2000% Silver Revaluation! This Is What Every Silver Stacker Should Do

2000% Silver Revaluation! This Is What Every Silver Stacker Should Do | Lynette Zang

Smart Silver Trends: 1-10-2026

The True Value of Precious Metals Silver and Gold Valuation: Lynette Zang argues that based on a historic 20:1 gold-to-silver ratio, silver's true fundamental value should be a minimum of *$300 per ounce*. Applying this historical context, she calculates the true fundamental value of an ounce of gold to be between *$33,000 and $40,000*.

Gold Revaluation: Lynette Zang views a revaluation of U.S. gold reserves as inevitable. She believes the Federal Reserve would not implement this at current market prices because the current nominal price does not reflect the amount of paper money that has been issued. Its main purpose would be to regain public confidence after a catastrophic event.

2000% Silver Revaluation! This Is What Every Silver Stacker Should Do | Lynette Zang

Smart Silver Trends: 1-10-2026

The True Value of Precious Metals Silver and Gold Valuation: Lynette Zang argues that based on a historic 20:1 gold-to-silver ratio, silver's true fundamental value should be a minimum of *$300 per ounce*. Applying this historical context, she calculates the true fundamental value of an ounce of gold to be between *$33,000 and $40,000*.

Gold Revaluation: Lynette Zang views a revaluation of U.S. gold reserves as inevitable. She believes the Federal Reserve would not implement this at current market prices because the current nominal price does not reflect the amount of paper money that has been issued. Its main purpose would be to regain public confidence after a catastrophic event.

⭐️ Prediction of Hyperinflation and Currency Reset The Scenario: The core argument is that hyperinflation is coming to "burn off the debt." This period will see prices soar dramatically—the speaker gives an extreme example of a loaf of bread costing $80,000.

The Reset: After the hyperinflationary crisis, the speaker predicts a government action, such as "lopping off zeros" in an overnight revaluation to bring prices back down (e.g., $80,000 to $8). While all fiat savings would be reset, she suggests gold's newly high nominal price would hold value for a period before beginning to climb again in the new currency system.

⭐️ The Genius Act and the Stablecoin Market A New Monetary System: She discusses the Genius Act as the first legal foundation for cryptocurrencies and stablecoins, claiming it has already fundamentally changed the global monetary system.

Artificial Market: By requiring new U.S. stablecoins to be dollar-backed on a one-to-one basis, the government is creating a new artificial market to support the dollar, replacing the reliance on the US Treasury market. She highlights that the stablecoin market, currently at around $125 billion, is projected by some to grow to *$2 trillion by 2028*.

Criminal Cartels: The video concludes by asserting that the legal framework being created is similar to the 2008 financial crisis, effectively allowing bankers to act unethically without legal consequence, which the speaker refers to as the legalization of "theft" (inflation).

Gold Exposes Dollar Reset While Media Pushes False Narrative

Gold Exposes Dollar Reset While Media Pushes False Narrative

Taylor Kenny: 1-8-2025

Is gold really rising because of Fed rate cuts—or is something far bigger happening?

Taylor breaks down the data, exposes the media lies, and shows how to protect your wealth in the face of a global monetary reset.

The recent surge in gold prices has left many investors and economists scratching their heads, trying to understand the underlying drivers behind this trend.

Gold Exposes Dollar Reset While Media Pushes False Narrative

Taylor Kenny: 1-8-2025

Is gold really rising because of Fed rate cuts—or is something far bigger happening?

Taylor breaks down the data, exposes the media lies, and shows how to protect your wealth in the face of a global monetary reset.

The recent surge in gold prices has left many investors and economists scratching their heads, trying to understand the underlying drivers behind this trend.

The mainstream narrative suggests that the anticipated Federal Reserve rate cuts are the primary reason for gold’s rise. However, a recent video presentation challenges this simplistic explanation, revealing a more complex and nuanced reality.

According to the presenter, the real driver behind gold’s surge is not the expected Fed rate cuts, but rather a profound and historic global monetary reset triggered by the accelerating collapse of the U.S. dollar and the unsustainable debt burden the country carries.

This narrative is rooted in outdated economic thinking and fails to account for the deeper structural issues plaguing the global economy.

The video highlights how main stream media’s reporting on economic indicators like unemployment often understates the true economic distress faced by many Americans.

Official numbers may look rosy, but they don’t tell the whole story. Meanwhile, gold prices have been skyrocketing, far outpacing what traditional Fed rate cut logic would predict.

A closer examination of historical gold price movements in relation to federal funds rate changes reveals a striking disconnect. The current gold price increases cannot be explained solely by expected rate cuts. Instead, the presenter argues that the massive U.S. debt, now exceeding $38 trillion, is the fundamental issue driving the gold market.

This unsustainable debt burden has created a debt doom loop, where rising interest costs further exacerbate fiscal instability.

Decades of overspending and currency printing have led to inflationary pressures that threaten to culminate in a currency reset, similar to historical examples from Venezuela, Germany, and Mexico.

In such scenarios, fiat currencies lose value rapidly, and those holding physical gold and silver are protected.

The video emphasizes that central banks worldwide are increasingly accumulating gold to back a new monetary system, underscoring gold’s role as a true store of value without counterparty risk.

As the global economy teeters on the brink of a monumental shift, acquiring physical gold and silver is becoming an essential insurance policy against the failing fiat system.

So, what can investors do to protect their wealth in this uncertain environment? The presenter advocates for educating oneself and developing a protective wealth strategy.

With the global monetary system on the cusp of a significant reset, it’s more crucial than ever to have a solid understanding of the underlying trends and drivers.

In conclusion, the recent surge in gold prices is not just a simple response to expected Fed rate cuts. Rather, it’s a symptom of a more profound and historic global monetary reset, driven by the accelerating collapse of the U.S. dollar and the unsustainable debt burden.

As the world hurtles towards a new monetary reality, investors would do well to take heed of the warning signs and position themselves accordingly.

Gold To $6,000, Silver Over $100 in 2026: Fiat Con Game Exposed!

Gold To $6,000, Silver Over $100 in 2026: Fiat Con Game Exposed!

Daniela Cambone: 1-7-2025

Gold’s surge toward $6,000 is no longer just a bullish forecast — it’s a reflection of mounting debt, persistent inflation, and a growing loss of confidence in the fiat monetary system.

According to legendary trader Todd “Bubba” Horwitz, the move higher in precious metals is a logical response to economic conditions that continue to deteriorate beneath the surface.

Gold To $6,000, Silver Over $100 in 2026: Fiat Con Game Exposed!

Daniela Cambone: 1-7-2025

Gold’s surge toward $6,000 is no longer just a bullish forecast — it’s a reflection of mounting debt, persistent inflation, and a growing loss of confidence in the fiat monetary system.

According to legendary trader Todd “Bubba” Horwitz, the move higher in precious metals is a logical response to economic conditions that continue to deteriorate beneath the surface.

“You know, there’s a big problem in this country. It’s called debt. It’s called inflation,” Horwitz says in a conversation with Daniela Cambone. He argues that gold’s rapid ascent should not be viewed as extreme, explaining that once prices reach higher levels, further gains come faster.

“There’s a real good chance that we could hit 6, 7, or 8,000 this year,” he says. Horwitz also points to silver’s strength as confirmation that the precious metals bull market is broadening.

“Notice how the spread, the ratio between gold and silver has dropped so precipitously,” he notes, highlighting the collapse from over 100:1 last year to closer to 60:1 today.

With silver increasingly used in industrial applications, demand continues to rise. “It has become much more in demand for the batteries that they’re making with silver,” he says.

Chapters:

00:00 Silver’s Next Move

03:09 What’s Driving Silver’s Price Surge?

06:04 Why Precious Metals Will Keep Rising

07:06 Is the U.S. Dollar Really Strong?

08:54 Can the U.S. Service Its Debt?

10:15 Venezuela’s Impact on the U.S.

12:07 The Case for Nuclear Power

13:22 Bubba’s Message for 2026

News, Rumors and Opinions Wednesday 1-7-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Wed. 7 Jan. 2026

Compiled Wed. 7 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: The Storm has (allegedly) arrived. The hour of reckoning for those who have betrayed the people is upon us. The Cabal’s fake fiat dollar is collapsing, banks are crumbling worldwide, top elites have been disappearing, their bunkers compromised, with their offshore accounts frozen by quantum tracking.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Wed. 7 Jan. 2026

Compiled Wed. 7 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: The Storm has (allegedly) arrived. The hour of reckoning for those who have betrayed the people is upon us. The Cabal’s fake fiat dollar is collapsing, banks are crumbling worldwide, top elites have been disappearing, their bunkers compromised, with their offshore accounts frozen by quantum tracking.

On Mon. 5 Jan. 2026 the Quantum Financial System (allegedly) began implementation around the world, keeping track of every financial transaction

The Global Currency Reset(allegedly) launched into its final phase, with the Revaluation of currencies set to explode in the coming hours and days. Payouts were accelerating rapidly, with full liquidity expected by mid-January 2026.

Bond holders and Tier 4A groups are (allegedly) receiving urgent notifications for appointments at Redemption Centers, where exchanges will commence under the secure Quantum Financial System.

This long-awaited wealth transfer from the corrupt elite to the people is divinely timed, ushering in an era of unprecedented abundance and justice.

It’s the beginning of Nesara/Gesara Debt Forgiveness activation worldwide. Debt forgiveness on mortgages, loans, and credit cards is(allegedly) being prepared for immediate implementation, returning ill-gotten taxes and interest to rightful owners.

The gold-backed QFS, now (allegedly) fully operational with interconnected portals across continents, blocks all deepstate manipulation—ensuring every transaction is transparent, secure, and blessed for humanitarian purposes.

BRICS nations have (allegedly) aligned, and the old fiat system crumbles as true prosperity flows to We the People.

After this 10-14 Day Communication Blackout, the fiat US Dollar will(allegedly) be no more, a new gold-backed US Note will emerge, plus all of the organizations of Government, Finance, Media, Health and Education will be transformed for the better.

~~~~~~~~~~~~~~~

Tues. 6 Jan. 2026 Bruce The Big Call: 667-770-1866 Access Code:123456# 6ff 4rr 5pause

The Venezuela Bolivar is back on the screens to trade at a Redemption Center.

There are 5 call centers in the US (Wells Fargo). There are a couple of thousand Redemption Centers in the US. Wells Fargo is overseeing Redemption Centers in the US.

Canada has one call center (HSBC).

You can get better exchange rates at a Redemption Center than you do at a bank. Zim can only be redeemed at a Redemption Center. The Dinar has a Contract Rate at the Redemption Center.

The Dong rate is quite high.

A Quantum Card is only to move money from your Quantum Account to a regular account.

You can (allegedly) get around $3,000 cash gold-backed USTN at your exchange.

The changeover from fiat currency to gold/asset-backed should happen by this Thurs. 8 Jan. 2026.

It looks like a Fri-Sat. 9-10 Jan. 2026 start for exchange appointments for Tier4b (Us, the Internet Group).

Read full post here: https://dinarchronicles.com/2026/01/07/restored-republic-via-a-gcr-update-as-of-january-7-2026/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff A meeting next week where the Central Bank will be joining parliament. Why? We have reforms coming forward...The reforms are rate change dependent...The huge basket of laws is also rate change dependent...They have tasks between them that overlap, such as the reforms... They're trying to show you there's now critical steps coming forward that require the rate to change. They're showing you that from so many angles...tax reforms, banking reforms...150+ laws...They have to start working together... All of this is coming together because the rate is about to change.

Militia Man Article: "BAHAA AL-ARAJI : AL-SUDANI IS THE MAN OF THE HOUR AND THE NEXT PRIME MINISTER". This is a strong indicator...that Al-Sudani has momentum for a second term. My view has been it would be cleaner for the REER transition and adjustment. I seriously like the push and the momentum I see for Al-Sudani second term! I am not alone in this. It makes the most sense and is seen as the cleanest way to move the country forward.

Ariel The Projected Timeline for Iraq’s International Exchange Rate Deployment, reportedly locked in at March 31, 2026, isn’t just a date it’s the culmination of a seismic shift brewing beneath the surface of Baghdad’s financial corridors. The Central Bank of Iraq (CBI) has been quietly welding together a framework to launch a redenominated dinar, sheering off those burdensome three zeros to breathe new life into an economy long shackled by cash-heavy chaos and oil dependency... This isn’t some hopeful guesswork; it’s a calculated strike, fueled by exclusive info with banknote printing contracts and digital spine integrations racing toward completion...

Is There Still Silver Out There? | Bill Holter

Liberty and Finance: 1-6-2026

Bill Holter explains that the extreme volatility in gold and silver is being driven by tightening physical supply, rising global demand, and growing stress in the broader financial system.

He highlights the breakdown of the Japanese carry trade and sovereign gold repatriation as signs that trust in fiat currencies and credit markets is eroding.

Holter warns that paper precious metals markets are moving toward irrelevance as physical metal becomes the true price setter.

He cautions viewers about AI generated financial commentary, noting that while much of the logic may be sound, dates and figures are often wrong and can cause unnecessary panic.

His suggests to investors to plan ahead, act deliberately, and avoid emotional decisions under pressure by using measured steps rather than all or nothing moves.

INTERVIEW TIMELINE:

0:00 Intro

1:27 Market volatility

11:25 Retail gold & silver availability

28:50 The path forward

Gold and Silver Swings Signals a Physical Market Takeover

Gold and Silver Swings Signals a Physical Market Takeover

Lynette Zang: 1-5-2026

Most people see gold and silver volatility as instability. In reality, these wild price swings signal that paper markets are losing control as physical demand takes over price discovery.

Watch to understand why this transition is happening and what it means for how you interpret gold and silver prices going forward.

Gold and Silver Swings Signals a Physical Market Takeover

Lynette Zang: 1-5-2026

Most people see gold and silver volatility as instability. In reality, these wild price swings signal that paper markets are losing control as physical demand takes over price discovery.

Watch to understand why this transition is happening and what it means for how you interpret gold and silver prices going forward.

Chapters:

00:00 Extreme Volatility in Gold and Silver

02:22 CME Margin Hikes, Profit Taking, and Paper Market Control

03:27 Why This Time Is Different: Physical Markets Taking Over

05:04 Paper Market Swings vs Physical Metal Reality

07:09 Silver’s Massive Trading Range & Why Volatility Doesn’t Matter

09:16 2008 Comparison: Spot Prices, Stocks, and Physical Gold

11:40 Higher Lows, Long-Term Trends, and Ignoring Wall Street Noise

12:31 If You Don’t Hold It, You Don’t Own It: Accumulation Strategy

13:34 Pre-1933 Territorial & Fractional Gold — Monetary vs Collectible Classification

14:33 Silver-to-Gold Ratio at 56:1 — Convert Silver to Gold Now or Wait?

15:23 Why Asian Markets Push Gold & Silver Prices Up While the U.S. Pushes Them Down

17:54 Does Tarnish (Toning) Matter on Silver Coins? Should You Clean Them?

18:02 What Is Glint and How Does It Work With Physical Gold?

18:22 What Is Arbitrage and How Does It Apply to Markets?

19:35 Call for Viewers Who Have Lived Through Currency Resets & Hyperinflation

Can Trump Fix the US Debt Crisis with Crypto and Gold?

Can Trump Fix the US Debt Crisis with Crypto and Gold?

Karlton Dennis: 1-6-2025

The United States is grappling with a daunting national debt of $39 trillion, a figure that continues to grow as government spending outpaces revenue.

As the nation hurtles towards its 250th anniversary in 2026, finding innovative solutions to this fiscal crisis has become imperative.

A recent video by Karlton Dennis explores the intriguing relationship between the national debt and potential strategies involving cryptocurrency and gold

Can Trump Fix the US Debt Crisis with Crypto and Gold?

Karlton Dennis: 1-6-2025

The United States is grappling with a daunting national debt of $39 trillion, a figure that continues to grow as government spending outpaces revenue.

As the nation hurtles towards its 250th anniversary in 2026, finding innovative solutions to this fiscal crisis has become imperative.

A recent video by Karlton Dennis explores the intriguing relationship between the national debt and potential strategies involving cryptocurrency and gold, possibly backed by President Donald Trump.

Initially, Trump’s approach to tackling the debt focused on creating the Department of Government Efficiency (DOGE), led by Elon Musk, which aimed to cut wasteful federal spending and improve budgeting efficiency.

While DOGE managed to save around $215 billion, this amount was merely a drop in the ocean compared to the overall national debt. It became clear that spending cuts alone were insufficient to resolve the debt crisis.

The national debt continues to balloon because the government spends more than it earns, necessitating the issuance of Treasury securities to borrow money. This borrowing is sustainable only as long as investors demand these securities at reasonable interest rates.

However, even a slight increase in interest rates could cause the government’s annual interest payments to skyrocket, having a devastating impact on the broader economy.

In response to these challenges, Trump’s administration explored new strategies involving emerging financial technologies, particularly cryptocurrencies.

The Genius Act, passed in July 2025, mandates that stablecoins – digital currencies pegged to the US dollar – must be backed by either actual US dollars or short-term Treasury bills. This linkage creates a direct demand mechanism for government debt, as growth in stablecoin circulation translates into increased demand for Treasury securities, helping to keep interest rates low and borrowing costs manageable.

Another innovative tool proposed is gold-backed Treasury bonds.

These bonds would allow investors to lend money to the government and receive physical gold upon maturity, without interest payments in the interim.

This method, supported by Judy Shelton, Trump’s economic adviser, leverages the government’s enormous gold reserves, which, if revalued closer to current market prices, could unlock trillions in liquidity. This liquidity could then be used to reduce debt or stabilize the economy.

While these financial innovations may offer temporary relief and stability, they do not address the root problem of federal overspending. Rising interest rates could slow economic growth by increasing the cost of capital for businesses and government projects. Thus, long-term solutions require fiscal discipline, smarter investments, and policies that promote sustainable economic expansion.

As the United States navigates its fiscal challenges, it is clear that a combination of short-term fixes and comprehensive fiscal reform is necessary to control the ever-growing national debt. The approaches discussed in Karlton Dennis’s video may provide critical short-term support to the nation’s finances, but the real challenge remains balancing quick fixes with long-term fiscal responsibility.

Watch the full video by Karlton Dennis to gain further insights into the potential solutions to the US national debt crisis.

News, Rumors and Opinions Tuesday 1-6-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Tues. 6 Jan. 2026

Compiled Tues. 6 Jan. 2026 12:01 am EST by Judy Byington

Global Currency Reset Update (Rumors)

Mon. 5 Jan. 2025 QFS GLOBAL ALERT Tier 4B Activation Surge …Quantum Financial System on Telegram

The Global ISO-20022 rainbow currency rollout now (allegedly) stands at 93.8% live integration across all compliant networks—pushing full parity within hours.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Tues. 6 Jan. 2026

Compiled Tues. 6 Jan. 2026 12:01 am EST by Judy Byington

Global Currency Reset Update (Rumors)

Mon. 5 Jan. 2025 QFS GLOBAL ALERT Tier 4B Activation Surge …Quantum Financial System on Telegram

The Global ISO-20022 rainbow currency rollout now (allegedly) stands at 93.8% live integration across all compliant networks—pushing full parity within hours.

On Sun. 4 Jan. 2026 the GCR/RV shotgun start(allegedly) locked into mathematical irreversibility at precisely 02:17 UTC, with quantum entanglement security locks fully engaged and no turning back.

Direct from the Reno/Zurich/Hong Kong QFS master control: In the last 18 hours:

Wells Fargo has (allegedly) synchronized over 12,500 military-protected Redemption Centers nationwide, prepping for immediate 800# release sequences.

Trump’s GENIUS Act has (allegedly) triggered Stablecoin approvals tied to gold-backed digital certificates, blocking CBDC surveillance traps.

8,400+ private humanitarian project wallets (allegedly) activated in real-time feeds from Zimbabwe/Hong Kong/Moscow liquidity pools

NDA 72–96 hour windows now (allegedly) auto-deploying for Tier 4A adjudicated settlements

Sovereign rate vs street rate screens (allegedly) flashing 1:1 asset-backed parity on mirrored accounts

Med-bed allocation trusts (allegedly) funded via Saint Germain World Trust tranches

Dragon Family yellow/gold dragon bonds (allegedly) redeemed in bulk transfers.

Off-ledger mirrored accounts (allegedly) fully on-ledger and NESARA debt jubilee packets (allegedly) uploaded for mass distribution—all confirmed from White Dragon and Space Force secure briefings, with zero delays.

The old fiat chains are (allegedly) shattering—freedom’s quantum pulse is here. The greatest wealth transfer in human history(allegedly) is now in motion.

~~~~~~~~~~~

Mon. 5 Jan. 2025 The New Quantum Financial System…

The new QFS (allegedly) operates completely independently from the existing “centralized” banking and ends the “Central Banking System” that perpetuates “Debt Slavery” around the world.

Even though it is the ultimate in design, reliability, security and safety, the roll-out process will occur over time.

QFS operates on a Distributed Ledger Technology. It is NOT crypto currency or Blockchain technology.

Quantum Qubits “interact” with every financial transaction anywhere in the world of finance to ensure that each transaction is legal, owner-intended and transparent.

Since Central Banks do not have the ability to “reconcile” old FIAT (paper) money into the new QFS system, all fractional reserve banking and central banking activities will (allegedly) cease.

Every sovereign currency and every bank represents a separate Ledger in QFS.

Data on all account holders, at all banks, in all 209 participating countries was (allegedly) downloaded into QFS in March 2017 and serves as a “Distributed Ledger”.

QFS is designed for and ready to (allegedly) convert ALL bank accounts denominated in any Fiat currency anywhere in the world into a local asset-backed currency.

QFS pings the originating Fiat currency bank account to ensure it is still valid, active, and operational at the time the exchange of fiat currency for asset-backed currency takes effect.

After the successful ping of a local bank account, the fiat currency holdings are converted into the new local asset-backed currency on a 1:1 basis.

Read Full Post Here: https://dinarchronicles.com/2026/01/06/restored-republic-via-a-gcr-update-as-of-january-6-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick All that is waiting for the new exchange rate has already been agreed upon by the right people. The monetary reform is done. It is a done deal. Ain't no stopping it now.

Frank26 [Iraq boots-on-the-ground report] OMAR: Many Iraqis feel reforms are too slow and patience is wearing thin especially among the youth and the unemployed population. FRANK: They know purchasing power is coming and been promised them. They know who says to them it's coming all the time. And they know the one that pulls the trigger doesn't open his damn mouth except to say, 'I got no plans in doing anything.' OMAR: Television showing foreign contractors, some of them Americans, being attacked at hotels by protesters. Citizens are very upset. They voted on November 11th for Sudani to be the prime minister and he's still not named. And the citizens are upset at the reforms and the lies. This is going sideways fast... FRANK: ...When the smoke clears...everything will be fine.

************

Silver Update: US Commits To $7.4 Billion Metal Refinery

Arcadia Economics: 1-5-2026

The gold and silver prices are soaring again to start the first full week of 2026, and in the midst of the rally, Donald Trump and the U.S. just committed $7.4 billion to build a critical minerals refinery in Tennessee.

It's the latest indication that the government realizes that it has work to do in securing our metals infrastructure, especially here in the U.S., where there are only two LBMA-approved refineries that process silver, and one of them is currently not taking any new silver.

So to find out more about this latest development, and the pricing in the precious metals world, click to watch this video now!

“Apocalypse is Unfolding”: Gold Soars as Tensions Escalate, Faith in Money Dies

“Apocalypse is Unfolding”: Gold Soars as Tensions Escalate, Faith in Money Dies

Daniela Cambone: 1-5-2026

Gold is hovering around $4,450—not just a bull market, but a symptom of a dawning realization that decades of money printing have hollowed out the dollar’s value.

People are waking up, stacking “junk silver” (pre-1965 coins) and physical metal as a form of preparation. “My number one concern about 2026 is a second wave of inflation,” says Jeffrey Tucker, Founder, Author, and President of the Brownstone Institute.

“Apocalypse is Unfolding”: Gold Soars as Tensions Escalate, Faith in Money Dies

Daniela Cambone: 1-5-2026

Gold is hovering around $4,450—not just a bull market, but a symptom of a dawning realization that decades of money printing have hollowed out the dollar’s value.

People are waking up, stacking “junk silver” (pre-1965 coins) and physical metal as a form of preparation. “My number one concern about 2026 is a second wave of inflation,” says Jeffrey Tucker, Founder, Author, and President of the Brownstone Institute.

In a conversation with Daniela Cambone, Tucker warns that inflation could intensify as the U.S. approaches the 2026 midterm elections, adding pressure to the housing market and increasing economic uncertainty.

“I would not be at all surprised to see inflation of 3% or higher,” he says. Tucker also criticizes the idea of cutting interest rates at this stage, calling it “the worst possible time” and “a disastrous idea.”

He cautions that current policies risk repeating past mistakes: “My concern has been that we’re going to repeat the experience of the 1970s.”

He concludes that the deeper issue is a loss of trust in the system: “This would not be happening if people had confidence in the fiat money system — and they just don’t.”

Chapters:

00:00 Is U.S. economic growth sustainable?

04:42 How much blame belongs to the Fed?

06:07 A return to sound money

08:08 Gold and silver outlook

09:28 Inflation and the loss of confidence in government

14:43 A new Fed chair — what comes next?

21:04 Housing: what’s ahead?

24:07 Silver coin bags make a comeback

News, Rumors and Opinions Monday 1-5-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Mon. 5 Jan. 2026

Compiled Mon. 5 Jan. 2026 12:01 am EST by Judy Byington

Sun. 4 Jan. 1016 QFS RV/GCR Intel Update (Rumors)

High-level sources deep in the Alliance confirm: the Global Currency Reset has been (allegedly) fully activated, and the Revaluation is rolling out across the planet faster than the Deepstate could scramble their jets!

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Mon. 5 Jan. 2026

Compiled Mon. 5 Jan. 2026 12:01 am EST by Judy Byington

Sun. 4 Jan. 1016 QFS RV/GCR Intel Update (Rumors)

High-level sources deep in the Alliance confirm: the Global Currency Reset has been (allegedly) fully activated, and the Revaluation is rolling out across the planet faster than the Deepstate could scramble their jets!

As of today, redemption centers were(allegedly) on full Red Alert, staffed and ready for Tier 4B notifications to blast out any hour now.

Bonds were (allegedly) being hydrated with massive liquidity, historic bonds (allegedly) paid out in full on the Quantum Financial System – no more fiat chains (allegedly) holding us back!

Iraq has officially (allegedly) revalued the Dinar overnight, with screen rates skyrocketing past expectations, paving the way for Vietnam Dong, Zim, and all revaluing currencies to follow suit immediately.

The greatest wealth transfer in human history is(allegedly) underway, ripping trillions from the cabal’s blood-soaked vaults and placing it directly into the hands of We the People.

Universal debt jubilee has (allegedly) kicked in – mortgages, credit cards, student loans vanishing as the QFS (allegedly) wipes the slate clean for humanity’s liberation.

Behind the scenes, White Hats have(allegedly) neutralized remaining Deepstate holdouts; thousands more arrests executed silently this week alone, clearing the path for full NESARA/GESARA announcement any day.

Trump and the military Alliance are(allegedly) in total command – the storm has arrived, and victory is ours!

Stay vigilant, pray without ceasing, and prepare your humanitarian projects because your 800# appointments are imminent. This isn’t rumor – it’s(allegedly) happening RIGHT NOW. The cabal is finished, their Great Reset (allegedly) crushed under our God-given reset. Freedom rings louder than ever! Hold the line, family – we’re crossing the finish line together. The golden age dawns today!

God bless America, God bless the Alliance, and God bless every patriot standing strong.

~~~~~~~~~~~~~

Quantum Financial System: THE QFS PROTOCOL AND TRUE OWNERSHIP …QFS on Telegram

Under the Quantum Financial System, every account (allegedly) exists outside the reach of banks, intermediaries, and political manipulation.

Ownership is absolute. Funds cannot be frozen, seized, or diluted.

Quantum encryption secures each wallet at the individual level, making corruption (allegedly) mathematically impossible.

The legacy banking system does not collapse loudly. It simply becomes irrelevant. THE ASSET BACKED ECONOMY EMERGES

Currencies are(allegedly) realigning with tangible value such as gold, commodities, and productive output. Fiat systems built on debt expansion are(allegedly) being reconciled into asset backed formats, restoring balance and trust. Inflation, artificial scarcity, and speculative distortions lose their power when money is once again anchored to reality. Trade becomes fair. Valuation becomes honest.

WHAT COMES NEXT

Illegitimate debt will be (allegedly) dissolved under GESARA reforms.

QFS wallets will (allegedly) unlock through biometric authentication, restoring direct access to personal wealth.

Global currency values will (allegedly) adjust to reflect true national resources and productivity.

Central banks will be (allegedly) phased out as sovereign treasuries reclaim issuance authority.

Legacy systems like SWIFT and coercive taxation structures will be (allegedly) rendered obsolete.

~~~~~~~~~~~~~

THE DAWN OF A NEW GOLDEN AGE

As suppressed capital and resources are released, humanitarian projects, innovation, and infrastructure expansion accelerate worldwide. Education improves. Communities rebuild. Individuals regain freedom of choice and economic mobility. This is not redistribution through force, but restoration through correction.

This is not merely a financial reform. It is a civilization upgrade.

Read full post here: https://dinarchronicles.com/2026/01/05/restored-republic-via-a-gcr-update-as-of-january-5-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff Iraq is transitioning to going international. The movements they're making right now are not sensitive to the rate changing ...but very soon the rate change sensitive matters will be implemented requiring the rate to change...The rate is probably not going to change until after the government has been formed...They're given 90 days which would theoretically per the constitution give them until around March 14th. Will it take that long?

Frank26 You can't show the lower notes before you show the exchange rate.

Frank26 Does [Venezuela's situation] affect our monetary reform with the Iraqi dinar? Not directly but I'm not going to say that it's not tangible. It is. Why? What do we seek for the monetary reform? ...Security and stability. We got it in Iraq. But we also need it globally, especially those that are dealing with oil...In my strong opinion the people of Iraq...Iran... Venezuela... Columbia...Cuba and many other countries are praying for the United States of America to come and help them...The countries around the world have been given hope...It seems to me that Iran which is the problem for security and stability in Iraq is going to see the same thing...

*************

SILVER ALERT! The Massive 140% Silver Gains in 2025 Will be DWARFED by 2026 Silver Gains!

(Bix Weir) 1-4-2025

Last year was a GREAT year for SILVER but it didn't fix ANY of the problems that currently face the silver market.

For one...the World is finding out that there is much less silver available for investors and industrial users than was claimed by the Silver Institute & CPM Group! This alone will send silver to massive new highs in 2026 but that's not all.

The COMEX Silver short is STILL over 750M ounces with no resolution in sight!

New 2026 EV Battery technologies use 20X the amount of silver that the old battery tech used and price is NOT the issue in a $50K 2026 Electric Vehicle!

The 2050 Green Energy Mandates can only be achieved by implementing Industrial Solar Power Stations all around the world...and Governments have agreed to print the fiat money to pay for it!

My conclusion...load up on physical because 2026 Silver gains will be like 2025 on STEROIDS!

Five Key Things To Know Before You Sell Your Silver Coins, Bars, Jewelry Or Flatware

Five Key Things To Know Before You Sell Your Silver Coins, Bars, Jewelry Or Flatware

Charles Passy and Andrew Keshner Wed, December 31, 2025 MarketWatch

Is It Time To Sell Your Silver?

That’s the question some may be asking in light of the fact that the precious metal’s price SI00 has risen well over 100% in the past year, reaching a record level above $82 an ounce on Monday. After all, many people have some silver tucked away in their closets in the form of flatware, coins and jewelry. Others may have purchased silver bars for investment purposes. Sure enough, those who buy silver for a living say they’ve been plenty busy of late responding to such folks.

Five Key Things To Know Before You Sell Your Silver Coins, Bars, Jewelry Or Flatware

Charles Passy and Andrew Keshner Wed, December 31, 2025 MarketWatch

Is It Time To Sell Your Silver?

That’s the question some may be asking in light of the fact that the precious metal’s price SI00 has risen well over 100% in the past year, reaching a record level above $82 an ounce on Monday. After all, many people have some silver tucked away in their closets in the form of flatware, coins and jewelry. Others may have purchased silver bars for investment purposes. Sure enough, those who buy silver for a living say they’ve been plenty busy of late responding to such folks.

“[We’re] seeing a deluge of silver sellers like we never have before,” said Brandon Aversano, CEO and founder of the Alloy Market, a Pennsylvania-based company that specializes in precious metals. Aversano noted that his firm has purchased nearly twice the amount of silver in the second half of 2025 as it did in the first half.

Fueling that demand, of course, are buyers aplenty who want a stake in silver, given the price gains of late.

“I’ve sold more silver in the past two weeks than I’ve probably sold in the past six months,” said Phil Neizvestny, owner of Bullion Holdings, a company based in New York City’s Diamond District.

If you do want to sell your silver items — whether it’s a set of cutlery you inherited from grandma or coins you collected long ago — what do you need to know? We spoke with some experts to find out. Let’s break it down into five questions.

1. Where Can You Sell Your Silver?

There are options galore. You can always head to your local pawnbroker or a merchant who specializes in coins or precious metals. You can also go the internet route, which will involve shipping your silver to a company that conducts such transactions.

Auction houses are yet another option, particularly for collectible items that have value beyond their intrinsic “melt value” (more on that later). There are also platforms like eBay EBAY, as well as social-media groups where buyers and sellers can connect.

Which option is best? Keep in mind that you can’t generally expect to receive the current market (or “spot”) price for your silver, since sellers have to make money on the transaction. “There is a bid/ask spread just like there is for any other traded asset,” explained Trip Brannen, chief financial officer at Coinfully, a company that appraises and purchases coins.

Experts say you will tend to get higher prices at online outlets — which typically have less overhead — but you then have to deal with shipping and you will also wait to receive your money. Pawnbrokers and other local merchants may pay less, but you’ll get your money right away.

And while going the eBay or social-media route can result in good prices, you need to ask yourself if you’re willing to deal directly with buyers.

No matter how you opt to sell, the usual caveat of getting different price quotes applies — don’t presume the first offer is the best. You’ll also want to check the buyer’s credentials or applicable ratings. And if you’re dealing with an online buyer, see if they’ll pay for shipping and insure your package.

2. How Can You Tell If An Item Is Real Silver?

TO READ MORE: https://news.yahoo.com/news/finance/news/five-key-things-know-sell-174700763.html

Basel III and Physical Gold

GP Q: Basel III and Physical Gold

1-3-2025

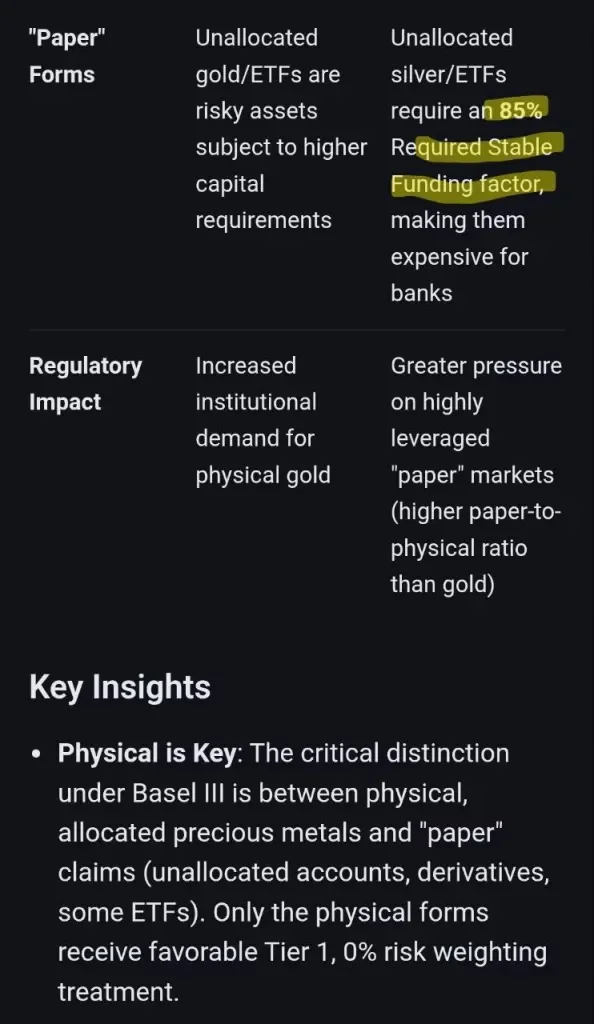

BASEL III + PHYSICAL GOLD

Basel III is a global banking regulation that significantly upgraded gold’s status from Tier 3 to Tier 1 (High-Quality Liquid Asset) as of mid-2025, meaning banks can hold physical gold at 100% value for capital reserves, like cash, increasing demand and its safe-haven appeal.

While silver also benefits, gold’s boost is: more direct as a recognized zero-risk asset, contrasting with paper gold

and incentivising banks to hold more physical metal, potentially driving prices up and shifting focus from speculative paper markets.

GP Q: Basel III and Physical Gold

1-3-2025

BASEL III + PHYSICAL GOLD

Basel III is a global banking regulation that significantly upgraded gold’s status from Tier 3 to Tier 1 (High-Quality Liquid Asset) as of mid-2025, meaning banks can hold physical gold at 100% value for capital reserves, like cash, increasing demand and its safe-haven appeal.

While silver also benefits, gold’s boost is: more direct as a recognized zero-risk asset, contrasting with paper gold

and incentivising banks to hold more physical metal, potentially driving prices up and shifting focus from speculative paper markets.

What Basel III Means for Gold:

Tier 1 Asset:

Physical, allocated gold is now treated like cash and U.S. Treasuries, with a 0% risk weighting.

Increased Demand:

Banks are encouraged to increase physical gold holdings to meet capital requirements, boosting institutional demand.

Reduced Capital Burden:

Gold no longer requires extra capital charges, making it more efficient for banks to hold.

Shift to Physical:

The rule lessens the appeal of speculative “paper gold,” pushing for more physical metal.

Impact on Silver:

Indirect Benefits:

Silver also benefits from Basel III’s focus on tangible assets, but its impact is more complex due to massive paper-to-physical ratios (around 300:1).

Price Volatility:

Unwinding massive paper silver positions could create significant supply shocks, potentially driving prices up dramatically.

Key Change Date:

The Basel III “Endgame” rules, bringing gold to Tier 1 status, became effective for many globally on July 1, 2025, though U.S. adoption has a transition period.

In essence:

Basel III formally recognizes gold as “money” again by making physical gold a top-tier reserve asset, strengthening its role as a core financial instrument for banks