“Tidbits From TNT” Monday Morning 5-20-2024

TNT:

Tishwash: The impact of the death of Iranian President Ebrahim Raisi on the Iranian currency

The Iranian currency witnessed a major collapse following the killing of Iranian President Ebrahim Raisi and Foreign Minister Hossein Amir Abdollahian. The currency fell by more than 8 percent as of last night, reflecting the profound impact of political events on the Iranian economy.

On Sunday, as news of the fate of Iranian President Ebrahim Raisi spread after his plane crashed in East Azerbaijan Province, the dollar exchange rate witnessed a noticeable increase against the Iranian riyal in the unofficial market. The price of the dollar rose from the level of 57 thousand riyals per dollar to more than 62 thousand riyals in Monday morning trading.

This increase came after the official death of President Ebrahim Raisi and the Minister of Foreign Affairs was officially confirmed on Monday morning, as their helicopter crashed in the East Azerbaijan region, northern Iran. As a result, the Iranian currency exchange rate reached 60.6 thousand tomans against the US dollar, knowing that the Iranian toman is equal to 10 riyals.

TNT:

Tishwash: The impact of the death of Iranian President Ebrahim Raisi on the Iranian currency

The Iranian currency witnessed a major collapse following the killing of Iranian President Ebrahim Raisi and Foreign Minister Hossein Amir Abdollahian. The currency fell by more than 8 percent as of last night, reflecting the profound impact of political events on the Iranian economy.

On Sunday, as news of the fate of Iranian President Ebrahim Raisi spread after his plane crashed in East Azerbaijan Province, the dollar exchange rate witnessed a noticeable increase against the Iranian riyal in the unofficial market. The price of the dollar rose from the level of 57 thousand riyals per dollar to more than 62 thousand riyals in Monday morning trading.

This increase came after the official death of President Ebrahim Raisi and the Minister of Foreign Affairs was officially confirmed on Monday morning, as their helicopter crashed in the East Azerbaijan region, northern Iran. As a result, the Iranian currency exchange rate reached 60.6 thousand tomans against the US dollar, knowing that the Iranian toman is equal to 10 riyals.

The Iranian rial had witnessed a slight recovery against the dollar after a period of increasing tensions with Israel, as the dollar exchange rate reached about 70 thousand riyals per dollar. With the decline in tensions, the dollar exchange rate began to gradually decline, reaching 57 thousand riyals in parallel market trading on Sunday morning.

It is worth noting that the Iranian government has set an official exchange rate for the dollar at 42,000 rials to one dollar since 2018. However, the rial is suffering from great pressure due to high inflation sparked by the ongoing US sanctions. These sanctions, imposed during the administration of former US President Donald Trump, reduced sales of some of Iran's main exports, especially oil and its products.

This incident comes at a time when the Iranian economy is suffering from major challenges, as political fluctuations make it more difficult to predict the future of the currency and stabilize the economy. This rapid decline in the value of the Iranian rial reflects the fragility of the economic situation and the great pressures that the country faces in light of the sanctions and political turmoil. link

************

Tishwash: Iraq declares one day of public mourning for the death of the Iranian president and his companions

Today, Monday (May 20, 2024), the official government spokesman, Bassem Al-Awadi, announced a one-day public mourning for the passing of Iranian President Ebrahim Raisi and his companions.

Al-Awadi said in a statement received by “Baghdad Today” that “in standing with the Iranian people and their leadership, in these difficult times, and in solidarity with the feelings of sadness and pain, with the passing of the President of the Islamic Republic of Iran, Ebrahim Raisi, and the Minister of Foreign Affairs, Hossein Amir Abdollahian, and their companions, in the painful incident, the government announced Iraqiya: Public mourning throughout Iraq, for one day, tomorrow, Tuesday.

He added: "We ask God Almighty to inspire the families of the victims and the general Iranian people and their leadership with patience and solace."

On Monday morning, the government and Iranian media sources confirmed the death of Iranian President Ebrahim Raisi and his Foreign Minister Amir Abdullahian in a helicopter crash in the northeast of the country, yesterday evening, Sunday. link

And here's what they tweeted

The Iraqi government declares one day of general mourning tomorrow, Tuesday, throughout the country for the death of Iranian President Ebrahim Raisi and Foreign Minister Hossein Amir Abdollahian and their entourage.

************

Tishwash: Does "dollar dominance" threaten the global economy?

In the world of an intertwined economy with multiple competing powers, the dominance of the US dollar remains a pivotal issue that raises many questions, at a time when the dollar plays a major role in the international financial system, as it participates in the majority of international transactions and constitutes a large portion of global reserves, and this situation gives the United States power. tremendous economic and political potential, but it comes with increasing challenges and risks.

With the rise in US interest rates and the strengthening of the dollar, pressures have begun to appear on international transactions that rely heavily on the US currency.

These pressures not only affect emerging markets, but may also lead to radical changes in the global financial system. With increasing talk about alternatives to the dollar by members of the BRICS group, for example, there is renewed debate about the future of the dollar’s dominance and whether it will continue in light of the mounting economic and political challenges.

Sovereign debt

In a related context, Joe Yark, head of the global markets department at Cedra Markets, says that the US dollar represents 58 percent of global reserves, and represents 70 to 80 percent of the volume of global trade, in addition to the pricing of oil and basic commodities in the US dollar, which makes it have an impact. Mainly on the global economy.

Yark points out that the steps taken by the US Federal Reserve, whether tightening or easing monetary policy, of course affect global banks, which is evident with regard to raising interest in recent periods to combat inflation. He explains in this context that:

* The US Federal Reserve is playing a positive role at the present time. It is considered a “tempo officer.”

* The huge US debt and the risks resulting from sovereign debt are the only fear.

* The US Federal Reserve’s decisions due to its excessive debt, and the so-called “global debt bubble” which exceeded $315 trillion, negatively affect the global economy.

* Markets are affected by the Federal Reserve’s decisions to raise interest rates, which hampers the economy in these countries (..), which are forced to pay additional costs to purchase goods.

Dollar dominance

From London, economist Anwar Al-Qassim says, “The dominance of the greenback currently appears more fragile than it seems, given the expected changes in the dollar’s exchange rate system and its eroding international standing in favor of multiple international currencies.”

We are witnessing a clear shift. When most Asian countries follow China, along with countries such as Russia and the BRICS countries, the dollar, which currently represents the base currency for about two-thirds of global GDP, may end up losing approximately half of its value.

During 2023, Russia and China transferred more than 90 percent of trade to the yuan and the ruble, which demonstrates the almost complete elimination of the dollar in economic relations between the two countries.

He added: “China is now considered an economic giant, not only in terms of production and exports, but also in terms of the size of its financial sector, which is currently the largest in the world, with the value of its assets amounting to 60 trillion dollars...while the total American debt to the federal government exceeds 34 trillion dollars.” This is a record number that foretells the upcoming economic challenges and the future of the dollar.

He stresses that while it is not entirely clear that the dollar will be eliminated as the primary means of exchange anytime soon, abolishing “dollarization” has become a strategic option for many countries, led by Moscow and Beijing. link

************

Tishwash: Washington is delaying its withdrawal from Iraq, and Baghdad is “evading”

Despite the many demands from some political forces and the Islamic resistance in Iraq to remove American forces, the government position is not at the required level regarding this issue.

Recently, Prime Minister Muhammad Shiaa Al-Sudani visited the United States and met with its President Joe Biden, while it was agreed to transform the relationship from military to economic and commercial based on trade exchange in various fields! .

Regarding the issue of removing American forces from Iraq, Representative Mahma Khalil said in an interview with “Al-Ma’louma” that “the law to remove foreign forces from Iraqi territory falls on the responsibility of the federal government,” stressing that “the law will work to remove every soldier, trainee, and advisor.”

Khalil called on "the government to work seriously on this issue and to expedite sending the law regarding the removal of American forces from Iraq to the House of Representatives for the purpose of voting on it."

*An explicit government position

In the same context, political analyst Sabah Al-Ukaili confirmed that the Iraqi government is not serious about the issue of removing American forces from the country.

Al-Ugaili told Al-Maalouma: “The political forces and the Iraqi government are not sincere in the issue of removing American forces from Iraq,” indicating “the American forces are not serious about leaving Iraq.”

He added, "The Iraqi government is evading this file despite the resistance factions' mandate to Prime Minister Muhammad al-Sudani," noting that "if the factions do not sense the seriousness of the Iraqi government in this regard, they will have another position "

He explained that "the method of the American military forces often violates the autonomy of the Iraqi state, most notably targeting the leaders of the Popular Mobilization Forces and other targets," calling on "the government to take a strict and resolute stance on this issue and to stay away from patchwork solutions and procrastination.”

For his part, the Chairman of the Parliamentary Security and Defense Committee, Karim Aliwi, confirmed in an interview with Al-Maalouma that “the talks taking place between the Iraqi and American delegations regarding ending the tasks of the international coalition forces are among the committee’s most prominent concerns,” noting that “the government asked the committee to be neutral and monitor those matters.” Dialogues. link

Mot: Ya Knows!!! -- NOT All Boots are fer Walking!!!!

Floating The Currency Between Economic Benefit And Disadvantages

An Unruly Policy Or A Necessary Need? .. Floating The Currency Between Economic Benefit And Disadvantages

Money and business Economy News – Baghdad The stability of the Iraqi dinar has always faced major challenges in recent years, as it has witnessed price fluctuations, not to mention a gap between what the central bank determines and what is sold in the parallel market.

In order to avoid the “volatility” syndrome and the “gap” in the price of the Iraqi dinar against foreign currencies, some experts believe that the solution lies in a kind of “surgical” operation for the country’s monetary system that may be painful, but it achieves long-term monetary stability for the national currency through... "float".

The cash selling price, according to the Central Bank, is 1,305 dinars per dollar, while the price for transfers abroad is 1,310 dinars per dollar, and the price in the parallel market is about 1,450 dinars per dollar in mid-May, according to local media, while it reached levels of 1,600 dinars per dollar in previous periods.

An Unruly Policy Or A Necessary Need? .. Floating The Currency Between Economic Benefit And Disadvantages

Money and business Economy News – Baghdad The stability of the Iraqi dinar has always faced major challenges in recent years, as it has witnessed price fluctuations, not to mention a gap between what the central bank determines and what is sold in the parallel market.

In order to avoid the “volatility” syndrome and the “gap” in the price of the Iraqi dinar against foreign currencies, some experts believe that the solution lies in a kind of “surgical” operation for the country’s monetary system that may be painful, but it achieves long-term monetary stability for the national currency through... "float".

The cash selling price, according to the Central Bank, is 1,305 dinars per dollar, while the price for transfers abroad is 1,310 dinars per dollar, and the price in the parallel market is about 1,450 dinars per dollar in mid-May, according to local media, while it reached levels of 1,600 dinars per dollar in previous periods.

For months, the Iraqi authorities have been imposing restrictions in their efforts to control exchange rates, restricting all commercial transactions within the country to the Iraqi dinar, and establishing a new mechanism that subjects external transfers to greater scrutiny.

Iraqi economic analysts who spoke to Al-Hurra website, some of them warned against taking a decision that would lead to floating the dinar, while some of them believe that a moderate policy could be taken that suits the Iraqi economy, based on “floating” and “stabilization” at the same time.

Is The Flotation Policy Compatible With The Iraqi Economy?

The specificity of the Iraqi economy is not proportional to the floating of the exchange rate. Archive

Advisor to the Prime Minister for Financial Affairs, Mazhar Salih, believes that floating the currency price does not suit the Iraqi economy, especially since it is a "rentier economy, dominated by foreign currency reserves."

He explains in statements to the “Al-Hurra” website that “the economic vision that wants to float the Iraqi dinar to end the gap between the official price and the parallel price may be possible in an economy in which the free market alone influences the movement of the balance of payments, and not in an economy in which the rentier government sector is dominant and generates reserves.” Foreign currency".

He added, "The monetary authority in Iraq alone is the main source of supply of foreign currency that meets the desired demand for foreign exchange in the local market."

Saleh believes that the demands for flotation inevitably mean “adopting the prevailing exchange rate in the parallel market, in order to achieve the goal of stability and balance in the official exchange rate itself at a new exchange point that the market will reach at the end of the assumed flotation policy and return to stability again.”

The flotation scenario also means “the withdrawal of the monetary authority as the main central offerer of foreign currency, and its replacement by new forces of free market makers, which certainly have only a weak, limited supply of foreign exchange,” according to Saleh.

He points out that these forces carry “an uncontrolled package of inflationary expectations, and are called in the economic literature (the forces generating inflationary expectations), which will give dominance to the supply forces of speculators” who own limited amounts of foreign exchange, matched by “an open demand for foreign currency from The market side" exceeds what is offered by "at least more than ten times in our estimate."

Chancellor Saleh described this policy as “unruly,” as as long as “the central government supply of foreign currency will be absent from the market, we will not obtain any equilibrium point in the exchange rate that flotation seeks except with a widespread deterioration of the exchange rate as long as it is carried out by forces generating inflationary expectations in a severe rentier economy.” "unilateralism."

He warns that if the exchange rate moves in “a market that is incomplete, in terms of productivity, in its compensation for the required supply of goods and services,” no one “will know how much the new exchange rate resulting from the flotation will be,” which will be accompanied by “a prior wave of inflationary expectations,” the trends of which are difficult to control. , which may push monetary policy makers to “intervene with excessive foreign reserves and unjustified extravagance in foreign exchange to impose a state of stability.”

According to the World Bank, Iraq has 145 billion barrels of proven oil reserves, which are among the largest crude oil reserves in the world.

But Iraq hopes that the country's oil reserves will exceed 160 billion barrels, according to what the Minister of Oil, Hayyan Abdul Ghani, recently announced.

What If The Iraqi Dinar Was Floated?

The claims that have appeared every now and then for years calling for floating the exchange rate of the Iraqi dinar are “strange,” and most of them are made by people who are “not specialized in economics or monetary policy,” according to what Professor of International Economic Relations, Abdul Rahman al-Mashhadani, confirms to the Al-Hurra website.

He asserts in a decisive tone, "Iraq cannot proceed with floating the dinar's exchange rate. The evidence for this is all the agreements concluded with the International Monetary Fund since 2004, and the reviews praised the stabilization of the exchange rate by the Central Bank of Iraq."

Al-Mashhadani added that there was a study by experts at the World Bank during the past years that recommended “raising the exchange rate,” noting that even then, “these recommendations cannot be taken into account because the World Bank is concerned with what is related to economic development, but following up on the recommendations for monetary policies is taken into account if It was from the International Monetary Fund.

In its latest review on Thursday, the International Monetary Fund praised the efforts of the Central Bank of Iraq to tighten monetary policy and strengthen its liquidity management framework.

He explains that “the real gap is in the wheel of production in the Iraqi economy, as the majority of goods are imported from abroad, which means that the flotation will cause a spiral in price rates to become significantly high and affect the marginalized classes,” indicating that such a decision cannot be taken “as a matter of politics.” “Cash” only, as we must “consider the burdens it will impose on citizens.”

Al-Mashhadani confirms that what has been applied in other Arab countries does not “mean that it can be applied to the Iraqi economy,” suggesting that “the exchange rate will become at the levels of 5,000 dinars to the dollar,” as “the Central Bank has lost control over exchange rates, leaving them to float.”

There is a fear that “floating” will cause “social” problems, as “salaries will erode significantly,” which may threaten “new classes to slide into poverty,” while “a class of merchants, politicians, and businessmen will benefit, who will benefit from the state of instability that will result from... This matter".

Al-Mashhadani agrees that floating in the end means “that the parallel market will control exchange rates,” but it will not achieve “the desired monetary stability,” as the central bank will then need to “print more local currency to keep up with demand in the markets,” and the government will need to increase salaries and allocations for aid packages. Social.

"Float With Controls" For Full "Editing".

The economic expert, Manar Al-Obaidi, recommends following a “currency float” policy, but with controls such that a “managed float policy is used to gradually liberalize the currency until complete liberalization of the exchange rate is reached.”

He said in a post on his Facebook account, "Such a policy could be a successful alternative in Iraq by following a managed float policy where the central bank controls the range of volatility and works to gradually increase it until the currency is completely liberalized."

Al-Obaidi gave the example of “the managed flotation policy followed by Morocco in 2018,” noting that it was accompanied by the abolition of customs tariffs on basic materials and “supporting funds for vulnerable classes,” stressing that this experience can be used to influence “inflation.”

Reasons For The Exchange Rate “Gap”.

A New Procedure For The Iraqi Dinar

The Iraqi government advisor, Saleh, attributes the reason and existence of a “gap” in the dinar’s exchange rates against the dollar between the official and parallel markets to “external factors imposed by the compliance platform and auditing administrative restrictions on external transfer movements, which is not related to the deficit in the authority’s monetary reserves,” noting that the reserve Iraq's foreign currency is considered the highest in the country's history, as it touches the levels of import coverage for 16 months, compared to the global standard, which does not exceed three months of import coverage.

Financial transfers in dollars through official channels have increased significantly in Iraq, while Iraq continues its reforms of the financial sector in line with international standards, according to a previous report by Agence France-Presse.

In late 2022, the Iraqi banking sector adopted the SWIFT electronic transfer system with the aim of providing better control over the use of the dollar, ensuring compliance with US sanctions on Tehran, and also in order to limit the prosperity of the informal economy.

The financial standards that were adopted encouraged the emergence of a parallel market for currencies, attracting those seeking to obtain dollars outside official channels.

Saleh pointed out that there is a distortion in support for the prices of some commodities “on the part of financial policy, which is support in which the rich and poor mostly enjoy it equally without discrimination, and it represents an added, imperceptible real income, and it is the product of a financial policy inherited from the consumer welfare state for the rentier resource.”

He continued, "It is inconceivable until this moment that 90 percent of Iraq's population is receiving food support provided by the state as an extension of the economic blockade phase of the nineties in light of the changing standards of living and lifestyle, the increasing number of affluent people, and the growth of the middle class."

In mid-May, the Iraqi authorities announced the purchase of 1.5 million tons of wheat since the beginning of the year.

According to the Ministry of Agriculture, Iraq, with a population exceeding 43 million people, needs between 4.5 million and five million tons of wheat annually.

The International Monetary Fund said Thursday that Iraq's internal imbalances have been exacerbated by significant fiscal expansion and low oil prices.

The Fund added that Iraq needs to gradually correct public financial conditions in Iraq to achieve debt stability in the medium term and rebuild financial reserves.

To ensure compliance with US standards regarding money laundering and sanctions on Iran, about 20 Iraqi banks were prevented from making dollar transfers.

Last September, the Iraqi government decided that merchants who deal with Iran are forced to turn to the parallel market to obtain currency, given that Tehran is subject to sanctions and “is not allowed to conduct financial transfers,” according to Agence France-Presse.

A Positive Step For The "Economy" But!!

The Iraqi economic academic, Nabil Al-Marsoumi, believes that the solution to addressing the discrepancy in the currency exchange rate through “free floating of the Iraqi dinar” may have “some economic positives.”

He added in an interview with Al-Hurra website that "the economy should not be taken in its abstract aspect, but rather in terms of its relationship to people, especially the poor among them."

Al-Marsoumi warns that "the Iraqi dinar may witness a violent collapse and rampant inflation that will cause prices in the Iraqi market to rise to record levels that will harm citizens, especially the low-income classes."

He explains that Iraq lacks "a national private sector that could contribute to increasing the supply of dollars in the local market, and because of the large volume of imports, which reach 67 billion dollars annually, the government is the only party that owns the dollar."

He notes that "if the government decides not to intervene in the exchange market, we are expected to witness consequences that will cause severe damage to citizens' living standards, making the poor even more miserable, and may lead to social tensions and a major rift in the social peace."

For his part, the economic expert Al-Obaidi defined the primary goal of liberalizing the currency as “creating an economy capable of withstanding various economic shocks, and reducing reliance on reserves that are greatly depleted in order to maintain a fixed exchange rate, which could stop once the reserves run out.” .

He added that this also "contributes to supporting the domestic product and changing the consumption pattern, and thus reducing the import bill for Iraq, which rises annually as an indirect reason as a result of the attempt to maintain a fixed exchange rate."

Not to mention, “continuing to try to maintain a fixed exchange rate depletes reserves,” which will lead at a certain stage, “accompanied by a decrease in reserves, followed by either a complete liberalization of the currency or a significant reduction in the price rate, which will have major repercussions on the citizen, and will cause great confusion in "A market that already suffers from a lack of economic stability."

What Is The Alternative To Floating The Currency?

The Iraqi Dinar Lost 25 Percent Of Its Value In Previous Periods

The Iraqi economic expert, Mahmoud Dagher, confirms to Al-Hurra website that the solution for Iraq may be a system “between floating and stabilization” to help stabilize currency exchange rates.

The expert, Dagher, a former official at the Central Bank of Iraq, explains that “the origin of the exchange system is floating, which is what free countries adopt.”

He explains that "the continuity of the gap requires reaching a middle system that solves the problem between free floating and stabilization. This is a system that many developing countries follow, and it helps solve the problems of currency fluctuation."

Financial expert Saleh proposes alternatives to floating, in a way that serves the objectives of monetary policy and limits inflationary risks, through the use of financial tools such as “taxes and customs duties that act as an intermediary to influence the exchange rate to achieve balance and price stability.”

He added, "Instead of resorting to lowering the exchange rate to harmonize the market through flotation, it would be through amending customs tariff schedules and imposing careful, thoughtful controls to protect the national economy."

Saleh called for correcting the defect in the structure of the Iraqi economy as a whole, as it is not possible to continue with “high operating spending in annual public budgets, which has always generated cash income from rentier sources that are matched only by very limited productivity of commodity and service flows, which has made the country It relies mainly on large-scale imported consumer goods.”

Counselor Saleh revealed, on Thursday, that the loans provided by the International Monetary Fund to Iraq since 2003 totaled no more than $8 billion, confirming that they had been repaid in full, according to a report published by the “INA” agency.

Last March, the International Monetary Fund stressed “the Iraqi economy’s need for broad structural measures to enhance private sector development and economic diversification, and to raise growth rates in the non-oil sector in a sustainable manner to accommodate the rapidly increasing workforce, and to increase non-oil exports and government revenues, in addition to Reducing the economy's exposure to oil price shocks.

He called for "accelerating the pace of reforms in the financial sector to improve access to financing, by modernizing the banking sector and supporting the ability of banks to establish banking relationships with other banks, and taking steps aimed at merging small-sized private banks," not to mention the need "to restructure the two largest government banks." ".

The Governor of the Central Bank, Ali Al-Alaq, announced in statements in early May that “the banking sector is witnessing major qualitative developments, while calling for cooperation and coordination between Arab central banks, banks and non-banking financial institutions to achieve stability and economic growth,” according to the “ Inaa ” agency.

He continued, "Central banks face new challenges in the interaction between financial and monetary stability, in light of the dominance of general financial policy and the necessity of central banks to facilitate excessive government debts, according to financial control, which requires reducing spending or increasing domestic revenues, or both."

Iraq has begun to recover relatively after years of wars, occupation, and sectarian violence that followed the US-led invasion in 2003, according to an Agence France-Presse report.

242 views 05/19/2024 - https://economy-news.net/content.php?id=43544

Provoking Thoughts and Points to Ponder on Advice :

Don't fight forces; use them. - Buckminster Fuller

Drink nothing without seeing it; sign nothing without reading it. - Spanish proverb

What is important is to keep learning, to enjoy challenge, and to tolerate ambiguity. In the end there are no certain answers. - Marina Horner

Simplicity, simplicity, simplicity. I say, let your affairs be as two or three, and not a hundred or a thousand; instead of a million count half a dozen, and keep your accounts on your thumbnail. - Henry David Thoreau

You must not think, sir, to catch old birds with chaff. - Cervantes

Some “Iraq News” Posted by TNT Members 5-19-2024

TNT:

Tishwash: Official working hours in Iraq will be suspended for 9 days next month - urgent

Baghdad Today publishes a schedule of official holidays for next June, where a holiday is expected to be announced for 9 consecutive days.

As shown below:

Friday, June 14: Weekly holiday.

Saturday, June 15: Weekly holiday.

Sunday, June 16: Day of Arafat.

Monday, June 17: Eid al-Adha.

Tuesday, June 18: Eid al-Adha.

TNT:

Tishwash: Official working hours in Iraq will be suspended for 9 days next month - urgent

Baghdad Today publishes a schedule of official holidays for next June, where a holiday is expected to be announced for 9 consecutive days.

As shown below:

Friday, June 14: Weekly holiday.

Saturday, June 15: Weekly holiday.

Sunday, June 16: Day of Arafat.

Monday, June 17: Eid al-Adha.

Tuesday, June 18: Eid al-Adha.

Wednesday, June 19: Eid al-Adha.

Thursday, June 20: Eid al-Adha.

Friday, June 21: Weekly holiday.

Saturday, June 22: Weekly holiday. link

Tishwash: Details of the extraordinary session of the Council of Ministers and the budget schedules sent to Parliament

The media office of Prime Minister Muhammad Shiaa Al-Sudani revealed, on Sunday, the details of the extraordinary session of the Council of Ministers and the budget schedules sent to Parliament.

The office stated in a statement received by Shafaq News Agency, “Al-Sudani chaired an extraordinary session of the Council of Ministers devoted to discussing the federal general budget schedules for the state ministries and institutions, for the year 2024, within the requirements of the Federal General Budget Law No. 13 of 2023, for the years 2023, 2024, and 2025.”

The session witnessed the approval of schedules (A, B, C, D, E, and F) and the planned deficit schedule for the year 2024, based on Article (77/Second) of the Federal General Budget Law No. (13) of 2023, for the years (2023 - 2024 - 2025). ), and refer it to the House of Representatives.

The session also included approval to re-announce the investment opportunity to implement the Baghdad Metro project, and the Holy Najaf-Karbala train, for an additional month, to ensure obtaining offers from other companies and entering the competition with the only offer.

The Council agreed to exclude the company executing the project to design and implement Al-Tajiyat Stadium (60,000 spectators), and the project to construct the fence and gates of Al-Tajiyat Sports City, from submitting a letter of guarantee for good implementation of the project, according to what was stated in the letter of the Ministry of Youth and Sports, dated May 19, 2024. link

***********

Tishwash: The Governor of the Central Bank announces the start of the second phase of the banking sector restructuring plan

Central Bank Governor, Ali Mohsen Al-Alaq, announced today, Sunday, the start of the second phase of the banking sector restructuring plan.

The media office of the Central Bank of Iraq said in a statement received by the Iraqi News Agency (INA): “Al-Alaq received a delegation from the World Bank headed by the Regional Director for Equitable Growth, Finance and Institutions for the Middle East and North Africa region, Nader Muhammad,” noting that “during the meeting, strengthening relations was discussed.”

The bilateral relationship between the Central Bank of Iraq and the World Bank, especially the restructuring of government banks, the launch of the Riyada Bank project and its economic and social importance, and the two parties also discussed the experiences of neighboring countries in confronting climate change and its impact on the national and regional economy.”

He added, "The meeting discussed small and medium enterprises and their support by the Central Bank, and the development of the financial and banking sector, non-banking financial institutions, financial markets and the insurance sector, as well as benefiting from the World Bank's experiences in digital transformation, financial inclusion, and digital banks," noting that "the governor reviewed during the meeting , The Central Bank of Iraq’s plan to restructure the banking sector,” noting that “this bank has completed the first phase of the plan, and has begun the second phase.”

Al-Alaq stated - according to the statement - that “the Board of Directors of the Central Bank licensed the Green Bank, which will be the nucleus of renewable energy and sustainable financing initiatives,” revealing “the Central Bank of Iraq’s intention to license a number of digital banks.” link

CandyKisses: Electricity goes on high alert as hot season begins

Baghdad - Iraq Today:

Minister of Electricity Ziad Ali Fadel called for mobilizing the ministry's energies in preparation for the next summer season.

The media office of the Minister of Electricity said in a statement that "the Minister of Electricity inspected the Sadr gas power station in Baghdad as part of his inspection tours to see the progress of maintenance and rehabilitation work in the production stations before the summer peak season."

He added, "The minister held a meeting with officials of the station, which consists of four production units with a total capacity of (636) megawatts, where they discussed topics related to maintenance work and the most prominent obstacles in work and developing solutions to them in order to complete the work according to the specified time frames."

He pointed out that "the minister conducted a field tour in the sections of the station and was briefed on the rehabilitation work carried out on the units by the experts of the German company Siemens and the ministry's staff, and praised the efforts of the engineering and technical teams to increase the efficiency of production stations and increase generating capacities," calling for "mobilizing energies in preparation for the next summer season, in order to provide reliable and stable electrical energy to citizens."

************

CandyKisses: Next month. A large conference to announce 8 cities as investment opportunities

{Economic: Al-Furat News} The New Cities Authority at the Ministry of Construction, Housing and Public Municipalities announced the imminent announcement of the second batch of cities as investment opportunities for companies and real estate developers.

The director of the authority, Hamed Abdel Hamad, said in a press statement that "the procedures have been completed, to reveal 8 new cities as investment opportunities within a second batch of residential cities in the government program for housing, as well as work to complete the procedures to announce three other cities soon," noting that "cities will be available for investment in front of Arab and international companies, and local investors wishing to invest in this vital sector."

Hamad explained that: "The beginning of next month will witness a large conference to announce investment opportunities, in the presence of international, Arab and Gulf companies," noting that "the headquarters of the authority witnessed the visit of dozens of companies to see investment opportunities in these cities, and we sensed a real desire to invest in this sector."

The director of the authority added that "five new cities have already been referred, including [Ali Al-Wardi] by signing the initial contract, while work began after the issuance of the investment license in the cities of {Al-Jawahiri} in Baghdad and {Al-Ghazlani} in Nineveh," pointing out that "the Chinese and Iraqi companies implementing the installation of concrete factories units, administrative buildings and soil leveling works in Al-Ghazlani, provided that the actual start of them will begin within the next three months."

"The other city is the [banks of Karbala], which is distributed among three experienced investors and previous similar businesses, including a Malaysian company, and is in the process of issuing the investment license and starting work next month after handing over the site, while the {gardens} in Babylon are in the process of preparing plans, handing over the land and issuing the license," he said.

Regarding construction operations, he explained that "all cities have been directed to be at the level of smart and sustainable cities in all its details, including electronic transactions and the use of technology in the daily movement of residents."

Regarding the marketing of housing units in the new cities, he said: "Directives will be issued to investing companies to announce the prices of the units through their websites, so that the citizen can enter and register directly," calling on citizens to "stay away from fake parties that claim to be related to the new cities and promote unrealistic things regarding prices or marketing housing units, and citizens can view the authority's website to answer all their inquiries and questions about this or go to the company directly instead of taking other methods that may not lead for the same purpose."

A Reading Of The Financial And Monetary Policies Of The International Monetary Fund Report - May 2024

A Reading Of The Financial And Monetary Policies Of The International Monetary Fund Report - May 2024

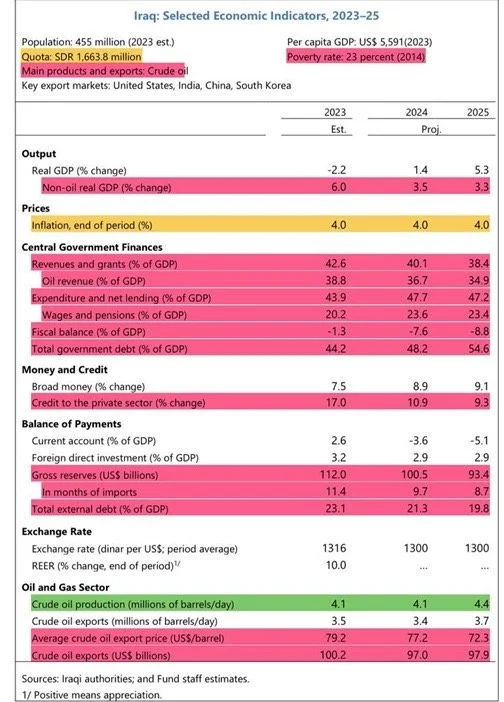

Ali Daadoush Economy News – Baghdad The report showed important data for the Iraqi economy during the period (2020-2023), actual and forecasts for the year 2024, and then predictions of the course of economic policy during the period (2025-2029), and

according to the data of the main table listed below, the data for Special Drawing Rights (SDR), inflation, and crude oil production were stable. To some extent,

but the other data were unstable, and some of them even portend danger in the coming years, especially for financial policy, in which the extent of the government’s intervention in the economy became apparent in terms of large expenditures, specifically the salaries, wages, and retirement sections, as well as the rise in public debt to levels of the danger zone, which are extremely high. (60%) of the gross domestic product.

Although oil output represents about 40% of the real gross domestic product, non-oil output represents only a small portion of total revenues and exports, making Iraq highly vulnerable to fluctuations in oil prices.

Moreover, the public sector wage bill (under increasing pressure from compulsory employment policies) remains the highest in the region.

A Reading Of The Financial And Monetary Policies Of The International Monetary Fund Report - May 2024

Ali Daadoush Economy News – Baghdad The report showed important data for the Iraqi economy during the period (2020-2023), actual and forecasts for the year 2024, and then predictions of the course of economic policy during the period (2025-2029), and

according to the data of the main table listed below, the data for Special Drawing Rights (SDR), inflation, and crude oil production were stable. To some extent,

but the other data were unstable, and some of them even portend danger in the coming years, especially for financial policy, in which the extent of the government’s intervention in the economy became apparent in terms of large expenditures, specifically the salaries, wages, and retirement sections, as well as the rise in public debt to levels of the danger zone, which are extremely high. (60%) of the gross domestic product.

Although oil output represents about 40% of the real gross domestic product, non-oil output represents only a small portion of total revenues and exports, making Iraq highly vulnerable to fluctuations in oil prices.

Moreover, the public sector wage bill (under increasing pressure from compulsory employment policies) remains the highest in the region.

This challenge is exacerbated by the lack of development in the private sector, which is hampered by factors including a large state footprint, corruption, bureaucracy, underdeveloped infrastructure, and poor access to credit.

Unemployment rates remain high and labor force participation levels are low, especially among youth and women, and although domestic stability has improved, public reforms still lag in key areas.

PIC

*The red color indicates a danger facing the Iraqi economy, the

yellow color indicates relative stability, and the

green color indicates economic growth.

First: economic policy discussions

Current policies significantly increase the dependence of the Iraqi economy on oil prices, and

to protect macroeconomic stability and sustainability, there must be financial reform (adjustment) that focuses on controlling the wage bill and mobilizing non-oil tax revenues while protecting vital social and investment needs, and this must be complemented by accelerating structural reforms. To stimulate private sector development, including through labor market reforms, restructuring of state-owned banks (Rafidain and Al-Rasheed in particular) and continued anti-corruption efforts.

Second: Financial policy

The fiscal situation is expected to deteriorate in 2024 and beyond, increasing vulnerabilities, and

although IMF staff expect only partial implementation of the investment budget due to capacity constraints, total government spending is expected to remain increasing by 3.8% of GDP in 2024, of which 3.4% is due to higher salaries and pensions (including transfers to the KRG).

Therefore, the deficit is expected to rise to about 7.6% of GDP in 2024 due to the increase in government expenditures, and

in light of the weakness of non-oil revenues and the continued dependence on oil revenues, it is expected that the fiscal deficit will deepen further under the assumption that there are no changes in fiscal policy,

Which forces the government to rely on cash financing, which means the central bank financing government expenditures in exchange for securities (discounting treasury transfers).

This increases government debt from 44% of GDP at the end of 2023 to more than 86% by 2029, resulting in a high risk signal in the medium term.

Fiscal policy reform requires a number of the following measures, including

(mobilizing non-oil revenues and

restrictions on current expenditures, while

protecting capital investment and perhaps

expanding targeted social transfers).

Provisional return estimates indicate that the following list of measures could provide sufficient savings:

A - The focus of any adjustment strategy should be to find savings in the wage bill.

Savings could start with phasing out mandatory staffing requirements, and could be followed up with an attrition-based strategy to adjust the size of government staffing.

Given the role of public sector employment in the Iraqi social contract and the large existing gender employment gaps, such measures must be gender balanced and supported by labor market reform to expand private sector employment opportunities.

B- It must be a mobilization of additional non-oil revenues.

By removing tax exemptions on profitable state institutions, reforming the salary tax and reviewing customs duties in the near term.

Material increases in revenues can be achieved by making payroll taxes more progressive, subjecting public sector allowances to tax, which can be as large as salaries, and personal income tax being withheld at source.

A review of the customs tariff structure, along with unification of customs regulations with the KRG, and the imposition of new duties (for example, on cigarettes) and sales taxes on luxury goods could also contribute to non-oil revenues.

Targeted technical cooperation in tax policy can help enrich and develop the design of these revenue mobilization measures.

Further improvements in revenue and customs administration could also bring in additional revenue.

The authorities should build on the remarkable progress achieved in the ASYCUDA system trial by expanding its use at other border control points and adjusting customs operations in accordance with the new system.

In the medium term, imposing a general sales tax or value-added tax could boost non-oil revenues.

Third: Monetary policy

The Central Bank of Iraq has resorted to using a tight monetary policy to improve the liquidity management framework, and

further liquidity absorption may be needed to support the monetary policy transition.

In response to the sharp increase in excess liquidity, the central bank raised the policy rate from 4% to about 7.5% and reduced funds for subsidized lending initiatives in mid-2023.

However, the penetration of the policy rate was weak due to excess liquidity and lack of market incentives in financial intermediaries. Especially in government banks.

The reserve requirement was also increased from 15% to 18% and the 14-day CBI billing facility was introduced.

After these measures by the monetary authority, the liquidity surplus decreased initially, but it rose again in August 2023 as a result of the implementation of the general budget,

which means the need for more measures to absorb the liquidity surplus, including improving coordination between fiscal and monetary policy towards achieving The goal of price stability.

As the fiscal policy is expansionary through the huge volume of expenditures, it is offset by a contractionary monetary policy through raising interest rates to confront the surplus liquidity in the economy.

Therefore, consideration can be given to increasing reserve require :heart: ments on government deposits, which will help absorb excess liquidity in government banks without harming private banks.

Organizing and securing correspondent banking relationships is crucial to ensuring an easy transition to the new trade finance system.

The authorities must intensify efforts to modernize the banking sector to facilitate the establishment of correspondent banking relationships.

Trade financing before 2023 was done through financial consolidation, but

after the introduction of the compliance platform, trade financing changed, and the

Iraqi Central Bank pre-financed dollar accounts abroad for local commercial banks that had correspondent banking relationships with Citi Bank for trade financing.

This allowed an increase in the share of cross-border payments settled through commercial banks.

At the beginning of 2025, the Central Bank of Iraq plans to fully transition to a supervisory role in settling cross-border payments (import financing).

To facilitate this transition, the Central Bank of Iraq has assisted private banks in securing correspondent banking relationships, including providing guidance on accrediting and evaluating banks in line with best practices. International.

As of the writing of the article, (6) banks have established correspondent relationships with American banks, and

many others have correspondent banking relationships with non-American banks.

Strengthening these efforts is essential to ensure a successful transition to the new trade finance system.

In addition, monetary policy has achieved an important breakthrough in expanding the scope of digital payments, as

many measures have been taken to promote digital payments, including

expanding the use of point-of-sale devices,

obligating the use of electronic payment cards in certain transactions such as purchasing fuel, and

raising transaction ceilings at ATMs.

Automated bank cards and

reduced bank fees.

These efforts are welcome and will help reduce Iraq's dependence on cash and improve financial inclusion, especially for women whose access to financial services may be restricted due to limited mobility and other obstacles.

Monetary policy also worked to integrate the banking sector, as the

Central Bank took a decision to increase the minimum banking capital requirements from 250 to 400 billion Iraqi dinars.

Banks (many of which are small) will either have to inject more capital or submit an M&A plan by the beginning of 2025, and

careful planning and public communication will be critical to achieving the reform goal of improving the efficiency and competitiveness of the private banking sector without creating a From uncertainty about the banks' viability.

However, the implementation of core banking systems, certification of previous financial statements and amendment of regulations to strengthen the governance of state banks remain weak, and the

slow progress in reforming state banks hampers the effective allocation of credit and transmission of monetary policy.

The authorities must continue to strengthen the AML/CFT framework and its effectiveness, including in the banking sector.

These efforts should be guided by the priority actions emerging from the MENAFATF Mutual Evaluation which will conclude in the third quarter of 2024.

Once key areas for further improvement have been identified, seeking more targeted technical assistance can Helps support these efforts.

views 621 05/17/2024 - https://economy-news.net/content.php?id=43504

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

“Tidbits From TNT” Sunday 5-19-2024

TNT:

Tishwash: Al-Sudani will visit Doha tomorrow to participate in the World Security Forum

A political source reported today, Sunday (May 19, 2024), the visit of Prime Minister Muhammad Shiaa Al-Sudani to the Qatari capital, Doha.

The source told "Baghdad Al-Youm", "Prime Minister Muhammad Shiaa Al-Sudani will head tomorrow, Monday, to the Qatari capital, Doha."

He added, "The reason for the visit is to participate in the 2024 World Security Forum."

The activities of the Global Security Forum will begin tomorrow in Doha, and will continue until the 22nd of this month with broad participation from officials, decision makers and policy makers.

The forum witnesses in-depth discussions on many sensitive issues related to global security, with the aim of addressing and discussing the challenges and opportunities posed by the interconnected world link

TNT:

Tishwash: Al-Sudani will visit Doha tomorrow to participate in the World Security Forum

A political source reported today, Sunday (May 19, 2024), the visit of Prime Minister Muhammad Shiaa Al-Sudani to the Qatari capital, Doha.

The source told "Baghdad Al-Youm", "Prime Minister Muhammad Shiaa Al-Sudani will head tomorrow, Monday, to the Qatari capital, Doha."

He added, "The reason for the visit is to participate in the 2024 World Security Forum."

The activities of the Global Security Forum will begin tomorrow in Doha, and will continue until the 22nd of this month with broad participation from officials, decision makers and policy makers.

The forum witnesses in-depth discussions on many sensitive issues related to global security, with the aim of addressing and discussing the challenges and opportunities posed by the interconnected world link

Tishwash: Iraqi Parliament adjourns amid chaos: Failure to elect Speaker leads to physical altercations

As speculated, and in a recurring scenario, the Iraqi Parliament adjourned its session on Saturday evening to an unspecified date after failing to reach a decisive third round in the election of its president.

The competition remained intense between the Siyada bloc’s Salem Al-Issawi and the Taqadum Bloc-backed Mahmoud Al-Mashhadani.

The scene did not differ much from January 3, 2024, as leaked by MPs about today's session, marked by verbal altercations, and physical scuffles, reminiscent of events witnessed and reported five months ago, orchestrated by members of the Taqadum Party under the leadership of Mohammed Al-Halbousi.

MPs' smartphones captured heated verbal exchanges and physical confrontations between members of the Taqadum Party and colleagues from other blocs over the election of the parliament's president.

Mishaan al-Jubouri, a leader in the Siyada Party, posted on the X, " When the quorum reached 190 deputies, Taqadum’s MPs set up a barrier between the seats and the presidency platform."

Al-Jubouri added that "MP Haibat Al-Halbousi from Taqadum assaulted Muthanna Al-Samarrai, the head of the Azm bloc, prompting MP Ahmed al-Jubouri to strike Haibat."

This incident highlights the tensions and physical confrontations that marred the proceedings during the parliament's session.

Prior to this, MPs from Taqadum demanded amendments to the parliament's internal regulations before proceeding with the voting round, fearing Salem Al-Issawi's potential victory in the third round, according to a parliamentary source.

While the quorum was complete, several Taqadum MPs opposed proceeding with the vote unless the internal regulations of the parliament were amended.

These demands led to chaos inside the council, escalating later into physical brawls and verbal abuse between MPs from the Taqadum Party and others from different blocs, as shown in leaked footage.

Yet again, the Iraqi Parliament failed to elect a new president in its second round of voting, which saw intense competition between Al-Issawii and Al-Mashhadani. The former garnered 158 votes while the latter received 137 votes.

Against the backdrop of this vote convergence, a state of division prevailed among political blocs. The Siyada and Al-Azm, alongside others aligned with them, as well as MPs supporting Salem Al-Issawi, insisted on continuing the session and initiating a third round to elect a new parliament president.

However, other blocs, including the State of Law, Taqadum, and Al-Sadara, supporting Mahmoud Al-Mashhadani for the parliament presidency, pushed for postponing the session to a later date, according to a parliamentary source.

Notably, on November 14, 2023, the Federal Supreme Court, the highest judicial authority in Iraq, decided to end the membership of Parliament Speaker Mohammed al-Halbousi. Then, the Iraqi Parliament officially terminated his membership on November 21, 2023.

On January 13, the Iraqi Parliament held an extraordinary session to choose the new Speaker. However, due to verbal altercations inside the council hall, the session was adjourned without completing the election process.

Nearly half a year after the dismissal of Al-Halbousi, the parliamentary council has again failed, for the fifth time, to settle the issue, thereby stalling the enactment of crucial legislation. link

************

CandyKisses: Cabinet holds extraordinary session to discuss budget tables for 2024

Shafaq News / The Council of Ministers held, on Sunday, an extraordinary session chaired by Prime Minister Mohamed Shia Al-Sudani to discuss the tables of the federal budget for the year 2024.

This session comes as Al-Sudani is scheduled to head tomorrow, Monday, to the Qatari capital, Doha, to participate in the Global Security Forum for the year 2024.

At the end of April, Acting Speaker of the House of Representatives Mohsen al-Mandalawi agreed with Prime Minister Mohamed Shia al-Sudani on the need to complete the schedules of the 2024 budget law and expedite sending them to the House of Representatives for discussion and voting, as they are related to the lives of citizens and focus on investment spending for new projects.

In the meantime, the Ministry of Finance referred to the controls contained in the circular of the Budget Department No. 69333 on 24/4/2024 to all ministries, which must be taken into account when approaching the department for the following purposes:

● Transfer of services from one destination to another.

• Request for a grade and job title on political segregation.

● Change job titles.

● Change the address of the unauthorized certificate upon appointment.

● Marking variables: (promotion / calculation of the certificate in accordance with Law No. 103 of 2012 / calculation of the duration of the contract and wage / previous services, press service and service of practicing the legal profession).

● Indication of the period of calculation of the political chapter.

● Promotion to the position of expert.

● Marking of variables of self-financing circles.

************

Tishwash: Paying off external debt is a step to promote stability and recovery

Experts in the field of economics expressed their confidence in the economic and financial reform steps undertaken by the current government under the direct supervision and guidance of Prime Minister Muhammad Shiaa Al-Sudani, and while they pointed out that Iraq’s payment of its foreign debts is a supportive step for financial and economic stability and moving towards recovery, they called for Accelerating the steps to move away from the framework of the “mono-rentier economy” towards a multi-resource economy.

The head of the “Osoul” Foundation for Economic and Sustainable Development, Khaled Al-Jabri, said in an interview with “Al-Sabah”: “Iraq’s payment of all its debts to the International Monetary Fund is a positive step towards enhancing economic stability and improving the country’s financial situation,” indicating that “this achievement has implications.” “There are multiple impacts on the Iraqi economy, in terms of improving the credit rating, as repaying debt enhances Iraq’s credit rating, which may reduce borrowing costs in the future, and it also reflects the country’s ability to fulfill its financial obligations, which increases the confidence of international lenders and investors.”

He added, “Enhancing international confidence confirms Iraq’s commitment to financial and economic reforms and can attract more foreign investments, as investors see that the financial environment has become more stable, and that the financial resources (money) that were used to repay debts can now be allocated to development projects.” And infrastructure, and can contribute to improving public services and increasing spending on health and education.”

Today, Thursday, the Advisor to the Prime Minister for Financial Affairs, Mazhar Muhammad Salih, announced that Iraq has fully repaid all loans provided by the International Monetary Fund since 2003, noting that their total did not exceed 8 billion dollars.

The head of the Al-Sharq Center for Strategic Studies and Information, Ali Mahdi Al-Araji, explained in an interview with “Al-Sabah” that “Iraq’s total debt amounts to about 70 billion dollars, divided into an internal debt worth 50 billion dollars scheduled between the Iraqi banking system and the three government banks (Al-Rasheed, Al-Rafidain, and Al-Basra). Iraqi Trade), and the other part is an external debt amounting to 20 billion dollars, meaning that in total it constitutes only 35 percent of the country’s gross domestic product.

He explained, “Iraq - as it is known - is a rentier country that depends on oil, and this is offset by a significant real exhaustion of the state budget estimated at $42 billion that goes annually between job salaries, retirement, and social care. Perhaps we will face in the future what is called (the Dutch disease), where reliance on... Natural resources and the collapse or decline of the industrial side.

Al-Araji expressed his confidence in “the great efforts of Prime Minister Muhammad Shiaa Al-Sudani to resolve the financial crises in Iraq,” stressing that “we find them to be good steps. There must be a wise administration that controls the country’s cash reserves and seeks to achieve harmony and balance between operational and investment expenses and... Its imports, and repairing the deficit in the trade balance, budget, and payments, to avoid any financial crisis that may afflict the country.” link

Mot: .... Finally!! --- Here Weeeeee - Goooooooooo!!! ((( I Hope )))

Iraq Economic News and Points to Ponder Late Saturday Evening 5-18-24

Iraq Economic News and Points to Ponder Late Saturday Evening 5-18-24

An economist warns of the worsening of Forex trade.. “It is being exploited to smuggle the dollar.”

May 16 Information/private.. Economic expert Nabil Al-Marsoumi stressed today, Thursday, the necessity of adopting legal legislation to regulate the worsening Forex trade in Iraq, adding that it could be used to smuggle hard currency abroad. Al-Marsawi said in an interview with the Maalouma Agency,

“There are many segments of society that have begun to use it after opening public Forex trading offices,” noting that “leaving things loose in this way will make them exploited in the file of money laundering and corruption.” He continued, "The operation is large and has included trade in gold, oil, and the dollar, and there are no accurate statistics for it yet," pointing out that "the matter is not limited to large capitals, but even employees and people with middle income."

He continued, "The escalation of such operations will contribute to the depletion of the country's financial and economic situation," pointing out that "it is possible that this trade will be used to smuggle hard currency abroad."

Iraq Economic News and Points to Ponder Late Saturday Evening 5-18-24

An economist warns of the worsening of Forex trade.. “It is being exploited to smuggle the dollar.”

May 16 Information/private.. Economic expert Nabil Al-Marsoumi stressed today, Thursday, the necessity of adopting legal legislation to regulate the worsening Forex trade in Iraq, adding that it could be used to smuggle hard currency abroad. Al-Marsawi said in an interview with the Maalouma Agency,

“There are many segments of society that have begun to use it after opening public Forex trading offices,” noting that “leaving things loose in this way will make them exploited in the file of money laundering and corruption.” He continued, "The operation is large and has included trade in gold, oil, and the dollar, and there are no accurate statistics for it yet," pointing out that "the matter is not limited to large capitals, but even employees and people with middle income."

He continued, "The escalation of such operations will contribute to the depletion of the country's financial and economic situation," pointing out that "it is possible that this trade will be used to smuggle hard currency abroad."

In an interview with the Al-Ma’louma Agency, Ali Al-Zubaidi, a member of the Al-Fateh Alliance, called for the need for the government and the central bank to control the currency selling platform and not other countries, while he stressed that the high rates of remittances through Forex trading represent the other side of money laundering. Ended 25/Y

https://almaalomah.me/news/64733/economy/اقتصادي-يحذر-من-تفاقم-تجارة-الفوركس-تستغل-لتهريب-الدولار

Forex Trading"... A Gateway To Money Laundering And Corruption Or Smuggling Of Green Currencies?

May 16 Information / private.. In light of the lack of financial oversight and excessive openness in many files,

Forex trade is entering forcefully, with frightening numbers of digital money transfers reaching billions of dollars annually, according to actual economic reports and studies, amid warnings of its deterioration to greater proportions that contribute to the smuggling of hard currency abroad.

According to observers, this trade was not limited only to those with huge capital, but also reached middle-income people and employees, and

it could be exploited for money laundering and corruption given the lack of clear legislation and legal materials for it.

*Money Laundering!

Speaking about this file, Ali Al-Zubaidi, a member of the Al-Fateh Alliance, calls for the

need for the government and the central bank to control the currency selling platform and not other countries, while he stressed that the

high rates of remittances through Forex trading represent the other side of money laundering.

Al-Zubaidi said in an interview with the Maalouma Agency,

“The continued entry and exit of money without oversight or accountability affects political and societal stability,” noting that “tightening control over transfers to banks will end many financial violations.”

He continues, "We do not know if there are legal provisions that allow making external transfers through Forex trading,"

calling on "the government to impose its control over the border crossings and prevent the smuggling operations that occur there."

Al-Zubaidi continues his speech:

“Most of the illegal and criminal transactions are carried out through the Forex transfer system,” pointing out that

“the high rates of transfers through Forex represent the other side of money laundering.”

*Dollar Smuggling

In addition, economic expert Nabil Al-Marsoumi stresses the

necessity of adopting legal legislation to regulate the worsening Forex trade in Iraq, adding that it could be used to smuggle hard currency abroad.

Al-Marsawi said in an interview with the Maalouma Agency,

“There are many segments of society that have begun to use it after opening public Forex trading offices,” noting that

“leaving things loose in this way will make them exploited in the file of money laundering and corruption.” He continues,

"The operation is large and has included trade in gold, oil, and the dollar, and

there are no accurate statistics for it yet," pointing out that

"the matter is not limited to large capitals, but even employees and people with middle income."

He added,

"The escalation of such operations will contribute to the depletion of the country's financial and economic situation," pointing out that

"it is possible that this trade will be used to smuggle hard currency abroad."

A report confirms, according to studies conducted, that Forex trade in Iraq amounts to more than $100 billion annually with money far from state control, marred by fraud, money laundering, and illegal operations that link young people to illusory dreams of quick and easy wealth. Ended 25/Y

Disclosure Of Draft Laws To Develop The Banking Sector

May 16 Information / Baghdad.. Representative Mahma Khalil revealed today, Thursday, the

imminent enactment of several laws to develop the banking system in Iraq. Khalil told Al-Maalouma, “The

banking sector suffers from neglect compared to international banks, indicating that

rehabilitating the banking sector needs more legislation.” He added,

"Iraqi banks have lagged far behind international banks, which are witnessing major developments day after day in their use and reliance on modern technological means." He pointed out that

“complying with international laws and controlling dollar smuggling are not sufficient steps to reach the level of ambition and help compete with developed countries.” Ended / 25h

https://almaalomah.me/news/64684/economy/الكشف-عن-مشاريع-قوانين-لتطوير-القطاع-المصرفي

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

Provoking Thoughts and Points to Ponder on Advice :

Don't fight forces; use them. - Buckminster Fuller

Drink nothing without seeing it; sign nothing without reading it. - Spanish proverb

What is important is to keep learning, to enjoy challenge, and to tolerate ambiguity. In the end there are no certain answers. - Marina Horner

Simplicity, simplicity, simplicity. I say, let your affairs be as two or three, and not a hundred or a thousand; instead of a million count half a dozen, and keep your accounts on your thumbnail. - Henry David Thoreau

You must not think, sir, to catch old birds with chaff. - Cervantes

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Good evening Dinar Recaps,

"Last week, in a letter to the council, Iraqi Prime Minister Mohamed Shia al-Sudani called for the United Nations Assistance Mission for Iraq (UNAMI), which has been operational since 2003, to end by December 31, 2025."

Resolution 1770 (2007) was devised to give guidance for Iraq on internal protocols that would enable them to secure a safe environment for their people and become prosperous in the world around them.

The resolution was co-sponsored by: * United Kingdom * United States * Italy * Slovakia

There will be a meeting at the end of May to discuss the gradual removal of the United Nations' involvement with Iraq.

It is believed that they have achieved their goals with Iraq, and they believe Iraq's ability to move forward on their own is showing consistent progress.

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Good evening Dinar Recaps,

"Last week, in a letter to the council, Iraqi Prime Minister Mohamed Shia al-Sudani called for the United Nations Assistance Mission for Iraq (UNAMI), which has been operational since 2003, to end by December 31, 2025."

Resolution 1770 (2007) was devised to give guidance for Iraq on internal protocols that would enable them to secure a safe environment for their people and become prosperous in the world around them.

The resolution was co-sponsored by:

* United Kingdom

* United States

* Italy

* Slovakia

There will be a meeting at the end of May to discuss the gradual removal of the United Nations' involvement with Iraq. It is believed that they have achieved their goals with Iraq, and they believe Iraq's ability to move forward on their own is showing consistent progress.

The UN's involvement with Iraq has been taking place since 2003. It has been a team of leaders from several Nations engaged in helping Iraq "transition" their political and economic economy into a place whereby their contribution to the world is capable of moving to a level of Independence.

Starting early June, Iraq will be gradually moving into their own. These stages of the independence will be monitored, but their control over their own Nation will increase with each passing day. Kurdistan24 Iraq UN

© Goldilocks

~~~~~~~~~

Hong Kong officially launches pilot for digital yuan payments | Business Times

"HONG Kong launched a pilot programme enabling digital yuan payments through major Chinese banks, the first example of China’s currency project being deployed beyond the mainland.

Residents of the city can now open digital yuan wallets with Bank of China, Bank of Communications, China Construction Bank and Industrial and Commercial Bank of China to pay merchants in mainland China directly, Hong Kong’s de facto central bank said in a statement on Friday (May 17)."

Hong Kong has officially launched a pilot program that will allow them to utilize the Yuan as a form of payment.

Users can use the FPS payment system. FPS stands for Faster Payments Service. FPS is a UK banking initiative allowing real-time electronic fund transfers between banks.

© Goldilocks

~~~~~~~~~

Resolution 1770 (2007) / adopted by the Security Council at its 5729th meeting, on 10 August 2007 | United Nations Digital Library System

~~~~~~~~~

Silver Daily Forecast and Technical Analysis for May 17, 2024, by Chris Lewis for FX Empire | Youtube

~~~~~~~~~

The days of shorting the silver market are coming to an end.

~~~~~~~~~

SEC Adopts Rule Amendments to Regulation S-P to Enhance Protection of Customer Information | SEC

~~~~~~~~~

Kraken ‘Actively Reviewing’ Tether’s Status Under New EU Rules | BloombergLaw

New regime for digital assets set to take effect in July

Tether says it plans to continue its dialog with regulators

Kraken is “actively reviewing” plans that may include removing support for the world’s most-traded cryptocurrency on its exchange in the European Union, under a new regime for digital assets that’s set to take effect in the bloc in July.

Tether Holdings Ltd.’s USDT, a stablecoin that aims to maintain a one-to-one value with the dollar, is expected to be impacted by upcoming EU rules known as MiCA.

~~~~~~~~~

Standard Chartered completes first Euro transactions on Partior Platform – Trade Finance Global

~~~~~~~~~

Eurosystem completes first DLT experiment - Central Banking

The Eurosystem completed its first experiment using distributed ledger technology (DLT), the European Central Bank (ECB) announced on May 14.

This is the first of three experiments the ECB plans to carry out. All three experiments will test interoperability-type solutions for central bank money settlement of wholesale financial transactions recorded on DLT platforms.

This experiment covered tokenization and simulated the deliver-versus-payment (DvP) settlement of government bonds in a secondary market transaction against central bank money.

The DLT platform for the experiment was provided by the National Bank of Austria. Other participants include the central banks of Germany, France, Italy and Luxembourg.

👆 Goldilocks pointed to this article

~~~~~~~~~

Is Blockchain the Key to Transforming the Global Tourism Industry? | Analytics Insight

~~~~~~~~~

‘All UAE banks have to launch Jaywan debit cards’: Rollout to happen in phases - News | Khaleej Times

~~~~~~~~~

WATCH & LISTEN HERE Video on XRP

~~~~~~~~~

They Are Dumping Our TREASURIES - The Economic Ninja | Youtube

~~~~~~~~~

Miners Eye Middle East as Next Region for Growth | Coindesk

~~~~~~~~~

Iraq Going for the International Investment Platform? | Youtube

~~~~~~~~~

Join the Seeds of Wisdom Team SNL call with Freedom Fighter breaking down Goldilock's weekly posts! Jester will be joining too! SNL Call Link

9 pm EDT / 8 pm CDT / 6 pm PDT

The SNL Q & A room will be open at 8 pm ET, 7 pm CT, and 5 pm PT to ask questions that will be answered on the call!

The call will be recorded and you can find it in the Archive Call Room after the call is over.

~~~~~~~~~

UNDP endorses Iraq’s electronic payment services system | Search4Dinar

Today, the United Nations Development Programme (UNDP) approved the electronic payment system in Iraq.

© Goldilocks

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Floating the dinar... Will it achieve monetary stability in Iraq?

KTFA:

Clare: Floating the dinar... Will it achieve monetary stability in Iraq?

Moaz Fraihat - Washington May 17, 2024 The stability of the Iraqi dinar in recent years has always faced major challenges, as it witnesses price fluctuations, not to mention a gap between what the central bank determines and what is sold in the parallel market.

In order to avoid the “volatility” syndrome and the “gap” in the price of the Iraqi dinar against foreign currencies, some experts believe that the solution lies in a kind of “surgical” operation for the country’s monetary system that may be painful, but it achieves long-term monetary stability for the national currency through... "float".

The cash selling price, according to the Central Bank, is 1,305 dinars per dollar, while the price for transfers abroad is 1,310 dinars per dollar, and the price in the parallel market is about 1,450 dinars per dollar in mid-May, according to local media , while it reached levels of 1,600 dinars per dollar in previous periods.

KTFA:

Clare: Floating the dinar... Will it achieve monetary stability in Iraq?

Moaz Fraihat - Washington May 17, 2024