and Rand Paul—voting against it, citing concerns over spending levels and government overreach.

Vice President JD Vance was on standby to cast a tie-breaking vote, though his intervention wasn’t needed. The tight margin highlights growing intra-party divides, even as Trump’s influence over the GOP remains strong.

On Truth Social, Trump criticized Senator Tillis and vowed to back a primary challenger in 2026, signaling an ongoing campaign to reshape the Republican Party around his core policy objectives.

What’s in Trump’s “Big, Beautiful Bill”?

The wide-reaching legislation includes several hallmark provisions:

✅ Permanent extension of the 2017 tax cuts

✅ Elimination of taxes on tips and overtime pay

✅ $150 billion in new defense and border security funding

✅ $5 trillion increase to the federal debt ceiling

✅ Cuts to Medicaid and SNAP, with a new $25 billion rural Medicaid fund (2028–2032)

✅ Repeal of green energy tax credits

✅ Phase-out of SALT (State and Local Tax) deductions

✅ Sale of 1.2 million acres of federal land

The mix of tax relief, spending boosts, and entitlement cuts has generated both praise from fiscal conservatives and criticism from progressive lawmakers.

Crypto Regulation Tied to Legislative Package

One of the bill’s more consequential side developments could soon affect U.S. crypto markets.

A proposed merger of the GENIUS Act and the CLARITY Act—two major crypto bills currently in progress—has gained new traction in the House of Representatives. These bills aim to establish a stablecoin framework (GENIUS Act) and market structure clarity for digital assets (CLARITY Act).

“This could be the most important moment for U.S. crypto policy since the SEC’s early actions,” said one policy analyst tracking the legislation.

House leadership is reportedly considering packaging the crypto bills together to ensure passage before the August recess, possibly delivering a major win for President Trump’s pro-crypto agenda.

Looking Ahead

With the Senate now on board, the bill heads to the House of Representatives, where Republicans hold a majority. If passed, it could lead to one of the most significant fiscal overhauls in recent U.S. history—and potentially reshape the global view of America’s crypto leadership.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Co-Founder Chris Larsen Claims XRP Is a ‘Better Bitcoin’

By Crypto News Flash | June 2025

Ripple’s co-founder Chris Larsen has reignited the long-standing debate in the crypto community by claiming that XRP was designed to outclass Bitcoin in core metrics such as speed, efficiency, and energy usage.

Speaking on the “When Shift Happens” podcast, Larsen praised Bitcoin’s foundational role while insisting that XRP was engineered to be a next-generation improvement over it.

XRP: Built to Surpass Bitcoin

▪️ XRP was developed with the specific intent of improving upon Bitcoin’s transaction speed, cost-effectiveness, and environmental footprint.

▪️ Larsen noted that XRP’s architecture came from a team of “really, really smart people” and was intended to be more efficient without losing the decentralization ethos of blockchain technology.

“We wanted to build a system that addressed Bitcoin’s limitations—faster settlement, lower energy, and long-term scalability,” Larsen explained.

He admitted that XRP still has limitations, but stressed that its core value has remained intact through consistent development and community support.

Criticism of Stellar and Ethereum

Larsen took aim at Stellar Lumens, co-founded by former Ripple executive Jed McCaleb, accusing the project of lacking direction and predictability.

▪️ He referenced McCaleb’s 50% token burn and a history of “constant changes, airdrops, and impulsive pivots” as a red flag for institutional trust.

▪️ “Successful currencies are built on stability, not sudden directional shifts,” Larsen remarked.

On Ethereum, Larsen questioned the long-term dedication of its community, implying it lacks the consistent loyalty seen among XRP and Bitcoin holders.

Will Ripple Go Public? ‘Not Yet,’ Says Larsen

While many in the industry speculate about Ripple's IPO potential, Larsen pushed back on the idea—citing the bureaucratic red tape and short-term market manipulation by misinformed retail sellers.

▪️ Ripple President Monica Long also echoed this sentiment recently, saying the company doesn’t need external capital and is focused on strategic acquisitions instead.

▪️ Ripple’s latest purchase of prime brokerage firm Hidden Road for $1.25 billion further confirms that strategy.

Analysts: XRP Price Could Surge

The comparison between XRP and Bitcoin is being mirrored by top analysts:

Charles Shrem predicts Bitcoin’s dominance is being actively challenged.

Edoardo Farina, founder of Alpha Lions Academy, believes XRP’s growth trajectory is more realistic than Bitcoin’s.

Dustin Layton estimates a 23x return is possible, projecting XRP could hit $52 by year-end.

Zach Rector places a nearer-term target at $15.

“You’d have to be insane to think Bitcoin at $106K is a better investment than XRP,” Farina claimed.

As the SEC case nears closure and Ripple refocuses on global expansion, the firm appears poised to position XRP not only as a better Bitcoin in function—but perhaps soon, in adoption and valuation.

@ Newshounds News™

Source: CryptoNewsFlash

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

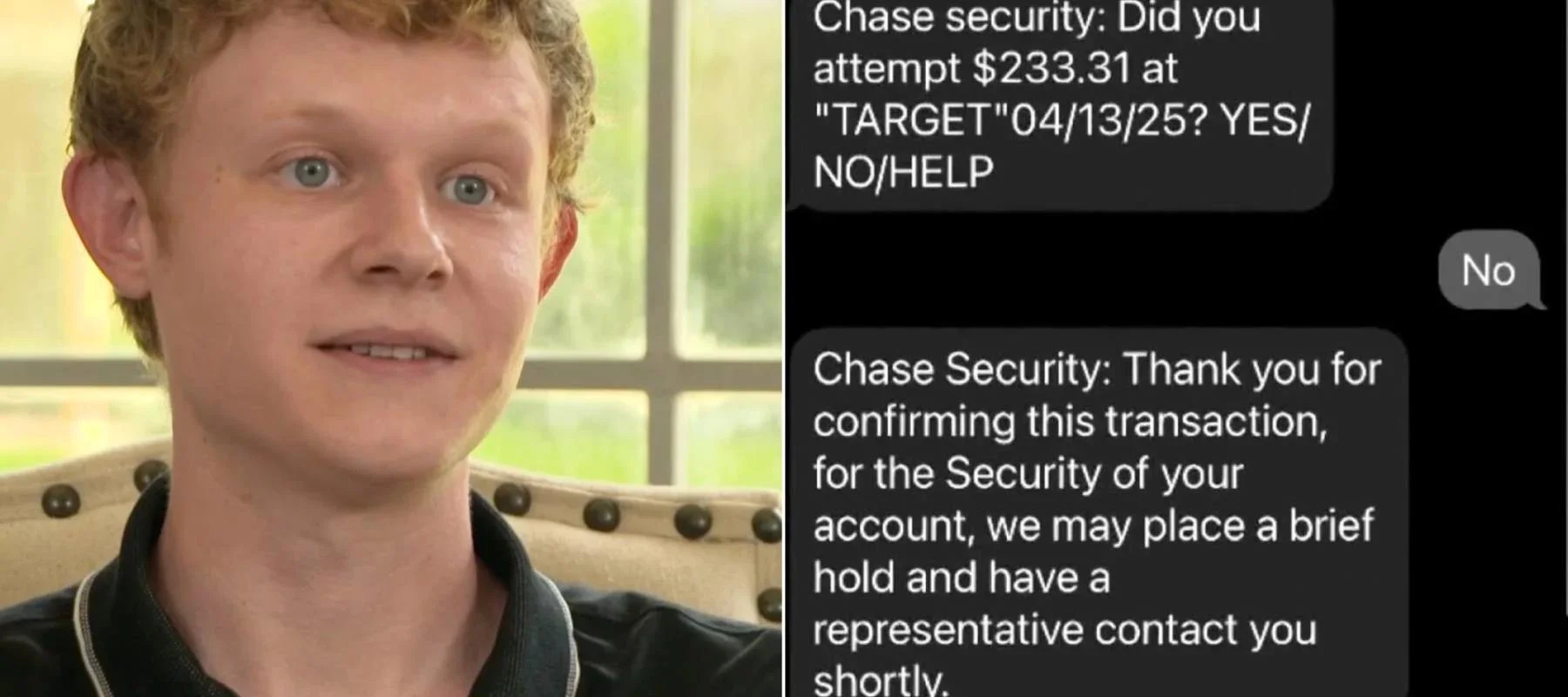

Fort Worth Teacher, 28, Loses $32K Fraud vs Scam

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Leahy was reportedly contacted by scammers who claimed to be representatives of Chase Bank. The supposed bank reps called to inform Leahy that his account had been compromised and that he needed to protect his finances by moving the cash into a secure account. All it took were a few text messages and some counterfeit banking information in order to appear genuine.

"I couldn't even believe how sophisticated it was," Leahy told WFAA.

Now, the newlywed is trying to warn people about the scam that cost him everything in the hopes of preventing others from falling for the same scheme.

Fraud vs. a scam

Unfortunately for Leahy, the situation went from bad to worse when he contacted Chase Bank to report the incident. According to WFAA, the bank told Leahy that his account isn’t covered by fraud protection, arguing that Leahy was the victim of a scam and not financial fraud.

In making this distinction, Chase Bank returned just over $2,000 to Leahy’s account, which is merely a fraction of his total loss. When WFAA contacted Chase Bank for comment, the bank offered clarification on the distinction between fraud and a scam.

"Fraud on a bank account involves someone illegally accessing someone else's account and making withdrawals, transfers, or purchases without the account holder's permission," the bank stated in its emailed reply.

A scam, on the other hand, is "a deceptive scheme or trick used to cheat someone out of their money or other valuable assets,” which is what happened to Leahy.

Chase Bank’s response likely isn’t what Leahy wanted to hear, but that hasn’t stopped him from sharing his story in order to prevent others from making the same mistakes.

"I'd rather I be the sacrificial lamb for the rest of these people and maybe save other people's money from being stolen," he said. "I'm really hoping to look ahead and move on with my life and not have to start over from scratch."

How to avoid falling for similar scams

TO READ MORE: https://www.yahoo.com/lifestyle/articles/fort-worth-teacher-28-loses-110000179.html

“Tidbits From TNT” Sunday Morning 6-29-2025

TNT:

Tishwash: Stay tuned... an expanded meeting will be held tomorrow in Baghdad to discuss the re-export of the region's oil.

Iraqi parliament member Sherwan Dubardani confirmed on Saturday that a delegation from the Kurdistan Region, headed by the Minister of Natural Resources, had arrived in Baghdad. He explained that the capital would host an expanded meeting tomorrow between the Kurdistan delegation and the federal government to discuss the re-export of the region's oil.

"The Kurdish delegation is currently holding a meeting, and an expanded meeting between Erbil and Baghdad is expected to be held tonight or tomorrow, Sunday, to discuss the region's oil file," Dubardani said in a statement monitored by Al-Masry.

TNT:

Tishwash: Stay tuned... an expanded meeting will be held tomorrow in Baghdad to discuss the re-export of the region's oil.

Iraqi parliament member Sherwan Dubardani confirmed on Saturday that a delegation from the Kurdistan Region, headed by the Minister of Natural Resources, had arrived in Baghdad. He explained that the capital would host an expanded meeting tomorrow between the Kurdistan delegation and the federal government to discuss the re-export of the region's oil.

"The Kurdish delegation is currently holding a meeting, and an expanded meeting between Erbil and Baghdad is expected to be held tonight or tomorrow, Sunday, to discuss the region's oil file," Dubardani said in a statement monitored by Al-Masry.

Kurdish media outlets quoted political sources regarding the upcoming meeting, stating that it will include Deputy Prime Minister Fuad Hussein, the Iraqi Oil Minister, a representative from the Iraqi State Oil Marketing Organization (SOMO), the Kurdistan Regional Government's Minister of Natural Resources, and a delegation from the region heading to Baghdad.

She pointed out that "a joint statement on the outcomes of the meeting is expected to be issued after its conclusion." link

Tishwash: Sharp fluctuations in the value of the Iranian currency amid regional tensions between Tehran and Tel Aviv.

Iranian markets have witnessed sharp fluctuations in the Iranian toman's exchange rate over the past few days, directly influenced by the escalating geopolitical tensions between Iran and Israel. The US dollar's exchange rate against the toman reached 9 million tomans at the height of talk of a possible direct war, after it had been expected to reach 10 million.

But with signs of calm and de-escalation between the two sides, the value of the toman has risen again, amidst a state of uncertainty that has gripped the market.

Decrease in trading volume and warnings against risk

"We sold the dollar for 7.6 million dinars, but we didn't buy back because of the price fluctuations," Kawa Yahya, an exchange office owner, told a Kurdistan 24 reporter. "The price had risen to 9 million tomans this morning due to the escalation, but later dropped to 7 million, which represents a difference of nearly 2 million in a very short period."

Money changers confirmed that toman banknotes are becoming less available in the market, and that daily trading volume has fallen to approximately 60% compared to previous levels.

Conditional optimism and expectations of more volatility

For his part, Shawan Muhammad, an exchange office owner, said, "After the calm, the toman began to regain some of its value, but its fate remains uncertain. There is talk of an impending agreement between the United States and Iran, and if it actually materializes, the toman will regain its strength. So far, Tehran has not conceded its interests, so we expect the market to remain volatile."

Observers believe that any new security or political unrest among the countries of the region would immediately impact the toman's exchange rate and trading volume in the Iranian market.

Despite the lack of stability, approximately 10 billion tomans are still traded daily, a source of concern for traders who face significant financial risks amid the lack of clear guarantees regarding the future of the Iranian currency. link

************

Tishwash: An economist warns of the continued dominance of the dollar in Iraqi-Chinese trade.

Data from the Chinese Customs Authority showed a significant increase in the value of Chinese exports to Iraq during the first five months of 2025, increasing by 9.5% compared to the same period in 2024. The value of these exports reached $7.4 billion, compared to $6.77 billion during the same period last year, according to a report by economic expert Manar Al-Obaidi.

Al-Abidi explained that this growth is driven by increased exports from a number of sectors, most notably:

Electrical and mechanical appliances : accounted for 24% of total exports and achieved a growth rate of 11.46%.

Electronics : represented 15% of exports and increased by 29.3%.

Clothing : accounted for 7.6% of total exports and increased by 21%.

Cars and spare parts : Its share reached 7.2% and recorded the highest growth rate of 35%.

In contrast, Iraqi exports to China declined by 5.77% during the same period, reaching $15.2 billion compared to $16.14 billion in 2024, and are almost entirely limited to petroleum products.

Despite the decline, the trade balance between the two countries remains in Iraq's favor, with a trade surplus of $7.7 billion during the first five months of 2025, down from $9.37 billion during the same period the previous year.

Al-Obaidi pointed out that "this surplus remains fragile, as it is almost entirely tied to Iraq's oil exports to China in terms of quantity and price. Any decline in the value or volume of these exports could lead to a shrinkage of the surplus or its transformation into a deficit, which necessitates diversifying Iraq's export base by boosting exports of raw materials and local goods."

Although annual trade between Iraq and China exceeds $54 billion, financial transactions between the two sides continue to be conducted in the US dollar, whether for oil sales or imports.

Al-Obaidi called for "the establishment of a direct financial and trade exchange platform between Iraq and China, similar to what other countries have done, such as the recent agreement between China and Turkey to adopt local currencies in trade exchanges."

He promised that "reducing dependence on the dollar represents a strategic step towards enhancing financial independence and increasing the effectiveness of bilateral trade."

It should be noted that this data represents direct Chinese exports to Iraq and does not include goods exported to other countries, particularly the UAE, and then re-exported to the Iraqi market. link

Mot: . First Teenage Rebellion

Mot: .. as mom sees it

Hundreds of Indicators Pointing to a Global Recession

Hundreds of Indicators Pointing to a Global Recession

Commodity Culture: 6-28-2025

Renowned financial analyst Henrik Zeberg recently joined Jesse Day on Commodity Culture to deliver a stark warning about the global economic outlook.

In a compelling discussion, Zeberg asserts that a global recession is not just a possibility, but an unavoidable certainty, culminating in a deflationary bust that most market participants will fail to anticipate.

Hundreds of Indicators Pointing to a Global Recession

Commodity Culture: 6-28-2025

Renowned financial analyst Henrik Zeberg recently joined Jesse Day on Commodity Culture to deliver a stark warning about the global economic outlook.

In a compelling discussion, Zeberg asserts that a global recession is not just a possibility, but an unavoidable certainty, culminating in a deflationary bust that most market participants will fail to anticipate.

Central to Zeberg’s thesis is the prediction of an imminent “blow-off top” in the broad market. This euphoric, final surge, he argues, will precede a dramatic and unexpected deflationary downturn. Zeberg meticulously outlined the specific indicators he is closely monitoring that underpin this contrarian view, suggesting that the current economic trajectory is far more precarious than widely acknowledged.

The “deflationary bust” is highlighted as a particularly insidious threat, precisely because its arrival is expected to blindside the majority of investors and policymakers.

Beyond the broader market, Zeberg also provided his detailed outlook on the future of gold and gold mining stocks, offering insights into their potential performance in a rapidly shifting economic landscape. The discussion further delved into the potential ripple effects of former President Trump’s tariff policies, analyzing how they might impact global trade and economic stability.

Perhaps one of the most memorable moments of the conversation was Zeberg’s candid assessment of the US dollar’s standing in the current global financial landscape, famously asking whether it remains “the prettiest mare at the glue factory of fiat currencies.”

This provocative statement encapsulates his skepticism about the long-term strength of the world’s reserve currency amidst unprecedented monetary policies.

Zeberg’s comprehensive analysis offers a compelling, albeit unsettling, counter-narrative to much of the prevailing market optimism. For investors and individuals keen to understand the full scope of Zeberg’s predictions, including the specific indicators and his nuanced arguments, the full video discussion on Commodity Culture provides invaluable insights.

It’s a critical watch for anyone looking to navigate the challenging economic waters ahead with a more informed perspective.

EMERGENCY: MASSIVE Silver Delivery Failure COMING in 72 Hours!

EMERGENCY: MASSIVE Silver Delivery Failure COMING in 72 Hours! - Bill Holter

Financial Wisdom: 6-27-2025

0:00 - Silver Exchange Delivery Failure: 250 Million Ounces at Stake

0:34 - Bull Market Status and Technical Support Levels

1:30 - Inverted Head and Shoulders Pattern in Silver Charts

2:18 - Silver as the Trigger for a Derivatives Collapse

EMERGENCY: MASSIVE Silver Delivery Failure COMING in 72 Hours! - Bill Holter

Financial Wisdom: 6-27-2025

0:00 - Silver Exchange Delivery Failure: 250 Million Ounces at Stake

0:34 - Bull Market Status and Technical Support Levels

1:30 - Inverted Head and Shoulders Pattern in Silver Charts

2:18 - Silver as the Trigger for a Derivatives Collapse

3:04 - Silver’s Dual Role: Industrial vs. Investment Demand

4:02 - Silver's Potential to Outperform Gold

5:16 - Gold Price Calculations Based on U.S. Debt

6:00 - Global Instability and Safe Haven Shifts

6:35 - U.S. Debt Expansion and Economic Consequences

7:02 - Overbought Gold, Oversold Oil, and Market Corrections

7:40 - Dollar Breakdown and Long-Term Support Violation

8:24 - Fed Losing Control of the Yield Curve

9:31 - Risks of Rising Yields and the Government’s Borrowing Crisis

10:11 - Final Warning: Economic System on the Brink

Iraq Economic News and Points To Ponder Saturday Afternoon 6-28-25

Al-Sudani: The Government's Approach Is Based On Continuing The Path Of Building Iraq.

Local Prime Minister Mohammed Shia al-Sudani affirmed on Saturday that the government's approach is based on completing the path of reform and continuing the path of building Iraq, in loyalty to the pure blood of the martyrs.

The Prime Minister's media office said in a statement that "Prime Minister Mohammed Shia al-Sudani received members of the Loyalty to the Martyrs Association, which represents the families of Iraqi martyrs from several governorates."

Al-Sudani: The Government's Approach Is Based On Continuing The Path Of Building Iraq.

Local Prime Minister Mohammed Shia al-Sudani affirmed on Saturday that the government's approach is based on completing the path of reform and continuing the path of building Iraq, in loyalty to the pure blood of the martyrs.

The Prime Minister's media office said in a statement that "Prime Minister Mohammed Shia al-Sudani received members of the Loyalty to the Martyrs Association, which represents the families of Iraqi martyrs from several governorates."

According to the statement, al-Sudani stated that "the value of sacrifice and martyrdom in our society and history laid the foundation for all the changes that occurred later, which extended to the confrontation with terrorism, just as it laid the foundation for the stability, social peace and economic development that we enjoy today."

The Prime Minister pointed out that "dealing with the families of martyrs must be based on the values they represent to society in terms of determination and dignity, and not out of sympathy," stressing that "the government's approach is based on completing the path of reform and continuing the path of building Iraq, in loyalty to the pure blood of the martyrs that were shed before and after 2003, which aimed for a better future."

Al-Sudani stressed that "the government is working to strengthen social cohesion in light of the developments taking place in the region, while preserving the legacy of the martyrs and striving to build a powerful Iraq that is inclusive of all communities." https://economy-news.net/content.php?id=56735

Iraq's Imports Amounted To $21 Billion In The First Quarter Of 2025.

Money and Business Economy News – Baghdad The Central Bank of Iraq announced on Saturday that Iraq's imports for the first quarter of 2025 amounted to more than $21 billion.

The bank stated in its statistics that "Iraq's imports amounted to $21 billion and 363 million," indicating that "imports included both the government and private sectors."

He added, "Government sector imports amounted to $1.377 billion, while private sector imports amounted to $19.985 billion."

The bank indicated that "government imports included consumer imports, capital imports, petroleum product imports, other government imports, and currency printing," while "private sector imports included consumer imports and capital imports." https://economy-news.net/content.php?id=56727

Babylon receives the file for becoming Iraq's industrial capital.

Saturday, June 28, 2025 Economic Number of readings: 92 Hillah/ NINA / Babylon Governor Adnan Fayhan Al-Dulaimi announced today, Saturday, the receipt of the Babylon file as the industrial capital of Iraq, to begin working with the federal government and create the necessary legislation and laws to officially declare Babylon the industrial capital of Iraq.

Fayhan said, “We meet today at a pivotal moment in Babylon’s history, to proudly announce the “Babylon, the Industrial Capital of Iraq” file, noting that this major national project restores Babylon’s leadership position not only in history and civilization, but also in the economy, production and industry.

He pointed out that Babylon, with its strategic location, distinguished human resources, and advanced infrastructure, is capable of being an integrated national industrial center and a strong competitor in various fields such as manufacturing industries, construction materials, food industries, energy, and others.

He explained that since taking over the management of the province, we have worked to develop and support industrial projects due to their importance in increasing national production and providing job opportunities for young people, stressing that this file would not have seen the light of day without the true cooperation between the public and private sectors, in addition to the deep belief that Iraq's renaissance begins with its provinces, and that sustainable development can only be achieved through an integrated vision and seriousness in implementation.

Al-Dulaimi pointed out that the local government in Babylon is proceeding with all determination to prepare the investment environment and provide facilities for industrialists and investors, in order to transform this announcement into realistic projects that create job opportunities and revive the national economy. /End https://ninanews.com/Website/News/Details?key=1237926

The Dollar Recorded A New Decline As The Stock Exchange Closed In Baghdad.

Stock Exchange The dollar price fell in Baghdad markets on Saturday afternoon, as the stock exchange closed at the beginning of the week.

The dollar exchange rate fell at the close of trading on the Al-Kifah and Al-Harithiya stock exchanges, recording 141,100 dinars per $100. This morning, it reached 141,300 dinars per $100.

Selling prices at exchange offices in Baghdad's local markets declined, with the selling price reaching 142,000 dinars for $100, while the buying price reached 140,000 dinars for $100. https://economy-news.net/content.php?id=56731

Iraqi Oil Prices In Global Markets

Economy | 09:26 - 06/28/2025 Mawazine News - Baghdad - Iraqi oil prices recorded a slight increase during daily trading on the global market on Saturday.

Basra Medium crude oil recorded $68.53 per barrel, while heavy crude oil recorded $65.53 per barrel, with a change of +1.11 for both.

The data also showed global oil prices, with British Brent crude recording $67.77 per barrel, while US West Texas Intermediate crude oil recorded $65.52 per barrel, with a change of +0.4 and +0.28, respectively. https://www.mawazin.net/Details.aspx?jimare=263177

Iraq, In Cooperation With The World Bank, Is Taking Steps To Address The Problem Of Air Pollution.

Local | 06/28/2025 Mawazine News - Follow-up: The Ministry of Environment announced, on Saturday, funding projects worth more than $58 million to combat pollution and confront climate change in Iraq. It also indicated that there is a proposed project with the World Bank to address the problem of air pollution in Baghdad, and indicated the existence of international cooperation to strengthen central laboratories and water and air monitoring programs.

Ministry of Environment spokesman Louay Al-Mukhtar said in a press statement that "the government has approved funding for the Integrated Management of Persistent Organic Pollutants and Contaminated Sites project at a value of $18.5 million for the years 2025-2031, in addition to the $40 million project to enhance resilience to climate change, which focuses on agricultural development and strengthening agricultural patterns in three governorates."

He added, "The Council of Ministers also approved a set of strategies in various fields, most notably the National Pollution Reduction Strategy, the National Adaptation Plan, and the National Mitigation Plan."

He pointed out that "the ministry has other important projects with United Nations organizations regarding strengthening national reserves and combating desertification, as well as initiatives to support afforestation inside and outside cities."

He continued, "The ministry's cooperation with UN organizations also includes implementing projects to strengthen and develop central laboratories, develop a water resources monitoring program, and strengthen air quality monitoring systems." He indicated that "there is a proposed project with the World Bank to address the problem of air pollution in Baghdad." https://www.mawazin.net/Details.aspx?jimare=263185

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 6-28-25

[⚠️ Suspicious Content] Good Afternoon Dinar Recaps,

Serbia Confirms Strong Interest in Joining BRICS at 2025 Summit By Watcher.Guru | June 2025

As the 17th BRICS Summit approaches, Serbia has officially reaffirmed its intention to join the expanding BRICS alliance. The summit will take place on July 6–7 in Rio de Janeiro, Brazil, and could mark a pivotal moment for the bloc’s next wave of expansion.

Good Afternoon Dinar Recaps,

Serbia Confirms Strong Interest in Joining BRICS at 2025 Summit

By Watcher.Guru | June 2025

As the 17th BRICS Summit approaches, Serbia has officially reaffirmed its intention to join the expanding BRICS alliance. The summit will take place on July 6–7 in Rio de Janeiro, Brazil, and could mark a pivotal moment for the bloc’s next wave of expansion.

Serbian Prime Minister: “It Is of Strategic Interest”

Serbian Prime Minister Duro Macut made the country’s position clear, stating that:

“We consistently advocate the need to deepen cooperation with our traditional partners and friends. The BRICS countries are the most important players on the world stage, and the development of strong, mutually beneficial relations with them is of a strategic interest to us.”

Serbia formally submitted its application to join BRICS in 2023, when the alliance last opened its doors for expansion.

BRICS Expansion: Who’s In—and Who’s Waiting

In 2024, BRICS added 13 new “Partner Countries”, including:

Algeria, Belarus, Bolivia, Cuba, Indonesia, Kazakhstan, Malaysia, Nigeria, Thailand, Turkey, Uganda, Uzbekistan, and Vietnam.

While Serbia was not included in that group, it remains among the 23 countries that have formally applied to join the bloc. An additional 22 countries have expressed informal interest, reflecting the growing global momentum around BRICS.

Balancing BRICS and the EU

In a noteworthy diplomatic move, PM Macut also reiterated Serbia’s parallel ambition to join the European Union:

“Serbia continues its path towards membership in the European Union,” he stated in a recent interview with foreign media.

Serbia continues to navigate complex post-Yugoslav geopolitics, including past sanctions, while seeking stronger ties with both Eastern and Western alliances.

Decision Expected in July—But Not Guaranteed

Whether Serbia will be invited to join BRICS will likely be decided during the July summit in Brazil. The BRICS expansion process is consensus-driven, meaning all existing member states must agree to admit new countries.

A key question remains: What value can Serbia bring to BRICS that strengthens the bloc's collective influence?

As the BRICS alliance seeks to redefine the global geopolitical landscape—especially amid rising tensions with Western institutions—Serbia's bid could serve as a strategic pivot between Europe and the multipolar order BRICS envisions.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Saturday 6-28-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 28 June 2025

Compiled Sat. 28 June 2025 12:01 am EST by Judy Byington

EBS & Ten Days of Darkness…(allegedly) Ben Fulford on Telegram

The Quantum Financial System (QFS) is moving. It’s not just a financial reset; it’s the end of the Cabal’s control over money. People are finding out about secret bank accounts, offshore havens, and illegal wealth.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 28 June 2025

Compiled Sat. 28 June 2025 12:01 am EST by Judy Byington

EBS & Ten Days of Darkness…(allegedly) Ben Fulford on Telegram

The Quantum Financial System (QFS) is moving. It’s not just a financial reset; it’s the end of the Cabal’s control over money. People are finding out about secret bank accounts, offshore havens, and illegal wealth.

The world is moving to a new credit-based system that will end debt slavery. As a result, trillions of dollars in assets are being taken. Picture this: you wake up and all of your debts—mortgages, student loans, and credit cards—are gone. This isn’t just a guess; it’s happening right now

Global Currency Reset:

Fri. 27 June 2025 Charlie Ward: Trump’s “Big Beautiful Bill” is far more than you think. It (allegedly) includes the Global Currency Reset.”

Fri. 27 June 2025 Wolverine: “Guys we are ready. Ready to go. Keep your eyes on the 4th July or earlier. Keep your eyes on your emails as well. It’s finally happening. God bless. Your friend and servant. Wolverine” (from his hospital bed. He just had an operation).

Fri. 27 June 2025 TNT Tony: TNT Tony says that it was announced on Iraqi TV that their purchasing power would increase. They have been told that the RV will happen tomorrow Sat. 28 June. Tony thinks they may be waiting for the 5:00 Pacific time close of Forex. He hopes they aren’t waiting for 5:00 Hawaii time. It could happen overnight. Tony also said the salaries have been paid. Nothing remains to be done. The bank screens were blank this morning, then flickering later in the day. They (banks) thought that was a good sign. A bond holder was paid 100 million dollars. We should be going very soon.

A High Up Source’s opinion was that Tier4b (us, the Internet Group) would be notified to set redemption appointments sometime between Fri. 27 June and Mon. 30 June.

Fri. 27 June 2025 Capathia: From a great friend who lives close to where the “planes fly in”: Someone has now received spendable funds, that persons group is very happy, and they, too, have heard we could perhaps receive what we are waiting for into tonight or tomorrow Sat. 28 June.

~~~~~~~~~~~~~

Wed. 25 June A2Z Update: A2Z Dreamz Team has vetted and believes all updates in this summary to be true:

Forex Activity: Rate suppression appears to be lifted. New rates have been briefly visible on multiple platforms. The system has passed the point of no return.

Funding Underway

• Mr. Salvage: Pentecostal group is actively dispersing funds.

• MarkZ: Bond holders are being paid today.

• Zester: Travel funds are being dispersed.

• Military confirmation: Bondholders are fully liquid; whales and 4A SKRs are next.

Reno Movement: Increased private jet traffic reported

Trigger Groups: trigger groups have been activated and are receiving funds

4A & 4B expected to roll out within minutes or hours of each other.

• Large firms and banks confirm liquidity is in place.

• Bankers say everything is complete — no further delays expected.

• If not released now, a restart would be required, which markets won’t allow.

~~~~~~~~~~~~~

Thurs. 26 June 2025 Bruce:

Tier 3 Bond Holders have been flying into Reno to be vetted and were to have access to their accounts by Thurs. 26 June or Friday 27 June.

A Redemption Center leader over 8 Redemption Centers said Tier4b could be notified to set appointments anytime between Friday through Monday 30 June.

Another source said we could be notified over the weekend and maybe start with exchanges on Mon. or Tues. 1 July.

As of 7:30 pm EST Thurs. 26 June all countries were on their new asset-backed currencies.

The new USTN was delivered in $150,000 packets to each US bank again today Thurs. 26 June.

Read full post here: https://dinarchronicles.com/2025/06/28/restored-republic-via-a-gcr-update-as-of-june-28-2025/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man If they drop three zeros, reinstate, apply the real effective exchange rate then you're going to have all the fundamentals. Iraq's going to be valued off her fundamentals. Back in the old days it was oil. Now it's non-oil resources - gas...phosphate, silica, sulfur, gold, uranium, thorium, taxes and tariffs all those things...

Frank26 [Iraq boots-on-the-ground report] FIREFLY: World Bank is talking on TV right now Channel One saying this development road project will bring so much more trade to Iraq. They are backing Iraq with $300 million. Why would they invest in something like 1310?

Sandy Ingram Iraq is about to pull off something huge. The World Bank just approved a whopping $930 million loan to overhaul Iraq's railways, a move that could reshape not just the country but the whole region...This isn't just about trains. This is Iraq's shot at becoming the main gateway between the Gulf and Europe. They call it the southern corridor. Some of us may know it as the Development Road Project. Think of it as a super highway for both cargo and people...This puts the country on the make as a key trade link between continents...Construction kicks off soon...

************

FRANK26….6-27-25….ALOHA…AKI TALKS