IQD Update News -Iraq PM - $83 Billion 3 Years - Stability - Global Contracts - Non-Oil GDP Growth

IQD Update News -Iraq PM - $83 Billion 3 Years - Stability - Global Contracts - Non-Oil GDP Growth

MilitiaMan and Crew: 9-27-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

IQD Update News -Iraq PM - $83 Billion 3 Years - Stability - Global Contracts - Non-Oil GDP Growth

MilitiaMan and Crew: 9-27-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economic Updates Friday Evening 9-27-24

Good Evening Dinar Recaps,

GENSLER SUGGESTS BNY MELLON’S CRYPTO CUSTODY MODEL COULD EXPAND BEYOND BITCOIN AND ETHER ETFS

BNY Mellon explores extending regulated crypto custody beyond ETFs.

▪️Gensler suggests BNY Mellon's crypto custody model could apply to various digital assets.

▪️The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

Good Evening Dinar Recaps,

GENSLER SUGGESTS BNY MELLON’S CRYPTO CUSTODY MODEL COULD EXPAND BEYOND BITCOIN AND ETHER ETFS

BNY Mellon explores extending regulated crypto custody beyond ETFs.

▪️Gensler suggests BNY Mellon's crypto custody model could apply to various digital assets.

▪️The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

In comments to Bloomberg today, SEC Chair Gary Gensler discussed BNY Mellon’s crypto custody structure. He suggested that the model used for Bitcoin and Ether ETFs could be applied to other digital assets.

While the current approval applies only to Bitcoin and Ether ETFs, Gensler noted that the custody structure is not limited to specific crypto assets.

“Though the actual consultation related to two crypto assets, the structure itself was not dependent on what the crypto was, it didn’t matter what the crypto was.” said Gensler.

BNY Mellon now has the flexibility to extend its custody services to other digital assets if it chooses. Gensler emphasized that the “non-objection” is based on the structure itself, not the type of crypto asset, allowing other banks to adopt the same model for crypto custody.

The approval hinges on BNY’s use of individual crypto wallets, ensuring that customer assets are protected and segregated from the bank’s own assets in the event of insolvency. This wallet structure was developed in consultation with the SEC’s Office of Chief Accountant, leading to the agency’s “non-objection” decision.

This approval guarantees that the bank’s approach complies with regulatory requirements, preventing customer assets from being at risk during bankruptcy, a key issue that has plagued crypto platforms like Celsius, FTX, and Voyager.

The crypto custody market, estimated to be worth $300 million and growing by 30% annually, represents a lucrative opportunity for financial institutions.

With non-bank providers typically charging much higher fees for digital asset custody compared to traditional assets, banks like BNY Mellon are well-positioned to capitalize on this growing demand by offering more secure and regulated solutions.

@ Newshounds News™

Source: CryptoBriefing

~~~~~~~~~

@ Newshounds News™

Live Call: https://t.me/+CpYhls2JLGc5YWRh

~~~~~~~~~

BIG Silver Price and coin news

The Economic Ninja

(9/26/2024)

🚀 Silver surged to a 12-year high in 2022, gaining 37% since January 2023, driven by expectations of Fed rate cuts and increased demand in renewable energy, electronics, and electric vehicles.

💡 The global renewable energy market is projected to grow from $1.14 trillion in 2023 to $5.62 trillion by 2025, with a 17.3% annual growth rate, boosting silver's industrial applications.

🔬 Silver has more patents tied to it than any other metal, used in everyday items like water filters, cell phones, and solar panels, with companies indifferent to price fluctuations due to the small amounts needed in production.

📈 The Federal Reserve's pivot towards easier monetary policy, potential future rate cuts, and China's economic boost efforts have supported silver's price gains.

💼 Silver is considered a tangible, real investment that can be vaulted, contrasting with the stock market's perceived "vaporware" nature, with recommendations to invest in the cheapest possible silver coins.

@ Newshounds News™

Source: The Economic Ninja

~~~~~~~~~

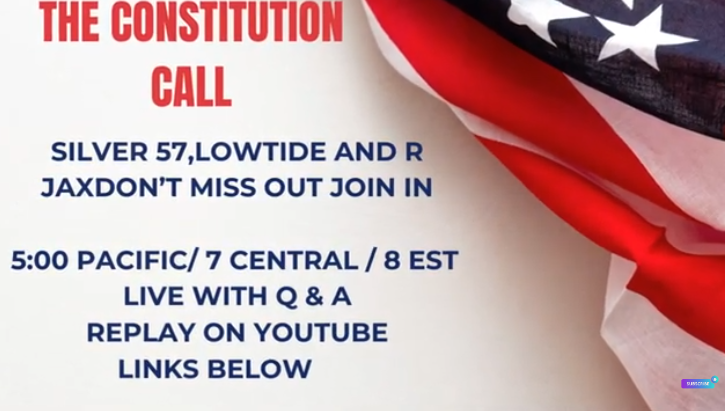

Join Us for the Constitution Call Tonight - You Won't Want to Miss It! Seeds of Wisdom Team | Youtube

@ Newshounds News™

Visit, Like and Subscribe to Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Some “Iraq News” Posted by Clare at KTFA 9-27-2024

KTFA:

Clare: The government announces the suspension of gasoline imports and the closure of the currency auction at the end of the year

9/26/2024

Prime Minister Mohammed Shia Al-Sudani participated in New York, after midnight on Wednesday, in a dialogue session held by the American Chamber of Commerce and Al-Monitor, in the presence of an elite group of investors, businessmen, representatives of American companies, and the Iraqi-American Business Council.

During the session, Al-Sudani pointed to the new reality of Iraq, which is witnessing an economic and developmental renaissance in all its sectors. It has also taken great steps in the field of energy investment and associated gas, which had been wasted for years and cost the country losses estimated at billions of dollars, due to the import of gas and petroleum derivatives.

KTFA:

Clare: The government announces the suspension of gasoline imports and the closure of the currency auction at the end of the year

9/26/2024

Prime Minister Mohammed Shia Al-Sudani participated in New York, after midnight on Wednesday, in a dialogue session held by the American Chamber of Commerce and Al-Monitor, in the presence of an elite group of investors, businessmen, representatives of American companies, and the Iraqi-American Business Council.

During the session, Al-Sudani pointed to the new reality of Iraq, which is witnessing an economic and developmental renaissance in all its sectors. It has also taken great steps in the field of energy investment and associated gas, which had been wasted for years and cost the country losses estimated at billions of dollars, due to the import of gas and petroleum derivatives.

Al-Sudani stressed that the government has embarked on a series of rapid projects, including the important agreement with Total, which will contribute to increasing oil production and investment in associated gas by about (600) million standard cubic feet, in addition to offering the fifth and sixth rounds’ annexes, and entering into contracts to produce oil and invest in gas

Indicating that after 2028, Iraq will achieve self-sufficiency in gas, in addition to activating oil derivatives projects, including the strategic Karbala refinery, whose production capacity reaches 140 thousand barrels per day, as well as rehabilitating the Baiji refinery, which was completely destroyed during the battles to liberate Baiji, and its production capacity is 150 thousand barrels per day.

The following are the highlights of the Prime Minister's speech during the dialogue session:

When I assumed my duties as Prime Minister, the investment in associated gas was less than 40 percent, and now the percentage has risen to about 70 percent.

We have ended the import of petroleum derivatives, and we will stop importing gasoline at the beginning of next year, after completing the FCC project in Basra.

We are ready to enter into a partnership with American companies in the oil industry sector.

Our vision is to convert 40% of exported oil into transformation industries, which will give us more benefits than selling crude oil.

Our policy is based on diversifying the contracting parties that invest in our oil and gas fields without specific conditions.

The licensing round procedures are clear and transparent, and there is no favoritism or preference for one company over another.

Development cannot be achieved without a solid banking sector that operates according to approved international standards, and 95% of financial transfers in Iraqi trade are conducted through reliable banks.

The currency selling window will be closed at the end of this year, and the money laundering office at the Central Bank is operating effectively. The government contracted with Ernst & Young to reform the government banking sector, and we strengthened citizens’ confidence in banks and expanded financial inclusion.

Iraq is going through an unprecedented period of stability and recovery since 2003, which is an opportunity to support the transition from a period of wars and conflicts to a period of development and stability.

A stable Iraq in a sensitive region is beneficial to the world, which is what we have witnessed since October 7, as Iraq has largely maintained balance and calm, and we have kept Iraq away from the arena of conflict.

Our security forces have reached an advanced stage of capability and efficiency, and we have begun an armament program to enhance their capabilities, and ISIS today does not pose a threat to our security.

We need American small and medium-sized companies to partner with Iraqi companies.

We work to create job opportunities for young people by activating the private sector or supporting their private projects, through several programs, including the (Riyada) initiative.

The size of the projects granted for investment will provide a large number of jobs, and it is necessary for companies operating in Iraq to open training centers to develop the capabilities of young people.

We have confirmed to the companies operating in the electricity sector the establishment of stations maintenance centers in order to speed up completion and reduce costs.

The government has a clear direction to support the agricultural sector, and farmers and growers are in a transitional phase to use modern irrigation technologies, which we supported by 30%.

We provided loans to workers in the food industries sector of various types, part of which is covered by sovereign guarantees.

The Central Bank has independence and exercises its powers with complete professionalism, and we intend to establish a new bank that adopts the latest technologies.

We invite all companies working in the field of electronic payment to work in Iraq and we will provide them with all facilities.

We have developed a plan to develop the infrastructure, with allocations amounting to $83 billion. LINK

**

Clare: Al-Sudani issues banking directives, including suspending capital increases for banks subject to US sanctions

9/26/2024

A Government source revealed, on Thursday, that Prime Minister Mohammed Shia al-Sudani issued directives related to financial and banking reforms, including not increasing the capital of banks subject to US sanctions.

The source told Shafaq News Agency, "Prime Minister Mohammed Shia al-Sudani, before leaving for New York, held a number of meetings with banks and the Central Bank of Iraq, where those meetings discussed in detail the Central Bank of Iraq's plan to rehabilitate private banks by contracting with an international consulting company."

He explained that "the Prime Minister directed a number of points, on the importance of the plan for developing private banks by Oliver Wyman Company being clear in terms of timing, distribution of responsibilities, and issuing progress reports in this regard."

The directives included "accelerating the implementation of the recommendations issued by the Ministerial Council for the Economy to support Iraqi banks, including delaying the increase in capital for banks banned from dealing in dollars by the US Treasury."

The source indicated that Al-Sudani also directed "the preparation of a study to activate the local cards project internally, as well as urging Iraqi ministries and institutions to increase dealings with licensed Iraqi banks in various banking services and open accounts with them."

Last Monday evening, Iraqi Prime Minister Mohammed Shia al-Sudani received US Deputy Treasury Secretary Wally Adeyemo and a number of officials from the Treasury Department, according to a statement received by Shafaq News Agency.

The meeting witnessed discussion of bilateral economic relations between the two countries in various vital sectors, review of the government's efforts and plans for economic and financial reform, the move towards diversifying sources of Iraqi output, enhancing development targets, and practical measures implemented in the field of combating money laundering.

Al-Sudani stressed that the government has made great strides in the financial and banking reform file, and 95% of bank transfers have been completed through the electronic platform, and less than 5% remains to be completed by the end of this year, after which the transition to the correspondent banking system will take place, in accordance with the government’s approach and its commitment to raising the capabilities of Iraqi banks, in line with international standards and meeting the needs of the thriving investment environment in Iraq.

For his part, Adeyemo praised the progress witnessed by Iraq in the field of economic and banking reforms that were achieved in record time, and the state of economic growth that reached a total of about 6 % , which enhances the government's efforts in development, expressing readiness to cooperate and work within a bilateral partnership that serves the interests of economic development. LINK

Clare: Masoud Barzani to a parliamentary delegation: There is an opportunity to legislate the oil and gas law

9/25/2024

The President of the Kurdistan Democratic Party, Masoud Barzani, stressed that "the opportunity exists to legislate the oil and gas law to regulate the distribution of wealth."

Barzani expressed during his reception of a delegation from the Parliamentary Finance Committee today, Wednesday, according to a press statement, his desire to resolve the differences between the central government and the region, expressing his support for the Finance Committee's movement in this regard.

The meeting discussed, according to the statement, "the overall common conditions and ways to resolve the outstanding issues between the central government and the Kurdistan Regional Government in a way that establishes a new phase of cooperation, coordination and understanding based on respect for the Iraqi constitution."

The head of the committee, Atwan Al-Atwani, reviewed the files that the Finance Committee delegation came to discuss with the Kurdistan Regional Government, most notably the implementation of the provisions of the Federal General Budget Law, the oil and national wealth file, the localization of employees' salaries, border crossings, taxes and customs, and other issues related to the financial aspect.

He stressed "the Finance Committee's constant endeavor to find understandings that lead to radical solutions to the outstanding issues between the federal government and the region," stressing that "deferring the differences does not solve them, but rather increases their complexity."

Barzani praised the efforts of the Finance Committee, in terms of legislating laws, monitoring performance, and taking the initiative to end the differences. LINK

************

Clare: Al-Atwani: Agreement with the Kurdistan Regional Government to review its oil contracts and adapt them constitutionally

9/26/2024

The head of the Parliamentary Finance Committee, Atwan Al Atwani, announced today, Thursday, an agreement with the Kurdistan Regional Government to review its oil contracts and adapt them constitutionally.

A statement from his office, a copy of which was received by {Atlfrat News}, stated that "the parliamentary finance committee delegation, currently visiting Erbil, headed by Al-Atwani, held an expanded technical meeting with representatives of the Kurdistan Regional Government, in the regional council of ministers building, to discuss resolving the outstanding issues between Baghdad and Erbil."

Al-Atwani said, "The meeting reviewed the oil files, financial revenues, automation of border crossings, unification of customs tariffs, and localization of employees' salaries," announcing "the development of a roadmap to resolve the points of contention between the central government and the regional government regarding the oil export file."

He stressed that "the attendees reached an initial agreement with the regional government to conduct a comprehensive review of the oil contracts to adapt them to the Iraqi constitution, in preparation for solving the problem of the halt in the region's oil exports," explaining that "the agreement stipulates that the central government and the regional government enter as a unified party in negotiations with international oil companies operating in the region with the aim of amending their contracts from production partnership to profit-sharing, in addition to reviewing the economic and commercial terms."

Al-Atwani pointed out that "the parliamentary finance committee is working to establish a sound basis for negotiations on resolving the pending issues, in order to resolve the oil export file during this year and eliminate the differences with the region," stressing that "the committee will meet, upon its return to Baghdad, with the federal oil ministry, in order to discuss the controversial issues and push towards resolving them under the umbrella of the constitution."

He said, "The meeting reviewed, in numbers, the steps for implementing the file of localizing the salaries of the region's employees, where the necessity of adhering to the decisions of the Federal Court was emphasized."

The meeting also discussed, according to Al-Atwani, the file of border crossings, customs, and taxes, and ways to include their revenues in the country's general budget, and the extent of the regional government's commitment to sending these funds to the federal government. LINK

Economist’s “News and Views” Friday 9-27-2024

Currencies BLOWING UP - Expect $3000/oz Gold Soon | Tony Greer

Liberty and Finance: 9-26-2024

Tony Greer discussed the current state of the gold and silver markets, emphasizing gold's strong performance amid ongoing fiat currency instability.

He pointed out that Western central banks' relentless currency creation is driving investors toward gold as a safe haven, predicting it could reach $3,000 per ounce by mid-2025.

Currencies BLOWING UP - Expect $3000/oz Gold Soon | Tony Greer

Liberty and Finance: 9-26-2024

Tony Greer discussed the current state of the gold and silver markets, emphasizing gold's strong performance amid ongoing fiat currency instability.

He pointed out that Western central banks' relentless currency creation is driving investors toward gold as a safe haven, predicting it could reach $3,000 per ounce by mid-2025.

Greer also expressed a cautious optimism about the stock market, noting that recent economic volatility has led to a potential resurgence in tech stocks and cyclicals, suggesting the S&P 500 could rally significantly.

He contrasted the investment behaviors in gold and silver, advocating for a focus on gold due to its stability and historical value as a hedge against inflation.

INTERVIEW TIMELINE:

0:00 Intro

1:15 Gold market

4:28 S&P 500 update

11:06 Recession

13:20 Stock market valuation

15:45 Silver vs gold

21:14 Commodities outlook

CHINA Sell Off 39% of US Treasury: What's Next?

Fastepo: 9-26-2024

The U.S. government continues to regard Treasury securities as stable and secure investment options, especially during economic uncertainties.

Despite this, there are growing concerns about the national debt, which has escalated to over $35 trillion as of mid-2024. This figure has doubled in the last 15 years, highlighting a trend of increasing government expenditure and debt accumulation.

The U.S. government's rising debt poses several long-term economic risks, notably due to the increasing cost of servicing this debt amidst rising interest rates. These higher rates make debt servicing more expensive, potentially leading to inflation and increased borrowing costs, which could crowd out private investment and necessitate higher taxes or reduced government spending.

Compounding these concerns is the U.S.'s reliance on foreign investment to fund its national debt.

Notably, China, which was once the largest foreign holder of U.S. debt, has reduced its holdings significantly, from a peak of $1.316 trillion in 2013 to about $749 billion by mid-2024.

This reduction is part of a broader trend of decreasing foreign ownership of U.S. debt, driven by geopolitical shifts and policy changes both in the U.S. and abroad.

Such a reduction in foreign investment could force the U.S. to offer higher interest rates to attract new investors, thereby increasing borrowing costs further.

This is How The Fed Just Ruined Your Life - George Gammon Goes Off

Daniela Carbone: 9-25-2024

In this insightful interview, George Gammon discusses the Federal Reserve's recent moves and the narrative they want us to believe. Are we heading for a hard landing, or can the Fed really control the economy?

George argues that despite the Fed's attempts to orchestrate a "soft landing," history shows that they often lag behind the curve.

Daniela Cambone dives deeper with George on the Fed’s decision-making, the realities of the labor market, and the significance of the inverted yield curve.

Tune in as they break down complex economic indicators and what they mean for the future of the economy.

CHAPTERS:

0:00 Fed’s Huge Mistake

4:30 More Rate Cuts Needed

8:30 Economic Downturn

13:00 Powell & Elections

18:00 Recession

24:00 Gold Safe Haven

33:00 Future Outlook

Seeds of Wisdom RV and Economic Updates Friday Morning 9-27-24

Good morning Dinar Recaps,

Ripple President Shares Bold Plans for RLUSD and Ethereum

Along with XRP’s function in smaller transactions, Ripple’s RLUSD aims to improve international transactions backed by dollars.

Ripple introduces Ethereum-compatible sidechains to XRPL, combining Ethereum’s programmability with XRP Ledger’s scalability and low costs.

Ripple has announced plans for its new stablecoin, Ripple USD (RLUSD), which will initially be available in countries or territories outside of the United States where Ripple has already obtained a license. Ripple President Monica Long made the statement during a recent interview with a Japanese media outlet.

She stated that after this initial launch, Ripple will look at entering more markets, with Japan being one of the possible targets due to its high adoption prospects for RLUSD.

Good morning Dinar Recaps,

Ripple President Shares Bold Plans for RLUSD and Ethereum

Along with XRP’s function in smaller transactions, Ripple’s RLUSD aims to improve international transactions backed by dollars.

Ripple introduces Ethereum-compatible sidechains to XRPL, combining Ethereum’s programmability with XRP Ledger’s scalability and low costs.

Ripple has announced plans for its new stablecoin, Ripple USD (RLUSD), which will initially be available in countries or territories outside of the United States where Ripple has already obtained a license. Ripple President Monica Long made the statement during a recent interview with a Japanese media outlet.

She stated that after this initial launch, Ripple will look at entering more markets, with Japan being one of the possible targets due to its high adoption prospects for RLUSD.

Ripple’s Legal Victory Sets the Stage for RLUSD Global Expansion

Before establishing RLUSD, Ripple won a substantial legal struggle with the United States Securities and Exchange Commission (SEC), with the court ruling that XRP is not a security. This decision brought legal clarity to the cryptocurrency market, allowing Ripple to expand its services.

Monica Long hailed this triumph as a turning point moment for Ripple, allowing it to strengthen its footprint in the US market, despite the fact that the majority of its growth continues to come from outside the US, particularly in the Asia-Pacific area.

One of Ripple’s primary objectives is to include RLUSD as part of an effective cross-border settlement solution. A trustworthy and open stablecoin will result from the full backing of RLUSD by US dollars and their equivalents in other currencies.

Within the Ripple ecosystem, RLUSD is expected to play an important role in increasing transaction liquidity and efficiency. Monica Long stated:

“RLUSD is not intended to replace XRP, but to supplement it. While XRP will continue to be used for lower market-cap assets, RLUSD will be an effective vehicle for larger transactions.”

Ripple has lofty intentions to add Ethereum interoperability to the XRP Ledger. This means that Ethereum developers will be able to use XRP as a gas token on sidechains that are compatible with the Ethereum Virtual Machine (EVM).

This interface provides developers with additional chances to implement financial solutions and decentralized applications (DeFi) on the XRPL, using XRP’s scalability and efficiency.

Japan stands out as one of Ripple’s most potential markets, given to its long-standing cooperation with the SBI Group. As we previously reporeted, Ripple and SBI have worked together on a number of projects, including the creation of a digital NFT wallet for Expo 2025 in Osaka, which highlights Ripple’s potential acceptance in Japan’s corporate sector.

Furthermore, SBI Remit, a part of the SBI Group, has been providing international remittance services since 2017, using XRP as a bridge currency to enable quick and cost-efficient transactions.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Republicans introduce bill forcing Gary Gensler to testify biannually

Senate Republicans have introduced legislation that would require the SEC chair, currently Gary Gensler, to testify before Congress twice a year.

This move comes amid mounting criticism of SEC Chair Gary Gensler’s leadership and the agency’s approach to regulating the digital asset sector.

As reported by Fox Business, the proposed bill, the “Empowering Main Street in America Act,” would extend provisions from the Dodd-Frank Act to include a mandate for the SEC chair’s biannual appearance.

This follows a postponed hearing originally scheduled for Gensler before the Senate Banking Committee.

The day before, the House Financial Services Committee scrutinized Gensler, with members of both parties questioning his approach to crypto regulation and the broader financial market.

Senate Banking Committee Ranking Member Tim Scott, a key advocate for the bill, criticized the postponement, viewing it as indicative of a lack of accountability under Gensler’s leadership, per Fox Business.

Scott and nine other Senate Republicans argued that more frequent testimony is essential to ensure the SEC maintains its mission of protecting investors, facilitating capital formation, and promoting fair and orderly markets.

Gensler vs. Crypto

Biden-appointed Gensler has vocally expressed skepticism toward crypto regulation. He came out forcefully against the FIT21 bill after it was passed in the House.

The crypto industry mostly views Gensler with skepticism and frustration. Many believe his strict enforcement approach and classifying most crypto assets as securities have stifled innovation and created legal uncertainty.

Gensler’s tenure has faced bipartisan pushback, particularly regarding the SEC’s handling of digital assets.

Critics argue that the agency’s aggressive enforcement actions have caused uncertainty in the crypto market. These concerns were recently highlighted during a congressional hearing in which all five SEC commissioners, including Gensler, were pressed on their stance on cryptocurrency oversight.

Senate Republicans are aiming for greater accountability and transparency in the SEC’s regulatory decisions with the Empowering Main Street in America Act. They want to ensure the SEC remains transparent as the financial landscape continues to evolve.

On Sept. 24, The SEC charged TrueCoin and TrustToken with securities violations over unregistered offerings of TUSD and TrueFi, resulting in a settlement with fines totaling over $500,000. The case adds to the SEC’s growing enforcement actions against crypto firms, with industry fines surpassing $7 billion since 2013.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

DEBUNKING MYTHS: OPINIONS VS. FACTS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Friday Morning 9-27-2024

TNT:

Tishwash: Prime Minister leaves New York for Baghdad

Prime Minister Mohammed Shia Al-Sudani left New York heading to Baghdad.

The Prime Minister's Media Office stated in a statement received by the Iraqi News Agency (INA), that "Prime Minister Mohammed Shia al-Sudani left New York heading to the capital, Baghdad, after concluding his participation in the meetings of the 79th session of the United Nations General Assembly." link

TNT:

Tishwash: Prime Minister leaves New York for Baghdad

Prime Minister Mohammed Shia Al-Sudani left New York heading to Baghdad.

The Prime Minister's Media Office stated in a statement received by the Iraqi News Agency (INA), that "Prime Minister Mohammed Shia al-Sudani left New York heading to the capital, Baghdad, after concluding his participation in the meetings of the 79th session of the United Nations General Assembly." link

Tishwash: Iraq discusses cooperation with SpaceX to provide internet services

Today, Thursday, the Chairman of the Communications and Media Commission, Ali Al-Moayyad, discussed with the Senior Director of Global Licensing and Market Activation at SpaceX, Ryan Goodnight, prospects for cooperation to provide Internet services in Iraq.

The Commission stated in a statement that "Chairman of the Communications and Media Commission, Ali Al-Moayyad, met with the Senior Director of Global Licensing and Market Activation at SpaceX, Ryan Goodnight, on the sidelines of Iraq's participation in the Future Summit held in New York," noting that "the meeting discussed the available means to spread Starlink services in the region, and the high-speed internet services it provides."

She added, "The two sides discussed how to benefit from these modern technologies and their licensing mechanisms to meet the needs of users, whether individuals or institutions."

She added, "SpaceX representatives provided a detailed explanation of the services provided by the company, the areas it covers, and the speeds that can be provided to operators." link

************

Tishwash: US State Department: Announcement of agreement on the future of the international coalition from Iraq within two weeks

The US State Department expected to announce the agreement on the future of the international coalition from Iraq within two weeks.

"We expect that in the coming days, within a week or two, I don't want to specify a specific date, but in the coming days and weeks, we will hear more about the position, and I don't mean the American position, but the joint position, because the partnership between the United States and Iraq is the most important

And when we say there is an agreement or a deal; there was a deal or there was an agreement years ago regarding the presence of the American army and the international coalition in Iraq, this was at the invitation of the Iraqi government and secondly to combat terrorism only, and therefore we must see in this context of the agreement that was in the past years, how we will change if the circumstances change

As we must change or at least we must renew this defense and security relationship with Iraq," said the US State Department's regional spokesman, Samuel Werberg, in a press statement.

"So far, there is no official announcement or statement for me to share, but as I said weeks ago, we knew that since the announcement by Secretary of Defense Austin, we saw that the US government and the Iraqi government were intervening in these discussions to set the appropriate conditions for the continuation of this coordination between the two countries, so we expect that in the coming days and maybe within a week or two we will hear more." link

************

Tishwash: Al-Samarrai praises Al-Sudani’s speech before the United Nations: It is worthy of Iraq, its history and its international standing

Today, Friday (September 27, 2024), the head of the Azm Alliance, MP Muthanna Al-Samarrai, praised the speech of Prime Minister Muhammad Shia Al-Sudani before the United Nations General Assembly, indicating that it is befitting of Iraq, its history and its international status.

Al-Samarrai said in a post on the (X) platform, which was followed by "Baghdad Today", "We followed the speech of Prime Minister Mohammed Shia al-Sudani before the seventy-ninth session of the United Nations General Assembly, and it was a speech that befits Iraq, its history and international standing, and clearly expresses its orientations and reflects the will of its people and its national, Arab, Islamic and humanitarian principles."

Al-Sudani stressed in his speech that stopping the violations taking place in Palestine and the region is everyone’s responsibility. While he pointed to the Security Council’s failure to maintain international peace and security, he stressed Iraq’s support for Lebanon and its continued provision of assistance to overcome the effects of these attacks. link

************

Tishwash: Prime Minister: Iraq is witnessing an urban and economic renaissance and revitalization of the industrial and agricultural sectors

Prime Minister Mohammed Shia al-Sudani received an official invitation to visit Islamabad on Thursday from his Pakistani counterpart, Shehbaz Sharif.

The Prime Minister's Media Office said in a statement, seen by "Al-Eqtisad News", that "Prime Minister Mohammed Shia Al-Sudani met - this evening, Thursday (Baghdad time) in New York - with Pakistani Prime Minister Shehbaz Sharif, on the sidelines of his participation in the 79th session of the United Nations General Assembly."

He added that "the meeting witnessed discussions on the overall bilateral relations and ways to develop them in various fields, in addition to discussing the latest developments in the aggression in Gaza and Lebanon and the efforts made to stop the war of genocide against the Palestinians and protect brotherly Lebanon and its secure people."

Al-Sudani explained to his Pakistani counterpart - according to the statement - "Iraq's desire to deepen the relationship with Pakistan in various fields, and that the government is following an open policy on all steps of economic partnership, just as Iraq is witnessing an urban and economic renaissance and the revitalization of industrial and agricultural fields, in addition to the deep desire to open the doors of constructive partnerships with brotherly and friendly countries."

He touched on "the pivotal efforts undertaken by Iraq to prevent the escalation of the situation in the region and stop the aggression, including the initiative to call for an Islamic summit that unites the ranks of Islamic countries, especially Pakistan, in order to prevent the situation from sliding into a comprehensive war and protect the steadfast Lebanese and Palestinian peoples."

For his part, Shehbaz Sharif extended an invitation to Al-Sudani to "visit Islamabad in order to establish more foundations for cooperation and partnership between the two countries and expand trade exchange agreements."

He expressed his "support for the Iraqi initiative calling for an Islamic summit to consider the current aggression on Lebanon and Palestine, and formulate a unified position regarding the ongoing massacre of the Palestinian people and the attempts to expand the war by the occupation government link

Mot: 3 of those.. nooo -- 5 of those --- nooooo 4 of

Mot: .... Always looking for a Good Hotel - Huh!!!

Seeds of Wisdom RV and Economic Updates Thursday Evening 9-26-24

Good Evening Dinar Recaps,

IRAQ BOOSTS GOLD RESERVES TO OVER 145 TONS

Data from the World Gold Council reveals that Iraq purchased a total of 51.9 tons of gold between 2022 and September of this year.

ERBIL (Kurdistan24) - Iraq has significantly increased its gold reserves over the past three years, acquiring approximately 52 tons of the precious metal. The majority of these purchases occurred in 2022, accounting for 65% of the total acquired gold.

Data from the World Gold Council reveals that Iraq purchased a total of 51.9 tons of gold between 2022 and September of this year.

Good Evening Dinar Recaps,

IRAQ BOOSTS GOLD RESERVES TO OVER 145 TONS

Data from the World Gold Council reveals that Iraq purchased a total of 51.9 tons of gold between 2022 and September of this year.

ERBIL (Kurdistan24) - Iraq has significantly increased its gold reserves over the past three years, acquiring approximately 52 tons of the precious metal. The majority of these purchases occurred in 2022, accounting for 65% of the total acquired gold.

Data from the World Gold Council reveals that Iraq purchased a total of 51.9 tons of gold between 2022 and September of this year.

The breakdown shows a significant purchase of 33.9 tons in 2022, followed by 12.3 tons in 2023, and 5.7 tons so far this year. Notably, there were substantial purchases of 3.1 tons in February and 2.6 tons in May of this year.

This strategic accumulation of gold aligns with a global trend among central banks seeking to diversify their reserves and hedge against economic uncertainties.

Gold Prices in Iraq Soar

The increased demand for gold has also driven up its price in Iraq across all carats. Currently, one gram of gold is priced as follows:

- 24 carat gold: 108.652 dinars (equivalent to 83 US dollars – based on the official exchange rate by the Iraqi government.)

- 22 carat gold: 99.598 dinars (equivalent to 76 US dollars – based on the official exchange rate by the Iraqi government.)

- 21 carat gold: 95.071 dinars (equivalent to 72 US dollars – based on the official exchange rate by the Iraqi government.)

- 18 carat gold: 81.489 dinars (equivalent to 62 US dollars – based on the official exchange rate by the Iraqi government.)

Iraq's Global Ranking

According to the World Gold Council's latest data for June, Iraq's gold reserves have now reached 145.7 tons, a notable increase from 142.6 tons in May.

This increase has solidified Iraq's position as a significant holder of gold reserves globally. While the country has dropped one place to 31st in the World Gold Council's ranking of the 100 countries with the largest gold reserves, its holdings represent a substantial 9.8% of its total reserves.

The United States, Germany, and Italy continue to hold the top three positions in terms of gold reserves, while Suriname ranks at the bottom of the list.

@ Newshounds News™

Source: Kurdistan24

~~~~~~~~~

US SANCTIONS RUSSIAN CRYPTO PLATFORMS FOR MONEY LAUNDERING TIES

Two crypto exchanges and two individuals have been sanctioned for ties to underground finance.

The United States government has taken action against two Russians and two cryptocurrency exchanges tied to alleged illicit Russian finance. The departments of the Treasury, Justice and State were involved, along with an assortment of overseas law enforcement agencies.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) identified PM2BTC, a Russian cryptocurrency exchange, and Sergey Ivanov, who is associated with that exchange, as being of “primary money laundering concern.” At the same time, Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned Ivanov and another crypto exchange, Cryptex.

Crypto exchanges to the underworld

PM2BTC is alleged to process the proceeds of ransomware attacks and other illicit activities. Half of its activities are linked to illegal operations, according to FinCen.

According to Chainalysis, PM2BTC shares wallet infrastructure with UAPS (Universal Anonymous Payment System), an underground payment processing system.

Cryptex is registered in St. Vincent and the Grenadines but advertises in Russian. According to the Treasury:

“Cryptex is also associated with over $720 million in transactions to services frequently used by Russia-based ransomware actors and cybercriminals, including fraud shops, mixing services, exchanges lacking KYC programs, and OFAC-designated virtual currency exchange Garantex.”

The Treasury Department acknowledged the US Secret Service Cyber Investigative Section, the Netherlands Police and the Dutch Fiscal Intelligence and Investigation Service for seizing web domains and infrastructure associated with PM2BTC, Cryptex and Ivanov. Chainalysis said that it and Tether also contributed to the effort.

Links to “carding”

In documents unsealed in the District Court of Eastern Virginia, Ivanov was charged with one count of conspiracy to commit and aid and abet bank fraud in connection with websites that engage in “carding,” or trading in stolen credit card information.

Timur Shakhmametov was charged with one count of conspiracy to commit and aid and abet bank fraud, one count of conspiracy to commit access device fraud, and one count of conspiracy to commit money laundering in connection with the same operations.

The State Department is offering a reward of up to $10 million for information leading to the arrest and/or conviction of Ivanov or Shakhmametov.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

BRICS NEWS: 40% GOLD AND 60% LOCAL—IS THERE ROOM FOR BITCOIN, XRP, AND OTHER CRYPTOS?

▪️The BRICS currency, which is reported to be in development, is said to be backed by 40% gold and 60% local currencies.

▪️The currency is disclosed to be apolitical and would be outside the “circumference” of the SWIFT payment network.

The much anticipated BRICS currency, which would be the principal driving force at the heart of the de-dollarization strategy, could be on the table at the upcoming summit in October.

According to experts, this kind of development could largely erode a significant portion of the US dollar dominance as several other developing countries show their willingness to join the alliance.

Even before that, details of the expected BRICS currency have started leaking as reports establish that the potential currency could be based on a “basket” of 40% gold reserves and 60% BRICS sovereign nation currencies.

According to the details, the regional currencies that could be involved are the Chinese yuan, Russian ruble, and Indian rupee. Interestingly, this report aligns with the alleged outcome of a recent meeting between Russian President Vladimir Putin and the Head of the BRICS New Development Bank (NDB).

In our review of a publication by a Russian news platform, it was discovered that shareholders directed the NDB to prioritize the new digital currency to facilitate trade and avoid Russian sanctions.

Some Exclusive Details Around the BRICS Currency

According to the report, Russia is facing limitations as its trade volume among certain members remains one-sided. A typical example is Russia’s possession of excessive rupees received in exchange for energy, such as oil and gas, with India.

In this case, backing the BRICS currency with gold and local currency could provide enough stability and take care of the exchange rate fluctuations. Conversely to the US dollar, the BRICS currency would be apolitical and transactional and operate externally from the SWIFT payment network.

According to reports, the West can only distract this arrangement by sanctioning currencies such as the Chinese RMB and the Indian Rupee. Unfortunately, this could negatively impact the Western economy as the trade between these two countries and the US and EU amounted to around $1.56 trillion last year.

According to experts, an attempt to impose sanctions could cause serious inflation and recession in the West. Meanwhile, the NDB shareholders include Brazil, India, China, and South Africa, and Bangladesh, Egypt, the UAE, and Uruguay have joined them. More than 30 other countries have expressed interest in joining the alliance.

Amid the ongoing developments, enthusiasts have highly recommended Bitcoin, XRP, and other cryptos for consideration for their democratic qualities. Already, countries like El Salvador have declared Bitcoin a legal tender and the process could be keenly studied by the BRICS nations. However, no official announcement on this possibility has ever been made.

Commenting on the impact of these developments, the founder and CEO of Zang Enterprises, Lynette Zang, recently disclosed in a CNF report that the US Dollar’s dominance has reduced to 3% and could dwindle to zero in 2025.

I believe with all my heart and everything that I know that we’ve already begun the transition to hyperinflation. We’re going to see more borrowing, more money printing, and more inflation because they have not killed that beast that they created and continue to create. It’ll become very obvious in 2025.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

SEC CHAIR GENSLER PLUGS CHANGES TO EXCHANGE DEFINITION THAT WORRIES CRYPTO

Gary Gensler reminded a conference on Treasury bonds about a proposed rule change that would impact DeFi, too.

The United States Securities and Exchange Commission will continue to pursue changes to the definition of “exchange” and alternative trading systems, Chair Gary Gensler told attendees of the US Treasury Market Conference on Sept. 26.

Gensler was speaking about issues that affect the efficiency and resilience of the US Treasury bond market, but that proposal has been heavily criticized in the digital asset space.

Defining dealers to include more market players

One of the measures the SEC has taken to buttress the Treasury market was a change to the definition of a “dealer” that was meant to clarify the role of market participants such as principal-trading firms, which might use algorithmic and high-frequency trading strategies.

The changes, proposed in 2022, were criticized at the time by pro-crypto politicians for the spillover effect they would have on digital asset trading. Nonetheless, they were adopted in February.

What makes an alternative trader?

The worst may be yet to come, however. Another issue for Treasury bonds that also touched digital assets is the definition of “exchange” and alternative trading systems. A proposal dating to 2022 would extend registration requirements for platforms that served as market makers for government securities.

The wording of that proposal implied other kinds of exchange platforms would be subject to the new rules as well, and potentially raised issues of constitutionality.

When the proposal was revived a year later, a section was added to apply specifically to decentralized finance (DeFi). “This update would close a regulatory gap among platforms,” Gensler said. The changes have not been finalized yet.

Notably, Prometheum and tZero are registered alternative trading systems. They are also the first and so far only firms to receive special purpose broker-dealer status for digital asset securities, which allows them to provide custody of digital asset securities on behalf of retail and institutional clients.

Gensler did not mention cryptocurrency or DeFi in his presentation. He stopped by CNBC the same day to talk about crypto regulation and claimed that the crypto industry is adequately regulated by existing laws.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

BILLIONAIRES FLOCKING TO DUBAI WHY? #DUBAI #BILLIONAIRE | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Recession Signals Are FLASHING Red, It's Much Worse Than You Think

Recession Signals Are FLASHING Red, It's Much Worse Than You Think

Atlantis Report: 9-26-2024

The US economy has been struggling for some time, and the situation has worsened with the onset of a recession. The recession is here, and it's not looking pretty. Despite the optimism and reassurances from various sources, the reality is that the recession is expected to have a severe impact.

Today, we will examine the factors that have contributed to this economic downturn, the potential consequences, and the measures that can be taken to endure the difficult times ahead. The silent depression - when we talk about the economy, we often hear about two types of data: hard and soft.

Recession Signals Are FLASHING Red, It's Much Worse Than You Think

Atlantis Report: 9-26-2024

The US economy has been struggling for some time, and the situation has worsened with the onset of a recession. The recession is here, and it's not looking pretty. Despite the optimism and reassurances from various sources, the reality is that the recession is expected to have a severe impact.

Today, we will examine the factors that have contributed to this economic downturn, the potential consequences, and the measures that can be taken to endure the difficult times ahead. The silent depression - when we talk about the economy, we often hear about two types of data: hard and soft.

Hard data includes tangible numbers like GDP growth, employment figures, and industrial production. Soft data, on the other hand, captures sentiments and perceptions, like consumer confidence and business optimism.

The soft data about the US economy today is not painting a great picture. Sentiment indicators are tanking, and they're closely mirroring the trends we see in hard data. There is a decline in business activity, a decrease in new orders, and a reduction in backlogs - all pointing towards an unhealthy economy.

While the term "recession" typically conjures up images of mass layoffs, shuttered businesses, and widespread economic hardship, the current downturn is taking on a more disturbing form – one that could be described as a "recession light.

" Rather than a sharp, dramatic contraction, we are witnessing a slow, steady erosion of economic vitality, marked by stagnating growth, persistent inflation, and a general unease that pervades every aspect of our financial lives.

As businesses struggle with decreasing demand, increasing costs, and tighter credit conditions, households are finding it challenging to manage their expenses due to rising prices and stagnant wages. But labor hoarding isn't the only piece of the puzzle.

There's something deeper at play here, something experts call the "silent depression." It's the underlying sense of unease that permeates the labor market, even in the absence of mass layoffs. It's the feeling that something isn't quite right, that the economy is in danger.

To understand this silent depression, we need to take a trip down memory lane. Before the 2008 financial crisis, businesses operated on a different rhythm. During economic recoveries, companies eagerly hired new workers, confident in the prospects of a booming economy. Nowadays, that optimism seems to be in short supply. Instead of a hiring spree, businesses are holding back and are reluctant to commit to long-term investments.

They're wary of the uncertain economic situation, unsure if the recovery will be as robust as they hope. And so, they're playing it safe, keeping their workforce lean and their expenses in check. The current recession is the result of a buildup of global events and economic imbalances over time. Though no single factor can be solely held responsible, the mixture of these forces has created an ideal situation that has proven to be too much for even the strongest economies to handle.

2020 disrupted global supply chains, shattered businesses, and altered consumer behavior in unprecedented ways. While the initial shock waves have subsided, the ripple effects continue reverberating through the global economy, worsening existing vulnerabilities and exposing structural weaknesses.

To combat the soaring inflation rates brought about by disruptions and geopolitical tensions, central banks worldwide have embarked on an aggressive path of interest rate hikes. While aimed at curbing runaway prices, these tightening monetary policies have also constricted access to credit and dampened consumer and business spending, further compounding economic woes.

Years of accommodative monetary policies and stimulus measures have left many economies saddled with mounting debt burdens, both at the governmental and private sector levels. As interest rates rise and economic conditions deteriorate, the ability to service these debts becomes increasingly strained, potentially setting the stage for a cascade of defaults and financial instability.

While recessions have far-reaching consequences, certain sectors and industries are particularly vulnerable to the current economic downturn. As households tighten their belts in response to rising costs of living and economic uncertainty, consumer spending – a vital driver of economic growth – has taken a significant hit. Retailers, particularly those in discretionary sectors like apparel and luxury goods, are feeling the brunt of this slump as consumers prioritize essential purchases.

The energy and commodities sectors are particularly vulnerable to fluctuations in global demand and geopolitical instability. As economic activity contracts, the demand for resources like oil, gas, and metals wanes, putting pressure on prices and profitability in these industries.

Seeds of Wisdom RV and Economic Updates Thursday Afternoon 9-26-24

Good Afternoon Dinar Recaps,

MOROCCO TURNS TO AI, BLOCKCHAIN TO ACHIEVE ‘DIGITAL HUB’ GOAL BY 2030

The Digital Morocco 2030 was announced on Sept. 25 and launched with a $1.1 billion budget.

Morocco is betting on artificial intelligence (AI) and blockchain technologies to transform the country into a global digital hub as part of its ambitious Digital Morocco 2030 strategy.

The initiative was announced on Sept. 25 and launched with a $1.1 billion budget. It aims to integrate advanced technologies to boost public services, drive economic growth, and create 240,000 new jobs in the digital sector by 2030.

Good Afternoon Dinar Recaps,

MOROCCO TURNS TO AI, BLOCKCHAIN TO ACHIEVE ‘DIGITAL HUB’ GOAL BY 2030

The Digital Morocco 2030 was announced on Sept. 25 and launched with a $1.1 billion budget.

Morocco is betting on artificial intelligence (AI) and blockchain technologies to transform the country into a global digital hub as part of its ambitious Digital Morocco 2030 strategy.

The initiative was announced on Sept. 25 and launched with a $1.1 billion budget. It aims to integrate advanced technologies to boost public services, drive economic growth, and create 240,000 new jobs in the digital sector by 2030.

In addition to reforming government services, the strategy aims to support the development of new AI-driven startups and blockchain-based platforms, which will play a key role in Morocco’s goal of becoming a major player in the global digital economy.

AI and Blockchain

The strategy places AI and distributed ledger technology (DLT) at the core of public service digitization, streamlining government operations and improving transparency.

A key component, the Unified Administrative Services Portal, will utilize the blockchain to securely manage services such as healthcare, education, and social protection, while AI systems will enhance service delivery by analyzing and processing data in real-time.

Minister of Digital Transition Ghita Mezzour emphasized that the strategy seeks to boost the digital economy while fully embracing digital technologies, including AI and DLT.

The Moroccan government aims to improve its ranking in the United Nations Online Services Index, moving from 100th to 50th place globally.

The Digital Morocco 2030 strategy also targets an increase in digital export revenues to 40 billion dirhams ($4.15 billion) and an overall contribution of 100 billion dirhams ($10.36 billion) to the country’s gross domestic product.

Additionally, the government plans to enhance 5G coverage to 70% of the country’s territory and create 3,000 startups.

Attracting global tech

Morocco seeks to attract global tech companies specializing in AI and blockchain, inviting them to establish operations and contribute to the country’s growing tech ecosystem.

The Moroccan Agency for Digital Development (ADD) will support the digitalization of public administrations and standardize administrative procedures through a unified digital portal.

The Digital Morocco 2030 plan also focuses on fostering innovation within the country by supporting startups that are developing AI and blockchain-based platforms.

The government is creating a supportive legal framework to accelerate the growth of these startups and enable them to expand globally.

By nurturing a dynamic tech ecosystem, Morocco hopes to generate hundreds of thousands of jobs while positioning itself as a competitive force in the AI and blockchain sectors on the international stage.

@ Newshounds News™

Source: Crypto Slate

~~~~~~~~~

NYDFS SUPPORTS FEDERAL CRYPTO REGULATIONS AND MAINTAINS STATE ROLE

NYDFS expresses support for federal crypto regulations while ensuring states retain their roles.

Adrienne Harris emphasizes the importance of both federal and state involvement in regulation.

Many companies relocate due to regulatory uncertainty, while some choose to remain in the U.S.

The New York Department of Financial Services (NYDFS) has expressed no concerns regarding federal cryptocurrency regulations. However, the office also believes that each state will retain its current role in overseeing digital assets.

Balancing Federal and State Authorities

Adrienne Harris, the New York State Financial Services Superintendent, spoke at the Digital Asset Compliance and Market Integrity Summit held in Manhattan on Wednesday. During the event, she defended federal cryptocurrency legislation while addressing the role of the states.

In her address, Harris stated that her office is ready to work with federal authorities, but insisted that states must also play a role to be more effective. She noted that states can move faster in regulating digital assets, which counters the perception that state oversight undermines regulatory standards. Harris remarked:

“Passing bills and drafting regulations is indeed important, but it is still essential for states to have a role.”

Continuing to discuss the role of states in crypto regulation, the Superintendent highlighted that NYDFS possesses one of the strongest digital asset regulatory frameworks globally. Harris expressed optimism that federal cryptocurrency legislation will soon be made public and confirmed that NYDFS has been in discussions with the U.S. House of Representatives and Senate.

With a team of 60 full-time staff, NYDFS’s crypto division has become one of the largest regulatory bodies for cryptocurrency in the world.

Cryptocurrency Regulations

Congress, the SEC, NYDFS, the Treasury, and the Fed all advocate for a regulated presence of cryptocurrencies in the U.S.

However, we have seen that tangible steps have not been taken to the desired level for years.

Cryptocurrency companies in the U.S. are being directed down a straight line with their eyes blindfolded, yet they can neither see nor find a straight line.

Due to the lack of necessary regulatory guidance, many companies have relocated their headquarters to countries like the UAE, Qatar, and Singapore.

However, giants like Coinbase and Ripple announced their intention to stay and continue fighting in America. If Trump is elected, it could be a significant win for cryptocurrencies, likely leading to tangible crypto laws. However, Harris also promised to focus on regulations in a scenario where she wins the elections.

@ Newshounds News™

Source: CoinTurk

~~~~~~~~~

XRPL’S XAMAN WALLET 3.0 LAUNCHES: REVENUE SHARING AND DEVELOPER PERKS UNVEILED

Xaman Wallet’s version 3.0 introduces a revenue-sharing program to support developers and enhance the XRPL ecosystem.

The new update offers a threshold-based model, universal transaction signing, and enhanced accessibility for developers and users.

The XRPL-based wallet, Xaman Wallet, has released version 3.0, which marks a huge step forward by introducing a monetization model that splits money with dApp developers.

This version includes various enhancements to improve the user experience, including a new xApp page, NFT offer previews, more detailed transaction insights, and more smooth interactions with AMM pools.

Xaman Upgrade: User-Centric Design and Developer Revenue Sharing

The new design not only provides a cleaner, more user-friendly interface, but it also makes browsing the wallet’s functionalities much simpler.

The most notable feature of this upgrade is the threshold-based paradigm, which allows low-transaction accounts to continue using the wallet for free while high-transaction accounts may need to subscribe to additional features.

This update demonstrates Xaman’s dedication to giving value to its consumers while also guaranteeing that frequent users have access to even more advanced features.

Looking ahead, Xaman has announced intentions to launch a revenue-sharing program for developers of popular tools and xApps within its ecosystem in early 2025.

Although the finer details are still being worked out, Xaman hopes to create an atmosphere in which user contributions not only fuel the platform’s growth but also benefit the community.

This program aims to build a more integrated and thriving community by allowing creators of popular xApps to earn monthly payouts.

For example, a developer who produces a highly engaging xApp will be compensated on a regular basis, encouraging innovation and the creation of useful tools inside the Xaman ecosystem.

By sharing money with developers, Xaman is actively aiming to create a collaborative atmosphere in which all participants profit from each other’s success.

Xaman version 3.0 also includes the Universal Transaction Signing tool. This tool allows developers to connect to any network while enabling a variety of amendments, making it easier to sign transactions and experiment with new transaction kinds.

This innovation is especially useful for developers wishing to experiment with new transaction models because it eliminates the difficulties associated with signing transactions across several networks.

Previously, CNF reported that Xaman Wallet had connected with C14, allowing for smooth fiat-to-crypto transfers and giving users access to the Xahau and XRPL tokens. C14’s integration greatly improves global accessibility by allowing crypto purchases in more than 50 countries.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

PROOF RIPPLE WORKS WITH THE FED What It Means For XRP HOLDERS | Youtube

@ Newshounds News™

~~~~~~~~~

ERIC ADAMS DID SOMETHING BAD... | Youtube

NYC Mayor Eric Adams is facing charges and his aides are resigning. by The Economic Ninja

@ Newshounds News™

~~~~~~~~~

BREAKING NEWS: IRAQ'S ECONOMY LATEST UPDATE - MUST WATCH! | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Will a BRICS Bretton Woods Take Place in Kazan?

Will a BRICS Bretton Woods Take Place in Kazan?

Arcadia Economics: 9-25-2024

As the geopolitical landscape continues to evolve rapidly, all eyes are on the upcoming BRICS meeting set to take place in Kazan, Russia next month. Renowned journalist and geopolitical analyst Pepe Escobar has been at the forefront of reporting on this pivotal gathering, particularly focusing on the emerging proposal for a BRICS settlement currency known as the ‘Unit.’

Will a BRICS Bretton Woods Take Place in Kazan?

Arcadia Economics: 9-25-2024

As the geopolitical landscape continues to evolve rapidly, all eyes are on the upcoming BRICS meeting set to take place in Kazan, Russia next month. Renowned journalist and geopolitical analyst Pepe Escobar has been at the forefront of reporting on this pivotal gathering, particularly focusing on the emerging proposal for a BRICS settlement currency known as the ‘Unit.’

The ‘Unit’ is a proposed settlement currency that aims to facilitate trade among BRICS nations without relying on the US dollar. As countries grapple with the implications of geopolitical tensions and economic sanctions, the need for an alternative currency becomes increasingly crucial. The ‘Unit’ could serve as a tool not just for trade, but also for creating a more interconnected and diverse global financial ecosystem.

The question now arises: will Kazan mark the dawn of a new financial era akin to the Bretton Woods Conference of 1944? While the situation is fluid, the stakes are undoubtedly high. If the BRICS nations successfully unveil a cohesive strategy that incorporates the ‘Unit’, it could redefine economic relations not just among its members, but also with the rest of the world.

The potential shift would not just challenge the dollar’s supremacy, but could also catalyze other regions to explore similar frameworks, seeking alternatives that reflect their specific geopolitical and economic realities.

As we approach the meeting in Kazan, anticipation grows. Will the BRICS nations be able to forge a path towards a unified settlement currency? If so, the implications for global economics could be profound. Economic analysts, policymakers, and investors alike will be watching closely as these developments unfold. Pepe Escobar’s insights serve as a reminder of the significant changes afoot in international finance, and the Kazan meeting may very well be a turning point in this ongoing saga.

Iraq Economic News and Points To Ponder Thursday AM 9-26-24

Urgent| The Central Bank Of Iraq Decides To Refer The Babylon National Bank To Forced Liquidation

September 25, 2024 Baghdad/Iraq Observer The Central Bank of Iraq decided to refer the Babel Al-Ahli Bank to forced liquidation.

According to a document issued by the Central Bank of Iraq, addressed to the Bank of Babylon, and received by “Iraq Observer,” “It was decided to refer the bank to forced liquidation based on the provisions of Article No. 69 of Banking Law No. 94 of 2004.” She added: “Appointment of Ahmed Abdel Mahdi Neama as liquidator of your bank.”

Urgent| The Central Bank Of Iraq Decides To Refer The Babylon National Bank To Forced Liquidation

September 25, 2024 Baghdad/Iraq Observer The Central Bank of Iraq decided to refer the Babel Al-Ahli Bank to forced liquidation.

According to a document issued by the Central Bank of Iraq, addressed to the Bank of Babylon, and received by “Iraq Observer,” “It was decided to refer the bank to forced liquidation based on the provisions of Article No. 69 of Banking Law No. 94 of 2004.” She added: “Appointment of Ahmed Abdel Mahdi Neama as liquidator of your bank.”

text of the document: https://observeriraq.net/wp-content/uploads/2024/09/IMG_3517.jpeg

Yesterday, Monday, the US Treasury confirmed its support for Prime Minister Muhammad Shiaa Al-Sudani’s reform agenda.

The ministry said in a statement received by “Iraq Observer,” that

“Deputy Treasury Minister Wali Adeyemo met with Iraqi Prime Minister Muhammad Shia’ al-Sudani on the sidelines of the United Nations General Assembly to discuss

reforming the Iraqi banking sector,

financial relations with the United States, and

combating illicit financing.” The statement added,

“The Deputy Minister of Treasury congratulated Al-Sudani on the great progress Iraq has made in reforming the banking sector, which led to

expanding Iraq’s international financial communication and

increasing financial inclusion.”

Adeyemo affirmed, according to the Treasury statement,

“the Treasury’s support for the Central Bank of Iraq and Prime Minister Muhammad Shia al-Sudani’s reform agenda.”

The Deputy Minister of the Treasury praised the growth of the non-oil economy in Iraq by 6.0 percent, asking about “the steps the Prime Minister is taking to diversify the Iraqi economy from hydrocarbons, according to the US Treasury statement.”

It is noteworthy that the Central Bank continues to take procedures and requirements set by the US Federal Bank for the banking system in Iraq. https://observeriraq.net/عاجل-البنك-المركزي-العراقي-يقرر-احالة/

Publication Of The Environmental, Social And Corporate Governance (ESG) Standards Guide For Banks

September 25, 2024 Based on the decision of the Board of Directors of this bank No. (209) of 2024, which includes the adoption of the Environmental, Social, and Corporate Governance (ESG) standards guide for banks..For more, click here : https://cbi.iq/static/uploads/up/file-172725786315494.pdf

https://cbi.iq/news/view/2677

The Economic Committee Supports Imposing Collection Fees On Services

The first 09/26/2024 Baghdad: Shaima Rasheed The Parliamentary Economic Committee expressed its support for imposing collection fees on services.

Committee member Representative Yasser Al-Husseini told Al-Sabah that “there is a trend to enhance non-oil revenues by imposing taxes and organizing collection better,” indicating that

“with regard to collection, the government has the right to impose fees on stable services such as water and sewage, but it must ensure continuity and quality.”

These services are before fees are imposed on them.

Al-Husseini believes that “the imposition of taxes must be linked to the presence of new economic activities, and that the government is obligated to activate its real non-oil resources, such as ports for example, which can generate good profits, making them an important source of income.”

He continued, "The government needs to address the gaps in collections and taxes to be able to transform these revenues into an actual source that finances the operational budget, employee salaries, and develops services." https://alsabaah.iq/103293-.html

Why Is The Government Unable To Curb Foreign Banks' Control Over Financial Policy?

Economy 09-22-2024, 16:15 |Baghdad today – Baghdad Today, Sunday (September 22, 2024), Professor of International Economics, Nawar Al-Saadi, revealed the reasons for the government’s inability to confront foreign banks’ control over financial policy and foreign transfers.

Al-Saadi told "Baghdad Today", "The government's inability to confront foreign banks' control over financial and monetary policy and foreign transfers is due to several main reasons, including

internal challenges related to managing the economy, and

regional and international pressures."

He added, "Control over the banking sector in Iraq suffers from the influence of large international economic interests, especially since many foreign banks dominate the Iraqi market through cross-border partnerships and interests."

He continued, "This limits the government's ability to impose independent economic policies, and

these banks may be linked to a network of regional and international interests that pressure the government through multiple channels, which makes taking radical decisions difficult."

He continued, “There are pressing regional factors, as international and regional powers such as the United States and European countries exercise political and economic influence in Iraq, including the banking sector, which hinders the government’s ability to bring about radical reforms.

In addition, the Iraqi economy is fragile and dependent on This greatly affects external support and oil prices, which increases the impact of these external pressures on financial decision-making.”

The professor of international economics added:

“As for bearing responsibility, the blame cannot be placed on the Sudanese government now, since

all successive governments ruling Iraq are all involved in these challenges, which are the main reason for the weakness of financial and administrative policies, and the widespread corruption in the banking system, in every way.”

This reinforces this phenomenon,” adding:

“Therefore, the matter requires broader coordination and a collective effort among all concerned parties to try to reduce the negative effects of foreign banks on the Iraqi economy.”

Al-Saadi concluded, "In general, it can be said that the Sudanese government, despite its promises of reform, is facing great difficulties as a result of external and regional pressures and international economic interests, in addition to the lack of preparedness of local institutions to deal with this situation effectively."

On Friday (September 20, 2024), the expert in banking affairs, Nasser Al-Kanani, stressed the need for Iraqi banks to have a specialized committee working to address failures and problems in the banking sector.

Al-Kanani said to “Baghdad Today” that “the Iraqi government’s step towards forming a higher committee aimed at developing treatments for the work of banks is an important step, although it came late, as there are many problems and failures in the banking sector, and this sector in Iraq is still not developed and does not keep pace with development.” banking in countries of the world.

He added, "The Iraqi government is moving towards forming such a specialized higher committee, after the recent Iraqi talks in New York between the Central Bank of Iraq, the US Treasury, and the US Federal Reserve, which stressed the need to develop the Iraqi banking sector." https://baghdadtoday.news/258328-ما-السر-وراء-عدم-قدرة-الحكومة-كبح-سيطرة-البنوك-الأجنبية-على-السياسة-المالية؟.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/