Seeds of Wisdom RV and Economic Updates Sunday Morning 11-24-24

Good Morning Dinar Recaps

STELLAR AND THIS NEW COIN: THE DEFI DUO WITH POTENTIAL TO MULTIPLY A CRYPTO PORTFOLIO

A seasoned crypto and a rising DeFi star are capturing investor attention, offering potential for major portfolio growth.

Investors are eyeing a dynamic pair shaking up the decentralized finance scene. One is a seasoned cryptocurrency with a solid track record. The other is a fresh player gaining rapid attention.

Together, they could offer a compelling opportunity to amplify investment returns. This duo might be the catalyst for significant portfolio growth.

Good Morning Dinar Recaps

STELLAR AND THIS NEW COIN: THE DEFI DUO WITH POTENTIAL TO MULTIPLY A CRYPTO PORTFOLIO

A seasoned crypto and a rising DeFi star are capturing investor attention, offering potential for major portfolio growth.

Investors are eyeing a dynamic pair shaking up the decentralized finance scene. One is a seasoned cryptocurrency with a solid track record. The other is a fresh player gaining rapid attention.

Together, they could offer a compelling opportunity to amplify investment returns. This duo might be the catalyst for significant portfolio growth.

Early access to ZDEX: A token with 1000x potential

The ZDEX presale is officially underway, offering early adopters a prime opportunity to invest in a rising DeFi star at an entry price of just $0.0019. By the end of the presale the price will increase to $0.0029, meaning that ZDEX will appreciate 50% even before it gets listed.

ZDEX is the cornerstone of ZircuitDEX, a next-generation decentralized exchange (DEX). Unlike many junk coins, DEX tokens are built to thrive, thanks to their high demand and real utility.

Take Raydium (RAY), which skyrocketed 1790% in a year, or Uniswap, starting at $1 and now over $8, an 8-fold price increase. ZDEX token has similar 1000x potential, ready to reward those who get in early.

Built on the ultra-fast Zircuit Layer 2 chain, ZircuitDEX is crafted to meet the needs of both new and seasoned DeFi traders with its key features:

▪️Lightning-fast transactions for smooth trading experiences

▪️Minimal slippage to ensure trades occur close to desired prices

▪️Near-zero fees for cost-effective transactions

Fully EVM-compatible, ZircuitDEX ensures smooth integration with Ethereum tools, while its implementation of zero-knowledge proofs (ZK proofs) provides enhanced security—a critical feature as market participants increasingly prioritize safeguarding their assets.

Riding the meme coin wave

ZircuitDEX’s built-in meme coin launchpad gives investors a front-row seat to the next viral crypto sensations. With exclusive access to promising meme projects, ZDEX is ready to replicate the explosive success of tokens like BRETT, which soared over 14,000%! As ZircuitDEX nurtures a vibrant, community-centered approach, it’s primed to become the hotspot for high-growth meme tokens.

Efficiency and profitability for liquidity providers

For liquidity providers, ZircuitDEX delivers up to 500x capital efficiency compared to traditional decentralized exchanges. Concentrated liquidity pools allow LPs to earn higher returns with lower capital input, while automated strategies streamline trading, making it easier for users to optimize their holdings. ZDEX token holders also gain governance rights, exclusive airdrops, trade incentives, and staking rewards—adding further value to early participation.

As anticipation builds, ZDEX is quickly becoming a must-watch in the DeFi space, with investors eager to capitalize on its potential for outsized returns.

Stellar: Decentralized network enhancing global financial collaboration

Stellar (XLM) is a decentralized, open-source payments network using blockchain to enable quick, low-cost fund transfers.

It does not favor any national currency and features its own cryptocurrency, Stellar Lumens. Since 2014, Stellar has processed billions of transactions and formed major partnerships. It allows transfers of any currency type, including digital versions of national currencies and cryptocurrencies like Bitcoin.

Unlike many cryptocurrencies aiming to replace financial systems, Stellar seeks to enhance them, offering a unified network for collaboration. Individuals can transfer funds globally using Stellar apps, and companies can develop blockchain applications or use the network for payments and currency conversion. The potential of Stellar’s technology makes it an attractive option in the current market cycle.

Conclusion

In conclusion, although established coins like XLM have less short-term potential during this 2024 bull run, ZircuitDEX offers an exceptional opportunity with 500X capital efficiency, lightning-fast transactions, and zero slippage. The ZDEX Token’s 70% presale discount and potential 500% returns upon launch make it a promising asset to enhance portfolio growth.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

THE FUTURE OF NFTS: A TRANSFORMATION, NOT A TOMBSTONE

What’s next fro non-fungible tokens? What’s shaping the industry going into potentially favorable 2025 and beyond?

As we navigate the landscape of digital assets, the question looms large: Are NFTs dead?

The fervor that once engulfed the NFT market has certainly dimmed since the euphoric days of 2021, often compared to tulip mania. However, rather than writing an epitaph for NFTs, we should consider a transformative future shaped by evolving perceptions and real-world utility.

The Loyalty of Web3 Audience

The first challenge that non-fungible tokens (NFTs) face is the inconsistency of the Web3 community. This community is very responsive to market conditions and quickly jumps from one trend to another and changes its loyalty overnight.

The market was cruel for NFTs, indicating that many enthusiasts came to participate in temporary hype rather than for long-term value. As the hype faded, interest waned, leading to disgruntled investors and deserted businesses.

When the reality set in, a number of the Web3 aficionados went shopping for bigger fish, and NFTs soon became out of favor, exposing the market’s appetite for bubble factors instead of fundamentals.

Web2’s Shift: Brands and Normies Depart

Simultaneously, the Web2 audience—once eager to explore blockchain and NFTs—has also moved on. Initially brands that adopted NFTs for promotion purposes have now lost interest in NFT amidst falling prices and the new narrative gaining the center stage.

The discussions about NFTs, primed before, remain dormant and have no elasticity to gain mainstream media attention. For the average consumer, NFTs are just a faded trend, just as the overemphasis on new technologies.

The Future Ahead?

So, what does this portend for the future of NFTs? In Web2, it is obvious that digital art is the new order, and NFTs are still necessary as a medium for auctioning and distributing this art.

Nevertheless, this is probably unlikely to start the next bull market. It is true that profile picture projects (PFP) will always amuse a select few, but they, too, are unlikely to trigger a mass market revival. Bull markets thrive on innovation, where originality intersects with scarcity, driving demand beyond supply.

The burning question is: what could give rise to this newness?

NFTs as the Core Infrastructure

Rather than a relic of a bygone era, NFTs hold the potential to be vital components of blockchain infrastructure. They can enhance identity protocols, facilitate social finance, enrich gaming experiences, and tokenize real-world assets.

When viewed through this lens, NFTs are as fundamental to blockchain as the ERC-20 standard is to decentralized finance(DeFi).

Imagine the scenarios: Instead of real estate parcels having only one owner, anyone can own a fraction of the property. This means that a house deed can be put on sale, and people can buy the NFT and trade it permissionless, making real estate transactions simpler.

Alternatively, NFT-backed real estate investments could allow investors to easily buy into real estate projects without owning the actual property. Fractional ownership might even allow groups to purchase vacation homes or shared assets, like a pair of skis, easily.

Moreover, NFTs are set to redefine community relationships through membership access, perks, and value exchange. A myriad of applications will emerge, such as health records management, credit history management, and embedding NFTs into everyday life.

Conclusion: Transformation is the Key to Success

While the NFT market as we know it may be undergoing a reorientation phase, it is far from dead. Instead of wailing its past, we should focus on the shifts that will redefine our understanding of NFTs. By recognizing their potential beyond digital collectibles, we can pave the way for a future where NFTs become integral to our digital lives—ushering in a new era of innovation and opportunity.

@ Newshounds News™

Source: CryptoPotato

~~~~~~~~~

DONALD TRUMP SELECTS PRO-CRYPTO SCOTT BESSENT AS TREASURY SECRETARY

▪️Donald Trump has nominated Scott Bessent, a hedge fund manager and crypto advocate, as Treasury Secretary.

▪️Bessent’s pro-crypto stance sparked optimism of a shift toward balanced regulation that would help the industry grow.

▪️His nomination is seen as a potential turning point for fostering innovation and clearer policies in the crypto space.

Donald Trump, the President-elect of the United States, has nominated Scott Bessent as Treasury Secretary for his administration. This decision has generated enthusiasm in the emerging industry due to Bessent’s pro-crypto reputation.

Bessent and Cantor Fitzgerald CEO Howard Lutnick had been considered strong favorites for the position. However, Lutnick was eventually nominated as Commerce Secretary.

Crypto Industry Welcomes Scott Bessent’s Nomination for Treasury Secretary

In a November 22 announcement on Truth Social, Trump praised Bessent as the ideal candidate to support his administration’s economic goals. The President stated that Bessent will play a pivotal role in strengthening the US economy, fostering innovation, and maintaining the dollar’s status as the global reserve currency.

“Scott will support my policies that will drive US competitiveness, and stop unfair trade imbalances, work to create an economy that places growth at the forefront, especially through our coming world energy dominance,” Trump added.

Wall Street veteran Bessent, who founded the international macro investment company Key Square Group, brings extensive experience to the role. He had previously served as the chief investment officer for the prominent investor George Soros.

While President Trump’s announcement did not directly reference cryptocurrencies, many in the digital asset space view Bessent’s appointment as a positive sign.

In past statements, Bessent has described crypto as a symbol of financial freedom. He also called Bitcoin an alternative investment for younger investors disillusioned with the traditional financial system.

“I have been excited about the president’s embrace of crypto and I think it fits very well with the Republican Party, crypto is about freedom in the crypto economy is here to stay,” Bessent stated.

His pro-crypto stance has led many to believe his leadership could encourage a more balanced approach to digital asset regulation. This would contrast with the outgoing administration’s enforcement-heavy tactics, such as its controversial sanctions on decentralized platforms like Tornado Cash.

Indeed, crypto industry leaders have responded enthusiastically to Bessent’s nomination. Ripple CEO Brad Garlinghouse commended Bessent’s nomination, calling it a win for innovation. He noted that Bessent’s leadership could mark a turning point for crypto-friendly policies in Washington.

Similarly, Kristin Smith, CEO of the Blockchain Association, highlighted the importance of Bessent working with Congress to establish clear regulations, ensure fair tax treatment, and protect self-custody rights for digital assets.

“Critical to this nomination would be working with Congress on a regulatory framework for digital assets, protecting the right to self custody, pushing for clearer tax treatment of digital assets, and working closely with industry experts to protect our nation’s security,” Smith remarked.

@ Newshounds News™

Source: Be In Crypto

~~~~~~~~~

UNLOCKING PERSONAL SOVEREIGNTY: YOUR GUIDE TO TOTAL FREEDOM | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

🌱ELON MUSK'S BEDSIDE TABLE SECRETS REVEALED! | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Dollar Devaluation Exposed, Gold up 800% in the Last 24 Years

Dollar Devaluation Exposed, Gold up 800% in the Last 24 Years

Kitco News: 11-22-2024

In a compelling analysis of the market landscape, Rich Checkan, President and COO of Asset Strategies International, has emphasized the remarkable performance of gold over the past 24 years, showcasing an astounding increase of over 800%.

This significant rise makes gold a standout asset, outperforming all major indices this millennium, and raising critical questions about the stability of traditional investments amidst the devaluation of the U.S. dollar.

Dollar Devaluation Exposed, Gold up 800% in the Last 24 Years

Kitco News: 11-22-2024

In a compelling analysis of the market landscape, Rich Checkan, President and COO of Asset Strategies International, has emphasized the remarkable performance of gold over the past 24 years, showcasing an astounding increase of over 800%.

This significant rise makes gold a standout asset, outperforming all major indices this millennium, and raising critical questions about the stability of traditional investments amidst the devaluation of the U.S. dollar.

Checkan shared his insights during an interview with Kitco News anchor Jeremy Szafron at the New Orleans Investment Conference, where he outlined the implications of economic policies and geopolitical tensions on various investment avenues. His remarks reflected a growing concern about the “real” performance of equity markets, which have been buoyed by the apparent rise in stock prices but are increasingly questioned due to the U.S. dollar’s loss of purchasing power.

The crux of Checkan’s argument lies in the persistent devaluation of the U.S. dollar, a phenomenon that has profound implications for investors.

As the dollar weakens, its purchasing power diminishes, rendering traditional assets like stocks, bonds, and real estate less reliable as hedges against inflation. In stark contrast, gold emerges as a durable safe haven, with Checkan noting that it is often viewed as a “d**d asset” for its lack of interest or dividends. Yet, its remarkable appreciation underscores its role as a stronghold during economic uncertainty.

“In the last 24+ years, gold is up 818%,” Checkan pointed out, highlighting its resilience in the face of financial instability. This striking statistic serves as a reminder to investors that sometimes, alternative assets may provide greater security and return potential than conventional investments.

The conversation also delved into how geopolitical tensions and government fiscal policies can directly impact the precious metals market. As nations grapple with conflict, instability, and economic changes, investors often flock to gold for its historical status as a store of value. Checkan noted that this behavior is particularly pronounced in environments where uncertainty reigns, making gold an attractive refuge.

Moreover, with ongoing discussions about inflation rates, interest rates, and expansive monetary policies, the interaction between fiscal measures and precious metals cannot be understated. The policies implemented by governments worldwide, particularly those related to money supply and stimulus measures, have significant ramifications for gold prices as they influence market confidence and investor behavior.

While Checkan primarily focused on gold, he also touched on the burgeoning realm of cryptocurrencies, specifically Bitcoin. As digital currencies gain traction, the perception of value and the diversification of portfolios continue to evolve.

Bitcoin, often dubbed “digital gold,” has attracted attention as both a speculative asset and a potential long-term store of value. Checkan’s outlook on Bitcoin encapsulates a broader conversation about the future of currencies and the ways in which they can coexist with traditional assets like gold.

As investors sift through the complexities of today’s financial landscape, Checkan’s insights serve as a crucial framework for understanding the dynamics of wealth preservation and growth. The impressive 800% increase in gold over more than two decades starkly contrasts with the volatility observed within equity markets. For many, gold’s enduring allure as a safe haven asset will continue to shine brightly, particularly in times of economic turbulence.

With Checkan’s observations echoing the sentiments of many financial experts, it appears that diversifying portfolios to include precious metals may not only be prudent but necessary.

As the world grapples with the interplay of currency fluctuations, geopolitical unrest, and inflationary fears, gold stands out not just as a commodity, but as a cornerstone of modern investment strategies.

Iraq Economic News and Points to Ponder Saturday Afternoon 11-22-24

Because It Contains A Political Aspect.. Parliamentary Wealth: The Oil And Gas Law Faces Difficulties

November 21 17:58 Information / private.. Member of the Parliamentary Oil, Gas and Resources Committee, Ali Abdel Sattar, confirmed today, Thursday, that the Oil and Gas Law has been facing difficulties since 2008.

Abdel Sattar told the Maalouma Agency, “The oil and gas law faces difficulties within the House of Representatives because it contains a political aspect between the region and the center.”

Because It Contains A Political Aspect.. Parliamentary Wealth: The Oil And Gas Law Faces Difficulties

November 21 17:58 Information / private.. Member of the Parliamentary Oil, Gas and Resources Committee, Ali Abdel Sattar, confirmed today, Thursday, that the Oil and Gas Law has been facing difficulties since 2008.

Abdel Sattar told the Maalouma Agency, “The oil and gas law faces difficulties within the House of Representatives because it contains a political aspect between the region and the center.”

He added, "The law regulates financial matters and oil management for all governorates, especially the governorates that produce oil and gas," noting that "the reason the law was suspended was because it contained controversial points with the region."

He explained that "the law is still included in the government and has not been sent to the House of Representatives despite the ongoing dialogues and discussions between the Baghdad government and the regional government."

He continued, "The dispute still exists between Baghdad and Erbil over the oil file, and we are waiting for it to be resolved and for the law to be sent to the House of Representatives in order to discuss and approve it."

https://almaalomah.me/news/83244/politics/لاحتوائه-جنبة-سياسية-الثروات-النيابية:-قانون-النفط-والغاز-يو

Census Results In Karbala Show The Oldest Woman In Iraq

Friday 22 November 2024 16:58 | General Number of readings: 169 Census results in Karbala show the oldest woman in Iraq (Pic 144 years old)

Karbala/ NINA / The results of the general population census in the holy Karbala governorate showed the oldest person from the governorate’s residents, born in 1880, who is 144 years old Shocked . She is the citizen Anoud Mazyan Hadi. /End https://ninanews.com/Website/News/Details?Key=1170450

Economist: The Total Cost Of The General Population Census Amounted To 951 Billion Dinars

Money and business Economy Economic expert Nabil Al-Marsoumi revealed, today, Friday (November 22, 2024), the financial and economic cost of the general population census.

Al-Marsoumi said in a post on Facebook that “the total financial and economic cost of the general population census amounted to 951 billion dinars.”

He explained that "the direct financial cost of the census amounted to 459 billion dinars, while the cost of suspending official work amounted to 492 billion dinars."

Al-Marsoumi added, "The economic cost is increasing due to the halt of public and private economic activities, and many individuals and local communities are harmed as a result, especially the poorest groups who depend on earning their living on a daily basis in normal times and do not save any resources to use during the curfew."

The economic expert pointed out that "the population census could have been conducted without the need to impose a comprehensive curfew in the country, even if that led to extending the data collection period for several more weeks, in order to save costs and take into account vulnerable groups and workers in the private sector." 153 views https://economy-news.net/content.php?id=50106

Iraqi Exhibitions Participate In The UFI Conference In Germany

Friday 22 November 2024 14:40 | Economic Number of readings: 203 Baghdad / NINA / The Iraqi General Company for Exhibitions and Commercial Services participated in the World Congress of the International Federation of Exhibitions "UFI" in Cologne, Germany, which started last Wednesday and will continue until tomorrow, Saturday.

A statement by the company indicated that "Mustafa Nizar Juma, General Manager and Chairman of the Board of Directors of the company, participated in the activities of the summit of the union, which includes 870 members of the organization from 87 countries around the world. The statement stated

that the conference is held at "Cologne Messe Confex", which is one of the largest trade fair centers in the world, and provides a unique platform for exclusive communication, professional development and exchange of ideas between members of the International Federation of Exhibitions and leaders of the exhibition industry in the world.

On the sidelines of the conference, the Director General of Iraqi Exhibitions met with a group of international exhibition organizers, the head of the regional office in the Middle East and North Africa in the UFI, and reviewed with them the exhibition activities of the Iraqi General Company for Exhibitions and Commercial Services, and discussed preparations for the upcoming 48th session of the Baghdad International Fair, in addition to discussing the criteria that must be taken into account regarding the company's membership in the UFI. / https://ninanews.com/Website/News/Details?key=1170441

Economist: Government Should Exploit Rising Oil Prices And Implement Sound Financial Management

Time: 2024/11/22 13:54:37 Read: 1,313 times {Economic: Al Furat News} An economic expert called on the government to exploit the circumstances of rising oil prices and implement sound financial management.

Rashid Al-Saadi told Al-Furat News Agency: "The rise in global oil prices is due to the impact of political circumstances. With the intensification of the Russian-Ukrainian war and the challenges facing the region, in addition to the decision of the International Criminal Court regarding Netanyahu and his Minister of War, and Israel's threats to Iraq and the pressure in the region, oil importing companies are being prompted to take precautions and be careful, and the political and security factor is the decisive and influential factor in the rise in oil prices."

He explained that "Iraq's benefit from this rise is that every dollar in which oil rises serves Iraq by no less than a billion dollars annually and strengthens its budget according to the size of its production."

Al-Saadi stressed, "The government must exploit the circumstances and the rise, because as soon as there is stability in the near or distant future, oil prices may drop significantly. This is a call for the government to manage the state's finances in a rational manner." LINK

Oil Prices Rise More Than 6% In A Week.. Brent Exceeds $ 75 Per Barrel

Energy Economy News - Follow-up Oil prices jumped about 1% at settlement on Friday, hitting a two-week high as geopolitical risk premiums rose in the market amid an escalation in the war in Ukraine this week.

Brent crude futures rose 94 cents, or 1.3%, to $75.17 a barrel. U.S. West Texas Intermediate (WTI) crude futures rose $1.14, or 1.6%, to $71.24 a barrel.

Crude prices rose more than 6% during the week, their highest settlement since November 7, as Russia intensified its campaign in Ukraine after the United States and Britain allowed Kiev to strike deep inside Russia with weapons provided by the two countries, according to Reuters.

“The escalation in Russia and Ukraine has raised geopolitical tensions beyond the levels seen during the year-long conflict between Israel and Iranian-backed militants,” said Ole Hansen, analyst at Saxo Bank.

Russian President Vladimir Putin said Moscow would continue to test new hypersonic Oreshnik missiles in combat and had a stockpile ready for use.

Russia fired the missile at Ukraine after Ukraine used US ballistic missiles and British cruise missiles to strike Russia.

"What the market fears is that inadvertent destruction of any part of the oil, gas and refining sector could not only cause long-term damage but accelerate the spread of the war," said John Evans, an analyst at PVM.

In a related context, the United States imposed new sanctions on the Russian Gazprom Bank at a time when US President Joe Biden is intensifying sanctions measures on Moscow over its invasion of Ukraine before leaving office on January 20.

The Kremlin said the new US sanctions were an attempt by Washington to hinder Russian gas exports, but indicated that Moscow would find a solution.

The United States has also banned food, minerals and other imports from nearly 30 Chinese companies over their alleged use of forced Uighur labor.

China, the world's largest importer of crude, on Thursday announced policy measures to boost trade, including subsidies for energy product imports, amid concerns about threats by U.S. President-elect Donald Trump to impose tariffs.

Analysts, traders and ship-tracking data suggest China's crude oil imports are set to rise in November.

Oil imports in India, the world's third-largest oil importer, rose as domestic consumption increased, according to government data.

Limit Price Increases

The price rise was capped today by a sharp decline in business activity in the euro zone this month as the region's dominant services sector contracted and manufacturing remained stagnant.

In contrast, S&P Global said the composite flash purchasing managers' index, which tracks the manufacturing and services sectors, rose to its highest level since April 2022, with the services sector recording the largest share of the increase.

The US dollar jumped to a two-year high against a basket of other currencies as business activity gauges moved in opposite directions in the US and Europe.

A stronger dollar makes oil more expensive in other countries, which could reduce demand.

The economy in Germany, Europe's largest, grew less than previously estimated in the third quarter, the Federal Statistical Office said. https://economy-news.net/content.php?id=50117

The European Union Organizes A Workshop In Basra On Central Administration And The Wealth Distribution System

Saturday 23 November 2024 15:29 | Economic Number of readings: 116 Basra / NINA / The European Union organized a workshop in Basra on central administration and the wealth distribution system.

Basra Governor Asaad Al-Eidani stressed during the workshop that the distribution of wealth has limitations for the poorest areas as well as areas with high population density, in addition to areas that were damaged by the wars that Iraq witnessed.

He added that Basra has three resources for distributing wealth in the budget, which are: regional development, border crossing revenues, and petrodollars.

Basra may not be given its full revenues, which are according to the constitution, due to the financial situation and challenges facing the country. He pointed out that during the past two years there are debts owed to the governorate that must be given those entitlements.

Al-Eidani explained that "the infrastructure projects being implemented in the governorate have contributed significantly to improving the economic situation in various housing units, noting that house prices in the governorate have witnessed a noticeable doubling during the past few years, reaching ten times their previous value.

Al-Eidani pointed out that these improvements reflect the impact of development projects on improving the standard of living and enhancing the value of real estate assets in Basra." / End

https://ninanews.com/Website/News/Details?key=1170624

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 11-23-24

Good Afternoon Dinar Recaps

BRICS: MORGAN STANLEY PREDICTS THE FUTURE OF THE US DOLLAR

BRICS is challenging the dominance of the US dollar by spreading the de-dollarization agenda across the globe. The bloc is pushing local currencies for trade and convincing other developing countries to sideline the US dollar. Using local currencies will strengthen their native economies and give them a boost in the forex markets. Amid the BRICS de-dollarization initiative, leading investment bank Morgan Stanley has predicted the future of the US dollar

Three sectors (see link below) in the US will be affected if BRICS ditches the dollar for trade. The move will make the US dollar lose out on the global supply and demand dynamics and push it into the path of decline. If the US fails to import the dollar, inflation could hit the homeland leading to higher prices for basic necessities.

Good Afternoon Dinar Recaps

BRICS: MORGAN STANLEY PREDICTS THE FUTURE OF THE US DOLLAR

BRICS is challenging the dominance of the US dollar by spreading the de-dollarization agenda across the globe. The bloc is pushing local currencies for trade and convincing other developing countries to sideline the US dollar. Using local currencies will strengthen their native economies and give them a boost in the forex markets. Amid the BRICS de-dollarization initiative, leading investment bank Morgan Stanley has predicted the future of the US dollar

Three sectors (see link below) in the US will be affected if BRICS ditches the dollar for trade. The move will make the US dollar lose out on the global supply and demand dynamics and push it into the path of decline. If the US fails to import the dollar, inflation could hit the homeland leading to higher prices for basic necessities.

BRICS: Morgan Stanley Reveals How the US Dollar Will Survive the Challenges

Analysts from the leading investment bank Morgan Stanley predict that the US dollar will remain the dominant currency for a longer period despite the challenges from BRICS. The bank’s analyst highlighted that in terms of financial instability, investors flock to the US dollar and not the Chinese yuan.

Historically, the USD has maintained stability during a market crisis while other local currencies plummeted. The USD can withstand the whips of the currency market as it is backed by global trade, said Morgan Stanley on the BRICS de-dollarization initiative.

“Which currency would you want to own when global stock markets start to fall? And the global economy tends to head into recession?” said James Lord, Morgan Stanley’s Head of Foreign Exchange Strategy. “You want to be positioning in US dollars because that has historically been the exchange rate reaction to those kinds of events.” In conclusion, Morgan Stanley predicts that the US dollar will reign supreme against the onslaught of the BRICS alliance.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

COIN CENTER WARNS US POLICIES COULD SCARE AWAY CRYPTO INVESTORS DESPITE TRUMP WIN

Coin Center says that while a Trump administration will undoubtedly be positive for crypto, there are still several ongoing cases that could prove troublesome to investors and developers.

Non-profit crypto advocacy group Coin Center has warned that even though a Trump win is a net positive for the crypto industry, entrenched policies could still scare crypto innovators away from the United States.

In a Nov. 21 blog post analyzing the landscape of US crypto policy following the 2024 election, Coin Center’s research director Van Valkenburgh shared three “grave threats” to the crypto users and developers in the US heading into 2025.

All three threats are described broadly as “surveillance issues” and range from tax reporting and Anti-Money Laundering (AML) policy to the ongoing criminal proceedings involving the crypto mixer Tornado Cash and Bitcoin wallet service Samourai Wallet.

Three “grave” threats to crypto

The first major threat comes from the crypto reporting requirements under Section 6050I of the US tax code, which currently mandates warrantless reporting to the IRS for those who have received $10,000 in crypto.

In August last year, Coin Center argued that these reporting requirements are unconstitutional.

The second and third major threats stem from the sanctions placed on Tornado Cash and include the criminal charges for unlicensed money transmission brought against the mixing service and Samourai Wallet.

Coin Center says the charges brought against Tornado Cash founder Roman Storm could set a worrying precedent for developers on non-custodial crypto services.

“At the agency level, there’s reason to believe that controversial ongoing rulemakings will be frozen or even abandoned due to President Trump’s generally pro-crypto stance and his likely choices for appointees at the SEC and Treasury.”

However, Valkenburgh wrote that the new administration may not be interested in scaling back “overzealous” sanctions and AML policies.

“The [Department of Justice] may change under a Trump administration, but it rightly guards its political independence and may therefore be unlikely to abandon these prosecutions because of a change in administration," Valkenburgh said.

“We’re nonetheless hopeful that there can be progress here if it becomes increasingly clear that even with a friendlier SEC, draconian surveillance and control policies will continue to drive innovators away from the US, chill development, and deny ordinary Americans the benefits of these technologies.”

Valkenburgh added that the ongoing measures to prevent people from accessing crypto services do “very little to actually prevent criminals and terrorists” from using the tools.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

🌱YOUR MONEY YOUR MORTGAGE AND MORE. AUDIO ONLY | Youtube

If you missed last night's Live Call you can listen here on our Youtube channel.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

HOW THE 2020 ELECTION SET UP A LEGAL NIGHTMARE FOR 2024 | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

MilitiaMan & Crew News Reporting-Expectations are High-IMF-Flexible Exchange Rate Regime-Prepare for Shocks-IMF

MilitiaMan & Crew News Reporting-Expectations are High-IMF-Flexible Exchange Rate Regime-Prepare for Shocks-IMF

11-23-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew News Reporting-Expectations are High-IMF-Flexible Exchange Rate Regime-Prepare for Shocks-IMF

11-23-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economic Updates Saturday Morning 11-23-24

Good Morning Dinar Recaps

GLOBAL ASSET MANAGER LAUNCHES XRP ETP WITH INDUSTRY-LEADING PRICING IN EUROPE

XRP advances with a new institutional-grade exchange-traded product, offering secure, physically backed exposure as Wisdomtree expands crypto products amid growing investor interest.

XRP Gains Ground: Major ETP Launched by a Top European Asset Manager

Asset management firm Wisdomtree announced on Thursday the launch of its latest cryptocurrency exchange-traded product (ETP), the Wisdomtree Physical XRP (XRPW), on major European exchanges, including Deutsche Börse Xetra, Six Swiss Exchange, and Euronext in Paris and Amsterdam.

Good Morning Dinar Recaps

GLOBAL ASSET MANAGER LAUNCHES XRP ETP WITH INDUSTRY-LEADING PRICING IN EUROPE

XRP advances with a new institutional-grade exchange-traded product, offering secure, physically backed exposure as Wisdomtree expands crypto products amid growing investor interest.

XRP Gains Ground: Major ETP Launched by a Top European Asset Manager

Asset management firm Wisdomtree announced on Thursday the launch of its latest cryptocurrency exchange-traded product (ETP), the Wisdomtree Physical XRP (XRPW), on major European exchanges, including Deutsche Börse Xetra, Six Swiss Exchange, and Euronext in Paris and Amsterdam.

With a management expense ratio of 0.50%, the asset management firm stated that its XRP ETP is Europe’s most competitively priced offering for XRP exposure.

Built for simplicity and security, Wisdomtree explained that the product is fully backed by XRP, providing exposure to its spot price through an institutional-grade, physically backed structure. According to the asset manager:

The Wisdomtree Physical XRP ETP is designed to offer investors a simple, secure, and cost-efficient way to gain exposure to the price of XRP. Investors also benefit from a dual-custody model with regulated custodians and with the underlying assets professionally secured in cold storage.

This latest addition expands Wisdomtree’s portfolio of nine cryptocurrency ETPs, which also cover bitcoin, ethereum, solana, and diversified crypto baskets.

“Cryptocurrency ETPs represent an efficient way to keep investors in a regulated framework and are becoming the preferred vehicle to access cryptocurrencies,” Alexis Marinof, Head of Europe at Wisdomtree, highlighted the benefits of ETPs.

“Wisdomtree leverages 20 years of expertise in providing and managing physically-backed ETPs for institutional investors. With over $100bn of assets under management globally across ETFs and ETPs, investors in our cryptocurrency ETPs can benefit from our global reach, scale and resources.”

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

BRICS: INDIA PROVIDES UPDATE ON CBDC CURRENCY

BRICS member India is among the few countries that successfully launched a pilot basis of Central Bank Digital Currency (CBDC). The Reserve Bank of India (RBI) began testing the CBDC currency early this year for trade and common transactions. The RBI is testing the security aspects of digital currencies and conducting studies about their potential impact on the economy.

The launch of the CBDC could change the fortunes of BRICS member India, as it’s ahead of the curve in digital currencies. Out of the 198 countries in the world, 134 nations are currently working towards the formation of a CBDC currency. All the countries are currently in testing mode while only a few have reached the pilot testing phase.

BRICS: India Gives Update on CBDC Currency Progress

Apart from the de-dollarization agenda, BRICS is also looking to topple the US dollar with CBDC digital currencies. Reserve Bank of India’s Deputy Governor T Rabi Sankar confirmed that the CBDC pilot mode is in its advanced stages.

Sankar signaled that the CBDC rollout will also be utilized for government, retail, and institutional users. When reporters questioned about its release date, the RBI deputy said that they were not in a hurry.

“We are in no hurry to roll it out (CBDC) immediately,” he said to reporters. The RBI deputy revealed that once things fall in place, details about the CBDC currency will be made public by BRICS. “Once we have some visibility of what the outcome or impact will be, we’ll roll it out. We don’t keep a specific timeline for that.”

Apart from India, its BRICS counterpart Russia is also in the advanced stages of testing its CBDC currency. Russia plans to launch the digital ruble and usher into a new era in the financial sector. Transactions in the US dollar will begin to decline gradually if BRICS starts using CBDC digital currencies for trade.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

🌱YOUR MONEY YOUR MORTGAGE AND MORE. AUDIO ONLY | Youtube

If you missed last night's Live Call you can listen here on our Youtube channel.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Saturday Morning 11-23-2024

TNT:

Tishwash: Parliament resumes its sessions next week... and clarification of the mechanism for extending its legislative term

A member of the Parliamentary Legal Committee explained the mechanism for extending the legislative term of the House of Representatives.

Aref Al-Hamami told Al-Furat News Agency that "extending the legislative term of the House of Representatives does not require a vote, but rather only a decision from the Speaker of the House and his deputies to decide the legislative term."

He added, "The next session is scheduled to include the general amnesty and personal status laws, and work will be done to resolve them."

TNT:

Tishwash: Parliament resumes its sessions next week... and clarification of the mechanism for extending its legislative term

A member of the Parliamentary Legal Committee explained the mechanism for extending the legislative term of the House of Representatives.

Aref Al-Hamami told Al-Furat News Agency that "extending the legislative term of the House of Representatives does not require a vote, but rather only a decision from the Speaker of the House and his deputies to decide the legislative term."

He added, "The next session is scheduled to include the general amnesty and personal status laws, and work will be done to resolve them."

He added, "There is nothing new regarding the 2025 budget schedules, and we are waiting for them to arrive from the government."

The Speaker of the House of Representatives decided on the fourth of this month to resume sessions next week after the completion of the population census operations in the country. link

Tishwash: Expectations of an "elite" Iranian delegation arriving in Baghdad.. 3 files on the table

An informed source expected, today, Friday (November 22, 2024), the arrival of an elite Iranian delegation to Baghdad within the next 72 hours.

The source said in an interview with "Baghdad Today", "Tehran has indirect lines of communication through 3 Arab countries, including Baghdad, with the White House to convey messages and positions regarding developments in the Middle East and ways to prevent it from reaching the stage of comprehensive war."

He added that "an elite Iranian delegation may arrive in Baghdad within the next 72 hours to discuss Tehran's positions on three files, most notably Gaza and Lebanon, the importance of stopping the war, and its vision of the situation and the roadmap that could stop the tensions at a certain point."

He pointed out that "Tehran is very open to the issue of stopping the war as quickly as possible and pressuring Western countries, including America, in order to move the pressure tools on the entity and stop the genocide machine," noting that "all indicators show that the Middle East is facing rapid changes, and the language of diplomacy may be slightly higher for the first time than the language of war."

In a related matter, an informed source revealed, on Thursday (November 21, 2024), an Iranian message with positive content to Washington through Iraqi mediators.

The source said in an interview with "Baghdad Today", "Tehran sent yesterday, through Iraqi mediators, an indirect message to America about its vision for resolving the crisis and the dangerous escalation in the Middle East, starting with ending the war of extermination in Gaza and southern Lebanon, stopping the bombing in Beirut and seeking a roadmap with an international vision."

He added that "the Iranian message carried diplomatic signals in most of its lines, which means that it wants to reach a solution that ends the current conflict according to a vision with specific dimensions, while indicating that it does not want a comprehensive war, but will engage in it if it is imposed on it directly."

He pointed out that "it can be sensed that the Iranian military option on Tel Aviv has been postponed at the present time in light of undeclared international efforts to prevent the explosion of the Middle East, in addition to waiting to see the new American president and how he will deal with the files of the East and his promises to end the war."

The source said that "Iran has begun to tone down its rhetoric towards diplomacy, through which solutions can be reached that contribute to stopping the bloodshed, while declaring a firm position that it will not abandon the axis of resistance."

Iraq played the role of mediator in the indirect dialogue between Washington and Tehran, and contributed to preventing events from developing into a major regional comprehensive war. link

************

Tishwash: Protecting Iraq is an American duty: Security agreements are not just ink on paper

In a tense atmosphere that portends an unprecedented escalation, news continues about intensive security and diplomatic moves to prevent a confrontation between Israel and Iraq, against the backdrop of attacks by armed factions on Israeli sites. While Israel has filed an official complaint with the UN Security Council against Iraq, fears are growing of an “imminent” Israeli strike that could open the door to escalation in the region.

The political advisor to the Iraqi Prime Minister, Fadi Al-Shammari, said in press statements that “the Israeli threats have become tangible after the complaint that Tel Aviv filed with the Security Council.” He explained that the Iraqi government is working on more than one level to contain the crisis and avoid its disastrous repercussions.

Sources said that Baghdad received direct warnings from Washington that Israel was prepared to take military action unless the government could rein in the armed factions.

A source said that the Security Council is witnessing intense discussions regarding the Israeli complaint. He added: “Israel is trying to provide justifications for a possible military strike, claiming that the attacks are being launched from Iraqi territory with Iranian support.”

Washington in the circle of pressure

For its part, Washington finds itself in a sensitive position under the “Strategic Framework Agreement” with Baghdad, which imposes on it the responsibility to defend Iraq against any external threat.

However, observers believe that the American position may be less clear than it seems, as an analysis published by a Washington research center indicated that “Israel may resort to limited surgical strikes without waiting for a public green light from the United States.”

Between the field and diplomacy

A citizen named Ahmed Al-Saadi spoke about the tense atmosphere in a Facebook post, saying: “What is happening now brings to mind the atmosphere of war in the nineties. People here are afraid of the repercussions of any new confrontation.” In a tweet on the “X” platform, an account said: “If the news of an imminent Israeli strike is true, Iraq may witness one of its most complex crises since the fall of the former regime.”

Faction movements and internal balances

Field reports indicated that some armed factions have begun taking precautionary measures in preparation for any possible attack. A source close to one of the factions said in a private interview: “We are ready to defend Iraqi territory if Israel targets it.” But a citizen from Baghdad named Zainab al-Ali expressed her fears about the repercussions of these moves, saying: “Iraqis always pay the highest price in such conflicts.”

Future analysis and escalation expectations

According to strategic analyses, Israel is exploiting the escalation to impose a new equation in the region, which was confirmed by a reliable source, who said: “Any Israeli strike could be the beginning of an expansion of the conflict, as the factions will not only respond from within Iraq, but we may witness other fronts igniting.” He added: “The biggest fear is that Iraq will turn into an arena for settling regional scores.”

Iraq needs a unified position from political forces to ward off the Israeli threat, away from the divisions that have weakened the country over the past years.” link

Mot: They are Sooooooooooo thoughtful -- HUH!!!!

Mot: . Ohhhh Nooooo - the Weather is Upon Us!

Seeds of Wisdom RV and Economic Updates Friday Afternoon 11-22-24

Good Afternoon Dinar Recaps,

BRICS: WHY 2025 COULD BE THE END OF ITS DE-DOLLARIZATION EFFORTS

Despite being the BRICS focus over the last two years, 2025 could mark the end of the alliance’s de-dollarization efforts. Although the bloc has sought increased financial prominence, it has yet to truly strike at international Western hegemony.

With President-elect Donald Trump set to take over the White House in the coming years, his relationship with Russia’s Vladimir Putin could orchestrate a massive shift in perspective for the group. Since Trump won the 2024 election, Putin has already assured he is no longer interested in abandoning the US dollar.

Good Afternoon Dinar Recaps,

BRICS: WHY 2025 COULD BE THE END OF ITS DE-DOLLARIZATION EFFORTS

Despite being the BRICS focus over the last two years, 2025 could mark the end of the alliance’s de-dollarization efforts. Although the bloc has sought increased financial prominence, it has yet to truly strike at international Western hegemony.

With President-elect Donald Trump set to take over the White House in the coming years, his relationship with Russia’s Vladimir Putin could orchestrate a massive shift in perspective for the group. Since Trump won the 2024 election, Putin has already assured he is no longer interested in abandoning the US dollar.

BRICS Fight Against the US Dollar Coming to Its Final Bell: Why Trump Changes Everything

2022 remains one of the most important years, geopolitically speaking.

That year marked the start of Russia’s invasion of Ukraine. Moreover, it forced the hand of the West, with the United States moving to sanction the country in response to its military advancement.

With that being more than two years ago now, things have changed. The invasion sparked increased cooperation with the global South BRICS alliance. Specifically, Russia sought to forge plans to lessen international reliance on the US dollar. Effectively, he struck back against the West in any way he could.

Yet, things have changed. Specifically, Trump is back in office, and the sentiment from the Russian president has shifted greatly. More importantly, things for the BRICS bloc could be set to change, as 2025 could be the end of its ongoing de-dollarization efforts.

A Reuters report notes that Putin has expressed a willingness to sit down with Donald Trump and discuss ending the ongoing war in Ukraine. Although he has extensive conditions, his openness for a ceasefire is progress nonetheless.

Moreover, that comes as he already denounced a desire to truly abandon the US dollar after Trump was elected as the incumbent US President.

Trump has been outspoken about his stance regarding de-dollarization. Just as certain, the 45th president has been vocal about his belief in his own capacity to end the Ukraine war. Those two things could create a perfect storm that only hinders the nations that put their faith in BRICS de-dollarization.

It is not out of the realm of possibility to see an increase in Russian and US cooperation. That is especially true amid Trump’s return. Such an action would threaten its advances on the US dollar. More importantly, it could ensure Trump gets what he wants, assuring the greenback’s position atop global economics.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

SEC COMMISSIONER JAIME LIZÁRRAGA TO STEP DOWN IN JANUARY

The U.S. Securities and Exchange Commission will see yet another exit in January after Commissioner Jaime Lizárraga announced he will step down.

Bloomberg Law reports that the former congressional aide has said he will leave the agency on January 17. The announcement comes just a day after SEC Chair Gary Gensler announced his resignation effective January 20.

Lizárraga, Gensler, and Caroline Crenshaw are the three Democrat commissioners among the SEC’s five members. The two exits will leave Crenshaw, Hester Peirce, and Mark Uyeda, the latter two having dissented on various SEC decisions.

Notably, Lizárraga and Gensler will exit as Donald Trump, elected on Nov. 5, gets into office amid expectations of a pro-crypto White House. Reports that the Trump administration is eyeing a “crypto czar” have added to optimism, even as the industry debates on who would be the best pick for SEC Chair.

Lizárraga joined the SEC in 2022, with his term ending in 2027. Lizárraga faced criticism for overreach, with his corporate reporting regulations burdening small businesses. He was also criticized for the controversial policies that the market saw as prioritizing politics over investors.

He says his resignation is for family reasons.

“In reflecting on the challenges that lie ahead, we have decided that it is in the best interests of our family to close this chapter in my 34-year public service journey,” he said in a statement quoted by Bloomberg Law.

The crypto industry has largely criticized the SEC’s approach over the past four years, pointing to what many see as an anti-crypto stance. Trump has pledged to fire Gensler immediately upon taking office, vowing to end the current administration’s “war on crypto.”

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

MASTERCARD INTEGRATES ITS MTN BLOCKCHAIN NETWORK WITH JP MORGAN’S KINEXYS DIGITAL PAYMENTS (JPM COIN)

Today Mastercard announced it has integrated its Multi-Token Network (MTN) for tokenized deposits and tokenized assets with Kinexys Digital Payments (formerly JPM Coin).

It allows clients of the two solutions to send payments across the networks. Both companies emphasized the benefits for cross border payments because of traditional challenges with speed, transparency and time zone differences.

Kinexys Digital Payments is designed to support clients with JP Morgan bank accounts, so it’s mainly used by corporates that want to move money between JP Morgan branches dotted around the world. MTN provides a simplified solution to enable banks to engage with tokenized deposits.

Instead of developing their own blockchain networks, it offers banks an API driven solution. Additionally, it provides interoperability with multiple blockchain networks. Kinexys is an example of one of those networks.

“For years, both Mastercard and Kinexys by J.P. Morgan have been committed to innovating for the future of digital asset and commercial infrastructure,” said Raj Dhamodharan, EVP, Blockchain and Digital Assets at Mastercard.

“By bringing together the power and connectivity of Mastercard’s MTN with Kinexys Digital Payments, we are unlocking greater speed and settlement capabilities for the entire value chain.”

Both solutions represent bank payments on a blockchain. Conventional cross border payments involve Swift messages being sent between banks, often with intermediary banks involved. The banks then move the money separately from the message. That works fine most of the time, but not always.

With blockchain-based transfers, there is no separation of the message and money movement. That avoids issues where money has departed the sender’s account but has not arrived at the recipient.

If there’s an issue with the payment, such as an AML query, then the transfer should not start until that’s resolved.

Kinexys and MTN experience

Kinexys Digital Payments are relatively mature, having launched in 2020. It now processes on average $2 billion in payments daily. Kinexys supports both Euros and Dollars, with plans to support instant FX soon. By contrast, MTN was first announced in mid 2023, and executed its first live transaction in a sandbox with Standard Chartered in May.

Both projects are explored in Ledger Insight’s new report on bank stablecoins and deposit tokens.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

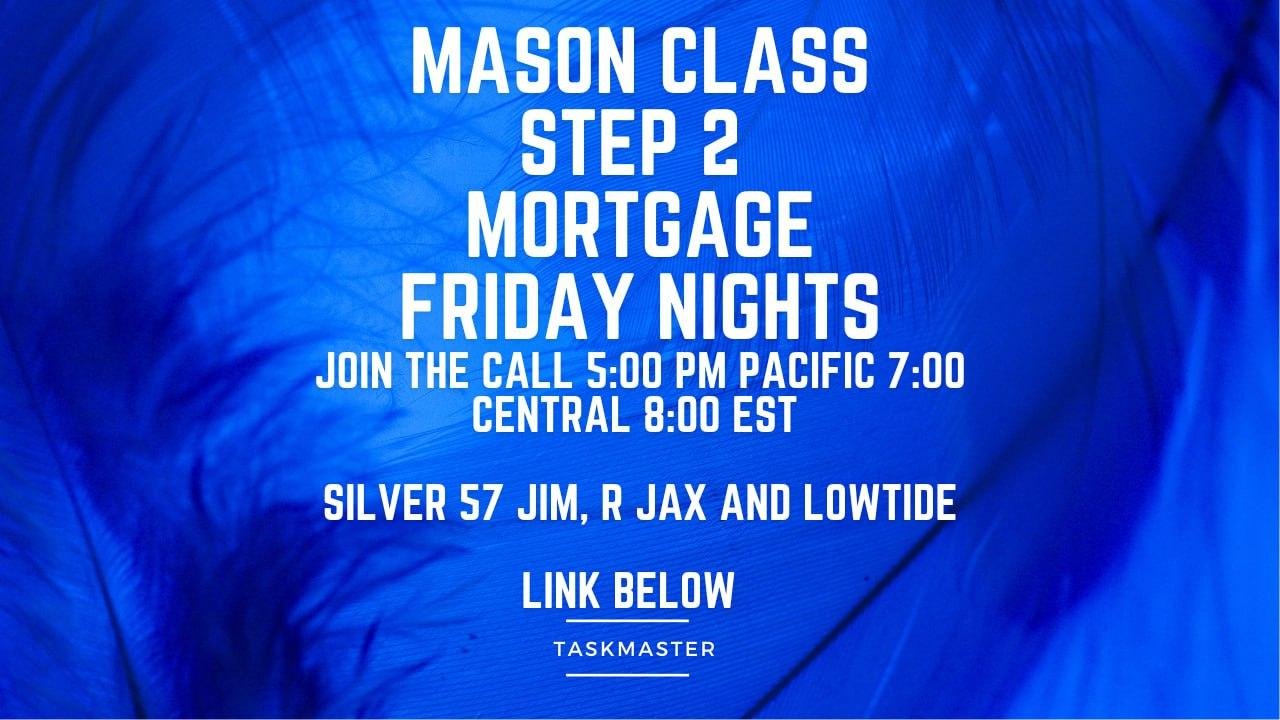

FRIDAY NIGHT LIVE CALL

Join us TONIGHT at 5 pm PT, 7 pm CT, 8 pm ET

JOIN THE CALL HERE

Docs Link

Hear More Calls Here

To join the call you will need the telegram app Here.

Download the app on either your mobile phone or PC, then click the 'Join the Call ' Link above to listen and ask questions..

@ Newshounds News™

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Iraq News Highlights and Points to Ponder Friday AM 10-22-24

Dollar-Dinar Exchange Rate Gap: Causes And Treatments

Dr. Haitham Hamid Mutlaq Al Mansour Iraq relies in its monetary policy to monitor the change in the value of its dinar against the dollar on a fixed exchange rate peg system. The overall policy aims to reduce the gap between the official and actual exchange rates and stabilize it close to the target exchange rate, curbing inflation, stimulating markets, commercial, financial and investment transactions, and stimulating growth.

Therefore, reducing the exchange gap at the target exchange rate level is one of the prominent issues facing the economic policy maker in Iraq in order to limit the major repercussions that go beyond the economic scope and crystallize significantly in the social stability of the country.

Dollar-Dinar Exchange Rate Gap: Causes And Treatments

Dr. Haitham Hamid Mutlaq Al Mansour Iraq relies in its monetary policy to monitor the change in the value of its dinar against the dollar on a fixed exchange rate peg system. The overall policy aims to reduce the gap between the official and actual exchange rates and stabilize it close to the target exchange rate, curbing inflation, stimulating markets, commercial, financial and investment transactions, and stimulating growth.

Therefore, reducing the exchange gap at the target exchange rate level is one of the prominent issues facing the economic policy maker in Iraq in order to limit the major repercussions that go beyond the economic scope and crystallize significantly in the social stability of the country.

This gap becomes more evident through the variation in the dollar exchange rates and the fluctuation of the real value of the dinar. Either positively, it generates revenue, or negatively, it generates additional costs that cause repercussions on purchasing power without taking individuals and economic units into account, negatively affecting local and foreign savings and investment.

The more the gap varies, the greater the economic cost of investment and the higher the levels of inflation, which increases the suffering of the limited-income family sector.

It has become known that the size of the Iraqi economy's GDP depends very heavily on the oil dollar, which is the main source of the Ministry of Finance's resources, instead of the non-oil dollar, which is called the non-oil export dollar, which has very low flexibility, resulting in a sharp decline in credit deposits in the accounts of traders exporting goods in Iraqi banks in exporting countries.

This dependence exposes the exchange gap to fluctuations in the global oil market. When global oil prices rise, we witness a decrease in the exchange gap due to the increase in the supply of the dollar, while in contrast, during periods of economic recession or when oil prices fall, the gap increases significantly when the government is unable to provide an adequate supply of dollars in the official window for buying and selling dollars.

In such cases, traders are forced to search for alternatives through the parallel market, which exacerbates price pressures on the weakest groups.

Referring to the reasons that widened the exchange gap, they are multiple. In addition to what was mentioned above, the reasons can be traced according to the axis of indirect reasons that are linked to the country's trade policy and the problems of border crossings related to dollar smuggling, including those related to activating the role of crossings as an authentic source of revenue.

There are also indirect reasons that have a political and security nature and medium- and long-term repercussions on the movement of money and investment.

While economic and monetary reasons stand out at the forefront of direct or technical reasons, some of them are related to the nature of the banking system and the extent of its credit capacity and the level of banking compliance with the monetary and credit conditions of the Federal Reserve, which affects the levels of supply of the petrodollar.

Therefore, we find that many international banks refuse to work as correspondent banks due to the low credit rating of our banking system as a result of smuggling operations, money laundering and sanctions that affect a third of Iraqi banks. Therefore, we find that they do not stand up in this regard, except for banks that have external partnerships with Arab banking capital.

They derive international acceptance from the quality of the credit rating of those countries, which facilitates the process of opening accounts with correspondent banks. Therefore, there is fear that pressures on the dollar exchange rate will increase, widening the gap.

It is also noted that among the technical reasons that led to the widening of the gap are the successive changes in the official exchange rate threshold taken by successive government administrations.

The gap witnessed a transition at the end of 2020 from the stable situation in which the gap between the official exchange rate of 0.118 dinars per dollar and the actual exchange rate of 1,200 dinars narrowed, to raise the threshold in 2021 to 1,450 due to the decision of the Central Bank at the time.

Then the threshold rose this time after the Council of Ministers approved in February 2023 the decision of the Board of Directors of the Central Bank of Iraq to amend the official exchange rate of the dollar against the dinar, to the threshold of 1,300 dinars per dollar.

By following the parallel dollar exchange rate in November of this year 2024, we find that it has reached the limits of 1500 dinars per dollar and exceeded it, and that the Central Bank’s selling price for cash dollars, transfers, documentary credits, and international settlements for electronic cards is at the threshold of 1300 dinars per dollar.

Therefore, it is concluded that the gap in the dollar exchange rate against the dinar is still widening despite the pressures of the Federal Reserve and the Central Bank’s efforts towards compliance.

Therefore, dealing with the gap between official and actual spending should require comprehensive, integrated policies that target technical and non-technical treatments within medium- and long-term planning, the most important of which are:

Reforming the structure of the banking system, developing its efficiency, and raising the levels of its credit capacity and the flexibility of its banking compliance.

Developing tools for targeting inflation and exchange rates, which would help reduce the exchange gap and achieve price stability.

Implementing solid reforms in the financial and monetary sectors to enhance the flexibility of banking performance in accordance with the SWIFT global financial settlement system.

Coordination between fiscal and monetary policies to achieve the target exchange rate by rationalizing government spending and tightening control over the money supply.

Economic policy should enhance transparency in all financial and banking operations, by implementing clear and strict control systems to contain opportunities for corruption and exploitation of the exchange gap.

Deepening the mechanisms of border control and combating administrative corruption to increase total revenue.

Government authorities must maintain and enhance security and political stability to contribute to building confidence between local and foreign investors on the one hand and the investment environment on the other, which will stimulate further stability and growth.[/rtl]

Formulating an economic policy that targets technical solutions to expand the non-oil production base, and serious planning on how to diversify sources of income for the overall economy.

The path of developing the agricultural and industrial sectors will be the decisive factor in reducing imports and stimulating the growth of fixed capital accumulation for the private sector. Hence, the demand for the dollar for consumer import purposes will decrease. https://economy-news.net/content.php?id=50102

US Report Shows The Importance Of The Population Census In Iraq: It Will Reshape This Map

Local Economy News - Follow-up The American Associated Press published a report on the population census and its results on the political process in Iraq.

The agency said in its report, which was reviewed by "I am Parliament", that "the population census will reduce the political influence of minorities in Iraq."

The report added, "The delay in conducting the population census in Iraq was not only due to security and political reasons, but there was also data that the parties did not want to publish, such as poverty levels in each governorate."

He pointed out that "the population census will reshape the map of political thinking and decision-making in Iraq."

The population census operations began in the Iraqi governorates on Wednesday, after a 27-year hiatus. https://economy-news.net/content.php?id=50098

Economist: Total Cost Of General Population Census Reached 951 Billion Dinars

Local |Today, Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi revealed, today, Friday (November 22, 2024), the financial and economic cost of the general population census.

Al-Marsoumi said in a post on Facebook, which was followed by "Baghdad Today", that "the total financial and economic cost of the general population census amounted to 951 billion dinars."

He explained that "the direct financial cost of the census amounted to 459 billion dinars, while the cost of suspending official work amounted to 492 billion dinars."

Al-Marsoumi added, "The economic cost is expanding due to the halt of public and private economic activities, and many individuals and local communities are harmed as a result, especially the poorest groups who depend on earning their living on a daily basis in normal times and do not save any resources to use during the curfew."

The economic expert pointed out that "the population census could have been conducted without the need to impose a comprehensive curfew in the country, even if that led to extending the data collection period for several more weeks, in order to save costs and take into account vulnerable groups and workers in the private sector." LINK

Economist: The Census Will Lead To An Increase In The Share Of Some Governorates In Regional Development

Posted on 2024-11-22 by sotaliraq Economic expert Nabil Al-Marsoumi confirmed that the general population census will lead to an increase in the share of some governorates in regional development and a decrease in the share of others.

Al-Marsoumi said in a blog post that the general population census will lead to an increase in the share of some governorates in regional development and a decrease in the share of others because the population is the only criterion in distributing regional development funds among the governorates.

[size=45]Iraq witnessed the last general population census that included all its governorates in 1987, and although the country conducted another population census in 1997, it did not include the governorates of the Kurdistan Region, because they were semi-independent during the era of the former regime. LINK

Setting The Date For Announcing The Preliminary Results Of The Population Census

Time: 2024/11/21 Reading: 962 times {Local: Al Furat News} An informed source revealed the date of announcing the preliminary results of the general population census.

The source told {Euphrates News} a copy of it, "The preliminary results of the general population census will be announced within two days from now, specifically next Saturday."

He said, "The operations room for the population census continues to operate around the clock."

Yesterday, Wednesday, the general population census process was launched in Iraq in all its governorates. It is the first of its kind since 1987, amidst strict security measures and the imposition of a comprehensive curfew, in an attempt to facilitate the work of the mobile teams working to record information from the residents.

At exactly 12 midnight local time on Tuesday, the security authorities imposed a curfew in all governorates of the country that will last for two days. Security checkpoints and all entrances and exits to cities were closed to prevent movement.

The census is also accompanied by the alert status (C) for Iraqi security and military units. From.. Raghad LINK

Seeds of Wisdom RV and Economic Updates Friday Morning 11-22-24

Good Morning Dinar Recaps,

CONGRESSMAN THAT LED SAB 121 HOUSE VOTE, VOWS TO OVERTURN CRYPTO CUSTODY RULE

Earlier this year, both the House and Senate voted to overturn the SEC’s SAB 121 accounting rule that prevented banks from providing crypto custody solutions. However, President Biden used his veto so the rule still stands. Mike Flood, the Congressman that led the bipartisan House vote, has vowed to work with a new SEC Chair to ditch SAB 121 for good.

However, Flood’s work wasn’t entirely wasted. The dual votes highlighted the issue that forcing banks to put assets under custody on their balance sheet is both unconventional and affects their compliance with bank balance sheet rules.

Good Morning Dinar Recaps,

CONGRESSMAN THAT LED SAB 121 HOUSE VOTE, VOWS TO OVERTURN CRYPTO CUSTODY RULE

Earlier this year, both the House and Senate voted to overturn the SEC’s SAB 121 accounting rule that prevented banks from providing crypto custody solutions. However, President Biden used his veto so the rule still stands. Mike Flood, the Congressman that led the bipartisan House vote, has vowed to work with a new SEC Chair to ditch SAB 121 for good.

However, Flood’s work wasn’t entirely wasted. The dual votes highlighted the issue that forcing banks to put assets under custody on their balance sheet is both unconventional and affects their compliance with bank balance sheet rules.

As a result, it makes it prohibitively expensive for banks to provide crypto custody and inhibits innovation on the tokenization front.

Since then, the SEC has softened its stance a little. Banks can apply for exceptions and it has granted them. That’s not a practical solution, because banks have to consult the SEC on most deals.

“SAB 121, despite widespread opposition, works effectively as a regulation even though it never went through the normal Administrative Procedures Act process required for one,” Congressman Flood wrote.

“I look forward to working with the next SEC Chair to rollback SAB 121.” He didn’t pull his punches about SEC Chair Gensler. “Whether the chair leaves on his own or President Trump delivers his famous line on January 20, 2025, there’s an incredible opportunity for the new administration to turn the page on the Gensler era.”

“It should be no surprise that Gensler opposed the digital assets regulatory framework that passed the House earlier this year on a bipartisan basis. 71 Democrats joined House Republicans to pass this common sense framework.

Even though the Democrat-led Senate has refused to take it up, it represents a breakthrough moment for cryptocurrency and is likely to inform the work of the unified Republican government as the next Congress begins in January.”

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

CFTC COMMISSIONER URGES US CRYPTO POLICY REFORMS

The CFTC’s Summer Mersinger advocated structured crypto regulations and urged the industry to engage with the incoming US administration.

Speaking at the North American Blockchain Summit on Nov. 21, CFTC Commissioner Summer Mersinger discussed the need for standard US crypto-related policies through notice and comment regulation.

The United States Commodity Futures Trading Commission (CFTC) has played a role in implementing the current “regulation by enforcement” strategy alongside the Securities and Exchange Commission (SEC) under the outgoing administration, as evidenced by recent charges against Uniswap Labs.

Mersinger also said recent litigation against a decentralized autonomous organization (DAO) required the CFTC to seek a court verdict for entity classification. In this case, the CFTC wanted to classify the DAO as a corporation or association:

“I really started to get uncomfortable with this idea that we were kind of setting some sort of policy through our enforcement cases and through going to court. To me, how you’re going to treat an entity that’s a policy question.”

Need for regulated relief for the crypto industry

Mersinger said that while crypto entities, including decentralized finance (DeFi), are often charged under existing categories and expected to operate under the same laws, there is no provision for them to be officially registered. She added:

“This is really tricky settlements because the information we share publicly with our enforcement settlements really doesn’t offer a lot of guidance for anyone who’s trying to do the right thing.”

As a result, Uniswap tried to do the right thing but ended up attracting more charges, Mersinger said. Still, Uniswap settled with the CFTC for a “very small fine.”

Despite its small size compared with the other agencies such as the SEC, Mersinger said that the CFTC is the “ideal regulator for the cryptocurrency spot market” as it can implement major legislative changes fairly quickly without disruptions to the market.

New laws can help crypto companies fight wrongful litigation

Moreover, she supported the introduction of new laws and regulations for crypto firms despite her predominantly conservative stance:

“What we’re seeing right now is that without those laws, you have agencies like the Federal Communications Commission (FCC) who can come in and create chaos and bring charges where maybe it doesn’t fit.”

Mersinger also recommended that the crypto industry start engaging with the new administration as soon as its leadership has been identified. “Don’t be afraid to start knocking on doors on day one because I think it’s critical to start” the conversations early on, she said.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

Friday Night Live Call

Join us TONIGHT at 5 pm PT, 7 pm CT, 8 pm ET

Join the Call Here

Docs Link

Hear More Here

To join the call you will need the telegram app Here.

Download the app on either your mobile phone or PC, then click the 'Join the Call ' Link above to listen and ask questions..

@ Newshounds News™

~~~~~~~~~

🌱 THE DOLLAR GAIN MEANS WHAT? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Friday Morning 11-22-2024

TNT:

Tishwash: MP Hassan Al-Asadi brings good news to a group of those covered by Article 140

Member of Parliament Hassan Al-Asadi announced, today, Thursday (November 21, 2024), good news for a group of those covered by Article 140.