Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Good evening Dinar Recaps,

Finance ministers discuss BRICS Bridge digital currency payments

"Specifically, the Ministry said, 'We are talking about creating a multilateral digital settlement and payment platform.' However, Sputnik International one of Russia’s English propaganda networks, went further. It said Finance Minister Anton Siluanov was ready to test digital currencies with China, the Eurasian Economic Union (EAEU) and the Gulf countries."

Another news outlet quoted Siluanov as saying, “The first thing to do is to create a connection to the existing central bank digital currency systems that are already operating in a number of countries. In parallel with this, national financial messaging systems need to be connected.”

Here, we have information with specific guidance on what has to be done in Russia and the BRICS system to see their local currencies onboarded to the new QFS. They give us a direct message in the last sentence of the above article.

Here it is again separated from the paragraph, "...national financial messaging systems need to be connected."

Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Good evening Dinar Recaps,

Finance ministers discuss BRICS Bridge digital currency payments

"Specifically, the Ministry said, 'We are talking about creating a multilateral digital settlement and payment platform.' However, Sputnik International one of Russia’s English propaganda networks, went further. It said Finance Minister Anton Siluanov was ready to test digital currencies with China, the Eurasian Economic Union (EAEU) and the Gulf countries."

Another news outlet quoted Siluanov as saying, “The first thing to do is to create a connection to the existing central bank digital currency systems that are already operating in a number of countries. In parallel with this, national financial messaging systems need to be connected.”

Here, we have information with specific guidance on what has to be done in Russia and the BRICS system to see their local currencies onboarded to the new QFS. They give us a direct message in the last sentence of the above article.

Here it is again separated from the paragraph, "...national financial messaging systems need to be connected."

Meanwhile, Russia will be testing their new digital currency this year. Remember, Putin is the chair of the BRICS System this year, and many of the currencies we are looking to revalue have already joined this group. BRICS Nations are formulating a digital gold token for trade, this will change everything.

Do you remember ISO 20022 messaging system? It is still important.

(https://sputnikglobe.com/20240226/russia-ready-to-test-payments-in-digital-currencies-with-china-eaeu---finance-minister-1116982914.html),

Watch the water.

© Goldilocks

Ledger Insights

Federal Reserve

~~~~~~~~~~

Fedwire is a real-time gross settlement system of central bank money used by Federal Reserve banks to transfer funds electronically between member institutions. Banks, businesses, and government agencies use Fedwire for large, same-day transactions. Investopedia

~~~~~~~~~~

When factoring in currency trades, it is the first currency in a currency pair that represents how much currency is needed to purchase a single unit of the corresponding currency beside it. Investopedia

© Goldilocks

~~~~~~~~~~

Freedom Fighter ©

A currency pair is the quoting of 2 different currencies, with the currency on the left of the slash

( / ) being exchanged FOR the currency on the right of the slash ( / )

Our exchange will be IQD/USD

AKA we are exchanging

✅DINAR for USD (IQD/USD)

NOT ❌USD for DINAR

(USD / IQD )

Hear Freedom Fighter's Explanation here: https://t.me/c/1545617426/75146

~~~~~~~~~~

Freedom Fighter ©

✅Another example

~~~~~~~~~~

Thank you Freedom Fighter for a wonderful explanation in detail.

~~~~~~~~~~

Iraq confirms it has completed the requirements to join the World Trade Organisation | Zawya News

~~~~~~~~~~

Official: Iraq's accession to the World Trade Organization is imminent | Shafaq

~~~~~~~~~~

RBI Expects Launch Of Interoperable Internet Banking In 2024: Shaktikanta Das | NDTV Profit

~~~~~~~~~~

Analyzing the latest updates and advancements in Stellar (XLM) | CryptoNewsz

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

KTFA Membrs "News and Views" Tuesday 3-5-2024

KTFA:

RE: Monday Night CC: https://fccdl.in/MeTj1sVDZZ

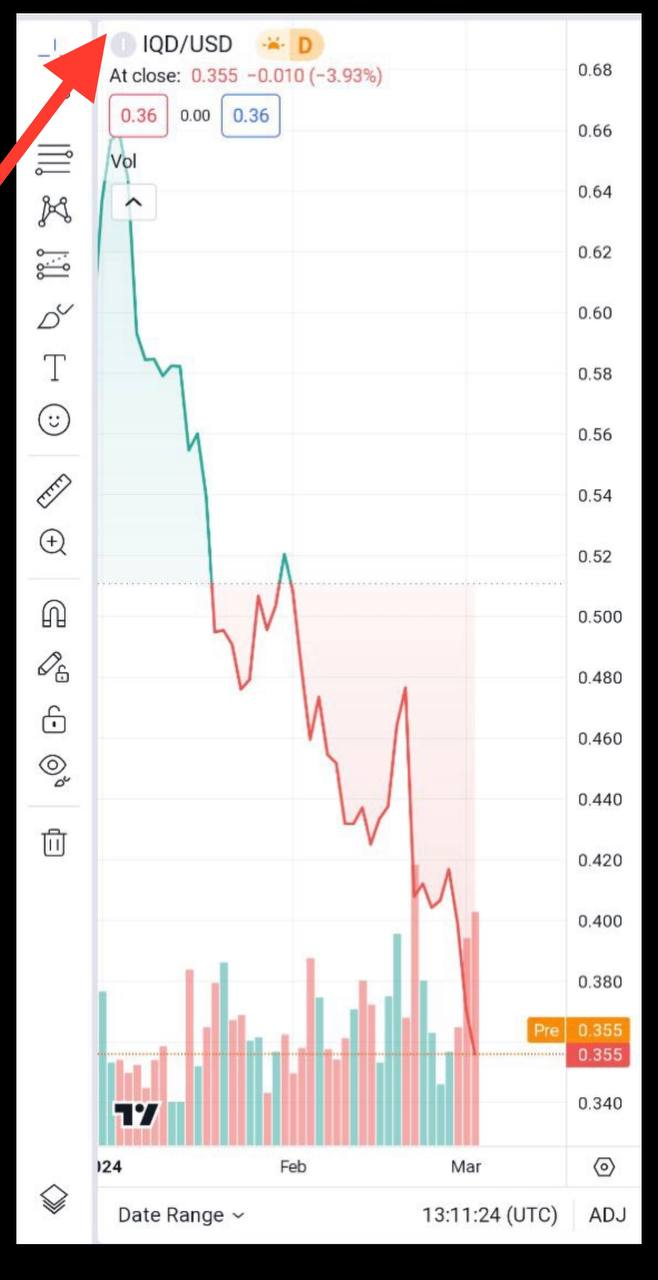

DeepWoodz: imo.. thanks for the call Frank. Just a heads up… The listing USD/IQD = 2.81 would mean $1 = 2.81 dinar. Not the other way around. Even if this is true, definitely an improvement worthy of praise. If you want to see the value of the dinar, simply list it the other direction. i.e….IQD/USD. Which equals .355. 1 dinar =0.35$

Frank26: TEAMWORK !!! ...........I APPRECIATE YOUR HELP DW !!! TY KINDLY

DeepWoodz: Something else I’d like to mention since you’re talking. I’ve been using Google the same way for several years now. You can type usdiqd into the search and Google has what I assume is a public rate of around 1310. So I am used to typing it in without the forward slash.

When I do that in forexlive, I get the 1310 there also. It is interesting that without the /, the Iraqi and American flags pop up beside the pair. With the /, nothing pops up with the pair but the rates are much different (better). Like you said, something is going on, and I like it. Imo

KTFA:

RE: Monday Night CC: https://fccdl.in/MeTj1sVDZZ

DeepWoodz: imo.. thanks for the call Frank. Just a heads up… The listing USD/IQD = 2.81 would mean $1 = 2.81 dinar. Not the other way around. Even if this is true, definitely an improvement worthy of praise. If you want to see the value of the dinar, simply list it the other direction. i.e….IQD/USD. Which equals .355. 1 dinar =0.35$

Frank26: TEAMWORK !!! ...........I APPRECIATE YOUR HELP DW !!! TY KINDLY

DeepWoodz: Something else I’d like to mention since you’re talking. I’ve been using Google the same way for several years now. You can type usdiqd into the search and Google has what I assume is a public rate of around 1310. So I am used to typing it in without the forward slash.

When I do that in forexlive, I get the 1310 there also. It is interesting that without the /, the Iraqi and American flags pop up beside the pair. With the /, nothing pops up with the pair but the rates are much different (better). Like you said, something is going on, and I like it. Imo

Moparman: I have found two exchanges so far showing the wonky movement of the dinar: the Toronto Stock Exchange and the Chicago Board Options Exchange. The CBOE is explicitly for options contracts. Intercontinental Exchange is still showing the 'official' rate of 1310 (IQD:USD -- the standard notation for ForEx pairing.)

The CBOE (USD/IQD) is showing USDIQD at 2.73 -- this means 2.73 dollars equals 1 dinar. The TSX (IQD/USD) is showing the inverse of that, which means .366 of 1 dinar equals 1 dollar -- .366 equals $2.73 per 1 dinar. They're responding in real time in sync.

As an example, a 25,000 dinar note would be $59,250 at that current rate.

Just thought it might help to post. No, this isn't the rate of the dinar currently -- it's futures options, which can run anywhere from 1 day up to 6 months -- but it absolutely shows something is going on with the dinar skyrocketing.

Addendum (I forgot to mention this): USD/IQD means how many dollars equal a dinar. IQD/USD (notice the inverse, it's flipped) means how many dinars equal a dollar. The 2.73 IS a dollar amount -- the inverse is how you'd calculate the exchange rate ($1 divided by .366 -- which is $2.73.) Someone was mentioning earlier that's not a dollar amount, but the USD/IQD way IS a dollar amount.

*************

Clare: Dinar and dollar

March 4, 2024 Mohammed Rashid

Most of the crises that accompanied us led to the collapse of our national currency (the dinar) were due to the wars that were forcibly imposed on Iraq by some major powers for many years, and the dollar was the final command that dominated the economic scene and contributed to destroying the value of the Iraqi dinar.

In 1970, a piece of land with an area of (600) square meters in the most prestigious place in our city of architecture was worth (5) thousand dinars, and today the same piece is worth (one billion) and (500) million dinars. This is how playing with the fate of peoples was in order to weaken them and control them. Its human and oil resources.

Today, the economic world is witnessing a qualitative boom in awareness, and very soon it will overthrow the “dollar” and its name will be changed in the coming period to “the dinar” and after a while to “the dollar,” and in the end it will completely lose its value and its printing price will be equal to (a number of cents).

In a televised interview with the “”Iraqi President, Engineer Muhammad Shiaa Al-Sudani””, he uttered a very important phrase (keep the dinar). Today, through my humble vision, I bear witness that the “”Iraqi dinar will return to its lofty economic value””, away from wars and violence, through a new era that imposes its cultural will in the region and the world. LINK

DallasDude: Well, this is as good as it gets as far as articles go...for some reason I am feeling a little more pep in my STEP today..

Moparman: I believe when forex hits the desired number, we as investors go to the bank. This guy talking is just more proof that we will soon celebrate

************

Clare: Saleh confirms Iraq's monetary sovereignty and reduces the effects of speculation in the parallel market

3/5/2024

The financial advisor to the Prime Minister, Mazhar Muhammad Saleh, ruled out any effects on the exchange market due to “speculation” of the dollar in the parallel market.

Saleh told Al-Furat News Agency, “The effects on the exchange market no longer represent the real price operations of the basic market forces.”

He stated, “Parallel market operations are nothing but illegal speculative acts that profit from accidental profits on individual or marginal transactions and are undertaken by forces of speculators working against the law. This irregular parallel market has become isolated from the power of the official or regular market since the end of the legalization of economic transactions and the prohibition of... Any transactions in dollars in clearing debts within the national economy between natural and legal persons, as today any internal contracts, transactions or obligations concluded in foreign currency and denominated in a currency other than the national currency are not legally valid.”

Saleh noted that "this confirms the monetary sovereignty of our country through the stability of the national currency and dealing in it alone without the participation of foreign currencies in internal economic operations."

Raghad Dahham LINK

Clare: The Sudanese advisor details Iraq's financial situation and addresses exchange rates

3/5/2024 Baghdad

Today, Tuesday, the Prime Minister’s Advisor for Financial and Economic Affairs, Mazhar Muhammad Salih, stated the real growth rate in Iraq’s non-oil gross domestic product, while referring to Iraq’s financial situation.

Saleh said, in an interview followed by “Al-Iqtisad News,” that “the basis comes from the strength of the foreign asset reserves that Iraq possesses, which exceed 100 billion dollars, and they are the cover of the national currency, which means that there is complete coverage of the national currency issued in foreign currency, which provides "Ideal stability for the Iraqi dinar exchange rate, in addition to the fact that these foreign reserves embody Iraq's commercial efficiency, as these reserves cover more than 15 commercial months, while the global standard is only three months."

He added, "We must not forget that the surplus in the current account of the balance of payments relative to the gross domestic product also did not fall below (positive 8%), which is a high indicator that reflects the strength of the external sector in the national economy, that is, its stability and growth."

He pointed out that "the real growth rate in Iraq's non-oil gross domestic product has touched (6%), and it expresses the growing activities of important sectors, most notably the reconstruction, construction and housing movement, and the development of the transport and digital communications sector, and there is a continuing movement in developing the agricultural sector thanks to government support for crops." We expect Iraq’s grain production in the next few months to reach 6 million tons.” LINK

************

Clare: Official: The issue of Iraq’s accession to the World Trade Organization is coming soon

3/5/2024

Undersecretary of the Minister of Commerce, Sattar Al-Jabri, considered on Tuesday that the issue of Iraq’s accession to the World Trade Organization was imminent, while he stressed that the current federal government would achieve self-sufficiency and not depend on the importer.

This came during his hosting of a discussion session on the sidelines of the seventh session of the activities of the third day of the Al-Rafidain Forum 2024 - Baghdad, under the title “Humanizing the Global Economy.”

Al-Jabri said during the hosting that the governmental curriculum developed by the Iraqi government is based on a strategy to keep pace with the development taking place in the global economy, as the government signed bilateral international memorandums of understanding in the field of trade and economics.

He stressed that "Iraq is seeking to enter the World Trade Organization, and the issue is coming soon."

The Iraqi government official spoke about the issue of import and export, saying: There is no trade balance between exported and imported materials, as the monetary mass was going to other countries, and this is what the current government seeks to address by relying on self-sufficiency.

At the beginning of 2024, the Kingdom of Saudi Arabia announced its support for Iraq’s accession to the World Trade Organization, especially after the political obstacles that prevented it were removed. LINK

"Tidbits From TNT" Tuesday 3-5-2024

TNT:

Tishwash: Central: We spend millions of dollars on electronic payment, and Iraqis prefer cash

The Central Bank confirmed, on Monday, March 4, 2024, that Iraqi society prefers to deal with cash, pointing out that millions of dollars are spent annually by the bank on electronic payment.

Iraqis prefer cash in their transactions, while the Central Bank spends millions of dollars on electronic payments

Deputy Governor Ammar Khalaf said in a speech followed by “Ultra Iraq” that “Iraqi society prefers to rely on cash in daily transactions,” noting that “the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank during the year.” the past".

TNT:

Tishwash: Central: We spend millions of dollars on electronic payment, and Iraqis prefer cash

The Central Bank confirmed, on Monday, March 4, 2024, that Iraqi society prefers to deal with cash, pointing out that millions of dollars are spent annually by the bank on electronic payment.

Iraqis prefer cash in their transactions, while the Central Bank spends millions of dollars on electronic payments

Deputy Governor Ammar Khalaf said in a speech followed by “Ultra Iraq” that “Iraqi society prefers to rely on cash in daily transactions,” noting that “the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank during the year.” the past".

According to experts , the Iraqi government, through attempts to implement electronic payment, aims to withdraw the monetary mass in circulation in Iraq, which amounts to 84 trillion dinars.

Khalaf pointed out that “the Central Bank spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for the development of electronic payment in Iraq,” explaining that “the digital financial transformation in Iraq began when the salaries of state employees were localized and bank accounts were opened” to use electronic payment .

The Deputy Governor stated that the Ministry of Oil, gas stations, and some ministries “quickly responded to the directives of the Central Bank and the Iraqi government,” in addition to “the Passport Directorate, which required that payment be electronic, and the General Traffic Directorate.”

Ten days ago, the regional president of Visa, in Central and Eastern Europe, the Middle East and Africa, Andrew Torrey, revealed “the company’s readiness to bring expertise, in addition to employing more Iraqis in its office in Baghdad, with the aim of reaching 500,000 acceptance points from points of sale with electronic payment.” in Iraq link

************

Tishwash: Central Bank: Iraqi society prefers to use cash in daily transactions

3/4/2024 - Baghdad

The Central Bank of Iraq announced today, Monday, the use of the best internationally approved systems and standards in the field of electronic payment, while indicating that it spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for the development of electronic payment in Iraq.

Deputy Governor of the Central Bank, Ammar Khalaf, said in a speech at the first Iraqi Digital Economy Forum, “The digital financial transformation in Iraq began with the localization of state employee salaries and the opening of bank accounts, the primary purpose of which is to use electronic payment in daily transactions, whether inside Iraq.” Or outside it.”

Khalaf added, “Iraqi society prefers to rely on cash in daily transactions, but the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank over the past year and it continues to encourage and activate electronic payment in Iraq by issuing many Among the laws, controls and instructions that encourage the use of electronic payment in Iraq.

He pointed out that "some ministries responded quickly to the directives of the Central Bank and the Iraqi government, especially the Ministry of Oil by making collections at gas stations and others via electronic payment, as well as the Passports Directorate, which obligated payment to be electronic, in addition to the General Traffic Directorate and other ministries." Stressing that "all this support gives a very strong and significant impetus to electronic payment."

He pointed out that "the Central Bank has been the only influential player for many years, as it has embraced the importance of digital transformation in most of its transactions, and spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for developing electronic payment in Iraq through the use of the best internationally approved systems and standards in this field." ". LINK

************

Tishwash: Central Bank: Using the best internationally approved systems and standards in the field of electronic payment

The Central Bank of Iraq announced today, Monday, the use of the best internationally approved systems and standards in the field of electronic payment, while indicating that it spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for the development of electronic payment in Iraq.

The Deputy Governor of the Central Bank, Ammar Khalaf, said in a speech at the first Iraqi Digital Economy Forum, attended by an Earth News correspondent, that “the digital financial transformation in Iraq began with the localization of the salaries of state employees and the opening of bank accounts, the primary purpose of which was to use electronic payment in daily transactions.” Whether inside or outside Iraq.”

Khalaf added, “Iraqi society prefers to rely on cash in daily transactions, but the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank over the past year and it continues to encourage and activate electronic payment in Iraq by issuing many Among the laws, controls and instructions that encourage the use of electronic payment in Iraq.”

He pointed out that “some ministries responded quickly to the directives of the Central Bank and the Iraqi government, especially the Ministry of Oil by making collections at gas stations and others via electronic payment, as well as the Passports Directorate, which obligated payment to be electronic, in addition to the General Traffic Directorate and other ministries.” He stressed that “all this support gives a very strong impetus to electronic payment.”

He pointed out that “the Central Bank has been the only influencer for many years, as it has embraced the importance of digital transformation in most of its transactions, and spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for developing electronic payment in Iraq through the use of the best internationally approved systems and standards in this field.” link

Mot: . HUH??? --- Did I Realy Read what I Just Read!!????

Mot: and YES!! Yet another Great ""Dieting Tip"" frum ole Mot of Course!!

Iraqi News Highlights and Points to Ponder Tuesday AM 3-5-24

Iraqi News Highlights and Points to Ponder Tuesday AM 3-5-24

The Sudanese Advisor Details Iraq's Financial Situation And Addresses Exchange Rates

Economy News – Baghdad Today, Tuesday, the Prime Minister’s Advisor for Financial and Economic Affairs, Mazhar Muhammad Salih, stated the real growth rate in Iraq’s non-oil gross domestic product, while referring to Iraq’s financial situation.

Saleh said, in an interview followed by “Al-Iqtisad News,” that “the basis comes from the strength of the foreign asset reserves that Iraq possesses, which exceed 100 billion dollars, and they are the cover of the national currency, which means that there is complete coverage of the national currency issued in foreign currency, which provides "Ideal stability for the Iraqi dinar exchange rate, in addition to the fact that these foreign reserves embody Iraq's commercial efficiency, as these reserves cover more than 15 commercial months, while the global standard is only three months."

He added, "We must not forget that the surplus in the current account of the balance of payments relative to the gross domestic product also did not fall below (positive 8%), which is a high indicator that reflects the strength of the external sector in the national economy, that is, its stability and growth."

Iraqi News Highlights and Points to Ponder Tuesday AM 3-5-24

The Sudanese Advisor Details Iraq's Financial Situation And Addresses Exchange Rates

Economy News – Baghdad Today, Tuesday, the Prime Minister’s Advisor for Financial and Economic Affairs, Mazhar Muhammad Salih, stated the real growth rate in Iraq’s non-oil gross domestic product, while referring to Iraq’s financial situation.

Saleh said, in an interview followed by “Al-Iqtisad News,” that “the basis comes from the strength of the foreign asset reserves that Iraq possesses, which exceed 100 billion dollars, and they are the cover of the national currency, which means that there is complete coverage of the national currency issued in foreign currency, which provides "Ideal stability for the Iraqi dinar exchange rate, in addition to the fact that these foreign reserves embody Iraq's commercial efficiency, as these reserves cover more than 15 commercial months, while the global standard is only three months."

He added, "We must not forget that the surplus in the current account of the balance of payments relative to the gross domestic product also did not fall below (positive 8%), which is a high indicator that reflects the strength of the external sector in the national economy, that is, its stability and growth."

He pointed out that "the real growth rate in Iraq's non-oil gross domestic product has touched (6%), and it expresses the growing activities of important sectors, most notably the reconstruction, construction and housing movement, and the development of the transport and digital communications sector, and there is a continuing movement in developing the agricultural sector thanks to government support for crops." We expect Iraq’s grain production in the next few months to reach 6 million tons.”

Views 172 03/05/2024 - https://economy-news.net/content.php?id=41130

Experts: We Are Optimistic About The Country's Financial Situation

Iraq 03/05/2024 Baghdad: Huda Al-Azzawi Specialists in financial and economic affairs expressed their optimism about the future outlook for the country’s financial situation, and while they saw that Prime Minister Muhammad Shiaa Al-Sudani’s statement regarding this aspect and the overall economic file is correct and consistent with reality, they called for the continuation of steps to leave the unilateral rentier economy to a productive economy.

Advisor to the Prime Minister for Financial and Economic Affairs, Dr. Mazhar Muhammad Salih, said in an interview with “Al-Sabah”: The basis comes from the strength of the foreign asset reserves that Iraq possesses, which exceeded 100 billion dollars, which is the cover of the national currency, which means that there is complete coverage of cash.

The national export in foreign currency, which provides ideal stability for the exchange rate of the Iraqi dinar, in addition to the fact that these foreign reserves embody the commercial efficiency of Iraq, as these reserves cover more than 15 commercial months, while the international standard is only three months.

He added, “We must not forget that the surplus in the current account of the balance of payments relative to the gross domestic product also did not fall below (positive 8 percent), which is a high indicator that reflects the strength of the external sector in the national economy, that is, its stability and growth.”

He pointed out that “the real growth rate in Iraq’s non-oil gross domestic product has touched (6 percent) and it reflects the growth of the activities of important sectors, most notably the reconstruction, construction and housing movement and the development of the transport and digital communications sector, and there is a continuing movement in developing the agricultural sector thanks to government support for crops.” “We expect Iraq’s grain production in the next few months to reach 6 million tons.”

He stressed, “There is a serious trend towards developing the manufacturing sector, whether on the part of the private or public sector itself, in accordance with recent encouraging ministerial decisions in the field of reducing customs tariffs and protecting the national product or in the inputs of the industry itself, especially in providing electricity or fuel for industrial purposes at competitive prices.” Supported.

Saleh stated, “Growth in real non-oil activity has become thriving after many years of failure, in addition to the boom in investments in the oil and energy sector itself, as all sectoral activities indicate that there is a high growth in the country’s economic capabilities with high flexibility and discipline in financial policy.”

In which government spending still constitutes approximately 50 percent of the gross domestic product, which means that the country’s financial strategy is the compass for moving the macroeconomic joints, and it is in a highly stable position, both in the flow of oil revenues and controlling public expenditures.”

For his part, the rapporteur of the Parliamentary Finance Committee for the fourth session, Dr. Ahmed Al-Saffar, indicated in an interview with “Al-Sabah” that “what Prime Minister Muhammad Shiaa Al-Sudani stated that the financial situation of Iraq is at its best is correct; If the political, economic and financial situation of Iraq remains as it is.”

He noted that “the financial conditions are stable according to current data, including the stability of the political situation and the possibility of Iraq exporting more than three and a half million barrels per day at a price of more than $70 per barrel, either if these indicators change, whether with regard to the political situation and a decrease in oil prices or a halt.” Export chains for Iraqi oil. Iraq has a cash reserve in the range of 115 or 120 billion dollars that can be used over a period of two years, after which it may be exposed to financial crises.”

He explained, “Despite Sudanese work to bring about some changes, the Iraqi economy is still a unilateral rentier economy that relies on oil as the main financier of the general budget, and non-oil revenues are still very low, and the main sectors of the Iraqi economy are still stalled or slow.”

He concluded by saying: “Therefore, it cannot be relied upon in the event of a decline in oil prices, the inability to export oil, changes, or great stability on the political side. Therefore, according to the current situation, what the Prime Minister stated - as I previously indicated - is correct.” “.

Edited by: Muhammad Al-Ansari https://alsabaah.iq/92892-.html

A Parliamentarian Denies That There Are Any Amendments To The Budget Schedules For The Year 2024

Political | 03/05/2024 Mawazine News – Baghdad The representative of the Sadiqoun parliamentary bloc, Muhammad Al-Baldawi, confirmed today, Tuesday, that there are no amendments to the federal budget for the year 2024.

Al-Baldawi said, in an interview followed by Mawazine News, that “the government will work to develop schedules for expenditures and revenues and submit them to the Council.” Representatives to approve it.

He added, "Work will continue to implement the judicial provisions and decisions related to the region's employees, and the localization of their salaries."

He pointed out that "there is a movement to resolve controversial issues related to financial issues between Baghdad and Erbil." https://www.mawazin.net/Details.aspx?jimare=243260

Through The Dollar Bill.. Washington Continues To Tighten The Noose On The Sudanese Government

Political | 04/03/2024 Mawazine News - Baghdad The political and security analyst, Muhammad Al-Yasiri, today, Monday, accused the American administration of continuing its hostile policy towards Iraq.

Al-Yasiri said in an interview with Mawazine News, “The American policy of hostility against Iraq depends on two things. The first is tightening the stranglehold on the flow of dollars to the Central Bank of Iraq and reducing cash liquidity, as well as the terrorist ISIS card.”

He pointed out that "the American administration is working hard to restrict the Iraqi government and discourage it from demanding the removal of its occupying forces from the country," adding, "Whoever says that America is a friend of the Iraqi people is subject to the policy of collusion and treason."

Al-Yasiri continued, "The American restrictions on Iraq regarding the dollar clearly confirm the lie of the so-called friendship of the United States of America with Iraq."

He pointed out that "the American administration always resorts to punishing Iraq by establishing solid institutions under the control of the Iraqi state."

The US Treasury Department recently imposed economic sanctions on eight Iraqi banks, preceded by sanctions on fourteen others, and prevented them from dealing in the dollar currency, as the reasons behind imposing such sanctions were not explained.

https://www.mawazin.net/Details.aspx?jimare=243237

Provoking Points to Ponder on Decisions

Authority without wisdom is like a heavy axe without an edge, fitter to bruise than to polish. - Anne Bradstreet

One faces the future with one's past. - Pearl S. Buck

Our deeds still travel with us from afar, and what we have been makes us what we are. - George Eliot

You must not change one thing, one pebble, one grain of sand, until you know what good and evil will follow on that act. - Ursula K. LeGuin

The beginning of compunction is the beginning of a new life. - George Eliot

The Pilgrims didn't have any experience when they landed here. Hell, if experience was that important, we'd never have anybody walking on the moon. - Doug Rader

Each person has a literature inside them. But when people lose language, when they have to experiment with putting their thoughts together on the spot-that's what I love most. That's where character lives. - Anna Deavere Smith

There is no data on the future. - Laurel Cutler

http://famousquotesandauthors.com/quotes_by_topic.html

http://famousquotesandauthors.com/topics/decisions_quotes.html

MilitiaMan: Iraqi Dinar & Dollar - IQD Dinar Update - Return to Value - Digital Transformation a Reality - Power

Iraqi Dinar & Dollar - IQD Dinar Update - Return to Value - Digital Transformation a Reality - Power

MilitiaMan and Crew: 3-4-2024

The Crew: Samson, PompeyPeter, Petra, Angel1, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraqi Dinar & Dollar - IQD Dinar Update - Return to Value - Digital Transformation a Reality - Power

MilitiaMan and Crew: 3-4-2024

The Crew: Samson, PompeyPeter, Petra, Angel1, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Good Evening Dinar Recaps,

I am aware that we have a back screen rate people have been sharing on the dinar indicating movement in the IQD. It is good to know that there is one.

Now, you can stop doubting that this is real.

Keep your eyes on gold, silver, and oil to solar sections of the Debt Clock. These numbers will be the foundation assets to the new economy, and they are numbers we need to see in order to formulate real values across all market sectors.

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Good Evening Dinar Recaps,

I am aware that we have a back screen rate people have been sharing on the dinar indicating movement in the IQD. It is good to know that there is one.

Now, you can stop doubting that this is real.

Keep your eyes on gold, silver, and oil to solar sections of the Debt Clock. These numbers will be the foundation assets to the new economy, and they are numbers we need to see in order to formulate real values across all market sectors.

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

U.S. National Debt Clock : Real Time | US Debt Clock

~~~~~~~~~~

Monday Night Team call with

Texas Snake and Bob Lock: Focus on Planning

Time: 9 pm ET, 8 pm CT, 6pm PT Team Call Live Link

The calls are recorded and in the Archive room Link

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Staff Concluding Statement of the 2024 IMF Article IV Mission

Clare: Staff Concluding Statement of the 2024 IMF Article IV Mission

March 3, 2024

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

March 3, 2024: An International Monetary Fund (IMF) mission, led by Mr. Jean-Guillaume Poulain, met with the Iraqi authorities in Amman during February 20–29 to conduct the 2024 Article IV consultation. The following statement was issued at the end of the mission:

KTFA:

Clare: Staff Concluding Statement of the 2024 IMF Article IV Mission

March 3, 2024

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

March 3, 2024: An International Monetary Fund (IMF) mission, led by Mr. Jean-Guillaume Poulain, met with the Iraqi authorities in Amman during February 20–29 to conduct the 2024 Article IV consultation. The following statement was issued at the end of the mission:

Economic growth is projected to continue amid fiscal expansion. Meanwhile, medium-term vulnerabilities to oil price volatility have increased significantly. Reducing oil dependence and ensuring fiscal sustainability while protecting critical social and investment spending will require a significant fiscal adjustment, focused on controlling the public wage bill and increasing non-oil tax revenues. In parallel, higher economic growth will be needed to absorb the rapidly expanding labor force, boost non-oil exports and broaden the tax base.

The authorities should therefore seek to enable private sector development, including through labor market reforms, modernization of the financial sector and restructuring of state-owned banks, pension and electricity sector reforms, and continued efforts to improve governance and reduce corruption.

Economic Outlook and Risks

Growth in the non-oil sector has rebounded strongly in 2023 while inflation receded. Supported by increases in public expenditure and solid agricultural output, real non-oil GDP is estimated to have grown by 6 percent in 2023 after stalling in 2022. Headline inflation declined from a high of 7.5 percent in January 2023 to 4 percent by year-end, reflecting lower international food and energy prices, and the impact of the February 2023 currency revaluation. The current account is expected to have recorded a surplus of 2.6 percent of GDP and international reserves increased to US$ 112 billion.

These positive developments were supported by the normalization of trade finance and the stabilization of FX market. After some initial disruptions following the introduction of new anti-money laundering and combating financing of terrorism (AML/CFT) controls on cross-border payments in November 2022, the improved compliance with the new system and the Central Bank of Iraq (CBI)’s initiatives to cut processing time led to a recovery in trade finance in the second half of 2023. This ensured private sector access to foreign exchange at the official rate for imports and travel purposes.

In the meantime, the fiscal position worsened. Although the expansionary budget was under-executed due to delayed Parliamentary approval, the fiscal balance still declined from a surplus of 10.8 percent of GDP in 2022 to a deficit of 1.3 percent in 2023, due to lower oil revenues and an increase in expenditures by 8 percentage points of GDP, of which salaries and pensions contributed 5 percentage points as the authorities started hiring in line with the budget law.

Overall growth is projected to rebound in 2024 and risks are tilted downwards amid heightened uncertainty. Non-oil growth momentum will continue in 2024. Larger declines in oil prices or extended OPEC+ cuts could weigh on fiscal and external accounts. If regional tensions escalate, a disruption of shipping routes or damage to the oil infrastructure could result in oil production losses that could outweigh the potential positive impact of higher oil prices.

In case of a deterioration in domestic security conditions, this could lead to a decline in business sentiment and suspension of investment projects. Over the medium term, non-oil growth is projected to stabilize around 2.5 percent given existing hurdles to private sector development. Furthermore, vulnerability to oil price declines has increased as higher expenditures are projected to push the fiscal break-even oil price above $90 in 2024. Absent new policy measures, the fiscal deficit is expected to reach 7.6 percent in 2024 and widen further thereafter as oil prices are projected to gradually decline over the medium term. As a consequence, public debt would almost double from 44 percent in 2023 to 86 percent by 2029.

Policy Priorities

An ambitious fiscal adjustment would be required to help stabilize debt in the medium term and rebuild fiscal buffers, while protecting critical capital spending. Most of the fiscal adjustment would have to come from reducing current expenditure, especially controlling the wage bill by limiting mandatory hiring and gradually introducing an attrition rule. The authorities should also seek to increase non-oil revenues by broadening the personal income tax base and making it more progressive, reviewing the customs tariff structure, and considering new taxes on luxury items.

In parallel, efforts to make revenue and customs administration more efficient should continue. Further savings could be obtained through better targeting social support and increasing cost recovery within the electricity sector. These adjustment measures should provide room for the expansion of the targeted social safety net.

The authorities should also strengthen public financial management and limit fiscal risks. The mission welcomes initial steps towards the establishment of a Treasury Single Account (TSA), which is crucial to improve cash management. Further progress is needed and close cooperation between the CBI and Ministry of Finance will be essential. The next steps are to define TSA design options and complete the bank account census. In future years, overall ceilings on the issuance of guarantees should be specified in the budget law and be enforced. The mission advise against the use of extrabudgetary funds and highlights potential fiscal risks associated with their use. As a second best, it would be important to ensure the Iraq Fund for Development has appropriate governance arrangements, including governing board independence while ensuring transparency of the Fund’s activities including by publishing its investment plans in the annual budget documentation and restricting its ability to borrow.

The mission encourages the authorities to build on the CBI welcomed efforts to reduce excess liquidity. The CBI appropriately raised the policy interest rate and reserve requirements, introduced a 14-day CBI bill facility last summer, and scaled back its subsidized lending to the real estate sector. However, monetary policy pass-through has been muted, hampered by large excess liquidity and lack of market incentives in financial intermediaries, especially at state-owned banks. The CBI’s ongoing efforts should be supported by consolidating idle government deposits in a TSA, refraining from procyclical fiscal policy, reducing the reliance on monetary finance, and improving public debt management. In parallel, efforts to develop an interbank market with the help of IMF technical assistance should continue. The mission also welcomes the authorities’ steps to speed up the digitalization of the economy, reduce the reliance on cash and enhance financial inclusion.

Wide-ranging structural reforms are needed to foster private sector development and economic diversification. Iraq needs higher and more sustainable non-oil growth to absorb the rapidly growing labor force, increase non-oil exports and government revenue, and reduce the economy’s vulnerability to oil price shocks. Key reform priorities include:

Adopting a comprehensive employment strategy aimed at phasing-out mandatory hiring in the public sector, leveling the playing field between public and private jobs, addressing mismatches between educational curricula and the skills needed in the private sector, and strengthening labor market institutions. The strategy should also aim at reducing informality and addressing legal, social, and cultural impediments to women’s participation in the workforce.

Accelerating financial sector reform to improve access to credit. The authorities are committed to modernizing the banking sector and supporting banks’ ability to secure correspondent banking relationships and have taken steps towards consolidation of small private banks. Efforts to restructure the two largest state-owned banks should intensify, including by expediting certification of past financial statements and implementation of core banking systems, and enhancing corporate governance in line with best practices.

Implementing a comprehensive pension reform. This is urgently needed to reduce the overall projected fiscal costs of the public pension scheme, better align the benefits and rules across the public and private schemes, ensure adequacy of pensions and intergenerational equity, and increase the ratio of workers participating in the private pension scheme.

Combating corruption and improving governance, particularly by strengthening the institutional and legal frameworks needed to ensure the independence of the Integrity Commission and the Board of Supreme Audit, enhancing the publication of assets and conflicts of interests declarations for top level officials, and adopting an updated anticorruption strategy. Further, public procurement and business regulations should also be enhanced. The authorities should also continue to strengthen the AML/CFT framework and its effectiveness, including in the banking sector, guided by the priority actions identified in the MENAFATF Mutual Evaluation that will be concluded in May 2024.

Removing other hurdles to private sector development by reforming the electricity sector to improve efficiency, cost recovery, and reliable access; simplifying procedures for business registration; and upgrading critical infrastructure.

The IMF staff team stands ready to support the authorities in their reform efforts and would like to thank them for constructive and productive discussions during this mission.

IMF Communications Department

https://www.imf.org/en/News/Ar.....iv-mission

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Good Evening Dinar Recaps,

"Glassnode on Wednesday reported that major US OTC platforms have run out of bitcoins, with only 40 coins remaining. This development shows an imminent supply shortage which directly signals the potential for a big price pump shortly."

Yes, Bitcoin is 15 years old and running out of supply. There are only 40 bitcoins left as of 3 days ago. At this point, the demand for Bitcoins are outpacing their supply.

When demand outpaces supply, the corresponding response for an asset is to rise in its value.

Historically, Bitcoin tends to lead the rally for all the crypto space. An upward movement is expected going forward inside our new digital economy.

A bull run in the crypto space will encourage digital adoption as this new asset class begins to form new price pressures going forward.

Remember, everything is being tokenized including Forex. Remember.... Coin Market Cap

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Good Evening Dinar Recaps,

"Glassnode on Wednesday reported that major US OTC platforms have run out of bitcoins, with only 40 coins remaining. This development shows an imminent supply shortage which directly signals the potential for a big price pump shortly."

Yes, Bitcoin is 15 years old and running out of supply. There are only 40 bitcoins left as of 3 days ago. At this point, the demand for Bitcoins are outpacing their supply.

When demand outpaces supply, the corresponding response for an asset is to rise in its value.

Historically, Bitcoin tends to lead the rally for all the crypto space. An upward movement is expected going forward inside our new digital economy.

A bull run in the crypto space will encourage digital adoption as this new asset class begins to form new price pressures going forward.

Remember, everything is being tokenized including Forex. Remember.... Coin Market Cap

© Goldilocks

~~~~~~~~~~

"Bitwise anticipates a surge in institutional investment into Bitcoin ETFs in the coming months as major financial institutions, known as “wirehouses,” start offering Bitcoin ETF trades to their clients."

A wirehouse is a full-service broker-dealer of any size. Although many broker-dealers are "independent" firms involved in broker-dealer services, others are subsidiaries of commercial banks, investment banks, or investment companies. They sell Securities such as spot Bitcoin ETFs for their clients leveling the playing field between the retail Market and Institutional Financing.

For this reason, the competition for gold through digital assets can now be obtained through anyone desiring to become a part of the new Financial System through these new additions to their portfolios.

This is expected to create a gold rush into the next economy for well over a decade. We are simply beginning a process of transformation that will change values in every sector of our Global markets going forward. Crypto News CoinTelegraph

© Goldilocks

~~~~~~~~~~

"Russia is testing digital asset payment technology as groundwork for a potential BRICS digital currency.

The move aims to reduce global dependency on the US Dollar, aligning with BRICS’ de-dollarization efforts.

Digital currency trials are starting with China and Eurasian Economic Union countries, under Russia’s initiative."

Russia is making a move inside the new digital economy. They are testing their new payment system with digital assets formulating a pre BRICS currency launch.

Vladimir Putin is the current chairman for the BRICS Nations. One of the qualifications in belonging to the BRICS Nations is that countries have to back their economy by gold or other commodities. These new global economic initiatives are what is leading the drive towards a Global Currency Reset.

A new trading currency with a backing by gold for the BRICS Nations is rapidly becoming more than just a simple threat to the current Global Monetary System.

Russia is currently taking practical steps in lowering their dependence on the US dollar in trade among nations. And, these changes are affecting the current ratings of their currency. Enough so, that the FATF is currently re-rating their currency.

When a countries' currency is re-rated, it means they are currently in process of a revaluation inside their new currency values and mechanisms for the dissemination of these new values in trade. Yes, new exchange rates.

"The Financial Action Task Force (FATF) is the global money laundering and terrorist financing watchdog. It sets international standards that aim to prevent these illegal activities and the harm they cause to society."

Look for the FATF to get more involved in the BRICS Nations as they set forth new trading mechanisms designed to enhance their group's local currency values through their new digital asset-based trading system.

This is a move from a pegged currency with the dollar to a free floating exchange rate determined by the markets. Gold adds value to currencies that have been devalued over the years and equalizes the playing field for each country involving themselves inside free-floating mechanisms.

Watch the water.

© Goldilocks

CryptoPolitan

FATF

Investopedia

Regulation Asia

Times of India

~~~~~~~~~~

What is The Dodd Frank Act? | YouTube

~~~~~~~~~~

Dodd-Frank Act Update:

The National Institute of Standards and Technology released a revised version of its Cybersecurity Framework guidance detailing steps organizations can take to reduce cybersecurity risks, placing a greater priority on the role of corporate governance and supply chains in protecting sensitive data.

Dodd Frank Update

~~~~~~~~~~

China and Russia have almost completely abandoned the US dollar in bilateral trade as the push to de-dollarize intensifies | Business Insider

~~~~~~~~~~

The U.S. national debt is rising by $1 trillion about every 100 days | CNBC

~~~~~~~~~~

ZTX Ushers in Digital Real Estate Era | InvestorsObserver

~~~~~~~~~~

Ripple offers a fast, and cost-effective cross-border payment solution for banks and financial institutions globally. Ripple’s platform, Ripple Net, facilitates instant and transparent transactions, positioning itself as a more efficient alternative to traditional financial services.

Ripple is a blockchain-based digital payment network working to facilitate the transfer of value between different fiat currencies for its customers. XRP is the native cryptocurrency of Ripple.

CrowdWisdom

~~~~~~~~~~

Great Reset Watch: EU Parliament Approves 'Digital Identity Wallet' | Breitbart

~~~~~~~~~~

Tether’s USDT stablecoin hits historic $100B market cap | CoinTelegraph

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Iraq Economic News and Points to Ponder Monday Afternoon 3-4-24

Iraq Economic News and Points to Ponder Monday Afternoon 3-4-24

Tlm724 Administrator Bondlady’s Corner

A Government Explanation For The Stability Of The Dollar Exchange Rates

Time: 03/04/2024 19:03:44 Read: 2,834 times {Economic: Al-Furat News} The economic and financial advisor to the Prime Minister, Mazhar Muhammad Saleh, today, Monday, provided an explanation for the stability of the dollar exchange rates in the local market.

Saleh told {Al-Furat News} that: “As long as the trade in importing goods and services for the private sectors and the government or public sectors is financed at the official fixed exchange rate of 1,320 dinars per dollar.”

He added, "It is also carried out through methods of financing foreign trade through the national banking sector, at a rate of more than 95% of the total foreign trade, whether through the compliance platform and the window of the Central Bank of Iraq with regard to private import trade, or through opening documentary credits to finance governmental and private import trade as well."

Iraq Economic News and Points to Ponder Monday Afternoon 3-4-24

Tlm724 Administrator Bondlady’s Corner

A Government Explanation For The Stability Of The Dollar Exchange Rates

Time: 03/04/2024 19:03:44 Read: 2,834 times {Economic: Al-Furat News} The economic and financial advisor to the Prime Minister, Mazhar Muhammad Saleh, today, Monday, provided an explanation for the stability of the dollar exchange rates in the local market.

Saleh told {Al-Furat News} that: “As long as the trade in importing goods and services for the private sectors and the government or public sectors is financed at the official fixed exchange rate of 1,320 dinars per dollar.”

He added, "It is also carried out through methods of financing foreign trade through the national banking sector, at a rate of more than 95% of the total foreign trade, whether through the compliance platform and the window of the Central Bank of Iraq with regard to private import trade, or through opening documentary credits to finance governmental and private import trade as well."

Saleh stated, “Therefore, the stability in the general level of prices, which is about 4% annually, expresses the state of stability of the exchange rate according to its official value, because the latter expresses the external value of money in the regular or official market.”

The local market has been witnessing stability for some time in the exchange rates of the dollar in the local market, which range between 150 thousand dinars to 149 thousand dinars for 100 US dollars. LINK

Central Bank: Iraqi Society Prefers To Use Cash In Daily Transactions

Ammar Hamad, Deputy Governor of the Central Bank of Iraq Economy News – Baghdad The Central Bank of Iraq announced today, Monday, the use of the best internationally approved systems and standards in the field of electronic payment, while indicating that it spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for the development of electronic payment in Iraq.

Deputy Governor of the Central Bank, Ammar Khalaf, said in a speech at the first Iraqi Digital Economy Forum, “The digital financial transformation in Iraq began with the localization of state employee salaries and the opening of bank accounts, the primary purpose of which is to use electronic payment in daily transactions, whether inside Iraq.” Or outside it.”

Khalaf added, “Iraqi society prefers to rely on cash in daily transactions, but the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank over the past year and it continues to encourage and activate electronic payment in Iraq by issuing many Among the laws, controls and instructions that encourage the use of electronic payment in Iraq.

He pointed out that "some ministries responded quickly to the directives of the Central Bank and the Iraqi government, especially the Ministry of Oil by making collections at gas stations and others via electronic payment, as well as the Passports Directorate, which obligated payment to be electronic, in addition to the General Traffic Directorate and other ministries." Stressing that "all this support gives a very strong and significant impetus to electronic payment."

He pointed out that "the Central Bank has been the only influential player for many years, as it has embraced the importance of digital transformation in most of its transactions, and spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for developing electronic payment in Iraq through the use of the best internationally approved systems and standards in this field." " 229 views 03/04/2024 - https://economy-news.net/content.php?id=41104

Iraq And The United States Are Discussing Measures Taken Against Iraqi Banks

The Ambassador of the Republic of Iraq to the United States of America, Nizar Al-Khair Allah, discussed the measures taken against Iraqi banks and attracting American energy companies to invest in the Iraqi market.

The Iraqi Embassy in Washington stated in a blog post on the (X) platform that “Ambassador Nizar Al-Khair Allah met with the Undersecretary of the Treasury for Terrorism and Financial Intelligence, Brian Nelson, to discuss the measures that were taken against Iraqi banks and their effects on the growth of the banking sector and government economic reforms.”

She added, "Ambassador Al-Khairallah also met with the US Assistant Secretary of State for Energy Resources Affairs, Jeffrey Payatt, and they exchanged views on ways to strengthen bilateral relations between Iraq and the United States," stressing that "the focus was on attracting American energy companies to invest in the Iraqi market and capture burning gas."

https://www.radionawa.com/all-detail.aspx?jimare=37565

Prime Minister's Office: If There Had Been Automation In Taxes, The Theft Of The Century Would Not Have Occurred

Deputy Director of the Prime Minister's Office, Ali Razouki Money and business Deputy Director of the Prime Minister's Office, Ali Razouki, confirmed today, Monday, the immediate establishment of priorities for combating corruption, providing services, and economic reform, while indicating the intention to send about 1,000 students abroad this year.

Razouki said in an interview during the activities of the Al-Rafidain Forum, “The tasks of the Prime Minister’s Office are many and are distinguished by the performance of administrative leaders,” noting that “the ministerial curriculum is intensive.”

He added, "We have begun setting priorities, including combating corruption, providing services, and financial and economic reform, in addition to the issue of youth and providing special opportunities for them, in addition to working to send students on scholarship, and this year we will send nearly a thousand students."

He pointed out that "Baghdad has turned into a workshop and the office has teams to follow up on projects," noting that "some projects were launched in 2008 and were just ink on paper."

He continued, "Today we feel positive reactions from the citizen," noting that "the Prime Minister's Office was interested in cooperating with all ministries, setting priorities, and focusing on hospital projects that will see the light soon, and most hospitals are simulating development."

He continued, "Energies were directed towards the entrances to the cities, in addition to projects to relieve bottlenecks."

He pointed out that if there had been automation in taxes, the theft of the century would not have occurred, especially since we have taken important steps in digital transformation, such as issuing passports and visas. 140 views 03/04/2024 - https://economy-news.net/content.php?id=41102

To read more current and reliable Iraqi news please visit BondLady’s Corner: https://www.bondladyscorner.com/

Provoking Points to Ponder on Decisions

What I emphasize is for people to make choices based not on fear, but on what really gives them a sense of fulfillment. - Pauline Rose Chance

We lose the fear of making decisions, great and small, as we realize that should our choice prove wrong we can, if we will, learn from the experience. - Bill W.

History is a stern judge. - Svetlana Alliluyeva

I get a little angry about this highhanded scrapping of the look of things. What else have we to go by? How else can the average person form an opinion of a girl's sense of values or even of her chastity except by the looks of her conduct? - Margaret Culkin Banning

You wouldn't want to be caught wearing cheap perfume, would you? Then why do you want to wear cheap perfume on your conduct? - Margaret Culkin Banning

The difference between weakness and wickedness is much less than people suppose; and the consequences are nearly always the same. - Lady Marguerite Blessington

http://famousquotesandauthors.com/quotes_by_topic.html

http://famousquotesandauthors.com/topics/decisions_quotes.html

Iraq Economic News and Points to Ponder Monday AM 3-4-24

Iraq Economic News and Points to Ponder Monday AM 3-4-24

Tlm724 Administrator Bondlady’s Corner

Sudanese: Lowering The Exchange Rate Means Giving The Dollar To Illegal Trade

Politics, |Baghdad Today – Baghdad Prime Minister Muhammad Shiaa Al-Sudani said this evening, Sunday (March 3, 2024), that lowering the exchange rate means giving the dollar to illegal trade.

Al-Sudani stated during his participation in the opening of the activities of the Al-Rafidain Dialogue Forum in Baghdad, that "the financial situation in Iraq is at its best and that commercial transactions are collected through commercial institutions." He added, "We give the student, the patient, the merchant, the contractor, and the investor the dollar at the official rate." Al-Sudani pointed out that

"the notes recorded on Iraqi banks from the US Treasury are from the time of previous governments." He pointed out that "economic reform was one of the most important priorities of the government program." Al-Sudani noted that "the salaries of employees and retirees constitute the largest cash block in the financial budget."

It is noteworthy that Iraq relies on the platform for selling currency directly to local banks and companies, which was previously known as the daily dollar auction, as one of the mechanisms for preserving the value of the Iraqi dinar and combating speculative operations in the parallel market.

Iraq Economic News and Points to Ponder Monday AM 3-4-24

Tlm724 Administrator Bondlady’s Corner

Sudanese: Lowering The Exchange Rate Means Giving The Dollar To Illegal Trade

Politics, |Baghdad Today – Baghdad Prime Minister Muhammad Shiaa Al-Sudani said this evening, Sunday (March 3, 2024), that lowering the exchange rate means giving the dollar to illegal trade.

Al-Sudani stated during his participation in the opening of the activities of the Al-Rafidain Dialogue Forum in Baghdad, that "the financial situation in Iraq is at its best and that commercial transactions are collected through commercial institutions." He added, "We give the student, the patient, the merchant, the contractor, and the investor the dollar at the official rate." Al-Sudani pointed out that

"the notes recorded on Iraqi banks from the US Treasury are from the time of previous governments." He pointed out that "economic reform was one of the most important priorities of the government program." Al-Sudani noted that "the salaries of employees and retirees constitute the largest cash block in the financial budget."

It is noteworthy that Iraq relies on the platform for selling currency directly to local banks and companies, which was previously known as the daily dollar auction, as one of the mechanisms for preserving the value of the Iraqi dinar and combating speculative operations in the parallel market.

The Governor of the Central Bank of Iraq, Ali Al-Alaq, confirmed on February 6 that “some groups are trying to stay away from the platform for selling foreign currency in order to evade taxes or customs or the presence of illegal trade,” indicating

“the possibility of meeting all requests for the dollar,” adding that “the bank has no problem.” In offering or selling the dollar. He pointed out that "the bank is in a comfortable position to respond to requests to buy dollars.

We have sufficient reserves, and soon we will launch a mechanism to ensure that only real travelers get the dollar." https://baghdadtoday.news/244006-السوداني-خفض-سعر-الصرف-يعني-منح-الدولار-للتجارة-غير-الشرعية.html

Including Facilitating Legitimate Trade.. Customs Explains The Advantages Of Implementing The Electronic System

local Basra - IA - Saad Al-Sammak Today, Sunday, Director General of the General Authority of Customs, Hassan Al-Ugaili, explained the advantages of implementing the electronic system in the country, while defining the duties of the Authority in three main axes.

Al-Ugaili said in his speech during the inauguration of customs automation at the Umm Qasr port, followed by the Iraqi News Agency (INA):

“The efforts of the General Authority of Customs, which were made over several years and with direct support by the Minister of Finance and direct follow-up from the Prime Minister, culminated this day in the electronic system that We hope that it will cover all the activities of the General Authority of Customs and customs activity.” Al-Ugaili added,

“The General Authority of Customs is committed to carrying out its duties, which focus on three main axes, the first of which is facilitating legitimate trade, as the current government has issued a set of decisions that help facilitate legitimate trade, and the General Authority of Customs is responsible for implementing those decisions, including:

canceling tax deposits that were collected.” At border crossings, which were obstructing or delaying the completion of customs transactions, as well as

canceling the import license for most imported materials, and

reducing duties on some imported materials.” He continued,

"The General Authority of Customs has begun reviewing many procedures and moving towards simplifying procedures.

Today, the electronic system is one of the tools of the General Authority of Customs to facilitate legitimate trade.

According to the system, transactions are supposed to be completed in a faster manner and with unified customs procedures, meaning that there will be no discrepancy in procedures between one center and another."

Pointing out that, “Under the system, the discretionary power of the employee will be greatly limited and thus the system will be dealt with, as there will be no role for people’s moods in completing these transactions.”

He explained that “the other axis that the General Authority of Customs is working on is protecting or implementing the state’s decisions in the field of restriction and prevention, and this protects the consumer and society from the entry of prohibited materials,” noting that “the third axis of the Authority is revenues or collection, as the system will collect according to Electronic mechanisms that are clear, transparent and announced at the same time, meaning that they provide real-time data to the decision maker at the level of the Ministry of Finance or at the government level that the revenues received by this body are in the amount and at the moment when the information is requested.” He pointed out that

"the system offers great advantages that we will feel by implementing it, as well as the dealing agents of customs clearance companies and the extent of the benefit achieved from this system in their work, as they can complete customs clearance procedures online." https://www/ina.iq/204286--.html

On Her First Visit To Iraq, The Vice President Of The International Finance Corporation Seeks To Support The Role Of The Private Sector

Last updated: March 3, 2024 Independent/- Hala Sheikh Rouhu, Vice President of the International Finance Corporation for the Middle East, Central Asia, Turkey, Afghanistan and Pakistan, is making her first visit to Iraq this week to support the role of the private sector in achieving sustainable development.

During her three-day mission, Ms. Sheikhrouhu will meet Prime Minister Mohamed Shiaa Al-Sudani and also participate in high-level discussions with government officials and representatives. Meetings will also be held with representatives of the private sector and women entrepreneurs.

This visit confirms the International Finance Corporation's commitment to supporting sustainable economic development in Iraq and its continuation of presenting its initiatives aimed at promoting private sector growth and economic diversification.

The International Finance Corporation has been and continues to be a partner of Iraq in its development journey, having invested and mobilized more than $1.9 billion since 2005 to support the private sector in the country.

Projects that IFC has supported over the past years include:

In the field of industry promotion: The International Finance Corporation invested up to $130 million in the Iraqi Doha Cement Industries Company with the aim of promoting energy-saving and climate-friendly technologies, and enhancing the sustainable production of cement clinker, thus creating 2,700 new job opportunities.

In the field of supporting food security: The International Finance Corporation led a financing package worth $112.5 million for “Turki Agro” company to develop a modern agricultural industrial complex in the port of Umm Qasr in Iraq, with the aim of enhancing production.

The sweetener consists of soybean flour and soybean oil, which is estimated to contribute to making the production of Sama Al-Manar Company, a subsidiary of Turki Agro Company, in Iraq one of the largest non-oil commodity exports.

In the area of promoting trade: IFC led a groundbreaking financing package worth $125 million to establish a multi-purpose shipping terminal at Umm Qasr Port in Basra. The project is expected to boost trade, It improves connectivity with global markets and stimulates economic growth.

Modernization of Baghdad International Airport: The International Finance Corporation signed an agreement to advise the government on structuring a public-private partnership project to rehabilitate, expand, finance, operate and maintain Baghdad International Airport and make its facilities, safety and services compatible with international standards, which will be the first public-private partnership project at an airport in Iraq.

It is noteworthy that the International Finance Corporation (IFC), a member of the World Bank Group, is the largest global development institution whose work focuses on the private sector in emerging market countries.

The Foundation operates in more than 100 countries around the world, using its capital, expertise and influence to create markets and create opportunities in developing countries.

https://mustaqila.com/في-زيارتها-الأولى-إلى-العراق-نائبة-رئي/

Government Advisor: We Will Transfer Pharmaceutical Manufacturing Technology To Iraq And Produce It Locally With The Same Effectiveness

Economy 2-03-2024, Baghdad - INA - Muhammad Al-Talbi, Adviser to the Prime Minister for Industry Affairs and Private Sector Development, Hamoudi Al-Lami, reviewed today, Saturday, the mechanism for transferring technology for manufacturing medicines that are not produced in Iraq, while confirming that locally produced medicines will be as effective as foreign medicines and will be sold for a quarter of their value.

Al-Lami said to the Iraqi News Agency (INA):

“The Prime Minister directed the transfer of pharmaceutical technology that is not produced in Iraq, and it must be through international companies governed by the controls of the Ministry of Health, and the company must be registered with the Ministry and have international certificates in order to allow the transfer of technology from them.”.

He added, "The transfer of technology takes place in three stages over a period of five years.

The first stage begins with secondary packaging from the foreign company and continues for one or two years at most, while

providing requirements,

training cadres, and

preparing supplies.

Then we begin the manufacturing stage inside Iraq." Al-Lami continued,

“After the end of five years as a maximum, the technology will be completely transferred, by owning the entire pharmaceutical file and manufacturing in Iraq,” warning that,

“The Ministry of Health does not allow tampering with the supply of medicine and then packaging it inside and claiming that it is Iraqi, and strict procedures are applied.” Al-Lami stated,

"The transfer of technology will bring foreign companies to Iraq as a first stage, and then we will enter the stage of establishing pharmaceutical factories for those major international companies in the country." He stressed,

"The Prime Minister's directives stressed that the

Iraqi medicine must be of the best international specifications and that

there be competition in price with the foreign medicine, meaning that the

citizen will take the medicine manufactured locally at a subsidized price of up to a quarter of the foreign value, with the same effectiveness." https://www.ina.iq/204237--.html

Automation At Border Crossings: Hope For Improving The Economy And Combating Corruption

Last updated: March 3, 2024 Independent/- Since the fall of the dictatorship in 2003, Iraqis have dreamed of transforming the state system from paper to automation through the electronic governance portal.

Border crossings, customs, and taxation are among the departments that suffer most from corruption and waste, which costs the state treasury huge sums estimated at $7 billion annually.

Hope in the Sudanese government:

The Sudanese government gives hope for implementing the automation system in departments and bodies such as border crossings, customs and tax.

Benefits of implementing an automation system:

Reducing evasion of customs duties and taxes.

Availability of detailed information on import content.

Reducing human interference in monitoring, evaluation and demarcation processes.

Providing a detailed statistical information base on the country’s foreign trade.

Availability of speed in completing customs transactions.

Great countries are role models:

Great countries tend to keep pace with technological progress by following a strategy of reducing expenses and maximizing revenues, and this can only be done by making governance an integral part of the structure of building an institutional state.

Benefits of implementing an automation system in the customs and border ports sector:

Achieving stability, economic leaps, and stability at various levels in the short and long term.

Contributing to reducing the spread of corruption in this joint and cutting the way for waste and tampering with public money.