“Tidbits From TNT” Thursday Morning 2-5-2026

TNT:

Tishwash: International Finance Corporation: Iraq is moving rapidly towards a better economic future

The resident representative of the International Finance Corporation, Bilal Al-Saghir, confirmed on Wednesday that the investment package launched in Iraq amounts to approximately one million dollars in the energy, health and industry sectors, while noting that Iraq is moving rapidly towards a better economic future.

Al-Saghir told the Iraqi News Agency (INA): “The institution is concerned with developing the private sector in emerging economies by providing investment services primarily, in addition to consulting services.”

TNT:

Tishwash: International Finance Corporation: Iraq is moving rapidly towards a better economic future

The resident representative of the International Finance Corporation, Bilal Al-Saghir, confirmed on Wednesday that the investment package launched in Iraq amounts to approximately one million dollars in the energy, health and industry sectors, while noting that Iraq is moving rapidly towards a better economic future.

Al-Saghir told the Iraqi News Agency (INA): “The institution is concerned with developing the private sector in emerging economies by providing investment services primarily, in addition to consulting services.”

He added that "the investment package launched amounts to approximately one million dollars and relates to providing a range of financial, funding and advisory services to a large number of projects."

He added that "part of these projects are in the energy sector, including gas conversion and preventing its flaring and converting it into energy, while the other part relates to the health, industrial and banking systems," noting that "this comes as a translation of our desire to invest more in Iraq."

He continued: "We will announce a large group of projects very soon," noting that "Iraq is moving forward rapidly towards a better future."

He affirmed that "the organization believes in the ability of Iraq and Iraqis to achieve a sustainable economy," expressing his "happiness to participate in this trip." link

Tishwash: Baghdad International Fair: An effective platform for connecting Iraq to global markets

The Baghdad International Fair train has reached the middle of its stations, amidst a wide interaction from Iraqi and international participants, reflecting the importance of this economic event and the real opportunities it holds for cooperation and partnership.

Over the past few days, the exhibition halls have witnessed remarkable activity, including direct meetings and exchanges of experiences between participating companies and delegations, reflecting a shared desire to build mutually beneficial economic relations.

The exhibition continues to play its role as an effective platform for linking the Iraqi market with its regional and international counterparts, and opening new horizons for partnerships that contribute to supporting the national economy and achieving sustainable development.

On its fourth day, the exhibition began its activities by organizing the Iraqi-Bulgarian Forum, which aims to enhance economic cooperation between the two friendly countries.

Mechanisms for cooperation

The Director General of the Private Sector Development Department at the Ministry of Trade, Dr. Malik Khalaf Al-Duraie, said: The current stage requires developing mechanisms for economic cooperation in line with the changes taking place in the Iraqi market and the increasing openness to international partnerships, indicating that the volume of trade exchange between Iraq and Bulgaria reached about 300 million dollars, distributed across several sectors, which reflects the existence of a common ground that can be built upon and expanded in the next stage.

Al-Duraie explained in an interview with Al-Sabah that the future vision focuses on activating the work of the Iraqi-Bulgarian Trade Council through well-defined plans and clear programs, aimed at increasing the volume of trade exchange by no less than 20 percent, based on market needs and the capabilities of both parties. He added that the ambition is not limited to import and export activity, but rather is directed towards moving towards real investment partnerships, especially in the fields of industry and agriculture, which will contribute to transferring expertise, enhancing local production, and achieving mutual economic benefit for the two countries.

Iraq's growing importance

For his part, the representative of the Iraqi Ministry of Foreign Affairs, Dr. Abdul Salam Saddam, considered the forum to be a reflection of the growing importance of Iraq on the global stage, and an affirmation of its position as an important link in its regional and international environment.

Saddam added to Al-Sabah that the forum represents a promising opportunity for participating countries and companies to strengthen cooperation frameworks and build economic and developmental partnerships that serve common interests and contribute to supporting development and stability efforts, stressing the Ministry of Foreign Affairs’ keenness to support such events that open new horizons for communication and economic openness.

Great efforts

Valentin Nikolov, the Chargé d'Affaires of the Embassy of the Republic of Bulgaria in Baghdad, praised the efforts made by the Iraqi government and the business community in organizing this forum, which aims to enhance economic cooperation and open new horizons for communication between the two countries. He considered the holding of such forums a real opportunity to develop economic cooperation and exchange experiences, in a way that serves common interests and strengthens the bilateral partnership.

Nikolov added to Al-Sabah that business fields represent a basis for organizing economic relations between Iraq and Bulgaria, and that Bulgarian companies have extensive experience in the industrial, energy and agricultural sectors, as well as other investment fields, indicating that Bulgaria pays great attention to working in Iraq within clear and transparent frameworks, which contributes to building sustainable partnerships that serve both parties.

Supporting positive decisions

Meanwhile, the head of the Federation of Iraqi Chambers of Commerce, Abdul Razzaq Al-Zuhairi, believes that the reality of the Iraqi private sector has become more distinguished in the current stage, supported by a number of positive decisions that have contributed to strengthening its role and stimulating its activity within the market.

Al-Zuhairi told Al-Sabah that these steps have clearly impacted the development of the work of the Iraqi-Bulgarian Business Council, which has become a positive model for joint economic cooperation. He pointed out that the goal is to reach a clear and effective Iraqi economic map that focuses on strategic sectors that serve the Iraqi market and meet its needs, and contribute to achieving sustainable growth and balanced partnerships with friendly countries.

A launchpad for strengthening cooperation

Meanwhile, the head of the Iraqi-Bulgarian Business Council, Salah al-Din Saleh, stated that the council is a launchpad for strengthening economic cooperation and encouraging mutual consultations between businessmen in the two countries, noting that the council works to create real job opportunities and provide a suitable environment for communication between Iraqi and Bulgarian companies, which contributes to building sustainable partnerships.

In his interview with Al-Sabah, Saleh stressed the importance of exchanging technical and knowledge-based expertise, noting that this path would attract promising investments and consultations, enhance economic development, and support productive sectors, thus achieving common benefit and keeping pace with the requirements of the next stage.

Insurance sector

The exhibition witnessed a remarkable presence of the insurance sector, as the representative of the Iraqi Union Insurance Company and the insurance sector, Dr. Karrar Abdullah Jaber, explained that the presence of insurance companies at the Baghdad International Fair comes within the framework of keenness to spread insurance culture in Iraq and to demonstrate the importance of this vital sector and its role in supporting economic and social stability, stressing that the insurance sector represents a fundamental pillar in protecting individuals and institutions, and contributes to reducing risks and supporting various economic activities.

Jaber told Al-Sabah newspaper that the specialized teams participating in the exhibition were keen to explain the role played by insurance companies and the diverse services they provide, which cover various fields and sectors, and to highlight the positive results that have directly impacted citizens. He emphasized that these teams worked to clarify the importance of insurance in public life and its role in supporting the national economy and serving all segments of society, as promoting insurance awareness contributes to building a more stable market. Confidence.

Purchase the service

In addition, Kawthar Salah Abd, representative of the Retirement and Social Security Department for Workers at the Ministry of Labor, was keen to highlight the department’s participation in the Baghdad International Fair, noting that it aims to clarify the mechanisms for benefiting from social security, the conditions of participation, and the resulting consequences.

In an interview with Al-Sabah, Abd explained that specialized teams explained the rights of those covered and the importance of social security in providing job and social stability. She added that the department has introduced a "service purchase" service for those who have reached retirement age but do not have enough service time. Through this service, they can purchase the required service period to fulfill the retirement requirements, which contributes to including a wider segment of the population in retirement benefits and strengthening social protection. For the workers.

A new experience

On the sidelines of the exhibition, New Yolk presented a new experience in the Iraqi market in investing in livestock.

The company's representative, Hawraa Abdul Amir, told Al-Sabah: "We have table egg production fields inside and outside Iraq, and the company's doors are open to the public to invest and obtain profits according to legal formulas. This is a unique experience in Iraq."

Foundations of a promising future

In addition, a number of traders and business owners expressed their country’s companies’ desire to engage in large commercial and industrial activities with Iraq. While they affirmed that the future of the Iraqi economy is large and important in the Arab world, they explained that the markets of Mesopotamia possess the elements of a promising future.

Nasser bin Abdullah Al-Sawafi, owner of a perfume and oil company from the Sultanate of Oman, said on the sidelines of the Baghdad International Fair: His country has had participation in the Iraqi market through the Baghdad International Fair for five years, noting that his company, which has commercial partnerships with the Gulf Arab states, is participating in the fair for the first time.

Al-Sawafi promised that participation in the exhibition would be "successful," explaining that the Iraqi market welcomes Omani goods.

He predicted that his country’s companies would have a promising future in Iraq, strong trade relations between the two brotherly countries, and the creation of a deep economic partnership and dialogue focused on investment and private sector activity, expressing his hope to facilitate the entry of citizens between the two countries to strengthen ties in all fields.

Egyptian desire

Meanwhile, Hani Mahmoud, a trader in the cotton industry, expressed his company's keenness to have priority in entering the local market, describing the Iraqi market as one of the strongest Arab markets currently in terms of purchasing power.

Mahmoud added to Al-Sabah that most Egyptian companies have a clear desire to expand their activities in general, calling for the exhibition to be extended to more than a week in order to allow for important commercial partnerships to be established between Arab and foreign delegations and Iraq.

Meanwhile, Zaidan Saud Al Abdullah, the owner of a perfume and cosmetics company and an Emirati businessman, stated that he works in the organizing body for international exhibitions in which his country participates, indicating that he has participated in more than five exhibitions in the capital, Baghdad.

Al-Abdullah added, in an interview with Al-Sabah, that his country seeks to open broad trade horizons with Iraq, appreciating the Baghdadi demand for Emirati products, which made it the first among Gulf companies, encouraging his country to open large stores for its products inside Iraq.

Business partnerships

In a related context, Murad Kamal, owner of the Jordanian National Paints Company, said that this is his company's second participation in the exhibition, noting that he found good interest among Iraqis in creating commercial partnerships with countries in the region because they have a promising market and a great economic future.

Kamal explained to Al-Sabah that his company had completed several contracts with the Iraqi side, while calling for special facilities for Jordanians in terms of entry and import, and for allowing Iraqi goods to enter as competitors with products from other countries.

He pointed out that the Jordanian side, in turn, will work to facilitate the activity and trade of Iraqis there, especially since several meetings have taken place between joint chambers of commerce between the two countries, which will result in actual measures on the ground. link

************

Tishwash: To curb currency manipulation: Security campaign and measures against dollar speculators

A security source confirmed on Tuesday that the security campaign to pursue those speculating on dollar exchange rates is still ongoing in the capital.Baghdad A number of governorates, as part of measures aimed at controlling the parallel market and reducing manipulation of the foreign exchange rate.

The source said in an interview with Alsumaria News that security services The military continues to carry out field operations against those manipulating dollar prices, explaining that the forces were able during the past days to arrest a number of speculators in several local markets, noting that these operations are based on accurate intelligence information.

He added that the campaign includes monitoring unlicensed money exchange shops and individuals who engage in speculation outside legal frameworks, stressing that the measures will continue and will not be limited to

specific areas inBaghdad This includes a number of governorates.

This comes amidst fluctuating dollar exchange rates in the parallel market recently, which has directly impacted the prices of food and basic commodities, causing widespread concern among citizens and prompting government authorities to take strict security and economic measures

.Ministry of Interior It was previously announced that 91 people had been arrested on charges of manipulating the dollar exchange rate, noting that these practices harm the national economy and contribute to financial instability.

Security officials confirmed that the campaign is being carried out in coordination with the Central Bank and relevant regulatory bodies, with

the aim of regulating the buying and selling of foreign currency and ensuring that markets adhere to the official exchange rate.

The authorities stressed that any attempt to exploit citizens' needs or influence the market through illegal speculation will be met with strict legal measures, and called on citizens to cooperate and report any suspicious practices that contribute to destabilizing the economy. link

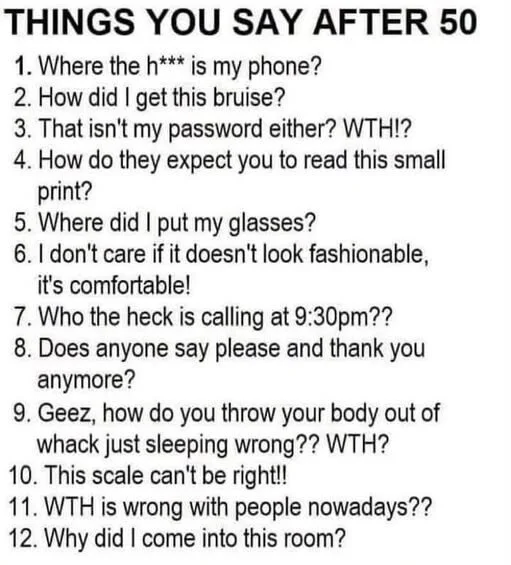

Mot: The Seasoned Vocabulary!!!

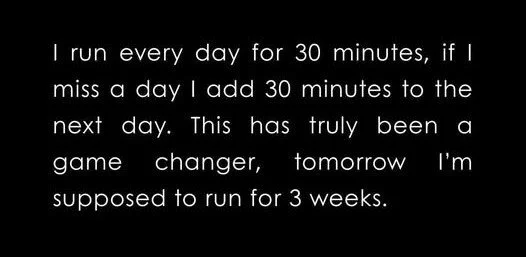

Mot: I Do Have This Great Plan - You See ----aaaahhhhh

MilitiaMan and Crew: IQD News Update-Integrity Commission, Anti Corruption

MilitiaMan and Crew: IQD News Update-Integrity Commission, Anti Corruption

2-4-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Integrity Commission, Anti Corruption

2-4-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Wednesday Evening 2-4-26

Good Evening Dinar Recaps,

U.S. Hosts Landmark Critical Minerals Ministerial With 50+ Countries

Washington convenes global partners to secure supply chains and reduce dependence on dominant producers

Good Evening Dinar Recaps,

U.S. Hosts Landmark Critical Minerals Ministerial With 50+ Countries

Washington convenes global partners to secure supply chains and reduce dependence on dominant producers

Overview

The United States hosted a high-level Critical Minerals Ministerial in Washington, D.C., bringing together senior officials from over 50 countries to discuss cooperation on securing and diversifying supply chains for critical minerals — essential inputs for technology, defense, clean energy, and advanced manufacturing. The meeting reflects growing global concern over reliance on concentrated supplies, particularly from China, and represents a coordinated effort to strengthen international industrial resilience.

Key Developments

1. U.S. Initiative Against Supply Concentration

Vice President J.D. Vance and Secretary of State Marco Rubio co-hosted the summit, highlighting the strategic need to reduce vulnerability to single-source dominance — especially rare earths and other minerals crucial for semiconductors, batteries, and defense technologies.

2. More Than 50 Countries Participating

Delegations from nations across Europe, Asia, Africa, and the Americas attended the talks, signaling widespread interest in diversified supply chains and cooperation frameworks. This includes long-standing U.S. allies and emerging partners alike.

3. Proposal for a Critical Minerals Trading Bloc

U.S. officials unveiled plans to create a preferential trade framework or bloc focused on critical minerals, including coordinated price floors and shared standards to stabilize markets and support allied producers. This proposal aims to counterpricing pressures and supply chain disruptions tied to concentrated suppliers.

4. Strategic “Project Vault” and Stockpiles

Alongside international cooperation, the U.S. announced “Project Vault,” a strategic stockpile initiative backed by billions in public and private funding, intended to cushion price volatility and ensure long-term access to essential minerals.

5. Bipartisan Support for Export Financing

Senators are pushing to reauthorize and expand the U.S. Export-Import Bank’s lending capacity to support critical minerals projects, signaling bipartisan interest in long-term industrial resilience.

Breakdown of Countries Participating

While the U.S. has not published a complete official list of all attendees, multiple sources confirm participation from a broad array of nations across regions:

Key Participating Countries (Confirmed):

United States (host)

South Korea

India

Thailand

Japan

Germany

Australia

Democratic Republic of Congo

European Union representatives including France, Italy, and others

Mexico (via coordinated trade policy discussions)

Saudi Arabia and other Middle Eastern states (delegates present)

Additional delegations reportedly included Canada, United Kingdom, and New Zealand among others.

Officials stated that approximately 55 countries attended the summit, representing governments with interests in critical mineral extraction, processing, or supply-chain resilience.

Pledges, Agreements, and Commitments

While few fully binding international treaties were announced, the ministerial produced multiple pledges and cooperative arrangements aimed at strengthening global critical minerals infrastructure:

1. Trade Partnerships and Policy Coordination

The U.S., European Union, Japan, and Mexico pledged to work toward coordinated critical minerals policies, including price supports, market standards, and strategic stockpiling arrangements.

2. Price Floor and Preferential Zone Proposal

U.S. Vice President J.D. Vance introduced a proposal to establish a price floor system for key critical minerals. The idea is to prevent market flooding with artificially low-priced material that could undercut domestic and allied producers. This framework could be implemented among participating states to stabilize prices and ensure fair access.

3. “Project Vault” Strategic Stockpile Initiative

The United States announced Project Vault, a planned strategic reserve of critical minerals backed by $10 billion in U.S. Export-Import Bank funding and $2 billion in private capital, with the aim of safeguarding supply for advanced manufacturing and defense applications.

4. Interest in a Critical Minerals Trade Bloc

Officials at the summit discussed the potential formation of a preferential trade bloc for critical minerals that could align tariffs, investment incentives, and supply chains among like-minded partners to counter external market dominance.

5. Future Expansions and Membership

U.S. Interior Secretary Doug Burgum indicated that additional countries will be named to a “critical minerals club,” with 11 new countries expected to be added and another ~20 showing strong interest in joining cooperative frameworks.

Why It Matters

Critical minerals — including rare earth elements, lithium, cobalt, nickel, and others — are fundamental to the technologies shaping 21st-century industries. Dependence on limited suppliers has raised economic and national security concerns worldwide. By convening a multinational ministerial and proposing cooperative mechanisms, the U.S. aims to reduce systemic risks, encourage supply diversification, and prevent supply chain chokepoints that could undermine global technological progress.

Why It Matters to Global Markets

A coordinated approach to critical minerals could:

Encourage investment in diverse mining and processing hubs outside of dominant sources.

Foster shared standards and pricing mechanisms that limit market manipulation and volatility.

Strengthen industrial cooperation across allied economies in technology and defense supply chains.

These dynamics may shift investment flows, reshape commodity market pricing structures, and influence geopolitical alignments.

Implications for Geopolitical Competition

Pillar 1: Supply Chain Resilience

Diversification reduces the leverage that any single country or bloc can exert over critical technology inputs, lowering systemic vulnerability.

Pillar 2: Industrial and Economic Security

Multilateral cooperation supports integrated production, processing, and financing systems that underpin advanced manufacturing and defense sectors globally.

This isn’t just a summit — it’s a strategic front in the evolving geopolitical competition over technological and industrial leadership.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Al Jazeera — “Trump’s critical minerals meet: Who’s attending, what’s at stake?”

Reuters — “US hosts countries for talks to weaken China’s grip on critical minerals”

Bloomberg — “Vance pitches price floors for key minerals to counter China”

~~~~~~~~~~

SAVE Act: Voter Eligibility Bill Advancing Through Congress

Legislation would tighten voter registration rules by requiring proof of U.S. citizenship

Overview

The Safeguard American Voter Eligibility (SAVE) Act (H.R. 22) is a proposed U.S. federal law that would amend the National Voter Registration Act of 1993 to require documentary proof of U.S. citizenship to register to vote in federal elections. The bill has passed the U.S. House of Representatives and is currently pending further action in the Senate.

What the SAVE Act Would Do

Require individuals to present documentary proof of U.S. citizenship — such as a birth certificate or passport — at the time of voter registration for federal elections.

Eliminate or restrict online and mail voter registration unless such proof is provided.

Require states to establish processes to identify and remove noncitizens from voter rolls, and potentially impose penalties on officials who register noncitizens.

Current Status

The SAVE Act was introduced in the House (H.R. 22) in January 2025 by Rep. Chip Roy (R-TX).

It passed the House on April 10, 2025 by a vote of 220–208, advancing to the Senate.

After House passage, the bill is pending in the U.S. Senate; it has not yet become law and would require Senate approval and the President’s signature to take effect.

Why It Matters

Supporters argue the SAVE Act would strengthen election integrity by ensuring only U.S. citizens can register and vote in federal elections. Critics contend it would restrict voting access for millions of eligible Americans who may lack acceptable documentation and disenfranchise historically underrepresented communities by limiting online and mail registration.

Why It Matters to Voters

If enacted, the SAVE Act could fundamentally change how Americans register to vote, potentially requiring more in-person documentation and reducing the accessibility of voter registration. This could affect turnout, administrative costs, and how election systems are structured nationwide.

Implications for U.S. Politics

The bill has become a flashpoint in broader debates over election integrity, voting access, and federal versus state control of election rules. Its progress will shape political strategy and discourse leading into upcoming election cycles.

This is not just electoral policy — it’s a defining moment in the ongoing fight over voting rights and democracy in America.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Congress.gov — “Titles – H.R.22 – 119th Congress (2025-2026): SAVE Act”

Brennan Center for Justice — “House Passes SAVE Act; Brennan Center Reacts”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Wednesday Evening 2-4-26

Iraq’s $567 Monthly Wage Trails Living Costs Nearly Threefold

2026-02-04 Shafaq News- Baghdad Iraq recorded an average monthly wage of $567 over the past year, placing ninth among Arab countries, according to the global database Numbeo. The ranking marks a slight shift from 2023, when Numbeo estimated Iraq’s average net monthly salary at about $549, placing it eighth in the Arab world.

Despite the modest wage level, the data estimated that monthly living costs for a family of four in Iraq –excluding rent– stand at around $1,837.

Iraq’s $567 Monthly Wage Trails Living Costs Nearly Threefold

2026-02-04 Shafaq News- Baghdad Iraq recorded an average monthly wage of $567 over the past year, placing ninth among Arab countries, according to the global database Numbeo. The ranking marks a slight shift from 2023, when Numbeo estimated Iraq’s average net monthly salary at about $549, placing it eighth in the Arab world.

Despite the modest wage level, the data estimated that monthly living costs for a family of four in Iraq –excluding rent– stand at around $1,837.

Gulf states dominated the regional rankings, with Qatar topping the list at an average monthly salary of $3,804, followed by the United Arab Emirates at $3,231 and Kuwait at $2,940. Oman ranked fourth with $2,381, ahead of Bahrain at $2,244 and Saudi Arabia at $2,057.

Jordan placed seventh with an average monthly wage of $703, narrowly ahead of Lebanon at $568, while Iraq followed in ninth place.

Morocco ranked tenth at $487, followed by Tunisia at $343 and Algeria at $312. Egypt recorded the lowest average among the listed countries, at $153 per month. https://www.shafaq.com/en/Economy/Iraq-s-567-monthly-wage-trails-living-costs-nearly-threefold

Central Bank Denies Raising Traveler's Dollar Quota {Document}

{Economic: Al-Furat News} The Central Bank of Iraq denied reports about raising the traveler's share of dollars to 5,000 per month. The Central Bank had set the limit at $3,000 per traveler at the official rate of 1,320 dinars. LINK

The Central Bank Issues A Clarification Regarding Travelers' Dollar Allocation.

Economy News – Baghdad The Central Bank of Iraq issued a clarification on Wednesday regarding travelers' share of dollars. Central Bank Governor Ali Al-Alaq said, “The traveler’s monthly allowance is only $3,000, and the money is received only in person at authorized companies, and then the traveler receives the cash dollar at the airport on the day of the trip.” The governor called for "this notice to be widely disseminated so that some do not fall into the trap of fraud." https://economy-news.net/content.php?id=65323

Oil Prices Near $70 a Barrel

Reuters reported on Wednesday that oil prices rose to near $70 a barrel.

Reuters stated that "oil prices are approaching $70 a barrel."

Oil prices rose on Wednesday morning, continuing the gains made the previous day.

Brent crude futures climbed 65 cents, or 1.0%, to $67 a barrel at 01:11 GMT.

West Texas Intermediate (WTI) crude futures reached $63.90 a barrel, up 69 cents, or 1.1%.

Both benchmarks rose by approximately 2% on Tuesday. https://ina.iq/en/45265-oil-prices-near-70-a-barrel.html

Chevron To Manage Iraq’s West Qurna-2 Oilfield, Replacing Russia’s Lukoil

2026-02-04 Shafaq News- Basra The state-run Basra Oil Company said on Wednesday that US-based Chevron has entered negotiations to assume management of the West Qurna-2 oilfield in southern Iraq, following the Russian energy giant Lukoil stepping down as operator.

The Iraqi government decided yesterday to assign the Basra Oil Company to manage the oil field, contracting a consortium of Bonatti and Basra Crescent, as a measure to mitigate the impact of a force majeure declared by Lukoil.

Kazem Abdul Hassan Karim, the company’s deputy director for oilfields affairs, told Shafaq News that Chevron joined discussions to operate the field after the transitional phase, noting that the Iraqi company is prepared to take over direct management if talks do not result in an agreement.

Basra Oil Company had received an official notice from Lukoil declaring force majeure, prompting immediate precautionary measures to ensure operational continuity, he said, pointing out that the company moved to temporarily take over petroleum operations with the support of an Iraqi technical operator, aimed at maintaining production and securing salary payments for Iraqi staff contracted with Lukoil, pending formal approvals.

Karim added that the Basra Oil Company had requested renewal of the operating license, which expires on February 28, and confirmed that financial obligations between the Russian side remain under negotiation. “An outcome is expected within 24 days, and failure to settle could lead to the activation of force majeure clauses under the contract.”

The current output from the West Qurna-2 oilfield stands at about 489,000 barrels per day, including roughly 450,000 bpd from the Mishrif reservoir and 30,000 bpd from the Yamama reservoir. The Yamama reservoir, according to Karim, is undergoing preliminary development studies aimed at raising production to 150,000 bpd, with longer-term plans to increase total field output to 350,000 bpd by the end of 2029.

Lukoil announced last Thursday that it had begun selling its overseas assets, including oil projects in Iraq, to a group of US companies, citing restrictions imposed on the firm and its subsidiaries. The Russian energy giant has been under US sanctions linked to the war in Ukraine.

In late October 2025, the United States placed Lukoil and Rosneft, Russia’s two largest oil producers, on its sanctions blacklist as part of efforts to pressure Moscow to end the conflict. https://www.shafaq.com/en/Economy/Chevron-to-manage-Iraq-s-West-Qurna-2-oilfield-replacing-Russia-s-Lukoil

USD/IQD Exchange Rates Dip In Baghdad, Erbil

2026-02-04 Shafaq News– Baghdad/ Erbil The US dollar closed Wednesday’s trading lower in Baghdad and Erbil, retreating below the 150,000-dinar mark per 100 dollars.

A Shafaq News market survey showed the dollar trading in Baghdad’s Al-Kifah and Al-Harithiya central exchanges at 149,750 dinars per 100 dollars, after having exceeded 150,000 dinars earlier in the session.

In Baghdad, exchange shops sold the dollar at 150,250 dinars and bought it at 149,250 dinars, while in Erbil, selling prices stood at 149,700 dinars and buying prices at 149,600 dinars. https://www.shafaq.com/en/Economy/USD-IQD-exchange-rates-dip-in-Baghdad-Erbil-9

The Sudanese Government Directs The Resolution Of Tax Obstacles Facing The Private Sector Until The Budget Is Approved.

Money and Business Economy News – Baghdad Prime Minister Mohammed Shia al-Sudani directed on Wednesday the formation of a committee to communicate with the Kurdistan tax authorities to unify tax procedures.

The Prime Minister’s Media Office stated in a statement received by “Al-Eqtisad News” that “Prime Minister Mohammed Shia Al-Sudani chaired a meeting of the Supreme Committee for Tax Reform, in the presence of the Director General of the General Authority for Taxes and its senior staff, and a number of the Prime Minister’s advisors in the economic and financial field.”

According to the statement, the meeting discussed "the mechanism for unifying tax accounting procedures, the most prominent obstacles facing companies in the tax field, as well as a detailed discussion of the (tax accounting) law, which falls under the tax reform program adopted by the government."

The statement noted that "the meeting witnessed a discussion of the file of unifying tax procedures between the Kurdistan Region of Iraq and the Federal Ministry of Finance, and the issue of internal (double taxation), and finding legal solutions and effective procedures for addressing it."

According to the statement, the meeting discussed "the issue of (tax evasion) and presented legal proposals to address this problem, in order to help and encourage companies and investors to adapt their financial and legal status, in addition to discussing the legal solutions offered to resolve the tax problems faced by the private sector."

The Prime Minister affirmed the government's commitment to addressing this important issue within an integrated program to maximize non-oil revenues, directing the preparation of a draft resolution to be submitted to the Cabinet that addresses tax obstacles facing the private sector and Iraqi companies, pending the approval of the 2026 general budget law.

The Prime Minister directed the formation of a committee from the Ministry of Finance and the Tax Authority to communicate with the tax institution in the Kurdistan Region of Iraq in order to reach advanced stages in unifying tax procedures. https://economy-news.net/content.php?id=65326

FRANK26….2-4-26…..TRUMP VETO (And Q&A)

KTFA

Wednesday Night Video

FRANK26….2-4-26…..TRUMP VETO (And Q&A)

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Wednesday Night Video

FRANK26….2-4-26…..TRUMP VETO (And Q&A)

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

"Why the Iraqi Dinar Will Revalue" Thoughts by Workinman (From Recaps Archives)

From Recaps Archives

(This content is for general information purposes only. All information given is the sole opinion of the provider.)

"Why the Iraqi Dinar Will Revalue" Thoughts by Workinman

Hopefully here I will explain why the Iraq Dinar revaluation was designed in the first place. This is based on a historical view of what has happened the last two decades. Some may read this and say "no way" and that is ok.

My goal is to properly inform you why we are where we are at with the speculative investment called the Iraqi Dinar. Also it may be an eye opener to many on how governments do what they do. So here it goes. To tell the full story, I would have to write a book, so I will try to condense as much as possible to bring the main points to life.

From Recaps Archives

(This content is for general information purposes only. All information given is the sole opinion of the provider.)

"Why the Iraqi Dinar Will Revalue" Thoughts by Workinman

Hopefully here I will explain why the Iraq Dinar revaluation was designed in the first place. This is based on a historical view of what has happened the last two decades. Some may read this and say "no way" and that is ok.

My goal is to properly inform you why we are where we are at with the speculative investment called the Iraqi Dinar. Also it may be an eye opener to many on how governments do what they do. So here it goes. To tell the full story, I would have to write a book, so I will try to condense as much as possible to bring the main points to life.

Understand my writings are my view from all that I have gathered and I am sure any who are mentioned will deny at any moment this is or could be the truth.

During the term George Bush, Sr. was president, I will say a group of people who have more power than any one government saw the way our country was going to be financially in the next ten to twenty years.

Due to the way we allowed financing to be done, the way mortgages were done it would cause our monetary system to fail in years to come.

It would cause millions to be without jobs, to lose their homes, allow millions to be in a position not be able to feed their families. Sound familiar? That time frame they saw back then that would be was from five years ago to our present time.

They saw back then that we were going down a path where we would be spending more than we could pay. United States as we know it would self destruct. From this, they had to do something that could change the course of events, otherwise, we would financially destroy ourselves.

If it wasn't for what they did, we would have. But what they did, will change the course of events just temporarily, until a more permanent fix could be implemented. The more permanent fix was and is a one world currency. But not to get ahead of myself, let me tell the story as I know it.

In order to fix a to be broken financial country, they needed to "use" a country that had all of the right "perks" that could be basically crushed and rebuilt, which would cause a new currency to be developed and then revalued. From this, the monies profited from this could fix the debt that would soon swallow the country if not corrected.

So, they saw that Iraq had all the "perks" needed to be the "fix". But how to get Iraq in a position to where this could happen.

Well, this group that I mentioned earlier that has more power than any one country government, paid Saddam Hussein to invade Kuwait. This provided the opportunity to go in Kuwait and drive Iraq out.

Having Iraq invade Kuwait, provided the event to oust Iraq from Kuwait which meant Kuwait needed a new currency and then revalue their currency.

This in turn, caused the United States to have a large surplus during the Clinton administration as the profits obtained from Kuwait revaluing their currency.

How that happened is when Iraq invaded Kuwait, they took their currency. So when we came into Kuwait, we had the UN devalue the Kuwait currency so Iraq could not buy weapons with it. Once, Iraq was removed from Kuwait, we had the UN create a new currency and re-implement the previous value to it.

The United States took Kuwait dinar as payment before the revaluation. When it revalued, the US made a huge profit causing a surplus for our country during the Clinton administration.

Now that is what happened that led to us invading Iraq later stating they had "weapons of Mass Destruction", which many found out later was never there. It was a term used for US to gain access to invade Iraq, so the same scenario could take place once again like it did in Kuwait so the US could make a huge profit and cure the deficit we created.

The big difference is it also provided us with a new allie in the Arab world that sat right next to Iran. In addition it allowed us the position to create a democratic Arab nation that in time would replicate itself throughout the Arab nations. We see this happening now in Yemen, Libya, and other Arab countries. But the main reason as all already know is it gives us a stronghold on the oil situation in the Arab community.

But back to the story.

Once we invaded Iraq, overthrew Saddam and freed Iraq from its dictator, we now had to rebuild Iraq. Like Kuwait, but drastically different. Why? Kuwait was already established as a democratic country. All that was needed there was to re-establish their dinar value after creating a new currency.

With Iraq, it had to be rebuilt from scratch.

We had to assist them to form a government through electoral process. We had to rebuild their electrical and water grids. Had to rebuild their roads and highways. Not to mention their oil pipelines and pumping stations.

Unfortunately, there was some drawbacks that was not foreseen such as no one in Iraq could trust each other for hundreds of years. So to create a government where the people of Iraq could trust took many years, and to this day is still not completely functional as you can see with the continuous feuding between blocs as Maliki and Allawi.

Both think they should be the Prime Minister and both think their way is the only way. It took over 9 months for Iraq to have a semi-functioning government that could start passing laws. And to this day, by their constitution, every law to be passed must be read three times in Parliament, allow any Parliament member to tear it apart before it can be passed by all before it is a law.

So the rebuilding took much longer than did Kuwait. Kuwait, 3 years verses Iraq 11 years and still going.

So when we invaded Iraq, we did the same thing as have the UN devalue the Iraq currency to zero, invaded, ousted the dictator, then printed a new currency, and now we are in the process of re-valuing the currency.

This is the part that makes you and me money. When the new currency was printed in 2003, the US spent $500 billion dollars to print new Iraq dinars, when printed, we took some of the new dinars as repayment for the $500 billion spent.

This was in the amount of many trillion dinars which is tucked away waiting on revalue. When Iraq re-values its currency, many feel it should be closely aligned with Kuwait which is at around $3.64 to 1 Kuwait Dinar.

When this happens, US will say ok Iraq, I have all these trillions of Iraq Dinars I want to cash out. There will be more than enough to pay off our national debt if it is chosen to be used that way. In addition, the more than 4 million US citizens that will cash out their dinar, will create millions of jobs that those who are now wealthy will end employment.

Businesses will prosper due to millions buying things. Real Estate will prosper, banks will prosper and IRS will prosper. All will benefit from this.

But, during the process of this being about us, things changed. Different countries who modeled our way of doing things also started tanking and before the Iraq Dinar could re-value it was stopped and the purpose for Iraq re-valuing had to be changed from a US fix to a global fix, which is where we are now.

At this point we have over 140 countries needing the Iraq Dinar to be the fix.

The global financial situation continues to grow into a gigantic world overhaul, which many presume was the purpose from the beginning. Hence, the one world currency which is still yet to be a threat by those same group that are more powerful than any one country.

So today, we have Iraq finalizing the Erbil (governmental power sharing agreement) which will be the immediate fix for the HCL (hydrocarbon law, which divides the profits of oil revenue to the different states of Iraq) as well as will complete the passing of the law of the Parliament Budget. What is important about the Parliament Budget being passed is the re-value is (allegedly) in this budget.

Now that you have been updated as to how the events took place to make this happen, lets go into why it will happen.

During Saddam's reign he created a massive debt to many countries. Owing $ billions of dollars to many. Once we got him out of power and started rebuilding Iraq, we had to get these countries to not go after the profits Iraq would make on their oil.

Understanding that Iraq has the 3rd largest oil reserve in the world, and soon to be the leader in oil reserves. Saudi Arabia is 1st and Canada is 2nd. I know, you are surprised that Canada is 2nd. I was too.

Anyways, to get the countries that Saddam owed to not come after the oil profits, we as in the UN (United Nations) and IMF (International Monetary Fund) froze Iraq Oil Profits and kept the countries that Saddam owed from gaining access to it.

Eventually we worked out with them that to trade in exchange for Iraq Dinar that was now worthless if they would forgive Iraq of their debt to them. Well, eighty percent forgave the debt owed to them completely in trade of a present worthless new Iraq Dinar and the other twenty percent forgave over eighty percent of the debt owed to them in exchange for the new worthless Iraq Dinar. Makes you go hmmmmm.

Now we have many countries around the world holding the new Iraq Currency that presently is worthless. Why would they go for this? Well, they know that in time, it will be worth what it used to be $3.22 per dinar or more somewhere down the road.

So, we have many countries that will not allow this to fail because they are holding a lot of Iraq's new currency.

We have a country (Iraq) that is pulling more gold out of their ground per day than they are pumping oil out. Which was just found a couple of months ago, right under the streets of Baghdad. Funny thing is, they was trying to fix their rain water run off when they discovered this. Now, they already had well over 500 thousand tons of gold in storage. So we know they have massive amounts of oil, natural gas, and gold.

They also have the most fertile ground for agriculture along the Euphrates river. At one time, Iraq was the number one producer of grain in the Arab nations, and will be again. So Iraq has the ability to cover the re-valuation of the Dinar just in assets alone but that is not how they will cover the re-evaluation. Let me explain the process, when the Iraq Dinar re-values and we cash out our dinars.

Here is the cash out process. (IMO)

When Iraq re-values their currency they will have to set a rate of exchange for it. They will do this through their "Federal Reserve" they call the Central Bank of Iraq (CBI), their website is www.cbi.iq .

Once this rate is set, we go to our local bank, probably one of the main four of either Chase, Bank of America, Wells Fargo or Citibank (the same banks that right now say they will not cash out Iraq Dinars, because, they say its not a tradable currency at present).

They, will most likely want to give you a little less than what the CBI states the value is and this is called a spread, which is a percentage or profit margin the bank will make to do the exchange for you (unless you group up with other dinarians and bring the bank an amount that will make them go WOW, lol). I'll explain more later on this.

But lets say for example their spread is 1%. What this does for the bank is the amount of cash, that you make from this exchange, that goes into their bank, will be used in a term called fractional banking. This means that they can now loan money out, ten times, what you put in the bank. So it gives the bank money to make money (Fractional Banking).

The bank will take your Iraq Dinars, give you money in your account, then send the Iraq Dinars to the United States Treasury (UST). The UST will give the bank the money either virtually or wire transfer the amount the CBI rate is. The UST now either sends Iraq the dinars or tells Iraq, they have this much Iraq Dinar, and in turn Iraq will give USA oil credits at $35 a barrel of oil (This has already been agreed upon and is in the records).

Now the USA can either take this $35 a barrel of oil and use it here or it can resell it for $100 a barrel or more to other countries. If they sell it, they just tell Iraq send 200,000 barrels of our oil to Germany for example.

Now, you have been paid, the bank has been paid and UST has been paid. Iraq cost to get a barrel of crude oil out of the ground is around $13. So, Iraq now has made a profit of each barrel of USA sold oil of $12.

In essence, it does not cost Iraq anything to cover the cost of the re-value (RV). Actually they made money by re-valuing their currency!

If this does not drop your lower jaw then I don't think nothing will.

A well executed plan to not only fix USA's debt problem, cover many other countries debt problem but also, place us in a position in the Arab Nation where we can indirectly control the western hemisphere, as well as get rid of the remaining countries dictators which will bring peace to the world all in one swoop!

Got to applaud ole Senior Bush and boys for a plan of a lifetime. And through all of this, you gained wealth.

Now after reading this, you understand why I invested in this 7 years ago.

OK, so there you have my rendition of what took place as to why the Iraq Dinar MUST revalue.

Always remember to STAY GROUNDED............GO RV................. Workinman......

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 2-4-26

Good Afternoon Dinar Recaps,

Mortgage Rate Pressure Builds as Borrowing Costs Rise

Mortgage rates tick up again — implications for housing demand and consumer finance

Good Afternoon Dinar Recaps,

Mortgage Rate Pressure Builds as Borrowing Costs Rise

Mortgage rates tick up again — implications for housing demand and consumer finance

Overview

Mortgage interest rates continued to tick higher in the past 24 hours, with the average 30-year fixed rate climbing further. These increases reflect broader tightening in credit markets and rising refinance costs, contributing to affordability pressures for homebuyers and signaling stress points in consumer credit that could ripple through the economy.

Key Developments

1. 30-Year Fixed Mortgage Rates Rise

The average 30-year fixed mortgage rate increased to over 6.23%, up from recent levels, making home financing more expensive for new buyers.

2. Shorter-Term Rates Also Increase

Rates on 15-year fixed mortgages and refinancing products also ticked upward, compounding the impact on borrowers looking to shorten terms or refinance.

3. Consumer Costs Creep Higher

Higher rates translate into larger monthly payments and greater overall interest costs over the life of a loan, tightening household financial flexibility.

4. Market Participants Monitor Lending Conditions

Borrowers and lenders alike are watching rate trends closely as central bank policy expectations and credit conditions evolve.

Why It Matters

Rising mortgage rates reduce housing affordability, temper demand for new homes, and increase long-term cost burdens for borrowers. This affects consumer spending, wealth effects from housing markets, and broader financial stability.

Why It Matters to Foreign Currency Holders

Higher borrowing costs in the U.S. can impact global financial flows, as rate spreads influence currency valuations, capital allocation decisions, and cross-border investment strategies.

Implications for the Global Reset

Pillar 1: Credit Cost Rebalancing

Higher mortgage rates signal tighter credit conditions, impacting consumption and investment dynamics.

Pillar 2: Monetary Policy & Confidence Signals

Mortgage costs provide a real-world reflection of monetary tightening pressures that influence confidence in economic growth and currency stability.

This isn’t just about homes — it’s about the broader cost of credit and confidence in economic resilience.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Forbes Advisor — “Mortgage Rates Today: February 4, 2026 – 30-Year Rate Hits One-Month High”

Forbes Advisor — “Mortgage Refinance Rates Today: February 3, 2026 – Rates Increase”

~~~~~~~~~~

Trump Cheers Weak Dollar as BRICS Accelerates De-Dollarization

Currency policy shockwaves collide with global reserve realignment

Overview

President Donald Trump has openly welcomed a weaker U.S. dollar, marking a sharp break from decades of American currency doctrine just as BRICS nations intensify efforts to reduce reliance on the greenback. With the dollar sitting at a four-year low, the convergence of U.S. policy shifts and BRICS de-dollarization is raising fundamental questions about the future of global currency dominance.

Key Developments

1. Trump Embraces a Weaker Dollar

Trump stated that the weaker dollar is “great” for America, highlighting increased business activity and export competitiveness. The U.S. dollar has fallen nearly 10% in 2025 and an additional 2% in early 2026, marking its sharpest annual decline since 2017.

2. Break From Traditional Strong-Dollar Policy

Historically, Republican administrations favored a strong dollar as a symbol of economic stability and global leadership. Trump’s stance departs from this orthodoxy, signaling a willingness to tolerate — or even encourage — dollar weakness to support domestic industry.

3. BRICS Accelerates De-Dollarization

BRICS nations are rapidly implementing alternatives to dollar-based systems:

Russia conducts ~90% of intra-BRICS trade in national currencies

BRICS central banks bought over 1,100 tons of gold in 2025, the largest increase in 70 years

BRICS Pay is expected to launch by late 2026, bypassing SWIFT

BRICS dollar reserves have declined to 56.92% as of January 2026

4. Treasury Attempts Damage Control

Treasury Secretary Scott Bessent reaffirmed the U.S. “strong dollar policy,” reframing it as a function of economic fundamentals rather than exchange-rate levels. Markets viewed the remarks as an effort to calm investor concerns following Trump’s comments.

Why It Matters

Currency value reflects confidence, stability, and geopolitical power. A weakening dollar may boost exports and tourism in the short term, but prolonged declines risk undermining investor confidence and accelerating global efforts to move away from dollar-based trade and reserves.

Why It Matters to Foreign Currency Holders

As BRICS nations expand gold holdings, local-currency trade, and alternative payment systems, foreign currency holders are watching for confirmation that the dollar’s dominance is structurally weakening — not just cyclical. These developments directly affect reserve diversification strategies worldwide.

Implications for the Global Reset

Pillar 1: Monetary Realignment

The dollar’s decline — combined with BRICS gold accumulation and CBDC infrastructure — signals a shift toward a multipolar reserve system rather than outright dollar replacement.

Pillar 2: Trade & Settlement Fragmentation

With BRICS Pay, mBridge, and bilateral currency swaps expanding, global trade settlement is moving away from a single dominant rail toward regional and bloc-based systems.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – Trump Says A Weaker Dollar Is Great For America As BRICS Gains Power

Reuters – Dollar Slides as Policy Uncertainty and Global Currency Shifts Deepen

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Bruce’s Big Call Dinar Intel Tuesday Night 2-3-26

Bruce’s Big Call Dinar Intel Tuesday Night 2-3-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. It is Tuesday, February 3, and you're listening. Thanks everybody for tuning in, out there, wherever you are in Zim Landia, or wherever people are in this world, around the globe. Thank you for listening. Thank you for being part of our call.

And now the all important Intel section of the call, I want to start by just saying there is. There have been some questions about, How do they know if I've been gifted Zim?

Bruce’s Big Call Dinar Intel Tuesday Night 2-3-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. It is Tuesday, February 3, and you're listening. Thanks everybody for tuning in, out there, wherever you are in Zim Landia, or wherever people are in this world, around the globe. Thank you for listening. Thank you for being part of our call.

And now the all important Intel section of the call, I want to start by just saying there is. There have been some questions about, How do they know if I've been gifted Zim?

And some people have, and they estimate that maybe 20% of Zim holders have been gifted the Zim that they have. Some people have bought them since they were gifted. Some people didn't, but those that were gifted Zim - how are they? How are they going to know your email?

They won't. They don't have it.

And what is the purpose of the big call, putting out email to our listeners that requested it and putting the 800 number when we get it on the landing page of big call universe.com -- It's to take care of the people that somehow either change emails they don't have The email for you or your gifted zim, and you that you did not buy it. It was gifted to you. Okay, well, that's where the big call comes in, because we will send, if you registered on our website, with your email, assuming you have one, okay, we will send out an email with a number in it.

When we get it to you, it'll be like an email blast. It'll go out to however many people -however many people have gone ahead and registered on our website, however many that is. And I'll contact Bob. Bob will contact Riley. We'll get it out. That's how it's going to work.

The other thing is, if you, let's say you had Zim, or your spouse had Zim, something happened, and the spouse is no longer with us, and you have the currency. Can you redeem the zim? Of course, you can. Yes, of course. Now they are not asking for receipts for what we have bought, for currency, and if you've been gifted, you have no receipt. You have the currency, you have the zim or the Dong or the dinar, whatever you were gifted. That;s cool -- They don't have time to monkey with that.

Point is, if you come in, you've got bonafide currency, and you can prove who you are with your know, your customer, your photo ID, you know your driver's license, maybe a passport, if you have that, it's and it's current, that's all good.

So they'll check you out. You put you give them a maybe one of the most recent utility bills could be a cell phone bill, could be a natural gas bill, could be electric bill, whatever that shows that you have an address that you live somewhere. And they go, Okay, I see that. Okay, good. So that's it's gonna go quickly.

They know your customer now they say, they say, they know who all the zim holders are. Okay, cool. If they do, great. That makes it that much easier, that much faster, okay? And so that'll be fine. That's good. But if you come in and been gifted zim, you can let them know, Hey, I was gifted this. There's no shame in that. No shame whatsoever. In fact, I think you're special if somebody gave you Zim, okay, or any other currency for that matter.

So not a big deal if it was in this was something that your spouse has passed away. Oh, you have to take over, take over and go into the redemption center, set your appointment, just like anybody would with the 800 number you'll call, set your appointment, and then you'll follow up and end up going to the redemption center no more than 10 minutes before appointment time.

Okay, so you don't clog up the parking lot trying to get there an hour early. Not happening. I'll send you the back of the line. You do that, just get there 10 minutes early and you'll be all set 10 minutes early, and if they give you in sooner. If you have to wait a little while, -- they are trying to run these things very quickly, and get our appointments done in 30 to 40 minutes total. That's a lot to do in 30 - 40 minutes, Delarue machines are gonna be going great guns - lights out on those – going to be quick and then setting up a new account, giving credit debit card from Wells Fargo - getting quantum account – getting biometric together - five digit pin code – that’s still good and email -- they said new email and password – Im not so sure they will the new email we’ll see – be prepared for the possibility of new email and password - as opposed to the one you currently use

Now, when is it going to go? When is it all going to happen?

Well, information today has been a little bit late. However we had this basically three or four days ago that we were looking at Tuesday, Wednesday was in play, Tuesday when it was in play -- prior to that we had from a number of sources that Wednesday / Thursday which is tomorrow and Thursday - 4th and 5th

Well it came back in today, and we're looking to receive notifications, which Listen when we go to notifications with 800 numbers that is 51% of the battle - . I dare say it's more than 51% - but we definitely got it – we set our appointments – go in and we do the exchanges and out the other side enjoying the experience --

It’s like getting married, and all sudden, you're in this ceremony and where you are not really aware of what’s going on. But you need, when you go in, to look around. Need to enjoy the atmosphere. You'll see like, see what's going on in the church, if you had a church wedding and enjoy it and you know, even though ceremony might be 30 – 40 minutes long 25 to 30 minutes, it goes like, boom, like that. Same thing is going to be true the exchanges.

But this is not the time for you to tell you know, an hour and a half speech about your project. It's not, I think three five minutes more like what they want now, five to eight they want, like, three to five minutes on your projects. They just want to know, kind of, like, what you're planning do with the Zim money, you know? And I recommend anybody that has zim that you should have some project. You don't have to have tons of projects you can have one project and be fine with it.

So what are we hearing? Notifications tomorrow night or Thursday, and the latest or about this could be, well, with this, supposed to have all the rates on the screen – tomorrow night which means show up on Thursday morning on banks and redemption centers so that, it's quite conceivable that we can get notified Wednesday night or Thursday morning

We could “quote un quote” wake up to it Thursday - and if we did – we would call set appointments, and then, based on availability, we would start exchanges on Thursday

Now that's the latest that I've received. And you know how it is a Tuesday night and a Thursday night, it's very likely that I will get an update, after the call is over which is very frustrating to me. Many times I've had information after the call that I wish I had during the call that I could bring to you, not the case tonight, so we'll see what happens. Maybe tonight I'll have something else here on Thursday, or maybe, just maybe, if we get the numbers, as we wake up to Thursday, we'll have a celebration call a Thursday night.

That's if, if, if then the old if then statement, if we get numbers, then we will have a celebration call Thursday we have numbers either tomorrow night or Thursday morning.

Either way, we'll have a call Thursday night all right now, that's very limited information right now. And a lot of our leaders at redemption centers and other leaders that know, are very quiet, very quiet. I think that quiet as they've been, maybe so and so, you know, things are moving forward in the right direction for us. We don't know everything, obviously that's happening, but we're going to have to just pay attention.

And I want to encourage everybody to go one day at a time. You know, when the Israelites were being fed manna from heaven, God told them only what you could eat. For that one day he was trying to build faith so they would trust God to receive Manna the next day, because if they had more than they could eat it one day, it was spoiled.

They live one day at a time. They finally got it, and then they asked for for meat, and they got quail, such a deal. And it was all, I think, to build trust in God and build a faith. We have to do the same thing. We trust in God, for this to come about bring everything to fruition, to completion, and it builds our faith day by day, as we go about our plan A, yep, still on Plan A, but we're planning for Plan B,

All right, well, guys, there's not a whole lot else. I think I covered the question that was proposed to me earlier about the Zim holders, and I think, guys, I can't think of anything other than the fact that we're looking for these numbers. Because once that happens, it's game on. We're ready to go. We're ready to get started and go,

But everything is a go, and we just need to see these numbers and make all this happen. And then remember, we're not going to rush, rush, rush, rush. Do, do do, as Sue always says, do, do, do in this. But we're going to go to the plan and go slowly at first, and then we'll take it and build a little momentum as we go.

Well, thanks everybody. I appreciate you, and thanks for listening, and we'll talk to you Thursday, and if we get our numbers, we'll have a celebration call all right. God bless everybody.

Bruce’s Big Call Dinar Intel Tuesday Night 2-3-26 REPLAY LINK Intel Begins 1:06:46

Bruce’s Big Call Dinar Intel Thursday Night 1-27-26 REPLAY LINK Intel Begins 1:26:36

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26 REPLAY LINK Intel Begins 1:23:23

Bruce’s Big Call Dinar Intel Thursday Night 1-22-26 REPLAY LINK Intel Begins 1:19:00

Bruce’s Big Call Dinar Intel Tuesday Night 1-20-26 REPLAY LINK Intel Begins 1:07:15

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26 REPLAY LINK Intel Begins 1:05:30

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26 REPLAY LINK Intel Begins 1:14:54

Bruce’s Big Call Dinar Intel Thursday Night 1-8-26 REPLAY LINK Intel Begins 1:22:42

Bruce’s Big Call Dinar Intel Tuesday Night 1-6-26 REPLAY LINK Intel Begins 1:13:10

Bruce’s Big Call Dinar Intel Thursday Night 1-1-26 New Year’s Day NO CALL

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25 REPLAY LINK Intel Begins 56:00

Bruce’s Big Call Dinar Intel Thursday Night 12-25-25 REPLAY LINK Intel Begins 20:40

Financial System on Edge of Crisis

Financial System on Edge of Crisis

WTFinance: 2-4-2026

As we navigate the choppy waters of 2026, the global economy, financial markets, and geopolitics are facing unprecedented challenges.

In a recent episode of the What the Finance (WTFinance) podcast, host Anthony Fatseas sat down with returning guest Simon Hunt to dissect the complex and precarious state of the world.

Financial System on Edge of Crisis

WTFinance: 2-4-2026

As we navigate the choppy waters of 2026, the global economy, financial markets, and geopolitics are facing unprecedented challenges.

In a recent episode of the What the Finance (WTFinance) podcast, host Anthony Fatseas sat down with returning guest Simon Hunt to dissect the complex and precarious state of the world.

The conversation was a sobering reminder that beneath the optimistic headlines, significant weaknesses lurk, threatening to upend the financial system.

Despite appearances of strength, the U.S. economy is showing signs of strain. Declining trucking indices and consumer sentiment are just a few indicators that suggest a slowdown is on the horizon.

Simon predicts a major global equity market correction of 20-30% that could last through mid-2026 to early Q3. This correction is not just a minor dip; it’s a significant adjustment that will test the mettle of investors and the financial system.

Simon reveals a critical event where the “plunge protection team” intervened to suppress the prices of gold, silver, and other assets.

This move was aimed at protecting the financial system from the destabilizing effects of massive short positions held by banks.

While this intervention may have provided a temporary reprieve, it doesn’t address the underlying issues. Simon remains bullish on precious metals over the long term, advising investors to hold physical assets and prepare for volatility.

The conversation also highlighted the unprecedented $416 trillion global debt burden, which is over four times the size of global GDP. This debt mountain, particularly in the U.S., where debt per capita and per entity far exceed those in China, constitutes the Achilles heel of the financial system.

The implications are stark: tightening monetary policy and significant bond market risks could trigger a catastrophic economic downturn.

Geopolitical tensions are another major concern. The ongoing conflict between Russia and NATO in UKraie is a case in point. Simon emphasizes Russia’s strategic goal of securing long-term border security and territorial control, which will likely disappoint Western interests and lead to a realignment of reconstruction contracts toward BRICS countries.

The risk of U.S. military action against Iran is also highlighted, with Iran’s threats to retaliate by targeting U.S. military bases and shutting down the strategically vital Strait of Hormuz. Simon assesses the likelihood of an Iran strike as 50/50, with potential delays until 2027 or 2028.

The growing strategic rivalry between the U.S. and China is another significant development. China’s rapid advancements in robotic manufacturing (“dark factories”), military capabilities, and alternative financial systems, including the soon-to-be-launched BRICS-backed currency unit partially backed by gold, challenge U.S. economic and geopolitical dominance.

China’s massive gold reserves and efforts to build gold vaults across BRICS nations will facilitate trade in local currencies and decrease reliance on the U.S. dollar.

Finally, Simon stresses the precarious future of the U.S. dollar and bond markets. While Treasury yields may temporarily fall mid-year due to government interventions, they are expected to surge dramatically by 2027-2028, exacerbating debt servicing costs and triggering economic turmoil.

The overarching message is clear: in a volatile, debt-laden, and geopolitically fraught environment, individuals must take steps to protect themselves.

Securing physical assets such as precious metals, land, and food is a prudent strategy. As Simon’s insights make clear, the perfect storm is brewing, and it’s essential to be prepared.

For further insights and information, watch the full video from WTFinance. The conversation with Simon Hunt is a wake-up call for investors, policymakers, and anyone concerned about the future of the global economy and geopolitics.

FIRST BANK FAILURE OF 2026: This Is How It Starts

FIRST BANK FAILURE OF 2026: This Is How It Starts

Taylor Kenny: 2-4-2026

The first bank failure of 2026 is here and it could be just the beginning.

Chicago's Metropolitan Capital Bank & Trust was shuttered by regulators this past weekend. The reason? "Unsafe and unsound conditions" and an "impaired capital position."

Translation: they were broke.

If you think this is an isolated incident, think again. The failure of Metropolitan Capital Bank isn't just a blip — it's a red flag waving from the crumbling foundations of our financial system. And it has direct implications for your deposits, retirement, and financial future.

FIRST BANK FAILURE OF 2026: This Is How It Starts

Taylor Kenny: 2-4-2026

The first bank failure of 2026 is here and it could be just the beginning.

Chicago's Metropolitan Capital Bank & Trust was shuttered by regulators this past weekend. The reason? "Unsafe and unsound conditions" and an "impaired capital position."

Translation: they were broke.

If you think this is an isolated incident, think again. The failure of Metropolitan Capital Bank isn't just a blip — it's a red flag waving from the crumbling foundations of our financial system. And it has direct implications for your deposits, retirement, and financial future.

News, Rumors and Opinions Wednesday 2-4-2026

Gold Telegraph: The Monetary System is Breaking Down

2-4-2026

Gold Telegraph @GoldTelegraph

Not much is being said about this: Illinois regulators shut down Metropolitan Capital Bank and Trust on Friday. A small bank, but with roughly $261 million in assets. The first U.S. bank failure of 2026. Watch the unrealized losses closely…

Ray Dalio: “The monetary system as we know it is breaking down.”

Gold Telegraph: The Monetary System is Breaking Down

2-4-2026

Gold Telegraph @GoldTelegraph

Not much is being said about this: Illinois regulators shut down Metropolitan Capital Bank and Trust on Friday. A small bank, but with roughly $261 million in assets. The first U.S. bank failure of 2026. Watch the unrealized losses closely…

Ray Dalio: “The monetary system as we know it is breaking down.”

I have been documenting this shift for nearly a decade. What’s interesting isn’t the quote… (obvious) It’s how many explosive stories are surfacing as the fabric finally gives way.

Watch on X: https://twitter.com/i/status/2017749495027761570

BREAKING NEWS: XI JINPING CALLS FOR CHINA’S RENMINBI TO ATTAIN GLOBAL RESERVE CURRENCY STATUS

“Latest commentary details ambitions for powerful currency to play a greater role in trade and forex…”

Source: https://www.ft.com/content/c948b978-c22b-44b7-ba3d-4798e641e673

This is going to get very interesting… Gold.

The United States will stockpile $12 billion in critical minerals. The trend only continues to accelerate.

The U.S. government just told the market today that metals are no longer just commodities… they are strategic tools $12 billion stockpile From rare earths to tungsten, the United States is stepping directly into the supply chain. Buyer, financier, and backstop Here we go…

Robert Friedland: Thank you, @realDonaldTrump , for the invitation to the Oval Office today… Mining is a critical industry vital to the re-industrialization of the United States' economy. Today mining as a sector only represents 1% of the S&P500... However, with your leadership and the Project Vault initiative, I am super excited for the future of this incredible industry in America and its future impact for the American economy.

Watch Video Here: https://x.com/i/status/2018474859567706155

Well said, Robert. No mining. No minerals. No technology. No infrastructure. No modern life. The world is waking up to the importance of mining and why it powers our world forward. @robert_ivanhoe

The free cash flow being generated by the majors has turned mining companies into modern-day printing presses. But the real leverage sits upstream, in select junior miners holding the raw substrate of the future. No code. No narratives. Just atoms, energy, and scale… what actually powers the next generation of digital innovation, wealth preservation, and electrification. @robert_ivanhoe

BREAKING NEWS: A US GOVERNMENT-BACKED MINING INVESTMENT FUND HAS AGREED TO BUY A 40 PER CENT STAKE IN GLENCORE’S COPPER AND COBALT PROJECTS

The trend is real.

Source: https://www.ft.com/content/24c089a8-28db-44ea-882d-c8e28ef57d03

It is raining now.

Foreign investors own almost $70 trillion worth of U.S. assets. Not saying this is going to be unwound dramatically overnight, that would be crazy. But the important thing to note: Questions are being asked out loud now, and world leaders are looking to diversify.

BREAKING NEWS: CHINA MAY LOOK TO STOCKPILE MORE COPPER AS PART OF ITS STRATEGIC MINERALS INVENTORY

“The China Nonferrous Metals Industry Association said the Chinese government should expand its strategic reserves of copper…”

Source: https://www.mining.com/chinas-metals-association-calls-for-expanded-copper-stockpile/

Copper… the glue.

On gold, from this past weekend: “We saw it in moments like 1944 and 1971, inflection points I have spent years highlighting… when the rules quietly changed and the consequences unfolded over decades, not days…”

Source(s): https://x.com/GoldTelegraph_/status/2017729590383333521

https://dinarchronicles.com/2026/02/04/gold-telegraph-the-monetary-system-is-breaking-down/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/