Seeds of Wisdom RV and Economic Updates Monday Evening 12-02-24

Good Evening Dinar Recaps,

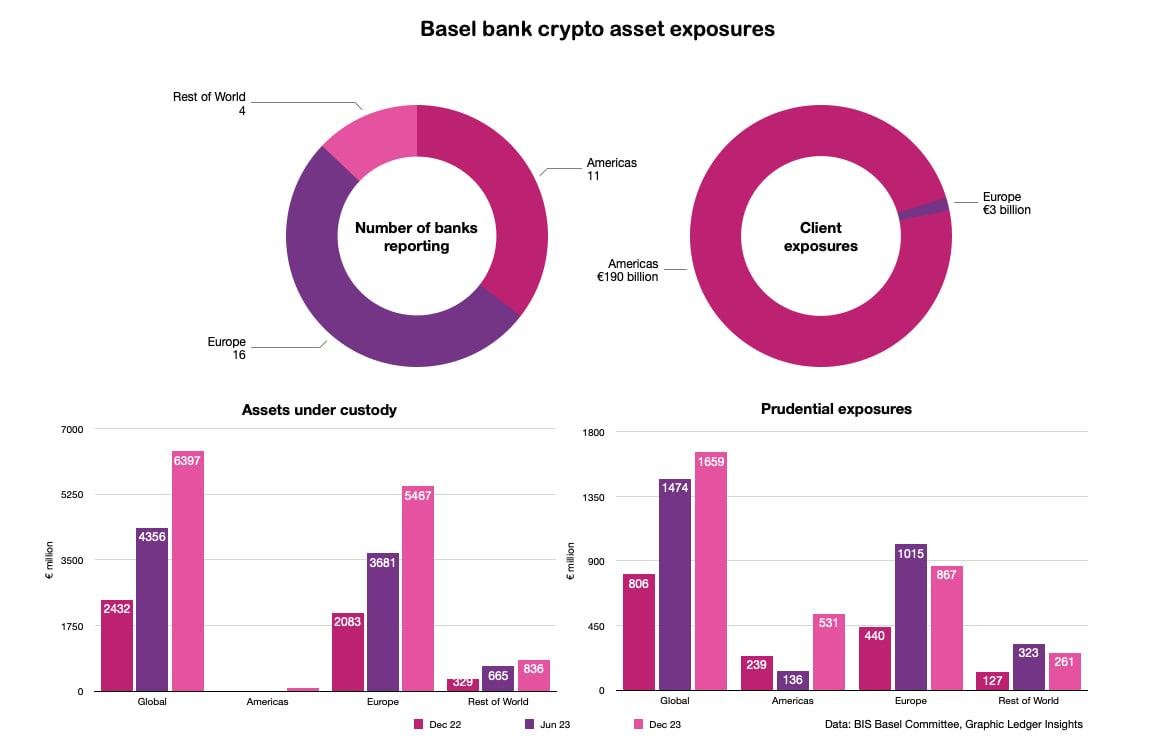

BASEL FIGURES: AMERICAN BANKS ENABLED $201 BILLION IN CLIENT CRYPTO EXPOSURES IN 2023

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale.

However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

Good Evening Dinar Recaps,

BASEL FIGURES: AMERICAN BANKS ENABLED $201 BILLION IN CLIENT CRYPTO EXPOSURES IN 2023

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale.

However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

In particular, the Americas are almost entirely absent from the crypto custody space, largely because of the SEC’s SAB 121 accounting rule, which makes it prohibitive for banks to provide custody. That’s already relaxing and will likely be dropped altogether by the incoming Trump administration.

n the second half of 2023, assets under custody in Europe grew by 49% to €5.5 billion ($5.8bn) compared to the first half. At a global level, 94% of custody was for spot crypto rather than tokenized assets or ETPs.

When it comes to enabling client exposures, the roles are completely reversed. The Americas dominate providing 98% of services. The figures are on a different scale, with American banks enabling €190 billion ($201 billion) of client exposures.

American banks also substantially increased their own exposures – by almost four times, albeit from a small base. 2023 year end prudential exposures amounted to €531 million.

While APAC is viewed as a promising growth sector, by the end of 2023 it still lagged far behind. However, the figures depend on which banks are included in the dataset.

Of the four banks reporting in the ‘rest of world’ category, none reported any client crypto exposures. The banks’ own exposures were down 20% to a negligible €261 million with custody at €836 million. A lot of legislative changes have happened this year, so next year’s figures could be more interesting.

The statistics cover a total of 31 banks globally.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

RIPPLE NEWS : WISDOMTREE SUBMITS XRP ETF S-1 APPLICATION WITH THE US SEC

▪️WisdomTree Files for XRP ETF: WisdomTree Digital submits S-1 filing for an XRP ETF, marking growing institutional interest in Ripple's cryptocurrency.

▪️XRP Demand Surge: XRP's market value rises as institutional investors, including 21Shares and Bitwise, file for XRP ETFs amid U.S. regulatory clarity.

Last week, WisdomTree Digital Commodity Services, LLC, a subsidiary of a prominent New York-based asset management firm with over $113 billion in AUM, filed for an XRP exchange-traded fund (ETF) with Delaware authorities. Earlier today, the investment firm submitted to the Securities and Exchange Commission (SEC) the S-1 filing for the WisdomTree XRP Fund.

According to the SEC filings, the WisdomTree XRP Fund will tap into the Bank of New York Mellon (BNYM) as the trustee, fund accountant, and transfer agent.

However, the prospectus for the WisdomTree XRP Fund did not reveal the ticker that will be listed on the Cboe BZX Exchange, thus indicating several updates of the filings will take place in the near term.

Growing Interest in XRP Among Institutional Investors

As Coinpedia previously reported, the demand for XRP among institutional investors has significantly grown following the anticipated crypto policy implementation in the United States.

In addition to WisdomTree, several other fund managers have filed to offer a spot XRP ETF to prospective investors to help diversify their crypto portfolios.

For instance, asset management firm 21Shares recently fueled for a spot XRP ETF. Additionally, Bitwise, Grayscale Investments, and Canary Capital have all filed for a similar product.

As a result, it is evident that the demand for XRP among institutional investors is exponentially growing amid regulatory clarity in the United States.

Market Impact

The direct impact of the high demand for XRP among institutional investors is visible on the rising market value. The large-cap altcoin, with a fully diluted valuation of about $240 billion, overtook Solana (SOL) and Binance (BNB) to become the third largest crypto asset, excluding stablecoins.

After more than six years of consolidation, XRP price is well positioned to enter its discovery phase of the macro bull cycle in the coming months.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

THE EASY WAY TO GROW YOUR WEALTH WITH XRP IN JUST 30 DAYS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Afternoon 12-02-24

Good Afternoon Dinar Recaps,

BRAZIL PROPOSES TO BAN STABLECOIN WITHDRAWALS TO SELF-CUSTODIAL WALLETS

A public consultation notice from the Central Bank of Brazil intends to prohibit stablecoin withdrawals to self-custody wallets.

The Central Bank of Brazil (BCB) has unveiled a regulatory proposal prohibiting centralized exchanges from allowing users to withdraw stablecoins to self-custodial wallets.

Good Afternoon Dinar Recaps,

BRAZIL PROPOSES TO BAN STABLECOIN WITHDRAWALS TO SELF-CUSTODIAL WALLETS

A public consultation notice from the Central Bank of Brazil intends to prohibit stablecoin withdrawals to self-custody wallets.

The Central Bank of Brazil (BCB) has unveiled a regulatory proposal prohibiting centralized exchanges from allowing users to withdraw stablecoins to self-custodial wallets.

According to the public consultation notice, the transfer of stablecoins — called “tokens denominated in foreign currencies” — between residents would be restricted in cases where Brazilian law already allows payments in foreign currencies.

The BCB shared in a statement:

“The initiative reflects our commitment to adapting the financial system to the realities of digital assets while safeguarding the integrity of international capital flows.”

The move is part of the crypto regulation bill approved in Brazil in December 2022, which determined that the BCB is responsible for creating the rules for the crypto industry in the country.

The public consultation will be open until Feb. 28, 2025, and market participants can share their opinions with the regulator. However, the BCB can override the inputs and do as described in the document.

Balancing regulations

According to the Brazilian central bank, the proposed rules aim to enhance legal certainty for businesses and individuals while fostering competition and efficiency in the foreign exchange market.

The proposed regulation outlines three core activities for virtual asset services providers operating in the foreign exchange market: facilitating international payments and transfers via crypto, providing exchange or custody services for tokens denominated in Brazilian reais for non-residents, and managing transactions involving tokens pegged to foreign currencies.

In addition, crypto investments, whether inbound or outbound, would be subject to the same regulatory standards as traditional investments. External credit, direct foreign investment, and Brazilian capital abroad involving crypto would require compliance with existing international capital regulations.

Under the public consultation, centralized exchanges must also get a foreign exchange license to offer stablecoin-related services.

A significant market

According to data from Brazil’s Internal Revenue Service (RFB) published on Nov. 13, nearly 4.4 million Brazilians transferred $4.2 billion in crypto in September.

Stablecoins represented 71.4% of all the value transferred during the month, with roughly $3 billion transacted. Tether USD (USDT) dominated with $2.77 billion moved by Brazilian crypto investors.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

COINBASE ANNOUNCES APPLE PAY FOR FIAT-TO-CRYPTO PURCHASES

“Coinbase Onramp takes the hassle out of fiat-to-crypto conversions with lightweight KYC for eligible purchases, free USDC on and offramping, and access to the most popular payment methods,” Coinbase said in a statement.

Apple Pay will allow users to get onchain in seconds granting quick access to some of the world’s leading cryptocurrencies. Users can access Moonshot, an app using Onramp to get Onchain quickly.

For eligible purchases, Coinbase provides lightweight KYC to make the process of getting Onchain even simpler while still protected. The addition of Apple Pay also allows users to access free USDC on and offramping on Coinbase.

According to Coinbase, if you’re an existing app using Coinbase Onramp, there’s nothing you need to do. Users will automatically see Apple Pay appear as an option when making an eligible purchase. Eligible users can sign up for Onramp quickstart to get started and access Apple Pay as an option on Coinbase. Users can also use one-click-buy for an even faster experience.

Coinbase investors gained confidence in the company following the announcement, with COIN stock climbing 3% Monday.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

XRP BECOMES THE TOP TRADED TOKEN ON BINANCE AND COINBASE, HITS ALMOST 7-YEAR HIGH

XRP, which saw its fourth ETF filing Monday, also now has the third-largest market cap among all cryptocurrencies, after it shot past Tether’s USDT and Solana’s SOL.

XRP has been the most popular token by trading volume in the last 24 hours on several centralized exchanges, such as Binance and Coinbase

XRP’s virality on centralized exchanges comes as the token climbed on Monday to a nearly seven-year high of $2.77, a 40% jump in the last 24 hours and a 433% increase over the past 30 days.

The token native to the Ripple ledger currently has a market cap of about $158 billion, surpassing both Tether’s USDT and Solana’s SOL, making XRP the third largest cryptocurrency by market cap.

On Binance, the dominant non-U.S. centralized exchange, XRP’s 24-hour volume of $7 billion makes up 13.3% of total trading activity. For the U.S.’s biggest exchange, Coinbase, XRP has a 24-hour volume of $3 billion, comprising almost 30% of the total volume.

XRP tops trading volume on OKX, Kraken, and KuCoin as well, market data from CoinGecko shows. XRP trading on Upbit, a prominent centralized exchange in South Korea, makes up 38.6% of the entire venue’s 24-hour trading volume of $19.8 billion.

Wall Street titans are also preparing to launch spot XRP exchange-traded funds as ETF provider WisdomTree submitted a Monday filing for a spot XRP ETF with the U.S. Securities and Exchange Commission, joining Bitwise, Canary Capital, and 21shares.

Small Retail FOMO

“The 6-year (nearly 7-year) high comes as wallets with 1M-10M XRP have accumulated 679.1M tokens (currently worth $1.66B) in just 3 weeks,” the team behind market intelligence platform Santiment wrote on X early Monday. At current prices, one million XRP tokens are worth almost $2.8 million.

Maksim Tkachuk, who works on product at Santiment, further told Unchained over Telegram that the team is observing high levels of FOMO, short for “fear of missing out,” from small retail holders, defined as addresses with 100 to 10,000 XRP tokens.

“Overall when those retail darlings take the spotlight, the whole market becomes dangerous as the main drivers of the price at this point are greed and FOMO,” Tkachuk wrote.

“Per [Santiment’s] internal agreement – the top is near… at least a very sizeable correction is what we agree on like 20-25 percent in majors.”

Stablecoin, RWA and DeFi Plans

Meanwhile, Ripple is gearing up to roll out a new USD stablecoin on its blockchain, as the New York Department of Financial Services is expected to approve the product, according to Fox Business last week.

Sally Zhu, who is part of the venture capital arm of crypto market-making firm Amber Group, messaged Unchained on Telegram saying, “I think XRP’s recent price surge is about the buzz around tokenizing [real-world assets]…” They’re teaming up with players like Archax to bring things like equities and global debts onto the XRP Ledger.”

Archax, a digital asset exchange, broker, and custodian, announced on Nov. 25 that it has provided access to a money market fund in a tokenized form on the XRP Ledger. “With such a huge opportunity to reshape how financial instruments are traded and managed, XRP is riding the wave of optimism now.”

Decentralized finance (DeFi), a subsector of the crypto space that enables users to conduct financial activities without intermediaries, has strong roots in Bitcoin, Ethereum, and Solana. Some crypto users are now exploring DeFi on the XRP Ledger.

For example, Robert Leshner, the CEO of asset management firm Superstate, said he was in the “trenches,” testing the infrastructure of automated market markets and inspecting the memecoins on the network, per an X post on Sunday.

Despite the recent upward price movement of XRP, people in the crypto space have long criticized the XRP Ledger for its lack of decentralization. Justin Bon, founder and chief investment officer of Cyber Capital, specifically pointed to the consensus mechanism for the XRP Ledger. “XRP’s consensus is based on UNLs (Unique Node Lists), literal centralized lists of trusted nodes released by single parties, including the foundation,” Bons wrote on X.

@ Newshounds News™

Source: Unchained Crypto

~~~~~~~~~

XRP WORLD RESERVE CURRENCY | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 12-01-24

Good Afternoon Dinar Recaps,

HONG KONG LAUNCHES DIGITAL BOND ISSUANCE GRANTS

Last month the Hong Kong Monetary Authority (HKMA) said it was planning to launch a grant program that would offer up to HK$2.5 million (US$ 321,000) in grants to digital bond issuers. Yesterday it announced that the program has started and will run for three years.

We believe the grant scheme also covers tokenized bonds, which are bonds issued conventionally and then a digital twin is created on a blockchain. Digital bonds often refer only to bonds issued natively on a blockchain.

Good Afternoon Dinar Recaps,

HONG KONG LAUNCHES DIGITAL BOND ISSUANCE GRANTS

Last month the Hong Kong Monetary Authority (HKMA) said it was planning to launch a grant program that would offer up to HK$2.5 million (US$ 321,000) in grants to digital bond issuers. Yesterday it announced that the program has started and will run for three years.

We believe the grant scheme also covers tokenized bonds, which are bonds issued conventionally and then a digital twin is created on a blockchain. Digital bonds often refer only to bonds issued natively on a blockchain.

The HKMA is using the digital bond term more expansively. “‘Digital bond’ refers to a bond that leverages distributed ledger technology (DLT) for digital representation of ownership, which could include, for example, legal titles and/or beneficial interests in the bond,” the HKMA wrote.

Digital bond grant criteria

The subsidy will cover up to half the expenses of each digital bond issuance, with a maximum of two issuances.

Half of the subsidy is available if most of the lead managers are based in Hong Kong and the team developing or maintaining the DLT platform has a substantial presence in Hong Kong.

Alternatively, instead of a local developer team, the issuance will qualify if it uses a DLT infrastructure where Hong Kong’s central securities depository, the CMU, is designated as the platform operator.

For Hong Kong’s sovereign digital bond issuance earlier this year, the CMU was the operator of the local HSBC Orion DLT platform. We believe this means other platforms can also request this designation.

In order to qualify for the full subsidy there are four additional requirements:

▪️the issuer is not associated with the DLT platform

▪️the bond is at least HK$1 billion (US$128.5m)

▪️there are five or more investors not associated with the issuer or DLT platform

▪️the issuance is listed on the stock exchange or by a regulated virtual asset trading platform (VATP).

With the exception of sovereign or semi sovereign bonds, many recent bond issuances globally would not meet these criteria. For example, HSBC recently issued a Hong Kong digital bond on the HSBC Orion DLT. That would only qualify for half the grant because it would fail the platform test.

There are some easy workarounds to the DLT platform criterion. For example, one bank could issue a bond on a second bank’s platform, and then the second bank could issue a bond on the first banks’s platform.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

SOUTH KOREA DELAYS CRYPTO TAX AGAIN: WHAT IT MEANS FOR INVESTORS IN 2024

▪️South Korea delays crypto tax to 2027, marking a significant policy shift after prolonged debates and investor criticism.

▪️Crypto trading in South Korea thrives as daily volumes hit 6 trillion won, reflecting growing investor interest despite tax uncertainty.

In a latest development, the main opposition Democratic Party of Korea (DPK) agreed on Sunday to delay the controversial crypto tax for two years following investor backlash.

The latest move pushes the tax’s implementation to 2027, marking a significant shift in the country’s stance on digital asset taxation, allowing the market additional time to adapt.

“After extensive discussions, we concluded that additional institutional arrangements are necessary for the virtual asset taxation,” DPK floor leader Rep. Park Chan-dae said during the press meeting at the National Assembly. “We have agreed to defer taxation for two years.”

Park also noted that the decision was made after a ‘prolonged deliberation, debate, and political judgment.’

This decision comes after months of disagreement between the ruling PPP and the KDP. While the PPP supported a three-year grace period, the KDP had previously pushed for implementing the tax in 2025 and had accused the ruling party of using delays as a political strategy regarding South Korea crypto tax policies.

South Korea’s Journey In Crypto Taxes

South Korea’s journey toward taxing cryptocurrency gains began in 2021 when the government proposed a 20% tax on digital asset profits exceeding $1,800 annually. However, criticisms from investors and industry stakeholders led to repeated delays. Notably, the South Korea crypto tax’s implementation was initially pushed to 2023, then to 2025, and now to 2027.

The current tax framework charges taxes on gains exceeding 2.5 million won, whereas stock trading profits are taxed only above 50 million won, a disparity that has been heavily criticised.

Government’s Plans To Impose Crypto Taxes

Beginning next year, the government had planned to impose a 22 percent tax, including local taxes, on annual income exceeding 2.5 million won ($1,790) from virtual asset investments. Although the policy had already been postponed twice, the DPK initially intended to implement the taxation plan by raising the tax exemption threshold to 50 million won.

However, the widespread criticism from the increasing number of crypto investors and opposition from the ruling People Power Party (PPP) led the party to agree to a further postponement.

South Korea Remains Key Player In Global Market

South Korea remains a key player in the global crypto market. Notably, the decision to delay taxation of the South Korea crypto tax reflects the government’s cautious approach to balance regulation with market growth.

Notably, in the first half of 2024, the country’s daily crypto trading volume soared 67% from the previous period to six trillion won. Local media source Naver also reported that the number of domestic investors increased by 21%, reaching 7.78 million, with Bitcoin and Ethereum comprising the majority of holdings.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

THE EASY WAY TO GROW YOUR WEALTH WITH XRP IN JUST 30 DAYS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 12-01-24

Good Morning Dinar Recaps,

NO TURNING BACK ON LAUNCHING BRICS PAYMENT SYSTEM: DIPLOMAT

BRICS Sherpa Sergey Ryabkov confirmed to reporters that the bloc will not scrap the formation of a new payment system. Speaking to reporters at the Sherpa meeting, the diplomat doubled down saying that there’s no turning back on launching the new BRICS payment system. The goal of the new system is to sideline the US dollar and settle cross-border transactions in a basket of local currencies.

For the uninitiated, BRICS is working on the formation of an independent payment system that will not incorporate the US dollar into its mechanism. The mechanism will include local currencies of the bloc and keep the US dollar away from all transactions.

Good Morning Dinar Recaps,

NO TURNING BACK ON LAUNCHING BRICS PAYMENT SYSTEM: DIPLOMAT

BRICS Sherpa Sergey Ryabkov confirmed to reporters that the bloc will not scrap the formation of a new payment system. Speaking to reporters at the Sherpa meeting, the diplomat doubled down saying that there’s no turning back on launching the new BRICS payment system. The goal of the new system is to sideline the US dollar and settle cross-border transactions in a basket of local currencies.

For the uninitiated, BRICS is working on the formation of an independent payment system that will not incorporate the US dollar into its mechanism. The mechanism will include local currencies of the bloc and keep the US dollar away from all transactions.

“The glass is always half-full; it is never half-empty,” said Ryabkov when answering about the independent payment system within BRICS.

“We can measure how full the glass is in different ways but this ultimately depends on who is holding this glass in their hands. Therefore, we’ve made significant strides today. How much time it will take to fill the framework we’ve established with tangible actions depends on us. On BRICS and the global majority,” the diplomat said to reporters at a press conference.

Why is BRICS Creating a New Payment System?

The BRICS bloc is creating a new payment system to safeguard the economies of developing countries from US sanctions. The goal is to protect themselves economically without being pinned down by the US and the West. The diplomat called the US and the West “hostile states” who want to harm the prospects of developing countries.

The diplomat called the upcoming BRICS payment system a “critical milestone” for the bloc and “a point of no return.” He added that “we will do everything in our power to ensure success.”

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

'GOVERNMENT HAS BECOME ADDICTED TO INDIRECT REGULATION' — RIPPLE CTO

In a recent Joe Rogan interview, Mark Andreesen revealed that the debanking of tech firms caused the Silicon Valley shift toward Trump.

Ripple chief technical officer David Schwartz recently joined the list of tech founders speaking out against Operation Chokepoint 2.0 — a government-run debanking operation against the crypto industry. Schwartz said the government is "addicted to indirect regulation" and laid out four reasons why de-banking undermines the rule of law.

Schwartz argued that debanked entities switch service providers or take their funds underground — thereby evading surveillance and sanctions control altogether.

The CTO also said de-banking undermines due process, freedom of speech, and the right against unlawful search and seizure. Schwartz wrote:

"Our government has become addicted to indirect regulation precisely because of these evils. It is cheaper and easier to pressure someone else to punish me than to charge me with a crime and give me due process, but the government ought not to punish people without giving them due process."

"It is easier to pressure banks to cut off disfavored businesses than to make that business illegal," The CTO continued before imploring the government to use lawful and above-board processes to regulate businesses.

Industry founders recount government debanking operation

According to venture capitalist Mark Andreesen, more than 30 tech firms were victims of Operation Chokepoint 2.0, and tech founders recently took to social media to share their debanking experiences.

The list of figures speaking out included Frax Finance founder Sam Kazemian, who claimed that JPMorgan Chase debanked him in December 2022.

Coinbase co-founder and CEO Brian Armstrong also petitioned the government for records relating to Operation Chokepoint 2.0 via the Freedom of Information Act (FOIA) and is currently compiling those records.

In September 2024, Castle Island Ventures partner Nic Carter revealed that the Biden administration deliberately killed Silvergate Bank — a major institution for crypto banking — in an effort to destroy the crypto industry. “I believe Silvergate could have survived its drawdown — and was on a path to do so,” Carter said.

However, Industry executives remain optimistic that the incoming Trump administration will reverse years of regulatory hostility toward the crypto industry.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ZIM ZIG: THE MOST BRILLIANT INVESTING STRATEGY EVER? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Morning 11-30-24

Good Morning Dinar Recaps,

XRP NEWS: RIPPLE’S RLUSD STABLECOIN SET TO LAUNCH IN 4 DAYS – WHAT YOU SHOULD KNOW

Ripple's stablecoin, RLUSD, is set to launch soon, pending NYDFS approval.

RLUSD aims to stabilize Ripple's offerings and capture a larger share of the cross-border payment market.

Positive regulatory shifts and market optimism are driving XRP's price surge.

Good Morning Dinar Recaps,

XRP NEWS: RIPPLE’S RLUSD STABLECOIN SET TO LAUNCH IN 4 DAYS – WHAT YOU SHOULD KNOW

Ripple's stablecoin, RLUSD, is set to launch soon, pending NYDFS approval.

RLUSD aims to stabilize Ripple's offerings and capture a larger share of the cross-border payment market.

Positive regulatory shifts and market optimism are driving XRP's price surge.

Ripple always seems to be in the spotlight, doesn’t it?

The company behind XRP is preparing to launch its highly anticipated stablecoin, RLUSD, with approval from the New York Department of Financial Services (NYDFS) expected on December 4.

Why is RLUSD so important and how will it change the game for Ripple AND crypto payments? Let’s find out.

RLUSD: Ripple’s Answer to Legal Problems?

The launch of RLUSD is more than just a product release—it’s Ripple’s strategy to address the ongoing legal uncertainty around XRP. Unlike XRP, which is known for its price swings, RLUSD will offer the stability that investors and institutions seek.

Ripple’s acquisition of Standard Custody & Trust Company earlier this year was a crucial step. It enabled Ripple to meet NYDFS’s strict regulatory standards, setting the stage for RLUSD’s launch and enhancing its credibility in the stablecoin space.

Can Ripple Compete With the Others?

With RLUSD, Ripple is entering a market dominated by heavyweights like Circle’s USDC and Paxos’ USDP. By partnering with platforms such as MoonPay and Uphold, Ripple aims to make RLUSD available globally.

The stablecoin’s primary use case?

Transforming cross-border payments. RLUSD could make these transactions faster and more cost-effective, further boosting the adoption of Ripple’s RippleNet, which already competes with traditional systems like SWIFT.

XRP Price Analysis

XRP has been trading within a tight range of $0.39 to $0.75 since March 2023. However, recent developments—such as the upcoming U.S. election and Ripple’s push for regulatory clarity—have renewed investor optimism.

The anticipated launch of RLUSD is seen as a catalyst that could push XRP beyond its current limits. Some market analysts predict XRP could climb above $2 by year-end, driven by increased confidence in Ripple’s ecosystem.

What’s Boosting Ripple Today?

Ripple’s position is further strengthened by global regulatory changes. The MiCA framework in Europe and a pro-crypto stance from the Trump administration in the U.S. are creating a more supportive environment for compliant blockchain projects like Ripple.

If the NYDFS grants approval as expected, RLUSD could launch on December 4. This would add stability to Ripple’s offerings, enhancing its appeal in the fast-growing stablecoin market.

The stablecoin race is heating up, and Ripple’s RLUSD could be the wildcard that changes the game. Stay tuned to Coinpedia to know just how far it will go.

FAQs

Why is XRP going up?

Optimism around regulatory clarity and Ripple’s stablecoin news is fueling the price surge.

How high can XRP go?

While predictions vary, some experts believe XRP could cross $2 by year end.

What is stablecoin?

A stablecoin is a cryptocurrency pegged to a stable asset like the U.S. dollar, reducing volatility.

Is XRP a good investment?

XRP has huge potential, but market volatility and regulatory factors should be considered.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

[Image 1: Screenshot of the official Bitcoin reserve bill document presented to Brazil’s Chamber of Deputies, outlining key provisions and objectives]

BRAZIL’S BITCOIN RESERVE BILL: HOW IT COULD CHANGE CRYPTO FOREVER

Brazil Bitcoin takes a bold step forward.

Congressman Eros Biondini has proposed a BTC reserve bill to make Bitcoin part of the national treasury. His plan, called the ‘Bitcoin Sovereign Strategic Reserve (RESBit)’, wants to put 5% of Brazil’s reserves into Bitcoin. This marks a major change in how countries handle cryptocurrency.

Understanding Brazil’s BTC Reserve Bill and Its Impact on Crypto Regulations

Key Components of RESBit

Brazil’s Central Bank will keep the Bitcoin in cold storage. They plan to buy it step by step. The BTC reserve bill aims to spread out financial risks and make Brazil a tech leader. Such Brazil Bitcoin initiatives could show other countries how to use cryptocurrency in their banking systems.

Global Implications and Market Response

More countries want to use cryptocurrency now. Argentina, Morocco, and Romania are interested, too. US President-elect Donald Trump supports creating a Bitcoin reserve, making the BTC reserve bill more important worldwide.

Implementation and Security Measures

RESBit has strong rules for keeping Bitcoin safe. The Central Bank will use new technology to watch over and protect the funds. This helps make sure national digital money stays secure. Brazil’s innovative Bitcoin security measures could set a global standard.

Economic Strategy and Innovation

The plan helps the economy now and builds for the future. Brazil Bitcoin’s move with RESBit creates a blueprint that other countries might follow. This could change how the world handles money.

Future Outlook

Biondini’s plan could make cryptocurrency more common. If it passes, Brazil Bitcoin legislation would make it one of the first big countries to keep Bitcoin as a national reserve. This might encourage other nations to do the same.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

RENO'S RV SECRETS REVEALED! | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Afternoon 11-29-24

Good Afternoon Dinar Recaps,

BRICS NEWS: BRICS DETERMINED TO TRADE IN LOCAL CURRENCIES, NOT US DOLLAR

The BRICS alliance is determined to trade in local currencies and not the US dollar for cross-border transactions. The US dollar is seen as an adversary that hinders their growth in the global financial sector. Local currencies are seen as an alternative option that can bring the hegemony of the USD down.

BRICS: Local Currencies First & Not the US Dollar

Good Afternoon Dinar Recaps,

BRICS NEWS: BRICS DETERMINED TO TRADE IN LOCAL CURRENCIES, NOT US DOLLAR

The BRICS alliance is determined to trade in local currencies and not the US dollar for cross-border transactions. The US dollar is seen as an adversary that hinders their growth in the global financial sector. Local currencies are seen as an alternative option that can bring the hegemony of the USD down.

BRICS: Local Currencies First & Not the US Dollar

Similar to the phrase ‘America First‘, the BRICS bloc is now emerging to make ‘local currencies first’. The bloc is pulling every trick up its sleeve to sideline the US dollar for cross-border payments. From oil deals to copper trade and infrastructural loans, the alliance is aiming to push local currencies for settlements.

Many other developing countries are keen on joining the bandwagon and could soon jump on the de-dollarization train. Several nations in Africa are on the sidelines and could seek the help of BRICS to put their local currencies to use.

The move will strengthen their native economies and make businesses thrive. It will also provide a way for their local currencies to make a mark in the currency markets.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

BRICS NEWS: 2 COUNTRIES OFFICIALLY ABANDON THE US DOLLAR FOR TRADE

BRICS members Russia and Iran announced that they have officially abandoned the US dollar for trade between the two nations. Russia reported that 96% of all cross-border transactions between Iran have been settled in local currencies, the ruble and rial. In 2024, the usage of local currencies between Russia and Iran is up by 12.4%, making 96% of all settlements.

“We (BRICS members Iran and Russia) have entered into a currency agreement with Russia and fully removed the US dollar. Now we only trade in rubles and rials,” said the Governor of the Central Bank of the Islamic Republic, Mohammad Reza Farzin. However, both nations face sanctions as the White House has made it difficult to accept the US dollar.

In July this year, both the BRICS countries agreed to a currency swap policy signed by the Russian and Iranian central banks. They also completed the integration of Russia’s Mir payment as a replacement for the SWIFT messaging system and the US dollar. Russia also allowed Iranian citizens to withdraw the rial in ATMs across the country.

BRICS: Russia & Iran Sidelines the US Dollar, Trades in Local Currencies

While the US pressed sanctions on BRICS member Russia to weaken its economy, the Kremlin is bypassing the sanctions by convincing other countries to ditch the US dollar and begin using local currencies. The de-dollarization initiative is growing and many developing countries are now eager to join the bandwagon.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

TAIWAN ENFORCES AML REGISTRATION MANDATE FOR CRYPTO PROVIDERS

Taiwan accelerates its crypto AML mandate, imposing stricter registration rules and penalties for noncompliance.

Taiwan advanced the introduction of its new Anti-Money Laundering (AML) regulations for cryptocurrency businesses after authorities fined two crypto exchanges for violations.

On Nov. 27, the Financial Supervisory Commission (FSC) announced that the upcoming money laundering prevention registration mandate for crypto exchanges was shifted to Nov. 30 from the previous Jan. 1, 2025 deadline.

Per the previous notice, virtual asset service providers (VASPs) failing to register with the government could be subject to a two-year prison sentence or fines of as much as 5 million New Taiwan dollars ($155,900).

The new mandate includes previously registered crypto businesses

According to Taiwan FSC records, 26 crypto providers are currently approved to continue to offer their services. All crypto entities, whether previously registered or not, must register in accordance with the new AML mandate. The authority said:

“No business operators have completed the Money Laundering Prevention Registration under the VASP Registration Measures.”

The authority provided a checklist of items crypto exchanges can use to track suspicious transactions or activities. When identifying suspicious customers, crypto service providers must look for names and bank account details, location via IP addresses, multiple trading accounts and frequent information changes, among other things.

Crypto exchanges in Taiwan were also asked to track unusual transaction activities, including but not limited to splitting funds, utilizing multiple accounts with the same IP address and switching assets.

Cracking down on crypto exchanges violating AML laws

According to a Regulation Asia report, the FSC fined crypto exchanges MaiCoin and BitoPro on Nov. 28 for AML violations in relation to customer due diligence (CDD), transaction monitoring, record-keeping and suspicious transaction reporting.

To register with Taiwan’s AML regulation, crypto service providers are required to submit a one-page form detailing the nature of their businesses.

The form states that any changes to the business or the information provided should be provided to the Securities Over-the-counter (OTC) Trading Center within five business days.

Crypto businesses will also be required to establish a quality management system for accounting and auditing their finances.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

RETAILERS PUSH FOR A DELAY IN ROLLOUT OF RUSSIA’S CBDC

In October the Bank of Russia revealed a time frame for the roll out of the digital ruble, which forms part of a Bill that has been submitted to the State Duma. The mass rollout date is 1 July 2025. By that time the largest banks and retailers must support the central bank digital currency (CBDC). Now the Ministry of Industry and Trade has asked for a longer timescale of up to two years, similar to that provided to smaller retailers, the Izvestia newspaper reported.

The 1 July deadline applies to retailers with a turnover of more than 30 million rubles ($274,000). Those with incomes between 20 to 30 million rubles have one extra year, and smaller firms have two years.

The Ministry complained that there are still no rules for the operation and functioning of the digital ruble, so it doesn’t allow sufficient time for retailers to prepare and for adapting their point of sale software.

Trade bodies agree. “We believe it is necessary to refrain from legislatively establishing specific deadlines for launching systems at the trade level and to provide for a transition period of at least two years, during which companies will carry out the necessary work,” a letter from the Retail Companies Association (ACORT) states.

Another industry body, the Association of Internet Trade Companies (AITC), has similar views. It said, “The absence of such important provisions does not give businesses the opportunity to assess the costs of implementation time, the necessary human resources, expenses for the company, and also to understand to what extent companies are ready to implement such payments.”

The main benefit of a CBDC for retail outlets is reduced acquiring fees, so retailers will pay less for processing payments.

What’s the rush?

Stepping back, one of the big motivators for a CBDC is for cross border payments in order to circumvent sanctions. If a CBDC isn’t rolled out domestically, then a cross border CBDC would need direct integration with the domestic payment system.

With the cross border payment platform mBridge, the only member that currently has a domestic CBDC is China, and even that is in pilot mode. Hence, it’s not completely clear why there’s such a rush in Russia. Especially given the central bank has a few other issues to deal with given the war with Ukraine.

On the other hand, Russia is known for its software prowess, and is trying to lead the BRICS Bridge cross border payment project. Hence, having an operational domestic CBDC gives it more credibility.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

THE UGLY TRUTH ABOUT AMERICAN COURT LAW NO ONE TELLS YOU | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Morning 11-29-24

Good Morning Dinar Recaps,

DE-DOLLARIZATION: 2 COUNTRIES OFFICIALLY ABANDON THE US DOLLAR

While Trump is bolstering efforts to reinstate US dollar dominance, the de-dollarization agenda is still a heavy narrative that is spreading like wildfire on a global domain. The Trump regime is focusing on imposing taxes on countries moving away from the dollar, while on the other side, these two nations have stopped using the dollar for bilateral trade. Is de-dollarization an agenda that can truly end sometime soon?

These 2 Nations Have Moved Away From The Dollar

Iran and Russia, the two leading nations, have decided to move away from the US dollar. Iran’s central bank governor, Mohammad Reza Farzin, officially announced plans on how Iran has lately been conducting trade with Russia without using the US dollar.

Good Morning Dinar Recaps,

DE-DOLLARIZATION: 2 COUNTRIES OFFICIALLY ABANDON THE US DOLLAR

While Trump is bolstering efforts to reinstate US dollar dominance, the de-dollarization agenda is still a heavy narrative that is spreading like wildfire on a global domain. The Trump regime is focusing on imposing taxes on countries moving away from the dollar, while on the other side, these two nations have stopped using the dollar for bilateral trade. Is de-dollarization an agenda that can truly end sometime soon?

These 2 Nations Have Moved Away From The Dollar

Iran and Russia, the two leading nations, have decided to move away from the US dollar. Iran’s central bank governor, Mohammad Reza Farzin, officially announced plans on how Iran has lately been conducting trade with Russia without using the US dollar.

Farzin outlined how both nations have established agreements to conduct trade in local currencies, giving the multipolar currency narrative a new boost.

“We have entered into a currency agreement with Russia and fully removed the dollar. Now we only trade in rubles and rials,” Farzin later shared.

The Governor of the Central Bank of Iran later clarified how the financial authorities of both nations have agreed on the exchange rate to be used while conducting active transactions.

The recent data uploaded by the Kremlin also reflected the rising multipolar currency narrative. The fresh Kremlin data emphasize how Iran and Russia have conducted nearly 96% of their trade transactions in local currencies.

“The Kremlin reported on October 21 that the use of national currencies in mutual settlements between Iran and Russia was up 12.4% in 2024, making up 96% of all transactions.” Tass Media reported

The rising de-dollarization wave is hard to maneuver as the majority of the nations, under BRICS and ASEAN, are all proposing local currencies, urging nations to pivot away from the dollar

Trump Tightens His Tax Agenda

Trump, in his recent spree of announcements, has shared how Canada, Mexico, and China will encounter higher tax restrictions. The president-elect has decided to impose a 10% tax on Canada and Mexico to address and restrict illegal immigration and drug smuggling.

At the same time, Trump has imposed a 25% tax on China, touting it as a measure to curb excessive fentanyl imports.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

CRYPTO EXCHANGE OKX ROLLS OUT SERVICES IN BELGIUM TO STRENGTHEN EUROPEAN PRESENCE

OKX expands its European footprint with a launch in Belgium, featuring free Euro deposits through a partnership with local payment provider Bancontact.

Seychelles-headquartered crypto exchange OKX has launched its services in Belgium, offering spot trading, conversion, and a range of crypto services through its exchange and wallet.

Belgian customers now have access to over 200 cryptocurrencies, including more than 60 crypto-euro trading pairs, along with Euro deposits and withdrawals, the company said in a Nov. 28 press release.

The exchange says the expansion in Belgium leverages Bancontact, Belgium’s online payment system, allowing customers to deposit funds instantly and free of charge. SEPA withdrawals and deposits are also available without fees.

OKX Europe general manager Erald Ghoos says the launch in Belgium marks a “key step in our regional expansion, supported by a local team and tailored services that meet the unique needs of Belgian customers.”

The Belgian launch is part of OKX’s broader strategy to increase its presence across Europe.

Earlier in 2024, the exchange debuted in the Netherlands and announced plans to establish OKX expands its European footprint with a launch in Belgium, featuring free Euro deposits through a partnership with local payment provider Bancontact.

Seychelles-headquartered crypto exchange OKX has launched its services in Belgium, offering spot trading, conversion, and a range of crypto services through its exchange and wallet.

Belgian customers now have access to over 200 cryptocurrencies, including more than 60 crypto-euro trading pairs, along with Euro deposits and withdrawals, the company said in a Nov. 28 press release.

The exchange says the expansion in Belgium leverages Bancontact, Belgium’s online payment system, allowing customers to deposit funds instantly and free of charge. SEPA withdrawals and deposits are also available without fees.

OKX Europe general manager Erald Ghoos says the launch in Belgium marks a “key step in our regional expansion, supported by a local team and tailored services that meet the unique needs of Belgian customers.”

The Belgian launch is part of OKX’s broader strategy to increase its presence across Europe. Earlier in 2024, the exchange debuted in the Netherlands and announced plans to establish a regulatory hub in Malta, where it secured a Class 4 Virtual Financial Assets license in 2021. The exchange said it plans to list additional tokens for Belgian users as part of its ongoing product expansion, though details on this initiative are yet to be disclosed.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

COINBASE ENDS USDC REWARDS IN EUROPE AS MICA DEADLINE LOOMS

The crypto exchange will end its USDC yield program for EEA customers on December 1, citing the EU’s upcoming stablecoin regulations.

Crypto exchange Coinbase will discontinue its USDC Rewards program for customers in the European Economic Area (EEA) starting December 1, 2024, as part of its compliance with the European Union’s Markets in Crypto-Assets (MiCA) regulations.

Coinbase users reported receiving an email Thursday in which the exchange announced the termination of its yield program, which allowed users to earn rewards on their holdings of the USDC stablecoin.

The change comes as MiCA, introduced in June 2023, imposes stricter rules on stablecoins, classifying them as electronic money tokens (EMTs).

These rules ban interest-earning features and require issuers to maintain sufficient reserves and obtain e-money authorization in at least one EU member state.

Impacted customers will receive their final payments within the first ten business days of December. Until then, they can continue earning rewards on balances through November 30.

Many customers have expressed dissatisfaction with the changes. Paul Berg, co-founder of Sablier, sarcastically remarked on Twitter that he feels “very grateful to the EU” for shielding him from earning rewards on his USDC.

Ripple’s CTO David Schwartz weighed in, describing the situation as an example of regulations preventing companies from offering “pro-consumer” services.

Coinbase had hinted at the coming change October, announcing plans to delist or adjust non-compliant tokens ahead of MiCA’s full enforcement on December 30.

At the time, the crypto exchange told Decrypt it would provide a detailed transition plan in November to help European customers switch to compliant stablecoins, such as USDC and EURC.

On Wednesday, stablecoin issuer Tether also announced it will stop minting euro-backed tokens, citing regulatory hurdles in Europe.

Tether CEO Paolo Ardoino said the focus will now shift to expanding Hadron, its asset tokenization platform.

Coinbase did not immediately respond to Decrypt’s request for comment.

@ Newshounds News™

Source: Decrypt

~~~~~~~~~

🌱WHAT ABOUT FREQUENCIES | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

World's Largest Gold Deposit Found, Worth Over Us$80 Billion

World's Largest Gold Deposit Found, Worth Over Us$80 Billion

Mike McRae Thu, November 28, 2024

A deposit of high-quality gold ore containing around 1,000 metric tons (1,100 US tons) of the precious metal has been discovered in central China, according to Chinese state media.

Valued at approximately 600 billion yuan or US$83 billion, the discovery could be considered the largest and most lucrative reservoir of gold ever uncovered, surpassing the 900 metric tons estimated to lie within the mother of all gold reserves, South Deep mine in South Africa.

World's Largest Gold Deposit Found, Worth Over Us$80 Billion

Mike McRae Thu, November 28, 2024

A deposit of high-quality gold ore containing around 1,000 metric tons (1,100 US tons) of the precious metal has been discovered in central China, according to Chinese state media.

Valued at approximately 600 billion yuan or US$83 billion, the discovery could be considered the largest and most lucrative reservoir of gold ever uncovered, surpassing the 900 metric tons estimated to lie within the mother of all gold reserves, South Deep mine in South Africa.

This photo taken on 20 November 2024 shows drilled rock samples from the Wangu gold field in Pingjiang County, central China's Hunan Province. (Xinhua/Dai Bin)

The Geological Bureau of Hunan Province announced the detection of 40 gold veins within a depth of 2 kilometers (1.2 miles) in the northeast Hunan county of Pingjiang.

These alone were thought to contain 300 metric tons of gold, with 3D modeling suggesting additional reserves may be found to a depth of 3 kilometers.

"Many drilled rock cores showed visible gold," says bureau prospector Chen Rulin.

Core samples suggest every metric ton of ore could contain as much as 138 grams (nearly 5 ounces) of gold – an extraordinary level of quality considering ore excavated from underground mines is considered high grade if it contains more than 8 grams.

China already dominates the world's gold market with reserves considered to be in excess of 2,000 tons earlier in 2024, its mining industry contributing around 10 percent of the global output.

TO READ MORE: https://www.yahoo.com/news/worlds-largest-gold-deposit-found-012530485.html

Seeds of Wisdom RV and Economic Updates Thursday Morning 11-28-24

Good Morning Dinar Recaps,

ROBINHOOD CRYPTO EU EXPANDS OFFERINGS WITH CIRCLE USDC STABLECOIN

Robinhood Crypto EU adds USDC stablecoin, providing users access to regulated dollar-backed digital assets and expanding crypto offerings.

▪️Robinhood Crypto EU added Circle's USDC stablecoin, giving 24M registered accounts access to the dollar-backed asset

▪️Circle's CEO confirmed USDC’s inclusion on Robinhood EU, alongside EURC, benefiting from Europe’s clear crypto regulations.

Good Morning Dinar Recaps,

ROBINHOOD CRYPTO EU EXPANDS OFFERINGS WITH CIRCLE USDC STABLECOIN

Robinhood Crypto EU adds USDC stablecoin, providing users access to regulated dollar-backed digital assets and expanding crypto offerings.

▪️Robinhood Crypto EU added Circle's USDC stablecoin, giving 24M registered accounts access to the dollar-backed asset

▪️Circle's CEO confirmed USDC’s inclusion on Robinhood EU, alongside EURC, benefiting from Europe’s clear crypto regulations.

▪️Robinhood EU supports 30+ digital assets.

Robinhood Crypto EU has expanded the options available on its platform, now including Circle’s USDC stablecoin to its European customers. The integration allows users to access a regulated digital asset that is dollar-based, expanding Robinhood’s product portfolio in the crypto space.

Robinhood Introduces USDC Stablecoin To European Users

According to a recent post on X, Robinhood Crypto EU has incorporated Circle’s USDC into its platform, enabling 24 million registered accounts to access the dollar-backed digital asset. This addition aligns with the trading platform’s strategy of offering users compliant options in the cryptocurrency space.

Circle’s CEO, Jeremy Allaire, acknowledged USDC coming on Robinhood stating that the platform could further boost the use of stablecoins in Europe. Beside USDC, Allaire emphasized on EURC, the euro stablecoin of Circle, as both assets operate within the framework of European regulations.

Circle’s CEO added,

“EURC is the largest Euro Stable, has grown fast this year, is taking advantage of clear and fair regulations in Europe (alongside USDC!) and is growing TX volume, onchain FX use, and more and more exchanges and wallets launching support.”

Crypto Services Across European Markets

Robinhood continues to broaden its cryptocurrency portfolio, offering support for over 30 digital assets. The platform provides the lowest-cost trading across European markets, further cementing its position as a leading crypto platform. The inclusion of USDC in its offerings demonstrates dedication to providing investors with a diverse range of options.

Recently, the trading platform added Dogwifhat (WIF), a Solana-based meme coin, to its list of supported cryptocurrencies. The listing triggered a surge in WIF price and trading volume, highlighting its influence on market trends within the crypto sector.

In parallel developments, Circle launched USDC stablecoin and Cross-Chain Transfer Protocol (CCTP) on the Aptos blockchain. This integration enables the native issuance of USDC on Aptos, improving its functionality within the network. It also enhances cross-chain interoperability and reduces dependence on bridged versions of the stablecoin.

The CCTP rollout facilitates seamless transfers between Aptos and other blockchains, such as Ethereum, Solana, and Base. The move complements Circle’s USDC strategy, further expanding its usability in decentralized finance.

@ Newshounds News™

Source: CoinGape

~~~~~~~~~

METAMASK INTEGRATES VENMO TO ENHANCE FIAT-TO-CRYPTO ONRAMP OPTIONS

MetaMask added a fiat on-ramp feature through Venmo, allowing US users to buy crypto using the payment app, according to a Nov. 27 announcement.

Crypto-focused fintech Moonpay enabled the new payment method.

Venmo, a PayPal subsidiary, introduced crypto transfers for its customers in April 2023. The company has supported buying, holding, and selling crypto since 2021.

Although the MetaMask fiat-to-crypto option is available in roughly 200 countries, the Venmo partnership is only available for US users.

Efforts on payments

MetaMask first launched a fiat-to-crypto feature in April 2023 and has since added support for payment options via Apple Pay, debit and credit cards, PayPal, wire transfer, and ACH bank transactions.

Other MetaMask partners include Transak, Stripe, Sardine, and Banxa, among others.

The company recently launched the MetaMask Card in August in partnership with Mastercard and crypto service provider Crypto Life. The card is still in its pilot phase and is only available in Europe and the UK.

The debit card allows users to spend balances in USD Coin (USDC), Tether USD (USDT), and Wrapped Ethereum (WETH) at any vendor that accepts Mastercard. Additionally, the card is supported by Apple Pay and Google Pay.

@ Newshounds News™

Source: CryptoSlate

~~~~~~~~~

🌱 WHAT IS THE BEST DICTIONARY | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Evening 11-27-24

Good Evening Dinar Recaps,

TRUMP’S TEAM PICKS PAUL ATKINS FOR SEC CHAIR: REPORT

In the ongoing developments surrounding the rapidly evolving cryptocurrency landscape, Donald Trump’s team has reportedly consider a new Securities and Exchange Commission (SEC) chair to replace the current chair, Gary Gensler. According to the latest report, the Trump’s team has consider pro-crypto former commissioner Paul Atkins for the SEC chair position.

Trump’s Team Consider Paul Atkins to Replace Gary Gensler

Atkins is known for his crypto expertise and innovative stance in supporting this rapidly evolving landscape. Following his election as SEC chair, there is a strong possibility that he could actively back and promote U.S. crypto regulation while encouraging rapid growth in the sector.

Good Evening Dinar Recaps,

TRUMP’S TEAM PICKS PAUL ATKINS FOR SEC CHAIR: REPORT

In the ongoing developments surrounding the rapidly evolving cryptocurrency landscape, Donald Trump’s team has reportedly consider a new Securities and Exchange Commission (SEC) chair to replace the current chair, Gary Gensler. According to the latest report, the Trump’s team has consider pro-crypto former commissioner Paul Atkins for the SEC chair position.

Trump’s Team Consider Paul Atkins to Replace Gary Gensler

Atkins is known for his crypto expertise and innovative stance in supporting this rapidly evolving landscape. Following his election as SEC chair, there is a strong possibility that he could actively back and promote U.S. crypto regulation while encouraging rapid growth in the sector.

Recently, Eleanor Terrett, a journalist at Fox Bussiness, noted on X (formerly Twitter),

“Atkins is someone who is not only crypto-savvy but possesses a deep understanding of the inner workings of the agency as both a former commissioner and staffer under two prior SEC Chairs — Richard C.”

Terrett further added that Atkins is seen as being capable of establishing a pro-innovation agenda while returning the agency to the so-called “gold standard” many in the Republican Party feel was lost under outgoing chair Gary Gensler.

Current Market Outlook

Following this much-awaited update, the overall cryptocurrency market began turning green.

As of press time, top assets including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have registered gains of over 2.75%, 7.5%, and 6%, respectively, in the past 24 hours. Meanwhile, other major cryptocurrencies are experiencing similar upside momentum.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

TETHER DOESN’T LIKE MICAR SO DITCHES EURO STABLECOIN

Tether, the issuer of the world’s largest stablecoin, doesn’t like Europe’s MiCA regulations. Other stablecoin issuers are also not keen on the requirement to put a substantial proportion of reserves into bank accounts, as required by MiCAR. But they nonetheless comply. Tether isn’t willing to do so, and today it confirmed it is shutting down EURT, its Euro stablecoin. Users have a year to redeem the coin.

EURT has a market capitalization of €26 million compared to Tether’s USD stablecoin at $132 billion. To date Tether has operated offshore so it’s likely just not worth the work involved to become MiCAR compliant.

MiCAR requires 30% of reserves to be held in bank accounts, with 60% for larger stablecoins. Tether views this as risky compared to investing in Treasuries. Bank deposits also pay less than government bonds.

“Until a more risk-averse framework is in place — one that fosters innovation and offers the stability and protection our users deserve — we have chosen to prioritize other initiatives,” Tether said in a statement.

Tether is known for keeping most of its stablecoin reserves in high risk assets in the past. The company is also accident prone. Over time the quality has improved significantly, but over 15% of its reserves would be considered moderate to high risk.

Instead of becoming MiCAR compliant itself, Tether’s investment arm (with assets separate from the stablecoin) has invested in Quantoz, a company that plans to issue MiCAR compliant US dollar and euro stablecoins. Quantoz will also use Tether’s Hadron tokenization infrastructure.

What about USDT in Europe?

MiCAR came into force for stablecoins at the end of June, but much of the regulations only apply from year end, at which time enforcement actions become a possibility.

The regulations don’t just apply to Euro stablecoins, but other currencies as well. There are caps of €200 million in daily transactions for non euro coins. Given Tether’s USDT sometimes transacts around $100 billion in a day, one might think it would breach these limits.

However, the limits relate to everyday retail transactions. It excludes crypto transactions and all investment transactions and only applies where both the payer and the recipient are within the EU. We previously published a deeper dive into the limits.

Meanwhile, Paxos, the regulated stablecoin issuer has acquired a MiCAR compliant firm, Membrane Finance.

Newshounds News™

Source: Ledger Insights

~~~~~~~~~

WHY ISO 20022 IS ABOUT TO REVOLUTIONIZE FEDWIRE PAYMENTS FOREVER | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Good Evening Dinar Recaps,

TRUMP’S TEAM PICKS PAUL ATKINS FOR SEC CHAIR: REPORT

In the ongoing developments surrounding the rapidly evolving cryptocurrency landscape, Donald Trump’s team has reportedly consider a new Securities and Exchange Commission (SEC) chair to replace the current chair, Gary Gensler. According to the latest report, the Trump’s team has consider pro-crypto former commissioner Paul Atkins for the SEC chair position.

Trump’s Team Consider Paul Atkins to Replace Gary Gensler

Atkins is known for his crypto expertise and innovative stance in supporting this rapidly evolving landscape. Following his election as SEC chair, there is a strong possibility that he could actively back and promote U.S. crypto regulation while encouraging rapid growth in the sector.

Recently, Eleanor Terrett, a journalist at Fox Bussiness, noted on X (formerly Twitter),

“Atkins is someone who is not only crypto-savvy but possesses a deep understanding of the inner workings of the agency as both a former commissioner and staffer under two prior SEC Chairs — Richard C.”

Terrett further added that Atkins is seen as being capable of establishing a pro-innovation agenda while returning the agency to the so-called “gold standard” many in the Republican Party feel was lost under outgoing chair Gary Gensler.

Current Market Outlook

Following this much-awaited update, the overall cryptocurrency market began turning green.

As of press time, top assets including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have registered gains of over 2.75%, 7.5%, and 6%, respectively, in the past 24 hours. Meanwhile, other major cryptocurrencies are experiencing similar upside momentum.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

TETHER DOESN’T LIKE MICAR SO DITCHES EURO STABLECOIN

Tether, the issuer of the world’s largest stablecoin, doesn’t like Europe’s MiCA regulations. Other stablecoin issuers are also not keen on the requirement to put a substantial proportion of reserves into bank accounts, as required by MiCAR. But they nonetheless comply. Tether isn’t willing to do so, and today it confirmed it is shutting down EURT, its Euro stablecoin. Users have a year to redeem the coin.

EURT has a market capitalization of €26 million compared to Tether’s USD stablecoin at $132 billion. To date Tether has operated offshore so it’s likely just not worth the work involved to become MiCAR compliant.

MiCAR requires 30% of reserves to be held in bank accounts, with 60% for larger stablecoins. Tether views this as risky compared to investing in Treasuries. Bank deposits also pay less than government bonds.

“Until a more risk-averse framework is in place — one that fosters innovation and offers the stability and protection our users deserve — we have chosen to prioritize other initiatives,” Tether said in a statement.

Tether is known for keeping most of its stablecoin reserves in high risk assets in the past. The company is also accident prone. Over time the quality has improved significantly, but over 15% of its reserves would be considered moderate to high risk.

Instead of becoming MiCAR compliant itself, Tether’s investment arm (with assets separate from the stablecoin) has invested in Quantoz, a company that plans to issue MiCAR compliant US dollar and euro stablecoins. Quantoz will also use Tether’s Hadron tokenization infrastructure.

What about USDT in Europe?

MiCAR came into force for stablecoins at the end of June, but much of the regulations only apply from year end, at which time enforcement actions become a possibility.

The regulations don’t just apply to Euro stablecoins, but other currencies as well. There are caps of €200 million in daily transactions for non euro coins. Given Tether’s USDT sometimes transacts around $100 billion in a day, one might think it would breach these limits.

However, the limits relate to everyday retail transactions. It excludes crypto transactions and all investment transactions and only applies where both the payer and the recipient are within the EU. We previously published a deeper dive into the limits.

Meanwhile, Paxos, the regulated stablecoin issuer has acquired a MiCAR compliant firm, Membrane Finance.

Newshounds News™

Source: Ledger Insights

~~~~~~~~~

WHY ISO 20022 IS ABOUT TO REVOLUTIONIZE FEDWIRE PAYMENTS FOREVER | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Morning 11-27-24

Good Morning Dinar Recaps,

TRUMP EYES HANDING CFTC OVERSIGHT OF CRYPTO: REPORT

Donald Trump's team is considering handing the regulation of crypto exchanges and spot markets for cryptocurrencies deemed commodities to the CFTC.

Donald Trump’s incoming administration reportedly wants the US Commodity Futures Trading Commission to oversee the crypto industry — a move that could drastically roll back some of the regulatory power from the Securities and Exchange Commission.

Good Morning Dinar Recaps,

TRUMP EYES HANDING CFTC OVERSIGHT OF CRYPTO: REPORT

Donald Trump's team is considering handing the regulation of crypto exchanges and spot markets for cryptocurrencies deemed commodities to the CFTC.

Donald Trump’s incoming administration reportedly wants the US Commodity Futures Trading Commission to oversee the crypto industry — a move that could drastically roll back some of the regulatory power from the Securities and Exchange Commission.

The role could see the CFTC take on the regulation of spot markets for digital assets deemed commodities and crypto exchanges, Fox Business reported on Nov. 26, citing sources familiar with the matter.

United States President-elect Trump’s team says the SEC’s enforcement actions against industry players have slowed crypto innovation in the US and that a less stringent approach is needed to facilitate growth, Fox reported.

If the CFTC is handed regulatory control of crypto, it would be a big win for the industry, which has long signaled the agency would be its preferred regulator as it’s perceived to be fairer and has a lighter touch.

“With adequate funding and under the right leadership, I think the CFTC could hit the ground running to begin regulating digital commodities on day one of Donald Trump’s presidency,” former CFTC chair Chris Giancarlo told Fox.

Giancarlo tried to convince the Senate Agriculture Committee — which oversees the CFTC — to support the CFTC’s oversight of the spot crypto market by noting that the regulator had called Bitcoin a commodity in 2015.

The CFTC approved Bitcoin options under Giancarlo’s leadership in December 2017.

Current CFTC Chair Rostin Behnam, who shares mostly moderate views on crypto, asked the Senate Agriculture Committee for extra funding to regulate crypto markets more effectively.

The CFTC’s $706 million operating budget to police fraud and market manipulation is more than four times smaller than the SEC’s $3 billion for the 2024 financial year.

The commodities regulator employs only about 700 staff compared to the SEC’s 5,300.

Around 50% of the CFTC’s enforcement actions have been brought against crypto businesses in 2024 — which Behnam has called a “staggering statistic” for an agency that isn’t mandated to regulate the industry.

Some of this enforcement action has come against crypto companies that are not even US-based.

Meanwhile, the SEC’s leadership is set to change, with Chair Gary Gensler confirming last week that he will resign on Jan. 20, 2025, when Trump is inaugurated.

SEC Commissioner Jaime Lizárraga will also step down from his position on Jan. 17, motivated by a desire to spend more time with his wife, who is reportedly battling cancer.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

🇲🇦 MOROCCO’S CENTRAL BANK DRAFTS CRYPTO LAW

The Bank Al Maghrib has drafted a law to regulate crypto assets, currently under review for adoption. Governor Jouahri also revealed that the bank is studying the potential of a central bank digital currency (CBDC) to meet financial policy goals.

@ Newshounds News™

Source: Crypto Insider

~~~~~~~~~

BRAZIL CONGRESSMAN PROPOSES CREATING A NATIONAL BITCOIN RESERVE

A congressman from Brazil has officially proposed a bill to establish a strategic Bitcoin reserve in the country: the Bitcoin Sovereign Strategic Reserve. The Reserva Estratégica Soberana de Bitcoins (RESBit) aims to diversify the country’s Treasury. According to Portal do Bitcoin, a Brazilian media platform, Congressman Eros Biondini filed the proposal on Monday.

“The creation of RESBit is a strategic measure that positions Brazil as a leader in the new digital economy, reducing economic risks and expanding opportunities for technological and financial development,” wrote Biondini in the justification for the bill. “The approval of this project is essential to guarantee the country’s economic sovereignty and align Brazil with global innovation trends.”

As presented, the bill stipulates planned and gradual acquisitions of Bitcoin, up to 5% of Brazil’s national reserves. Biondini’s proposal would also make the Central Bank of Brazil responsible for the acquisition and management of the RESBit.

Brazil’s cryptocurrency market now stands as the 10th largest in the world, according to Chainanalysis data. Brazil has seen a rise in crypto exports over the last two months, likely contributing to the pitch of a new Bitcoin reserve.

The king cryptocurrency by market cap has surged to new all-time highs over the last month following the US election. Additionally, the country has seen an influx of stablecoin usage within the country. The US dollar-pegged digital asset accounted for almost 70% of all crypto-related transactions.

Multiple countries and governments around the world have turned the tide on crypto regulation. Nations are opting to involve the growing industry in everyday finance. Brazil as a BRICS member has been forward in involving crypto within the bloc, especially Bitcoin and Ripple (XRP).

Central banks and corporate interest in Bitcoin and blockchain technology continue to rise worldwide. While there is some opposition, as seen in Europe as an example, it is clear that most are in favor of establishing crypto reserves. The US is even seeking a similar program under incoming president Donald Trump.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

INSIDE THE HIDDEN POWERS OF US SHERIFFS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps