Goldilocks' Comments and Global Economic News Saturday Evening 1-27-24

Goldilocks' Comments and Global Economic News Saturday Evening 1-27-24

Good Evening Dinar Recaps,

Easing of sanctions against Venezuela boosts marine and energy sectors

"Since June, the US Treasury’s Office of Foreign Assets Control (OFAC) has issued seven general licenses authorizing certain business activities or transactions with Venezuela, including those relating to the export of liquefied petroleum gas (General License 40B), gas sector operations (General License 44), the state-run mining company Minerven (General License 43) and the state-run airline Conviasa (General License 45A)."

This releasing of sanctions is creating opportunities for traders on the market that once were prohibited. The country's control of the largest crude oil Market makes this country's Energy and Marine sector of the markets very appealing.

This will create new demands on the Venezuela Bolivar as this year progresses. These demands will create opportunities for people in the Forex Market to capitalize on price pressures pushing new volumes and new values going forward.

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Saturday Evening 1-27-24

Good Evening Dinar Recaps,

Easing of sanctions against Venezuela boosts marine and energy sectors

"Since June, the US Treasury’s Office of Foreign Assets Control (OFAC) has issued seven general licenses authorizing certain business activities or transactions with Venezuela, including those relating to the export of liquefied petroleum gas (General License 40B), gas sector operations (General License 44), the state-run mining company Minerven (General License 43) and the state-run airline Conviasa (General License 45A)."

This releasing of sanctions is creating opportunities for traders on the market that once were prohibited. The country's control of the largest crude oil Market makes this country's Energy and Marine sector of the markets very appealing.

This will create new demands on the Venezuela Bolivar as this year progresses. These demands will create opportunities for people in the Forex Market to capitalize on price pressures pushing new volumes and new values going forward. | Clyde Co

© Goldilocks

~~~~~~~~~~

Let's take a closer look today on what's happening in March and on March the 11th, 2024 in particular.

We already know that the Feds are doing away with the Bank Term Funding Program in March. This will deplete liquidity availability for the banking system going forward.

There is the option of lowering interest rates that will give our money more purchasing power at that time. Lowering interest rates would provide more cash flow, but will it be enough? With the amount of debt that the US owes, economists across the board say the answer to that question is no.

So, we are left with two more options. One is to use up the rest of our Repo Market liquidity program that is expected to run out by the end of this year.

This leaves us with one other option. To increase the price of gold and other commodities that are being used to back our new tokenized asset based system.

March is a turning point, a reversal point, and a pivotal point in our Global Economy. Gold has always been the bridge into new economies, and it is our pathway into the road ahead.

The use of gold in liquidating the new economy will create the acceleration and adoption of a new digital economy backed by the commodity market across all sectors of the market.

Look for new ETFs on several digital asset classes to be accelerated during this time. Movement into the new digital asset-based trading system will synchronize our banking system with our markets.

This will give us new Digital Network Protocols that are standardized and regulated under the support of gold inside our new digital economy.

All roads lead to gold, and gold will set us free.

© Goldilocks

Blue Prism

Brookings Edu

Federal Reserve 1

Federal Reserve 2

~~~~~~~~~~

It is important for us to watch what happens in Texas. Governor Abbott was in India this past week talking about trade deals between Texas and India.

Texas has its own shipping port capabilities that will allow them to trade Globally with the rest of the world. Texas has 29 official ports of entry into the Global Economy. They literally have the capability of being a self-sustaining Financial System within their own state.

If these new trade deals are successful and Texas begins to move into the new Digital Asset-Based Trading System utilizing the UPI or Unified Payment Interface mechanism in trade, we will literally be witnessing the first state in the US to move into our new Global Economy.

Watch the water.

© Goldilocks

Abbott travels to India as his national profile is growing | Houston Chronicle

Why Gov. Greg Abbott is visiting India | Axios

Texas: A Major Player in Global E-Commerce Shipping and Logistics | Cube Work

~~~~~~~~~~

Republican governors rally behind Texas in border showdown after Supreme Court ruling | https://youtu.be/LqfXHUSnp7Q?feature=shared

~~~~~~~~~~

Border standoff between Texas, feds intensifies as governor defies Supreme Court ruling | https://youtu.be/Hd-H79ua19w?feature=shared

~~~~~~~~~~

Governor: Texas can defend itself against border 'invasion | https://youtu.be/WSiwRDQp_DA?feature=shared

~~~~~~~~~~

After hearing the concerns expressed by various participants in the Stellar ecosystem — including contract developers, wallet developers, validators, and tools builders — the SDF has decided to disarm our validators to prevent them from voting to upgrade the network to Protocol 20 on January 30. As the network introduces the biggest protocol change to date, it's important to have broad consensus at the vote, but also in the lead-up to it — everyone needs to be ready.

On January 25, 2024, we notified the ecosystem of a that was discovered in Stellar Core v20.1.0 that could impact applications and services that use fee bumps for Soroban transactions if or when the Mainnet upgrades to Protocol 20. We noted that we (the ecosystem and particularly network validators) had a choice to continue with the Protocol 20 upgrade vote on January 30 or to delay it.

We at SDF spent time with the bug, saw its potential impacts and decided that the bug posed little risk given the phased rollout plan along with the implementation of best practices. But we are not an ecosystem of one.

Upgrading the network is not something SDF does alone, and to inform the decision about whether to move forward given the bug, we opened threads on the Stellar Dev Discord and our developer mailing list, and encouraged the ecosystem to weigh in. Ultimately, the robust feedback and discussions regarding this choice caused us to change our approach. Stellar Blog

👆 Will keep you updated!

"...we will coordinate to determine a future vote date once a new version of Stellar Core that contains a bug fix is released. That release should be available within the next two weeks.". SDF

~~~~~~~~~~

Key Fed Inflation Rate's Slide Puts March Rate Cut In Play; S&P 500 Wavers | Investors

The primary Federal Reserve inflation rate, the core PCE price index, showed that price pressures cooled more than expected in December, keeping a March rate cut on the table. The S&P 500 fell slightly on Friday afternoon, following another record closing high on Thursday.

~~~~~~~~~~

IRS to launch free online filing system pilot in March | The Hill

~~~~~~~~~~

‼️ ALERT – Civil War Update Texas: Massive military deployment of forces from the National Guard of Republican states to the state of Texas,

This step comes out in defiance to the administration of President Joe Biden and federal forces, to combat the increasing waves of migrants on the border between the United States and Mexico, coinciding with escalating tensions between Greg Abbott, Governor of Texas, and the Biden administration.

See video here: https://t.me/c/1545617426/74313

~~~~~~~~~~

BIS Announces Tokenization Project Among Six Initiatives for 2024 | Kryptomoney

~~~~~~~~~~

CBDCs, Green Finance Among BIS Innovation Hub Projects Announced for 2024 | Fintech Singapore

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Evening 1-26-24

Goldilocks' Comments and Global Economic News Friday Evening 1-26-24

Good evening Dinar Recaps,

The World Trade Organization has been working on reforms for some time. In the past, it has been believed that this organization has favored the larger countries. Attempts have been made to reconcile some of the mechanisms to create a "More Level Playing Field" among the smaller countries.

In 2024, a renewed mechanism is at play to settle some disputes among countries feeling the need to call into question certain trades that have been favored towards larger countries over their own.

With the upcoming 13th Ministerial Conference (MC13) in February, a meeting with several representatives from around the world to talk and implement a new mechanism put into place called the "appellate mechanism."

The appellate mechanism is governed by seven people who will make decisions on disputes that are called into question. Last year, I shared with you how foreign exchange rates were being reformed within the WTO. Now, we are witnessing many trade products being brought to the table for adjustments throughout this year.

Goldilocks' Comments and Global Economic News Friday Evening 1-26-24

Good evening Dinar Recaps,

The World Trade Organization has been working on reforms for some time. In the past, it has been believed that this organization has favored the larger countries. Attempts have been made to reconcile some of the mechanisms to create a "More Level Playing Field" among the smaller countries.

In 2024, a renewed mechanism is at play to settle some disputes among countries feeling the need to call into question certain trades that have been favored towards larger countries over their own.

With the upcoming 13th Ministerial Conference (MC13) in February, a meeting with several representatives from around the world to talk and implement a new mechanism put into place called the "appellate mechanism."

The appellate mechanism is governed by seven people who will make decisions on disputes that are called into question. Last year, I shared with you how foreign exchange rates were being reformed within the WTO. Now, we are witnessing many trade products being brought to the table for adjustments throughout this year.

You might want to start trying to understand what a "unit of measure" and "storer of value" is in gold. Our new currency values will be determined by these references.

The term "unit of value" was recently used on the Debt Clock, and it is giving us a clue as to how our new monetary system is going to measure monetary values going forward that will give us a Global Currency Reset based on these new values.

Each week, "Freedom Fighter" opens up a room for discussion utilizing the Debt Clock as a source for topics giving us clues about the new monetary system. The symbol or coins above was on the last discussion and gives us an idea of where the powers that be are taking us inside the new monetary system.

© Goldilocks

GoldFellow

US Debt Clock

Congress Link 1

Congress Link 2

~~~~~~~~~~

25 JAN, 18:50 Russia, Ukraine show readiness to cooperate IAEA

The diplomatic engagement continues, Grossi added

UNITED NATIONS, January 26. /TASS/.

The governments of Russia and Ukraine demonstrate readiness to cooperate with the International Atomic Energy Agency (IAEA), the organization’s Director General Rafael Grossi said after a UN Security Council briefing on the Zaporozhye Nuclear Power Plant (ZNPP).

"Yes, I would say by and large, yes," the IAEA chief said when asked whether the IAEA was getting the cooperation it needs from the Russian and the Ukrainian authorities.

"Of course, there are moments of frustration, mine and theirs, I guess, because sometimes, when I say things they don’t appreciate, or they would prefer me to say differently. There is tension there, but this is a little bit what the IAEA is all about," the official continued.

However, the diplomatic engagement continues, Grossi added. "I think, this is what we need. We need diplomacy," he said. https://tass.com/world/1737561

~~~~~~~~~~

Will the bank term funding program be extended?

The Federal Reserve is likely to allow its Bank Term Funding Program to expire on March 11, 2024, rather than renew the banking crisis-era lending program, according to commentary from Wrightson ICAP. Dec 26, 2023 Seeking Alpha

~~~~~~~~~~

What is bank term funding program?

Program: To provide liquidity to U.S. depository institutions, each Federal Reserve Bank would make advances to eligible borrowers, taking as collateral certain types of securities. 2 days ago

Federal Reserve

~~~~~~~~~~

What is the band term funding program?

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. Federal Reserve

~~~~~~~~~~

Now, let's take a look at why the "Bank Term Funding Program" that's going away providing liquidity to our banks is so important. We have talked about this over two weeks ago, but I have yet to hear many people explain the importance of this in moving towards the new system.

Will it be easy? No, but it will be worth it.

On March 11th, 2024, this will be a shift in capital requirements to sustain our banking system going forward from BTFP to Basel 3. It will put a tremendous stress on gold in making this shift.

Let's put some of the pieces together. By that time, we will have tokenized assets that are backed by gold and other commodities already on the market trading in the new Digital Asset-Based Trading System.

This will create a demand for gold to go into a real value and our tokenized assets across all sectors of the market to move into their new prices because of it. It includes the Forex Market where you and I hold many of our currencies from around the world.

Since our assets across all Market sectors have been inflated for such a long time, it will require value adjustments to take place shifting our financial system from a stock market to a commodity Market led system.

Here, our stock market and banking system will be synchronized and coordinated by our new Basel 3 requirements. It won't take place all in one day, but the process will begin. Federal Reserve

© Goldilocks

~~~~~~~~~~

CFTC Customer Advisory Cautions the Public to Beware of Artificial Intelligence Scams | CFTC

~~~~~~~~~~

CFTC Staff Releases Request for Comment on the Use of Artificial Intelligence in CFTC-Regulated Markets | CFTC

~~~~~~~~~~

Prices of New Houses Drop to 2-Year Low | Wolf Street

~~~~~~~~~~

This is why XRP kills swift 😳 #crypto #xrp #bitcoin #shorts

https://youtube.com/shorts/uio4NySWBD0?feature=shared

~~~~~~~~~~

Plaid is Everywhere in Fintech Today | Fintech Nexus

~~~~~~~~~~

Release No.: IC-35117 <-SEC pdf file Date: Jan. 26, 2024

Details: Notice of Applications for Deregistration under Section 8(f) of the Investment Company Act of 1940

BNY Mellon International Securities Funds, Inc. 811-07502

Corbin Multi-Strategy Fund, LLC 811-22517

EQ Premier VIP Trust 811-10509

Fiera Capital Series Trust 811-23220

JPMorgan Insurance Trust 811-07874

Strategas Trust 811-23608

~~~~~~~~~~

Tucker Carlson Interviews Governor Greg Abbot on the Border Crisis in Texas

Confirmed: 10 states have sent NG or other law enforcement to protect our border!

"There have been about 10 [states] so far that have sent National Guard or other law enforcement. They now are joined together with us and this is a fight for the future of America," Abbott said.

https://t.me/c/1545617426/74292

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Evening 1-25-24

Goldilocks' Comments and Global Economic News Thursday Evening 1-25-24

Good evening Dinar Recaps,

We are approaching a sink-or-swim situation. The Banking System has prepared well for the up-and-coming volatility inside the markets and banking system with new capital requirements to minimize many of the fluctuations that are about to come our way in every sector of the market.

New Tokenized Assets are creating new Protocols and opportunities to bring in money spent outside of the banking system. These new assets will be governed through artificial intelligence in many cases capable of helping investors navigate through the new landscape of the new digital economy.

As these forces are brought together, price distortions will come into the new financial system seeking new algorithmic support levels. It will be the new support levels that will determine new prices on the road ahead of us as Global Markets begin to transition into a Global Currency Reset capable of measuring and controlling these new rates through new Quantum Technologies.

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Thursday Evening 1-25-24

Good evening Dinar Recaps,

We are approaching a sink-or-swim situation. The Banking System has prepared well for the up-and-coming volatility inside the markets and banking system with new capital requirements to minimize many of the fluctuations that are about to come our way in every sector of the market.

New Tokenized Assets are creating new Protocols and opportunities to bring in money spent outside of the banking system. These new assets will be governed through artificial intelligence in many cases capable of helping investors navigate through the new landscape of the new digital economy.

As these forces are brought together, price distortions will come into the new financial system seeking new algorithmic support levels. It will be the new support levels that will determine new prices on the road ahead of us as Global Markets begin to transition into a Global Currency Reset capable of measuring and controlling these new rates through new Quantum Technologies.

© Goldilocks

~~~~~~~~~~

SEC opens comment period on proposal that would allow options trading on BlackRock's spot bitcoin ETF | The Block

~~~~~~~~~~

Fintech, Including Crypto, Is Reshaping How Funds Flow Worldwide | Forbes

~~~~~~~~~~

XRP BANKS CONFIRMED✅ 👀 #xrp #btc #crypto

https://youtube.com/shorts/pduFSdScfRs?feature=shared

~~~~~~~~~~

Millions to be left without access to cash as bank branch closures speed up at ‘alarming rate’ | GB News

~~~~~~~~~~

INVESTMENT COMPANY ACT OF 1940 Release No. 35097 / January 24, 2024 | Pdf Link

Release No.:IC-35097 Date: Jan. 24, 2024 Details:

Order Under Section 8(f) of the Investment Company Act of 1940 Declaring that Applicant has Ceased to be an Investment Company

AOG Institutional Diversified Master Fund 811-23765 Order: Rel No. IC-35097

AOG Institutional Diversified Tender Fund 811-23766 Order: Rel No. IC-35098

ASYMmetric ETFs Trust 811-23622 Order: Rel No. IC-35099

BlackRock 2022 Global Income Opportunity Trust 811-23218 Order: Rel No. IC-35100

BlackRock Florida Municipal 2020 Term Trust 811-21184 Order: Rel No. IC-35101

BlackRock Muni New York Intermediate Duration Fund, Inc. 811-21346 Order: Rel No. IC-35102

BlackRock Municipal 2020 Term Trust 811-21181 Order: Rel No. IC-35103

BlackRock New York Municipal Bond Trust 811-21037 Order: Rel No. IC-35104

Cushing Mutual Funds Trust 811-23293 Order: Rel No. IC-35105

Eaton Vance Tax-Managed Buy-Write Strategy Fund 811-22380 Order: Rel No. IC-35106

Goldman Sachs Credit Income Fund 811-23498 Order: Rel No. IC-35107

Invesco BLDRS Index Funds Trust 811-21057 Order: Rel No. IC-35108

Kayne Anderson NextGen Energy & Infrastructure, Inc. 811-22467 Order: Rel No. IC-35109

Mutual of America Variable Insurance Portfolios, Inc. 811-23449 Order: Rel No. IC-35110

Nuveen Corporate Income November 2021 Target Term Fund 811-23075 Order: Rel No. IC-35111

Nuveen Select Tax Free Income Portfolio 2 811-06622 (Order: Rel No. IC-35112

Nuveen Select Tax Free Income Portfolio 3 811-06693 Order: Rel No. IC-35113

~~~~~~~~~~

👆 If you own any of these investments above, you may want to take a look at them. Be sure to read that one page PDF file.

This is not financial advice, you just may simply want to take this to your wealth manager to see if there's anything you need to do with these assets.

Things are changing my friends.

@ Goldilocks

~~~~~~~~~~

What is Bitcoin Halving & How Does it Affect BTC's Price?

"Bitcoin halving events have historically been associated with price increases. This is because the reduced rate of new Bitcoin creation can cause scarcity, potentially driving up demand and, as a result, the price."

Do you see how the timing of this event and why the major players in the game such as Black Rock have invested on the ground floor of this spot Bitcoin ETF opportunity?

Bitcoin tends to be the leader in the digital economy, and those invested in digital assets during this rise will reap the benefits. This includes our new Digital Asset Based Trading System.

Each sector of the market that has transitioned or on their way to transitioning into the new digital economy will experience cause and effects on the decisions being made during this time.

© Goldilocks

AXI Link

Buy Bitcoin

~~~~~~~~~~

A critical area that requires reform in the WTO is equity. The current system is often criticised for favouring developed countries over developing countries, leading to an imbalance in global trade relations. ORF Link

~~~~~~~~~~

👆 This is why the WTO has been in economic reforms as of late. Attempts are being made to level the playing field.

~~~~~~~~~~

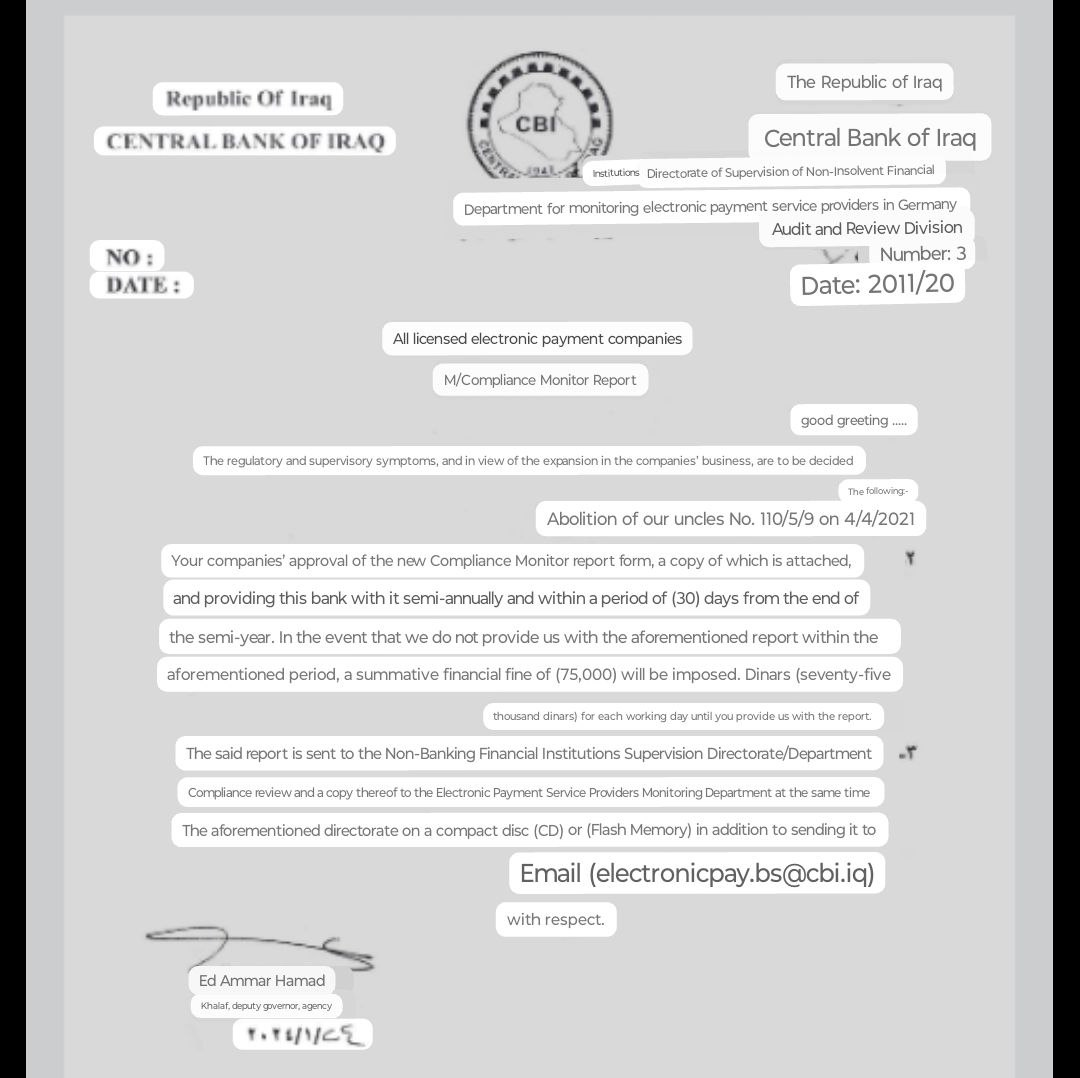

For regulatory and supervisory purposes and in view of the expansion in the work of all licensed electronic payment companies, the following was decided.. https://cbi.iq/news/view/2507

~~~~~~~~~~

🔴 BANK RUNS ALERT: European Central Bank Monitors Social Media For Red Flags, Has Liquidity Concerns https://youtu.be/EuBHi8lTj3Q?feature=shared

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday Evening 1-24-24

Goldilocks' Comments and Global Economic News Wednesday Evening 1-24-24

Good Evening Dinar Recaps,

A Rewiring of the World’s Biggest Bond Market Will Transform Trading

"Securities and Exchange Commission Chair Gary Gensler, who once oversaw federal debt management at the US Treasury, has championed a move to require the vast majority of Treasuries trading to migrate to a central counterparty clearinghouse — an intermediary between buyers and sellers that assumes ultimate responsibility for the transaction."

This movement of the Bond Market or US Treasuries to a Central Clearing House for Market transactions creates a burden of care upon the dealers to screen their clients more carefully in trading transactions between two parties such as foreign currency trades.

This will create less liquidity taking place in a trade, but the ability to collateralize one's transactions will secure all parties involved. It will shift a lot of responsibility toward the Commodities Futures Trading Commission (CFTC) where many of our new tokenized assets going forward will be governed.

This is all part of the new transition of the markets into a new digital economy. Yahoo Finance

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Wednesday Evening 1-24-24

Good Evening Dinar Recaps,

A Rewiring of the World’s Biggest Bond Market Will Transform Trading

"Securities and Exchange Commission Chair Gary Gensler, who once oversaw federal debt management at the US Treasury, has championed a move to require the vast majority of Treasuries trading to migrate to a central counterparty clearinghouse — an intermediary between buyers and sellers that assumes ultimate responsibility for the transaction."

This movement of the Bond Market or US Treasuries to a Central Clearing House for Market transactions creates a burden of care upon the dealers to screen their clients more carefully in trading transactions between two parties such as foreign currency trades.

This will create less liquidity taking place in a trade, but the ability to collateralize one's transactions will secure all parties involved. It will shift a lot of responsibility toward the Commodities Futures Trading Commission (CFTC) where many of our new tokenized assets going forward will be governed.

This is all part of the new transition of the markets into a new digital economy. Yahoo Finance

© Goldilocks

~~~~~~~~~~

Bitcoin-based stablecoin could rival modern stablecoins in 2024 | CryptoTvplus - The Leading Blockchain Media Firm

~~~~~~~~~~

Consistent regulatory approach globally and technical standardisations across different blockchains will be key to widespread adoption of stablecoins. | Regulation Asia

~~~~~~~~~~

Novo rolls out an embedded payroll tool for small businesses | Banking Dive

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday AM 1-24-24

Goldilocks' Comments and Global Economic News Wednesday AM 1-24-24

Good Morning Dinar Recaps,

Figure Technologies Incorporated is looking for regulatory approval from US authorities.

They are looking to initiate to the public an interest-bearing stablecoin. It will establish a new category for stablecoins.

This particular stablecoin will give Federal legitimacy to the new digital economy.

If approved, Figure Technologies Incorporated will be the first issuer of a stablecoin regulated as a security in the United States.

The stablecoin will accrue daily interest, and it will distribute a monthly gain to their holders.

The interest will come from reserves backed by the Treasury, Commercial Paper (cash), Corporate Bonds (SOFR) and other assets.

© Goldilocks

Goldilocks' Comments and Global Economic News Wednesday AM 1-24-24

Good Morning Dinar Recaps,

Figure Technologies Incorporated is looking for regulatory approval from US authorities.

They are looking to initiate to the public an interest-bearing stablecoin. It will establish a new category for stablecoins.

This particular stablecoin will give Federal legitimacy to the new digital economy.

If approved, Figure Technologies Incorporated will be the first issuer of a stablecoin regulated as a security in the United States.

The stablecoin will accrue daily interest, and it will distribute a monthly gain to their holders.

The interest will come from reserves backed by the Treasury, Commercial Paper (cash), Corporate Bonds (SOFR) and other assets. CryptoNewsFlash Link

© Goldilocks

~~~~~~~~~~

"To:

Chief Executive Officers of All National Banks, Federal Savings Associations, and Federal Branches and Agencies; Department and Division Heads; All Examining Personnel; and Other Interested Parties

The Securities and Exchange Commission (SEC) has adopted final rules that shorten the standard settlement cycle for most broker-dealer transactions from the second business day after the trade date (T+2) to the first business day after the trade date (T+1). The compliance date for this change is May 28, 2024."

The final rule means it's being implemented now, and all banks have until the end of May to be compliant. This does not affect currency rate changes.

The next and final step later this year is to go to instant settlement cycles. OCC Link

© Goldilocks

~~~~~~~~~~

Two important events this week could determine the future of Fed rate policy | CNBC

~~~~~~~~~~

Banking Announcement:

The disruption to traffic via the Red Sea/Suez Canal route could continue for months.

The higher freight costs and the delays in deliveries could reignite inflation.

Central bank interest rate cuts could be delayed by a few months if monetary policymakers see an uptick in inflation.

OilPrice Link

~~~~~~~~~~

Digital economy named as one of the main vectors of co-operation between Russia and India | TV BRICS, 22.01.24

"We are united by the common goal of building the most modern infrastructure, creating a safe and comfortable urban environment. One of the most promising areas of our co-operation is undoubtedly information technology and digital economy. India and Russia are striving to become leaders in this field, and joining forces can create a synergistic effect," Cheremin said.

~~~~~~~~~~

From stall to supermarkets, India’s QR codes show the future of payments. India’s Unified Payments Interface revolutionises finance for more than 1 billion people The Sydney Morning Herald

~~~~~~~~~~

2024-01-22 07:13:55

Vietnam Digital Freight Forwarding Market Precision Pathways Navigating the Importance of Market Segmentation | Taiwan News

~~~~~~~~~~

Trade settlement in Chinese RMB soars 600pc | Business Recorder

~~~~~~~~~~

UK Regulators Consult on Operational Resilience for Critical Third Parties | Katten Muchin Rosenman LLP | JDSupra

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Tuesday Evening 1-23-24

Goldilocks' Comments and Global Economic News Tuesday Evening 1-23-24

Good evening Dinar Recaps,

"On 27 December 2023, the Hong Kong Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA) jointly issued a consultation paper1 (the Consultation) proposing regulatory regime for fiat-referenced stablecoin (FRS)2 issuers in Hong Kong.

The Consultation aims to establish licensing, supervision, and enforcement measures that align with global standards to effectively control the existing and potential risks linked to the development of stablecoins in Hong Kong.

The HKMA plans to launch a "regulatory sandbox" for potential issuers to facilitate the observation of stablecoins at the regulatory level in a controlled environment and will shortly be announcing the details of the arrangement."

We have gone over what a sandbox is before in this room. A sandbox is used to test and prepare for regulation a group of assets, and this one is testing Stablecoins. Stablecoins represent a currency inside of a country. In order for Hong Kong to test the currencies that trade with them in digital format, they are going through this testing period, so they can prepare these new Stablecoins for regulation under Global Standards on the new digital economy.

Goldilocks' Comments and Global Economic News Tuesday Evening 1-23-24

Good evening Dinar Recaps,

"On 27 December 2023, the Hong Kong Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA) jointly issued a consultation paper1 (the Consultation) proposing regulatory regime for fiat-referenced stablecoin (FRS)2 issuers in Hong Kong.

The Consultation aims to establish licensing, supervision, and enforcement measures that align with global standards to effectively control the existing and potential risks linked to the development of stablecoins in Hong Kong.

The HKMA plans to launch a "regulatory sandbox" for potential issuers to facilitate the observation of stablecoins at the regulatory level in a controlled environment and will shortly be announcing the details of the arrangement."

We have gone over what a sandbox is before in this room. A sandbox is used to test and prepare for regulation a group of assets, and this one is testing Stablecoins. Stablecoins represent a currency inside of a country. In order for Hong Kong to test the currencies that trade with them in digital format, they are going through this testing period, so they can prepare these new Stablecoins for regulation under Global Standards on the new digital economy.

This will give us more clarity on the payment side of the new digital economy. On February the 29th, 2024, this consultation period will be over. At that time, they will be able to move forward with their Stablecoin in Hong Kong.

The beauty of this venue is that several other stablecoins will be tested and capable of being regulated according to Global Standards through this process as well.

This puts us inside the implementation stage for stablecoins to begin adoption into the new Digital asset-based Trading System. These new stablecoins on the new digital economy will then be able to put price pressures on the foreign currencies from around the world.

© Goldilocks

https://www.jdsupra.com/legalnews/hk-licensing-regulatory-sandbox-for-7963008/

~~~~~~~~~~

👆 👇 Freedom Fighter and Jester will break down these two articles on the SNL Call 👆 👇

➡️ SNL Call 1/27/24 at 9pm EST ~: LINK

➡️ SNL Q and A opens the day of the call ~ Link

👆 👇 Freedom Fighter and Jester will break down these two articles on the SNL Call 👆 👇

~~~~~~~~~~

"Between now and March the 11th, 2024, many adjustments will be made to secure company growth through these new Basel 3 Capital requirements. At that time, old liquidity will give way to a commodity-based support system."

Do you remember this quote by me on January 16th, 2024? On that day, we shared an article together on how the old liquidity system is going away and the reliance on a commodity-based system will be emerging early March.

Take a close look at the article today and see how all of these steps since the beginning of January and even January of 2 years ago have been layering themselves one on top of the other getting us to the point where we can start seeing price pressures starting to be made on the Forex currency markets.

Below is the old article for your viewing. Read for yourself, it is in black and white from Governmental Financial resources. The first one will give you the date you're looking to see.

This shift will begin putting price pressures on gold, paper currencies, and our new digital assets because of their connection to one another going forward. Banking Dive Link ISDA Link

© Goldilocks

~~~~~~~~~~

The new language of payments: BAFT releases whitepaper on navigating the ISO 20022 transition | Trade Finance Global

~~~~~~~~~~

Artificial intelligence in central banking

Central banks have been early adopters of machine learning techniques for statistics, macro analysis, payment systems oversight and supervision, with considerable success.

Artificial intelligence brings many opportunities in support of central bank mandates, but also challenges – some general and others specific to central banks.

Central bank collaboration, for instance through knowledge-sharing and pooling of expertise, holds great promise in keeping central banks at the vanguard of developments in artificial intelligence.

https://www.bis.org/publ/bisbull84.htm

~~~~~~~~~~

Protocol 20 Vote is One Week Out

On January 30th, the network's validators will cast their votes, and if they approve the upgrade, the Stellar network will immediately switch from Protocol 19 to Protocol 20.

This is super important and exciting!

After more than two years of technical discussions, hundreds of thousands of lines of code, and over 150 projects (that we know of) deployed on Testnet, the upgrade will mark the era of a new Stellar smart contracts tech stack, one that delivers productivity through a batteries-included developer experience built to scale.

That said, validators are opting to increase capacity for Soroban transactions on Mainnet through a phased approach. The limited capacity for Soroban transactions on Mainnet means that Soroban dapps won’t be ready for use at scale until later phases. Limits on transactions that make use of existing Stellar operations won't be impacted, which means existing applications will continue uninterrupted.

With one week left before the vote, please upgrade all of your mission-critical software in preparation for Protocol 20. A new era of the Stellar Network is upon us, make sure you’re ready for it! Stellar Blog

~~~~~~~~~~

After Coronavirus 'War,' Bretton Woods-Style Shakeup Could Dethrone the Dollar

Remember, we have talked several times in this room that currency revaluations happen during or just after a war. It has happened time after time throughout history. Coin Desk Link

© Goldilocks

~~~~~~~~~~

"What is the difference between distressed and opportunistic credit?

Dedicated distressed credit funds have almost 'disappeared' and been replaced by opportunistic credit or 'special situations' funds which typically target a much less cyclical opportunity set that is less dependent on a default cycle while retaining flexibility to invest in bankruptcy and restructuring scenarios."

"It may be helpful to think of opportunistic credit as an investment in dislocation. Put simply, it's a strategy that seeks to capitalize on periodic disruptions across public and private credit markets that can cause assets to become mispriced."

Take a look at these articles below, and you will notice how many companies are currently restructuring their debt and moving into opportunistic credit.

© Goldilocks

The Frontier Line

AB - AllianceBernstein

SEC Link

~~~~~~~~~~

👆 We are revaluing and refactoring in new prices on all sectors of the market going forward.

Forex is one of them.

© Goldilocks

~~~~~~~~~~

"Agents of foreign remittance service providers ( Western Union, MoneyGram ) and external remittances."

Iraq is sharing with us their ways of moving money from one country to another. This can be done individually, through a business, or government transactions.

© Goldilocks

https://cbi.iq/news/view/2506

~~~~~~~~~~

Treasury officials call for action from US policymakers to regulate crypto before the next crisis hits | The Block

~~~~~~~~~~

FTX Sold About $1B of Grayscale's Bitcoin ETF (GBTC): Sources | Coindesk

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 1-22-24

Goldilocks' Comments and Global Economic News Monday Evening 1-22-24

Good Evening Dinar Recaps,

"Digital Assets Set to Disrupt Dollar Dominance"

Bitcoin, the growth of Stablecoins, and Central Bank Digital Currencies are expected to chip at the dollar dominance this year.

These disruptions will cause a recalculation and a refactoring of the dollar value in relation to other currencies around the world.

Price pressures on these new assets will begin to formulate new patterns and support levels for these new assets, and this is when you start to see the markets begin to price in new valuations.

We will be monitoring these changes as they take place.

© Goldilocks

Goldilocks' Comments and Global Economic News Monday Evening 1-22-24

Good Evening Dinar Recaps,

"Digital Assets Set to Disrupt Dollar Dominance"

Bitcoin, the growth of Stablecoins, and Central Bank Digital Currencies are expected to chip at the dollar dominance this year.

These disruptions will cause a recalculation and a refactoring of the dollar value in relation to other currencies around the world.

Price pressures on these new assets will begin to formulate new patterns and support levels for these new assets, and this is when you start to see the markets begin to price in new valuations.

We will be monitoring these changes as they take place.

© Goldilocks

https://www.cryptotimes.io/digital-assets-set-to-disrupt-dollar-dominance/

~~~~~~~~~~

US Virginia State Senator Proposes Bill Protecting Digital Asset Miners and Validators | Finance Yahoo

~~~~~~~~~~

U.S. Senators Unveil Innovative Legislation to Foster Collaboration Against Crypto Crimes

In an effort to navigate the evolving landscape of crypto assets, U.S. Senators Bill Hagerty and Cynthia Lummis have introduced the Preventing Illicit Finance Through Partnership Act of 2024.

The bill, designed to combat the misuse of crypto assets, aims to foster collaboration between federal regulators and the private sector. Senators Hagerty and Lummis, both members of the Senate Banking Committee, emphasize the importance of distinguishing bad actors without stifling the growth of the emerging crypto industry.

The Preventing Illicit Finance Through Partnership Act proposes the establishment of an information-sharing pilot program dedicated to combating the illicit use of crypto assets. The primary focus is on enhancing communication between federal law enforcement agencies and private companies, allowing regulators to gain insights into the crypto world and identify and eliminate bad actors.

Thecurrencyanalytics

~~~~~~~~~~

Sebi to use in-house developed generative AI tool to clear IPO applications

Markets regulator Sebi will be using a generative AI tool, which has been developed in-house, to clear IPO applications on time, as it has been found to be effective in cutting the time lag massively.

"One of our junior officers in the tech team has just developed a generative AI tool that can check the various compliances in the LODR (listing obligations and disclosure requirements) in no time.

"So, we want to deploy this and within the next few months, hopefully as much as 80 per cent of the LODR compliance checks in DRHPs, which are done manually now, will be automated using this tool," its chairperson Madhabi Puri Buch said here on Friday while addressing an event organised by investment bankers lobby AIBI. Business-Standard

~~~~~~~~~~

"BRICS Poses A Threat To America’s Ability To Weaponize The Dollar To Sanction Nations"

We talked about this a while back. There will be a need to have a governing body to oversee countries not being compliant under the new guidelines of the new digital economy.

AI and smart contracts will capture a great deal of compliance issues, but the need to govern these mechanisms is still in process.

Actions are being taken through several countries to govern their AI mechanisms.

© Goldilocks

Bitcoinik Link

AI Accelerator Institute Link

~~~~~~~~~~

Navigating the financial landscape: Trends reshaping banking for SMEs in 2024 | Daily Herald

~~~~~~~~~~

The world’s crypto user base crossed half a billion in 2023 – Crypto.com | Page One

~~~~~~~~~~

Institutional money is beginning to create new price pressures on digital assets.

These will be priced into the market.

© Goldilocks

~~~~~~~~~~

I am aware that a lot of you would like to see this become more than just a read-only room, but there are dangers in doing that for you.

One is that you become prey for those who want to take your information out of this room for their own selfish intentions. You will not go on my email list for any reason. I do plan on creating a history book from these articles, so I have purposefully used factual information in this room to help me pull together it's contents into a book. No, you will not go on to my email list even for this book. Just look for the author under the name of Goldilocks, and I will be there.

This is why you see my work copyrighted in this room just for that purpose as instructed by my publisher in protecting my work. You are free to take my information outside of this room to anyone, but the use of any content in this room belongs to my copyrighted material being gathered for the general public to read when this venture is over.

Two, it is tempting to share information that comes out of an opinion rather than actual facts the Government, the Banking System, the Markets, the Legislative process, International Lawyers, and Developers Technical understanding of the new Digital Economy.

This is a read-only room so that people can focus and learn about the new factual economy, so it can clearly help you in the projects you choose to share with your bankers down the road.

I want you to have clarity from this room to the degree it is possible for me and you to understand.

God Bless you my friends.

© Goldilocks

~~~~~~~~~~

Message from Isaac today!

"Hello 👋 I will have an update tomorrow , blessings"

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday AM 1-22-24

Goldilocks' Comments and Global Economic News Monday AM 1-22-24

Good morning Dinar Recaps,

"SEC Updates Digital Token Regulations and Asset Custodial Services"

The Securities and Exchange Commission has updated some rules to governing digital tokens and digital asset custodial services.

Key Changes:

* lifting investment restrictions on certain digital tokens

* establishment of criteria for businesses that provide custodial wallet services

* required to seek permission prior to engaging in other business activities

* SEC has also made more noticeable service standards

Goldilocks' Comments and Global Economic News Monday AM 1-22-24

Good morning Dinar Recaps,

"SEC Updates Digital Token Regulations and Asset Custodial Services"

The Securities and Exchange Commission has updated some rules to governing digital tokens and digital asset custodial services.

Key Changes:

* lifting investment restrictions on certain digital tokens

* establishment of criteria for businesses that provide custodial wallet services

* required to seek permission prior to engaging in other business activities

* SEC has also made more noticeable service standards

These took effect on January the 16th, 2024. It shows a commitment to move forward with the new Digital Asset Based Trading System by the SEC.

© Goldilocks

BNN Breaking

~~~~~~~~~~

🔴 BRICS DILEMMA: Saudi Arabia Sends Mixed Messages On BRICS, Deletes Media Reports of It Joining

https://youtu.be/9iW8pyZ2KIU?feature=shared

👆 Goldilocks pointed to this article

~~~~~~~~~~

China and Russia test ‘hack-proof’ quantum communication link for BRICS countries

Scientists in Russia and China have established quantum communication encrypted with the help of secure keys transmitted by China’s quantum satellite, showing that a Brics quantum communication network may be technically feasible.

The scientists were able to span 3,800km (2,360 miles) between a ground station close to Moscow and another near Urumqi in China’s western Xinjiang region to send two encoded images secured by quantum keys. SCMP Link

~~~~~~~~~~

US bank regulator: new liquidity rules needed to handle bank runs

Jan 18 (Reuters) - A top U.S. banking regulator on Thursday called for new liquidity rules to help lenders respond to runs by depositors of the kind that felled Silicon Valley Bank and other mid-size banks last year.

"I believe a new targeted regulatory requirement for mid-size and large banks to have sufficient liquidity to cover stress outflows over a five-day period warrants serious consideration," Acting Comptroller of the Currency Michael Hsu said, according to a copy of prepared remarks.

Hsu's remarks were the latest sign that regulators are continuing to tinker with the rule book after a spate of bank failures in the spring of 2023. (Reporting by Douglas Gillison; Editing by Chizu Nomiyama)

https://finance.yahoo.com/news/us-bank-regulator-liquidity-rules-143000226.html

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Sunday Evening 1-21-24

Good evening Dinar Recaps,

"When you trade FX forwards, you are agreeing to trade a currency pair at a set price on a set date in the future. This means you intend to buy one currency (base currency) and sell another (quote currency)at a predetermined price because you believe one of the currencies will strengthen against the other by a specific date."

Here we have it. It looks like traders are anticipating currency changes.

Let's look at a couple of reports:

1. "CLS REPORTS METEORIC 67.8% SURGE IN FX FORWARDS TRADING"

2. "CLS has reported a significant uptick in foreign exchange trading activity for December 2023."

This is a huge shift for traders. Most traders stay away from Forex opportunities because there is far more to be made in the rest of the market.

Something is changing to create this kind of shift in the minds of investors who usually stay away from this sector of the market.

© Goldilocks

Goldilocks' Comments and Global Economic News Sunday Evening 1-21-24

Good evening Dinar Recaps,

"When you trade FX forwards, you are agreeing to trade a currency pair at a set price on a set date in the future. This means you intend to buy one currency (base currency) and sell another (quote currency)at a predetermined price because you believe one of the currencies will strengthen against the other by a specific date."

Here we have it. It looks like traders are anticipating currency changes.

Let's look at a couple of reports:

1. "CLS REPORTS METEORIC 67.8% SURGE IN FX FORWARDS TRADING"

2. "CLS has reported a significant uptick in foreign exchange trading activity for December 2023."

This is a huge shift for traders. Most traders stay away from Forex opportunities because there is far more to be made in the rest of the market.

Something is changing to create this kind of shift in the minds of investors who usually stay away from this sector of the market. Finance Feeds IG Link

© Goldilocks

~~~~~~~~~~

In an era defined by rapid technological advancements, the logistics industry is experiencing a transformative shift through the integration of digital solutions.

Digital freight forwarding, a cutting-edge approach to managing and optimising cargo transportation, is proving to be a game-changer for businesses worldwide.

Talk Business Link

The GWW Link

Forbes Link

Seatrade Maritime Link

~~~~~~~~~~

SEC Publishes Risk Alert: Observations Related to Security-Based Swap Dealers.

On January 10, the SEC’s Division of Examination published a Risk Alert presenting examination and outreach observations concerning compliance with rules applicable to security-based swap dealers.

The SEC stated that in sharing these observations, the Division seeks to remind security-based swap dealers of their obligations under relevant security-based swap rules and encourage security-based swap dealers to consider improvements in their compliance programs, as may be appropriate, to further compliance with Exchange Act requirements.

The Risk Alert presents observations in the following areas:

(1) reporting of security-based swap transactions and correction of reporting errors;

(2) business conduct standards;

(3) security-based swap trading relationship documentation and portfolio reconciliation; and

(4) recordkeeping.

~~~~~~~~~~

Ten spot bitcoin ETFs launched on Jan. 11.

Eight days later, two funds have distinguished themselves in terms of net inflows: BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Investments’ Wise Origin Bitcoin Fund (FBTC).

While the BlackRock offering reached $1 billion in assets after four days of trading, Fidelity’s fund hit the milestone on its fifth trading day. BlockWorks Link

~~~~~~~~~~

For the last 15 years, people have been spending their money on Bitcoin and other cryptocurrencies. This has led to a significant rise in money leaving the banking system.

Bringing Bitcoin into the markets and soon other tokenized assets backed by a real value such as gold will add value to our assets and banking system that supports these new digitized portfolios.

Currently, money is coming back to the banks through a new digital asset-based trading system with spot Bitcoin ETF being the first to step into the game.

The difference is going to be in the area of our new virtual assets having a real-world value going forward with the ability for AI and crypto networks to standardize the protocols inside our banking system under a fixed value of gold and other commodities.

This move from a fiat-based debt system to a sound money system gives the new QFS real numbers to work with in computing trades between countries and Cross-border International Trading and Bank the Bank transfers.

Standard protocols will provide security and efficiency and the ability to move our money at the push of a button. Investopedia Link

© Goldilocks

~~~~~~~~~~

Amid Collapsed Demand for Existing Homes, Prices Drop Further, Supply Highest for any December since 2018, New Listings Come out of the Woodwork | Wolf Street

~~~~~~~~~~

Africa stuck in debt trap as restructuring efforts continue - Business News

~~~~~~~~~~

Watch the Debt Clock at 6pm ET tonight! A Secret Message appears every Sunday, Tuesday, and Thursday at 6pm ET. Join the discussions in the Living Room as we try to decode the message!

Discussions ON THE DEBT CLOCK Topic begin at 6pm ET

Join in the fun with your decoding ideas.

While the Debt Clock topic is being discussed please stay on topic. Off-topic comments during this time are subject to being removed. Thank you The Living Room Link The Debt Clock Link

The Debt Clock on the SOWT Website Link

~~~~~~~~~~

"Breaking: US Banks Adopt Ripple’s XRP for International Payments" | ZA Investing

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Evening 1-20-24

Goldilocks' Comments and Global Economic News Saturday Evening 1-20-24

Good evening Dinar Recaps,

Graham Steele, U.S. Treasury Assistant Secretary for Financial Institutions, calls for establishing crypto regulation standards to preempt potential crises.

U.S. Treasury Assistant Secretary for Financial Institutions Graham Steele emphasized establishing standards before potential crises occur. Speaking at a George Washington University Law School event, Steele highlighted the opportunity for policymakers to learn from past financial crises, like those leading to the Dodd-Frank Act and the National Bank Act.

“For crypto-assets, policymakers have a chance to act before a crisis to adopt higher standards that support responsible innovation,” Steele said.

He stressed the balance needed in legislative proposals, advocating for regulations that bolster innovation without compromising existing financial regulations.

Goldilocks' Comments and Global Economic News Saturday Evening 1-20-24

Good evening Dinar Recaps,

Graham Steele, U.S. Treasury Assistant Secretary for Financial Institutions, calls for establishing crypto regulation standards to preempt potential crises.

U.S. Treasury Assistant Secretary for Financial Institutions Graham Steele emphasized establishing standards before potential crises occur. Speaking at a George Washington University Law School event, Steele highlighted the opportunity for policymakers to learn from past financial crises, like those leading to the Dodd-Frank Act and the National Bank Act.

“For crypto-assets, policymakers have a chance to act before a crisis to adopt higher standards that support responsible innovation,” Steele said.

He stressed the balance needed in legislative proposals, advocating for regulations that bolster innovation without compromising existing financial regulations. (https://twitter.com/steelewheelz)

https://coinmarketcap.com/community/articles/65a99bdd0e7cd25ca6b0970b/

~~~~~~~~~~

Sergey Nazarov, Co-Founder, Chainlink, said:

“We’re excited to support the adoption of stablecoins across a variety of cross-chain use cases. I’m pleased to see that the defense-in-depth security infrastructure of CCIP, with multiple layers of decentralization, is something highly valued by developers building with USDC. It’s also exciting to see CCIP’s advanced risk management features have such a value-added role to play in how USDC can be sent in a way that complies with various key user requirements.”—

Here we go. The USDC coin was tested all last year and found to have a stable value based on use case scenarios and its support through the commodity sector.

At this time, USDC coin has been integrated and approved to be on several networks across the Digital Asset Based Trading System. The USDC coin is currently going through the SEC process to be sold as a tokenized asset in the new digital markets.

The USDC is now capable of crossing various lines of networks securely through Chainlink's Cross-Chain Interoperability Protocol CCIP. The system has its own messaging system capable of giving instructions about the transaction. Crowd Fund Insider Link Chain Link

© Goldilocks

~~~~~~~~~~

Court decisions could scale back SEC authority over crypto industry | Fox Business

~~~~~~~~~~

Technology Cooperation Is Set to Radically Improve Global Trade - Modern Diplomacy

~~~~~~~~~~

Protocol 20 is moving forward January 30th, 2024. It looks like all the pieces of the puzzle are put together at this point on the Stellar Network. Real-life sectors of all markets will be tested. Let the games begin. https://youtu.be/T9lTA54TJVo?feature=shared

© Goldilocks

~~~~~~~~~~

What are Asset-Backed Tokens? Definition, Types & Advantages | Techopedia

~~~~~~~~~~

Regulator adjusts rules for digital token investment | Bangkok Post

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Late Friday Evening 1-19-24

Goldilocks' Comments and Global Economic News Late Friday Evening 1-19-24

Good Evening Dinar Recaps,

Washington, D.C. — "The Commodity Futures Trading Commission today announced it has issued an Order of Designation to IMX Health, LLC, granting it designation as a contract market (DCM). IMX Health is a limited liability company registered in Delaware and headquartered in Chicago, Illinois."

Intelligent Medicine Exchange IMX has been awarded a Securities futures contract. This will give individual and institutional market investors the ability to invest in various sectors of the healthcare ecosystem.

This means that an investor will be capable of investing in various drugs that are used in a patient's care along with new Quantum Technologies for the use of healing care.

Creating a financial exchange for the healthcare economy enables technological advances to move forward as tokenized assets in the markets.

© Goldilocks

Goldilocks' Comments and Global Economic News Late Friday Evening 1-19-24

Good Evening Dinar Recaps,

Washington, D.C. — "The Commodity Futures Trading Commission today announced it has issued an Order of Designation to IMX Health, LLC, granting it designation as a contract market (DCM). IMX Health is a limited liability company registered in Delaware and headquartered in Chicago, Illinois."

Intelligent Medicine Exchange IMX has been awarded a Securities futures contract. This will give individual and institutional market investors the ability to invest in various sectors of the healthcare ecosystem.

This means that an investor will be capable of investing in various drugs that are used in a patient's care along with new Quantum Technologies for the use of healing care.

Creating a financial exchange for the healthcare economy enables technological advances to move forward as tokenized assets in the markets.

© Goldilocks

https://www.cftc.gov/PressRoom/PressReleases/8849-24

https://www.imxhealth.com/

~~~~~~~~~~

Conservatives pitch last-minute border amendment on bill to avert shutdown | ABC News

~~~~~~~~~~

What banks are switching to digital currency?

The pilot will test how banks using digital dollar tokens in a common database can speed up payments. Participating banks include BNY Mellon, Citi, HSBC, Mastercard, PNC Bank, TD Bank, Truist, U.S. Bank and Wells Fargo.Dec 12, 2022 Baker Tilly Link

~~~~~~~~~~

Will banks start using cryptocurrency?

In early January, the OCC announced that national banks and federal savings associations can now use public blockchains and stablecoins to perform payment activities. This opens the door for banks to have the ability to process payments much quicker and without the need of a third-party agency.

How Cryptocurrencies May Impact the Banking Industry

~~~~~~~~~~

Is Bank of America changing to digital currency?

Central bank digital currencies (CBDCs) are coming, but a digital dollar is unlikely in the near term, Bank of America (BAC) said in a report on Monday. Nov 15, 2023

U.S. CBDC Is Unlikely in the Near Term: Bank of America - CoinDesk

~~~~~~~~~~

How many banks are using blockchain?

Thus, in a bid to adopt blockchain technology in India for providing various financial services, 15 banks, including 11 private sector, and four PSBs have formed Indian Banks' Blockchain Infrastructure Company Private Limited (IBBIC). May 25, 2023 Blockchain technology and Indian Banking Industry. - LinkedIn

~~~~~~~~~~

How many banks own cryptocurrency?

From 2021 to the end of 2022, at least 23 banks are known to have invested in the crypto world. These included big names like Morgan Stanley, BNY Mellon, Citigroup, and United Overseas Bank. Apr 14, 2023

.

How Many Banks are Using Cryptocurrency in 2023?

~~~~~~~~~~

Is Bank of America using XRP?

This partnership goes beyond 2020, as some of BofA's senior executives have been instrumental in setting up RippleNet's compliance standards for international payments. The bank plays a central role in ensuring Ripple XRP's legal and operational consistency. Ripple (XRP): Everything you Need to Know - Atato

~~~~~~~~~~

Will cash become obsolete?

As people move toward more electronic or digital forms of payment, it might seem like paper money is on its way toward obsolescence. But experts say that cash will always be around. Apr 21, 2023

What would happen if paper money became obsolete? - Marketplace.org

~~~~~~~~~~

Why are countries ditching the US dollar?

The US dollar has been the world's reserve currency for decades, but its dominance is fading. Sanctions against Russia have spurred other countries into considering backup currencies for trade. US monetary policies, the strong USD, and structural shifts in the global oil trade also contribute. Dec 27, 2023

3 reasons countries around the world want to break up with the dollar ()

~~~~~~~~~~

Is digital currency here to stay?

If you're interested in a career in business, fintech, accounting or a similar field, you'll need a solid understanding of what digital currencies are and the impact they continue to have on the global market. Not only is digital cash likely here to stay—but you will likely be working with it in your future career. Oct 31, 2023 Understanding Digital Currency and Its Far-Reaching Impacts | Keiser ()

~~~~~~~~~~

In late 2023, the Consumer Financial Protection Bureau (CFPB) proposed a rule that would subject nonbank fintech companies to the CFPB’s authority. The CFPB articulated that it intends the rule to “level the playing field” between banks and fintech companies by regulating digital payments, such as peer-to-peer mobile payment apps. This would add an extra layer of oversight beyond the federal and state money transmitter laws traditionally used to regulate these types of services. JD Supra Link

👆 Goldilocks pointed to this article

~~~~~~~~~~

It’s Time to Explore Institutional DeFi

Technology continually evolves and modernizes financial services by creating new ways of executing and recording transactions. Each step in this evolution brings new business opportunities. For example, dematerialization replaced paper certificates with digital ones in the form of electronic book entries, fostering the rise of electronic payments and trading. That, in turn, made securitization possible, which added value to previously illiquid assets such as mortgages.

Despite recent waves of digitization, trillions of dollars worth of real-world assets are recorded in a multiplicity of ledgers that remain separate from messaging networks. This means that financial intermediaries have to record transactions on siloed ledgers and then message each other to reconcile their books and finalize the settlement. The need for coordination across ledgers and networks between entities creates inefficiencies that increase costs and risks, lengthen settlement times, and in general add overhead to financial services. Oliver Wyman Forum

~~~~~~~~~~

Managing Sovereign Wealth Funds of other countries such as the Middle East in the US is met with great challenges, but it has profitable results for both countries in doing so.

This practice ensures secured foreign exchange practices that are expected to be a prominent venue going forward on Forex. In contrast with banks, this practice is the holding of investments in government foreign reserves inside the financial system of another country.

SWFs typically invest in a wide range of asset classes:

* equities (i.e. foreign currency)

* fixed income

* real estate

* alternative investments like private equity and infrastructure.

The purpose of this practice is to increase diversification and reduce risk on cross-border transactions between countries.

As you can see from many of the articles in this room, blockchain technology allows us to create opportunities never seen before in history. The ability to move across the borders to exchange monies is becoming something of an enigma.

At the touch of a button, things are progressing towards instant payment systems through the new digital economy allowing faster and efficient forms of trade.

Many of these blockchain technologies have been operational for some time, but the interfacing of Global economies on a Quantum Financial System will transform the way we live that most of us have never ever attempted to imagine. DLA Piper

© Goldilocks

~~~~~~~~~~

Chapter 16 Sovereign Wealth Funds in the New Normal in: Economics of Sovereign Wealth Funds | E-Library

~~~~~~~~~~

Ukraine ranks third in the ranking of bitcoin-holding countries - data from Bitcointreasuries.

The top 3 also include:

- USA - 215,000 BTC;

- China - 190,000 BTC;

- Ukraine - 46,351 BTC.

~~~~~~~~~~

OpenAI on Thursday announced its first partnership with a higher education institution.

Starting in February, Arizona State University will have full access to ChatGPT Enterprise and plans to use it for coursework, tutoring, research and more.

The partnership has been in the works for at least six months.

ASU plans to build a personalized AI tutor for students, allow students to create AI avatars for study help and broaden the university’s prompt engineering course. CNBC Link

~~~~~~~~~~

Protocol 20 Mainnet Vote Less Than 2 Weeks Away

January 30, the date of the Protocol 20 Mainnet vote, is fast approaching. Protocol 20 will mark the most transformative upgrade to the Stellar network to date. And to preserve the network's performance, security, and stability during this time, the ecosystem has agreed to a phased rollout for Soroban transactions.

Following a positive validator vote, Phase 0 begins, which is designed to allow network operators to observe the network after the upgrade, and not intended for end users to interact with applications. During Phase 0, developers are encouraged to continue utilizing Testnet.

In Phase 1, builders gain the ability to deploy contracts on Mainnet for testing. Like Phase 0, this environment is not meant for application users. As Phase 1 progresses, smart contract usability will expand based on network health and user feedback.

So, while exciting times are ahead, we suggest managing expectations throughout the community – and if you’re building on Stellar/Soroban – your user base. If you haven’t already, please upgrade all of your relevant software in preparation for Protocol 20. Stellar Link

~~~~~~~~~~

Mortgage broker Loan Market Vantage on why brokers are pivoting to business lending | Financial Review

~~~~~~~~~~

Inside Innovation Live 09 - Connecting blockchains: Overcoming fragmentation in tokenised assets | YouTube

👆 Goldilocks pointed to this article

~~~~~~~~~~

Mortgage Brokers Dive into Commercial Lending | Financial Review

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps