Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 8-14-24

Good Afternoon Dinar Recaps,

NON-MARKET ECONOMY STATUS FOR VIETNAM: 'opportunities amid danger'

RECENTLY THE US COMMERCE DEPT REFUSED TO RECOGNIZE VIETNAM AS A "MARKET ECONOMY". THIS ARTICLE FROM A VIETNAMESE NEWSPAPER REVEALS THE REASONS BEHIND THIS STATUS

"The US Department of Commerce's decision to continue classifying Vietnam as a non-market economy was disappointing news. However, this gives Vietnam the chance to accelerate reform towards a market economy."

"This is the driving force for the Ministry of Industry and Trade (MOIT) to implement the commitment that it will research and analyze the US Department of Commerce’s (DOC) report about Vietnam’s economy, to supplement and complete arguments before submitting dossiers to DOC on granting market economy status, a step to concretize the Vietnam-US comprehensive strategic partnership."

Good Afternoon Dinar Recaps,

NON-MARKET ECONOMY STATUS FOR VIETNAM: 'opportunities amid danger'

RECENTLY THE US COMMERCE DEPT REFUSED TO RECOGNIZE VIETNAM AS A "MARKET ECONOMY". THIS ARTICLE FROM A VIETNAMESE NEWSPAPER REVEALS THE REASONS BEHIND THIS STATUS

"The US Department of Commerce's decision to continue classifying Vietnam as a non-market economy was disappointing news. However, this gives Vietnam the chance to accelerate reform towards a market economy."

"This is the driving force for the Ministry of Industry and Trade (MOIT) to implement the commitment that it will research and analyze the US Department of Commerce’s (DOC) report about Vietnam’s economy, to supplement and complete arguments before submitting dossiers to DOC on granting market economy status, a step to concretize the Vietnam-US comprehensive strategic partnership."

"After doi moi (renovation), Vietnam has been consistent in carrying out a reform to turn the single-sectoral economy into multi-sectoral economy. The economy has been liberated from the state’s strict and rigid control, while people have freedom to trade and do business.

In addition, Vietnam has signed 16 new-generation FTAs (free trade agreements), becoming one of the most open economies in the world."

"Thanks to economic reform, Vietnam has become an example in hunger elimination and poverty reduction, with the hunger and poverty rate falling from nearly 60 percent in early 1990s to 3 percent now. Private domestic invested enterprises with official registrations have been growing steadfastly. "

"Vietnam has finished the underdevelopment period, becoming an average income country with a dynamic market economy which is integrating deeply into the global economy."

"There is no doubt that the reforms and considerable progress in recent years are why 73 economies have recognized Vietnam as a market economy."

"Economic Freedom of the World Index by Canadian Frazer Institute released late last year showed that Vietnam ranked 106th among 165 countries and territories. The position represented a four-grade promotion compared with the year before, a relatively big improvement compared with other regional countries."

"After 40 years of doi moi, Vietnam’s economy is still undergoing the transition with some shortcomings as follows:

1. First, the pricing mechanism of some products, such as petroleum, electricity, airfare and healthcare services still bears administrative intervention.

2. Second, the protection of ownership and property rights still cannot be carried out thoroughly. In some places, land is recovered by the state at non-market prices.

3. Third, the state-owned economic sector still accounts for a large proportion of the national economy.

"A report of the World Bank shows that the state still participates in many economic activities through SOEs, while the land and capital allocation bear the impact of administrative commands rather than market conditions."

Costa Rica recognizes Vietnam as market economy

@ Newshounds News™

Source: Vietnam Net

~~~~~~~~~

INDIA's CENTRAL BANK: the impact of tokenized deposits, CBDC on deposit insurance

Yesterday during a speech, Reserve Bank of India (RBI) Deputy Governor MD Patra discussed how tokenized deposits and central bank digital currency (CBDC) might impact deposit insurance.

Tokenized deposits are a digital version of bank deposits using blockchain infrastructure to process programmable payments 24/7. In a digital world, they compete with stablecoins and CBDCs, although the design is quite different.

From a deposit insurance perspective, most tokenized deposit infrastructures aim to maintain the same deposit insurance coverage as a conventional bank deposit. However, Mr Patra noted that tokenization potentially can amplify bank runs in times of stress.

Hence, the risks posed by tokenized deposits need to be modelled to determine the insurance fund size and premium rates.

If there’s a bank failure, compensating clients might be less straightforward. “With different banks using different technologies there’s also the possibility that tokenised deposits could be held by depositors who are not KYC compliant and not clients of issuing banks,” said Mar Patra. “Consequently, verification of the authenticity and genuineness of claims may prove to be a testing challenge.”

Like the United States, India has a recent history of failing banks. In 2020 YES Bank started experiencing a run and the central bank took it over for a while. It restructured the bank with several other Indian banks taking equity stakes. Subsequently, YES Bank raised additional capital and is still operational today.

CBDC impact on deposit insurance

In an economy with a retail CBDC, if a bank fails, those with uninsured deposits will quickly try to transfer the money elsewhere.

The advantage of a CBDC its low risk because it is the liability of the central bank. On the one hand, depositors could just transfer the money to another commercial bank. Alternatively, they could switch to a CBDC.

Hence, the Deputy Governor observed that “particularly uninsured deposits, (would be) more prone to withdrawal and hence the risk of bank runs. Given the inherent links between such systems and the objectives and operations of deposit insurers, it is expected that the topic of CBDC will continue to grow in relevance for deposit insurers.”

In other words, if CBDCs encourage bank runs, that makes a bank more likely to fail and hence there’s a higher probability of drawing down the insurance fund.

“The impact of CBDC on deposits and hence deposit insurance is largely unknown as of today,” said Mr Patra. “The operating models and design features of each individual jurisdiction’s CBDC will be a crucial factor in expanding our understanding of the balance of risks.”

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

Canada needs to overhaul crypto regulations — Coinbase exec

The Canadian government has previously come under fire for undermining the economic freedom of its citizens and freezing crypto donations.

Coinbase country director for Canada Lucas Matheson took the stage at the Blockchain Futurist Conference on Aug. 13 to discuss the state of Canadian digital asset regulation and promote the newly expanded Stand With Crypto initiative.

Matheson argued that although Canada’s regulatory framework is already robust, the country still needs to modernize crypto regulation.

The director noted that 85% of countries will be adopting comprehensive regulatory frameworks for digital assets over the next year and urged the importance of public dialogue in educating public officials about the importance of cryptocurrencies. Coinbase’s Canadian director summed up the long-term goal for Stand With Crypto’s advocacy:

“Canada frankly has a lot of work to do to change laws, and the goal is to change laws in Canada so that we can increase economic freedom and update the financial system in Canada.”

Matheson concluded his presentation by directing audience members to sign up for the advocacy group.

Coinbase launches Stand With Crypto in Canada

Coinbase launched the Stand With Crypto initiative in Canada in July of 2024, following the success of the political advocacy group in the United States.

When the advocacy group launched, Matheson said that Canadian regulators tended to be much more cooperative with the industry than American regulators but noted that input from elected politicians was lacking.

Binance cited changes in stablecoin policy and investor limits outlined in the 2023 regulation as the main drivers for the company’s exit from the country.

@ Newshounds News™

Source: Coin Telegraph

~~~~~~~~~

BRICS should focus on creating seamless economic environment — Indian expert

Apart from economic integration, BRICS should also address "critical global challenges with a collaborative and proactive approach," Vice Chairman of BRICS Chamber of Commerce and Industry Sameep Shastri said

NEW DELHI, August 14. /TASS/. BRICS nations should focus on creating a seamless economic environment to expand trade, industrial and investment cooperation, Vice Chairman of BRICS Chamber of Commerce and Industry Sameep Shastri told TASS when commenting on the upcoming meeting of BRICS industry ministers in Russia’s Nizhny Novgorod on August 16.

"The BRICS ministerial meeting is an invaluable opportunity to strengthen the bonds between our member nations further and address key global challenges with a unified approach," he said. "We must focus on creating a seamless economic environment that fosters growth and innovation.

This might involve harmonizing trade policies, facilitating cross-border investments, and addressing any trade imbalances that may exist," Shastri added.

Technological disparities among BRICS nations can hinder collaborative progress, the expert noted. "The meeting should address ways to bridge these gaps through joint research initiatives, technology transfer, and innovation partnerships.

Prioritizing advancements in fields such as artificial intelligence, cybersecurity, and clean technologies will be critical," he said.

Apart from economic integration, BRICS should also address "critical global challenges with a collaborative and proactive approach," the expert said. "BRICS needs to lead by example in setting ambitious sustainability targets and implementing actionable plans.

The meeting should also focus on strengthening global health systems ensuring that we are better prepared for future public health crises," he said.

Shastri believes that peace and security should be central to BRICS discussions. "With rising geopolitical tensions and the persistent threat of terrorism, BRICS must work collaboratively to develop strategies that promote global stability.

This includes enhancing counterterrorism efforts, supporting peacekeeping missions, and fostering diplomatic dialogue to resolve conflicts," he stressed.

@ Newshounds News™

Source: TASS

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Late Tuesday Evening 8-13-24

Good Evening Dinar Recaps,

THESE QUOTES,RESEARCH, AND OPINIONS ARE FROM ASHELEY PROSPER ON X DEFINITELY WORTH A READ!!

We keep telling you XRP is the one. But you just won't listen. Maybe some of these quotes will help you see the truth.

Brad Garlinghouse "XRP is a bridge currency. We believe it has the potential to reduce liquidity costs and enable faster, lower-cost cross-border payments."

Christine Lagarde (President of the European Central Bank) "Ripple is doing a lot of work in facilitating exchanges and making sure that there is no need for a central counterparty, but that we know exactly who is doing what and who is exchanging what."

Good Evening Dinar Recaps,

THESE QUOTES,RESEARCH, AND OPINIONS ARE FROM ASHELEY PROSPER ON X

DEFINITELY WORTH A READ!!

We keep telling you XRP is the one. But you just won't listen. Maybe some of these quotes will help you see the truth.

Brad Garlinghouse

"XRP is a bridge currency. We believe it has the potential to reduce liquidity costs and enable faster, lower-cost cross-border payments."

Christine Lagarde (President of the European Central Bank)

"Ripple is doing a lot of work in facilitating exchanges and making sure that there is no need for a central counterparty, but that we know exactly who is doing what and who is exchanging what."

JP Morgan

"If Ripple wins SEC lawsuit, XRP is poised for significant adoption."

Bank of America (2019 Report)

"Ripple’s technology is attractive for its ability to settle cross-border transactions almost instantly."

David Schwartz

"XRP was designed to be a better Bitcoin."

World Economic Forum

"Ripple’s XRP is one of the most scalable and efficient digital assets available for cross-border payments."

Jesse Lund (IBM)

"Ripple’s approach with XRP is interesting as it provides a digital asset that can settle in real-time across multiple networks."

SBI Holdings

"XRP has the potential to become the global standard in digital currencies for cross-border transactions."

Chris Larsen

"We’re working with regulators, we’re working with central banks. I think that’s an important part of our strategy."

Christine Lagarde

"Ripple has addressed many of the issues associated with cross-border payments, particularly around speed, transparency, and cost-efficiency."

American Express

"Ripple offers a compelling proposition in cross-border transactions, reducing settlement times from days to seconds."

Bank of America

"Ripple’s solution can potentially bring substantial cost efficiencies in our cross-border transactions."

Yoshitaka Kitao

"XRP is the most efficient, scalable digital asset for payments, and it plays a pivotal role in the development of new financial infrastructure."

Cathy Bessant (Bank of America)

"We’ve been in partnership with Ripple for a while. We’re testing and piloting the use of blockchain technology in different areas where we see the potential for immediate value."

Marc Andreessen (Andreessen Horowitz)

"Ripple’s approach to leveraging blockchain for the financial industry shows immense promise. The speed and efficiency gains are remarkable."

Digital Currency Group (DCG)

"Ripple’s innovative approach to cross-border payments is setting new standards in the financial industry, and XRP plays a crucial role in this evolution."

Amazon Web Services (AWS) - Ripple Case Study

"Ripple provides one frictionless experience to send money globally using the power of blockchain."

Ross Leckow (IMF)

"Ripple’s technology can help enhance financial inclusion and improve the efficiency of the global financial system."

Ripple and Apple’s Collaboration with Interledger Protocol (ILP)

"Apple’s integration of Interledger Protocol, which Ripple helped develop, shows the potential for broader adoption of blockchain technology in mainstream tech ecosystems."

Google Ventures

"Ripple’s vision of instant, secure, and low-cost global payments aligns with the future of financial services. XRP’s utility as a bridge currency is an integral part of that vision."

Santander Bank

"We are excited to leverage Ripple’s technology to provide our customers with faster, more secure international payments, allowing us to stay ahead in the rapidly evolving financial industry."

Microsoft’s Azure Blockchain Workbench

"Ripple’s integration with Microsoft’s Azure Blockchain Workbench enables businesses to send and receive cross-border payments with unprecedented speed and security."

Tom Jessop (President, Fidelity Digital Assets)

"We see Ripple and XRP as one of the more mature and viable digital assets in the market, with a clear use case in cross-border payments."

@ Newshounds News™

Source: Twitter

~~~~~~~~~

Big news from the Seeds of Wisdom team! We're expanding and reaching new heights, thanks to the incredible support of Nate (Mr Anonymous) to take this on to help our community. To share valuable insights with even more people, we're launching a YouTube series! 🎥

Our inaugural guest is the knowledgeable Bob Lock who will share his expertise on planning and currency. Get ready to learn and grow! 💡

Don't miss this opportunity to gain wisdom from the best!

📣 Listen: YouTube ----- Date and Time To Be Announced Soon

Please Like and Subscribe on YouTube

Bob Lock: Link

Newshound's News Telegram Room Link

Q & A Classroom Link

All Rooms: Link

Website:Link

Subscribe:Link

@ Newshounds News™

~~~~~~~~~

Superstate integrates Chainlink for tokenized treasury fund

Superstate, a blockchain-based asset management firm, has integrated Chainlink’s technology as it taps into the growing tokenization market.

The asset manager will leverage the Chainlink Data Feeds to bring net asset value data for its tokenized treasury fund on-chain. In the announcement Superstate stated it aims to enhance the composability of its Superstate Short Duration US Government Securities Fund by utilizing Chainlink’s technology.

The integration enables the firm to access crucial off-chain data, essential for market pricing, utility, and transparency.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

IOTA launches blockchain tool to simplify music rights management

IOTA has introduced a new blockchain-based tool aimed at simplifying music rights management in the film industry.

IOTA (IOTA), a distributed ledger focused on the exchange of value and data, has unveiled a blockchain-driven tool designed to transform the management of music rights in films, addressing what the project describes as a traditionally time-consuming process.

The new solution, developed under the European Blockchain Pre-Commercial Procurement initiative and funded by the European Commission, leverages distributed ledger technology to streamline negotiations and secure intellectual property rights more efficiently, according to an Aug. 12 blog announcement.

The core of IOTA’s latest solution is the Smart Contracts for Media system, which automates contracts between film producers and rights holders. These smart contracts are self-executing digital agreements, intended to reduce the time traditionally required for negotiations and payment processes.

IOTA claims its solution promises to “revolutionize the way intellectual property rights are handled,” enabling producers to select predefined contract templates, make real-time adjustments, and finalize terms digitally. Once agreed upon, the smart contracts are deployed on the IOTA Smart Contract Chain, ensuring the agreements are immutable.

The tool also incorporates non-fungible tokens (NTFs) to represent rights and obligations. These NFTs contain unique identifiers that link to detailed data stored off-chain using the InterPlanetary File System (IPFS), a decentralized storage solution.

@ Newshounds News™

Source: Crypro News

~~~~~~~~~

Coinbase Urges SEC to 'Abandon' Its 'Irrational' DeFi Exchange Rule

The SEC’s move to regulate DEXs would make it functionally impossible for DeFi projects to exist in the United States, Coinbase wrote Monday.

Coinbase once again came out swinging Monday against the U.S. Securities and Exchange Commission (SEC’s) yearslong attempt to expand a bureaucratic definition of the word “exchange,” which if successful would bring the DeFi ecosystem firmly under the regulator’s purview.

In an eight-page comment submitted to the SEC on Monday, Coinbase Chief Legal Office Paul Grewal chastised the potential rule change as “arbitrary” and “irrational” in several respects, and urged the agency to “abandon its effort” to apply the proposed rule to decentralized exchanges (DEXs).

Fundamental to Coinbase’s argument against the change is the SEC’s continued refusal to concede that DEXs—which are run by automated, on-chain software (aka smart contracts) with little to no human management—are by definition incapable of complying with rules and standards designed for traditional securities exchanges like the New York Stock Exchange.

“DEXs cannot comply with registration and disclosure requirements designed for legacy financial exchanges managed by centralized companies,” Grewal wrote.

“And even if DEXs could somehow comply with existing registration and disclosure rules, the Commission does not explain how SEC-registered DEXs could facilitate the trading of digital assets.”

Because of these apparent tensions, Coinbase implied in its letter to the SEC today, the agency may well be attempting to outlaw DEXs implicitly, without saying so.

“The SEC benefits from robust engagement from the public and will review all comments submitted during the open comment period. Generally, we respond to comments received as part of the final rulemaking and not beforehand," an agency spokesperson told Decrypt following the initial publication of this story.

Coinbase further accused the SEC of failing to complete a proper cost-benefit analysis of the proposed rule change. That’s due to the fact that the regulator has only stated in blanket terms that it would regulate exchanges that deal in “crypto asset securities,” without defining which sorts of digital assets constitute securities and which do not.

The SEC’s longstanding refusal to draw such a line—between which cryptocurrencies it views as securities, and which it does not—remains one of the crypto industry’s greatest grievances with the agency. Insteading of putting forth such a framework, the SEC has opted to sue crypto projects it alleges constitute illegal securities offerings, one at a time.

The regulator has even, in recent months, appeared to flip-flop on its own views of certain crypto assets. For over a year, for example, the SEC reportedly secretly considered Ethereum to be a security. Then, in May, the agency abruptly changed course, approving the trade of spot Ethereum ETFs on Wall Street.

Because the SEC has not clearly defined which cryptocurrencies it considers to be securities, Coinbase wrote today, it cannot possibly have properly calculated an accurate cost-benefit analysis determining how much financial activity would fall under its purview if DEXs were regulated like securities exchanges.

“The SEC cannot rationally make these calculations without a single, stable view on which digital assets are subject to the securities laws,” Grewal wrote.

@ Newshounds News™

Read more: Decrypt

~~~~~~~~~

The SEC has been going after numerous crypto companies for billions of dollars. There was an article yesterday with negative comments on CFTC rules too. Congress needs to get some of those bills passed that define what entity regulates what so America can catch up to other countries regulating our new financial system. Taking companies to court and fining them billions of dollars is just hindering our progress.

I found these two bills that were introduced in the Senate two years ago but never passed.

Senate Bill S. 4760

Digital Commodities Consumer Protection Act of 2022 (DCCPA)

Introduced in Senate (08/03/2022)

To amend the Commodity Exchange Act to provide the Commodity Futures Trading Commission jurisdiction to oversee the spot digital commodity market, and for other purposes.

https://www.congress.gov/bill/117th-congress/senate-bill/4760/text

Senate Bill S.5030

Digital Trading Clarity Act of 2022 (DTCA)

Introduced in Senate (09/29/2022)

This bill establishes a safe harbor from securities regulation for certain digital asset exchanges and intermediaries. This safe harbor applies if (1) such digital asset is not classified as a security by the Securities and Exchange Commission (SEC) or by a U.S. court; and (2) the exchange or intermediary complies with requirements regarding listings, customer protection, and disclosures.

If a digital asset is determined to be a security and otherwise meets these requirements, the exchange or intermediary has a two year period during which the SEC may not pursue specified enforcement activity against the exchange or intermediary.

https://www.congress.gov/bill/117th-congress/senate-bill/5030

@ Newshounds News™

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Morning 8-13-24

Good Morning Dinar Recaps,

Kenya to introduce digital asset ETPs

Kenyan investors will soon access digital asset exchange-traded products (ETPs) on the country’s main equities exchange.

DeFi Technologies, a Canada-based company, has struck a new partnership with the Nairobi Stock Exchange (NSE) to facilitate the issuance and trading of digital asset ETPs in the East African country.

NSE signed the Memorandum of Understanding (MoU) with Valour, a subsidiary of DeFi Technologies, this week. Established in 2019, Valour offers 33 ETPs in Europe, including in Börse Frankfurt, Euronext Paris, Euronext Amsterdam, and the Nordic Growth Market.

Good Morning Dinar Recaps,

Kenya to introduce digital asset ETPs

Kenyan investors will soon access digital asset exchange-traded products (ETPs) on the country’s main equities exchange.

DeFi Technologies, a Canada-based company, has struck a new partnership with the Nairobi Stock Exchange (NSE) to facilitate the issuance and trading of digital asset ETPs in the East African country.

NSE signed the Memorandum of Understanding (MoU) with Valour, a subsidiary of DeFi Technologies, this week. Established in 2019, Valour offers 33 ETPs in Europe, including in Börse Frankfurt, Euronext Paris, Euronext Amsterdam, and the Nordic Growth Market.

The MoU, which also includes market liquidity provider SovFi, allows Valour to deploy its ETPs on the Kenyan stock exchange, develop market infrastructure for digital assets, and eventually expand to tokenizing real-world assets.

@ Newshounds News™

Source: CoinGeek

~~~~~~~~~

Dragonfly, Crypto.com Weigh in on CFTC's Proposed Prediction Market Rules

Both parties argue the CFTC's move to regulate prediction markets is an overreach, with Dragonfly arguing that the recent 'Chevron' court ruling limits its power.

▪️ The CFTC's notice of proposed rulemaking for prediction markets drew various comments from the public, including the crypto industry.

▪️ Crypto industry stakeholders say the rules are too broad and would constitute an overreach, considering the recent 'Chevron court decision.

Dragonfly Digital Management and Crypto.com have joined crypto exchange Coinbase (COIN) in criticizing the Commodities Futures Trading Commission's (CFTC) proposed rules on prediction markets.

Critics say that the CFTC's proposed rules broadly categorize and ban certain event contracts, including those related to gaming – with Coinbase calling the CFTC's proposed definition of gaming too ambiguous – and elections, raising concerns that this overreach exceeds statutory authority, stifles innovation, and neglects the economic benefits these contracts provide.

"Political event contracts should not be equated with gambling on games of chance like the Super Bowl. Rather, elections have significant economic implications," Dragonfly's Jessica Furr and Bryan Edelman, its counsel, wrote in a letter to CFTC.

"These contracts were designed to serve crucial risk hedging functions, aligning with the requirements of the Commodity Exchange Act (CEA), and offer valuable predictive data to the public."

Dragonfly also argues that the CFTC's proposed rule overreaches by broadly banning prediction markets without proper evaluation, especially given the Supreme Court's recent 'Chevron' decision, which limits the agency's interpretive authority without a Congressional mandate.

Crypto.com's Steve Humenik, its Special Vice President in charge of Capital Markets, argues that the CFTC's attempt to ban prediction markets violates a rulemaking process dictated by the CEA, which involves a three-step approach.

According to the CEA, the three-step process requires the CFTC to assess whether a contract involves an excluded commodity, whether it engages in specified activities, and whether it's contrary to the public interest before banning it.

"The CFTC must articulate its justification for determining that a given contract has an underlying excluded commodity. This should not be a foregone conclusion," Humenik wrote.

"We urge the CFTC not to sidestep its obligations to undergo a three-step review process with respect to these types of event contracts, and to eliminate this aspect of the Event Contracts NOPR [notice of proposed rulemaking]."

@ Newshounds News™

Source: CoinDesk

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Afternoon 8-12-24

Good Afternoon Dinar Recaps,

ISO 20022 Crypto: List of Compliant Coins & Tokens in 2024

Cryptocurrency projects that are ISO 20022 compliant can seamlessly integrate into traditional financial systems and introduce blockchain immutability and data decentralization to the financial sector.

It is worth noting that not all institutions have adopted the requirements to be ISO 20022 ready yet – according to a Forbes report from earlier this year, about 72% of banks are ISO 20022 compliant. The institutions that haven’t yet taken the necessary steps to become ISO 20022 compliant will have until 2025 to do so.

It is also worth mentioning that “ISO 20022 compliant coin” could be considered a misnomer, as the coin or token itself is not compliant. Instead, what we mean when referring to a project as ISO 20022 compliant is that it leverages some of the messaging language defined by the standard to more easily communicate and exchange data between the project’s own solutions (for example, Ripple’s payment network) and external financial systems (for example, SWIFT).

Good Afternoon Dinar Recaps,

ISO 20022 Crypto: List of Compliant Coins & Tokens in 2024

Cryptocurrency projects that are ISO 20022 compliant can seamlessly integrate into traditional financial systems and introduce blockchain immutability and data decentralization to the financial sector.

It is worth noting that not all institutions have adopted the requirements to be ISO 20022 ready yet – according to a Forbes report from earlier this year, about 72% of banks are ISO 20022 compliant. The institutions that haven’t yet taken the necessary steps to become ISO 20022 compliant will have until 2025 to do so.

It is also worth mentioning that “ISO 20022 compliant coin” could be considered a misnomer, as the coin or token itself is not compliant. Instead, what we mean when referring to a project as ISO 20022 compliant is that it leverages some of the messaging language defined by the standard to more easily communicate and exchange data between the project’s own solutions (for example, Ripple’s payment network) and external financial systems (for example, SWIFT).

XRP KEY FEATURES

1. Fast and cheap cross-border payments

2. The XRP ledger can handle up to 1,500 transactions per second

3. Uses the cost and energy-efficient XRP Ledger Consensus Protocol

4. Ripple has established partnerships with numerous traditional financial institutions, including Bank of America, Santander Bank, and Intesa Sanpaolo

CARDANO ADA

1. Smart contract support

2. Rappidly expanding DeFi ecosystem

3. Specially designed proof-of-stake (PoS) consensus algorithm called Ouroboros

QUANT QNT

1. A blockchain interoperability protocol, allowing different blockchains to communicate with each other

2. It can handle a large number of transactions without sacrificing performance

3. Governed by a decentralized body of stakeholders

ALGORAND ALGO

1. Algorand can be used to send and receive payments quickly and easily

2. Can be used to create and deploy smart contracts

3. Supports decentralized applications (dApps)

4. Uses a proof-of-stake consensus mechanism, which is very energy-efficient

STELLAR XLM

1. Fast and cheap transactions

2. Uses a unique consensus mechanism called the Stellar Consensus Protocol (SCP)

3. Stellar transactions are cheaper than traditional remittance methods, such as wire transfers

4. Stellar can be used to build decentralized applications

HEDARA HBAR

1. Heder HashGraph supports smart contracts and dApps

2. Very energy efficient and suitable for high-volume applications

IOTA (MIOTA)

1. IOTA transactions do not require any fees

2. Designed to be data-oriented, meaning that it can be used to transfer data as well as value

3. IOTA is designed to be quantum-resistant, meaning that it is secure against attacks from quantum computers

4. Uses a unique consensus mechanism called the Tangle

XDC NETWORK XINFIN (XDC)

1. The XDC Network is a hybrid blockchain, meaning that it combines the benefits of both public and private blockchains

2. Can handle up to 2,000 transactions per second

3. Designed to be compliant with regulatory requirements

4. Can be used to track the movement of goods and materials through a supply chain

"ISO 20022’s primary aim is to modernize the traditional financial sector, making it easier for institutions to handle data. The standard could help cryptocurrencies integrate with the traditional sector in ways that were previously impossible."

@ Newshounds News™

Source: CoinCodex

~~~~~~~~~

TEN SECOND MONEY TRANSFERS

European Council adopts regulation on instant payments:

"The instant payments regulation will allow people to transfer money within ten seconds at any time of the day, including outside business hours, not only within the same country but also to another EU member state. The regulation takes into consideration particularities of non-euro area entities."

"Payment service providers such as banks, which provide standard credit transfers in euro, will be required to offer the service of sending and receiving instant payments in euro."

"The new rules will come into force after a transition period that will be faster in the euro area and longer in the non-euro area, that needs more time to adjust."

@ Newshounds News™

Read more: Consilium

~~~~~~~~~

Bitcoin price 12 Months after each halving event :

2012 HALVING - $182

12 Months later- $510

2026 HALVING- $661

12 Months later- $2,600

2020 HALVING- $8,600

12 Months later- $58,000

2024 HALVING-$63,870

12 months later- _?

Where you think Bitcoin price will be 12 months after this halving?

@ Newshounds News™

Source: Twitter

~~~~~~~~~

@ Newshounds News™

Source:

~~~~~~~~~

You are here in 2024.

#XRP Tokenization of Everything

@ Newshounds News™

Source: Twitter

~~~~~~~~~

BRICS countries no longer attaching much importance to DOLLAR — Indian expert

"Sameep Shastri also underscored that he completely disagrees with the assertions that Western countries are the strongest economies in the world

NEW DELHI, August 12. /TASS/. The BRICS member states are no longer attaching much importance to the dollar and successfully using national currencies, Vice Chairman of BRICS Chamber of Commerce and Industry, Sameep Shastri, told TASS."

""I think we are going to see de-dollarization soon. We have already started our trade using rubles and rupee and yuan and rupee, our own currencies, and we do not attach much value to dollar anymore. And I think that is important for each and every country that we should not be dependent on one single currency. We should be dependent on our own currency, and we should make it strong and make our economy strong," he said."

@ Newshounds News™

Source: TASS

~~~~~~~~~

Thailand launches crypto regulatory sandbox to kick-off adoption

The initiative is designed to support the testing and development of services related to digital assets,

The Securities and Exchange Commission of Thailand (SEC Thailand) has launched a Digital Asset Regulatory Sandbox.

The initiative is designed to support the testing and development of services related to digital assets, providing a structured environment where businesses can explore innovative solutions within a regulated framework.

The sandbox aims to facilitate the integration of new financial technologies while maintaining a flexible regulatory approach that addresses the specific risks associated with digital asset transactions.

The term “digital asset” is often usually broadly, but has a specific meaning in Thailand. It includes both cryptocurrencies and digital tokens. Cryptocurrencies are classified as being used as a medium of exchange. In contrast, the feature of a digital token is it grants rights.

It might be an investment token that provides rights in a project or business or a utility token used to receive goods, services or other rights. Thailand has specific rules for real estate tokens.

The sandbox covers both types of tokens and six roles:

Digital Asset Exchange

Digital Asset Broker

Digital Asset Dealer

Digital Asset Fund Manager

Digital Asset Advisor

Digital Asset Custodial Wallet Provider

In order to take part in the sandbox, applicants have to have sufficient capital and adequate management and systems in place.

@ Newshounds News™

Source: CryptoSlate, Ledger Insights

~~~~~~~~~

Japan: SBI-backed ODX to list digital bonds following release of START

Osaka Digital Exchange is set to begin listing digital bonds that meet its strict requirements of complying with Know Your Customer and anti-money laundering rules.

Barely one year after Osaka Digital Exchange (ODX) rolled out a digital securities platform for trading security tokens, several reports have emerged that the exchange is set to begin listing digital bonds.

The SBI-backed digital exchange confirmed that ODX’s START platform will host digital bonds that meet the listing criteria. Since START’s launch in late 2023, real estate security tokens have been the most common issuances on the platform, given their innate popularity in Japan.

ODX will open its doors to three digital bonds in the coming months but specifics were not disclosed to the public. The successes of digital bonds in Europe may have played a role in ODX’s decision to expand the scope of its offering, with its backers reportedly giving the nod to the move.

SBI, the largest shareholder in the exchange, has approved the decision to list digital bonds while Nomura (NASDAQ: NRSCF), SMBC, and Daiwa Securities (NASDAQ: DSECF) have also given the green light to the move.

Armed with the raft of approvals, ODX appears set to begin listing digital bonds that meet its stringent requirements. The exchange will look for bonds that are regulatory compliant and meet relevant Know Your Customer (KYC) and anti-money laundering (AML) rules.

The incoming digital bonds will be approved for secondary trading if they possess smart contract functionality to automate redemption processes and highly secure systems. Other perks to speed up the listing process include interoperability, high liquidity levels, and proper risk management.

It appears that the exchange will stick to its policy of discounting seller fees to improve adoption, but it remains unclear whether the firm will bring back zero fees for users.

“We will dedicate our best efforts to collaborate with our participants and supporters so that the secondary market “START” can contribute to the further development of the security tokens market,” ODX said in December.

@ Newshounds News™

Read more: CoinGeek

~~~~~~~~~

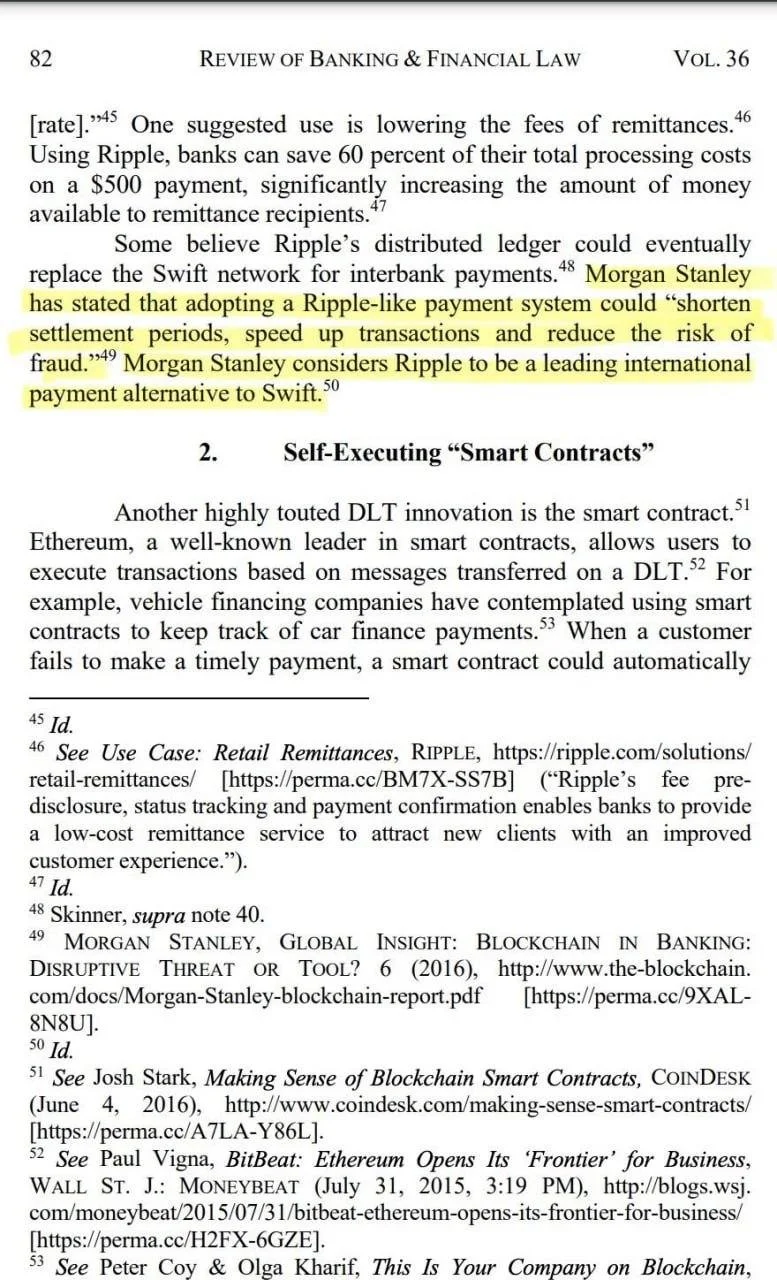

JP Morgan Documentation on Banks’ Involvement in Blockchain acknowledges Ripple’s potential to disrupt cross border payments GLOBALLY.

Major nod to Ripple from the worlds largest bank.

But more importantly, note the text at the bottom of the document.

“This document is being provided for the EXCLUSIVE USE of Mihail Turlakov at Sberbank of Russia”

Exclusive use.🧩

This document was crafted specifically to present relevant initiatives in blockchain to the largest Commercial bank in Russia while citing Ripple as a prominent example.

Russia + JP Morgan + Ripple

Plans on Plans

@ Newshounds News™

Source: Twitter

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Morning 8-12-24

Good Morning Dinar Recaps,

Putin signs law allowing FOREIGN BANKS to OPEN BRANCHES in Russia

"Russian President Vladimir Putin signed a law that allows foreign banks to open branches in Russia but also provides for a number of restrictions on their activities. The document was published on the official portal of legal information."

"The goal is to create conditions for the development of a system of international settlements and attracting foreign investment, the explanatory note says."

"The work of branches of foreign banks will be aimed precisely at this. That is why they will not be able, like ordinary banks, to open deposits for individuals and companies, accounts in precious metals, engage in trust management of money and other property."

Good Morning Dinar Recaps,

Putin signs law allowing FOREIGN BANKS to OPEN BRANCHES in Russia

"Russian President Vladimir Putin signed a law that allows foreign banks to open branches in Russia but also provides for a number of restrictions on their activities. The document was published on the official portal of legal information."

"The goal is to create conditions for the development of a system of international settlements and attracting foreign investment, the explanatory note says."

"The work of branches of foreign banks will be aimed precisely at this. That is why they will not be able, like ordinary banks, to open deposits for individuals and companies, accounts in precious metals, engage in trust management of money and other property."

"Foreign banks will have the right to work in the securities market through a branch created in Russia. Each bank will be allowed to establish only one branch. The law also provides for setting requirements for the qualifications and business reputation of the banks’ officials."

"The law will come into force on September 1, 2024."

@ Newshounds News™

Source: TASS

~~~~~~~~~

How to Protect Your Cryptocurrency Holdings

THIS ARTICLE IS FOR THOSE WHO MAY BE INTERESTED IN STORING THEIR DIGITAL CURRENCY IN AN OFFLINE WALLET

"The first step to protect your cryptocurrency is picking the right wallet type. Wallets are divided into various categories like hardware wallets, software wallets, and paper wallets. "

Hardware wallets which can be put on USB devices offer robust security as they store private keys offline where possible online dangers cannot access them.

Software wallets can be used for handling keys and carrying out transactions, as they are simple to use in desktop or mobile applications. But, they do not offer very high security because they can be influenced by malware or hacking.

Paper Wallets are created by printing private keys and public addresses on physical paper, which gives a physical dimension to the concept of safety. Every wallet type has advantages and restrictions, so choose one that matches your security needs and how frequently you use it.

1. Use powerful passwords that are unique to the wallet and any associated accounts.

2. Avoid using simple passwords or ones that have been used before on other accounts.

3. Use two-factor authentication (2FA) as a second layer of security, which will ask for a different verification like a code sent to your mobile.

4. Always make sure that you are updated with the latest updates on your software and wallet firmware – this is important so as to have all security fixes in place and safeguard against any known vulnerabilities.

5. When linking up with your wallet from public or unsecured networks, do it cautiously as this could let potential threats get access into contact with the stored assets within it.

Backing Up Your Wallet

Nearly all wallets include a backup feature that provides you with a recovery phrase, often called a seed phrase. It’s basically a list of words which can be utilized to restore your wallet if anything happens to it. Ensure you keep this recovery phrase somewhere safe. Having several copies stored in different locations

"By choosing the right type of wallet, using strong safety methods, backing up your wallet, and taking additional security steps; you can greatly reduce the risk of losing digital assets.

If you do these careful actions, then it is certain that your cryptocurrency will remain safe but also simple to access. This allows for confident management and improvement of investments. "

@ Newshounds News™

Source: CryptoTimes

~~~~~~~~~

Ripple XRPL and Dubai

"Ripple plans to strengthen its global presence by partnering with the Dubai International Financial Center (DIFC). The DIFC is a special economic zone in the city established as a financial hub for businesses operating throughout the Middle East, Africa, and South Asia."

" Speaking on the matter was Ripple’s CEO – Brad Garlinghouse – who described the UAE as “one of the most advanced jurisdictions globally” when it comes to offering regulatory clarity for licensed companies to offer crypto services.

“Our partnership with the DIFC Innovation Hub promises to drive the adoption of blockchain technology in the region as the XRPL continues to be a leading blockchain for the region’s start-ups and scaleups building real use cases,” he added.

"Arif Amiri – CEO of the DIFC – highlighted the deal with Ripple as a “significant milestone” that “further cements DIFC’s role as a leading global hub for talent, tech, and innovation.”

"It is interesting to note that Ripple’s Middle East and Africa (MEA) regional office is located within the Dubai International Financial Center.

Less than a year ago, the zone approved XRP for use, meaning licensed crypto firms operating within can incorporate the token into their services. "

@ Newshounds News™

Source: CryptoPotato

~~~~~~~~~

Venezuelan Government Blocks Binance, Cutting P2P Market Access for Thousands

THIS ARTICLE REVEALS HOW VULNERABLE DIGITAL ASSETS CAN BE IF A ROGUE GOVERNMENT BEGINS TO RESTRICT ACCESS TO YOUR CRYPTO EXCHANGE.

THIS RE-ESTABLISHES THE NEED FOR SOLID LAWS AND REGULATIONS TO PROTECT THE PUBLIC

"Venezuelan Government Cuts Access to Binance Users Connecting Through State-Owned ISP"

"The censorship actions of the Venezuelan government have reached the cryptocurrency sector. According to local media, state-owned telecom and internet service provider (ISP) CANTV has blocked access to Binance, the world’s largest cryptocurrency exchange."

"CANTV, a Venezuelan state-owned ISP, has reportedly started blocking traffic to Binance, one of the largest cryptocurrency exchanges in the world.

The company, which controls a significant portion of the Venezuelan broadband market, has left thousands of Venezuelans without access to their savings and even P2P markets, which are popular among those using crypto as a savings tool."

@ Newshounds News™

Source: Bitcoin

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 8-11-24

Good Morning Dinar Recaps,

What Was the Bretton Woods Agreement and System?

The Bretton Woods agreement was negotiated in July 1944 by delegates from 44 countries at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire.

Federal Reserve History. "Creation of the Bretton Woods System."

Under the Bretton Woods system, gold was the basis for the U.S. dollar, and other currencies were pegged to the U.S. dollar’s value.

The Bretton Woods system effectively came to an end in the early 1970s when President Richard M. Nixon announced that the U.S. would no longer exchange gold for U.S. currency.

Good Morning Dinar Recaps,

What Was the Bretton Woods Agreement and System?

The Bretton Woods agreement was negotiated in July 1944 by delegates from 44 countries at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire.

Federal Reserve History. "Creation of the Bretton Woods System."

Under the Bretton Woods system, gold was the basis for the U.S. dollar, and other currencies were pegged to the U.S. dollar’s value.

The Bretton Woods system effectively came to an end in the early 1970s when President Richard M. Nixon announced that the U.S. would no longer exchange gold for U.S. currency.

Key Takeaways

▪️The Bretton Woods agreement and system created a collective international currency exchange regime that lasted from the mid-1940s to the early 1970s.

▪️The Bretton Woods system required a currency peg to the U.S. dollar which was in turn pegged to the price of gold.

▪️The Bretton Woods system collapsed in the 1970s but had a lasting influence on international currency exchange and trade through the development of the International Monetary Fund and the World Bank.

The Bretton Woods Agreement and System Explained

Approximately 730 delegates representing 44 countries met in Bretton Woods in July 1944 with the principal goals of creating an efficient foreign exchange system, preventing competitive devaluations of currencies, and promoting international economic growth.

The Bretton Woods agreement and system were central to these goals. The agreement also created two important organizations—the International Monetary Fund (IMF) and the World Bank.

While the Bretton Woods system was dissolved in the 1970s, both the IMF and World Bank have remained strong pillars for the exchange of international currencies.

Though the Bretton Woods conference itself took place over just three weeks, the preparations for it had been going on for several years.

The primary designers of the Bretton Woods system were the famous British economist John Maynard Keynes and chief international economist of the U.S. Treasury Department Harry Dexter White.

Keynes’ hope was to establish a powerful global central bank to be called the "Clearing Union" and issue a new international reserve currency called the bancor.

White’s plan envisioned a more modest lending fund and a greater role for the U.S. dollar, rather than the creation of a new currency. In the end, the adopted plan took ideas from both, leaning more toward White’s plan.

It wasn't until 1958 that the Bretton Woods system became fully functional. Once implemented, its provisions called for the U.S. dollar to be pegged to the value of gold. Moreover, all other currencies in the system were then pegged to the U.S. dollar’s value. The exchange rate applied at the time set the price of gold at $35 an ounce.

Benefits of Bretton Woods Currency Pegging

The Bretton Woods system included 44 countries. These countries were brought together to help regulate and promote international trade across borders.

As with the benefits of all currency pegging regimes, currency pegs are expected to provide currency stabilization for the trade of goods and services as well as financing.

All of the countries in the Bretton Woods system agreed to a fixed peg against the U.S. dollar with diversions of only 1% allowed.

Countries were required to monitor and maintain their currency pegs which they achieved primarily by using their currency to buy or sell U.S. dollars as needed.

The Bretton Woods system, therefore, minimized international currency exchange rate volatility which helped international trade relations.

More stability in foreign currency exchange was also a factor in the successful support of loans and grants internationally from the World Bank.

The IMF and World Bank

The Bretton Woods agreement created two institutions, the IMF and the World Bank. Formally introduced in December 1945, both institutions have withstood the test of time, globally serving as important pillars for international capital financing and trade activities.

The purpose of the IMF was to monitor exchange rates and identify nations that needed global monetary support.

The World Bank, initially called the International Bank for Reconstruction and Development, was established to manage funds available for providing assistance to countries that had been physically and financially devastated by World War II.

Today, the IMF has 190 member countries and still continues to support global monetary cooperation.

In tandem, the World Bank helps to promote these efforts through its loans and grants to governments.

The Bretton Woods System Collapse

In 1971, concerned that the U.S. gold supply was no longer adequate to cover the number of dollars in circulation, President Richard M. Nixon devalued the U.S. dollar relative to gold. After a run on gold reserve, he declared a temporary suspension of the dollar’s convertibility into gold.

By 1973 the Bretton Woods system had collapsed. Countries were then free to choose any exchange arrangement for their currency, except pegging its value to the price of gold.

They could, for example, link its value to another country's currency, or a basket of currencies, or simply let it float freely and allow market forces to determine its value relative to other countries' currencies.

The Bretton Woods agreement remains a significant event in world financial history.

The two Bretton Woods institutions it created in the International Monetary Fund and the World Bank played an important part in helping to rebuild Europe in the aftermath of World War II.

Subsequently, both institutions have continued to maintain their founding goals while also transitioning to serve global government interests in the modern-day.

Is the Bretton Woods Agreement Still in Effect?

The Bretton Woods system—which required a currency peg to the U.S. dollar and linked the value of the dollar to gold—is no longer in effect.

In the 1960s, the dollar had struggled within the system set up under the Bretton Woods agreement. In 1971, President Nixon suspended its convertibility into gold. Today, currencies float against each other, rather than keeping at firm pegs.

What Is the Difference Between the Gold Standard and the Bretton Woods System?

The gold standard refers to any monetary system in which the value of currency is linked to gold. Currently, there are no countries that use the gold standard.

Under the Bretton Woods system, the U.S. was originally convertible to gold at a rate of $35 per ounce. By 1971, this convertibility was severed.

What Backs the U.S. Dollar?

Previously, the U.S. dollar was backed by gold. Today, the U.S. dollar isn't backed by anything, other than the U.S. government's own ability to generate revenue.

The Bottom Line

The Bretton Woods agreement established a currency exchange regime system in 1944, following years of negotiations among 44 nations.

This system required a currency peg to the U.S. dollar which was in turn pegged to the price of gold. The Bretton Woods system ultimately would go on to collapse in the 1970s.

The Bretton Woods agreement also established institutions such as the International Monetary Fund and the World Bank, both of which continue to play an important role in the financial world today.

@ Newshounds News™

Source: Investopedia

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 8-10-24

Good Afternoon Dinar Recaps,

DOLLAR SLIPS AGAINST DONG "The U.S. dollar weakened against Vietnamese dong both at banks and unofficial exchange points Friday morning.

Vietcombank sold the greenback at VND25,280, down 0.16% from Thursday."

"The dollar has increased against the dong by 3.52% since the beginning of the year. Globally, the dollar hovered close to a one-week high against major rivals on Friday, after the biggest drop in U.S. jobless claims in close to a year allayed fears of a looming economic downturn, Reuters reported."

Good Afternoon Dinar Recaps,

DOLLAR SLIPS AGAINST DONG

"The U.S. dollar weakened against Vietnamese dong both at banks and unofficial exchange points Friday morning.

Vietcombank sold the greenback at VND25,280, down 0.16% from Thursday."

"The dollar has increased against the dong by 3.52% since the beginning of the year. Globally, the dollar hovered close to a one-week high against major rivals on Friday, after the biggest drop in U.S. jobless claims in close to a year allayed fears of a looming economic downturn, Reuters reported."

"The U.S. currency extended gains against the Japanese yen to a fourth day, buoyed by a spike in Treasury yields following Thursday's firmer-than-expected employment data, which spurred a paring back in bets for Federal Reserve interest rate cuts this year."

@ Newshounds News™

Source: VN Express

~~~~~~~~~

JP Morgan has even said that stablecoin issuers who adhere to regulations will benefit from the upcoming regulatory crackdown AND GAIN MARKETSHARE💯

Looks like JP Morgan knows what’s coming.

@ Newshounds News™

Source: Twitter

~~~~~~~~~

August 2024 Harvard Business Review: The Race to Dominate Stablecoins.

Yes, it is a race.

Companies are fighting to capture the market share that this new form of money is creating in the crypto universe.

“Stablecoins have the potential to REWIRE the global financial system and DISPLACE legacy payment systems like SWIFT.

@ Newshounds News™

Source: Twitter

~~~~~~~~~

"Bringing a trusted stablecoin onto XRPL will drive more adoption and development, contributing to a vibrant ecosystem." QUOTE from Brad Garlinghouse

"The stablecoin market is about $150B today, and is forecasted to exceed $2.8 trillion by 2028. There’s clear demand for stablecoins that deliver trust, stability, and utility.

To meet this growing demand, Ripple will issue a stablecoin, leveraging its decade-plus of experience building real-world financial solutions for institutions around the world."

"This move is also monumental for the XRP Ledger community, driving more use cases, liquidity and opportunities for developers and users.

At launch, the stablecoin will be available on the XRP Ledger (XRPL) and Ethereum (ETH) blockchains, with plans to expand to additional blockchains and decentralized finance (DeFi) protocols and apps over time."

"Issuing our stablecoin on the XRP Ledger and Ethereum will serve as a pivotal entry point to unlock new opportunities for institutional and DeFi use cases across multiple ecosystems," added Monica Long, Ripple President.

"The XRP Ledger’s native capabilities, including a decentralized exchange and automated market maker, were built to utilize XRP as THE BRIDGE ASSET."

LET'S CONSIDER THE QUOTES FOUND IN THIS ARTICLE AS WE CONTEMPLATE THE ROLE RLUSD WILL PLAY ALONG WITH XRP.

IT'S OBVIOUS THAT RIPPLE HAS POSITIONED ITSELF AS A PIONEER IN THE DEFI ARENA

RLUSD POSSIBLY BECOMING THE STABLECOIN OF CHOICE AFTER LAUNCH AND THE UTLITIY FACTOR THAT XRP PLAYS IN THE DIGITAL ECOSYSTEM, THERE CAN BE LITTLE DOUBT THAT RLUSD WILL ENHANCE THE MARKETABILITY OF XRP, EVEN THOUGH THEY PROVIDE ARE TWO COMPLETELY DIFFERENT PRODUCTS.

XRP WILL LIKELY RISE IN VALUE BASED ON ITS OWN USE AND UTILITY, BUT MAY SEE A BUMP IN VALUE WHEN RLUSD IS LAUNCHED.

@ Newshounds News™

Source: Finance Yahoo

~~~~~~~~~

All About ZiG, Zimbabwe’s Latest Shot at a Stable Currency

"IN the latest effort to devise a credible national currency, Zimbabwe in April replaced its dollar with the ZiG, short for Zimbabwe Gold.

The new unit is backed by bullion and foreign currency reserves held at the central bank. It’s the country’s sixth attempt at establishing its own currency since 2008, when inflation crossed 500 billion percent, according to International Monetary Fund estimates."

"Not only did that render it worthless, it turned the unit into a global punchline: US Treasury secretaries would carry the notes as a reminder of the evils of hyperinflation.

Confident that they’ve finally got it right, Zimbabwe has announced plans to go all-in on the ZiG and make it the southern African nation’s sole legal tender. That’s an audacious goal, given that the dollar still accounts for the bulk of transactions in the country."

What went wrong with the Zimbabwean dollar?

"Brought back to life in 2019 after a decade-long furlough when the country ran solely on foreign currency, the Zimbabwean dollar lost ground against the US dollar every trading day this year.

This had wiped around 80% off its value by the time newly appointed central bank Governor John Mushayavanhu put it out of its misery on April 5."

"The collapse had already forced more than four-fifths of the southern African nation’s economy to transact in US dollars for everything from food to medicine, with some businesses only accepting payment in greenbacks.

Few people have forgotten the experience of 2008 when their savings were wiped out by inflation, so public trust in the local unit had always been low."

"The ZiG started trading on April 8 at an exchange rate of 13.56 to the dollar.

Banks, mobile-money platforms, retailers and other intermediaries reconfigured their systems to take account of the new currency, though the process has been a bumpy one."

Where does the currency’s value come from?

"The central bank said the new currency would be fully backed by $100 million in cash and 2,522 kilograms of gold worth $185 million. New banknotes were released on April 30, and the central bank went on a publicity drive to raise awareness of the new currency. "

"They have also fined traders for refusing to accept payment in ZiG. The authorities say that dollar-denominated transactions have declined to around 70% from 85% when it was introduced."

"In early August, the cabinet said it had adopted a “de-dollarization roadmap” without providing details of when it would take effect, though President Emmerson Mnangagwa has hinted it could happen as early as 2026. Official statistics suggest that the ZiG has helped to rein in surging price pressures since its April launch, though there are only a few months’ worth of data to go on."

@ Newshounds News™

Source: The Zimbabwe Mail

~~~~~~~~~

WHERE IS THE LEGAL CLARITY UNDER THE BIDEN ADMINISTRATION TO THE CRYPTO INDUSTRY TO OPERATE LEGALLY IN THE US?

Crypto Industry execs met with White House officials to discuss crypto policy on August 8. Representatives from Coinbase, Kraken, Ripple and Circle reportedly attended a video call with US policymakers to discuss their approach to crypto regulation.

IMO, THE FOLOWING IS THE MOST IMPORTANT THING DISCUSSED DURING THAT MEETING:

"The crypto executives reportedly pushed the Biden administration for regulatory clarity in the digital asset space, hinting at the removal of Securities and Exchange Commission (SEC) Chair Gary Gensler.

Many in the industry have criticized the SEC under Gensler for bringing enforcement actions against crypto firms that seemingly do not have a clear path to operate legally in the US."

Lawfirm Holland & Knight made the following statement in a report titled, "Blockchain & Cryptocurrency Laws and Regulations 2024":

"In the United States, cryptocurrencies have been the focus of much attention by both federal and state governments.

At the federal level, most of the focus has been at the administrative and agency level, including the Securities and Exchange Commission (the “SEC”), the Commodity Futures Trading Commission (the “CFTC”), the Federal Trade Commission (the “FTC”) and the Department of the Treasury (the “Treasury”), through the Internal Revenue Service (the “IRS”), the Office of the Comptroller of the Currency (the “OCC”) and the Financial Crimes Enforcement Network (“FinCEN”).

While there has been significant engagement by these agencies, little formal rulemaking has occurred. Many federal agencies and policymakers have praised the technology as being an important part of the U.S.’s future infrastructure and have acknowledged the need for the U.S. to maintain a leading role in the development of the technology."

The Seeds of Wisdom Team " Roadmap ", has documented many laws that have been introduced in both the House and the Senate. Some have passed the House or the Senate, but only one was passed by both the House and the Senate. However, that bill was Vetoed by Biden.

The industry executives were correct in saying that they are operating without a clear legal path to do so in the US. The BRICs nations have Russia in the lead providing a framework for cross border payments and stablecoins.

The EU Parliament has passed and implemented the Markets in Crypto-Assets (MiCA) to provide regulatory clarity to crypto businesses in the European Union.

The US is way behind and needs to pass laws to provide not only legal clarity to the crypto Industry in the US, but also security and protection regulations to it's citizens.

@ Newshounds News™

Read more: CoinTelegraph, Roadmap, Global Legal Insights

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Afternoon 8-9-24

Good Afternoon Dinar Recaps,

Trump Jr. to Launch Crypto Platform, to “Take on” Banks

PAY ATTENTION TO THIS ONE. THIS ARTICLE IS ANOTHER CONFIRMATION THE DIRECTION OF THE FINANCE WORLD .

"On August 8, Donald Trump Jr. revealed plans for a new DeFi platform aimed at addressing banking access inequality. During a Q&A session on the subscription-based platform Locals, Trump Jr. clarified that this venture is not a memecoin but a comprehensive crypto platform designed to take on traditional banking systems."

“This isn’t about creating a memecoin,” Trump Jr. stated, emphasizing that his initiative represents a broader and more impactful platform. However, he did caution that it will be some time before the project comes to fruition, withholding specific timelines for now.

Good Afternoon Dinar Recaps,

Trump Jr. to Launch Crypto Platform, to “Take on” Banks

PAY ATTENTION TO THIS ONE. THIS ARTICLE IS ANOTHER CONFIRMATION THE DIRECTION OF THE FINANCE WORLD .

"On August 8, Donald Trump Jr. revealed plans for a new DeFi platform aimed at addressing banking access inequality. During a Q&A session on the subscription-based platform Locals, Trump Jr. clarified that this venture is not a memecoin but a comprehensive crypto platform designed to take on traditional banking systems."

“This isn’t about creating a memecoin,” Trump Jr. stated, emphasizing that his initiative represents a broader and more impactful platform. However, he did caution that it will be some time before the project comes to fruition, withholding specific timelines for now.

"He expressed frustration with the current financial system’s exclusivity and its tendency to limit financing opportunities to select individuals. “Decentralized finance is very appealing to me, especially for those of us who have been debanked,” he said.

"Speculation about the new crypto project surged earlier in the week after Trump Jr. tweeted about DeFi, leading many to believe it might involve a new memecoin. On August 7, he posted on X, “We’re about to shake up the crypto world with something HUGE. Decentralized finance is the future — don’t get left behind.”

"Trump Jr. also warned against fraudulent tokens claiming affiliation with the Trump name, stating, “I love the crypto community’s enthusiasm for Trump, but beware of fake tokens. The only official project will be announced by us directly, and it will be fair for everyone.”

@ Newshounds News™

Source: CryptoTimes

~~~~~~~~~

RIPPLE´S STUART ALDEROTY MENTIONS THE PHRASE "HITTING THE #RESET BUTTON" FOUR TIMES IN HIS INTERVIEW WITH CNBC

CLICK ON THE LINK TO HEAR THE 1 MINUTE INTERVIEW

1) "[...] FINALLY, THIS ADMINISTRATION WILL TURN THE PAGE ON THEIR WAR ON CRYPTO AND HIT THE RESET BUTTON."

2) "[...] AND THIS ADMINISTRATION TRULY IS SERIOUS ABOUT HITTING THE RESET BUTTON ON THEIR WAR ON CRYPTO, THERE SHOULD BE NO APPEAL."

3) "WHAT WE NEED AS A COUNTRY IS TO HIT THE RESET BUTTON [...] AND CREATING CLEAR LAWS."

4) "THE COMBINATION OF OUR LITIGATION OUTCOME, THE COMBINATION OF THE ELECTION SEASON WE´RE IN, WE CAN REALLY SEE A RESET BUTTON HERE"

@ Newshounds News™

Read more: X formerly Twitter

~~~~~~~~~

Speaking of RESET

Here is the New US Debt Clock image from yesterday

AND NEW BOXES WERE ADDED TO THE DEBT CLOCK YESTERDAY

@ Newshounds News™

Source: US Debt Clock

~~~~~~~~~

RIPPLE RIPPLE RIPPLE

"Testing, testing…RLUSD! We’re excited to share that Ripple USD (RLUSD) is now in private beta on XRP Ledger and Ethereum mainnet. RLUSD has not yet received regulatory approval and therefore is not available for purchase or trading – please be cautious of scammers who claim they have or can distribute Ripple USD"

"RLUSD will be valued 1:1 to the US dollar (USD) and 100% backed by US dollar deposits, short-term US government treasuries, and other cash equivalents. These reserve assets will be audited by a third-party accounting firm, and Ripple will publish monthly attestations."

"This is a significant milestone and a step closer to bringing more high-quality assets to the XRP Ledger, driving new opportunities, liquidity, and institutional use cases for users, developers, and applications."

@ Newshounds News™

Source: X formerly Twitter

~~~~~~~~~

BRICS Strike Back: Russia and India Team Up to Challenge Dollar Dominance

The trend of de-dollarization continues to gain traction despite many analysts saying the threat is overblown as India and Russia have announced a new partnership that will see their respective payment systems – India’s RuPay and Russia’s MIR – integrated to allow for seamless cross-border transactions without the need for U.S. dollars.

The partnership announcement follows the recent visit by India’s Prime Minister Narendra Modi to Moscow, during which the two countries forged new alliances and trade agreements. At the meeting, India confirmed its commitment to open trade with Russia, a key BRICS counterpart, and will facilitate trade using the RuPay and MIR payment systems.

As part of their agreement, Russian President Vladimir Putin and Modi reportedly set a goal to achieve $100 billion in trade turnover between Russia and India by 2030.

As part of their agreement, Russian President Vladimir Putin and Modi reportedly set a goal to achieve $100 billion in trade turnover between Russia and India by 2030.

@ Newshounds News™

Source: InfoBrics

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Thursday Evening 8-8-24

Good evening Dinar Recaps,

Economist Jim Rickards Highlights Gold's Opportunity During Market Meltdowns

"Gold is being profiled as a relevant investment option in economic uncertainty and market instability times. Jim Rickards, a U.S. economist and best-selling author of books like “Currency Wars” and an opinion contributor to several newspapers and publications including The New York Times and The Washington Post, has referred to the investment opportunity that gold presents during acute market setbacks."

"In social media, Rickards reinforced its solid opinion of gold as a hedge against market instability, predicting the price movement of the precious metal during these events.

"Rickards says, "In a stock market meltdown, gold goes down due to selling by weak hands who need cash for margin calls. The strong hands take a beat, wait for a bottom. Then they jump in with both feet because they know it’s way up from there."

"Rickards has been analyzing gold’s position in today’s economy, stating that the metal might be used in case of a global currency meltdown to re-establish the gold standard, with many countries, including the U.S., purchasing gold to support the value of their currency."

Good evening Dinar Recaps,

Economist Jim Rickards Highlights Gold's Opportunity During Market Meltdowns

"Gold is being profiled as a relevant investment option in economic uncertainty and market instability times. Jim Rickards, a U.S. economist and best-selling author of books like “Currency Wars” and an opinion contributor to several newspapers and publications including The New York Times and The Washington Post, has referred to the investment opportunity that gold presents during acute market setbacks."

"In social media, Rickards reinforced its solid opinion of gold as a hedge against market instability, predicting the price movement of the precious metal during these events."

Rickards says, "In a stock market meltdown, gold goes down due to selling by weak hands who need cash for margin calls. The strong hands take a beat, wait for a bottom. Then they jump in with both feet because they know it’s way up from there."

"Rickards has been analyzing gold’s position in today’s economy, stating that the metal might be used in case of a global currency meltdown to re-establish the gold standard, with many countries, including the U.S., purchasing gold to support the value of their currency."

"Nonetheless, while some markets rebounded after Monday’s meltdown, gold continued to trade down, losing the $2,400 mark. Even after slipping down, gold prices are still almost 15% up during 2024, reaching historic high levels just some days ago."

"According to the World Gold Council, demand is expected to maintain the next year supported by central bank gold purchases for portfolio diversification and protection purposes."

@ Newshounds News™

Source: Bitcoin

~~~~~~~~~

BREAKING: Victory for Ripple as XRP Is Not a Security in the US; $125M Fine for the Truth

Ripple’s decisive victory over the SEC has officially ruled XRP a non-security.

Judge Torres reduced the SEC’s demanded fine from $2 billion to $125 million.

Ripple has exciting news following its recent victory over the US Securities and Exchange Commission (SEC). XRP has been officially classified as a non-security, a designation that was highly disputed during Ripple’s litigation against the Commission.

Court Significantly Reduces SEC Penalties for Ripple’s Institutional XRP Sales

In addition, as Ripple CEO Brad Garlinghouse noted in his most recent tweet, the court has reduced the SEC’s penalties for institutional XRP sales that violate federal securities laws.

"The SEC asked for $2B, and the Court reduced their demand by ~94% recognizing that they had overplayed their hand. We respect the Court’s decision and have clarity to continue growing our company.

This is a victory for Ripple, the industry and the rule of law. The SEC’s headwinds against the whole of the XRP community are gone."

Judge Torres of the Southern District of New York levied the penalties after concluding that Ripple’s 1,278 institutional sales transactions breached securities regulations.

Previously, Judge Torres decided in July 2023 that Ripple violated federal securities laws by selling XRP directly to institutional clients. However, automated sales of XRP to retail clients through exchanges did not violate securities regulations.

Recently, the SEC failed to appeal a portion of the order that excused Ripple from securities law violations in programmatic sales.

Furthermore, Judge Torres has forbidden Ripple from future violations of federal securities laws, signaling that any violations will necessitate the issue of a court order. Ripple must file a registration statement if it intends to sell securities in the future.

Interestingly, Ripple’s convincing triumph has generated a surge in demand for XRP. At the time of writing, XRP was up 17.88% over the last 24 hours to $0.6055. Its daily trade volume has risen more than 200% to $5.05 billion. The price of XRP has quickly risen to pass crucial levels, $0.50 and $0.60.

@ Newshounds News™