Goldilocks' Comments and Global Economic News Sunday Afternoon 5-26-24

Goldilocks' Comments and Global Economic News Sunday Afternoon 5-26-24

Good Evening Dinar Recaps,

There is currently a lot of cash building in the markets from traders who are building their portfolios in Gold-backed ETFs and the mining sectors of the market.

Cash building in gold is the current trend for Professional Traders and the Retail Market. It gives an investor collateral for the trades he or she would like to make, and even, investments made outside of the marketplace.

It is becoming increasingly clear that the sentiment for the Retail Market is over-the-counter products in physical gold.

The growing popularity for cryptocurrency over Fiat money is beginning to gain traction as institutional money is moving their assets around on the Traditional Market in preference for new digital assets onboarding to the new digital asset based trading system.

Goldilocks' Comments and Global Economic News Sunday Afternoon 5-26-24

Good Evening Dinar Recaps,

There is currently a lot of cash building in the markets from traders who are building their portfolios in Gold-backed ETFs and the mining sectors of the market.

Cash building in gold is the current trend for Professional Traders and the Retail Market. It gives an investor collateral for the trades he or she would like to make, and even, investments made outside of the marketplace.

It is becoming increasingly clear that the sentiment for the Retail Market is over-the-counter products in physical gold.

The growing popularity for cryptocurrency over Fiat money is beginning to gain traction as institutional money is moving their assets around on the Traditional Market in preference for new digital assets onboarding to the new digital asset based trading system.

The purchasing of Tokenized Assets is a ground-floor opportunity and big money is piling into the fray being pulled from two directions right now on the opportunities the market provides.

Currently, we have Bitcoin and Ethereum ETFs. These digital asset opportunities are considered commodities, and big money is placing their bets on their success.

The first one is a storehouse of value and the second transacts Market values through Smart Contracts. Look for Ripple ETF to join in the mix soon to provide a Payment Network to move Bitcoin and Ethereum opportunities across all sectors of the market as a liquidity coin.

When the QFS is clearly established with regulations and laws to govern the new digital system, the trend toward OTC products is likely to reverse as consumers begin to realize we are back on a Gold Standard with a set of Digital Protocols on assets and stablecoins that shows a consistency toward potential for growth. Kitco Coinpedia Reuters CFTC Kitco 2

Gold will set us free.

© Goldilocks

~~~~~~~~~

"The BOE is now the first major central bank discussing how it plans to revert to a similar system as before, draining reserves, then using repos – instead of bond purchases (QE) – to deal with issues."

The transition from government bonds to repos will take time as the remaining "Approved Financial Projects" that deal with infrastructure, real estate, and home loans “will take time to unwind.”

Here we go. The movement from utilizing bonds for liquidity to Repo Market lending such as the one we are in now called SOFR.

The Secured Overnight Financing Rate is collateralized by US Securities. The US Treasury holds gold as security for the use of gold certificates issued to the Federal Reserve Banks.

Gold is a Tier 1 asset under the Basel III banking regulations. This classifies physical allocated gold as the safest tier asset in comparison to cash. Gold is about to become King.

Under the Basel III rules, gold in allocated accounts is considered a Tier 1 asset and has zero risk weighting.

ETFs or Exchange Traded Funds that we are seeing be formulated on the market through Bitcoin and Ethereum are Tier 3 assets holding a riskier custody opportunity.

Gold is now being relisted, at the Bank of England, as the safest asset over cash going forward. Through the use of our new Tokenized Asset Commodity Based Market, our Stablecoins coins that represent a country's currency is about to be reclassified through gold.

Any country holding gold as collateral can now reclassify their currency as a collateralized security. It will increase the demand for gold and for Stablecoins that represents a country's currency.

This will be inclusive of all countries (ie Iraq) who have become Basel 3 compliant and moving to a local currency regimen as a payment source on the new digital economy.

As our new Digital Global Regulations through MICA finish this month and produce a white paper for other countries to follow, we can look for new credit valuation adjustments to begin after the June 30th, 2024 deadline for them to become law.

The demand for gold is the bridge into our next economy, and its path forward to a new world is about to commence. 11Onze WolfStreet

Gold will set us free.

© Goldilocks

~~~~~~~~~

The first of many CENTRAL BANKS (BOE) is beginning to switch over from bond market liquidity to gold market liquidity Repo Services through SOFR.

We need to watch closely as this develops. Everything will turn to Gold when this is done.

This is the transition that will provide liquidity for every sector of the market including Forex.

© Goldilocks

~~~~~~~~~

They Now Control The Gold Price (The Comex Is DONE) | Youtube

~~~~~~~~~

ISDA reviews legal treatment of tokenized collateral - Ledger Insights - blockchain for enterprise | LedgerInsights

~~~~~~~~~

AI in the Fields: Revolutionizing Agriculture With Smart Technology | SciTechDaily

~~~~~~~~~

"SEC approval of Ether ETFs acknowledges Ether is a commodity" LedgerInsights FederalRegister

~~~~~~~~~

Bitcoin Poised For New All-Time High Amid Strong ETF Inflows » The Merkle News

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Evening 5-25-24

Goldilocks' Comments and Global Economic News Saturday Evening 5-25-24

Good Evening Dinar Recaps,

HKMA is making changes to their USD liquidity facility. "A liquidity facility is a committed, undrawn backup facility that can be used to refinance a customer's debt obligations if they are unable to roll it over in financial markets."

HKMA is moving their money settlement process from T+1 to T+0. The Hong Kong Monetary Authority is making this policy change to give them instant access to money flows.

Hong Kong has been in pilot programs in the new digital economy that enables them to process their digital money instantly.

This will give them a trading advantage that many countries will want to catch up to going forward. This is why I told you a while back that the movement from T+1 settlements at the end of this month would not last long.

Goldilocks' Comments and Global Economic News Saturday Evening 5-25-24

Good Evening Dinar Recaps,

HKMA is making changes to their USD liquidity facility.

"A liquidity facility is a committed, undrawn backup facility that can be used to refinance a customer's debt obligations if they are unable to roll it over in financial markets."

HKMA is moving their money settlement process from T+1 to T+0. The Hong Kong Monetary Authority is making this policy change to give them instant access to money flows.

Hong Kong has been in pilot programs in the new digital economy that enables them to process their digital money instantly.

This will give them a trading advantage that many countries will want to catch up to going forward. This is why I told you a while back that the movement from T+1 settlements at the end of this month would not last long.

It looks like the new digital asset-based trading system has now become a driver for the rest of the global economy to interface new electronic settlement protocols just to keep pace.

The new digital payment system has now become a competitive edge for countries who are further along in the new QFS. HKMA ADGM

© Goldilocks

~~~~~~~~~

HKMA Announcement:

"HKMA Updates Social Performance Module (SPM) to Drive Banking Sector Upskilling"

We have recently been talking about many banks going through logistics training and especially in their foreign currency exchange departments.

Here, we have a report that Hong Kong is Upskilling their banking practitioners.

Part of the reskilling of their banking employees deals with The Exchange Stabilization Fund. The ESF deals with three types of assets:

* The US Dollar

* Foreign Currencies

* Special Drawing Rights

The SDR is an international reserve asset. It is created by the International Monetary Fund. This particular asset class is a transitional currency. It will help stabilize and redistribute monetary volumes and access expansion to various currencies to aid in the process of moving from a World Reserve Asset to a local currency regimen backed by gold.

This process will begin to create price pressures on global currencies. Credit valuation adjustments will be a part of this process.

As of August 2023, the SDR basket of currencies consists of the following percentages:

* US dollar: 43.38

* Euro: 29.31

* Chinese yuan: 12.28

* Japanese yen: 7.59

* British pound sterling: 7.44

These percentages will shift during the transition as new alliances have been formed the last few years through new trading partners. Don't be surprised if we do not see a digital currency added to this list.

Hong Kong is an open market economy driven by supply and demand. Currently, the United States dollar is their main asset to drive their Market, but a shift change to a gold backed regimen will immediately change everything for Hong Kong and those who trade with them which is many countries.

Hong Kong has been through several digital pilot programs and completed many of their projects. They are well equipped for the new shift in our economy.

China is currently driving the gold market to new highs along with new BRICS Nations. These changes will come at a heavy price on the US Dollars' performance.

We are in a transition that has taken a lot of time, but the shifts to the global economy are beginning to take a different shape. Investopedia HKMA Linkedin Home Treasury. RegulationAsia

Gold will set us free.

© Goldilocks

~~~~~~~~~

Hong Kong | Imports and Exports | World | ALL COMMODITIES | Value (US$) and Value Growth, | Trend Economy

~~~~~~~~~

UK Approves First Physically Backed Bitcoin and Ethereum ETPs for Listing on London Stock Exchange – Bitcoin News

UK Approves First Physically Backed Bitcoin and Ethereum ETPs for Listing on London Stock Exchange. At this time, these Exchange Traded Products will only be available for professional traders.

Its 100% physically backed Bitcoin and Ethereum ETPs, Wisdomtree Physical Bitcoin and WisdomTree Physical Ethereum will be listed on the LSE at the earliest date possible which is expected to be on Tuesday, May 28th.

~~~~~~~~~

Swap Connect: new tools, enhanced products and more solutions | HKEX Group

👆 Hong Kong is ready to transition folks.

~~~~~~~~~

RIPPLE XRP HOLDERS THIS IS HOW XRP BECOMES BIGGER THAN BITCOIN | Youtube

~~~~~~~~~

UBS distributes first fund issued on iCapital's DLT infrastructure - Ledger Insights

iCapital, the marketplace for alternative investment funds, has launched its distributed ledger technology (DLT) solution. The first fund issued using the technology is being distributed by UBS Wealth Management and administered by Gen II, although it did not disclose the asset manager.

https://www.ledgerinsights.com/ubs-distributes-first-fund-issued-on-icapitals-dlt-infrastructure/

~~~~~~~~~

Hong Kong is one of the few open market economies that we have. Vietnam is about to become one in July.

There will be many more, and the changes in currency rates will be determined by these changes.

© Goldilocks

~~~~~~~~~

~~~~~~~~~

This is CRITICAL | Youtube

~~~~~~~~~

Join the Seeds of Wisdom Team SNL call with Freedom Fighter breaking down Goldilock's weekly posts! Jester will be joining too! SNL Call Link

9 pm EDT / 8 pm CDT / 6 pm PDT

The SNL Q & A room will be open at 8 pm ET, 7 pm CT, and 5 pm PT to ask questions that will be answered on the call!

The call will be recorded and you can find it in the Archive Call Room after the call is over.

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Afternoon 5-24-24

Goldilocks' Comments and Global Economic News Friday Afternoon 5-24-24

Good Evening Dinar Recaps,

" Chairman of the Securities Commission in Iraq, Faisal Al-Haims, confirmed today, Wednesday, that the authority is studying the possibility of licensing brokerage companies to trade in shares on international stock exchanges."

Forex is sold "in shares" through exchange-traded products (ETPs) and exchange-traded notes (ETNs).

Licensing brokerage companies to trade on the global exchange, also known as a foreign exchange (forex) market, is a necessary process that allows companies to operate in the market.

As long as global financial standards and International digital norms/regulations are followed, a forex license can be issued by regulatory authorities.

This procedure guarantees a company's compliance with International regulatory standards. Without a license, a broker's work is considered illegal.

Goldilocks' Comments and Global Economic News Friday Afternoon 5-24-24

Good Evening Dinar Recaps,

" Chairman of the Securities Commission in Iraq, Faisal Al-Haims, confirmed today, Wednesday, that the authority is studying the possibility of licensing brokerage companies to trade in shares on international stock exchanges."

Forex is sold "in shares" through exchange-traded products (ETPs) and exchange-traded notes (ETNs).

Licensing brokerage companies to trade on the global exchange, also known as a foreign exchange (forex) market, is a necessary process that allows companies to operate in the market.

As long as global financial standards and International digital norms/regulations are followed, a forex license can be issued by regulatory authorities.

This procedure guarantees a company's compliance with International regulatory standards. Without a license, a broker's work is considered illegal.

These procedures will allow the Iraqi Dinar to be bought and sold on Forex when they are done. At the present time, banks are in process of learning how to do foreign currency exchanges through an electronic process.

Now, it makes sense why my friend told me they were doing foreign currency exchange training with every currency except the dinar, but this is about to change with the reclassification of the Iraqi dinar by the end of this month. Economy Gofaizen & Sherle FinJuris

© Goldilocks

~~~~~~~~~

House Passes CBDC Anti-Surveillance State Act | Financial Services Committee

~~~~~~~~~

The Middle East and North Africa Financial Action Task Force (MENAFATF), at its general meeting, held in the Kingdom of Bahrain for the period from 19-23 May 2024, approved the mutual assessment report for the Republic of Iraq, which reflects its great commitment to applying international standards to combat money laundering and the financing of terrorism. | CBI

~~~~~~~~~

"Commissioner Pham Announces CFTC Global Markets Advisory Committee Meeting on June 4"

Time:

* 10am to 3pm

Where:

* CFTC’s New York Regional Office

Who:

*Global Markets Advisory Committee

Agenda:

* To advance three recommendations from the March meeting

Topics:

* Global Market Structure Subcommittee Recommendation - Inclusion of U.S. Treasury ETFs as Eligible Initial Margin Collateral

* Technical Issues Subcommittee Recommendation – Publication of Resource Document to Support Transition to T+1 Securities Settlement

* Digital Asset Markets Subcommittee Recommendation – Adoption of an Approach for the Classification and Understanding of Digital Assets (Iraqi Dinar will be one of these)

As we have seen by following the news, these topics for review are already underway inside the new QFS.

I am simply sharing this report to let you know that the Commodities Futures Trading Commission (CFTC) is the governing body of the new QFS based on its ties to the commodity sector of the markets.

Each of our tokenized assets and opportunities for banking portfolios will have been reviewed and approved through the CFTC. CFTC 1 CFTC 2

This meeting gives us a good idea of where we are in the implementation stages of the QFS.

© Goldilocks

~~~~~~~~~

DTCC Announcement:

"DTCC Completes Blockchain Pilot for Mutual Fund Data"

Depository Trust & Clearing Corporation completes fund data tokenization pilot with Chainlink.

Chainlink is a Smart Contract Network that enables the beginning and conclusion of a trade through the linking of assets wanting to be cleared in a transaction.

The pilot explored the ease of access in determining Net Asset Value (NAV) data for mutual funds across different blockchain networks.

In other words, various stocks, bonds, and other investments are being tested to be listed with new NAV values on the DTCC. (Reset) Investors Observer Wikipedia

© Goldilocks

~~~~~~~~~

Russia signs decree allowing seizure of US assets in Russia | Jurist

~~~~~~~~~

Ether ETFs Clear Major Hurdle, Though SEC Hasn't Cleared Them for Trading Yet | Coindesk

~~~~~~~~~

Elon Musk predicts AI will take everybody's jobs | 9News

~~~~~~~~~

Digitalization of trade and maritime transport accelerates thanks to UNECE tools | UNECE

~~~~~~~~~

Third Conference on the International Role of the U.S. Dollar: Welcoming Remarks by Governor | Youtube

~~~~~~~~~

Iran's Supreme Leaders Promise to Iraq IQD Rate | Youtube

~~~~~~~~~

~~~~~~~~

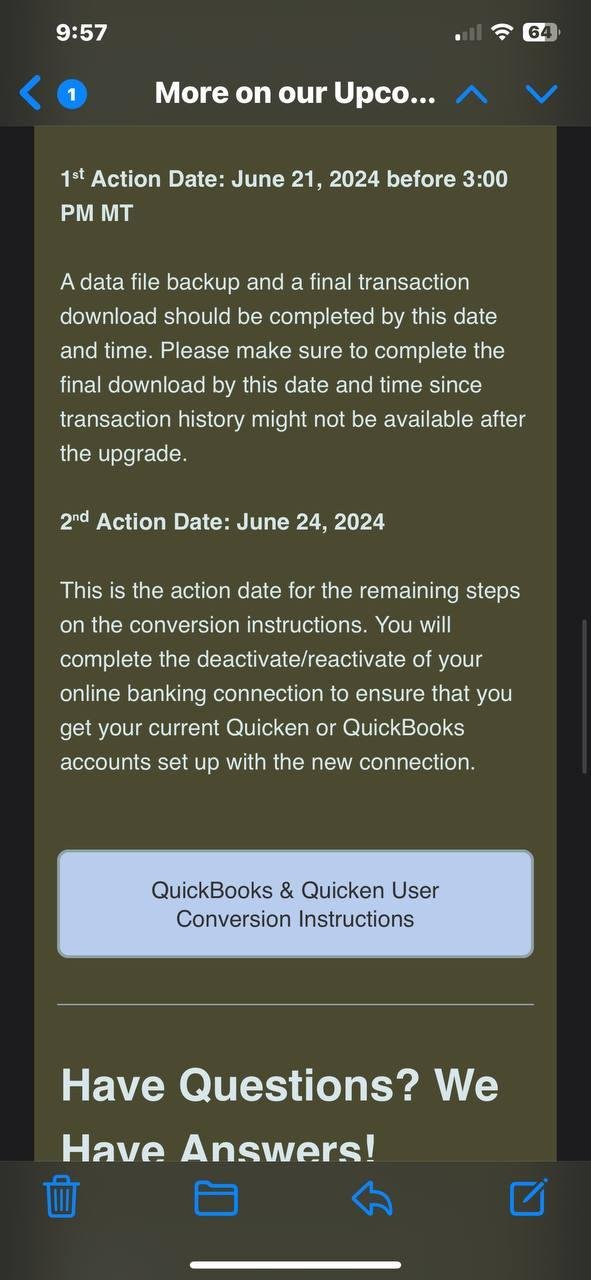

👆Oh My God. This Bank just told us about when they are going to move onto the QFS.

First action date: June 21, 2024 before 3:00 p.m. MT

Second action date: June 24, 2024 for the remaining steps.

Is important to note that this is one bank's timeline, but I can't help from notice that this one is before the June 30th, 2024 laws that are taking effect on crypto regulations and stablecoins at the end of the month.

© Goldilocks

~~~~~~~~~

CSI Partners with TruStage%2 Compliance | Valdosta Daily Times

~~~~~~~~~

👆 Banking Systems are moving to digital. Several of them are beginning to make announcements. You may be getting a notice yourself soon.

~~~~~~~~~

SEC approves rule change to allow creation of ether ETFs | CNBC

The SEC has approved a rule change that paves the way for ETFs that buy and hold ether. The commission approved bitcoin ETFs less than six months ago - those funds have proven a big success for the industry.

Many of the companies that sponsor bitcoin ETFs have already started the process of launching an ether fund. The approval of ether ETFs is a sign that the SEC's stance toward crypto may be softening. The approval for ether ETFs does not extend to other crypto projects on the Ethereum network.

~~~~~~~~~

Bitcoin and Ethereum are both considered a commodity. More on this tomorrow with Ethereum.

~~~~~~~~~

Bionic Eye Gets a New Lease of Life | IEEE Spectrum

Pixium Vision, a company with an innovative retinal implant that tackles vision loss, has been acquired by Science, a bioelectronics startup run by Neuralink's co-founder, Max Hodak. Pixium was in danger of disappearing completely after running out of money last November. Studies suggest that its technology is safe and potentially effective. Science will push to get the technology approved in Europe as quickly as possible.

~~~~~~~~~

World now multipolar! | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Good Evening Dinar Recaps,

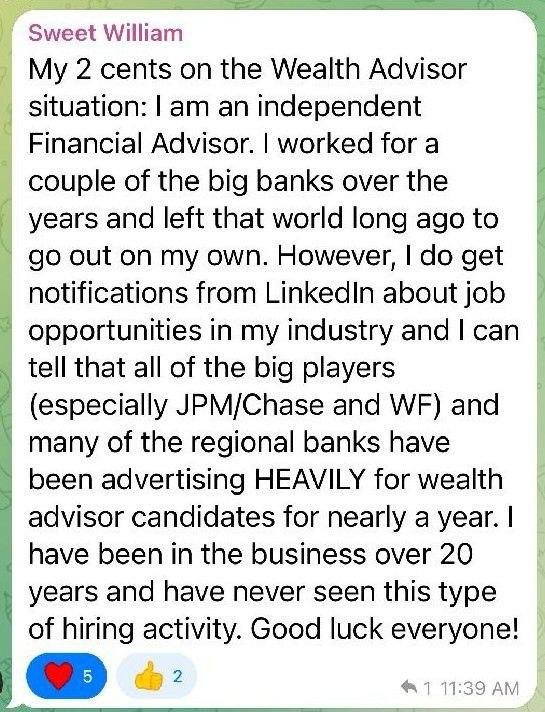

What Is a Private Wealth Manager?

A bank's ledger balance is a record of all transactions that have been processed and approved at the end of a business day, including deposits, withdrawals, interest income, and bill payments.

That being said, is it really a stretch to anyone's imagination that we are moving into a digital processing center on a Global scale, and the banking system is just simply one section interfaced onto a Quantum Technological Systematic set of protocols designed to run numbers on equations until a balance between two parties are cleared?

Yes, we are finding that many positions in the banking system and around the world can be automated. Still, the need for a personal touch remains.

This would account for why Personal Wealth Manager positions are on the rise and Banks are currently making these changes to meet the needs of a new society.

Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Good Evening Dinar Recaps,

What Is a Private Wealth Manager?

A bank's ledger balance is a record of all transactions that have been processed and approved at the end of a business day, including deposits, withdrawals, interest income, and bill payments.

That being said, is it really a stretch to anyone's imagination that we are moving into a digital processing center on a Global scale, and the banking system is just simply one section interfaced onto a Quantum Technological Systematic set of protocols designed to run numbers on equations until a balance between two parties are cleared?

Yes, we are finding that many positions in the banking system and around the world can be automated. Still, the need for a personal touch remains. This would account for why Personal Wealth Manager positions are on the rise and Banks are currently making these changes to meet the needs of a new society.

The synchronization of human behavior and technological advances are currently being held at a balance. Where we go from here will be determined by the choices both AI and Human Nature co-create in this new world.

There will always be pros and cons to each choice we make going forward, but the integration of the Techno-Human Race is forging a new path. It is an experimentation beyond everything we have encountered so far in history.

Movement forward is both scary and filled with opportunity. Yet, inside each of us is an explorer of space and time. We are walking into new frontiers and decisions will have to be made by each of us how far we are willing to go.

The transition into digital money and sudden wealth is a much larger step than many realize. We will cross over into a dimension of life few have seen in this lifetime.

We are at a crossroads, and movement into a new digital world that moves our money and the choices we make is rapidly approaching.

True freedom will not be the result of sudden wealth. Freedom comes from a much deeper place. The more that is given to us, the more is required for us to reach into those places hands can no longer touch. Here, we ask for wisdom and guidance from a place of creativity. Our creative nature knows how to walk beside the presence of our Creator forming a relationship that always has, is, and will be with us to the end.

The time to evolve is right in front of us now, and the choice to become creative entrepreneurs exploring New Frontiers is calling on us to resonate with new vibrations capable of moving our attention into higher ground. | CFA Institute

© Goldilocks

~~~~~~~~~

"XRP Price Nears Major Converging Point: Analyst Predicts 3,600% Jump To $20" | Trading View

When you take a look at some of the technical analysis on the price of XRP, it currently has a Relative Strength Index potential of moving into a bull run.

"An RSI is a technical tool used to measure the speed and change of price movements in a cryptocurrency. It is also used to determine the short-term momentum of a cryptocurrency’s market."

Twenty dollars would be just a beginning point of reference to obtain on its way to integrating its full demand over time at much higher levels.

Remember, Ripple is the liquidity coin that allows the movement of our money to take place in the digital economy. Ripple uses its cryptocurrency, XRP, as a liquidity bridge for cross-border payments. Financial institutions can convert fiat currency into XRP, send it across the XRP Ledger blockchain, and then convert it back to the destination currency.

It is necessary for Ripple to have a much higher price range than it is currently displaying to bring in a catalyst for its movement.

Ripple is moving from a speculative investment to one that is based on demand. This shift in its purpose and its role in the new economy will raise it to much higher levels to meet these new demands inside the new digital asset-based economy.

From a trading perspective, the movement of Ripple in its price and demand will pull us into the next economy.

Watch Ripple.

© Goldilocks

~~~~~~~~~

Central banking: embracing change | BIS

~~~~~~~~~

ABCs of Banking - Banks and Our Economy | CT Department of Banking

~~~~~~~~~

Imaging a better climate future in China: Greenpeace-hosted climate change forum - Greenpeace East Asia

~~~~~~~~~

Lawmakers Push to Make IRS Direct File Program Permanent After Successful Pilot - Franklin County Free Press

~~~~~~~~~

US Debt Clock: Elon Musk’s Revolutionary Vision! Transforming the American Economy with Blockchain and AI, the New US Treasury Dollar, and Precious Metals Backing Currency! - American Media Group

~~~~~~~~~

#Ripple’s $XRP is a military operation. | Twitter

~~~~~~~~~

IMPORTANT IMF Report on Iraq's Economy GDP Prediction Good News | Youtube

~~~~~~~~~

Text - H.R.4763 - 118th Congress (2023-2024): Financial Innovation and Technology for the 21st Century Act | Congress.gov | Library of Congress

👆Now, we can move forward.

~~~~~~~~~

LIVE | FOMC Meeting Minutes Data Release - LIVE | 5/22/2024 | Youtube

👆 Goldilocks pointed to this article

~~~~~~~~~

(ZiG/USD) IMF Calls Zimbabwe Switch to Gold-Backed ZiG an ‘Important’ Step - Bloomberg

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday Evening 5-22-24

Goldilocks' Comments and Global Economic News Wednesday Evening 5-22-24

Good Evening Dinar Recaps,

"Ripple CLO Claims The SEC Has a NODE on the XRP Ledger" A NODE offers ways to approve and process transactions without a centralized authority.

A node validates and authenticates blockchain transactions. A Blockchain node's primary job is to confirm the legality of network transactions.

Once a confirmation is made between two digital networks through a blockchain consensus, a transaction is validated on both sides of an exchange.

A protocol brings all nodes of a distributed blockchain network into agreement on a single data set or similar data confirming the right to move forward inside a blockchain connection. Then, a digital transaction can go through for both parties.

Goldilocks' Comments and Global Economic News Wednesday Evening 5-22-24

Good Evening Dinar Recaps,

"Ripple CLO Claims The SEC Has a NODE on the XRP Ledger"

A NODE offers ways to approve and process transactions without a centralized authority.

A node validates and authenticates blockchain transactions. A Blockchain node's primary job is to confirm the legality of network transactions.

Once a confirmation is made between two digital networks through a blockchain consensus, a transaction is validated on both sides of an exchange.

A protocol brings all nodes of a distributed blockchain network into agreement on a single data set or similar data confirming the right to move forward inside a blockchain connection. Then, a digital transaction can go through for both parties.

This is done electronically and without the need of someone mediating the transaction on the QFS.

It looks like XRP and the SEC have decided to play ball together. Times Tabloid Trade Marks Ledger

© Goldilocks

~~~~~~~~~

Okay. It is official. Ripple and the SEC are doing more than playing ball together. They are in business together.

"Ripple has filed a new trademark for the phrase “RLUSD,” suggesting the likely listing symbol for its proposed dollar-based stablecoin." Trade Mark

A trademark does three things:

* It identifies the source of your product

* It provides legal protection for your brand name and product

* It protects you against counterfeiting and fraud

This officially ties the SEC and Ripple together in a partnership. This new filing has given them intellectual property rights to copy and expand in a business together.

This love/hate relationship has certainly turned a corner. As the pages are turned on their past relationship in courts, it will certainly be interesting to read the next chapters of what they can do together. The Crypto Basic Maynardnexsen

© Goldilocks

~~~~~~~~~

Do you see why the XRP and SEC connection is so important? Yes, Ripple is ISO compliant. Now that changes things a little bit... 😉

© Goldilocks

~~~~~~~~~

ISO 20022 Crypto: Which Coins & Tokens are Compliant? - CoinCheckup

~~~~~~~~~

Iraq clears all debts to IMF | Iraqi News

Baghdad (IraqiNews.com) – The financial advisor to the Iraqi Prime Minister, Mazhar Salih, confirmed recently that Iraq has repaid all the loans it has taken from the International Monetary Fund (IMF) since 2003, a total of just under $8 billion.

Salih explained that the IMF provided several loans to Iraq, aiming to support macroeconomic stability and financial reforms, the Iraqi News Agency (INA) reported.

Between 2003 and 2021, Iraq obtained several financing programs from the IMF, including emergency loans and long-term financial assistance.

In 2016, the IMF approved a financial program worth $5.34 billion to support economic reforms in Iraq. Within five years, Iraq paid out the loan in full after obtaining two-thirds of the total.

Iraq sought a $6 billion emergency loan from the IMF in 2021; however, the loan was not granted because, at the time, it hadn’t been linked to any of the IMF’s initiatives.

Iraq’s engagement with the IMF was intended to assist in addressing the economic issues brought on by the drop in oil prices, which were connected to fluctuations in the balance of payments, as well as to promote government reforms.

~~~~~~~~~

The People’s Bank of China (PBOC) and the Bank of Thailand signed a memorandum of understanding (MOU) on Tuesday to enhance cooperation in facilitating bilateral transactions using local currencies. | Modern Diplomacy

~~~~~~~~~

The American Bankers Association urged House leaders to back a bill that would stop the Federal Reserve from creating a CBDC for individuals. | Crypto News

~~~~~~~~~

"Ripple believes in CBDCs seeing them as crucial for asset tokenization!"

Is Ripple about to be the CBDC alternative? Is Ripple quickly becoming the new CBDC? Will Ripple replace the dollar?

The answer to these questions are simply put, not likely. Yet, Ripple is what is going to move CBDCs and all assets inside the new digital economy.

Ripple respects your privacy and intends to keep your information secure. (See article below) Ripple will be the settlement token that will move your money.

This is the most likely scenario that will be seen going forward. It is an alternative option that may very well be what will take place.

Life is a Quantum Soup and the taste of the final product is and will be determined by the ingredients that make it up. Rich Turrin Substack Ripple Energy

© Goldilocks

~~~~~~~~~

👆Ripple is at the forefront of the CBDC revolution, engaging with governments globally to leverage its technology for digital currency development. In May 2023, Ripple launched a dedicated platform to assist central banks, governments, and financial institutions in issuing CBDCs and stablecoins. 2 days ago | Forbes

~~~~~~~~~

3 Unconventional Trends Reshaping The Business Landscape | Forbes

~~~~~~~~~

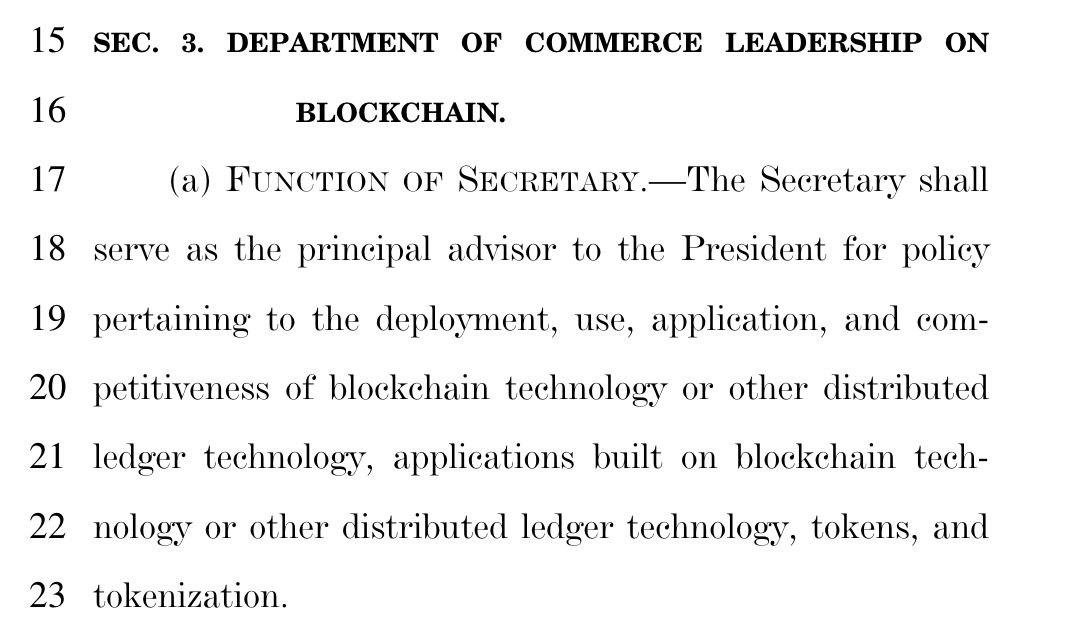

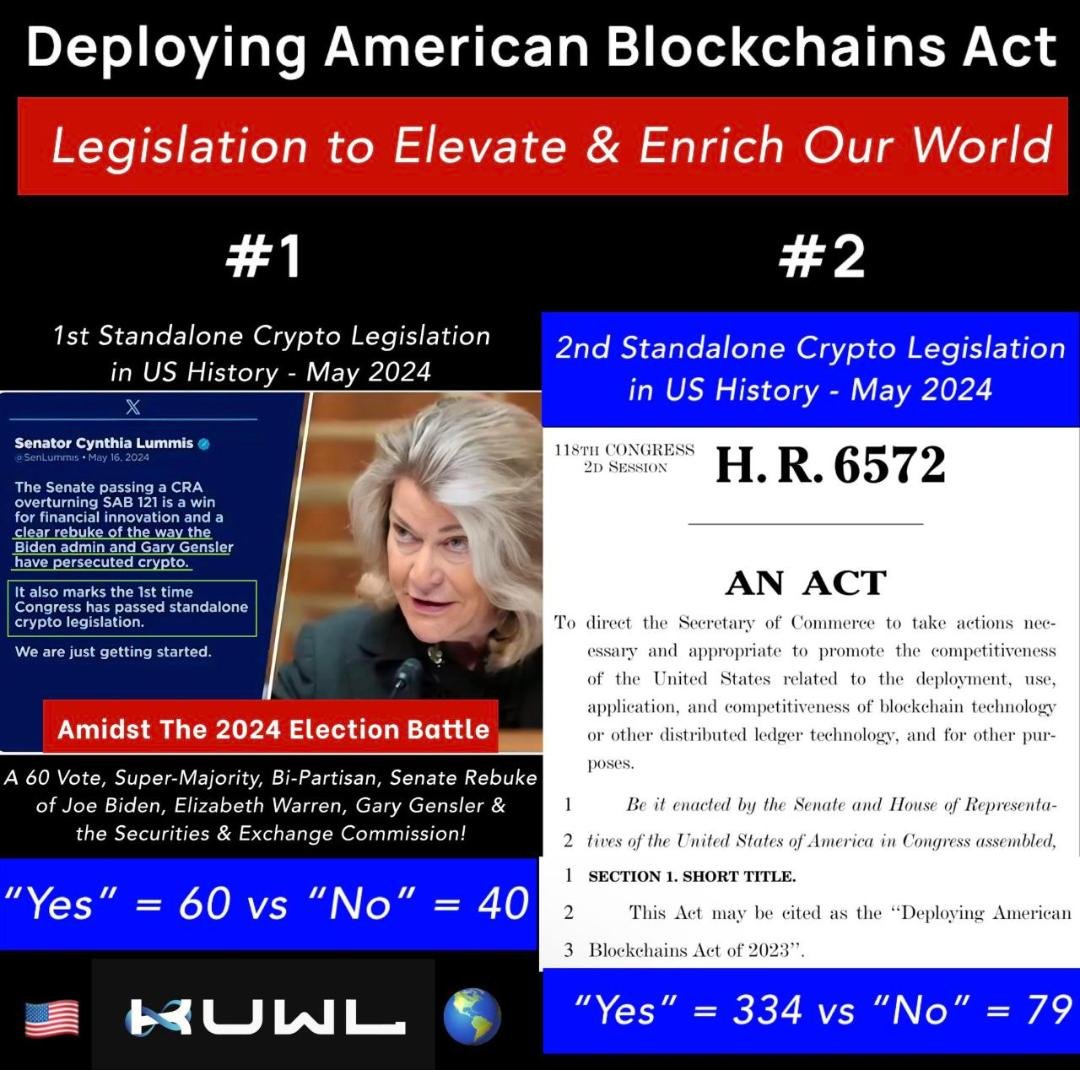

Todays House Bill removes the @SECGov entirely from crypto.

Puts all power in the hand of the Secretary of the Department of Commerce. Twitter Congress

Since 2021 this was Gina M. Raimondo. @SecRaimondo

~~~~~~~~~

Banking Announcement:

Spot Ethereum ETF approved. Ethereum is a smart contract. Here's what it does. ETHV is currently listed on DTCC.

The DTCC is the Depository Trust & Clearing Corporation. The DTCC clears and settles virtually all broker-to-broker equity markets. Yes, Forex is an equity Market.

"A smart contract is a computer program or a transaction protocol () that is intended to automatically execute, control or document events and actions according to the terms of a contract () or an agreement."

It ensures that both sides of a trade can be securely executed with enough funds to ensure all requirements are fulfilled. Reuters TheBlock

© Goldilocks

~~~~~~~~~

Swift Unveils New Cross-Border Payment Tracking Solution | PYMNTS

Swift Announcement:

Swift is extending ISO 20022 across the entire payment chain. 👇

"Swift has unveiled new ways for financial institutions to streamline cross-border payments for corporate customers.

The financial messaging service said it is doing this “by extending ISO 20022 across the entire payment chain and giving banks ready-to-use, white-labeled tracking services that can be activated for customers at the click of a button,” per a Tuesday (May 21) news release.

Swift plans to allow financial institutions (FIs) to capture rich data at its source by standardizing payments end-to-end with ISO 20022, according to the release.

In addition, Swift says it will also help banks offer customers payment tracking services by API or messaging channel, for complete transparency on the status of a payment as well as confirmation that it has been received."

So now, we have access to the ISO 20022 messaging system.

* Goldilocks

~~~~~~~~~

What a month to remember...

~~~~~~~~~

Expanding the cross-boundary e-CNY | Hong Kong Monetary Authority

The Hong Kong Monetary Authority (HKMA) and the People’s Bank of China (PBoC) have made further progress in the e-CNY pilot for cross-boundary payments, to expand the scope of e-CNY pilot in Hong Kong to facilitate the setup and the use of e-CNY wallets by Hong Kong residents, as well as the top-up of e-CNY wallets through the Faster Payment System (FPS).

The interoperability between the FPS and the e-CNY system operated by the Digital Currency Institute (DCI) of the PBoC also marks the first linkage of a faster payment system with a central bank digital currency system in the world. It provides an innovative use case which underscores interoperability, a key area set out in the G20 Roadmap for enhancing cross-border payments.

~~~~~~~~~

AI Is Taking Over Accounting Jobs As People Leave The Profession | Forbes

~~~~~~~~~

Asia Pacific Outshines Globally in Instant Payments Adoption - Blockchain News

~~~~~~~~~

Swift standardizes payments end-to-end and gives banks ready-to-use tracking services to enhance corporate | Swift

👆 this is going to change ISO20222 timelines a bit...😄

~~~~~~~~~

Brussels, 21 May 2024 - Swift has today set out plans to help financial institutions streamline the cross-border payments experience for their corporate customers, by extending ISO 20022 across the entire payment chain and giving banks ready-to-use, white-labelled tracking services that can be activated for customers ...1 day ago | Swift

👆 I will say more on this tomorrow. This changes the game quite a bit my friends.

~~~~~~~~~

VanEck's Ethereum ETF listed on DTCC ahead of SEC decision | ReadWrite

VanEck's spot Ethereum ETF listed on DTCC platform under "ETHV" ticker, awaiting SEC approval to become active.

SEC officials in contact with major exchanges to update and modify existing spot Ether ETF applications.

Crypto community divided as May 23 deadline for SEC's decision on VanEck's ETF application approaches.

~~~~~~~~~

A smart contract can execute an FX swap contract by locking the agreed rates and amounts on the blockchain, and transferring the funds automatically on the specified dates. This can reduce the need for intermediaries, such as banks or brokers, and lower the transaction fees and settlement time. | Linkedin

~~~~~~~~~

This Is Serious BRICS Nations Have Officially Set A Date To Ditch The US Dollar. | Twitter

~~~~~~~~~

Ripple Vs. SEC Lawsuit: Latest Filing Marks Beginning Of The End Of Historic Battle | Bitcoinist

~~~~~~~~~

IF THIS HAPPENS - CRYPTO WILL EXPLODE OVERNIGHT! MEGA CRYPTO NEWS! | Youtube

~~~~~~~~~

Secret Banking Crisis Looms; What the Fed Doesn’t Want You to Know – Insider Nomi Prins | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Tuesday Evening 5-21-24

Goldilocks' Comments and Global Economic News Tuesday Evening 5-21-24

Good Evening Dinar Recaps,

"The final elements for the implementation of Basel III in the EU are now agreed and will start applying on the 1st of January 2025."

Currently, we have tokenized assets and stablecoins backed by gold and other commodities moving through legislation and expected to become law at the end of June 2024.

This is forcing governments around the world to begin making decisions to implement their new digital economy. These monetary policy shifts will create credit valuation adjustments across all sectors of the market including Forex.

Countries have began moving towards bilateral trade agreements utilizing their own currencies in trade. This move will increase the demand for their currencies, yet they still need a stable price on them.

Goldilocks' Comments and Global Economic News Tuesday Evening 5-21-24

Good Evening Dinar Recaps,

"The final elements for the implementation of Basel III in the EU are now agreed and will start applying on the 1st of January 2025."

Currently, we have tokenized assets and stablecoins backed by gold and other commodities moving through legislation and expected to become law at the end of June 2024.

This is forcing governments around the world to begin making decisions to implement their new digital economy. These monetary policy shifts will create credit valuation adjustments across all sectors of the market including Forex.

Countries have began moving towards bilateral trade agreements utilizing their own currencies in trade. This move will increase the demand for their currencies, yet they still need a stable price on them.

This is where stablecoins come into play. Stablecoins are backed by commodities. This alone will support the need to raise the value of currencies around the world to level the playing field in trade.

For the last 4 years, trade has been disrupted and rerouted to increase the level of exports in countries around the world offering support for these new currency values that are about to come into play.

The IMF has been working with countries globally to give guidance and instruction on their countries' ability to shift into a new supply and demand regimen. Work has been done to increase Capital Requirements through commodities and increasing exports.

These measures will support new values and justification for currency valuation adjustments because their credit in the ability of doing so will be met by the above requirements.

We have a deadline for these changes to take full effect by January 1st, 2025. As you can surmise, price pressures to move into a real value between now and then are about to begin.

Look for XRP and XLM to be the first movers in the new digital economy. Their supporting actors will be ISO 20022 digital coins. These ISO tokens will be networks that will move money from one sector of the market to another.

Our movement from wire transfers to instant transfers electronically and through a quantum computer will increase money velocity. This will increase demand and increase the value and support for currencies going to higher levels.

Just holding ISO tokens and utilizing them in the new economy, with gold backing each of them, will serve as the bridge to our next economy. Commodities will be the next long-term Bull Run.

Our first RV (digital) is about to interface with traditional market assets on the QFS. This will transform our banking system and markets (paper money) into the new digital asset based trading system - the second RV. Study Smarter The Print IT Supply Chain Investopedia Deloitte

© Goldilocks

~~~~~~~~~

RESULTS of Iraq's Emergency Budget Meeting | Youtube

~~~~~~~~~

~~~~~~~~~

CBI Meeting with World Bank Vietnam in Trouble? Maybe | Youtube

~~~~~~~~~

NEW: House Democratic leaders said today they will NOT whip against House Republicans' crypto bill, I'm told.

The whip question sent to members this a.m. says that Waters and Scott "strongly oppose" the legislation, but does not urge them to vote "no": politico.com/f/?id=0000018f… Twitter

~~~~~~~~~

Folks, the new digital economy continues to move forward, and it is beginning to force decisions around the world on the government level.

Things have reached a critical state in the currency markets forcing the issue to move forward with credit valuation adjustments across all sectors of the market.

We now have a drivers for the market. It is digital, gold, and sailed across the Open Seas.

© Goldilocks

~~~~~~~~~

FIT21 Gets House Vote, Will Crypto Stay a Partisan Issue | CCN

~~~~~~~~~

H.R.4763 - 118th Congress (2023-2024): Financial Innovation and Technology for the 21st Century Act | Congress.gov | Library of Congress

~~~~~~~~~

H.R. 5403, CBDC Anti-Surveillance State Act | Congressional Budget Office

~~~~~~~~~

Saudi fintech barq and TerraPay forge strategic partnership | Arab News

~~~~~~~~~

Santander, Iberpay introduce global instant transfers | The Paypers

~~~~~~~~~

Highlighted here, the Ripple case and the ruling of #XRP was the main catalyst that started the push for real legislation to pass.

Without Ripple v SEC, this week would not have happened. Twitter

~~~~~~~~~

Biden extends Iraq’s national emergency for more year | Search4Dinar

~~~~~~~~~

Russia purchased arms manufactured by its BRICS counterpart India by paying $4 billion in local currencies and not the US dollar. The Indian-made arms and equipment were procured by Russia citing 'defense purposes'. | CryptoRank

~~~~~~~~~

BlackRock Exec Predicts Tidal Wave of Institutional Money Flooding Into Bitcoin ETFs — TradingView News

~~~~~~~~~

World Economic Forum founder Klaus Schwab will leave executive post | Semafor

~~~~~~~~~

Several States Take Steps To Block A Central Bank Digital Currency | ZeroHedge

👆 it's going to be a fight

~~~~~~~~~

JUST IN: Donald Trump's presidential campaign officially accepts Bitcoin and crypto. | @Watcher Guru

~~~~~~~~~

Silver's Final Breakout Has Begun as World Trumps US Derivative Markets | Youtube

~~~~~~~~~

"Ripple CLO Claims The SEC Has a NODE on the XRP Ledger"

A NODE offers ways to approve and process transactions without a centralized authority.

A node validates and authenticates blockchain transactions. A Blockchain node's primary job is to confirm the legality of network transactions.

Once a confirmation is made between two digital networks through a blockchain consensus, a transaction is validated on both sides of an exchange.

A protocol brings all nodes of a distributed blockchain network into agreement on a single data set or similar data confirming the right to move forward inside a blockchain connection. Then, a digital transaction can go through for both parties.

This is done electronically and without the need of someone mediating the transaction on the QFS.

It looks like XRP and the SEC have decided to play ball together. Times Tabloid Trade Marks Ledger

© Goldilocks

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 5-20-24

Goldilocks' Comments and Global Economic News Monday Evening 5-20-24

Good Evening Dinar Recaps,

"Geopolitical Tensions Continue to Shape Global Trade"

The BRICS Nations is and will continue to grow. The next economy will be determined by the price of gold, and not, the dollar. Many countries are leaving the dollar and trading in their own local currencies. To join the BRICS Nations, you have to own gold to support your country's currency. And then, you can be trading partners inside the BRICS Nations.

Saudi Arabia is expected to join this time around. They are expected to join in August of 2024. This shift from the Petro dollar to a Petro Yuan is expected to be a significant shift in monetary flow. It will create a more balanced set of demands on local currencies in a way we have not seen in a long time.

These new demands are forming because of geopolitical tensions, but we would have eventually had to move this direction anyway. A Fiat monetary system just simply is not meant to last forever. We have been in a transitional economy since we moved off of the gold standard in 1973 under President Richard Nixon.

Goldilocks' Comments and Global Economic News Monday Evening 5-20-24

Good Evening Dinar Recaps,

"Geopolitical Tensions Continue to Shape Global Trade"

The BRICS Nations is and will continue to grow. The next economy will be determined by the price of gold, and not, the dollar. Many countries are leaving the dollar and trading in their own local currencies. To join the BRICS Nations, you have to own gold to support your country's currency. And then, you can be trading partners inside the BRICS Nations.

Saudi Arabia is expected to join this time around. They are expected to join in August of 2024. This shift from the Petro dollar to a Petro Yuan is expected to be a significant shift in monetary flow. It will create a more balanced set of demands on local currencies in a way we have not seen in a long time.

These new demands are forming because of geopolitical tensions, but we would have eventually had to move this direction anyway. A Fiat monetary system just simply is not meant to last forever. We have been in a transitional economy since we moved off of the gold standard in 1973 under President Richard Nixon.

For the last 4 years, new alliances have been formed on the sea and on the land that will determine new trading routes and trading partners. These new bilateral agreements between countries will form new trading relationships and new demands on our local currencies.

This will shift our economies forming new business models that will determine prices on goods and services through supply and demand. Each country will be backed by gold and other commodities to level the playing field and opportunities going forward.

This is never been a 'push of the button' reset moment. Rather, it has been a gradual evolution into a new way of life determined by an inner desire by each country to experience a level of freedom through conscious choices that bring forth what is best in all of us.

It is a movement of the body, mind, and soul to restore a separation that was never meant to occur. As we return to our natural habitat, our lives will be forever changed by an event that calls on what is highest in us to live in the world as it is.

The G20 will meet late this year to discuss and work on countries that still need attention in the Global South. The focus of this meeting is to level the playing field in the Emerging Markets. No one is left behind on this global transition. Every effort is being made to include every country in the world on this new digital asset-based trading system. CSIS BIS AP News

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

The Bank of London launches GenAI assistant to aid enterprise API integration | Verdict

The Bank of London has launched an AI code assistant, and it is moving into mainstream banking. GenAI collects and interprets financial data on a large scale.

It helps banking managers make decisions for clients determining a good path forward for their money. It establishes portfolios designed to meet each customer's unique needs. And, it detects fraud and suspicious activities on people's accounts along with many other services.

These products generated through an AI code goes into an Application Programming Interface (API).

APIs are used to create an open structure that allows interaction between a bank's core services and third-party developers.

This allows banking services such as payments, identity verification, and data sharing to function.

© Goldilocks

~~~~~~~~~

Implementation Status & Results Iraq - Iraq: Banking Sector Reform

P1133370ISR0Di012201101318434831701.pdf

Mr. Ali Mohsen Al-Alaq recently met with the World Bank to discuss the next steps in the restructuring of Iraqi Banks into the new digital economy.

They have completed Phase 1 of their restructuring process, and now, they're moving into Phase 2. Phase 2 is the implementation stage of the Riyada Bank project.

Currently, the Central Bank of Iraq is licensing a number of digital banks.

© Goldilocks

~~~~~~~~~

Real-time Analytics News for the Week Ending May 18 | RTinsights

~~~~~~~~~

Food for Others- Inspiring.MP4

This is how life is supposed to be just so everyone knows..

Lots of love, lots of selfless giving that goes all the way around until it becomes a free energy engine of love.

👆 Goldilocks pointed to this article

👆 a project idea...

~~~~~~~~~

World Bank becomes first international issuer of digital Swiss franc bonds | Global Capital

~~~~~~~~~

Ripple’s Global Payment Initiative in Collaboration with US Faster Payments Council | CoinPedia

According to the report, Ripple is positioning global payments as a top priority, aiming to revolutionize the industry. The survey, conducted in partnership with the FPC, delves into current and future adoption trends of blockchain payment systems, shedding light on the present scenario and what lies ahead.

Ripple’s CEO, Brad Garlinghouse, emphasizes, “[Blockchain will drive] faster payments between businesses, reducing settlement windows, and ensuring close-to-real-time payments for all bookings.”

Quoting from the report, Ripple emphasizes the real value that blockchain in payments unlocks. An impressive 77% of respondents believe that using blockchain for payments is either “Very Beneficial” or “Somewhat Beneficial” for their organizations’ end customers. Additionally, over 60% share the same sentiment regarding customers using cryptocurrency for payments.

~~~~~~~~~

New Era of Inclusive Digital Payments Unveiled by NPCI | Smartphone Magazine

~~~~~~~~~

Keep your eyes on Digital Ledger Technology. Once this is regulated, instant payments become possible. (T+0 instant settlements) This will effect prices on tokenized assets and stablecoins.

This year, the movement of money itself will create a higher demand in the faster payment sectors of our Market. These new demands create price pressures.

© Goldilocks

~~~~~~~~~

IBC to Ethereum: Building the interconnected Internet of Blockchains | CryptoSlate

~~~~~~~~~

From the Goldilocks Q&A room

~~~~~~~~~

~~~~~~~~~

What Is Apple Doing in AI? Summaries, Cloud and On-Device LLMs, OpenAI Deal - Bloomberg

~~~~~~~~~

$1800 Stimulus Checks 2024 for Everyone: USD 1,800 Payment Status & Know Eligibility | Paymentweek

~~~~~~~~~

Analyze This! Foreign Currency Liberalization | IMF Videos

~~~~~~~~~

Stellar Network Adds Smart Contract Capabilities Bolstered by Extensive Onramp Network - The Defiant

~~~~~~~~~

Goodbye to charging cars forever: the diamond battery that lasts 28,000 years and has an incalculable | ECO News

~~~~~~~~~

KRG shares first list of Know Your Customer (KYC) data with the Trade Bank of Iraq (TBI) | Search4Dinar

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Good evening Dinar Recaps,

"Last week, in a letter to the council, Iraqi Prime Minister Mohamed Shia al-Sudani called for the United Nations Assistance Mission for Iraq (UNAMI), which has been operational since 2003, to end by December 31, 2025."

Resolution 1770 (2007) was devised to give guidance for Iraq on internal protocols that would enable them to secure a safe environment for their people and become prosperous in the world around them.

The resolution was co-sponsored by: * United Kingdom * United States * Italy * Slovakia

There will be a meeting at the end of May to discuss the gradual removal of the United Nations' involvement with Iraq.

It is believed that they have achieved their goals with Iraq, and they believe Iraq's ability to move forward on their own is showing consistent progress.

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Good evening Dinar Recaps,

"Last week, in a letter to the council, Iraqi Prime Minister Mohamed Shia al-Sudani called for the United Nations Assistance Mission for Iraq (UNAMI), which has been operational since 2003, to end by December 31, 2025."

Resolution 1770 (2007) was devised to give guidance for Iraq on internal protocols that would enable them to secure a safe environment for their people and become prosperous in the world around them.

The resolution was co-sponsored by:

* United Kingdom

* United States

* Italy

* Slovakia

There will be a meeting at the end of May to discuss the gradual removal of the United Nations' involvement with Iraq. It is believed that they have achieved their goals with Iraq, and they believe Iraq's ability to move forward on their own is showing consistent progress.

The UN's involvement with Iraq has been taking place since 2003. It has been a team of leaders from several Nations engaged in helping Iraq "transition" their political and economic economy into a place whereby their contribution to the world is capable of moving to a level of Independence.

Starting early June, Iraq will be gradually moving into their own. These stages of the independence will be monitored, but their control over their own Nation will increase with each passing day. Kurdistan24 Iraq UN

© Goldilocks

~~~~~~~~~

Hong Kong officially launches pilot for digital yuan payments | Business Times

"HONG Kong launched a pilot programme enabling digital yuan payments through major Chinese banks, the first example of China’s currency project being deployed beyond the mainland.

Residents of the city can now open digital yuan wallets with Bank of China, Bank of Communications, China Construction Bank and Industrial and Commercial Bank of China to pay merchants in mainland China directly, Hong Kong’s de facto central bank said in a statement on Friday (May 17)."

Hong Kong has officially launched a pilot program that will allow them to utilize the Yuan as a form of payment.

Users can use the FPS payment system. FPS stands for Faster Payments Service. FPS is a UK banking initiative allowing real-time electronic fund transfers between banks.

© Goldilocks

~~~~~~~~~

Resolution 1770 (2007) / adopted by the Security Council at its 5729th meeting, on 10 August 2007 | United Nations Digital Library System

~~~~~~~~~

Silver Daily Forecast and Technical Analysis for May 17, 2024, by Chris Lewis for FX Empire | Youtube

~~~~~~~~~

The days of shorting the silver market are coming to an end.

~~~~~~~~~

SEC Adopts Rule Amendments to Regulation S-P to Enhance Protection of Customer Information | SEC

~~~~~~~~~

Kraken ‘Actively Reviewing’ Tether’s Status Under New EU Rules | BloombergLaw

New regime for digital assets set to take effect in July

Tether says it plans to continue its dialog with regulators

Kraken is “actively reviewing” plans that may include removing support for the world’s most-traded cryptocurrency on its exchange in the European Union, under a new regime for digital assets that’s set to take effect in the bloc in July.

Tether Holdings Ltd.’s USDT, a stablecoin that aims to maintain a one-to-one value with the dollar, is expected to be impacted by upcoming EU rules known as MiCA.

~~~~~~~~~

Standard Chartered completes first Euro transactions on Partior Platform – Trade Finance Global

~~~~~~~~~

Eurosystem completes first DLT experiment - Central Banking

The Eurosystem completed its first experiment using distributed ledger technology (DLT), the European Central Bank (ECB) announced on May 14.

This is the first of three experiments the ECB plans to carry out. All three experiments will test interoperability-type solutions for central bank money settlement of wholesale financial transactions recorded on DLT platforms.

This experiment covered tokenization and simulated the deliver-versus-payment (DvP) settlement of government bonds in a secondary market transaction against central bank money.

The DLT platform for the experiment was provided by the National Bank of Austria. Other participants include the central banks of Germany, France, Italy and Luxembourg.

👆 Goldilocks pointed to this article

~~~~~~~~~

Is Blockchain the Key to Transforming the Global Tourism Industry? | Analytics Insight

~~~~~~~~~

‘All UAE banks have to launch Jaywan debit cards’: Rollout to happen in phases - News | Khaleej Times

~~~~~~~~~

WATCH & LISTEN HERE Video on XRP

~~~~~~~~~

They Are Dumping Our TREASURIES - The Economic Ninja | Youtube

~~~~~~~~~

Miners Eye Middle East as Next Region for Growth | Coindesk

~~~~~~~~~

Iraq Going for the International Investment Platform? | Youtube

~~~~~~~~~

Join the Seeds of Wisdom Team SNL call with Freedom Fighter breaking down Goldilock's weekly posts! Jester will be joining too! SNL Call Link

9 pm EDT / 8 pm CDT / 6 pm PDT

The SNL Q & A room will be open at 8 pm ET, 7 pm CT, and 5 pm PT to ask questions that will be answered on the call!

The call will be recorded and you can find it in the Archive Call Room after the call is over.

~~~~~~~~~

UNDP endorses Iraq’s electronic payment services system | Search4Dinar

Today, the United Nations Development Programme (UNDP) approved the electronic payment system in Iraq.

© Goldilocks

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Evening 5-17-24

Goldilocks' Comments and Global Economic News Friday Evening 5-17-24

Good Evening Dinar Recaps,

Iraq: 2024 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Iraq

Domestic stability has improved since the new government took office in October 2022. This has facilitated the passage of Iraq’s first three-year budget, which entailed a large fiscal expansion starting in 2023. The non-oil economy has rebounded strongly in 2023 after stalling in 2022 and was largely unaffected by the ongoing conflict in the region.

Nonetheless, Iraq remains highly vulnerable to oil price fluctuations, and private sector activity is hindered by the large state footprint—including as an employer of first resort—corruption, red tape, underdeveloped infrastructure, and poor access to credit.

Goldilocks' Comments and Global Economic News Friday Evening 5-17-24

Good Evening Dinar Recaps,

Iraq: 2024 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Iraq

Domestic stability has improved since the new government took office in October 2022. This has facilitated the passage of Iraq’s first three-year budget, which entailed a large fiscal expansion starting in 2023. The non-oil economy has rebounded strongly in 2023 after stalling in 2022 and was largely unaffected by the ongoing conflict in the region.

Nonetheless, Iraq remains highly vulnerable to oil price fluctuations, and private sector activity is hindered by the large state footprint—including as an employer of first resort—corruption, red tape, underdeveloped infrastructure, and poor access to credit. IMF

~~~~~~~~~

DTCC explores posting fund NAV data on blockchain with JPM, BNY Mellon, Chainlink - Ledger Insights

The Depository Trust and Clearing Corporation DTCC just made public the result of a proof of concept (PoC) test exploring the posting of tokenized funds by setting net asset values (NAV) data onto a blockchain.

In order to reach a real value on an asset, the value of an asset is reached by deducting the asset's liabilities from the market value of all of its shares. Then, you divide that number by the number of issued shares.

This is what happens in a reset when values across the board on the market have been inflated beyond their actual worth.

Until these calculations are completed across the board of the markets, it's hard to say we are going to have a crash or a rise in values of these new assets that are being tokenized and supported by gold and other commodities.

Forex will go into these equations as well finding representations of a real value for currencies giving them a Level Playing Field in the purchasing power of Global currencies around the world. This will give us a Global Currency Reset.

These correlated calculations will link themselves to the banking system causing the reformation of new values inside our new digital asset-based trading system.

This is the credit valuation adjustment we spoke of about a month ago that was going to start taking place. We are in the testing phase, but these assets will soon be interfaced onto the QFS reflecting new values in the new Financial System.

"The ten participants in the Smart NAV trial were American Century Investments, BNY Mellon, Edward Jones, Franklin Templeton, Invesco, JP Morgan, MFS Investment Management, Mid Atlantic Trust d/b/a American Trust Custody, State Street and U.S. Bank." Ledger Insights

© Goldilocks

~~~~~~~~~

CME Stock Exchange is planning to launch Bitcoin trading. This is currently in the discussion phase, but if it does go any further it will connect CME and the Swiss EBS.

The Chicago Mercantile Exchange is a global derivatives marketplace based in Chicago. The Swiss Electronic Bourse (EBS) is a "computer linking system between the former stock exchange trading floors in Zurich, Geneva, and Basel, Switzerland."

The connection would allow trades to be executed on all three of these trading floors onto Digital Ledger Technologies.

This is why it is so important to complete the MICA regulations. Currently, the integration at the full QFS is being set into motion. Cryptonomist Nasdaq

© Goldilocks

~~~~~~~~~

China Sells Record Sum of US Debt Amid Signs of Diversification | Finance Yahoo

~~~~~~~~~

Rep. Massie Introduces Federal Reserve Board Abolition Act to "End the Fed" | U.S. Representative Thomas Massie

~~~~~~~~~

Trafigura, IXM caught in COMEX copper short squeeze as prices hit record | StreetInsider

~~~~~~~~~

The state of play and what’s to come with CBDCs | London Blockchain Conference | Youtube

~~~~~~~~~

Final Rules on Measuring Domestic Control of REITs | FTI

~~~~~~~~~

Palo Alto Networks and IBM on Wednesday announced a significant partnership in which the two companies will jointly provide cybersecurity solutions, and IBM will deliver consulting services across Palo Alto’s platforms.

Palo Alto Networks is an American multinational cybersecurity company with headquarters in Santa Clara, California. The core product is a platform that includes advanced firewalls and cloud-based offerings that extend those firewalls to cover other aspects of security. The company serves over 70,000 organizations in over 150 countries, including 85 of the Fortune 100. It is home to the Unit 42 threat research team and hosts the Ignite cybersecurity conference. It is a partner organization of the World Economic Forum. SecurityWeek Wikipedia

~~~~~~~~~

World Bank to issue Swiss digital bond settled in wholesale CBDC - Ledger Insights

Yesterday the World Bank announced it has priced a CHF 200 million digital bond to be issued on June 11 on the SIX Digital Exchange (SDX) and settled using the Swiss Franc wholesale central bank digital currency (wholesale CBDC).

The Swiss National Bank (SNB) is currently in pilot mode for its wholesale CBDC on the SDX DLT platform as part of Project Helvetia. Several digital bonds have used it for settlement. However, the World Bank, or rather the International Bank for Reconstruction and Development (IBRD), is the first international issuer to use the wCBDC.

~~~~~~~~~

We are beginning to witness how Digital Ledger Technologies, Tokenized Assets, and Stablecoins are currently being tested and regulated to go into law by the end of June 2024.

Do you see how these three networks work together to complete the functionality of the QFS?

Once these functionalities are complete, we will move into credit valuation adjustments to determine real values going forward.

The system will be tweaked during this time as the rest of the world catches up and interfaces their assets onto the system.

© Goldilocks

~~~~~~~~~

Regulators Preparing to Finalize Basel IV | Insights | Mayer Brown

~~~~~~~~~

Visa Reinvents the Card, Unveils New Products for Digital Age | Visa

~~~~~~~~~

Press release: Basel Committee publishes report on the digitalisation of finance | BIS

~~~~~~~~~

********************************

URGENT NEWS: Emergency Meeting on Iraq 2024 Budget #iqd Rate in Budget | Youtube

~~~~~~~~~

The modern CEO job is completely broken — but AI could make executives useful again | Business Insider

~~~~~~~~~

Overview | World Bank

Iraq has a mixed economic system with some private freedom, but weak centralized economic planning and government regulation. The country's economy is dominated by oil exports, which serve as the basis of its GDP. Successive governments have done little to wean Iraq off this heavy dependency on oil rents and diversify the economy.

However, non-oil growth has rebounded strongly in 2023, while inflation has receded. The World Bank has highlighted the importance of banking reforms and promoting digital financial services to increase financial intermediation and promote financial inclusion.

The Iraq Vision 2030 plan includes diversifying the economy, reducing dependence on oil, promoting innovation, supporting SMEs, and attracting foreign investment. The plan also promotes sectors such as agriculture, tourism, manufacturing, and technology.

~~~~~~~~~

How Gold Affects Currencies | Investopedia

Gold can add value to a country's currency. Gold is used as a standard of value for currencies worldwide, and the price of gold can influence a country's currency value. For example, if a country exports gold, the value of its currency will increase when gold prices increase.

~~~~~~~~~

BIS DROPS A BOMBSHELL! They Referenced Ripple/XRP On Their Panel! You Will Regret Not Owning XRP! | Youtube

~~~~~~~~~

14 Fireside chat - Technological innovation to enhance existing infrastructures | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Evening 5-16-24

Goldilocks' Comments and Global Economic News Thursday Evening 5-16-24

Good evening Dinar Recaps,

Wirex chooses OpenPayd to launch embedded accounts across UK and EEA | PRN Newswire

"The partnership between the two entities aims to provide named virtual IBANs to Wirex customers across the UK and European Economic Area (EEA), aligning with Wirex's mission to offer secure payment methods to its customers.

Under this partnership, OpenPayd will issue virtual IBANs to Wirex customers in over 30 countries across the UK and EEA. These customers will gain access to the Faster Payments network in the UK and Single Euro Payments Area (SEPA) Instant payments for Euro-denominated deposits and withdrawals."

This service will be interfaced into Wirex's infrastructure using OpenPayd's single API.

Goldilocks' Comments and Global Economic News Thursday Evening 5-16-24

Good evening Dinar Recaps,

Wirex chooses OpenPayd to launch embedded accounts across UK and EEA | PRN Newswire

"The partnership between the two entities aims to provide named virtual IBANs to Wirex customers across the UK and European Economic Area (EEA), aligning with Wirex's mission to offer secure payment methods to its customers.

Under this partnership, OpenPayd will issue virtual IBANs to Wirex customers in over 30 countries across the UK and EEA. These customers will gain access to the Faster Payments network in the UK and Single Euro Payments Area (SEPA) Instant payments for Euro-denominated deposits and withdrawals."

This service will be interfaced into Wirex's infrastructure using OpenPayd's single API.

Banking API is the process of integrating banking functions to a web service. It will decentralize the banking system inside the new QFS. This unique feature will allow access to third-party companies.

Wirex customers will get unique IBANs. IBAN is an International Bank Account Number. It will facilitate transfers of EUR and GBP between Wirex and bank accounts.

OpenPayd's SEPA Instant Payments transactions will occur in real-time. Here we go. The beginning stages of instant payments. PRN Newswire

© Goldilocks

~~~~~~~~~

The integration of Digital Payment Systems, Digital Ledger Technology, and Digital Payment Sources are all in process of being interfaced onto the QFS.

The new rules and regulations to govern them are in process of becoming law by the end of June.

Europe will begin the Global Reset. It will be up to the rest of the world to follow the Regulations they are building at the present time.

The rest of the world will build around these new Banking and Market guidelines. It is a process that begins the end of June 2024.

© Goldilocks

~~~~~~~~~

The Gold Iraqi Dinar | The Economic Ninja | Youtube

~~~~~~~~~

Iraq maintains its 30th rank with the largest gold reserves | Iraqi News

"Iraq's central bank, the Central Bank of Iraq (CBI), has been buying gold since 2022 to diversify its foreign assets."

Every time Iraq buys more gold. They are adding more value to the net worth of their currency.

"When gold is set free, so are we."

© Goldilocks

~~~~~~~~~

"Due diligence procedures in inquiring about customers of exchange companies category (A, B) and brokerage companies that buy and sell foreign currencies."

Brokerage companies that buy and sell foreign currencies with Iraq and their new registered A&B categorization of the Iraqi Dinar have been given due diligence procedures.

Due diligence procedures include information gathered about the clients who are participating in an exchange. It includes background checks, risk assessments, and more. CBI Investopedia Signicat

© Goldilocks

~~~~~~~~~

Mastercard executes first tokenized deposit transactions with StanChart subsidiaries - Ledger Insights

Mastercard has executed its first live test of the Mastercard Multi-Token Network

() (MTN) involving tokenized deposits and tokenized assets in collaboration with Standard Chartered Bank Hong Kong (SCBHK) and subsidiaries. Mastercard introduced MTN in mid-2023.

This proof of concept was completed as part of the Hong Kong Fintech Supervisory Sandbox. It involved a client of Standard Chartered’s Hong Kong digital bank, Mox Bank, buying a carbon credit.

Mox requested SCBHK to tokenize the carbon credit, a task executed by Libeara, the tokenization platform incubated by Standard Chartered’s SC Ventures. Mastercard’s MTN was used to tokenize the deposit and execute an atomic swap between the tokenized deposit and the carbon credit. Ultimately the Mox client received the tokenized carbon credit in their wallet.

~~~~~~~~~

Financial Services and Markets Act 2022 | Monetary Authority of Singapore

~~~~~~~~~

Escobar: De-Dollarization Bombshell - The Coming Of BRICS+ Decentralized Monetary Ecosystem | ZeroHedge

~~~~~~~~~

BIS’ Project Agorá Opens to Private Sector for Tokenised Cross-Border Payments | Fintech Singapore

Project Agorá, an initiative by the Bank for International Settlements (BIS) alongside major central banks and the Institute of International Finance (IIF), is moving forward and inviting private sector involvement.

The project aims to explore how tokenization can improve wholesale cross-border payments. Private sector financial institutions are encouraged to apply for participation in Project Agorá and the application window is open until 31 May 2024.

Project Agorá involves seven central banks, including the Bank of France (Eurosystem), Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, Bank of England, and the Federal Reserve Bank of New York.

The initiative will build on the unified ledger concept proposed by BIS, aiming to integrate tokenized commercial bank deposits with tokenized wholesale central bank money.

~~~~~~~~~

The Rise of Tokenised Economy: Unified Ledger, RLN, RSN & More..| Linkedin

In simple terms, a unified ledger could be considered a “common venue” where money and other tokenized objects come together to enable seamless integration of transactions and open the door to entirely new types of economic arrangement. 3 days ago

EU wholesale DLT settlement trials start - Ledger Insights - blockchain for enterprise | Ledger Insights

Yesterday, the Oesterreichische Nationalbank participated in the first trial of wholesale DLT settlement transactions as part of the Eurosystem experiments.

As reported last month, 16 institutions were onboarded to participate in the first wave of DLT trials, which use real central bank money. In addition, there are experiments involving simulations.

The Oesterreichische National bank example was a simulation involving the tokenization and simulated settlement of government bonds against central bank money – a delivery versus payment (DvP) transaction.

The ECB says upcoming trials and experiments will include

DvP transactions in primary and secondary markets securities lifecycle management automated wholesale payments, and payment-versus-payment transactions.

~~~~~~~~~

Ripple’s Latest Move Bolsters It As A Digital Asset Custody Provider | Mitrade

Ripple is transitioning into a full-service digital asset custody provider, following its acquisition of Metaco, a Swiss-based leader in the sector, for $250 million in May 2023. This development represents a significant expansion of the fintech’s capabilities into the institutional crypto custody market—a segment that is expected to experience substantial growth over the next decade.

~~~~~~~~~

Bankster Boss Christine Lagarde Reveals Plan for Europe’s GREAT RESET | Awake in 3D

“A hotter climate and the degradation of natural capital are forcing change in our economy and financial system. We must understand and keep up with this change to continue to fulfill our mandate.”

Christine Lagarde, President European Central Bank

~~~~~~~~~