Seeds of Wisdom RV and Economic Updates Thursday Morning 12-05-24

Good Morning Dinar Recaps,

MISSOURI BILL WOULD BAN CBDCS, MAKE GOLD AND SILVER LEGAL TENDER

Missouri lawmakers have been trying hard to pass an anti-CBDC bill, and one of these days, they may succeed.

Attempts continue in the US state of Missouri to prohibit the potential use of central bank digital currencies (CBDCs). The state has seen several bills this year to stave off the digital currency, which does not currently exist in the United States.

Good Morning Dinar Recaps,

MISSOURI BILL WOULD BAN CBDCS, MAKE GOLD AND SILVER LEGAL TENDER

Missouri lawmakers have been trying hard to pass an anti-CBDC bill, and one of these days, they may succeed.

Attempts continue in the US state of Missouri to prohibit the potential use of central bank digital currencies (CBDCs). The state has seen several bills this year to stave off the digital currency, which does not currently exist in the United States.

Bullion yes, CBDC no

Republican Senator Rick Brattin pre-filed Senate Bill (SB) 194 on Dec. 1. The bill introduces changes to state law that would prohibit public entities from accepting a CBDC or participating in any testing of a CBDC. It also changes the definition of money in the state’s Uniform Commercial Code (UCC) to exclude CBDCs.

In addition to the provisions on CBDCs, the bill would require the state treasurer to keep at least 1% of state funds in gold and silver. It would also exempt the sale or exchange of gold and silver from the state capital gains tax and make gold and silver legal tender.

“The act declares that gold and silver shall be accepted as legal tender at their spot price plus market premium […] in the state of Missouri. Costs incurred in the course of verification of the weight and purity of any gold or silver […] shall be borne by the receiving entity.”

Massive legislative anti-CBDC push

The bill’s provisions on CBDC are similar or identical to those in other bills introduced in Missouri earlier this year.

SB 1352 would make numerous changes to the state UCC, including a prohibition on CBDCs. It is still in committee. House Bill 2780 would also ban CBDCs and affect a variety of commercial transactions. It passed a House vote and has been forwarded to the state Senate.

SB 826 concerned CBDCs alone and failed to pass. SB 736 and its companion bill in the state House of Representatives concerned CBDCs and gold and silver and failed to pass. Brattin had previously introduced SB 866, which contained substantially identical provisions with differences in wording. It died in committee.

Anti-CBDC legislation is being passed in an increasing number of US states. Louisiana and North Carolina have passed laws to that effect in recent months.

The struggle against CBDC has been taken up on the national level as well. The US House of Representatives passed the CBDC Anti-Surveillance State Act on May 23.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

BITCOIN ENDORSED BY US FED CHAIR POWELL AND RUSSIA’S PUTIN IN HISTORIC SHIFT

In an unprecedented turn of events, Bitcoin received endorsements from two of the world’s most influential leaders yesterday. US Federal Reserve Chair Jerome Powell and Russian President Vladimir Putin independently acknowledged the cryptocurrency’s growing significance during separate events on December 4, 2024. Their remarks signal a potential paradigm shift in the global financial landscape, as Bitcoin continues to gain mainstream acceptance.

Jerome Powell Compares Bitcoin To Gold

During the New York Times DealBook Summit, Jerome Powell engaged in a conversation with Andrew Sorkin about the role of cryptocurrencies in the banking system. When questioned about Bitcoin’s rising prominence and talks in Washington about creating a strategic BTC reserve, Powell outlined the Federal Reserve’s perspective.

“From the jobs that we have, what’s relevant is really two things,” Powell said. “One is just, you know, what role should crypto assets be allowed to play in the banking system. We try to keep the banking system safe and sound. We regulate and supervise banks, and we would want the interaction between the crypto business and the banks to not threaten the health and wellbeing of the banks.”

Powell added that the other task of the US Federal Reserve is consumer protection. “We would want the public to know crypto products and things like that. There’s sort of a consumer protection aspect of it. They need to understand exactly what it is. But we don’t regulate it directly and we don’t have that big of a role.”

When asked if he would ever own Bitcoin himself, Powell succinctly replied, “I’m not allowed to.”

Sorkin then suggested that BTC might symbolize people’s faith—or lack thereof—in the US dollar or the Federal Reserve. Powell responded by likening Bitcoin to a traditional store of value: “I don’t think that’s how people think about it. I mean, people use Bitcoin as a speculative asset, right? It’s like gold.

It’s just like gold, only it’s virtual. It’s digital. People are not using it as a form of payment or as a store of value. It’s highly volatile. It’s not a competitor for the dollar. It’s really a competitor for gold. You know, that’s really how I think of it.”

Vladimir Putin Highlights Bitcoin’s Resilience

On the same day, President Vladimir Putin spoke at the Russia Calling forum, where he discussed the diminishing dominance of the US dollar and the rise of alternative financial instruments. Putin emphasized the inevitability of new technologies like BTC in reshaping the global economy.

“The use of the dollar as a world currency gives the US a lot of money,” Putin stated. “Thanks to the dollar, the US continues to exploit other economies of the world for their benefit.

One thing is to prohibit the use of dollars and the other thing is not to use it. That is why we see (economic) processes with the use of other instruments.”

He pointedly added, “For instance, who can ban Bitcoin? Nobody. And who can prohibit the use of other electronic means of payment? Nobody. Because these are new technologies.

And no matter what happens to the dollar, these tools will develop one way or another, because everyone will strive to reduce costs and increase reliability.”

Putin also commented on the global shift away from the dollar: “Even the countries that are allies of the US reduced their currency reserves in dollars and in euros.”

Reactions From Community

The endorsements from Powell and Putin sparked immediate reactions from prominent figures in the cryptocurrency space. Vijay Boyapati, a former Google engineer and author known for his book The Bullish Case for Bitcoin, took to X to express his thoughts:

“Jerome Powell calling Bitcoin digital gold is the biggest endorsement of Bitcoin yet, if you understand where financial power lies. Bigger than Fink or even Trump.”

David Bailey, CEO of BTC Inc and advisor to former President Trump’s team—who was instrumental in turning Trump pro-Bitcoin —also weighed in via X: “The Bitcoin Space Race is here. […] It couldn’t be more clear what’s happening. It must be a national priority to stand up the Strategic Bitcoin Reserve in the first 100 days of the Trump admin. We need an aggressive plan to grow USA’s proportional ownership of the Bitcoin supply.”

@ Newshounds News™

Source: Bitcoinist

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Evening 12-04-24

Good Evening Dinar Recaps,

FED CHAIR POWELL VIEWS BITCOIN AS DIGITAL GOLD, NOT A DOLLAR COMPETITOR

Powell reiterated his remarks on Bitcoin being used solely for speculative purposes, not being a competitor for the US dollar.

The Federal Reserve Chairman Jerome Powell dismissed the notion of Bitcoin as a replacement for the U.S. dollar, instead framing the leading crypto as a speculative asset comparable to gold.

Good Evening Dinar Recaps,

FED CHAIR POWELL VIEWS BITCOIN AS DIGITAL GOLD, NOT A DOLLAR COMPETITOR

Powell reiterated his remarks on Bitcoin being used solely for speculative purposes, not being a competitor for the US dollar.

The Federal Reserve Chairman Jerome Powell dismissed the notion of Bitcoin as a replacement for the U.S. dollar, instead framing the leading crypto as a speculative asset comparable to gold.

Powell shared his insights during an appearance at The New York Times DealBook Summit in Manhattan, emphasizing Bitcoin’s volatility and limited use as a form of payment or store of value.

According to Powell:

“It’s just like gold, only it’s virtual… It’s very volatile, it’s not a competitor for the dollar, it’s really a competitor for gold. That’s how I think of it.”

Powell’s comments come amid heightened speculation about Bitcoin’s growing influence in global finance. Crypto recently achieved a market capitalization of $1.92 trillion, surpassing silver, valued at $1.75 trillion, to become the world’s eighth most valuable asset. However, it remains far behind gold, which holds an estimated market value of $18 trillion.

This is not the first time Powell has used this comparison to address Bitcoin. In 2021, the Fed chair said that crypto is not useful as a store of value due to its intrinsic volatility, with Bitcoin being “essentially a substitute for gold, rather than for the dollar.”

Under President Joe Biden’s administration, the Fed is accused of being pivotal in Operation Chokepoint 2.0, an alleged plan to hinder the progress of the US crypto industry.

In August, following a Fed mandate directed at crypto-friendly Customers Bank urging tighter risk management and compliance measures, Gemini co-founder Tyler Winklevoss stated that the initiative “is alive and well.”

DeFi as ally

Despite Powell’s conservative tone toward Bitcoin and crypto as an asset class, Fed Governor Christopher J. Waller recently praised DeFi as an ally.

At the Vienna Macroeconomics Workshop on Oct. 18, Waller argued that intermediaries are still fundamental for the financial markets. However, he acknowledged that DeFi applications presented technologies that offer efficiency to traditional financial instruments.

He recognized the benefits of distributed ledger technology (DLT), tokenization, and smart contracts, which can enhance the speed and accuracy of financial transactions.

Moreover, Waller recognized at The Clearing House Annual Conference 2024 on Nov. 12 that central bank digital currencies (CBDC) are not helpful for payments, questioning whether the payments system has a problem that CBDCs could solve.

@ Newshounds News™

Source: Crypto Slate

~~~~~~~~~

RIPPLE’S RLUSD STABLECOIN SET TO LAUNCH TODAY, WHAT’S NEXT FOR XRP?

The highly anticipated launch of Ripple’s dollar-pegged stablecoin, RLUSD, is expected to take place today, December 4, 2024. However, Ripple is reportedly awaiting approval from the New York Department of Financial Services, according to local media reports.

What is RLUSD?

Ripple USD (RLUSD), a 1:1 USD-backed stablecoin, offers transparency and stability on the XRP Ledger and Ethereum. With the launch of RLUSD, Ripple aims to leverage both its stablecoin and native token, XRP, to enhance its cross-border payment solutions.

At present, Ripple Labs has warned investors and institutions to avoid engaging with any token claiming to be RLUSD or Ripple USD before its official launch to prevent falling victim to scams. Despite this warning, RLUSD is currently listed on the cryptocurrency data platform CoinGecko.

Since August 2024, Ripple has been beta testing its RLUSD stablecoin on the XRP Ledger (XRPL) and Ethereum’s mainnet. The firm has shared plans to gradually expand RLUSD to more blockchains and DeFi protocols in the future.

Will RLUSD Impact XRP Price?

Despite the RLUSD launch, Ripple’s native token XRP, has already gained significant attention over the past week. Furthermore, experts anticipate a notable upward momentum for XRP once RLUSD becomes available on exchanges.

Currently, XRP is trading near $2.55 and has registered a price decline of 2.55% in the past 24 hours. During the same period, its trading volume dropped by $28%, indicating lower participation from traders and investors amid a bullish outlook.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

THE SURPRISING TRUTH ABOUT BITCOIN GOLD NOBODY TELLS YOU I Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 12-04-24

Good Afternoon Dinar Recaps,

WHY HEDERA STANDS OUT: GOVERNANCE, INSTITUTION-FOCUS, TOKENIZATION, AND MORE—IS HBAR A SLEEPING GIANT?

▪️Hedera has been highlighted as one of the notable institution-focused distributed ledger technologies with incredible use cases.

▪️An analyst has spotted the formation of a golden cross, which could soon send HBAR to $1.

Hedera (HBAR) has been impressive so far, as it prints a staggering 669% surge on its monthly price chart and a 139% surge on its weekly price chart. At press time, the asset was trading at $0.329. However, its 24-hour trading volume has declined by 36%, with $4.6 billion changing hands.

Good Afternoon Dinar Recaps,

WHY HEDERA STANDS OUT: GOVERNANCE, INSTITUTION-FOCUS, TOKENIZATION, AND MORE—IS HBAR A SLEEPING GIANT?

▪️Hedera has been highlighted as one of the notable institution-focused distributed ledger technologies with incredible use cases.

▪️An analyst has spotted the formation of a golden cross, which could soon send HBAR to $1.

Hedera (HBAR) has been impressive so far, as it prints a staggering 669% surge on its monthly price chart and a 139% surge on its weekly price chart. At press time, the asset was trading at $0.329. However, its 24-hour trading volume has declined by 36%, with $4.6 billion changing hands.

Subjecting Hedera to critical analysis, crypto, and stock rating platform, Weiss Crypto has pointed out that the asset is backed by efficient technology and an evolving ecosystem that makes it exceptional amid competitors.

Firstly, Weiss Crypto highlighted that Hedera is one of the most “notable institution-focused distributed ledger technologies. According to the post, Hedera’s governing council is made up of 32 major financial institutions, including IBM (IBM), Google, Dell (DELL), Boeing (BA), and Deutsche Telekom.

On the blockchain, the platform explained that Hedera’s network is permissioned, unlike the permissionless blockchains.

This implies that it only facilitates the approval of entities that can become nodes. Additionally, this makes it a perfect match for Real-World Asset (RWA) use cases. The post also highlighted its active involvement in asset tokenization.

Hedera is actively involved in tokenizing assets like commercial real estate, securities, carbon credits, and even diamonds. Through these applications, Hedera is positioning itself as one of the leading players in the adoption of blockchain technology for institutional use.

More About Hedera (HBAR

Hedera is strengthening its position in the Web3 ecosystem by sealing jaw-dropping partnerships and introducing cutting-edge solutions. Recently, NoviqTech strengthened its partnership with Hedera by acquiring an additional 490,622 HBAR tokens for $150,000, increasing its holdings to 1.5 million.

According to NoviqTech’s Chief Executive Officer (CEO) Freddy El Turk, Hedera has extensively contributed to the success of its Carbon Central environmental monitoring platform.

Our growing investment in Hedera is a clear testament to our belief in its transformative potential. Hedera provides the perfect platform to power Carbon Central’s mission of delivering unparalleled transparency and efficiency in ESG compliance and traceability and we look forward to deepening this partnership as we continue to invest in its ecosystem and align our innovative solutions with its cutting-edge technology.

Recently, CNF reported that Hedera has been integrated into the Federal Reserve’s FedNow payment platform via Dropp. As we disclosed, it would facilitate real-time payment with increased security and efficiency.

Ripple has also partnered with Hedera for USD transactions. However, Ripple is waiting for regulatory approval to launch its stablecoin RLUSD.

Also, there has been growing optimism around the spot HBAR Exchange Traded Fund (ETF) filed by Canary Capital to the U.S. Securities and Exchange Commission (SEC). With the SEC chair Gary Gensler stepping down, this product could be approved and send the price skyrocketing.

According to analysts, HBAR is currently forming a golden cross pattern as its 50-day (SMA 50) trends above the 200-day (SMA 200) simple moving averages. A validation of this thesis could see the asset hitting $1

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

BRICS NEWS: BRICS TO ADOPT BITCOIN FOR TRADE SETTLEMENTS?

In a new sit-down interview, BRICS Member Russia’s president, Vladimir Putin, sang praises for the recent growth of the Bitcoin cryptocurrency. Speaking on Russian TV, Putin said that Bitcoin & digital assets will continue to develop.

In the past, the alliance has revealed plans that align with the crypto industry, particularly surrounding its new currency under development. Indeed, BRICS proposed the use of Bitcoin for international payments at its 2024 Summit. Now, one of the bloc’s leaders, Vladimir Putin, says that Bitcoin is inevitable.

When discussing the potential regulation of Bitcoin, Russia’s president rhetorically asks “Who can ban Bitcoin,” before quickly answering “Nobody.” “These are new technologies, and no matter what happens to the dollar, these tools will develop one way or another,” he adds. As the world strives “to reduce costs and increase stability,” in Putin’s eyes, methods like Bitcoin are becoming more popular. This message is also eerily similar to that of the BRICS currency, one set to rival the US dollar upon launch.

The economic alliance has continued to find new ways to promote local currencies through its policies. Moreover, there has been discussion that cryptocurrencies could factor into that in a massive way. Bitcoin could be set to play a big part in the BRICS bloc over the next several years, especially after Putin’s recent comments.

BRICS Member Russia Recognizes Bitcoin and Crypto’s Potential

Furthermore, according to recent reports, digital currencies are now formally recognized as a type of property in international trade settlements. This falls under a new law that has now been approved in Russia by Putin. The president has jumped into the crypto scene by embracing digital assets for trade, including Bitcoin.

Other members of the bloc: including China and Brazil, have also recently begun backing Bitcoin and crypto. Most notably, a bill was introduced in Brazil to develop a Bitcoin treasury reserve. The bill is currently being reviewed by Brazil’s government.

By establishing a legal framework, Russia’s legislation is expected to accelerate the adoption of digital assets within its financial ecosystem. Putin’s latest comments further reflect Russia’s strategic interest in leveraging Bitcoin for geopolitical and economic advantages.

During the Ukraine conflict, Bitcoin was utilized to mitigate the impact of Western sanctions. Russia is also in talks to digitalize the Ruble on the XRP Ledger.

In the future, the digital asset industry, led by Bitcoin, will likely shake up the BRICS bloc and how it sees trade. As a result, de-dollarization could see a new level brought by cryptocurrency.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

TOP 5 REASONS TO INVEST IN IRAQI DINAR RIGHT NOW | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Morning 12-04-24

Good Morning Dinar Recaps,

CRYPTO COMPLIANCE ‘NO LONGER OPTIONAL’ UNDER AUSTRALIA’S NEW DRAFT GUIDELINES

Sweeping proposed changes would force most crypto firms in Australia to obtain financial licensing, which some worry could drive innovators offshore.

Crypto exchanges and firms dealing with digital assets in Australia would no longer be able to avoid costly licensing under proposed guidance from the country’s corporate regulator.

Good Morning Dinar Recaps,

CRYPTO COMPLIANCE ‘NO LONGER OPTIONAL’ UNDER AUSTRALIA’S NEW DRAFT GUIDELINES

Sweeping proposed changes would force most crypto firms in Australia to obtain financial licensing, which some worry could drive innovators offshore.

Crypto exchanges and firms dealing with digital assets in Australia would no longer be able to avoid costly licensing under proposed guidance from the country’s corporate regulator.

On Dec. 4, the Australian Securities and Investment Commission (ASIC) released a consultation paper on proposed guidance for crypto, placing many digital assets under the category of financial products requiring in no uncertain terms that most firms dealing in crypto must be licensed.

“It’s a bit of a wake-up call,” Kate Cooper, CEO of Australia and head of APAC at the Standard Chartered-backed crypto custodian Zodia Custody told Cointelegraph.

“Compliance really is no longer optional for the industry, and a lot of the players, both local and international [...] are going to have to really look at and take an audit of what they’re doing from a custody and compliance management perspective.”

In Australia, businesses offering financial services and dealing in financial products need an Australian Financial Services License (AFSL), while platforms facilitating the trading of financial products may also need an Australian Market License.

The new guidance would require crypto exchanges and many other crypto firms to get one or both licenses.

Some worry that ASIC’s draft guidance could hang crypto startups out to dry and cause an exodus of crypto firms from the country.

“Obviously, the bigger businesses will be better able to withstand all of that regulation, all of that legal cost, compliance cost that is associated with it. Smaller businesses may struggle,” Liam Hennessy, a partner at Clyde and Co law firm and adjunct professor at the University of Sydney, told Cointelegraph.

Joni Pirovich, a crypto lawyer, wrote on LinkedIn that the updated guidance will make launching in Australia “on par or more expensive than launching offshore.”

“From a timing perspective, Australian innovators that want to launch now will likely do so offshore. Those that are based here face a significant step up in compliance costs,” she wrote.

Block Earner co-founder and CEO Charlie Karaboga, who was sued by ASIC for offering an unlicensed crypto-yield product in 2022, said it was an “amazing direction around clarity” but shared concerns about his business, which has just 13 employees, according to Pitchbook.

“I think ASIC underestimates the requirements needed to be met for an AFSL,” Karaboga told Cointelegraph, adding that firms need to hold millions of dollars on their balance sheets.

“Asking us to hold that much money basically could kill all the startups like us.”

“What’s clear is that this guidance will have significant implications for pockets of the local crypto industry,” Swyftx CEO Jason Titman said in a statement sent to Cointelegraph. “We’re not aware of any other countries that regulate exchanges like bourses. Rightly or wrongly, Australia is going it alone.”

ASIC provides much-needed crypto clarity

The silver lining, according to the executives, is that the regulator has finally released much-needed clarity for crypto — even if it is harsh.

“It is a significant piece of regulatory guidance to the market,” said Hennessy. “Anything which gives regulatory clarity is a good thing for the market.”

ASIC is considering a significant expansion of what it considers a financial product or service, including stablecoins, native token staking services, exchange tokens and wrapped tokens.

On the other hand, memecoins, gaming-linked NFTs, Bitcoin and Ether may be able to escape the classification.

“I think it is quite an expansive view that has been taken as to what constitutes a financial product in the market,” said Zodia’s Cooper.

ASIC has invited feedback on the proposed updates until Feb. 28, 2025.

“We want to promote the growth of responsible financial innovation while ensuring consumer protection,” ASIC Commissioner Alan Kirkland said in a statement. “A well-regulated financial system benefits everyone in the community as it supports consumer confidence, market integrity and facilitates competition and innovation.”

“We encourage all stakeholders to engage with the consultation process,” he added.

A final version of the guidance is expected to come in mid-2025 after considering the feedback.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

XRP LAWSUIT NEWS: CAN GENSLER’S REPLACEMENT PAUL ATKINS DISMISS RIPPLE CASE?

▪️Paul Atkins Appointed SEC Chair: Trump selects pro-crypto figure Paul Atkins as SEC chair, sparking debate on his impact on crypto regulation.

▪️XRP Lawsuit Update: Ripple’s legal battle continues as the SEC appeals the ruling, while Paul Atkins' appointment raises questions on crypto policy.

President-elect Donald Trump has chosen Paul Atkins, a pro-crypto figure, to chair the Securities and Exchange Commission (SEC), according to reports by Unchained.

Current SEC Chair Gary Gensler announced he will step down on January 20 when Trump is inaugurated. Atkins, who served as an SEC commissioner under President George W. Bush, is well-respected in conservative legal circles and among the Republican establishment.

One major case before the federal courts is the ongoing Ripple (XRP) lawsuit, in which the SEC claims Ripple violated securities laws by issuing XRP.

In July 2023, Judge Analisa Torres ruled that XRP was not a security when sold to retail investors on exchanges but was a security in institutional sales.

The SEC initially sought a $2 billion fine against Ripple but was instead given a $125 million penalty. In October 2024, Judge Torres rejected the SEC’s request to appeal, saying they didn’t have strong enough reasons. Despite this, the SEC appealed to the Second Circuit Court, arguing the decision went against Supreme Court rulings.

‘Paul Atkins is not what Trump Needs’

John Deaton recently explained that Paul Atkins would be a very traditional choice, one that Wall Street would likely approve of. He stated that Atkins is someone who respects the SEC and its staff, but what is truly needed is someone who challenges the SEC’s actions.

Deaton believes the SEC has harmed investors, rather than protecting them, and that a change in attitude is necessary. While Deaton would support Atkins if chosen, he feels he’s not the right fit if President Trump aims to bring change to crypto regulation.

Attorney Jeremy Hogan mentioned the cons of Atkins’ appointment and wrote,

“He won’t be the bull in the china shop many in the crypto space want. He will make measured and deliberate changes. Overall, I give his appointment a B+ for the digital asset industry, and that was good enough to get me a law degree so, yeah!”

FAQs

Who is Paul Atkins and why is he important for crypto regulation?

Paul Atkins is a pro-crypto figure nominated as SEC chair by Trump, potentially influencing crypto policies and regulations.

What happened in the SEC vs Ripple case?

The SEC sought a $2 billion fine against Ripple but was given a $125 million penalty. The SEC continues appealing the decision in higher courts.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

RIPPLE LABS IS ABOUT TO USE XRP TO TURN REAL ESTATE UPSIDE DOWN | Youtube

@ Newshounds News™

~~~~~~~~~

IRAQI PARLIAMENT MEETING TURNS INSANE! | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Evening 12-03-24

Good Evening Dinar Recaps,

TRUMP TAPS PAUL ATKINS FOR NEXT SEC CHAIR, MAKING GOOD ON HIS CRYPTO PROMISES

Atkins has been vocal in his support of the industry and was the first libertarian to serve as an SEC commissioner under President George W. Bush.

President-elect Donald Trump has selected the pro-crypto Paul Atkins to chair the Securities and Exchange Commission (SEC), according to three sources familiar with the discussions.

Good Evening Dinar Recaps,

TRUMP TAPS PAUL ATKINS FOR NEXT SEC CHAIR, MAKING GOOD ON HIS CRYPTO PROMISES

Atkins has been vocal in his support of the industry and was the first libertarian to serve as an SEC commissioner under President George W. Bush.

President-elect Donald Trump has selected the pro-crypto Paul Atkins to chair the Securities and Exchange Commission (SEC), according to three sources familiar with the discussions.

One source specified that Trump has reached out to Atkins but is waiting on him to accept. By selecting Atkins, Trump is delivering on a promise he made to the crypto community during his campaign.

Spokespeople for Atkins did not respond to immediate requests for comment.

“President-Elect Trump has made brilliant decisions on who will serve in his second Administration at lightning pace,” Trump-Vance Transition Spokeswoman Karoline Leavitt told Unchained. “Remaining decisions will continue to be announced by him when they are made.”

Current Chair Gary Gensler, who announced two weeks ago that he will resign on Jan. 20 when Trump is inaugurated, has made himself a pariah in the crypto industry for pursuing what’s been seen as a policy of regulation by enforcement.

Atkins will now need to be confirmed by the Senate, unless Trump chooses to pursue a recess appointment while the Senate is out of session.

Atkins served as an SEC commissioner under President George W. Bush and is widely respected in conservative legal circles and amongst the establishment Republican party.

Since leaving the commission he’s become outspokenly supportive of the crypto industry, having co-chaired the Token Alliance at the industry group Digital Chamber of Commerce since 2017.

As founder and chief executive of the consultancy Potomak Global Partners, Atkins has advised digital finance companies on regulatory compliance topics since 2009.

“Senate Republicans really respect the tradition of Commissioner Paul Atkins,” explained George Mason University professor J.W. Verret, who previously served on the SEC Advisory Committee, in a call earlier this month. “He was the first time anyone had been a true libertarian and SEC commissioner, and that was a unique thing.”

The team vetting candidates for the chairperson position reached out to crypto industry leaders two weeks ago asking for their preferences, demonstrating how much Gensler’s unpopularity has figured in Trump’s latest nomination.

Gensler was criticized for not establishing clear rules and guidelines for the crypto industry.

Under his leadership, the SEC instead pursued a plethora of enforcement actions against crypto companies and protocols, including exchanges, token issuers, and NFT creators, for failing to register with the agency or disclose their work with what the SEC claimed were unregistered securities offerings.

For his part, Gensler only clarified that he saw Bitcoin as a commodity, insisting that existing securities laws could be applied to other crypto projects, even including ether until the SEC approved spot ether ETFs.

Gensler had also developed a reputation for being difficult to work with. Atkins, by contrast, is known to find a way to retain strong working relationships with people despite ideological disagreements.

“There was never a commissioner at the history of the commission that was more respectful and thankful of the staff at the commission,” said John Reed Stark, who worked with Atkins at the SEC in 2008.

Seizing upon the industry’s hatred for Gensler, Trump began promising clearer rules for the industry this summer. Framing crypto innovation as a key point of competition between the United States and other countries, Trump promised to make the United States a “world capital” for crypto in part by replacing Gensler.

He also said that he would appoint an “advisory council” focused on crypto to help him fine-tune policy, and potentially establish a national bitcoin strategic reserve, in part by not selling bitcoin that the government has seized in various financial crimes.

Because of his support for the industry, numerous crypto entrepreneurs donated both cash and crypto to Trump’s campaign. People interested in crypto who prioritized crypto policy in their voting decisions, from industry leaders to retail traders, had also tilted towards favoring Trump in the months leading up to the national election.

@ Newshounds News™

Source: Unchained Crypto

~~~~~~~~~

FED RATE CUT IN DECEMBER? HERE’S HOW BITCOIN PRICE WILL REACT

▪️The market is anticipating a 0.25% interest rate cut by the US Federal Reserve in December.

▪️A rate cut could boost investor confidence, leading to increased investment in riskier assets like Bitcoin.

▪️The overall economic outlook, especially under a potential Trump presidency, could influence the Fed's decision.

The crypto market is buzzing with anticipation as investors bet that the US Federal Reserve will cut interest rates by 0.25% in December. According to the CME FedWatch tool, the chances of this happening have jumped to 74.5%, up from 66% just a few days ago. What’s driving this growing confidence? If the Fed cuts rates, it would mark the third reduction this year, and it could have major implications for the economy—and for Bitcoin.

What Could a Fed Rate Cut Mean for Crypto?

A rate cut lowers the cost of borrowing for individuals and businesses. When interest rates are lower, loans become cheaper, which can encourage spending and investment. For the stock market and riskier assets like Bitcoin, rate cuts are generally seen as a positive development.

Investors tend to feel more comfortable taking on risks when borrowing costs decrease, making them more likely to invest in assets with higher potential returns, like cryptocurrencies.

Currently, the Federal Reserve’s interest rate is between 4.5% and 4.75%, following two previous cuts this year. Another reduction would signal a more supportive economic environment, which could encourage investors to put their money into riskier assets like Bitcoin.

Experts Weigh In

Marko Papic, Chief Strategist at BCA Research, predicts the US Federal Reserve will cut interest rates in December. He also believes the US dollar may peak by mid-2025, driven by possible economic disappointments under Donald Trump.

At the same time, Federal Reserve officials are hinting at a rate cut. Governor Christopher Waller stated on December 2 that he leans toward supporting a cut, but the decision will depend on upcoming economic data, like inflation and job reports. New York Fed President John Williams has also mentioned that interest rates might be reduced gradually, though he hasn’t specified when this might happen.

Ultimately, the Fed’s decision will depend on the economic performance over the next few weeks.

Could the Rate Cut Fuel Bitcoin?

Bitcoin has already seen impressive growth this year, more than doubling in value. Many analysts are optimistic that Bitcoin could break the $100,000 mark by the end of 2024. With a possible rate cut from the Fed, Bitcoin’s price could continue to rise, benefiting from the increased investor interest in riskier assets.

With Bitcoin on the rise, the stage is set for a thrilling end to 2024, with the Fed’s actions playing a central role.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

CRYPTO EXPERT SHARES TOP BOND INVESTING STRATEGIES | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 12-03-24

Good Afternoon Dinar Recaps,

COINBASE WILL DROP LAW FIRMS WHO HIRE ANTI-CRYPTO FORMER SEC STAFF — CEO

Coinbase CEO Brian Armstrong said the exchange stopped working with law firm Milbank after it hired former SEC official Gurbir Grewal.

Coinbase CEO Brian Armstrong said the cryptocurrency exchange will not work with law firms that hire individuals involved in what he described as anti-crypto actions during their tenure in government.

Good Afternoon Dinar Recaps,

COINBASE WILL DROP LAW FIRMS WHO HIRE ANTI-CRYPTO FORMER SEC STAFF — CEO

Coinbase CEO Brian Armstrong said the exchange stopped working with law firm Milbank after it hired former SEC official Gurbir Grewal.

Coinbase CEO Brian Armstrong said the cryptocurrency exchange will not work with law firms that hire individuals involved in what he described as anti-crypto actions during their tenure in government.

On Dec. 3, Armstrong said in an X post that Coinbase will avoid law firms that hire people who tried to “unlawfully kill” an industry without clarifying the rules. He urged the crypto community not to support individuals who had worked against the sector.

Armstrong claimed senior partners at law firms are often unaware of the crypto industry’s position on this issue. He encouraged community members to make their law firms aware that hiring anti-crypto officials could result in losing business.

Coinbase drops Milbank after law firm hires Gurbir Grewal

Armstrong said that Coinbase ended its relationship with Milbank after the law firm hired Gurbir Grewal, the former enforcement director at the United States Securities and Exchange Commission.

On Oct. 2, the SEC announced that Grewal would resign from his position at the agency. The securities regulator said that Grewal had recommended over 100 enforcement actions to address “widespread noncompliance” in the digital asset industry.

On Oct. 15, Milbank said it had onboarded the former SEC official to its litigation and arbitration group. Milbank chairman Scott Edelman praised Grewal’s “record of success” as a federal prosecutor and the SEC’s enforcement head.

Because of this, Armstrong said Coinbase decided to stop working with Milbank. He said:

“If you were senior there, you cannot say you were just following orders. They had the option to leave the SEC and many good people did. It was not a normal SEC tenure.”

Following Donald Trump’s victory in the 2024 US presidential election, members of the crypto community have expressed optimism about a more favorable regulatory environment in the US. This has contributed to bullish momentum in the market, with Bitcoin reaching an all-time high of $99,645 on Nov. 22.

@ Newshounds News™ Source: CoinTelegraph

~~~~~~~~~

BRICS NEWS: BRICS COUNTRIES REACT TO TRUMP’S 100% TARIFF THREATS

President-elect Donald Trump threatened BRICS countries with 100% tariff rates if they decide to ditch the US dollar for trade.

Trump made it clear that de-dollarization or launching a new currency and payment system to bypass the US dollar will be met with a 100% tariff on goods entering the US markets. If the tariff is imposed, BRICS countries will find it hard as their imports and export sectors will be hit.

On the heels of the recent 100% tariff threats by Trump, BRICS countries have reacted to the development. While some members doubt the tariff can be put in place, others remain cautious to not irk the President-elect. The balancing act of diplomacy now comes into the picture and how they navigate the next four years will decide the success of the de-dollarization agenda.

100% Tariffs on Goods Entering the US: BRICS

BRICS member Russia said that Trump’s threats will backfire as the alliance is committed to uprooting the US dollar’s dominance. “More and more countries are switching to the use of national currencies in their trade and foreign economic activities,” said Kremlin spokesman Dmitry Peskov to Reuters.

The spokesperson said that BRICS countries will band together stronger if Trump adds further economic pressure on the alliance. “If the US uses force, as they say, economic force, to compel countries to use the dollar it will further strengthen the trend of switching to national currencies,” said Peskov.

On the other hand, BRICS member India also remains skeptical of Trump’s 100% tariff threats. The think tank GTRI said that imposing tariffs will inadvertently make consumer goods more expensive for US customers. While the export and import sectors will take heat, eventually the sellers will place the tax on the consumer’s shoulders.

@ Newshounds News™ Source: Watcher Guru

~~~~~~~~~

WANT TO STAY AHEAD IN CRYPTO? WATCH THIS NOW | Youtube

The UK Introduces Regulations!

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Morning 12-03-24

Good Morning Dinar Recaps,

HOUSE LAWMAKERS PROPOSE STUDIES ON AI IN FINANCIAL SERVICES, HOUSING

Top lawmakers in the United States introduced a bill that would require federal regulators to conduct studies on how artificial intelligence (AI) impacts the financial services and housing industries.

Congresswoman Maxine Waters introduced a bill directing several federal financial regulators to study the present and potential benefits and risks of AI in the two industries. It was co-sponsored by House Financial Services Committee Chair Patrick McHenry.

Good Morning Dinar Recaps,

HOUSE LAWMAKERS PROPOSE STUDIES ON AI IN FINANCIAL SERVICES, HOUSING

Top lawmakers in the United States introduced a bill that would require federal regulators to conduct studies on how artificial intelligence (AI) impacts the financial services and housing industries.

Congresswoman Maxine Waters introduced a bill directing several federal financial regulators to study the present and potential benefits and risks of AI in the two industries. It was co-sponsored by House Financial Services Committee Chair Patrick McHenry.

The pair have also supported each other in a resolution acknowledging the increasing use of AI in the finance and housing markets, according to a Dec. 2. statement from the House Financial Services Committee.

Under the Waters-sponsored AI Act of 2024, key regulators like the Federal Reserve and the Federal Deposit Insurance Corporation would have to report how banks implement AI to detect and deter money laundering, cybercrime and fraud.

AI is already impacting mortgage lending and credit scoring, among other things, Waters said, explaining the need for a more comprehensive AI reporting regulatory framework.

AI-powered research is also being used for market surveillance purposes and tenant screening, McHenry’s resolution said.

McHenry added: “These bills are a small, but critical, step forward to empower the financial system to realize the numerous benefits artificial intelligence can offer for consumers, firms, and regulators.”

His resolution suggested the House Financial Services Committee should consider whether to reform privacy laws as data use becomes more AI-driven.

McHenry said he wants the US to remain a leader in AI development and utilization.

Waters and McHenry’s measures build on the House Committee’s Bipartisan AI Working Group, which was established on Jan. 11.

Republican members include French Hill, Young Kim, Mike Flood, Zach Nunn and Erin Houchin, while the Democrat members include Stephen Lynch, Sylvia Garcia, Sean Casten, Ayanna Pressley and Brittany Pettersen.

The group’s formation followed US President Joe Biden’s executive order on Oct. 30 to establish a “Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence.”

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

TRUMP’S SEC CHAIR SELECTION: PREDICTION MARKETS SIGNAL MAJOR REGULATORY CHANGES

These prediction markets show trader speculation, not confirmed plans. Paul Atkins leads in trading as a possible Trump’s SEC chair pick, with markets showing a 70% probability. Any appointment would follow the 2024 election results, but traders expect significant changes in financial market oversight.

How Trump’s SEC Chair Appointment Could Impact Crypto Regulation and Market Oversight

The race for the next possible SEC chair shows clear patterns in prediction markets. Here’s what current trading reveals:

Paul Atkins Emerges as Leading SEC Chair Candidate

Traders strongly back Atkins for Trump’s SEC chair position. His SEC commissioner experience and pro-innovation views match his 70% rating in prediction markets. His selection could bring major changes to crypto regulation approaches.

New SEC Chair Appointment Could Reshape Markets

Paul Atkins Emerges as Leading SEC Chair Candidate

Traders strongly back Atkins for Trump’s SEC chair position. His SEC commissioner experience and pro-innovation views match his 70% rating in prediction markets. His selection could bring major changes to crypto regulation approaches.

New SEC Chair Appointment Could Reshape Markets

Prediction markets suggest big changes if Trump picks a new SEC chair. Current market odds favor:

▪️Paul Atkins: Former SEC commissioner (70% chance)

▪️Brian Brooks: Crypto industry expert (20% chance)

▪️Hester Peirce: Current SEC commissioner (2% chance)

Crypto Regulation 2024 Faces Potential Overhaul

Traders believe crypto regulation in 2024 could change significantly. Markets suggest Atkins as SEC chair might ease current restrictions. His past work shows he supports innovation with reasonable oversight.

Market Trading Shows Strong Confidence

Over $503,418 in trading volume reveals high interest in the SEC chair position. Atkins’ probability has jumped from 25% to 70% since November, though these remain speculative bets.

Regulatory Framework Faces Possible Changes

Markets suggest a new SEC chair might change:

▪️How crypto is overseen

▪️Market rules

▪️Support for new ideas

▪️How rules are enforced

Prediction markets offer insights but can’t guarantee outcomes. Any SEC chair needs proper nomination and approval. Current trading shows what markets expect while acknowledging many factors could affect the final choice.

Trading patterns point to possible regulatory shifts, but all predictions remain speculative. The high trading volume shows strong market interest in potential SEC leadership changes, even as the actual appointment process awaits future developments.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

What's Driving XLM Price to OVERTAKE XRP - The Economic Ninja | Youtube

The Ninja compares XLM and XRP.

@ Newshounds News™

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Evening 12-02-24

Good Evening Dinar Recaps,

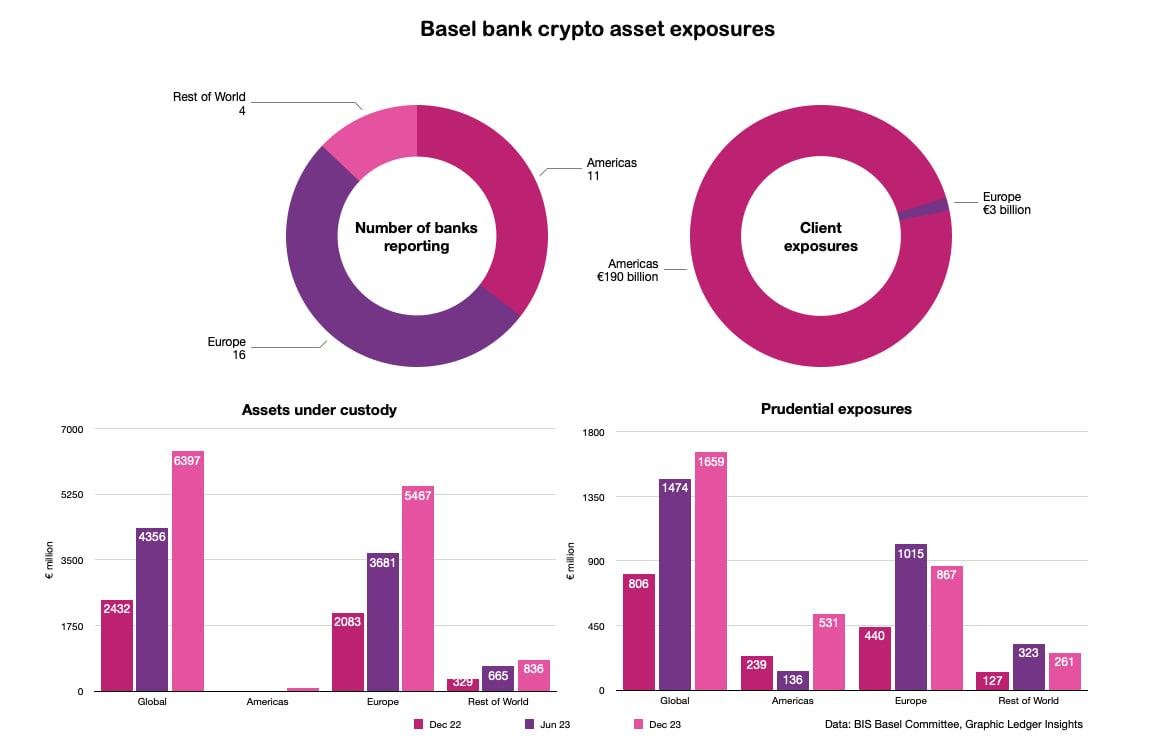

BASEL FIGURES: AMERICAN BANKS ENABLED $201 BILLION IN CLIENT CRYPTO EXPOSURES IN 2023

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale.

However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

Good Evening Dinar Recaps,

BASEL FIGURES: AMERICAN BANKS ENABLED $201 BILLION IN CLIENT CRYPTO EXPOSURES IN 2023

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale.

However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

In particular, the Americas are almost entirely absent from the crypto custody space, largely because of the SEC’s SAB 121 accounting rule, which makes it prohibitive for banks to provide custody. That’s already relaxing and will likely be dropped altogether by the incoming Trump administration.

n the second half of 2023, assets under custody in Europe grew by 49% to €5.5 billion ($5.8bn) compared to the first half. At a global level, 94% of custody was for spot crypto rather than tokenized assets or ETPs.

When it comes to enabling client exposures, the roles are completely reversed. The Americas dominate providing 98% of services. The figures are on a different scale, with American banks enabling €190 billion ($201 billion) of client exposures.

American banks also substantially increased their own exposures – by almost four times, albeit from a small base. 2023 year end prudential exposures amounted to €531 million.

While APAC is viewed as a promising growth sector, by the end of 2023 it still lagged far behind. However, the figures depend on which banks are included in the dataset.

Of the four banks reporting in the ‘rest of world’ category, none reported any client crypto exposures. The banks’ own exposures were down 20% to a negligible €261 million with custody at €836 million. A lot of legislative changes have happened this year, so next year’s figures could be more interesting.

The statistics cover a total of 31 banks globally.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

RIPPLE NEWS : WISDOMTREE SUBMITS XRP ETF S-1 APPLICATION WITH THE US SEC

▪️WisdomTree Files for XRP ETF: WisdomTree Digital submits S-1 filing for an XRP ETF, marking growing institutional interest in Ripple's cryptocurrency.

▪️XRP Demand Surge: XRP's market value rises as institutional investors, including 21Shares and Bitwise, file for XRP ETFs amid U.S. regulatory clarity.

Last week, WisdomTree Digital Commodity Services, LLC, a subsidiary of a prominent New York-based asset management firm with over $113 billion in AUM, filed for an XRP exchange-traded fund (ETF) with Delaware authorities. Earlier today, the investment firm submitted to the Securities and Exchange Commission (SEC) the S-1 filing for the WisdomTree XRP Fund.

According to the SEC filings, the WisdomTree XRP Fund will tap into the Bank of New York Mellon (BNYM) as the trustee, fund accountant, and transfer agent.

However, the prospectus for the WisdomTree XRP Fund did not reveal the ticker that will be listed on the Cboe BZX Exchange, thus indicating several updates of the filings will take place in the near term.

Growing Interest in XRP Among Institutional Investors

As Coinpedia previously reported, the demand for XRP among institutional investors has significantly grown following the anticipated crypto policy implementation in the United States.

In addition to WisdomTree, several other fund managers have filed to offer a spot XRP ETF to prospective investors to help diversify their crypto portfolios.

For instance, asset management firm 21Shares recently fueled for a spot XRP ETF. Additionally, Bitwise, Grayscale Investments, and Canary Capital have all filed for a similar product.

As a result, it is evident that the demand for XRP among institutional investors is exponentially growing amid regulatory clarity in the United States.

Market Impact

The direct impact of the high demand for XRP among institutional investors is visible on the rising market value. The large-cap altcoin, with a fully diluted valuation of about $240 billion, overtook Solana (SOL) and Binance (BNB) to become the third largest crypto asset, excluding stablecoins.

After more than six years of consolidation, XRP price is well positioned to enter its discovery phase of the macro bull cycle in the coming months.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

THE EASY WAY TO GROW YOUR WEALTH WITH XRP IN JUST 30 DAYS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Afternoon 12-02-24

Good Afternoon Dinar Recaps,

BRAZIL PROPOSES TO BAN STABLECOIN WITHDRAWALS TO SELF-CUSTODIAL WALLETS

A public consultation notice from the Central Bank of Brazil intends to prohibit stablecoin withdrawals to self-custody wallets.

The Central Bank of Brazil (BCB) has unveiled a regulatory proposal prohibiting centralized exchanges from allowing users to withdraw stablecoins to self-custodial wallets.

Good Afternoon Dinar Recaps,

BRAZIL PROPOSES TO BAN STABLECOIN WITHDRAWALS TO SELF-CUSTODIAL WALLETS

A public consultation notice from the Central Bank of Brazil intends to prohibit stablecoin withdrawals to self-custody wallets.

The Central Bank of Brazil (BCB) has unveiled a regulatory proposal prohibiting centralized exchanges from allowing users to withdraw stablecoins to self-custodial wallets.

According to the public consultation notice, the transfer of stablecoins — called “tokens denominated in foreign currencies” — between residents would be restricted in cases where Brazilian law already allows payments in foreign currencies.

The BCB shared in a statement:

“The initiative reflects our commitment to adapting the financial system to the realities of digital assets while safeguarding the integrity of international capital flows.”

The move is part of the crypto regulation bill approved in Brazil in December 2022, which determined that the BCB is responsible for creating the rules for the crypto industry in the country.

The public consultation will be open until Feb. 28, 2025, and market participants can share their opinions with the regulator. However, the BCB can override the inputs and do as described in the document.

Balancing regulations

According to the Brazilian central bank, the proposed rules aim to enhance legal certainty for businesses and individuals while fostering competition and efficiency in the foreign exchange market.

The proposed regulation outlines three core activities for virtual asset services providers operating in the foreign exchange market: facilitating international payments and transfers via crypto, providing exchange or custody services for tokens denominated in Brazilian reais for non-residents, and managing transactions involving tokens pegged to foreign currencies.

In addition, crypto investments, whether inbound or outbound, would be subject to the same regulatory standards as traditional investments. External credit, direct foreign investment, and Brazilian capital abroad involving crypto would require compliance with existing international capital regulations.

Under the public consultation, centralized exchanges must also get a foreign exchange license to offer stablecoin-related services.

A significant market

According to data from Brazil’s Internal Revenue Service (RFB) published on Nov. 13, nearly 4.4 million Brazilians transferred $4.2 billion in crypto in September.

Stablecoins represented 71.4% of all the value transferred during the month, with roughly $3 billion transacted. Tether USD (USDT) dominated with $2.77 billion moved by Brazilian crypto investors.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

COINBASE ANNOUNCES APPLE PAY FOR FIAT-TO-CRYPTO PURCHASES

“Coinbase Onramp takes the hassle out of fiat-to-crypto conversions with lightweight KYC for eligible purchases, free USDC on and offramping, and access to the most popular payment methods,” Coinbase said in a statement.

Apple Pay will allow users to get onchain in seconds granting quick access to some of the world’s leading cryptocurrencies. Users can access Moonshot, an app using Onramp to get Onchain quickly.

For eligible purchases, Coinbase provides lightweight KYC to make the process of getting Onchain even simpler while still protected. The addition of Apple Pay also allows users to access free USDC on and offramping on Coinbase.

According to Coinbase, if you’re an existing app using Coinbase Onramp, there’s nothing you need to do. Users will automatically see Apple Pay appear as an option when making an eligible purchase. Eligible users can sign up for Onramp quickstart to get started and access Apple Pay as an option on Coinbase. Users can also use one-click-buy for an even faster experience.

Coinbase investors gained confidence in the company following the announcement, with COIN stock climbing 3% Monday.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

XRP BECOMES THE TOP TRADED TOKEN ON BINANCE AND COINBASE, HITS ALMOST 7-YEAR HIGH

XRP, which saw its fourth ETF filing Monday, also now has the third-largest market cap among all cryptocurrencies, after it shot past Tether’s USDT and Solana’s SOL.

XRP has been the most popular token by trading volume in the last 24 hours on several centralized exchanges, such as Binance and Coinbase

XRP’s virality on centralized exchanges comes as the token climbed on Monday to a nearly seven-year high of $2.77, a 40% jump in the last 24 hours and a 433% increase over the past 30 days.

The token native to the Ripple ledger currently has a market cap of about $158 billion, surpassing both Tether’s USDT and Solana’s SOL, making XRP the third largest cryptocurrency by market cap.

On Binance, the dominant non-U.S. centralized exchange, XRP’s 24-hour volume of $7 billion makes up 13.3% of total trading activity. For the U.S.’s biggest exchange, Coinbase, XRP has a 24-hour volume of $3 billion, comprising almost 30% of the total volume.

XRP tops trading volume on OKX, Kraken, and KuCoin as well, market data from CoinGecko shows. XRP trading on Upbit, a prominent centralized exchange in South Korea, makes up 38.6% of the entire venue’s 24-hour trading volume of $19.8 billion.

Wall Street titans are also preparing to launch spot XRP exchange-traded funds as ETF provider WisdomTree submitted a Monday filing for a spot XRP ETF with the U.S. Securities and Exchange Commission, joining Bitwise, Canary Capital, and 21shares.

Small Retail FOMO

“The 6-year (nearly 7-year) high comes as wallets with 1M-10M XRP have accumulated 679.1M tokens (currently worth $1.66B) in just 3 weeks,” the team behind market intelligence platform Santiment wrote on X early Monday. At current prices, one million XRP tokens are worth almost $2.8 million.

Maksim Tkachuk, who works on product at Santiment, further told Unchained over Telegram that the team is observing high levels of FOMO, short for “fear of missing out,” from small retail holders, defined as addresses with 100 to 10,000 XRP tokens.

“Overall when those retail darlings take the spotlight, the whole market becomes dangerous as the main drivers of the price at this point are greed and FOMO,” Tkachuk wrote.

“Per [Santiment’s] internal agreement – the top is near… at least a very sizeable correction is what we agree on like 20-25 percent in majors.”

Stablecoin, RWA and DeFi Plans

Meanwhile, Ripple is gearing up to roll out a new USD stablecoin on its blockchain, as the New York Department of Financial Services is expected to approve the product, according to Fox Business last week.

Sally Zhu, who is part of the venture capital arm of crypto market-making firm Amber Group, messaged Unchained on Telegram saying, “I think XRP’s recent price surge is about the buzz around tokenizing [real-world assets]…” They’re teaming up with players like Archax to bring things like equities and global debts onto the XRP Ledger.”

Archax, a digital asset exchange, broker, and custodian, announced on Nov. 25 that it has provided access to a money market fund in a tokenized form on the XRP Ledger. “With such a huge opportunity to reshape how financial instruments are traded and managed, XRP is riding the wave of optimism now.”

Decentralized finance (DeFi), a subsector of the crypto space that enables users to conduct financial activities without intermediaries, has strong roots in Bitcoin, Ethereum, and Solana. Some crypto users are now exploring DeFi on the XRP Ledger.

For example, Robert Leshner, the CEO of asset management firm Superstate, said he was in the “trenches,” testing the infrastructure of automated market markets and inspecting the memecoins on the network, per an X post on Sunday.

Despite the recent upward price movement of XRP, people in the crypto space have long criticized the XRP Ledger for its lack of decentralization. Justin Bon, founder and chief investment officer of Cyber Capital, specifically pointed to the consensus mechanism for the XRP Ledger. “XRP’s consensus is based on UNLs (Unique Node Lists), literal centralized lists of trusted nodes released by single parties, including the foundation,” Bons wrote on X.

@ Newshounds News™

Source: Unchained Crypto

~~~~~~~~~

XRP WORLD RESERVE CURRENCY | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 12-01-24

Good Afternoon Dinar Recaps,

HONG KONG LAUNCHES DIGITAL BOND ISSUANCE GRANTS

Last month the Hong Kong Monetary Authority (HKMA) said it was planning to launch a grant program that would offer up to HK$2.5 million (US$ 321,000) in grants to digital bond issuers. Yesterday it announced that the program has started and will run for three years.

We believe the grant scheme also covers tokenized bonds, which are bonds issued conventionally and then a digital twin is created on a blockchain. Digital bonds often refer only to bonds issued natively on a blockchain.

Good Afternoon Dinar Recaps,

HONG KONG LAUNCHES DIGITAL BOND ISSUANCE GRANTS

Last month the Hong Kong Monetary Authority (HKMA) said it was planning to launch a grant program that would offer up to HK$2.5 million (US$ 321,000) in grants to digital bond issuers. Yesterday it announced that the program has started and will run for three years.

We believe the grant scheme also covers tokenized bonds, which are bonds issued conventionally and then a digital twin is created on a blockchain. Digital bonds often refer only to bonds issued natively on a blockchain.

The HKMA is using the digital bond term more expansively. “‘Digital bond’ refers to a bond that leverages distributed ledger technology (DLT) for digital representation of ownership, which could include, for example, legal titles and/or beneficial interests in the bond,” the HKMA wrote.

Digital bond grant criteria

The subsidy will cover up to half the expenses of each digital bond issuance, with a maximum of two issuances.

Half of the subsidy is available if most of the lead managers are based in Hong Kong and the team developing or maintaining the DLT platform has a substantial presence in Hong Kong.

Alternatively, instead of a local developer team, the issuance will qualify if it uses a DLT infrastructure where Hong Kong’s central securities depository, the CMU, is designated as the platform operator.

For Hong Kong’s sovereign digital bond issuance earlier this year, the CMU was the operator of the local HSBC Orion DLT platform. We believe this means other platforms can also request this designation.

In order to qualify for the full subsidy there are four additional requirements:

▪️the issuer is not associated with the DLT platform

▪️the bond is at least HK$1 billion (US$128.5m)

▪️there are five or more investors not associated with the issuer or DLT platform

▪️the issuance is listed on the stock exchange or by a regulated virtual asset trading platform (VATP).

With the exception of sovereign or semi sovereign bonds, many recent bond issuances globally would not meet these criteria. For example, HSBC recently issued a Hong Kong digital bond on the HSBC Orion DLT. That would only qualify for half the grant because it would fail the platform test.

There are some easy workarounds to the DLT platform criterion. For example, one bank could issue a bond on a second bank’s platform, and then the second bank could issue a bond on the first banks’s platform.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

SOUTH KOREA DELAYS CRYPTO TAX AGAIN: WHAT IT MEANS FOR INVESTORS IN 2024

▪️South Korea delays crypto tax to 2027, marking a significant policy shift after prolonged debates and investor criticism.

▪️Crypto trading in South Korea thrives as daily volumes hit 6 trillion won, reflecting growing investor interest despite tax uncertainty.

In a latest development, the main opposition Democratic Party of Korea (DPK) agreed on Sunday to delay the controversial crypto tax for two years following investor backlash.

The latest move pushes the tax’s implementation to 2027, marking a significant shift in the country’s stance on digital asset taxation, allowing the market additional time to adapt.

“After extensive discussions, we concluded that additional institutional arrangements are necessary for the virtual asset taxation,” DPK floor leader Rep. Park Chan-dae said during the press meeting at the National Assembly. “We have agreed to defer taxation for two years.”

Park also noted that the decision was made after a ‘prolonged deliberation, debate, and political judgment.’

This decision comes after months of disagreement between the ruling PPP and the KDP. While the PPP supported a three-year grace period, the KDP had previously pushed for implementing the tax in 2025 and had accused the ruling party of using delays as a political strategy regarding South Korea crypto tax policies.

South Korea’s Journey In Crypto Taxes

South Korea’s journey toward taxing cryptocurrency gains began in 2021 when the government proposed a 20% tax on digital asset profits exceeding $1,800 annually. However, criticisms from investors and industry stakeholders led to repeated delays. Notably, the South Korea crypto tax’s implementation was initially pushed to 2023, then to 2025, and now to 2027.

The current tax framework charges taxes on gains exceeding 2.5 million won, whereas stock trading profits are taxed only above 50 million won, a disparity that has been heavily criticised.

Government’s Plans To Impose Crypto Taxes

Beginning next year, the government had planned to impose a 22 percent tax, including local taxes, on annual income exceeding 2.5 million won ($1,790) from virtual asset investments. Although the policy had already been postponed twice, the DPK initially intended to implement the taxation plan by raising the tax exemption threshold to 50 million won.

However, the widespread criticism from the increasing number of crypto investors and opposition from the ruling People Power Party (PPP) led the party to agree to a further postponement.

South Korea Remains Key Player In Global Market

South Korea remains a key player in the global crypto market. Notably, the decision to delay taxation of the South Korea crypto tax reflects the government’s cautious approach to balance regulation with market growth.

Notably, in the first half of 2024, the country’s daily crypto trading volume soared 67% from the previous period to six trillion won. Local media source Naver also reported that the number of domestic investors increased by 21%, reaching 7.78 million, with Bitcoin and Ethereum comprising the majority of holdings.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

THE EASY WAY TO GROW YOUR WEALTH WITH XRP IN JUST 30 DAYS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 12-01-24

Good Morning Dinar Recaps,

NO TURNING BACK ON LAUNCHING BRICS PAYMENT SYSTEM: DIPLOMAT

BRICS Sherpa Sergey Ryabkov confirmed to reporters that the bloc will not scrap the formation of a new payment system. Speaking to reporters at the Sherpa meeting, the diplomat doubled down saying that there’s no turning back on launching the new BRICS payment system. The goal of the new system is to sideline the US dollar and settle cross-border transactions in a basket of local currencies.

For the uninitiated, BRICS is working on the formation of an independent payment system that will not incorporate the US dollar into its mechanism. The mechanism will include local currencies of the bloc and keep the US dollar away from all transactions.

Good Morning Dinar Recaps,

NO TURNING BACK ON LAUNCHING BRICS PAYMENT SYSTEM: DIPLOMAT

BRICS Sherpa Sergey Ryabkov confirmed to reporters that the bloc will not scrap the formation of a new payment system. Speaking to reporters at the Sherpa meeting, the diplomat doubled down saying that there’s no turning back on launching the new BRICS payment system. The goal of the new system is to sideline the US dollar and settle cross-border transactions in a basket of local currencies.

For the uninitiated, BRICS is working on the formation of an independent payment system that will not incorporate the US dollar into its mechanism. The mechanism will include local currencies of the bloc and keep the US dollar away from all transactions.

“The glass is always half-full; it is never half-empty,” said Ryabkov when answering about the independent payment system within BRICS.

“We can measure how full the glass is in different ways but this ultimately depends on who is holding this glass in their hands. Therefore, we’ve made significant strides today. How much time it will take to fill the framework we’ve established with tangible actions depends on us. On BRICS and the global majority,” the diplomat said to reporters at a press conference.

Why is BRICS Creating a New Payment System?

The BRICS bloc is creating a new payment system to safeguard the economies of developing countries from US sanctions. The goal is to protect themselves economically without being pinned down by the US and the West. The diplomat called the US and the West “hostile states” who want to harm the prospects of developing countries.

The diplomat called the upcoming BRICS payment system a “critical milestone” for the bloc and “a point of no return.” He added that “we will do everything in our power to ensure success.”

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

'GOVERNMENT HAS BECOME ADDICTED TO INDIRECT REGULATION' — RIPPLE CTO

In a recent Joe Rogan interview, Mark Andreesen revealed that the debanking of tech firms caused the Silicon Valley shift toward Trump.

Ripple chief technical officer David Schwartz recently joined the list of tech founders speaking out against Operation Chokepoint 2.0 — a government-run debanking operation against the crypto industry. Schwartz said the government is "addicted to indirect regulation" and laid out four reasons why de-banking undermines the rule of law.

Schwartz argued that debanked entities switch service providers or take their funds underground — thereby evading surveillance and sanctions control altogether.

The CTO also said de-banking undermines due process, freedom of speech, and the right against unlawful search and seizure. Schwartz wrote:

"Our government has become addicted to indirect regulation precisely because of these evils. It is cheaper and easier to pressure someone else to punish me than to charge me with a crime and give me due process, but the government ought not to punish people without giving them due process."

"It is easier to pressure banks to cut off disfavored businesses than to make that business illegal," The CTO continued before imploring the government to use lawful and above-board processes to regulate businesses.

Industry founders recount government debanking operation

According to venture capitalist Mark Andreesen, more than 30 tech firms were victims of Operation Chokepoint 2.0, and tech founders recently took to social media to share their debanking experiences.

The list of figures speaking out included Frax Finance founder Sam Kazemian, who claimed that JPMorgan Chase debanked him in December 2022.

Coinbase co-founder and CEO Brian Armstrong also petitioned the government for records relating to Operation Chokepoint 2.0 via the Freedom of Information Act (FOIA) and is currently compiling those records.

In September 2024, Castle Island Ventures partner Nic Carter revealed that the Biden administration deliberately killed Silvergate Bank — a major institution for crypto banking — in an effort to destroy the crypto industry. “I believe Silvergate could have survived its drawdown — and was on a path to do so,” Carter said.

However, Industry executives remain optimistic that the incoming Trump administration will reverse years of regulatory hostility toward the crypto industry.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ZIM ZIG: THE MOST BRILLIANT INVESTING STRATEGY EVER? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps