Goldilocks' Comments and Global Economic News Friday Evening 5-31-24

Goldilocks' Comments and Global Economic News Friday Evening 5-31-24

Good Evening Dinar Recaps,

"Professor Frank Gunter publishes a new paper commissioned as part of a series by IBBC's advisory council on the challenges of de-dollarisation for Iraq.

The Advisory Council members and IBBC members have actively contributed to the paper in the past 4 months. It will be presented online on the 18th June in a webinar and in person at the Spring Conference on 2nd July."

Professor Gunter shows an analysis on the drivers inside the market that impact the Iraqi Dinar exchange rate and how to close the gap between the Parallel Market and Official Rate of the Iraqi Dinar.

Goldilocks' Comments and Global Economic News Friday Evening 5-31-24

Good Evening Dinar Recaps,

"Professor Frank Gunter publishes a new paper commissioned as part of a series by IBBC's advisory council on the challenges of de-dollarisation for Iraq.

The Advisory Council members and IBBC members have actively contributed to the paper in the past 4 months. It will be presented online on the 18th June in a webinar and in person at the Spring Conference on 2nd July."

Professor Gunter shows an analysis on the drivers inside the market that impact the Iraqi Dinar exchange rate and how to close the gap between the Parallel Market and Official Rate of the Iraqi Dinar.

The Iraq Britain Business Council (IBBC) has been working closely with Iraq to help assess and meet the needs of the Iraqi private sector. These assessments inside this research paper will go a long way towards the implementation of meeting the needs of Iraq's private citizens through a determination of an exchange rate that can do so.

Practical policy initiatives are mentioned in this paper to carry forward new monetary policies. They are not calling this project a white paper, but it sure does have all the hallmarks of one.

These new measures are inclusive of budgetary needs for the Iraqi people. One of the items on the CBI website presented today is instructions on home loans. A mortgage is calculated with the inclusivity of an exchange rate to support it.

It is clear that the Iraqi Dinar is moving towards a credit valuation adjustment that can support the needs of their people and Government.

Iraq Britain Business Investopedia Iraq Britain Business 2 Indeed CBI

© Goldilocks

~~~~~~~~~

"The path to adopting digital asset securities begins with collaboration. Introducing the Digital Asset Securities Control Principles framework, in collaboration with @Clearstream, @EuroclearGroup and @BCG."

This is the Depository Trust and Clearing Corporation (DTCC) White Paper that describes our movement towards T+0 settlements or instant settlements.

In order to achieve the full spectrum of the QFS being utilized as a Global Economic System, instant settlements have to be in play to level the playing field. Asset Servicing Times DTTC Ledger Insights

We now have a framework to work from to move towards achieving these objectives.

© Goldilocks

LINK to the white paper document : okt.to/1kdFLM

Twitter

~~~~~~~~~

"Commissioner Pham Announces Agenda for Global Markets Advisory Committee Meeting on June 4" | CFTC

Meeting Agenda:

* Basel 3 Capital proposals and impacts

* Trading impacts with these new credit valuation adjustments

* Impact on Global Market Structures and how this affects liquidity swaps at swap execution facilities

Do you see how we are moving into a phase whereby research on credit valuations and their adjustments are becoming important?

This report will include an assessment of where the International community is at the present time in the integration into the QFS.

© Goldilocks

~~~~~~~~~

Let's take a closer look at hype today. "To promote or publicize (a product or idea) intensively, often exaggerating its importance or benefits."

In society, hype can significantly influence what people think and buy. It is a form of manipulation used for a specific outcome that usually focuses on giving attention to the one sharing its contents.

When you provide an idea that is bigger than it actually is, you alter a person's mind and emotions to focus his or her attention towards the creator of its contents.

This kind of stimulus/response over time has the ability to control the overall actions and mindset of a person to the point of losing a concept of reality that separates a person from self-reflection and self-determination.

Here, a dependency is created for their followers who have not been empowered to think for themselves and totally rely upon their leaders to determine their minds and emotions experiences.

We at the "Seeds of Wisdom Team" have been focusing on factual content to help get us to the end of this ride known as the Global Currency Reset.

We are at this point whereby paying close attention to facts is so valuable to the determination you make at the time of your exchange.

I know I speak for the entire team when I say that it has been a privilege to serve the authentic needs of this community with integrity and dignity.

God Bless each of you.

© Goldilocks

~~~~~~~~~

The Singapore Innovation Hub Centre | Youtube

~~~~~~~~~

BISness podcast - Finternet: the financial system for the future | Youtube

~~~~~~~~~

Bearish Dow future 37,500.

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Evening 5-30-24

Goldilocks' Comments and Global Economic News Thursday Evening 5-30-24

Good Evening Dinar Recaps,

"Big Short’ investor Michael Burry just made a multimillion-dollar bet on gold — and dumped tech giants Alphabet and Amazon. 3 ways to add the yellow metal now"

The move from a bull market in stocks has shifted to a bull market run in gold. Since gold is being interfaced inside digital assets that represent our traditional assets, our traditional assets will maintain a steady value even if they go to a lower value. Some will rise in value. These new stock digital values will at least be a solid value, and it will be as good as gold.

Big money is starting to finally pour into gold. Why? Gold has outpaced the S&P 500 with a gain of 11.7% since the beginning of the year. Gold was trading at $2,062 per ounce. Today, it’s at $2,357 per ounce. This is a 14.3% increase.

Gold deflates an inflated economy. Not only this is going on at this time, but we have BRICS Nations trading in their local currency with the stipulation of joining stating that each country who joins holds gold.

Goldilocks' Comments and Global Economic News Thursday Evening 5-30-24

Good Evening Dinar Recaps,

"Big Short’ investor Michael Burry just made a multimillion-dollar bet on gold — and dumped tech giants Alphabet and Amazon. 3 ways to add the yellow metal now"

The move from a bull market in stocks has shifted to a bull market run in gold. Since gold is being interfaced inside digital assets that represent our traditional assets, our traditional assets will maintain a steady value even if they go to a lower value. Some will rise in value. These new stock digital values will at least be a solid value, and it will be as good as gold.

Big money is starting to finally pour into gold. Why? Gold has outpaced the S&P 500 with a gain of 11.7% since the beginning of the year. Gold was trading at $2,062 per ounce. Today, it’s at $2,357 per ounce. This is a 14.3% increase.

Gold deflates an inflated economy. Not only this is going on at this time, but we have BRICS Nations trading in their local currency with the stipulation of joining stating that each country who joins holds gold.

To top it all off, the Global Economy is moving into virtual assets that are called "tokenized assets." Each asset contains gold to support its value even the stablecoins which represents a country's currency has to have enough gold to sustain a Level Playing Field price in trade. MoneyWise YCharts.

Everything is turning to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~

Thank you Sam for finding the above information for me. I knew it had to be somewhere.

~~~~~~~~~

Everything on the new QFS either relates to gold, or it is backed by a precious metal.

These new digital standard protocols will be the mechanism by which money is moved going forward.

The future of money is in gold. Everything the world touches going forward will be because of a metal asset that enables it to do so.

© Goldilocks

~~~~~~~~~

Status of Banks’ Unrealized Losses in Q1: Worsened after Brief Rate-Cut-Mania Relief | Wolf Street

~~~~~~~~~

New York Stock Exchange to list Bitcoin options - Ledger Insights - blockchain for enterprise

Bitcoin Announcement:

"Today the New York Stock Exchange (NYSE) said it plans to launch cash-settled spot Bitcoin options with the price tracking the CoinDesk Bitcoin Price Index (XBX), subject to regulatory approval."

~~~~~~~~~

Once our digital assets moving towards regulation and becoming law are complete, the ability to move our "tokenized assets" backed by gold as a tier one asset will bring the banking system and the markets into correlated price patterns.

This will enable us to move forward with the new economy and begin the process of credit valuation adjustments across all sectors of the market including Forex.

© Goldilocks

~~~~~~~~~

The BuyBacks that started yesterday have not turned the markets around. BuyBacks usually reset a market and support a market. So far, it is not working. The next FOMC meeting is June 11th through the 12th. We may be looking at some monetary policy changes. We have to keep our eyes open much wider than before...

~~~~~~~~~

Article (10) of the Anti-Money Laundering and Terrorist Financing Law No. (39) of 2015 and based on the supervisory and supervisory role of this bank, it was decided to oblige the Anti-Money Laundering and Terrorist Financing Department in the electronic payment service providers/processors company to follow up on the movements that take place. On cards (whether prepaid, credit or debit)

https://cbi.iq/news/view/2595

~~~~~~~~~

Meeting with the Minister of Agriculture at ROSL, 2024 | Youtube

~~~~~~~~~

Comparing the IQD to the VND Iraqi News IQD VND HTG Rates | Youtube

~~~~~~~~~

THE WORLD ECONOMY IS COLLAPSING FASTER... AND SOCIETY IS BEING "DECONSTRUCTED." Mannarino | Youtube

~~~~~~~~~

Trading Halt | Investopedia

Market Announcement:

A delay in ticker reporting was announced about an hour ago. This delay is expected to be over 2 hours.

This does not make sense to me as a trader. Something is not right. Why would anyone buy in a stock market whereby the buy/sell indicators were delayed?

This is very dangerous.

"Trading can be halted in anticipation of a news announcement, to correct an order imbalance, as a result of a technical glitch, due to regulatory concerns or because the price of the security or an index has moved rapidly enough to trigger a halt based on exchange rules."

~~~~~~~~~

It looks like I have the rest of the day off.

~~~~~~~~~

All Time High Asset Prices | Youtube

~~~~~~~~~

Ripple submits a letter to Judge Torres:

1 & 2

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday Evening 5-29-24

Goldilocks' Comments and Global Economic News Wednesday Evening 5-29-24

Good Evening Dinar Recaps,

Commerz Banking Announcement:

"Commerzbank has completed a strategic migration and simplification of its global FX, FX derivatives, equities and commodities activity, streamlining trading and risk in Murex’s integrated MX.3 platform."

MX.3 is a cloud-based solution. It enables public agencies, banks, clearing brokers and other businesses to manage operations in trading, costs, funding, risk management, compliance tracking, and more.

Several banks are making their transition into the new digital economy.

This is one of many that are currently involved in making foreign currency exchange possible.

Goldilocks' Comments and Global Economic News Wednesday Evening 5-29-24

Good Evening Dinar Recaps,

Commerz Banking Announcement:

"Commerzbank has completed a strategic migration and simplification of its global FX, FX derivatives, equities and commodities activity, streamlining trading and risk in Murex’s integrated MX.3 platform."

MX.3 is a cloud-based solution. It enables public agencies, banks, clearing brokers and other businesses to manage operations in trading, costs, funding, risk management, compliance tracking, and more.

Several banks are making their transition into the new digital economy. This is one of many that are currently involved in making foreign currency exchange possible. AssetServicingTimes | Murex News

© Goldilocks

~~~~~~~~~

e-HKD Announcement:

"The Hong Kong Monetary Authority (HKMA) is accelerating its exploration of a central bank digital currency (CBDC) with the launch of the next phase of its e-HKD pilot program. A key area of focus will be the use of e-HKD for mortgage pricing and disbursement, potentially offering benefits for both consumers and banks.

This initiative follows a successful six-month trial that concluded last October, providing valuable insights into potential applications for digital currency. The new phase will involve a deeper dive into the technology, business models, and regulatory frameworks surrounding e-HKD transactions."

This comes at a time when Hong Kong is in process of going through their Inspection of Crypto Platforms’ Offices Licensing process.

June 1st, 2024, is the deadline for applications to be finished and inspections to begin. This process will ensure that new monetary policies and regulations are being followed. CrypTotimes Bitcoinist

© Goldilocks

~~~~~~~~~

CBDC Announcement:

"In a vote of 216 - 192, the House of Representatives passed Emmer's bill that would prohibit the Federal Reserve from issuing a surveillance-style central bank digital currency (CBDC) that could give the federal government the ability to monitor and control individual Americans' spending habits."

This new bill is moving through Congress as we speak. It does not mean that Retail CBDC is going away entirely. It just means that the ability to know and interfere with your private affairs through a Central Bank Digital Coin is an issue no one wants to live with going forward.

Project Tourbillon is in the works to produce a form of cash like anonymity for Retail CBDC. The protection of people's identities is currently being tested. There is a question of speed that needs to be resolved along with the above therefore mentioned.

Last Updated on March 21st, 2024.

This is the name for the trial of a prototype Central Bank Digital Currency (CBDC), using technology based on David Chaum's eCash 2.0 design. (See link below) Emmer House BIS Pat Crypt

© Goldilocks

~~~~~~~~~

"Thailand will apply to become a member of the BRICS economic bloc, the government of the Southeast Asian country announced on Tuesday."

To give you an idea how important this move is. Vietnam is the largest trading partner with Thailand at the present time. This could shift when they become a market economy in July adding to the ability to trade with the US as well.

It is just simply important to note that the world Trading Map is changing rapidly. As we have discussed before, 80% Plus trades are done across the waters. This is more than enough of a percentage to change exchange rates on a global scale.

This is also why the World Trade Organization is reconfiguring trade exchange rate percentages and plans on presenting them to us the second half of this year. BigNewsNetwork Trade

Watch the water.

© Goldilocks

~~~~~~~~~

Project Tourbillon explores anonymity for digital payments | Youtube

~~~~~~~~~

Semler Scientific unveils strategy for Bitcoin Treasury | Crypto News

~~~~~~~~~

Ripple and Axelar Foundation Partner to Enhance XRP Ledger’s Interoperability Across Blockchains | Axelar

Ripple and Axelar Foundation are partnering to bring seamless interoperability to the XRP Ledger (XRPL) across a diverse range of blockchain networks. XRPL is a decentralized, layer 1 blockchain with reliability and stability proven for over a decade that is trusted by businesses and builders globally for the efficient tokenization and exchange of crypto-native and real-world assets. This collaboration aims to drive forward a more interconnected blockchain ecosystem, offering developers new opportunities for integration and application development. Axelar’s network will serve as an additional resource to further broaden XRPL's utility and reach.

~~~~~~~~~

Digital Asset Investor | Twitter

~~~~~~~~~

Microsoft introduces Copilot bot for Telegram users; here's how it works - BusinessToday

~~~~~~~~~

BBPA_20240529174000.pdf

Here is the Treasury BuyBacks we talked about yesterday.

~~~~~~~~~

"Master's in Digital Financial Technologies at KSU"

👆 It looks like we are far enough along with understanding the new Financial System that we can now teach a class in it.

Somebody has the full picture, or they would not be able to teach it. Drive News Letter

Here we go.

© Goldilocks

~~~~~~~~~

IMPORTANT Iraq Loosing Millions Each Month | Youtube

~~~~~~~~~

European Commission Arm Says Convergence of Blockchain and AI Is ‘Upcoming Trend’ To Watch - The Daily Hodl

~~~~~~~~~

Master of Science in Digital Financial Technologies (Fintech) | Kennesaw State University

Here is another one. Do you see a trend?

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Tuesday Evening 5-28-24

Good Evening Dinar Recaps,

"Wall Street Moves to Fastest Settlement of Trades in a Century" T

oday, Wall Street moves to T+1 settlement times. This will minimize risks taken in the market when it comes to ensuring enough money secured on both sides of a trade.

I am aware that many people are calling for a crash in the market this week, but it probably will have more to do with moving from T+2 settlements to T+1 settlements this week.

Some of the trades from Friday will get caught in T+2 settlements until all trades are cleared this week. Also, BuyBacks are coming back into play. This has not been done since the early 2000s.

Look for many companies and the Governments to buyback some of their bonds. Buying back bonds at a discounted price will support the market and give companies the opportunity to buyback some of their own shares.

Goldilocks' Comments and Global Economic News Tuesday Evening 5-28-24

Good Evening Dinar Recaps,

"Wall Street Moves to Fastest Settlement of Trades in a Century"

Today, Wall Street moves to T+1 settlement times. This will minimize risks taken in the market when it comes to ensuring enough money secured on both sides of a trade.

I am aware that many people are calling for a crash in the market this week, but it probably will have more to do with moving from T+2 settlements to T+1 settlements this week.

Some of the trades from Friday will get caught in T+2 settlements until all trades are cleared this week.

Also, BuyBacks are coming back into play. This has not been done since the early 2000s. Look for many companies and the Governments to buyback some of their bonds.

Buying back bonds at a discounted price will support the market and give companies the opportunity to buyback some of their own shares.

A buyback in bonds will increase liquidity allowing a company to own more of their shares at a discounted price during volatile moments. It increases the company's ownership of the shares they repurchase bringing in more profits to the company.

This creates a higher share price on the markets allowing more dividend opportunities for those who own the shares and profits for the company.

Going to a T+1 settlement process will give companies the opportunity to execute new plans for their company with this new money that will be coming in for their use. Finance Yahoo Bloomberg

© Goldilocks

~~~~~~~~~

Don't look for this T+1 settlement to last very long. Many countries have already gone to T+0 settlements.

Those with instant settlement payment systems will have an advantage until everyone catches up.

This is all part of the process in moving to the QFS. The QFS is an electronic system that will allow instant payments to take place. This is the goal.

© Goldilocks

~~~~~~~~~

Digital Vs Electronic Records Management Explained | Armstrong Archives

When we move from T+1 settlements to T+0 settlements across the Nations, the shift into the QFS will become possible.

Why?

The only way to do that is through a digital process moving away from wire payment processing services (ACH) for good.

© Goldilocks

~~~~~~~~~

Digital Payments - Worldwide | Statista Market Forecast

Digital processing will be able to utilize many Networks in the future to process a payment.

Digital Networks that run on the QFS will provide many choices in payment sources going forward.

© Goldilocks

~~~~~~~~~

Hong Kong's Currency Market Announcement | HKEX

"The “FIC Advisory Panel” chaired by HKEX Co-Head of Markets Glenda So, will advise the exchange on its FIC strategy and facilitate the introduction of new FIC products and services, further developing the FIC market and supporting Hong Kong's position as an international financial centre."

The FIC Advisory Panel has come in to help in the transition of the new digital economy regarding the Currency Market and fixed-income businesses.

The FIC is expected to expand their Currency Market internationally.

© Goldilocks

~~~~~~~~~

Once Iraq's digital banks are licensed and good to go, their currency will be licensed as well.

© Goldilocks

~~~~~~~~~

Iraq 7 Factors to Increase Iraq's Currency- Iraqi News | Youtube

~~~~~~~~~

US Ambassador to Iraq Alina Romanowski commended Iraq for its official ratification of an electronic payment system at the end of April. | Shafaq News

~~~~~~~~~

"The implementation of electronic procedures by the Central Bank of Iraq under the supervision of the US Treasury Department had a clear impact on economic growth as well as on the decline in the value of the dollar against the Iraqi dinar." | Shafaq News

~~~~~~~~~

International Monetary Fund mission for the current year 2024 for Article Four consultations praised the Iraqi government’s measures, including the monetary policy led by the Central Bank of Iraq.

The report indicated that the Central Bank of Iraq has taken several measures aimed at stabilizing the national currency and controlling monetary inflation.

Adding that the Central Bank raised the interest rate on monetary policy tools from 4% to 7.5% and increased the mandatory reserve requirements for banks from 15% to 18%, and these steps were decisive in reducing the inflationary pressures that Iraq suffered from, and this contributed to creating an economic environment. More stable.

The report emphasized that important reforms in the banking sector, such as the gradual increase in bank capital and mergers between small banks, aim to strengthen the banking sector and increase its efficiency and flexibility in the face of economic shocks.

The report noted that Iraq has implemented new compliance measures to improve the transparency of cross-border financial transactions, by launching an electronic platform that imposes the disclosure of financial beneficiaries, which enhances the integrity of financial transfers in accordance with international banking standards, as well as the role of the Central Bank of Iraq in expanding relations. Correspondent banking, to facilitate smoother international trade financing operations.

Central Bank of Iraq

Information Office

May 27, 2024

https://cbi.iq/news/view/2592

~~~~~~~~~

The Iraqi banking system may soon receive banks of another type called (digital banks). What are these banks and will the citizen, the banking system, and the Iraqi economy benefit from them? Files that the beneficiary of the banking sector services in Iraq is trying to ask. | Economy News

~~~~~~~~~

Financial Services Providers Highlight Opportunities in Cloud-Native Banking | Pymnts

The modernization of back-end systems represents an ongoing challenge for banks, especially as they seek to introduce new digital-first services.

The options used to be stark: Rip and replace, or get the most mileage of the legacy systems already in place.

In recent years we’ve seen the continued emergence of cloud-core banking systems used in the service of conducting daily banking activities, while future-proofing financial institutions for the changes to come — through API connectivity — particularly in instant payments.

Private and public cloud setups (not hosted on the premise of the companies themselves) connect financial services companies with providers and applications that handle everything from payments processing to reporting to compliance. Tied to all those functions are cloud ledgers, which record the transactions themselves automatically.

The shift to the cloud is especially timely, given the rise of embedded payments and embedded lending. Those two trends, along with virtual card issuance, can create new revenue streams for digitally minded enterprises.

~~~~~~~~~

Stablecoins and Economic Stability: A Balancing Act - Daijiworld

~~~~~~~~~

A flood of cheap Chinese exports is putting the entire global economy at risk, France’s finance minister warns | Fortune

~~~~~~~~~

MoMo, VNPAY, and ZaloPay Enable QR Payments for Visa Cardholders in Vietnam - Fintech Singapore

~~~~~~~~~

What the SEC's Pivot To Approve Spot Ether ETFs Means | Investopedia

~~~~~~~~~

SWIFT |Swift

Register now to explore the transformative journey that ISO 20022 offers for the future of payment systems around the world.

Swift’s Tom Dunbar will be joined by Mel Gauci from the Australian Payments Network, and Christine Orina from the Central Bank of Kenya, to discuss market standards for ISO 20022, and how these will bolster financial stability and spur innovation.

Join us to learn more about this exciting topic!

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 5-27-24

Goldilocks' Comments and Global Economic News Monday Evening 5-27-24

Good Evening Dinar Recaps,

Cognitive Computing Market is Going to Boom | Microsoft, IBM, | OpenPR

~~~~~~~~~

Russia and China insist on a new "multipolar" world order | Atalayar

~~~~~~~~~

US Government Pays $514,000,000,000 in Interest on National Debt in Seven Months, Surpassing Defense and Medicare Costs: Report - The Daily Hodl

~~~~~~~~~

OVHcloud Adds Qiskit To Market Leading Quantum Notebooks Portfolio | TheQuantumInsider

~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday Evening 5-27-24

Good Evening Dinar Recaps,

Cognitive Computing Market is Going to Boom | Microsoft, IBM, | OpenPR

~~~~~~~~~

Russia and China insist on a new "multipolar" world order | Atalayar

~~~~~~~~~

US Government Pays $514,000,000,000 in Interest on National Debt in Seven Months, Surpassing Defense and Medicare Costs: Report - The Daily Hodl

~~~~~~~~~

OVHcloud Adds Qiskit To Market Leading Quantum Notebooks Portfolio | TheQuantumInsider

~~~~~~~~~

*******************

China Sells $48,900,000,000 in US Treasuries in One Quarter, Analyst Says 'Clear Intention' To Dump US Dollar Holdings on Display - The Daily Hodl

~~~~~~~~~

BRICS: China sold off US Treasury bonds worth 74 billion USD in 7 months | US 2024 | Aliteq

~~~~~~~~~

US Treasury Secretary Yellen Warns of Challenges in Controlling Deficits and Interest Expense – News Bytes Bitcoin News

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Afternoon 5-27-24

Goldilocks' Comments and Global Economic News Monday Afternoon 5-27-24

Good evening Dinar Recaps,

I will be taking the day off Monday to spend time with my family and friends for Memorial Day. I expect to return Tuesday morning with more information on where we are in the transition of our economy. © Goldilocks

Goldilocks' Comments and Global Economic News Monday Afternoon 5-27-24

Good evening Dinar Recaps,

I will be taking the day off Monday to spend time with my family and friends for Memorial Day.

I expect to return Tuesday morning with more information on where we are in the transition of our economy.

© Goldilocks

504,339 views May 25, 2016 Memorial Day Tribute

The Oasis Christian Church video honoring the fallen hero's of war. Freedom came at a high price and we want to say thank you to all the men and women of our armed forces. https://youtu.be/i-ZCvBct6lA?si=zrgCtIFgSAVwW0Bn

~~~~~~~~~

Tomorrow, MICA (Global Regulations) are done. Then, we begin the process of implementing the QFS. It will not be done in one day, but the process begins.

© Goldilocks

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Currency Insider Video Update Sunday Afternoon 5-26-24

Currency Insider Video Update Sunday Afternoon 5-26-24

Iraqi Dinar Shocking It’s Big News Update – 2:30

Vietnam Dong It’s Massive Change – 2:16

Iraqi Dinar Rate Update It’s Higher – 2:26

Currency Insider Video Update Sunday Afternoon 5-26-24

Iraqi Dinar Shocking It’s Big News Update – 2:30

Vietnam Dong It’s Massive Change – 2:16

Iraqi Dinar Rate Update It’s Higher – 2:26

Iraqi Dinar Shocking It’s Big News Update – 2:30

Vietnam Dong It’s Massive Change – 2:16

Iraqi Dinar Rate Update It’s Higher – 2:26

Goldilocks' Comments and Global Economic News Sunday Afternoon 5-26-24

Goldilocks' Comments and Global Economic News Sunday Afternoon 5-26-24

Good Evening Dinar Recaps,

There is currently a lot of cash building in the markets from traders who are building their portfolios in Gold-backed ETFs and the mining sectors of the market.

Cash building in gold is the current trend for Professional Traders and the Retail Market. It gives an investor collateral for the trades he or she would like to make, and even, investments made outside of the marketplace.

It is becoming increasingly clear that the sentiment for the Retail Market is over-the-counter products in physical gold.

The growing popularity for cryptocurrency over Fiat money is beginning to gain traction as institutional money is moving their assets around on the Traditional Market in preference for new digital assets onboarding to the new digital asset based trading system.

Goldilocks' Comments and Global Economic News Sunday Afternoon 5-26-24

Good Evening Dinar Recaps,

There is currently a lot of cash building in the markets from traders who are building their portfolios in Gold-backed ETFs and the mining sectors of the market.

Cash building in gold is the current trend for Professional Traders and the Retail Market. It gives an investor collateral for the trades he or she would like to make, and even, investments made outside of the marketplace.

It is becoming increasingly clear that the sentiment for the Retail Market is over-the-counter products in physical gold.

The growing popularity for cryptocurrency over Fiat money is beginning to gain traction as institutional money is moving their assets around on the Traditional Market in preference for new digital assets onboarding to the new digital asset based trading system.

The purchasing of Tokenized Assets is a ground-floor opportunity and big money is piling into the fray being pulled from two directions right now on the opportunities the market provides.

Currently, we have Bitcoin and Ethereum ETFs. These digital asset opportunities are considered commodities, and big money is placing their bets on their success.

The first one is a storehouse of value and the second transacts Market values through Smart Contracts. Look for Ripple ETF to join in the mix soon to provide a Payment Network to move Bitcoin and Ethereum opportunities across all sectors of the market as a liquidity coin.

When the QFS is clearly established with regulations and laws to govern the new digital system, the trend toward OTC products is likely to reverse as consumers begin to realize we are back on a Gold Standard with a set of Digital Protocols on assets and stablecoins that shows a consistency toward potential for growth. Kitco Coinpedia Reuters CFTC Kitco 2

Gold will set us free.

© Goldilocks

~~~~~~~~~

"The BOE is now the first major central bank discussing how it plans to revert to a similar system as before, draining reserves, then using repos – instead of bond purchases (QE) – to deal with issues."

The transition from government bonds to repos will take time as the remaining "Approved Financial Projects" that deal with infrastructure, real estate, and home loans “will take time to unwind.”

Here we go. The movement from utilizing bonds for liquidity to Repo Market lending such as the one we are in now called SOFR.

The Secured Overnight Financing Rate is collateralized by US Securities. The US Treasury holds gold as security for the use of gold certificates issued to the Federal Reserve Banks.

Gold is a Tier 1 asset under the Basel III banking regulations. This classifies physical allocated gold as the safest tier asset in comparison to cash. Gold is about to become King.

Under the Basel III rules, gold in allocated accounts is considered a Tier 1 asset and has zero risk weighting.

ETFs or Exchange Traded Funds that we are seeing be formulated on the market through Bitcoin and Ethereum are Tier 3 assets holding a riskier custody opportunity.

Gold is now being relisted, at the Bank of England, as the safest asset over cash going forward. Through the use of our new Tokenized Asset Commodity Based Market, our Stablecoins coins that represent a country's currency is about to be reclassified through gold.

Any country holding gold as collateral can now reclassify their currency as a collateralized security. It will increase the demand for gold and for Stablecoins that represents a country's currency.

This will be inclusive of all countries (ie Iraq) who have become Basel 3 compliant and moving to a local currency regimen as a payment source on the new digital economy.

As our new Digital Global Regulations through MICA finish this month and produce a white paper for other countries to follow, we can look for new credit valuation adjustments to begin after the June 30th, 2024 deadline for them to become law.

The demand for gold is the bridge into our next economy, and its path forward to a new world is about to commence. 11Onze WolfStreet

Gold will set us free.

© Goldilocks

~~~~~~~~~

The first of many CENTRAL BANKS (BOE) is beginning to switch over from bond market liquidity to gold market liquidity Repo Services through SOFR.

We need to watch closely as this develops. Everything will turn to Gold when this is done.

This is the transition that will provide liquidity for every sector of the market including Forex.

© Goldilocks

~~~~~~~~~

They Now Control The Gold Price (The Comex Is DONE) | Youtube

~~~~~~~~~

ISDA reviews legal treatment of tokenized collateral - Ledger Insights - blockchain for enterprise | LedgerInsights

~~~~~~~~~

AI in the Fields: Revolutionizing Agriculture With Smart Technology | SciTechDaily

~~~~~~~~~

"SEC approval of Ether ETFs acknowledges Ether is a commodity" LedgerInsights FederalRegister

~~~~~~~~~

Bitcoin Poised For New All-Time High Amid Strong ETF Inflows » The Merkle News

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Evening 5-25-24

Goldilocks' Comments and Global Economic News Saturday Evening 5-25-24

Good Evening Dinar Recaps,

HKMA is making changes to their USD liquidity facility. "A liquidity facility is a committed, undrawn backup facility that can be used to refinance a customer's debt obligations if they are unable to roll it over in financial markets."

HKMA is moving their money settlement process from T+1 to T+0. The Hong Kong Monetary Authority is making this policy change to give them instant access to money flows.

Hong Kong has been in pilot programs in the new digital economy that enables them to process their digital money instantly.

This will give them a trading advantage that many countries will want to catch up to going forward. This is why I told you a while back that the movement from T+1 settlements at the end of this month would not last long.

Goldilocks' Comments and Global Economic News Saturday Evening 5-25-24

Good Evening Dinar Recaps,

HKMA is making changes to their USD liquidity facility.

"A liquidity facility is a committed, undrawn backup facility that can be used to refinance a customer's debt obligations if they are unable to roll it over in financial markets."

HKMA is moving their money settlement process from T+1 to T+0. The Hong Kong Monetary Authority is making this policy change to give them instant access to money flows.

Hong Kong has been in pilot programs in the new digital economy that enables them to process their digital money instantly.

This will give them a trading advantage that many countries will want to catch up to going forward. This is why I told you a while back that the movement from T+1 settlements at the end of this month would not last long.

It looks like the new digital asset-based trading system has now become a driver for the rest of the global economy to interface new electronic settlement protocols just to keep pace.

The new digital payment system has now become a competitive edge for countries who are further along in the new QFS. HKMA ADGM

© Goldilocks

~~~~~~~~~

HKMA Announcement:

"HKMA Updates Social Performance Module (SPM) to Drive Banking Sector Upskilling"

We have recently been talking about many banks going through logistics training and especially in their foreign currency exchange departments.

Here, we have a report that Hong Kong is Upskilling their banking practitioners.

Part of the reskilling of their banking employees deals with The Exchange Stabilization Fund. The ESF deals with three types of assets:

* The US Dollar

* Foreign Currencies

* Special Drawing Rights

The SDR is an international reserve asset. It is created by the International Monetary Fund. This particular asset class is a transitional currency. It will help stabilize and redistribute monetary volumes and access expansion to various currencies to aid in the process of moving from a World Reserve Asset to a local currency regimen backed by gold.

This process will begin to create price pressures on global currencies. Credit valuation adjustments will be a part of this process.

As of August 2023, the SDR basket of currencies consists of the following percentages:

* US dollar: 43.38

* Euro: 29.31

* Chinese yuan: 12.28

* Japanese yen: 7.59

* British pound sterling: 7.44

These percentages will shift during the transition as new alliances have been formed the last few years through new trading partners. Don't be surprised if we do not see a digital currency added to this list.

Hong Kong is an open market economy driven by supply and demand. Currently, the United States dollar is their main asset to drive their Market, but a shift change to a gold backed regimen will immediately change everything for Hong Kong and those who trade with them which is many countries.

Hong Kong has been through several digital pilot programs and completed many of their projects. They are well equipped for the new shift in our economy.

China is currently driving the gold market to new highs along with new BRICS Nations. These changes will come at a heavy price on the US Dollars' performance.

We are in a transition that has taken a lot of time, but the shifts to the global economy are beginning to take a different shape. Investopedia HKMA Linkedin Home Treasury. RegulationAsia

Gold will set us free.

© Goldilocks

~~~~~~~~~

Hong Kong | Imports and Exports | World | ALL COMMODITIES | Value (US$) and Value Growth, | Trend Economy

~~~~~~~~~

UK Approves First Physically Backed Bitcoin and Ethereum ETPs for Listing on London Stock Exchange – Bitcoin News

UK Approves First Physically Backed Bitcoin and Ethereum ETPs for Listing on London Stock Exchange. At this time, these Exchange Traded Products will only be available for professional traders.

Its 100% physically backed Bitcoin and Ethereum ETPs, Wisdomtree Physical Bitcoin and WisdomTree Physical Ethereum will be listed on the LSE at the earliest date possible which is expected to be on Tuesday, May 28th.

~~~~~~~~~

Swap Connect: new tools, enhanced products and more solutions | HKEX Group

👆 Hong Kong is ready to transition folks.

~~~~~~~~~

RIPPLE XRP HOLDERS THIS IS HOW XRP BECOMES BIGGER THAN BITCOIN | Youtube

~~~~~~~~~

UBS distributes first fund issued on iCapital's DLT infrastructure - Ledger Insights

iCapital, the marketplace for alternative investment funds, has launched its distributed ledger technology (DLT) solution. The first fund issued using the technology is being distributed by UBS Wealth Management and administered by Gen II, although it did not disclose the asset manager.

https://www.ledgerinsights.com/ubs-distributes-first-fund-issued-on-icapitals-dlt-infrastructure/

~~~~~~~~~

Hong Kong is one of the few open market economies that we have. Vietnam is about to become one in July.

There will be many more, and the changes in currency rates will be determined by these changes.

© Goldilocks

~~~~~~~~~

~~~~~~~~~

This is CRITICAL | Youtube

~~~~~~~~~

Join the Seeds of Wisdom Team SNL call with Freedom Fighter breaking down Goldilock's weekly posts! Jester will be joining too! SNL Call Link

9 pm EDT / 8 pm CDT / 6 pm PDT

The SNL Q & A room will be open at 8 pm ET, 7 pm CT, and 5 pm PT to ask questions that will be answered on the call!

The call will be recorded and you can find it in the Archive Call Room after the call is over.

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Afternoon 5-24-24

Goldilocks' Comments and Global Economic News Friday Afternoon 5-24-24

Good Evening Dinar Recaps,

" Chairman of the Securities Commission in Iraq, Faisal Al-Haims, confirmed today, Wednesday, that the authority is studying the possibility of licensing brokerage companies to trade in shares on international stock exchanges."

Forex is sold "in shares" through exchange-traded products (ETPs) and exchange-traded notes (ETNs).

Licensing brokerage companies to trade on the global exchange, also known as a foreign exchange (forex) market, is a necessary process that allows companies to operate in the market.

As long as global financial standards and International digital norms/regulations are followed, a forex license can be issued by regulatory authorities.

This procedure guarantees a company's compliance with International regulatory standards. Without a license, a broker's work is considered illegal.

Goldilocks' Comments and Global Economic News Friday Afternoon 5-24-24

Good Evening Dinar Recaps,

" Chairman of the Securities Commission in Iraq, Faisal Al-Haims, confirmed today, Wednesday, that the authority is studying the possibility of licensing brokerage companies to trade in shares on international stock exchanges."

Forex is sold "in shares" through exchange-traded products (ETPs) and exchange-traded notes (ETNs).

Licensing brokerage companies to trade on the global exchange, also known as a foreign exchange (forex) market, is a necessary process that allows companies to operate in the market.

As long as global financial standards and International digital norms/regulations are followed, a forex license can be issued by regulatory authorities.

This procedure guarantees a company's compliance with International regulatory standards. Without a license, a broker's work is considered illegal.

These procedures will allow the Iraqi Dinar to be bought and sold on Forex when they are done. At the present time, banks are in process of learning how to do foreign currency exchanges through an electronic process.

Now, it makes sense why my friend told me they were doing foreign currency exchange training with every currency except the dinar, but this is about to change with the reclassification of the Iraqi dinar by the end of this month. Economy Gofaizen & Sherle FinJuris

© Goldilocks

~~~~~~~~~

House Passes CBDC Anti-Surveillance State Act | Financial Services Committee

~~~~~~~~~

The Middle East and North Africa Financial Action Task Force (MENAFATF), at its general meeting, held in the Kingdom of Bahrain for the period from 19-23 May 2024, approved the mutual assessment report for the Republic of Iraq, which reflects its great commitment to applying international standards to combat money laundering and the financing of terrorism. | CBI

~~~~~~~~~

"Commissioner Pham Announces CFTC Global Markets Advisory Committee Meeting on June 4"

Time:

* 10am to 3pm

Where:

* CFTC’s New York Regional Office

Who:

*Global Markets Advisory Committee

Agenda:

* To advance three recommendations from the March meeting

Topics:

* Global Market Structure Subcommittee Recommendation - Inclusion of U.S. Treasury ETFs as Eligible Initial Margin Collateral

* Technical Issues Subcommittee Recommendation – Publication of Resource Document to Support Transition to T+1 Securities Settlement

* Digital Asset Markets Subcommittee Recommendation – Adoption of an Approach for the Classification and Understanding of Digital Assets (Iraqi Dinar will be one of these)

As we have seen by following the news, these topics for review are already underway inside the new QFS.

I am simply sharing this report to let you know that the Commodities Futures Trading Commission (CFTC) is the governing body of the new QFS based on its ties to the commodity sector of the markets.

Each of our tokenized assets and opportunities for banking portfolios will have been reviewed and approved through the CFTC. CFTC 1 CFTC 2

This meeting gives us a good idea of where we are in the implementation stages of the QFS.

© Goldilocks

~~~~~~~~~

DTCC Announcement:

"DTCC Completes Blockchain Pilot for Mutual Fund Data"

Depository Trust & Clearing Corporation completes fund data tokenization pilot with Chainlink.

Chainlink is a Smart Contract Network that enables the beginning and conclusion of a trade through the linking of assets wanting to be cleared in a transaction.

The pilot explored the ease of access in determining Net Asset Value (NAV) data for mutual funds across different blockchain networks.

In other words, various stocks, bonds, and other investments are being tested to be listed with new NAV values on the DTCC. (Reset) Investors Observer Wikipedia

© Goldilocks

~~~~~~~~~

Russia signs decree allowing seizure of US assets in Russia | Jurist

~~~~~~~~~

Ether ETFs Clear Major Hurdle, Though SEC Hasn't Cleared Them for Trading Yet | Coindesk

~~~~~~~~~

Elon Musk predicts AI will take everybody's jobs | 9News

~~~~~~~~~

Digitalization of trade and maritime transport accelerates thanks to UNECE tools | UNECE

~~~~~~~~~

Third Conference on the International Role of the U.S. Dollar: Welcoming Remarks by Governor | Youtube

~~~~~~~~~

Iran's Supreme Leaders Promise to Iraq IQD Rate | Youtube

~~~~~~~~~

~~~~~~~~

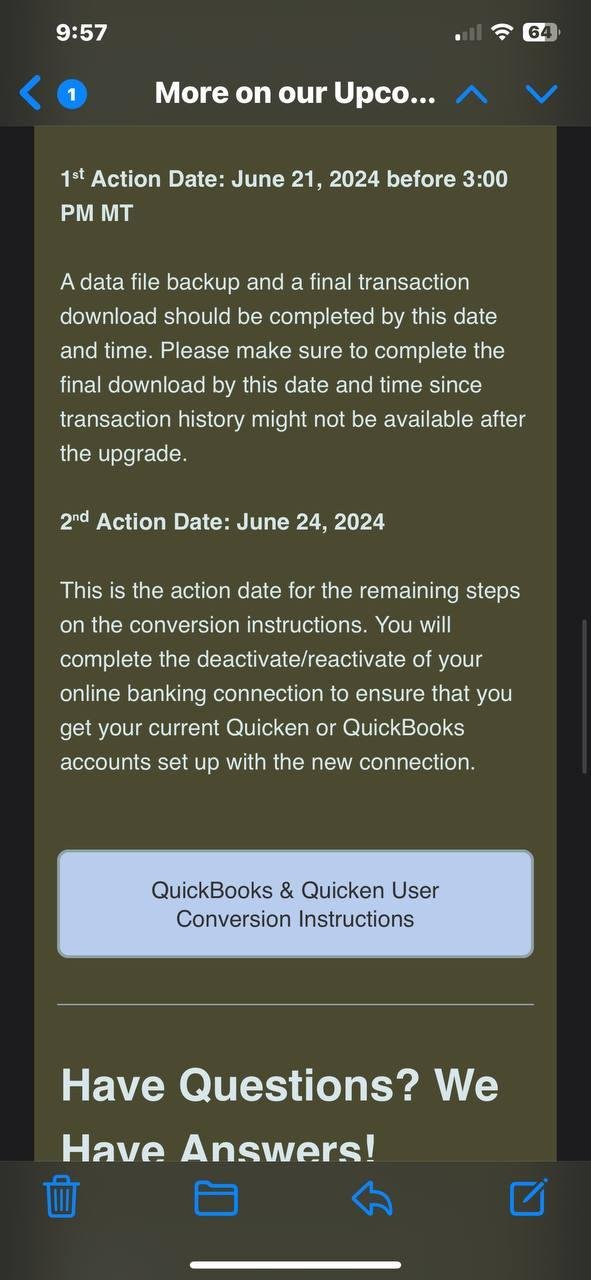

👆Oh My God. This Bank just told us about when they are going to move onto the QFS.

First action date: June 21, 2024 before 3:00 p.m. MT

Second action date: June 24, 2024 for the remaining steps.

Is important to note that this is one bank's timeline, but I can't help from notice that this one is before the June 30th, 2024 laws that are taking effect on crypto regulations and stablecoins at the end of the month.

© Goldilocks

~~~~~~~~~

CSI Partners with TruStage%2 Compliance | Valdosta Daily Times

~~~~~~~~~

👆 Banking Systems are moving to digital. Several of them are beginning to make announcements. You may be getting a notice yourself soon.

~~~~~~~~~

SEC approves rule change to allow creation of ether ETFs | CNBC

The SEC has approved a rule change that paves the way for ETFs that buy and hold ether. The commission approved bitcoin ETFs less than six months ago - those funds have proven a big success for the industry.

Many of the companies that sponsor bitcoin ETFs have already started the process of launching an ether fund. The approval of ether ETFs is a sign that the SEC's stance toward crypto may be softening. The approval for ether ETFs does not extend to other crypto projects on the Ethereum network.

~~~~~~~~~

Bitcoin and Ethereum are both considered a commodity. More on this tomorrow with Ethereum.

~~~~~~~~~

Bionic Eye Gets a New Lease of Life | IEEE Spectrum

Pixium Vision, a company with an innovative retinal implant that tackles vision loss, has been acquired by Science, a bioelectronics startup run by Neuralink's co-founder, Max Hodak. Pixium was in danger of disappearing completely after running out of money last November. Studies suggest that its technology is safe and potentially effective. Science will push to get the technology approved in Europe as quickly as possible.

~~~~~~~~~

World now multipolar! | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Good Evening Dinar Recaps,

What Is a Private Wealth Manager?

A bank's ledger balance is a record of all transactions that have been processed and approved at the end of a business day, including deposits, withdrawals, interest income, and bill payments.

That being said, is it really a stretch to anyone's imagination that we are moving into a digital processing center on a Global scale, and the banking system is just simply one section interfaced onto a Quantum Technological Systematic set of protocols designed to run numbers on equations until a balance between two parties are cleared?

Yes, we are finding that many positions in the banking system and around the world can be automated. Still, the need for a personal touch remains.

This would account for why Personal Wealth Manager positions are on the rise and Banks are currently making these changes to meet the needs of a new society.

Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Good Evening Dinar Recaps,

What Is a Private Wealth Manager?

A bank's ledger balance is a record of all transactions that have been processed and approved at the end of a business day, including deposits, withdrawals, interest income, and bill payments.

That being said, is it really a stretch to anyone's imagination that we are moving into a digital processing center on a Global scale, and the banking system is just simply one section interfaced onto a Quantum Technological Systematic set of protocols designed to run numbers on equations until a balance between two parties are cleared?

Yes, we are finding that many positions in the banking system and around the world can be automated. Still, the need for a personal touch remains. This would account for why Personal Wealth Manager positions are on the rise and Banks are currently making these changes to meet the needs of a new society.

The synchronization of human behavior and technological advances are currently being held at a balance. Where we go from here will be determined by the choices both AI and Human Nature co-create in this new world.

There will always be pros and cons to each choice we make going forward, but the integration of the Techno-Human Race is forging a new path. It is an experimentation beyond everything we have encountered so far in history.

Movement forward is both scary and filled with opportunity. Yet, inside each of us is an explorer of space and time. We are walking into new frontiers and decisions will have to be made by each of us how far we are willing to go.

The transition into digital money and sudden wealth is a much larger step than many realize. We will cross over into a dimension of life few have seen in this lifetime.

We are at a crossroads, and movement into a new digital world that moves our money and the choices we make is rapidly approaching.

True freedom will not be the result of sudden wealth. Freedom comes from a much deeper place. The more that is given to us, the more is required for us to reach into those places hands can no longer touch. Here, we ask for wisdom and guidance from a place of creativity. Our creative nature knows how to walk beside the presence of our Creator forming a relationship that always has, is, and will be with us to the end.

The time to evolve is right in front of us now, and the choice to become creative entrepreneurs exploring New Frontiers is calling on us to resonate with new vibrations capable of moving our attention into higher ground. | CFA Institute

© Goldilocks

~~~~~~~~~

"XRP Price Nears Major Converging Point: Analyst Predicts 3,600% Jump To $20" | Trading View

When you take a look at some of the technical analysis on the price of XRP, it currently has a Relative Strength Index potential of moving into a bull run.

"An RSI is a technical tool used to measure the speed and change of price movements in a cryptocurrency. It is also used to determine the short-term momentum of a cryptocurrency’s market."

Twenty dollars would be just a beginning point of reference to obtain on its way to integrating its full demand over time at much higher levels.

Remember, Ripple is the liquidity coin that allows the movement of our money to take place in the digital economy. Ripple uses its cryptocurrency, XRP, as a liquidity bridge for cross-border payments. Financial institutions can convert fiat currency into XRP, send it across the XRP Ledger blockchain, and then convert it back to the destination currency.

It is necessary for Ripple to have a much higher price range than it is currently displaying to bring in a catalyst for its movement.

Ripple is moving from a speculative investment to one that is based on demand. This shift in its purpose and its role in the new economy will raise it to much higher levels to meet these new demands inside the new digital asset-based economy.

From a trading perspective, the movement of Ripple in its price and demand will pull us into the next economy.

Watch Ripple.

© Goldilocks

~~~~~~~~~

Central banking: embracing change | BIS

~~~~~~~~~

ABCs of Banking - Banks and Our Economy | CT Department of Banking

~~~~~~~~~

Imaging a better climate future in China: Greenpeace-hosted climate change forum - Greenpeace East Asia

~~~~~~~~~

Lawmakers Push to Make IRS Direct File Program Permanent After Successful Pilot - Franklin County Free Press

~~~~~~~~~

US Debt Clock: Elon Musk’s Revolutionary Vision! Transforming the American Economy with Blockchain and AI, the New US Treasury Dollar, and Precious Metals Backing Currency! - American Media Group

~~~~~~~~~

#Ripple’s $XRP is a military operation. | Twitter

~~~~~~~~~

IMPORTANT IMF Report on Iraq's Economy GDP Prediction Good News | Youtube

~~~~~~~~~

Text - H.R.4763 - 118th Congress (2023-2024): Financial Innovation and Technology for the 21st Century Act | Congress.gov | Library of Congress

👆Now, we can move forward.

~~~~~~~~~

LIVE | FOMC Meeting Minutes Data Release - LIVE | 5/22/2024 | Youtube

👆 Goldilocks pointed to this article

~~~~~~~~~

(ZiG/USD) IMF Calls Zimbabwe Switch to Gold-Backed ZiG an ‘Important’ Step - Bloomberg

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps