KTFA Members “News and Views” Wednesday 5-15-2024

KTFA:

Clare: The Prime Minister receives the Vice President of the World Bank for the Middle East and North Africa

5/15/2024- Baghdad

Prime Minister Muhammad Shiaa Al-Sudani received Al-Abaa, Vice President of the World Bank for the Middle East and North Africa.

The Prime Minister's Media Office said in a statement, seen by Al-Iqtisad News, that "Prime Minister Muhammad Shiaa Al-Sudani received the Vice President of the World Bank for the Middle East and North Africa region." LINK

KTFA:

Clare: The Prime Minister receives the Vice President of the World Bank for the Middle East and North Africa

5/15/2024- Baghdad

Prime Minister Muhammad Shiaa Al-Sudani received Al-Abaa, Vice President of the World Bank for the Middle East and North Africa.

The Prime Minister's Media Office said in a statement, seen by Al-Iqtisad News, that "Prime Minister Muhammad Shiaa Al-Sudani received the Vice President of the World Bank for the Middle East and North Africa region." LINK

Clare: Securities: We are studying the possibility of licensing brokerage companies to trade in shares on international stock exchanges

5/15/2024 Baghdad

Chairman of the Securities Commission, Faisal Al-Haims, confirmed today, Wednesday, that the authority is studying the possibility of licensing brokerage companies to trade in shares on international stock exchanges.

Al-Haims said in a statement received by Al-Iqtisad News, “The Authority has begun studying the licensing of brokerage companies to trade in shares on global stock exchanges through a technical committee within it.”

He added, "The Authority is working seriously to support and develop the stock market by studying the licensing of brokerage companies to enable them to trade in shares on international stock exchanges for the first time in Iraq."

He explained, "This step comes in the context of protecting the rights of citizens to trade through brokerage companies that practice this activity without an official license from the Securities Commission, which seeks to develop the financial markets in the country," noting that "the Commission is working to provide a stimulating and regulated investment environment." “It contributes to enhancing confidence among investors and raising Iraq’s position in global financial markets.” LINK

************

Clare: The reform process will begin with the government banking sector, which represents 85% - Sudanese Advisor

5/15/2024 Baghdad –

Mazhar Saleh, advisor to the Prime Minister for Financial Affairs, said today, Wednesday, that the government banking sector represents 85% of banking work in Iraq, and there is a reform process that will begin from it, indicating that the sanctions that affected the banks are an opportunity for reform.

Saleh confirmed in a statement to the official agency, followed by the 964 Network , that “Prime Minister Muhammad Shiaa Al-Sudani is keen to protect national capital, in addition to the fact that banking institutions need reform,” indicating that “what happened in depriving some banks of foreign currency is an opportunity to restore Structuring and organizing it.”

He added, “There is a program to reform the banking sector by starting with the government sector because the government banking sector dominates 85 percent of banking work and the rest of the small emerging markets, although their capital constitutes 78 percent of the banking system’s capital, but they need to be reorganized and restructured to transform into Correct market institutions integrate with the global economic system and have a role in finance and economic development.”

He pointed out that “there is a reform process in Iraq that begins with the government banking sector and then the private sector,” pointing out that “the injustice that happened to the banks is an opportunity for reform.” LINK

***********

Clare: Al-Sudani briefs Washington on economic and financial reform efforts and calls on its companies to invest in Iraq

5/15/2024

On Wednesday, Prime Minister Muhammad Shiaa Al-Sudani briefed US Assistant Secretary of State for Energy Resources Affairs Jeffrey Payette on the government’s efforts and steps in the field of economic and financial reform, calling on American companies to work and invest in Iraq.

In the meeting, which was attended by the US Ambassador to Iraq, the most prominent files of cooperation in the field of energy, in all its forms, and ways to develop it were reviewed, in a way that contributes to achieving common interests, according to a statement issued by Al-Sudani’s office and received by Shafaq News Agency.

During the meeting, Al-Sudani stressed the government’s keenness to implement its executive approach within the axis of achieving energy self-sufficiency, in the areas of exploiting locally produced natural and associated gas, generating electricity, providing petroleum derivatives, and producing chemical fertilizers and petrochemical materials, pointing to the memorandums of understanding that were signed during his visit to The United States of America last April, which is being implemented on the ground.

Al-Sudani pointed to the government's efforts and steps in the field of economic and financial reform, especially in the areas of tax, customs, and the banking sector, and completing the elements of the ideal investment environment, calling on American companies to work and invest in Iraq.

For his part, Payet praised the efforts of the Iraqi government in developing the energy sector. He also referred to the joint statement of the Prime Minister and US President Joseph Biden, which represents a road map and framework for fruitful work and cooperation, stressing the desire of American companies to invest and expand their activities inside Iraq. LINK

Frank26: "AN EXTRAORDINARY SESSION... FOR AN EXTRAORDINARY ANNOUNCEMENT!!!".....F26

Sudanese directs to hold an extraordinary session next Sunday to discuss the 2024 budget schedules

- Baghdad

Today, Tuesday, Prime Minister Muhammad Shiaa Al-Sudani directed that an extraordinary session of the Council be held next Sunday to discuss the federal budget schedules for the year 2024.

Al-Sudani’s media office stated in a statement received by Mawazine News, “The Prime Minister directed that an extraordinary session of the Council be held on Sunday.” Next, corresponding to May 19, to discuss the federal budget schedules for the year 2024.

He added, "Al-Sudani also directed the formation of a committee headed by a representative of the Ministry of Planning and membership of representatives of the Ministry of Finance, the Council of Advisors, the General Secretariat of the Council of Ministers, and the Federal Public Service Council, which will undertake a re-examination of (the draft law on the Public Service Institute), and submit its recommendations within a working month to the Council of Ministers for consideration." "The appropriate decision." LINK

************

Frank26: "SHOULDER TO SHOULDER!!!"...........F26

The Prime Minister and Barzani stress the continuation of dialogues at various levels

5/14/2024 Baghdad -

The Prime Minister, Muhammad Shiaa Al-Sudani, and the President of the Iraqi Kurdistan Region, Nechirvan Barzani, stressed the continuation of dialogues and meetings between the two sides at various levels.

The Prime Minister's Media Office stated in a statement received by the Iraqi News Agency (INA), that "Prime Minister Muhammad Shia al-Sudani received, today, Tuesday, the President of the Iraqi Kurdistan Region, Nechirvan Barzani, and during the meeting, the general conditions in the country and a number of issues at the national level were discussed." As well as the situation in the Kurdistan region of Iraq, and the government’s actions in implementing its strategic plans, which relate to strengthening the Iraqi economy and achieving development and prosperity for all the Iraqi people.”

He added: "The meeting also witnessed discussion of a number of common files, and an emphasis on continuing dialogues and meetings between the two sides at various levels, within the framework of reaching sustainable solutions within the constitution and the law." LINK

************

Clare: A deficit exceeding 75 trillion, and this is the date of its arrival.. Parliament’s finances talk about the 2024 budget

5/13/2024 Baghdad

Today, Monday, the Parliamentary Finance Committee expected the schedules of the general budget law from the government to reach the House of Representatives this week, while it determined the expected deficit percentage.

Committee member Faisal Al-Naeli said, in an interview followed by Al-Iqtisad News, that “the House of Representatives is awaiting the arrival of the budget schedules and the start of discussing its provisions and making the necessary amendments to them by the Finance Committee to ensure the proper implementation of the government curriculum.”

He pointed out that "indicators confirm that the schedules will reach the House of Representatives this week in order to proceed with their approval as quickly as possible."

In turn, a member of the Parliamentary Finance Committee, Moin Al-Kadhimi, revealed the expected deficit in the current year’s budget, indicating that it may exceed 75 trillion dinars.

Al-Kadhimi said, “The current year’s budget amounts to 228 trillion dinars, with a planned deficit of up to 75 trillion.”

He added, "The budget included total revenues and spending in the amount of 150 trillion dinars, indicating that the government seeks for actual spending to be 228 trillion."

He pointed out that "the committee will amend the budget schedules during the second reading." LINK

************

DeepWoodz: snippet..”Al-Kadhimi said, “The current year’s budget amounts to 228 trillion dinars, with a planned deficit of up to 75 trillion.”

A “PLANNED DEFICIT” is very telling. To me, an uneducated electrician, this means they plan on adding 75 billion more dollars to their re-construction efforts once the rate changes.

************

Paulette: IMO.......Iraq is on the UN Agenda for tomorrow.......again on 5/30..........and, UNAMI mandate is scheduled to end 5/31

***************

Clare: International Development opens a new branch in Times Square in Basra

5/15/2024

The International Development Bank announced the opening of a new branch in the Times Square Center in Basra Governorate, confirming its adoption of a new strategy to enhance banking services and stimulate investment in southern Iraq.

He said in a statement received by Shafaq News Agency, “The first day of yesterday (May 13), the International Development Bank opened its second branch in Basra Governorate, in Times Square Mall, to provide its banking services to citizens and businessmen in this vital region of southern Iraq.”

He stated that this opening comes within the bank's strategy to expand and modernize its effective network of branches, with the aim of providing high-quality and convenient banking services to customers.

The bank's authorized director, Saad Faiq, said that this branch will be an important tributary to economic development in Basra and will enhance investment and growth opportunities in the region. LINK

“Tidbits From TNT” Wednesday 5-15-2024

TNT:

Tishwash: Will the volume of trade exchange between Iraq and China increase to about 55 billion dollars?

Today, Wednesday, the Iraqi-Chinese Business Council expected the volume of trade exchange between Iraq and China to rise to about 55 billion dollars, calling for the necessity of financial regulation of this trade.

Council member Sabah Al-Daraji said in an interview followed by Al-Iqtisad News, “The development of relations between Iraq and China in various sectors is leading to a noticeable increase in the volume of trade exchange to more than last year, which amounted to 53 billion dollars, with the increase in projects and agreements as well as the proximity of... “Working on the path of development,” expecting that “the volume of trade exchange will exceed about 55 billion dollars.”

Al-Daraji added, "The volume of trade between Iraq and China requires finding financial solutions to regulate it," pointing out that "many Iraqi merchants are still in a spiral of routine with Iraqi banks and the requirements of the electronic platform."

TNT:

Tishwash: Will the volume of trade exchange between Iraq and China increase to about 55 billion dollars?

Today, Wednesday, the Iraqi-Chinese Business Council expected the volume of trade exchange between Iraq and China to rise to about 55 billion dollars, calling for the necessity of financial regulation of this trade.

Council member Sabah Al-Daraji said in an interview followed by Al-Iqtisad News, “The development of relations between Iraq and China in various sectors is leading to a noticeable increase in the volume of trade exchange to more than last year, which amounted to 53 billion dollars, with the increase in projects and agreements as well as the proximity of... “Working on the path of development,” expecting that “the volume of trade exchange will exceed about 55 billion dollars.”

Al-Daraji added, "The volume of trade between Iraq and China requires finding financial solutions to regulate it," pointing out that "many Iraqi merchants are still in a spiral of routine with Iraqi banks and the requirements of the electronic platform."

The Chinese Deputy Ambassador, Xu Haifeng, had revealed in previous press statements that “China has a great interest in developing trade and economic relations with Iraq because of its economic weight in the world and the Middle East region,” adding that “the volume of trade exchange between the two countries reached in 2023.” It reached 53.37 billion dollars, an annual increase of 43.1 percent, while the volume of China’s imports from Iraq reached 39.38 billion dollars, an annual increase of 47.8 percent,” stressing, “China is the largest buyer of Iraqi oil.” link

CandyKisses: Iraq can add 75,000 barrels per day of oil to its OPEC+ quota

Kazakhstan opened a thorny debate on OPEC+ production levels later on Tuesday, saying it believes it should be allowed to pump more oil in 2025, when all current production cuts for the group of producers end.

OPEC+ has tasked three companies – IHS, Wood Mackenzie and Rystad Energy – to assess the capabilities of all members to use in benchmark production – figures by which production cuts or increases are calculated – from 2025. Reviews are scheduled to take place by 2025. End of June.

Five OPEC+ sources said that as a result, the issue will not be raised at the June 1 meeting, allowing the group to decide on policy for the rest of 2024 more easily. But it also means that the June meeting won't give the market much policy guidance for 2025, when all the current cuts are over.

"Figures on production capacity will not be presented at the June meeting," said one OPEC+ source, who asked not to be identified, adding that "the reason is that some countries have not fully concluded their discussions with secondary sources."

The UAE is expected to gain up to 180,000 bpd of additional capacity until 2027, while Kazakhstan is expected to reach 80,000 bpd of new capacity, according to JPMorgan estimates. Iraq could add another 50,000 to 75,000 bpd.

The IMF estimates that Saudi Arabia needs the oil price of $96.20 this year to balance its budget, then drop to $84.70 in 2025.

Iraq's budget needs a price of $90 for oil next year, and Algeria and Kazakhstan need prices well above $100.

************

Tishwash: After implementing electronic systems, Customs announces a “historic” increase in its revenues

The General Authority of Customs announced today, Tuesday, achieving what it described as a historic increase in its revenue rate during the first quarter of this year, while it expected a doubling of revenues once the automation project is completed.

The head of the General Authority for Customs, Hassan Al-Ugaili, told the Iraqi News Agency (INA): “During the years 2022 and 2023, the General Authority for Customs achieved an increase in the percentage of its revenues, and last year it reached 28%.”

He added, "In the first quarter of this year, the Authority achieved an increase of 120% over the first quarter of last year, as the first quarter of this year is the highest revenue since the founding of the Customs."

He continued, "The increase came as a result of a set of measures by the authority through simplifying procedures, in addition to monitoring and implementing some electronic systems," pointing out that "the authority is in the process of generalizing the application of electronic systems in all ports of the Iraqi state, and we hope in the middle of next year to end automation in all Customs centers.

He pointed out that “the authority is looking forward to achieving an increase in revenues this year to more than 100% over the previous year,” expecting that “if automation is completed and fully disseminated, the increase may reach three times.” link

************

Tishwash: Al-Sudani told an American official: The memorandums of understanding concluded between the two countries are being implemented on the ground

Today, Wednesday, Prime Minister Muhammad Shiaa Al-Sudani, with US Assistant Secretary of State for Energy Resources Affairs Jeffrey Payette, in the presence of the US Ambassador to Iraq, reviewed the most prominent files of cooperation in the field of energy, in all its forms, and ways to develop it, in a way that contributes to Achieving common interests.

During the meeting, Al-Sudani stressed, according to a statement from the Prime Minister’s Office, a copy of which {Al-Furat News} received, “the government’s keenness to implement its executive approach within the axis of achieving energy self-sufficiency, in the areas of exploiting locally produced natural and associated gas, generating electricity, providing oil derivatives, and producing chemical fertilizers.” And petrochemical materials,” referring to “the memorandums of understanding that were signed during his visit to the United States of America last April, and which are being implemented on the ground.”

Al-Sudani pointed to "the government's efforts and steps in the field of economic and financial reform, especially in the areas of tax, customs, and the banking sector, and completing the elements of the ideal investment environment, calling on American companies to work and invest in Iraq."

For his part, the American official praised the efforts of the Iraqi government in developing the energy sector. He also referred to the joint statement of the Prime Minister and US President Joseph Biden, which represents a road map and framework for fruitful work and cooperation, stressing the desire of American companies to invest and expand their activities inside Iraq. link

Mot: The Angry Ghost

Mot: Sooooon to Change - Right!!!!

Iraqi News Highlights and Points to Ponder Wednesday AM 5-15-24

Iraqi News Highlights and Points to Ponder Wednesday AM 5-15-24

Parliamentary Finance Indicates Government Negligence Regarding The Budget

Economy Information/Baghdad.. Member of the Parliamentary Finance Committee, MP Hussein Moanis, confirmed on Tuesday that delaying sending amendments to the 2024 budget schedules to Parliament is a negligence on the part of the government.

Mu'nis told Al-Maalouma, "Extending the legislative term of the House of Representatives for a month was aimed at allowing the government to complete and implement amendments to the special schedules for the 2024 budget and send them to Parliament within this period."

He added, "The committee believes that the delay in sending the schedules is negligent and cannot last longer due to the governorates and state sectors' need for funds to implement projects," indicating that "the committee is still waiting for them to be sent in order to study them and present them to the council for a vote."

Iraqi News Highlights and Points to Ponder Wednesday AM 5-15-24

Parliamentary Finance Indicates Government Negligence Regarding The Budget

Economy Information/Baghdad.. Member of the Parliamentary Finance Committee, MP Hussein Moanis, confirmed on Tuesday that delaying sending amendments to the 2024 budget schedules to Parliament is a negligence on the part of the government.

Mu'nis told Al-Maalouma, "Extending the legislative term of the House of Representatives for a month was aimed at allowing the government to complete and implement amendments to the special schedules for the 2024 budget and send them to Parliament within this period."

He added, "The committee believes that the delay in sending the schedules is negligent and cannot last longer due to the governorates and state sectors' need for funds to implement projects," indicating that "the committee is still waiting for them to be sent in order to study them and present them to the council for a vote."

The House of Representatives decided to extend the current legislative term for a period of 30 days, in order to wait for the 2024 budget schedules to be sent from the government and to resolve the crisis of electing a new Speaker of the House of Representatives. Ended / 25 AD LINK

A Government Meeting To Review The 2024 Budget Schedules

Money and business Economy News – Baghdad Today, Wednesday, the Minister of Planning, Muhammad Ali Tamim, chaired a ministerial meeting to review the schedules of the federal general budget for the year 2024.

A statement from the ministry received by “Al-Iqtisad News” stated, “Today, the Minister of Planning, Muhammad Ali Tamim, chaired a meeting of the committee concerned with reviewing the schedules of the federal general budget for the year 2024, in the presence of the Minister of Oil, Hayan Abdul-Ghani, the Minister of Construction, Housing, and Municipalities, Benkin Rikani, the Minister of Electricity, Ziad Ali Fadel, and the Prime Minister.

” The Office of Financial Supervision, Ammar Sobhi, the Prime Minister’s advisors for legal, economic and strategic affairs, the head of the legal department in the General Secretariat of the Council of Ministers, and also a delegation from the Kurdistan Regional Government, which included the Minister of Finance, the head of the Office of the Regional Council, the Secretariat of the Council of Ministers and the head of the Coordination and Follow-up Department.” .

He added, "During the meeting, a number of files were discussed on the agenda, including a discussion of the transfer mechanism for the Kurdistan Regional Government's allocations within the budget tables, especially with regard to employee compensation, social care, and regional government revenues, and the mechanism for handing them over to the federal government according to what was stated in the Federal Court's decision and the law." Financial management, and the state’s general budget law.”

He continued, "The meeting also discussed the discussion of maximizing revenues to reduce the percentage of the deficit contained in the general budget by creating legal texts to include electricity sales and local oil sales as revenues in the budget tables." Views 65 05/15/2024 - https://economy-news.net/content.php?id=43451

Al-Sudani Told An American Official: The Government Is Proceeding With Economic And Financial Reform

Political | 02:24 - 05/15/2024 Mawazine News - Baghdad Prime Minister Muhammad Shiaa Al-Sudani confirmed today, Wednesday, that the government’s efforts and steps in the field of economic and financial reform, especially in the areas of tax, customs, and the banking sector, and completing the elements of an ideal investment environment

Al-Sudani’s media office stated in a statement received by Mawazine News that “Al-Sudani received US Assistant Secretary of State for Energy Resources Affairs Jeffrey Payette, in the presence of the US Ambassador to Iraq,” noting that “the meeting reviewed the most prominent files of cooperation in the field of energy, in all its forms, and ways to develop it.” “In a way that contributes to achieving common interests.”

The Prime Minister stressed “the government’s keenness to implement its executive approach within the axis of achieving energy self-sufficiency, in the areas of exploiting locally produced natural and associated gas, generating electricity, providing petroleum derivatives, and producing chemical fertilizers and petrochemical materials,” referring to the memorandums of understanding that were signed during his visit to The United States of America last April, which is being implemented on the ground.”

Al-Sudani pointed to "the government's efforts and steps in the field of economic and financial reform, especially in the areas of tax, customs, and the banking sector, and completing the elements of the ideal investment environment, calling on American companies to work and invest in Iraq."

For his part, Payet praised the efforts of the Iraqi government in developing the energy sector, noting that “the joint statement by Prime Minister Muhammad Shia al-Sudani and US President Joseph Biden represented a road map and a framework for fruitful work and cooperation.”

He stressed “the desire of American companies to invest and expand their activities within Iraq"

https://www.mawazin.net/Details.aspx?jimare=248040

Al-Sudani Calls On American Companies To Work And Invest In Iraq

Policy - 2024-05-15 Today, Wednesday, Al-Akhbariya - Baghdad, US Assistant Secretary of State for Energy Resources Affairs, Jeffrey Payette, confirmed on Wednesday the desire of American companies to invest and expand their activities inside Iraq.

The media office of Prime Minister Muhammad Shiaa Al-Sudani stated in a statement received by Al-Youm Al-Akhbariya that “Al-Sudani received US Assistant Secretary of State for Energy Resources Affairs Jeffrey Payette, in the presence of the US Ambassador to Iraq,” noting that “the meeting reviewed the most prominent files of cooperation in the field of energy, In all its forms, and ways to develop it, in a way that contributes to achieving common interests.”

Al-Sudani stressed, “The government’s keenness to implement its executive approach within the axis of achieving energy self-sufficiency, in the areas of exploiting locally produced natural and associated gas, generating electricity, providing petroleum derivatives, and producing chemical fertilizers and petrochemical materials,” referring to the memorandums of understanding that were signed during his visit to the United States of America. Last April, which is being implemented on the ground.”

Al-Sudani pointed to "the government's efforts and steps in the field of economic and financial reform, especially in the areas of tax, customs, and the banking sector, and completing the elements of the ideal investment environment, calling on American companies to work and invest in Iraq."

For his part, Payet praised the efforts of the Iraqi government in developing the energy sector, noting that “the joint statement by Prime Minister Muhammad Shia al-Sudani and US President Joseph Biden represented a road map and a framework for fruitful work and cooperation.”

He stressed “the desire of American companies to invest and expand their activities within Iraq".

https://today-agency.net/Details/11004#hathalyoum

The President Of The Republic: Iraq Is Facing A New Stage And Horizons Of Growth And Economic Development

Baghdad - IA The President of the Republic, Abdul Latif Jamal Rashid, confirmed today, Wednesday, that Iraq is facing a new stage and horizons of growth and economic development.

The Presidency’s Media Department stated, in a statement received by the Iraqi News Agency (INA), that “The President of the Republic, Abdul Latif Jamal Rashid, received today at Al-Salam Palace in Baghdad, the Vice President of the World Bank for the Middle East and North Africa, Othman Dion, and his accompanying delegation, where the President welcomed... At the beginning of the meeting, the delegation also congratulated Dion on the occasion of assuming his position.

The President of the Republic explained "the importance of strengthening relations between Iraq and the World Bank, noting" the necessity of working to consolidate cooperation and joint coordination in the financial, monetary and technical sectors in a way that strengthens the Iraqi economy.

He pointed out that "Iraq is facing a new stage and horizons of growth and economic development," stressing that "the government's ministerial program includes the implementation of construction and reconstruction projects and infrastructure development."

The President of the Republic stated that "one of our priorities is to establish security and stability in the country because it is the starting point for achieving comprehensive development, developing the economy, investing, and undertaking strategic projects that serve citizens and improve their living conditions," noting that "Iraq is full of human energies, competencies, and expertise."

For his part, Othman Dion expressed his happiness at visiting Iraq and learning directly about the situation in Iraq, praising "the progress that has been achieved."

He also reviewed the work of the World Bank in Iraq in the fields of water, energy, and reducing unemployment. https://www.ina.iq/208846--.html#hathalyoum

New Policies May Push Iraq To Add 75 Thousand Barrels Of Oil Per Day To Its OPEC Quota

Economy - 2024-05-15 Kazakhstan later on Tuesday opened a thorny debate over OPEC+ production levels, saying it believes it should be allowed to pump more oil in 2025, when all of the producers' group's current production cuts end.

OPEC+ commissioned three companies - IHS, Wood Mackenzie and Rystad Energy - to assess the capabilities of all members for use in reference production - figures by which production cuts or increases are calculated - from 2025. The reviews are scheduled to take place by 2025. End of June.

As a result, the issue will not come up at the June 1 meeting, allowing the group to decide on policy for the rest of 2024 more easily, five OPEC+ sources said. But it also means the June meeting won't give the market much policy guidance for 2025, when all the current cuts end.

One OPEC+ source who requested anonymity said: “Figures related to production capabilities will not be presented at the June meeting,” adding that “the reason is that some countries have not fully concluded their discussions with secondary sources.”

The UAE is expected to gain up to 180,000 barrels per day of additional capacity until 2027, while Kazakhstan is expected to gain up to 80,000 barrels per day of new capacity, according to estimates by JPMorgan. Iraq can add another 50 to 75 thousand barrels per day.

The International Monetary Fund estimates that Saudi Arabia needs an oil price of $96.20 this year to balance its budget, then falling to $84.70 in 2025.

Iraq's budget needs an oil price of $90 next year, and Algeria and Kazakhstan need prices well above $100. dollar. https://today-agency.net/Details/10951

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible." It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS © Goldilocks ~~~~~~~~~

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible."

It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS

© Goldilocks

~~~~~~~~~

"UAE: Liv Digital Bank enters tokenization deal targeting Gen Zs" | CoinGeek

We are moving at a rapid pace at this point in the tokenization of our assets around the world.

You are going to notice the word digital added to many banking titles and companies going forward. Old traditional assets have been reformed into digital assets.

Hong Kong is leading the way in the digital asset transformation, and the innovation of our new banking system on a global scale is in its final stages there.

Hong Kong is presently finishing up many of their pilot programs, and their movement forward will lead our way into the new digital age.

© Goldilocks

~~~~~~~~~

Franklin Templeton CEO: All Investment Funds Going Blockchain | Crypto Times

"Jenny Johnson, CEO of the $1.6 trillion asset management giant Franklin Templeton, stated that all exchange-traded funds (ETFs) and mutual funds will eventually migrate to blockchain technology."

I know we have gone over this several times, but this gives you an idea of how much money is transferred into blockchain technology.

This is just one of many companies that are doing the same as we speak.

Institutional money and institutional integration are beginning to take place on the blockchain at larger magnitudes indicating that the new digital economy is moving towards mass adoption.

© Goldilocks

~~~~~~~~~

U.S. banks undertake blockchain experiment | Investment Executive

"The U.S. financial sector is exploring the idea of tokenizing various financial instruments, including U.S. Treasuries, wholesale central bank money, and commercial bank money, which would enable transactions in these instruments to settle on a single shared ledger.

Currently, transactions in various components of the wholesale financial system all take place on separate systems. A new project will examine the concept of tokenizing these instruments to facilitate settlement on a single platform, under existing legal frameworks.

SIFMA is serving as project manager, with participation from several large financial institutions including Citi, J.P. Morgan, Mastercard, Swift, TD Bank N.A., U.S. Bank, USDF, Wells Fargo, Visa, and Zions Bancorp.

Other project contributors include the Bank of New York Mellon, Broadridge, DTCC, the International Swaps and Derivatives Association, Tassat Group, and the MITRE Corp"

I want to point out that this article is sharing with us how this new experiment is being conducted on the Swift System and the new Digital Ledger Transmission System (DLT) Ledger.

This indicates that the movement of foreign currency exchange services is transitioning from wire services that can take days for transmissions to occur to electronic exchange services that are done in a matter of seconds and far more cost-efficient.

This is what my banker friend was referring to yesterday as to why her friend was going through foreign exchange services training.

© Goldilocks

~~~~~~~~~

Tokenizing assets on a scalable blockchain | Naeem Aslam, Antonino Sardegno, Stas Trock | Youtube

~~~~~~~~~

Swarm Markets (SMT) Price Today, News & Live Chart | Forbes Crypto Market Data

~~~~~~~~~

...by the Securities and Exchange Commission

H.J. Res. 109 would invalidate SEC Staff Accounting Bulletin 121 (SAB 121), which reflects considered SEC staff views regarding the accounting obligations of certain firms that safeguard crypto-assets. 6 days ago

~~~~~~~~~

SEC issues SAB 121 on digital asset custodial obligations | KPMG

~~~~~~~~~

👆The US is still working on who has governing power over these digital assets. This is why many Governments are moving ahead of the United States in the mobilization of the new digital economy.

This is why the MICA regulations are so important for us to finish. It will give more clarity and government power to authentic leaders in government to facilitate the movement of our new digital economy. House Financial Services

© Goldilocks

~~~~~~~~~

US Department of Treasury, Pacific Northwest National Laboratory, and Cloudflare Partner to Share Early Warning Threat | CoudFlare

San Francisco, CA, May 9, 2024 – Cloudflare, Inc (NYSE: NET), the leading connectivity cloud company, today announced a partnership with the United States Department of Treasury and Pacific Northwest National Laboratory (PNNL) under the Department of Energy to improve the cyber resilience of the financial services industry by sharing an advanced threat intelligence feed through Cloudflare. With this new offering, financial services institutions that are using Cloudflare Gateway now have privileged access to Custom Indicator Feeds that share threat indicators and enable direct action to be taken, to better defend against ransomware, phishing, and other threats.

~~~~~~~~~

Ranking Member Waters Statement on Resolution to Overturn SEC’s Guidance on Crypto Assets: H.J. Res. 109 “Would Have Broad and Negative Consequences for All Public Companies and Their Investors, with Implications for the Entire Securities Market, Not Just Crypto.” | U.S. House Committee on Financial Services Democrats

~~~~~~~~~

May 9, 2024

Tokenized Real-World Assets: Pathways to SEC Registration

By: Ryan Mitteness, Ryan M. McRobert, Andrew T. Albertson

What You Need to Know

Global demand for Tokenized Real-World Assets (RWAs) is growing rapidly in the decentralized finance (DeFi) community and traditional finance industry.

Tokenized RWAs allow legal ownership or rights to traditionally illiquid assets to be digitalized and traded on digital platforms, leading to expedited settlements and potentially reduced operating costs.

Regulatory hurdles have slowed adoption in U.S. markets where companies have to navigate existing securities laws and often lengthy review processes by the Securities Exchange Commission (SEC).

While a clear preferred registration pathway through the SEC for tokenized RWAs has yet to emerge, there are various potential approaches issuers of RWAs may explore for broadly marketed offerings in the United States. Fenwick

~~~~~~~~~

ETFs and mutual funds are all going to be on blockchain, says Franklin Templeton CEO - Ledger Insights - blockchain for enterprise | LedgerInsights

~~~~~~~~~

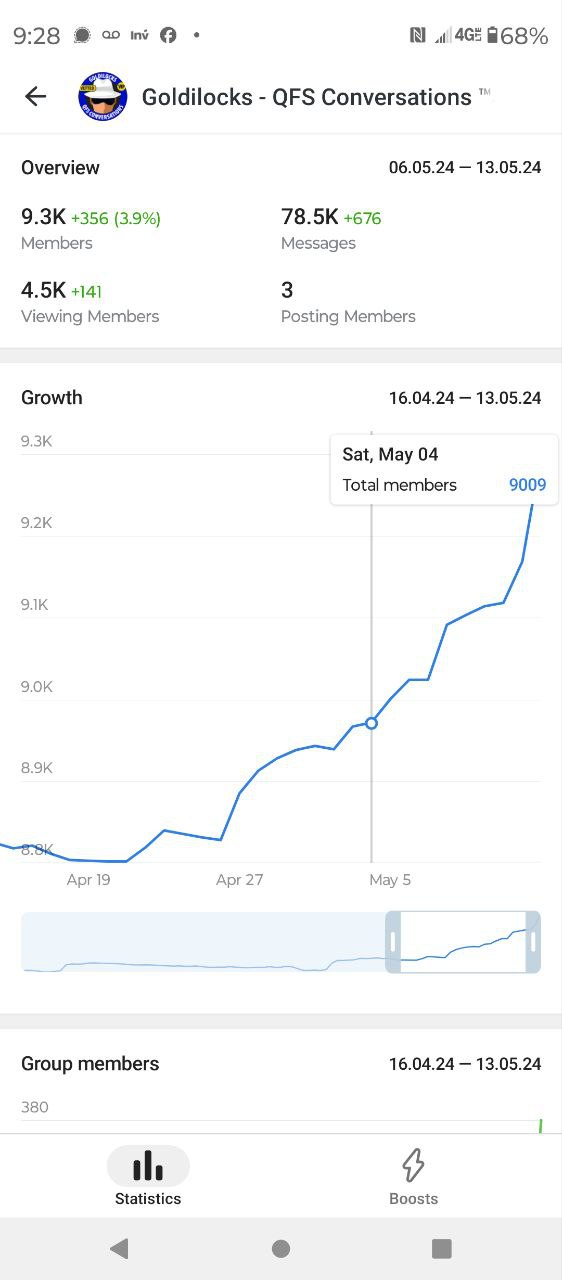

Thank you everyone for your participation in this room. I thought I would give you an idea of the statistics that actually take place in this room. This is the current total.

It is important to note that almost 50% of the people in this room actually come to it every day. This is very rare due to the fact that most people join rooms and then move on to others.

What you are looking at above is an active room where people realize and know that the information being shared is important, and I take this room and the lives of the people within it as an important piece instilled within my heart of prayer each and every day as I write to support and encourage all of us to move forward in faith, hope, and love.

© Goldilocks

~~~~~~~~~

ECB conducts first DLT trials for wholesale central bank money settlement | FinExtra

~~~~~~~~~

Report on OTC derivatives data reporting and aggregation requirements

The final regulations come into operation on 21 October 2024, introducing the UPI, UTI, CDE and ISO 20022 in reporting.10 hours ago

~~~~~~~~~

Miami Federal Court Orders Multiple Individuals and Entities to Pay Over $225 Million for Foreign Currency Fraud and Misappropriation Scheme | CFTC

~~~~~~~~~

May 14, 2024

Washington, D.C. — The Commodity Futures Trading Commission today announced the Honorable Darrin P. Gayles of the U.S. District Court for the Southern District of Florida issued an order of default judgment against four individuals and five companies (nine defendants): Jase Davis of Brandon, Mississippi; Borys Konovalenko of Ukraine; Anna Shymko of Duluth, Georgia; Alla Skala of Grand Island, New York and/or Fort Erie, Canada; Easy Com LLC d/b/a ROFX, a New Hampshire LLC; Global E-Advantages LLC a/k/a Kickmagic LLC d/b/a ROFX, a Delaware LLC and New York foreign LLC; Grovee LLC d/b/a ROFX, a Delaware LLC; Notus LLC d/b/a ROFX, a dissolved Colorado LLC; and Shopostar LLC d/b/a ROFX, a Colorado LLC.

The default judgment order stems from the CFTC’s August 31, 2022 amended complaint charging the nine defendants and defendant Timothy F. Stubbs with fraud, misappropriation, and registration violations in connection with a fraudulent foreign currency (forex) scheme. [See CFTC Press Release Nos. 8486-22 and 8790-23]

~~~~~~~~~

DTCC Comments on Industry’s Affirmation Progress | DTCC

~~~~~~~~~

H.R.4766 - 118th Congress (2023-2024): Clarity for Payment Stablecoins Act of 2023 | Congress Gov

~~~~~~~~~

Using MRI, engineers have found a way to detect light deep in the brain | MIT News | Massachusetts Institute of Technology

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Some “Tuesday News” Posted by Clare at KTFA

KTFA:

Clare: Al-Sudani announces the imminent formation of a directorate concerned with the affairs of the Iraqi community in the world

5/14/2024

Prime Minister Muhammad Shiaa Al-Sudani announced, on Tuesday, the imminent formation of a directorate in the Prime Minister’s Office concerned with the affairs of the Iraqi community in the world.

This came during his meeting with the delegation of the General Synod of the Evangelical Seventh-day Adventist Church, headed by Pastor Magdel Izer Schulz, Assistant President of the Church in the World, and his accompanying delegation.

Al-Sudani explained that the goal of forming this directorate is “in order to maintain communication (i.e., the Iraqi community) with their country, and to benefit from their experiences in construction and reconstruction.”

The Prime Minister also expressed the government's readiness to cooperate in reopening the Seventh-day Adventist Church in Baghdad, as part of its care for the members of this sect and other sects. LINK

KTFA:

Clare: Al-Sudani announces the imminent formation of a directorate concerned with the affairs of the Iraqi community in the world

5/14/2024

Prime Minister Muhammad Shiaa Al-Sudani announced, on Tuesday, the imminent formation of a directorate in the Prime Minister’s Office concerned with the affairs of the Iraqi community in the world.

This came during his meeting with the delegation of the General Synod of the Evangelical Seventh-day Adventist Church, headed by Pastor Magdel Izer Schulz, Assistant President of the Church in the World, and his accompanying delegation.

Al-Sudani explained that the goal of forming this directorate is “in order to maintain communication (i.e., the Iraqi community) with their country, and to benefit from their experiences in construction and reconstruction.”

The Prime Minister also expressed the government's readiness to cooperate in reopening the Seventh-day Adventist Church in Baghdad, as part of its care for the members of this sect and other sects. LINK

Clare: Nechirvan Barzani makes a new visit to Baghdad to meet with Al-Sudani

5/14/2024

The official spokesman for the Presidency of the Kurdistan Region, Dilshad Shihab, said that Nechirvan Barzani, President of the Kurdistan Region, is visiting Baghdad today, Tuesday.

Regarding the visit program, Shehab indicated in a statement published on the official website of the regional presidency today, that President Nechirvan Barzani will meet with the Federal Prime Minister of Iraq, Muhammad Shia al-Sudani, to discuss Erbil-Baghdad relations and issues of common interest.

At the end of last April, the President of the Region made a visit to the federal capital, Baghdad, and held meetings with the Presidents of the Republic, the ministers, and a group of political party leaders. He also participated in a meeting of the State Administration Coalition. LINK

************

Clare: The automobile trade announces a new mechanism to open production lines with international companies

5/14/2024 Baghdad

The General Company for Automotive Trading revealed today, Tuesday, that it is adopting a new mechanism to open production lines with international companies, while indicating a move to equip the departments with vehicles and equipment.

The Director General of the company affiliated with the Ministry of Commerce, Hashim Al-Sudani, said in an interview with the Iraqi News Agency, followed by Al-Eqtisad News, that “theGeneral Company for Automotive Trade seeks to equip state departments with

machinery, equipment, and vehicles of various types and from well-known international origins.”

He added that "contracts were concluded with state departments, in addition to participation in tenders announced by the ministry," indicating that "the company's future plans aim to achieve real partnerships with the manufacturer directly and not with the middle merchant or agent, so that the company is the official representative of the manufacturing companies." Inside Iraq, visits were made to automobile factories in Brazil and Europe, in addition to Spanish, Italian and French companies.”

He pointed out that "the company's plan is moving towards agreement with these companies and seeking to open production lines in agreement with the Ministry of Industry and Minerals and opening factories to produce these machines and equipment inside Iraq, especially after the decision to implement the development path, as it will open horizons and facilitate trade, and Iraq will be the focus of the world's attention." LINK

************

Clare: Iraq increases its possession of gold by more than three tons, bringing the total to "145,661" tons

5/14/2024

Iraq's gold reserves witnessed a noticeable increase during the month of February 2024, as International Monetary Fund data showed that "Iraq has increased its possession of the precious metal by 3,079 tons, bringing the total to 145,661 tons."

This increase indicates "Iraq's continued strategy to diversify its foreign reserves and enhance financial and monetary stability in the long term."

Gold is a traditional safe haven for investors, especially during periods of economic and geopolitical uncertainty.

This step by Iraq comes at a time when the world is witnessing a rise in gold prices, as the price reached its highest level in its history last month above $2,400 per ounce.

Iraq is among the countries that possess large amounts of gold reserves in the Arab region, as it ranks fourth after Saudi Arabia, Algeria, and Morocco.

In general, this increase in Iraq's gold reserves is considered a positive indicator of the health and strength of the Iraqi economy. LINK

DeepWoodz: Just a heads up. This should read 145 tons. The comma is a decimal. But yall prolly knew that.

Clare: Sudanese directs to hold an extraordinary session next Sunday to discuss the 2024 budget schedules

5/14/2024

Today, Tuesday, Prime Minister Muhammad Shiaa Al-Sudani directed that an “extraordinary” session of the Council be held next Sunday, to discuss the federal budget schedules for the year 2024.

This came during his presidency of the twentieth regular session of the Council of Ministers, during which the general situation in the country was discussed, and a number of vital files included within the government’s program were discussed, in addition to considering the topics on the agenda and taking the necessary decisions regarding them.

A statement from Al-Sudani’s office, a copy of which was received by NRT Arabic, stated that the Prime Minister directed that an extraordinary session of the Council be held next Sunday, May 19, to discuss the federal budget schedules for the year 2024.

He directed the formation of a committee headed by a representative of the Ministry of Planning and membership of representatives of the Ministry of Finance, the Council of Advisors, the General Secretariat of the Council of Ministers, and the Federal Public Service Council, which will re-examine (the draft Public Service Institute Law) and submit its recommendations within one working month to the Council of Ministers to take the appropriate decision.

Based on the directives of Prime Minister Muhammad Shiaa Al-Sudani, issued in February 2023, the Council of Ministers approved proceeding with the procedures for evacuating and opening the military zone (known as the Fifth Division) in the city of Kadhimiya, and converting its land into recreational, educational and cultural facilities, hotels, hospitals, health and medical centers, sports stadiums, and a defense center.

The city and cities for visitors, according to an integrated architectural vision, and a special conference will be held on this topic, and specialized international companies will be approved to implement these vital and important projects, which will serve the city’s people and visitors. As part of implementing the government’s approach, which aims to restart lagging projects and address the problems and obstacles they face, the following was approved:

Firstly, changing the name of the project (Rehabilitation of the Martyr Othman Al-Obaidi Hall) to become (Rehabilitation of the Martyr Othman Al-Obaidi Hall - Method of Implementation: Secretariat), and increasing the total cost of the project.

Secondly: Increasing the total cost and the amount of reserve for the project (constructing the second corridor of the road leading to the Tarmiyah District, with a length of 15 km).

Third: Increasing the total cost of the project (equipping, installing, inspecting and operating the Al-Kahla secondary mobile in Al-Kahla district). Fourth: Creating a component (the remaining works for the project to expand the Tourism Department building in Holy Karbala/the Center).

In the field of the educational sector, and in order to speed up the process of printing textbooks and provide them at the required times, the Council of Ministers approved the recommendations of the Audit Committee regarding the printing of textbooks as follows:

1- Authorizing the Ministry of Education to assign (Al-Nahrain General Company) to complete the work of printing school books and notebooks, and excluding it from the contracting methods stipulated in the Instructions for Implementing Government Contracts (2 of 2014) before holding any tender, in order to exploit its full production capacity and rely exclusively on its machines. Provided that the aforementioned Ministry shall provide full support to the company from the Central Education Fund to Al-Nahrain General Company in providing the necessary amounts to purchase the raw materials involved in the printing work at the specified times, in a way that ensures the completion of contracts from the company, in light of the instructions and controls, and is spent from the Fund’s funds.

2- Referring the remainder and surplus capacity of the Al-Nahrain General Company, using the public tender method, to the public and private sector printers at an amount of (50%) for each, provided that a schedule worth two billion dinars is allowed for each company, without being restricted by the number of titles, and that the books reach the students within the timings. Determined before the start of the school year.

3- Obliging the Ministry of Education to adhere to the financial allocations included in the 2024 estimates tables upon contracting, and the Ministry of Finance must provide funding to ensure the Ministry of Education’s commitment to fulfilling its contractual obligations and delivering books to students within the specified times before the start of the academic year.

4- Continuation of implementation of Cabinet Resolution (23424 of 2023) so that the period between referral and signing of the contract will be (5) working days for textbook printing contracts, without the need to issue a warning to the printing press that is reluctant to sign the contracts.

The Council of Ministers approved the following:

1- The Ministry of Oil contracted with the Military Industrialization Authority to purchase machinery from its financial allocations, provided that the amount required for purchase, amounting to (76.150) billion dinars, would be divided among its extractive companies benefiting from the service of the Energy Police Directorate, in two stages:

-The first phase (43.65) billion dinars.

-The other stage (32.5) billion dinars, regarding the request for an M4 (Babylon) rifle weapon, will be considered later. The Ministry of Oil will gift these mechanisms to the Ministry of the Interior for the purposes of the tasks of the Energy Police Directorate, in accordance with the provisions of the instructions to facilitate the implementation of the General Budget Law, as an exception to the requirement that these goods be not purchased during the current year, and surplus to the need of the concerned department, according to the authority stipulated in the aforementioned instructions. above.

2. Excluding profitable, self-financed oil companies from work, from the decision of the Committee for the Restructuring of Public State-Owned Companies No. (1 of 2024), provided that the Ministry of Interior is responsible for the integrity of the procedures, the formation of opening committees, the analysis of bids, and the preparation of estimated costs for the subject of the research decision

A vote was also taken to stop the exceptions granted to the Ministry of Electricity pursuant to Council of Ministers Resolution (24049 of 2024), and any text that conflicts with this decision shall not be implemented.

The Council of Ministers reviewed the financial data tables for the state’s account, based on the provisions of the amended Federal Financial Management Law (6 of 2019).

The Council also reviewed the annual report for the year 2023 of the Iraq Assets Recovery Fund, based on the provisions of Article (7) of the amended Iraq Assets Recovery Law (9 of 2012) .LINK

Iraq Economic News and Points to Ponder Tuesday AM 5-14-24

Iraq Economic News and Points to Ponder Tuesday AM 5-14-24

The Dollar Is Reeling From A Fatal Blow And There Are Fears Of A Collapse Of The Dinar Time: 05/10/2024 Read: 33,332 times {Reports: Al-Furat News} Report: Wafaa Al-Fatlawi

The fluctuation in dollar prices and the rise in gold prices has significantly affected the contraction of the commercial market in terms of imports and purchases of goods, amid confusion in opinions between the return of the rise in green and its decline to the official price set by the state of 1,320 dinars per dollar.

The price of the dollar in the parallel market is currently 1,460 dinars, whether higher or lower than this rate.

The Central Bank of Iraq's cancellation of the currency {auction} window at the end of 2024 and Washington's sanctions on Iraqi banks have opened a door of doubts that will end up placing the dollar in the face of speculation, which will make it vulnerable to demand after the recovery of the Iraqi dinar with government orders that limited dealing in the dinar to restrict the movement of the dollar.

Iraq Economic News and Points to Ponder Tuesday AM 5-14-24

The Dollar Is Reeling From A Fatal Blow And There Are Fears Of A Collapse Of The Dinar

Time: 05/10/2024 Read: 33,332 times {Reports: Al-Furat News} Report: Wafaa Al-Fatlawi

The fluctuation in dollar prices and the rise in gold prices has significantly affected the contraction of the commercial market in terms of imports and purchases of goods, amid confusion in opinions between the return of the rise in green and its decline to the official price set by the state of 1,320 dinars per dollar.

The price of the dollar in the parallel market is currently 1,460 dinars, whether higher or lower than this rate.

The Central Bank of Iraq's cancellation of the currency {auction} window at the end of 2024 and Washington's sanctions on Iraqi banks have opened a door of doubts that will end up placing the dollar in the face of speculation, which will make it vulnerable to demand after the recovery of the Iraqi dinar with government orders that limited dealing in the dinar to restrict the movement of the dollar.

While officials find that the establishment of the electronic platform and the level of regularity of the flow of external remittances responsible for financing private sector trade and the escalation of financing rates have reached very high rates through the compliance platform of banks active in this regard, and

the rise in gold prices is not considered a direct impact on the improvement of the exchange rate.

This was confirmed by the Prime Minister’s Advisor for Financial and Economic Affairs, Mazhar Muhammad Salih {to Al-Furat News}, saying:

“Active positive factors have affected the recovery of the Iraqi dinar in the secondary exchange market,

foremost of which is the high level of regular flow of foreign remittances responsible for financing private sector trade and the escalation of Financing rates are very high through the compliance platform of active banks in this regard.” He explained,

"What this means is that the demand for foreign currency through official external transfer operations, which is responsible for 90% of the total desired demand for foreign currency, as most of it is now met at the official exchange rate of 1,320 dinars per one dollar, which gave the official market dominance over the market." Parallel to the exchange.” Saleh stated,

“As for the developments taking place in the gold commodity market or gold filigree, especially the sudden price developments therein, up and down, they are not considered an alternative directly affecting the improvement of the exchange rate because they are limited in impact and impact on the movements of the parallel exchange market, and that

the main gold trade is financed as foreign trade through Transfers from the banking system and the official exchange market.

Contrary to the government opinion, the Parliamentary Finance Committee supported the theory of doubts and confirmed that the dollar would reach {200} thousand dinars with the cancellation of the currency auction.

Deputy Chairman of the Parliamentary Finance Committee, Ahmed Mazhar Al-Janabi, said {to Al-Furat News} that

“the Central Bank’s decision to cancel the currency auction at the end of the year will open space for exploitation and a problem will occur.

If the auction is canceled and ends, the exchange rate in the markets may double, and

if the Central Bank goes towards this option, the dollar exchange will "It will reach 200 thousand dinars," according to his opinion. I am certain that

“it will open space for speculators to exploit the matter.

The current price is higher than the official price, despite the sale of approximately $250 million per day. So what if the auction stops?”

In light of this, economists expected that the demand for the dollar would continue to exceed supply,

thus leading to a re-depreciation of the dinar, due to the central bank’s limited ability to provide coverage.

Economist Manar Al-Obaidi said in a statement,

“The demand for the dollar depends primarily on commercial transactions and covering imports.

The greater the demand for imports, the higher the demand for the dollar, and

with the central bank’s limited ability to cover this demand as a result of the set limits, it is expected to continue.”

Demand is greater than supply and thus leads to a decline in the price of the dinar against the dollar.” He added,

"An observer of the exports of the main countries exporting to Iraq notices an increase in the value of these countries' exports, as the value of Turkish exports to Iraq increased by 30% in the first quarter, while Chinese exports to Iraq increased by 20% in the first quarter, as well as the exports of other countries such as the Emirates, India, Iran, and Brazil."".

Al-Obaidi attributed the reasons for this increase to five basic factors:

1- The rise in global inflation, which led to an increase in the values of various commodities in various exporting countries.

2- Inflation of invoices, as some merchants agree with the processing party to inflate invoices to obtain transfers in higher amounts. In order to resell the converted dollar in those markets

3- The change in the consumption pattern of the Iraqi citizen and the high population growth rates that increase the demand for various commodities, which increases demand

4- The increase in government agreement as a result of the increase in operational and investment expenses

5- The lack of a capable local industry To compete with the imported product as a result of high costs. Al-Obaidi added,

“These four reasons are mostly due to the loss of tools to control the state’s financial policy (taxes + customs + control of expenditures).

In order to control this significant rise in the value of imports, which leads to an increase in demand for the dollar, customs and tax policy must be changed.”

"For many sectors, there is a need to possess the tools capable of implementing these policies in a more effective and productive manner." Al-Obaidi added,

"Continuing the import bill will lead to an increase in demand for the dollar and thus an increase in its price in the parallel market, which is what many of those who benefit from the low official price are looking for.

The inability to control imports and the loss of control over financial policy tools will put the state in front of a single solution."

There is no second option, which is the use of monetary policy, which is something that many economic specialists do not favor, and

they prefer to always focus on controlling financial policy.”

As the Hajj season approached, the Central Bank stopped selling the dollar to travelers, and to find out its reasons, the former director of the Financial Supervision Bureau, financial expert, Salah Nouri, said {to Al-Furat News} that

“the recent Financial Supervision Bureau report, which was covered by satellite channels, about violations in the sale of the dollar to travelers, is a major reason to review the procedures and address them.” The defect in the transfer system, and stopping until the situation is corrected.”

In the same context, the economic expert, Safwan Qusay, revealed the leakage of travelers’ dollars to the parallel market. Qusay said {to Al-Furat News},

“The current policy of the Central Bank of Iraq goes towards auditing the cash dollar, which was marred by many failures in the first periods, especially its leakage through travelers to the irregular market, and

this issue needs a new and clear mechanism.” He added,

"It is assumed that travelers are dealt with through tourism and airline companies, and the travel ticket is not allowed to be canceled unless the traveler returns the amount he purchased from exchange outlets or banks." Qusay stressed that

"this measure will restore confidence in the cash dollar and the possibility of facilitating the mission of real tourists and filling the gaps that accompanied the process of establishing the electronic platform for the cash sale of foreign currencies." He stated that

"the Central Bank will not hesitate to provide the dollar to those entitled to it, whether at the level of Hajj or other windows," noting that

"the Central Bank's emphasis on procedures for granting citizens the cash dollar ensures that it reaches those who need it."

Meanwhile, travelers expressed their surprise at the Central Bank’s decisions to prevent government banks from selling dollars to travelers. Travelers said, via {Al-Furat News}:

“We are surprised by the Central Bank’s decisions to prevent government banks from selling the dollar to travelers and monopolizing it only with financial transfer and exchange companies.”

Travelers called on Parliament and members of the Parliamentary Finance Committee to “intervene and solve the problem and allow government banks to carry out the process of selling the dollar, especially in conjunction with the delegation of pilgrims to the Holy House of God, and they need to buy the dollar at the official price.”

https://alforatnews.iq/news/الدولار-يترنح-بضربة-قاضية-ومخاوف-من-انهيار-للدينار

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

“Tidbits From TNT” Tuesday 5-14-2024

TNT:

Tishwash: International Monetary Fund: We do not rule out the collapse of the global monetary system

The Executive Director of the International Monetary Fund for Russia, Alexei Mugin, said that he does not rule out the possibility of the collapse of the current global monetary system.

In an interview with the "Novosti" agency, Mogin asked: "Is there a possibility of the collapse of the global monetary system? It seems to me that such a possibility actually exists."

The expert stated that the currently existing system relies on confidence that dollar assets are safe, but central banks, institutions, and even families have already begun to sell dollar assets and buy gold, due to growing lack of confidence in their safety.

Mogin warned of chaos in the global economy, and said: “Once this confidence is lost, a period of chaos will occur in the global economy.”

TNT:

Tishwash: International Monetary Fund: We do not rule out the collapse of the global monetary system

The Executive Director of the International Monetary Fund for Russia, Alexei Mugin, said that he does not rule out the possibility of the collapse of the current global monetary system.

In an interview with the "Novosti" agency, Mogin asked: "Is there a possibility of the collapse of the global monetary system? It seems to me that such a possibility actually exists."

The expert stated that the currently existing system relies on confidence that dollar assets are safe, but central banks, institutions, and even families have already begun to sell dollar assets and buy gold, due to growing lack of confidence in their safety.

Mogin warned of chaos in the global economy, and said: “Once this confidence is lost, a period of chaos will occur in the global economy.”

Last April, the International Monetary Fund warned, in its financial monitoring report, that the debts of the United States and China pose a threat to global finances.

The rise in US public debt and the dependence of global trade on the dollar raises concerns among experts and a number of countries around the world.

Data issued by the Treasury Department, earlier this month, revealed that the US budget deficit exceeded one trillion dollars in the first six months of the fiscal year, partly paid for by the rise in interest on public debt. link

Tishwash: Iraq increases its gold holdings by more than three tons, bringing its reserves to more than 145 tons

Iraq’s gold reserves witnessed a noticeable increase during the month of February 2024, as International Monetary Fund data showed that Iraq had increased its possession of the precious metal by 3,079 tons, bringing the total to 145,661 tons.

This increase indicates Iraq's continued strategy to diversify its foreign reserves and enhance financial and monetary stability in the long term.

Gold is a traditional safe haven for investors, especially during periods of economic and geopolitical uncertainty.

This step by Iraq comes at a time when the world is witnessing a rise in gold prices, as the price reached its highest level in its history last month above $2,400 per ounce.

Iraq is among the countries that possess large amounts of gold reserves in the Arab region, as it ranks fourth after Saudi Arabia, Algeria, and Morocco.

In general, this increase in Iraq's gold reserves is considered a positive indicator of the health and strength of the Iraqi economy. link

************

Tishwash: Chinese companies are delving into the field of exploration in Iraq.. What about American and European companies?

Iraq aspires to increase oil reserves to more than 160 billion barrels, and to do so it has launched a group of projects to increase production, opening the door to more investments in the field of exploration.

In this context, Chinese companies have emerged as a major player, after a number of companies won more new investments to explore oil and gas fields in Iraq as part of a licensing round to develop the oil and gas sector in the country launched by the Ministry of Oil.

The licensing round included 29 projects, aiming to increase production for local consumption. More than 20 companies qualified for the licensing round, including European, Chinese, Arab and Iraqi groups. The only Chinese companies among the participating foreign companies were able to obtain investments in the licensing round that began on Saturday, and this This means that there are no major American oil companies participating.

The list of Chinese companies that recently won the new bids, according to what was announced by Iraqi Oil Minister Hayan Abdul Ghani on Sunday, included: the Chinese company “CNOOC Iraq” , which won the investment to develop Block 7 for oil exploration, extending over an area of 6,300 square kilometers across the provinces of Diwaniyah. Babil, Najaf, Wasit, and Muthanna in the center and south of the country.

Zhenhua , Anton, and Sinopec also won investments to develop the Abu Khaimah fields in Muthanna, Al Dhafriya in Wasit, and Sumer in Muthanna, respectively.

*Support competition

In turn, the director of the Iraqi Center for Studies, Ghazi Faisal, confirms in a press statement that “China is in fact in a state of widespread economic competition with America, the European Union countries, Britain, and with various international economic powers,” noting that “China enjoys broad economic influence in the fields of Investment, loans and financing, with the aim of ensuring energy security and covering its daily needs - which are estimated at about 11 million barrels per day, the volume of China’s imports - other than gas.”

He added, "The Middle East and the Arabian Gulf region is one of the strategic regions for China... and therefore competes with American and regional companies in the field of gas, energy, and manufacturing industries," noting that "the Middle East region possesses enormous wealth, especially Iraq, which alone possesses more than $20 worth of wealth." A trillion dollars in minerals are still uninvested, and major companies can compete to enter into large-scale investments, in addition to gas and oil reserves, as Iraq is the second largest oil reserve after Saudi Arabia.”

He explains that "this Chinese activity in Iraq comes within the framework of the current international economic competition," noting that "China is competing in particular with American and European companies to provide the best."

Faisal adds, "China's activity comes within the framework of legitimate competition in international economic relations, to obtain the best gains and to guarantee China's interests and needs for minerals and energy in light of its possession of the best advanced technology in various industries."

According to official Chinese data, issued by the General Administration of Customs, Beijing’s imports of crude oil reached their highest levels ever in 2023 as demand for fuel recovered after the decline resulting from the Corona pandemic, despite the economic headwinds.

Imports increased by 11 percent compared to 2022 to 563.99 million tons, or the equivalent of 11.28 million barrels per day, an increase from the previous record level recorded in 2020, which reached 10.81 million barrels per day.

*Strategic objectives

For his part, the professor of economics in Iraq, Nabil Al-Marsoumi, explains in a press statement that “It is noted that China has broad control over the fields offered within the current licensing round for exploration that was put forward by the Ministry of Oil, and that most of the Chinese companies that won contracts are already present in Iraq.” ", adding that "the most important areas and fields that were awarded were owned by Chinese companies in particular."

He explained that "China's interest in Iraq is due to the presence of Baghdad as a global energy center and as one of the largest producers," adding that "China is a large importer of oil, and therefore it needs to secure energy supplies on a regular basis, and Iraq achieves this."

He stressed that "Iraq is a suitable place for China in light of the ability of Chinese companies to harmonize with the Iraqi environment, thus supporting their ability to achieve strategic goals."

On Saturday (May 11, 2024), the Iraqi Minister of Oil, Hayan Abdul Ghani, expressed his hope that the country’s oil reserves would exceed 160 billion barrels, during the launch of two rounds of new licenses to invest in 29 fields, in addition to exploratory patches of oil and gas.

The two tours included exploration fields and areas in 12 governorates and areas located in Iraqi territorial waters.

*An important investment environment

In addition, the Iraqi economic expert, Dr. Jaafar Al-Husseinawi, pointed out in a press statement that “There is no doubt that Iraq represents an important investment environment for all international companies because of its enormous natural resources of crude oil, major untapped gas reservoirs, large quantities of phosphate and sulfur, and so on.” that".

He added, "Companies are flocking to Iraq - including Chinese companies - driven by the desire to achieve economic returns and real investment opportunities, from an economic standpoint."

On the political level, Iraq's location is of particular importance in the region, and therefore China is trying to be present there and remove American control (influence).

The Iraqi Prime Minister, Muhammad Shiaa Al-Sudani, said during the launch of the licensing round, “Iraq expects to obtain more than 3,459 million standard cubic feet per day of gas, and more than one million barrels of oil per day, through these two rounds.”

He added: "These strategic projects will contribute to increasing investments in these governorates, which will help improve their economic and service reality."

*Developed relationships

Mustafa Al-Bazarkan, an advisor on energy affairs, points out that “commercial and political relations between China and Iraq are “developed,” and there is popular support for the government’s steps to strengthen and develop bilateral relations, especially in light of popular positions opposed to strengthening relations with Washington and London. This was in the interest of the developed relations with China.” .

He continues: “During the past two years, there has been more than one departure of American and Western oil companies from Iraq, which prompted Chinese companies to direct their investments and technical expertise to Iraq, the most recent of which was last Monday when a Chinese company won oil investments in the Jabal Sanam region on the border with Kuwait.”

Crude oil sales constitute 90 percent of Iraqi budget revenues. But despite its enormous oil wealth, the country still depends on imports to meet its energy needs, especially gas to power electricity.

Iraq, a founding member of OPEC, has announced its commitment, along with other countries, to voluntarily reduce production to support prices affected by economic uncertainty.

Iraqi Oil Minister Hayan Abdul Ghani said on Sunday (May 12, 2024) that Baghdad will adhere to the voluntary production cuts reached by the OPEC+ alliance at its next meeting on June 1.

The coalition includes the Organization of the Petroleum Exporting Countries (OPEC) and producers from outside it, led by Russia.

The minister amends these statements from others he made on Saturday, saying that Iraq has made enough voluntary cuts and will not agree to any new cuts in production. link

Mot: ... When Enough is Enough! -- Just Loves Karma I Do!

Mot: . and da Word of da Day!! -- Spuddle !!!

MilitiaMan: Iraq Dinar - IQD Update - UN Chapter VII - $3 Billion Revenue - Trade Minister - Arab League - WTO

Iraq Dinar - IQD Update - UN Chapter VII - $3 Billion Revenue - Trade Minister - Arab League - WTO

MilitiaMan and Crew: 5-13-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Dinar - IQD Update - UN Chapter VII - $3 Billion Revenue - Trade Minister - Arab League - WTO

MilitiaMan and Crew: 5-13-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24