Seeds of Wisdom RV and Economic Updates Friday Morning 11-22-24

Good Morning Dinar Recaps,

CONGRESSMAN THAT LED SAB 121 HOUSE VOTE, VOWS TO OVERTURN CRYPTO CUSTODY RULE

Earlier this year, both the House and Senate voted to overturn the SEC’s SAB 121 accounting rule that prevented banks from providing crypto custody solutions. However, President Biden used his veto so the rule still stands. Mike Flood, the Congressman that led the bipartisan House vote, has vowed to work with a new SEC Chair to ditch SAB 121 for good.

However, Flood’s work wasn’t entirely wasted. The dual votes highlighted the issue that forcing banks to put assets under custody on their balance sheet is both unconventional and affects their compliance with bank balance sheet rules.

Good Morning Dinar Recaps,

CONGRESSMAN THAT LED SAB 121 HOUSE VOTE, VOWS TO OVERTURN CRYPTO CUSTODY RULE

Earlier this year, both the House and Senate voted to overturn the SEC’s SAB 121 accounting rule that prevented banks from providing crypto custody solutions. However, President Biden used his veto so the rule still stands. Mike Flood, the Congressman that led the bipartisan House vote, has vowed to work with a new SEC Chair to ditch SAB 121 for good.

However, Flood’s work wasn’t entirely wasted. The dual votes highlighted the issue that forcing banks to put assets under custody on their balance sheet is both unconventional and affects their compliance with bank balance sheet rules.

As a result, it makes it prohibitively expensive for banks to provide crypto custody and inhibits innovation on the tokenization front.

Since then, the SEC has softened its stance a little. Banks can apply for exceptions and it has granted them. That’s not a practical solution, because banks have to consult the SEC on most deals.

“SAB 121, despite widespread opposition, works effectively as a regulation even though it never went through the normal Administrative Procedures Act process required for one,” Congressman Flood wrote.

“I look forward to working with the next SEC Chair to rollback SAB 121.” He didn’t pull his punches about SEC Chair Gensler. “Whether the chair leaves on his own or President Trump delivers his famous line on January 20, 2025, there’s an incredible opportunity for the new administration to turn the page on the Gensler era.”

“It should be no surprise that Gensler opposed the digital assets regulatory framework that passed the House earlier this year on a bipartisan basis. 71 Democrats joined House Republicans to pass this common sense framework.

Even though the Democrat-led Senate has refused to take it up, it represents a breakthrough moment for cryptocurrency and is likely to inform the work of the unified Republican government as the next Congress begins in January.”

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

CFTC COMMISSIONER URGES US CRYPTO POLICY REFORMS

The CFTC’s Summer Mersinger advocated structured crypto regulations and urged the industry to engage with the incoming US administration.

Speaking at the North American Blockchain Summit on Nov. 21, CFTC Commissioner Summer Mersinger discussed the need for standard US crypto-related policies through notice and comment regulation.

The United States Commodity Futures Trading Commission (CFTC) has played a role in implementing the current “regulation by enforcement” strategy alongside the Securities and Exchange Commission (SEC) under the outgoing administration, as evidenced by recent charges against Uniswap Labs.

Mersinger also said recent litigation against a decentralized autonomous organization (DAO) required the CFTC to seek a court verdict for entity classification. In this case, the CFTC wanted to classify the DAO as a corporation or association:

“I really started to get uncomfortable with this idea that we were kind of setting some sort of policy through our enforcement cases and through going to court. To me, how you’re going to treat an entity that’s a policy question.”

Need for regulated relief for the crypto industry

Mersinger said that while crypto entities, including decentralized finance (DeFi), are often charged under existing categories and expected to operate under the same laws, there is no provision for them to be officially registered. She added:

“This is really tricky settlements because the information we share publicly with our enforcement settlements really doesn’t offer a lot of guidance for anyone who’s trying to do the right thing.”

As a result, Uniswap tried to do the right thing but ended up attracting more charges, Mersinger said. Still, Uniswap settled with the CFTC for a “very small fine.”

Despite its small size compared with the other agencies such as the SEC, Mersinger said that the CFTC is the “ideal regulator for the cryptocurrency spot market” as it can implement major legislative changes fairly quickly without disruptions to the market.

New laws can help crypto companies fight wrongful litigation

Moreover, she supported the introduction of new laws and regulations for crypto firms despite her predominantly conservative stance:

“What we’re seeing right now is that without those laws, you have agencies like the Federal Communications Commission (FCC) who can come in and create chaos and bring charges where maybe it doesn’t fit.”

Mersinger also recommended that the crypto industry start engaging with the new administration as soon as its leadership has been identified. “Don’t be afraid to start knocking on doors on day one because I think it’s critical to start” the conversations early on, she said.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

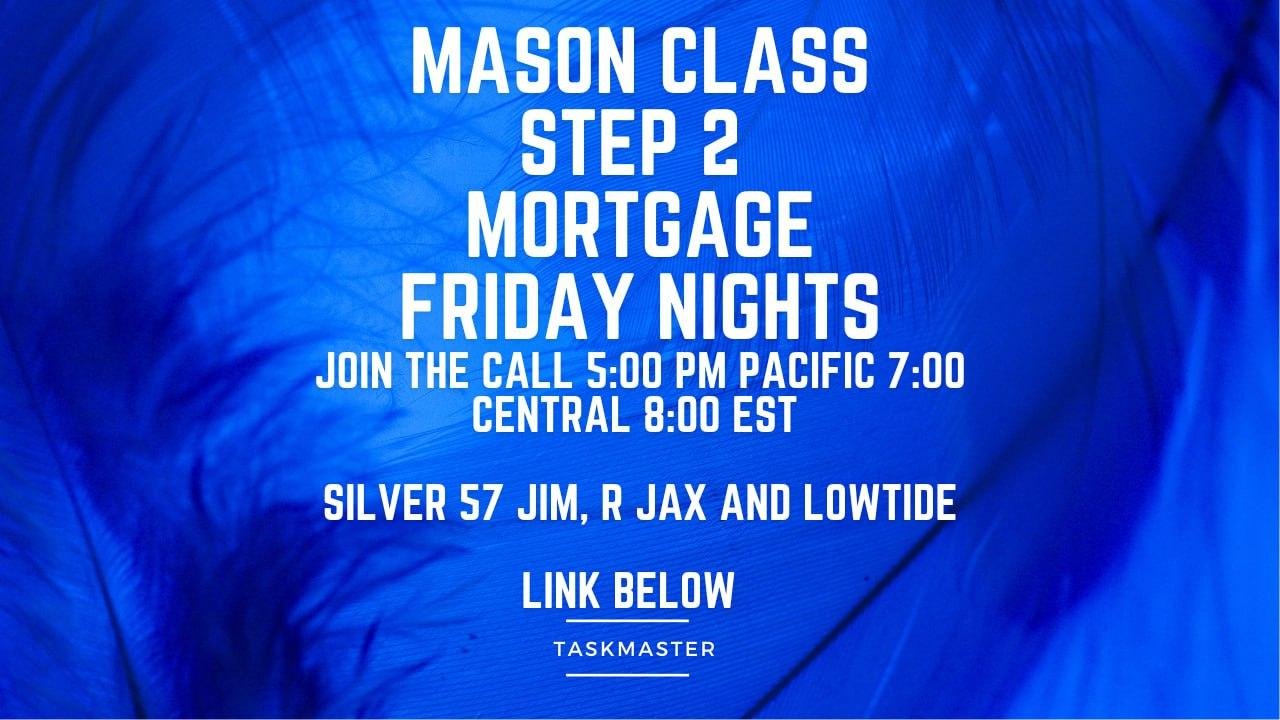

Friday Night Live Call

Join us TONIGHT at 5 pm PT, 7 pm CT, 8 pm ET

Join the Call Here

Docs Link

Hear More Here

To join the call you will need the telegram app Here.

Download the app on either your mobile phone or PC, then click the 'Join the Call ' Link above to listen and ask questions..

@ Newshounds News™

~~~~~~~~~

🌱 THE DOLLAR GAIN MEANS WHAT? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Thursday Evening 11-21-24

Good Evening Dinar Recaps,

INDUSTRY EXECS SEEK POSITIONS ON TRUMP’S CRYPTO ADVISORY COUNCIL

President-elect Trump promised the establishment of a strategic Bitcoin ‘stockpile’ during the Bitcoin 2024 event in Nashville Tennessee.

Industry executives are reportedly seeking a seat at President-elect Donald Trump’s highly-anticipated crypto advisory council, which will be responsible for crafting regulatory policy and expected to establish a Bitcoin strategic reserve.

According to a Reuters report, Coinbase, Ripple Labs, and venture capital firm a16z are among some of the firms looking to join the council.

Good Evening Dinar Recaps,

INDUSTRY EXECS SEEK POSITIONS ON TRUMP’S CRYPTO ADVISORY COUNCIL

President-elect Trump promised the establishment of a strategic Bitcoin ‘stockpile’ during the Bitcoin 2024 event in Nashville Tennessee.

Industry executives are reportedly seeking a seat at President-elect Donald Trump’s highly-anticipated crypto advisory council, which will be responsible for crafting regulatory policy and expected to establish a Bitcoin strategic reserve.

According to a Reuters report, Coinbase, Ripple Labs, and venture capital firm a16z are among some of the firms looking to join the council.

The council may be nestled under the White House’s National Economic Council, but this is not certain, and the council may operate as a separate, standalone entity.

Speaking at the North American Blockchain Summit on Nov. 21, Bitcoin advocate and co-founder of the Satoshi Action Fund Dennis Porter explained the importance of establishing a Bitcoin strategic reserve in the United States:

"A great way for us to protect ourselves from outside influence — undue influence from our foreign adversaries — is to be in the market buying and selling Bitcoin, acting as a shock absorber for all the incredible Bitcoin miners that we have here in this country."

Porter continued by comparing the establishment of a Bitcoin strategic reserve to the Louisiana Purchase in 1803 and the US government’s acquisition of Alaska in 1867 — a point previously stated by MicroStrategy CEO Michael Saylor.

“We bought these things for pennies on the dollar,” Porter remarked and argued that the US has the same option to do the same today by adopting Bitcoin as a reserve asset before other countries beat the US to the punch.

The race is on for a Bitcoin strategic reserve

Senator Cynthia Lummis — who introduced the Bitcoin strategic reserve bill to the Senate earlier in 2024 — recently argued that the Treasury Department should convert some of its gold to Bitcoin to seed the strategic reserve with assets.

Pro-Bitcoin investor and asset manager Anthony Pompliano also remarked that the Bitcoin race between sovereign powers is underway in a Nov. 16 appearance on Yahoo Finance, and urged the US government to “Get as much Bitcoin onto the balance sheet as possible.”

However, not all industry participants are optimistic about the Bitcoin strategic reserve being established under the incoming Trump administration.

Galaxy Digital CEO Mike Novogratz previously opined that he believes a Bitcoin strategic reserve is unlikely under a Trump administration, but also forecasted a $500,000 Bitcoin price tag if the strategic reserve is founded in the near term.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

CHARLES SCHWAB TO ENTER SPOT CRYPTO MARKET ONCE REGULATIONS IMPROVE

Incoming CEO Rick Wurster emphasized readiness to capitalize on evolving regulations and anticipates significant industry impact.

Charles Schwab Corp. is gearing up for a foray into the spot crypto market, signaling a strategic pivot for the financial giant in anticipation of regulatory clarity.

Incoming CEO Rick Wurster disclosed the company’s plans during a Bloomberg Radio interview on Nov. 21, emphasizing Schwab’s readiness to capitalize on evolving regulations.

Wurster said:

“We will get into spot crypto when the regulatory environment changes, and we do anticipate that it will change. We’re getting ready for that eventuality.”

His comments mark a notable shift for Schwab, which has so far limited its crypto exposure to products like exchange-traded funds (ETFs) and futures.

VanEck’s Matthew Sigel noted that the firm’s entry would be a significant moment for the industry and highlighted Wurster’s admission of regret, who said during the interview:

“I have not bought crypto, and now I feel silly.”

Competition and timing

Schwab’s move comes as competition intensifies among retail-focused investment platforms vying for investor dollars. Rival firms like Robinhood Markets and Interactive Brokers have already integrated spot crypto trading, forcing Schwab to reassess its cautious approach.

The so-called “Trump trade,” fueled by President-elect Donald Trump’s victory and its implications for crypto-friendly policies, has further accelerated the industry’s momentum.

Schwab’s current offerings focus on crypto-linked ETFs and futures contracts, allowing clients indirect exposure to the digital asset market. However, industry observers have long speculated that the firm would eventually embrace direct trading to remain competitive.

Adding to the speculation, Sigel hinted at behind-the-scenes activity, stating that a prominent crypto asset manager recently approached Schwab to pitch a partnership.

While details remain unclear, such collaborations could provide Schwab with a quicker and less risky entry into the spot market, leveraging established expertise to navigate operational and regulatory challenges.

Broader institutional shift

Shwab’s evolving stance mirrors a broader shift in institutional attitudes toward digital assets. With regulatory clarity potentially on the horizon, major players in traditional finance are increasingly exploring direct crypto exposure.

The firm’s strategic pivot could position it as a key player in the next wave of crypto adoption, bridging the gap between traditional finance and the burgeoning digital economy.

For now, Schwab appears to be laying the groundwork, aiming to meet investor demand while mitigating risks. The timeline for its entry into spot crypto markets, however, hinges on the regulatory landscape and the firm’s ability to execute its plans effectively.

@ Newshounds News™

Source: Crypto Slate

~~~~~~~~~

🌱 SEC CHAIR GENSLER TO DEPART AGENCY ON JANUARY 20 - What it means | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Thursday Afternoon 11-21-24

Good Afternoon Dinar Recaps,

BREAKING NEWS

SEC CHAIR GENSLER TO DEPART AGENCY ON JANUARY 20

Gensler implemented reforms to enhance efficiency, resiliency, and integrity in U.S. capital markets; agency held wrongdoers accountable and returned billions to harmed investors.

For Immediate Release 2024-182 Washington D.C., Nov. 21, 2024 —

The Securities and Exchange Commission today announced that its 33rd Chair, Gary Gensler, will step down from the Commission effective at 12:00 pm on January 20, 2025. Chair Gensler began his tenure on April 17, 2021, in the immediate aftermath of the GameStop market events.

Good Afternoon Dinar Recaps,

BREAKING NEWS

SEC CHAIR GENSLER TO DEPART AGENCY ON JANUARY 20

Gensler implemented reforms to enhance efficiency, resiliency, and integrity in U.S. capital markets; agency held wrongdoers accountable and returned billions to harmed investors.

For Immediate Release 2024-182 Washington D.C., Nov. 21, 2024 —

The Securities and Exchange Commission today announced that its 33rd Chair, Gary Gensler, will step down from the Commission effective at 12:00 pm on January 20, 2025. Chair Gensler began his tenure on April 17, 2021, in the immediate aftermath of the GameStop market events.

He led the agency through a robust rulemaking agenda to enhance efficiency, resiliency, and integrity in the U.S. capital markets. He also oversaw high-impact enforcement cases to hold wrongdoers accountable and return billions to harmed investors.

“The Securities and Exchange Commission is a remarkable agency,” said Chair Gensler. “The staff and the Commission are deeply mission-driven, focused on protecting investors, facilitating capital formation, and ensuring that the markets work for investors and issuers alike.

The staff comprises true public servants. It has been an honor of a lifetime to serve with them on behalf of everyday Americans and ensure that our capital markets remain the best in the world.

“I thank President Biden for entrusting me with this incredible responsibility. The SEC has met our mission and enforced the law without fear or favor. I’ve greatly enjoyed working with my fellow Commissioners, Allison Herren Lee, Elad Roisman, Hester Peirce, Caroline Crenshaw, Mark Uyeda, and Jaime Lizárraga. I also thank Congress, my colleagues across the U.S. government, and fellow regulators around the world.”

@ Newshounds

Read More: SEC

~~~~~~~~~

CFTC ADVISORY SUBCOMMITTEE RECOMMENDS TOKENIZED COLLATERAL WITH NO RULE CHANGES NEEDED

The Commodity Futures Trading Commission (CFTC) has a Global Markets Advisory Committee (GMAC) made up of industry participants. Today the subcommittee on digital assets voted in favor (27-0) of three recommendations to adopt DLT and tokenized assets as collateral for margin.

The proposals would need to be adopted by the full GMAC Committee and it’s up to the CFTC to decide whether it proceeds.

The problem addressed by tokenized collateral

Stepping back, the CFTC is the primary regulator for derivatives markets. Typically derivatives require the posting of margin to cover the risk of price swings. Initial margin is provided at the outset, with variation margin during the lifetime of the derivative.

Non cash collateral is already allowed by the CFTC but is not used much for variation margin, because moving assets involves multiple intermediaries and hence delays. Plus, assets can only be transferred during office opening hours.

By contrast, tokenized assets are directly transferrable 24/7. The ability to quickly transfer tokenized assets for use as variation margin reduces counterparty and other risks. Plus, it saves money by removing the need to liquidate assets to meet margin calls.

During market panics, the need to post additional cash margin often requires selling collateral that increases market volatility.

Collateral mobility is one of the killer apps for tokenization. Beyond the CFTC and derivatives, there are already significant industry initiatives targeting collateral mobility, including HQLAᵡ, JP Morgan’s Tokenized Collateral Network, and Broadridge’s DLR which supports repo and Treasury tokenization.

The Digital Asset subcommittee proposals

The GMAC Digital Assets Markets subcommittee believes that tokenized assets could be used for margin without the need for regulatory changes. Likewise the use of DLT as books and records (without tokenization), should also not require new legislation.

Given non cash collateral is already eligible for margin, it also doesn’t require changes in eligibility rules. Committee members also concluded that existing policies and procedures for managing risks should be sufficient to support DLT.

The assets they had in mind as collateral would be World Bank bonds, government securities, corporate debt, money market funds and gold. Current CFTC criteria for non cash collateral is that the assets are liquid, hold value and lack correlation to counterparty or portfolio risks.

The Global Head of DTCC Digital Assets, Nadine Chakar, commented that “This is an opportunity for us to be able to increase the velocity of collateral in the marketplace without any changes to rules and guidance.”

DRW has been operating a significant digital asset business for years. DRW’s Chris Zuehlke said it has seen the benefits of the ability to move assets in real time 24/7 in practice. He said the company has a different view on risk where there’s a bank wire involved versus real time settlement with a DLT-based asset.

“We often times feel much more confident in our risk management processes when we know we can have a 24/7 real time settlement capability with these counterparties,” said Mr Zuehlke.

“I think that will transfer very directly to the collateral management side for derivatives based businesses under the CFTC’s purview. And I’m really excited to see that evolution take place.”

The risk of not proceeding

Christopher Perkins from Coinfund is another subcommittee member strongly in favor. He spent a large part of his career at Citi, latterly as Global Co-Head, Futures, Clearing and FX Prime Brokerage.

There’s been much criticism about a lack of technology neutrality with DLT, with extra hurdles often put in place. He argued for the reverse: that market participants should be incentivized to move to tokenized collateral.

He considers the level of ongoing Herstatt risk in the marketplace as too high. “The risk here is being able to tolerate the very inefficient settlement processes today,” said Mr Perkins. “We’re living in a world now where it takes days to settle Yen. Completely unacceptable.” He advocated for using stablecoins for variation margin.

The potential figures involved are massive. Exchange traded derivatives are small fry compared to over the counter (OTC). Global exchange traded derivatives have a notional open interest of $88 trillion versus $742 trillion for OTC. To put that in context, global stock markets total $124 trillion.

Even if the full GMAC committee proposes to advance the recommendation, the CFTC might be slow to adopt. During today’s meeting, Commissioner Pham noted that the CFTC has not yet implemented a recommendation from November 2023. That one aimed to harmonize rules relating to money market funds as eligible collateral.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

🌱JUDICIAL NAME - LEGAL NAME - MAINTAINING SOVEREIGNTY #CONSTITUTION #SOVEREIGNTY | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Thursday Morning 11-21-24

Good Morning Dinar Recaps,

BRICS COUNTRIES GAIN INFLUENCE OVER G20

The G20 summit is ongoing in Brazil’s Rio and all the five BRICS countries are a part of the bloc. The world leaders are discussing trade deals and renewing policies at the summit. US President Joe Biden attended the summit but missed out on the photo op on Tuesday.

However, the world leaders retook the photo op placing Biden at the center and standing next to India’s Prime Minister Narendra Modi to his left and Canada’s Justin Trudeau to his right.

Good Morning Dinar Recaps,

BRICS COUNTRIES GAIN INFLUENCE OVER G20

The G20 summit is ongoing in Brazil’s Rio and all the five BRICS countries are a part of the bloc. The world leaders are discussing trade deals and renewing policies at the summit. US President Joe Biden attended the summit but missed out on the photo op on Tuesday.

However, the world leaders retook the photo op placing Biden at the center and standing next to India’s Prime Minister Narendra Modi to his left and Canada’s Justin Trudeau to his right.

BRICS Influence in G20 Grows

The BRICS countries are having a bigger role in the G20 summit dominating the news cycle and photo ops. The show of unity was on full display making the leaders of Western countries seem like background noise. The show of unity was met with a starkly farcical smile by Biden as leaders clapped and held hands.

“The BRICS countries as a whole are gaining in their role and influence in the G20. This was evident both in Delhi at last year’s summit and in the year before in Indonesia. And here (Rio de Janeiro) it was especially clear,” said Russian Foreign Minister Sergey Lavrov in a press conference.

During the previous G20 summits, BRICS countries rarely hit the news cycles but the 2024 event has turned things around. The bloc is displaying strength through unions and other trade deals indicating their economy can sustain without the West. The alliance recently sent invitations to 13 new nations to join as ‘Partner countries’

Indonesia accepted the invitation to join BRICS as a ‘Partner countries’ while the G20 summit was ongoing. Indonesian Ambassador to Russia, Jose Antonio Morato Tavares said that Indonesia “will actively contribute to and participate in any initiatives of BRICS. This is a positive development. Now, we are already a BRICS partner state,” he said.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

MALAYSIA EXPLORING WHOLESALE CBDC

Two years ago Bank Negara Malaysia (BNM) outlined its plans for central bank digital currency (CBDC). At the time it intended to explore wholesale CBDC (wCBDC) in the short term and a general purpose retail CBDC this year.

However, during a digital payments event yesterday it disclosed that the emphasis is solely on wholesale CBDC. It believes retail payments are already well served by existing systems.

Currently it is building expertise, performing preparatory work and getting to grips with the technology.

“If we were to issue wholesale CBDC in the future, we would know what it takes and what policy implications we need to bear in mind,” the central bank said, as reported by the Sun Malaysia.

The central bank envisages a wholesale CBDc as supporting interbank settlement for tokenized deposits both domestically and for cross border payments. International payments have been of interest for some time.

BNM was a participant in Singapore’s multi-CBDC Project Dunbar, and is an observer of mBridge, the cross border CBDC project that is currently at the minimum viable product stage. Active mBridge participants include the central banks of China, Hong Kong, Saudi Arabia, Thailand and the UAE.

Despite its preparations, the central bank has no immediate plans to issue one. It will continue working on wCBDC and DLT during 2024-25. Several Asian economies are currently exploring a wholesale CBDC to support tokenized deposits. They include the central banks of Hong Kong, Korea, Singapore and Taiwan.

Ledger Insights recently released a report exploring tokenized deposits and bank stablecoins, highlighting more than 70 initiatives.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

🌱NFTS IN COURT?! LEGAL SERVICE VIA AIRDROP EXPLAINED! | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Evening 11-20-24

Good Evening Dinar Recaps,

A NEW FRONTIER: COURT AUTHORIZES SERVICE OF PROCESS THROUGH NFT AIRDROP

In a landmark decision highlighting the unique aspects of blockchain technology, an S.D.N.Y. Bankruptcy Judge ruled in favor of Celsius’s motion for alternative service, whereby Celsius sought to provide legal service by airdopping non-fungible tokens (NFTs) to anonymous defendants’ digital asset wallets.

Judge Approves Celsius’s NFT Airdrop for Legal Service

In the wake of the cryptocurrency exchange’s insolvency, its bankruptcy estate filed suit seeking to void allegedly fraudulent transfers and recover additional funds for its creditors.

Good Evening Dinar Recaps,

A NEW FRONTIER: COURT AUTHORIZES SERVICE OF PROCESS THROUGH NFT AIRDROP

In a landmark decision highlighting the unique aspects of blockchain technology, an S.D.N.Y. Bankruptcy Judge ruled in favor of Celsius’s motion for alternative service, whereby Celsius sought to provide legal service by airdopping non-fungible tokens (NFTs) to anonymous defendants’ digital asset wallets.

Judge Approves Celsius’s NFT Airdrop for Legal Service

In the wake of the cryptocurrency exchange’s insolvency, its bankruptcy estate filed suit seeking to void allegedly fraudulent transfers and recover additional funds for its creditors.

Due to the pseudonymous nature of the technology, however, Celsius has thus far been unable to identify the owners of the wallets connected to the relevant transfers.

As a result, the Litigation Administrator designed a novel solution for an alternative method of service. Celsius proposed to airdrop NFTs that include a hyperlink to a website containing the complaint and other relevant legal documents to the wallet addresses in question.

To ensure the NFTs are properly served, Celsius will have FTI Consulting confirm the wallets receive the NFTs on-chain, and record the exact date and time the NFTs are opened. FTI will also monitor website traffic to ensure the links are opened by actual humans rather than automated bots.

Furthermore, FTI Consulting confirmed that it traced the transfers to the wallets in question, that the wallets have been active since the transfers, and that the same individuals likely remain in control of the wallets.

Alternative methods of service are generally permitted if the statutory methods of service are “impracticable.” According to New York case law, service is typically impracticable when the plaintiff is unable to locate either a business or home address for the defendant despite diligent efforts to do so.

Alternative methods must also satisfy constitutional due process requirements, which requires service to be reasonably calculated, under all the circumstances, to give notice to interested parties of the nature of the action against them.

Recognizing that the anonymity of the wallet owners deemed traditional service impracticable, the Court was satisfied the defendants were likely to receive the summons and complaint via the hyperlink in the NFT since the NFT was being sent to the exact wallets used by the defendants to receive the funds at issue, and the activity could be traced on-chain.

Judge Glenn concluded the NFT airdrop was “the best possible way” to apprise the defendants of the actions against them, and praised Celsius on its “innovative” solution. In terms of service, email addresses pioneered the way for the internet. Wallet addresses just paved the way for blockchain.

This case highlights one of the many challenges of adopting new technology into society, and exemplifies how blockchain technology continues to disrupt the status quo. Luckily, the industry has taken the initiative to craft novel solutions that allow for its implementation into everyday life.

As attorneys operating exclusively in the digital asset space, we understand the importance of staying up to date on the latest developments and helping clients stay informed whenever the legal landscape shifts.

Whether you are an investor, entrepreneur, or business involved in cryptocurrency, our team is here to provide the legal counsel needed to maneuver this complex landscape. If you believe we can be of assistance, schedule a consultation here.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

SHANGHAI JUDGE SAYS CRYPTOCURRENCY IS A COMMODITY, LEGAL TO OWN

Shanghai Judge Sun Jie calls virtual currency a commodity with property attributes in a commentary on a 2017 business dispute.

A judge in the People’s Court of Songjiang District in Shanghai, China has released an article on the court’s WeChat account about the legality of issuing virtual currency in China. She was commenting on a business dispute dating to 2017, but her opinion sheds light on cryptocurrency’s murky legal status in China.

A virtual commodity with property attributes

An agricultural development company signed a “Blockchain Incubation Agreement” with an investment management company to produce a white paper as the basis for the issuance of a cryptocurrency, paying 300,000 yuan (about $44,400 at the time) for the service.

A year later, no token had been produced, and the investment company said the agricultural company should develop an app before the token could be issued. Instead, the agricultural company sued to recover the money it had paid.

The court ruled that the agreement between the companies envisioned illegal activities, for which both sides were at fault. It ordered the investment company to return 250,000 yuan.

Judge Sun Jie wrote that virtual currency does not have the status of fiat currency, but is rather a virtual commodity with “property attributes.” She stated:

“Although it is not illegal for individuals to simply hold virtual currency, commercial entities cannot participate in virtual currency investment transactions or even issue tokens on their own.”

How banned is crypto in China?

The judge went on to give a lengthy warning about the potential ills of cryptocurrency. For example:

“Virtual currency trading speculation activities such as Bitcoin will not only disrupt the economic and financial order, but also may become a payment and settlement tool for illegal and criminal activities, breeding money laundering, illegal fund-raising, fraud, pyramid schemes and other illegal and criminal activities.”

By “blindly participating in virtual currency transactions,” individuals and enterprises may not have the full protection of the law, the judge concluded. The article reproduces Article 153 of the Civil Code of the People’s Republic of China, as it is the relevant legislation to the case.

China ordered virtual currency exchanges to close down in 2017. In 2021, the People’s Bank of China and 10 Chinese government agencies joined forces to tighten control over transactions with virtual currencies. Nonetheless, ownership of crypto was never prohibited.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

IRAQ'S ACCESSION TO THE WORLD TRADE ORGANIZATION (WTO) | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 11-20-24

Good Afternoon Dinar Recaps,

BIS RESEARCH FINDS PROS DOMINATE CRYPTO DEX DEFI EXCHANGES

In traditional finance (TradFi), market makers and high frequency traders act as intermediaries on exchanges. Decentralized Finance (DeFi) was meant to provide an alternative, with retail investors providing liquidity in a crowdsourcing manner.

The Bank for International Settlements (BIS) was curious about the extent of disintermediation, so it crunched the data on decentralized exchange (DEX) transactions. It found that sophisticated players dominate and are equivalent to professional intermediaries in TradFi.

Good Afternoon Dinar Recaps,

BIS RESEARCH FINDS PROS DOMINATE CRYPTO DEX DEFI EXCHANGES

In traditional finance (TradFi), market makers and high frequency traders act as intermediaries on exchanges. Decentralized Finance (DeFi) was meant to provide an alternative, with retail investors providing liquidity in a crowdsourcing manner.

The Bank for International Settlements (BIS) was curious about the extent of disintermediation, so it crunched the data on decentralized exchange (DEX) transactions. It found that sophisticated players dominate and are equivalent to professional intermediaries in TradFi..

That said, a sophisticated player in the crypto world could still be a spotty teenager working in their parent’s basement, albeit a wealthy one. So from that perspective, DeFi is democratized.

Despite retail investors making up 93% of DEX liquidity providers (LPs), a few larger actors provide 65-85% of the liquidity on DEXs. They also dominate profits, making an average net return of 3 basis points more daily. That’s equivalent to 11.65% more annually compared to retail LPs. While the average position of a retail investor is $29,000, for the professionals, the figure is $3.7 million.

The BIS found that retail investors earn about 10-25% of fees and are generally less skilled.

More sophisticated AMMs favor the pros

The study focused on Uniswap V3. In the early days of DeFi, the algorithmic model used by most automated market makers (AMMs) was a crude straight line formula. That meant that a crypto holder could provide liquidity in a relatively passive manner.

That changed with Uniswap V3, which encourages liquidity providers to target narrow price ranges close to the market price, helping to provide deeper liquidity around the price action.

Given prices are dynamic, that requires more monitoring. If an LP provides a broad price range, something retail LPs are more prone to do, their position will be inactive some of the time, earning less fees. The research showed that sophisticated LPs provided significantly narrower tick range spreads, less than half of retail LPs’ range.

The introduction of V3 has accelerated the shift to sophisticated players. At launch, sophisticated LPs accounted for 40-50% of transactions, rising to 70-80% by the end of 2023.

Sophisticated LPs show distinct patterns. They target high volume pools where daily trading volume exceeds $10m, and they completely dominate those pools.

Retail LPs provide liquidity to pools where volumes are less than $100,000 a day. Sophisticated LPs also target less volatile trading pairs, which are lower risk.

However, when the markets are in a temporary volatile period, the pros really stand out. During those times, rather than earning 3 basis points more than retail daily, the figure is 2.5 times higher at 7.6 basis points.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

RUSSIA CRACKS DOWN ON CRYPTO MINING AMID WINTER ENERGY CRISIS

▪️Russia plans to ban crypto mining in specific regions to address energy shortages during winter.

▪️The ban will affect Siberia and certain Ukrainian territories under Russian control, with varying degrees of restriction.

▪️The move comes alongside new crypto regulations aimed at overseeing mining activities.

As winter approaches, Russia, one of the world’s top cryptocurrency mining hubs, is gearing up to impose targeted bans on mining to address looming energy shortages. Alongside the U.S., China, Kazakhstan, and Canada, Russia has become a key player in the global mining scene.

However, with winter temperatures plunging and energy demands rising, the country is forced to make tough choices.

The Moscow Times reports that these restrictions will mainly affect Siberia and Ukrainian territories currently under Russian control.

Crypto Mining Restrictions During Winter Months

A government commission, led by Deputy Prime Minister Alexander Novak, has outlined the plan to ensure stable energy supplies during the heating season. Starting December 1, 2024, mining in Siberia will be suspended until March 15, 2025, with similar bans scheduled annually through 2031.

In addition, the North Caucasus and occupied Ukrainian regions will face a total mining ban from December 2024 to March 2031, with no seasonal exemptions, as reported by Kommersant.

New Regulations in Effect

These mining bans are part of a broader set of crypto regulations signed into law by President Vladimir Putin on November 1, 2024. The new rules aim to regulate mining activities and establish infrastructure for experimental cross-border cryptocurrency transactions.

While domestic crypto payments remain illegal, Russian lawmakers view these measures as a possible way to bypass international sanctions by using digital currencies.

The Energy Cost of Crypto Mining

As the world’s second-largest cryptocurrency mining country after the U.S., Russia uses about 16 billion kilowatt-hours annually for mining—roughly 1.5% of its total electricity consumption, according to the Energy Ministry. In addition to the mining bans, the new laws introduce taxes on mining activities, which could generate up to 200 billion roubles ($2 billion) annually for the Russian economy.

Bitcoin Mining Difficulty Soars

Bitcoin’s mining difficulty has recently hit a record 102.29 trillion, reflecting the increasing computational power needed to secure the network.

This key metric adjusts every two weeks to maintain steady block production despite fluctuations in miner activity. Since mid-2024, Bitcoin’s mining difficulty has increased by nearly 20%, driven by intense global competition.

At the same time, Bitcoin’s hash rate peaked at over 900 EH/s before stabilizing around 730 EH/s.

Russia’s decision to implement these mining bans highlights the country’s challenge of supporting the expanding crypto sector while ensuring enough energy is available during peak demand periods.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

JUST IN: 🇷🇺🇨🇳 China and Russia officially complete East-Route Natural Gas Pipeline, directly connecting both countries.

The pipeline is expected to deliver 38 billion cubic metres of natural gas annually.

@ Newshounds News™

Source: BRICSNews

~~~~~~~~~

🌱THE "BRUNSON CASE" AND WHY IT IS IMPORTANT | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Morning 11-20-24

Good Morning Dinar Recaps,

BRICS NEWS: 4 NEW COUNTRIES SHOW INTEREST TO JOIN BRICS ALLIANCE

A total of four new countries have expressed their interest in joining the BRICS alliance this month. The number of countries that are ready to be a part of the bloc is only growing lately. The de-dollarization agenda, clubbed with a renewed consideration of local currencies is what’s attracting emerging economies into the bloc.

Four new nations have come forward officially expressing their intent to be a part of the BRICS alliance. The four countries that want to join the bloc are: Bolivia Columbia Libya Namibia

Good Morning Dinar Recaps,

BRICS NEWS: 4 NEW COUNTRIES SHOW INTEREST TO JOIN BRICS ALLIANCE

A total of four new countries have expressed their interest in joining the BRICS alliance this month. The number of countries that are ready to be a part of the bloc is only growing lately. The de-dollarization agenda, clubbed with a renewed consideration of local currencies is what’s attracting emerging economies into the bloc.

Four new nations have come forward officially expressing their intent to be a part of the BRICS alliance. The four countries that want to join the bloc are: Bolivia Columbia Libya Namibia.

While Bolivia is already a part of the BRICS alliance via the ‘Partner countries.’ It is now looking to be a full-time member. “BRICS is a new alternative that will be able to help first of all countries like Bolivia, but also many others,” said Foreign Minister Celinda Sosa. “This shows that there is a vision of integration, a multilateral vision where all countries have this opportunity,” she said.

Columbia, Libya, and Namibia are knocking on the doors of the BRICS alliance for an official membership. Nonetheless, the expansion could only happen in 2025 as the bloc started the new ‘Partner Countries’ initiative. Therefore, these countries are unlikely to be a part of the grouping this year or any time soon.

The BRICS alliance invited 13 new nations to join the bloc as ‘Partner Countries’ during the 16th summit in Kazan. Russian President Vladimir Putin confirmed that all the countries will officially become partners after they approve the invitation.

“The establishment of a new category of partner countries has become a significant conclusion of the Kazan Summit. The list of potential candidate countries was also agreed upon, to which the Russian presidency will send a relevant invitation,” said Putin.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

PAYPAL TAPS XOOM FOR CROSS-BORDER STABLECOIN PAYMENTS

The partnership is designed to expand access to PYUSD in Asian and African markets, PayPal said

PayPal has tapped Xoom to enable cross-border payments using its stablecoin, PayPal USD, the payments giant said on Nov. 19.

The partnership is designed to expand access to PYUSD in Asian and African markets and let PayPal settle cross-border transactions outside of traditional banking hours, PayPal said.

Xoom is working with Cebuana Lhuillier and Yellow Card to handle PYUSD disbursements.

“[S]tablecoins like PYUSD are changing the payments landscape, and by integrating our technology, they will be able to move money in the most effective way possible thanks to our stablecoin and payments infrastructure,” Chris Maurice, Yellow Card’s CEO, said in a statement.

Launched in 2023, PYUSD is backed 1:1 by US dollars and is issued by Paxos Trust Company, a United States-regulated crypto custodian. It competes with other regulated, dollar-backed stablecoins, such as Circle Internet Financial’s USDC.

An Ethereum-compatible ERC-20 token, PYUSD is the only stablecoin supported on PayPal’s payment rails. It is designed to be “available to an already large and growing community of external developers, wallets and Web3 applications” and easily onboarded by cryptocurrency exchanges, according to PayPal.

PayPal has been taking steps to expand PYUSD’s accessibility, including working with Anchorage Digital to launch a rewards program for clients who custody PayPal USD stablecoins with the crypto custodian.

In May, PayPal launched PYUSD on Solana, partnering with Crypto.com, Phantom and Paxos to on-ramp users onto the blockchain network.

It also partnered with Web3 infrastructure provider MoonPay to buy cryptocurrency using a PayPal account. That partnership extended to on-ramping users to crypto betting platform Polymarket in July.

Coinbase, which also has an institutional custody arm, incentivizes users to hold stablecoins on its platform as well. It currently offers approximately 5.2% annual percentage yield on USDC. Coinbase owns an equity stake in Circle.

Despite its recent successes, PYUSD still greatly lags behind dollar-pegged stablecoins USDT and USDC. According to data from CoinMarketCap, the two leading stablecoins command market capitalizations of some $128 billion and $37 billion, respectively.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

🌱 MELANIA TRUMP'S LAUNCH OF THE "ON THE MOVE" DIGITAL SERIES IS SIGNIFICANT FOR SEVERAL REASONS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Evening 11-19-24

Good Evening Dinar Recaps,

CHAINLINK COLLABORATES WITH MICROSOFT ON CBDC COMMISSIONED BY BRAZIL’S CENTRAL BANK

Blockchain oracle service provider Chainlink (LINK) is working on a pilot project for Brazil’s proposed central bank digital currency (CBDC) called DREX with Microsoft and other firms in the country.

In a press release, Chainlink says it is collaborating with Microsoft Brazil, digital bank Banco Inter and blockchain finance firm 7COMm to build a trade finance solution as part of the second phase of the DREX pilot.

Good Evening Dinar Recaps,

CHAINLINK COLLABORATES WITH MICROSOFT ON CBDC COMMISSIONED BY BRAZIL’S CENTRAL BANK

Blockchain oracle service provider Chainlink (LINK) is working on a pilot project for Brazil’s proposed central bank digital currency (CBDC) called DREX with Microsoft and other firms in the country.

In a press release, Chainlink says it is collaborating with Microsoft Brazil, digital bank Banco Inter and blockchain finance firm 7COMm to build a trade finance solution as part of the second phase of the DREX pilot.

The goal of the pilot, according to the announcement, is to “demonstrate the automated settlement of agricultural commodity transactions across borders, across platforms, and via different currencies.”

Chainlink will use its Cross-Chain Interoperability Protocol (CCIP) to create interoperability between Brazil’s Central Bank and other foreign banks using DREX, ensuring efficient transaction settlements.

The pilot also aims to tokenize an Electronic Bill of Lading (eBoL) – or receipts for cargo used by shippers and carriers – and put them on-chain using supply chain data to trigger payments to exporters.

Says Angela Walker, global head of banking and capital markets at Chainlink Labs,

“We look forward to working with the Central Bank of Brazil, Banco Inter, and Microsoft to demonstrate how the adoption of blockchain technology combined with Chainlink’s interoperability protocol CCIP can transform trade finance… Chainlink CCIP is essential to enabling secure cross-border, cross-currency, and cross-chain transactions and will help showcase what tokenized assets can do at scale for this key CBDC use case in Brazil.”

Chainlink’s CCIP technology was recently used by Swiss crypto firm Taurus in its proof-of-concept run with asset management giant State Street to tokenize funds.

Chainlink creator Sergey Nazarov recently predicted that CCIP would help real-world assets (RWAs) overtake the value of all other sectors in crypto, and become the main mechanisms that allows traditional finance to bring trillions of dollars into the blockchain industry.

“So this is kind of the world that I think we should all be preparing for, and that the Chainlink ecosystem is working towards, by both enabling DeFi to grow and be secure and reach the kind of level of reliability and guarantees that the DeFi community needs and that the TradFi community needs, and enabling the TradFi community’s value to flow onto blockchains and into the DeFi ecosystem eventually.

What this will result in, if it works as intended, is CCIP (cross-chain interoperability protocol) becoming one of the key protocols of the Internet, what we call the Internet of contracts and internet of value. Because CCIP is fundamentally the data and value transport mechanism by which that data and value flows into and across all of those chains.”

@ Newshounds News™

Source: The Daily Hodl

~~~~~~~~~

BRIAN ARMSTRONG PROPOSES US SOVEREIGN WEALTH FUND THAT PAYS AMERICANS DIVIDENDS THROUGH ELON MUSK’S D.O.G.E.

Coinbase co-founder and CEO Brian Armstrong is proposing a plan that would pay dividends to Americans while making the size of the government leaner.

Armstrong says on the social media platform X that President-elect Donald Trump’s proposed Department of Government Efficiency (DOGE) is a “once in a lifetime opportunity” to “cut the size of government back to health.”

According to the Coinbase CEO, America’s founding fathers may have failed to anticipate the tendency of politicians to promise more free stuff in an effort to get more votes.

“To future-proof this, we may need a constitutional amendment capping total government expenditure (at say 10%), or a way to align incentives.”

Armstrong says that the creation of a US sovereign wealth fund could potentially help in increasing federal government spending when necessary while curtailing expenditure over the long term.

“You’d ideally have a way to temporarily dial up burn (say in wartime), but still have the right incentives to not let spending get totally out of control longer term.

An example would be a US sovereign wealth fund, where every citizen gets a share (maybe people can buy more if they want), and any budget surplus pays a dividend.

Every citizen then has skin in the game. Maybe Congress gets a slightly larger stake.”

To support his argument for a leaner US federal government, the Coinbase CEO says,

“[Economist and Nobel laureate] Milton Friedman famously suggested the function of government be limited to:

1. Courts to enforce contracts and settle disputes.

2. Police to keep the peace at home (enforce laws, protect property rights).

3. Military for national defense.”

Billionaire tech mogul Elon Musk, who was handpicked by Trump to spearhead the Department of Government Efficiency (DOGE), responded to Armstrong saying, “Milton Friedman was great.”

Last week, President-elect Donald Trump announced he was appointing Musk and biotech entrepreneur, Vivek Ramaswamy, to lead DOGE shortly after his election. Trump said DOGE would help his administration’s quest to “dismantle government bureaucracy, slash excess regulations, cut wasteful expenditures and restructure federal agencies.”

@ Newshounds News™

Source: The Daily Hodl

~~~~~~~~~

🌱 BIG REWARDS FROM STAKING! WHAT IS IT? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 11-19-24

Good Afternoon Dinar Recaps,

STABLECOIN ISSUER PAXOS TO ACQUIRE FINLAND’S MEMBRANE FINANCE FOR EU ACCESS

Today stablecoin issuer Paxos said it acquired Finnish e-money institution Membrane Finance, the issuer of EURe. The deal gives Paxos a licensed e-money institution (EMI) enabling access to all EU states, subject to regulatory approval.

Paxos and its affiliates are already regulated in New York, Abu Dhabi and Singapore. Under Europe’s MiCA regulations crypto legislation, registration in one state is passported to all other member states.

Good Afternoon Dinar Recaps,

STABLECOIN ISSUER PAXOS TO ACQUIRE FINLAND’S MEMBRANE FINANCE FOR EU ACCESS

Today stablecoin issuer Paxos said it acquired Finnish e-money institution Membrane Finance, the issuer of EURe. The deal gives Paxos a licensed e-money institution (EMI) enabling access to all EU states, subject to regulatory approval.

Paxos and its affiliates are already regulated in New York, Abu Dhabi and Singapore. Under Europe’s MiCA regulations crypto legislation, registration in one state is passported to all other member states.

Paxos is the issuer of the PayPal stablecoin (PYUSD) and its own Paxos dollar (USDP). Its UAE affiliate has issued a yield bearing stablecoin. And in Singapore it recently launched the Global Dollar Network, which will share interest revenues on the USDG stablecoin with distribution partners.

“Stablecoins offer a global solution to challenges that countless people and companies feel when it comes to money movement and payments. Stablecoins are becoming increasingly more prevalent throughout the market as more use cases emerge for everyday users, “ said Walter Hessert, Head of Strategy at Paxos. “With Membrane, we expect to extend our reach to EU customers looking to benefit from stablecoins.”

Stablecoins in the EU

In terms of other stablecoin players, Circle historically had a strong presence in Europe (Ireland). It chose France as its base for MiCAR, directly registering as an EMI.

MiCA regulations require a high proportion of reserves to be held at banks – 30% for smaller stablecoins and 60% for significant ones. Tether claims this is the reason it has not registered in the EU. However, so far it has chosen to remain offshore, avoiding jurisdictions that require it to be regulated. A large part of Tether’s stablecoin balance is on TRON, a blockchain that’s popular in Africa.

Meanwhile, MiCAR also has some quite complicated rules limiting the scale of foreign currency stablecoins in the EU. However, this is widely misunderstood, so we previously provided a deep dive on the topic.

Bank issued stablecoins are also explored as part of our Research report on tokenized deposits and DLT payments.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

JOHN DEATON EMPHASIZES NEED FOR MODERNISED REGULATORY FRAMEWORK, CRITICIZES SEC OVER OUTDATED LAWS

In a latest X post, the pro-XRP lawyer, John Deaton has expressed concerns over the outdated regulatory framework applied by the US SEC in response to Michael Saylor’s interview. He shared that the SEC should be focused on ‘fraud, pump and dump schemes and the bad guys.’

The Need For Modernised Regulatory Framework

He pointed out that we are essentially applying 1933 disclosure laws in 2024 to modern-day technologies like AI, Robotics, Automation, and Blockchain and that the existing disclosure laws were meant to reduce the asymmetries between those offering investments and those acquiring investments.

He stressed that this was during a time when technologies like the internet did not exist. He asserted that the SEC should focus on clear and straightforward principles to guide the industry.

“People like Gary Gensler, Jay Clayton, and Bob Stebbins prefer the law and rules of the road to be vague. WE NEED REFORMERS AS REGULATORS LIKE Brian Brooks and Brad Bondi,” he noted.

Deaton’s remarks highlight the need for a modernized framework that accommodates emerging technologies.

Deaton’s ‘Dream Team’

Amidst the speculations of the current SEC Chair Gary Gensler’s resignation, Deaton has endorsed Brad Bondi as a suitable replacement. Deaton noted that Bondi represents a more balanced and progressive approach to regulatory oversight and voiced skepticism over other contenders, such as Bob Stebbins.

The US Treasury Secretary and the SEC Chairman are the two most important remaining positions to be filled. Deaton emphasized that these two selections must be compatible and complement each other to truly implement the America First Agenda envisioned by President Trump.

Elon Musk had recently suggested that Howard Lutnick might be the right choice for Treasury secretary but had also suggested others to provide input on who President Trump should select to be America’s next Treasury secretary.

Deaton expressed his views by stating:

“The Dream Team that would foster innovation in America, securing its place as the number one market in the world, causing an economic explosion in our capital, crypto, and IPO markets, while bolstering demand for the USD and ensuring its dominance around the world, while, at the same time, shaking things up and reforming the agencies is Brian Brooks as Treasury Secretary and Brad Bondi as SECGov Chairman.”

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

🌱 FEDERALIST TO SILVER AND VOTING | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Morning 11-19-24

Good Morning Dinar Recaps,

PHILIPPINES TO DISTRIBUTE TOKENIZED GOVERNMENT BONDS VIA GCASH WALLET, PDAX CRYPTO EXCHANGE

The Philippines government is about to embark on the next phase of its government bond tokenization path. Last year it tokenized bonds targeting institutional investors. That was followed by releasing 90 day Treasury Bills available to retail investors.

Now the Bureau of the Treasury is planning to distribute longer term tokenized Treasury Bonds, or GBonds, in December targeting consumers.

Good Morning Dinar Recaps,

PHILIPPINES TO DISTRIBUTE TOKENIZED GOVERNMENT BONDS VIA GCASH WALLET, PDAX CRYPTO EXCHANGE

The Philippines government is about to embark on the next phase of its government bond tokenization path. Last year it tokenized bonds targeting institutional investors. That was followed by releasing 90 day Treasury Bills available to retail investors.

Now the Bureau of the Treasury is planning to distribute longer term tokenized Treasury Bonds, or GBonds, in December targeting consumers.

Its primary distribution mechanisms will be via GCash and PDAX. GCash is the wallet app that has been used by 94 million people and was recently valued at $5 billion.

Ant, the owner of Alipay owns around a third of GCash parent Mynt and MUFG owns 8%. PDAX is a cryptocurrency exchange with around four million users that has already been distributing the Treasury Bills, with a minimum investment of 500 pesos ($8.52).

“We envision a future where investing in government bonds is no longer a luxury but a new normal for Filipinos — with just a few swipes away and as easy as ordering their favorite food delivery,” said Ralph Recto, the Philippines Secretary of Finance. “This empowers our people to effortlessly secure their future, all from the comfort of their homes.”

The government news agency said Recto called for GCash and PDAX to speed up the launch.

The country already has retail government bonds, but the minimum investment is ten times higher at 5,000 pesos. PDAX, who we suspect is providing the tokenization technology, says one of the key benefits is reducing the administration costs to support the smaller denominations.

In 2020, the government first explored using blockchain for retail government bonds and launched the Bonds.PH app in collaboration with UnionBank. Back then, the bank also partnered with PDAX for the blockchain aspect.

Other tokenized government bonds

Issuing tokenized government bonds as digital twins, or natively digital bonds, is becoming increasingly popular, although most still target institutions. Slovenia became the first European state to issue a digital bond, and the UK is planning one in the next two years. The largest digital government bod so far was a multicurrency green bond issuance worth $756m by Hong Kong.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

IOTA announces network upgrade for more real-world adoption

The IOTA Foundation has announced a sweeping upgrade to its blockchain network, aiming to improve scalability, decentralization, and real-world use cases.

Dubbed “IOTA Rebased,” the proposal will transition IOTA’s Layer 1 network to a Move-based object ledger, introducing programmability and enabling tens of thousands of transactions per second.

If approved by token holders, the upgrade will mark a shift to a delegated proof-of-stake mechanism with 150 permissionless validators to secure the network.

This move will replace IOTA’s (IOTA) existing architecture with a decentralized structure, allowing for faster and more secure transactions.

The proposal also incorporates the Move programming language, enabling smart contracts directly on the Layer 1 network.

This feature is designed to expand IOTA’s application in industries such as supply chain tracking, asset tokenization, and digital identity systems, according to the company.

IOTA has created a governance post so the community can discuss and debate the protocol upgrade. The vote will officially go live on December 2.

In August, IOTA introduced a blockchain-based tool to simplify music rights management in the film industry. Developed under the European Blockchain Pre-Commercial Procurement initiative, the tool aims to streamline negotiations and secure intellectual property rights.

Move ecosystem merge

Joining the Move ecosystem alongside platforms like Sui and Aptos, IOTA aims to leverage MoveVM’s capabilities while becoming the first Layer 1 network to adopt this architecture.

The IOTA Foundation has launched a Move-based testnet to showcase the upgrade’s potential, accompanied by tools for developers, including a browser wallet extension and updated documentation.

The economic model under the proposed system introduces staking rewards and a dynamic token supply. Validators and delegators will earn newly minted IOTA tokens with an initial annual inflation rate of 6-7%, translating to a projected 10-15% annual return for stakers, according to the company release.

This model aims to incentivize network participation while maintaining fair tokenomics through mechanisms like fee burning.

“This upgrade could significantly accelerate our adoption efforts by introducing programmability and full decentralization to IOTA. We believe this proposal has the best chance of delivering value for the IOTA ecosystem.” — Dominik Schiener, Co-Founder and Chair of the IOTA Foundation.

With the Rebased proposal, IOTA seeks to strengthen its position as a leading blockchain infrastructure, focusing on bridging decentralized technology with practical, real-world applications.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Evening 11-18-24

Good Evening Dinar Recaps,

GAMETA AND ROBIN ECOSYSTEM PARTNER TO ADVANCE WEB3 PAYMENT SOLUTIONS

Gameta, a top player in the GameFi market, has commenced an exclusive strategic collaboration with Robin Ecosystem. As per Gameta, the partnership intends to increase Web3 adoption with the merger of advanced payment technologies and gaming innovation. The platform disclosed this endeavor on its official X account.

Gameta’s Collaboration with Robin Ecosystem Marks a Revolution in Web3 Payments

In a recent post, Gameta mentioned that its collaboration with Robin Ecosystems focuses on revolutionizing Web3-based payment solutions.

Good Evening Dinar Recaps,

GAMETA AND ROBIN ECOSYSTEM PARTNER TO ADVANCE WEB3 PAYMENT SOLUTIONS

Gameta, a top player in the GameFi market, has commenced an exclusive strategic collaboration with Robin Ecosystem. As per Gameta, the partnership intends to increase Web3 adoption with the merger of advanced payment technologies and gaming innovation. The platform disclosed this endeavor on its official X account.

Gameta’s Collaboration with Robin Ecosystem Marks a Revolution in Web3 Payments

In a recent post, Gameta mentioned that its collaboration with Robin Ecosystems focuses on revolutionizing Web3-based payment solutions.

In this respect, this development increases the accessibility of GameFi and DeFi to a wider audience. Robin Ecosystem has obtained a significant position in the market with its inclusive payment platform. It has integrated its Robin Wallet with a social empowerment instrument Zapry.

By merging the social interaction capabilities and payment solutions, it targets offering a broad forum for Web3 exposure.

Gameta deals with blockchain-based gaming and GameFi. The latest partnership thereof with Robin Ecosystem serves as an opportunity to broaden its access and provide improved payment features.

The collaboration will potentially fortify the gaming ecosystem of Gameta with the integration of Robin Wallet’s consumer-friendly payment solutions. This enables streamlined transfers for rewards and purchases within the games.

Moreover, Zapry’s integration could also improve community engagement and player interaction, making the GameFi experience more immersive.

The Partnership Leads to the Next Wave of Growth in Blockchain Gaming

In line with Gameta’s announcement, the partnership mirrors a wider trend of ecosystem collaborations across the Web3 sector. By filling the gap between payment solutions and gaming, Robin Ecosystem and Gameta are paving the way for the next growth rally for blockchain gaming.

@ Newshounds News™

Source: Blockchain Reporter

~~~~~~~~~

XRP NEWS: LEGAL EXPERT SAYS SEC’S LATEST APPEAL HAS NOTHING TO DO WITH $125 MILLION PENALTY

Ripple has come a long way since its early days when reaching $1 seemed impossible. Now, with XRP surging past $1, some are even predicting that it could reach previous ATHs at $3.30. While this may sound far-fetched, recent rumors of SEC Chair Gary Gensler’s resignation and Ripple’s potential victory in its legal battle with the SEC have fueled speculation that XRP’s future could be brighter than ever.

Although Gensler’s resignation is still unconfirmed, the mere rumor has sparked a wave of optimism across the crypto space, with many hoping it signals a shift in the SEC’s stance on digital assets.

If true, it could open the door to greater adoption and investment in Ripple’s XRP. As the momentum continues to build, many are now watching closely to see if this rally is just the beginning of something much bigger for XRP.

Amid the uncertainty, one user claimed that the only remaining issue in the case is the settlement fee, with the SEC seeking more than $125 million. The user also claimed that XRP has already won the key point: it was ruled not to be a security.

But former SEC lawyer Marc Fagel disagreed, saying this view is inaccurate. He explained that the appeal isn’t about a “settlement fee,” as there’s no such thing. Instead, the SEC is appealing the ruling on programmatic sales, while Ripple is cross-appealing the decision on institutional sales.

Fagel wrote, “That’s not remotely accurate, sorry; the appeal has nothing to do with the penalty (there’s no such thing as a “settlement fee”). The SEC is appealing the liability finding for programmatic sales; Ripple is cross-appealing liability for institutional sales.”

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

SWIFT AND CHAINLINK UNLOCK GLOBAL ACCESS TO TOKENIZED ASSETS ACROSS 200+ COUNTRIES

▪️Chainlink and SWIFT will power tokenized fund recovery with a new solution.

▪️With defined roles from both firms, this solution can remove inefficiencies in the mutual fund market.

Building on their existing partnership, Chainlink (LINK) and SWIFT continue to push forward for the global adoption of Real-World Asset (RWA) tokenization. Chainlink, SWIFT, and UBS Asset Management recently highlighted their ongoing tokenization efforts via the Monetary Authority of Singapore’s (MAS) Project Guardian initiative.

How Institutions Can Access Tokenized Asset

Specifically, Chainlink, SWIFT, and UBS have unveiled an innovative pilot for settling tokenized fund subscriptions and redemptions. The solution will enable over 11,500 financial institutions across 200 countries to settle digital asset transactions, particularly tokenized funds.

How can 11,500+ institutions across 200+ countries access tokenized assets?@swiftcommunity, @UBS Asset Management, and #Chainlink showcase their major @MAS_sg Project Guardian work around tokenized fund settlement—a solution that is “extremely practical for commercializing” ↓ pic.twitter.com/U0zSp7RwDi — Chainlink (@chainlink) November 7, 2024

This latest advancement uses existing SWIFT infrastructure and Chainlink’s platform to settle fund subscriptions and redemptions. It calculates the preconditions for automatically minting or burning fund tokens for the UBS tokenized investment fund. This technique can improve operations and remove costly inefficiencies across the $63 trillion global mutual fund market.

During a panel session, Andrew Wong, Executive Director at UBS Asset Management, noted that SWIFT and Chainlink have facilitated the automatic minting and burning of UBS tokenized fund tokens.

He said the integration with SWIFT and Chainlink aims to enhance the payment efficiency of the UBS tokenized investment fund.

In a workflow chart, SWIFT Director Giles Goh explained how SWIFT acts as a transfer bridge for USB’s tokenized fund. He noted that the SWIFT transaction manager will implement a program-scheduled task to retrieve pending subscriptions and redemption from smart contracts.

Chainlink then receives the subscription details, such as the amount and funds distributor ID.

This is key to ensuring the entire flow from the USB-tokenized fund, Digital Transfer Agent (DTA), and Chainlink to the SWIFT network is coherent. Once the transactions come back down, SWIFT triggers a payment initiation or request.

The fund distributor receives this information and initiates a payment converted to a trackable inter-bank payment over SWIFT UETR. Payment fund delivery is confirmed through the SWIFT network and GPI tracker status update. Next, SWIFT triggers subscription and redemption state closure based on proof of funds delivery.

Chainlink calls the subscription redemption functions in the DTA through its Cross Chain Interoperability Platform (CCIP). Finally, CCIP sends and mints the tokens, fulfilling the entire redemption process. Chainlink’s co-founder Sergey Nazarov commented that the pilot opens up a universe of users, which will likely make the fund more successful.

LINK’s Price and Prediction

Meanwhile, Chainlink’s native asset, LINK, continues to move upward, following in Bitcoin’s footsteps.

At press time, LINK price was trading at $14.65, up 3.09% in the last 24 hours and 28.3% in the past 30 days. However, the daily trading volume decreased by 34.6% to $556.6 million, suggesting likely reduced investor interest in the short term.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

🌱 WHAT IS AN EXECUTIVE ORDER EO? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps