Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 7-9-25

Good Afternoon Dinar Recaps,

No BRICS Currency Planned, Says Group’s Envoy

Despite ongoing de-dollarization efforts, the BRICS alliance has no plans to launch a new joint currency, according to Brazil’s Ambassador to India, Kenneth Felix Haczynski da Nobrega. The statement follows the 17th BRICS Summit in Rio de Janeiro (July 6–7, 2025), where the focus shifted to trade in local currencies rather than creating a shared alternative to the U.S. dollar.

Good Afternoon Dinar Recaps,

No BRICS Currency Planned, Says Group’s Envoy

Despite ongoing de-dollarization efforts, the BRICS alliance has no plans to launch a new joint currency, according to Brazil’s Ambassador to India, Kenneth Felix Haczynski da Nobrega. The statement follows the 17th BRICS Summit in Rio de Janeiro (July 6–7, 2025), where the focus shifted to trade in local currencies rather than creating a shared alternative to the U.S. dollar.

No BRICS Currency — Only Local Settlement Initiatives

“To speak of a BRICS currency… that is something that does not exist,”

— Kenneth da Nobrega, Brazilian Ambassador to India

Contrary to previous speculation, no BRICS-wide digital or fiat currency was discussed at the recent summit. Instead, BRICS members — which now include Brazil, Russia, India, China, South Africa and several newer entrants — are choosing a pragmatic approach: encouraging trade settlements in local currencies.

This move will be conducted on a “voluntary basis”, with the aim of reducing reliance on the U.S. dollar in cross-border trade. Nobrega emphasized this strategy is not a direct attack on the dollar, but rather an expansion of available trade options.

Local Currency Use Gains Momentum

“What we are envisaging is stimulating businesses of BRICS countries to adopt local currencies as an option for conducting trade,” Nobrega explained. “This will be on a voluntary basis... just one more option, not a move against the dollar.”

The statement aligns with earlier remarks from Russia, which reported that 90% of its BRICS trade is already settled in local currencies.

This signals a growing trend across the bloc: de-dollarization by decentralization — empowering nations to transact in their own currencies rather than developing a complex and potentially controversial joint currency.

Why No BRICS Currency Yet?

According to the Ambassador, creating a BRICS currency is simply not feasible at this stage:

A new tender would require a robust legal and financial framework

The proposed currency would need global acceptance and forex credibility

Building such trust would take years of coordinated effort — something the bloc is not prepared to undertake now

For now, the strategic focus is on building mechanisms for local currency usage, which are easier to implement and less politically sensitive.

BRICS Pushes for a Multipolar Financial System — Without a Single Currency

While a joint BRICS currency isn’t on the table, the broader mission remains: reshape the global financial order into a more multipolar and inclusive system.

The Rio summit saw member nations calling for fairer global trade practices

The emphasis was placed on sovereign monetary policies and regional payment infrastructure

Moves like the expansion of the BRICS New Development Bank are reinforcing financial independence

Conclusion: No New Currency — But De-Dollarization Marches On

While some anticipated a BRICS currency rollout to rival the U.S. dollar, the alliance has made clear its current path: voluntary trade in local currencies, not a shared tender.

This shift offers flexibility, respects member sovereignty, and lowers the risk of geopolitical backlash — all while chipping away at dollar dominance through incremental, cooperative de-dollarization.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

If the Fed Cuts, Long-Term Yields are Going to Rise in their Face

If the Fed Cuts, Long-Term Yields are Going to Rise in their Face

Arcadia Economics: 7-9-2025

Amidst escalating geopolitical tensions and a turbulent financial landscape, few voices command the attention of Dr. Jim Willie, famously known as the “Golden Jackass.” With a reputation for prescient, albeit often contrarian, analysis, Willie offers critical insights into the forces shaping both the Middle East and global financial markets.

As financial markets keenly await the Federal Reserve’s next move, particularly heading into July, speculation is rampant regarding a potential rate cut. Conventional wisdom often suggests that central bank rate cuts are intended to stimulate the economy by lowering borrowing costs across the board, including long-term interest rates. However, Willie offers a starkly different outlook.

If the Fed Cuts, Long-Term Yields are Going to Rise in their Face

Arcadia Economics: 7-9-2025

Amidst escalating geopolitical tensions and a turbulent financial landscape, few voices command the attention of Dr. Jim Willie, famously known as the “Golden Jackass.” With a reputation for prescient, albeit often contrarian, analysis, Willie offers critical insights into the forces shaping both the Middle East and global financial markets.

As financial markets keenly await the Federal Reserve’s next move, particularly heading into July, speculation is rampant regarding a potential rate cut. Conventional wisdom often suggests that central bank rate cuts are intended to stimulate the economy by lowering borrowing costs across the board, including long-term interest rates. However, Willie offers a starkly different outlook.

He contends that if the Fed proceeds with a rate cut, long-term US interest rates are not only unlikely to fall but are poised to “rise in their face.” This counter-intuitive prediction directly challenges market expectations and suggests underlying systemic pressures could override the Fed’s intended policy direction.

While the full rationale is explored in his analysis, such a scenario often implies a lack of market confidence in the central bank’s ability to manage the economy, accelerating inflation expectations, or a flight from sovereign debt amidst growing instability.

Beyond the intricate dance of monetary policy, Dr. Willie also lends his considerable insight to the fraught geopolitical situation engulfing the Middle East. With tensions between Iran, Israel, and the United States continuously simmering, Willie dissects the latest dynamics.

He offers a perspective on how these global flashpoints could ripple through the financial system, exacerbating existing vulnerabilities or creating new ones.

His analysis underscores the critical interconnectedness of global politics and financial stability, suggesting that events in one sphere inevitably influence the other. For Dr. Jim Willie, the “Golden Jackass,” these are not isolated concerns but pieces of a complex puzzle that demand a holistic understanding.

Dr. Jim Willie’s unique perspective and bold predictions serve as a crucial counter-narrative to mainstream financial commentary.

For a comprehensive understanding of these complex issues – from the potential fallout of a Fed rate cut on long-term yields to the intricate geopolitical dynamics shaping the Middle East – the full video discussion from Arcadia Economics featuring Dr. Jim Willie is essential viewing.

It promises further insights and information that challenges conventional wisdom and prepares viewers for the potential shifts ahead.

Iraq Economic News and Points To Ponder Wednesday Morning 7-9-25

Government Advisor: 3 Factors That Have Stripped The Parallel Exchange Market Of Its Price Influence And Diversified Our Financial Reserves

2025/07/07 Reads: 840 Times {Economic: Al Furat News} The Prime Minister's Economic Advisor, Mazhar Mohammed Salih,confirmed that the stability of the price structure and the decline in annual inflation rates in Iraq are the result of the success of three integrated economic policies that operated in a coordinated manner within the framework of the state's general economic policy. Saleh said in a statement to {Al Furat News} that:

Government Advisor: 3 Factors That Have Stripped The Parallel Exchange Market Of Its Price Influence And Diversified Our Financial Reserves

2025/07/07 Reads: 840 Times {Economic: Al Furat News} The Prime Minister's Economic Advisor, Mazhar Mohammed Salih,confirmed that the stability of the price structure and the decline in annual inflation rates in Iraq are the result of the success of three integrated economic policies that operated in a coordinated manner within the framework of the state's general economic policy. Saleh said in a statement to {Al Furat News} that:

"Fiscal policy has contributed significantly to supporting prices through the general budget,

whose expenditures constitute more than 13% of the gross domestic product," noting that

"this support has been reflected in the expansion of social safety nets through food baskets, fuel price subsidies, and support for farmers, in addition to the provision of wide-ranging government services."

He added, "Monetary policy, in turn, has achieved tangible success in maintaining the external value of the dinar by controlling domestic liquidity levels through the introduction of electronic payment systems and increasing demand for foreign currency at local banks through their correspondents abroad.

This has contributed to reducing financial transfer times and implementing compliance rules related to money movement risks."

Saleh pointed out that "the third of these policies was price defense through the establishment of a hybrid market network, which provided a wide supply of goods at stable prices and directly impacted the local market by creating price competition that reduced opportunities for speculation.

As a result of these three factors, the effects of the parallel exchange market (the black market) were neutralized, especially with regard to generating inflationary expectations, whose effects have gradually faded."

He stated that "there are commodity stocks available to the state and the private sector, some of which have a shelf life of three to five years, especially with regard to spare parts and durable goods, which enhances market stability in the medium term."

Regarding the increase in gold reserves, Saleh explained that

"this is a successful monetary policy tool for diversifying Iraq's foreign reserves portfolio," noting that

"gold represents a safe haven against fluctuations in global exchange rates and interest rates." ‘

He added that "this diversification, which includes various foreign currencies and monetary gold,

is based on precise international standards to protect the country's assets from value fluctuations between currencies."

Regarding the impact of OPEC+ decisions, Saleh emphasized that

"Iraq is part of the international consensus within the organization regarding oil production levels, and

that the national oil policy enjoys great flexibility that enables it to maintain export levels within Iraq's quota, thus mitigating the impact of the decline in oil prices on public revenues."

He noted in this context that "Triennial Budget Law No. 13 of 2023 includes flexible financial tools to address any emergency gaps through the possibility of resorting to bridge borrowing from the local financial market,

supported by monetary policy that provides sustainable liquidity through open market instruments, in accordance with the provisions of Central Bank of Iraq Law No. 56 of 2004."

The advisor concluded his remarks by emphasizing that "the economic stability Iraq is witnessing today is the result of the integration of fiscal, monetary, and pricing policies into a unified framework

that promotes sustainable development and supports the implementation of the government's program and comprehensive economic reforms." https://alforatnews.iq/news/مستشار-حكومي-3-عوامل-جردت-سوق-الصرف-الموازي-من-تأثيراته-السعرية-وتنوع-احتياطاتنا-المالية

International Financing To Liberalize The Railway Sector

Economic 07/09/2025 Dr. Maytham Adham Al-Zubaidi In a remarkable move aimed at modernizing the transportation sector and boosting economic growth in Iraq, the World Bank has approved $930 million in financing for an ambitious project to expand and modernize Iraq's railway network.

This project falls within the "Development Road," which seeks to transform Iraq into a regional logistics hub linking the Gulf region to Europe via Turkey.

However, the importance of this project goes beyond simply improving infrastructure;

it represents a qualitative leap in

liberating the railway sector from monopoly,

enhancing competitiveness, and

opening the door to vital private sector participation.

The project encourages the establishment of dry ports and logistics centers in cooperation with the private sector, creating a new competitive environment and giving national and foreign companies the opportunity to enter the modern transportation system.

This transformation not only reduces costs, but also improves efficiency and creates competition in terms of quality and service.

Improving rail transport means

opening up markets to producers and consumers,

reducing shipping time and costs, and

enhancing competitiveness as a lever for economic development domestically and regionally.

Shifting a significant portion of road freight to rail will also

break the dominance of certain groups of companies that control the land transport sector,

creating a more equitable and competitive market balance.

The renewed railway line is expected to transport about (6.3) million tons of goods and more than (2.85) million passengers by 2037, which will enhance the connection between the governorates and drive economic activity across the country.

In addition, the project does not neglect the social aspect of job creation and sustainable development.

It is expected to provide more than 3,000 direct jobs during the construction phase,

in addition to approximately 22,000 job opportunities annually by 2040 in the field of operations and support services.

The project also includes specialized training programs for railway sector workers, with special attention paid to the participation of women.

The World Bank's railway modernization project in Iraq, if implemented properly and thoughtfully,

will not merely be a technical financing exercise,

but rather a genuine structural reform aimed at building a more open and diversified economy based on partnership, competition, and transparency.

As Iraq enters a new phase of development after years of challenges, this initiative represents a turning point in building a competitive, sustainable, and equitable infrastructure. https://alsabaah.iq/117161-.html

Shorter Route Linking Turkey To Kuwait Through Iraq Now Operational

Iraq Amr Salem July 8, 2025 303 2 min Container trucks on a road. Photo: IRU

Baghdad (IraqiNews.com) – In a remarkable development, a new roadway corridor connecting Turkey to Kuwait across Iraq is now operating, significantly lowering transit times and increasing commercial effectiveness.

Major Turkish logistics company Hasbayrak International Transport successfully completed the first cargo across this route using the International Road Transport (TIR) transit system, according to the International Road Transport Union (IRU).

Three trucks carrying fresh fruit and vegetables left Turkey and arrived in Kuwait in just four days,

a substantial improvement over the customary 45-day sea route.

TIR-registered trucks crossed into Iraq at the Al Abdali border crossing and completed customs processes at the Sulaybia Dry Port, demonstrating the country’s operational preparedness.

The step also signified the formal resurrection of TIR in Kuwait, in collaboration with Kuwaiti authorities.

Iraq’s Border Ports Commission started applying the

International Road Transport (TIR) transit system in the country in the beginning of April.

As the only worldwide transit system, TIR permits the shipment of commodities in sealed load compartments under customs supervision from a country of origin to a country of destination d through a multilateral and mutually recognized system.

https://www.iraqinews.com/iraq/shorter-route-linking-turkey-to-kuwait-through-iraq-now-operational/

All Iraqi Government Institutions Now Using E-Payment Systems, Says Official

Iraq Jawad Al-Samarraie July 8, 2025 A person in Iraq using a POS machine to make an electronic payment. Photo by: INA Baghdad (IraqiNews.com) – All official government institutions in Iraq are now using electronic systems for payments and revenue collection,

marking a major milestone in the country’s digital transformation strategy, Government Media spokesperson Haider Majeed announced on Tuesday (July 8, 2025). Majeed stated

this nationwide shift, a key priority of the government program, aims to enhance transparency,

simplify procedures for citizens, and combat corruption by reducing reliance on cash transactions.

“This reflects the government’s strategic effort to modernize the financial infrastructure,” he said.

The directive has also been extended to all private sector entities with direct public interaction, including clinics, pharmacies, stores, and fuel stations.

Majeed noted there has been “wide acceptance” of e-payments from citizens, which has encouraged businesses to adopt the new systems.

The move is expected to improve the efficiency of government revenue and tax collection,

reduce financial leakage, and boost financial inclusion by encouraging more citizens to use modern banking services.

The General Secretariat of the Council of Ministers is overseeing the nationwide implementation.

https://www.iraqinews.com/iraq/all-government-institutions-adopt-e-payment-systems-2025/

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Wednesday Morning 7-9-25

Good Morning Dinar Recaps,

5 Countries Where Crypto Is (Surprisingly) Tax-Free in 2025

As governments tighten their grip on digital assets, a handful of nations are charting a radically different course—offering legal, zero-tax treatment for crypto. From offshore havens to EU surprises, here are five countries where cryptocurrency remains tax-free in 2025, making them attractive destinations for investors, traders, and crypto entrepreneurs.

Good Morning Dinar Recaps,

5 Countries Where Crypto Is (Surprisingly) Tax-Free in 2025

As governments tighten their grip on digital assets, a handful of nations are charting a radically different course—offering legal, zero-tax treatment for crypto. From offshore havens to EU surprises, here are five countries where cryptocurrency remains tax-free in 2025, making them attractive destinations for investors, traders, and crypto entrepreneurs.

1. Cayman Islands: No Tax, Full Compliance

Tax Status: No income tax, no capital gains tax, no corporate tax — and yes, that includes crypto.

Who Benefits: Traders, DeFi treasuries, offshore crypto funds.

Regulatory Framework: The updated Virtual Asset (Service Providers) Act is fully operational as of April 2025, providing legal clarity for exchanges, custodians, and platforms.

Why it matters: With a stable, USD-pegged currency, English common-law protections, and a pro-investor business climate, the Cayman Islands remain the world’s most complete crypto tax haven.

2. United Arab Emirates: Tax-Free Across All Emirates

Tax Status: Zero tax on crypto trading, staking, mining, or sales — across all seven emirates.

Regulators:

Dubai’s VARA (Virtual Asset Regulatory Authority)

Dubai Financial Services Authority (DIFC)

Abu Dhabi Global Market (FSRA)

Why it matters: The UAE is more than a tax shelter — it’s a global regulatory hub for crypto innovation. With world-class infrastructure and business-friendly visa regimes, it’s fast becoming the go-to destination for crypto founders and high-net-worth individuals.

3. El Salvador: Bitcoin Legal Tender and Tax-Free

Tax Status: No capital gains or income tax on Bitcoin transactions.

Adoption: Bitcoin is legal tender; widely used with Lightning wallets like Chivo.

Future Plans: Bitcoin City — a zero-tax, geothermal-powered city for crypto miners, investors, and startups.

Why it matters: El Salvador remains a bold global experiment, proving that state-backed crypto adoption and tax exemption can go hand-in-hand — at least for now.

4. Germany: Long-Term Holders Rejoice

Tax Status: Hold crypto for 12+ months and pay zero tax on sales or swaps.

Additional Benefit: Annual short-term gains under €1,000 are also tax-free.

Why it matters: As an EU powerhouse, Germany’s progressive stance is unexpected. It rewards hodlers with tax exemption and allows local EU-based investors to enjoy legal relief without going offshore.

5. Portugal: Europe’s Sun-Soaked Tax Haven

Tax Status: Long-term capital gains on crypto (held over 1 year) are tax-exempt.

NHR Program (before March 31, 2025 cutoff): Offers 20% flat tax on domestic income and exemption for foreign-source crypto income.

Caveats:

Short-term gains (<1 year) taxed at 28%

Staking and professional activity also taxed

Why it matters: Despite tightening rules, Portugal remains one of the few EU nations offering meaningful tax benefits to long-term crypto investors, retirees, and remote workers.

Where Is Crypto Tax-Free in 2025?

These five countries—Cayman Islands, UAE, El Salvador, Germany, and Portugal—are not just regulatory outliers. They are actively shaping the future of global crypto policy by creating pro-growth, pro-innovation tax environments for digital assets.

Zero tax: Cayman, UAE, El Salvador

Long-term exemption: Germany, Portugal

Yet, proceed with caution:

Residency or relocation is often required.

Regulatory frameworks vary.

Tax status can change rapidly based on political or IMF pressures.

“In a tightening global regulatory climate, these five nations offer rare crypto tax relief — but it may not last forever.”

Planning to relocate for crypto tax advantages?

Consult a local tax advisor, monitor regulatory shifts, and ensure legal compliance. Because in 2025, tax freedom in crypto still exists — just not everywhere.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Ripple Picks BNY Mellon to Back RLUSD Stablecoin Amid $500M Surge

Ripple’s U.S. dollar-backed stablecoin, RLUSD, just got a major boost — with Wall Street's oldest bank, BNY Mellon, now serving as the official custodian of its reserves. This move signals growing institutional confidence in Ripple's crypto-fintech strategy and places RLUSD in the center of what some are calling “Stablecoin Summer.”

BNY Mellon Now Custodies RLUSD Reserves

In a landmark development, BNY Mellon — the oldest bank in the United States — will act as primary custodian for RLUSD’s reserves.

“As primary custodian, we are thrilled to support the growth and adoption of RLUSD by facilitating the seamless movement of reserve assets and cash to support conversions,”

— Emily Portney, Global Head of Asset Servicing, BNY Mellon

This partnership marks a major trust upgrade for Ripple’s stablecoin, aligning it with one of the most trusted institutions in global finance.

RLUSD Market Cap Surges Past $500 Million

Launched in December 2024, RLUSD has already crossed the $500 million mark in just seven months — an impressive feat in a fast-evolving market.

RLUSD is fully backed 1:1 by cash and U.S. Treasuries, offering transparency and security.

Built to complement Ripple’s payments network and XRP token, RLUSD is already seeing early adoption in institutional and cross-border use cases.

Ripple Eyes National Banking Charter and Fed Access

Ripple isn’t stopping at a stablecoin. The company has officially:

Applied for a U.S. national banking charter

Requested a Federal Reserve master account

These steps would allow Ripple to hold reserves directly with the Fed, effectively integrating crypto into the traditional banking system. It’s a bold move — and a strong signal that Ripple is serious about long-term regulatory alignment.

AMINA Bank Brings RLUSD to Global Institutions

Adding to RLUSD’s institutional push, Swiss-based AMINA Bank — a licensed, FINMA-regulated institution — has announced:

Custody and trading support for RLUSD

Availability on mobile and desktop platforms

Infrastructure built for institutional-grade reliability

This gives RLUSD global banking credibility and expands its reach into European and international markets.

The Bigger Picture: “Stablecoin Summer” in Full Swing

Ripple’s move comes amid a wave of pro-stablecoin momentum in the U.S.:

The Trump administration is relaxing crypto restrictions

Congress is advancing stablecoin legislation

Tech giants like Amazon, Uber, Apple, Walmart, and Airbnb are exploring stablecoin use cases

This institutional wave is what analysts are calling Stablecoin Summer — and RLUSD is now right in the middle of it.

What’s Next for RLUSD?

With BNY Mellon backing reserves and global custody support from AMINA, Ripple is positioning RLUSD as a top-tier stablecoin contender.

Next milestone? $1 billion market cap may be closer than expected.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Wed. Morning 7-9-2025

TNT:

Tishwash: Demonstrations in Sulaymaniyah protesting the deteriorating living conditions and delayed salaries.

Baghdad Today correspondent reported, on Tuesday evening (July 8, 2025), that popular demonstrations broke out in the cities of Ranya and Qala Diza, affiliated with Sulaymaniyah Governorate, in protest against the deteriorating living conditions and the ongoing salary crisis in the region.

Our correspondent said that dozens of young people from both cities took to the streets in angry demonstrations demanding improvements to their living conditions and the payment of overdue salaries. They asserted that "their patience has run out as the crisis continues without any real solutions."

TNT:

Tishwash: Demonstrations in Sulaymaniyah protesting the deteriorating living conditions and delayed salaries.

Baghdad Today correspondent reported, on Tuesday evening (July 8, 2025), that popular demonstrations broke out in the cities of Ranya and Qala Diza, affiliated with Sulaymaniyah Governorate, in protest against the deteriorating living conditions and the ongoing salary crisis in the region.

Our correspondent said that dozens of young people from both cities took to the streets in angry demonstrations demanding improvements to their living conditions and the payment of overdue salaries. They asserted that "their patience has run out as the crisis continues without any real solutions."

Our correspondent noted that security forces in the area had begun moving toward the demonstration site to contain the situation, with no clashes reported at the time of writing. link

Tishwash: Where are the 2025 budget schedules? Projects are suspended, plans are postponed, and Parliament holds the government accountable.

Despite more than half a year having passed since the start of the fiscal year, the 2025 budget schedules remain absent from the House of Representatives, a scene that rekindles concerns about a financial paralysis that threatens service and development projects in the governorates.

This delay comes despite the country's adoption of the "Tripartite Budget" law, which was supposed to spare Iraq the annual wait for approval of financial allocations and ensure stability in the flow of funds and project planning.

In this context, the Deputy Chairman of the Parliamentary Committee for Regions and Governorates, Jawad Al-Yasari, ruled out on Tuesday (July 8, 2025) the approval of the 2025 budget schedules during the remaining term of Parliament, holding the government responsible for the delay.

"The Iraqi government is responsible for the delay in approving the 2025 budget schedules, as it has not yet sent them to Parliament for review," Al-Yasari told Baghdad Today. "We don't know anything about them yet, and we don't believe the government is serious about sending them, which is why we rule out approving them within the remaining term of Parliament."

He added, "This delay has clear consequences, most notably the disruption of the launch of a large number of projects in the governorates, as well as the obstruction of the completion of existing projects that require financial allocations." He noted that "the government is currently content with paying salaries and outstanding financial obligations, in the absence of schedules and a parliamentary vote on them."

According to observers, the government's continued delay in submitting budget schedules reflects confusion in financial planning and a lack of a clear vision regarding spending priorities. This threatens to widen the gap between the central government and the governorates and weaken the state's ability to fulfill its service and development commitments. It also portends escalating popular discontent in some areas, particularly those that rely on investment allocations for infrastructure development and job creation, at a time when economic and living pressures on citizens are increasing. link

************

Tishwash: The House of Representatives will hold its first session of the second legislative term next Saturday.

Reciting verses from the Holy Quran

Agenda

Session No. (1)

Saturday 12/June/2025

Al-Nawar session

Affairs Department

First: Voting on the proposed law of the Iraqi Programmers Syndicate. Labor and Civil Society Organizations Committee, Legal Committee), (26) articles.

Second: Voting on the draft law of mental health. (Health and Environment Committee), (42) articles.

Third: Voting on the draft law of protection from the harms of tobacco. Health and Environment Committee), (21) articles.

Fourth: First reading of the proposed law of the Union of Private Hospitals in Iraq. Health and Environment Committee), (8) articles

Fifth: Report and discussion of the second reading of the proposed law amending the first amendment to the Law of the National Authority for Nuclear, Radiological, Chemical and Biological Control No. (1) of 2024. (Health and Environment Committee).

Sixth: Report and discussion of the second reading of the proposed law amending the third amendment to the Law on Compensating Those Affected Who Lost Parts of Their Bodies as a Result of the Practices of the Former Regime No. (5) of 2009, as amended. (Martyrs, Victims and Political Prisoners Committee).

Seventh: Report and discussion of the second reading of the draft law on the Republic of Iraq's accession to the Convention Amending the Convention on the Physical Protection of Nuclear Material (Foreign Relations Committee, Health and Environment Committee).

The session begins at one o'clock in the afternoon link

Mot: . Mirror -- Mirror ......... Siiigghhhhhhh

Mot: and then there is ""Opal"" ....

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 7-8-25

Good Afternoon Dinar Recaps,

Lula Defies Trump as U.S. Targets 50+ Nations in BRICS Tariff Threat

A Diplomatic Showdown Over Tariffs and Global Trade

Tensions between Brazilian President Luiz Inácio Lula da Silva and Donald Trump have escalated into a full-blown diplomatic standoff. At the heart of the crisis: Trump’s threat to impose a 10% tariff on countries aligning with BRICS, a coalition increasingly seeking alternatives to U.S. economic dominance.

In a sharp rebuke, Lula directly challenged Trump’s tariff threats, rejecting what he sees as outdated and coercive economic policies.

Good Afternoon Dinar Recaps,

Lula Defies Trump as U.S. Targets 50+ Nations in BRICS Tariff Threat

A Diplomatic Showdown Over Tariffs and Global Trade

Tensions between Brazilian President Luiz Inácio Lula da Silva and Donald Trump have escalated into a full-blown diplomatic standoff. At the heart of the crisis: Trump’s threat to impose a 10% tariff on countries aligning with BRICS, a coalition increasingly seeking alternatives to U.S. economic dominance.

In a sharp rebuke, Lula directly challenged Trump’s tariff threats, rejecting what he sees as outdated and coercive economic policies.

Trump’s Tariff Ultimatum Against BRICS

The controversy erupted following Trump’s warning that any nation aligning with BRICS policies would face an “additional 10% tariff.” His administration is reportedly preparing dozens of trade deals and intends to apply tariffs only if countries are deemed “anti-American.”

Trump stated:

“Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy.”

This statement followed public condemnation by BRICS leaders of recent U.S. military actions and growing dissatisfaction with the global trade order.

Lula: “We Don’t Want an Emperor”

Speaking at the BRICS Summit in Rio de Janeiro, Lula was blunt:

“The world has changed. We don’t want an emperor.”

He elaborated on BRICS' purpose as a counterbalance to Western dominance:

“This is a set of countries that wants to find another way of organizing the world from the economic perspective. I think that’s why the BRICS are making people uncomfortable.”

Lula also called for a gradual shift away from the dollar:

“The world needs to find a way that our trade relations don’t have to pass through the dollar. Our central banks have to discuss it with central banks from other countries. That’s something that happens gradually until it’s consolidated.”

BRICS Pushes Back: Toward De-Dollarization

With 50+ nations now cooperating with BRICS, including 13 partner countries—Algeria, Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Turkey, Uganda, Vietnam, and Uzbekistan—calls for alternative trade systems are growing louder.

Iran’s Supreme Leader Ayatollah Ali Khamenei declared:

“One of our problems today is being dependent on the dollar. BRICS countries must strive to eliminate the dollar in trade as much as possible.”

Other responses:

South African President Cyril Ramaphosa affirmed BRICS does not seek confrontation but wants fair trade.

🇨🇳 Chinese Foreign Ministry spokesperson Mao Ning condemned the tariffs as “tools of coercion” and reaffirmed BRICS’ commitment to “win-win cooperation.”

A Larger Battle Over U.S. Economic Hegemony

What began as a spat between Lula and Trump is fast becoming a global referendum on U.S. trade policy and the dollar’s role in international finance.

More than 40 countries have applied to join BRICS or become partners—driven by:

Discontent with U.S. dollar hegemony

Concerns over weaponized trade policies

Interest in multipolar trade frameworks

The broader implications are clear: this is not just a tariff fight—it’s a challenge to the structure of the global financial order.

Summary:

Trump threatens 10% tariffs on “anti-American” BRICS-aligned nations.

Lula responds: “We don’t want an emperor.”

BRICS members call for de-dollarization and a new economic system.

Over 50 countries now aligned with BRICS’ growing influence.

The conflict signals a shift away from U.S.-centric trade norms toward a multipolar financial world.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

India’s Triumph at BRICS: PM Unites Summit Against Terrorism, Pushes Global Reforms

Modi’s Diplomatic Victory at the 17th BRICS Summit

India emerged as a decisive voice at the 17th BRICS Summit in Brazil, uniting the bloc on a firm stance against terrorism and driving calls for reform of global governance institutions.

🔹 Key Outcomes:

• India led unanimous condemnation of terrorism

• PM Modi condemned the Pahalgam terror attack as an “assault on humanity”

• BRICS declaration demanded action against UN-designated terrorists

Terrorism Takes Center Stage

At the session on Peace and Security, Prime Minister Narendra Modi delivered a powerful message against terrorism, directly addressing the April 22 Pahalgam attack in Jammu and Kashmir, which killed 26 civilians.

“This is not just a regional problem—it is an assault on humanity,” the Prime Minister declared.

The Rio de Janeiro Declaration, adopted at the summit’s close, condemned the attack in “the strongest terms”, and emphasized that there can be no “double standards” in the global fight against terrorism.

Para 34 of the declaration, shaped by India’s diplomacy, called for action against those who “abet, finance, covertly or overtly” support terrorism—an implicit rebuke of Pakistan’s alleged role in cross-border attacks.

PM Modi: “Victims and Supporters Cannot Be Treated the Same”

Modi reaffirmed India’s long-standing demand for sanctions on those aiding terrorism, stating:

“Victims and supporters of terrorism cannot be weighed on the same scale.”

All 11 BRICS members and partners endorsed the statement, marking a rare moment of consensus on this issue.

However, China’s double game drew attention. While Premier Li Qiang joined the condemnation, Beijing’s ongoing resistance to UN sanctions against Pakistan-based terrorists remained a sticking point.

Modi’s pointed remark about nations offering “silent consent” for terrorism was seen as a direct critique of China’s contradictory position.

Reforming Global Institutions: A Call for Inclusivity

Beyond security, India led the charge for reforming global governance bodies such as the UN Security Council, IMF, World Bank, and WTO.

“We must build a multipolar and inclusive world order,” Modi told the summit.

According to officials, Para 6 of the declaration “strongly endorsed” this message, and highlighted the roles of India and Brazil in amplifying the voice of the Global South.

Innovation and Development: BRICS Research Push

India also proposed a BRICS Science and Research Repository to:

Strengthen critical mineral supply chains

Advance responsible AI initiatives

Support sustainable growth across developing economies

PM Modi held bilateral meetings with Malaysia, Cuba, South Africa, and Vietnam, promoting collaboration in digital infrastructure (like UPI) and the integration of Ayurveda into healthcare innovation.

India’s BRICS Leadership in 2026

With India set to assume the BRICS presidency in 2026, this summit further solidified its position as:

A global advocate against terrorism

A champion of institutional reform

A driver of inclusive and sustainable development

While China’s strategic contradictions remain a challenge, the Rio summit marked a clear diplomatic win for India—one that could shape the direction of the bloc for years to come.

Summary:

India secured unanimous condemnation of terrorism at BRICS 17.

The Rio Declaration echoed India’s language on sanctions and double standards.

PM Modi pushed for UNSC and IMF reform, backed by Global South partners.

India proposed a BRICS research initiative focused on AI and supply chains.

As future chair, India’s leadership is seen as a defining force in the bloc’s evolution.

@ Newshounds News™

Source: India Today

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Economist’s “News and Views” 7-8-2025

Trump’s 10% Tariff Just Shook BRICS as U.S. Debt Hits a Breaking Point

Daniela Cambone: 7-8-2025

“Tariffs, gold, and the great unraveling.”

Adrian Day, CEO of Adrian Day Asset Management, joins Daniela Cambone at the Rule Symposium in Boca Raton to unpack the global crosswinds shaking the foundation of U.S. dominance.

From Trump’s new 10% tariff threats against BRICS-aligned nations to Powell’s reluctance to cut rates, Day sees deep contradictions in U.S. policy — and a brewing inflection point for the dollar.

Trump’s 10% Tariff Just Shook BRICS as U.S. Debt Hits a Breaking Point

Daniela Cambone: 7-8-2025

“Tariffs, gold, and the great unraveling.”

Adrian Day, CEO of Adrian Day Asset Management, joins Daniela Cambone at the Rule Symposium in Boca Raton to unpack the global crosswinds shaking the foundation of U.S. dominance.

From Trump’s new 10% tariff threats against BRICS-aligned nations to Powell’s reluctance to cut rates, Day sees deep contradictions in U.S. policy — and a brewing inflection point for the dollar.

He warns of a silent shift away from the dollar as a reserve currency, citing its sharp decline in central bank holdings, and points to record debt servicing costs as the real driver behind coming rate cuts.

Amid shaky CPI data, political brinkmanship, and a confused Fed, Day argues gold remains the ultimate hedge. “The messaging is broken. The math is unsustainable. But the case for gold? Stronger than ever.”

The World Is DITCHING the Dollar - Here's WHY

Lena Petrova: 7-8-2025

Market Sell-Off Ahead? | Todd "Bubba" Horwitz

Liberty and Finance: 7-7-2025

Join Todd "Bubba" Horwitz for a live discussion on the recent downside moves in the stock market and what they could mean for investors.

He’ll break down the factors driving the decline and why the risk of further downside remains on the table.

Iraq Economic News and Points To Ponder Tuesday Morning 7-8-25

Al-Mustaqilla Reveals: 30 Iraqi Banks No Longer Deal In Dollars!

Al-Mustaqilla publishes the full list: Banks banned from receiving dollars by order of the Central Bank.

July 7, 2025 Last updated: July 7, 2025 Al-Mustaqilla/- Al-Mustaqilla today obtained an updated list of licensed private banks in Iraq that have been banned from dealing in dollars by the Central Bank of Iraq.

This decision comes amidst uncertainty and the lack of official confirmation of the precise reasons that prompted the bank to ban these banks from dollar trading.

Al-Mustaqilla Reveals: 30 Iraqi Banks No Longer Deal In Dollars!

Al-Mustaqilla publishes the full list: Banks banned from receiving dollars by order of the Central Bank.

July 7, 2025 Last updated: July 7, 2025 Al-Mustaqilla/- Al-Mustaqilla today obtained an updated list of licensed private banks in Iraq that have been banned from dealing in dollars by the Central Bank of Iraq.

This decision comes amidst uncertainty and the lack of official confirmation of the precise reasons that prompted the bank to ban these banks from dollar trading.

It is speculated that these banks are linked to US sanctions and other financial oversight concerns.

Banks prohibited from dealing in dollars

According to the official website of the Central Bank of Iraq,

the list included the following banks:

Middle East Iraqi Investment Bank

Iraqi investment

Dar Al Salam Investment

Babylon consumption

Sumer Commercial

Mosul Development and Investment

Iraqi Federation

Ashur International Investment

Across Iraq for Investment

Guidance

Erbil Investment and Finance

Hammurabi's Commercial Code

Elaph Islamic

Kurdistan International Islamic Investment and Development

Islamic Cooperation for Investment (under liquidation, prohibited from dealing in dollars)

Islamic Giving for Investment and Finance

Islamic Investment and Finance Advisor

Islamic World Investment and Finance

South Islamic Investment and Finance

Islamic Arabic

Noor Al Iraq Islamic Investment and Finance

Zain Iraq Islamic Investment and Finance

International Islamic

Islamic Finance Holding Company

Al Ansari Islamic Investment and Finance

International Islamic Trust

Al Rajhi Islamic

Islamic Paper for Investment and Finance

Asia Iraq Islamic Investment and Finance

Islamic Spectrum for Investment and Finance

Islamic money for investment

Possible reasons for ban

To date, the Central Bank of Iraq has not issued an official statement detailing the reasons for banning these banks from dealing in dollars.

However, financial sources and banking sector observers point to the possibility of a link between this decision and US or international sanctions on some of these institutions,

in addition to potential violations related to: money launderingsmuggling hard currency illegal transfers

Failure to comply with financial compliance and banking oversight standards

The repercussions of the decision on the Iraqi economy

This ban comes at a time when the Iraqi economy is suffering from several pressures, including the decline in the value of the Iraqi dinar and fluctuating dollar prices in the local market, which could lead to: The complexity of transactions for companies and individuals dealing with these banks.

Increased demand on the black market for dollar exchange, with the accompanying financial risks. Undermining confidence in the local banking system, especially among private banks facing the threat of sanctions.

Calls for more transparency

Economists believe the Central Bank of Iraq should issue a transparent statement explaining the true reasons behind these decisions, along with a clear plan to address the financial issues related to the banks in question.

Some MPs have also called for the formation of a parliamentary investigation committee to monitor the violating banks and ensure the protection of citizens' funds.

in conclusion

All eyes are on the Central Bank of Iraq's next steps regarding banks banned from dealing in dollars.

Will additional sanctions be imposed, or are these merely temporary measures to regulate the market and improve financial oversight? What impact will this have on the stability of the banking system and the Iraqi economy in general?

https://mustaqila.com/المستقلة-تكشف-30-مصرفًا-عراقيًا-خارج-ال/

Inflation In Iraq Has Declined And Its Gold Reserves Have Increased. Expert Explains

Time: 2025/07/07 21:23:08 Read: 825 times {economic: Al-Furat News} Iraq recorded a noticeable decline in the inflation rate in conjunction with the rise in its gold reserves during the first quarter of 2025, in financial and monetary indicators described as positive despite the challenges posed by oil price fluctuations.

Financial expert Salah Nouri explained in a statement to {Al-Furat News} that:

"The decline in the inflation rate is due to a group of factors, most notably the policy of the Central Bank of Iraq in controlling the supply of cash for circulation, in addition to regulating borrowing to finance the private sector at limited rates that contribute to revitalizing the economy without causing a cash surplus".

He added, "The decline in global commodity prices had a direct impact, given Iraq's heavy reliance on imports to meet its needs for goods and merchandise, which was reflected in a reduction in local price levels."

As for the increase in gold reserves, the expert attributed it to the Central Bank's policy of diversifying investment instruments by balancing debt securities in dollars with the purchase of gold, which is a safe store of value.

According to him He stressed that "these policies aim to support and enhance the Central Bank's reserves within its monetary policy orientations."

In the same context, Nouri warned of

"the negative effects of the decline in the prices of exported oil,

which came as a result of OPEC Plus' decisions to increase production,

which may reflect negatively on the state's general revenues and

thus on the implementation of the operational and investment budget items".

He pointed out that "the Federal Ministry of Finance has two options in light of this decline: either reduce spending to maintain the deficit rate specified in the budget, or continue spending and increase the deficit, which will force the government to resort to internal borrowing".

The expert said, "This challenge is directly related to fiscal policy, which requires a careful balance between spending and revenues."

According to an official report issued by the Central Bank of Iraq, the

Iraqi economy witnessed significant shifts in monetary indicators during the first quarter of 2025.

Inflation fell by 21%, while money transfers abroad fell by 0.6%, indicating a relative improvement in the monetary balance and liquidity control.

The report, which covered the months of January, February and March, also showed a significant increase in the value of Iraq's gold reserves, rising from 17.8 trillion dinars to 21.2 trillion dinars, reflecting the Central Bank's reliance on a policy of diversifying assets and enhancing safe havens to protect cash reserves in light of global market fluctuations.

https://alforatnews.iq/news/تراجع-نسبة-التضخم-في-العراق-وارتفاع-احتياطه-من-الذهب-خبير-يوضح

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Tuesday Morning 7-8-25

Good Morning Dinar Recaps,

Ripple CEO Brad Garlinghouse to Testify at Senate Hearing, Urges Clear Crypto Rules

Brad Garlinghouse to Testify Before U.S. Senate on July 9

Ripple CEO Brad Garlinghouse is set to appear before the U.S. Senate Banking Committee on July 9, where he will urge lawmakers to adopt clear, fair, and strong crypto regulations. This will be Garlinghouse’s first testimony before the committee, signaling a pivotal moment in the industry’s ongoing call for legal clarity.

Good Morning Dinar Recaps,

Ripple CEO Brad Garlinghouse to Testify at Senate Hearing, Urges Clear Crypto Rules

Brad Garlinghouse to Testify Before U.S. Senate on July 9

Ripple CEO Brad Garlinghouse is set to appear before the U.S. Senate Banking Committee on July 9, where he will urge lawmakers to adopt clear, fair, and strong crypto regulations. This will be Garlinghouse’s first testimony before the committee, signaling a pivotal moment in the industry’s ongoing call for legal clarity.

Garlinghouse: “Strong but Fair Rules” Are Key

In a recent announcement, Garlinghouse said he is “honored to speak directly to lawmakers” about the urgent need for clear digital asset laws in the U.S. He thanked Senators Tim Scott, Cynthia Lummis, and Ruben Gallego for advancing legislation that supports innovation while protecting consumers.

“We need smart rules that protect people without killing innovation,” he noted.

For years, Ripple and other crypto firms have asked Congress to clarify how digital assets are classified—specifically, which are treated as securities regulated by the SEC, and which are commodities overseen by the CFTC. The current lack of clarity has led to legal disputes, enforcement confusion, and regulatory overlap.

Key Legislation on the Table

The hearing comes at a critical time. Congress is now reviewing three major crypto-related bills:

The CLARITY Act – Aims to define whether digital assets fall under SEC or CFTC jurisdiction.

The GENIUS Act – Addresses stablecoin standards and regulatory oversight.

The Anti-CBDC Surveillance State Act – Seeks to restrict surveillance mechanisms tied to central bank digital currencies (CBDCs).

Among them, the CLARITY Act stands out. Senator Tim Scott has suggested it could be passed as early as October, depending on bipartisan support. If passed, it could significantly reduce regulatory uncertainty for crypto developers, brokers, and exchanges.

Who Else Is Testifying?

Garlinghouse will join a panel of prominent figures in the crypto and policy sectors, including:

Jonathan Levin, CEO of Chainalysis

Summer Mersinger, CEO of the Blockchain Association

A top Harvard legal expert on digital finance

Together, they aim to present a united case for establishing sensible regulatory frameworks that ensure the U.S. remains a leader in blockchain innovation.

“With clear rules, crypto companies can keep building—and investors can feel confident,” one panelist is expected to say.

The Stakes for the Crypto Industry

This hearing marks a turning point. For industry leaders, congressional inaction is no longer an option. As regulatory ambiguity continues to push innovation offshore, executives like Garlinghouse argue that federal clarity is essential for protecting American leadership in the rapidly evolving crypto economy.

With billions of dollars in market value and countless innovation opportunities at stake, July 9 could become a defining moment for U.S. crypto policy.

Summary:

Ripple CEO Brad Garlinghouse to testify before Senate Banking Committee on July 9.

Will push for strong but fair crypto rules to clarify SEC/CFTC roles.

Hearing coincides with review of major legislation: CLARITY, GENIUS, and Anti-CBDC Acts.

Other speakers include top crypto CEOs and academic experts.

Senate could pass landmark regulation by October, reshaping the U.S. crypto landscape.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Applies for National Banking License as Stablecoin Regulation Accelerates

Ripple Targets OCC Charter to Cement RLUSD Oversight

Ripple has filed an application for a national banking license with the Office of the Comptroller of the Currency (OCC), aiming to elevate the regulatory credibility and oversight of its U.S. dollar-backed stablecoin, RLUSD. The filing was submitted on Wednesday, July 2, according to reporting by The Wall Street Journal.

If approved, Ripple would join a growing class of crypto-native firms seeking national trust bank charters, bringing stablecoin issuance more directly under the dual oversight of federal and state regulators.

“The dual nature of that regulation would basically have set a new bar for transparency and compliance in the stablecoin market,” said Jack McDonald, SVP of Stablecoins at Ripple.

Currently, RLUSD already operates under the jurisdiction of the New York Department of Financial Services (NYDFS). A federal trust bank charter would place RLUSD more squarely within the OCC’s regulatory framework, giving Ripple greater operational latitude and legitimacy in the U.S. financial system.

Ripple Subsidiary Also Seeks Fed Master Account

In a parallel development, Standard Custody & Trust Company, a Ripple subsidiary, filed an application for a Federal Reserve master account on Monday, June 30. If granted, this would allow Ripple to:

Custody stablecoin reserves directly with the Fed

Issue and redeem RLUSD outside of standard banking hours

Streamline operational independence from third-party banks

Such a move would enable Ripple to align more closely with emerging federal standards for stablecoin infrastructure, and to offer enhanced stability and liquidity for users and institutions.

Ripple and Circle Signal New Era of Crypto-Fintech Convergence

Ripple’s application follows a similar move by Circle Internet Group, which also filed on June 30 for a national trust charter. If approved, Circle plans to establish the First National Digital Currency Bank, N.A., a federally chartered entity that would manage the USDC reserve and offer digital asset custody services to institutional clients.

“By applying for a national trust charter, Circle is taking proactive steps to further strengthen our USDC infrastructure,” said Jeremy Allaire, Circle Co-founder and CEO.

“We will align with emerging U.S. regulation for the issuance and operation of dollar-denominated payment stablecoins.”

Circle’s strategic move mirrors Ripple’s efforts and reflects growing readiness among leading crypto firms to embrace full-scale federal oversight—once considered a barrier to innovation.

Institutional Custody and Compliance: The Next Crypto Frontier

As digital asset custody continues to draw attention from both traditional institutions and FinTech platforms, companies like Ripple and Circle are positioning themselves to operate as regulated financial infrastructure providers, not just crypto startups.

A recent PYMNTS report highlighted that these applications show crypto firms are preparing to meet the same supervisory and compliance standards as federally chartered banks—a development that may significantly reshape the crypto regulatory landscape in the U.S.

Summary:

Ripple files application for national trust bank license with OCC

Would place RLUSD under dual oversight of OCC and NYDFS

Subsidiary Standard Custody applies for Federal Reserve master account

Circle also seeks national charter to launch a trust bank for USDC

Signals a broader push by crypto firms toward federal integration and institutional-grade compliance

@ Newshounds News™

Source: PYMNTS

~~~~~~~~~

Worldpay Expands Platform Offering Amid Soaring Embedded Finance Demand

Expansion Reaches Canada, UK, and Deepens Presence in Australia

Worldpay has announced the expansion of its Worldpay for Platforms product into Canada and the United Kingdom, while also extending its reach in Australia, in a move designed to meet the growing demand for embedded finance solutions.

The announcement, made on Tuesday, July 8, marks a strategic pivot as software providers increasingly seek to embed secure and scalable payment services directly into their platforms.

“As business software tools converge into unified experiences, we’re investing in embedded payments to help SaaS providers become the everything platforms for their users,” said Matt Downs, head of Worldpay for Platforms.

“We are committed to serving our current software platforms and new clients in the key geographies where they do business by making embedded solutions easier to integrate and elevating the experiences they provide their users.”

Embedded Finance: Driving a Shift in Digital Commerce

According to PYMNTS, embedded finance is accelerating a larger trend that “moves banking, payments and lending into the non-financial realm.” These solutions allow consumers to access Buy Now, Pay Later (BNPL), credit, and other financial services within apps or digital commerce platforms, transforming smartphones and tablets into full-service commercial gateways.

“These ecosystems keep users engaged while improving the cash flow of businesses and their financial partners,” the report notes.

Embedded Lending Sees Massive Adoption

Recent research by Visa and PYMNTS Intelligence illustrates just how rapidly embedded finance is being adopted:

47% of lenders now offer only embedded lending products

31% offer a hybrid model combining embedded and traditional lending

Just 12% of firms offer no embedded options

These figures reflect growing confidence in embedded lending’s ability to expand financial inclusion, increase conversion rates, and tailor financial offerings using real-time data.

Worldpay Eyes Future with Agentic AI Integration

Looking forward, Worldpay is betting big on the next evolution of payments: agentic artificial intelligence (AI). In a recent interview with PYMNTS, Nabil Manji, SVP and Head of FinTech Growth at Worldpay, outlined the company's vision:

“We’re quite bullish on agentic checkout and agentic commerce,” said Manji.

“Payments companies have been using machine learning and AI for years, if not decades. One of the prerequisites for leveraging these tools is a large, rich dataset — and there’s a lot of data in payments and financial services.”

Agentic AI refers to autonomous digital agents capable of planning, reasoning, and executing transactions on behalf of users—ushering in what experts describe as a seismic shift in commerce infrastructure.

Summary:

Worldpay for Platforms expands into Canada, UK, and Australia

Responds to surge in demand for embedded finance and payments integration

Embedded finance enables in-app lending, BNPL, and payments for non-financial businesses

47% of lenders now operate using embedded finance models exclusively

Agentic AI seen as the next frontier in commerce and checkout experiences

@ Newshounds News™

Source: PYMNTS

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 7-8-2025

TNT:

Tishwash: Oil brings distances closer... Baghdad and Kurdistan on the verge of a formal agreement

2025-07-08 13:09

The Parliamentary Oil and Gas Committee announced on Tuesday that Baghdad and Erbil have reached a preliminary agreement to end the Kurdistan Region's employee salary crisis. The committee indicated that the agreement may be announced within the next few hours, followed by an official signing and presentation to the Council of Ministers at its scheduled session on Tuesday.

Committee member Sabah Sobhi said in a statement to the official newspaper, followed by Al-Mutala'a, that: "The preliminary agreement stipulates that the regional government will deliver 300,000 barrels of oil per day to the federal government through the National Oil Marketing Company (SOMO), in exchange for the region receiving 46,000 barrels per day for local consumption and refining."

TNT:

Tishwash: Oil brings distances closer... Baghdad and Kurdistan on the verge of a formal agreement

2025-07-08 13:09

The Parliamentary Oil and Gas Committee announced on Tuesday that Baghdad and Erbil have reached a preliminary agreement to end the Kurdistan Region's employee salary crisis. The committee indicated that the agreement may be announced within the next few hours, followed by an official signing and presentation to the Council of Ministers at its scheduled session on Tuesday.

Committee member Sabah Sobhi said in a statement to the official newspaper, followed by Al-Mutala'a, that: "The preliminary agreement stipulates that the regional government will deliver 300,000 barrels of oil per day to the federal government through the National Oil Marketing Company (SOMO), in exchange for the region receiving 46,000 barrels per day for local consumption and refining."

He added, "It is hoped that the agreement will be announced within the next few hours, to be officially signed and presented to the Council of Ministers at its session scheduled for today."

This comes 48 hours after Parliament Speaker Mahmoud al-Mashhadani visited Erbil, where he met with regional officials to discuss resolving the disputes between Baghdad and the region. Prime Minister Mohammed Shia al-Sudani and President Abdul Latif Jamal Rashid also discussed the issue of funding the salaries of Kurdistan Region employees on Monday. link

Tishwash: Central Bank: Inflation fell by 21% and gold reserves rose by 19% in the first quarter of 2025.

A report by the Central Bank of Iraq revealed that inflation in Iraq fell by 21% in the first quarter of this year, and that remittances abroad declined by 0.6%, while the value of gold reserves increased from 17.8 trillion dinars to 21.2 trillion dinars.

The Central Bank's report stated that these statistics covered the first quarter of this year, specifically the months of January, February, and March.

The report indicated that the overall inflation rate in Iraq fell by 21% in the first quarter of 2025, reaching 2.2%, compared to the last quarter of 2024, when the inflation rate was 2.8%. The

Central Bank's report stated that this decline indicates a decline in the general price level and an improvement in the purchasing power of individuals and institutions in Iraq.

The report stated that the volume of Iraqi currency transfers abroad by the Central Bank decreased by 0.6% in the first quarter of this year, reaching 99.9 trillion dinars.

This comparison is with the fourth quarter of 2024, when the volume of foreign currency transferred abroad at that time was 100.5 trillion dinars.

Money transfers abroad in Iraq are linked to the conversion of Iraqi oil revenues into dollars, which the bank provides to importers at the official exchange rate.

The Central Bank of Iraq indicated in its report that this decline played a role in reducing inflation and maintaining the stability of the general price level in Iraq.

The report stated that the total money supply granted by banks to the private sector in the first quarter of this year grew by 1.1%. link

************

Tishwah: Iraq gold surges, inflation dips as deficit grows: Central Bank

Iraq's economy showed signs of stabilization in the first quarter of 2025, with inflation dropping by 21 percent and gold reserves seeing a significant increase, according to a report from the Central Bank of Iraq (CBI). This comes as the country grapples with a persistent budget deficit despite rising overall revenues.

The CBI report seen by Rudaw, covering January to March 2025, revealed that the average inflation rate fell to 2.2 percent from 2.8 percent in the last quarter of 2024. “This reduction indicates a decrease in the general price level and an improvement in the purchasing power of individuals and institutions in Iraq,” the report said.

The latter is seen as a good sign for the economy as it means that the cost of goods and services is rising at a slower pace, or even decreasing for some items, thus increasing the purchasing power.

The CBI report also noted a slight decrease in the circulation of Iraqi dinars, down 0.6 percent in the same period, reaching 99.9 trillion dinars (about $76.3 billion) from 100.5 trillion dinars (roughly $76.7 billion) in the final quarter of 2024. This decline, linked to better management of USD oil revenues, is seen as a factor in curbing inflation and stabilizing prices.

Further bolstering economic indicators, lending to the private sector rose by 1.1 percent in the first quarter of 2025, with total credit reaching 44.1 trillion dinars (about $33.7 billion). This increase suggests growing support for private sector projects and a potential diversification of the oil-dependent economy.

Significantly, Iraq’s gold reserves Iraq's gold reserves surged by 19 percent in value, reaching 21.2 trillion dinars (approximately $16.2 billion). This dramatic rise is a positive sign for the country's financial stability and its resilience against economic shocks.

However, the positive economic news is tempered by fiscal challenges.

Iraq’s finance ministry on Wednesday reported revenues of 28 trillion dinars (about $21.3 billion) in the first four months of 2025, a 34 percent increase compared to last year. Yet, expenditures also rose, contributing to a deficit of nearly 900 billion dinars (about $690 million) in the first three months of the year, a 12 percent increase compared to the same period last year.

Oil revenues continued to dominate, accounting for 88.9 percent of total state income. The ongoing deficit, despite higher revenues, highlights Iraq's heavy reliance on oil prices and the substantial spending outlined in its $152 billion federal budget for 2023-2025. The budget, passed in June 2023, had raised concerns about financial stability should oil prices fall below the $70 per barrel threshold set in the legislation.

Iraqi Prime Minister Mohammed Shia’ al-Sudani had previously stated that the record-high budget aimed to address social needs, enhance infrastructure, and foster economic progress. link

Mot: ..... Anyone Has an Idea WHAT this might beeeee bout????

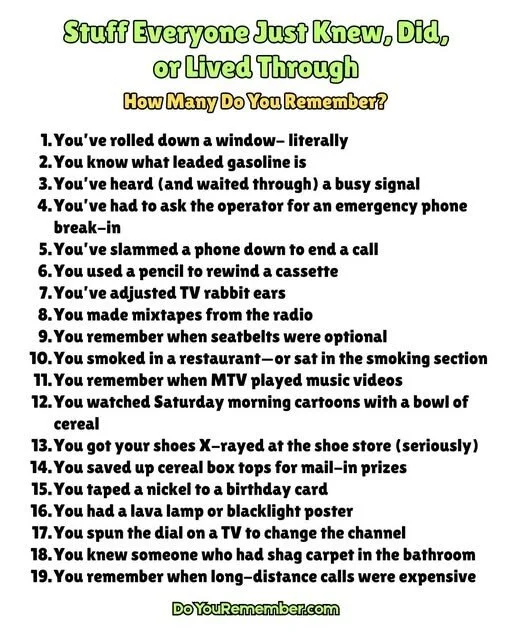

Mot: . Did Ya!!!??? Remember when?

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

Lena Petrova: 7-7-2025

The recent BRICS summit in Rio de Janeiro marks a significant geopolitical realignment, with Southeast Asia increasingly engaging with the expanded BRICS bloc.

Originally comprising Brazil, Russia, India, China, and South Africa, BRICS has grown to include Egypt, Ethiopia, Indonesia, Iran, and the UAE, representing nearly 40% of global GDP by purchasing power—surpassing the G7.

Southeast Asia, led by Indonesia’s full membership and Malaysia, Thailand, and Vietnam’s partner status, is now strategically aligning with BRICS to secure long-term peace and prosperity by leveraging two key initiatives: the New Development Bank (BRICS Bank) and the Contingent Reserve Arrangement (CRA)

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

Lena Petrova: 7-7-2025

The recent BRICS summit in Rio de Janeiro marks a significant geopolitical realignment, with Southeast Asia increasingly engaging with the expanded BRICS bloc.

Originally comprising Brazil, Russia, India, China, and South Africa, BRICS has grown to include Egypt, Ethiopia, Indonesia, Iran, and the UAE, representing nearly 40% of global GDP by purchasing power—surpassing the G7.

Southeast Asia, led by Indonesia’s full membership and Malaysia, Thailand, and Vietnam’s partner status, is now strategically aligning with BRICS to secure long-term peace and prosperity by leveraging two key initiatives: the New Development Bank (BRICS Bank) and the Contingent Reserve Arrangement (CRA)

These financial mechanisms offer alternatives to Western-dominated institutions, supporting infrastructure, green energy, and crisis liquidity, helping emerging economies reduce dependence on China or Western powers.

Beyond economics, BRICS offers Southeast Asian nations a strategic hedge amid intensifying US-China tensions, promoting cooperative multipolarity and enabling countries to avoid binary Cold War-style choices.

This aligns with South-South cooperation, empowering developing nations to gain more influence in global affairs. However, this shift is not without challenges: some Southeast Asian countries remain wary of BRICS due to China’s dominant role, ongoing territorial disputes in the South China Sea, and concerns over ASEAN unity. The US views BRICS skeptically, with previous administrations threatening tariffs and economic sanctions against members cooperating too closely with the bloc.

Full ASEAN membership in BRICS is unlikely in the near term, but individual Southeast Asian states will continue to deepen ties with BRICS to diversify economic partnerships and strengthen sovereignty in an unpredictable global environment.

Ultimately, Southeast Asia’s engagement with BRICS reflects a broader desire for autonomy and multipolar cooperation rather than allegiance to a single global power.

The evolving BRICS bloc is reshaping global geopolitics and economics, with Southeast Asia emerging as a key player in this transformation.

The region’s engagement with BRICS reflects a strategic pursuit of economic diversification, financial resilience, and geopolitical autonomy. By leveraging the New Development Bank and the Contingent Reserve Arrangement, Southeast Asian countries gain alternatives to traditional Western institutions and the ability to better navigate global uncertainties.

However, the path forward is fraught with challenges stemming from territorial disputes, regional unity concerns, and US opposition. Ultimately, Southeast Asia’s cautious but steady move toward BRICS embodies a broader global south ambition: to assert sovereignty, avoid binary power struggles, and foster a more multipolar, cooperative international order.