FRANK26….1-4-26…..THE ENEMY OF THE MR

KTFA

Sunday Night Video

FRANK26….1-4-26…..THE ENEMY OF THE MR

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Sunday Night Video

FRANK26….1-4-26…..THE ENEMY OF THE MR

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

UBS Shocking Warning, European Bank on the Verge of Collapse

UBS Shocking Warning, European Bank on the Verge of Collapse

Steven Van Metre: 1-4-2025Top of Form

A recent analysis by UBS has sent shockwaves through the financial world, revealing that Deutsche Bank, one of the globe’s largest banks, has a staggering 30% of its portfolio tied to high-risk, unregulated private credit loans.

This is a far cry from the 8% average seen in Europe’s other major banks, and it’s a red flag that can’t be ignored. As we edge closer to a potential global financial crisis, it’s essential to understand the warning signs and take proactive steps to protect and grow your wealth.

UBS Shocking Warning, European Bank on the Verge of Collapse

Steven Van Metre: 1-4-2025Top of Form

A recent analysis by UBS has sent shockwaves through the financial world, revealing that Deutsche Bank, one of the globe’s largest banks, has a staggering 30% of its portfolio tied to high-risk, unregulated private credit loans.

This is a far cry from the 8% average seen in Europe’s other major banks, and it’s a red flag that can’t be ignored. As we edge closer to a potential global financial crisis, it’s essential to understand the warning signs and take proactive steps to protect and grow your wealth.

The situation is dire. A global manufacturing slowdown, unseen since the 2008 financial crisis, is wreaking havoc on key economies, including France, Germany, the UK, Canada, and the US.

As manufacturing demand contracts, companies are left with rising inventories financed by private credit, leading to increasing delinquencies. This, in turn, forces banks to tighten lending standards, creating a vicious cycle of defaults, layoffs, and economic downturn.

Deutsche Bank’s exposure to private credit loans is a ticking time bomb. With over 30% of its portfolio at risk, the bank’s fragility could have far-reaching consequences for the global economy. If Deutsche Bank were to fail, it could trigger a catastrophic collapse of the financial system, echoing the 2008 crisis.

While the impending crisis is unsettling, it also presents opportunities for savvy investors. Diversification is key.

It’s time to rethink your portfolio and shift away from tech and cyclical stocks into more defensive sectors like utilities and healthcare. These industries tend to be more resilient during economic downturns, providing a safer haven for your investments.

For high-risk tolerant investors, tactical short positions in big tech could be profitable as the AI bubble bursts. However, it’s crucial to exercise caution and avoid jumping into gold or silver prematurely.

A more prudent approach would be to hold a significant portion of your portfolio in cash or liquid instruments like short-term treasuries, monitoring interest rate trends as rates are expected to fall amid the credit bust.

To navigate this treacherous landscape, you’ll need a reliable trading system that can capitalize on market moves before machine-driven buying or selling occurs. A well-designed trading system can provide you with daily optimized trade alerts, risk management tools, and market insights to make informed decisions.

The writing is on the wall: a global financial crisis is on the horizon, triggered by the fragility of some of the world’s largest banks, particularly Deutsche Bank.

While the situation is dire, it’s not without opportunities. By diversifying your portfolio, staying informed, and leveraging the right tools, you can weather the storm and come out stronger on the other side.

“Special Announcement” It is time to retire Bondlady's Corner !!!

Iraq Economic News and Points To Ponder Sunday Afternoon 1-4-26

“Special Announcement” It is time to retire Bondlady's Corner !!!

It is with a heavy heart that I announce it is time to retire Bondlady's Corner !!! Over the next several days this site will transition over to a "read only" site, meaning that any further comments or posts will stop. The archived posts will still be here.

Iraq Economic News and Points To Ponder Sunday Afternoon 1-4-26

“Special Announcement” It is time to retire Bondlady's Corner !!!

It is with a heavy heart that I announce it is time to retire Bondlady's Corner !!! Over the next several days this site will transition over to a "read only" site, meaning that any further comments or posts will stop. The archived posts will still be here.

What a ride this has been. We lost our beloved Bondlady on August 25th of 2016. She was the most dedicated person I knew and she was always here for us. I'd like to think that she would be proud that we kept her site running for nearly 10 years now.

None of this would have been possible without ALL of you, her dedicated members !! There have been over 12,000 registered members along the way and over 280,000 posts !!! So many of you have come and gone but some of you remain in my heart.

Too many to mention personally but a few stand out in my memory ...first and foremost BondLady, Miskebam, Shredd, Dogznova, Bubbies and Oggie, Dealerdean, crazydonk64,UNEEK, gaffi, Tobyboy, Mikey and a special thank you to IKEA (thanks Ike for being here). I am sure I have left out so many but please know that you are appreciated !

I have so many wonderful memories and I am sure you will agree. The "chat room" was a blast and I have missed that. I became a member of BLC on January 1st of 2012 and the first time I logged into the chatroom Bondlady said welcome "Timmy", my chat name was tlm724 but she thought it was "tim" and the name stuck ! From that moment on I was called Timmy.

I had the pleasure of helping Bondlady with many things but the most important thing that I did was facilitate the radio interview with Ambassador Paul Bremer. I had the distinct honor of meeting the Ambassador at his home in Vermont and help put together that historic interview. He was gracious and informative and spent several hours with me. I will include a picture of us at his home.

It truly has been my honor and privilege to be a member here at BLC. I still believe in our investment, it sure is taking a long time though

All my best wishes to each and every one of you ... Timmy Tlm724

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 1-4-26

Good Afternoon Dinar Recaps,

Markets Send Mixed Signals as 2026 Opens With Thin Liquidity

Equity optimism masks structural fragility beneath the surface

Good Afternoon Dinar Recaps,

Markets Send Mixed Signals as 2026 Opens With Thin Liquidity

Equity optimism masks structural fragility beneath the surface

Overview

Global equity markets opened 2026 with modest gains

Precious metals and commodities continued to outperform

Liquidity remains thin following year-end positioning

Valuations remain elevated despite macro uncertainty

Risk buffers across markets are increasingly compressed

Key Developments

Major stock indices posted early gains, extending momentum from late 2025

Precious metals advanced simultaneously, signaling hedging demand alongside equity exposure

Trading volumes remain light, amplifying volatility risk

Investors remain positioned for soft-landing scenarios, leaving limited margin for disappointment

Geopolitical and fiscal risks remain underpriced relative to historical cycles

Why It Matters

Markets are not signaling stress through falling prices — they are signaling stress through divergence. When equities rise while metals strengthen and liquidity thins, it suggests confidence is conditional, not secure.

This pattern historically appears during late-cycle and transition periods, where optimism persists until an external catalyst forces repricing across assets.

Why It Matters to Foreign Currency Holders

Thin liquidity magnifies FX volatility

Risk-on positioning can reverse quickly

Capital flows become disorderly during sentiment shifts

Currencies price disappointment faster than equities

For currency holders, divergence across asset classes is a warning that stability is fragile, not durable.

Implications for the Global Reset

Pillar: Asset Divergence Signals Transition Phases

Confidence splits before systems reorganize.Pillar: Liquidity Is the Silent Risk

When buffers vanish, repricing accelerates.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Investing.com – “Stocks make upbeat start to 2026 as metals extend rally”

Reuters – “Global markets open year cautiously amid thin trading”

~~~~~~~~~~

Khamenei Stands Firm as Protests Simmer and U.S. Issues Threats

Currency collapse and external pressure test Iran’s political and monetary resilience

Overview

Iran is facing renewed nationwide unrest driven by inflation and currency collapse

Supreme Leader Ayatollah Ali Khamenei has rejected compromise and called for firm control

The Iranian rial’s sharp decline has intensified public anger

U.S. President Donald Trump has warned of possible action

Iranian authorities are struggling to contain unrest without escalating instability

Key Developments

Protests erupted after the rial plunged, compounding inflation pressures already fueled by sanctions

Rights groups report more than 10 deaths and widespread arrests during demonstrations

Khamenei publicly dismissed engagement with protesters, labeling them “rioters” and calling for firm control

Security forces used tear gas and crowd control measures, particularly in western Iranian cities

President Trump stated the U.S. was “locked and loaded,” escalating external pressure without specifying action

Iranian officials acknowledged economic grievances, even as state media blamed unrest on outside infiltration

Why It Matters

Iran’s unrest represents more than social discontent — it is a monetary legitimacy crisis. The collapse of the rial has exposed the limits of Iran’s economic resilience under sanctions, while leadership rigidity narrows policy options.

When governments respond to currency-driven protests with force rather than reform, confidence erodes faster than inflation statistics suggest. External threats amplify the pressure, raising the risk of escalation both domestically and regionally.

Why It Matters to Foreign Currency Holders

Currency collapse accelerates political instability

Sanctions magnify inflation and settlement risk

State credibility weakens when monetary tools fail

FX volatility rises sharply during legitimacy crises

For currency holders, Iran illustrates how monetary failure precedes political fracture, even when regimes remain formally intact.

Implications for the Global Reset

Pillar: Currency Credibility Equals Political Stability

When money fails, authority is challenged.Pillar: Sanctions Compress Policy Space

External pressure accelerates internal fracture points.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “Khamenei Stands Firm as Protests Simmer and U.S. Issues Threats”

Reuters – “Iran faces renewed protests as currency slide deepens under sanctions pressure”

~~~~~~~~~~

Strategic Metals Beyond Gold Signal Structural Repricing Ahead

Copper and industrial metals reflect real-economy reset pressures

Overview

Industrial metals are strengthening alongside precious metals

Copper demand is rising due to electrification and AI infrastructure

Supply constraints are colliding with long-term structural demand

Metals tied to the real economy are being repriced

Commodity markets are signaling more than speculative interest

Key Developments

Copper prices remain elevated, supported by demand from EVs, renewable energy, and data centers

Supply growth lags demand, due to underinvestment, permitting delays, and geopolitical risk

Mining output constraints persist, limiting near-term production increases

Investors increasingly view copper and strategic metals as infrastructure assets, not cyclical trades

Other industrial metals are showing correlated strength, reinforcing the structural trend

Why It Matters

Unlike gold, which reflects confidence and monetary risk, industrial metals reflect the real economy. Sustained strength in copper and related metals suggests that the global system is repricing physical infrastructure needs, not just financial hedges.

This points to a reset dynamic driven by energy transition, digitization, and supply fragmentation, where physical inputs regain pricing power.

Why It Matters to Foreign Currency Holders

Resource-linked currencies gain relative strength

Import-dependent economies face cost pressure

Trade balances shift with metal access

FX markets price real-economy constraints early

For currency holders, industrial metal trends offer insight into which currencies are structurally supported versus exposed.

Implications for the Global Reset

Pillar: Real Assets Anchor the Next System

Infrastructure demand reshapes monetary relationships.Pillar: Supply Constraints Drive Repricing Cycles

Physical scarcity matters more than financial abundance.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Seeking Alpha – “What’s the Best Metals Play Besides Gold and Silver?”

Reuters – “Copper demand surges as energy transition accelerates”

~~~~~~~~~~

BRICS Gold-Backed Currency Unit Faces Structural Hurdles Ahead of Global Launch

Ambitious de-dollarization plan collides with coordination and credibility limits

Overview

BRICS’ proposed gold-backed Unit faces mounting implementation challenges

Member nations remain divided on structure, purpose, and timing

Technical infrastructure and verification remain unproven

Economic divergence inside BRICS complicates monetary unity

Full rollout before 2030 appears increasingly unlikely

Key Developments

Member disagreement persists

Russia signaled in late 2024 that it was not abandoning the dollar, reversing earlier momentum. India has opposed a shared currency outright, citing trade retaliation risks. China has not publicly committed, despite holding the bloc’s largest gold reserves. Brazil expressed early enthusiasm but offered limited concrete support.Pilot credibility questions remain

A limited BRICS Unit pilot launched in October 2025 with just 100 Units issued. Documentation gaps, incomplete technical specifications, and lack of confirmation from major BRICS central banks have raised concerns over operational readiness.Gold logistics are unresolved

Backing the Unit with more than 6,000 metric tons of gold would require massive secure storage, verification, and auditing systems. Estimated annual maintenance costs approach $1 billion — yet no unified framework has been publicly disclosed.Divergent economic models complicate coordination

BRICS members operate under vastly different systems: China’s capital controls, India’s democratic market structure, Russia’s sanction-constrained economy, Brazil’s currency volatility, and South Africa’s structural unemployment all limit policy alignment.

Why It Matters

The BRICS Unit highlights a critical truth of the global reset: alternative monetary systems are harder to implement than to announce. While dissatisfaction with dollar dominance is real, building a trusted, scalable replacement requires coordination, transparency, and political alignment that BRICS has not yet achieved.

This does not invalidate de-dollarization — but it shows that fragmentation will likely advance through trade settlement, bilateral currency use, and payment rails before any shared reserve instrument emerges.

Why It Matters to Foreign Currency Holders

Announcements ≠ implementation: Markets price execution, not intent

Gold backing requires trust, verification, and access

Fragmented blocs create uneven FX repricing

De-dollarization will be gradual, not sudden

For currency holders, the BRICS Unit is a long-term signal, not a near-term switch.

Implications for the Global Reset

Pillar: De-Dollarization Is Incremental, Not Binary

The dollar weakens through alternatives, not replacements.Pillar: Trust Infrastructure Matters More Than Reserves

Gold alone does not create credibility.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Gold-Backed Currency Unit Faces Challenges Before Global Launch”

Reuters – “BRICS debate common currency as members clash over dollar alternatives”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Sunday 1-4-2026

TNT:

Tishwash: The House of Representatives publishes the agenda for its second session and moves towards voting on its internal regulations.

The media department of the Iraqi parliament published today, Saturday, the agenda for the second session of the sixth electoral cycle, for the first legislative year, first chapter.

The department stated that the session is scheduled to be held next Monday, January 5, 2026, at 10:00 AM, indicating that the agenda is limited to three main items.

TNT:

Tishwash: The House of Representatives publishes the agenda for its second session and moves towards voting on its internal regulations.

The media department of the Iraqi parliament published today, Saturday, the agenda for the second session of the sixth electoral cycle, for the first legislative year, first chapter.

The department stated that the session is scheduled to be held next Monday, January 5, 2026, at 10:00 AM, indicating that the agenda is limited to three main items.

She added that the first paragraph includes voting on the internal regulations of the House of Representatives, while the second paragraph stipulates the formation of a committee that will select members of parliamentary committees in accordance with the provisions of the internal regulations, and the third paragraph is to be dedicated to conducting general discussions.

The Iraqi parliament held its first session of its new term on December 29, during which it voted to elect Hebat al-Halbousi as Speaker of the House, Adnan Faihan as First Deputy Speaker, and Farhad al-Atroushi as Second Deputy Speaker. link

Tishwash: Foreign Ministry: Iraq has taken over all sites of the UN mission "UNAMI".

The Ministry of Foreign Affairs announced on Saturday the handover of all UNAMI sites across the country, in accordance with Security Council Resolution 2732 (2024) mandating the termination of the mission's mandate.

In a statement received by the Video News Agency, the Ministry said, "In line with the government's decision to end the work of the United Nations Assistance Mission for Iraq (UNAMI), and pursuant to Security Council Resolution 2732 (2024)

Mandating the termination of the mission by December 31, 2025, the Undersecretary of the Ministry of Foreign Affairs and Head of the Committee for the Handover of UNAMI Sites throughout the Country, Ambassador Mohammed Hussein Bahr Al-Uloom, and the Deputy Special Representative of the Secretary-General of the United Nations, Claudio Cordone, signed the handover report for the UN Integrated Compound in Baghdad."

She added that "the signing ceremony included a tour of the complex and its facilities, during which Ambassador Bahr Al-Uloom commended the efforts exerted by UNAMI over the past two decades and the level of cooperation and fruitful partnership with Iraq, which has actively contributed to supporting stability and development in various sectors, particularly consolidating democracy and promoting human rights, women's rights, and social justice."

According to the statement, Ambassador Bahr Al-Uloom also recalled "the sacrifices of UNAMI, especially the mission members who lost their lives while performing their duties in 2003, most notably the first head of the mission, the late Sergio Vieira de Mello," expressing "Iraq's gratitude and appreciation to all the Special Representatives of the Secretary-General who have led the mission, up to the current Special Representative, Ambassador Mohammed Al-Hassan."

Both sides affirmed that "the conclusion of UNAMI's work does not represent the end of cooperation between Iraq and the United Nations, but rather the beginning of a new phase of development partnership, led by the UN Country Team, in line with national priorities and building upon the successes achieved." link

************

Tishwash: The Iraqi government allocates "high" capital to the newly revamped Rafidain Bank.

On Saturday, Mazhar Mohammed Saleh, the financial advisor to the outgoing Prime Minister, revealed that the new Rafidain Bank will have highly efficient capital, with the possibility of bringing in an international strategic banking partner.

Mazhar told Shafaq News Agency that "the study prepared by one of the major financial companies specializing in banking and financial reform does not go for the option of privatizing Rafidain Bank before starting its structural reform through institutional specialization."

He explained that "this study proposes redefining Rafidain Bank as the sovereign bank of the government, so that its role is limited to managing government financial operations, primarily managing the unified treasury account, and its operational link with more than a thousand government disbursement and spending units."

Saleh also pointed out that “this sovereign bank is entrusted with an organic link to the center of finance and policy in the financial authority, in order to ensure the organization of state finances through precise coordination between revenues and expenditures, and linking this to the cash budget (the government’s cash flow budget), with the aim of achieving the highest levels of efficiency in financial management, discipline, governance, and transparency.”

The government financial advisor added that "the study proposes the establishment of another bank called (Al-Rafidain - One), which operates as a mixed public-private joint-stock company, and follows the principles of the modern banking market."

“This bank is supposed to have highly efficient capital and operate in accordance with Basel (3) regulations, which will enhance the strength of the banking system and deepen the national banking market,” according to Saleh.

He pointed out that “this bank’s business model is based on high compliance levels and low risks, and its main activity is to grant bank credit to natural and legal persons, in accordance with the latest modern banking practices, while employing advanced financial information technology (FinTech) in a way that achieves digital financial inclusion, and contributes to integrating the national banking market and transforming it into a unified and effective force.”

Saleh concluded by saying that “Rafidain Bank – One undertakes the practice of financing foreign trade, with the possibility of bringing in an international strategic banking partner, which will raise its operational and technical capabilities, and gradually elevate it to the ranks of regional banks with high credit ratings, and make it a real lever for modernizing the Iraqi banking sector and supporting sustainable economic development.”

In 2021, the Iraqi Ministry of Finance approved a package of reform measures related to the restructuring of Al-Rafidain Bank, in accordance with the "White Paper" on economic reform in the country.

At the end of 2024, Ernst & Young, a professional services firm, confirmed that the restructuring of Rafidain Bank had reached 74%. Firas Kilani, an expert on the restructuring project from the British company, said that "the bank's restructuring project has progressed very significantly since it began in September 2024."

At the beginning of 2025, outgoing Iraqi Prime Minister Mohammed Shia al-Sudani announced that the project to restructure Rafidain Bank had reached its final stages.

Rafidain Bank was established under Law No. (33) of 1941 and commenced its operations on 5/19/1941 with a paid-up capital of (50) fifty thousand dinars. The bank currently has (164) branches inside Iraq in addition to (7) branches abroad, namely: Cairo, Beirut, Abu Dhabi, Bahrain, Sana’a, Amman, Jabal Amman.

Despite the Iraqi government's attempts to improve the performance of Rafidain Bank and restructure it, the bank's branch in Abu Dhabi committed financial and administrative violations, in addition to monitoring indicators of mismanagement that prompted the UAE Central Bank to impose "large financial" fines on the branch, amid warnings that these measures may end with the complete closure of the branch, according to informed sources who spoke to Shafaq News Agency at the end of 2025.

The Yemeni Minister of Information, Culture and Tourism, Muammar Al-Iryani, announced at the beginning of October 2025 the closure of the Iraqi state-owned Rafidain Bank branches in Sana'a.

Al-Iryani said in a post on the “X” website that “the decision by the Iraqi Rafidain Bank to close its branch in Sana’a and end its financial and banking activity is a step in the right direction, and a direct result of international efforts aimed at drying up the sources of funding for the Houthi group.”

He pointed out that this measure "reflects a positive response to governmental warnings and American and international pressure, and sends a clear message to the rest of the regional and international financial institutions, about the need to review their activities, and to ensure that they do not fall into the circle of exploitation or employment to serve the agendas of the Iranian regime and its terrorist arms in the region."

Al-Iryani stressed that "the Houthis have turned the financial and banking institutions operating in the areas under their control into tools for plundering the money of Yemenis and financing their cross-border terrorist activities."

Last August, US Congressman Joe Wilson accused the state-owned Rafidain Bank of conducting financial transactions with the Houthi group in Yemen, threatening to cut off US funding to Iraq as a result.

Wilson wrote in a post on the “X-formerly Twitter” platform that “the Iraqi state-owned Rafidain Bank is conducting financial transactions on behalf of the Houthis, a terrorist organization,” adding, “We have a name for these countries: state sponsors of terrorism.”

He added, "I will work to cut off funding to Iraq during the next appropriations bill" in the US budget. Wilson also urged the US Treasury Department to "sanction" Rafidain Bank. link

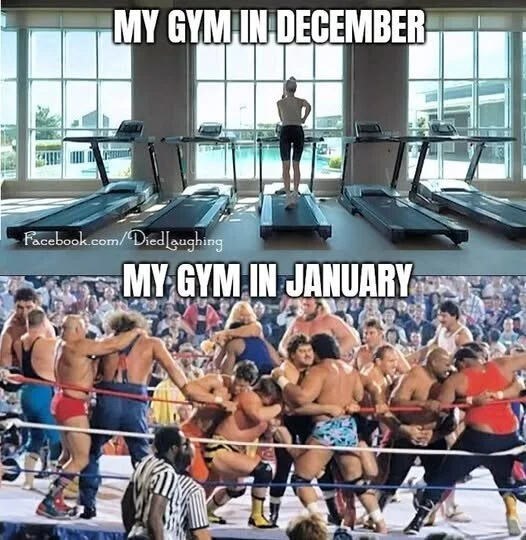

Mot: The New Year Already!- at Me Gym!!!!

Mot: Where to Begin!!!! - siigghhhhhh!!!!

Seeds of Wisdom RV and Economics Updates Sunday Morning 1-4-26

Good Morning Dinar Recaps,

Precious Metals Extend Rally as Confidence in Fiat Systems Frays

Gold and silver strength signals hedging against structural risk

Good Morning Dinar Recaps,

Precious Metals Extend Rally as Confidence in Fiat Systems Frays

Gold and silver strength signals hedging against structural risk

Overview

Gold and silver continue to outperform as 2026 begins

Investor demand reflects rising concern over debt and policy limits

Safe-haven flows persist despite stable equity markets

Metals are increasingly treated as monetary hedges

Confidence divergence is emerging across asset classes

Key Developments

Gold prices remain near record levels, supported by geopolitical tension and debt concerns

Silver prices advanced alongside gold, benefiting from both industrial demand and safe-haven flows

Platinum and other strategic metals showed renewed strength, reflecting broader commodity repricing

Markets continue to price potential rate cuts, but credibility constraints limit central bank flexibility

Investor allocations increasingly favor hard assets over long-duration financial instruments

Why It Matters

Precious metals historically rise during periods when confidence in monetary authorities weakens, not merely during inflation spikes. The persistence of this rally — even as equities remain elevated — suggests markets are hedging structural rather than cyclical risk.

This divergence often appears during transition phases, when the existing system continues functioning but belief in its long-term stability erodes.

Why It Matters to Foreign Currency Holders

Metals signal declining confidence in fiat stability

Rising bullion demand reflects FX hedging behavior

Reserve diversification pressures increase

Currencies without asset backing face repricing risk

For currency holders, sustained metal strength acts as a leading indicator of monetary stress, not a reaction to headlines.

Implications for the Global Reset

Pillar: Confidence Shifts Precede Structural Change

Markets hedge before systems reset.Pillar: Hard Assets Reassert Monetary Relevance

Metals function as trust anchors in uncertain cycles.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The Nation Thailand – “Gold, silver extend gains as markets hedge global risk”

Reuters – “Gold steadies near record highs as investors assess rate outlook and risk”

~~~~~~~~~~

Central Bank Bond Support Shows Limits as Yields Stay Elevated

Policy intervention no longer guarantees market stability

Overview

Central bank bond purchases are failing to calm markets

Government yields remain elevated despite liquidity injections

Investor demand for sovereign debt is weakening

Currency pressure is rising alongside bond stress

Policy credibility constraints are becoming visible

Key Developments

India’s central bank executed record bond-buying operations, injecting liquidity into markets

Despite intervention, long-term yields remained elevated, signaling investor caution

Foreign participation in bond markets stayed limited, reflecting confidence concerns

The domestic currency weakened, highlighting spillover from bond stress into FX markets

Similar dynamics are emerging globally, as debt issuance collides with tighter policy limits

Why It Matters

Bond markets are the load-bearing wall of the financial system. When central bank intervention no longer suppresses yields, it signals a loss of policy control. This does not mean immediate crisis — but it does mean credibility is being tested.

Once markets begin responding more to fiscal math than forward guidance, systemic reset dynamics accelerate.

Why It Matters to Foreign Currency Holders

Rising yields can signal stress, not strength

Debt sustainability concerns weaken currencies

Capital outflows accelerate when intervention fails

FX markets react faster than policymakers

For currency holders, bond instability is often the earliest transmission mechanism of broader reset events.

Implications for the Global Reset

Pillar: Central Banks Are No Longer Omnipotent

Inflation and debt cap rescue capacity.Pillar: Bond Markets Trigger Repricing Cycles

They move slowly — then all at once.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Record central bank intervention buys bonds but offers limited relief”

Bank for International Settlements – Annual Economic Report: Bond Market Stress and Policy Limits

~~~~~~~~~~

China Tightens Control Over Silver Exports, Raising Global Supply Risks

Strategic metals emerge as leverage in trade and monetary realignment

Overview

China has imposed new licensing requirements on silver exports

The move affects a majority of global refined silver supply

Silver is critical for solar, EVs, electronics, and data infrastructure

Western dependence on Chinese metals is exposed

Commodity control is increasingly used as geopolitical leverage

Key Developments

China implemented export approval requirements for silver shipments beginning January 2026

The country controls an estimated 60–70% of global refined silver output, giving Beijing outsized influence

Silver is a key input for clean energy, semiconductors, and defense technologies

Traders reported early price sensitivity and supply uncertainty

The move follows earlier Chinese restrictions on gallium, germanium, and rare earths

Why It Matters

Silver sits at the intersection of energy transition, technology infrastructure, and monetary hedging. By tightening control over exports, China is signaling that critical materials are no longer purely commercial goods — they are strategic assets.

This development reinforces a broader shift away from open commodity markets toward state-managed resource leverage, particularly in industries central to future growth.

Why It Matters to Foreign Currency Holders

Commodity leverage reshapes trade balances

Supply controls increase inflation pressure

Resource-dependent currencies face volatility

Hard assets gain relevance in hedging strategies

For currency holders, metal supply constraints translate into pricing power, trade realignment, and FX repricing.

Implications for the Global Reset

Pillar: Resource Control Equals Financial Influence

Strategic materials now function as economic leverage.Pillar: Trade Fragmentation Accelerates Through Commodities

Export controls reshape settlement and supply chains.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

MarketWatch – “China launches its silver export controls, tightening global supply”

Reuters – “China expands export controls on strategic metals”

~~~~~~~~~~

As Yemen Crisis Escalates, UAE Urges Immediate Restraint

Gulf power rivalry resurfaces as coalition fractures deepen

Overview

Fighting in Yemen has intensified following territorial reversals

Saudi-backed forces retook areas previously held by UAE-backed southern separatists

The rift between Saudi Arabia and the UAE has widened

Southern separatists are pressing forward with independence plans

Yemen’s strategic location heightens regional and global stakes

Key Developments

Saudi-backed forces regained control of key areas in Hadramout province, including reported entry into the capital, Mukalla

The UAE-backed Southern Transitional Council (STC) lost territory captured just weeks earlier

The UAE publicly urged restraint and dialogue, warning against further destabilization

The STC announced plans to hold an independence referendum within two years

Saudi Arabia demanded remaining UAE forces withdraw, and reportedly struck an STC-linked base

Coalition unity against Iran-backed Houthis has visibly fractured

Why It Matters

The escalation in Yemen exposes deep structural fractures among Gulf allies. While Saudi Arabia and the UAE once presented a unified front, competing visions for Yemen’s future now drive open confrontation.

Yemen’s location near the Bab al-Mandeb strait, a critical global shipping corridor, elevates this conflict beyond regional politics. Disruption risks extend to trade flows, energy shipments, and maritime security at a time when global supply chains remain fragile.

Why It Matters to Foreign Currency Holders

Regional conflict raises geopolitical risk premiums

Disruption near key trade corridors threatens settlement stability

Fractured alliances undermine policy predictability

Capital flows react quickly to Middle East escalation

For currency holders, instability near strategic choke points translates into volatility across energy-linked and regional currencies.

Implications for the Global Reset

Pillar: Alliance Fragmentation Accelerates Systemic Stress

Political splits weaken coordinated crisis response.Pillar: Control of Trade Routes Equals Monetary Influence

Maritime security underpins currency confidence.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “As Yemen Crisis Escalates, UAE Urges Immediate Restraint”

Reuters – “Saudi-backed forces retake territory from UAE-backed separatists in Yemen”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Sunday Morning 1-4-26

Iraqis Welcome Their New Year With Hopes For The Formation Of A Government That Meets Their Aspirations.

January 3, 2026 Baghdad – Qusay Munther

Iraqis bid farewell to 2025, a year fraught with challenges, and welcomed the new year with hopes for security and stability, and for the swift formation of a government capable of meeting citizens' needs and fulfilling their aspirations, free from political infighting. Citizens expressed their hopes for the new year, stating, "Our wish is for a government that meets the needs of the people and achieves our ambitions, one that is free from conflict and political maneuvering." They also emphasized the importance of strengthening the rule of law and ensuring development and essential services for all provinces.

Iraqis Welcome Their New Year With Hopes For The Formation Of A Government That Meets Their Aspirations.

January 3, 2026 Baghdad – Qusay Munther

Iraqis bid farewell to 2025, a year fraught with challenges, and welcomed the new year with hopes for security and stability, and for the swift formation of a government capable of meeting citizens' needs and fulfilling their aspirations, free from political infighting. Citizens expressed their hopes for the new year, stating, "Our wish is for a government that meets the needs of the people and achieves our ambitions, one that is free from conflict and political maneuvering." They also emphasized the importance of strengthening the rule of law and ensuring development and essential services for all provinces.

Decent Life

They emphasized the necessity of providing a dignified and secure life for all Iraqis. President Abdul Latif Jamal Rashid expressed his hope that the new year would be filled with national achievements. In a post on the X platform yesterday, Rashid said, "On the occasion of the new year, we extend our sincerest congratulations to our people, wishing everyone greater security, stability, and progress."

He added, "We hope this year will be full of national achievements, continued progress on the path of construction and reform, strengthening the rule of law, and fulfilling the people's aspirations for a dignified and secure life, one characterized by peace and prosperity." For his part, caretaker Prime Minister Mohammed Shia' al-Sudani also congratulated the people on the new year.

In a statement yesterday, Al-Sudani said, “As we welcome a new year, I am pleased to extend my best wishes to all segments of our brotherly nation, that the new year will be a year of continued sincere work for the well-being and progress of our people, praying to God Almighty to protect Iraq and its people, a country as vast as the history of humanity, and a source of civilizations and contributions that have enriched humanity with its knowledge, sciences, and heritage.”

He added, “In the new year, we renew our determination to reaffirm to our people our commitment to serving our people everywhere, continuing our efforts in development, services, and reconstruction, and dedicating ourselves to providing all the aspirations of citizens and the requirements for their dignified lives.”

Consolidating Stability

Speaker of Parliament Haibat al-Halbousi also offered his congratulations on the New Year. In a post on the X platform yesterday, al-Halbousi said, “Our national responsibility compels us to work towards consolidating stability, strengthening confidence in constitutional institutions, and moving forward in a way that serves the Iraqi people and fulfills their hopes and aspirations.

May Iraq grow stronger each year through the unity of its people.” For his part, Deputy Speaker of Parliament Adnan Faihan expressed his hope that the New Year would bring tidings of goodness, progress, and stability.

In a statement yesterday, Faihan affirmed that “this occasion represents a unifying human milestone, transcending borders, geography, nationalities, and sects, and reinforcing the values of coexistence and tolerance among all peoples.

” He pointed out that “Iraq, with its rich civilizational and human history, is steadily moving towards consolidating stability and building a state of institutions,” calling for the New Year to be “an opportunity to strengthen national unity and support the paths of reform and development.”

Values Of Tolerance

Deputy Speaker of Parliament Farhad al-Atroushi also extended his New Year's greetings to the Iraqi people. In a statement yesterday, al-Atroushi said, "This occasion represents an opportunity to strengthen the values of tolerance, peaceful coexistence, and national unity," emphasizing "the importance of continuing efforts and joint cooperation to build a state of institutions and achieve the aspirations of citizens for security, prosperity, and social justice."

Meanwhile, Nouri al-Maliki, head of the State of Law Coalition, wished that the New Year would bring all goodness, peace, and stability.

In a statement yesterday, al-Maliki said, "We hope that peace will prevail in the world, alleviating the pain, fear, and poverty of our citizens, and opening doors of hope for our people, and for our Iraq, greater tranquility and prosperity." He added, "May the Iraqi people and their national forces continue to embrace and support the political, security, and economic processes until a prosperous and well-being-oriented Iraq is achieved." LINK

Iraq Takes Over UNAMI Sites Across The Country

Baratha News Agency1912026-01-03 The Ministry of Foreign Affairs announced on Saturday that it had taken over the sites of the UN mission "UNAMI" throughout the country after the end of its mission.

The ministry stated in a statement that “within the framework of the government’s decision to end the work of the United Nations Assistance Mission for Iraq (UNAMI), and based on Security Council Resolution No. 2732 (2024) stipulating the termination of the mission’s work on 12/31/2025, the Undersecretary of the Ministry of Foreign Affairs and Chairman of the Committee concerned with receiving the sites of the UN mission throughout the country, Mohammed Hussein Bahr Al-Uloom, signed with the Deputy Special Representative of the Secretary-General of the United Nations, Claudio Cordone, the minutes of the handover of the integrated United Nations compound in Baghdad.”

She added that "the signing ceremony included an inspection tour of the complex and its facilities, where Ambassador Bahr Al-Uloom praised the efforts made by the UNAMI mission over the past two decades, and the level of cooperation and fruitful partnership with Iraq, which has contributed effectively to supporting stability and development in various sectors, especially consolidating democracy and promoting human rights, women's rights and social justice."

Ambassador Bahr Al-Uloom recalled the sacrifices of the UNAMI mission, especially the mission members who lost their lives while performing their duties in 2003, most notably the first head of the mission, the late Sergio de Mello, expressing “Iraq’s thanks and appreciation to all the Special Representatives of the Secretary-General who have led the mission, up to the current Special Representative, Mohammed Al-Hassan.”

Both sides affirmed that “the termination of UNAMI’s mission does not represent the end of cooperation between Iraq and the United Nations, but rather constitutes the beginning of a new phase of development partnership, led by the United Nations Country Team in line with national priorities and enhancing the successes achieved.”

https://burathanews.com/arabic/news/469564

Government Advisor: The Complexities Of Oil And Gold Are Having Silent Repercussions On Iraq's Economy.

Time: 2026/01/03 16:16:43 Reading: 60 times {Economic: Al-Furat News} The economic advisor to the Prime Minister, Mazhar Muhammad Saleh, described the relationship between oil and gold as "complex," stressing that its repercussions are often silent but influential on the Iraqi economy.

Saleh told Al-Furat News Agency that “expectations of a decline in gold and silver gains with rising oil prices are not a fixed rule,” noting that “it is only true if the rise in oil prices is due to strong global demand and tight monetary policy, especially on the part of the US Federal Reserve.”

He added that "the picture is different if the rise in oil prices is driven by geopolitical tensions or supply-side shocks, in which case oil and gold could rise together as hedging tools in global markets."

Regarding the impact of these changes on Iraq, Saleh explained that "the direct impact remains limited; however, the indirect impact is significant," indicating that "the rise in oil prices in the absence of a general budget temporarily improves liquidity; but on the other hand, it exacerbates the limitations of spending planning and fuels imported inflationary pressures."

He pointed out that "the weakness of global gold prices may lead to additional pressure on the exchange rate due to its connection with the components of Iraq's foreign reserves, which currently constitute about 29% of total international reserves."

Saleh concluded by saying that "the rise in oil prices, even in the absence of a clear budgetary framework, transforms temporary gains into limited and short-term positive financial effects, regardless of the trends in gold and silver in global markets." LINK

Oil Prices Fluctuated In The First Days Of 2026 Due To Concerns About Oversupply And Political Tensions

Energy Economy News — Follow-up Oil prices fluctuated on the first trading day of 2026, as expectations of a supply surplus offset the impact of geopolitical risks on production in a number of OPEC+ member countries.

Brent crude futures settled below $61 a barrel in a relatively thin trading session, while West Texas Intermediate settled at $57. Middle Eastern markets, including derivatives such as the regional benchmark Dubai crude, stumbled amid heavy selling pressure during a key Asian trading window, according to traders familiar with the matter.

Amid a seasonal decline in consumption, OPEC is inclined to be cautious. Key members of the Saudi-led OPEC+ alliance are scheduled to hold an online meeting on January 4, where they are expected to confirm a decision to halt supply increases during the first quarter.

Selling pressure on oil amid expectations of a supply glut

Oil prices fell in 2025 as OPEC+ and other competitors, such as the United States and Guyana, increased production at a time when demand growth slowed. The International Energy Agency predicted a surplus of about 3.8 million barrels per day during the year.

Amid these expectations, advisors increased their short positions on Brent crude to 91% on Friday, up from 82%, according to data from Bridgeton Research Group, which was acquired by Kpler in December. Short positions on West Texas Intermediate crude stood at 73%. Expectations of a supply surplus act as a buffer against a range of potential supply disruptions.

Political Tensions

One such scenario could unfold in Iran, where US President Donald Trump has hinted that the United States is prepared to assist protesters if authorities intensify their crackdown on unrest, prompting a senior Iranian official to threaten retaliation against US forces in the region. Tehran and other cities have witnessed a wave of demonstrations following the collapse of the local currency to a record low. Iran was the world's ninth-largest producer of crude oil in 2023, according to the International Energy Agency.

Another threat is emerging in Venezuela, where the Trump administration has escalated its campaign against the country's oil exports by imposing a naval blockade and sanctions on companies in Hong Kong and mainland China, as well as on ships accused of circumventing restrictions. These measures are part of an effort to increase pressure on the regime of Nicolás Maduro.

Meanwhile, Russia’s war in Ukraine continues despite peace efforts by Europe and the United States. Moscow and Kyiv exchanged attacks on Black Sea ports during the New Year period, damaging oil infrastructure, including a refinery. The conflict has also affected energy flows from Kazakhstan, another member of the OPEC+ alliance. https://economy-news.net/content.php?id=64119

Precious Metals Enter 2026 On A High Note

Time: 2026/01/02 10:09:32 Reading: 150 times {Economic: Al-Furat News} Precious metals started the new year on a high note on Friday, with gold rising slightly from its lowest level in two weeks, which it reached in the previous session, while other metals recovered some of the losses they incurred during the week.

Gold rose 0.8% in spot trading to $4,346.69 an ounce by 0019 GMT, after hitting a record high of $4,549.71 on December 26. It had fallen to its lowest level in two weeks last Wednesday.

U.S. gold futures for February delivery rose 0.5% to $4,360.60 an ounce.

The precious metal achieved a huge rise during 2025, ending the year with annual gains of 64%, the largest since 1979.

Silver rose 2.1% in spot trading to $72.75 an ounce, after hitting an all-time high of $83.62 last Monday, and ended the year up 147%, significantly outperforming gold, making 2025 its best year ever.

Platinum rose 0.2% in spot trading to $2,057.74 an ounce, after hitting an all-time high of $2,478.50 on Monday, and posting its biggest ever annual gain after climbing 127%.

Palladium rose 2.4% to $1,642.90 an ounce, ending last year up 76%, its best performance in 15 years. LINK

Iraq Ranks Third In The Arab World In Foreign Currency Reserves With $112 Billion

Banks Economy News – Baghdad With the acceleration of economic crises and trade tensions globally, questions arise about financial resilience and a country's ability to withstand the volatility of global markets. One of the safety valves and first lines of defense is the foreign exchange reserves a country holds. World Bank data even measures these reserves by the number of months of import coverage.

Countries’ policies on building or relying on reserves vary to a degree that is related to their exposure to different risks, population size, imports, international relations, and the international standing of their currency.

What If Egypt Paid Off All Its Debts? An unprecedented scenario for a debt-free economy.

In the Arab world, the picture begins in Riyadh, where Saudi Arabia tops the list with a massive reserve of nearly $463 billion. This figure is not merely a financial indicator, but a reflection of a strong oil-based economy and a strategic vision that seeks to diversify income sources through mega-projects within the framework of "Vision 2030."

The UAE occupies second place, amid rapid growth and strong reserve coverage of up to about 7 months with a balanced asset management policy between return and risk.

Iraq pulls off a surprise

In October 2025, reserves reached $256.9 billion (AED 991.6 billion), according to central bank data.

The surprise comes from Baghdad. Despite years of turmoil, the Iraqi central bank has reserves of up to $112 billion, thanks to oil exports which remain the backbone of its economy.

In November 2025, Iraq's foreign currency reserves stood at approximately $112 billion, according to data from the Central Bank of Iraq. These reserves represent one of the highest levels in the region after Saudi Arabia and the UAE, covering more than 15 months of imports and providing Iraq with a significant safety net despite internal political and economic challenges.

Libya ranks fourth in the Arab world with large foreign currency reserves.

From the Gulf to the heart of Africa, despite political divisions, Libya maintains its fourth position in the Arab world with foreign currency reserves approaching $99 billion, covering about four years of imports.

Oil and gas exports define the features of economic power, as Arab countries' finances seize their windfall by increasing reserves and managing liquidity during periods of recession.

Qatar’s central bank’s foreign exchange reserves rose to $71.7 billion last November, covering 11 months of imports.

Egypt's Substantial Reserves Exceeded $50.2 Billion.

In Cairo, the most populous Arab country, foreign currency reserves stand at approximately $50.2 billion, a significant figure for supporting the Egyptian pound amidst import pressures and debt repayments. These reserves are now sufficient to cover more than six months of imports.

The figures at the Central Bank of Egypt improved during a year that witnessed an improvement in most indicators, and a rise in dollar revenues from exports, tourism and remittances from Egyptians abroad to more than $100 billion combined.

Reserves in Morocco and Algeria

Both Morocco and Algeria maintain similar levels of foreign exchange reserves, ranging between $39 billion and $41 billion.

These figures are not just data in central bank reports, but rather indicators of the strength of countries and their ability to withstand fluctuations in oil prices, the challenges of inflation, and to ensure the stability of local currencies.

The world's largest foreign exchange reserves

Globally, China has the largest foreign exchange reserves, exceeding $3.2 trillion, followed by Japan, which exceeds $1 trillion.

Ultimately, whoever holds the reserves holds the initiative, and in a world full of fluctuations, these treasuries are the first line of defense for the stability of Arab economies. https://economy-news.net/content.php?id=64092

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

The ‘Flight From the Dollar’ Is Real – Here’s What Comes Next

The ‘Flight From the Dollar’ Is Real – Here’s What Comes Next | Arthur Laffer & Michelle Makori

1-2-2025

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, is joined by legendary economist Arthur Laffer, founder of Laffer Associates and former economic advisor to Presidents Ronald Reagan and Donald Trump, to examine the accelerating global shift away from the U.S. dollar.

Laffer explains why the “flight from the dollar” has moved from theory into real-world action – as central banks buy more gold than U.S. Treasuries, BRICS nations experiment with gold-anchored settlement systems, and countries build alternative payment rails outside the dollar-centric system.

The ‘Flight From the Dollar’ Is Real – Here’s What Comes Next | Arthur Laffer & Michelle Makori

1-2-2025

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, is joined by legendary economist Arthur Laffer, founder of Laffer Associates and former economic advisor to Presidents Ronald Reagan and Donald Trump, to examine the accelerating global shift away from the U.S. dollar.

Laffer explains why the “flight from the dollar” has moved from theory into real-world action – as central banks buy more gold than U.S. Treasuries, BRICS nations experiment with gold-anchored settlement systems, and countries build alternative payment rails outside the dollar-centric system.

He breaks down why fiat currencies lose credibility, why gold is re-emerging as a neutral reserve asset, and how inflation, Fed policy, and balance-sheet expansion have weakened trust in the dollar.

This focused conversation also explores the growing role of gold, crypto, and stablecoins, whether the U.S. risks losing reserve-currency status, and what must change if the dollar is going to remain credible in a rapidly shifting global monetary order.

In this Quick Cut:

The global “flight from the dollar”

Central banks buying gold over Treasuries

BRICS and gold-anchored settlement experiments

Alternatives to SWIFT and dollar-based payments

Inflation, Fed balance-sheet policy, and credibility

Can the dollar still be stabilized?

Ready for a deep dive? Watch the full episode for the complete conversation on sound money, gold, and the future of the global monetary system:

00:00 The Decline of the US Dollar

00:31 Global Shift Away from the Dollar

02:19 Challenges & Criticisms of US Monetary Policy

04:33 The Role of Interest Rates & Inflation

05:57 Historical Perspectives on Monetary Policy

10:36 The Case for Commodity-Backed Currency

17:35 Gold's Reemergence in the Global Economy

21:30 The Bretton Woods System & Its Legacy

23:24 Conclusion: The Future of the US Dollar

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 1-3-26

Good Afternoon Dinar Recaps,

Venezuela Enters Power Vacuum as Maduro’s Rule Collapses

Leadership uncertainty becomes the new economic risk

Good Afternoon Dinar Recaps,

Venezuela Enters Power Vacuum as Maduro’s Rule Collapses

Leadership uncertainty becomes the new economic risk

Overview

Nicolás Maduro’s removal has triggered a sudden power vacuum

Multiple factions are positioning to claim legitimacy

International recognition now outweighs internal control

Economic recovery hinges on leadership clarity

Sanctions policy is directly tied to succession outcomes

Key Developments

U.S. officials confirmed Maduro was removed from power

Opposition figure Edmundo González remains internationally recognized

María Corina Machado retains broad popular support

Vice President Delcy Rodríguez has emerged as a regime continuity option

Security forces and state institutions remain fragmented

Why It Matters

Venezuela’s crisis has moved beyond protest and repression into a leadership legitimacy collapse. Control of ministries means little without international recognition, especially where sanctions, trade access, and reserves are concerned.

History shows that currency recovery follows legitimacy, not ideology. The next leadership decision will determine whether Venezuela re-enters the global system or remains isolated.

Why It Matters to Foreign Currency Holders

Leadership recognition unlocks settlement access

Sanctions relief drives currency stabilization

Unclear succession prolongs volatility

Political legitimacy precedes monetary reform

For currency holders, who governs matters more than who controls the streets.

Implications for the Global Reset

Pillar: Legitimacy Is the New Reserve Asset

Pillar: Political Transitions Reprice National Currencies

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Who Could Replace Nicolás Maduro as Venezuela’s Leader”

Reuters – “EU says Maduro lacks legitimacy, urges restraint”

~~~~~~~~~~

Trump Signals U.S. Control Pivot Toward Venezuela’s Oil Sector

Energy reconstruction replaces sanctions stalemate

Overview

President Trump signaled deep U.S. involvement in Venezuela’s oil industry

American oil giants are positioned to invest billions

Sanctions enforcement shifts toward managed reintegration

Oil infrastructure collapse becomes a strategic opportunity

Energy access ties directly to post-Maduro governance

Key Developments

Trump stated the U.S. would be “strongly involved” in oil operations

Chevron remains the only active U.S. producer

ExxonMobil and ConocoPhillips retain historical claims

Oilfield service companies await regulatory clarity

Infrastructure decay requires long-term capital commitments

Why It Matters

Venezuela holds the largest proven oil reserves on Earth, yet years of mismanagement turned abundance into scarcity. U.S. involvement signals a shift from pressure to structured reconstruction.

Oil access is not just about energy — it determines currency inflows, reserve rebuilding, and trade normalization.

Why It Matters to Foreign Currency Holders

Oil exports underpin currency recovery

Foreign investment restores balance-of-payments

Energy contracts rebuild sovereign credibility

Commodity-backed inflows stabilize exchange rates

For reset watchers, oil is Venezuela’s monetary reset lever.

Implications for the Global Reset

Pillar: Energy Access Drives Monetary Recovery

Pillar: Reconstruction Replaces Sanctions as Control Tool

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Trump Says US To Be ‘Strongly Involved’ in Venezuela Oil Industry”

Reuters – “Venezuela’s Oil Paradox: Richest Reserves, Crumbling Industry”

~~~~~~~~~~

From Narco-State to Reconstruction: Venezuela’s Strategic Reframe

U.S. intervention recasts collapse as criminal-state failure

Overview

Venezuela is increasingly framed as a criminalized state

Drug trafficking allegations redefine intervention logic

Humanitarian language replaces regime-change framing

Law enforcement rationale reshapes sanctions architecture

Reconstruction narratives gain traction

Key Developments

Maduro was indicted on narcotics-related charges

U.S. military presence increased in the Caribbean

Oil embargo enforcement intensified

European leaders questioned Maduro’s legitimacy

Talks now center on transition and stabilization

Why It Matters

Labeling Venezuela as a narco-state shifts the legal foundation for intervention. Criminal-state framing enables asset seizures, financial restructuring, and supervised recovery without traditional war declarations.

This model mirrors future reset playbooks for failed states with strategic assets.

Why It Matters to Foreign Currency Holders

Criminal designations crush currencies fastest

Asset freezes precede redenomination

Reconstruction phases introduce new monetary systems

Legality determines settlement access

Currency holders should watch legal status changes before exchange-rate announcements.

Implications for the Global Reset

Pillar: Criminal-State Designation Enables Financial Reset

Pillar: Reconstruction Becomes a Monetary Event

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Saturday Morning 1-3-26

Good Morning Dinar Recaps,

U.S. Strikes Venezuela as Trump Claims Maduro Captured

Direct military action escalates regime-change risk and global fallout

Good Morning Dinar Recaps,

U.S. Strikes Venezuela as Trump Claims Maduro Captured

Direct military action escalates regime-change risk and global fallout

Overview

U.S. President Donald Trump announced a large-scale U.S. military strike on Venezuela

Trump claimed Venezuelan President Nicolás Maduro and his wife were captured and removed from the country

Multiple explosions were reported across Caracas, including military and aviation sites

U.S. officials confirmed Maduro has been indicted on narco-terrorism charges

Russia, Iran, and regional actors condemned the operation as armed aggression

Key Developments

U.S. forces reportedly targeted major Venezuelan military installations, including airbases, ports, and command centers

Trump stated the operation was conducted with U.S. law enforcement, with a press conference scheduled to provide details

U.S. Attorney General confirmed Maduro and Cilia Flores were indicted in the Southern District of New York

Flight tracking transponders were disabled, obscuring U.S. military aircraft movements

Russia and Iran called for emergency clarification, warning of escalation and sovereignty violations

Colombia deployed forces to its border, citing regional security concerns

Why It Matters

This marks a dramatic escalation in U.S.–Venezuela relations, shifting from sanctions and pressure to direct kinetic action. The removal of a sitting head of state by force represents a rare and destabilizing precedent in modern geopolitics.

Venezuela sits atop some of the world’s largest oil reserves. Any disruption to governance, energy infrastructure, or regional stability has direct implications for energy markets, sanctions frameworks, and geopolitical alignment.

The operation also raises serious questions about international law, sovereignty, and retaliation risk, particularly given condemnation from major powers.

Why It Matters to Foreign Currency Holders

For foreign currency holders, this event highlights acute reset risks:

Regime removal events trigger immediate FX and capital flow shocks

Sanctions, asset freezes, and payment restrictions escalate rapidly

Energy-linked currencies face heightened volatility

Political legitimacy directly impacts monetary credibility

In reset terms, forceful regime change accelerates currency repricing and settlement fragmentation.

Implications for the Global Reset

Pillar: Geopolitics Now Overrides Monetary Stability

Military action can instantly invalidate financial assumptions.Pillar: Energy and Currency Risk Are Interlinked

Resource control remains central to financial power.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Trump Says Maduro Captured as U.S. Attacks Venezuela: Live Updates”

Reuters – “Russia and Iran condemn U.S. strikes on Venezuela, call for de-escalation”

~~~~~~~~~~

Contenders Emerge to Replace Nicolás Maduro as Venezuela’s Leader

Power vacuum opens amid claims of regime removal

Overview

U.S. President Donald Trump announced that Nicolás Maduro had been captured and removed from Venezuela

The announcement has created an immediate political power vacuum

Opposition figures long sidelined by Caracas are now emerging as potential successors

The situation remains fluid, with competing claims and high uncertainty

Leadership transition carries major implications for sanctions, energy markets, and currency stability

Key Developments

Trump stated the operation was conducted with U.S. law enforcement, asserting Maduro and his wife were flown out of the country

Edmundo González, recognized by the U.S. as the winner of the disputed 2024 election, is viewed as a leading contender

González fled to Spain after an arrest warrant was issued, following the Supreme Court’s validation of Maduro’s re-election

María Corina Machado, head of Vente Venezuela, is widely regarded as the true opposition leader

Machado won the 2023 opposition primary but was barred from running by the Supreme Tribunal of Justice

She has remained in exile after escaping Venezuela and received the 2025 Nobel Peace Prize

Why It Matters

The removal of Maduro — if confirmed — represents a historic rupture in Venezuelan politics. Leadership transitions following external intervention are inherently unstable, particularly in a country facing economic collapse, sanctions, and institutional erosion.

Who governs next will determine whether Venezuela moves toward reintegration with global markets or descends into prolonged instability. Competing claims to legitimacy, fractured institutions, and external influence raise the risk of prolonged uncertainty.

Why It Matters to Foreign Currency Holders

For foreign currency holders, leadership uncertainty in Venezuela highlights critical reset dynamics:

Political legitimacy directly affects sanctions relief and settlement access

Regime change events trigger rapid FX repricing

Energy-linked currencies and regional trade flows face elevated volatility

Confidence, not reserves, drives currency stabilization in transition periods

In reset terms, currency value depends on governance credibility and access to global systems.

Implications for the Global Reset

Pillar: Political Transitions Drive Monetary Repricing

Leadership legitimacy shapes currency access and trust.Pillar: Sanctions Relief Hinges on Governance Outcomes

Reset pathways open or close based on political alignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Contenders to Replace Nicolás Maduro as Venezuela’s Leader”

Reuters – “Venezuela opposition figures re-emerge as power vacuum opens after Maduro removal claims”

~~~~~~~~~~

BRICS Shapes a New Global Economy as Canada Weighs Strategic Alignment

Commodity power and multipolar finance redraw global trade pathways

Overview

The BRICS bloc is reshaping global trade through commodity concentration and alternative financial infrastructure

BRICS members now control roughly 44% of global grain production and nearly half of the world’s population

Canada’s position as a major commodity exporter places it at a strategic crossroads

Multipolar settlement systems are expanding alongside traditional markets

Middle powers are gaining leverage by navigating between economic blocs

Key Developments

BRICS has expanded to ten full members, significantly increasing control over agricultural output and strategic resources

Plans for a BRICS grain exchange aim to establish independent pricing mechanisms, reducing reliance on Western benchmarks

Local-currency settlement frameworks are advancing, offering alternatives to dollar-denominated trade

Canada remains the world’s third-largest wheat exporter, accounting for roughly 15% of global trade

Rising U.S. tariff pressure and trade uncertainty are accelerating diversification discussions in Canada

Why It Matters

The BRICS initiative reflects a structural shift in how trade and pricing power are organized. Rather than replacing the existing system outright, BRICS is building parallel channels that allow commodity exporters and importers to operate with greater flexibility.

For countries like Canada, this moment is pivotal. Access to alternative markets representing a substantial share of global demand offers resilience, especially as traditional trade relationships face rising political and tariff risk.

This is not ideological realignment — it is strategic optionality.

Why It Matters to Foreign Currency Holders

For foreign currency holders, these developments highlight key reset dynamics:

Commodity-backed trade strengthens currency credibility

Settlement optionality reduces single-currency dependency

Bloc-based pricing alters FX demand patterns

Middle-power currencies gain leverage through access, not dominance

In reset terms, currencies tied to real assets and diversified trade routes gain strategic value.

Implications for the Global Reset

Pillar: Commodity Control Shapes Monetary Influence

Pricing power follows production and access.Pillar: Multipolar Settlement Expands Currency Choice

Optionality replaces dependence.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Shapes a New Global Economy as Canada Prepares to Lead”

Reuters – “BRICS expansion boosts commodity influence and local-currency trade”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Saturday Morning 1-3-26

Map Of Arab Monetary Reserves: Iraq Ranks Third With $112 Billion

January 2, 2026 Baghdad/Iraq Observer With the acceleration of economic crises and trade tensions globally, questions arise about financial resilience and a country's ability to withstand the volatility of global markets. One of the safety valves and first lines of defense is the foreign exchange reserves a country holds. World Bank data even measures these reserves by the number of months of import coverage.

Map Of Arab Monetary Reserves: Iraq Ranks Third With $112 Billion

January 2, 2026 Baghdad/Iraq Observer With the acceleration of economic crises and trade tensions globally, questions arise about financial resilience and a country's ability to withstand the volatility of global markets. One of the safety valves and first lines of defense is the foreign exchange reserves a country holds. World Bank data even measures these reserves by the number of months of import coverage.

Countries’ policies on building or relying on reserves vary to a degree that is related to their exposure to different risks, population size, imports, international relations, and the international standing of their currency.

What if Egypt paid off all its debts? An unprecedented scenario for a debt-free economy.

In the Arab world, the picture begins in Riyadh, where Saudi Arabia tops the list with a massive reserve of nearly $463 billion. This figure is not merely a financial indicator, but a reflection of a robust oil-based economy and a strategic vision that seeks to diversify income sources through mega-projects within the framework of "Vision 2030."

The UAE occupies second place, amid rapid growth and strong reserve coverage of up to about 7 months with a balanced asset management policy between return and risk.

Iraq Pulls Off A Surprise

In October 2025, reserves reached $256.9 billion (AED 991.6 billion), according to central bank data.

The surprise comes from Baghdad. Despite years of turmoil, the Iraqi central bank has reserves of up to $112 billion, thanks to oil exports which remain the backbone of its economy.

In November 2025, Iraq's foreign currency reserves stood at approximately $112 billion, according to data from the Central Bank of Iraq. These reserves represent one of the highest levels in the region after Saudi Arabia and the UAE, covering more than 15 months of imports and providing Iraq with a significant safety net despite internal political and economic challenges.

Libya ranks fourth in the Arab world with large foreign currency reserves.