Seeds of Wisdom RV and Economic Updates Wednesday Morning 8-21-24

Good Morning Dinar Recaps,

IOTA Foundation Develops 3 Innovative Solutions for EU_EBSI Funded by European Commission

▪️The IOTA Foundation has introduced three groundbreaking products in collaboration with the European Commission to enhance transparency across various sectors by utilizing blockchain technology.

▪️The new tools include a Digital Product Passport for electronics, a Digital Product Passport for plastics, and an Intellectual Property Rights (IPR) management solution.

Good Morning Dinar Recaps,

IOTA Foundation Develops 3 Innovative Solutions for EU_EBSI Funded by European Commission

▪️The IOTA Foundation has introduced three groundbreaking products in collaboration with the European Commission to enhance transparency across various sectors by utilizing blockchain technology.

▪️The new tools include a Digital Product Passport for electronics, a Digital Product Passport for plastics, and an Intellectual Property Rights (IPR) management solution.

In the latest development, the IOTA Foundation recently developed three revolutionary products, which they launched in association with the European Commission. With these products, IOTA focuses on raising levels of transparency in numerous industries and sectors.

Moreover, these innovations come within the framework of the European Blockchain Pre-Commercial Procurement (PCP). For context, PCP focuses on developing enhanced solutions for blockchain. Let’s take a look at all three products from IOTA.

1. Digital Product Passport For Electronics (H2)

The DPP for electronics manages the lifecycle of electronic goods. The IOTA Foundation built it in collaboration with the Technical University of Catalonia and eReuse. This tool uses blockchain to ensure that all electronics right from manufacturing to its disassembling and recycling are well recorded.

The DPP addresses key stages in an electronic device’s lifecycle: procurement of the raw materials, manufacturing, utilization, and disposal of the product. Also, there is a record of each level of the process, which guarantees proper documentation of all information about the device regarding its chemical content, breakdowns, and recycling procedures.

Furthermore, effective record-keeping also boosts the area of accountability. The DPP prototype uses IOTA Smart Contracts in order to record key information and to easily track and validate the history of electronic products throughout the chain, per the CNF report.

2. Digital Product Passport For Plastics (H2)

To tackle the ecological concern of plastic waste, the IOTA Foundation has developed a DPP prototype designed specifically for agroplastic products like agricultural mulch films. For this initiative, IOTA has partnered with Digimarc and Agro2Circula, and together, they will work on tracing the journey of plastics right from use to reuse, recycling, and reuse as products, reported Crypto News Flash.

However, this operation is rather complex and implies the involvement of many parties, and its specifics depend on national legislation. Nonetheless, the solution gives a comprehensive account of the lifecycle of plastic. It also includes the journey in which the waste is disposed of through recycling and upcycling techniques.

This prototype by the IOTA Foundation provides proof of work in tracking the disposed plastic in a transparent and verifiable manner. As such, it assists in minimizing the effects of plastic waste on the environment.

3. Intellectual Property Rights (IPR) Management Solution (H2)

The third innovation is an identification model created to provide more efficient guidance on Intellectual Property Rights related to the media. IOTA was developed keeping in mind the complexity of the process of licensing music used in films. Thus, this tool uses distributed ledger technology and smart contracts for rights management and royalty payments.

The IPR Marketplace system relies on IOTA Smart Contracts that turn conventional negotiations and paperwork into digital contracts that self-execute and self-enforce. Furthermore, it ensures that rights holders can protect and claim their compensation in an orderly manner, reported CNF.

The system also supports Non-Fungible Tokens (NFTs), designed to ensure timely payment for everyone, from the performer to songwriters and record companies. These NFTs also enhance traceability and reduce disputes.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

isaac

Listen and learn from this man. He has facts and shares with us as we all wait. Share with others!

August 21, 2024 12:00 Central Noon, 1 pm ET

Listen Here - Podcast Room https://t.me/+VAm-AlWWqWPzyK8G

Replays - YouTube Currency Facts - YouTube

Directly from Isaac when ask for a bio

“But understand I do not have contacts. Isaac

"I have buyers the us treasury , DOD , Admiral , HSBC several big platforms that I have signed contracts with all and they paid already for the inspection several times" Isaac

See photos of Isaacs bonds here:

https://telegra.ph/Isaacs-Facts-and-Truth-08-03

@ Newshounds News™

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Evening 8-20-24

Good Evening Dinar Recaps,

Ripple Important Level of Contact with IMF Revealed in Fresh Palau Report

A recently released report on Palau’s National Government Payment Service has revealed a significant level of contact between Ripple and the International Monetary Fund (IMF).

Prominent XRP community member WrathofKahneman (WoK) unearthed this observation and highlighted it in a recent post on X.

Notably, the report from Palau highlighted the successful completion of Phase 2a of the country’s digital payment initiative. For context, this initiative focuses on developing a stablecoin service, “PSC.” Palau is carrying out this project in collaboration with Ripple, utilizing the XRP Ledger (XRPL).

Good Evening Dinar Recaps,

Ripple Important Level of Contact with IMF Revealed in Fresh Palau Report

A recently released report on Palau’s National Government Payment Service has revealed a significant level of contact between Ripple and the International Monetary Fund (IMF).

Prominent XRP community member WrathofKahneman (WoK) unearthed this observation and highlighted it in a recent post on X.

Notably, the report from Palau highlighted the successful completion of Phase 2a of the country’s digital payment initiative. For context, this initiative focuses on developing a stablecoin service, “PSC.” Palau is carrying out this project in collaboration with Ripple, utilizing the XRP Ledger (XRPL).

This recently completed phase analyzed stakeholder requirements in six key socioeconomic areas to develop a framework for a convenient and accessible national payment ecosystem, especially for the unbanked and underbanked.

Additionally, the Palau digital payment system seeks to emulate the services of PayPal and Alipay in ways that precisely fit the context of Palau’s needs.

Its goals are reducing cash reliance, lowering fuel consumption and travel time, and offering lower fees. The report also reviews the pilot program, incorporating feedback and recommendations for a phased nationwide rollout.

Ripple’s Important Level of Contact with IMF

What stands out in this latest report is the inclusion of the IMF Technical Assistance Team among the stakeholders consulted for the project. According to WrathofKahneman, this points to an important level of technical engagement between Ripple and the IMF.

WoK emphasized the significance of this connection, noting that while the XRP community has long been aware of Ripple’s discussions with the IMF, this report serves as tangible evidence of their collaboration on a practical level.

Furthermore, WoK strengthens his argument by pointing out that the IMF’s recommendations align closely with the objectives of Palau’s National Payment System, which Ripple is helping to develop.

The IMF’s focus on enhancing financial resilience, improving payment systems, and carefully approaching fintech innovations mirrors the goals of the Ripple-Palau collaboration.

WoK believes this alignment suggests that Ripple’s involvement is not just incidental but deeply integrated with IMF-led financial strategies in the region, reinforcing the idea of meaningful contact between Ripple and the IMF.

Essentially, this revelation reinforces the idea that Ripple is not just working in isolation but is actively engaging with major global financial institutions like the IMF.

Such collaborations could pave the way for Ripple to play a more central role in future financial systems, particularly in regions where digital innovation and financial modernization are priorities.

@ Newshounds News™

Source: The Crypto Basic

~~~~~~~~~

RFK Jr.'s campaign may drop out to support Trump, says running mate Nicole Shanahan

Both candidates have adopted a pro-crypto position; their collaboration could create a powerful narrative in the 2024 election.

Key Takeaways

▪️ Kennedy's campaign is evaluating a potential endorsement of Trump to avoid splitting votes.

▪️ Trump has become a pro-crypto candidate, promising to support the industry.

Pro-crypto presidential candidate Robert F. Kennedy Jr.’s campaign is mulling quitting the election bid and joining forces with Donald Trump, said Nicole Shanahan, Kennedy’s running mate, on Tom Bilyeu’s Impact Theory podcast. Shanahan’s statements were first shared by Collin Rugg, Trending Politics’ co-owner.

Dropping out of the election race is just one of two possible outcomes. Shanahan said Kennedy’s campaign is also considering continuing their third-party bid, but it comes at the risk of splitting votes with Trump, which could benefit Kamala Harris’ campaign.

“There are two options that we’re currently looking at and one is staying in and forming that new party, but we run the risk of a Kamala Harris and Waltz presidency because we draw votes from Trump,” Shanahan stated.

“Or we walk away right now and join forces with Donald Trump,” she noted, adding that it would not be an easy decision and they would need to justify it to their supporters.

According to Politico, Kennedy’s campaign is struggling financially, with $3.9 million in cash and $3.5 million in debt as of July 2024. Despite efforts to boost fundraising, the campaign’s expenditures have consistently outstripped its income.

If Kennedy’s campaign team chooses to collaborate with Trump’s team, that could create a powerful narrative in the 2024 election as both two figures have adopted a pro-crypto stance.

Trump has positioned himself as a pro-crypto candidate, pledging to retain all Bitcoin held by the US government and to ease regulatory pressures on the crypto industry.

Harris’ position on crypto is unclear, though reports indicate that her campaign team has been working to reconnect with the industry in recent weeks.

Despite crypto’s growing popularity, its potential impact on voting behavior remains uncertain. Voters often make decisions heavily influenced by key issues like economic conditions.

Harris has recently faced criticism for her new economic proposals, with figures like former Obama economist Jason Furman questioning the practicality and sensibility of her plans.

Following her speech on these proposals, Harris’ odds of winning the election dropped to 49% on the decentralized prediction marketplace Polymarket, while Trump’s odds saw a corresponding surge to 49%.

@ Newshounds News™

Source: Crypto Briefing

~~~~~~~~~

Listen and learn from this man. He has facts and shares with us as we all wait. Share with others!

August 21, 2024 12:00 Central Noon, 1 pm ET

Listen Here - Podcast Room https://t.me/+VAm-AlWWqWPzyK8G

Replays - YouTube Currency Facts - YouTube

Directly from Isaac when ask for a bio

“But understand I do not have contacts. Isaac

"I have buyers the us treasury , DOD , Admiral , HSBC several big platforms that I have signed contracts with all and they paid already for the inspection several times" Isaac

See photos of Isaacs bonds here:

https://telegra.ph/Isaacs-Facts-and-Truth-08-03

@ Newshounds News™

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 8-20-24

Good Afternoon Dinar Recaps,

Bank of England to develop analytics data platform for ISO 20022

The Bank of England is working with the BIS Innovation Hub London centre on a project that will explore how technology can enhance the analytical use of ISO 20022 data to shed light on economic conditions, system liquidity and compliance.

The increased use of ISO 20022 standards for payment messages in Real Time Gross Settlement (RTGS) systems means many central banks will adopt the protocol in the coming years. The UK's high value payments system Chaps completed the cutover to the new data standard in June last year.

Project Keystone aims to develop a standardised data analytics platform focused on ISO 20022 data. As part of the project, two modules will be developed.

Good Afternoon Dinar Recaps,

Bank of England to develop analytics data platform for ISO 20022

The Bank of England is working with the BIS Innovation Hub London centre on a project that will explore how technology can enhance the analytical use of ISO 20022 data to shed light on economic conditions, system liquidity and compliance.

The increased use of ISO 20022 standards for payment messages in Real Time Gross Settlement (RTGS) systems means many central banks will adopt the protocol in the coming years. The UK's high value payments system Chaps completed the cutover to the new data standard in June last year.

Project Keystone aims to develop a standardised data analytics platform focused on ISO 20022 data. As part of the project, two modules will be developed.

The first will address the complexities of handling the ISO 20022 data structure and the associated data storage requirements, and the second will provide analysis based on the data.

Keystone is intended to become an off-the-shelf component that payment system operators can integrate into their own systems.

The Bank of England believes that Keystone's support of analytics capabilities could enable payment system operators to utilize the enriched data contained within the ISO 20022 message scheme for greater understanding of economic conditions, system liquidity, and compliance with ISO 20022 standards.

In addition, as Keystone will create a standardised data platform, future users will be able to create and share additional analytics capabilities within the central banking community.

@ Newshounds News™

Source: FinExtra

~~~~~~~~~

Nigerian tax authority to introduce crypto regulation bill in September: report

The Federal Inland Revenue Service, Nigeria’s tax authority, plans to introduce a bill to regulate the cryptocurrency sector by the end of 2024.

Speaking at a recent stakeholder engagement session with the National Assembly’s Finance Committees, FIRS Executive Chairman Zacch Adedeji said the country is set to propose a bill that would introduce laws to regulate the crypto sector, mitigate the risks involved, and benefit the nation’s economy, according to a Vanguard report.

Zacch Adedeji, Executive Chairman of the Federal Inland Revenue Service:

“Today, we cannot run away from cryptocurrency. But as we are here today, there is no law anywhere in Nigeria that regulates cryptocurrency. But it is the new thing that is happening, and we cannot run away from them.”

The new regulation is part of a broader effort to modernize existing laws in the taxation system to keep up with Nigeria‘s evolving economic landscape. Adedeji urged the FIRS’s collaboration with lawmakers to implement the bill, with the first iteration expected to be introduced in September.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

Time is NOON CST

Listen Here: Podcast Call Link

Isaac's Room Link

Replay YouTube Link

@ Newshounds News™

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Morning 8-20-24

Good Morning Dinar Recaps,

US federal agencies are planning to redefine 'money' to include crypto in reporting rules

Federal regulators aim to treat crypto and traditional currency equally for financial institution reporting.

Key Takeaways

▪️US agencies aim to treat cryptocurrencies as traditional money for reporting purposes.

▪️Final rulemaking on crypto as money expected by September 2025.

Good Morning Dinar Recaps,

US federal agencies are planning to redefine 'money' to include crypto in reporting rules

Federal regulators aim to treat crypto and traditional currency equally for financial institution reporting.

Key Takeaways

▪️US agencies aim to treat cryptocurrencies as traditional money for reporting purposes.

▪️Final rulemaking on crypto as money expected by September 2025.

Several top US federal agencies are collaborating to revise the definition of “money” to strengthen reporting requirements for financial institutions handling domestic and cross-border cryptocurrency transactions.

The US Department of the Treasury’s semiannual regulatory agenda, released on August 16, reveals an upcoming federal effort to level the regulatory playing field for cryptocurrencies and traditional fiat currency.

The Board of Governors of the Federal Reserve System and the Financial Crimes Enforcement Network intend to revise the meaning of “money” used in the Bank Secrecy Act.

According to the agenda, the agencies aim to ensure that the rules apply to transactions involving convertible virtual currency, defined as a medium of exchange that either has an equivalent value as currency or acts as a substitute for currency, but lacks legal tender status.

The proposal will also extend reporting requirements to digital assets with legal tender status, including central bank digital currencies.

The final notice of proposed rulemaking is currently scheduled for September 2025, subject to clearance. This move comes as the US government recently shifted approximately 10,000 Bitcoin linked to a dated Silk Road raid on August 14.

In addition to crypto, the Department of Justice is actively amending regulations and legal mandates for artificial intelligence.

On August 7, the DOJ asked the United States Sentencing Commission to update its guidelines to provide additional penalties for crimes committed with the aid of AI.

These recommendations seek to expand beyond established guidelines and apply to any crime aided or abetted by simple algorithms.

In June, the US Supreme Court overturned the Chevron doctrine, significantly affecting the SEC’s regulatory authority over crypto policies.

In May, the US Treasury and IRS introduced new tax regulations for crypto brokers, requiring transaction reporting and record-keeping of token costs starting in 2026.

Earlier this month, Senators Wyden and Lummis criticized the DOJ’s treatment of crypto software services as equivalent to unlicensed money-transmitting businesses, highlighting potential conflicts with the First Amendment.

This regulatory push reflects the growing recognition of crypto and digital assets as significant components of the financial system. By aligning reporting requirements for crypto with those of traditional currency, regulators aim to enhance transparency and combat potential illicit activities in the crypto space.

@ Newshounds News™

Source: CryptoBriefing and Federal Register

~~~~~~~~~

IOTA News: Tangle Treasury Implements New Anti-Fraud Measures to Protect Grant Distribution

▪️ The Tangle Treasury has implemented significant improvements in data and financial security, introducing a new anti-money laundering (AML) and counter-terrorist financing (CTF) policy.

▪️ Nicole O’Brien will lead as the AML/CTF officer for IOTA’s Tangle Treasury, overseeing adherence to best practices, improving internal protocols, and training staff.

The IOTA and Shimmer communities received an important update from the Tangle Treasury regarding the enhanced backend improvements.

The latest advancements currently focus on boosting data and financial security while refining proposal reviews and grant management processes.

Thus, in an effort to mitigate risks associated with fund allocations, the Tangle Treasury unveiled a new counter-terrorist financing (CTF) and anti-money laundering (AML) policy.

The broader goal here is to safeguard the Treasury’s primary mission of issuing grants to other promising projects while minimizing the risk of the funds falling into the hands of scammers and other malicious players.

These improved screening features will further enhance the Treasury’s operational efficiency while protecting community investments. As we know, the Tangle Treasury has made significant strides in enhancing internal processes while ensuring community funds’ safety.

With its AML and CTF policy, Tangle DAO has also implemented additional protective measures such as conducting rigorous background checks and enhanced know-your-customer (KYC) procedures for all the proponents as well as grant recipients such as proof-of-address, proof of identity, screening against sanction lists from major countries and blocs, as well as checks for politically exposed persons (PEP).

IOTA Tangle Treasury Appoints Nicole O’Brien

In order to oversee all these processes, IOTA’s Tangle Treasury has appointed Nicole O’Brien as its CTF/AML officer. In her role, O’Brien will ensure adherence to best practices, enhance internal protocols and provide training for staff members.

These advancements, along with improved data security, bookkeeping, and the introduction of standard operating procedures (SOPs) for finance administration and grant management, will help boost the Tangle Treasury’s efficiency and professionalism.

Further updates, including a call for new proposals, will likely come in the coming weeks.

The IOTA Tangle is an innovative form of Distributed Ledger Technology (DLT) specifically created for Web3 while using a unique structure based on directed acyclic graphs (DAG) instead of the conventional blockchain model, per the CNF report.

Recently, IOTA has put a major focus on enhancing trust and security, especially for its Identity wallets, per the CNF report.

Also, the European Identity Wallet seeks to transform the Identity verification process by allowing users to log into websites without passwords while securely sharing verified information with simplicity.

In collaboration with the European Commission, IOTA has introduced a new prototype solution using distributed ledger technology (DLT) in order to boost the management of the intellectual property rights marketplace while allowing users to utilize automated, transparent digital contracts, eliminating the need for traditional negotiations, reported CNF.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Cardano Founder Charles Hoskinson Launches $1 Million Bug Bounty Challenge Ahead of the Chang Hard Fork

▪️ Charles Hoskinson, Cardano’s co-founder, has announced a $1 million prize for hackers who successfully breach its newly introduced Lace Paper Wallet.

▪️ At the Rare Evo 2024 event, Hoskinson highlighted the upcoming Chang hard fork and the transition to the Voltaire Era.

Cardano’s (ADA) Charles Hoskinson has announced a $1 million bug bounty challenge to the ADA community pending the implementation of the long-awaited Chang Hard Fork.

Speaking at the recent Rare Evo 2024 event, Hoskinson announced that the newly introduced Lace Paper Wallet would be the object at the center of this challenge, with participants expected to breach its defense.

The Lace Paper Wallet Bug Bounty Program would run until the end of 2024, or someone successfully breaches its security and retrieves the Non-Fungible Tokens (NFT) inside.

The Web3 wallet was developed by Cardano’s (ADA) parent company, Input Output Global (IOG), with Paper Wallet integrated to beef up its security. According to reports, the added features would enable users possessing PGP keys to use a single encrypted QR code to restore their wallet.

This is, I think, the most secure paper wallet ever generated in the history of our industry.

In a video posted on X on August 17, Hoskinson expressed confidence in the wallet, boasting of its protection against attacks that encourage malicious actors to gain control of private keys to facilitate an authorized transaction.

Hoskinson Highlights Other Updates in the Cardano

At the Rare Evo 2024 event , Hoskinson highlighted the demonstration of the powerful scaling solution, Hydra, featuring the classic game “Doom”.

According to experts, this underscores its capabilities of handling high-throughput, real-time applications. Also, the expected Voltaire Era, which the Chang Hard Fork would introduce, was highlighted.

As we explained earlier, this upgrade would transfer governance controls to the community. According to Cardano’s Emurgo, the first phase was initiated in July 2024 with the next part expected in the fourth quarter of 2024 (Q4 2024).

The Chang Hard Fork is a technical component of the Voltaire era of the Cardano roadmap, which focuses on implementing a sustainable and distributed governance framework. With the first part set to be initiated in July 2024, the next part of the Hard Fork upgrade is set to happen by Q4 of this year.

The second phase would mark the full-force decentralized governance and an exit from the technical bootstrapping phase.

The Delegate Representatives (DReps) are also expected to be introduced as a governance body. In addition to the possibility of the SPOs voting on governance actions, a Constitutional Committee would be online to grow membership above the seven of the interim committee.

Finally, the community will take charge of the Treasury withdrawal.

Cardano users will be able to propose treasury debits via governance actions. The three bodies (Constitutional Committee, DReps, and SPOs) will vote on them, and if approved, ADA will be moved out of the treasury.

From that point forward, the future of the Cardano blockchain will be in the hands of its community, along with its power to draft and ratify the Cardano Constitution. This will mark a monumental step not only for the network but also for the blockchain industry as a whole, as Cardano will be the first truly distributed and community-run blockchain network.

At press time, ADA was trading at $0.33, having declined by 2% in the last 24 hours.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Afternoon 8-19-24

Good Afternoon Dinar Recaps,

US federal agencies are planning to redefine 'money' to include crypto in reporting rules

Federal regulators aim to treat crypto and traditional currency equally for financial institution reporting.

Key Takeaways

▪️US agencies aim to treat cryptocurrencies as traditional money for reporting purposes.

▪️Final rulemaking on crypto as money expected by September 2025.

Several top US federal agencies are collaborating to revise the definition of “money” to strengthen reporting requirements for financial institutions handling domestic and cross-border cryptocurrency transactions.

The US Department of the Treasury’s semiannual regulatory agenda, released on August 16, reveals an upcoming federal effort to level the regulatory playing field for cryptocurrencies and traditional fiat currency.

Good Afternoon Dinar Recaps,

US federal agencies are planning to redefine 'money' to include crypto in reporting rules

Federal regulators aim to treat crypto and traditional currency equally for financial institution reporting.

Key Takeaways

▪️US agencies aim to treat cryptocurrencies as traditional money for reporting purposes.

▪️Final rulemaking on crypto as money expected by September 2025.

Several top US federal agencies are collaborating to revise the definition of “money” to strengthen reporting requirements for financial institutions handling domestic and cross-border cryptocurrency transactions.

The US Department of the Treasury’s semiannual regulatory agenda, released on August 16, reveals an upcoming federal effort to level the regulatory playing field for cryptocurrencies and traditional fiat currency.

The Board of Governors of the Federal Reserve System and the Financial Crimes Enforcement Network intend to revise the meaning of “money” used in the Bank Secrecy Act.

According to the agenda, the agencies aim to ensure that the rules apply to transactions involving convertible virtual currency, defined as a medium of exchange that either has an equivalent value as currency or acts as a substitute for currency, but lacks legal tender status.

The proposal will also extend reporting requirements to digital assets with legal tender status, including central bank digital currencies.

The final notice of proposed rulemaking is currently scheduled for September 2025, subject to clearance. This move comes as the US government recently shifted approximately 10,000 Bitcoin linked to a dated Silk Road raid on August 14.

In addition to crypto, the Department of Justice is actively amending regulations and legal mandates for artificial intelligence.

On August 7, the DOJ asked the United States Sentencing Commission to update its guidelines to provide additional penalties for crimes committed with the aid of AI. These recommendations seek to expand beyond established guidelines and apply to any crime aided or abetted by simple algorithms.

In June, the US Supreme Court overturned the Chevron doctrine, significantly affecting the SEC’s regulatory authority over crypto policies.

In May, the US Treasury and IRS introduced new tax regulations for crypto brokers, requiring transaction reporting and record-keeping of token costs starting in 2026.

Earlier this month, Senators Wyden and Lummis criticized the DOJ’s treatment of crypto software services as equivalent to unlicensed money-transmitting businesses, highlighting potential conflicts with the First Amendment.

This regulatory push reflects the growing recognition of crypto and digital assets as significant components of the financial system. By aligning reporting requirements for crypto with those of traditional currency, regulators aim to enhance transparency and combat potential illicit activities in the crypto space.

@ Newshounds News™

Source: CryptoBriefing and Federal Register

~~~~~~~~~

IOTA News: Tangle Treasury Implements New Anti-Fraud Measures to Protect Grant Distribution

▪️ The Tangle Treasury has implemented significant improvements in data and financial security, introducing a new anti-money laundering (AML) and counter-terrorist financing (CTF) policy.

▪️ Nicole O’Brien will lead as the AML/CTF officer for IOTA’s Tangle Treasury, overseeing adherence to best practices, improving internal protocols, and training staff.

The IOTA and Shimmer communities received an important update from the Tangle Treasury regarding the enhanced backend improvements. The latest advancements currently focus on boosting data and financial security while refining proposal reviews and grant management processes.

Thus, in an effort to mitigate risks associated with fund allocations, the Tangle Treasury unveiled a new counter-terrorist financing (CTF) and anti-money laundering (AML) policy.

The broader goal here is to safeguard the Treasury’s primary mission of issuing grants to other promising projects while minimizing the risk of the funds falling into the hands of scammers and other malicious players.

These improved screening features will further enhance the Treasury’s operational efficiency while protecting community investments. As we know, the Tangle Treasury has made significant strides in enhancing internal processes while ensuring community funds’ safety.

With its AML and CTF policy, Tangle DAO has also implemented additional protective measures such as conducting rigorous background checks and enhanced know-your-customer (KYC) procedures for all the proponents as well as grant recipients such as proof-of-address, proof of identity, screening against sanction lists from major countries and blocs, as well as checks for politically exposed persons (PEP).

IOTA Tangle Treasury Appoints Nicole O’Brien

In order to oversee all these processes, IOTA’s Tangle Treasury has appointed Nicole O’Brien as its CTF/AML officer. In her role, O’Brien will ensure adherence to best practices, enhance internal protocols and provide training for staff members.

These advancements, along with improved data security, bookkeeping, and the introduction of standard operating procedures (SOPs) for finance administration and grant management, will help boost the Tangle Treasury’s efficiency and professionalism. Further updates, including a call for new proposals, will likely come in the coming weeks.

The IOTA Tangle is an innovative form of Distributed Ledger Technology (DLT) specifically created for Web3 while using a unique structure based on directed acyclic graphs (DAG) instead of the conventional blockchain model, per the CNF report.

Recently, IOTA has put a major focus on enhancing trust and security, especially for its Identity wallets, per the CNF report.

Also, the European Identity Wallet seeks to transform the Identity verification process by allowing users to log into websites without passwords while securely sharing verified information with simplicity.

In collaboration with the European Commission, IOTA has introduced a new prototype solution using distributed ledger technology (DLT) in order to boost the management of the intellectual property rights marketplace while allowing users to utilize automated, transparent digital contracts, eliminating the need for traditional negotiations, reported CNF.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Cardano Founder Charles Hoskinson Launches $1 Million Bug Bounty Challenge Ahead of the Chang Hard Fork

▪️ Charles Hoskinson, Cardano’s co-founder, has announced a $1 million prize for hackers who successfully breach its newly introduced Lace Paper Wallet.

▪️ At the Rare Evo 2024 event, Hoskinson highlighted the upcoming Chang hard fork and the transition to the Voltaire Era.

Cardano’s (ADA) Charles Hoskinson has announced a $1 million bug bounty challenge to the ADA community pending the implementation of the long-awaited Chang Hard Fork.

Speaking at the recent Rare Evo 2024 event, Hoskinson announced that the newly introduced Lace Paper Wallet would be the object at the center of this challenge, with participants expected to breach its defense.

The Lace Paper Wallet Bug Bounty Program would run until the end of 2024, or someone successfully breaches its security and retrieves the Non-Fungible Tokens (NFT) inside.

The Web3 wallet was developed by Cardano’s (ADA) parent company, Input Output Global (IOG), with Paper Wallet integrated to beef up its security. According to reports, the added features would enable users possessing PGP keys to use a single encrypted QR code to restore their wallet.

This is, I think, the most secure paper wallet ever generated in the history of our industry.

In a video posted on X on August 17, Hoskinson expressed confidence in the wallet, boasting of its protection against attacks that encourage malicious actors to gain control of private keys to facilitate an authorized transaction.

Hoskinson Highlights Other Updates in the Cardano

At the Rare Evo 2024 event , Hoskinson highlighted the demonstration of the powerful scaling solution, Hydra, featuring the classic game “Doom”.

According to experts, this underscores its capabilities of handling high-throughput, real-time applications. Also, the expected Voltaire Era, which the Chang Hard Fork would introduce, was highlighted.

As we explained earlier, this upgrade would transfer governance controls to the community. According to Cardano’s Emurgo, the first phase was initiated in July 2024 with the next part expected in the fourth quarter of 2024 (Q4 2024).

The Chang Hard Fork is a technical component of the Voltaire era of the Cardano roadmap, which focuses on implementing a sustainable and distributed governance framework. With the first part set to be initiated in July 2024, the next part of the Hard Fork upgrade is set to happen by Q4 of this year.

The second phase would mark the full-force decentralized governance and an exit from the technical bootstrapping phase. The Delegate Representatives (DReps) are also expected to be introduced as a governance body.

In addition to the possibility of the SPOs voting on governance actions, a Constitutional Committee would be online to grow membership above the seven of the interim committee.

Finally, the community will take charge of the Treasury withdrawal.

Cardano users will be able to propose treasury debits via governance actions. The three bodies (Constitutional Committee, DReps, and SPOs) will vote on them, and if approved, ADA will be moved out of the treasury.

From that point forward, the future of the Cardano blockchain will be in the hands of its community, along with its power to draft and ratify the Cardano Constitution.

This will mark a monumental step not only for the network but also for the blockchain industry as a whole, as Cardano will be the first truly distributed and community-run blockchain network.

At press time, ADA was trading at $0.33, having declined by 2% in the last 24 hours.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Morning 8-19-24

Good Morning Dinar Recaps,

U.S. Government’s Crypto Holdings: Everything You Must Know

Arkham Intelligence shows that a wallet tied to the U.S. government is sitting on a hefty stash of cryptocurrency. A massive fortune can heavily influence the markets, and we have previously seen how the German Government’s Bitcoin sell-off affected the markets. Amid the political drama and crypto confusion, let’s find out how much the U.S. Government holds.

Good Morning Dinar Recaps,

U.S. Government’s Crypto Holdings: Everything You Must Know

Arkham Intelligence shows that a wallet tied to the U.S. government is sitting on a hefty stash of cryptocurrency. A massive fortune can heavily influence the markets, and we have previously seen how the German Government’s Bitcoin sell-off affected the markets. Amid the political drama and crypto confusion, let’s find out how much the U.S. Government holds.

When we say hefty, think 203,200 BTC, which clocks in at roughly $12 billion, along with 50,200 ETH, worth around $130 million. On top of that, the address holds 750.7 wBTC, valued at about $44.41 million, plus a variety of other tokens. Altogether, the total value of the assets is estimated to be around $12.4 billion.

Jackson Hole Symposium

@ Newshounds News™

Read More: https://telegra.ph/Jackson-Hole-Symposium-08-19

~~~~~~~~~

Mastercard to cut around 1000 jobs - Bloomberg

@ Newshounds News™

Source: https://telegra.ph/Mastercard-to-cut-around-1000-jobs---Bloomberg-08-19

~~~~~~~~~

Jackson Hole Economic Policy Symposium The 2024 Economic Policy Symposium. "Reassessing the Effectiveness and Transmission of Monetary Policy," will be held Aug. 22-24.

@ Newshounds News™

Source: https://telegra.ph/Jackson-Hole-Addressing-policy-challenges-and-marking-milestones-08-19

~~~~~~~~~

Crypto Market Jitters Amid Political Drama

This discovery comes at a rather tense time, with the U.S. political landscape adding more fuel to the already unpredictable crypto market. Vice President Kamala Harris has thrown her support behind the digital currencies, echoing the vision of the Democratic President-Elect.

But here’s the kicker: the current administration doesn’t seem to be on the same page. The government’s recent $2 billion crypto sell-off has stirred the pot, contradicting the pro-crypto stance many expected.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

Dubai court recognizes crypto as a valid salary payment

UAE lawyer Irina Heaver said the ruling shows the growing acceptance of crypto in employment contracts, recognizing the evolving nature of Web3 financial transactions.

In a significant update to the United Arab Emirates’ judiciary approach to crypto, the Dubai Court of First Instance recognizes salary payments in crypto as valid under employment contracts.

Irina Heaver, a partner at UAE law firm NeosLegal, explained that the ruling in case number 1739 of 2024 shows a shift from the court’s earlier stance in 2023, where a similar claim was denied because the crypto involved lacked precise valuation.

Heaver believes this shows a “progressive approach” to integrating digital currencies into the country’s legal and economic framework.

Dubai court recognizes inclusion of tokens in salary

Heaver said that the case involved an employee who filed a lawsuit claiming that the employer had not paid their wages, wrongful termination compensation and other benefits.

The worker’s employment contract stipulated a monthly salary in fiat and 5,250 in EcoWatt tokens. The dispute stems from the employer’s inability to pay the tokens portion of the employee’s salary in six months.

In 2023, the court acknowledged the inclusion of the EcoWatts tokens in the contract. Still, it did not enforce the payment in crypto, as the employee failed to provide a clear method for valuing the currency in fiat terms.

“This decision reflected a traditional viewpoint, emphasizing the need for concrete evidence when dealing with unconventional payment forms,” Heaver said.

However, the lawyer said that in 2024, the court “took a step forward,” ruling in favor of the employee and ordering the payment of the crypto salary as per the employment contract without converting it into fiat. Heaver said:

“This decision reflects a broader acceptance of cryptocurrency in employment contracts and highlights the court’s recognition of the evolving nature of financial transactions within the Web3 economy.”

Heaver added that the court’s reliance on the UAE Civil Transactions Law and Federal Decree-Law No. 33 of 2021 in both judgments shows the consistent application of legal principles in wage determination. 🍳

Far-reaching implications for UAE crypto adoption

According to Heaver, the decision also sets a positive precedent that encourages the further integration of digital currencies in everyday financial transactions. The lawyer believes that this fosters a more inclusive and innovative business environment. Heaver said:

“This ruling affirms that if an employment contract includes such terms, both the company and the employee must honor them. It is reassuring to see the court recognize that wages, whether paid in fiat or cryptocurrency, are the rightful entitlement of the employee for their agreed-upon work.”

Heaver added that it’s a win for employees and a significant step forward in the UAE’s journey toward becoming a digital economy leader.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 8-18-24

Good Afternoon Dinar Recaps,

Colorado Church group tokenizes $2.5M chapel

This may be the first tokenized church in the world.YEP

A network of affiliated church groups called the “Colorado House of Prayer” has tokenized its main chapel in an effort to purchase the $2.5 million building.

The pastor heading the project, Blake Bush, says he was compelled by a higher power to use blockchain technology as a tool for advancing the group’s mission.

Good Afternoon Dinar Recaps,

Colorado Church group tokenizes $2.5M chapel

This may be the first tokenized church in the world.YEP

A network of affiliated church groups called the “Colorado House of Prayer” has tokenized its main chapel in an effort to purchase the $2.5 million building.

The pastor heading the project, Blake Bush, says he was compelled by a higher power to use blockchain technology as a tool for advancing the group’s mission.

Tokenize the building

According to a report from Forbes, Bush’s congregation and other church groups had been renting the building from its owner, a local businessperson who also owns a car dealership.

The 11,457-square-foot building, called “Old Stone Church” due to its stone exterior, was purchased by its current owner in 2022 at a cost of $2.2 million. Reportedly, Bush and the Colorado House of Prayer group intend to purchase the building for $2.5 million

Bush says he came up with the idea of tokenizing the building — putting it on the blockchain as a digital asset that can be split into shares — after a spiritual experience.

“I heard the Lord say, ‘tokenize the building,'" Bush told Forbes, later adding that he had been “praying for this for years” and that God had told him to “go get my house.”

Blockchain and real estate

In order to accomplish his holy mission, Bush and the group created “Stone Coin,” a digital asset used to raise money for the purchase of Old Stone Church. The coin is tied to a real estate token created by REtokens and running on the Polymesh private blockchain.

Like any tokenization project, the results will depend on the amount of positive token-flow and reactive value. The project is reportedly seeking investors after having raised about half of its goal.

In the future the token’s board, which includes Bush and other religious leaders as well as the mayor of a nearby town, plans to open up token sales to non-parishioners. While this could potentially put the digital asset ownership at risk of an outsider takeover, Bush doesn’t appear to be too concerned about that.

When presented with the notion that, for example, Satanists could end up making a run on the church’s tokens, Bush quipped that he’d be grateful, “let’s introduce you to Jesus.”

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

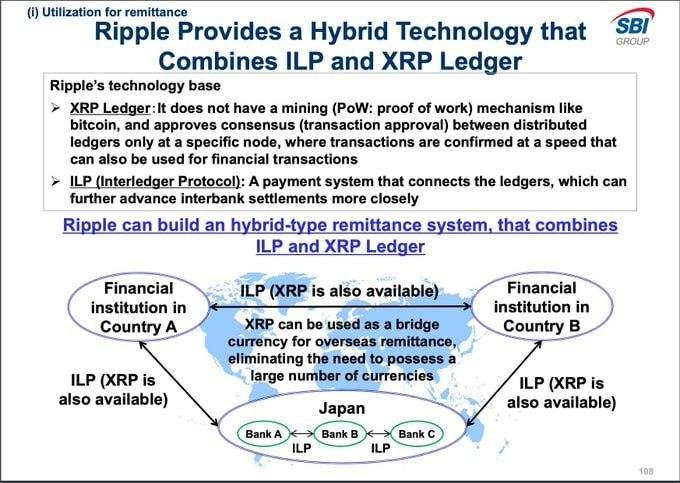

“How does the ILP have global scalability?”

Because it is based on the internet.🎯 The internet is technology that is already global, has unlimited volume, and unlimited scalability.. And can reach any Human with an internet connection.💯

Now, overlay the internet with the ILP, and you have an international payments routing system that finds that most efficient route online to facilitate transactions between payment systems.

Powered by the XRPL🧩

Ripple’s solution is a hybrid solution that combines the ILP and the XRPL, as illustrated below as well.✅

@ Newshounds News™

Source: SMQKE (@SMQKEQG) on X , Nth Exception

☝️☝️☝️ THIS IS THE QFS ☝️☝️☝️

~~~~~~~~~

Newly Released Map Illustrates XRP’s Role as a Future World Reserve and Bridge Currency

▪️ XRP may play a top role in bridging different countries’ CBDC in a possible global monetary reset.

▪️The cryptocurrency is best suited for this purpose owing to its cross-border settlement capabilities.

XRP will likely serve as a world reserve and bridge currency in the future. Per a recently published Map, this proposition comes amid heightened discussions of a potential restructuring of the international monetary system.

XRP’s Role as Global Reserve and Bridge Currency

Crypto enthusiast Edward Farina highlighted the map in a post on the social media platform X. The map describes how coins like XRP can serve as a global reserve asset, with gold as an essential anchor.

As a result, it challenges the long-running discussion surrounding gold as the cornerstone of a stable monetary system.

A map presents how $XRP could act as a World Reserve Currency and Bridge Currency 🔥

See Twitter Link Below for entire map

Gold has historically been seen as a reliable store of value and a hedge against inflation. However, its role in modern finance is increasingly being viewed through the lens of digital transformation.

The map outlines a tiered structure for global currencies. At the top of the rank is the SDR, an international reserve asset developed by the International Monetary Fund (IMF). Next on the rank are Tier 1 currencies, which may include the U.S. Dollar, Euro, Japanese Yen, and others from top nations.

Beneath these are Tier 2 assets encompassing Central Bank Digital Currencies (CBDCs). These assets would be connected to the currencies of different countries and issued by their central banks.

This means bridge currencies like XRP can facilitate conversions and transactions between these government-backed digital currencies, allowing them to interact seamlessly across national boundaries.

The map implies that XRP could help speed up the conversion of other CBDCs. This expectation is based on the digital asset’s ability to provide liquidity and reduce friction in international transactions.

XRP’s role as a bridge currency was accelerated during COVID-19 due to difficulties in making cross-border payments. At the time, Ripple’s head of global banking, Marjan Delatinne, said XRP is well positioned to bridge multiple or different CBDCs.

XRP’s role as a bridge currency is crucial due to the multiple digital currencies that are used globally. XRP can help ensure interoperability between these digital currencies for efficient global commerce.

@ Newshounds News™

Read More: Crypto News Flash , Twitter

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 8-17-24

Good Afternoon Dinar Recaps,

Bank of Ghana unveils draft rules for cryptocurrency exchanges

The Bank of Ghana introduces draft guidelines to regulate digital assets, focusing on exchanges and consumer protection measures.

The Bank of Ghana (BoG) has proposed fresh regulatory measures for digital assets following an extensive internal review of Bitcoin, Tether, USDT, and other cryptocurrencies.

On Aug. 16, the central bank of the West African nation issued draft guidelines on digital assets while seeking feedback on the upcoming crypto regulations from the public and industry stakeholders.

According to the BoG, data collected over three years shows a significant increase in Ghana’s appetite for crypto. As a result, it intends to implement laws targeting risks related to money laundering and terrorism financing, fraud and other measures for consumer protection.

Good Afternoon Dinar Recaps,

Bank of Ghana unveils draft rules for cryptocurrency exchanges

The Bank of Ghana introduces draft guidelines to regulate digital assets, focusing on exchanges and consumer protection measures.

The Bank of Ghana (BoG) has proposed fresh regulatory measures for digital assets following an extensive internal review of Bitcoin, Tether, USDT, and other cryptocurrencies.

On Aug. 16, the central bank of the West African nation issued draft guidelines on digital assets while seeking feedback on the upcoming crypto regulations from the public and industry stakeholders.

According to the BoG, data collected over three years shows a significant increase in Ghana’s appetite for crypto. As a result, it intends to implement laws targeting risks related to money laundering and terrorism financing, fraud and other measures for consumer protection.

The central bank proposed an eight-pillar framework for crypto regulations, mainly intensifying the registration and reporting requirements of cryptocurrency exchanges or virtual asset service providers (VASPs).

Ghana pays special attention to crypto exchanges

If signed into law, the proposed regulations will require crypto exchanges to monitor and report suspicious transactions and comply with the Financial Action Task Force’s Travel Rule. Additionally, the bank plans to collaborate with external stakeholders such as commercial banks and offshore regulators.

“The Bank would collaborate with the Securities and Exchange Commission (SEC) to develop distinct complementary regulatory frameworks that encompass various applications or use cases of digital assets.”

Curating crypto laws based on public feedback

Exchanges will also need to register with the BOG and undergo sandbox testing before being allowed to provide trading services in Ghana. The bank is currently seeking recommendations from industry players, experts and the public until Aug. 31.

“The bank will consider these inputs in determining the next steps forward,” the draft proposal said.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

XRP Ledger Sets New $1 Trillion Trust Limit in Ripple USD (RLUSD)

▪️A significant event on the XRP Ledger involved setting a $1 trillion trust limit for Ripple USD (RLUSD), though no actual issuance of RLUSD has occurred yet.

▪️This action serves as a preparatory framework for future transactions, reflecting the XRP Ledger’s scalability and users’ confidence in the ecosystem.

Popular crypto analyst Amelie has brought the XRP community’s attention to a significant event taking place on the XRP Ledger. As tweeted by Amelie, the XRP Ledger has set a new trust limit of $1 trillion in Ripple USD (RLUSD).

Let’s first understand the concept of Trust lines and Trust limits on the XRP Ledger. A trust line helps the user build a trusted relationship with the currency issuer on the XRP Ledger. After setting up the trust line, users enable the recei[t of the issuer’s currency up to a certain predefined limit also known as the trust limit. This limit basically safeguards users from receiving more of the currency than they are willing to trust.

In the case of Ripple, a trust line was created for RLUSD, setting up the trust limit of $1 million. This figure represents the maximum amount of RLUSD the account holder is willing to trust. However, there’s no RLUSD transfer or creation in the process. Instead, this action simply establishes the framework for future transactions involving RLUSD on the ledger.

Last week, Ripple started beta-testing the RLUSD stablecoin facilitating cross-border transactions between the XRP Ledger and Ethereum, reported CNF.

XRP Ledger Implications and Community Reaction

The $1 trillion trust limit even in the absence of the actual asset shows high flexibility and scalability of the XRP Ledger. Also, the ability of users t also prompts questions about the role trust lines play in the issuance and circulation of digital assets on the XRP Ledger.

With Ripple expanding its range of products and services including the introduction of the RLUSD stablecoin, it becomes increasingly crucial to understand the technical workings of the XRP Ledger.

RLUSD will compete in the highly competitive stablecoin landscape currently dominated by Tether’s USDT and Circle’s USDC, reported CNF.

Interestingly, this announcement of the $1 trillion trust limit has also sparked some reactions from the community. Many users were actually curious to under the purpose behind this trust limit.

One community member Aron Madarasz confused it with some illicit activity stating: “It means that this is a fake. RLUSD isn’t issued yet. This is a trustline on the XRPL everybody can create, and everybody can name it as wanted. RLUSD will be issued by Ripple on the ledger but not as a trustline thing.”

Madarasz clarified that while a trust line for RLUSD has been established, Ripple has not yet issued the asset. As a result, the substantial trust limit set does not represent an asset currently in circulation. Rather, it serves as a preparatory measure within the XRPL, while enabling users to set up trust lines in anticipation of RLUSD’s future issuance.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

IMF Proposes Drastic 85% Electricity Tax Increase For Crypto Mining

Two IMF officials pitched for steep electricity taxation on cryptocurrency miners and recommended increasing their average global electricity cost by 85%.

The proposal has, in fact, called for a sharp rise in the electricity tax paid by crypto miners to drastically bring down carbon emissions from the mining of such cryptocurrencies, which have been rising and pose an environmental threat.

IMF: Over $5 Billion In Taxes

The International Monetary Fund says that a levy of $0.047 per kilowatt hour would bring in about $5.2 billion annually and trim global emissions by about 100 million tons, equivalent to current emissions of Belgium.

However, the actual reduction of emissions from such a tax is arguable, as miners have the tendency to shift operations to countries where electricity is cheap.

Here, IMF executives Shafik Hebous and Nate Vernon-Lin have used an astonishing figure for the consumption of energy used in cryptocurrency transactions. According to them, a single transaction in Bitcoin uses as much electricity as the average person in Pakistan uses over three years.

Crypto mining data centers, added to this, and the aggregate energy use for artificial intelligence will grow to a level comparable in use to Japan’s electricity in three years.

Though the proposed tax might provide incentives for miners to become more energy-efficient, the IMF acknowledges that global coordination is needed to avoid having miners simply move their bases of operation into countries and jurisdictions with lower standards.

Environmental Impact Of Crypto Mining

Thus, environmental considerations argue for crypto mining regulation. The IMF’s decision shows a rising awareness of the need to intervene in a fast-expanding polluter. Finding solutions is necessary because crypto mining and AI data centers account for almost 1% of global carbon emissions and 2% of global electricity usage. This tax could encourage miners to invest in greener technologies, making the sector more sustainable.

Economic Considerations

While the yield in tax from this proposal is huge, it opens up a Pandora’s box on the economic viability of crypto mining operations. Small miners—who are already hard hit by the reduction in profits after Bitcoin’s halving in April—may not survive easily if electricity costs rise even further.

That would mean consolidation in the industry, and only the large and more efficient miners able to survive would do so. The analysis by the IMF estimates that the tax may further drive innovations in energy-efficient mining technologies, but its immediate impact on smaller players could be quite destructive.

@ Newshounds News™

Source: Bitcoinist

~~~~~~~~~

EU Merchants Accept Ripple Payments; Buy Gold & More With XRP

It feels like we just pulled a shiny rabbit out of the hat; various merchants in Europe accept Ripple’s XRP as a payment method for gold and silver! Yes, you read that right—your favorite altcoin can now buy you some solid gold bars.

It’s not just gold and silver; they’ve thrown in platinum, palladium, and rhodium for good measure. Plus, they’ve got live pricing in XRP, so you can watch those rates in real time, like a hawk eyeing its prey.

Ripple’s XRP: Shaking Up the Financial Scene Like a Snow Globe

Suisse Gold, Swiss Bullion, W. Hamond, have jumped on the XRP bandwagon and it isn’t just a fluke; it’s a sign of the times. Ripple’s cryptocurrency, XRP, has been strutting its stuff lately, making waves that are hard to ignore.

Take this: (OPINION) previously, reports circulated that Russian President Vladimir Putin, of all people, confirmed that BRICS—think of them as the cool kids of emerging economies—are cooking up their own independent payment system. And guess what? XRP might just be the secret sauce for cross-border payments in this new setup. If that doesn’t get your financial radar pinging, I don’t know what will.

@ Newshounds News™

Source: CryptoNewsz

~~~~~~~~~

US Financial Services Committee leaders want ‘regulatory sandboxes’ for AI

In a letter signed only by republicans, the committee responded to a request for information sent by the Department of the Treasury.

US Financial Services Committee leaders want ‘regulatory sandboxes’ for AI News

Members of the United States House Financial Services Committee (FSC) responded to a request for feedback from the US Treasury concerning the regulation of artificial intelligence in an Aug. 16 letter addressed to Treasury Secretary Janet Yellen.

The letter, signed by the committee’s Republican leadership, calls for what amounts to a light-touch approach to regulation. “A one-size-fits-all approach will only stifle competition among financial institutions,” wrote the signatories, adding that “regulators must evaluate each institution’s use of AI technology on a case-by-case basis”

AI sandbox

The committee appeared bullish on the use of generative AI — which includes services and products such as OpenAI’s ChatGPT and Anthropic’s Claude — in the financial services sector. It highlighted the potential for these technologies to provide greater access to financial services, increasing both adoption and inclusion.

It also strongly recommended an organic approach to creating new regulations and laws. Describing a “regulatory sandbox” for AI, the FSC appears to be advocating maintaining a general focus on sustaining the status quo by applying existing rules to challenges as they arise.

@ Newshounds News™

Read more: CoinTelegraph

~~~~~~~~~

Newshound's Currency Facts Youtube

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Morning 8-17-24

Good Morning Dinar Recaps,

XRP Ledger Sets New $1 Trillion Trust Limit in Ripple USD (RLUSD)

▪️A significant event on the XRP Ledger involved setting a $1 trillion trust limit for Ripple USD (RLUSD), though no actual issuance of RLUSD has occurred yet.

▪️This action serves as a preparatory framework for future transactions, reflecting the XRP Ledger’s scalability and users’ confidence in the ecosystem.

Popular crypto analyst Amelie has brought the XRP community’s attention to a significant event taking place on the XRP Ledger. As tweeted by Amelie, the XRP Ledger has set a new trust limit of $1 trillion in Ripple USD (RLUSD).

Good Morning Dinar Recaps,

XRP Ledger Sets New $1 Trillion Trust Limit in Ripple USD (RLUSD)

▪️A significant event on the XRP Ledger involved setting a $1 trillion trust limit for Ripple USD (RLUSD), though no actual issuance of RLUSD has occurred yet.

▪️This action serves as a preparatory framework for future transactions, reflecting the XRP Ledger’s scalability and users’ confidence in the ecosystem.

Popular crypto analyst Amelie has brought the XRP community’s attention to a significant event taking place on the XRP Ledger. As tweeted by Amelie, the XRP Ledger has set a new trust limit of $1 trillion in Ripple USD (RLUSD).

Let’s first understand the concept of Trust lines and Trust limits on the XRP Ledger. A trust line helps the user build a trusted relationship with the currency issuer on the XRP Ledger.

After setting up the trust line, users enable the recei[t of the issuer’s currency up to a certain predefined limit also known as the trust limit. This limit basically safeguards users from receiving more of the currency than they are willing to trust.

In the case of Ripple, a trust line was created for RLUSD, setting up the trust limit of $1 million. This figure represents the maximum amount of RLUSD the account holder is willing to trust.

However, there’s no RLUSD transfer or creation in the process. Instead, this action simply establishes the framework for future transactions involving RLUSD on the ledger.

Last week, Ripple started beta-testing the RLUSD stablecoin facilitating cross-border transactions between the XRP Ledger and Ethereum, reported CNF.

XRP Ledger Implications and Community Reaction

The $1 trillion trust limit even in the absence of the actual asset shows high flexibility and scalability of the XRP Ledger. Also, the ability of users t also prompts questions about the role trust lines play in the issuance and circulation of digital assets on the XRP Ledger.

With Ripple expanding its range of products and services including the introduction of the RLUSD stablecoin, it becomes increasingly crucial to understand the technical workings of the XRP Ledger.

RLUSD will compete in the highly competitive stablecoin landscape currently dominated by Tether’s USDT and Circle’s USDC, reported CNF.

Interestingly, this announcement of the $1 trillion trust limit has also sparked some reactions from the community. Many users were actually curious to under the purpose behind this trust limit. One community member Aron Madarasz confused it with some illicit activity stating:

“It means that this is a fake. RLUSD isn’t issued yet. This is a trustline on the XRPL everybody can create, and everybody can name it as wanted. RLUSD will be issued by Ripple on the ledger but not as a trustline thing.”

Madarasz clarified that while a trust line for RLUSD has been established, Ripple has not yet issued the asset. As a result, the substantial trust limit set does not represent an asset currently in circulation.

Rather, it serves as a preparatory measure within the XRPL, while enabling users to set up trust lines in anticipation of RLUSD’s future issuance.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Dubai court recognizes crypto as a valid salary payment

UAE lawyer Irina Heaver said the ruling shows the growing acceptance of crypto in employment contracts, recognizing the evolving nature of Web3 financial transactions.

In a significant update to the United Arab Emirates’ judiciary approach to crypto, the Dubai Court of First Instance recognizes salary payments in crypto as valid under employment contracts.

Irina Heaver, a partner at UAE law firm NeosLegal, explained that the ruling in case number 1739 of 2024 shows a shift from the court’s earlier stance in 2023, where a similar claim was denied because the crypto involved lacked precise valuation.

Heaver believes this shows a “progressive approach” to integrating digital currencies into the country’s legal and economic framework.

Dubai court recognizes inclusion of tokens in salary

Heaver said that the case involved an employee who filed a lawsuit claiming that the employer had not paid their wages, wrongful termination compensation and other benefits.

The worker’s employment contract stipulated a monthly salary in fiat and 5,250 in EcoWatt tokens. The dispute stems from the employer’s inability to pay the tokens portion of the employee’s salary in six months.

In 2023, the court acknowledged the inclusion of the EcoWatts tokens in the contract. Still, it did not enforce the payment in crypto, as the employee failed to provide a clear method for valuing the currency in fiat terms.

“This decision reflected a traditional viewpoint, emphasizing the need for concrete evidence when dealing with unconventional payment forms,” Heaver said.

However, the lawyer said that in 2024, the court “took a step forward,” ruling in favor of the employee and ordering the payment of the crypto salary as per the employment contract without converting it into fiat. Heaver said:

“This decision reflects a broader acceptance of cryptocurrency in employment contracts and highlights the court’s recognition of the evolving nature of financial transactions within the Web3 economy.”

Heaver added that the court’s reliance on the UAE Civil Transactions Law and Federal Decree-Law No. 33 of 2021 in both judgments shows the consistent application of legal principles in wage determination. 🍳

Far-reaching implications for UAE crypto adoption

According to Heaver, the decision also sets a positive precedent that encourages the further integration of digital currencies in everyday financial transactions. The lawyer believes that this fosters a more inclusive and innovative business environment. Heaver said:

“This ruling affirms that if an employment contract includes such terms, both the company and the employee must honor them. It is reassuring to see the court recognize that wages, whether paid in fiat or cryptocurrency, are the rightful entitlement of the employee for their agreed-upon work.”

Heaver added that it’s a win for employees and a significant step forward in the UAE’s journey toward becoming a digital economy leader.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

Bank of Ghana unveils draft rules for cryptocurrency exchanges

The Bank of Ghana introduces draft guidelines to regulate digital assets, focusing on exchanges and consumer protection measures.

The Bank of Ghana (BoG) has proposed fresh regulatory measures for digital assets following an extensive internal review of Bitcoin, Tether, USDT, and other cryptocurrencies.

On Aug. 16, the central bank of the West African nation issued draft guidelines on digital assets while seeking feedback on the upcoming crypto regulations from the public and industry stakeholders.

According to the BoG, data collected over three years shows a significant increase in Ghana’s appetite for crypto. As a result, it intends to implement laws targeting risks related to money laundering and terrorism financing, fraud and other measures for consumer protection.

The central bank proposed an eight-pillar framework for crypto regulations, mainly intensifying the registration and reporting requirements of cryptocurrency exchanges or virtual asset service providers (VASPs).

Ghana pays special attention to crypto exchanges

If signed into law, the proposed regulations will require crypto exchanges to monitor and report suspicious transactions and comply with the Financial Action Task Force’s Travel Rule. Additionally, the bank plans to collaborate with external stakeholders such as commercial banks and offshore regulators.

“The Bank would collaborate with the Securities and Exchange Commission (SEC) to develop distinct complementary regulatory frameworks that encompass various applications or use cases of digital assets.”

Curating crypto laws based on public feedback

Exchanges will also need to register with the BOG and undergo sandbox testing before being allowed to provide trading services in Ghana. The bank is currently seeking recommendations from industry players, experts and the public until Aug. 31.

“The bank will consider these inputs in determining the next steps forward,” the draft proposal said.

@ Newshounds News™

Read more: CoinTelegraph

~~~~~~~~~

NEWS BRIEFS from the NEWSHOUNDS

▪️Trump Organization to launch crypto real estate initiative says Eric Trump | Crypto Briefing

▪️Xaman Wallet Partners with Mastercard’s Immersve to Roll out Self-Custody Web3 Cards | The Crypto Basics

▪️Cantor Fitzgerald CEO to co-lead Trump transition team | Coin Telegraph

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Afternoon 8-16-24

Good Afternoon Dinar Recaps,

U.S. Crypto Bill Can Happen This Year, Senate's Schumer Tells Crypto Backers of Harris

At the opening Crypto4Harris event, industry supporters of the Democratic presidential candidate suggested Harris will lead a crypto surge, though she hasn't yet shared her view.“something passed out of the Senate.”

▪️U.S. Senate Majority Leader Chuck Schumer came out guns-blazing during a Crypto4Harris event, saying what's been considered a longshot idea of getting some kind of crypto legislation out this year could really happen.

▪️Billionaire Mark Cuban said former President Donald Trump and his party are primarily interested in crypto to make rich digital assets investors richer.

Good Afternoon Dinar Recaps,

U.S. Crypto Bill Can Happen This Year, Senate's Schumer Tells Crypto Backers of Harris

At the opening Crypto4Harris event, industry supporters of the Democratic presidential candidate suggested Harris will lead a crypto surge, though she hasn't yet shared her view.“something passed out of the Senate.”

▪️U.S. Senate Majority Leader Chuck Schumer came out guns-blazing during a Crypto4Harris event, saying what's been considered a longshot idea of getting some kind of crypto legislation out this year could really happen.

▪️Billionaire Mark Cuban said former President Donald Trump and his party are primarily interested in crypto to make rich digital assets investors richer.

Sens. Debbie Stabenow and Kirsten Gillibrand joined nearly a dozen other Democratic lawmakers, as well as industry titans like Mark Cuban and Anthony Scaramucci, in a virtual event to garner crypto support for Vice President Kamala Harris's presidential bid.

U.S. crypto legislation can happen this year, Senate Majority Leader Chuck Schumer (D-N,Y,) said Wednesday at the first major event in which crypto insiders have come out for Vice President Kamala Harris as their favored presidential contender.

@ Newshounds News™

Read more: CoinDesk

~~~~~~~~~

Stablecoins Can Make the World a Safer Place. Regulators Should Encourage Them - OPINION

The global financial system will be better off if stablecoins are fully adopted and foreign exchange risk goes the way of the dinosaurs, says Christopher Perkins, president of CoinFund.

In 1974, German regulators liquidated Herstatt Bank because it was unable to settle its foreign exchange obligations. Time zone differences and a lack of global settlement technology led to its demise.

In the aftermath of this and other bank failures, central bankers formed the Basel Committee on Banking Supervision that same year to set standards for bank capital, liquidity and funding.

Fifty years later, “Herstatt” risk is synonymous with foreign exchange settlement risk, and the Basel Committee has become a powerful forum for global bank supervision because of the regulatory capital standards it sets. Its Basel Rules are designed to ensure that banks are sufficiently capitalized based on the underlying risks of their activities.

However, across the $7.5 trillion a day global foreign exchange markets, Herstatt risk remains. While the financial services industry has sought to modernize its infrastructure, many currencies still take as long as two days to settle.

And across the $700 trillion derivatives market, lumbering daily batch settlement processes fail to keep pace with the real time volatility of the markets that they seek to collateralize.

But breakthroughs in technology have the potential to banish settlement risk to a thing of the past. There’s a crucial role for blockchain technology to play. Stablecoins, tokens designed to be pegged to an underlying currency and settled on blockchains, can now reduce currency settlement latency from days to a matter of seconds.

The global financial system will be better off if stablecoins are fully adopted and Herstatt risk goes the way of the dinosaurs

Stablecoins, a form of cryptocurrency, are not without risk. Unregulated stablecoins have “de-pegged” in the past because of design flaws or the failure of traditional banks that held their fiat reserves.