MilitiaMan & Crew News Report on Iraq Dinar-2024 Budget Focus-Oil & Gas Export Ceyhan Port-Integrity-Central Bank

MilitiaMan & Crew News Report on Iraq Dinar-2024 Budget Focus-Oil & Gas Export Ceyhan Port-Integrity-Central Bank

10-28-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew News Report on Iraq Dinar-2024 Budget Focus-Oil & Gas Export Ceyhan Port-Integrity-Central Bank

10-28-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Monday Evening 10-28-24

Baghdad Renews Desire To Transform Security Relationship With Washington Into Economic Alliance

October 28, 2024 Baghdad - Qusay Munther Baghdad has renewed its desire to transform the nature of its relationship with Washington, and move from the traditional focus on military cooperation to building a strong economic alliance, reflecting the common desire to strengthen economic ties and deepen the strategic partnership between the two countries.

A statement received by Al-Zaman yesterday said that (the Higher Coordination Committee for the Strategic Framework Agreement for Friendship and Cooperation with the United States of America stressed the need to move the relationship with Washington to an economic partnership and not to focus on military affairs),

Baghdad Renews Desire To Transform Security Relationship With Washington Into Economic Alliance

October 28, 2024 Baghdad - Qusay Munther Baghdad has renewed its desire to transform the nature of its relationship with Washington, and move from the traditional focus on military cooperation to building a strong economic alliance, reflecting the common desire to strengthen economic ties and deepen the strategic partnership between the two countries.

A statement received by Al-Zaman yesterday said that (the Higher Coordination Committee for the Strategic Framework Agreement for Friendship and Cooperation with the United States of America stressed the need to move the relationship with Washington to an economic partnership and not to focus on military affairs),

and Foreign Minister Fuad Hassan, who chaired the committee’s regular meeting in the presence of all representatives of the subcommittees within the Higher Committee, confirmed that (the latest developments in bilateral relations between Iraq and the United States of America were discussed,

in addition to reviewing the achievements approved during the recent meetings between the two parties in mid-April in the capital, Washington), adding that (the meeting touched on future working papers that will be discussed during the upcoming meetings of the committee, scheduled to be held in February of next year, within the agreed upon axes, which include cooperation in the political, diplomatic, security, defense, energy, economic, education, health and environment fields),

and Hussein stressed (the importance of strengthening relations with the United States of America by implementing the provisions of the agreement, and moving the relationship to a solid economic partnership), stressing (the need not to focus only on military and security aspects, but rather to expand cooperation to include economic, health, educational and other fields).

In Erbil, the Prime Minister of the Kurdistan Regional Government, Masrour Barzani, received the new Ambassador of the Kingdom of Spain to Iraq, Alicia Rico Perez del Pulgar.

A statement received by (Al-Zaman) yesterday said that (Barzani congratulated the ambassador on her new mission at the beginning of the meeting, wishing her success), and expressed (his thanks to Spain for its support and cooperation within the framework of the international coalition against ISIS).

The statement indicated that (the two sides stressed the importance of resolving the contentious issues between the region and the federal government on the basis of the constitution, and respecting the federal system and the constitutional entity of Kurdistan).

For her part, Pulgar stressed (the importance of strengthening her country's relations with Iraq and the region in various fields, and congratulated the Prime Minister on the success of the Kurdistan Parliament elections). In addition, the Undersecretary of the Federal Ministry of Finance, Masoud Haider, confirmed the absence of direct dealings between the federal institutions and the departments of the region regarding the disbursement of salaries.

Haider said in a statement yesterday that (no federal institution can deal directly with the departments of the regional government, and that dealing with the region is only done through the Kurdistan government itself), and he pointed out that (salaries are paid exclusively by the Ministry of Finance in the regional government), stressing (the necessity of not exploiting these sensitive issues for political purposes that may increase tensions). LINK

Parliamentary Finance To Nina: We Are Discussing With The Government The Preparation Of The 2025 General Budget...And These Are Our Observations

Monday 28 October 2024 17:16 | Economic Number of readings: 170 Baghdad / NINA / The Parliamentary Finance Committee disclosed part of the joint meetings with government agencies to prepare the new general budget law 2025 and its tables related to revenues and expenditures.

Committee member, MP Moeen Al-Kazemi, stated in a statement to the National Iraqi News Agency / NINA /, that "the Finance Committee has ongoing discussions and meetings with the Minister of Finance on the implementation of the 2024 budget items, especially those related to revenues and expenditures, as we found that there is a reduction in spending and complaints from governorates and ministries about the weak actual funding of spending units."

He added, "The Parliamentary Finance Committee is working on formulating the new general budget tables for next year 2025 in a realistic manner, away from the increases that cannot be guaranteed to be secured, as happened in the current year's budget 2024."

He explained, "We seek to have a general budget of 150 trillion dinars, distributed as oil revenues of 120 trillion dinars, and non-oil revenues of 30 trillion dinars, so that the budget tables are realistic in which revenues can be collected and spent."

He continued, "During the joint meetings with the Minister of Finance and ministry officials, the need to activate the revenues of government departments, including electricity, the Baghdad Municipality, municipal departments and other services provided by all ministries, in addition to taxes, border crossing revenues and customs, as well as supporting the private sector in the fields of agriculture, industry, trade, services and investment, was emphasized.

This would also contribute to increasing the country's revenues in general, and stabilizing hundreds of thousands of unemployed workers." / https://ninanews.com/Website/News/Details?Key=1164808

The Integrity, Accountability And Justice Commissions Affirm The Concerted Efforts Of State Institutions To Combat The Scourge Of Corruption

Money and business Economy News – Baghdad The Chairman of the Federal Integrity Commission, Mohammed Ali Al-Lami, and the Chairman of the Accountability and Justice Commission, Bassem Al-Badri, confirmed, on Monday, the combined efforts of state institutions to combat the scourge of corruption.

A statement by the Integrity Commission, seen by Al-Eqtisad News, said, "The Chairman of the Federal Integrity Commission (Mohammed Ali Al-Lami) called on state institutions to adopt a comprehensive reform policy that is consistent with the government program; to achieve the aspirations of the people in combating corruption and providing the best services to citizens."

The Chairman of the Federal Integrity Commission confirmed, according to the statement, that "the oversight agencies work in partnership with various state institutions and enjoy the support of the three legislative, judicial and executive authorities," noting "close cooperation with the heads of the courts of appeal in Baghdad and the governorates in confronting corruption and striking the hands of the corrupt."

He continued, "The Commission strives to maintain the independence of the oversight agencies and work with complete neutrality, and to stay away from any purposes or goals other than adhering to the tasks stipulated in its effective law No. (30 of 2011) as amended and other effective laws."

For his part, the head of the Accountability and Justice Commission, Bassem Al-Badri, said, according to the statement, that “Al-Lami’s assumption of the presidency of the commission represents a moral boost for the commission’s members, whom he described as soldiers of integrity on the battlefields of combating corruption, and who deserve support and assistance to carry out their arduous and serious tasks to eradicate corruption and strike the hands of anyone who dares to encroach on public funds.” 84 views Added 10/28/2024 - 4:17 PM https://economy-news.net/content.php?id=49238

Al-Sudani: The Government Relies On The Projects Of The Iraq Development Fund

Prime Minister Mohammed Shia al-Sudani confirmed on Monday that the government relies on the projects of the Iraq Development Fund and its subsidiary funds.

The Prime Minister's media office said in a statement that al-Sudani chaired the periodic meeting of the Board of Directors of the Iraq Development Fund, where the steps for implementing the (EDOPA) project for school buildings were followed up, and the final qualification of the companies that submitted their offers to participate and begin implementation was followed up.

Al-Sudani pointed out that the government relies on the projects of the Iraq Development Fund and its subsidiary funds to involve the private sector and expand its contribution to the national product, provide job opportunities, meet infrastructure needs and shorten the necessary time.

The meeting also discussed proceeding with the partnership with the Al-Suwaidi Group of Companies, based on the memorandum of understanding signed with it, and determining the location of the industrial city that will be established in partnership between the Fund and the Egyptian group. https://www.radionawa.com/all-detail.aspx?jimare=39969

Oil Falls More Than 4% As Geopolitical Risks Recede

Monday 28 October 2024 09:10 | Economic Number of readings: 195 Baghdad / NINA / Oil prices fell more than $ 3 a barrel in Asian trading on Monday, after the Israeli strike on Iran at the weekend avoided hitting oil and nuclear facilities in Tehran and did not disrupt energy supplies, which eased geopolitical tensions in the Middle East.

Brent crude futures and US West Texas Intermediate crude hit their lowest levels since October 1 at the opening.

This morning, Brent crude was at $ 72.66, down $ 3.39, or 4.5 percent, a barrel, while WTI crude fell $ 3.28, or 4.6 percent, to $ 68.50 a barrel, according to Reuters data. Both crudes rose four percent last week in volatile trading as markets digested uncertainty about the extent of Israel's response to Iran's missile attack on October 1 and the US elections next month.

Dozens of Israeli warplanes carried out three waves of strikes before dawn on Saturday against missile factories and other sites near Tehran and in western Iran, in the latest exchange of fire in the escalating conflict between the two Middle East rivals.

Analysts said the geopolitical risk premium that had built into oil prices in anticipation of an Israeli attack had eased.

In October, the Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, left their oil production policy unchanged, including a plan to start increasing output from December. The group’s joint ministerial committee will meet on Dec. 1 ahead of a full OPEC+ meeting./End9 https://ninanews.com/Website/News/Details?key=1164683

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Monday Evening 10-28-24

Good Evening Dinar Recaps,

IF TOKENIZED DEPOSITS DON’T PROGRESS, BANK OF ENGLAND LIKELY TO LAUNCH CBDC

During a speech on Saturday, Andrew Bailey the Governor of the Bank of England, discussed the importance of central bank money for both wholesale and retail payments.

He argued that the role of central bank money is particularly important for wholesale high value payments and the settlement of payment systems. Hence, the Bank wants to enable digital innovation in the wholesale sector.

Good Evening Dinar Recaps,

IF TOKENIZED DEPOSITS DON’T PROGRESS, BANK OF ENGLAND LIKELY TO LAUNCH CBDC

During a speech on Saturday, Andrew Bailey the Governor of the Bank of England, discussed the importance of central bank money for both wholesale and retail payments.

He argued that the role of central bank money is particularly important for wholesale high value payments and the settlement of payment systems. Hence, the Bank wants to enable digital innovation in the wholesale sector.

In July the Bank published a discussion paper on wholesale money, highlighting likely trials for both wholesale CBDC and an RTGS synchronization solution.

However, for retail payments, Governor Bailey thinks the Bank of England should be indifferent to whether payments use central bank money such as a retail CBDC or commercial bank money.

He’s quite keen to maintain the status quo in that most retail payments are in commercial bank money. Doing so doesn’t interfere with fractional reserve banking and the availability of credit in the economy. Regarding digital innovation such as tokenized deposits, he thinks commercial banks are where this should happen.

However, he added, “If for some reason innovation is unlikely to happen, then the central banks have to decide whether they are the only game in town. For me, this justifies why we must continue to prepare for retail CBDC. We have not yet seen enough evidence that the innovation will happen in commercial banks.”

Governor Bailey noted that on occasion, infrastructures and technologies have failed to incentivize innovation. Sometimes that relates to the concentration of market power. Hence the ongoing exploration of CBDC. “That is not my preferred outcome, but not one that we should rule out.”

Tokenized deposits trials

Meanwhile, the UK banking sector has been exploring tokenized deposits as part of the Regulated Liability Network. In September it said the next step was to engage with regulators.

The speech comes across as a ‘giddy up’, and is not the first time the Bank has made such comments. In April Deputy Governor Sarah Breeden outlined a potential scenario where bank innovation is slow, unsuccessful or fragmented.

Fragmentation has been a feature of digital securities, but for tokenized deposits, slightly less so. Some banks purely support tokenized deposits for their own clients. But there are many multi-bank projects.

Ledger Insights Research mapped more than 70 tokenized deposit, stablecoin and other DLT payment initiatives. At least 18 are multi-bank, without counting cross border payment initiatives.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

HBAR ADOPTION EXPANDS AS DUBAI LAUNCHES DIGITAL WILL SOLUTION ON HEDERA

▪️Unlike traditional wills that manage physical assets, the DIFC Courts have chosen Hedera for its reliability, security, speed, and trust, ensuring a transparent process.

▪️This initiative underscores Dubai’s strategic approach to establishing a sustainable digital asset infrastructure and regulatory framework.

The Dubai International Financial Centre (DIFC) announced its integration of Hedera’s Hashgraph technology which will power a new Digital Asset Will inheritance solution.

This initiative is distinct from the traditional FinTech focuses like tokenized assets and payments.

Thus, it marks a unique application of distributed ledger technology (DLT) in estate planning, especially for digital asset inheritance.

Managing digital assets in inheritance is a new challenge, unlike conventional wills that distribute stocks, cash, and gold. As a result, the DIFC Courts have chosen Hedera’s technology for its reliability, security, speed, and, most importantly, trust.

Moreover, the governing council of Hedera provides the DIFC and beneficiaries a complete peace of mind via a trusted, transparent process.

Some of the key features of Hedera like the Hedera Consensus Service (HCS), have played a crucial role in offering audit trails at every step along with accuracy. This helps to ensure the correct management of inheritances. For example, HCS’s real-time audit logs prevent mistakes in transferring assets, safeguarding beneficiaries from potential delays or errors.

The DIFC’s move highlights Dubai’s forward-thinking strategy in building sustainable digital asset infrastructure and regulation, setting a standard for digital asset planning. This collaboration is a win for both Hedera as a DLT leader and Dubai’s vision for long-term, responsible digital asset growth.

Key Developments in the Hedera Ecosystem

The Hedera ecosystem is currently seeing strong growth as several industry players are willing to transition to blockchain tech and prefer Hedera for its transparent governance and trust.

Earlier this month, investment firm Canary Capital announced the launch of the first HBAR Trust in the United States, reported CNF. This fueled further speculation around the potential introduction of a Hedera-focused Exchange-Traded Fund (ETF).

The Canary HBAR Trust will provide safe access for investors to cryptocurrency HBAR while opening the gates for institutional participation in the crypto.

Steven McClurg, CEO of Canary Capital, highlighted that the HBAR Trust is designed to provide U.S. institutional investors with new opportunities to tap into the growing demand for crypto-related products.

On the other hand, Prove AI recently launched its artificial intelligence product on the Hedera blockchain allowing businesses to securely manage their AI training data while ensuring compliance by using Hedera’s secure and scalable infrastructure.

Furthermore, Hedera will also provide governance solutions for businesses interacting with AI regulations and development, reported CNF.

In other news, Karate Combat, the world’s premier professional strike league, has announced the upcoming launch of its Layer-2 platform on the Hedera blockchain.

Named “UP,” this Layer-2 blockchain and crypto-native software licensing platform is set to go live in Q1 2025, aiming to propel Web3 adoption across esports, sports, and entertainment sectors, reported CNF.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

The President of China says:

“At present, the world is going through changes unseen in a hundred years, the international situation is intertwined with chaos.”

The big word here…

Change.

Read: https://x.com/goldtelegraph_/status/1848901796821168254?s=46

@ Newshounds News™

Source: Gold Telegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Afternoon 10-28-24

Good Afternoon Dinar Recaps,

IOTA NEARS MAINNET SMART CONTRACTS RELEASE, PAVING PATH FOR POTENTIAL ATH IN 2024

▪️IOTA is set to launch smart contracts on its Layer 1 network this year, with the transition from testnet to the mainnet expected to be swift.

▪️This would enable the L1 network to anchor decentralized applications and support tokenization, which founder Dominik Schiener says is the network’s key target market.

Good Afternoon Dinar Recaps,

IOTA NEARS MAINNET SMART CONTRACTS RELEASE, PAVING PATH FOR POTENTIAL ATH IN 2024

▪️IOTA is set to launch smart contracts on its Layer 1 network this year, with the transition from testnet to the mainnet expected to be swift.

▪️This would enable the L1 network to anchor decentralized applications and support tokenization, which founder Dominik Schiener says is the network’s key target market.

IOTA has been working towards being an all-encompassing network that can anchor decentralized applications, NFTs, tokenization, decentralized exchanges, and every other blockchain application. While most of these developments have been on the Shimmer staging network, the IOTA Layer 1 could catch up before the end of the year, starting with the debut of smart contracts.

According to discussions from the IOTA’s developers forum, the smart contracts could launch later this year. As noted by one community member on X, they would initially launch in a testnet environment but quickly transition to the main network.

Known as IOTA Academy, he noted:

If this is true and major RWA (real-worl assets) liquidity starts flowing in, we might easily approach IOTA‘s ATH next year.

According to the quoted forum conversation, IOTA developers have been working in private repos on big tech upgrades, but they are bound by non-disclosure agreements against speaking out about these developments.

It also claims that the smart contracts upgrade might include the introduction of MoveVM, a virtual machine designed to run smart contracts written in the Move programming language.

MoveVM enhances flexibility and security while also promoting speed through parallel transaction processing; it has been credited with allowing Web3 apps on networks like Aptos to process up to 150,000 transactions per second.

Earlier this year, IOTA announced the integration of Supra Oracles for IOTA EVM to enhance the data accuracy of its smart contracts.

IOTA Prepares for a Revolution

This year, IOTA has made significant advancements. While every development has been important to the growth of the ecosystem, none has been as significant as the launch of IOTA 2.0. It launched in May this year on a testnet and signals the network’s most radical development in years.

The testnet allows the entire ecosystem of developers, users, and the Foundation to experiment with the new decentralized framework. It comes with features such as feeless transactions and permissionless voting.

IOTA has already been recognized as the best infrastructure for the Internet of Things ecosystem, with Tangle being singled out as the best implementation of decentralized ledger technology for the rapidly growing sector by a recent study.

As we reported recently, a separate study showed that smart contracts on IOTA 2.0 can enhance and secure software-defined networking (SDN), which makes networks more flexible by separating the components of a data network.

IOTA trades at $0.1097 at press time, dipping 2% in the past day despite a 24% rise in the trading volume and a broader uptick in the overall market cap.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

XRP LAWSUIT: LEGAL EXPERT SAYS THE SEC IS ‘NOT DELAYING’ THE RIPPLE APPEAL TO 2025

Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC) continues, with the SEC requesting yet another extension for its main brief submission, now pushing the deadline to January 2025. According to legal analyst Fred Rispoli, this request hints at more than just logistical issues; it shows that the SEC is struggling with its resources in handling cryptocurrency cases, adding to an already packed agenda.

During his appearance on the “Good Morning Crypto Show,” Rispoli said that Ripple’s appeal will focus exclusively on written submissions, characterizing the situation as a “battle of briefs” rather than live courtroom confrontations. Oral arguments are expected to take place in late 2025, providing both parties an opportunity to strengthen their positions.

However, former SEC attorney Marc Fagel countered Rispoli’s assessment, asserting that the SEC merely selected a date to file its briefs within the established timeline and that there are no delays occurring.

Taking to his X handle, Rispoli wrote,

“False. The SEC simply picked a day to file their briefs within the allocated time period. Nothing is being delayed.”

Gary Gensler, New Laws and More

On the show, Fred also discussed how a new law could affect Ripple. If a law were passed stating it would start on January 1, 2026, it might make the current legal arguments irrelevant, as long as it clearly includes Ripple. If the law is unclear about Ripple’s status, the appellate court might send the case back to the trial court for more clarification.

Fred said that new SEC leadership could greatly impact Ripple’s lawsuit. Regarding Gary Gensler, the current SEC chairman, Fred predicted there’s a “0% chance” he’ll still be in that role by 2026.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

🌱ZIMBABWE DITCHES U.S. DOLLAR FOR GOLD-BACKED CURRENCY. WHAT DOES IT MEAN? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Some Iraq News Posted by Clare at KTFA 10-28-2024

KTFA:

Clare: Opening of 7 new outlets for supplying liquefied gas in Iraq

10/28/2024

The Oil Products Distribution Company, affiliated with the Ministry of Oil, announced today, Monday, the opening of 7 new outlets to supply liquefied gas (LPG) to vehicles, as about 29 million and 500 thousand liters of gas were supplied to vehicles through the outlets spread across various governorates.

The company's general manager, Hussein Talib, said in a statement that the new outlets were distributed across a number of governorates, as three outlets were opened in Nineveh, two in Muthanna, and one outlet in each of Baghdad and Maysan, stressing that work is ongoing to open more outlets to meet the needs of citizens.

KTFA:

Clare: Opening of 7 new outlets for supplying liquefied gas in Iraq

10/28/2024

The Oil Products Distribution Company, affiliated with the Ministry of Oil, announced today, Monday, the opening of 7 new outlets to supply liquefied gas (LPG) to vehicles, as about 29 million and 500 thousand liters of gas were supplied to vehicles through the outlets spread across various governorates.

The company's general manager, Hussein Talib, said in a statement that the new outlets were distributed across a number of governorates, as three outlets were opened in Nineveh, two in Muthanna, and one outlet in each of Baghdad and Maysan, stressing that work is ongoing to open more outlets to meet the needs of citizens.

For his part, the Director of the Equipment Authority, Falah Hashem, explained that the distribution company currently manages 70 outlets for vehicle gas, while the gas filling company manages 53 outlets, bringing the total number of outlets to 123 outlets, stressing the continuation of efforts to expand the number of outlets to cover all governorates with liquefied gas services for vehicles.

The General Company for Gas Filling and Services indicated that more than 10% of cars in the country have converted to the gas system, considering that this system is safer than gasoline, with the increasing demand of citizens to convert their cars to operate on gas due to the high prices of improved and premium gasoline. LINK

************

Clare: Al-Lami and Al-Alaq stress the need to combine efforts to prevent corruption and recover its proceeds

10/28/2024 Baghdad

The Chairman of the Federal Integrity Commission, Mohammed Ali Al-Lami, stressed the need for concerted efforts by state institutions to prevent and combat corruption, and to strive diligently to recover smuggled corruption proceeds, in addition to focusing on preventive, awareness-raising and educational methods to prevent corruption and spread and consolidate the culture of integrity among society.

Al-Lami, during his reception of the Governor of the Central Bank, Ali Al-Alaq, at the Authority’s headquarters, noted “the Authority’s determination to continue efforts to combat corruption and pursue its perpetrators, noting that corruption hinders reconstruction, development and investment operations and contributes to the decline in services provided to citizens.”

For his part, the Governor of the Central Bank offered his "congratulations to Mohammed Ali Al-Lami on assuming his duties as Chairman of the Federal Integrity Commission," wishing him "success in carrying out the great national mission of combating corruption and cleansing state institutions of its filth."

The two parties agreed to "intensify levels of cooperation and coordination between the Authority and the Central Bank, especially in the file of money laundering and smuggling, noting the sanctity and inviolability of public money, and the importance of doubling efforts to preserve it, and recovering what was stolen, embezzled and smuggled out of the country." LINK

************

Clare: Rafidain Bank explains the mechanism of selling dollars to travelers

10/28/2024

Rafidain Bank explained, today, Monday, the mechanism for selling dollars to travelers.

A statement by the bank received by the Iraqi News Agency (INA) stated that "the traveler makes an electronic reservation through the bank's website, and the reservation form is filled out 72 hours before the date stated on the travel ticket after completing the reservation procedures and confirming the date," indicating that "the traveler then goes to one of the branches for the purpose of depositing cash in dinars in the branch exclusively."

The statement added that "the dollar will be received at the bank's outlet inside the Babylon Hall at Baghdad International Airport exclusively, and the dollar will not be delivered to the traveler until after completing the travel procedures and after finishing the passport stamping."

He added, "The branches designated for depositing the Iraqi dinar are the Karkh branches (Al-Mansour, Al-Rafei, Al-Ma'rifah, Al-Muheet), the Rusafa branches (Al-Senak, Al-Firdaws, the main branch, Palestine Street, the officers' houses, Al-Waziriyah)."

He pointed out that "the requirements for selling the dollar are a valid Iraqi passport with a valid visa or residency, a civil status ID, a nationality certificate or a unified national card, a residence card, and a valid travel ticket." LINK

Clare: Iraqi-US Negotiating Committee Stresses Transition from Military to Economic Relations

The Higher Coordination Committee for the Strategic Framework Agreement for Friendship and Cooperation with the United States of America stressed the need to move the relationship with Washington to an economic partnership and not to focus on military affairs.

This came during the committee's periodic meeting headed by Foreign Minister Fuad Hussein, in the presence of all representatives of the subcommittees within the Higher Committee, according to a statement by the committee.

The statement stated that "the meeting discussed the latest developments in bilateral relations between Iraq and the United States of America, in addition to reviewing the achievements approved during the recent meetings between the two parties in mid-April in the capital, Washington. Future working papers were also discussed during the upcoming meetings of the committee, scheduled to be held in February of next year, within the agreed upon axes, which include cooperation in the political and diplomatic fields, security and defense, energy, economy, education, health, and the environment."

The Foreign Minister stressed the importance of strengthening relations with the United States of America by implementing the provisions of the agreement, and moving the relationship to a solid economic partnership. He also stressed the need not to focus only on military and security aspects, but rather to expand cooperation to include economic, health, educational, and other fields. link

Iraq Economic News and Points To Ponder Monday AM 10-28-24

An Expert Comments On The Iraqi Central Bank’s Decision To Reduce Interest Rates: It Is Incomprehensible

October 27, 2024 Baghdad/Iraq Observer Economist Ziad Al-Hashemi commented today, Sunday, on the measures of the Central Bank of Iraq to reduce interest rates.

Al-Hashemi said in a tweet on his account on the X platform, which was followed by “Iraq Observer”, that “the Central Bank of Iraq is following in the footsteps of the Federal Reserve and Western central banks, and reducing interest rates from 7.5% to 5.5% despite its failure to achieve its monetary goals

An Expert Comments On The Iraqi Central Bank’s Decision To Reduce Interest Rates: It Is Incomprehensible

October 27, 2024 Baghdad/Iraq Observer Economist Ziad Al-Hashemi commented today, Sunday, on the measures of the Central Bank of Iraq to reduce interest rates.

Al-Hashemi said in a tweet on his account on the X platform, which was followed by “Iraq Observer”, that “the Central Bank of Iraq is following in the footsteps of the Federal Reserve and Western central banks, and reducing interest rates from 7.5% to 5.5% despite its failure to achieve its monetary goals.

He added: “The major central banks around the world have reduced interest rates after inflation rates fell from 10% to below 2%, confirming the success of the high interest rates followed by the major central banks over the past two years in curbing inflation.” He continued:

“As for (in Iraq), the previous interest rates of 7.5% did not succeed in (withdrawing the hoarded cash liquidity) outside the banking system, which exceeds 80% of the mass of the dinar exported, and

it also did not help in reducing (high inflation) which the citizen feels with The continued high prices of goods (which the Ministry of Planning is trying to cover up by issuing illogical data indicating low inflation rates).” Al-Hashemi pointed out that

“despite the failure to achieve the required goals of high interest, and the absence of an urgent and necessary economic need to reduce interest, and the absence of fears that the Iraqi economy will fall into recession, and

there is no need to encourage (already high) spending, the Iraqi Central Bank decided suddenly and without Obvious reasons for lowering interest rates.” He stated that

“such incomprehensible decisions remind and confirm that there is clear randomness in the decision-making process of the Central Bank’s management, as

its decisions depend in many of them on the method of trial and error, reactions, or imitation and imitation of the decisions of others without study, and this is a clear and diagnosed weakness.” In the way this institution works.” He continued by saying: “The decision to reduce interest rates taken by the Iraqi Central Bank is just a (formal measure) for no reason.

It came to create an (illusory impression) among the public of the success of the Central Bank’s measures, just as the measures of the Federal Reserve and the Bank of England succeeded in reducing inflation, and this is far from the truth".

https://observeriraq.net/خبير-اقتصادي-يعلق-حول-إجراءات-البنك-ال/

The Iraqi Central Bank Fined Banks And Exchange Companies About 250 Billion Dinars

Economy Central Bank of Iraq Exchange companies Administrative and financial penalties Iraqi banks 2024-10-27 01:03 Shafaq News/ The Central Bank of Iraq announced on Sunday that the fines imposed on banks and non-banking institutions (exchange companies) amounted to more than 249 billion Iraqi dinars during the past nine months.

A table of the bank, viewed by Shafaq News Agency, showed that the fines imposed on banks and financial companies during the past 9 months, starting from January and until the end of last September, amounted to 249 billion, 889 million, 756 thousand and 16 dinars, indicating that “the fines also included 221 dinars.” Administrative punishment for these banks and non-banking institutions varied between a warning, a warning, and a grace period.”

The table showed that “the month of January witnessed the highest fines on banks and non-financial institutions, as these fines amounted to 98 billion, 277 million, 722 thousand and 62 dinars, with administrative penalties amounting to 17 penalties, while the month of September witnessed the lowest fines, as they amounted to 2 billion, 331 million, 465 thousand and 48 dinars.” With administrative penalties amounting to 13 penalties.

The table did not show the names of the banks on which fines and administrative penalties were imposed.

The Association of Investors in the Iraqi Stock Exchange criticized the Central Bank of Iraq's increase in fines on banks, noting that it would affect the profitability of investors in the shares of these banks.

https://shafaq.com/ar/اقتصـاد/المركزي-العراقي-يغر-م-مصارف-وشركات-صرافة-نحو-250-مليار-دينار

The Era Of Mafias Prosperity In Iraq"... People's Crises Strengthen The Positions Of Currency Smuggling Gangs - Urgent

Politics | Yesterday, 16:32 |Baghdad today – Baghdad Today, Sunday (October 27, 2024), economic affairs specialist Nasser Al-Kanani confirmed the existence of mafias that exploit the crises in Iraq and the region in order to increase currency smuggling operations.

Al-Kanani told “Baghdad Today” that “as soon as the war in Lebanon and Gaza escalated and security tensions throughout the region, specialized mafias emerged working to exploit such security conditions in order to increase the process of smuggling currency from Iraq, and

there are different methods for this smuggling, some of which are carried out.” Through foreign imports, which take place outside the platform.”

He added, “Iraq is working to strengthen its national currency, but there are those who are working to weaken this currency by making the dollar very high against the national currency, and

some are working to limit large commercial transactions exclusively to the dollar, and sell real estate, cars, etc., and this also weakens the national currency.” Despite all the campaigns to prevent internal transactions in dollars.”

The specialist in economic affairs continued, "Iraq cannot take advantage of conflicts and wars to strengthen its national currency, especially as it works hard, internally and externally, to stay away from those wars.

Iraq is aware of the great economic danger if it enters the circle of conflict and wars.".

The war on Gaza and its repercussions, which included multiple regions of the Middle East, dealt a blow to the global economy, especially the economy of Israel, where government spending exceeded $140 billion, and it also lost nearly $15 billion from the attack on Lebanon, according to economic experts.

Speaking about the repercussions of the ongoing conflict in the region on Iraq, Fares Al-Jawari, a researcher and specialist in aviation affairs, reveals that there are significant material losses in Iraq as a result of the recent Israeli bombing of Iran.

Al-Jawari told “Baghdad Today” yesterday, Saturday, that

“there are losses and material damage to the Iraqi air transport sector in particular and the airport sector as a result of the recent Israeli aggression against Iran, and

this impact is clear and tangible during the recent period, but the recent aggression is the most dangerous because it was the cause of a complete cessation of aviation.” "The Iraqi." He stated,

"The cessation means the interruption of the financial revenues that come to the Iraqi government through the passage of aircraft over Iraqi airspace, and this is worth ($450) per aircraft.

According to the latest report of the Iraqi Airports Company, approximately (600) aircraft pass over Iraq monthly, and this means Iraq." He loses 270 thousand dollars in one day.”

He added, "There are other material losses as a result of the planes not arriving at the airports, and their failure to arrive there means providing ground services to them, and this provision is in exchange for a sum of money, and this matter is estimated at around ($2000), and

this means that there are major economic damages and losses as a result of the aggression." "Israel's influence on Iran and the general security situation in the region."

The specialist in aviation affairs confirmed that “Iraqi aircraft are the ones that are directly affected, since most companies were refraining from landing at Iraqi airports, and this means that the major losses fall on the Iraqi Airways Company, and there is a service impact at the airports on travelers through the cessation of flights.”

“This disrupts the work of many travelers, and it has definite economic impacts as well.”

Israel launched a series of air strikes on Iran early on Saturday morning, and four hours after the beginning of the operation, which Tel Aviv called “Days of Response,” the Israeli army announced that it had completed the attack on military targets in Iran, and that all of its aircraft that carried out the attack Iran must return to its bases safely, and that the operation achieved all its objectives. https://baghdadtoday.news/260830-عصر-ازدهار-المافيات-في-العراق.-أزمات-الشعوب-تعزز-مواقع-عصابات-تهريب-العملة-عاجل.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Monday Morning 10-28-24

Good Morning Dinar Recaps,

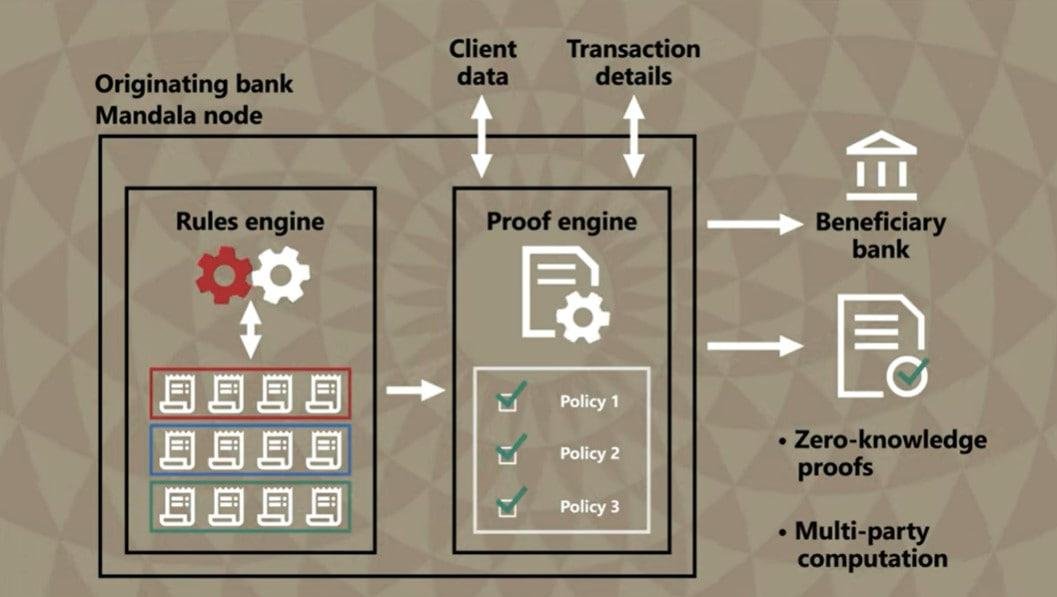

BIS PROJECT DEMONSTRATES AUTOMATED CROSS-BORDER TRANSACTION COMPLIANCE',.

Project Mandala uses zero-knowledge proofs to complete compliance checks across different jurisdictions.

The Bank for International Settlements (BIS) and its central bank partners have shown through Project Mandala that regulatory compliance can be embedded into cross-border transaction protocols.

Good Morning Dinar Recaps,

BIS PROJECT DEMONSTRATES AUTOMATED CROSS-BORDER TRANSACTION COMPLIANCE',.

Project Mandala uses zero-knowledge proofs to complete compliance checks across different jurisdictions.

The Bank for International Settlements (BIS) and its central bank partners have shown through Project Mandala that regulatory compliance can be embedded into cross-border transaction protocols.

The project is a collaboration involving central banks worldwide, including the BIS Innovation Hub Singapore Centre, the Reserve Bank of Australia, the Bank of Korea, Bank Negara Malaysia and the Monetary Authority of Singapore (MAS).

On Oct. 28, the BIS updated its page for Project Mandala, highlighting that the project has reached its proof-of-concept stage.

The project, which seeks to automate compliance for cross-border transactions, is one of the BIS’ key projects for 2024. On Jan. 23, the BIS included Project Mandala in its work program.

The project also aligns with the G20 priority actions for enhancing cross-border payments.

Automated compliance checks in cross-border transactions

In an explainer video, the BIS detailed that, during the proof-of-concept phase of Project Mandala, all participant institutions, including commercial banks, central banks and other regulated financial entities, will operate a Mandala node within their systems.

Participants will interact through a peer-to-peer messaging system, which will help them obtain relevant policies applicable to transactions. The system will then transmit the necessary data to generate proof of compliance and manage any other information needed for automated compliance checks.

Within the Mandala system, rules across jurisdictions are stored in a repository and distributed across relevant parties. The data is applied against consumer transaction data to ensure that cross-border transactions are compliant.

How Project Mandala would streamline cross-border transactions. Source: BIS

The system implements zero-knowledge proofs to complete transaction compliance checks privately. ZK-proofs allow a prover to convince a verifier that a particular claim is true without revealing the details of the claims.

BIS “optimistic” about early results

In an announcement, Maha El Dimachki, head of the BIS Innovation Hub Singapore Centre, said that the central bank is optimistic about the potential of Project Mandala’s early results to enhance cross-border payments.

The official said that Mandala is “pioneering the compliance-by-design approach to improve cross-border payments without compromising privacy or the integrity of regulatory checks.”

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

HONG KONG PARTNERS CENTRAL BANKS OF BRAZIL, THAILAND FOR TOKENIZATION. TO OFFER DIGITAL BOND GRANTS

Today the Hong Kong Monetary Authority (HKMA) announced collaborations with the central banks of Brazil and Thailand for cross border tokenization transactions, including atomic settlement of digital asset transactions (delivery versus payment / DvP) and wholesale CBDC (payment versus payment / PvP). Additionally, the HKMA plans to provide grants of up to HK$2.5 million for digital bond issuances to promote Hong Kong as a tokenization venue.

Hong Kong has previously issued two tokenized government green bond issuances, one tokenized (so the primary issuance was conventional) the other natively digital. The second one was worth more than US$750 million across multiple currencies and was the largest digital bond at the time. It has since been eclipsed by two KfW issuances.

As part of Hong Kong’s push to promote the digital asset ecosystem, it soon plans to publish guidelines for a new Digital Bond Grant Scheme that will offer a maximum grant of HK2.5 million for each eligible issuance.

Cross border collaborations

Given Brazil’s hugely successful launch of its Pix real time payment system, many are eagerly watching the progress of DREX, the Banco Central do Brasil’s wholesale CBDC and tokenization project. DREX recently announced the 13 themes to be trialed and re-opened applications for participants.

Now DREX and Hong Kong’s Project Ensemble tokenization project will trial cross border transactions, including for trade finance and carbon credits.

Previously, Hong Kong conducted a trial with the Banque de France.

HKMA unveiled a similar collaboration with the Bank of Thailand, with whom it previously partnered for CBDC in Project Inthanon-LionRock. That initiative expanded to mBridge, the cross border CBDC project that has reached the minimum viable project stage.

The Thai collaboration will involve Thailand’s Project San, an internal experiment that is testing a tokenization ecosystem. This includes wholesale settlement, Ethereum-compatible ledgers for tokenized deposits and digital assets, plus an interoperability mechanism.

HKMA emphasized the interoperability work, specifically how to enable the interoperability of separate distributed financial market infrastructures (dFMIs).

For the interoperability aspect, the HKMA is also a new associate member of the Linux Foundation (LF) Decentralized Trust (an evolution of Hyperledger), joining seven other central bank members that are collaborating on the technical requirements for central bank digital currencies (CBDC).

Project Ensemble Sandbox update

Additionally, the HKMA provided an update on its Project Ensemble Sandbox for wholesale CBDC, tokenized deposits and tokenization. It previously outlined some of the planned use cases, and today disclosed which ones have completed. JP Morgan has joined the sandbox alongside two technology firms, R3 and Tencent affiliate, WeBank Technology Services.

It added a new use case for tokenized or digital funds involving China Construction Bank (Asia), Fubon Bank (Hong Kong), JETCO and OSL Digital Securities.

These announcements were part of the Hong Kong Fintech Week. This morning, keynotes by the Treasury, Securities and Futures Commission and HKMA involved sharing other updates on stablecoins and cryptocurrency.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

🌱WHAT ARE BONDS? WHY WE WATCH ISAAC. WHAT IS ISAAC'S WORD WHEN HE IS COMPLETE? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Monday Morning 10-28-2024

TNT:

Tishwash: 150,000 Kurdish employees receive their salaries digitally via the “Hisabi” system

The Financial System Administration "Hisabi" in the Kurdistan Region announced, on Sunday, the expansion of the scope of its digital operations so that the number of beneficiaries of the system reached 150 thousand employees during the past week.

According to the official website of the "My Account" system, which Shafak News Agency has reviewed, the number is increasing monthly and 150,000 employees have received their salaries through the system, which reflects the continuous growth in the adoption of the system to facilitate the process of disbursing salaries through digital bank accounts.

TNT:

Tishwash: 150,000 Kurdish employees receive their salaries digitally via the “Hisabi” system

The Financial System Administration "Hisabi" in the Kurdistan Region announced, on Sunday, the expansion of the scope of its digital operations so that the number of beneficiaries of the system reached 150 thousand employees during the past week.

According to the official website of the "My Account" system, which Shafak News Agency has reviewed, the number is increasing monthly and 150,000 employees have received their salaries through the system, which reflects the continuous growth in the adoption of the system to facilitate the process of disbursing salaries through digital bank accounts.

The system is expected to include all eligible employees in the region by the end of next year, as they will be able to receive their salaries directly through their own bank accounts.

This expansion comes within the framework of the Kurdistan Region's efforts to enhance the digital infrastructure and facilitate financial transactions for citizens. link

Tishwash: Economist: Lowering interest rates encourages investment but carries caveats

Economic expert Salah Nouri confirmed today, Sunday, that reducing the interest rate is one of the main tools of monetary policy used by the Central Bank to influence the economy, whether by increasing or decreasing it according to inflation or deflation rates.

Nouri explained in his interview with {Euphrates News} that “reducing the interest rate encourages individuals and companies to borrow for productive projects, which leads to stimulating the economy,” adding: “Lower interest makes the cost of loans lower, and thus encourages consumption and investment.”

Nouri pointed out that "reducing the interest rate reduces the cost of production and perhaps the prices of imported goods, which leads to a reduction in selling prices," but he warned that "reducing the interest rate may push depositors to withdraw their deposits due to the decrease in returns, and resort to alternative investments such as gold."

He added: "It is necessary for the Central Bank to monitor the money market and commodity prices to measure the level of c: Al Furat News}inflation, especially since facilitating borrowing may affect the elasticity of demand versus supply." link

************

Tishwash: The Age of Mafia Flourishing in Iraq" .. People's Crises Strengthen the Positions of Currency Smuggling Gangs - Urgent

Economic expert Nasser Al-Kanani confirmed today, Sunday (October 27, 2024), the existence of mafias exploiting crises in Iraq and the region in order to increase currency smuggling operations.

Al-Kanani told Baghdad Today, "As soon as the war in Lebanon and Gaza escalated and security tensions in the region as a whole, specialized mafias emerged that work to exploit such security conditions in order to increase the process of smuggling currency from Iraq. There are different methods for this smuggling, some of which are done through foreign imports, which take place outside the platform."

He added, "Iraq is working to strengthen its national currency, but there are those who are working to weaken this currency by making the dollar very high against the national currency, and some are working to limit large commercial transactions to the dollar exclusively, and the sale of real estate, cars, etc., and this also weakens the national currency, despite all the campaigns to prevent internal transactions in dollars."

The economic expert continued, "Iraq cannot exploit conflicts and wars to strengthen its national currency, especially since it is working hard, internally and externally, to stay away from these wars. Iraq realizes the great economic danger if it enters the circle of conflict and wars."

The war on Gaza and its consequences, which included many regions of the Middle East, dealt a blow to the global economy, especially the Israeli economy, where government spending exceeded $140 billion, and it also lost approximately $15 billion from the attack on Lebanon, according to economic experts.

Speaking about the consequences of the ongoing conflict in the region on Iraq, researcher and aviation specialist Faris Al-Jawari reveals that there are significant material losses for Iraq as a result of the recent Israeli bombing of Iran.

Al-Jawari told Baghdad Today yesterday, Saturday, that "there are losses and material damages to the Iraqi air transport sector in particular and the airport sector as a result of the recent Israeli aggression on Iran, and this impact is clear and tangible during the recent period, but the recent aggression is the most dangerous as it was the reason for a complete halt to Iraqi aviation."

He explained that "the stoppage means the interruption of financial revenues that come to the Iraqi government through the passage of aircraft over Iraqi airspace, and this is worth ($450) per aircraft, and according to the latest report of the Iraqi Airports Company, approximately (600) aircraft pass over Iraq monthly, and this means that Iraq loses (270) thousand dollars per day."

He added, "There are other material losses as a result of the planes not arriving at the airports, and their failure to arrive there means providing ground services to them, and this provision is in exchange for a sum of money, and this matter is estimated at around ($2,000), and this means that there are great economic damages and losses as a result of the Israeli aggression on Iran and the general security situation in the region."

The aviation specialist confirmed that "Iraqi aircraft are the ones that are directly affected, as most companies were refusing to land at Iraqi airports, and this means that the major losses are incurred by Iraqi Airways, and there is also a service impact at the airports on passengers through the suspension of flights, and this disrupts the work of many passengers and it has economic impacts as well, of course."

Israel launched a series of air strikes on Iran early Saturday morning. Four hours after the start of the operation, which Tel Aviv called "Days of Response," the Israeli army announced that it had completed the attack on military targets in Iran, that all of its aircraft that carried out the attack on Iran had returned safely to their bases, and that the operation had achieved all of its goals. link

Mot: .. When the Door Bell Rings

Mot: Trying to Do As Asked I Do!!!

MilitiaMan & Crew News Reporting-Politics-Financial Reform-Billions Lost-Pressure-Interest- Exchange Rate Changes

MilitiaMan & Crew News Reporting-Politics-Financial Reform-Billions Lost-Pressure-Interest- Exchange Rate Changes

Sunday Night: 10-27-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew News Reporting-Politics-Financial Reform-Billions Lost-Pressure-Interest- Exchange Rate Changes

Sunday Night: 10-27-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 10-27-24

Good Afternoon Dinar Recaps,

INDO-PACIFIC NATIONS OUTPACING THE US IN CRYPTO REGULATION, SEC COMMISSIONER SAYS

A U.S. Securities and Exchange Commission (SEC) commissioner has urged the U.S. to adopt a more proactive approach to crypto regulation, pointing to the leadership of Indo-Pacific nations like Japan, Singapore, and Hong Kong. He emphasized that these countries have crafted clear frameworks that foster innovation while protecting investors, in contrast to the U.S., where unclear guidelines leave market participants struggling with uncertainty.

SEC Commissioner Urges US to Learn from Indo-Pacific’s Crypto Leadership

U.S. Securities and Exchange Commission (SEC) Commissioner Mark T. Uyeda compared the U.S. SEC’s regulatory approach to those of other countries, especially in the Indo-Pacific, regarding crypto and fintech, at the AIMA APAC Annual Forum in Hong Kong on Wednesday.

Good Afternoon Dinar Recaps,

INDO-PACIFIC NATIONS OUTPACING THE US IN CRYPTO REGULATION, SEC COMMISSIONER SAYS

A U.S. Securities and Exchange Commission (SEC) commissioner has urged the U.S. to adopt a more proactive approach to crypto regulation, pointing to the leadership of Indo-Pacific nations like Japan, Singapore, and Hong Kong. He emphasized that these countries have crafted clear frameworks that foster innovation while protecting investors, in contrast to the U.S., where unclear guidelines leave market participants struggling with uncertainty.

SEC Commissioner Urges US to Learn from Indo-Pacific’s Crypto Leadership

U.S. Securities and Exchange Commission (SEC) Commissioner Mark T. Uyeda compared the U.S. SEC’s regulatory approach to those of other countries, especially in the Indo-Pacific, regarding crypto and fintech, at the AIMA APAC Annual Forum in Hong Kong on Wednesday.

He stressed that while the U.S. continues to grapple with unclear regulatory frameworks for digital assets, countries like Japan, Singapore, Hong Kong, and Australia have taken a leadership role in fostering innovation while protecting investors.

Uyeda praised the regulatory advancements in the Indo-Pacific, stating: “I believe there is much to learn from market regulators in the Indo-Pacific region on how to promote these values and objectives.”

The SEC commissioner highlighted how countries in the region have crafted forward-looking regulations that balance the need for innovation with investor protection.

For instance, Hong Kong has introduced a stablecoin licensing regime, Singapore has committed $150 million to promote fintech, Japan has issued guidelines for crypto exchange supervision, and Australia has its own regulatory sandbox.

Uyeda said:

My impression is that Hong Kong, Singapore, Japan, and Australia, among others, have shown leadership in how to facilitate crypto and fintech capital formation and innovation while promoting investor protection.

The U.S. regulator emphasized that many companies have been forced to navigate these uncertainties on their own. “My view is that the SEC could do much more in addressing the key gating question of whether a crypto asset is a security.

Market participants have been forced to struggle with this analysis and decipher SEC views from various settled enforcement actions and litigation in the courts,” he detailed.

“One concern expressed by market participants has been that the SEC has not provided sufficient guidance on key issues, such as when does a particular crypto offering need to be regulated as a security offering.”

In comparison, the SEC’s approach has been less clear, leaving market participants uncertain about key regulatory issues, Uyeda pointed out, adding:

By comparison to the Indo-Pacific region, the SEC’s current regulatory approach to crypto and related technology is less advanced.

Uyeda urged the SEC to learn from the Indo-Pacific’s proactive stance and become more transparent and engaged with the crypto industry. He pointed to fintech events and regulatory sandboxes used by regulators in the region as examples of how to support innovation.

In contrast, the U.S. lacks a specific registration form for crypto, making the regulatory process difficult for issuers.

Uyeda warned that the U.S. must not “bury our heads in the sand about the growing benefits and risks of crypto and financial technology,” calling for the SEC to take a more active role in addressing these challenges.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

WILL JAPAN LAUNCH BITCOIN AND ETHEREUM CRYPTO ETFS? KEY INDUSTRY GROUP PUSHES FOR APPROVAL

In a recent move to boost the growth of crypto investment products in Japan, a coalition of Japanese companies has recommended that any upcoming exchange-traded funds (ETFs) in the region should focus on Bitcoin (BTC) and Ethereum (ETH).

This recommendation comes as Japan debates whether to follow the US and other nations that have already approved crypto-backed ETFs.

The Push For Crypto ETF Approval

It is no more news that the recent introduction of crypto ETFs in the US and other major countries such as Hong Kong is viewed as a milestone for the digital asset industry, following years of regulatory resistance.

Despite the embrace crypto ETFs have received from these countries, Japan, on the other hand, has been so far cautious on this front, with officials from the Financial Services Agency (FSA) previously expressing reservations about the advantages of these ETFs.

However, as of October 25, a certain group, which includes prominent financial institutions appears to be pushing and urging the country’s regulator to prioritize Bitcoin and Ethereum ETFs due to their “market value and long-term performance” which make them “well-suited” for asset-building over medium to long-term horizons.

Particularly, the group’s proposal highlights the perceived reliability of Bitcoin and Ethereum, pointing out their track records, and significant market caps, which are key players in the overall digital currency market.

As Japan explores a potential shift in its stance on crypto ETFs, this coalition seems to ensure that the focus remains on well-established assets such as Bitcoin and Ethereum.

In addition to recommending that Bitcoin and Ethereum be prioritized in potential ETF offerings, the coalition also advised that Japan reconsider its tax policies on crypto income.

Japan’s tax rate on crypto gains can reach as high as 55%, which many argue is a deterrent to individual and institutional investors.

The group suggested that a separation of tax on income earned from cryptocurrencies could help make Japan a more “competitive” destination for digital currency investment.

Notably, members of this coalition include key players in Japan’s financial landscape, such as Mitsubishi UFJ Trust and Banking Corp., Sumitomo Mitsui Trust Bank Ltd., crypto exchange bitFlyer Inc., and brokerage firms like Nomura Securities Co. and SBI Securities Co.

These institutions with vast industry experience have collectively expressed their concerns and recommendations as a consensus rather than individual opinions.

The coalition’s insights come when Japan’s digital currency regulatory environment is under close examination, and the FSA has confirmed its intent to review its regulatory policies. However, this review is expected to take time and its outcome remains uncertain.

@ Newshounds News™

Source: Bitcoinist

~~~~~~~~~

RUSSIA PUBLISHES NEW CRYPTO LAW EXPANDING STATE CONTROL OVER DIGITAL ASSETS

Russia’s new crypto law amplifies state control, enabling regional restrictions, tighter infrastructure regulations, and enhanced transaction monitoring.

State Authority Over Digital Currency Grows as Russia Publishes New Law

The Russian government released a document on Friday detailing a law signed by President Vladimir Putin that broadens the scope of digital currency regulations.

This new law significantly extends government oversight of cryptocurrency mining activities and related infrastructure across the nation.

Taking effect on Nov. 1, the legislation includes several amendments designed to strengthen oversight and impose limitations on crypto mining activities based on regional needs.

The law enables the Russian government to implement mining restrictions by location and define specific procedures and circumstances for banning mining operations.

A notable provision in the law gives the government the power to stop digital currency mining pools from functioning in certain areas.

Additionally, the government now has the authority to regulate infrastructure providers supporting mining operations.

This legislation also grants multiple federal agencies, beyond the Federal Financial Monitoring Service (Rosfinmonitoring), access to digital currency identifier addresses. This expansion includes federal executive agencies and law enforcement, bolstering their capability to track transactions that may be linked to money laundering or terrorist financing activities.

Moreover, the amendments transfer responsibility for the national mining register from the Ministry of Digital Development to the Federal Tax Service, which will now oversee mining registrations for businesses and remove those with repeated infractions.

While individual miners can continue without registering if they adhere to specific electricity consumption limits, companies and individual entrepreneurs must comply with new registration requirements.

In its approach to digital currencies, Russia is advancing crypto regulations and developing a state-backed digital currency, the digital ruble. The country has legalized crypto mining and permitted cryptocurrency use in international trade, aiming to bypass sanctions and reduce reliance on the U.S. dollar in foreign exchanges.

Putin signed legislation in August allowing experimental frameworks for cryptocurrency use in international transactions.

This law enables legal adjustments for cross-border crypto transactions, placing oversight of pilot projects with the Bank of Russia and requiring approval from the Finance Ministry, Federal Security Service, and Rosfinmonitoring.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “ News and Views” 10-27-2024

G7 Banking Giant Joins China’s RMB Payments System, Bypassing USD In Global Trade

Sean Foo: 10-27-2024

In a big move, UK banking Giant, HSBC, has officially joined China's interbank cross-border payment system.

This is a signal that no matter the political pressure from the US, China's economy is just too important to ignore.

Meanwhile, China is preparing for a fierce economic battle in 2025 where the stimulus bazooka could be fired again.

G7 Banking Giant Joins China’s RMB Payments System, Bypassing USD In Global Trade

Sean Foo: 10-27-2024

In a big move, UK banking Giant, HSBC, has officially joined China's interbank cross-border payment system.

This is a signal that no matter the political pressure from the US, China's economy is just too important to ignore.

Meanwhile, China is preparing for a fierce economic battle in 2025 where the stimulus bazooka could be fired again.

Timestamps & Chapters:

0:00 UK Giant Joins China Payments System

2:57 China's Economy Too Big To Ignore

6:17 Beijing's Russian Advantage

8:33 Yellen Scolds China Again

9:25 Unthinkable Economic War In 2025

11:57 Big Stimulus Bazooka Coming

Why Social Security Is On Borrowed Time

Lynette Zang: 10-27-2024

Today we are talking about social security and the looming crisis that's about to hit as the entire program is on borrowed time.

IMF WARNS “New Financial Crisis”: Your Savings at Risk

Taylor Kenny: 10-27-2024

Discover the truth behind shadow banking and the unregulated lending sector threatening global financial stability. Learn how shadow banks, which operate outside traditional regulations, pose a significant risk to your savings and financial security.

Find out why financial experts are warning of a potential crisis and what you can do to protect yourself.

CHAPTERS:

00:00 Introduction to Shadow Banking

00:35 The Growing Threat of Shadow Banks

01:09 The Size and Scope of Shadow Lending

02:22 Lack of Regulation and FDIC Limitations

03:37 IMF Warnings on Shadow Banking Risks

04:12 Traditional Banks’ Risk from Shadow Banking

05:24 Increased Volatility as the New Norm

06:33 Potential Economic Fallout and Hyperinflation

08:12 Protecting Wealth Outside the System

08:50 How to Take Action for Financial Security

09:52 Conclusion