Goldilocks' Comments and Global Economic News Sunday Afternoon 6-16-24

Goldilocks' Comments and Global Economic News Sunday Afternoon 6-16-24

Good Evening Dinar Recaps,

EU Basel 3 Announcement: The Fundamental Review of the Trading Book (FRTB) is a comprehensive suite of capital rules. They are developed by the Basel Committee on Banking Supervision (BCBS) as part of Basel III. Their intentions are to apply these rules to banks' wholesale trading activities.

The EU plans to delay FRTB because moving first would put EU banks at a competitive disadvantage to US banks.

This is a coordinated effort globally. Where one goes, we all go. Europe has given themselves a back wall date of January 1st, 2025 to to fully implement Basel 3 requirements. It looks like they have moved into a place that other countries are going to have to catch up to going forward.

Goldilocks' Comments and Global Economic News Sunday Afternoon 6-16-24

Good Evening Dinar Recaps,

EU Basel 3 Announcement:

The Fundamental Review of the Trading Book (FRTB) is a comprehensive suite of capital rules. They are developed by the Basel Committee on Banking Supervision (BCBS) as part of Basel III. Their intentions are to apply these rules to banks' wholesale trading activities.

The EU plans to delay FRTB because moving first would put EU banks at a competitive disadvantage to US banks.

This is a coordinated effort globally. Where one goes, we all go. Europe has given themselves a back wall date of January 1st, 2025 to to fully implement Basel 3 requirements. It looks like they have moved into a place that other countries are going to have to catch up to going forward.

Look for gold to be reclassified during this time and the digital economy to go ahead and move into its mass adoption. ICMA Group

© Goldilocks

~~~~~~~~~

"Lagarde Urges Governments to Respect Global Trade Rules"

Remember what we said the other day about Trade Wars beginning, and how, Treaty Agreements are signed at the end of them.

Trade Wars are attempts by countries to damage each other's trade, typically by the imposition of tariffs or quota restrictions.

This will cause distortions in prices that will have to be reset under new Treaty Agreements that are universally signed.

Look for this to come at a time when Basel 3 Capital Requirements can be implemented into a new financial order. Bloomberg

Here we go.

© Goldilocks

~~~~~~~~~

Here is the list of countries that will join BRICS:

* Africa:

* Algeria;

* Morocco;

* Nigeria;

* Chad;

* Equatorial Guinea;

* Eritrea;

* Senegal;

* Zimbabwe;

* South Sudan.

* Asia:

* Azerbaijan;

* Bangladesh;

* Bahrain;

* Indonesia;

* Kazakhstan;

* Kuwait;

* Palestine;

* Pakistan;

* Syria;

* Thailand;

* Vietnam;

* Sri Lanka;

* Türkiye.

* Latin America:

* Bolivia;

* Venezuela;

* Honduras.

BRICS Summit October 2024

Gazeta

~~~~~~~~~

Hello, World!

Figure Technology Solutions has launched Figure Connect, its blockchain-based marketplace for private credit. Outside of the qualified mortgage sector, most loan purchase agreements (LPAs) are bespoke, making them illiquid. Figure’s is promoting the use of standardized sales terms and documentation to make the market more liquid. Ledger Insights Figure Technology Solutions

~~~~~~~~~

Bitcoin Suisse, one of the largest digital asset players in the country, has issued a digital bond via the Obligate platform. When asked for more details about the bond, Bitcoin Suisse told Ledger Insights that it is a technical prototype with a 12 month maturity, available only to qualified investors.

Ledger Insights Bitcoin Suisse

~~~~~~~~~

Marui, the large Japanese department store, issued a digital green bond in May. Not only did it use blockchain, but it was also directly issued to its customers as investors, with Securitize Japan providing the blockchain platform. Besides the digital bond, the green investment also has a blockchain angle.

It was a small digital bond issuance of just Yen 170 million ($1.1 million) with the investment available to Marui’s EPOS credit card holders. The 1% interest on the bond is partially paid in EPOS points and partly in real money.

The bond proceeds are intended to purchase a renewable energy power plant, although the small print also allows for energy-efficient building upgrades. Marui is partnering with Updater (formerly Minna Denryoku or Minden) for the renewable energy plant.

Updater has a blockchain-based platform, Enection 2.0, which tracks the source of renewable energy, allowing business buyers to pair electricity sales with energy attribute certificates (EACs) for green energy. Ledger Insights Marui Enection 2.0 Digital Bond

~~~~~~~~~

BIS launches Toronto Innovation Hub - Ledger Insights - blockchain for enterprise

~~~~~~~~~

Testimony of Chairman Rostin Behnam Before the Subcommittee on Financial Services and General Government, Committee on Appropriations, U.S. Senate | CFTC

~~~~~~~~~

PCPD Corporate Video | Youtube

~~~~~~~~~

FADGI is part of a broader effort by NARA to move away from paper-based processes towards digitization.

Federal Agencies Digital Guideline Initiative (FADGI) guidelines are mandatory for federal agencies and affiliated organizations when digitizing archival records.

The guidelines went into effect in June 2024 as part of the National Archives and Records Administration's (NARA) effort to move away from paper-based processes. By June 2024, all permanent records archived in the National Archives must be digitized and meet FADGI three-star quality standards. Digitization Guidelines Government Technology Insider

~~~~~~~~~

Seeds of Wisdom Team Presents

The Goldilocks Daily Breakdown Podcast:

Are you too tired or too busy to read the daily Goldilocks articles that keep you up to date on the GCR?

We have you covered with a new podcast called the Goldilocks Daily’s.

Tune in each day at your convenience and listen to Mr. Anonymous break down the articles the Goldilocks Team brings to this community.

Mr. Anonymous will read each article for you and explain them in layman’s terms.

Listen on the go, in the car on your way to work, while walking the dog, or exercising at the gym. Listen anywhere, anytime, but listen and stay informed.

The New Goldilocks Daily’s - you’re sure to love it!

Goldilocks' Daily Breakdown Podcast Link

Goldilocks' Telegram Room

Goldilocks' Q & A Classroom Link

~~~~~~~~~

What Iraq Must Do Before RV Can Happen | Youtube

~~~~~~~~~

XRP RIPPLE UPDATE: CAN XRP ESCAPE THIS? | SEC VS RIPPLE | XRP Lawsuit Heats Up with Judge | Youtube

~~~~~~~~~

BIS Survey: 94% of Central Banks Exploring Digital Currency – Featured Bitcoin News

~~~~~~~~~

Goldilocks' Daily Breakdown Podcast Link

Goldilocks' Telegram Room

Goldilocks' Q & A Classroom Link

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Afternoon 6-14-24

Goldilocks' Comments and Global Economic News Saturday Afternoon 6-14-24

Good Evening Dinar Recaps,

Project Meridian FX: Joint project by the Eurosystem and London Centres, and the Bank of England, to test synchronised settlement in FX | BIS | Project Meridian

Project Meridian Announcement: "The Eurosystem and London Centres of the BIS Innovation Hub, together with the Bank of England, have launched Project Meridian FX, to build on the findings of Project Meridian by focusing on foreign exchange (FX) transactions." Meridian FX has completed testing of the usability regarding standing orders for various types of assets and technologies ie foreign currency exchange.

It is expected to take the lead on innovations regarding real-time gross settlement (RTGS) systems operated by central banks.

Goldilocks' Comments and Global Economic News Saturday Afternoon 6-14-24

Good Evening Dinar Recaps,

Project Meridian FX: Joint project by the Eurosystem and London Centres, and the Bank of England, to test synchronised settlement in FX | BIS | Project Meridian

Project Meridian Announcement:

"The Eurosystem and London Centres of the BIS Innovation Hub, together with the Bank of England, have launched Project Meridian FX, to build on the findings of Project Meridian by focusing on foreign exchange (FX) transactions."

Meridian FX has completed testing of the usability regarding standing orders for various types of assets and technologies ie foreign currency exchange.

It is expected to take the lead on innovations regarding real-time gross settlement (RTGS) systems operated by central banks.

By focusing on FX transactions, Project Meridian is expected to settle FX trade issues, such as costs, risks, and time involved in cross-border transactions. BIS | Project Meridian

© Goldilocks

~~~~~~~~~

Project Meridian | Youtube

~~~~~~~~~

Why It’s Time for Corporates to Jump on the ISO 20022 Bandwagon | Pymnts | Investopedia

“Now with the CHIPS ISO 20022 migration completed, the entire industry is clearly one step closer to realizing the benefits together,” Lee told PYMNTS recently."

She goes on to emphasize that the potential for ISO 20022 cannot be complete without involvement with banks, corporates, and financial institutions.

Clearing House Interbank Payments System (CHIPS) is well on its way in interfacing ISO on the QFS several financial institutions that are still in process of completing this launch.

"CHIPS is a private-sector, bank-owned system for electronic payments in US dollars. CHIPS is the largest US dollar-based money transfer system in the US and is used for large interbank transactions."

CHIPS is the preferred method of payment for large transfers. Over 95% of USD cross-border payments utilize this service for its completion.

© Goldilocks

~~~~~~~~~

What is Clearing House Inter bank Payment System (CHIPS)? Urdu / Hindi | Youtube

~~~~~~~~~

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More Goldilocks' Comments and Global Economic News Friday Evening 6-14-24

More Goldilocks' Comments and Global Economic News Friday Evening 6-14-24

Good Evening Dinar Recaps,

G7 vows to drop fossil fuels faster, but activists unimpressed - Swiss Info Channel

~~~~~~~~~

How the U.S.-China Trade War Is Delivering Big Wins for Mexico | WSJ

Do you remember back at the first of the year, and even late last year, when we said that the peso would rise? © Goldilocks

~~~~~~~~~

Putin voices support for Turkey’s desire to join BRICS during talks with Fidan - Turkish Minute

More Goldilocks' Comments and Global Economic News Friday Evening 6-14-24

Good Evening Dinar Recaps,

G7 vows to drop fossil fuels faster, but activists unimpressed - Swiss Info Channel

~~~~~~~~~

How the U.S.-China Trade War Is Delivering Big Wins for Mexico | WSJ

Do you remember back at the first of the year, and even late last year, when we said that the peso would rise?

© Goldilocks

~~~~~~~~~

Putin voices support for Turkey’s desire to join BRICS during talks with Fidan - Turkish Minute

~~~~~~~~~

KFC Attacked in Baghdad! | Youtube

~~~~~~~~~

Iraq and Japan discuss projects to produce energy from waste and sustainable management in agriculture and water – Iraq News Gazette

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Afternoon 6-14-24

Goldilocks' Comments and Global Economic News Friday Afternoon 6-14-24

Good evening Dinar Recaps,

First, enlarge the chart above so you can get the full picture where you will see the last two charts at the bottom.

Take a look at the two bottom sections of this chart on the US Debt Clock. If you look at it closely, you will see that the production rate is not meeting the demand and supply rate.

As you can see from the numbers, the demand and supply is way above production. When the need rises as it will for our utility tokens on the QFS, prices will rise including our tokenized (gold) assets on the new market.

Goldilocks' Comments and Global Economic News Friday Afternoon 6-14-24

Good evening Dinar Recaps,

First, enlarge the chart above so you can get the full picture where you will see the last two charts at the bottom.

Take a look at the two bottom sections of this chart on the US Debt Clock. If you look at it closely, you will see that the production rate is not meeting the demand and supply rate.

As you can see from the numbers, the demand and supply is way above production. When the need rises as it will for our utility tokens on the QFS, prices will rise including our tokenized (gold) assets on the new market.

So, the shipping industry along with gold are in process of finding equilibrium that will enable the stabilized production of goods to synchronize themselves with stabilized prices in tokenized assets.

There is a shift in attention towards credit valuation adjustments taking place. This is where the fun begins. US Debt Clock

© Goldilocks

~~~~~~~~~

Let's sum up a little bit from the last article posted last night and this morning. On the Moscow Exchange, we have local currencies currently being traded.

This will enable countries to individually synchronize their gold with their shipping correlations through tokenized assets.

As these assets are interfaced on the QFS, real-world assets can now find real-world values as they are traded on the market.

As these new prices that form on the Moscow Exchange begin to solidify, we will notice a domino effect Globally as currencies and goods begin to exchange Internationally. This is the starting point. This is where it all begins.

This is a process determined by supply and demand revealing price determinations through price actions that take place on the market.

© Goldilocks

Last Night's Article

Russian economy forced into China pivot after sanctions bombshell | Newsweek

Goldilocks Room Message Link

~~~~~~~~~

Sovereign Wealth Fund Announcement:

"Hong Kong: New Sovereign Fund Starts Deploying Capital" The first batch of investments and start-ups begin this month. Why?

The purpose of a Sovereign Wealth Fund is to move onto the Global Market the assets and startup pools of liquidity in a country on the International stage through the liquidity provided by the SWF.

Hong Kong's new "tokenized assets" are in process of being interfaced onto the QFS. These new real-world asset prices based on real-world values will begin to reset and correlate themselves with new market chart patterns.

As they are being formed, movement into actual prices going forward will be gradual and not a shock to the system. Asian Investor Toptal

© Goldilocks

~~~~~~~~~

World Federation of Exchanges says tokenization’s main benefit is fractionalization | Ledger Insights

The World Federation of Exchanges (WFE), the global trade body for stock exchanges and clearing houses, today published a paper on tokenization.

On balance, it was critical of the concept, although it concluded that it “may be the next phase for traditional assets."

It found that the primary benefit of tokenization is fractionalization. And by making fractional assets available to a larger pool of investors, there’s potential to enhance liquidity.

WFE, Published Paper

~~~~~~~~

Do wholesale CBDCs compete with bank services? | Ledger Insights

Most banks are not keen on retail central bank digital currencies (CBDCs) because they fear it will lure away bank deposits. The recent support by the American Bankers Association for the anti-CBDC Bill is evidence of this. Wholesale CBDCs – the ones only usable by institutions – were considered useful for banks.

However, some institutions are keener than others, often depending on the application of the wholesale CBDC. Executives in the securities services sector are usually the most enthusiastic. On the payments side, JP Morgan’s Umar Farooq appeared to have reservations during last month’s Consensus event.

CBDCs American Bankers Association Wholesale CBDCs

~~~~~~~~~

Iraq's Development Road may link with China's Belt and Road | Iraq Business News

l-Sudani outlined Iraq's interest in developing gas projects to boost the manufacturing and fertilizer industries, adding value to the economy and creating job opportunities. He proposed presenting potential sites to CNPC for integrated energy projects comprising oil and gas production, processing plants, power plants, and petrochemical refineries.

~~~~~~~~~

Risk of a global trade war if U.S. administration changes: Barclays | Youtube

~~~~~~~~~

And the trade war begins...

... at the end of this trade war, new credit valuation agreements will be signed.

© Goldilocks.

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More Goldilocks' Comments and Global Economic News Thursday Evening 6-13-24

More Goldilocks' Comments and Global Economic News Thursday Evening 6-13-24

Good evening Dinar Recaps,

Multiple Chinese banks announced their involvement in the mBridge cross-border central bank digital currency (cross-border CBDC) trials after the initiative launched its minimum viable product (MVP) last week.

At least nine Chinese institutions are involved in the project, although that figure might now expand with the MVP. | Ledger Insights

More Goldilocks' Comments and Global Economic News Thursday Evening 6-13-24

Good evening Dinar Recaps,

Multiple Chinese banks announced their involvement in the mBridge cross-border central bank digital currency (cross-border CBDC) trials after the initiative launched its minimum viable product (MVP) last week. At least nine Chinese institutions are involved in the project, although that figure might now expand with the MVP. | Ledger Insights

Stablecoin issuer Paxos cuts 20% of its staff as PayPal receives Trust charter | Ledger Insights

Stablecoin issuer Paxos sent an email to staff saying it’s cutting its workforce by 65 people or around 20% of its staff. That’s according to The Block and Bloomberg, who viewed a company-wide email that Paxos confirmed. The move comes despite a strong balance sheet. Two weeks ago we reported that PayPal received a New York trust charter for digital assets, which it has not yet formally announced. The two pieces of news may be related.

~~~~~~~~~

Introducing Ripple USD (RLUSD) | The Crypto Basic

A 1:1 USD-backed stablecoin, offering transparency and stability on the XRP Ledger and Ethereum. Coming later this year.

~~~~~~~~~

Worldwide - Oil, Gas & Electricity - Another Major European Bank Withdraws From Fossil Fuel Financing | Mondaq

~~~~~~~~~

United States - Renewables - Treasury Department, IRS Issue Section 45Z Clean Fuel PTC Registration Guidance | Mondaq

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Afternoon 6-13-24

Goldilocks' Comments and Global Economic News Thursday Afternoon 6-13-24

Good Evening Dinar Recaps,

"Singapore Consults on Implementation of Global Minimum Tax" The Organisation for Economic Co-operation and Development has a 15% tax on multinational enterprises.

Singapore is the latest country to propose the implementation of this tax upon their companies. This is a market-based collaboration between Global economies designed to develop policy standards that promote sustainable economic growth.

This Capital requirement for the banking system on a global scale comes under pillar 2 banking procedures. Pillar 2 banking supports pillar 1 banking to cover the needs of capital requirements that are not covered in pillar 1. Pillar 3 deals with the open banking system allowing changes to be determined as needed. Below is an article if you would like to do further study on this announcement.

Goldilocks' Comments and Global Economic News Thursday Afternoon 6-13-24

Good Evening Dinar Recaps,

"Singapore Consults on Implementation of Global Minimum Tax"

The Organisation for Economic Co-operation and Development has a 15% tax on multinational enterprises.

Singapore is the latest country to propose the implementation of this tax upon their companies.

This is a market-based collaboration between Global economies designed to develop policy standards that promote sustainable economic growth.

This Capital requirement for the banking system on a global scale comes under pillar 2 banking procedures. Pillar 2 banking supports pillar 1 banking to cover the needs of capital requirements that are not covered in pillar 1. Pillar 3 deals with the open banking system allowing changes to be determined as needed. Below is an article if you would like to do further study on this announcement.

Its purpose is to level the playing field between economies and their opportunities for growth. A unified approach will give countries' currencies the ability to compete with demands for their money based on their own merits and ability to operate a business through the new Basel 3 requirements. Orbitax StateGov Acodez

© Goldilocks

~~~~~~~~~

HSBC Announcement | Finance Feeds

"HSBC China has become one of the first foreign banks in the country to provide digital yuan services to both corporate and retail customers."

~~~~~~~~~

Fortune 500 Announcement | DailyHodl

Currently, over half of the Fortune 500 companies listed on the market are currently in process of interfacing their goods and services on the blockchain.

This means that they have currently begun the process of moving into the new QFS and operating their tokenized asset opportunities through the new digital asset-based trading system.

© Goldilocks

~~~~~~~~~

Zimbabwe is taking an exciting step into the future by launching a public consultation to get opinions on regulating cryptocurrency operations in the country, Bloomberg reports. This is a big change for a nation that has historically struggled with currency issues.

By asking for feedback from the public and talking to industry experts, Zimbabwe aims to balance encouraging innovation in the growing crypto sector with making sure it’s done responsibly and in line with international standards. Bitcoinist

~~~~~~~~~

Quant ISO 20022 Token utilized on the Shanghai Exchange Announcement:

"Chinese regulators' prompt supervision of quantitative trading will help narrow the gap between programs and individual investors in terms of technology, access to information and speed, thereby boosting the confidence of A-share investors and sustaining the stability of the market in the long run, according to market mavens.

The mainland's three major stock exchanges in Shanghai, Shenzhen and Beijing released on Friday rules on quant trading, or program trading, and solicited public feedback till June 14.

The rules cover six major areas — the management over reporting, trading activities, information systems, high-frequency trading, quant trading via the stock connect program linking the Shanghai, Shenzhen and Hong Kong bourses, as well as supervision."

Quant is a ISO 20022 Network. Quant is a network that connects existing distributed ledger networks such as the Shanghai Exchange to the new digital asset based trading system.

Through the adoption of this ISO 20022 Standard, Quant brings compatibility with traditional financial systems and streamlines secure exchanges of data across several networks simultaneously such as the Shanghai Exchange. ChinaDaily CoinCheckup

© Goldilocks

~~~~~~~~~

Bank of Thailand opens DLT programmable payment testing in sandbox - Ledger Insights - blockchain for enterprise

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday Afternoon 6-12-24

Goldilocks' Comments and Global Economic News Wednesday Afternoon 6-12-24

Good evening Dinar Recaps,

"BASEL COMMITTEE MUST STOP GLOBAL BANKS FROM CONTINUING TO CHEAT ON KEY REGULATORY TESTS AND ENDANGERING FINANCIAL STABILITY" | BetterMarkets

These tests include examinations of the bank's capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to systemic risk.

The above sentence is otherwise known as stress tests. A stress test determines how well a bank is capable of handling a liquidity crisis.

The OCC and FDIC conduct several tests to measure a bank's capacity to withstand transitional periods like we are in at the present time.

Goldilocks' Comments and Global Economic News Wednesday Afternoon 6-12-24

Good evening Dinar Recaps,

"BASEL COMMITTEE MUST STOP GLOBAL BANKS FROM CONTINUING TO CHEAT ON KEY REGULATORY TESTS AND ENDANGERING FINANCIAL STABILITY" | BetterMarkets

These tests include examinations of the bank's capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to systemic risk.

The above sentence is otherwise known as stress tests. A stress test determines how well a bank is capable of handling a liquidity crisis.

The OCC and FDIC conduct several tests to measure a bank's capacity to withstand transitional periods like we are in at the present time.

These tests are conducted to prevent crisis interventions and collapse situations that could become a contagion to other Banks.

Tighter controls on the new digital banking system are not only expected, but they will determine the compliance level a bank has in their standing going forward. BetterMarkets

© Goldilocks

~~~~~~~~~

BRICS: BRICS calls for enhanced use of local currencies in trade between member countries - The Economic Times

~~~~~~~~~

Joint Statement of the BRICS Ministers of Foreign Affairs/International Relations, Nizhny Novgorod, Russian Federation, 10 June 2024 - The Ministry of Foreign Affairs of the Russian Federation | Ministry of Foreign Affairs

~~~~~~~~~

Call to Action: ISSB Global Adoption

"The International Sustainability Standards Board (ISSB) is an independent, private-sector organization that develops and approves IFRS Sustainability Disclosure Standards."

The International Financial Reporting Standards are intended to make financial statements consistent, transparent, and comparable around the world.

The IFRS S1 and IFRS S2 are climate standards on an economy looking to be accepted on a world wide basis by 2025.

"IFRS S1 requires companies to disclose material information on all sustainability-related risks and opportunities that could reasonably be expected to affect their prospects. IFRS S2 sets out the requirements for climate-related disclosures."

Sustainability-related risks deal primarily with liquidity issues surrounding the banking system such as Governmental risks and economic factors.

Greenhouse gas (GHG) emissions is a climate-related risk. It is a climate related disclosure being proposed, and how, the banking system will be a part of managing those risks ie car loans.

Many compliance rules are expected to shift inside the new digital economy along with climate risks that will affect banking operations. This is one of the new adaptations that is being called for to help us adjust to our changing world.

As you can see from the previous article, new changes are being developed and governed by the ruling bodies above and beyond the banking system to recommit their International compliance standards inside this new digital banking system. CorpGovLaw EY IFRS PWC Zurich

© Goldilocks

~~~~~~~~~

National and International governing bodies are starting to get involved with their new policies that will govern the new digital banking system.

This gives us an indication that the governing bodies of our new banking system are beginning to shift their attention to new rules and regulations that will move our money going forward.

© Goldilocks

~~~~~~~~~

How will Europe's elections impact digital euro legislation? - Ledger Insights - blockchain for enterprise

~~~~~~~~~

Russia intends to perform its first cross-border payments using the digital ruble in the second half of 2025. Central bank digital currency (CBDC) transactions with China or Belarus are on the cards. That’s according to Anatoly Aksakov, who chairs the Financial Markets Committee of Russia’s State Duma. | LedgerInsights

~~~~~~~~~

Panel perspectives: Navigating the new waves of supply chain finance | TradeFinanceGlobal

~~~~~~~~~

Project Cedar, Explained (Wholesale Central Bank Digital Currency Prototype). How the 7 trillion dollar a day Forex Market will move its money. | Youtube

~~~~~~~~~

We are moving from a World Reserve Asset transaction to Central Bank Digital Ledger Technological (blockchain) transactions.

© Goldilocks

~~~~~~~~~

~~~~~~~~~

🚨BREAKING: BRICS Says 59 Nations Plan to Join, New Financial System, Dedollarization Priorities | Youtube

~~~~~~~~~

A Distributed Systems Reading List | Ferd CA

~~~~~~~~~

Putin Says BRICS Developing Independent Payment System Free From Political Pressure – Featured Bitcoin News

~~~~~~~~~

Ripple Completes Acquisition of Standard Custody & Trust Company – News Bytes Bitcoin News

~~~~~~~~~

Saudi Arabia's petro-dollar exit: A global finance paradigm shift | The Business Standard

~~~~~~~~~

Russia’s Moscow Exchange to stop trading in dollars after latest US sanctions | ARA TV

~~~~~~~~~

~~~~~~~~~

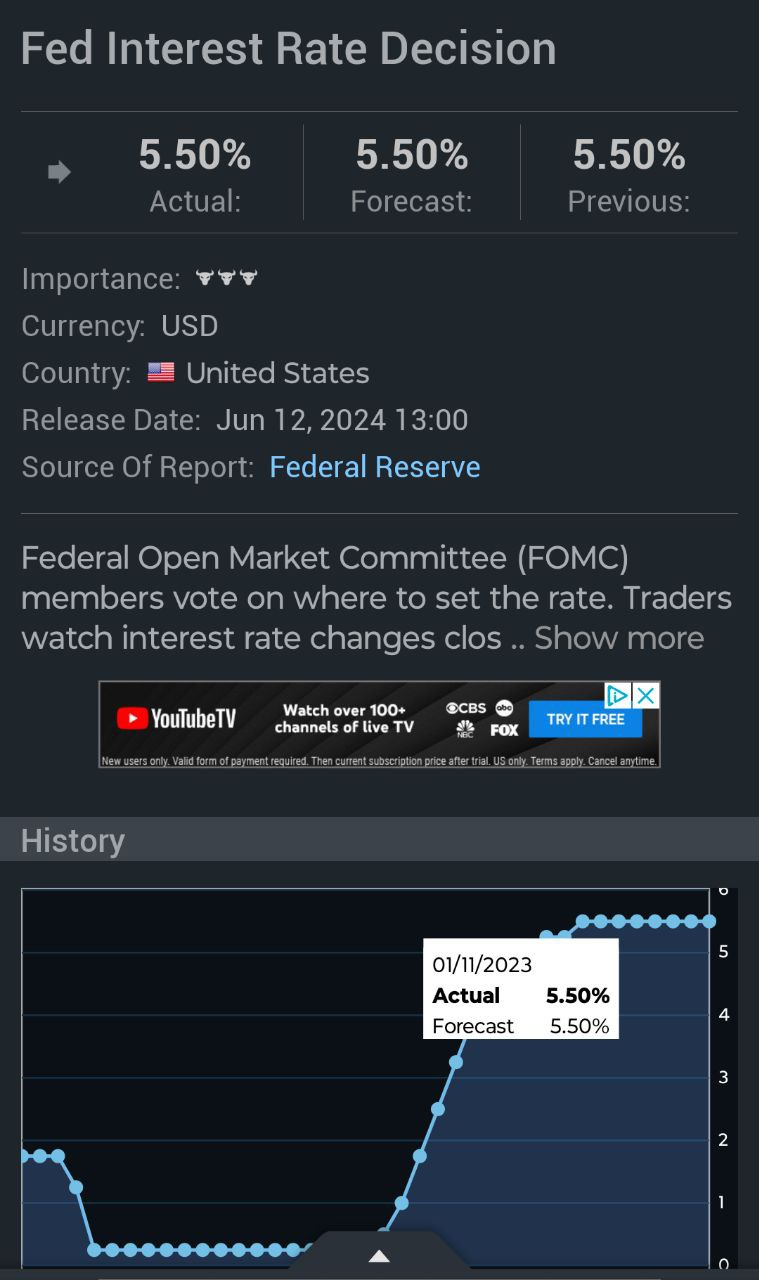

FOMC Press Conference June 12, 2024 | Youtube

~~~~~~~~~

~~~~~~~~~

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Tuesday Evening 6-11-24

Goldilocks' Comments and Global Economic News Tuesday Evening 6-11-24

Good Evening Dinar Recaps,

"Project mBridge continues its development and has reached the minimum viable product (MVP) stage, while broadening its international reach."

This project has reached its minimum requirements that will allow it to work with early adopters on this Digital Ledger Technology enabling instant payments through cross-border International (CBDC) trades. This system will allow foreign currency exchanges through local currencies.

There are now over 26 observing members and Saudi Arabia has just recently joined as a full participant. This DLT will allow payments to be settled in local currencies of those who are early adopters of this new digital payment system.

Goldilocks' Comments and Global Economic News Tuesday Evening 6-11-24

Good Evening Dinar Recaps,

"Project mBridge continues its development and has reached the minimum viable product (MVP) stage, while broadening its international reach."

This project has reached its minimum requirements that will allow it to work with early adopters on this Digital Ledger Technology enabling instant payments through cross-border International (CBDC) trades. This system will allow foreign currency exchanges through local currencies.

There are now over 26 observing members and Saudi Arabia has just recently joined as a full participant. This DLT will allow payments to be settled in local currencies of those who are early adopters of this new digital payment system.

"Project mBridge is the result of extensive collaboration “starting in 2021 between the BIS Innovation Hub, the Bank of Thailand, the Central Bank of the United Arab Emirates, the Digital Currency Institute of the People’s Bank of China, and the Hong Kong Monetary Authority.”

In 2022, real value transactions took place on a pilot program and were successful. This project has been coordinated with the Bank of International Settlements, and it is expected to be available by mid-2024.

Since mbridge has reached its minimum viable product stage, it is now able to invite the International community to begin interfacing onto this section of the QFS.

© Goldilocks

Crowdfund Insider

As of June 2024, the observing members to Project mBridge include: Asian Infrastructure Investment Bank, Bangko Sentral ng Pilipinas; Bank Indonesia; Bank of France; Bank of Israel; Bank of Italy; Bank of Korea; Bank of Namibia; Central Bank of Bahrain; Central Bank of Chile; Central Bank of Egypt; Central Bank of Jordan; Central Bank of Malaysia; Central Bank of Nepal; Central Bank of Norway; Central Bank of the Republic of Türkiye; European Central Bank; International Monetary Fund; Magyar Nemzeti Bank; National Bank of Cambodia; National Bank of Georgia; National Bank of Kazakhstan; New York Innovation Centre, Federal Reserve Bank of New York; Reserve Bank of Australia; South African Reserve Bank; and World Bank. BIS Ledger Insights Product Plan

~~~~~~~~~

According to this report, supply and demand issues in trade are currently in an imbalanced state. The demand for goods and services has steadily grown since the Covid-19 pandemic, and first quarter numbers show a significant growth for the United States and for China. Yet, we are not out of the woods, and supply and demand need to be brought into equilibrium.

High demand is good for traders, and it looks good on the Markets. It is the supply side that is lacking at the present moment due to inflated prices on goods and services. In order to balance the economy and make it grow steadily and forward, there needs to be more attention on moving the products across the country. This will increase money flow and demands on our Stablecoins that in turn gives more purchasing power to our currencies.

Here is where monetary policies come into play. As we move into a tokenized asset and gold token regimen for payment, this will stimulate the process of deflating the economy. A shift in interest rate reduction or remaining steady will give our suppliers liquidity capable of catching up to the demands of companies across the United States and China.

We are at a wait-and-see approach on the FOMC meeting. The changes made at this meeting and the next one are critical to the transition of our economy and it's moving back into profitable status. Supply Chain Brain Investopedia

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

When will the next fed rate cut be? Look ahead to future FOMC meetings | Investopedia

~~~~~~~~~

Mastercard Launches Open Banking Solutions in Partnership With Atomic to ‘Enhance User Experiences’ | The Fintech Times

Payments giant Mastercard has integrated Deposit Switch and Bill Pay Switch into its open banking platform, in a move that enables consumers to automatically switch their direct deposits and update their recurring bill payments, when opening a digital account or when updating information on an existing account.

~~~~~~~~~

XRP COULD BECOME THE WORLD'S RESERVE CURRENCY - RIPPLE XRP NEWS | Youtube

~~~~~~~~~

Iraq Seeks $2.5 Billion Missile System from South Korea #iqd #vnd #htg #ZiG Rates | Youtube

~~~~~~~~~

Central Bank of Saudi Arabia Teams Up with Ripple to Transform Cross-Border Settlements | Coin Trust

~~~~~~~~~

Italian Banking Association trials two styles of wholesale CBDC - Ledger Insights - blockchain for enterprise

~~~~~~~~~

Fidelity Intl tokenizes fund on JPM Tokenized Collateral Network - Ledger Insights - blockchain for enterprise

~~~~~~~~~

Solar-Powered Planes Are Ready to Take Off (And Fly for Months at a Time) - WSJ

~~~~~~~~~

BREAKING NEWS:

Apple unveils "tap to pay" between iPhones! 📲

Apple is interconnected with Ripple's Interledger Protocol! 🤝🏼

All the roads lead to one destination and the destination is called #XRP 💎 Crypto Barbie on Twitter

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Afternoon 6-10-24

Goldilocks' Comments and Global Economic News Monday Afternoon 6-10-24

Good Evening Dinar Recaps,

"Core Banking Systems Market Now Well-Established, Cloud Infrastucture to Drive Innovation – Report" | Crowdfund Insider

Cloud banking infrastructure allows financial institutions to deliver banking services and operations through the internet on-demand.

On Demand Banking allows you to deposit to and withdraw funds immediately and whenever you want. This electronic digital banking model provides access to computing resources like servers, data storage, and applications.

Goldilocks' Comments and Global Economic News Monday Afternoon 6-10-24

Good Evening Dinar Recaps,

"Core Banking Systems Market Now Well-Established, Cloud Infrastucture to Drive Innovation – Report" | Crowdfund Insider

Cloud banking infrastructure allows financial institutions to deliver banking services and operations through the internet on-demand.

On Demand Banking allows you to deposit to and withdraw funds immediately and whenever you want.

This electronic digital banking model provides access to computing resources like servers, data storage, and applications.

The top five vendors in 2024 for this new digital banking service include:

* Temenos

* FIS

* Mambu

* Finastra

* Tata Consultancy Services

As we have previously noted, the Iraqi digital banking services are now live on Temenos.

A core banking system is like a nervous system is to the body. It transmits electrical signals to the various components of a banking system allowing it to operate seamlessly.

A core banking system is a back-end system that processes daily banking transactions and posts updates to accounts and other financial records. Crowdfund Insider

© Goldilocks

~~~~~~~~~

Foreign Exchange | Five Degrees

The Core Banking System is the foundation of our Global Financial Markets.

It enables seamless currency exchanges, and it is the part of the banking system that coordinates risk management tools and digital networks to move virtual assets through the new QFS system on a Global scale.

Cross-border international trading is made possible through this new digital banking system mechanism. It will allow foreign currency exchanges to move through the system.

The beauty of this new digital banking system that is the nuts and bolts of all transactions done in a bank lies in the fact that it is done.

© Goldilocks

~~~~~~~~~

China's New Investment Play: Shifting Away from US Treasuries to Global Opportunities" | MSN

"China has diversified its holdings by selling $53.3 billion worth of US Treasuries and agency bonds. This adjustment aligns with BRICS nations gradually broadening their investment portfolios since 2022."

China is moving away from buying US Treasuries to Global opportunities that will expand the Chinese Yuan and the BRICS Nations coalition.

This is all part of leveling the playing field from a World Reserve Currency to payments transacted in local currencies.

This shift will increase the demand for their own currency and make available higher exchange rates with China and whoever they trade with going forward.

© Goldilocks

~~~~~~~~~

As US Treasury bonds are being sold around the world, we have a growing interest in Stablecoin use case scenarios designed to minimize the risk factors of a falling monetary system as it embraces a new digital asset-based trading system.

© Goldilocks

👆 Soft landing potential for the dollar...

~~~~~~~~~

What is Core Banking System | Youtube

~~~~~~~~~

Dodd-Frank Final Rule Announcement | Dodd-Frank Update

In a move to help accelerate a shift to open banking in the U.S., the Consumer Financial Protection Bureau finalized a rule outlining the qualifications an organization must demonstrate to be recognized as an industry standard-setting body to develop technical standards for protecting consumer data rights.

~~~~~~~~~

Managing Risk With Trade Compliance In Global Supply Chains - Global Trade Magazine

~~~~~~~~~

Leaving the US dollar behind, embracing digital currency | The Jerusalem Post

~~~~~~~~~

📰 So … all kinds of activity out there … in other news … Link

🔘Italy 🇮🇹

🔘Austria 🇦🇹

🔘European Parliament 🏰

🔘France 🇫🇷

🔘Belgium 🇧🇪

🔘Spain 🇪🇸

🔘Israel 🇮🇱

🔘Germany 🇩🇪

Italy - exit polls show right-wing party is set to win most seats

Austria - Right-Wing surge; Freedom Party takes the lead in recent election, narrowly outpacing the Conservative People’s Party

European Parliament - Marine Le Pen’s party is on target to become the largest single party in the parliament

France - French President Emmanuel Macron announced that he’s dissolving the National Assembly & calls for snap elections on June 30 & July 7

Belgium - The PM, Alexander De Croo, announced his resignation after the defeat of his party in the European elections. “Tomorrow I will resign as Prime Minister,” announced De Croo.

Spain - Spain’s center-right People’s Party (PP) came out on top in today’s European election, gaining 22 seats out of the 61 allocated to the country, and dealing a blow to the Socialist-led govt of Pedro Sanchez

Israel - 4 resignations in less than an hour: Benny Gantz, Gadi Eisenkot, Avi Rosenfeld, Hili Tropper (all resigned). Israel is crumbling from within - Netanyahu wanted to avoid this by doing the massacre yesterday

Germany - far-right gain in election stunning defeat to Germany’s Scholz

Seems things are heating up & technically Summer hasn’t started yet

🔥 🔥🔥 🔥🔥 🔥🔥

EDIT: can’t forget Germany 🇩🇪

~~~~~~~~~

iTrustCapital | The #1 Crypto IRA Retirement Platform | iTrustCapital

iTrustCapital is a software platform that allows users to buy and sell cryptocurrencies and precious metals through tax-advantaged retirement accounts. It's considered a leading digital asset IRA software platform and offers a selection of over 25 cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin. iTrustCapital also offers gold and silver.

~~~~~~~~~

XRP Ledger Ready to Adopt Tokenized Gold, Silver in Q3, 2024 | U Today

~~~~~~~~~

ECB In Focus Webinar with Stuart J. Russell - AI: Concepts, Trends, and Coexistence | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Sunday Evening 6-9-24

Goldilocks' Comments and Global Economic News Sunday Evening 6-9-24

Good evening Dinar Recaps,

Saudi Arabia joins BIS- and China-led central bank digital currency project | Reuters

Today, we are witnessing a 100-year cycle/bubble in the markets and a 50-year pact going away with Saudi Arabia moving from the Petro Dollar to trading in local currencies.

I wouldn't expect too much of a shift the next 2 to 3 days on the Dollar, but the weeks ahead will have a significant toll on the Dollar going forward.

This shift in the Global Economy will begin the process of "leveling the playing field" and reset new demands on currencies that have not been utilized in trade for a long time. All of this is coming at a very pivotal time.

As we shift our attention from the Petrol Dollar to Stablecoins that represent our local currencies in trade among nations, these new demands will increase money velocity that will raise the value of currencies around the world.

Goldilocks' Comments and Global Economic News Sunday Evening 6-9-24

Good evening Dinar Recaps,

Saudi Arabia joins BIS- and China-led central bank digital currency project | Reuters

Today, we are witnessing a 100-year cycle/bubble in the markets and a 50-year pact going away with Saudi Arabia moving from the Petro Dollar to trading in local currencies.

I wouldn't expect too much of a shift the next 2 to 3 days on the Dollar, but the weeks ahead will have a significant toll on the Dollar going forward.

This shift in the Global Economy will begin the process of "leveling the playing field" and reset new demands on currencies that have not been utilized in trade for a long time.

All of this is coming at a very pivotal time. As we shift our attention from the Petrol Dollar to Stablecoins that represent our local currencies in trade among nations, these new demands will increase money velocity that will raise the value of currencies around the world.

This is a process that takes a little time to see changes happen, but the process has begun. Reuters

WATCH THE WATER.

©✓Goldilocks

~~~~~~~~~

Breaking the Bank: Sen. Lee Introduces Bill to Abolish the Federal Reserve | Lee Senate

~~~~~~~~~

Central Banks of the World Explained

It is important to note that we are moving from a Petro Dollar regimen to a Central Bank Digital System.

There are about 214 Central Banks around the world that are officially recognized by countries as of Feb 16, 2023.

The new Global Economy is moving into a "shared governance regimen" whereby "leveling the playing field" between countries through Central Banks are beginning to lead the way.

It is the wCBDC coins that will move money around in cross-border International trading. This is causing a shift in the movement from a World Reserve Asset to a shared Central Bank Governance. PLUS50 Stabroek News

© Goldilocks

~~~~~~~~~

Remember the Golden Rule! Whoever has the gold, makes the rules! | Economic Sociology

"He who holds the gold makes the rules." This is never been more applicable than it is as we approach our new world.

The Central Banks govern the banking system.

Who has been storing the gold? The Central Banks. Now, you can begin to see where this is heading.

© Goldilocks

~~~~~~~~~

DTCC testifies to Congress on opportunities to advance financial markets | Asset Servicing Times

~~~~~~~~~

The New York Fed acts as the guardian and custodian of the gold on behalf of account holders, which includes the U.S. government, foreign governments, other central banks, and official international organizations. No individuals or private sector entities are permitted to store gold in the vault. | NewYorkFed

~~~~~~~~~

What Central Banks Do | Investopedia

On a macro basis, central banks influence interest rates and participate in open market operations to control the cost of borrowing and lending throughout an economy. Central banks also operate on a micro-scale, setting the commercial banks' reserve ratio and acting as lenders of last resort when necessary.

~~~~~~~~~

Central Bank | Wikipedia

In some countries a central bank, through its subsidiaries, controls and monitors the banking sector. In other countries banking supervision is carried out by a government department such as the UK Treasury, or by an independent government agency, for example, UK's Financial Conduct Authority.

~~~~~~~~~

Steady as we go: results of the 2023 CPMI cross-border payments monitoring survey | BIS

Enhancing cross-border payments has been a G20 priority since 2020. This ambitious programme requires action by individual jurisdictions and payment systems. The CPMI survey results show determined progress: the vast majority of payment systems have or are in the process of implementing at least one action that the G20 considers to be relevant to enhance cross-border payments.

Despite the promising number of initiatives planned to enhance cross-border payments, the survey results also highlight potential areas for further work. Projects to enhance cross-border payments cannot be seen in isolation and should complement domestic projects, given that the first and last miles of cross-border payments are typically processed in a domestic payment system.

Central banks, in their roles as catalysts and operators, are key to bringing cross-border payments forward. International organisations and standard-setting bodies, such as the CPMI, the IMF, and the World Bank, can support central banks in their ambitions.

~~~~~~~~~

Cash isn't going away, despite declining use | PaymentsSource | American Banker

~~~~~~~~~

Russia and China to cooperate on Arctic shipping route | Ship Technology

~~~~~~~~~

New Law Grants U.S. President Sweeping Powers to Block Digital Asset Access, Sparking Concerns - Crypto Daily

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Afternoon 6-8-24

Goldilocks' Comments and Global Economic News Saturday Afternoon 6-8-24

Good Evening Dinar Recaps,

Stablecoin News:

"Three Stablecoin startups are announcing funding rounds: Mountain Protocol, M^0 and Tether-backed XREX. Additionally, Paxos announced a yield earning stablecoin in Dubai, and Franklin Templeton said it would allow investors to use USDC to buy its tokenized money market fund FOBXX."

It looks like more asset managers are beginning to issue more Stablecoins. The momentum in Stablecoin production and soon to be used is an indication of where we are in the process of implementing this QFS.

There would be no reason to manufacture digital currencies that pay for tokenized assets unless there was a reason to do so. As we edge closer to the end of this month and laws go into play to govern our new QFS, "liquidity" is being built for its implementation.

Goldilocks' Comments and Global Economic News Saturday Afternoon 6-8-24

Good Evening Dinar Recaps,

Stablecoin News:

"Three Stablecoin startups are announcing funding rounds: Mountain Protocol, M^0 and Tether-backed XREX. Additionally, Paxos announced a yield earning stablecoin in Dubai, and Franklin Templeton said it would allow investors to use USDC to buy its tokenized money market fund FOBXX."

It looks like more asset managers are beginning to issue more Stablecoins. The momentum in Stablecoin production and soon to be used is an indication of where we are in the process of implementing this QFS.

There would be no reason to manufacture digital currencies that pay for tokenized assets unless there was a reason to do so. As we edge closer to the end of this month and laws go into play to govern our new QFS, "liquidity" is being built for its implementation.

As stated many times in this room, Stablecoins represent a country's currency. The use of these banking coins will create demand and price pressures. This will help to redirect our currencies' current path and send them into a more positive direction.

Going forward, Stablecoins are backed by some form of a commodity. This will give our currencies a real value and enable a deflationary effect on our Global economies. This move will reset Global currencies and put them into a positive direction over time. Ledger Insights The Motley Fool

© Goldilocks

~~~~~~~~~

Bitcoin Scarcity Grows as Miner and Exchange Reserves Drop by 183,253 BTC Since January – Bitcoin News

Over the past 158 days, starting from the beginning of the year, the quantity of bitcoin held by exchanges and miners has decreased by 183,253 BTC, valued at nearly $13 billion. Roughly 90.95% of this bitcoin withdrawal originated from cryptocurrency exchange reserves.

From Jan. 1 to June 7, 2024, a substantial amount of bitcoin (BTC) has exited the reserves of bitcoin miners and exchanges. Although less than 10% of the total originated from BTC miners, their combined holdings are steadily decreasing.

This continuous depletion of bitcoin from exchanges and miners not only underscores a trend toward greater individual holding but also amplifies bitcoin’s inherent value through increased scarcity.

~~~~~~~~~

Meld Gold and Ripple are partnering to bring Real World Assets (RWAs) to the XRP Ledger (XRPL) platform. This partnership will bring in institutional grade functionality along with secure and efficient protocols.

This is done through leveraging the Algorand Standard Asset Core functionality. In essence, Meld will tokenize digital gold in the form of a Meld Digital Gold Certificate. Each token will be equal the value of 1 gram of physical gold.

The implementation of this new digital asset (Meld Gold) is just around the corner. Fungible gold and silver assets on XRPL will begin in Q3. Yes, July.

Through the use of the new digital economy, gold standard protocols uniting real world assets backed by gold and gold payment tokens are about to usher in a new Financial System.

Medium Algorand Technologies Algorand Developer

Gold will set us free!

© Goldilocks

~~~~~~~~~

A multipolar economy is needed to reduce the risk of global economic instability caused by problems in large economies, Dilma Rousseff, a former president of Brazil and the current president of the New BRICS Development Bank (NDB), said Thursday. | Anadolu Agency

~~~~~~~~~

Sturdy central bank gold buying since 2009 and a rising gold price has grown the precious metal’s share of global international reserves to the detriment of fiat currencies. By the end of 2023 gold surpassed the euro and the next fiat currency to be challenged is the US dollar. | ZeroHedge

👆 Goldilocks pointed to this article

~~~~~~~~~

New Texas-based stock exchange looks to take on Nasdaq, NYSE | CBS News Texas

"TXSE will be a "fully electronic national securities exchange" that seeks to expand access to U.S. capital markets "for all investors while providing greater access and alignment for public companies and those seeking access to public capital," according to the press release."

~~~~~~~~~

Bretton Woods meeting 2024 | Twitter

“Where we go with our money isn’t being led by central banks, its led by society. It’s our mandate to provide for the needs of the population.

We need to replace our plastics and metals for bits and bites, and we can do that in many different ways.

The physical economy is going down, and the digital economy is going up”

~~~~~~~~~

Join the Seeds of Wisdom Team SNL call with Freedom Fighter breaking down Goldilock's weekly posts! Jester will be joining too! SNL Call Link

9 pm EDT / 8 pm CDT / 6 pm PDT

The SNL Q & A room will be open at 8 pm ET, 7 pm CT, and 5 pm PT to ask questions that will be answered on the call if time allows! Listeners can also ask questions on the call following Freedom Fighter's breakdown!

The call will be recorded and you can find it in the Archive Call Room after the call is over.

~~~~~~~~~

Gold is in an intermediate degree profit-taking event | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps