Iraq Economic News and Points to Ponder Late Saturday Evening 2-28-25

In A Graphical Analysis.. The Months With The Most And Least Impact On The Fluctuations Of The Dollar Against The Dinar Since 2005

Time: 2025/02/28 12:20:11 Read: 2,235 times {Economic: Al Furat News} Economic expert Manar Al-Obaidi stated that the exchange rate of the Iraqi dinar against the US dollar in the parallel market has witnessed noticeable fluctuations over the course of twenty-one years, as a result of being affected by political, legislative and economic factors, with supply and demand dominating as the most influential factors.

Al-Obaidi explained in a statement received by {Euphrates News} a copy of it, after analyzing the exchange rate data from 2005 to 2024, that there is a recurring pattern that reflects the dinar’s value being affected by specific months more than others.

In A Graphical Analysis.. The Months With The Most And Least Impact On The Fluctuations Of The Dollar Against The Dinar Since 2005

Time: 2025/02/28 12:20:11 Read: 2,235 times {Economic: Al Furat News} Economic expert Manar Al-Obaidi stated that the exchange rate of the Iraqi dinar against the US dollar in the parallel market has witnessed noticeable fluctuations over the course of twenty-one years, as a result of being affected by political, legislative and economic factors, with supply and demand dominating as the most influential factors.

Al-Obaidi explained in a statement received by {Euphrates News} a copy of it, after analyzing the exchange rate data from 2005 to 2024, that there is a recurring pattern that reflects the dinar’s value being affected by specific months more than others.

He pointed out that December was the month with the most frequent increase in the value of the dinar, as it witnessed a decline in the exchange rate against the dollar in thirteen years out of twenty-one.

He added, “It is followed by August and June with increases in the value of the dinar against the dollar in eleven years, then April with ten times, while October and November witnessed an increase nine times, and March eight times.”

Al-Obaidi continued, “As for May, it was the month with the least frequent decrease in the value of the dinar, as its value rose during it only four times throughout the period studied, which gives the impression of a relationship between the seasonality of demand and the exchange rate, as the value of the dinar usually rises in the months of February, March and April, then declines again in May with the return of strong demand.”

The economic expert noted that "despite this clear seasonal effect, there are other factors that cannot be ignored, such as the levels of dollar sales by the Central Bank of Iraq, which directly affect the size of the money supply in the market, in addition to the timing of the general budget launch and geopolitical factors that may cause sudden disturbances in the demand for foreign currency."

He pointed out that the seasons of the year remain one of the main elements in determining the exchange rate trends in Iraq, as a recurring pattern appears at the end of the year and the beginning of the fiscal year, in addition to the market being affected by official holidays in countries exporting goods to Iraq.

However, monetary policies and political and economic developments continue to have a direct impact on the parallel market, making it necessary to monitor all these variables to understand exchange rate changes more accurately." LINK

The Central Bank Calls On The Ministry Of Culture To Decide The Fate Of 23 Boxes Filled With Gold And Historical Artifacts

Buratha News Agency107 2025-03-01 The Central Bank of Iraq, on Saturday, invited the Ministry of Culture to provide 23 boxes containing gold and historical artifacts to enhance Iraqi museums.

A statement from the Central Bank stated that, “In light of Baghdad being chosen as the Arab Tourism Capital for 2025 by the Arab Tourism Organization, and in order to provide Iraqi museums with original artifacts to be a tourist destination that attracts tourists from all over the world, the Central Bank of Iraq confirmed the existence of about 23 boxes containing gold and historical artifacts, such as the Nimrud artifacts, which were deposited in the vaults of the Central Bank of Iraq in previous years to preserve them.”

The bank also called on the Ministry of Culture to receive these trusts to enhance the contents of the Iraqi National Museum and other museums. https://burathanews.com/arabic/news/457006

Prime Minister's Advisor: The Central Bank Is Moving Towards Issuing A Digital Currency As A Gradual Alternative To Paper Currency

Saturday 01 March 2025 10:49 | Economic Number of readings: 373 Baghdad / NINA / The financial advisor to the Prime Minister, Mazhar Mohammed Salih, announced today, Saturday: "The Central Bank is moving towards issuing a digital currency, as a gradual alternative to paper currency," explaining the benefits of issuing a digital currency specific to the Central Bank, while indicating that its issuance will represent a qualitative leap in the national payment system and enhance transparency.

Salih said, according to the official agency: "This step will achieve many benefits, including reducing cash leakage, reducing printing costs, and limiting the circulation of paper currency outside the banking system, in addition to reducing the need to print money repeatedly, which reduces the costs associated with its production and distribution, in addition to enhancing transparency and control over financial flows and the ability to track digital liquidity and spending trends, whether consumer, savings, or investment, in addition to improving control over capital and foreign transfers, and supporting efforts to combat money laundering."

He pointed out: "Digital currencies contribute to achieving financial inclusion, especially for the groups least integrated into the banking system, which contributes to enhancing economic and social integration."

He noted that: "The transition to digital currency requires a strong technical infrastructure, including reliable and advanced internet networks, advanced cybersecurity systems to protect data and transactions, as well as promoting a culture of societal acceptance of digital currencies, starting with government agencies, through their use in collection operations and official transactions."

The advisor stressed: "Digital cash will maintain its traditional functions as a unit of account, payments and savings, with the possibility of using it over the internet and smartphones, which contributes to the development of a more stable and efficient financial environment." https://ninanews.com/Website/News/Details?key=1189385

Prime Minister's Advisor: The Central Bank Is Moving Towards Issuing A Digital Currency As A Gradual Alternative To Paper Currency

Saturday 01 March 2025 10:49 | Economic Number of readings: 373 Baghdad / NINA / The financial advisor to the Prime Minister, Mazhar Mohammed Salih, announced today, Saturday: "The Central Bank is moving towards issuing a digital currency, as a gradual alternative to paper currency," explaining the benefits of issuing a digital currency specific to the Central Bank, while indicating that its issuance will represent a qualitative leap in the national payment system and enhance transparency.

Salih said, according to the official agency: "This step will achieve many benefits, including reducing cash leakage, reducing printing costs, and limiting the circulation of paper currency outside the banking system, in addition to reducing the need to print money repeatedly, which reduces the costs associated with its production and distribution, in addition to enhancing transparency and control over financial flows and the ability to track digital liquidity and spending trends, whether consumer, savings, or investment, in addition to improving control over capital and foreign transfers, and supporting efforts to combat money laundering."

He pointed out: "Digital currencies contribute to achieving financial inclusion, especially for the groups least integrated into the banking system, which contributes to enhancing economic and social integration."

He noted that: "The transition to digital currency requires a strong technical infrastructure, including reliable and advanced internet networks, advanced cybersecurity systems to protect data and transactions, as well as promoting a culture of societal acceptance of digital currencies, starting with government agencies, through their use in collection operations and official transactions."

The advisor stressed: "Digital cash will maintain its traditional functions as a unit of account, payments and savings, with the possibility of using it over the internet and smartphones, which contributes to the development of a more stable and efficient financial environment." https://ninanews.com/Website/News/Details?key=1189385

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Sunday Morning 3-02-25

Good Morning Dinar Recaps,

IRAQ’S CENTRAL BANK TO CREATE ITS OWN DIGITAL CURRENCY

Baghdad (IraqiNews.com) – The Governor of the Central Bank of Iraq (CBI), Ali Al-Alaq, revealed on Wednesday that the bank is planning to create a digital currency to replace paper notes in transactions with central banks.

During his speech in the 9th edition of the Iraq Finance Expo, Al-Alaq said that fundamental changes will take place in the banking and financial systems, including the limited use of paper notes as they will be replaced by digital currencies in transactions between central banks.

Good Morning Dinar Recaps,

IRAQ’S CENTRAL BANK TO CREATE ITS OWN DIGITAL CURRENCY

Baghdad (IraqiNews.com) – The Governor of the Central Bank of Iraq (CBI), Ali Al-Alaq, revealed on Wednesday that the bank is planning to create a digital currency to replace paper notes in transactions with central banks.

During his speech in the 9th edition of the Iraq Finance Expo, Al-Alaq said that fundamental changes will take place in the banking and financial systems, including the limited use of paper notes as they will be replaced by digital currencies in transactions between central banks.

Iraq is seriously examining establishing a data center, according to Al-Alaq, and the CBI has started working on this project as part of the digital transformation process.

Al-Alaq also indicated that Iraq’s financial inclusion rate increased to over 40 percent compared to 20 percent three years ago due to the CBI’s promotion of mobile phone-based electronic wallets that enable bill payment and money transfer.

Over 4,000 ATMs have been installed, and there are roughly 17 million bank cards in use, according to Al-Alaq, and there are now 1.2 million electronic wallets in Iraq.

Iraq’s electronic payment system has been connected to global payment networks, allowing Iraqi bank cards to be used abroad and bank cards issued by foreign banks to be accepted locally.

@ Newshounds News™

Source: Iraqi News

~~~~~~~~~

BRICS EXTENDS FRIENDLY TIES WITH EUROPE AS US TARIFFS HIT

Europe is extending friendly ties with the BRICS alliance as Trump’s tariffs hit the market in February. Several European leaders have expressed displeasure at Trump’s decision to impose tariffs on close Western allies. BRICS member China is making use of the escalating tensions between the US and Europe and extending cordial relations.

Some countries in Europe are reconsidering their relations with BRICS member China, while others are aiming to diversify their partnerships with Japan and South Korea. Many other European nations are reaching out to India to procure goods. The widening rift between the US and Europe stems out of tariffs and its stance in the Ukraine war.

US Tariffs: Will Europe Get Friendly With BRICS?

However, the European Union faces a mixed approach with BRICS member China as some advocate for partnerships while others take a cautious stance. However, China is making use of the situation and pushing cordial ties with Europe as US tariffs hit the market.

“Europe must take its own decisions, on its own. And we have to decide when China can be a partner and when China is a competitor,” said Spain’s Foreign Minister Jose Manuel Albares. Germany’s chancellor-in-waiting Friedrich Merz said that Trump “does not care much about the fate of Europe”. This gives BRICS a chance to build bridges with Europe as the US is looking to burn it.

“My absolute priority will be to strengthen Europe as quickly as possible so that, step by step, we can really achieve independence from the USA,” said Merz. If Europe extends ties with BRICS countries, the US will remain isolated, and other countries scheme for its downfall.

While Europe is grappling with a realignment, maintaining cordial relations with BRICS member China is not a friendly option. The Communist country aims to dominate the global financial sector and keep the West in the backseat. The US needs to maintain its relations with Europe and not let things fall apart.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

HUGE CHANGE TO IRAQI DINAR JUST ANNOUNCED

The Central Bank of Iraq just announced it will create its own digital currency.

@ Newshounds News™

Source: The Economic Ninja

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Sunday Morning 3-2-2025

TNT:

Tishwash: Iraq's gold reserves rise to more than 17 trillion dinars

The Central Bank of Iraq announced, on Sunday, that it recorded a growth in its gold reserves by 45.1% in the fourth quarter of 2024 compared to the same quarter of the previous year.

The bank stated in a statement today that its gold reserves "increased from 12.29 trillion dinars in the fourth quarter of 2023 to 17.83 trillion dinars for the same quarter in 2024 as a result of the increase in the quantity of gold and gold prices.

The statement added, "This has many benefits, as it enhances economic and financial stability, protects against risks, and is considered an important tool for intervening in the foreign exchange market."

TNT:

Tishwash: Iraq's gold reserves rise to more than 17 trillion dinars

The Central Bank of Iraq announced, on Sunday, that it recorded a growth in its gold reserves by 45.1% in the fourth quarter of 2024 compared to the same quarter of the previous year.

The bank stated in a statement today that its gold reserves "increased from 12.29 trillion dinars in the fourth quarter of 2023 to 17.83 trillion dinars for the same quarter in 2024 as a result of the increase in the quantity of gold and gold prices.

The statement added, "This has many benefits, as it enhances economic and financial stability, protects against risks, and is considered an important tool for intervening in the foreign exchange market." link

Tishwash: The Federal Finance will begin funding February salaries for the region’s employees within two days

An informed source revealed, today, Sunday (March 2, 2025), that the Federal Ministry of Finance will begin financing the salaries of Kurdistan Region employees within the next two days.

The source told Baghdad Today, "The lists sent by the regional government have been audited, and the financing of employees' salaries in Kurdistan will begin within the next two days, after all the problems."

He added, "The Federal Ministry of Finance will send 950 billion dinars to finance February salaries, after which the regional government will announce a schedule for disbursing salaries."

Yesterday, Saturday (March 1, 2025), a responsible Kurdish source stated that the Ministry of Finance will send February salaries to the region’s employees in the middle of next week, confirming that there is a problem with the agreement between the region and the center.

It seems that the source expressed his fear to "Baghdad Today", saying, "The regional government did not abide by the terms of the agreement with Baghdad, and this may cause problems with salaries."

Meanwhile, the member of the Kurdistan Justice Party, Ribwar Muhammad Amin, confirmed earlier that the federal banks had expressed their readiness to localize the salaries of Kurdistan employees, presenting the argument to the regional government. link

************

Tishwash: Sudanese Advisor: Digital currency is a qualitative leap that improves oversight and supports combating money laundering

The financial advisor to the Prime Minister, Mazhar Mohammed Salih, praised, on Saturday, the Central Bank of Iraq’s move towards issuing a digital currency, considering it a qualitative leap that enhances transparency and control over financial flows, improves oversight of capital and foreign transfers, and supports efforts to combat money laundering.

Saleh said in a statement reported by the official news agency, and seen by "Al-Eqtisad News", that "the Central Bank is moving towards issuing a digital currency as a gradual alternative to paper currency," indicating that "this trend represents a qualitative leap in the national digital payments system."

He added, "This step will achieve many benefits, including reducing cash leakage, lowering printing costs, and limiting the circulation of paper currency outside the banking system, in addition to reducing the need to print money repeatedly, which reduces the costs associated with its production and distribution, in addition to enhancing transparency and control over financial flows and the ability to track digital liquidity and spending trends, whether consumption, savings or investment, in addition to improving control over capital and foreign transfers, and supporting efforts to combat money laundering."

He pointed out that "digital currencies contribute to achieving financial inclusion, especially for groups less integrated into the banking system, which contributes to enhancing economic and social integration."

He stressed that "the transition to digital currency requires a strong technical infrastructure that includes reliable and advanced internet networks and advanced cybersecurity systems to protect data and transactions, in addition to promoting a culture of societal acceptance of digital currencies, starting with government agencies, through their use in collection operations and official transactions."

He explained that "digital cash will maintain its traditional functions as a unit of account, payments and savings, with the possibility of using it online and on smartphones, which will contribute to developing a more stable and efficient financial environment." link

Mot: . Whoosh!

Mot: Lets Hope So!!!! -- HUH!!!!

Iraq Economic News and Points to Ponder Saturday Afternoon 2-28-25

An Analysis Explains In Detail The Reasons For The Fluctuations Of The Iraqi Dinar Exchange Rate Against The Dollar In 21 Years

Economy Iraq Breaking Dollar Fluctuations Dinar prices 2025-02-28 01:04 Shafaq News/ The "Iraq Future" Foundation for Economic Studies and Consultations attributed, on Friday, the reasons for the fluctuations of the dinar exchange rate against the US dollar in the parallel market over more than two decades in the country to internal and external factors.

This came according to an analysis issued by the Foundation in which these fluctuations explained from 2005 until 2024.

An Analysis Explains In Detail The Reasons For The Fluctuations Of The Iraqi Dinar Exchange Rate Against The Dollar In 21 Years

Economy Iraq Breaking Dollar Fluctuations Dinar prices 2025-02-28 01:04 Shafaq News/ The "Iraq Future" Foundation for Economic Studies and Consultations attributed, on Friday, the reasons for the fluctuations of the dinar exchange rate against the US dollar in the parallel market over more than two decades in the country to internal and external factors.

This came according to an analysis issued by the Foundation in which these fluctuations explained from 2005 until 2024.

In its analysis, the Foundation stated that

"the Iraqi dinar exchange rate against the US dollar in the parallel market witnessed noticeable fluctuations over the past 21 years, as it was affected by a group of factors that ranged between

politics,

legislative and

economic."

However, the analysis added that "the supply and demand were the most influential, as the

patterns of changing the exchange rate differed according to the months of the year as a result of internal and external factors, such as the

timing of the public budget launch and

official holidays in major countries exporting goods to Iraq, such as China and Iran."

He pointed out that "by analyzing the exchange rate data in the parallel market from 2005 to the year 2024, it appears almost a repeated format that reflects the impact of the value of the dinar in more months than others." According to the Foundation,

"The month of December was the most frequent in the high value of the dinar, as it witnessed a decline in 13 years out of 21 years, followed by: August and June, with heights in the value of the dinar against the dollar in 11 years, then April 10 times, while the month of October and November had witnessed an increase in 9 times, and March 8 times."

The month of May was the least repeated in the decline in the value of the dinar, as

its value increased only 4 times throughout the studied period, which gives almost the impression that the dinar prices against the dollar rise in February, Azar and Nissan, then the decrease against the dollar in May as a result of the return of the demand strongly in May.

In its analysis, the Foundation warned that

"despite this clear seasonal effect on the exchange rate,

there are other factors that cannot be ignored, such as the levels of the dollar selling by the Central Bank of Iraq that directly affect the size of the cash supply in the market, as well as

political and financial factors such as the timing of the public budget funds, as well as the

geopolitical conditions that may cause sudden disturbances in the demand for foreign currency." The analysis concluded that "the effect of the

seasons of the year remains one of the main elements in determining the trends of the exchange rate in Iraq, where

a frequent pattern appears at the end of the year and the beginning of the fiscal year, in addition to its influence on the official holidays in the countries exporting goods to Iraq,

but other factors, such as

monetary policies and

political and economic developments,

remain a direct impact on the parallel market, which makes it necessary to monitor all these variables to understand the exchange rate changes with more accurately."

https://www.shafaq.com/ar/اقتصـاد/تحليل-يشرح-سباب-تقلبات-سعر-صرف-الدينار-العراقي-مام-الدولار-خلال-21-عاما

Al-Alaq: Iraq Has Become One Of The Best Countries In The World In Controlling The Sale Of The Dollar

Banks Economy News – Baghdad The Governor of the Central Bank, Ali Al-Alaq, confirmed on Saturday that Iraq has become one of the best countries in the world in controlling the sale of the dollar.

Al-Alaq said in a statement reported by the official news agency, and reviewed by "Al-Eqtisad News", that "Iraq has today become one of the best countries in the world in controlling the sale of the dollar, as this process is carried out with transparency and accuracy, and through it the citizen verifies his documents and his departure from the country," explaining that "this mechanism is the most disciplined, transparent and controlled in the world, as indicated by international experts."

Al-Alaq noted that "false news and media distortion may harm the interests of Iraq and the banking sector," stressing the importance of being proud of the major developments that Iraq is witnessing.

He pointed out that "the government and the Central Bank are working hard to establish sound practices that are compatible with international standards," calling for "the need to highlight these achievements in the media."

He pointed out that "highlighting these transformations and developments helps enhance international confidence in the Iraqi banking sector, which is vital to the continued development of the financial system in Iraq." https://economy-news.net/content.php?id=53062

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 3-01-25

Good afternoon Dinar Recaps,

RUSSIA WANTS TO REVERSE DE-DOLLARIZATION: WHAT IT MEANS FOR THE US DOLLAR?

The US dollar has always been surrounded by serious foes and enemies, the ones that want to derail its reserve currency status.

To expedite the de-dollarization concept, Russia and China have always been quite vocal about their ideas, adding how they both want to derail the US dollar hegemony by putting forth the idea of the multi-polar currency world.

Good afternoon Dinar Recaps,

RUSSIA WANTS TO REVERSE DE-DOLLARIZATION: WHAT IT MEANS FOR THE US DOLLAR?

The US dollar has always been surrounded by serious foes and enemies, the ones that want to derail its reserve currency status.

To expedite the de-dollarization concept, Russia and China have always been quite vocal about their ideas, adding how they both want to derail the US dollar hegemony by putting forth the idea of the multi-polar currency world.

This roughly sparked the promotion of local currencies on an international scale, jeopardizing the dollar’s supremacy. With the US and EU sanctioning Russia and expelling it out of the SWIFT system, Russia opted for yuan, all while promoting the narrative of de-dollarization at a rapid pace.

But now it seems that things have started to take an interesting turn, with Russia showing a softening stance against the US. What is this all about? Let’s find out.

Tables Turning Around: Trump Supporting Russia

With Donald Trump assuming the role of the US president, his ideas of bolstering the US economy via tariffs have been gaining widespread momentum. Apart from that, another significant development that has caught the world’s attention is Trump’s increased effort to conclude the ongoing Ukraine-Russia war.

The US president has often been noted stating the gruesome repercussions of the ongoing Russia-Ukraine war, adding that Zelensky should have made a deal to end the war earlier, showing a supportive stance towards Russia.

“I hear that they’re upset about not having a seat. Well, they’ve had a seat for three years and a long time before that. This could have been settled very easily… Russia wants to do something. They want to stop the savage barbarism.”

"You should have never started it. You could have made a deal…I could have made a deal for Ukraine… That would have given them almost all of the land, everything. Almost all of the land—and no people would have been killed, and no city would have been demolished.”

Trump earlier shared how he has the power to end the war.

“I think I have the power to end this war,” he added.

De-Dollarization To End: Russia Praises Trump

On the other hand, Russian PM Vladimir Putin has notably praised Trump’s effort to resolve the ongoing Russia-Ukraine war.

“Let me note that the first contacts with the American administration instill hope. They too are willing to work towards resuming our ties, solving a colossal amount of strategic problems in world architecture.”

In addition to this, Putin also acknowledged how certain external forces are trying to disrupt the budding Russian-US sense of friendship and commitment.

“I understand that not everybody is pleased with the resumption of Russian-American contacts. Some of the forces are interested in keeping hostilities, and they will try to disrupt the emerging dialogue. We will need to use all the possibilities of diplomacy and special forces to firmly defend our national interests.”

With such developments taking place, the Russia-US fostering relationship could ultimately result in a lasting resolution thwarting BRICS efforts of derailing the US dollar. This development can ultimately put a stop to the rising de-dollarization concepts and ideations.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

RUSSIA DELAYS DIGITAL RUBLE CBDC ROLLOUT

A year ago, the Bank of Russia set July 2025 as the date for the first launch phase of its digital ruble central bank digital currency (CBDC). Now the central bank is delaying the roll out. It follows resistance from merchants, a major banking association, and its largest bank, Sber.

The big bank was excluded from the first wave of banks involved in the pilot, so it only joined this January, a year later than planned. Perhaps its inclusion was delayed to avoid it dominating trials, but that’s speculation. The reality is that six months from the first pilot to launch is rather short for a bank.

Central Bank Governor Elvira Nabiullina announced the delay at a meeting with the Association of Russian Banks (ASROS). However, she said that the pilots are progressing well.

“Our intention is to move on to the mass implementation of the digital ruble somewhat later than originally planned, namely after we have worked out all the details in the pilot and held consultations with banks on the economic model that is most attractive to their clients – for businesses, for people,” the Governor said, as reported by the Association.

The central bank first shared details about the planned business model late last year.

A new schedule has not yet been set, and the central bank did not mention the delay on its website. However, the launch postponement was also reported by the Interfax news agency.

Digital ruble: addressing bank concerns

When banks raised their concerns in the State Duma in December, they highlighted several issues. The main ones were worries about deposit outflows and the costs of implementation.

On the first point, from the start the central bank has appeared unconcerned about this impact. This may be partly because it plans a three phase rollout. Initially larger banks and merchants will join, followed by other banks and mid-sized merchants. The final phase will require non bank providers and all merchants to participate, but that will be two years later.

Regarding the expense, the banking association estimated the cost to a bank could be up to Rubles 100 million ($1.1m). The central bank says it will provide some technical elements to banks free of charge, to help smaller banks.

“For those components that are mandatory from the point of view of information security, we (will) provide these solutions to banks free of charge. This software module for embedding is created and transferred to organizations, and in three different forms, so that banks can choose the most optimal one for their landscape,” said Deputy Governor of the Bank of Russia, Zulfiya Kakhrumanova.

“We provide free cryptographic information protection tools for subordinate certification centers that are deployed by banks, and this is also a significant cost aspect for banks,” she added, according to Interfax.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

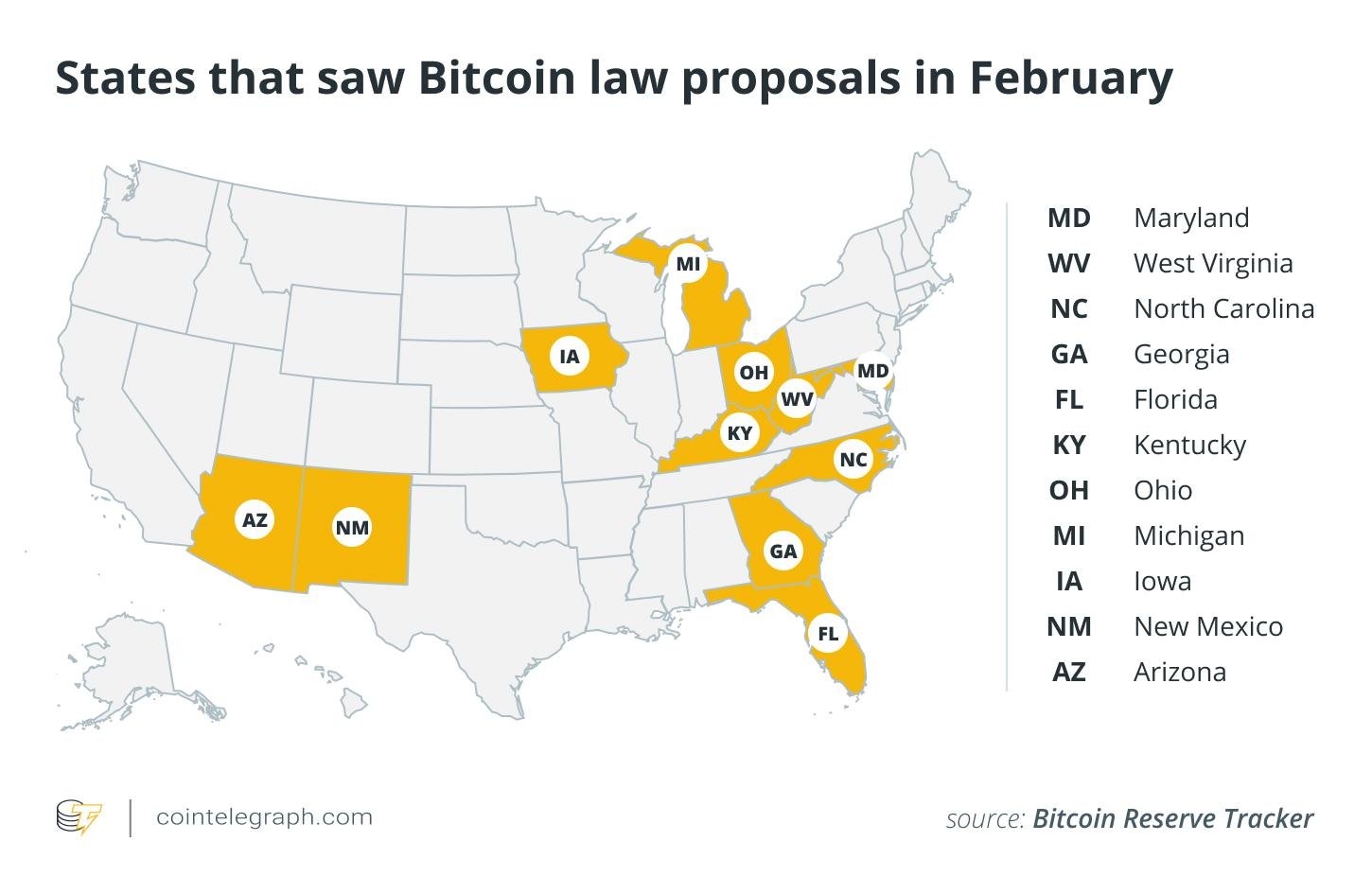

ARIZONA APPROVES BITCOIN RESERVES, BUT WYOMING AND MONTANA ARE SAYING NO – HERE’S WHY

▪Arizona advances crypto legislation - two bills, one establishing a digital asset reserve and another focused on Bitcoin investment

▪While Arizona embraces crypto reserves, other states like Wyoming and Montana reject them due to volatility concerns.

▪Bitcoin's recent price drop fuels skepticism, while predictions suggest federal crypto legislation is forthcoming.

Arizona is pushing ahead with cryptocurrency investment as two Bitcoin reserve bills have passed the Senate, setting the stage for final approval in the state’s House of Representatives.

While states like Wyoming and Montana are rejecting similar measures over concerns about crypto’s volatility, Arizona is doubling down on digital assets.

If these bills pass in the state’s House of Representatives, Arizona could become one of the first states to officially hold Bitcoin in its reserves.

Senate Approves Bitcoin Reserve Bills

On Feb. 27, the Arizona Senate approved the Strategic Digital Assets Reserve bill (SB 1373) in a 17-12 vote, sending it to the House for final approval. Sponsored by Republican Senator Mark Finchem, the bill aims to create a Digital Assets Strategic Reserve Fund, which will be managed by the state treasurer. The fund will include legislative appropriations and crypto assets seized by the state.

To limit risk, the treasurer would be allowed to invest no more than 10% of total fund deposits per fiscal year. However, the state could loan out digital assets to generate returns as long as it doesn’t add financial risk.

Another Bill Aims to Allow Bitcoin Investments

A second Bitcoin-related bill is also moving forward. The Strategic Bitcoin Reserve Act (SB 1025), co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, passed the Senate with a 17-11 vote.

Unlike Finchem’s bill, which focuses on managing seized crypto assets, SB 1025 allows the state to invest public funds directly into Bitcoin and other cryptocurrencies. This signals Arizona’s growing commitment to incorporating digital assets into its financial strategy.

Crypto Legislation Gaining Momentum Nationwide

Dennis Porter, founder of Satoshi Action Fund, believes federal regulation of cryptocurrencies is inevitable. He predicts lawmakers will first regulate stablecoins, followed by broader market structure rules, and eventually, Bitcoin reserves.

While Arizona and Utah are leading the push for crypto reserves, 18 other states are still waiting for approval. However, not all states are on board—Montana, Wyoming, and others have rejected similar plans, calling Bitcoin too risky.

Trump Weighs Heavy on the Markets

Despite increasing political support for crypto, Bitcoin’s price has taken a hit. The asset dropped below $80K, and analysts fear it could fall further to $70K–$75K. Bitcoin is down 17% this week, with Trump’s tariff policies adding to market uncertainty.

Amid the panic, Michael Saylor jokingly told investors to “sell a kidney if you must, but keep the Bitcoin.” While Saylor continues to advocate for a U.S. Bitcoin reserve, the recent price drop has given skeptics more reason to doubt Bitcoin’s long-term stability.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

BITCOIN NOT FIT FOR SWISS NATIONAL BANK RESERVES, SAYS PRESIDENT

▪The Swiss National Bank president dismissed the idea of holding Bitcoin in reserves due to volatility, liquidity concerns, and security risks.

▪The SNB views cryptocurrencies as a small, volatile "niche phenomenon" unsuitable for central bank reserves.

▪A Swiss initiative is pushing for a public vote to mandate the SNB to include Bitcoin in its reserves.

The Swiss National Bank (SNB) has made its stance on Bitcoin crystal clear—it’s not interested. Despite growing global adoption and a push from Swiss crypto advocates, SNB President Martin Schlegel has firmly rejected the idea of adding Bitcoin to the bank’s reserves.

In a recent interview, he explained why digital assets don’t make the cut, pointing to volatility, liquidity concerns, and security risks.

@ Newshounds News™

Read more: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Iraq Economic News and Points to Ponder Late Friday Evening 2-28-25

Kurdistan Banks Will Take Their Share Of Sanctions .. Economic Shows The Reasons

Economy Yesterday, 12:40 |Baghdad today – Baghdad Economic expert Hevidar Shaban, today, Thursday (27 February 2025), is the reasons for imposing US sanctions on a number of banks in the Kurdistan region.

Shaaban said in an interview with "Baghdad Today" that "in the context of coordination between the US Treasury and the Central Bank of Iraq, sanctions will be imposed on banks in the region, including joint banks in my accounting project for employees salaries in Kurdistan."

Kurdistan Banks Will Take Their Share Of Sanctions .. Economic Shows The Reasons

Economy Yesterday, 12:40 |Baghdad today – Baghdad Economic expert Hevidar Shaban, today, Thursday (27 February 2025), is the reasons for imposing US sanctions on a number of banks in the Kurdistan region.

Shaaban said in an interview with "Baghdad Today" that "in the context of coordination between the US Treasury and the Central Bank of Iraq, sanctions will be imposed on banks in the region, including joint banks in my accounting project for employees salaries in Kurdistan."

He added that "this process is to control the

smuggling of currency in some banks in the region, control

money laundering,

illegal dealings, and the

structural organization of banks."

Earlier this month, two informed sources reported that the

Central Bank of Iraq would prevent local banks from dealing with dollars.

"The Central Bank of Iraq will prevent 5 local banks from dealing with dollars in the US Treasury request." The two sources added,

"3 companies for payment services will be banned from dealing in dollars according to the US Treasury request," the two sources added. They pointed out,

"America has submitted its request due to

severe cash violations and the

smuggling of the dollar outside the country."

https://baghdadtoday.news/268804-مصارف-كردستان-ستأخذ-نصيبها-من-العقوبات.-اقتصادي-يبين-الأسباب.html

The Digital Currency To Be Launched In Iraq ... Between Economic Opportunities And Potential Risks

Economy Yesterday, 16:12 | Baghdad today – Baghdad The specialist in the international economic affairs, Nawar Al -Saadi, revealed today, Thursday (27 February 2025), the importance of the Central Bank of Iraq to launch its own digital currency.

Al -Saadi told "Baghdad Today" that "economically, this step carries great benefits,

but at the same time it involves challenges and risks that must be dealt with with caution." He indicated,

"The importance of this step lies in several aspects, most notably that

it provides a more efficient and transparent electronic payment method, which

reduces dependence on paper criticism and

limits the informal economy."

He continued, "The digital currency of the central bank can contribute to

reducing the costs of printing and

managing the paper currency, and

improving monitoring of cash flows, which contributes to

fighting corruption and money laundering."

He added, "Nevertheless, this step is not without risks, especially in light of the challenges facing the Iraqi financial system," noting that "the most prominent concerns, the possibility of using the digital currency in smuggling operations, especially if there are no strict mechanisms to control digital transactions, and Iraq is already suffering from challenges in controlling transfer of money through informal channels, and any weakness in the management of the digital currency may lead to exploitation before Legal.

Al -Saadi also warned that "there are risks related to cash stability, as

the rapid shift to the digital currency may lead to pressure on the traditional banking system,

especially if the banks are not technically and practically prepared for this change, moreover,

any security or technical defect in the digital infrastructure may make the financial system more vulnerable to electronic or piracy attacks."

The specialist in the international economic affairs pointed out that

"in order to ensure the success of this step, it is necessary for the central bank to

follow a deliberate policy to implement it gradually,

with a clear legal framework to regulate the use of digital currency," stressing "the need to

enhance the digital banking infrastructure and

ensure the readiness of the financial system to accommodate this transformation without affecting economic stability, and

if this policy is applied with caution and transparency, the

digital currency can form The Central Bank has an effective tool to

enhance the Iraqi economy and

push it towards more modernity and financial openness. "

The Governor of the Central Bank, Ali Al -Alaq, revealed earlier on Wednesday,

the approach to the establishment of a bank digital currency, to replace paper currencies.

Al-Alaq said, in a speech during the Ninth Finance and Banking Conference and Exhibition, and followed by "Baghdad Today", that "the financial and banking system will witness fundamental transformations,

including the decline of paper currencies to be replaced by digital payments for central banks." He added that "the central bank is moving to create a digital currency of its own,

to gradually replace the paper process as it is taking place in some central banks in the world," noting that "we are seriously thinking about establishing a data center in Iraq, and the bank starts moving in this matter within the steps of digital transformation."

https://baghdadtoday.news/268817-العملة-الرقمية-المزمع-اطلاقها-في-العراق.-بين-الفرص-الاقتصادية-والمخاطر-المحتملة.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Morning 3-01-25

Good Morning Dinar Recaps,

CARDANO-XRP BRIDGE GOES LIVE – A GAME CHANGER FOR BOTH ECOSYSTEMS

▪Cardano and XRP Ledger now have a direct connection through the Wanchain bridge.

▪The linkup is a mutually beneficial one for native assets within both ecosystems.

Cardano (ADA) and the XRP Ledger (XRPL), two leading blockchains, have formed a coalition to strive for seamless interoperability. Both ecosystems have launched a new bridge, connecting ADA and XRP, the native coin operating on the XRPL.

Good Morning Dinar Recaps,

CARDANO-XRP BRIDGE GOES LIVE – A GAME CHANGER FOR BOTH ECOSYSTEMS

▪Cardano and XRP Ledger now have a direct connection through the Wanchain bridge.

▪The linkup is a mutually beneficial one for native assets within both ecosystems.

Cardano (ADA) and the XRP Ledger (XRPL), two leading blockchains, have formed a coalition to strive for seamless interoperability. Both ecosystems have launched a new bridge, connecting ADA and XRP, the native coin operating on the XRPL.

Cardano and XRPL Expand Interoperability With New Bridge

TapTools, a digital wallet tracking Cardano trading, brought the attention of the crypto community to the Cardano-XRP bridge. This bridge, which is now live, is facilitated by Wanchain, a decentralized blockchain interoperability solution.

As reported by TapTools, the Cardano-XRP bridge is designed to expand interoperability and liquidity between the two networks. This technical advancement marks a massive milestone for both blockchains, representing the first time they connect via a bridge.

Besides promoting interoperability and liquidity, the bridge will support DeFi adoption and enhance utility for both ADA and XRP.

Historically, both communities have different technological and market positioning. However, they can now leverage the new bridge to interact in unprecedented ways.

Users can utilize the bridge to transfer ADA onto the XRP Ledger and vice versa.

It will also increase the Total Value Locked (TVL) for users exploring Decentralized Finance (DeFi) opportunities on Cardano. This increased interoperability is crucial as the world moves swiftly toward widespread blockchain adoption.

Beyond these benefits, the bridge potentially paves the way for integrating Ripple’s stablecoin, RLUSD, as a bridged asset. It is important to note that the Cardano-XRP bridge operates without centralized control. This means users retain control over their assets without interference from a third party.

Meanwhile, Wanchain will help to preserve the underlying value of wrapped versions of XRP and ADA as they seamlessly interact with applications on the opposite chain.

Wanchain uses a distributed key generation and secure multi-party computation (MPC) mechanism to ensure assets move safely across different blockchains.

Impact on ADA, XRP, and Broader Market

The Wanchain XRP/Cardano bridge will benefit Cardano and the XRP ecosystems in numerous ways. For Cardano, the bridge will help strengthen users’ appeal for the blockchain as more capital flows into ADA-based DeFi platforms. Our latest report covered that the XRPL Decentralized Exchange has surpassed $20 billion in liquidity, highlighting XRP’s expanding role in DeFi.

Also, thanks to this bridge, XRP users are encouraged to explore Cardano’s ecosystem more. This attention toward the network can lead to greater adoption of Cardano’s native smart contracts and Decentralized Applications (dApps).

Regarding XRP, the new bridge can unlock staking, borrowing, lending, and yield farming opportunities previously unavailable to XRP holders. The bridge can also elevate XRP’s role in multi-chain ecosystems, extending its potential beyond traditional payments and remittances.

For the broader market, the new bridge demonstrates that achieving a more interconnected blockchain environment is possible. It also demonstrates the growing importance of interoperability in the blockchain industry and ensures that cryptocurrencies are not isolated.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

BRICS CONFIRMS DEVELOPMENT OF NEW PAYMENT SYSTEMS IN 2025

Brazil, which chairs the upcoming BRICS summit in 2025 confirmed that they plan on the formation of new payment systems. Under the leadership of Brazilian President Luiz Lula da Silva, the alliance will discuss alternative payment options to the US dollar.

The BRICS Sherpas meeting will take the ideas forward and the upcoming 17th summit could see massive changes in the way the bloc operates and settles cross-border transactions.

The move could lead to a paradigm shift in global trade and tilt the financial powers from the West to the East. Developing countries are looking to cut ties with the US dollar and strengthen their local currencies in the forex markets.

The US dollar is in the crosshairs of a major shift that could pave the way for native currencies to take the driver’s seat of the financial markets.

BRICS: New Payment Systems in 2025 Could Be a Reality

Brazil’s President Luiz Lula da Silva made a strong statement saying that BRICS will continue advancing the de-dollarization agenda. The President also added that under their leadership, BRICS will work towards developing new payment systems as an alternative to the US dollar.

“Brazil is going during the period of its presidency to fully develop transparent and safe payment systems,” he said.

The bloc will work towards launching safe payment systems to uplift their GDP and strengthen their native economies. The move will give a boost in the arm to their local currencies making businesses thrive.

The next BRICS summit is scheduled to be held in Brazil’s Rio De Janeiro on July 6th and 7th. All the nine member countries will meet at the summit and discuss policies and sign new trade deals. Details on the new payment systems could be revealed at the 17th summit in July this year.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Saturday Morning 3-1-2025

TNT:

Tishwash: Iraq among the best in the world in controlling the sale of the dollar

The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Saturday, that Iraq has become one of the best countries in the world in controlling the sale of the dollar.

Al-Alaq said in an interview with the official agency, followed by Iraq Observer, that “Iraq has today become one of the best countries in the world in controlling the sale of the dollar, as this process is carried out with transparency and accuracy, and through it the citizen verifies his documents and his departure from the country,” explaining that “this mechanism is the most disciplined, transparent and controlled in the world, as indicated by international experts.”

TNT:

Tishwash: Iraq among the best in the world in controlling the sale of the dollar

The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Saturday, that Iraq has become one of the best countries in the world in controlling the sale of the dollar.

Al-Alaq said in an interview with the official agency, followed by Iraq Observer, that “Iraq has today become one of the best countries in the world in controlling the sale of the dollar, as this process is carried out with transparency and accuracy, and through it the citizen verifies his documents and his departure from the country,” explaining that “this mechanism is the most disciplined, transparent and controlled in the world, as indicated by international experts.”

Al-Alaq added that “false news and media distortion may harm the interests of Iraq and the banking sector,” stressing the importance of being proud of the major developments witnessed by Iraq. He explained that “the government and the Central Bank are working hard to establish sound practices that are compatible with international standards,” calling for “the need to highlight these achievements in the media.”

He pointed out that “highlighting these transformations and developments helps enhance international confidence in the Iraqi banking sector, which is vital to continue developing the financial system in Iraq.” link

Tishwash: Financial Advisor: Central Bank Digital Currency Will Boost Transparency, Improve National Payments

The financial advisor to the Prime Minister, Mazhar Mohammed Saleh, explained today, Saturday, that issuing a digital currency for the Central Bank will be an important step towards enhancing transparency and achieving a qualitative leap in the national payments system.

Saleh said in a statement to the official agency, followed by NRT Arabic, that "the Central Bank plans to issue a digital currency as a gradual alternative to paper currency," noting that this step will contribute to reducing cash leakage and lowering the costs of printing paper currency, in addition to reducing the circulation of money outside the banking system.

He added that the digital currency will allow tracking financial flows, improve control over capital and foreign transfers, support anti-money laundering efforts, and contribute to enhancing financial inclusion, especially for groups less integrated into the banking system.

Saleh explained that Iraq's transition to digital currency requires a strong technical infrastructure, including advanced internet networks and advanced cybersecurity systems to protect data and transactions.

Digital currencies will also support efforts to enhance economic and social integration through government use in collection operations and official transactions. link

************

Tishwash: Federal Oil invites "APICOR" and Kurdistan Wealth to meet in Baghdad

The Federal Ministry of Oil has set next Tuesday as the date for a meeting with the Ministry of Natural Resources in the Kurdistan Region to discuss issues related to the concluded contracts and reach understandings that contribute to the development of oil fields, while an invitation was extended to foreign companies contracting with the Kurdistan Regional Government to develop the region’s fields.

The ministry stated in a statement, received by the Iraqi News Agency (INA) today, Saturday, that it "extended an invitation to international foreign companies under (APICOR) and contracted with the Kurdistan Regional Government to develop the region's fields."

The statement continued, "The ministry extended an invitation to the Ministry of Natural Resources in the region to attend in Baghdad next Tuesday for the purpose of discussing and debating issues related to the concluded contracts to reach understandings that contribute to developing the oil fields with the best international practices and in a manner that serves the national interest." link

*************

Tishwash: Reasons for stopping cash withdrawals outside Iraq by TBI

Today , Friday (February 28, 2025), banking and financial affairs specialist Ahmed Abdul Rabbo revealed the reasons for stopping cash withdrawals outside Iraq by the Trade Bank of Iraq.

“There is a strong possibility that the decision is related to combating currency smuggling, as the Central Bank of Iraq and financial institutions have previously taken similar measures to limit the exit of the dollar through unofficial means,” Abdul Rabbo told Baghdad Today.

He explained that “some parties were using electronic payment cards to withdraw cash from abroad with money purchased at the official exchange rate inside Iraq, then reselling it at higher prices in the parallel market, which constitutes a type of currency smuggling.”

He explained that "there is a strong possibility that the decision came in response to American pressures related to regulating dollar flows and preventing its smuggling to countries subject to American sanctions, such as Iran. Washington has imposed strict restrictions on Iraqi banks in recent periods, and asked the Central Bank of Iraq to take strict measures to control financial transfers, especially after detecting currency smuggling operations through the use of electronic payment cards."

He added that "the decision appears to have come as part of broader measures to control the banking sector and prevent the misuse of the dollar, and is an extension of previous measures imposed by the Central Bank, either in response to American pressure or as part of efforts to combat financial corruption and smuggling."

Yesterday, Wednesday, the Trade Bank of Iraq announced the suspension of cash withdrawals via ATMs outside Iraq.

The bank's media advisor, Aqil Al-Shuwaili, said in a brief statement, "Due to the risks resulting from the misuse of electronic cards (Visa and MasterCard), and to avoid these risks, cash withdrawals via ATM machines for these cards outside Iraq only have been stopped."

He added, "Cards can be used to pay through POS machines and online." link

Mot: . Gotcha!

Mot: . Isn't This da Way it Always Works Out!! --- siiggghhhh

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

2-28-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

2-28-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Lawrence Lepard: The Big Print - Make the Money System Great Again

Lawrence Lepard: The Big Print - Make the Money System Great Again

Palisades Gold Radio: 2-28-2025

Tom welcomes back Lawrence Lepard from Equity Management Associates to discuss his new book, "The Big Print: What Happened to America and How Sound Money Will Fix It."

Lepard emphasized that the U.S. monetary system began deteriorating with Nixon's abandonment of the gold standard in 1971, leading to persistent inflation and debt accumulation.

He argued that sound money — gold, silver, and Bitcoin — is essential to fix these issues.

Lawrence Lepard: The Big Print - Make the Money System Great Again

Palisades Gold Radio: 2-28-2025

Tom welcomes back Lawrence Lepard from Equity Management Associates to discuss his new book, "The Big Print: What Happened to America and How Sound Money Will Fix It."

Lepard emphasized that the U.S. monetary system began deteriorating with Nixon's abandonment of the gold standard in 1971, leading to persistent inflation and debt accumulation.

He argued that sound money — gold, silver, and Bitcoin — is essential to fix these issues.

Gold provides stability, while Bitcoin offers a digital solution to scarcity and divisibility, though it is still volatile.

The interview explored how inflation affects everyday life, with Lepard noting that the government's reported inflation rates often underestimate real costs.

He criticized the Federal Reserve for prioritizing debt servicing over economic fairness, leading to a cycle of printing money that disproportionately harms wage earners. Lepard also discussed the political challenges in transitioning to sound money, suggesting that widespread public awareness and grassroots support are needed to push for systemic change.

He warned against complacency, noting that the U.S. is on a trajectory toward a debt crisis unless decisive action is taken.

The conversation concluded with Lepard encouraging listeners to engage with his book to better understand these issues and advocating for a future where sound money restores economic health and fairness.

Time Stamp Reference

0:00 - Introduction

0:40 - The Big Print

7:20 - Where It Went Wrong

10:00 - CPI Chart 1800-2005

12:00 - Inflation a Key Issue

15:00 - The Wealth Gap

18:30 - Next Monetary Crisis

21:20 - A Moral Imperative

23:00 - Debt System Origin

26:00 - Top Vs. Bottom Wealth

27:00 - Why All Fiats Fail

31:00 - Lies & Inflation Stats

34:50 - Deflation Boogeyman

38:00 - Solutions & Outcomes

45:00 - Peg to Real Assets

48:45 - Bitcoin Advantages

52:20 - Resets & Reserve Currency

56:30 - Book & Wrap Up

Seeds of Wisdom RV and Economic Updates Friday Afternoon 2-28-25

Good Afternoon Dinar Recaps,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

Good Afternoon Dinar Recaps,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

According to the commissioner’s Feb. 27 statement, memecoins could satisfy the Howey test’s condition of profiting from the managerial efforts of others due to the coordination between developer teams and promoters.

The commissioner added that most, if not all, cryptocurrencies could be defined as memecoins under the SEC’s recent guidance, which was released on the same day. In this guidance, the agency stated that memecoins represent online social trends with speculative value and high volatility — and are not securities. Commissioner Crenshaw, however, has a different viewpoint:

“Today’s statement paints meme coins as cultural projects whose purpose is entertainment and social engagement. The reality is that meme coins, like any financial product, are issued to make money.”

Memecoins have come into sharper focus following several high-profile scams, hacks and even presidential memecoin launches that threaten the long-term viability of the sector and invite scrutiny from state officials.

US regulators and lawmakers attempt to reign in memecoins

Following US President Donald Trump’s memecoin launch, several Democrat lawmakers, including Elizabeth Warren, called for an investigation into potential ethics violations of the presidential token.

On Feb. 27, California Member of Congress Sam Liccardo announced that House Democrats are prepping a bill that would ban presidential memecoins.

The proposed bill, titled “The Modern Emoluments and Malfeasance Enforcement (MEME) Act,” would prohibit US lawmakers from sponsoring, issuing or endorsing any digital asset.

Moreover, spouses and dependents of US representatives, the president, vice president and senior executive branch officials are also prohibited from issuing or sponsoring memecoins under the bill.

Attorney Elizabeth Davis, former chief attorney at the Commodity Futures Trading Commission (CFTC), recently argued that memecoins should be regulated by the CFTC.

Davis told Cointelegraph that if the commodities regulator is granted regulatory oversight over crypto, then there is a strong likelihood that memecoins will be included in their purview.

The attorney also expressed confidence that comprehensive memecoin regulations would be established in the United States over the next year — putting an end to the regulatory ambiguity surrounding social tokens.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ARIZONA APPROVES BITCOIN RESERVES, BUT WYOMING AND MONTANA ARE SAYING NO – HERE’S WHY

▪Arizona advances crypto legislation - two bills, one establishing a digital asset reserve and another focused on Bitcoin investment

▪While Arizona embraces crypto reserves, other states like Wyoming and Montana reject them due to volatility concerns.

▪Bitcoin's recent price drop fuels skepticism, while predictions suggest federal crypto legislation is forthcoming.

Arizona is pushing ahead with cryptocurrency investment as two Bitcoin reserve bills have passed the Senate, setting the stage for final approval in the state’s House of Representatives.

While states like Wyoming and Montana are rejecting similar measures over concerns about crypto’s volatility, Arizona is doubling down on digital assets.

If these bills pass in the state’s House of Representatives, Arizona could become one of the first states to officially hold Bitcoin in its reserves.

Senate Approves Bitcoin Reserve Bills

On Feb. 27, the Arizona Senate approved the Strategic Digital Assets Reserve bill (SB 1373) in a 17-12 vote, sending it to the House for final approval. Sponsored by Republican Senator Mark Finchem, the bill aims to create a Digital Assets Strategic Reserve Fund, which will be managed by the state treasurer. The fund will include legislative appropriations and crypto assets seized by the state.

To limit risk, the treasurer would be allowed to invest no more than 10% of total fund deposits per fiscal year. However, the state could loan out digital assets to generate returns as long as it doesn’t add financial risk.

Another Bill Aims to Allow Bitcoin Investments

A second Bitcoin-related bill is also moving forward. The Strategic Bitcoin Reserve Act (SB 1025), co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, passed the Senate with a 17-11 vote.

Unlike Finchem’s bill, which focuses on managing seized crypto assets, SB 1025 allows the state to invest public funds directly into Bitcoin and other cryptocurrencies. This signals Arizona’s growing commitment to incorporating digital assets into its financial strategy.

Crypto Legislation Gaining Momentum Nationwide

Dennis Porter, founder of Satoshi Action Fund, believes federal regulation of cryptocurrencies is inevitable. He predicts lawmakers will first regulate stablecoins, followed by broader market structure rules, and eventually, Bitcoin reserves.

While Arizona and Utah are leading the push for crypto reserves, 18 other states are still waiting for approval. However, not all states are on board—Montana, Wyoming, and others have rejected similar plans, calling Bitcoin too risky.

Trump Weighs Heavy on the Markets

Despite increasing political support for crypto, Bitcoin’s price has taken a hit. The asset dropped below $80K, and analysts fear it could fall further to $70K–$75K. Bitcoin is down 17% this week, with Trump’s tariff policies adding to market uncertainty.

Amid the panic, Michael Saylor jokingly told investors to “sell a kidney if you must, but keep the Bitcoin.” While Saylor continues to advocate for a U.S. Bitcoin reserve, the recent price drop has given skeptics more reason to doubt Bitcoin’s long-term stability.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

FEBRUARY IN CHARTS: SEC DROPS 6 CASES, MEMECOIN CRAZE COOLS AND MORE

@ Newshounds News™

Read the story: CoinTelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps