Basel III and Physical Gold

GP Q: Basel III and Physical Gold

1-3-2025

BASEL III + PHYSICAL GOLD

Basel III is a global banking regulation that significantly upgraded gold’s status from Tier 3 to Tier 1 (High-Quality Liquid Asset) as of mid-2025, meaning banks can hold physical gold at 100% value for capital reserves, like cash, increasing demand and its safe-haven appeal.

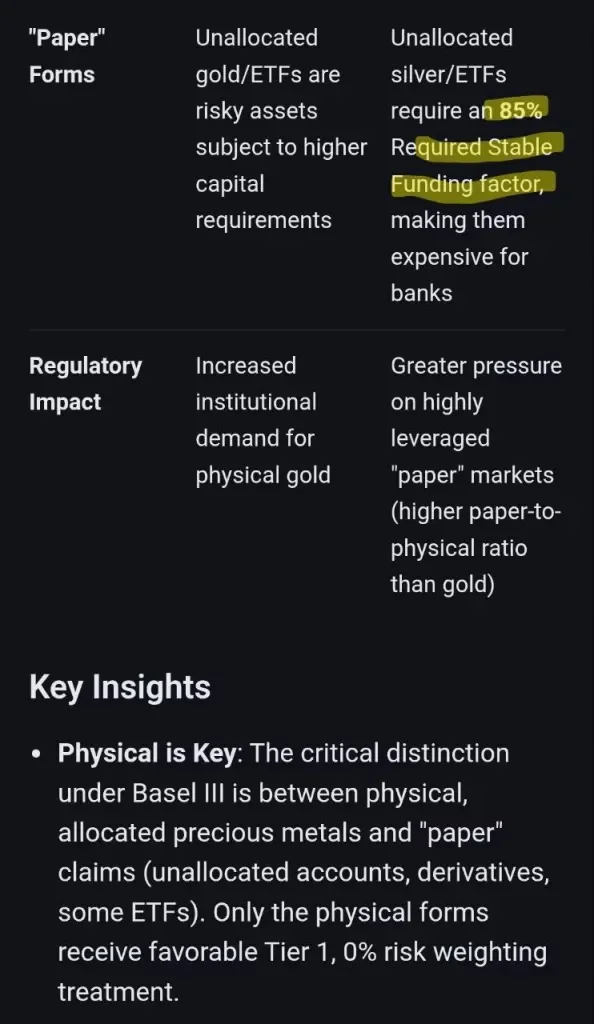

While silver also benefits, gold’s boost is: more direct as a recognized zero-risk asset, contrasting with paper gold

and incentivising banks to hold more physical metal, potentially driving prices up and shifting focus from speculative paper markets.

What Basel III Means for Gold:

Tier 1 Asset:

Physical, allocated gold is now treated like cash and U.S. Treasuries, with a 0% risk weighting.

Increased Demand:

Banks are encouraged to increase physical gold holdings to meet capital requirements, boosting institutional demand.

Reduced Capital Burden:

Gold no longer requires extra capital charges, making it more efficient for banks to hold.

Shift to Physical:

The rule lessens the appeal of speculative “paper gold,” pushing for more physical metal.

Impact on Silver:

Indirect Benefits:

Silver also benefits from Basel III’s focus on tangible assets, but its impact is more complex due to massive paper-to-physical ratios (around 300:1).

Price Volatility:

Unwinding massive paper silver positions could create significant supply shocks, potentially driving prices up dramatically.

Key Change Date:

The Basel III “Endgame” rules, bringing gold to Tier 1 status, became effective for many globally on July 1, 2025, though U.S. adoption has a transition period.

In essence:

Basel III formally recognizes gold as “money” again by making physical gold a top-tier reserve asset, strengthening its role as a core financial instrument for banks