Iraq News Highlights and Points To Ponder Wednesday Evening 7-31-24

A Parliamentarian Reveals Gold Smuggling In An “Innovative” Way.. What Is Its Relation To The Rise Of The Dollar?

Economy News – Baghdad Member of Parliament, Alia Nassif, revealed today, Wednesday, innovative gold smuggling operations, while she mentioned the story of the death of Qarun.

Nassif said in a post on the Aks platform, followed by “Al-Eqtisad News”, that “after more than 5,000 years since the death of Qarun, a new Qarun is born, to become the crocodile of corruption in Iraq,” adding: “In short, there is currently an innovative method to destroy the Iraqi economy, which is to buy gold (local and imported), melt it, turn it into ingots, and smuggle it abroad!”

She continued: “I call on the Central Bank, the Anti-Money Laundering and Terrorism Financing Office, the Organized Crime Directorate, the Federal Integrity Commission, and all regulatory agencies to investigate the sources of funds transferred through the currency sales window to purchase gold and precious metals during 2024, and to verify the validity of the procedures in customs and the Central Agency for Standardization and Quality Control, and to verify the sales operations in the markets and who are the beneficiaries of buying gold.”

A Parliamentarian Reveals Gold Smuggling In An “Innovative” Way.. What Is Its Relation To The Rise Of The Dollar?

Economy News – Baghdad Member of Parliament, Alia Nassif, revealed today, Wednesday, innovative gold smuggling operations, while she mentioned the story of the death of Qarun.

Nassif said in a post on the Aks platform, followed by “Al-Eqtisad News”, that “after more than 5,000 years since the death of Qarun, a new Qarun is born, to become the crocodile of corruption in Iraq,” adding: “In short, there is currently an innovative method to destroy the Iraqi economy, which is to buy gold (local and imported), melt it, turn it into ingots, and smuggle it abroad!”

She continued: “I call on the Central Bank, the Anti-Money Laundering and Terrorism Financing Office, the Organized Crime Directorate, the Federal Integrity Commission, and all regulatory agencies to investigate the sources of funds transferred through the currency sales window to purchase gold and precious metals during 2024, and to verify the validity of the procedures in customs and the Central Agency for Standardization and Quality Control, and to verify the sales operations in the markets and who are the beneficiaries of buying gold.”

She pointed out that "the reason for the increase in dollar sales is the import of large quantities of gold (which are not sold in the markets), but are remelted and smuggled out of Iraq, taking advantage of the difference between the official and parallel exchange rates, in addition to financing suspicious operations and giving legitimacy to money coming through financial corruption and extortion." 2024/07/31 - https://economy-news.net/content.php?id=45778

Experts: Dollar Stability Depends On Creating A “New Platform” With Iran And Syria

Economic 2024/07/31 Financial and economic experts believe that the stability of the dollar exchange rate depends on creating a new platform for trade with Syria and Iran, and dealing with countries banned from the dollar in another currency.

Like the euro or the Chinese yuan.

The exchange rate yesterday in the parallel market was recorded at 149 thousand dinars for every 100 dollars, although the official rate at the Central Bank is 132 thousand dinars for every 100 dollars. Economic researcher Mustafa Al-Faraj said in a statement to “Sabah” that “the parallel market for the dollar is facing great pressure

By traders and travelers to Iran, Syria and other countries banned from using the dollar,” noting that “this increases the demand for the dollar and thus prices rise.”

He pointed out that "the solution to this problem lies in finding a new platform with these countries and dealing with them in a currency other than the dollar, such as the euro and the yuan, with the importance of finding an appropriate formula for the US Treasury that removes sanctions from our banking sector."

Al-Faraj explained that “Iraq lacks economic diversity and is completely dependent on oil, which has weakened other economic sectors,” explaining that supporting the productive sector can limit the drain on hard currency for imports.

For his part, the official spokesman for the currency market in Sulaymaniyah, Jabbar, explained:

Kuran said that “the rise of the dollar this time is not linked to a political or economic crisis or external factors, but rather is linked to the measures of the Central Bank of Iraq, and it is possible that the bank will control this.” Height".

The Central Bank called for "taking measures that could reduce the dollar shortage in local markets."

In addition, economic researcher Alaa Al-Fahd expected the dollar exchange rate to gradually decrease in the coming days, explaining that this increase is common with the implementation of any new policy by the Central Bank of Iraq, as speculators try to exploit this in order to increase their profits.

He added, "The Central Bank of Iraq has discussions and procedures with the US Federal Reserve in order to control the exchange rate in the parallel market, and we hope that these discussions will yield positive results." https://alsabaah.iq/100272-.html

Economist Explains The Objectives Of Monetary Policy: Reducing Unemployment And Achieving Stability Of The Local Currency

Posted On2024-07-30 By Sotaliraq Economic researcher Diaa Al-Mohsen explained the objectives of monetary policy in the country, explaining that it reduces unemployment rates and achieves stability for the local currency against foreign currencies.

Al Mohsen said, “Monetary policy is adopted to control the profit rate paid for short-term borrowing, to allow for a reduction in inflation rates or interest rates, ensuring price stability and high confidence in the value and stability of the local currency.” He noted that “monetary policy has other objectives, the most important of which may be achieving GDP stability and reducing unemployment rates.”

Al Mohsen added that “monetary policy aims to achieve stability of the local currency against foreign currencies, as the monetary authority is responsible for implementing monetary policy, which includes two types of policies that differ from each other. The first is called an expansionary policy, as it works to reduce interest rates imposed on loans.

Here, this mechanism works to increase demand for loans for investment purposes, which results in increased demand for investment goods and increased demand for goods and commodities.” He pointed out that “this mechanism works to increase demand for labor for the purpose of expanding production to meet the growing demand, as we notice here the consumer’s lack of interest in keeping cash. ‘

This policy ensures the decline of the local currency against foreign currencies, and then the foreign investor can put his money in to buy local goods at a lower price than usual, which increases demand for these goods, which increases the accelerating multiplier, which results in an increase in wages and a decrease in unemployment rates.”

“The other policy is the opposite of the first, and we call it a contractionary policy. Here, the monetary authority works to raise interest rates to withdraw the largest amount of local currency available in the market.

When interest rates are high, we find that consumers are less willing to buy goods and services. On the other hand, we find that consumers are more willing to save because interest rates are rewarding. ‘

However, this negatively affects investment, due to the high interest rates imposed on loans, which results in reducing opportunities for increased production and increasing unemployment rates. We also notice that investors are not willing to buy locally produced goods because their prices are high compared to their foreign counterparts,” Al Mohsen added.

He continued, “Monetary policy is a necessity undertaken by the monetary authority, in order to maintain the stability of the monetary system. The above is also fundamentally linked to the ability of the monetary authority to monitor the market in the cases of expansion and contraction. It is also necessary to remember the necessity of having a developed financial market.”

The problems of the banking sector and its urgent need for radical reforms in the monetary and supervisory policy of the Central Bank, and the creation of effective mechanisms to reduce corruption and ensure transparency in the management of public funds to achieve real and sustainable economic development in Iraq, are highlighted. With the ongoing dollar crisis and the absence of effective solutions, there must be a real need to establish a monetary policy that establishes the foundation for creating economic stability while preserving the country’s interests and putting an end to the US Federal Reserve’s sanctions against Iraqi banks. LINK

MP: The Iraqi Banking Sector Is Being Executed In Favor Of Arab Banks

Policy , 07/31/2024 10:38 , Number of readings: 168 Baghdad - Iraq Today: MP Alia Nassif Jassim expressed her dissatisfaction with the current situation of Iraqi banks, considering that there is an “execution” of these banks.

The MP wrote in a recent post on the X platform, “This is how Iraqi banks are being executed! A license was granted to the Jordanian Arab Bank and the Emirates Union Bank to work in #Iraq and they will start their work at the beginning of next September alongside the National Bank

The license will also be granted to two banks (Kuwaiti and Qatari), while many Iraqi banks continue to stop and more of them will stop due to the management of the Central Bank of Iraq, which did not. address the problem during the past period, but rather worked to enter them into contracts with K2 and pay them money without result!

The banking sector is being punished for mistakes made in previous years during which it was under the supervision of the same current management of the Central Bank, so why was this management not punished for failure to fulfill its duty to supervise the work of these banks?”

These statements come at a time when the banking sector in Iraq is witnessing major challenges, with increasing criticism of the Central Bank's management. LINK

Parliamentary Integrity: Transparency Is Absent In The Dollar Auction

July 29, 2024 Baghdad/Al-Masala: The Parliamentary Integrity Committee accused, on Monday, the Central Bank of Iraq of not being transparent regarding the dollar auction, and not providing data on the destinations where hard currency is spent, stressing that it will hold the bank’s governor, Ali Al-Alaq, accountable.

Committee member Hadi Al-Salami said, “There is a lack of transparency in the dollar auction, and the daily bulletin is not disclosed to know where the dollar goes and is sold through the auction. The bulletin is still secret, and only the amount of dollars sold is announced, and we do not know where this amount goes.”

He pointed out that "there is a parliamentary movement to hold the Central Bank Governor, Ali Al-Alaq, accountable, and the first step is to direct an oral parliamentary question, and we are waiting for his presence inside the parliament dome for the purpose of holding him accountable."

He added, "There is an effort by some representatives to question the Governor of the Central Bank, Ali Al-Alaq, due to the failure, especially in the issue of controlling the dollar exchange rate, which is still significantly higher in the parallel market than the official price."

Al-Salami stressed that “some blocs and parties refuse to question the governor of the Central Bank, as there is political protection for him, despite the failure in tasks and work, and there are indicators and observations in the work of the Central Bank, especially the currency auction.” https://almasalah.com/archives/97046

Advisor: Budget Implementation Instructions {Procedural Issue}

First 2024/07/31 Baghdad: Shaima Rashid The Prime Minister's Financial Advisor, Mazhar Muhammad Salih, stated that the budget schedules have become a reality, and that issuing implementation instructions to institutions is a "procedural matter" that does not affect financial obligations.

Saleh told WAA: “The legal options available to implement the provisions of the federal general budget have become more flexible for the federal financial authority, in addition to the availability of the federal financial management law itself, which allows financial transactions - even if any approval of the general budget formalities is delayed in principle - especially allowing the continuation of spending or disbursement on investment projects approved in the three-year general budget as ongoing projects, as well as operational spending, or any financial transactions.” https://alsabaah.iq/100297-.html

Al-Sudani's Advisor: Budget Implementation Instructions Are A Procedural Matter

Money and business Economy News – Baghdad The Prime Minister's Financial Advisor, Mazhar Muhammad Salih, stated that the budget schedules have become a reality, and that issuing implementation instructions to institutions is a "procedural matter" that does not affect financial obligations.

[rtl]Saleh said: “The legal options available to implement the provisions of the federal general budget have become more flexible for the federal financial authority, in addition to the availability of the federal financial management law itself, which allows financial transactions –

even if any approval of the general budget formalities is delayed in principle - especially allowing the continuation of spending or disbursement on investment projects approved in the three-year general budget as ongoing projects, as well as operational spending, or any financial transactions.” Views 62 2024/07/31 https://economy-news.net/content.php?id=45764

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 7-31-24

Good Afternoon Dinar Recaps,

RUSSIA LEGALIZES BITCOIN AND CRYPTO TRANSACTIONS FOR GOVERNMENT AND BUSINESSES "In a significant legislative move, Russian lawmakers have passed a bill permitting businesses to use Bitcoin and other cryptocurrencies in international trade, according to a report by Retuers.

This development is part of Russia's strategy to circumvent Western sanctions imposed following the invasion of Ukraine. The new law, expected to take effect in September, aims to address delays in international payments, particularly with key trading partners like China, India, and the UAE."

"Central bank Governor Elvira Nabiullina, a proponent of the law, announced that the first cryptocurrency transactions will occur before the year's end. The central bank will establish an "experimental" infrastructure for these payments, with further details pending."

Good Afternoon Dinar Recaps,

RUSSIA LEGALIZES BITCOIN AND CRYPTO TRANSACTIONS FOR GOVERNMENT AND BUSINESSES

"In a significant legislative move, Russian lawmakers have passed a bill permitting businesses to use Bitcoin and other cryptocurrencies in international trade, according to a report by Retuers.

This development is part of Russia's strategy to circumvent Western sanctions imposed following the invasion of Ukraine. The new law, expected to take effect in September, aims to address delays in international payments, particularly with key trading partners like China, India, and the UAE."

"Central bank Governor Elvira Nabiullina, a proponent of the law, announced that the first cryptocurrency transactions will occur before the year's end. The central bank will establish an "experimental" infrastructure for these payments, with further details pending."

"The legislation also includes regulations on cryptocurrency mining and the circulation of other digital assets but maintains the ban on cryptocurrency payments within Russia. The central bank highlighted that payment delays have caused an 8% drop in Russian imports in the second quarter of 2024.

"Despite efforts to shift to trading partners' currencies and develop an alternative BRICS payment system, many transactions still rely on dollars and euros via the SWIFT system, risking secondary sanctions. Nabiullina emphasized that these sanctions have complicated import payments, extending supply chains and increasing costs."

" Anatoly Aksakov, the head of the Duma lower house of parliament, reportedly told lawmakers, "We are taking a historic decision in the financial sphere" by passing this legislation. "

@ Newshounds News™

Read more: Bitcoin Magazine

~~~~~~~~~

DIGITAL RUSSIAN RUBLE SET FOR MASS DISTRIBUTION JULY 2025

"MOSCOW, July 30. /TASS/. If the digital ruble is successfully tested its mass introduction is possible starting July 2025, Russian Central Bank Governor Elvira Nabiullina said addressing the Federation Council (upper house of the parliament)."

"Now I can say that if everything goes as we plan further on, with pilots implemented successfully, we will be able to shift from tests to massively introducing the digital ruble from July 2025. We target those dates, though it will be a gradual process, a gradual process of using digital rubles," she said.

"Russian President Vladimir Putin said earlier that the platform of digital ruble showed efficiency and reliability as it was tested."

"The Bank of Russia has been implementing a pilot project with real digital rubles since August 15, 2023. At the first stage, active operations are tested, such as opening wallets in digital rubles for banks and clients (individuals and legal entities), transferring digital rubles between clients, and payments at trade and service enterprises."

@ Newshounds News™

Read more: TASS

~~~~~~~~~

Statement of Commissioner Caroline D. Pham in Support of Foreign Boards of Trade Final Rule

July 29, 2024

I support the Foreign Boards of Trade (FBOT) Final Rule because it promotes access to markets for U.S. participants, competition, and liquidity. I would like to thank Maura Dundon, Roger Smith, and Alexandros Stamoulis in the CFTC’s Division of Market Oversight for their work on this rulemaking.

I will reiterate key points from my statement on the FBOT proposed rule. [1] As a CFTC Commissioner, I have made it clear that I believe in good policy that enables growth, progress, and access to markets.[2]

Accordingly, I am pleased to support Commission efforts that take a pragmatic approach to issues that hinder market access and cross-border activity. I continue to believe that this rulemaking exemplifies policy that ensures a level playing field, and I applaud this step in the right direction for market structure.

FBOTs have been a critical piece of the CFTC’s markets for decades and provide access for U.S. market participants to non-U.S. markets in realization of the global economy and international business.[3]

The main substantive amendment in the FBOT Final Rule is to Regulation 48.4, which will now include

1. introducing brokers (IBs)[4] as a permissible intermediary, in addition to

2. futures commission merchants (FCMs),

3. commodity pool operators (CPOs), and

4. commodity trading advisors (CTAs),

to enter orders on behalf of customers or commodity pools via direct access on a registered FBOT.[5]

I believe that the FBOT Final Rule will provide more choice in brokers and broker arrangements for U.S. market participants that trade foreign futures and ensure that appropriate customer protections are in place.

As sponsor of the CFTC’s Global Markets Advisory Committee (GMAC),[6] I have devoted a significant part of my Commissionership to supporting solutions that will enhance the resiliency and efficiency of global markets.[7] The FBOT Final Rule is policy that mitigates market fragmentation and the associated impact on liquidity, and promotes the overall competitiveness of our derivatives markets. I am pleased to support the FBOT Final Rule.

@ Newshounds News™

Read more: CFTC

~~~~~~~~~

GOLD ON THE MOVE with Fed Rate Cut Speculation

"The latest economic data has sparked renewed optimism in the gold market, with prices climbing over $20 as investors digested signs of cooling inflation and robust economic growth"

"The central bank’s actions in the coming months could have far-reaching implications for gold prices and the broader financial landscape."

@ Newshounds News™

Read more: Dedollarize News

~~~~~~~~~

Bank of England seeks feedback for wholesale CBDC trials

Today the Bank of England published a discussion paper on innovation in money and payments. While it covers payments across the board, it aims to gather feedback for planned wholesale central bank money trials. This will include both a wholesale central bank digital currency (wCBDC) and a synchronization solution enabling DLT transactions to settle using the real-time gross settlement (RTGS) system.

The report states, “We judge that these risks are an order of magnitude greater than the risks posed by retail use cases.”

At a retail level, the UK is now testing tokenized deposits through the Regulated Liability Network initiative. However, the paper warns of the need for progress. “Commercial bank money needs to keep pace with the needs of consumers and so carry functionalities to deliver safe and sustainable innovation in payments,” wrote the authors. “Absent such innovation, central banks may be left as the only game in town insofar as retail payments innovation is concerned.”

Regarding the wholesale CBDC trials,

in conjunction with the BIS Innovation Hub, the Bank already ran Project Meridian, which enabled a digital real estate transaction to settle via connectivity with the RTGS. Currently it’s running Project Meridien FX with the European Central Bank.

The paper outlines a series of planned wholesale tests for both the wCBDC and the synchronization solution. It envisages the latter as being a third system that integrates between the RTGS and various DLTs. It wants to run the tests side-by-side so it can make comparisons between the wCBDC and synchronization risks and complexity.

The tests encompass delivery versus payment (DvP). Other uses cases will involve payment versus payment (PvP). Synchronization is already being trialed as part of Project Meridian FX, but it also wants to explore wCBDC.

Finally, it will test interoperability with global initiatives such as the BIS Project Agorá for cross-border payments in which the Bank is a participant.

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

UAE residents can now trade crypto directly with their bank accounts

The new integration enables the direct conversion of UAE dirhams into Bitcoin and Ether using M2’s spot market.

Crypto exchange M2 announced that it will allow residents in the United Arab Emirates to buy and sell Bitcoin and Ether directly using their bank accounts.

In an announcement shared with Cointelegraph, the digital asset custodian said that the new integration allows UAE residents to directly convert their dirhams into Bitcoin and Ether. Through trading pairs listed on M2’s spot markets, users can trade BTC and ETH for dirhams and vice versa. In addition, users can also deposit and withdraw dirhams.

The M2 team believes that the new integration enables users to “swiftly adapt to market changes,” allowing them to easily convert their local currency into crypto.

Wider accessibility of virtual assets in the UAE

According to M2, the new integration allows the exchange to expand its offerings amid a rapidly evolving landscape. The team also believes the new integration is a milestone for the “wider accessibility of virtual assets in the region.”

Kimmel told Cointelegraph that the new integration could also help everyday investors, especially those who are not “fully entrenched” in the nuances of the trading environment.

UAE is one of the world’s “strictest” in consumer protection. In addition, the executive highlighted that this move is also regulated by the UAE government, which he described as one of the world’s “strictest regulatory frameworks” that prioritizes consumer protection.

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

HOW MUCH MONEY IS IN CRYPTO?

HAVE YOU EVER CONSIDERED THE MARKET CAP ON THE LARGEST CRYPTOCURRENCIES?

IT MIGHT SURPRISE YOU

1. BITCOIN 1.3 Trillion

2. ETHEREUM 398 Billion

3. TETHER-USDT 114 Billion

4. BNB 86 Billion

5. SOLANA 84 Billion

6. XRP 35 Billion

7. USDC 33 Billion

8. DOGE 18 Billion

9. TON 17 Billion

10. CARDANO ADA 18 Billion

@ Newshounds News™

Read more: Coin Market Cap

~~~~~~~~~

What Is Market Capitalization?

"Market capitalization, or "market cap," represents the total dollar market value of a company's outstanding shares of stock. Investors use this figure to determine a company's size instead of sales or total asset value."

"Market capitalization estimates a company's value by extrapolating what the market thinks it is worth for publicly traded companies and multiplying the share price by the number of available shares. After a company goes public and begins trading on an exchange, its share price is determined by supply and demand. As market prices move, the market cap becomes a real-time estimate of the company's value. "

Market Cap and Digital Currency

Because new digital currency offerings theoretically thin the value of existing coins, tokens, or shares, a different market cap formula can be used to calculate the market cap for all authorized shares or tokens. Analysts use diluted market cap to understand potential changes to a security, token, or coin's price."

@ Newshounds News™

Read more: Investopedia

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

BRICS to Leave World Bank: What are alternatives?

BRICS to Leave World Bank: What are alternatives?

Fastepo: 7-30-2024

Are the World Bank and IMF Truly Serving the Global South, or Is It Time for Change? The effectiveness of the World Bank and the International Monetary Fund (IMF) has come under increasing scrutiny from BRICS nations, which argue that these institutions are dominated by Western interests and fail to address the needs of developing countries.

Critics highlight the stringent loan conditions imposed by the World Bank and IMF, which often do not align with local priorities and can exacerbate economic and social challenges.

BRICS to Leave World Bank: What are alternatives?

Fastepo: 7-30-2024

Are the World Bank and IMF Truly Serving the Global South, or Is It Time for Change? The effectiveness of the World Bank and the International Monetary Fund (IMF) has come under increasing scrutiny from BRICS nations, which argue that these institutions are dominated by Western interests and fail to address the needs of developing countries.

Critics highlight the stringent loan conditions imposed by the World Bank and IMF, which often do not align with local priorities and can exacerbate economic and social challenges.

Indian Prime Minister Narendra Modi has publicly criticized the World Bank's governance structure, describing it as outdated and disproportionately favoring Western nations. Modi has called for a more equitable system that provides greater representation and decision-making power to developing countries.

This stance reflects India's broader push for reforms in international financial institutions to ensure fairer treatment of emerging economies.

South Africa's experiences with the World Bank have also been contentious. The country has faced significant challenges due to the stringent conditions attached to World Bank loans, particularly those affecting its economic policies and social programs.

In the 1980s and 1990s, South Africa was subject to structural adjustment programs mandated by the World Bank and IMF, which included austerity measures, privatization of state-owned enterprises, and trade liberalization. These policies are widely believed to have undermined South Africa's economic sovereignty and increased social inequalities.

Nobel laureate economist Joseph Stiglitz has been a vocal critic of the IMF and World Bank, particularly in the context of Russia. Stiglitz argues that the rapid privatization and market liberalization policies advocated by these institutions in the 1990s led to severe economic and social turmoil.

These policies resulted in a significant decline in GDP, increased poverty rates, and greater economic inequality, with a dramatic fall in life expectancy and rising unemployment.

Critics argue that the World Bank's policies perpetuate Western influence, marginalizing the unique economic contexts of Global South nations.

In response, BRICS has established the New Development Bank (NDB) to support infrastructure and sustainable development projects, providing an alternative to traditional financial institutions.

Geopolitical considerations also play a crucial role in BRICS' stance. The bloc's resistance to Western sanctions and efforts to trade in non-dollar currencies illustrate its push for a more equitable global financial system.

These actions underscore the growing desire among BRICS nations to reduce dependency on the US dollar and create a more inclusive economic order.

This video explores the criticisms of the World Bank, examining its historical Western control and the contentious programs that have had mixed impacts on global development.

It delves into the reasons behind the Global South's shift towards alternatives like the NDB, emphasizing the need for financial systems that support more sustainable and equitable growth.

MilitiaMan: IQD Update - Iraq Dinar News - Time to Move - US FED - Not able to Wait - A Moments Notice #2

IQD Update - Iraq Dinar News - Time to Move - US FED - Not able to Wait - A Moments Notice #2

MilitiaMan and Crew: 7-31-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

IQD Update - Iraq Dinar News - Time to Move - US FED - Not able to Wait - A Moments Notice #2

MilitiaMan and Crew: 7-31-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Wednesday AM 7-31-24

Experts: The Stability Of The Dollar Depends On The Creation Of A “New Platform” With Iran And Syria

Economical 07/31/2024 Baghdad: Ahmed Al-Janabi Financial and economic specialists believe that the stability of the dollar exchange rate depends on creating a new platform for trade with Syria and Iran, and dealing with countries banned from the dollar in another currency. Euro or Chinese yuan.

Yesterday, the exchange rate in the parallel market recorded 149 thousand dinars for 100 dollars, although the official price in the Central Bank is 132 thousand dinars for every 100 dollars. Economic affairs researcher Mustafa Al-Faraj said in a statement to Al-Sabah that “the parallel market for the dollar is facing great pressure.”

By merchants and travelers to Iran, Syria, and other countries banned from the dollar,” noting that “this increases the demand for the dollar and thus prices rise.”

Experts: The Stability Of The Dollar Depends On The Creation Of A “New Platform” With Iran And Syria

Economical 07/31/2024 Baghdad: Ahmed Al-Janabi Financial and economic specialists believe that the stability of the dollar exchange rate depends on creating a new platform for trade with Syria and Iran, and dealing with countries banned from the dollar in another currency. Euro or Chinese yuan.

Yesterday, the exchange rate in the parallel market recorded 149 thousand dinars for 100 dollars, although the official price in the Central Bank is 132 thousand dinars for every 100 dollars. Economic affairs researcher Mustafa Al-Faraj said in a statement to Al-Sabah that “the parallel market for the dollar is facing great pressure.”

By merchants and travelers to Iran, Syria, and other countries banned from the dollar,” noting that “this increases the demand for the dollar and thus prices rise.”

He pointed out that “the solution to this problem lies in finding a new platform with those countries and dealing with them in a currency other than the dollar, such as the euro and the yuan, with the importance of finding an appropriate formula for the US Treasury that removes sanctions from our banking sector.”

Al-Faraj explained that “Iraq lacks economic diversification and depends entirely on oil, which has weakened other economic sectors,” explaining that supporting the productive sector can limit the depletion of hard currency imports.

For his part, the official spokesman for the currency market in Sulaymaniyah, Jabbar, explained Curran said, “The rise in the dollar this time is not linked to a political or economic crisis or external factors, but rather it is linked to the actions of the Central Bank of Iraq, and it is possible that the bank will control this.” Height".

He called on the Central Bank to “take sufficient measures that can reduce the scarcity of the dollar in local markets.”

In addition, economic affairs researcher Alaa Al-Fahd expected a gradual decline in the dollar exchange rate in the coming days, explaining that

this rise is common with the implementation of any new policy by the Central Bank of Iraq, as speculators try to exploit this in order to increase their gains. He added,

"The Central Bank of Iraq has discussions and procedures with the US Federal Bank in order to control the exchange rate in the parallel market, and we hope that these discussions will produce positive results." https://alsabaah.iq/100272-.html

At An American Request, The Iraqi Central Bank Is Moving To Merge Banks Prohibited From Dealing In Dollars

Economy breaking US Department of the Treasury Central Bank of Iraq US sanctions Iraqi banks 2024-07-30 Twilight News/ Informed sources revealed, on Tuesday, the existence of a new American request to the Central Bank The Iraqi bank includes merging banks banned from dealing in dollars in the currency auction. She said Sources told Shafaq News Agency,

“The US Treasury and the Federal Reserve A request from the Central Bank of Iraq to merge and close banks restricted from using the dollar Some distressed banks.

She added Sources said, “The Central Bank of Iraq is required today to take rapid measures to merge And closing troubled banks in order to return to banking, which reflects positively on The exchange rate, and for this reason the

Central Bank contracted with an international company to present a plan for the sector Banking, which will include merging banks and closing some of them.” And revealed Informed sources said,

“This company, on the recommendation of the Americans, is similar to the work of K2 Company, without revealing its name or disclosure more details". https://shafaq.com/ar/اقتصـاد/بطلب-مريكي-المركزي-العراقي-يتجه-لدمج-المصارف-الممنوعة-من-التعامل-بالدولار

Nassif: The Banking Sector Is Being Punished For Mistakes Made In Previous Years

Member of Parliament Alia Nassif commented on Tuesday after granting a license to the Arab Jordanian Bank and the Emirates Federation to work in Iraq, stressing that this method is killing Iraqi banks.

Nassif said in a tweet on the (x) platform, this method is killing Iraqi banks. A license was granted to the Arab Jordanian Bank and the Emirates Federation to work in Iraq and they will start their work at the beginning of next September, along with the National Bank.

The license will also be granted to two banks (Kuwaiti and Qatari), while many Iraqi banks continue to stop and more of them are stopped due to the management of the Central Bank of Iraq, which did not address the problem during the past period.

She added: Paying them money without results. The banking sector is being punished for mistakes for previous years in which it was under the supervision of the same current management of the Central Bank, so why was this management not punished for failing to fulfill its duty to supervise the work of those banks?! https://www.radionawa.com/all-detail.aspx?jimare=39029

Iraq’s Reserves Of Liquefied Gas Rise To More Than 133,000 Tons

Amr Salem July 30, 2024 An employee turns a valve at the Nahr Bin Omar natural gas field, north of the southern Iraqi port of Basra. Photo: AFP

Baghdad (IraqiNews.com) – The Iraqi Ministry of Oil revealed on Tuesday that its output of liquefied gas had increased to over 7,000 tons and that its reserves had reached over 133,000 tons.

The Oil Ministry’s Undersecretary for Gas Affairs, Izzat Saber, mentioned in a statement that the daily production rate of liquefied gas in Iraq reached 7,370 tons.

The Iraqi Prime Minister and the Oil Minister both support the gas industry, Saber said, adding that

the government’s gas utilization projects are the reason behind the increase in liquefied gas output.

The Director of Iraq’s Gas Filling and Services Company, Anmar Ali Hussein, said that the company succeeded in meeting the needs of citizens and service sectors in the capital, Baghdad, and the rest of the Iraqi governorates.

Compared to the daily rate of gas consumption in Iraq, which is 5,700 tons, there is a surplus in the quantity of gas generated nationwide, according to Hussein.

According to the government plans, Hussein said, there will be several initiatives in the upcoming stage that will aid in the expansion and development of the gas industry.

https://www.iraqinews.com/iraq/iraqs-reserves-of-liquefied-gas-rise-to-more-than-133000-tons/

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

MilitiaMan: IQD Update - Iraq Dinar News - Iraq Dinar News - Time to Move - US FED - At Moments Notice

IQD Update - Iraq Dinar News - Iraq Dinar News - Time to Move - US FED - At Moments Notice

MilitiaMan and Crew: 7-30-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

IQD Update - Iraq Dinar News - Iraq Dinar News - Time to Move - US FED - At Moments Notice

MilitiaMan and Crew: 7-30-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq News Highlights and Points To Ponder Tuesday Evening 7-30-24

Hasty Implementation... Who Bears The Responsibility For The Mistakes Of Government Projects?

Tuesday, 07-30-2024, Karar Al-Asadi Since Prime Minister Mohammed Shia al-Sudani announced the implementation of projects, including plans to relieve traffic congestion in the capital, Baghdad, the construction, building of bridges and overpasses, and widening of streets have been marred by many shortcomings and errors, which led to some of them being repaired shortly after their opening, or details being added to them, which raised several questions about the priority of speed of completion at the expense of quality.

However, observers considered the matter, despite that, a step forward in the reconstruction process. Regarding these errors, economic researcher Mustafa Akram Hantoush points out that “the occurrence of some errors does not affect the good service construction and development movement of Baghdad Governorate, and if errors occur, they can be addressed and what the government has done regarding the bridges issue can be considered an achievement because if it were not for the current trend, the Baghdad Municipality would not have built any of these bridges.”

Hasty Implementation... Who Bears The Responsibility For The Mistakes Of Government Projects?

Tuesday, 07-30-2024, Karar Al-Asadi Since Prime Minister Mohammed Shia al-Sudani announced the implementation of projects, including plans to relieve traffic congestion in the capital, Baghdad, the construction, building of bridges and overpasses, and widening of streets have been marred by many shortcomings and errors, which led to some of them being repaired shortly after their opening, or details being added to them, which raised several questions about the priority of speed of completion at the expense of quality.

However, observers considered the matter, despite that, a step forward in the reconstruction process. Regarding these errors, economic researcher Mustafa Akram Hantoush points out that “the occurrence of some errors does not affect the good service construction and development movement of Baghdad Governorate, and if errors occur, they can be addressed and what the government has done regarding the bridges issue can be considered an achievement because if it were not for the current trend, the Baghdad Municipality would not have built any of these bridges.”

Hantoush believes that “the Iraqi government is very good with regard to bridges and some issues related to infrastructure. In fact, we have never seen anything similar from previous governments. The Baghdad Municipality often received money to transfer it to replacing sidewalks on an ongoing basis, so no bridges or gates were built.”

It is noteworthy that the Prime Minister announced at the beginning of 2023 the commencement of a package of projects, starting with supplying residential areas on the outskirts of Baghdad and slums with infrastructure, including sewage, water, electricity and road paving networks, while launching a plan to relieve traffic congestion, which includes the construction of a number of bridges and overpasses and the expansion of many streets.

For his part, political analyst Hassan Fadel says, “Some of the failures that occur in completing the projects implemented by Al-Sudani’s government are not directly borne by the government, nor by Mr. Al-Sudani himself, but rather are primarily borne by the Ministry of Construction and Housing, because it is necessary to evaluate the companies implementing the project according to standards set by the ministry before approving the bids of the implementing companies.”

“Among these criteria, this company must have implemented similar projects and possess the capabilities, tools, experts and engineers.

This means that the company submitting the bid has previous experience in similar projects, is it a company that has been working in this field for years, does it have sufficient experience or is it a new company, and what is the nationality of this company? These criteria and others must be taken into consideration to avoid these mistakes in the future,” Fadel added.

“The Prime Minister is trying to fix what was spoiled by years of government failures, but all the projects undertaken by the current government fall within its duties and cannot be considered achievements, because the achievement is the realization of huge strategic goals such as the development road and the Grand Faw Port, which can be classified among the huge strategic achievements and projects if they are completed,” he added.

“As for building bridges and factories, these are routine procedures that every government in the world undertakes, and they cannot be classified as achievements. Rather, building bridges and overpasses is the duty of the Baghdad Municipality and the Ministry of Reconstruction and is within their powers, and sometimes there may be a simple intervention from the Prime Minister, not a large-scale intervention,” he added,

“but because of the situation in Iraq and the nature of the circumstances it has suffered, the government was forced to intervene in such small projects that are of lower responsibilities in order to speed up completion and achieve a solution to the problem of traffic congestion and bottlenecks, and therefore these projects are not considered achievements.”

The General Traffic Directorate had previously announced the closure of the Cordoba Bridge in central Baghdad for maintenance purposes, four months after its opening, in addition to the completion of the Rustumiyah Bridge in Baghdad without channels to drain rainwater.

The Federal Integrity Commission had previously announced the failure of most of the electronic gates in parking garages in Baghdad and the governorates, after costing the state about eight and a half billion dinars.

Regarding the malfunction of these electronic gates, legal expert Adnan Al-Sharifi comments, “What is related to the malfunction of the electronic gates is either due to poor equipment or exposure to electronic hacking or sabotage by an agent.

If it is a sudden malfunction, this is a normal thing that may happen anywhere, provided that the materials of these gates are equipped and implemented according to good controls, contracts and specifications. However, if it is due to an agent, the investigation will reveal his identity and he will be referred to the competent authorities.”

He continued, “As for the poor quality of the projects, it is divided into two parts. The first is the poor quality of the plans, quantity schedules, and engineering specifications, which is the responsibility of the party that carried them out.

The second is the poor quality of the implementation, which is due to the collusion of the resident engineer, the supervisory authorities, and the receiving committees. All of these bear full responsibility for the intentional damages and will be held accountable in accordance with Articles 341 and 340 of the Penal Code, and as the results of the investigation show.” https://non14.net/public/168799

Alsumaria Publishes The Dollar Exchange Rates In The Iraqi Stock Exchanges Today

Economy 2024-07-30 | Alsumaria News – Economy Alsumaria News publishes the exchange rates of the dollar against the Iraqi dinar in the local Iraqi markets for Tuesday, July 30, 2024.

The dollar prices decreased with the opening of the Al-Kifah and Al-Harithiya stock exchanges, recording 149,000 dinars for every 100 dollars. As for the selling prices in the exchange shops in the local markets in Baghdad, they decreased, as the selling price reached 150,000 dinars, while the purchase price reached 148,000 dinars for every 100 dollars.

On February 7, 2022, the Council of Ministers announced its approval to amend the dollar exchange rate to 1,320 dinars per dollar.

For about a year, specifically since the Central Bank began operating the electronic platform and the international financial transfer system "SWIFT", the dollar exchange rate in Iraq has not witnessed stability despite the government and the Central Bank's attempts to control the exchange rate in parallel markets. LINK

Al-Sadr Calls For Boycotting American Products And Those Supporting The Israeli Entity: Peacefully, Not Through Violence

Politics | 07/29/2024 Mawazine News – Baghdad The leader of the Shiite National Movement, Muqtada al-Sadr, called today, Monday, for boycotting American products and goods that support the Israeli entity, while stressing the need not to use violence as some parties that want to destroy Iraq are doing.

In response to a question directed to the leader of the Shiite National Movement, which read: “What is your advice to all Muslims and Iraqis in particular regarding boycotting American goods and goods that support the usurping Zionist entity, in support of the people of Gaza in particular and Islam and humanity in general?”

Al-Sadr said the following text: “Yes, all believers in the Palestinian cause, all lovers of humanity, and all those who reject the mass massacres taking place in Gaza, and all those who reject the terrorist Zionist entity, its actions, crimes, and terrorism, and its master, America, the great evil occupier who hates peoples, should boycott all products that support Israel, America, colonialism, and the unjust global arrogance that is trying to make the world a village in its hands like a toy...

Boycotting them inside and outside Iraq is an act that pleases God Almighty and even pleases our consciences as Muslims and lovers of humanity and peace...

All of this is done through a peaceful boycott by not selling, not buying, or even using them... and not using violence as some parties do that want to destroy our beloved Iraq and benefit personally and partisanly from that in: #We are all boycotting.” https://www.mawazin.net/Details.aspx?jimare=252290

Government Advisor: Adopting Budget Schedules Has Become A Reality And Does Not Affect Financial Obligations

Money and business Economy News – Baghdad The financial advisor to the Prime Minister, Mazhar Muhammad Salih, confirmed today, Tuesday, that the budget schedules have become a reality, and issuing instructions is a procedural matter that does not affect financial obligations.

Saleh said, in an interview with the Iraqi News Agency, followed by "Al-Eqtisad News", that "the legal basis for the current fiscal year 2024 is a matter that has been legislated and approved primarily, based on the provisions of the federal general budget for the years 2023, 2025, 2024 issued by Law No. 13 of 2023, which was published on June 26, 2023 in the Official Gazette."

He explained that "what is stipulated in Article Two / 77 of the law includes the executive authority submitting the financial tables for the two fiscal years 2024, 2025 to enable the House of Representatives to approve them sequentially," noting that "this was achieved in the fiscal year 2024."

He pointed out that "the three-year federal general budget was applied for the first time in the country, which was based in its approval on one of the articles included in the provisions of the Federal Financial Management Law No. 6 of 2019, as amended, which authorized the work of a financial plan consisting of a general budget for three fiscal years."

He added that "the legal options available to implement the provisions of the federal general budget have become more flexible for the federal financial authority, in addition to the availability of the federal financial management law itself, which allows financial transactions even if any approval of the general budget formalities is delayed in principle, especially allowing continued spending or disbursement on investment projects approved in the three-year general budget as ongoing projects, as well as operational spending, or any financial transactions stipulated in the three-year general budget law."

He added, "Despite this, the adoption of the financial tables for the current fiscal year 2024, which were approved by the House of Representatives earlier this year, has become a reality, and issuing instructions for their implementation is a procedural matter that does not affect the obligations of the fiscal year itself, as these instructions are in all cases consistent with the emerging financial transactions when issued."

He added that "the Ministry of Finance announced earlier this month the issuance of financial bonds (achievement bond) as a source of financing for the budget by borrowing from the local financial market worth 1.5 trillion dinars,"

stressing that "spending on operating expenses such as salaries, pensions, social care, debt services, and others is ongoing, in addition to the continued financing of ongoing investment projects and those under implementation."

He pointed out that "all of these activities are financial activities in which spending has not stopped, which is consistent with the legal work rules that came with the three-year federal general budget, with high flexibility, transparency, and governance."

He noted that "the instructions for implementing the general budget schedules for the fiscal year 2024 will touch upon some of the developments and partial financial transactions that have been created or adapted, and not the faculties of public finance,

and that the financial activity in the country with its three pillars: revenues, expenditures, and deficit management is proceeding in a consistent and harmonious manner and in accordance with the objectives of the three-year general budget law, and that the executive and legislative authorities are in continuous communication and high coordination to ensure the achievement of public interests without interruption." Views 14 Added 2024/07/30 - https://economy-news.net/content.php?id=45743

Economist’s “News and Views” Tuesday 7-30-2024

West Panic: Italy’s Meloni In Beijing For Desperate Reset, Russia Drops Major BRICS Update

Sean Foo: 7-30-2024

After breaking away from China's Belt & Road, Italy's Meloni is in Beijing to reset economic relations.

Rome follows more G7 countries trying to tilt towards China to hedge themselves against an unpredictable US election.

Meanwhile, Russia has dropped a big update. A major South-East Asian economy could be joining BRICS very soon.

West Panic: Italy’s Meloni In Beijing For Desperate Reset, Russia Drops Major BRICS Update

Sean Foo: 7-30-2024

After breaking away from China's Belt & Road, Italy's Meloni is in Beijing to reset economic relations.

Rome follows more G7 countries trying to tilt towards China to hedge themselves against an unpredictable US election.

Meanwhile, Russia has dropped a big update. A major South-East Asian economy could be joining BRICS very soon.

35 TRILLION DEBT WALL: Historic National Debt Surges, US Pays $2.4 Billion in Interest Daily

Lena Petrova: 7-30-2024

WARNING: Banks May Not Survive This (what the experts aren’t telling you)

Taylor Kenny: 7-30-2024

New data reveals unprecedented levels of lending to banks, suggesting an alarming fragility within the sector. Despite reassurances of stability, the sudden surge in bank term funding and credit lending signals deep underlying issues.

As experts warn of a looming financial meltdown, the urgency to protect personal wealth has never been more critical.

Stay tuned as Taylor Kenney uncovers the stark realities facing our banking system.

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 7-30-24

Good afternoon Dinar Recaps,

USDT= TETHER'S STABLECOIN IS THE BIGGEST CRYPTOCURRENCY BEHIND BITCOIN IN EAST ASIA

"There’s arguably nothing special about Tether in itself, not least because the stablecoin still hasn’t undergone a full audit. However, it has become a lifeline in parts of the world where trading crypto with fiat currencies is either prohibited or very difficult, whereas it remains marginal in markets such as the United States."

"Tether may be viewed with a mixture of suspicion and bemusement in the West, but in East Asia it is the biggest cryptocurrency after Bitcoin."

"According to Chainalysis’ 2020 Geography of Cryptocurrency Report, STABLECOINS account for 33% of all value traded on-chain in East Asia, as opposed to 21% or Western Europe and 17% for North America. And of the STABLECOINS traded in East Asia, 93% of the traded value comes from Tether."

Good Afternoon Dinar Recaps,

USDT= TETHER'S STABLECOIN IS THE BIGGEST CRYPTOCURRENCY BEHIND BITCOIN IN EAST ASIA

"There’s arguably nothing special about Tether in itself, not least because the stablecoin still hasn’t undergone a full audit. However, it has become a lifeline in parts of the world where trading crypto with fiat currencies is either prohibited or very difficult, whereas it remains marginal in markets such as the United States."

"Tether may be viewed with a mixture of suspicion and bemusement in the West, but in East Asia it is the biggest cryptocurrency after Bitcoin."

"According to Chainalysis’ 2020 Geography of Cryptocurrency Report, STABLECOINS account for 33% of all value traded on-chain in East Asia, as opposed to 21% or Western Europe and 17% for North America. And of the STABLECOINS traded in East Asia, 93% of the traded value comes from Tether."

"This is big, and pretty much all of this outflow comes from China. As the table below indicates, Chinese traders exclusively use Tether to trade with Bitcoin, while traders in Japan and South Korea predominantly use their respective national currencies."

@ Newshounds News™

Read more: Crypto Advantage

~~~~~~~~~

UK joins ‘E-Commerce Joint Initiative’ to promote digitalization of customs documents and processes

The agreement, known as the E-Commerce Joint Initiative, was finalized on July 26, 2024, after five years of negotiations involving 90 countries, aiming to eliminate customs duties on digital content

▪️ The agreement eliminates customs duties on digital content, lowering costs for UK businesses

▪️ It mandates the adoption of digital customs systems and e-documents, potentially increasing UK GDP by up to £24.2 billion

▪️ The initiative also introduces legal safeguards against online fraud, enhancing consumer protection.

The UK has joined a groundbreaking global digital trade agreement, the first of its kind negotiated under the World Trade Organization (WTO).

The agreement, known as the E-Commerce Joint Initiative, was finalized on July 26, 2024, after five years of negotiations involving 90 countries.

This initiative aims to modernize international trade by promoting the digitalization of customs documents and processes, and is expected to significantly benefit the UK economy.

Digitalisation of customs documents and processes

The E-Commerce Joint Initiative focuses on creating a more efficient and secure global trade environment.

By committing to the digitalization of customs documents and processes, the agreement seeks to replace outdated paper-based systems.

This transition is expected to save time and reduce costs for businesses by eliminating the need for physical signatures and the physical exchange of documents.

The Organization for Economic Co-operation and Development (OECD) estimates the value of global digital trade at around £4 trillion and growing.

The UK’s involvement in this agreement could see a significant economic boost.

According to the UK government’s analysis, adopting advanced digital trading systems could increase the UK’s GDP by up to £24.2 billion, based on 2023 GDP figures.

The agreement also aims to protect consumers from online fraud and misleading product claims.

By establishing a common set of rules, it helps create a safer environment for digital transactions.

For UK businesses, particularly those in financial services, the adoption of e-documents and e-signatures will simplify international transactions, reducing reliance on paper contracts and manual processes.

@ Newshounds News™

Read more: Trade Finance Global

~~~~~~~~~

WTO Agreement Looks to Pave Way for Paperless Cross-Border Commerce

With the news that five years of trade negotiations under the World Trade Organization (WTO) Joint Statement Initiative on Electronic Commerce reached a milestone Friday (July 26) — with participants agreeing to a two-year extension of a moratorium on taxation of cross-border electronic transmissions — mitigating the fragmentation that businesses face when transacting internationally is top of mind for global enterprises.

The 91 WTO members participating in the discussions account for over 90% of global trade, and the joint statement’s co-conveners, Australia, Japan and Singapore, were able to pass an agreement banning the imposition of “customs duties on electronic transmissions between a person of one Party and a person of another Party.”

Role of Standardization

Crucially, within the text of the WTO agreement, are the hints of a slow-but-sure reimagining of cross-border commerce’s digital transformation — both around international e-invoicing and paperless global trade.

“The Parties recognize that electronic invoicing frameworks can help improve the cost effectiveness, efficiency, accuracy, and reliability of electronic commerce transactions.

As PYMNTS has covered, the move toward e-invoicing is not merely about converting a paper invoice into a digital format; it’s about reimagining the entire business-to-business (B2B) invoicing process to be more streamlined and better integrated into digital business ecosystems.

The workflow transformation promises to reduce errors, lower costs, and speed up B2B payment processes, offering benefits to companies of all sizes.

Already, more than 80 countries have put in place a mandate for e-invoicing or continuous transaction control (CTC) requirements as governments around the world look to prioritize tax reform and real-time reporting.

PYMNTS Intelligence data has found that nearly half (45%) of small and medium-sized businesses (SMBs) cited manual invoice review as a problem when making payments, with 19% saying it was their top issue.

“With a view to creating a paperless border environment for trade in goods, the Parties recognize the importance of eliminating paper forms and documents required for importation, exportation, or transit of goods …

Cross-border payments often involve multiple intermediaries, resulting in high fees and long processing times.

“If you do a $10 transaction today, you’ll probably spend a very significant part of that $10 as fees. And we need to get to a point where that base fee is something that you don’t have to think about, so that you can do low-value transactions at scale — that could change the landscape of cross-border payments,” Ram Sundaram, COO at TerraPay, explained to PYMNTS.

@ Newshounds News™

Read more: PTMNTS

~~~~~~~~~

RICS Summit 2024

Russia will hold the BRICS Summit in Kazan from October 22 to 24, 2024.

During its BRICS presidency this year, Russia has said it will focus on "promoting the entire range of partnership and cooperation within the framework of the association on three key tracks – politics and security, the economy and finance, and cultural and humanitarian ties."

@ Newshounds News™

Read more: Uniting to Combat NTDs

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday 7-30-2024

TNT:

Tishwash: Urgent Al-Sudani visits Tehran today

Prime Minister Mohammed Shia Al-Sudani will visit today, Tuesday, to participate in the swearing-in ceremony of the new Iranian President, Masoud Pezeshkian, which will take place in the Islamic Shura Council {Parliament}.

Foreign delegations will continue to arrive in Tehran from yesterday until the remaining hours of the swearing-in ceremony of the ninth Iranian president.

It is worth noting that the implementation ceremony of President Masoud Pezeshkian’s decree was held the day before yesterday, Sunday, and the text of the fourteenth presidential decree was delivered to the president-elect by the Leader of the Islamic Revolution in Iran.

TNT:

Tishwash: UrgentAl-Sudani visits Tehran today

Prime Minister Mohammed Shia Al-Sudani will visit today, Tuesday, to participate in the swearing-in ceremony of the new Iranian President, Masoud Pezeshkian, which will take place in the Islamic Shura Council {Parliament}.

Foreign delegations will continue to arrive in Tehran from yesterday until the remaining hours of the swearing-in ceremony of the ninth Iranian president.

It is worth noting that the implementation ceremony of President Masoud Pezeshkian’s decree was held the day before yesterday, Sunday, and the text of the fourteenth presidential decree was delivered to the president-elect by the Leader of the Islamic Revolution in Iran.

According to Article 121 of the Iranian Constitution, the President of the Republic must take the constitutional oath before the Glorious Word of God and in the presence of members of Parliament, members of the Guardian Council, and the head of the judiciary in the Islamic Consultative Assembly.

The swearing-in ceremony of President Masoud Pezeshkian will be held in the Islamic Consultative Assembly on Tuesday evening, and according to Alireza Sharifi, the executive deputy of the parliament, more than 70 foreign delegations from different countries will participate in this ceremony. link

Tishwash: In the presence of Al-Sudani.. 3 files bring the framework together at the nightly negotiating table

The Coordination Framework, which includes the Shiite forces forming the government of Mohammed Shia al-Sudani, is scheduled to hold an important meeting on Monday evening, with the attendance of all its leaders, in addition to the Prime Minister.

A leader in the framework told Shafaq News Agency, "The Coordination Framework will hold a meeting in an hour from now, in the presence of its leadership and the Prime Minister, to discuss a number of important topics and issues on the political scene."

The leader added, "The meeting of the framework leaders will discuss the issue of the position of the Speaker of the House of Representatives and agree to set a record date for holding the session to elect the president."

He explained that "the meeting will also discuss the file of forming local governments in the provinces of Diyala and Kirkuk, in addition to discussing with Al-Sudani the file of the Turkish incursion into Iraqi territory."

Despite the passage of more than 8 months, the Sunni political forces have not succeeded in agreeing on an alternative candidate for Parliament Speaker Mohammed al-Halbousi .

The parliament failed five times in a row to resolve the issue, in light of the division between the political parties in supporting one of the candidates for the position, namely Mahmoud Al-Mashhadani, the candidate of the Progress Party, and Salem Al-Issawi, the candidate of the Sunni parties (Sovereignty and the Azm and Al-Hasm alliances), who obtained the majority of votes during the last parliament session .

A few days ago, the Azm Alliance, led by Muthanna al-Samarrai, warned the Shiite forces against continuing to obstruct the election of the Parliament Speaker .

The leader of the coalition, Haider Al-Mulla, told Shafaq News Agency, "The talk about achieving a Sunni-Sunni consensus is an attempt to obstruct the election of the Speaker of the Council of Representatives. Throughout the life of the political process in Iraq, there has been no consensus or agreement on choosing any of the three presidencies." link

************

Tishwash: Article 140 raises controversy again.. Calls to delay its implementation and take into account the “sensitivity of the situation”

MP Mudhar Al-Karwi called, today, Monday (July 29, 2024), to delay the implementation of Article 140 in 38 villages in eastern Iraq, stressing that the sensitivity of the situation must be taken into account .

Al-Karwi said in an interview with Baghdad Today, "The Committee for the Implementation of Article 140 recently issued a decision regarding agricultural contracts in 38 villages located within the vicinity of Khanaqin District in Diyala Governorate. This is a sensitive issue and requires flexible procedures because hundreds of farmers have official contracts that extend for decades."

Al-Karwi called on the Prime Minister to “issue an order to delay the implementation of the decision of the Committee for the Implementation of Article 140 and to give an opportunity to review the contracts in the villages covered by a higher committee affiliated with the Ministry of Agriculture and the rest of the parties to avoid any injustice or unfairness that affects Arab farmers. The sensitivity of the situation must be taken into account and the matter must be done according to fair and just principles to avoid any confusion.”

He pointed out that "waiting is the most appropriate thing at the moment and agreeing on specific procedures that will lead to achieving justice and fairness for all parties and that no farmer will be wronged, especially since the residents of these villages have been living there for decades."

It is noteworthy that the Article 140 Implementation Committee, headed by Hadi al-Amiri, recently issued a decision regarding agricultural contracts in the villages of Khanaqin and returning them to Kurdish farmers. link

Tishwash: Government Advisor: Adopting budget schedules has become a reality and does not affect financial obligations

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, confirmed today, Tuesday, that the budget schedules have become a reality, and issuing instructions is a procedural matter that does not affect financial obligations.

Saleh said, in an interview with the Iraqi News Agency, followed by "Al-Eqtisad News", that "the legal basis for the current fiscal year 2024 is something that has been legislated and approved primarily, based on the provisions of the federal general budget for the years 2023, 2025, 2024 issued by Law No. 13 of 2023, which was published on June 26, 2023 in the Official Gazette."

He explained that "what is stipulated in Article Two/77 of the law includes the executive authority submitting the financial tables for the two fiscal years 2024, 2025 to enable the House of Representatives to approve them sequentially," noting that "this was achieved in the fiscal year 2024." He

pointed out that "the three-year federal general budget was implemented for the first time in the country, which was based in its approval on one of the articles included in the provisions of the Federal Financial Management Law No. 6 of 2019, as amended, which authorized the work of a financial plan consisting of a general budget for three fiscal years."

He added that "the legal options available to implement the provisions of the federal general budget have become more flexible for the federal financial authority, in addition to the availability of the federal financial management law itself, which allows financial transactions even if any approval of the general budget formalities is delayed in principle, especially allowing continued spending or disbursement on investment projects approved in the three-year general budget as ongoing projects, as well as operational spending, or any financial transactions stipulated in the three-year general budget law."

He added, "Despite this, the adoption of the financial tables for the current fiscal year 2024, which were approved by the House of Representatives earlier this year, has become a reality, and issuing instructions for their implementation is a procedural matter that does not affect the obligations of the fiscal year itself, as these instructions are in all cases consistent with the emerging financial transactions when issued."

He added that "the Ministry of Finance had announced earlier this month the issuance of financial bonds (achievement bond) as a source of financing for the budget by borrowing from the local financial market worth 1.5 trillion dinars," stressing that "spending on operating expenses such as salaries, pensions, social care, debt services, and others is ongoing, in addition to the continued financing of ongoing investment projects and those under implementation."

He pointed out that "all of these activities are financial activities in which spending has not stopped, which is consistent with the legal work rules that came with the three-year federal general budget, with high flexibility, transparency, and governance."

He noted that "the instructions for implementing the general budget schedules for the fiscal year 2024 will touch upon some of the developments and partial financial transactions that have been newly created or adapted, and not the faculties of public finance, and that the financial activity in the country with its three pillars: revenues, expenditures, and deficit management is proceeding in a consistent and harmonious manner and in accordance with the objectives of the three-year general budget law, and that the executive and legislative authorities are in continuous communication and high coordination to ensure the achievement of public interests without interruption link

Mot: . Happy Tuesday everyone

Mot: .... Nuttning Better -- HUH!!!!

Seeds of Wisdom RV and Economic Updates Tuesday Morning 7-30-24

Good morning Dinar Recaps,

EU and Singapore finalise Digital Trade Agreement

The European Union (EU) and Singapore have successfully concluded negotiations for a landmark Digital Trade Agreement (DTA), an initiative aimed at setting global standards for digital trade and cross-border data flows.

On 25 July 2024, the European Union (EU) and Singapore successfully concluded negotiations for a landmark Digital Trade Agreement (DTA), an initiative aimed at setting global standards for digital trade and cross-border data flows.

This agreement, the first of its kind for the EU, complements the existing 2019 EU-Singapore Free Trade Agreement (EUSFTA) and shows deepening economic relations between the two regions.

Good Morning Dinar Recaps,

EU and Singapore finalise Digital Trade Agreement

The European Union (EU) and Singapore have successfully concluded negotiations for a landmark Digital Trade Agreement (DTA), an initiative aimed at setting global standards for digital trade and cross-border data flows.

On 25 July 2024, the European Union (EU) and Singapore successfully concluded negotiations for a landmark Digital Trade Agreement (DTA), an initiative aimed at setting global standards for digital trade and cross-border data flows.

This agreement, the first of its kind for the EU, complements the existing 2019 EU-Singapore Free Trade Agreement (EUSFTA) and shows deepening economic relations between the two regions.

The DTA is designed to facilitate digitally-enabled trade in goods and services, ensuring that data flows across borders without unjustified barriers.

It provides a framework that guarantees consumer trust, predictability, and legal certainty for businesses, especially small and medium-sized enterprises (SMEs).

This agreement also includes rules on spam and cybersecurity, reinforcing the EU and Singapore’s commitment to a secure digital environment (Trade) (EURAXESS).

European Commission Executive Vice-President Valdis Dombrovskis and Singapore’s Minister-in-charge of Trade Relations Grace Fu announced the conclusion of the negotiations, highlighting the agreement’s importance.

They emphasised that the DTA not only reflects the growing digital economies of the EU and Southeast Asia but also their shared commitment to maintaining open, competitive, and fair digital markets.

The agreement is part of the EU’s broader strategy to update digital trade rules globally, as seen in recent digital trade chapters with the UK, Chile, and New Zealand.

The EU and Singapore will now proceed with their respective domestic procedures to formally sign and conclude the DTA.

The deal is expected to enhance the digital transformation of both economies, fostering innovation and providing new economic opportunities.

It also aligns with the EU’s Indo-Pacific strategy, aiming to strengthen ties with key partners in this region.

In conjunction with the DTA, the second Trade Committee meeting under the EUSFTA took place, co-chaired by Minister Fu and Executive Vice-President Dombrovskis.

They noted the strong trade relations between the EU and Singapore, with annual trade in goods and services surpassing €130 billion in 2022.

The meeting also covered bilateral cooperation in areas like the green economy and discussed recent global economic developments, including issues at the World Trade Organisation (WTO).

The EU-Singapore Digital Partnership, launched in February 2023, laid the groundwork for this agreement.

This partnership included Digital Trade Principles aimed at facilitating the free flow of goods and services while upholding privacy and data protection standards.

The Digital Partnership and the DTA together represent a significant advancement in the EU’s efforts to lead in global digital governance.

The formal signing and implementation of the EU-Singapore Digital Trade Agreement will further strengthen economic ties and provide a model for future digital trade agreements worldwide.

The agreement is expected to be fully operational by mid-2025, providing a boost to digital commerce and innovation in both regions.

@ Newshounds News™

Read more: Trade Finance Global

~~~~~~~~~

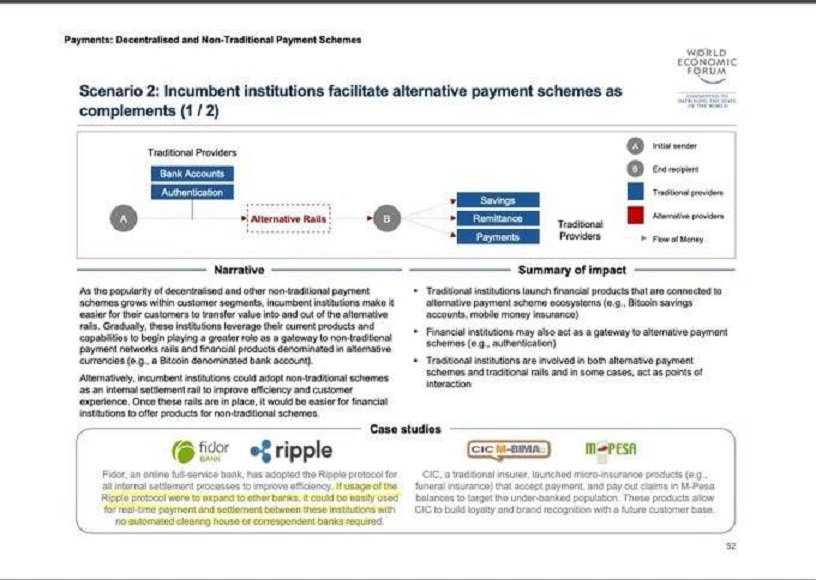

World Economic Forum document on “Decentralized and Non-Traditional Payment Schemes” cites Ripple as an example of an alternative rail for traditional payment systems 🔑

“If usage of the Ripple protocol were to expand to other banks, it could be EASILY used for real-time payment and settlement BETWEEN these institutions with NO automated clearing house or correspondent banks required.”

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

TRUMP'S PLAN IS TO DOLLARIZE THE WORLD THROUGH STABLECOINS

"This past Saturday, former president Donald Trump addressed the Bitcoin 2024 conference in Nashville, Tennessee, expounding upon the crypto and bitcoin policies likely to be implemented as part of a likely future Trump administration.

Speaking in front of a banner emblazoned with the logo of Xapo bank, an institution which hopes to serve as a global bridge between bitcoin, the U.S. dollar and stablecoins, Trump’s speech revealed a policy vision that would integrate those three in order to “extend the dominance of the U.S. dollar to new frontiers all around the world.”