Seeds of Wisdom RV and Economic Updates Monday Evening 3-03-25

Good Evening Dinar Recaps,

BRICS: BRAZIL REITERATES NEED TO END US DOLLAR, WILL 150% TARIFFS FOLLOW?

The ongoing tension between the global south and west has been a key matter of geopolitical uncertainty. That may only take a step forward as the BRICS 2025 president, Brazil, has reiterated its need to end the US dollar as 150% tariffs loom large over the nation.

Speaking on the alliance’s operations, Brazil president Luiz Inacio Lula Da Silva noted that the group will not cease its de-dollarization approach. However, that may come with steep consequences. Indeed, US President Donald Trump has warned that there will be import taxes levied on nations that he views are seeking to “destroy” the greenback.

Good Evening Dinar Recaps,

BRICS: BRAZIL REITERATES NEED TO END US DOLLAR, WILL 150% TARIFFS FOLLOW?

The ongoing tension between the global south and west has been a key matter of geopolitical uncertainty. That may only take a step forward as the BRICS 2025 president, Brazil, has reiterated its need to end the US dollar as 150% tariffs loom large over the nation.

Speaking on the alliance’s operations, Brazil president Luiz Inacio Lula Da Silva noted that the group will not cease its de-dollarization approach. However, that may come with steep consequences. Indeed, US President Donald Trump has warned that there will be import taxes levied on nations that he views are seeking to “destroy” the greenback.

Brazil Re-Commited to Ditching the US Dollar: Will It Face Trump’s 150% Tariffs?

The BRICS economic alliance operates on a rotating chairmanship model. This means that the alliance will be under the guidance of a shifting presidency, with one nation taking the mantle at the start of the year. In 2025, it is Brazil that is taking that position, and it is already standing firm on what it expects of the bloc.

Amid the growing tension between BRICS and the United States, Brazil has reiterated its need to end the US dollar dominance despite 150% tariffs being threatened on such countries.

Earlier this year, the bloc rejected a BRICS currency plan. However, that hasn’t forced it to change its tone on the group’s relationship with the greenback.

“US President Donald Trump’s threats of tariffs won’t stop the group’s determination to seek alternative platforms for payments between member countries,” Brazil’s President said. Now, whether or not they face those promised Trump tariffs will depend on how the US President views the action.

Last week, Trump said, “‘Any BRICS state that even mentions the destruction of the dollar will be charged a 150% tariff.” The bloc has yet to claim to be seeking the greenback’s destruction. Therefore, will the pursuit of alternative payment methods trigger the tariff?

Moreover, is Brazil’s position opposing a BRICS currency freeing it from those threats? It certainly became the main focus of the geopolitical sector over the next several months

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

SEC DROPS LAWSUIT AGAINST KRAKEN, ENDING ‘POLITICALLY MOTIVATED CAMPAIGN’SEC DROPS LAWSUIT AGAINST KRAKEN, ENDING ‘POLITICALLY MOTIVATED CAMPAIGN’

The dropped lawsuit follows dismissals of other SEC lawsuits and investigations against other cryptocurrency companies like Coinbase and Gemini.

The US Securities and Exchange Commission has agreed to drop its lawsuit against Kraken, the cryptocurrency exchange revealed on March 3. The move ends what the exchange calls a “wasteful, politically motivated campaign” and “clears the path toward a stable, forward-thinking regulatory regime.”

According to Kraken, the lawsuit is being dismissed with prejudice, with no admission of wrongdoing, no penalties paid, and no changes to Kraken’s business. The SEC sued Kraken in November 2023, alleging that the exchange acted as a broker, dealer, exchange and clearing agency without registering with the SEC.

The SEC, under Gary Gensler’s leadership, was prone to a policy of regulation by enforcement, suing or investigating crypto companies, such as Coinbase, Uniswap and non-fungible marketplace OpenSea, for a variety of reasons. This approach was widely criticized in the industry for stifling innovation, targeting legitimate crypto companies instead of going after bad actors and more.

The SEC’s latest actions may reflect the changing environment of the US government regarding crypto. Kraken writes about its case, “This case was never about protecting investors — it and other enforcement actions clouded instead of clarified. It undermined a nascent industry that repeatedly urged clear rules of the road.”

A shifting regulatory climate

Since the change in SEC leadership, the agency has dismissed or is rumored to drop various lawsuits and investigations that began during Gensler’s tenure. On Feb. 27, it dismissed its lawsuit against Coinbase. Previously, it had dropped lawsuits or investigations against Consensys, Uniswap, OpenSea, Gemini and Robinhood.

The moves come as the US is shaping up for increased regulatory clarity surrounding digital assets. On Feb. 7, US lawmakers introduced a stablecoin bill to boost dollar dominance. It is possible that lawmakers may introduce a general crypto regulation bill that is a stronger version of FIT21.

In addition, there are further tailwinds: US President Donald Trump, who has said he wants to make the US the “world capital of crypto,” has announced plans for a crypto strategic reserve consisting of BTC, ETH, XRP, SOL and ADA. The president will be hosting the first White House Crypto Summit on March 7.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

HESTER PEIRCE ANNOUNCES SEC’S NEW CRYPTO TASK FORCE AMID POLICY SHIFT

The U.S. Securities and Exchange Commission has officially released the list of members for its Crypto Task Force, which brings together advisors from key divisions.

This follows a memo published by Commissioner Hester Peirce on March 3 on the official SEC website. According to the memo, the task force consists of staff from Acting Chairman Mark Uyeda’s office, along with representatives from multiple divisions within the agency.

Peirce highlighted the team’s experience and commitment to addressing complex crypto regulatory challenges, stating that the Crypto Task Force is composed of knowledgeable and dedicated staff focused on developing practical regulatory solutions for the industry.

She also emphasized that the team would collaborate with other SEC experts and engage with the public to shape effective crypto regulations.

SEC’s new crypto-focused team

The task force includes Richard Gabbert as Chief of Staff, Michael Selig as Chief Counsel, and Taylor Asher as Chief Policy Advisor. Additional members include Sumeera Younis (Chief of Operations), Landon Zinda (Senior Advisor), and multiple senior advisors such as Donald Battle, Bernard Nolan, and Laura Powell.

Peirce has long been an advocate for clear and fair regulations in the crypto sector. Her latest initiative follows ongoing calls from industry leaders for more regulatory clarity.

This development aligns with a broader trend within the SEC to reevaluate its stance on cryptocurrency oversight. Under the previous administration, the agency intensified enforcement actions against crypto firms, imposing significant penalties.

For instance, in 2024 alone, the agency imposed fines totaling $4.68 billion on crypto businesses, accounting for 68% of its lifetime penalties in this sector.

However, recent months have seen a notable shift. The SEC has closed investigations into several prominent crypto entities, including Gemini, Coinbase, OpenSea, Uniswap Labs, Robinhood Crypto, Consensys, and lately Kraken. This move suggests a more lenient regulatory approach under the current administration.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Monday 3-3-2025

How Gold Is Valued & Why $25k-$55k Makes Sense in a Revaluation Scenario | Tavi Costa

Kitco News: 3-3-2025

What do historical financial crises tell us about today's market? Kitco News Anchor Jeremy Szafron interviews Tavi Costa, Partner & Macro Strategist, Crescat Capital on the sidelines of PDAC in Toronto.

Costa discusses the rare convergence of demand for gold from both Eastern and Western economies and why he believes silver is on the verge of a significant move back to its all-time highs.

Costa analyzes the potential impact of revaluing gold prices and inventories, referencing historical comparisons to the 1940s and 1970s.

How Gold Is Valued & Why $25k-$55k Makes Sense in a Revaluation Scenario | Tavi Costa

Kitco News: 3-3-2025

What do historical financial crises tell us about today's market? Kitco News Anchor Jeremy Szafron interviews Tavi Costa, Partner & Macro Strategist, Crescat Capital on the sidelines of PDAC in Toronto.

Costa discusses the rare convergence of demand for gold from both Eastern and Western economies and why he believes silver is on the verge of a significant move back to its all-time highs.

Costa analyzes the potential impact of revaluing gold prices and inventories, referencing historical comparisons to the 1940s and 1970s.

He also touches on the U.S. dollar's overvaluation and potential strategies for investors in response to these macro trends, including opportunities in emerging markets and natural resources. Key points:

Gold revaluation: Could reach $24,000-$55,000/ounce based on historical comparisons.

Dollar Overvaluation: The U.S. dollar is at its most overvalued level in 120 years.

Silver's Potential: Silver is showing positive short-term action, derivatives of gold are looking attractive near term.

Investment strategy: Consider rebalancing investments from tech to commodities and emerging markets.

00:00 Introduction: Gold and Silver Market Insights

01:02 Historical Context of Gold Valuation

02:36 Current Economic Indicators and Predictions

04:15 Impact of U.S. Fiscal Policy on Gold

08:51 Energy Policy and Natural Resources

14:55 Investment Strategies and Market Rebalancing

19:34 Silver Market Opportunities

URGENT WARNING: “They Can’t Prevent the Crash That Is Going To Happen” - Mike Maloney

3-3-2025

Is another historic market crash on the horizon? In this eye-opening video, Mike Maloney breaks down the worrying signs that echo past financial crises—from extreme stock market valuations to unprecedented debt levels.

Discover why gold is capturing renewed attention, how yield curve inversions have been a consistent recession indicator, and what the Federal Reserve might do next.

If you’re wondering how to protect yourself from a potential economic storm, this episode is for you.

Key Takeaways

• Learn about critical market signals that have predicted past crashes

• Understand the shift of capital from speculative stocks into gold

• See why record-high consumer debt might lead to a harsh economic reality

• Find out how Federal Reserve policy could shape the next financial chapter

WARNING! Without DIRECT AND IMMEDIATE Intervention, The US Economy Has 6 Months Left...

Greg Mannarino: 3-3-2025

Seeds of Wisdom RV and Economic Updates Monday Afternoon 3-03-25

Good Afternoon Dinar Recaps,

LAWMAKERS LAUNCH BIPARTISAN CONGRESSIONAL CRYPTO CAUCUS FOLLOWING TRUMP BITCOIN PUSH

The first of its kind group will allow pro-industry lawmakers to vote as a bloc on key legislation.

House Majority Whip Tom Emmer (R-MN) announced the creation of the first ever congressional crypto caucus on Monday, which he says will allow pro-industry lawmakers to vote as a unified bloc on pertinent legislation.

The move comes just a day after President Donald Trump announced he's directed the Presidential Working Group to "move forward" with plans to establish a "crypto strategic reserve"—a federal stockpile of state-owned digital assets—which would include Bitcoin, Ethereum, Solana, Cardano, and XRP.

Good Afternoon Dinar Recaps,

LAWMAKERS LAUNCH BIPARTISAN CONGRESSIONAL CRYPTO CAUCUS FOLLOWING TRUMP BITCOIN PUSH

The first of its kind group will allow pro-industry lawmakers to vote as a bloc on key legislation.

House Majority Whip Tom Emmer (R-MN) announced the creation of the first ever congressional crypto caucus on Monday, which he says will allow pro-industry lawmakers to vote as a unified bloc on pertinent legislation.

The move comes just a day after President Donald Trump announced he's directed the Presidential Working Group to "move forward" with plans to establish a "crypto strategic reserve"—a federal stockpile of state-owned digital assets—which would include Bitcoin, Ethereum, Solana, Cardano, and XRP.

The caucus appears to be a bipartisan effort, led both by Emmer—a staunch crypto advocate—and Rep. Ritchie Torres (D-NY), one of the industry’s most vocal Democratic allies.

In a post to X on Monday morning, Emmer characterized the caucus as “a nonpartisan group of members ready to mobilize to support and defend open, permissionless, and private innovation in the United States.”

The inclusion of the term “private” in that definition would seem to be an attempt to smother any notion that as the U.S. government gets more involved in crypto, it might seek to develop technologies like a central bank digital currency, or CBDC.

Major foreign bodies like the European Union have pushed ahead in developing digital currencies in recent weeks. President Donald Trump, on the other hand, moved to ban the creation of an American CBDC days after retaking the White House. Republicans have, for years, claimed that CBDCs would pose an existential risk to financial privacy.

Decrypt reached out to Emmer’s office regarding the House crypto caucus’ top priorities and the potential initial size of its membership but did not immediately receive a response.

House caucuses are formally organized groups of lawmakers who meet to pursue shared legislative objectives and tend to vote in blocs on key issues.

Dozens of such groups currently meet on Capitol Hill. They are shaped around identity groups (Congressional Black Caucus); ideological leanings (Congressional Progressive Caucus); foreign policy (Congressional Friends of Denmark Caucus); and, in many cases, industry representation (see: Congressional Cranberry Caucus, Chicken Caucus, and Natural Gas Caucus).

While crypto has notched a slew of high profile political victories in recent weeks—from the dismissal of key lawsuits targeting industry leaders, to Trump’s doubling down on a controversial federal crypto stockpile—the somewhat less flashy announcement of an industry caucus nonetheless brings the sector one step closer to more permanent status as a mainstay special interest group in Washington.

After years of extreme political volatility for crypto that have reaped both the lowest of lows and highest of highs, perhaps becoming a household staple akin to chicken or cranberries isn’t so unappealing.

@ Newshounds News™

Source: Decrypt

~~~~~~~~~

BRICS REACTS TO TRUMP & ZELENSKY’S WHITE HOUSE HUMILIATION

Trump and Zelensky’s White House interaction has taken the world by storm as the dirty laundry was washed in public. The war of words turned cinema as both leaders indulged in sharp criticism.

In the aftermath of the show, the minerals deal, which Zelensky visited the US was rejected by Trump. However, the Ukrainian President said that he is open to signing the deal if the US agrees to move forward. BRICS member Brazil has reacted to the Trump-Zelensky fight and came down hard on the US President.

BRICS: Brazil Reacts to Trump-Zelensky’s War of Words

Brazilian President Luiz Lula da Silva, who will chair the upcoming BRICS summit, reacted to Trump and Zelensky’s White House war. He sharply criticized the way Trump treated Zelensky in front of reporters and other dignitaries. Lula da Silva called Trump’s attitude “grotesque and disrespectful,” against Zelensky. Additionally, he added that the US President “humiliated” Zelensky for no reason as he visited the US to discuss the minerals deal.

“I have never seen a scene as grotesque and disrespectful as the one that took place in the Oval Office of the White House. I sincerely believe that part of society thrives on disrespecting others. And it is not possible to speak of democracy if there is no respect for other human beings.

I think Zelensky was hamulated; in Trump’s mind, he probably deserved it. I think the European Union was harmed by the American speech,” said the Brazilian President who will chair the 17th BRICS summit.

Trump’s stance against Ukraine is alienating Europe as the European Union (EU) wants to hold Russia accountable for the war. BRICS member China is making use of the tensions and is extending cordial relations with Europe. Moreover, many European countries are looking to increase business deals with China as negotiating with the US has become increasingly difficult.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

CONTROVERSIAL IRS CRYPTO REPORTING REGULATION

Lawmakers, including Senator Ted Cruz and Cynthia Lummis, have introduced a resolution to overturn the IRS rule, with a vote expected this week.

▪The US Senate is set to vote on an IRS rule requiring crypto brokers to report detailed transaction data, a move that has sparked controversy in the industry.

▪Critics argue that the tax reporting mandate could stifle DeFi innovation, leading to legal challenges and calls for its repeal.

▪Lawmakers will also review a separate Consumer Financial Protection Bureau (CFPB) regulation that affects digital payment apps.

The US Senate is preparing to vote on a controversial IRS regulation requiring “brokers” to report gross proceeds, cost basis, and gains or losses from digital asset transactions, including cryptocurrency, stablecoins, and non-fungible tokens (NFTs).

The law, formally introduced in December 2024 and enacted in January 2025, has faced strong opposition from the crypto community. Critics argue that the regulation threatens the growth and innovation of the decentralized finance (DeFi) sector, leading to a lawsuit challenging its implementation.

Lawmakers Push for Repeal

While the legal battle continues, Senator Ted Cruz, alongside Senators Cynthia Lummis, Pete Ricketts, and others, has taken legislative action to challenge the rule, according to a CoinDesk report on Monday, citing sources familiar with the matter.

The lawmakers have introduced a joint resolution urging the repeal of the IRS regulation. A source close to the matter revealed that Congress is expected to vote on the resolution this week, a decision that could determine the rule’s future.

The Congress has the power to challenge and potentially overturn unfavourable new laws enacted by government agencies under the Congressional Review Act (CRA).

In addition to the IRS measure, Congress is also set to review what CoinDesk described as an “11th-hour regulation” from the Consumer Financial Protection Bureau (CFPB), which impacts digital payment applications.

Donald Trump Finally Adds Crypto to National Reserve

The previous administration introduced both rules in an attempt to curb innovation within the crypto sector. In 2024, the then-US president signed an executive order directing the government to assess the risks and benefits of cryptocurrencies.

The measures targeted six key areas: consumer protection, financial stability, illicit activity, US competitiveness, financial inclusion, and responsible innovation. However, despite these efforts, the industry remained without clear regulatory guidance during his tenure.

In contrast, the current administration is taking steps to establish a well-defined regulatory framework for cryptocurrencies in the US.

Last month, President Donald Trump issued an executive order instructing federal agencies to review existing laws and create a clear regulatory structure for digital assets and related services. Agencies such as the Commodity Futures Trading Commission (CFTC) and the Department of Justice (DOJ) have been given 30 days, starting January 23, 2025, to carry out this directive.

Beyond regulatory reforms, Trump has pledged to position the US as the “world crypto capital,” aiming to lead in regulation, innovation, and technological advancements within the sector.

On Sunday, Trump officially unveiled the long-anticipated crypto reserve, incorporating major digital assets like XRP, SOL, and ADA. He emphasized that Bitcoin and Ethereum would be the “heart of the reserve,” reaffirming his strong support for the top two cryptocurrencies.

@ Newshounds News™

Source: CoinSpeaker

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

New York Fed GOLD Vault! Your Gold & Silver Investment is About to Become Priceless - EB Tucker

New York Fed GOLD Vault! Your Gold & Silver Investment is About to Become Priceless - EB Tucker

Money Sense: 3-3-2025

A potential gold revaluation presents a unique, non-default pathway for managing the United States surging national debt.

The discussion extends beyond simple market pricing, with central banks showing renewed interest in physical gold and a global trend toward repatriating tangible assets.

EB Tucker explains that if gold reaches 4,000 dollars per ounce, US reserves would be worth 27 trillion dollars —about half the US stock market's valuation.

New York Fed GOLD Vault! Your Gold & Silver Investment is About to Become Priceless - EB Tucker

Money Sense: 3-3-2025

A potential gold revaluation presents a unique, non-default pathway for managing the United States surging national debt.

The discussion extends beyond simple market pricing, with central banks showing renewed interest in physical gold and a global trend toward repatriating tangible assets.

EB Tucker explains that if gold reaches 4,000 dollars per ounce, US reserves would be worth 27 trillion dollars —about half the US stock market's valuation.

He highlights that stocks are a uniquely American asset, contrasting them with the London Stock Exchange, which struggles to retain major companies. It took gold a decade to appreciate from 2,000 to 3,000 dollars, and according to our charts, the market is behaving similarly to 2011, a peak that lasted a decade.

Thus, moving from 3,000 to 4,000 dollars might take another decade. If so, the interest payments on an equivalent amount of debt would roughly wipe out the price gain.

Reflecting on his personal experience, Tucker recalls visiting the New York Fed gold vault in 2001. He notes that institutional investors avoid physical gold, preferring futures and contracts since physical metal is lately seen as "dead money" that doesn't generate returns.

However, recent developments have raised concerns over the accuracy and transparency of these reserves. Speculation about potential shortages or overstatements in US gold reserves could significantly impact financial markets, inflation expectations, and investor sentiment.

However, Tucker emphasizes JP Morgan's near silver crisis due to the Wall Street Silver movement. He explains that institutions avoid holding physical metals, preferring to lease gold and create complex financial instruments.

Recently, gold deliveries on the COMEX have reached record levels, a clear indicator of the explosion in demand for physical gold. This phenomenon could create a snowball effect, prompting other major institutions and central banks to step up their delivery demands, putting further pressure on the system as a whole.

Looking at major fundamentals, EB Tucker argues that gold's price movements over the past few years were due to a well-managed, financialized market rather than external factors like tariffs. He explains that large-scale futures trading was used to control price volatility, but recent declines in futures volume indicate a shift in market dynamics.

Strength in gold earlier this month is linked to increased safe-haven demand, increasing expectations of accelerated Federal Reserve interest rate cuts, and growing inflows into gold-backed exchange-traded funds.

Since December, over 600 tons of gold have been transferred to New York City vaults, according to the World Gold Council.

Gold has not been a direct target of tariffs, but market reactions to trade uncertainty have driven a significant shift in trading behavior and impacted the gold price.

The movement of gold from London to the US, rising COMEX premiums, and concerns over availability were largely the result of risk management decisions rather than true supply issues.

Seeds of Wisdom RV and Economic Updates Monday Morning 3-03-25

Good Morning Dinar Recaps,

RIPPLE UNLOCKS 1B XRP AS TRUMP ADDS IT TO US CRYPTO RESERVE, PRICE JUMPS 30%

▪Ripple unlocked 1 billion XRP on March 3, but re-locked 700 million tokens into escrow after Trump's crypto reserve announcement.

▪Whale Alert reported major XRP movements, with 500 million XRP sent to two different wallets.

▪XRP’s price hit $2.60 but faces resistance at $3; if it breaks through, the next target could be $3.40, its January high.

Good Morning Dinar Recaps,

RIPPLE UNLOCKS 1B XRP AS TRUMP ADDS IT TO US CRYPTO RESERVE, PRICE JUMPS 30%

▪Ripple unlocked 1 billion XRP on March 3, but re-locked 700 million tokens into escrow after Trump's crypto reserve announcement.

▪Whale Alert reported major XRP movements, with 500 million XRP sent to two different wallets.

▪XRP’s price hit $2.60 but faces resistance at $3; if it breaks through, the next target could be $3.40, its January high.

As part of the monthly release of 1 billion XRP tokens, Ripple unlocked another 1 billion XRP on the 3rd of March before re-locking the 700 million XRP tokens into an escrow wallet.

This came after U.S. President Donald Trump announced on Truth Social that select cryptocurrencies, including XRP, were added to the new U.S. Crypto Strategic Reserves. Following this news, XRP, the third-largest cryptocurrency by market cap, surged 30% in a day, reaching a market cap of $150 billion.

Could this endorsement bring in more institutional investors and fuel an even bigger rally? Let’s dive into the details.

XRP On the Move!

On March 3, blockchain tracker Whale Alert reported the release of 1 billion XRP from Ripple’s escrow accounts, worth around $2.6 billion in multiple transactions. The first 500 million XRP was sent in two batches 100 million first, followed by 400 million to the wallet ‘rGKHD…2Bdh.’

However, a few minutes later, another 500 million XRP was sent in a single transaction to the wallet ‘rHGfm…sbQr.’

Ripple unlocks XRP every month, but this time, the release gained more attention due to Trump’s announcement. Many believe that adding XRP to the U.S. Crypto Reserve could bring in more big investors and boost its price.

700 Million XRP Locked Back in Escrow

Despite unlocking 1 billion XRP, Ripple did not release all of it into the market. Instead, 700 million XRP was locked back into escrow. Here’s how the distribution played out:

First wallet: Received 500 million XRP but has not moved it yet. Previously, it sent 300 million to another wallet on March 1 and locked back 200 million.

Second wallet: Received 500 million XRP but quickly moved the same amount to another Ripple wallet, which then locked it back in escrow.

If Ripple follows its usual monthly pattern, another 100 million XRP might be locked, leaving only 200 million XRP in circulation.

XRP Price Jumps but Faces Resistance

Following these events, XRP’s price surged 17%, reaching $2.60 at the time of writing. In the past 24 hours, it has gained 30%, pushing its market cap to $150 billion.

However, technical indicators suggest that XRP is now facing resistance at the $3 level, which could slow down its rally. If buyers break past this level, the next target could be $3.40, its January high.

XRP’s bullish surge signals growing confidence—whether it can sustain this momentum is the real question.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

TOKENIZATION CAN TRANSFORM REAL ESTATE INVESTING — POLYGON CEO

Tokenizing real estate and overhauling property investment markets has its challenges but is a killer use case for blockchain technology.

Real-world asset (RWA) tokenization can completely overhaul the real estate investment sector, which is highly illiquid, filled with intermediaries, and high transaction costs, according to Polygon CEO Mark Boiron.

In an interview with Cointelegraph, the CEO said that tokenization of properties could remove unnecessary intermediaries, thereby lowering transaction costs.

The CEO added that fractional ownership and trading tokenized real estate on the secondary markets would open up liquidity and increase the velocity of money. Boiron told Cointelegraph:

"The thing you really want is the ability to eliminate the illiquidity discount on real estate. All real estate is illiquid and therefore it's discounted to some degree. It can be more valuable if it's liquid."

Lumia Towers, an ongoing $220 million commercial real estate development in Istanbul, Turkey, featuring two skyscrapers with 300 mixed-use commercial and residential units, used Polygon's technology to tokenize the project.

Boiron said that the future of real estate is onchain. However, regulators must be comfortable with blockchain technology and public permissionless systems before tokenized real estate becomes the de facto standard.

In the United States, Quarter offers tokenized alternatives to debt-based home mortgages to increase levels of home ownership and make it more affordable to aspiring home buyers.

The company achieves this by assigning fractionalized equity rights to both the property investor and the prospective home buyer, which can be sold — deviating from the traditional debt-based mortgage financing that is the current standard in many jurisdictions.

In February 2025, real estate platform Blocksquare launched a real estate tokenization framework for the European Union that allows equity rights to be assigned and transferred onchain.

Real estate asset tokenization is gaining popularity in the United Arab Emirates (UAE) in what has become one of the hottest real estate markets in the world.

According to Tokinvest founder and CEO Scott Thiel, property developers in the UAE are scrambling to tokenize their projects as an alternative means to traditional financing structures.

Stablecoin issuer Tether also partnered with real estate platform Reelly Tech in February 2025 to expand the use of USDt in real estate transactions in the UAE.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 3-02-25

Good Afternoon Dinar Recaps,

WHITE HOUSE CRYPTO CZAR CONFIRMS US TO ESTABLISH RESERVE WITH BITCOIN AND OTHER TOP CRYPTOCURRENCIES

White House Crypto Czar David Sacks has endorsed President Donald Trump’s U.S. Crypto Strategic Reserve, highlighting its inclusion of bitcoin and other top cryptocurrencies to position the U.S. as a global leader.

Trump’s US Crypto Strategic Reserve Sparks Industry Buzz

Good Afternoon Dinar Recaps,

WHITE HOUSE CRYPTO CZAR CONFIRMS US TO ESTABLISH RESERVE WITH BITCOIN AND OTHER TOP CRYPTOCURRENCIES

White House Crypto Czar David Sacks has endorsed President Donald Trump’s U.S. Crypto Strategic Reserve, highlighting its inclusion of bitcoin and other top cryptocurrencies to position the U.S. as a global leader.

Trump’s US Crypto Strategic Reserve Sparks Industry Buzz

David Sacks, the White House AI and crypto czar, has expressed support for President Donald Trump’s announcement of a U.S. crypto strategic reserve. In a post on social media platform X, Sacks stated:

"President Trump has announced a Crypto Strategic Reserve consisting of bitcoin and other top cryptocurrencies. This is consistent with his week-one E.O. 14178. President Trump is keeping his promise to make the U.S. the ‘Crypto Capital of the World.’ More to come at the Summit."

On March 2, President Trump outlined the composition and goals of a proposed U.S. crypto reserve on Truth Social. He claimed the initiative would revitalize the cryptocurrency sector, which he said was harmed under the Biden administration.

Trump stated that his executive order on digital assets directed the Presidential Working Group to develop a Crypto Strategic Reserve, including XRP, SOL, and ADA, aiming to position the U.S. as a global leader in crypto.

In a follow-up post, he confirmed that BTC and ETH would be central to the reserve, expressing support for bitcoin and ethereum. His statements indicate a push to integrate major cryptocurrencies into national financial policy.

Historically, President Trump’s stance on cryptocurrencies has evolved. Initially skeptical, he has recently adopted a more supportive position, aligning with his promise to establish the U.S. as a hub for cryptocurrency innovation. The issuance of Executive Order 14178 reflects this commitment, directing federal agencies to develop frameworks that support digital asset integration and regulation.

Sacks also announced on Feb. 28 plans for a significant industry event, stating on X: “President Trump will host the first White House Crypto Summit on Friday, March 7. Attendees will include prominent founders, CEOs, and investors from the crypto industry. Look forward to seeing everyone there!”

The summit is expected to facilitate dialogue between the administration and key stakeholders, further solidifying the U.S.’s leadership role in the global cryptocurrency landscape.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

INSIDE THE WHITE HOUSE CRYPTO SUMMIT: TRUMP TO LEAD TALKS WITH 25 KEY GUESTS

This Friday, March 7th, marks the first-ever White House Crypto Summit, a key event that aims to shape the future of cryptocurrency policy in the U.S. According to Fox Business, the summit is part of a series designed to replace the previously proposed Crypto Advisory Council, giving the President’s Working Group on Digital Assets a chance to collaborate directly with the crypto industry on key issues.

“The White House announced today that President Trump will host and deliver remarks at the first ever White House Crypto Summit on Friday, March 7. Attendees will include prominent founders, CEOs, and investors from the crypto industry, as well as members of the President’s Working Group on Digital Assets,” the press release stated.

Around 25 invitees are expected to attend the summit, though the guest list is still under wraps. It’s anticipated that more details on who will be present will be released soon.

Some important figures, like David Sacks (the White House’s crypto czar) and Bo Hines, are expected to be involved, which signals a positive direction for crypto legislation and future policy clarity.

The shift from a formal advisory council to these summits suggests a more flexible approach to policymaking, allowing for direct engagement with industry leaders. This is seen as a step in the right direction for crypto, offering a clearer path forward and showcasing the government’s growing support for the industry.

The White House crypto summit is expected to spark important discussions that could influence future legislation and solidify the role of crypto in the U.S. economy. As crypto continues to gain mainstream acceptance, this summit is a strong signal that the government is committed to ensuring its place in the financial landscape.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

DE-DOLLARIZATION: GLOBAL BANK PREDICTS FUTURE OF THE US DOLLAR

Despite de-dollarization, the US dollar rebounded in price as the DXY index, which measures its performance climbed above the 107 mark. The DXY index is now trading at the 107.40 level after surging 0.15% on Friday. The US treasury yields rose this month making the greenback strengthen in the charts. The move pushed gold prices below the $2,900 range making the XAU/USD index trade at $2,860 on Friday’s opening bell.

Leading investment bank Goldman Sachs predicted the future of the US dollar as de-dollarization looms. The global bank weighed the pros and cons of the currency markets and wrote in the latest note to stakeholders that the greenback will make a comeback.

Goldman Sachs Predicts the Future of the US Dollar Amid De-Dollarization

Global investment bank Goldman Sachs wrote in a note that the US dollar could get a boost despite de-dollarization as Trump’s tariffs could uplift the greenback. Goldman Sachs strategists Karen Reichgott Fishman and Lexi Kanter wrote that the US dollar looks attractive due to the tariffs.

Trump has vowed to protect the US dollar amid the onslaught of the de-dollarization agenda kick-started by developing nations. “Ultimately, not all tariffs are equal when it comes to FX,” the strategists wrote in a note. “But given the unwind of premium in key crosses in recent weeks, we once again think tariff risks look underpriced, making long dollar exposure now look even more attractive.”

Therefore, currency investors can take long positions in the US dollar now as its prospects look “more attractive”. Local currencies are under pressure due to tariffs and the USD is coming out on top. The Indian rupee has fallen to a lifetime low while the Chinese yuan and the Japanese yen have dipped to yearly lows. The development indicates that tariffs are working against de-dollarization and placing the US dollar on top.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 3-02-25

Good Morning Dinar Recaps,

IRAQ’S CENTRAL BANK TO CREATE ITS OWN DIGITAL CURRENCY

Baghdad (IraqiNews.com) – The Governor of the Central Bank of Iraq (CBI), Ali Al-Alaq, revealed on Wednesday that the bank is planning to create a digital currency to replace paper notes in transactions with central banks.

During his speech in the 9th edition of the Iraq Finance Expo, Al-Alaq said that fundamental changes will take place in the banking and financial systems, including the limited use of paper notes as they will be replaced by digital currencies in transactions between central banks.

Good Morning Dinar Recaps,

IRAQ’S CENTRAL BANK TO CREATE ITS OWN DIGITAL CURRENCY

Baghdad (IraqiNews.com) – The Governor of the Central Bank of Iraq (CBI), Ali Al-Alaq, revealed on Wednesday that the bank is planning to create a digital currency to replace paper notes in transactions with central banks.

During his speech in the 9th edition of the Iraq Finance Expo, Al-Alaq said that fundamental changes will take place in the banking and financial systems, including the limited use of paper notes as they will be replaced by digital currencies in transactions between central banks.

Iraq is seriously examining establishing a data center, according to Al-Alaq, and the CBI has started working on this project as part of the digital transformation process.

Al-Alaq also indicated that Iraq’s financial inclusion rate increased to over 40 percent compared to 20 percent three years ago due to the CBI’s promotion of mobile phone-based electronic wallets that enable bill payment and money transfer.

Over 4,000 ATMs have been installed, and there are roughly 17 million bank cards in use, according to Al-Alaq, and there are now 1.2 million electronic wallets in Iraq.

Iraq’s electronic payment system has been connected to global payment networks, allowing Iraqi bank cards to be used abroad and bank cards issued by foreign banks to be accepted locally.

@ Newshounds News™

Source: Iraqi News

~~~~~~~~~

BRICS EXTENDS FRIENDLY TIES WITH EUROPE AS US TARIFFS HIT

Europe is extending friendly ties with the BRICS alliance as Trump’s tariffs hit the market in February. Several European leaders have expressed displeasure at Trump’s decision to impose tariffs on close Western allies. BRICS member China is making use of the escalating tensions between the US and Europe and extending cordial relations.

Some countries in Europe are reconsidering their relations with BRICS member China, while others are aiming to diversify their partnerships with Japan and South Korea. Many other European nations are reaching out to India to procure goods. The widening rift between the US and Europe stems out of tariffs and its stance in the Ukraine war.

US Tariffs: Will Europe Get Friendly With BRICS?

However, the European Union faces a mixed approach with BRICS member China as some advocate for partnerships while others take a cautious stance. However, China is making use of the situation and pushing cordial ties with Europe as US tariffs hit the market.

“Europe must take its own decisions, on its own. And we have to decide when China can be a partner and when China is a competitor,” said Spain’s Foreign Minister Jose Manuel Albares. Germany’s chancellor-in-waiting Friedrich Merz said that Trump “does not care much about the fate of Europe”. This gives BRICS a chance to build bridges with Europe as the US is looking to burn it.

“My absolute priority will be to strengthen Europe as quickly as possible so that, step by step, we can really achieve independence from the USA,” said Merz. If Europe extends ties with BRICS countries, the US will remain isolated, and other countries scheme for its downfall.

While Europe is grappling with a realignment, maintaining cordial relations with BRICS member China is not a friendly option. The Communist country aims to dominate the global financial sector and keep the West in the backseat. The US needs to maintain its relations with Europe and not let things fall apart.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

HUGE CHANGE TO IRAQI DINAR JUST ANNOUNCED

The Central Bank of Iraq just announced it will create its own digital currency.

@ Newshounds News™

Source: The Economic Ninja

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 3-01-25

Good afternoon Dinar Recaps,

RUSSIA WANTS TO REVERSE DE-DOLLARIZATION: WHAT IT MEANS FOR THE US DOLLAR?

The US dollar has always been surrounded by serious foes and enemies, the ones that want to derail its reserve currency status.

To expedite the de-dollarization concept, Russia and China have always been quite vocal about their ideas, adding how they both want to derail the US dollar hegemony by putting forth the idea of the multi-polar currency world.

Good afternoon Dinar Recaps,

RUSSIA WANTS TO REVERSE DE-DOLLARIZATION: WHAT IT MEANS FOR THE US DOLLAR?

The US dollar has always been surrounded by serious foes and enemies, the ones that want to derail its reserve currency status.

To expedite the de-dollarization concept, Russia and China have always been quite vocal about their ideas, adding how they both want to derail the US dollar hegemony by putting forth the idea of the multi-polar currency world.

This roughly sparked the promotion of local currencies on an international scale, jeopardizing the dollar’s supremacy. With the US and EU sanctioning Russia and expelling it out of the SWIFT system, Russia opted for yuan, all while promoting the narrative of de-dollarization at a rapid pace.

But now it seems that things have started to take an interesting turn, with Russia showing a softening stance against the US. What is this all about? Let’s find out.

Tables Turning Around: Trump Supporting Russia

With Donald Trump assuming the role of the US president, his ideas of bolstering the US economy via tariffs have been gaining widespread momentum. Apart from that, another significant development that has caught the world’s attention is Trump’s increased effort to conclude the ongoing Ukraine-Russia war.

The US president has often been noted stating the gruesome repercussions of the ongoing Russia-Ukraine war, adding that Zelensky should have made a deal to end the war earlier, showing a supportive stance towards Russia.

“I hear that they’re upset about not having a seat. Well, they’ve had a seat for three years and a long time before that. This could have been settled very easily… Russia wants to do something. They want to stop the savage barbarism.”

"You should have never started it. You could have made a deal…I could have made a deal for Ukraine… That would have given them almost all of the land, everything. Almost all of the land—and no people would have been killed, and no city would have been demolished.”

Trump earlier shared how he has the power to end the war.

“I think I have the power to end this war,” he added.

De-Dollarization To End: Russia Praises Trump

On the other hand, Russian PM Vladimir Putin has notably praised Trump’s effort to resolve the ongoing Russia-Ukraine war.

“Let me note that the first contacts with the American administration instill hope. They too are willing to work towards resuming our ties, solving a colossal amount of strategic problems in world architecture.”

In addition to this, Putin also acknowledged how certain external forces are trying to disrupt the budding Russian-US sense of friendship and commitment.

“I understand that not everybody is pleased with the resumption of Russian-American contacts. Some of the forces are interested in keeping hostilities, and they will try to disrupt the emerging dialogue. We will need to use all the possibilities of diplomacy and special forces to firmly defend our national interests.”

With such developments taking place, the Russia-US fostering relationship could ultimately result in a lasting resolution thwarting BRICS efforts of derailing the US dollar. This development can ultimately put a stop to the rising de-dollarization concepts and ideations.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

RUSSIA DELAYS DIGITAL RUBLE CBDC ROLLOUT

A year ago, the Bank of Russia set July 2025 as the date for the first launch phase of its digital ruble central bank digital currency (CBDC). Now the central bank is delaying the roll out. It follows resistance from merchants, a major banking association, and its largest bank, Sber.

The big bank was excluded from the first wave of banks involved in the pilot, so it only joined this January, a year later than planned. Perhaps its inclusion was delayed to avoid it dominating trials, but that’s speculation. The reality is that six months from the first pilot to launch is rather short for a bank.

Central Bank Governor Elvira Nabiullina announced the delay at a meeting with the Association of Russian Banks (ASROS). However, she said that the pilots are progressing well.

“Our intention is to move on to the mass implementation of the digital ruble somewhat later than originally planned, namely after we have worked out all the details in the pilot and held consultations with banks on the economic model that is most attractive to their clients – for businesses, for people,” the Governor said, as reported by the Association.

The central bank first shared details about the planned business model late last year.

A new schedule has not yet been set, and the central bank did not mention the delay on its website. However, the launch postponement was also reported by the Interfax news agency.

Digital ruble: addressing bank concerns

When banks raised their concerns in the State Duma in December, they highlighted several issues. The main ones were worries about deposit outflows and the costs of implementation.

On the first point, from the start the central bank has appeared unconcerned about this impact. This may be partly because it plans a three phase rollout. Initially larger banks and merchants will join, followed by other banks and mid-sized merchants. The final phase will require non bank providers and all merchants to participate, but that will be two years later.

Regarding the expense, the banking association estimated the cost to a bank could be up to Rubles 100 million ($1.1m). The central bank says it will provide some technical elements to banks free of charge, to help smaller banks.

“For those components that are mandatory from the point of view of information security, we (will) provide these solutions to banks free of charge. This software module for embedding is created and transferred to organizations, and in three different forms, so that banks can choose the most optimal one for their landscape,” said Deputy Governor of the Bank of Russia, Zulfiya Kakhrumanova.

“We provide free cryptographic information protection tools for subordinate certification centers that are deployed by banks, and this is also a significant cost aspect for banks,” she added, according to Interfax.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

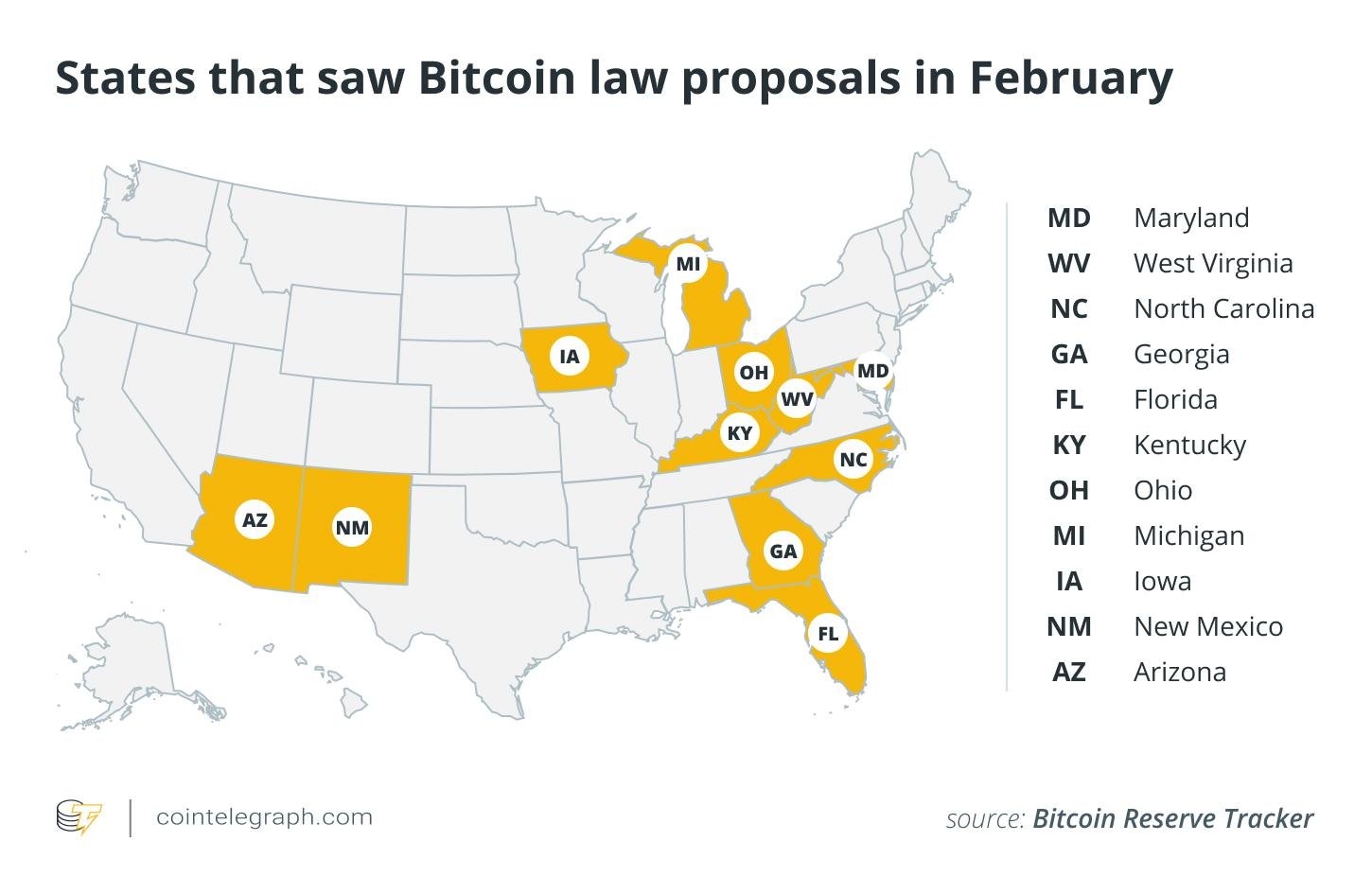

ARIZONA APPROVES BITCOIN RESERVES, BUT WYOMING AND MONTANA ARE SAYING NO – HERE’S WHY

▪Arizona advances crypto legislation - two bills, one establishing a digital asset reserve and another focused on Bitcoin investment

▪While Arizona embraces crypto reserves, other states like Wyoming and Montana reject them due to volatility concerns.

▪Bitcoin's recent price drop fuels skepticism, while predictions suggest federal crypto legislation is forthcoming.

Arizona is pushing ahead with cryptocurrency investment as two Bitcoin reserve bills have passed the Senate, setting the stage for final approval in the state’s House of Representatives.

While states like Wyoming and Montana are rejecting similar measures over concerns about crypto’s volatility, Arizona is doubling down on digital assets.

If these bills pass in the state’s House of Representatives, Arizona could become one of the first states to officially hold Bitcoin in its reserves.

Senate Approves Bitcoin Reserve Bills

On Feb. 27, the Arizona Senate approved the Strategic Digital Assets Reserve bill (SB 1373) in a 17-12 vote, sending it to the House for final approval. Sponsored by Republican Senator Mark Finchem, the bill aims to create a Digital Assets Strategic Reserve Fund, which will be managed by the state treasurer. The fund will include legislative appropriations and crypto assets seized by the state.

To limit risk, the treasurer would be allowed to invest no more than 10% of total fund deposits per fiscal year. However, the state could loan out digital assets to generate returns as long as it doesn’t add financial risk.

Another Bill Aims to Allow Bitcoin Investments

A second Bitcoin-related bill is also moving forward. The Strategic Bitcoin Reserve Act (SB 1025), co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, passed the Senate with a 17-11 vote.

Unlike Finchem’s bill, which focuses on managing seized crypto assets, SB 1025 allows the state to invest public funds directly into Bitcoin and other cryptocurrencies. This signals Arizona’s growing commitment to incorporating digital assets into its financial strategy.

Crypto Legislation Gaining Momentum Nationwide

Dennis Porter, founder of Satoshi Action Fund, believes federal regulation of cryptocurrencies is inevitable. He predicts lawmakers will first regulate stablecoins, followed by broader market structure rules, and eventually, Bitcoin reserves.

While Arizona and Utah are leading the push for crypto reserves, 18 other states are still waiting for approval. However, not all states are on board—Montana, Wyoming, and others have rejected similar plans, calling Bitcoin too risky.

Trump Weighs Heavy on the Markets

Despite increasing political support for crypto, Bitcoin’s price has taken a hit. The asset dropped below $80K, and analysts fear it could fall further to $70K–$75K. Bitcoin is down 17% this week, with Trump’s tariff policies adding to market uncertainty.

Amid the panic, Michael Saylor jokingly told investors to “sell a kidney if you must, but keep the Bitcoin.” While Saylor continues to advocate for a U.S. Bitcoin reserve, the recent price drop has given skeptics more reason to doubt Bitcoin’s long-term stability.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

BITCOIN NOT FIT FOR SWISS NATIONAL BANK RESERVES, SAYS PRESIDENT

▪The Swiss National Bank president dismissed the idea of holding Bitcoin in reserves due to volatility, liquidity concerns, and security risks.

▪The SNB views cryptocurrencies as a small, volatile "niche phenomenon" unsuitable for central bank reserves.

▪A Swiss initiative is pushing for a public vote to mandate the SNB to include Bitcoin in its reserves.

The Swiss National Bank (SNB) has made its stance on Bitcoin crystal clear—it’s not interested. Despite growing global adoption and a push from Swiss crypto advocates, SNB President Martin Schlegel has firmly rejected the idea of adding Bitcoin to the bank’s reserves.

In a recent interview, he explained why digital assets don’t make the cut, pointing to volatility, liquidity concerns, and security risks.

@ Newshounds News™

Read more: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Morning 3-01-25

Good Morning Dinar Recaps,

CARDANO-XRP BRIDGE GOES LIVE – A GAME CHANGER FOR BOTH ECOSYSTEMS

▪Cardano and XRP Ledger now have a direct connection through the Wanchain bridge.

▪The linkup is a mutually beneficial one for native assets within both ecosystems.

Cardano (ADA) and the XRP Ledger (XRPL), two leading blockchains, have formed a coalition to strive for seamless interoperability. Both ecosystems have launched a new bridge, connecting ADA and XRP, the native coin operating on the XRPL.

Good Morning Dinar Recaps,

CARDANO-XRP BRIDGE GOES LIVE – A GAME CHANGER FOR BOTH ECOSYSTEMS

▪Cardano and XRP Ledger now have a direct connection through the Wanchain bridge.

▪The linkup is a mutually beneficial one for native assets within both ecosystems.

Cardano (ADA) and the XRP Ledger (XRPL), two leading blockchains, have formed a coalition to strive for seamless interoperability. Both ecosystems have launched a new bridge, connecting ADA and XRP, the native coin operating on the XRPL.

Cardano and XRPL Expand Interoperability With New Bridge

TapTools, a digital wallet tracking Cardano trading, brought the attention of the crypto community to the Cardano-XRP bridge. This bridge, which is now live, is facilitated by Wanchain, a decentralized blockchain interoperability solution.

As reported by TapTools, the Cardano-XRP bridge is designed to expand interoperability and liquidity between the two networks. This technical advancement marks a massive milestone for both blockchains, representing the first time they connect via a bridge.

Besides promoting interoperability and liquidity, the bridge will support DeFi adoption and enhance utility for both ADA and XRP.

Historically, both communities have different technological and market positioning. However, they can now leverage the new bridge to interact in unprecedented ways.

Users can utilize the bridge to transfer ADA onto the XRP Ledger and vice versa.

It will also increase the Total Value Locked (TVL) for users exploring Decentralized Finance (DeFi) opportunities on Cardano. This increased interoperability is crucial as the world moves swiftly toward widespread blockchain adoption.

Beyond these benefits, the bridge potentially paves the way for integrating Ripple’s stablecoin, RLUSD, as a bridged asset. It is important to note that the Cardano-XRP bridge operates without centralized control. This means users retain control over their assets without interference from a third party.

Meanwhile, Wanchain will help to preserve the underlying value of wrapped versions of XRP and ADA as they seamlessly interact with applications on the opposite chain.

Wanchain uses a distributed key generation and secure multi-party computation (MPC) mechanism to ensure assets move safely across different blockchains.

Impact on ADA, XRP, and Broader Market

The Wanchain XRP/Cardano bridge will benefit Cardano and the XRP ecosystems in numerous ways. For Cardano, the bridge will help strengthen users’ appeal for the blockchain as more capital flows into ADA-based DeFi platforms. Our latest report covered that the XRPL Decentralized Exchange has surpassed $20 billion in liquidity, highlighting XRP’s expanding role in DeFi.

Also, thanks to this bridge, XRP users are encouraged to explore Cardano’s ecosystem more. This attention toward the network can lead to greater adoption of Cardano’s native smart contracts and Decentralized Applications (dApps).

Regarding XRP, the new bridge can unlock staking, borrowing, lending, and yield farming opportunities previously unavailable to XRP holders. The bridge can also elevate XRP’s role in multi-chain ecosystems, extending its potential beyond traditional payments and remittances.

For the broader market, the new bridge demonstrates that achieving a more interconnected blockchain environment is possible. It also demonstrates the growing importance of interoperability in the blockchain industry and ensures that cryptocurrencies are not isolated.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

BRICS CONFIRMS DEVELOPMENT OF NEW PAYMENT SYSTEMS IN 2025

Brazil, which chairs the upcoming BRICS summit in 2025 confirmed that they plan on the formation of new payment systems. Under the leadership of Brazilian President Luiz Lula da Silva, the alliance will discuss alternative payment options to the US dollar.

The BRICS Sherpas meeting will take the ideas forward and the upcoming 17th summit could see massive changes in the way the bloc operates and settles cross-border transactions.

The move could lead to a paradigm shift in global trade and tilt the financial powers from the West to the East. Developing countries are looking to cut ties with the US dollar and strengthen their local currencies in the forex markets.

The US dollar is in the crosshairs of a major shift that could pave the way for native currencies to take the driver’s seat of the financial markets.

BRICS: New Payment Systems in 2025 Could Be a Reality

Brazil’s President Luiz Lula da Silva made a strong statement saying that BRICS will continue advancing the de-dollarization agenda. The President also added that under their leadership, BRICS will work towards developing new payment systems as an alternative to the US dollar.

“Brazil is going during the period of its presidency to fully develop transparent and safe payment systems,” he said.

The bloc will work towards launching safe payment systems to uplift their GDP and strengthen their native economies. The move will give a boost in the arm to their local currencies making businesses thrive.

The next BRICS summit is scheduled to be held in Brazil’s Rio De Janeiro on July 6th and 7th. All the nine member countries will meet at the summit and discuss policies and sign new trade deals. Details on the new payment systems could be revealed at the 17th summit in July this year.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Afternoon 2-28-25

Good Afternoon Dinar Recaps,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

Good Afternoon Dinar Recaps,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

According to the commissioner’s Feb. 27 statement, memecoins could satisfy the Howey test’s condition of profiting from the managerial efforts of others due to the coordination between developer teams and promoters.

The commissioner added that most, if not all, cryptocurrencies could be defined as memecoins under the SEC’s recent guidance, which was released on the same day. In this guidance, the agency stated that memecoins represent online social trends with speculative value and high volatility — and are not securities. Commissioner Crenshaw, however, has a different viewpoint:

“Today’s statement paints meme coins as cultural projects whose purpose is entertainment and social engagement. The reality is that meme coins, like any financial product, are issued to make money.”

Memecoins have come into sharper focus following several high-profile scams, hacks and even presidential memecoin launches that threaten the long-term viability of the sector and invite scrutiny from state officials.

US regulators and lawmakers attempt to reign in memecoins

Following US President Donald Trump’s memecoin launch, several Democrat lawmakers, including Elizabeth Warren, called for an investigation into potential ethics violations of the presidential token.

On Feb. 27, California Member of Congress Sam Liccardo announced that House Democrats are prepping a bill that would ban presidential memecoins.

The proposed bill, titled “The Modern Emoluments and Malfeasance Enforcement (MEME) Act,” would prohibit US lawmakers from sponsoring, issuing or endorsing any digital asset.

Moreover, spouses and dependents of US representatives, the president, vice president and senior executive branch officials are also prohibited from issuing or sponsoring memecoins under the bill.

Attorney Elizabeth Davis, former chief attorney at the Commodity Futures Trading Commission (CFTC), recently argued that memecoins should be regulated by the CFTC.

Davis told Cointelegraph that if the commodities regulator is granted regulatory oversight over crypto, then there is a strong likelihood that memecoins will be included in their purview.

The attorney also expressed confidence that comprehensive memecoin regulations would be established in the United States over the next year — putting an end to the regulatory ambiguity surrounding social tokens.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ARIZONA APPROVES BITCOIN RESERVES, BUT WYOMING AND MONTANA ARE SAYING NO – HERE’S WHY

▪Arizona advances crypto legislation - two bills, one establishing a digital asset reserve and another focused on Bitcoin investment

▪While Arizona embraces crypto reserves, other states like Wyoming and Montana reject them due to volatility concerns.

▪Bitcoin's recent price drop fuels skepticism, while predictions suggest federal crypto legislation is forthcoming.

Arizona is pushing ahead with cryptocurrency investment as two Bitcoin reserve bills have passed the Senate, setting the stage for final approval in the state’s House of Representatives.

While states like Wyoming and Montana are rejecting similar measures over concerns about crypto’s volatility, Arizona is doubling down on digital assets.

If these bills pass in the state’s House of Representatives, Arizona could become one of the first states to officially hold Bitcoin in its reserves.

Senate Approves Bitcoin Reserve Bills

On Feb. 27, the Arizona Senate approved the Strategic Digital Assets Reserve bill (SB 1373) in a 17-12 vote, sending it to the House for final approval. Sponsored by Republican Senator Mark Finchem, the bill aims to create a Digital Assets Strategic Reserve Fund, which will be managed by the state treasurer. The fund will include legislative appropriations and crypto assets seized by the state.

To limit risk, the treasurer would be allowed to invest no more than 10% of total fund deposits per fiscal year. However, the state could loan out digital assets to generate returns as long as it doesn’t add financial risk.

Another Bill Aims to Allow Bitcoin Investments

A second Bitcoin-related bill is also moving forward. The Strategic Bitcoin Reserve Act (SB 1025), co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, passed the Senate with a 17-11 vote.

Unlike Finchem’s bill, which focuses on managing seized crypto assets, SB 1025 allows the state to invest public funds directly into Bitcoin and other cryptocurrencies. This signals Arizona’s growing commitment to incorporating digital assets into its financial strategy.

Crypto Legislation Gaining Momentum Nationwide

Dennis Porter, founder of Satoshi Action Fund, believes federal regulation of cryptocurrencies is inevitable. He predicts lawmakers will first regulate stablecoins, followed by broader market structure rules, and eventually, Bitcoin reserves.

While Arizona and Utah are leading the push for crypto reserves, 18 other states are still waiting for approval. However, not all states are on board—Montana, Wyoming, and others have rejected similar plans, calling Bitcoin too risky.

Trump Weighs Heavy on the Markets

Despite increasing political support for crypto, Bitcoin’s price has taken a hit. The asset dropped below $80K, and analysts fear it could fall further to $70K–$75K. Bitcoin is down 17% this week, with Trump’s tariff policies adding to market uncertainty.

Amid the panic, Michael Saylor jokingly told investors to “sell a kidney if you must, but keep the Bitcoin.” While Saylor continues to advocate for a U.S. Bitcoin reserve, the recent price drop has given skeptics more reason to doubt Bitcoin’s long-term stability.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

FEBRUARY IN CHARTS: SEC DROPS 6 CASES, MEMECOIN CRAZE COOLS AND MORE

@ Newshounds News™

Read the story: CoinTelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Homes aren’t Getting More Expensive and Gold Just Proved it

Homes aren’t Getting More Expensive and Gold Just Proved it

Taylor Kenny: 2-27-2025

We’re all feeling the squeeze. Whether it’s at the grocery store, the gas pump, or even just contemplating the dream of homeownership, the rising cost of everything is a palpable reality.

While inflation is the word on everyone’s lips, understanding the why behind this economic phenomenon is crucial to protecting your financial future. And a key piece of the puzzle lies in the history of the US dollar and its relationship with gold.

For decades, wages and housing prices largely moved in tandem, reflecting a relatively stable economic environment.

However, a significant shift occurred in 1971 when the U.S. government completely severed the dollar’s link to gold. This pivotal decision unleashed forces that continue to impact our financial lives today.

Homes aren’t Getting More Expensive and Gold Just Proved it

Taylor Kenny: 2-27-2025

We’re all feeling the squeeze. Whether it’s at the grocery store, the gas pump, or even just contemplating the dream of homeownership, the rising cost of everything is a palpable reality.

While inflation is the word on everyone’s lips, understanding the why behind this economic phenomenon is crucial to protecting your financial future. And a key piece of the puzzle lies in the history of the US dollar and its relationship with gold.

For decades, wages and housing prices largely moved in tandem, reflecting a relatively stable economic environment.

However, a significant shift occurred in 1971 when the U.S. government completely severed the dollar’s link to gold. This pivotal decision unleashed forces that continue to impact our financial lives today.

Prior to 1971, the dollar’s value was directly tied to gold, meaning a certain amount of dollars could be exchanged for a fixed quantity of gold. This provided a natural constraint on the money supply. With the gold standard abandoned, the Federal Reserve gained the ability to print money virtually without limit.

Without the gold standard to tether it, the dollar’s value became increasingly susceptible to inflation. Printing more money effectively dilutes the existing currency, driving up prices for goods and services.

The detachment of the dollar from gold was a watershed moment in modern economic history. While the full ramifications are still unfolding, understanding the link between monetary policy, inflation, and your purchasing power is paramount.

By taking proactive steps to protect your wealth through diversification, strategic investments, and a proactive approach to financial planning, you can navigate the challenges of dollar devaluation and build a more secure financial future. Remember, knowledge is power, and informed decisions are your best defense against the silent thief of inflation.

Watch the video below from ITM Trading with Taylor Kenney for further insights and information.