Seeds of Wisdom RV and Economic Updates Monday Morning 11-25-24

Good Morning Dinar Recap

NEW TEXAS REGULATION: CRYPTO MINERS MUST REPORT POWER USAGE

Texas mandates crypto miners in ERCOT to report power usage, aligning mining growth with grid stability and efficiency.

Texas introduces a new rule requiring crypto miners to report electricity demand to manage power grid stability effectively.

Global trends show varying regulatory responses to crypto mining, from New York’s temporary moratorium to China’s outright ban.

Good Morning Dinar Recap

NEW TEXAS REGULATION: CRYPTO MINERS MUST REPORT POWER USAGE

Texas mandates crypto miners in ERCOT to report power usage, aligning mining growth with grid stability and efficiency.

Texas introduces a new rule requiring crypto miners to report electricity demand to manage power grid stability effectively.

Global trends show varying regulatory responses to crypto mining, from New York’s temporary moratorium to China’s outright ban.

In a move to better manage its power grid amid the growing popularity of cryptocurrency mining, Texas has introduced new regulations requiring crypto miners in the Electric Reliability Council of Texas (ERCOT) region to report their power demand.

Announced by the Public Utilities Commission of Texas (PUCT) Chairman Thomas Gleeson on November 21, the rule mandates Bitcoin [BTC] miners to provide detailed information about the location, ownership, and electricity demand of their operations.

This regulation aims to ensure stability and efficiency in the state’s power grid as the number of mining facilities increases.

The necessity for such regulations comes as Texas continues to attract a significant number of crypto mining operations due to its relatively low energy costs and crypto-friendly policies.

However, the surge in energy consumption by these operations has raised concerns about the potential strain on the state’s power infrastructure, especially during peak demand periods.

By having a clear picture of the energy demands from crypto mining, Texas can better prepare and adjust its grid management strategies to prevent outages and maintain reliable energy distribution.

Global regulatory trends in crypto mining

Texas is not alone in its efforts to regulate the energy use of crypto mining activities. Around the world, various jurisdictions have started implementing similar rules to address the environmental and infrastructural impacts of this burgeoning industry.

For example, New York recently passed a bill that places a temporary moratorium on certain types of cryptocurrency mining operations that use carbon-based fuel. This legislation is part of broader efforts to align the state’s crypto mining activities with its climate targets.

Similarly, countries like China have taken more drastic measures by completely banning cryptocurrency mining, citing excessive energy consumption and environmental concerns as primary reasons.

These global shifts in the regulatory landscape indicate a growing awareness and response to the complex interplay between cryptocurrency mining and regional energy systems.

The new Texas rule is part of a broader trend where regional governments are scrutinizing the environmental and infrastructural impacts of cryptocurrency mining.

While more territories evaluate and implement regulations, crypto miners are increasingly required to adapt to these changing conditions. Compliance with such regulations not only supports local infrastructure but also pushes the crypto mining industry towards more sustainable practices.

As the BTC mining industry continues to expand, the introduction of regulatory measures like those in Texas is crucial for ensuring that growth is balanced with the needs and limitations of local power grids and environmental standards.

These regulations could set precedents for how other regions manage the intersection of technology, energy consumption, and environmental responsibility in the age of cryptocurrency.

@ Newshounds News™

Source: AMBCrypto

~~~~~~~~~

COINBASE EXPLORES BLOCKCHAIN PARTNERSHIP WITH KENYA'S SAFARICOM

Coinbase is reportedly exploring a partnership with Safaricom to enhance M-PESA with blockchain technology. This move aligns with Coinbase’s broader strategy of promoting crypto adoption in Africa, particularly in Kenya and Nigeria. Coinbase is also working with the Kenyan government to foster blockchain development and education.

While regulatory uncertainties have previously hindered Coinbase’s operations in Kenya, recent positive developments and partnerships with local entities like Yellowcard suggest a growing interest in cryptocurrencies and blockchain technology in the country.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

HONG KONG’S ZA BANK IS FIRST BANK IN ASIA TO LAUNCH RETAIL CRYPTO SERVICES

Today Hong Kong digital bank Zhong An Bank (ZA Bank) unveiled a retail cryptocurrency trading service. It claims to be the first Asian bank to launch a retail service. Rather than building an exchange from scratch, like most banks, it is launching in partnership with an existing cryptocurrency exchange, HashKey Exchange

Initially the bank supports trading only in Bitcoin and Ethereum in both HKD and USD. For the first three months after activation, ZA Bank is offering 0% commission, with minimum investments of USD 70 or HKD 600.

The offering has been integrated with the main bank app. The bank cited a recent survey by the Hong Kong Association of Banks, saying it found that 70% of respondents would find it convenient to trade crypto via their banking apps.

“The rise of cryptocurrency presents investors with more diverse asset allocation opportunities,” said Calvin Ng, alternative CEO of ZA Bank. “As a bank, we prioritise security and compliance, which is why we’ve partnered with HashKey, a global-leading licensed virtual asset exchange, to meet regulatory standards and deliver bank-grade security in virtual assets trading – our key competitive advantage in the Asian market.”

ZA Bank is Hong Kong’s largest digital bank with 800,000 users as of June 2024 (Hong Kong population 7.5m). The company is owned by ZA Global, an affiliate of Zhong An, the large Chinese insurance company which was co-founded by the entrepreneurs behind some of China’s biggest technology firms – Alibaba, Tencent and Ping An insurance.

Other bank cryptocurrency services

While ZA Bank may be the first Asian bank to offer retail crypto trading, Singapore’s DBS Bank was the first to launch a crypto service almost four years ago, which it built in-house. However, the DBS Digital Exchange targets only institutional and accredited investors.

Probably the largest number of retail bank crypto services are in Latin America. Europe is catching up, especially with the enactment of the bulk of the EU’s MiCA crypto regulations at the end of this year. BBVA was one of the pioneers, starting a service in Switzerland in mid 2021, followed by the launch of Garanti BBVA Digital Assets in Turkey last year.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

THE UGLY TRUTH ABOUT THE 2020 ELECTION CONTROVERSY NO ONE TELLS YOU | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

THE ECONOMIC RESET: NESARA & GESARA EXPLAINED | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 11-24-24

Good Afternoon Dinar Recaps,

XRP LAWSUIT NEWS: EX-SEC ATTORNEY SAYS ‘NO SETTLEMENT’ BECAUSE GENSLER WON ‘HALF THE CASE’

XRP’s price surged massively following Gary Gensler’s announcement that he will step down as SEC Chairman in January 2025. This revelation has sparked speculation about whether the XRP-SEC lawsuit could come to an end before Gensler’s departure.

A social media user speculated that Gary Gensler and the SEC might offer a settlement before he leaves, in an attempt to avoid looking like total losers, or to at least make it seem like they had a win.

Good Afternoon Dinar Recaps,

XRP LAWSUIT NEWS: EX-SEC ATTORNEY SAYS ‘NO SETTLEMENT’ BECAUSE GENSLER WON ‘HALF THE CASE’

XRP’s price surged massively following Gary Gensler’s announcement that he will step down as SEC Chairman in January 2025. This revelation has sparked speculation about whether the XRP-SEC lawsuit could come to an end before Gensler’s departure.

A social media user speculated that Gary Gensler and the SEC might offer a settlement before he leaves, in an attempt to avoid looking like total losers, or to at least make it seem like they had a win.

However, former SEC lawyer Marc Fagel responded, saying that the SEC has already won half of the case. He doubts the same commissioners who voted to appeal the other half would change their stance now. While it’s possible, he finds it unlikely and reassured that the case won’t get dismissed.

He wrote, “They already won half the case. I don’t know why the same commissioners who voted to appeal the other half would reverse course now. Possible, but seems unlikely.”

Conclusion: What’s Next For Ripple And XRP?

XRP has reached $1.5, with an increase in trading volume. Analysts are bullish, with some predicting a price surge to $2 in the near term. XRP is currently showing strong bullish momentum, and the launch of an XRP exchange-traded fund (ETF) in the U.S. could push its price even higher.

The recent rise is also fueled by new developments, such as the listing of physical XRP across major European exchanges. Ripple’s CEO, Brad Garlinghouse, has expressed optimism about the future of XRP, especially with Donald Trump’s potential Treasury Secretary pick, Scott Bessent, which could further benefit XRP’s outlook.

According to lawyer Jeremy Hogan, the Ripple vs. SEC case could be resolved by spring or early summer 2025. Gensler’s exit may speed up the process and lead to a more favorable regulatory environment for XRP.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

RWA INC ANNOUNCES $RWA TOKEN LAUNCH ACROSS MAJOR EXCHANGES ON NOVEMBER 25, 2024

On November 25, 2024, RWA Inc is set to launch its utility token $RWA on KuCoin, Gate.io, and MEXC, bringing years of hard work to fruition. Since its founding, RWA Inc has aimed to redefine how investors and businesses interact with real-world assets, by creating a trusted platform that bridges the gap between traditional markets and the Web3 space.

$RWA Token: Powering the Ecosystem

The $RWA token serves as the backbone of RWA Inc’s multi-asset platform, playing an integral role in the functions of its products and services. It supports staking mechanisms, reduces transaction fees, and powers user engagement across the ecosystem, including the Launchpad, Exchange, Community Hub, and the forthcoming Marketplace.

RWA Launchpad: The launchpad utilizes a tiered-staking mechanism, enabling users to stake $RWA and earn high APYs, allocation for launchpad projects, rewards, and early access to innovative ventures.

RWA Exchange: The exchange incorporates a tiered-staking system that reduces trading fees for investors and allows $RWA to be used for transaction fee payments.

Community Hub: While staking is not available, users can earn $RWA by engaging with campaigns, creating content, and participating in community-driven activities.

RWA Marketplace: In the forthcoming marketplace, $RWA will function similarly to the exchange, lowering transaction fees through staking and serving as a payment method for transactions.

In addition to its core functionalities, the $RWA token provides:

Governance: Token holders can participate in governance decisions, influencing the future development of the platform.

Access: The token grants priority access to launchpad projects, exclusive campaigns, and reward programs.

Liquidity: As the primary medium for transactions within the ecosystem, $RWA facilitates secure trading and ensures smooth operations across products.

IDO Fundraising Campaign

As part of RWA Inc’s launch it is actively raising $800,000 USD through a series of Initial DEX Offerings (IDOs). These IDOs are hosted on prominent launchpads Decubate, Eesee, and Ape Terminal, chosen for their reputations and ability to reach diverse investor audiences.

This multi-platform raise is designed to maximize brand exposure and offer investors the flexibility to participate using their preferred platforms. This approach effectively expands RWA Inc’s market reach, laying the foundation for a successful fundraising campaign and in turn, the next phase of the project development.

Exchange Listings

Upon the conclusion of the IDOs, the $RWA token is set to go live on three CEXs. This listing marks a pivotal moment for RWA Inc, with trading set to begin on November 25, 2024, at 10:00 AM UTC. Investors will be able to trade the token on KuCoin, Gate.io, and MEXC, three exchanges renowned for their global reach, reliable trading infrastructure, and support for innovative projects.

Go-to-Market Strategy

RWA Inc’s go-to-market strategy leverages its Launchpad for onboarding innovative startups and driving adoption of real-world asset tokenization. They are focused on a specific profile of token issuers, starting with Web2 startups/scaleups from seed to B-series stage, who are looking for disruptive ways to raise capital for their growth companies. With a carefully curated pipeline of projects ready for launch. RWA Inc will likely start onboarding its first clients shortly after launch.

The companies’ revenue streams are generated through their tokenization service, launchpad IDOs, listing fees, staking mechanisms, and transaction fees paid in $RWA, creating a diversified and sustainable model for platform growth.

To further strengthen the ecosystem, 50% of the platform’s profit has been committed to a buy-back and burn mechanism, fortifying long-term value for stakeholders.

The RWA Inc project was carefully designed for long-term value generation and aims to lead the tokenized RWA market by example. This strategic approach has garnered the company traction in what is the fastest-growing market in the Web3 space.

About RWA Inc:

RWA Inc offers end-to-end real-world asset tokenization through a cutting-edge multi-asset platform that includes tokenization as-a service, a launchpad, and a marketplace.

With a short-term focus on startup utility tokens for our go-to-market strategy, our primary emphasis is on strategically expanding into startup equity tokens, real estate, collectibles, and other asset classes via registered security tokens.

As an innovator in the RWA niche, we help tech startups and established companies successfully launch utility and security compliant tokens and thrive in the Web3 market. Our approach addresses the need for extensive tokenization support for Web2 startups, fostering their dynamic growth potential. Our versatile solution aims to unlock opportunities across diverse asset classes, enhance liquidity, broaden market reach, support business development, and unlock asset value, effectively meeting market demands.

@ Newshounds News™

Source: Blockchain Reporter

~~~~~~~~~

XRP SECURES GOLDEN CROSS AGAINST BITCOIN, WHAT'S NEXT?

XRP has achieved a major technical pattern in its Bitcoin (BTC) pairing, forming a golden cross. This technical pattern, often seen as a bullish signal, occurs when a short-term moving average crosses above a long-term moving average.

A golden cross happens when the 50-day simple moving average (SMA) crosses above the 200-day SMA, indicating potential upward momentum. XRP has been steadily gaining ground against Bitcoin in recent weeks. The recent altcoin bull run has seen funds flowing from Bitcoin into other cryptocurrencies, including XRP.

@ Newshounds News™

Source and Read more: U Today

~~~~~~~~~

GOLDEN CROSS PATTERN EXPLAINED WITH EXAMPLES AND CHARTS

What Is a Golden Cross?

A Golden Cross is a chart pattern in which a relatively short-term moving average crosses above a long-term moving average. It is a bullish breakout pattern that forms when a security's short-term moving average (such as the 50-day moving average) crosses above its long-term moving average (such as the 200-day moving average) or resistance level.

As long-term indicators carry more weight, the Golden Cross indicates the possibility of a long-term bull market emerging. High trading volumes generally reinforce the indicator.

▪️A Golden Cross is a technical chart pattern indicating the potential for a major rally.

▪️The Golden Cross appears on a chart when a stock’s short-term moving average crosses above its long-term moving average.

▪️The Golden Cross can be contrasted with a Death Cross, which indicates a bearish price movement.

How Does a Golden Cross Form?

The Golden Cross is a momentum indicator, which means that prices are continuously increasing—gaining momentum. It means that traders and investors have changed their outlooks to bullish rather than bearish. The indicator generally has three stages.

The first stage requires that a downtrend eventually bottoms out as buyers overpower sellers. In the second stage, the shorter moving average crosses over the larger moving average to trigger a breakout and confirms a downward trend reversal.

Note

Support is a low price level that the market does not allow. Resistance is a high price level that the market resists. A breakout occurs when the price crosses one of these levels.

The last stage is a continuing uptrend after the crossover. The moving averages act as support levels on pullbacks until they cross back down.

The most commonly used moving averages for observing the Golden Cross are the 50-day- and 200-day moving averages. Generally, longer periods tend to form stronger, lasting breakouts. For example, the 50-day moving average crossover up through the 200-day moving average on an index like the S&P 500 is one of the most popular bullish market signals.

Day traders commonly use smaller periods like the 5-day and 15-day moving averages to trade intra-day Golden Cross breakouts. Some traders might use different periodic increments, like weeks or months, depending on their trading preferences and what they believe works for them.

But when choosing different periods, it's important to understand that the larger the chart time frame, the stronger and more lasting the Golden Cross breakout tends to be.

@ Newshounds News™

Source and Read More: Investopedia

~~~~~~~~~

BRICS Breaking News: 🇨🇳 China discovers $83 billion gold reserve.

“This comes as gold prices have soared recently and are set to reach record highs in the coming months” 👀🔥

@ Newshounds News™

Source: X BRICS INFO

~~~~~~~~~

A BIG CHANGE FOR THE IRAQI DINAR - Economic Ninja | Youtube

@ Newshounds News™

~~~~~~~~~

THE END OF THE DOLLAR: GLOBAL FINANCE SHIFT 2024 | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to. Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 11-24-24

Good Morning Dinar Recaps

STELLAR AND THIS NEW COIN: THE DEFI DUO WITH POTENTIAL TO MULTIPLY A CRYPTO PORTFOLIO

A seasoned crypto and a rising DeFi star are capturing investor attention, offering potential for major portfolio growth.

Investors are eyeing a dynamic pair shaking up the decentralized finance scene. One is a seasoned cryptocurrency with a solid track record. The other is a fresh player gaining rapid attention.

Together, they could offer a compelling opportunity to amplify investment returns. This duo might be the catalyst for significant portfolio growth.

Good Morning Dinar Recaps

STELLAR AND THIS NEW COIN: THE DEFI DUO WITH POTENTIAL TO MULTIPLY A CRYPTO PORTFOLIO

A seasoned crypto and a rising DeFi star are capturing investor attention, offering potential for major portfolio growth.

Investors are eyeing a dynamic pair shaking up the decentralized finance scene. One is a seasoned cryptocurrency with a solid track record. The other is a fresh player gaining rapid attention.

Together, they could offer a compelling opportunity to amplify investment returns. This duo might be the catalyst for significant portfolio growth.

Early access to ZDEX: A token with 1000x potential

The ZDEX presale is officially underway, offering early adopters a prime opportunity to invest in a rising DeFi star at an entry price of just $0.0019. By the end of the presale the price will increase to $0.0029, meaning that ZDEX will appreciate 50% even before it gets listed.

ZDEX is the cornerstone of ZircuitDEX, a next-generation decentralized exchange (DEX). Unlike many junk coins, DEX tokens are built to thrive, thanks to their high demand and real utility.

Take Raydium (RAY), which skyrocketed 1790% in a year, or Uniswap, starting at $1 and now over $8, an 8-fold price increase. ZDEX token has similar 1000x potential, ready to reward those who get in early.

Built on the ultra-fast Zircuit Layer 2 chain, ZircuitDEX is crafted to meet the needs of both new and seasoned DeFi traders with its key features:

▪️Lightning-fast transactions for smooth trading experiences

▪️Minimal slippage to ensure trades occur close to desired prices

▪️Near-zero fees for cost-effective transactions

Fully EVM-compatible, ZircuitDEX ensures smooth integration with Ethereum tools, while its implementation of zero-knowledge proofs (ZK proofs) provides enhanced security—a critical feature as market participants increasingly prioritize safeguarding their assets.

Riding the meme coin wave

ZircuitDEX’s built-in meme coin launchpad gives investors a front-row seat to the next viral crypto sensations. With exclusive access to promising meme projects, ZDEX is ready to replicate the explosive success of tokens like BRETT, which soared over 14,000%! As ZircuitDEX nurtures a vibrant, community-centered approach, it’s primed to become the hotspot for high-growth meme tokens.

Efficiency and profitability for liquidity providers

For liquidity providers, ZircuitDEX delivers up to 500x capital efficiency compared to traditional decentralized exchanges. Concentrated liquidity pools allow LPs to earn higher returns with lower capital input, while automated strategies streamline trading, making it easier for users to optimize their holdings. ZDEX token holders also gain governance rights, exclusive airdrops, trade incentives, and staking rewards—adding further value to early participation.

As anticipation builds, ZDEX is quickly becoming a must-watch in the DeFi space, with investors eager to capitalize on its potential for outsized returns.

Stellar: Decentralized network enhancing global financial collaboration

Stellar (XLM) is a decentralized, open-source payments network using blockchain to enable quick, low-cost fund transfers.

It does not favor any national currency and features its own cryptocurrency, Stellar Lumens. Since 2014, Stellar has processed billions of transactions and formed major partnerships. It allows transfers of any currency type, including digital versions of national currencies and cryptocurrencies like Bitcoin.

Unlike many cryptocurrencies aiming to replace financial systems, Stellar seeks to enhance them, offering a unified network for collaboration. Individuals can transfer funds globally using Stellar apps, and companies can develop blockchain applications or use the network for payments and currency conversion. The potential of Stellar’s technology makes it an attractive option in the current market cycle.

Conclusion

In conclusion, although established coins like XLM have less short-term potential during this 2024 bull run, ZircuitDEX offers an exceptional opportunity with 500X capital efficiency, lightning-fast transactions, and zero slippage. The ZDEX Token’s 70% presale discount and potential 500% returns upon launch make it a promising asset to enhance portfolio growth.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

THE FUTURE OF NFTS: A TRANSFORMATION, NOT A TOMBSTONE

What’s next fro non-fungible tokens? What’s shaping the industry going into potentially favorable 2025 and beyond?

As we navigate the landscape of digital assets, the question looms large: Are NFTs dead?

The fervor that once engulfed the NFT market has certainly dimmed since the euphoric days of 2021, often compared to tulip mania. However, rather than writing an epitaph for NFTs, we should consider a transformative future shaped by evolving perceptions and real-world utility.

The Loyalty of Web3 Audience

The first challenge that non-fungible tokens (NFTs) face is the inconsistency of the Web3 community. This community is very responsive to market conditions and quickly jumps from one trend to another and changes its loyalty overnight.

The market was cruel for NFTs, indicating that many enthusiasts came to participate in temporary hype rather than for long-term value. As the hype faded, interest waned, leading to disgruntled investors and deserted businesses.

When the reality set in, a number of the Web3 aficionados went shopping for bigger fish, and NFTs soon became out of favor, exposing the market’s appetite for bubble factors instead of fundamentals.

Web2’s Shift: Brands and Normies Depart

Simultaneously, the Web2 audience—once eager to explore blockchain and NFTs—has also moved on. Initially brands that adopted NFTs for promotion purposes have now lost interest in NFT amidst falling prices and the new narrative gaining the center stage.

The discussions about NFTs, primed before, remain dormant and have no elasticity to gain mainstream media attention. For the average consumer, NFTs are just a faded trend, just as the overemphasis on new technologies.

The Future Ahead?

So, what does this portend for the future of NFTs? In Web2, it is obvious that digital art is the new order, and NFTs are still necessary as a medium for auctioning and distributing this art.

Nevertheless, this is probably unlikely to start the next bull market. It is true that profile picture projects (PFP) will always amuse a select few, but they, too, are unlikely to trigger a mass market revival. Bull markets thrive on innovation, where originality intersects with scarcity, driving demand beyond supply.

The burning question is: what could give rise to this newness?

NFTs as the Core Infrastructure

Rather than a relic of a bygone era, NFTs hold the potential to be vital components of blockchain infrastructure. They can enhance identity protocols, facilitate social finance, enrich gaming experiences, and tokenize real-world assets.

When viewed through this lens, NFTs are as fundamental to blockchain as the ERC-20 standard is to decentralized finance(DeFi).

Imagine the scenarios: Instead of real estate parcels having only one owner, anyone can own a fraction of the property. This means that a house deed can be put on sale, and people can buy the NFT and trade it permissionless, making real estate transactions simpler.

Alternatively, NFT-backed real estate investments could allow investors to easily buy into real estate projects without owning the actual property. Fractional ownership might even allow groups to purchase vacation homes or shared assets, like a pair of skis, easily.

Moreover, NFTs are set to redefine community relationships through membership access, perks, and value exchange. A myriad of applications will emerge, such as health records management, credit history management, and embedding NFTs into everyday life.

Conclusion: Transformation is the Key to Success

While the NFT market as we know it may be undergoing a reorientation phase, it is far from dead. Instead of wailing its past, we should focus on the shifts that will redefine our understanding of NFTs. By recognizing their potential beyond digital collectibles, we can pave the way for a future where NFTs become integral to our digital lives—ushering in a new era of innovation and opportunity.

@ Newshounds News™

Source: CryptoPotato

~~~~~~~~~

DONALD TRUMP SELECTS PRO-CRYPTO SCOTT BESSENT AS TREASURY SECRETARY

▪️Donald Trump has nominated Scott Bessent, a hedge fund manager and crypto advocate, as Treasury Secretary.

▪️Bessent’s pro-crypto stance sparked optimism of a shift toward balanced regulation that would help the industry grow.

▪️His nomination is seen as a potential turning point for fostering innovation and clearer policies in the crypto space.

Donald Trump, the President-elect of the United States, has nominated Scott Bessent as Treasury Secretary for his administration. This decision has generated enthusiasm in the emerging industry due to Bessent’s pro-crypto reputation.

Bessent and Cantor Fitzgerald CEO Howard Lutnick had been considered strong favorites for the position. However, Lutnick was eventually nominated as Commerce Secretary.

Crypto Industry Welcomes Scott Bessent’s Nomination for Treasury Secretary

In a November 22 announcement on Truth Social, Trump praised Bessent as the ideal candidate to support his administration’s economic goals. The President stated that Bessent will play a pivotal role in strengthening the US economy, fostering innovation, and maintaining the dollar’s status as the global reserve currency.

“Scott will support my policies that will drive US competitiveness, and stop unfair trade imbalances, work to create an economy that places growth at the forefront, especially through our coming world energy dominance,” Trump added.

Wall Street veteran Bessent, who founded the international macro investment company Key Square Group, brings extensive experience to the role. He had previously served as the chief investment officer for the prominent investor George Soros.

While President Trump’s announcement did not directly reference cryptocurrencies, many in the digital asset space view Bessent’s appointment as a positive sign.

In past statements, Bessent has described crypto as a symbol of financial freedom. He also called Bitcoin an alternative investment for younger investors disillusioned with the traditional financial system.

“I have been excited about the president’s embrace of crypto and I think it fits very well with the Republican Party, crypto is about freedom in the crypto economy is here to stay,” Bessent stated.

His pro-crypto stance has led many to believe his leadership could encourage a more balanced approach to digital asset regulation. This would contrast with the outgoing administration’s enforcement-heavy tactics, such as its controversial sanctions on decentralized platforms like Tornado Cash.

Indeed, crypto industry leaders have responded enthusiastically to Bessent’s nomination. Ripple CEO Brad Garlinghouse commended Bessent’s nomination, calling it a win for innovation. He noted that Bessent’s leadership could mark a turning point for crypto-friendly policies in Washington.

Similarly, Kristin Smith, CEO of the Blockchain Association, highlighted the importance of Bessent working with Congress to establish clear regulations, ensure fair tax treatment, and protect self-custody rights for digital assets.

“Critical to this nomination would be working with Congress on a regulatory framework for digital assets, protecting the right to self custody, pushing for clearer tax treatment of digital assets, and working closely with industry experts to protect our nation’s security,” Smith remarked.

@ Newshounds News™

Source: Be In Crypto

~~~~~~~~~

UNLOCKING PERSONAL SOVEREIGNTY: YOUR GUIDE TO TOTAL FREEDOM | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

🌱ELON MUSK'S BEDSIDE TABLE SECRETS REVEALED! | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Some “Gold-Backed” News Saturday 11-23-2024

udy Shelton: "Why Don't We Use Our Gold As Collateral For A New Treasury Debt Instrument"

Arcadia Economics: 11-23-2024

Judy Shelton: "Why Don't We Use Our Gold As Collateral For A New Treasury Debt Instrument"

Former Trump economic advisor Judy Shelton has talked a lot about bringing gold back into the monetary system in the US.

And while she has not yet been officially brought back aboard Trump's team, it sure is fascinating to imagine what could happen if she is.

Because in a recent interview with David Morgan of The Morgan Report, in addition to sharing some fascinating monetary history, including how even Fed officials like Paul Volcker and Alan Greenspan agree that 2% inflation is far from the definition of stable, she also proposes the idea of using the nation's gold as collateral for a new treasury debt instrument.

Judy Shelton: "Why Don't We Use Our Gold As Collateral For A New Treasury Debt Instrument"

Arcadia Economics: 11-23-2024

Judy Shelton: "Why Don't We Use Our Gold As Collateral For A New Treasury Debt Instrument"

Former Trump economic advisor Judy Shelton has talked a lot about bringing gold back into the monetary system in the US.

And while she has not yet been officially brought back aboard Trump's team, it sure is fascinating to imagine what could happen if she is.

Because in a recent interview with David Morgan of The Morgan Report, in addition to sharing some fascinating monetary history, including how even Fed officials like Paul Volcker and Alan Greenspan agree that 2% inflation is far from the definition of stable, she also proposes the idea of using the nation's gold as collateral for a new treasury debt instrument.

Which is fascinating to hear, especially at the same time when the eastern half of the world continues to express a desire to turn to gold in place of treasuries.

So whether you're a monetary advocate, historian, or someone who just wants to navigate the changes to our monetary system that are coming, you're really going to enjoy this interview.

And to hear David Morgan talk with Judy Shelton, just click to watch the video now!

Texas proposes gold and silver-backed currencies to compete with fiat money

Kitco News: 11-23-2024

(Kitco News) – In a quest for sound money, a Texas lawmaker has filed two bills that, if passed, would create gold and silver-backed transactional currencies, backed 100% by the underlying asset, that would serve as legal tender in the state.

According to a report from the Tenth Amendment Center, Texas State Representative Mark Dorazio filed House Bill 1049 and House Bill 1056 on November 12, two bills with similar language that would add provisions to different sections of the Texas legal code.

“Under the proposed law, the Texas Comptroller would issue gold and silver specie (coins) through the Texas Bullion Depository and also establish gold and silver transactional currency defined as ‘the representation of gold and silver specie and bullion held in the pooled depository account,’” wrote Mike Maharrey, Communications Director at the Tenth Amendment Center. “The Depository would be required to hold enough gold and silver to back 100 percent of the issued currency.”

If approved, the bills would enable “Holders of gold and silver specie and currency to use them as ‘legal tender in payment of debt,’ in the state of Texas,” he noted. “The gold and silver-backed currency would be electronically transferable to another person. Gold and silver-backed currency would be redeemable in specie or at the spot price of gold in U.S. dollars minus applicable fees.”

Said differently, the passage of either bill would allow anyone in the state to conduct business transactions using gold or silver.

“The passage of this legislation would create a sound money alternative to U.S. dollars in both physical and electronic form,” Maharrey said. “Using gold and silver-backed transactional currency, any person or entity would be able to do business using a debit card that seamlessly converts gold and silver to fiat currency in the background. Private individuals and businesses would be able to purchase goods and services using assets held in the Texas Gold Depository in the same way they use dollars held in a bank today.”

He stressed that the ability to use gold and silver-backed transactional currencies “would give people a way to shield themselves from the rapid loss of purchasing power inherent in the fiat dollar.”

“Over time, making gold and silver available for regular, daily transactions by the general public could have a wide-ranging impact,” Maharrey noted. “Professor William Greene is an expert on constitutional tender and said in a paper for the Mises Institute that if people in multiple states actually start using gold and silver instead of Federal Reserve notes, it would effectively nullify the Federal Reserve and end the federal government’s monopoly on money.”

According to Greene, “Over time, as residents of the state use both Federal Reserve notes and silver and gold coins, the fact that the coins hold their value more than Federal Reserve notes do will lead to a ‘reverse Gresham’s Law’ effect, where good money (gold and silver coins) will drive out bad money (Federal Reserve notes).”

“As this happens, a cascade of events can begin to occur, including the flow of real wealth toward the state’s treasury, an influx of banking business from outside of the state – as people in other states carry out their desire to bank with sound money – and an eventual outcry against the use of Federal Reserve notes for any transactions,” Greene added

“Gresham’s Law holds that ‘bad money drives out good,’” Maharrey explained. “For example, when the U.S. government replaced silver quarters and dimes with coins made primarily of less valuable copper, the cheap coins drove the silver out of circulation. People hoarded the more valuable silver coins and spent the less valuable copper money.”

This led him to ask, “So, how do you reverse Gresham?”

“The key is to make it easier to use gold and silver in everyday transactions,” he said. “The reason bad money drives out good is that governments put up barriers to using sound money in day-to-day life. That makes it more costly to spend gold and silver and incentivizes hoarding.”

“When you remove legal and tax barriers, you level the playing field and allow gold and silver to compete head-to-head with Federal Reserve notes,” he added. “On an even playing field, gold and silver beat fiat money every time.”

Maharrey highlighted the U.S. Consitution to strengthen his case, noting that Article I, Section 10 decrees that “No State shall…make any Thing but gold and silver Coin a Tender in Payment of Debts.”

“In most states, debts and taxes must either get paid with Federal Reserve Notes (dollars), authorized as legal tender by Congress, or with coins issued by the U.S. Treasury — very few of which have gold or silver in them,” he said. “The creation of a transactional gold and silver currency would take another step toward that constitutional requirement, ignored for decades in every state. Such a tactic would undermine the monopoly of the Federal Reserve System by introducing competition into the monetary system.”

The proposed bills will be assigned to Texas House committees when the 2025 legislative session begins on Jan. 14.

Texas gold-backed digital currency could aid in Bitcoin adoption

While Maharrey is looking to get gold and silver recognized as transactional currencies in their own right, the Texas legislature is also making progress on legislation to create a blockchain-based gold-backed token, which could benefit not only the yellow metal but also Bitcoin.

In April 2023, two Texas lawmakers, Senator Bryan Hughes and Representative Mark Dorazi, introduced two separate bills for creating a state-issued digital currency backed by gold. And while the legislation is still working through the state’s Congress, one lawmaker thinks that once launched, the proposed gold-backed digital currency could help boost cryptocurrency adoption.

As reported by Cointelegraph, Cody Harris, a Republican Party member of the Texas State House of Representatives, sat down for a fireside chat with Coinbase’s David Duong at the North American Blockchain Summit on Thursday and provided an update on the stats of the gold-backed token.

“This [state-issued digital currency backed by gold] is something safe that people can get their feet wet with,” he said. “It’s more of a stepping stone to owning Bitcoin than competing with it or taking the place or something like that.”

Under the proposed plan, each digital currency token will represent a fraction of a troy ounce of gold held in trust and will enable holders to accumulate and spend gold via blockchain, removing a barrier that makes it difficult to utilize gold for daily transactions.

Harris said the benefits of the token are twofold. Not only will it simplify the use of gold for everyday use, but it could also help skeptics become more comfortable with cryptocurrency by serving as a government-issued digital alternative to fiat, which is a stepping stone to helping them open to the idea of using decentralized assets like Bitcoin.

For those who are hesitant to acquire BTC or explore crypto, he suggested that a state-issued coin would provide a higher “comfort level” than tokens issued by startups.

But not all digital tokens are seen as equal in his eyes, with Harris saying that digital fiat – also known as central bank digital currencies (CBDCs) – would have an overall negative impact on the state and the public at large.

“I think we would all agree that a CBDC is detrimental to the nation and the state of Texas,” he said, referring to the variety of threats CBDDs pose, such as surveillance and privacy concerns.

Harris called for the crypto community and broader public to take an active role in the CBDC and digital asset conversation to make sure they aren’t saddled with a dystopian currency that enables things like social credit scores.

“I think it makes it easier for us who are pro-Bitcoin to have conversations about why someone should change their perspective on it,” he said. “If we start at a CBDC, is it the goal of some parts of the US government? So let’s lock arms together and make sure that that doesn’t happen.”

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 11-23-24

Good Afternoon Dinar Recaps

BRICS: MORGAN STANLEY PREDICTS THE FUTURE OF THE US DOLLAR

BRICS is challenging the dominance of the US dollar by spreading the de-dollarization agenda across the globe. The bloc is pushing local currencies for trade and convincing other developing countries to sideline the US dollar. Using local currencies will strengthen their native economies and give them a boost in the forex markets. Amid the BRICS de-dollarization initiative, leading investment bank Morgan Stanley has predicted the future of the US dollar

Three sectors (see link below) in the US will be affected if BRICS ditches the dollar for trade. The move will make the US dollar lose out on the global supply and demand dynamics and push it into the path of decline. If the US fails to import the dollar, inflation could hit the homeland leading to higher prices for basic necessities.

Good Afternoon Dinar Recaps

BRICS: MORGAN STANLEY PREDICTS THE FUTURE OF THE US DOLLAR

BRICS is challenging the dominance of the US dollar by spreading the de-dollarization agenda across the globe. The bloc is pushing local currencies for trade and convincing other developing countries to sideline the US dollar. Using local currencies will strengthen their native economies and give them a boost in the forex markets. Amid the BRICS de-dollarization initiative, leading investment bank Morgan Stanley has predicted the future of the US dollar

Three sectors (see link below) in the US will be affected if BRICS ditches the dollar for trade. The move will make the US dollar lose out on the global supply and demand dynamics and push it into the path of decline. If the US fails to import the dollar, inflation could hit the homeland leading to higher prices for basic necessities.

BRICS: Morgan Stanley Reveals How the US Dollar Will Survive the Challenges

Analysts from the leading investment bank Morgan Stanley predict that the US dollar will remain the dominant currency for a longer period despite the challenges from BRICS. The bank’s analyst highlighted that in terms of financial instability, investors flock to the US dollar and not the Chinese yuan.

Historically, the USD has maintained stability during a market crisis while other local currencies plummeted. The USD can withstand the whips of the currency market as it is backed by global trade, said Morgan Stanley on the BRICS de-dollarization initiative.

“Which currency would you want to own when global stock markets start to fall? And the global economy tends to head into recession?” said James Lord, Morgan Stanley’s Head of Foreign Exchange Strategy. “You want to be positioning in US dollars because that has historically been the exchange rate reaction to those kinds of events.” In conclusion, Morgan Stanley predicts that the US dollar will reign supreme against the onslaught of the BRICS alliance.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

COIN CENTER WARNS US POLICIES COULD SCARE AWAY CRYPTO INVESTORS DESPITE TRUMP WIN

Coin Center says that while a Trump administration will undoubtedly be positive for crypto, there are still several ongoing cases that could prove troublesome to investors and developers.

Non-profit crypto advocacy group Coin Center has warned that even though a Trump win is a net positive for the crypto industry, entrenched policies could still scare crypto innovators away from the United States.

In a Nov. 21 blog post analyzing the landscape of US crypto policy following the 2024 election, Coin Center’s research director Van Valkenburgh shared three “grave threats” to the crypto users and developers in the US heading into 2025.

All three threats are described broadly as “surveillance issues” and range from tax reporting and Anti-Money Laundering (AML) policy to the ongoing criminal proceedings involving the crypto mixer Tornado Cash and Bitcoin wallet service Samourai Wallet.

Three “grave” threats to crypto

The first major threat comes from the crypto reporting requirements under Section 6050I of the US tax code, which currently mandates warrantless reporting to the IRS for those who have received $10,000 in crypto.

In August last year, Coin Center argued that these reporting requirements are unconstitutional.

The second and third major threats stem from the sanctions placed on Tornado Cash and include the criminal charges for unlicensed money transmission brought against the mixing service and Samourai Wallet.

Coin Center says the charges brought against Tornado Cash founder Roman Storm could set a worrying precedent for developers on non-custodial crypto services.

“At the agency level, there’s reason to believe that controversial ongoing rulemakings will be frozen or even abandoned due to President Trump’s generally pro-crypto stance and his likely choices for appointees at the SEC and Treasury.”

However, Valkenburgh wrote that the new administration may not be interested in scaling back “overzealous” sanctions and AML policies.

“The [Department of Justice] may change under a Trump administration, but it rightly guards its political independence and may therefore be unlikely to abandon these prosecutions because of a change in administration," Valkenburgh said.

“We’re nonetheless hopeful that there can be progress here if it becomes increasingly clear that even with a friendlier SEC, draconian surveillance and control policies will continue to drive innovators away from the US, chill development, and deny ordinary Americans the benefits of these technologies.”

Valkenburgh added that the ongoing measures to prevent people from accessing crypto services do “very little to actually prevent criminals and terrorists” from using the tools.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

🌱YOUR MONEY YOUR MORTGAGE AND MORE. AUDIO ONLY | Youtube

If you missed last night's Live Call you can listen here on our Youtube channel.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

HOW THE 2020 ELECTION SET UP A LEGAL NIGHTMARE FOR 2024 | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Morning 11-23-24

Good Morning Dinar Recaps

GLOBAL ASSET MANAGER LAUNCHES XRP ETP WITH INDUSTRY-LEADING PRICING IN EUROPE

XRP advances with a new institutional-grade exchange-traded product, offering secure, physically backed exposure as Wisdomtree expands crypto products amid growing investor interest.

XRP Gains Ground: Major ETP Launched by a Top European Asset Manager

Asset management firm Wisdomtree announced on Thursday the launch of its latest cryptocurrency exchange-traded product (ETP), the Wisdomtree Physical XRP (XRPW), on major European exchanges, including Deutsche Börse Xetra, Six Swiss Exchange, and Euronext in Paris and Amsterdam.

Good Morning Dinar Recaps

GLOBAL ASSET MANAGER LAUNCHES XRP ETP WITH INDUSTRY-LEADING PRICING IN EUROPE

XRP advances with a new institutional-grade exchange-traded product, offering secure, physically backed exposure as Wisdomtree expands crypto products amid growing investor interest.

XRP Gains Ground: Major ETP Launched by a Top European Asset Manager

Asset management firm Wisdomtree announced on Thursday the launch of its latest cryptocurrency exchange-traded product (ETP), the Wisdomtree Physical XRP (XRPW), on major European exchanges, including Deutsche Börse Xetra, Six Swiss Exchange, and Euronext in Paris and Amsterdam.

With a management expense ratio of 0.50%, the asset management firm stated that its XRP ETP is Europe’s most competitively priced offering for XRP exposure.

Built for simplicity and security, Wisdomtree explained that the product is fully backed by XRP, providing exposure to its spot price through an institutional-grade, physically backed structure. According to the asset manager:

The Wisdomtree Physical XRP ETP is designed to offer investors a simple, secure, and cost-efficient way to gain exposure to the price of XRP. Investors also benefit from a dual-custody model with regulated custodians and with the underlying assets professionally secured in cold storage.

This latest addition expands Wisdomtree’s portfolio of nine cryptocurrency ETPs, which also cover bitcoin, ethereum, solana, and diversified crypto baskets.

“Cryptocurrency ETPs represent an efficient way to keep investors in a regulated framework and are becoming the preferred vehicle to access cryptocurrencies,” Alexis Marinof, Head of Europe at Wisdomtree, highlighted the benefits of ETPs.

“Wisdomtree leverages 20 years of expertise in providing and managing physically-backed ETPs for institutional investors. With over $100bn of assets under management globally across ETFs and ETPs, investors in our cryptocurrency ETPs can benefit from our global reach, scale and resources.”

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

BRICS: INDIA PROVIDES UPDATE ON CBDC CURRENCY

BRICS member India is among the few countries that successfully launched a pilot basis of Central Bank Digital Currency (CBDC). The Reserve Bank of India (RBI) began testing the CBDC currency early this year for trade and common transactions. The RBI is testing the security aspects of digital currencies and conducting studies about their potential impact on the economy.

The launch of the CBDC could change the fortunes of BRICS member India, as it’s ahead of the curve in digital currencies. Out of the 198 countries in the world, 134 nations are currently working towards the formation of a CBDC currency. All the countries are currently in testing mode while only a few have reached the pilot testing phase.

BRICS: India Gives Update on CBDC Currency Progress

Apart from the de-dollarization agenda, BRICS is also looking to topple the US dollar with CBDC digital currencies. Reserve Bank of India’s Deputy Governor T Rabi Sankar confirmed that the CBDC pilot mode is in its advanced stages.

Sankar signaled that the CBDC rollout will also be utilized for government, retail, and institutional users. When reporters questioned about its release date, the RBI deputy said that they were not in a hurry.

“We are in no hurry to roll it out (CBDC) immediately,” he said to reporters. The RBI deputy revealed that once things fall in place, details about the CBDC currency will be made public by BRICS. “Once we have some visibility of what the outcome or impact will be, we’ll roll it out. We don’t keep a specific timeline for that.”

Apart from India, its BRICS counterpart Russia is also in the advanced stages of testing its CBDC currency. Russia plans to launch the digital ruble and usher into a new era in the financial sector. Transactions in the US dollar will begin to decline gradually if BRICS starts using CBDC digital currencies for trade.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

🌱YOUR MONEY YOUR MORTGAGE AND MORE. AUDIO ONLY | Youtube

If you missed last night's Live Call you can listen here on our Youtube channel.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Afternoon 11-22-24

Good Afternoon Dinar Recaps,

BRICS: WHY 2025 COULD BE THE END OF ITS DE-DOLLARIZATION EFFORTS

Despite being the BRICS focus over the last two years, 2025 could mark the end of the alliance’s de-dollarization efforts. Although the bloc has sought increased financial prominence, it has yet to truly strike at international Western hegemony.

With President-elect Donald Trump set to take over the White House in the coming years, his relationship with Russia’s Vladimir Putin could orchestrate a massive shift in perspective for the group. Since Trump won the 2024 election, Putin has already assured he is no longer interested in abandoning the US dollar.

Good Afternoon Dinar Recaps,

BRICS: WHY 2025 COULD BE THE END OF ITS DE-DOLLARIZATION EFFORTS

Despite being the BRICS focus over the last two years, 2025 could mark the end of the alliance’s de-dollarization efforts. Although the bloc has sought increased financial prominence, it has yet to truly strike at international Western hegemony.

With President-elect Donald Trump set to take over the White House in the coming years, his relationship with Russia’s Vladimir Putin could orchestrate a massive shift in perspective for the group. Since Trump won the 2024 election, Putin has already assured he is no longer interested in abandoning the US dollar.

BRICS Fight Against the US Dollar Coming to Its Final Bell: Why Trump Changes Everything

2022 remains one of the most important years, geopolitically speaking.

That year marked the start of Russia’s invasion of Ukraine. Moreover, it forced the hand of the West, with the United States moving to sanction the country in response to its military advancement.

With that being more than two years ago now, things have changed. The invasion sparked increased cooperation with the global South BRICS alliance. Specifically, Russia sought to forge plans to lessen international reliance on the US dollar. Effectively, he struck back against the West in any way he could.

Yet, things have changed. Specifically, Trump is back in office, and the sentiment from the Russian president has shifted greatly. More importantly, things for the BRICS bloc could be set to change, as 2025 could be the end of its ongoing de-dollarization efforts.

A Reuters report notes that Putin has expressed a willingness to sit down with Donald Trump and discuss ending the ongoing war in Ukraine. Although he has extensive conditions, his openness for a ceasefire is progress nonetheless.

Moreover, that comes as he already denounced a desire to truly abandon the US dollar after Trump was elected as the incumbent US President.

Trump has been outspoken about his stance regarding de-dollarization. Just as certain, the 45th president has been vocal about his belief in his own capacity to end the Ukraine war. Those two things could create a perfect storm that only hinders the nations that put their faith in BRICS de-dollarization.

It is not out of the realm of possibility to see an increase in Russian and US cooperation. That is especially true amid Trump’s return. Such an action would threaten its advances on the US dollar. More importantly, it could ensure Trump gets what he wants, assuring the greenback’s position atop global economics.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

SEC COMMISSIONER JAIME LIZÁRRAGA TO STEP DOWN IN JANUARY

The U.S. Securities and Exchange Commission will see yet another exit in January after Commissioner Jaime Lizárraga announced he will step down.

Bloomberg Law reports that the former congressional aide has said he will leave the agency on January 17. The announcement comes just a day after SEC Chair Gary Gensler announced his resignation effective January 20.

Lizárraga, Gensler, and Caroline Crenshaw are the three Democrat commissioners among the SEC’s five members. The two exits will leave Crenshaw, Hester Peirce, and Mark Uyeda, the latter two having dissented on various SEC decisions.

Notably, Lizárraga and Gensler will exit as Donald Trump, elected on Nov. 5, gets into office amid expectations of a pro-crypto White House. Reports that the Trump administration is eyeing a “crypto czar” have added to optimism, even as the industry debates on who would be the best pick for SEC Chair.

Lizárraga joined the SEC in 2022, with his term ending in 2027. Lizárraga faced criticism for overreach, with his corporate reporting regulations burdening small businesses. He was also criticized for the controversial policies that the market saw as prioritizing politics over investors.

He says his resignation is for family reasons.

“In reflecting on the challenges that lie ahead, we have decided that it is in the best interests of our family to close this chapter in my 34-year public service journey,” he said in a statement quoted by Bloomberg Law.

The crypto industry has largely criticized the SEC’s approach over the past four years, pointing to what many see as an anti-crypto stance. Trump has pledged to fire Gensler immediately upon taking office, vowing to end the current administration’s “war on crypto.”

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

MASTERCARD INTEGRATES ITS MTN BLOCKCHAIN NETWORK WITH JP MORGAN’S KINEXYS DIGITAL PAYMENTS (JPM COIN)

Today Mastercard announced it has integrated its Multi-Token Network (MTN) for tokenized deposits and tokenized assets with Kinexys Digital Payments (formerly JPM Coin).

It allows clients of the two solutions to send payments across the networks. Both companies emphasized the benefits for cross border payments because of traditional challenges with speed, transparency and time zone differences.

Kinexys Digital Payments is designed to support clients with JP Morgan bank accounts, so it’s mainly used by corporates that want to move money between JP Morgan branches dotted around the world. MTN provides a simplified solution to enable banks to engage with tokenized deposits.

Instead of developing their own blockchain networks, it offers banks an API driven solution. Additionally, it provides interoperability with multiple blockchain networks. Kinexys is an example of one of those networks.

“For years, both Mastercard and Kinexys by J.P. Morgan have been committed to innovating for the future of digital asset and commercial infrastructure,” said Raj Dhamodharan, EVP, Blockchain and Digital Assets at Mastercard.

“By bringing together the power and connectivity of Mastercard’s MTN with Kinexys Digital Payments, we are unlocking greater speed and settlement capabilities for the entire value chain.”

Both solutions represent bank payments on a blockchain. Conventional cross border payments involve Swift messages being sent between banks, often with intermediary banks involved. The banks then move the money separately from the message. That works fine most of the time, but not always.

With blockchain-based transfers, there is no separation of the message and money movement. That avoids issues where money has departed the sender’s account but has not arrived at the recipient.

If there’s an issue with the payment, such as an AML query, then the transfer should not start until that’s resolved.

Kinexys and MTN experience

Kinexys Digital Payments are relatively mature, having launched in 2020. It now processes on average $2 billion in payments daily. Kinexys supports both Euros and Dollars, with plans to support instant FX soon. By contrast, MTN was first announced in mid 2023, and executed its first live transaction in a sandbox with Standard Chartered in May.

Both projects are explored in Ledger Insight’s new report on bank stablecoins and deposit tokens.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

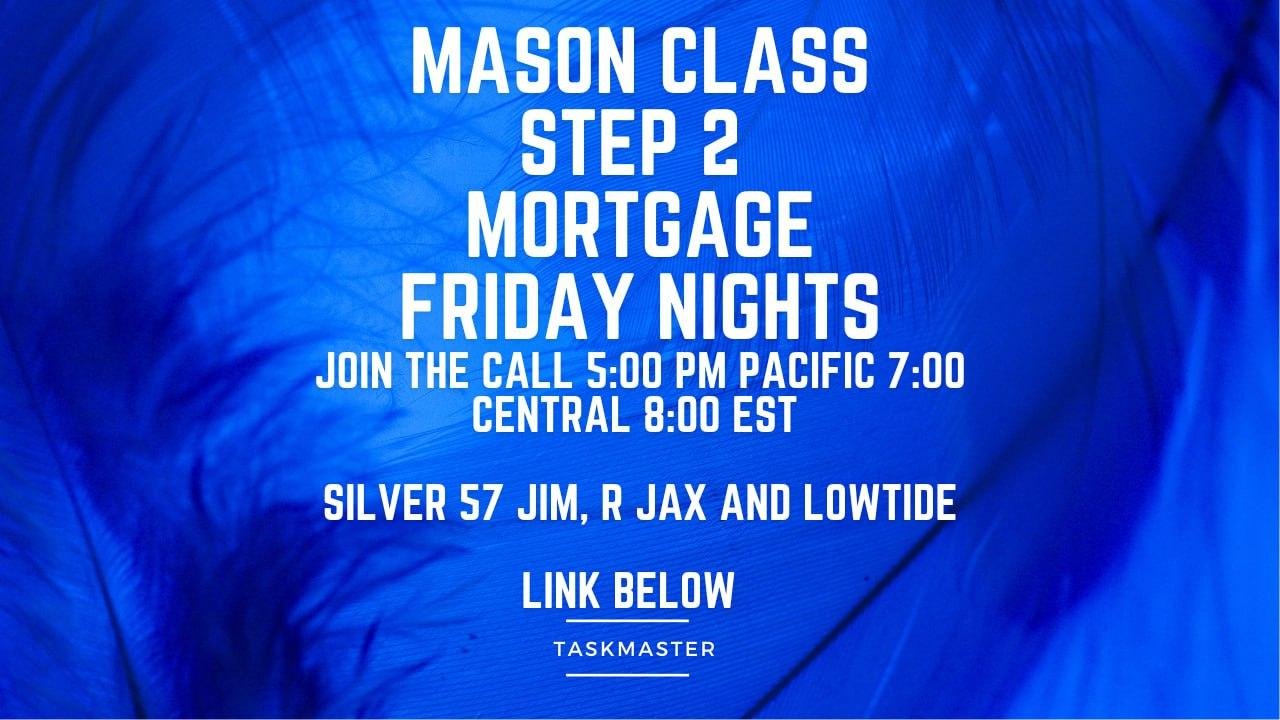

FRIDAY NIGHT LIVE CALL

Join us TONIGHT at 5 pm PT, 7 pm CT, 8 pm ET

JOIN THE CALL HERE

Docs Link

Hear More Calls Here

To join the call you will need the telegram app Here.

Download the app on either your mobile phone or PC, then click the 'Join the Call ' Link above to listen and ask questions..

@ Newshounds News™

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Morning 11-22-24

Good Morning Dinar Recaps,

CONGRESSMAN THAT LED SAB 121 HOUSE VOTE, VOWS TO OVERTURN CRYPTO CUSTODY RULE

Earlier this year, both the House and Senate voted to overturn the SEC’s SAB 121 accounting rule that prevented banks from providing crypto custody solutions. However, President Biden used his veto so the rule still stands. Mike Flood, the Congressman that led the bipartisan House vote, has vowed to work with a new SEC Chair to ditch SAB 121 for good.

However, Flood’s work wasn’t entirely wasted. The dual votes highlighted the issue that forcing banks to put assets under custody on their balance sheet is both unconventional and affects their compliance with bank balance sheet rules.

Good Morning Dinar Recaps,

CONGRESSMAN THAT LED SAB 121 HOUSE VOTE, VOWS TO OVERTURN CRYPTO CUSTODY RULE

Earlier this year, both the House and Senate voted to overturn the SEC’s SAB 121 accounting rule that prevented banks from providing crypto custody solutions. However, President Biden used his veto so the rule still stands. Mike Flood, the Congressman that led the bipartisan House vote, has vowed to work with a new SEC Chair to ditch SAB 121 for good.

However, Flood’s work wasn’t entirely wasted. The dual votes highlighted the issue that forcing banks to put assets under custody on their balance sheet is both unconventional and affects their compliance with bank balance sheet rules.

As a result, it makes it prohibitively expensive for banks to provide crypto custody and inhibits innovation on the tokenization front.

Since then, the SEC has softened its stance a little. Banks can apply for exceptions and it has granted them. That’s not a practical solution, because banks have to consult the SEC on most deals.

“SAB 121, despite widespread opposition, works effectively as a regulation even though it never went through the normal Administrative Procedures Act process required for one,” Congressman Flood wrote.

“I look forward to working with the next SEC Chair to rollback SAB 121.” He didn’t pull his punches about SEC Chair Gensler. “Whether the chair leaves on his own or President Trump delivers his famous line on January 20, 2025, there’s an incredible opportunity for the new administration to turn the page on the Gensler era.”

“It should be no surprise that Gensler opposed the digital assets regulatory framework that passed the House earlier this year on a bipartisan basis. 71 Democrats joined House Republicans to pass this common sense framework.

Even though the Democrat-led Senate has refused to take it up, it represents a breakthrough moment for cryptocurrency and is likely to inform the work of the unified Republican government as the next Congress begins in January.”

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

CFTC COMMISSIONER URGES US CRYPTO POLICY REFORMS

The CFTC’s Summer Mersinger advocated structured crypto regulations and urged the industry to engage with the incoming US administration.

Speaking at the North American Blockchain Summit on Nov. 21, CFTC Commissioner Summer Mersinger discussed the need for standard US crypto-related policies through notice and comment regulation.

The United States Commodity Futures Trading Commission (CFTC) has played a role in implementing the current “regulation by enforcement” strategy alongside the Securities and Exchange Commission (SEC) under the outgoing administration, as evidenced by recent charges against Uniswap Labs.

Mersinger also said recent litigation against a decentralized autonomous organization (DAO) required the CFTC to seek a court verdict for entity classification. In this case, the CFTC wanted to classify the DAO as a corporation or association:

“I really started to get uncomfortable with this idea that we were kind of setting some sort of policy through our enforcement cases and through going to court. To me, how you’re going to treat an entity that’s a policy question.”

Need for regulated relief for the crypto industry

Mersinger said that while crypto entities, including decentralized finance (DeFi), are often charged under existing categories and expected to operate under the same laws, there is no provision for them to be officially registered. She added:

“This is really tricky settlements because the information we share publicly with our enforcement settlements really doesn’t offer a lot of guidance for anyone who’s trying to do the right thing.”

As a result, Uniswap tried to do the right thing but ended up attracting more charges, Mersinger said. Still, Uniswap settled with the CFTC for a “very small fine.”

Despite its small size compared with the other agencies such as the SEC, Mersinger said that the CFTC is the “ideal regulator for the cryptocurrency spot market” as it can implement major legislative changes fairly quickly without disruptions to the market.

New laws can help crypto companies fight wrongful litigation

Moreover, she supported the introduction of new laws and regulations for crypto firms despite her predominantly conservative stance:

“What we’re seeing right now is that without those laws, you have agencies like the Federal Communications Commission (FCC) who can come in and create chaos and bring charges where maybe it doesn’t fit.”

Mersinger also recommended that the crypto industry start engaging with the new administration as soon as its leadership has been identified. “Don’t be afraid to start knocking on doors on day one because I think it’s critical to start” the conversations early on, she said.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

Friday Night Live Call

Join us TONIGHT at 5 pm PT, 7 pm CT, 8 pm ET

Join the Call Here

Docs Link

Hear More Here

To join the call you will need the telegram app Here.

Download the app on either your mobile phone or PC, then click the 'Join the Call ' Link above to listen and ask questions..

@ Newshounds News™

~~~~~~~~~

🌱 THE DOLLAR GAIN MEANS WHAT? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Thursday Evening 11-21-24

Good Evening Dinar Recaps,

INDUSTRY EXECS SEEK POSITIONS ON TRUMP’S CRYPTO ADVISORY COUNCIL

President-elect Trump promised the establishment of a strategic Bitcoin ‘stockpile’ during the Bitcoin 2024 event in Nashville Tennessee.

Industry executives are reportedly seeking a seat at President-elect Donald Trump’s highly-anticipated crypto advisory council, which will be responsible for crafting regulatory policy and expected to establish a Bitcoin strategic reserve.

According to a Reuters report, Coinbase, Ripple Labs, and venture capital firm a16z are among some of the firms looking to join the council.

Good Evening Dinar Recaps,

INDUSTRY EXECS SEEK POSITIONS ON TRUMP’S CRYPTO ADVISORY COUNCIL

President-elect Trump promised the establishment of a strategic Bitcoin ‘stockpile’ during the Bitcoin 2024 event in Nashville Tennessee.

Industry executives are reportedly seeking a seat at President-elect Donald Trump’s highly-anticipated crypto advisory council, which will be responsible for crafting regulatory policy and expected to establish a Bitcoin strategic reserve.

According to a Reuters report, Coinbase, Ripple Labs, and venture capital firm a16z are among some of the firms looking to join the council.

The council may be nestled under the White House’s National Economic Council, but this is not certain, and the council may operate as a separate, standalone entity.

Speaking at the North American Blockchain Summit on Nov. 21, Bitcoin advocate and co-founder of the Satoshi Action Fund Dennis Porter explained the importance of establishing a Bitcoin strategic reserve in the United States:

"A great way for us to protect ourselves from outside influence — undue influence from our foreign adversaries — is to be in the market buying and selling Bitcoin, acting as a shock absorber for all the incredible Bitcoin miners that we have here in this country."

Porter continued by comparing the establishment of a Bitcoin strategic reserve to the Louisiana Purchase in 1803 and the US government’s acquisition of Alaska in 1867 — a point previously stated by MicroStrategy CEO Michael Saylor.

“We bought these things for pennies on the dollar,” Porter remarked and argued that the US has the same option to do the same today by adopting Bitcoin as a reserve asset before other countries beat the US to the punch.

The race is on for a Bitcoin strategic reserve

Senator Cynthia Lummis — who introduced the Bitcoin strategic reserve bill to the Senate earlier in 2024 — recently argued that the Treasury Department should convert some of its gold to Bitcoin to seed the strategic reserve with assets.

Pro-Bitcoin investor and asset manager Anthony Pompliano also remarked that the Bitcoin race between sovereign powers is underway in a Nov. 16 appearance on Yahoo Finance, and urged the US government to “Get as much Bitcoin onto the balance sheet as possible.”

However, not all industry participants are optimistic about the Bitcoin strategic reserve being established under the incoming Trump administration.

Galaxy Digital CEO Mike Novogratz previously opined that he believes a Bitcoin strategic reserve is unlikely under a Trump administration, but also forecasted a $500,000 Bitcoin price tag if the strategic reserve is founded in the near term.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

CHARLES SCHWAB TO ENTER SPOT CRYPTO MARKET ONCE REGULATIONS IMPROVE

Incoming CEO Rick Wurster emphasized readiness to capitalize on evolving regulations and anticipates significant industry impact.

Charles Schwab Corp. is gearing up for a foray into the spot crypto market, signaling a strategic pivot for the financial giant in anticipation of regulatory clarity.

Incoming CEO Rick Wurster disclosed the company’s plans during a Bloomberg Radio interview on Nov. 21, emphasizing Schwab’s readiness to capitalize on evolving regulations.

Wurster said:

“We will get into spot crypto when the regulatory environment changes, and we do anticipate that it will change. We’re getting ready for that eventuality.”

His comments mark a notable shift for Schwab, which has so far limited its crypto exposure to products like exchange-traded funds (ETFs) and futures.

VanEck’s Matthew Sigel noted that the firm’s entry would be a significant moment for the industry and highlighted Wurster’s admission of regret, who said during the interview:

“I have not bought crypto, and now I feel silly.”

Competition and timing

Schwab’s move comes as competition intensifies among retail-focused investment platforms vying for investor dollars. Rival firms like Robinhood Markets and Interactive Brokers have already integrated spot crypto trading, forcing Schwab to reassess its cautious approach.

The so-called “Trump trade,” fueled by President-elect Donald Trump’s victory and its implications for crypto-friendly policies, has further accelerated the industry’s momentum.

Schwab’s current offerings focus on crypto-linked ETFs and futures contracts, allowing clients indirect exposure to the digital asset market. However, industry observers have long speculated that the firm would eventually embrace direct trading to remain competitive.

Adding to the speculation, Sigel hinted at behind-the-scenes activity, stating that a prominent crypto asset manager recently approached Schwab to pitch a partnership.

While details remain unclear, such collaborations could provide Schwab with a quicker and less risky entry into the spot market, leveraging established expertise to navigate operational and regulatory challenges.

Broader institutional shift

Shwab’s evolving stance mirrors a broader shift in institutional attitudes toward digital assets. With regulatory clarity potentially on the horizon, major players in traditional finance are increasingly exploring direct crypto exposure.

The firm’s strategic pivot could position it as a key player in the next wave of crypto adoption, bridging the gap between traditional finance and the burgeoning digital economy.

For now, Schwab appears to be laying the groundwork, aiming to meet investor demand while mitigating risks. The timeline for its entry into spot crypto markets, however, hinges on the regulatory landscape and the firm’s ability to execute its plans effectively.

@ Newshounds News™

Source: Crypto Slate

~~~~~~~~~

🌱 SEC CHAIR GENSLER TO DEPART AGENCY ON JANUARY 20 - What it means | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Thursday Afternoon 11-21-24

Good Afternoon Dinar Recaps,

BREAKING NEWS

SEC CHAIR GENSLER TO DEPART AGENCY ON JANUARY 20

Gensler implemented reforms to enhance efficiency, resiliency, and integrity in U.S. capital markets; agency held wrongdoers accountable and returned billions to harmed investors.

For Immediate Release 2024-182 Washington D.C., Nov. 21, 2024 —

The Securities and Exchange Commission today announced that its 33rd Chair, Gary Gensler, will step down from the Commission effective at 12:00 pm on January 20, 2025. Chair Gensler began his tenure on April 17, 2021, in the immediate aftermath of the GameStop market events.

Good Afternoon Dinar Recaps,

BREAKING NEWS

SEC CHAIR GENSLER TO DEPART AGENCY ON JANUARY 20

Gensler implemented reforms to enhance efficiency, resiliency, and integrity in U.S. capital markets; agency held wrongdoers accountable and returned billions to harmed investors.