Seeds of Wisdom RV and Economic Updates Tuesday Morning 7-30-24

Good morning Dinar Recaps,

EU and Singapore finalise Digital Trade Agreement

The European Union (EU) and Singapore have successfully concluded negotiations for a landmark Digital Trade Agreement (DTA), an initiative aimed at setting global standards for digital trade and cross-border data flows.

On 25 July 2024, the European Union (EU) and Singapore successfully concluded negotiations for a landmark Digital Trade Agreement (DTA), an initiative aimed at setting global standards for digital trade and cross-border data flows.

This agreement, the first of its kind for the EU, complements the existing 2019 EU-Singapore Free Trade Agreement (EUSFTA) and shows deepening economic relations between the two regions.

Good Morning Dinar Recaps,

EU and Singapore finalise Digital Trade Agreement

The European Union (EU) and Singapore have successfully concluded negotiations for a landmark Digital Trade Agreement (DTA), an initiative aimed at setting global standards for digital trade and cross-border data flows.

On 25 July 2024, the European Union (EU) and Singapore successfully concluded negotiations for a landmark Digital Trade Agreement (DTA), an initiative aimed at setting global standards for digital trade and cross-border data flows.

This agreement, the first of its kind for the EU, complements the existing 2019 EU-Singapore Free Trade Agreement (EUSFTA) and shows deepening economic relations between the two regions.

The DTA is designed to facilitate digitally-enabled trade in goods and services, ensuring that data flows across borders without unjustified barriers.

It provides a framework that guarantees consumer trust, predictability, and legal certainty for businesses, especially small and medium-sized enterprises (SMEs).

This agreement also includes rules on spam and cybersecurity, reinforcing the EU and Singapore’s commitment to a secure digital environment (Trade) (EURAXESS).

European Commission Executive Vice-President Valdis Dombrovskis and Singapore’s Minister-in-charge of Trade Relations Grace Fu announced the conclusion of the negotiations, highlighting the agreement’s importance.

They emphasised that the DTA not only reflects the growing digital economies of the EU and Southeast Asia but also their shared commitment to maintaining open, competitive, and fair digital markets.

The agreement is part of the EU’s broader strategy to update digital trade rules globally, as seen in recent digital trade chapters with the UK, Chile, and New Zealand.

The EU and Singapore will now proceed with their respective domestic procedures to formally sign and conclude the DTA.

The deal is expected to enhance the digital transformation of both economies, fostering innovation and providing new economic opportunities.

It also aligns with the EU’s Indo-Pacific strategy, aiming to strengthen ties with key partners in this region.

In conjunction with the DTA, the second Trade Committee meeting under the EUSFTA took place, co-chaired by Minister Fu and Executive Vice-President Dombrovskis.

They noted the strong trade relations between the EU and Singapore, with annual trade in goods and services surpassing €130 billion in 2022.

The meeting also covered bilateral cooperation in areas like the green economy and discussed recent global economic developments, including issues at the World Trade Organisation (WTO).

The EU-Singapore Digital Partnership, launched in February 2023, laid the groundwork for this agreement.

This partnership included Digital Trade Principles aimed at facilitating the free flow of goods and services while upholding privacy and data protection standards.

The Digital Partnership and the DTA together represent a significant advancement in the EU’s efforts to lead in global digital governance.

The formal signing and implementation of the EU-Singapore Digital Trade Agreement will further strengthen economic ties and provide a model for future digital trade agreements worldwide.

The agreement is expected to be fully operational by mid-2025, providing a boost to digital commerce and innovation in both regions.

@ Newshounds News™

Read more: Trade Finance Global

~~~~~~~~~

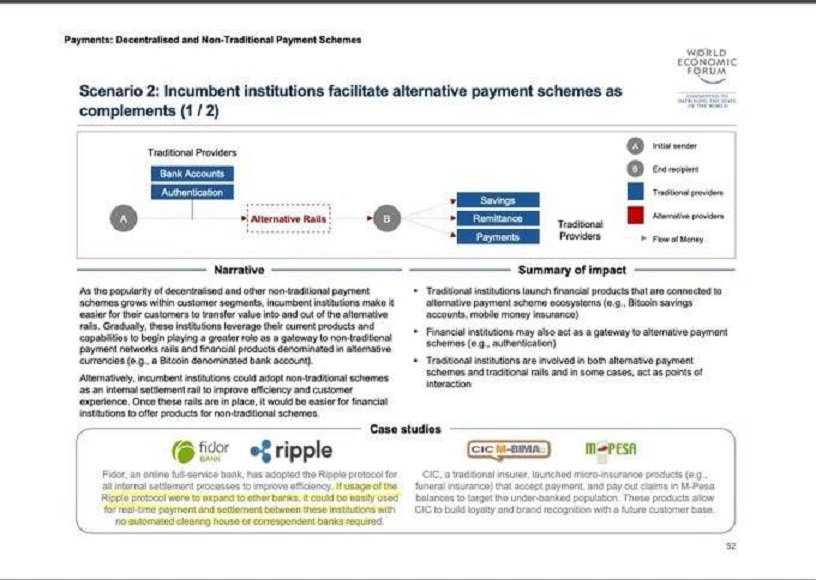

World Economic Forum document on “Decentralized and Non-Traditional Payment Schemes” cites Ripple as an example of an alternative rail for traditional payment systems 🔑

“If usage of the Ripple protocol were to expand to other banks, it could be EASILY used for real-time payment and settlement BETWEEN these institutions with NO automated clearing house or correspondent banks required.”

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

TRUMP'S PLAN IS TO DOLLARIZE THE WORLD THROUGH STABLECOINS

"This past Saturday, former president Donald Trump addressed the Bitcoin 2024 conference in Nashville, Tennessee, expounding upon the crypto and bitcoin policies likely to be implemented as part of a likely future Trump administration.

Speaking in front of a banner emblazoned with the logo of Xapo bank, an institution which hopes to serve as a global bridge between bitcoin, the U.S. dollar and stablecoins, Trump’s speech revealed a policy vision that would integrate those three in order to “extend the dominance of the U.S. dollar to new frontiers all around the world.”

"Talk of a threatened dollar has been circulating for years, with the petrodollar system now having ended and increasingly influential power blocs seeking alternatives to the dollar as a reserve currency. However, Trump – per his recent speech – seems poised to employ bitcoin as a sink for out-of-control U.S. government debt and to unleash the expansion of digital dollar stablecoins, which are already quietly dollarizing numerous countries in the Global South as the consequences of Covid-era fiscal policies continue to decimate the purchasing power of the 99% globally."

"Trump promised, among other things, to “create a framework to enable the safe, responsible expansion of stablecoins […] allowing us to extend the dominance of the U.S. dollar to new frontiers all around the world.” He then asserted that, as a result of his future administration’s embrace of dollar stablecoins, “America will be richer, the world will be better, and there will be billions and billions of people brought into the crypto economy and storing their savings in bitcoin."

@ Newshounds News™

Read more: Bitcoin Magazine

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Afternoon 7-29-24

Good afternoon Dinar Recaps,

Worldwide, People Reject the Central Bank Digital Currency

"Do people want central bank digital currencies, better known as CBDCs? Countries that have experimented with or launched digital versions of their respective currencies have witnessed little fanfare for these endeavors. Put simply, they are not appealing to the general public.

Yet governments are still foisting them onto their populations, perhaps because they might be the greatest surveillance tool known to man."

"At the onset of the coronavirus pandemic, the Bahamas became the first nation in the world to issue a central bank digital currency. Whether it was out of fear that touching physical cash would result in COVID is unclear.

Good afternoon Dinar Recaps,

Worldwide, People Reject the Central Bank Digital Currency

"Do people want central bank digital currencies, better known as CBDCs? Countries that have experimented with or launched digital versions of their respective currencies have witnessed little fanfare for these endeavors. Put simply, they are not appealing to the general public.

Yet governments are still foisting them onto their populations, perhaps because they might be the greatest surveillance tool known to man."

"At the onset of the coronavirus pandemic, the Bahamas became the first nation in the world to issue a central bank digital currency. Whether it was out of fear that touching physical cash would result in COVID is unclear.

But the Caribbean island made history nevertheless by unleashing the Sand Dollar digital currency. It maintains two forms: retail and wholesale. The former allows consumers to utilize the CBDC, while the latter is solely dedicated to financial institutions."

"Now, about four years after the Sand Dollar’s introduction, it accounts for less than 1% of the money in circulation as acceptance and usage by businesses and consumers remain limited.

Additionally, digital wallet values tumbled to $12 million in the first eight months of last year (the latest data), down from $49.8 million in the same period a year ago."

"China became one of the world’s largest economies to introduce a central bank digital currency, known as the digital yuan or e-CNY. It had been years in the making, and because the Asian powerhouse is a hyper-digital location, officials had high expectations and believed their communities would ebulliently embrace the e-CNY. Today, there is very little action in the world of CBDCs."

"INDIA'S CBDC – the digital RUPEE – has experienced a decline in usage. Transaction rates had been solid in the months following its launch, mainly because the country’s banks had disbursed employee benefits in CBDC units. However, more consumers and merchants have shrugged off the authoritarian digital payment “innovation” throughout 2024."

"With growing pushback, central banks have modified their expectations. According to a 2023 Business of International Settlements survey, the number of central banks that are very likely to issue a retail or wholesale CBDC within three to six years has diminished significantly from the 2022 survey."

"The Atlantic Council maintains a CBDC tracker, which shows that 36 countries are in the pilot phase. Thirty are still in the development stage, and 44 are actively researching a central bank digital currency. Seventeen are inactive, while two have been canceled.

What about the United States? The Federal Reserve insists that it is several years away from putting together a CBDC. Republican lawmakers have introduced legislation to put the kibosh on its creation. Former President Donald Trump and independent presidential candidate Robert F. Kennedy, Jr. pledge to ban the formation of a CBDC."

@ Newshounds News™

Read more: Currency Insider

~~~~~~~~~

Indian Expert Says BRICS, SCO May MERGE in Five Years

" BRICS (Brazil, Russia, India, China, South Africa) may merge with the Shanghai Cooperation Organization (SCO) within the next five years, giving birth to a stronger entity with a more meaningful role, Robinder Sachdev, president of the New Delhi-based analytical center, the Imagindia Institute, told TASS."

"Both BRICS and SCO are initially founded by China and Russia. Many big picture goals of both organizations are same. It is necessary for both organizations to have very different roadmap in future. Otherwise, I have said many times that it is now time to consider merging of the SCO and BRICS into a single organization."

""If the BRICS countries work together strongly on some common agenda then BRICS can have an important role. If BRICS becomes a strong organization, then it can play very important role in building the New World Matrix of the 21st century," he stressed.

"BRIC was established in 2006 by Brazil, Russia, India, and China. In 2011, South Africa joined the group, adding the S to the acronym."

"Set up in 2001 in Shanghai, the SCO initially included six countries, namely Russia, Kazakhstan, Kyrgyzstan, China, Tajikistan, and Uzbekistan. India and Pakistan joined in 2017. Iran was admitted to the organization at the SCO virtual summit in early July.

@ Newshounds News™

Read more: TASS

~~~~~~~~~

XRP News Today: Ripple-Led $1.5 Billion Token Flood to Hit Market in August

August is a major month for crypto token unlocks, with nearly $1.5 billion worth of tokens hitting the market.

Ripple leads the pack with a $609 million XRP unlock, followed by Avalanche and Wormhole.

Numerous other projects, including Sui, dYdX, ZetaChain, ImmutableX, Aptos, The Sandbox, Starknet, and Arbitrum.

XRP This morning $0.61 up 0.54%

@ Newshounds News™

Read more: Coinpedia

~~~~~~~~~

Swiss regulator FINMA targets stablecoin issuers in new proposal

As stablecoins continue to gain traction globally, regulatory initiatives such as FINMA’s guidance are likely to influence policies in other jurisdictions.

In a move aimed at bolstering regulatory oversight and mitigating financial risks, the Swiss Financial Market Supervisory Authority (FINMA) has proposed new guidelines for stablecoin issuers. The proposal comes amid growing concerns over the potential impact of stablecoins on regulated institutions and the broader financial ecosystem.

Stablecoins — digital assets linked to the value of traditional currencies or other assets — have experienced increased adoption. However, their rapid growth has also prompted global regulatory concerns due to potential illicit activity and misuse.

In its guidance issued on July 26, FINMA emphasized that stablecoin issuers must be subject to the same Anti-Money Laundering (AML) obligations as traditional financial institutions. This includes verifying the identity of stablecoin holders and establishing the identity of beneficial owners.

In addition to AML compliance, FINMA explained how stablecoin issuers can operate without a banking license if they meet certain conditions. It claims that these conditions ensure depositors are protected, and issuers must have a bank guarantee in case of default.

While FINMA claims its measures boost depositor protection, they do not match the security of a banking license. Still, the regulator is committed to mitigating default guarantee risks and ensuring stablecoin issuers meet robust standards to safeguard customers.

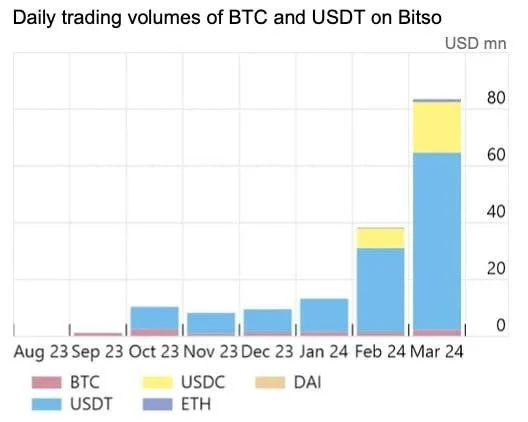

The stablecoin sector has experienced exponential expansion in recent times, reaching an unprecedented market capitalization in 2023. In response, global regulators are hastening to establish guidelines for this rapidly evolving sector.

According to the “PwC Global Crypto Regulation Report 2023,” at least 25 countries, including Switzerland, had implemented stablecoin regulations or legislation by the year’s end.

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

Malaysia sends application to Russia to join BRICS — PM

Lavrov promised that as the BRICS president Russia will help Malaysia promote its interest to the partnership with the association

TOKYO, July 28. /TASS/. Malaysia has sent an application for BRICS membership to Russia, which is currently holding BRICS presidency, Malaysian Prime Minister Anwar Ibrahim said.

"Malaysia has sent a letter of application to join the (BRICS) organization to Russia as the BRICS chairman, besides expressing openness to participate as a member country or strategic partner," the BERNAMA news agency quoted him as saying.

Earlier on Sunday, Anwar Ibrahim met with visiting Russian Foreign Minister Sergey Lavrov. According to the Malaysian prime minister, the conversation focused on Malaysia’s application to join BRICS, which, in his words, will have a considerable potential for both sides.

Anwar and Lavrov also discussed "the current situation in Palestine, with Malaysia emphasizing the urgent need for a permanent ceasefire and rapid humanitarian aid in Gaza, as well as Palestine’s acceptance as a full member of the United Nations," the agency said. "Regarding Ukraine, Anwar also called for dialogue and discussion as the means to resolve the conflict."

Lavrov promised that as the BRICS president Russia will help Malaysia promote its interest to the partnership with the association.

@ Newshounds News™

Read more: TASS

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Seeds of Wisdom RV and Economic Updates Monday Morning 7-29-24

Good Morning Dinar Recaps,

Financial Stability Implications of Emerging Market CURRENCY DEVELOPMENTS

"A global soft landing remains the base case, as the July World Economic Outlook update showed. The forecast for economic growth in emerging markets has changed little, with projections edging up to 4.3 percent for both this year and next. Inflation in most major emerging markets is forecast to ease further and reach target ranges, allowing monetary policy to ease in the foreseeable future."

"And yet, emerging market currencies have declined by about 4 percent year-to-date, on net, against the US dollar, even after partially recovering in recent weeks. Latin American currencies have dropped 5 percent, while currencies in Asian emerging markets are lower by 4 percent.

Central and Eastern European and African currencies saw milder depreciations. It’s important to assess whether further declines could have adverse consequences for financial stability."

Good Morning Dinar Recaps,

Financial Stability Implications of Emerging Market CURRENCY DEVELOPMENTS

"A global soft landing remains the base case, as the July World Economic Outlook update showed. The forecast for economic growth in emerging markets has changed little, with projections edging up to 4.3 percent for both this year and next. Inflation in most major emerging markets is forecast to ease further and reach target ranges, allowing monetary policy to ease in the foreseeable future."

"And yet, emerging market currencies have declined by about 4 percent year-to-date, on net, against the US dollar, even after partially recovering in recent weeks. Latin American currencies have dropped 5 percent, while currencies in Asian emerging markets are lower by 4 percent.

Central and Eastern European and African currencies saw milder depreciations. It’s important to assess whether further declines could have adverse consequences for financial stability."

"A key determinant of exchange rates is the difference in interest rates between a given country and the United States—the benchmark in global capital markets.

At the beginning of this year, investors expected the Federal Reserve to cut interest rates significantly, which would widen or at least maintain the interest differentials with emerging markets.

With the US economy proving stronger than previously anticipated and inflation not yet reaching the Fed’s target, expectations for US interest rate cuts dissipated over the course of the year, and the US dollar appreciated. As a result, major emerging markets’ interest rate differentials vis-à-vis the US narrowed. "

CURRENCIES AND FINANCIAL STABILITY

"Orderly depreciation of a currency toward levels broadly in line with economic fundamentals—including interest rate differentials—can be constructive for an economy.

More troubling are cases where there are abrupt selloffs, which can trigger financial instability. Sudden foreign capital outflows can severely affect asset prices and open up funding gaps. Financial institutions could see foreign exchange mismatches intensify and may be unable to rollover foreign currency (particularly US dollar) funding at reasonable costs"

@ Newshounds News™

Read more: IMF

~~~~~~~~~

US home sales fell in June to slowest pace since December amid rising mortgage rates, home prices

LOS ANGELES (AP) — The nation’s housing slump deepened in June as sales of previously occupied homes slowed to their slowest pace since December, hampered by elevated mortgage rates and record-high prices.

Sales of previously occupied U.S. homes fell 5.4% last month from May to a seasonally adjusted annual rate of 3.89 million, the fourth consecutive month of declines, the National Association of Realtors said Tuesday.

Existing home sales were also down 5.4% compared with June of last year. The latest sales came in below the 3.99 million annual pace economists were expecting, according to FactSet.

Despite the pullback in sales, home prices climbed compared with a year earlier for the 12th month in a row. The national median sales price rose 4.1% from a year earlier to $426,900, an all-time high with records going back to 1999.

Home prices rose even as sales slowed and the supply of properties on the market climbed to its highest level since May 2020.

That translates to a 4.1-month supply at the current sales pace. Traditionally, a 4- to 5-month supply is considered a balanced market between buyers and sellers.

While still below pre-pandemic levels, the recent increase in homes for sale suggests that, despite record-high home prices, the housing market may be tipping in favor of homebuyers.

@ Newshounds News™

Read more: AP News

~~~~~~~~~

Ripple Celebrates BRAZILIAN REAL STABLECOIN Integration On XRP LEDGER

"RippleX, the development arm of Ripple, has formally announced the integration of the BRLA Token, a stablecoin pegged to the Brazilian Real (BRL), on the XRP Ledger. This event signifies a crucial advancement for the XRP Ledger and its ecosystem, offering a new layer of stability and efficiency for cross-border and domestic transactions."

"“Designed to facilitate seamless and cost-effective transactions, BRLA Token offers businesses a reliable avenue for both domestic and international payments. The team has been exploring and testing the XRP Ledger extensively for payment processing, with much more excitement on the horizon,” RippleX stated in a blog post."

"BRLA Digital, spearheading this innovation, aims to disrupt the traditional financial sector in Brazil. Their creation, the BRLA Token, is crafted to simplify and economize business transactions, both internationally and within the country."

"RippleX’s enthusiasm about this collaboration is evident. In a statement shared on X (formerly Twitter), they remarked, “BRLA Digital’s commitment to evolving Brazil’s financial scene comes to fruition with the BRLA Token. This venture into stablecoins signifies a pivotal stride towards redefining business transactions in Brazil.”

"By anchoring the BRLA Token’s value to the Brazilian Real and backing it with audited reserves, we ensure a stable and reliable medium for transactions, shielding businesses from the whims of cryptocurrency volatility,” explains Ripple. This stability is crucial for businesses seeking consistency in their financial operations."

@ Newshounds News™

Read more: Bitcoinist

~~~~~~~~~

Judge Torres Considers Final Judgment in RIPPLE vs. SEC CASE

"Judge Analisa Torres is currently focusing on issuing a final ruling regarding penalties and injunctions in the Ripple vs. SEC lawsuit. Both parties can still appeal earlier decisions, adding layers of complexity to the legal proceedings. As the case draws closer to a verdict, the XRP community and legal experts are fervently anticipating a resolution, likely by August."

"The possibility of appeals looms large in this high-profile legal battle. Ripple has claimed several victories, making the SEC’s position appear increasingly tenuous. Legal analysts like Mickle suggest that despite these wins for Ripple, appeals are still on the table. Experts such as Fred Rispoli and James Murphy speculate that Judge Torres might expedite her final ruling, bypassing motions currently before Judge Sarah Netburn, potentially delivering a judgment as early as August."

@ Newshounds News™

Read More: CoinTag

~~~~~~~~~

ISO 20022 - The new language of payments

What is ISO 20022?

ISO 20022 is a flexible standard for financial messages that enables interoperability between financial institutions, market infrastructures and the Banks’ customers. All banks must be ready to support the new language/standard to continue processing payments and customers should also prepare for changes.

The ISO 20022 standard supports the inclusion of richer, better structured transaction data in payments messages, and aims to deliver a better customer experience by enabling less manual intervention, more accurate compliance processes, higher resilience, and improved fraud prevention measures.

Benefits and timeline

What are the benefits of ISO 20022?

ISO 20022 adoption will provide benefits to the entire payments ecosystem i.e. Banks, Market infrastructures and to the Banks customers:

▪️ Rich structured party data and increased field size will provide greater levels of transparency and create efficiencies by reducing delays caused due to unstructured, incomplete, or inconsistent data.

▪️ By adopting dedicated returns and investigation messages and using standardized return codes, the current delays in applying returned funds back to the customers and responding to inquiries from other Banks will be drastically reduced.

▪️ By maintaining dedicated reference fields that remain unaltered in the end to end payment journey and introducing structured remittance data, customer’s reconciliation capabilities will be augmented.

▪️ Greater message harmonisation across the entire payments industry, with a universal message type for all payments will help integrate with many more schemes on a faster basis.

What are the timelines for migrating to ISO 20022 standards in different markets?

ISO 20022 adoption will take place over multiple years. Payment Market infrastructures (PMIs) of all major currencies are either live or in the process of adopting ISO 20022 by November 2025 for cross border payments. SWIFT has published a roadmap to migrate the existing message type 1,2,& 9 series which began in March 2023. Adoption plans are still evolving in each market and further clarity will be provided over time.

Adoption by major Real Time Gross Settlement (RTGS) market infrastructures/currency is currently planned as follows:

Impact, adoption and strategy

Which SWIFT messages are impacted by the ISO migration?

SWIFT plans to migrate all Customer and Inter-bank payments, as well as related advice and statement messages (the MT1xx, MT2xx and MT9xx series of messages).

What is HSBC’s plan to adopt ISO 20022?

HSBC is actively involved with SWIFT and the different market infrastructures that are migrating towards ISO. HSBC has successfully enabled its global network to receive and forward SWIFT CBPR+ messages in all of its 50+ locations and to exchange ISO messages in the newly migrated domestic markets.

We will align ourselves with the market requirements and delivery timelines set by different market infrastructures and ensure we are well placed to comply with the adoption strategies set forth by the market infrastructure.

What is HSBC’s strategy to align to SWIFT’s adoption of ISO for cross border payments?

HSBC’s adoption strategy will be driven by two different approaches:

--Markets with domestic migration announced

ISO enablement of SWIFT cross-border payments is prioritised with domestic ISO migrations in HSBC markets. This is targeted to enable ISO for both domestic and cross-border payments together for customers to choose to adopt in one go.

--Markets with no domestic migration announced

The approach is to complete SWIFT cross border traffic migration in all countries and be compliant by November 2025. If a market infrastructure announces a domestic scheme migration before 2025, our current migration strategies are flexible enough to adapt accordingly.

What are the common adoption strategies?

The common adoption strategies are:

▪️ ‘Like for like’, where the message format will be replaced from MT to ISO 20022 XML format that has comparable elements and character lengths to the existing SWIFT MT messages.

▪️ ‘Full/enhanced ISO’, where additional and enhanced existing elements are available. In order to ensure consistent usage and inter-operability, guidelines are defined by the industry.

Market practice guidelines

What are the current market practice guidelines being followed by the industry for ISO adoption?

Two guidelines are available for the payment market infrastructures:

▪️ High Value Payments Plus (HVPS+) market practice guidelines followed by certain Market infrastructures

▪️ Cross Border Payments and Reporting plus (CBPR+) guidelines. The CBPR+ group are experts nominated from the SWIFT community tasked with developing usage guidelines for ISO implementation by Banks for SWIFT cross-border payments.

While HVPS+ and CBPR+ are almost fully aligned with a few minor differences, HSBC will provide updates to the possible impacts they may have on our customers in the respective markets.

HOW TO PREPARE FOR ISO 20022

Readiness Handbooks

We have created readiness handbooks to support our customers through the transition to ISO 20022, highlighting the significant changes this will bring across the payments industry, how and why these changes will happen, and the benefits they can bring.

What should banks* be considering?

* Also includes NBFIs sending instruction via SWIFT

As published in SWIFT’s connectivity guidance document it is mandatory that all Banks are required to upgrade their messaging interface to support InterAct (store-and-forward) by 20 March 2023.

Institutions can also define the channel and format preferences for the transactions they receive through SWIFTs Transaction Manager (TM) platform. SWIFTs TM platform will ensure interoperability between users of different data formats and connectivity channels.

Here are some further considerations that banks should be looking at:

Industry Testing: Get ready to participate in industry testing as mandated by market infrastructures and SWIFT. If you use another bank for clearing, please reach out to that bank

Process & Systems: Have processes and systems geared up to fulfil your Sanctions and AML controls based on new party fields in the chain

Archive Data: Ensure that you are able to archive the rich ISO payments data as per your country regulations

Data Availability: Create solutions to make enriched data available to your customers

Structured Data: Start preparing to provide structured Name and address information for your customers(Debtors)

Training: Training and awareness of internal staff on the new language

For banks* sending Payments to:

▪️ Clearing/SWIFT

--Clearing: Be ready to accept and align with the clearing market infrastructure based on their timelines

--your Currency Provider

▪️ Have conversations with your Currency Provider

▪️ Agree the roadmap/migration timelines and expectations on message formats

For banks* receiving Payments from:

▪️ Clearing/SWIFT

--Clearing: Be ready to accept and align with the clearing market infrastructure based on their timelines

--your Currency Provider

If you use non-SWIFT based channels have a discussion with your provider

* Also includes NBFIs sending instruction via SWIFT

What should Corporate customers be preparing for?

We recommend our Corporate customers understand the potential of XML for your business and make the most of the opportunity.

Here are some considerations for Corporate customers:

▪️ Preparing for the future: A few market infrastructures already mandate corporates to provide XML as a standard while communicating to their Banks. With the increased adoption of ISO 20022 as a standard by SWIFT and major market infrastructures worldwide it is possible that more market infrastructures may recommend ISO as a messaging standard for communicating. Considering this in your technology plans will support preparation for these requirements from market infrastructures in the future.

▪️ Structured Data requirements: Market infrastructures and Clearing schemes have introduced new data requirements for party information. These include fields like creditor, ultimate debtor, initiating party, and ultimate creditor that will require corporates to provide to the bank in a structured or hybrid manner. HSBC will soon be providing communications on the required changes.

We strongly recommend you start looking at the data that is provided to HSBC and work closely with your Enterprise Resource Planning (ERP) and Treasury Management System (TMS) providers to start making required updates to comply to the new industry requirements.

▪️ Capitalising on rich standards: ISO offers multiple benefits that will help streamline end to end processing. Early adoption will allow you to capitalise on the information that is supported in remittance information and enhanced end to end references, which will be available through ISO based cash management(camt) statements/advises.

What you can expect from us

HSBC is eager to work with our clients to assist in their migration to ISO 20022. HSBC has been a strong advocate for XML and a key driver in the evolution of the ISO 20022 XML standard. Customers will be able to leverage the experience we have gained from previous implementations.

As market infrastructures finalize specifications, our team of experts will reach out to you and provide the details of changes to our existing offerings, and information on any new value added services that we will be able to offer leveraging the richer data elements that ISO 20022 offers.

Listen to our latest podcast – ISO 20022: The new language of payments

PODCAST

ISO 20022 will enable richer and more detailed data to be included in payment messages, along with a host of other benefits, resulting in a better customer experience. In this episode, Mark Avery, Senior Product Manager, HSBC, and Umut Uysal, Senior Global Product Manager, HSBC, discuss what you need to know about this exciting innovation in banking.

@ Newshounds News™

Read more: CBM HSBC

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 7-28-24

Good Morning Dinar Recaps,

BRICS PROPOSAL TO LINK ALL MEMBER COUNTRY'S PAYMENT SYSTEMS

The proposal aims to enhance BRICS countries’ financial sovereignty by establishing a resilient and sanctions-resistant payment infrastructure. Discussions include integrating financial markets, payments in national currencies, and new mechanisms for mutual financial settlements."

"Russian Deputy Foreign Minister Andrey Rudenko revealed in an interview with TASS this week. He noted Tehran’s suggestion to integrate the payment systems of BRICS countries, similar to the integration of Russia’s Mir and Iran’s Shetab electronic banking and automated payment systems."

"Rudenko emphasized that establishing a clearance and payment infrastructure independent and resilient to sanctions would significantly enhance the financial sovereignty of BRICS. However, Iran’s initiative remains under discussion, and it is premature to define any final parameters, the Russian diplomat clarified."

Good Morning Dinar Recaps,

BRICS PROPOSAL TO LINK ALL MEMBER COUNTRY'S PAYMENT SYSTEMS

"The proposal aims to enhance BRICS countries’ financial sovereignty by establishing a resilient and sanctions-resistant payment infrastructure. Discussions include integrating financial markets, payments in national currencies, and new mechanisms for mutual financial settlements."

"Russian Deputy Foreign Minister Andrey Rudenko revealed in an interview with TASS this week. He noted Tehran’s suggestion to integrate the payment systems of BRICS countries, similar to the integration of Russia’s Mir and Iran’s Shetab electronic banking and automated payment systems."

"Rudenko emphasized that establishing a clearance and payment infrastructure independent and resilient to sanctions would significantly enhance the financial sovereignty of BRICS. However, Iran’s initiative remains under discussion, and it is premature to define any final parameters, the Russian diplomat clarified."

"This integration seeks to facilitate trade using national currencies, thereby reducing reliance on the U.S. dollar and countering U.S. sanctions. A monetary contract signed on July 6 allows the use of local currencies in trade, enhancing financial cooperation, economic resilience, and reducing dependence on Western financial systems."

@ Newshounds News™

Read more: Bitcoin News

~~~~~~~~~

Donald Trump 2024 Bitcoin Conference Speech Recap:

• On day one I will fire Gary Gensler and appoint a new SEC chairman.

• Create a US Government strategic national Bitcoin stockpile if elected.

• US Government will keep 100% of Bitcoin it owns

• Bitcoin is going to the moon.

• Never sell your Bitcoin

• Bitcoin will one day probably surpass the market cap of Gold.

• I reaffirm my pledge to commute Ross Ulbricht's sentence.

• There will never be a CBDC while I am President of the United States.

• Bitcoin and crypto will skyrocket like never before if elected president.

• Bitcoin is not threatening the dollar, the current U.S. government is threatening the dollar.

• The United States will be the crypto capital of the planet and the Bitcoin superpower of the world.

• Bitcoin stands for freedom, sovereignty, and independence from government coercion and control.

• I pledge to the Bitcoin community that the day I take oath of Office, Joe Biden and Kamala Harris' anti-crypto crusade will be over.

@ Newshounds News™

Read more: Watcher Guru

~~~~~~~~~

BRICS Poised to Dominate World Bank and IMF

"The World Bank Executive Director for Russia forecasts that BRICS nations will soon dominate the World Bank and the International Monetary Fund (IMF), attributing this shift to inevitable macroeconomic and demographic changes away from Western dominance. He emphasized the importance of working patiently toward this goal and resisting provocations from those upholding the old global system."

"BRICS, an acronym for Brazil, Russia, India, China, and South Africa, represents a coalition of major emerging economies. Earlier this year, the group expanded to include Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates (UAE), broadening its geopolitical and economic influence."

"The World Bank Executive Director concluded by stressing the importance of Russia’s involvement in this shift. “Russia’s voice is important here, and it would be irrational not to use those possibilities, particularly now as we observe a new world order emerging,” he stated, underscoring the necessity of adapting to the evolving global landscape."

@ Newshounds News™

Read more: Bitcoin News

~~~~~~~~~

United States Senator Roger Marshall has overturned his support for the Digital Asset Anti-Money Laundering Act (DAAMLA) Bill, a legislation introduced by Democratic Party Elizabeth Warren.

"Marshall’s move to back down from the bill indicates the growing concerns about the possible overreach of regulatory actions regarding the emerging crypto market."

"The Digital Asset Anti-Money Laundering Act (DAAMLA) Bill was first introduced in December 2022 by Elizabeth Warren and co-sponsor by Roger Marshall and later reintroduced into the Senate in July 2023 to target unlawful use of crypto assets.

At the time, Warren maintained that large amounts of illegal funds were being laundered by rogue nations, oligarchs, drug lords, and human traffickers through the use of digital currencies such as Bitcoin, prompting her to move toward introducing the bill.

The legislation aimed to incorporate the cryptocurrency sector into the current frameworks for counterterrorism financing and anti-money laundering (AML)."

"Since its introduction, the law has received criticism from major figures and institutions in the industry."

"This positive development comes a few months following the Blockchain Association, a trade group representing the crypto industry in Washington D.C., efforts to debunk the DAAMLA bill. Specifically, the Blockchain Association sent out a letter in February, which marks the second time, to the House Financial Services Committee and Senate Banking Committee expressing serious concerns about the measure."

"About 80 US military, national security, and intelligence officers signed the letter. According to the Association, the law jeopardizes the strategic advantage of the US, threatening tens of thousands of employment while having minimal impact on illegal actors it targets."

@ Newshounds News™

Read more: Bitcoinist

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 7-27-24

Good Afternoon Dinar Recaps,

Cardano Launches Node 9.1.0: The Dawn of the Chang Hard Fork Era

▪️ Cardano’s Node 9.1.0 launch is pivotal for the Chang Hard Fork, marking significant progress in on-chain decision-making.

▪️ While ADA’s price hasn’t surged yet, the upgrade holds potential for a future rally similar to the Alonzo Hard Fork.

Following the innovative launch of Cardano Ogmios v6.4.0, we reported last month, Cardano has launched Node 9.1.0, which is crucial for the upcoming Chang Hard Fork upgrade. This node introduces the final version needed to implement on-chain decision-making within the Cardano ecosystem. The Dawn of the Chang Hard Fork Era is equipped with a crucial feature, the Conway genesis file, which differentiates it from the previous Node 9.0.0.

This launch was announced by Intersect on X and confirmed by Cardano founder Charles Hoskinson on his personal X account. The Chang Hard Fork upgrade, initially scheduled for the first half of 2024, is expected to significantly advance Cardano’s infrastructure and capabilities.

Good Afternoon Dinar Recaps,

Cardano Launches Node 9.1.0: The Dawn of the Chang Hard Fork Era

▪️ Cardano’s Node 9.1.0 launch is pivotal for the Chang Hard Fork, marking significant progress in on-chain decision-making.

▪️ While ADA’s price hasn’t surged yet, the upgrade holds potential for a future rally similar to the Alonzo Hard Fork.

Following the innovative launch of Cardano Ogmios v6.4.0, we reported last month, Cardano has launched Node 9.1.0, which is crucial for the upcoming Chang Hard Fork upgrade. This node introduces the final version needed to implement on-chain decision-making within the Cardano ecosystem. The Dawn of the Chang Hard Fork Era is equipped with a crucial feature, the Conway genesis file, which differentiates it from the previous Node 9.0.0.

This launch was announced by Intersect on X and confirmed by Cardano founder Charles Hoskinson on his personal X account. The Chang Hard Fork upgrade, initially scheduled for the first half of 2024, is expected to significantly advance Cardano’s infrastructure and capabilities.

From Intersect on Twitter

Node 9.1.0 is here!

The final version to bring on-chain decision making to Cardano is here. As with all hard-forks, Cardano upgrades when the community is ready.

SPO's ➡️ https://bit.ly/3ycXnVF

However, unlike the previous update, as discussed in the CNF earlier report, which drove ADA price up 10% as 159 projects launched on Cardano, accompanied by 9.62M native tokens and 84.2M transactions, this upgrade is still taking its time to hit the expected surge.

Previous upgrades like the Alonzo Hard Fork in 2021 had a substantial positive impact on ADA’s price, suggesting potential similar outcomes with the Chang Hard Fork.

The upgrade could potentially lead to a price rally, as it is expected to break the upper boundary of the wedge pattern. As of now, according to CoinMarketCap data today, Cardano (ADA) is trading at $0.3966, with a decrease of 2.47% in the past day and 5.75% in the past week. See ADA price chart below.

However, unlike the previous update, as discussed in the CNF earlier report, which drove ADA price up 10% as 159 projects launched on Cardano, accompanied by 9.62M native tokens and 84.2M transactions, this upgrade is still taking its time to hit the expected surge.

Previous upgrades like the Alonzo Hard Fork in 2021 had a substantial positive impact on ADA’s price, suggesting potential similar outcomes with the Chang Hard Fork.

The upgrade could potentially lead to a price rally, as it is expected to break the upper boundary of the wedge pattern. As of now, according to CoinMarketCap data today, Cardano (ADA) is trading at $0.3966, with a decrease of 2.47% in the past day and 5.75% in the past week.

UPDATE: Cardano is trading at $0.4232 today.

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

Copper will be the investment of the decade? Kitco Live ‘Copper Masters Panel’ on August 22, 2024

(Kitco News) - Copper presents a generational investment opportunity. A looming supply crunch fueled by high demand required for the energy transition is elevating prices to record highs with a positive outlook for investors.

The copper market is expected to enter into deficit in the near-term, which is forecast to increase to 5-8Mtpa by the end of the decade as new demand gathers pace. Eergy transition applications and the power infrastructure required for the electrification of everything, data centers, and emerging markets such as India are all factors vying for dwindling copper supplies.

The positive market outlook has not garnered a corresponding supply response as few development projects are in the pipeline, and miners are risk-averse due to the increasing economic uncertainty, costs, and timescales of project development.

Hosted by Paul Harris, the ‘Kitco Copper Masters Panel’ will hear from industry leaders Robert Friedland, Kathleen Quirk, and Colin Hamilton discussing why copper may be the natural resources investment of the decade.

Join us live on Kitco Mining’s YouTube channel on Thursday, August 22, 2024, at 3PM ET / 12PM PST for the latest copper investment insights from these copper masters.

@ Newshounds News™

Read more: Kitco

~~~~~~~~~

Chinese Firm Boasts of Using Tether Stablecoin to Skirt Russian Sanctions

Chinese-owned import-export firm Qifa specializes in trade between China and Russia, a booming sector. According to Reuters, the company is now using the Tether stablecoin for cross-border payments because of sanctions affecting bank payments.

It’s possible that Qifa spoke to Reuters to boost the price of its IPO on the Moscow Exchange. However, that benefit could prove short lived. Several Russian companies featured in recent press reports have been the subject of sanctions shortly afterwards.

For instance, Reuters reported in April that the Shanghai branch of Russian bank VTB played a key role in facilitating money transfers between Russia and China. In the latest package of sanctions announced on 12 June, OFAC added VTB Shanghai to its sanction list. Within a week this caused problems with money reaching Chinese suppliers.

The reason for using VTB Shanghai is the threat of sanctions on Chinese banks. Hence, any Chinese banks willing to receive payments are smaller ones, and they conduct significant due diligence to ensure that any goods are not dual use for military purposes.

Meanwhile, the use of Tether as a settlement asset may be illegal in both countries. Reuters classed Tether as a Digital Financial Asset. That’s not the case.

Digital Financial Assets

Digital Financial Assets (DFAs) are a specific class of Russian digital assets, including tokenized gold, other commodities and factored invoices.

There’s a short list of firms that operate platforms approved to issue DFA tokens, and most of them have been sanctioned. Not only does Tether not run an approved DFA issuing platform, but stablecoins are not approved DFA assets.

Originally Russian legislation banned the use of DFAs for payment, but it recently passed a new law allowing them to be used for cross-border payments, precisely to skirt sanctions. Less than two weeks later more DFA issuers were sanctioned alongside some Russian cryptocurrency firms.

That means only those comfortable dealing with sanctioned entities would accept them. There are also practical hurdles we have previously explored.

Tether would be classed as a cryptocurrency rather than a DFA.

Russia is working on legislation to support the use of cryptocurrencies for cross-border payments. Even the central bank governor has agreed it’s a practical move, despite her misgivings about crypto. As of today, using Tether may not be legal in Russia, but the Russians would most likely turn a blind eye.

It’s far less clear that’s the case in China where the use of stablecoins such as Tether is not permitted.

@ Newshounds News™

Read More: Ledger Insights

~~~~~~~~~

BLOCKCHAIN and DIGITAL ASSET NEWS from Ledger Insights

▪️ LUXEMBOURG proposes relaxing DLT laws LINK

▪️ BNP Paribas hosts issuance of SLOVENIAs digital bond settled in CBDC LINK

▪️ JP Morgan-backed Ownera partners with Digital Asset’s Canton network LINK

▪️ Franklin Templeton planning digital-asset joint venture with JAPANs SBI LINK

@ Newshounds News™

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Afternoon 7-26-24

Good Afternoon Dinar Recaps,

UK travellers told to SWAP FOREIGN CURRENCY NOW ahead of coming SWITCH

"If you still have the notes from your travels you may find it hard to swap them back next year."

"UK holidaymakers are being advised to exchange any leftover Bulgarian Levs or Romanian Leu ahead of a significant financial shift which was due next year. Both nations are preparing to adopt the Euro, joining the eurozone, which will render their current native currencies obsolete and potentially complicate the process of converting them back into sterling."

"Bulgaria has been growing in popularity as a family holiday destination for UK travellers since 2018, with its beach resorts being named the most affordable in Europe. Hundreds of thousands of Brits now choose Bulgaria for their annual holiday each year."

"A similar situation is expected for the Lev and Leu, sparking concerns among tourists and expats. Mario Van Poppel, founder of Leftover Currency, said: "With Bulgaria and Romania joining the eurozone, British travellers holding onto Levs or Leu need to act promptly. "Once the Euro is adopted, it will become increasingly difficult and costly to convert these currencies back to sterling."

Good Afternoon Dinar Recaps,

UK travellers told to SWAP FOREIGN CURRENCY NOW ahead of coming SWITCH

"If you still have the notes from your travels you may find it hard to swap them back next year."

"UK holidaymakers are being advised to exchange any leftover Bulgarian Levs or Romanian Leu ahead of a significant financial shift which was due next year. Both nations are preparing to adopt the Euro, joining the eurozone, which will render their current native currencies obsolete and potentially complicate the process of converting them back into sterling."

"Bulgaria has been growing in popularity as a family holiday destination for UK travellers since 2018, with its beach resorts being named the most affordable in Europe. Hundreds of thousands of Brits now choose Bulgaria for their annual holiday each year."

"A similar situation is expected for the Lev and Leu, sparking concerns among tourists and expats. Mario Van Poppel, founder of Leftover Currency, said: "With Bulgaria and Romania joining the eurozone, British travellers holding onto Levs or Leu need to act promptly. "Once the Euro is adopted, it will become increasingly difficult and costly to convert these currencies back to sterling."

"He warned: "The window of opportunity is closing fast. If people don't exchange their levs or leu before the transition, they might face significant hurdles. Banks in the UK may no longer accept these currencies, and travellers might find themselves forced to travel back to Bulgaria or Romania just to get their money's worth."

"This is not only inconvenient but can also lead to financial losses."

@ Newshounds News™

Read more: Liverpool Echo

~~~~~~~~~

Israel selects 14 participants for Digital Shekel Challenge

In May the Bank of Israel unveiled the Digital Shekel Challenge, inviting participants to propose novel central bank digital currency (CBDC) applications through the use of application programming interfaces (APIs). It was inspired by a similar BIS and Bank of England initiative, Project Rosalind.

Today it announced the selection of 14 teams. Given the deep technical skill base in Israel, it’s not surprising that around a dozen of the teams are Israeli.

We believe just two teams don’t have direct Israeli links. One is IDEMIA France, known for its offline CBDC functionality. The other is OxPay, although there are several companies that go by that name.

Apart from IDEMIA which has more than $3 billion in revenues, two of the larger participants are Fireblocks and PayPal (Israel). Technically Fireblocks is U.S. based but is Israeli founded. It’s best known for its custody technology and the Fireblocks Network and recently has been using that network to target payments. Fireblocks is also a partner of the Tel Aviv Stock Exchange (TASE) in the development of digital government bonds and digital assets.

The full participant list is:

▪️Bits of Gold

▪️Brinks Israel Ltd. + Committed Digital Ltd

▪️COTI

▪️Credics Technologies LTD

▪️Team Energy, led by Viacheslav Pozharskii

▪️Fireblocks

▪️Idemia France SAS

▪️Kima Finance

▪️Open Finance LTD

▪️0xPay

▪️Paypal Israel LTD

▪️Qedit

▪️Shva

▪️Team Levana, led by Doron Asor

CBDC use cases

Meanwhile, the use cases range from connecting the CBDC to other payment systems to split payments, conditional payments and sub wallets. The participants will also explore implementing various technologies while using the digital shekel for payment.

Trials run for three months start in early August.

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

RIPPLE- SEC UPDATE ON CLOSED-DOOR MEETING JULY 25

1. SEC did not ask Ripple to pay $102.6 million in penalty, attorney Jeremy Hogan says it was a legal argument.

2. SEC vs. Ripple lawsuit awaits final ruling from Judge Analisa Torres.

3. XRP hovers around psychological support level at $0.60, early on July 26.

"Pro-crypto attorney says Securities & Exchange Commission (SEC) and Ripple could settle in a “compromise” and not a win for the two parties. Attorney Bill Morgan, Fred Rispoli and Jeremy Hogan commented on the recent events in the SEC vs. Ripple lawsuit, the closed-doors meeting and the likelihood of a settlement. "

"Pro crypto attorney Jeremy Morgan says that the SEC did not ask Ripple for $102.6 million in its filing. Instead, the regulator noted that even by Ripple’s argument the fine would be $102.6 million, far exceeding the remittance firm’s $10 million offer. "

"Ripple had argued in its filing that a $10 million fine would be apt for the alleged securities law violation.

Attorney Fred Rispoli predicted that the SEC vs. Ripple lawsuit will end by the end of July 2024. In a recent tweet attorney Bill Morgan commented on the closed-doors meeting with the SEC and said that a settlement is most likely with a compromise rather than a win for the parties. "

@ Newshounds News™

Read more: FX Street

~~~~~~~~~

Philippines to launch wholesale CBDC by 2029 latest

Bangko Sentral ng Pilipinas (BSP) is working on Project Agila for wholesale central bank digital currency trials (wCBDC) trials. During a press briefing on the topic, Deputy Governor Mamerto Tangonan said he expected the wCBDC to go live within the term of new BSP Governor Eli Remolona Jr which runs until 2029. FinTech News reported that the launch would be early in the term.

The purpose of the current trials is to help both the central bank and ten participating commercial banks to go up the learning curve.

The Deputy Governor outlined three uses cases. The highest priority requirement is for interbank settlement on weekends and holidays. Another is the settlement of securities. And a third is cross border payments. Notably, the BSP is an observer of the mBridge project involving the BIS and the central banks of China, Hong Kong, Thailand, the UAE and Saudi Arabia.

@ Newshounds News™

Read more: Ledger Insighta

~~~~~~~~~

WHAT IS A NON-MARKET ECONOMY AND WHICH COUNTRIES ARE IN THIS CLASS

Nonmarket Economy Status under U.S. Trade Laws

The Department of Commerce has the authority to designate countries as NMEs for the purpose of U.S. antidumping and countervailing duty (AD/CVD) laws. An NME is a country that Commerce determines “does not operate on market principles of cost or pricing structures, so that sales of merchandise in such country do not reflect the fair value of merchandise.”

In designating a country as an NME, Commerce considers the extent to which :

(1) the country’s currency is convertible;

(2) its wage rates result from free bargaining between labor and management;

(3) joint ventures or other foreign investment are permitted;

(4) the government owns or controls the means of production; and

(5) the government controls the allocation of resources and price and output decisions.

"Commerce may also consider other factors that it considers appropriate. An NME designation remains in effect until revoked by Commerce. There are currently 12 countries, including Vietnam, designated as NMEs. Commerce designated Vietnam as an NME in 2002 during its antidumping investigation into Vietnamese catfish exports."

VIETNAM

"The U.S. Commerce Department said on Wednesday it has delayed a difficult decision on whether to upgrade VIETNAM to market economy status by about a week until early August, citing IT disruptions from the CrowdStrike software bug.

A decision on the upgrade that Hanoi has long sought had been due by Friday. The upgrade is opposed by U.S. steelmakers, Gulf Coast shrimpers and honey farmers, but backed by retailers and some other business groups."

"VIETNAM has long argued it should be freed of the non-market label because of recent economic reforms, and it said that retaining the moniker is bad for increasingly close two-way ties that Washington sees as a counterbalance to China.

Opponents of upgrading VIETNAM - one of 12 economies labeled by Washington as non-market, including China, Russia, North Korea and Azerbaijan - argue that Hanoi's policy commitments have not been matched by concrete actions and it operates as a planned economy governed by the ruling Communist Party."

@ Newshounds News™

Read more: CRS Reports, Reuters

~~~~~~~~~

Silver Falls As Dollar Index Rebounds Amid Key Economic Data Analysis.

Silver prices experienced a significant decline of 4.2%, settling at 81,331 due to the fluctuating dollar index as traders assessed key economic data.

The U.S. economy demonstrated stronger-than-expected growth in the second quarter, with a 2.8% annualized rate increase in GDP, as reported by the Commerce Department's Bureau of Economic Analysis.

Despite substantial rate hikes by the Federal Reserve in 2022 and 2023, the U.S. economy remains robust, buoyed by a resilient labor market even though the unemployment rate has risen to a 2-1/2-year high of 4.1%.

Additionally, the Labor Department reported a larger-than-expected decrease in new applications for unemployment benefits, with a drop of 10,000 to a seasonally adjusted 235,000 for the week ending July 20. This reduction is partly attributed to the fading impact of weather-related distortions and temporary automobile plant closures.

The previous week saw a rise in claims due to disruptions from Hurricane Beryl and retooling closures in the automobile sector. In a surprising move, China's central bank reduced its one-year medium-term lending facility rate by 20 basis points to 2.3%, the most significant cut since April 2020. This unexpected rate cut aims to stimulate economic activity amid global economic uncertainties.

From a technical perspective, the silver market is experiencing fresh selling pressure, with a 6.52% increase in open interest, bringing it to 29,188. Prices have fallen by 3,563 rupees, indicating a bearish trend. Currently, silver is receiving support at 79,830, and if this level is breached, it could test 78,330. On the upside, resistance is anticipated at 83,665, with a potential move above this level leading to a test of 86,000.

Silver Price Today

Open 27.99

High 28.22

Low 27.75

Prev close 27.98

@ Newshounds News™

Read more: Investing

~~~~~~~~~

RKF Jr. says he would include Bitcoin, gold, and platinum in a basket to back Treasury bills

(Kitco News) – The list of politicians calling on the U.S. government to purchase and hold Bitcoin (BTC) as a strategic reserve asset continues to grow, with Presidential candidate Robert F. Kennedy Jr. becoming the latest to advocate for holding the top crypto in the Treasury.

Kennedy spoke during industry day at Bitcoin 2024, the annual Bitcoin conference currently underway in Nashville, Tennesse, where he unveiled a plan that could see the U.S. become the world’s largest BTC holder.

During a conference panel with Roundtable’s Scott Melker and Custodia Bank CEO Caitlin Long, RFK Jr. admonished the Federal Reserve, saying the central bank had the interest of bankers, not the general public, at heart.

“The relationship between Congress and the Fed is both parasitical to our country, and it’s a symbiotic relationship,” he said. “The Fed is not a public institution … The decision-makers are appointed by the banking industry. Its function with these cycles of quantitative easing followed by high interest rates are… strip-mining cash and equity from the American middle class and pumping it upward to this new oligarchy of billionaires.”

"The coup de grâce was the lockdowns during Covid, which shut down all the small business in this country, which is what we should be nurturing, and kept open the Walmarts, and the Amazons, and Facebook, and the oil industry, and the processed food industries, and Big Ag, they all flourished during that period,” he added. “And meanwhile, Main Street just got liquidated.”

To help start the process of leveling the playing field and returning the U.S. to a system of sound money, Kennedy recommended the creation of a basket of hard currencies and other assets that could be used to provide solid backing for the U.S. dollar.

“I would be willing to add Bitcoin to the balance sheet. I’m going to do that. I’m gonna actually do a basket of hard currencies of maybe platinum and gold and other hard currencies and begin issuing at least the class of Treasury bills that are anchored to hard currency,” he said. “Let’s say the first year by 1% and then maybe the next year by 2% to watch how that goes because that will inject discipline into the product and ultimately get up to 100%.”

“I would like to have the federal government begin to buy Bitcoin and over my term of office [and] ultimately have an equivalent amount of Bitcoin that we have gold,” he added. “Because Bitcoin is an honest currency, it’s a currency that’s based upon proof of work.”

The plan, as laid out by RFK Jr., would see the government purchase enough BTC to equal the amount they hold in gold – currently estimated at 8,134 tons worth approximately $615 billion.

According to data provided by Arkham, the Department of Justice currently holds 213,239 Bitcoin that were acquired through various enforcement actions, meaning that to achieve Kennedy’s goal, the Treasury would need to acquire more than 9 million additional BTC at the current market price – equal to 45% of all the BTC that will ever exist.

For perspective, MicroStrategy, the largest corporate holder of Bitcoin, owns 226,331 BTC, and BlackRock, the largest spot Bitcoin ETF manager, controls 334,000 BTC.

Kennedy said the goal of the move is to redefine monetary policy and enhance fiscal discipline within the federal government.

He also appealed to the crypto community’s ideals of personal freedom, property rights, and governmental integrity, saying, “Bitcoin is not only an offramp to this inflationary highway which is the highway to hell, but it also is a way of restoring integrity to our government. It’s a way of restoring personal freedoms, it’s a way the middle class can isolate itself from inflation, which is just a form of government theft.”

As president, he vowed to reform the Fed, block the creation of a central bank digital currency (CBDC), and end “money printing” to fund budget deficits.

@ Newshounds News™

Read more: Kitco

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Thursday Evening 7-25-24

Good Evening Dinar Recaps,

XRP ETF Expected as Ripple Partner SBI Enters US ETF Market SBI Holdings plans to enter the US ETF market, sparking speculation of an XRP ETF due to its strong partnership with Ripple and digital asset focus.

Ripple partner SBI Holdings is making headlines as it prepares to enter the ETF market. This move has led to speculation about a potential XRP ETF, given SBI’s strong partnership and association with Ripple, a company that holds the largest share of XRP.

For instance, on July 1, SBI Holdings began minting non-fungible tokens (NFTs) for the upcoming 2025 World Expo in Osaka, Japan. SBI leaders have also consistently endorsed XRP.

Now, a local report reveals that SBI Holdings plans to establish an investment management company with Franklin Templeton, a major US investment firm. This new venture will focus on digital assets, with SBI holding a 51% stake and Franklin Templeton 49%.

Good Evening Dinar Recaps,

XRP ETF Expected as Ripple Partner SBI Enters US ETF Market

SBI Holdings plans to enter the US ETF market, sparking speculation of an XRP ETF due to its strong partnership with Ripple and digital asset focus.

Ripple partner SBI Holdings is making headlines as it prepares to enter the ETF market. This move has led to speculation about a potential XRP ETF, given SBI’s strong partnership and association with Ripple, a company that holds the largest share of XRP.

For instance, on July 1, SBI Holdings began minting non-fungible tokens (NFTs) for the upcoming 2025 World Expo in Osaka, Japan. SBI leaders have also consistently endorsed XRP.

Now, a local report reveals that SBI Holdings plans to establish an investment management company with Franklin Templeton, a major US investment firm. This new venture will focus on digital assets, with SBI holding a 51% stake and Franklin Templeton 49%.

The new company from SBI Holdings and Franklin Templeton, expected to form by the end of the year, will focus on crypto assets, reports suggest. Notably, SBI will hold 51% of the company, while Franklin Templeton will hold 49%.

Launching XRP ETF Makes Sense

In June, Ripple President Monica Long had argued that launching an XRP spot ETF in the US market makes sense.

She highlighted that XRP, consistently among the top 10 cryptocurrencies, meets key criteria for such an investment product. However, Nate Geraci, President of The ETF Store, suggested that the market is not ready for an XRP spot ETF. He noted that an XRP futures ETF must precede a spot ETF, emphasizing the need for a regulated trading history.

Industry Opinions on XRP

Recall Yoshitaka Kitao, Chairman and CEO of SBI Holdings, had shared his optimistic views on XRP’s future, expressing confidence that XRP would benefit significantly if Ripple ultimately wins its ongoing legal battle with the US Securities and Exchange Commission (SEC).

On his hand, Crypto expert The Bearable Bull predicts that XRP will hit new all-time highs this cycle. He asserts there’s “0% chance XRP won’t go to new all-time highs.” According to him, XRP’s price has often depended on Bitcoin’s rise. With the approval of a BTC ETF and new record values, he expects XRP ETFs in 2025.

The Bearable Bull identifies several bullish catalysts for XRP. These include its relisting on all exchanges, the launch of AMMs, the Xahau sidechain, Ripple’s stablecoin, and the Metaco custody solution. He also mentions a potential Ripple IPO, increased political focus on crypto, and expected regulatory clarity. Additionally, Ripple’s legal case is likely to conclude this summer.

@ Newshounds News™

Read more: The Crypto Basic

~~~~~~~~~

Gold price collapses to two-week low amid robust US economic data

—Gold prices fall 5% from July 17 peak of $2,483 to $2,364.

—US Q2 GDP beats expectations, strengthening the US Dollar and impacting gold.

—Market certainty grows for a Fed rate cut in September as Treasury yields decline.

Gold price tumbled to a two-week low on Thursday after the US Bureau of Economic Analysis reported that the economy in the United States (US) fared better than expected in the second quarter of 2024. This weighed on the precious metal, which lost over 1.30%, and XAU/USD trades at $2,364 at the time of writing.

Bullion prices hit their highest level on July 17, at $2,483; since then, they have fallen about 5% toward the current spot price. XAY/USD’s fall is mostly attributed to profit-taking as US Treasury yields also dropped while the Greenback remained firm.

US data revealed that the Gross Domestic Product in Q2 was better than expected, crushing the first-quarter numbers. Meanwhile, the number of Americans filing for unemployment benefits dipped compared to the week ending July 30. Durable Goods Orders contracted more than -6%, though excluding aircraft and transport, they recovered from May’s drop.

Despite all that, the US 10-year Treasury note coupon edged lower by more than four basis points (bps) and ended at 4.245% on Thursday. According to the CME FedWatch Tool data, investors seem 100% certain that the Federal Reserve will slash interest rates a quarter of a percentage point at the September meeting.

Daily digest market movers: Gold price on the backfoot as US GDP advances

—US GDP for Q2 2024 jumped from 1.4% to 2.8% QoQ, exceeding forecasts of 2% on its advance reading.

—US Initial Jobless Claims for the week ending July 20 rose by 235K, less than the estimated 238K and lower than the previous week's 245K.

—US Durable Goods Orders plummeted by -6.6% MoM in June, significantly below the estimated 0.3%. However, Core Durable Goods, which excludes aircraft, expanded by 0.5% MoM, up from -0.1% and above the consensus projection of 0.2%.

—The Fed’s preferred measure of inflation, the Core PCE, is expected to dip from 2.6% to 2.5% year-over-year (YoY).

@ Newshounds News™

Read more: FX Street

~~~~~~~~~

Copper: Demand expectations melt down – TDS

7/25/2024

Prices are more likely to overshoot to the downside, notwithstanding the likely overly pessimistic sentiment surrounding demand, TDS senior commodity strategist Daniel Ghali notes.

Demand sentiment may be nearing a local bottom

Our gauge of demand sentiment embedded within the cross-section of commodities prices is now nearing its lowest levels of the year. These levels are now quantitatively inconsistent with recent history, and considering macro vol has been fairly muted, commodity demand sentiment now appears oversold.

This is a massive shift from just a few short months ago when demand sentiment appeared extremely overbought, contributing to the speculative fervor that catalyzed a momentous rally in Copper prices. Today, we now estimate that 80% of discretionary length in the red metal has already been liquidated, and we now see signs that the top traders in Shanghai are notably covering their shorts.

That being said, CTA trend followers still hold a substantial amount of dry-powder to sell and now have only a narrow margin of safety against selling programs. In fact, our simulations of future prices also suggest that a flat tape can now spark large-scale CTA selling activity over the next week. Overall, this suggests that prices are more likely to overshoot to the downside, notwithstanding the likely overly pessimistic sentiment surrounding demand.

@ Newshounds News™

Read more: FX Street

~~~~~~~~~

Setting Sail for Success: TLIP and IOTA’s Role in Maritime Advancements through the EU-Funded MISSION Project

—The EU-funded MISSION project aims to address the maritime industry’s challenges by leveraging IOTA’s TLIP infrastructure, which uses distributed ledger technology for secure and seamless data sharing.

—The MISSION project also aims to integrate TLIP with AI-driven smart contracts thereby enhancing responsiveness to exchanged data.

Maritime transport, which accounts for nearly 80% of the global trade has been facing major challenges with the fragmented IT infrastructure. So far, this sector has been using disparate IT systems used by different intermediaries within the supply chain involving port community systems and fleet performance management systems.

Although these systems can automate data for real-time data sharing, they usually operate in isolation and separately leading to resource-intensive efforts in order to maintain essential information. However, this inefficiency in real-time communication largely disrupts the maritime supply chain as all actors are not in sync to receive the updated information.

In the absence of a comprehensive system for planning and monitoring port operations and sea traffic, most maritime ports operate the ships on a first-come-first-serve basis instead of working in a well-orchestrated and planned scheme. this leads to greater inefficiencies and delays within the maritime industry.

In order to address all these challenges, the EU-funded MISSION project is working on a new communication and logistics platform to optimize planning, orchestrate port operations, and coordinate port traffic. Thus, to solve all the crucial challenges associated with the maritime industry, project MISSION will leverage IOTA’s TLIP infrastructure.

https:///t.co /61tsZqWABe

🚢🚢🚢🚢🚢🚢🚢🚢🚢🚢🚢

🚢🌍 IOTA plays a pivotal role in the EU-funded MISSION project! Using its distributed ledger technology, IOTA ensures secure and seamless data sharing within the Trade and Logistics Information Pipeline (TLIP). This enhances port operations by decreasing traffic, costs, and...

pic.twitter.com/61tsZqWABe

🚢🚢🚢🚢🚢🚢🚢🚢🚢🚢🚢

Leveraging IOTA’s TLIP Infrastructure

The IOTA TLIP infrastructure uses distributed ledger technology to facilitate seamless integration with existing systems while using APIs and state-of-the-art data standards, per the CNF report. TLIP’s role would be very crucial in the implementation of the MISSION project, thereby ensuring the security and auditability of shared data even within complex environments.

One of the key advantages of TLIP is inherent interoperability which facilitates a seamless integration of the MISSION platform into the European Blockchain Service Infrastructure (EBSI), as updated by Crypto News Flash. This integration will boost the platform’s data-sharing capabilities significantly.

Along with being crucial for just-in-time port call optimization, TLIP will improve the planning and alignment of port operations with better coordination of vessel arrivals and departures. It addresses the challenges posed by ships at sea with limited bandwidth and unstable connections, making it an essential component of the MISSION project. TLIP revolutionizes data sharing, fosters collaboration, and propels port operations into a new era of innovation.

Moving ahead, project MISSION is planning to integrate TLIP with AI-driven smart contracts thereby enhancing responsiveness to exchanged data while including alarms for non-compliance and delays. This integration of TLIP in the MISSION project highlights IOTA’s commitment to improving global supply chains via the industrial adoption of its technology, as reported by CNF.

Amid the broader market sell-off, the IOTA cryptocurrency is currently trading 7.1% down at $0.1575 with a market cap of $529 million and daily trading volumes shooting by 53%.

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

Charles Hoskinson Envisions Cardano Surpassing Bitcoin: ADA’s Growth Trajectory and Upcoming Chang Hardfork

—Cardano’s founder has unveiled the plans to topple Bitcoin in the near future.

—He believes in giving developers the tools to create usable tools that can add value.

Cardano (ADA) founder Charles Hoskinson is highly optimistic about the blockchain taking up Bitcoin (BTC) position as the leading digital asset. The founder hinted at the disclosure, ADA’s growth movement, and the upcoming Chag Hardfork upgrade in an interview on Altcoin Daily.

Hoskinson Touts Cardano as a Major Bitcoin Contender