Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible." It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS © Goldilocks ~~~~~~~~~

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible."

It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS

© Goldilocks

~~~~~~~~~

"UAE: Liv Digital Bank enters tokenization deal targeting Gen Zs" | CoinGeek

We are moving at a rapid pace at this point in the tokenization of our assets around the world.

You are going to notice the word digital added to many banking titles and companies going forward. Old traditional assets have been reformed into digital assets.

Hong Kong is leading the way in the digital asset transformation, and the innovation of our new banking system on a global scale is in its final stages there.

Hong Kong is presently finishing up many of their pilot programs, and their movement forward will lead our way into the new digital age.

© Goldilocks

~~~~~~~~~

Franklin Templeton CEO: All Investment Funds Going Blockchain | Crypto Times

"Jenny Johnson, CEO of the $1.6 trillion asset management giant Franklin Templeton, stated that all exchange-traded funds (ETFs) and mutual funds will eventually migrate to blockchain technology."

I know we have gone over this several times, but this gives you an idea of how much money is transferred into blockchain technology.

This is just one of many companies that are doing the same as we speak.

Institutional money and institutional integration are beginning to take place on the blockchain at larger magnitudes indicating that the new digital economy is moving towards mass adoption.

© Goldilocks

~~~~~~~~~

U.S. banks undertake blockchain experiment | Investment Executive

"The U.S. financial sector is exploring the idea of tokenizing various financial instruments, including U.S. Treasuries, wholesale central bank money, and commercial bank money, which would enable transactions in these instruments to settle on a single shared ledger.

Currently, transactions in various components of the wholesale financial system all take place on separate systems. A new project will examine the concept of tokenizing these instruments to facilitate settlement on a single platform, under existing legal frameworks.

SIFMA is serving as project manager, with participation from several large financial institutions including Citi, J.P. Morgan, Mastercard, Swift, TD Bank N.A., U.S. Bank, USDF, Wells Fargo, Visa, and Zions Bancorp.

Other project contributors include the Bank of New York Mellon, Broadridge, DTCC, the International Swaps and Derivatives Association, Tassat Group, and the MITRE Corp"

I want to point out that this article is sharing with us how this new experiment is being conducted on the Swift System and the new Digital Ledger Transmission System (DLT) Ledger.

This indicates that the movement of foreign currency exchange services is transitioning from wire services that can take days for transmissions to occur to electronic exchange services that are done in a matter of seconds and far more cost-efficient.

This is what my banker friend was referring to yesterday as to why her friend was going through foreign exchange services training.

© Goldilocks

~~~~~~~~~

Tokenizing assets on a scalable blockchain | Naeem Aslam, Antonino Sardegno, Stas Trock | Youtube

~~~~~~~~~

Swarm Markets (SMT) Price Today, News & Live Chart | Forbes Crypto Market Data

~~~~~~~~~

...by the Securities and Exchange Commission

H.J. Res. 109 would invalidate SEC Staff Accounting Bulletin 121 (SAB 121), which reflects considered SEC staff views regarding the accounting obligations of certain firms that safeguard crypto-assets. 6 days ago

~~~~~~~~~

SEC issues SAB 121 on digital asset custodial obligations | KPMG

~~~~~~~~~

👆The US is still working on who has governing power over these digital assets. This is why many Governments are moving ahead of the United States in the mobilization of the new digital economy.

This is why the MICA regulations are so important for us to finish. It will give more clarity and government power to authentic leaders in government to facilitate the movement of our new digital economy. House Financial Services

© Goldilocks

~~~~~~~~~

US Department of Treasury, Pacific Northwest National Laboratory, and Cloudflare Partner to Share Early Warning Threat | CoudFlare

San Francisco, CA, May 9, 2024 – Cloudflare, Inc (NYSE: NET), the leading connectivity cloud company, today announced a partnership with the United States Department of Treasury and Pacific Northwest National Laboratory (PNNL) under the Department of Energy to improve the cyber resilience of the financial services industry by sharing an advanced threat intelligence feed through Cloudflare. With this new offering, financial services institutions that are using Cloudflare Gateway now have privileged access to Custom Indicator Feeds that share threat indicators and enable direct action to be taken, to better defend against ransomware, phishing, and other threats.

~~~~~~~~~

Ranking Member Waters Statement on Resolution to Overturn SEC’s Guidance on Crypto Assets: H.J. Res. 109 “Would Have Broad and Negative Consequences for All Public Companies and Their Investors, with Implications for the Entire Securities Market, Not Just Crypto.” | U.S. House Committee on Financial Services Democrats

~~~~~~~~~

May 9, 2024

Tokenized Real-World Assets: Pathways to SEC Registration

By: Ryan Mitteness, Ryan M. McRobert, Andrew T. Albertson

What You Need to Know

Global demand for Tokenized Real-World Assets (RWAs) is growing rapidly in the decentralized finance (DeFi) community and traditional finance industry.

Tokenized RWAs allow legal ownership or rights to traditionally illiquid assets to be digitalized and traded on digital platforms, leading to expedited settlements and potentially reduced operating costs.

Regulatory hurdles have slowed adoption in U.S. markets where companies have to navigate existing securities laws and often lengthy review processes by the Securities Exchange Commission (SEC).

While a clear preferred registration pathway through the SEC for tokenized RWAs has yet to emerge, there are various potential approaches issuers of RWAs may explore for broadly marketed offerings in the United States. Fenwick

~~~~~~~~~

ETFs and mutual funds are all going to be on blockchain, says Franklin Templeton CEO - Ledger Insights - blockchain for enterprise | LedgerInsights

~~~~~~~~~

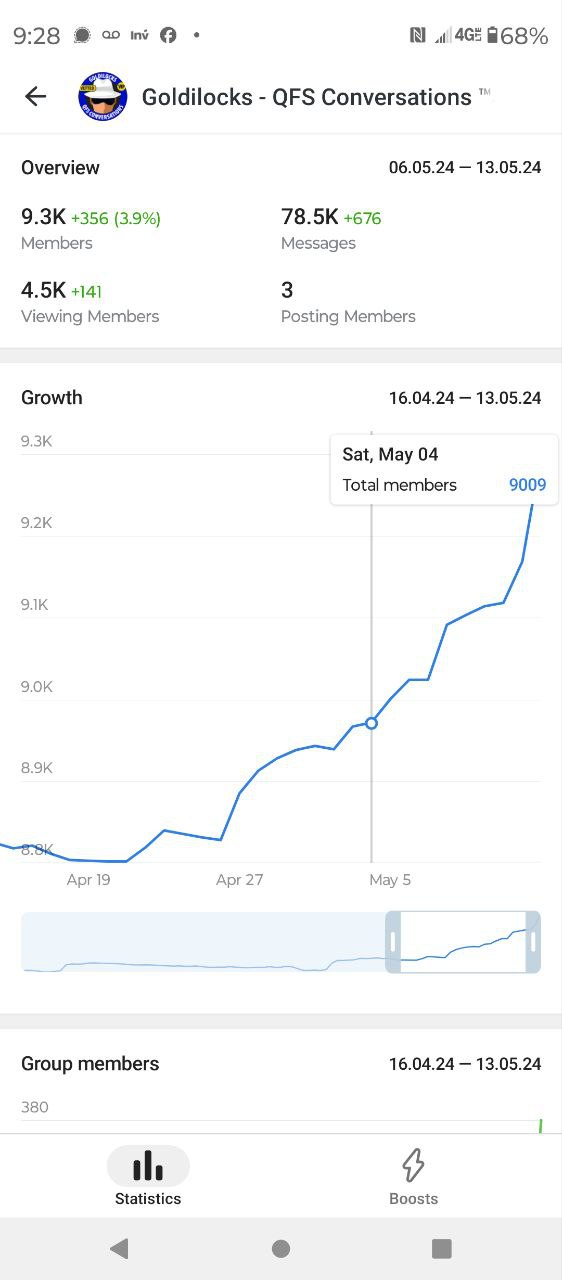

Thank you everyone for your participation in this room. I thought I would give you an idea of the statistics that actually take place in this room. This is the current total.

It is important to note that almost 50% of the people in this room actually come to it every day. This is very rare due to the fact that most people join rooms and then move on to others.

What you are looking at above is an active room where people realize and know that the information being shared is important, and I take this room and the lives of the people within it as an important piece instilled within my heart of prayer each and every day as I write to support and encourage all of us to move forward in faith, hope, and love.

© Goldilocks

~~~~~~~~~

ECB conducts first DLT trials for wholesale central bank money settlement | FinExtra

~~~~~~~~~

Report on OTC derivatives data reporting and aggregation requirements

The final regulations come into operation on 21 October 2024, introducing the UPI, UTI, CDE and ISO 20022 in reporting.10 hours ago

~~~~~~~~~

Miami Federal Court Orders Multiple Individuals and Entities to Pay Over $225 Million for Foreign Currency Fraud and Misappropriation Scheme | CFTC

~~~~~~~~~

May 14, 2024

Washington, D.C. — The Commodity Futures Trading Commission today announced the Honorable Darrin P. Gayles of the U.S. District Court for the Southern District of Florida issued an order of default judgment against four individuals and five companies (nine defendants): Jase Davis of Brandon, Mississippi; Borys Konovalenko of Ukraine; Anna Shymko of Duluth, Georgia; Alla Skala of Grand Island, New York and/or Fort Erie, Canada; Easy Com LLC d/b/a ROFX, a New Hampshire LLC; Global E-Advantages LLC a/k/a Kickmagic LLC d/b/a ROFX, a Delaware LLC and New York foreign LLC; Grovee LLC d/b/a ROFX, a Delaware LLC; Notus LLC d/b/a ROFX, a dissolved Colorado LLC; and Shopostar LLC d/b/a ROFX, a Colorado LLC.

The default judgment order stems from the CFTC’s August 31, 2022 amended complaint charging the nine defendants and defendant Timothy F. Stubbs with fraud, misappropriation, and registration violations in connection with a fraudulent foreign currency (forex) scheme. [See CFTC Press Release Nos. 8486-22 and 8790-23]

~~~~~~~~~

DTCC Comments on Industry’s Affirmation Progress | DTCC

~~~~~~~~~

H.R.4766 - 118th Congress (2023-2024): Clarity for Payment Stablecoins Act of 2023 | Congress Gov

~~~~~~~~~

Using MRI, engineers have found a way to detect light deep in the brain | MIT News | Massachusetts Institute of Technology

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Good Evening Dinar Recaps,

"The End Of The World Order And The Rise Of Trade Regulation" Throughout the world, the US has been in process of signing Free Trade Agreements with countries.

These FTAs eliminate barriers to trade significantly. This includes tariffs, improving intellectual property rights, and more.

In addition, they improve laws protecting intellectual property rights, open up government procurement opportunities, and easing investment rules.

The world of trade between countries are changing rapidly at this point. These new trade agreements require credit valuation adjustments across the board including foreign currency exchange rates. Mondaq Trade Cornell Law

WATCH THE WATER.

© Goldilocks.

~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Good Evening Dinar Recaps,

"The End Of The World Order And The Rise Of Trade Regulation"

Throughout the world, the US has been in process of signing Free Trade Agreements with countries.

These FTAs eliminate barriers to trade significantly. This includes tariffs, improving intellectual property rights, and more.

In addition, they improve laws protecting intellectual property rights, open up government procurement opportunities, and easing investment rules.

The world of trade between countries are changing rapidly at this point. These new trade agreements require credit valuation adjustments across the board including foreign currency exchange rates. Mondaq Trade Cornell Law

WATCH THE WATER.

© Goldilocks.

~~~~~~~~~*

"The network value-to-transaction ratio, or NVT ratio, is a proposed approach that is determined by dividing the market capitalization of a digital asset by the transaction value during a certain time period. These are the important metrics that help in the valuation of digital assets."

The above information is exactly what will begin happening at some level when our new regulated digital assets become law on June 30th.

We will go through a process of credit valuation adjustments based on demands for their use and corresponding underlying assets that support what used to stand alone in the traditional markets.

Backing traditional assets with gold and other commodities will change the way we look at the price of these assets going forward.

During this time, we can expect to see caps on gold released for many of these new digital assets to find a real value as we approach January 1st, 2025.

The first of next year is when the expectation for Basel 3 compliant measures to be fully complete. At that time, solid rates will become possible for many of the assets a trader will hold.

Price fluctuations across the board between now and then are expected including Forex. Our markets will be in process of finding real values. Eqvista MoodysAnalytics

© Goldilocks

~~~~~~~~~

Crypto Regulations Act update for the US:

"Today, the House Committee on Rules publicly noticed its intent to consider the Financial Innovation and Technology for the 21st Century (FIT21) Act, clearing a pathway for a floor vote later this month.

The FIT for the 21st Century Act is an important first step towards achieving regulatory clarity for digital assets. FIT21 provides the robust, time-tested consumer protections and regulatory certainty necessary to allow the digital asset ecosystem to flourish in the United States."

After this vote, you can expect movement towards the Senate to come soon after in order to meet those deadlines for June 30th, 2024 for the European Union.

China is already in the regulatory process, and expected to coordinate with a global efforts of Europe and the US. House Financial Services DailyCryptoNews

© Goldilocks

~~~~~~~~~

Global Banking Announcement:

This is a note to follow up on the banker who went into foreign currency exchange training last week.

The banks now have the capability to send wires in every currency around the world with the exception of the Iraqi dinar.

There will be much faster settlement times utilizing a country's own currencies for the exchange.

This makes sense to me due to the fact that Dee and I have been told that the IQD would not float. It will be given a revalued rate.

What is important to take from this piece of Intel is, for this Bank, these new procedures began today.

This does not mean that all Banks have started these protocols yet, but it does mean that expectations are high that they begin.

© Goldilocks

~~~~~~~~~

"Navigating the New Frontier: Updates to Federal Onshore Oil and Gas Leasing Rules and Regulations" | JD Supra

These new rules and regulations for the oil sector have reached their final stages. And now, the transition into the energy sector of our markets that includes solar power and electric cars will proceed.

© Goldilocks

~~~~~~~~~

SAN FRANCISCO, May 9, 2024 — WisdomTree Prime Launches to 41 States, Leveraging Stellar Network for Enhanced Digital Asset Services | Crypto News

WisdomTree, a notable asset management firm, has launched its innovative financial app, WisdomTree Prime, to cover 75% of the U.S. population across 41 states despite shareholder wishes.

This strategic extension is powered by the Stellar Development Foundation, which supports the app’s robust digital asset services. (https://www.crypto-news.net/tokenization-government-money-fund/)

WisdomTree has integrated Stellar’s efficient transaction platform to power WisdomTree Prime, aligning with its goal to streamline financial operations for its users.

~~~~~~~~~

WisdomTree Digital Trust Company, LLC. | Wisdom Tree Inc

~~~~~~~~~

ASEAN - The key Player in the Indo-Pacific Region - Indian Defence Review

~~~~~~~~~

Dow Gold Ratio: Stocks vs Gold Charts | SD Bullion

~~~~~~~~~

Hong Kong and Saudi Arabia Consider Establishing ETF - Claps

~~~~~~~~~

Alternative Trading Systems (ATSs) | Investor Gov

~~~~~~~~~

Zimbabwe set to be invited to join BRICS | The Zimbabwe Mail

👆 Goldilocks pointed to this article

~~~~~~~~~

Currently, indications are pointing at Zimbabwe, together with Argentina and Saudi Arabia, being officially announced as new members of the NDB at the BRICS summit to be held in South Africa this August. | Herald

~~~~~~~~~

Institutions Coming In! Pivotal Moment For XRP! | Youtube

~~~~~~~~~

RIPPLE VS. SEC

Tomorrow on May 13th:

Parties and any third parties file omnibus letter motions and also file proposed redactions to such materials!

As @attorneyjeremy1 said: We‘re just waiting for the judge now! #Ripple Twitter

~~~~~~~~~

BREAKING NEWS Iraq at Odds w/OPEC Over Oil Production Cuts | Youtube

~~~~~~~~~

When You Put Money in the Bank annnddd It's Gone - SOUTH PARK | Youtube

~~~~~~~~~

Crash Landing Ahead? Fed May Cut Rates but We’ve Run Out of Time | Youtube

~~~~~~~~~

The Gold Team Breaking down Goldilocks. Their backgrounds is why Goldilocks gave them all the Gold Seal of approval. Goldilocks QFS Goldilocks Q A Saturday Night Live Call

~~~~~~~~~

The Association of Private Banks praises the direction of the Iraqi Central Bank to establish digital banks | Search 4 Dinar

Economy News – Baghdad

The Executive Director of the Association of Iraqi Private Banks, Ali Tariq, praised the Central Bank’s direction to establish digital banks to keep pace with the great development in the global banking sector.

In an interview with “Economy News”, Tariq said that “the world is moving towards digitizing banking services, and Iraq has started its first steps in establishing digital banks, as so far there is a licensed digital bank inside Iraq, and provides its services naturally to the public.”

~~~~~~~~~

Why is Crude oil price crashing? | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Nebraska Becomes 12th State to End Taxes on Gold and Silver Sales

Nebraska Becomes 12th State to End Taxes on Gold and Silver Sales

Sunday, 12 May 2024, 21:50 PM

Executive Director of the Sound Money Defense League 5/8/2024 With Gov. Jim Pillen’s recent signature, Nebraska has become the 12th state to end capital gains taxes on sales of gold and silver.

LB 1317 is the fourth major sound money bill to become law this year, as state lawmakers across the nation scramble to protect the public from the ravages of inflation and runaway federal debt.

Under the new Nebraska law, any “gains” or “losses” on precious metal sales reported on federal income tax returns are backed out, thereby removing them from the calculation of a Nebraska taxpayer’s adjusted gross income (AGI).

Nebraska Becomes 12th State to End Taxes on Gold and Silver Sales

Sunday, 12 May 2024, 21:50 PM

Executive Director of the Sound Money Defense League 5/8/2024

With Gov. Jim Pillen’s recent signature, Nebraska has become the 12th state to end capital gains taxes on sales of gold and silver.

LB 1317 is the fourth major sound money bill to become law this year, as state lawmakers across the nation scramble to protect the public from the ravages of inflation and runaway federal debt.

Under the new Nebraska law, any “gains” or “losses” on precious metal sales reported on federal income tax returns are backed out, thereby removing them from the calculation of a Nebraska taxpayer’s adjusted gross income (AGI).

Supported by the Sound Money Defense League, Money Metals Exchange, and in-state advocates, Nebraska’s sound money measure passed out of the unicameral legislature’s Revenue committee unanimously before being amended into a larger bill.

Sponsor Sen. Ben Hansen said upon news of the formal enactment of his legislation:

Gold and silver are the only forms of currency mentioned in our Constitution and with that comes the people’s ability to use it as such without penalty from the government. Saving, and using, gold and silver is our right and one of the only checks and balances to our federal government’s unending devaluation of our paper currency.

Taxpayers often realize ‘gains’ when converting the monetary metals back into Federal Reserve notes even though the ‘gains’ do not reflect an increase in real value but rather reflect the currency’s ongoing devaluation.Despite the lack of “real” gains, the Internal Revenue Service imposes capital gains taxes on such transactions. Nebraska has now opted out at the state level, declining to carry the IRS’s position into the definition of Nebraska income.

Jp Cortez, executive director of the Sound Money Defense League, explained during his testimony before the Revenue Committee that the ferocious wave of inflation facing Nebraskans is largely caused by harmful actions of the Federal Reserve: The state can take a different course and provide Nebraska citizens cleaner access to gold and silver ownership – and these metals are not only a proven inflation hedge but states all over the country are remonetizing constitutional sound money in the form of gold and silver.

Eleven other states already do not charge an income tax on sales of precious metals, with Arkansas, Arizona, and Utah recently enacting such laws. Meanwhile, Iowa, Georgia, Oklahoma, Missouri, West Virginia, and Kansas have been considering similar legislation in 2024.

“Investments in precious metals coins and bullion in Nebraska are now rightly exempt from both sales tax and income tax,” said Stefan Gleason, CEO of Money Metals and Chairman of the Sound Money Defense League.

Neutralizing Nebraska’s income tax treatment of the monetary metals removes significant disincentives in the Cornhusker State against the ownership and use of the monetary metals.

Meanwhile, LB 1317 revises the state’s formal definition of money by adding language that states: “Money does not include central bank digital currency.”

The new law defines central bank digital currency as “a digital medium of exchange, token, or monetary unit of account issued by the United States Federal Reserve System or any analogous federal agency that is made directly available to the consumer by such federal entities. Central bank digital currency (CBDC) includes a digital medium of exchange, token, or monetary unit of account so issued that is processed or validated directly by such federal entities.”

Sen. Hansen said: “I believe we have to be extra vigilant in our assessment and application of a Central bank digital currency to make sure they do not become a danger to our freedom. That’s why we defined in LB 1317 that CBDC’s are not classified as currency in Nebraska, which should help protect against unwarranted mandates for their use in the future.”

Versions of this “anti-CBDC language” have advanced or signed into law in Tennessee, North Carolina, and Florida, South Dakota, and Indiana . Congressman Alex Mooney has also introduced a federal measure to block the Federal Reserve’s digital currency scheme.

In his testimony, Cortez discussed the potential risks of adopting a CBDC, including creating a greater ability to track all financial transactions, disallowing certain types of purchases, or even completely “turning off” a targeted individual’s access to money.

Nebraska joins Utah, Wisconsin, and Kentucky as states to have enacted pro-sound money legislation into law so far in 2024.

Currently ranked 22nd in the 2024 Sound Money Index, Nebraska’s ranking is expected to rise.

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Good Morning Dinar Recaps,

The link below provides information on Vietnam's review by the US Department of Commerce regarding Vietnam's ability to move into a Market Economy.

My understanding from the previous article on Vietnam reviewed is that this is not a graded review. It is simply a valuation of the types of goods and services they can provide comprehensively.

Vietnam is showing steady growth in several areas of their Market. Their potential to increase National Capital Investment opportunities on a Global scale is evident.

Clearly, hurdles are being cleared for Vietnam to move into a Market Economy. A Market Economy will allow them to freely move their money through supply and demand.

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Good Morning Dinar Recaps,

The link below provides information on Vietnam's review by the US Department of Commerce regarding Vietnam's ability to move into a Market Economy.

My understanding from the previous article on Vietnam reviewed is that this is not a graded review. It is simply a valuation of the types of goods and services they can provide comprehensively.

Vietnam is showing steady growth in several areas of their Market. Their potential to increase National Capital Investment opportunities on a Global scale is evident.

Clearly, hurdles are being cleared for Vietnam to move into a Market Economy. A Market Economy will allow them to freely move their money through supply and demand.

******************************

Credit Valuation Adjustments on their currency will be determined by Vietnam's ability to move their goods and services near and far at competitive rates.

© Goldilocks

https://vietnamnet.vn/en/vietnam-business-news-may-12-2024-2279536.html

~~~~~~~~~

Vietnam's Foreign Exchange Rate Review:

HCMC (Saigon) inspects authorized foreign exchange agents.

The State Bank of Vietnam-Ho Chi Minh City Branch (SBV-HCMC) has urged commercial banks to conduct inspections of their authorized foreign exchange agents and submit reports on the findings to the SBV-HCMC no later than June 15, 2024.

The SBV-HCMC has issued a letter requesting commercial banks and branches of foreign banks authorized to engage in foreign exchange activities within the city to conduct inspections of the authorized foreign exchange agents appointed by commercial banks.

Accordingly, commercial banks are required to inspect their authorized foreign exchange agents, covering compliance with legal regulations, adherence to foreign exchange agency contracts, identification of any existing limitations or misconduct, and the outcomes of any corrective actions taken.

The SBV has urged commercial banks to conduct these inspections on authorized foreign exchange agents appointed by banks to ensure compliance with regulations governing foreign currency transactions and the appropriate use of foreign currency, thus contributing to promoting the development of production and business activities, import-export, tourism, and services.

Simultaneously, commercial banks authorized to delegate foreign exchange agents must strictly adhere to all legal regulations regarding the delegation of authority to economic organizations to ensure that the appointed agents comply with legal requirements, adhere to contracts, and play a crucial role in stabilizing foreign exchange rates, the foreign exchange market, and socio-economic development.

VietnamNet

~~~~~~~~~

Peter Schiff: Gold, Silver 'Ready to Explode Higher' — Sees 'Biggest Precious Metals Bull Market in History' – Markets and Prices Bitcoin News

~~~~~~~~~

US Scrutiny of Tether Could Disrupt Crypto Ecosystem, Ripple CEO Warns – News Bytes Bitcoin News

~~~~~~~~~

***********************************

Franklin Templeton CEO says all ETFs and mutual funds will be on blockchain | CoinTelegraph

~~~~~~~~~

JPMorgan’s Onyx to industrialize blockchain PoCs from Project Guardian | CoinTelegraph

~~~~~~~~~

IMF Official: Countries Are Reevaluating Their Reliance on the US Dollar – Economics Bitcoin News

~~~~~~~~~

BRICS joining hands with North Korea to fight against US dollar dominance? | The News

~~~~~~~~~

The Ticking Time Bomb Has Started For Tether! When It Erupts, EVERYTHING WILL FALL Including XRP!! | Youtube

~~~~~~~~~

Recession has begun since October of 2023 | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Sunday Evening 5-12-24

Goldilocks' Comments and Global Economic News Sunday Evening 5-12-24

Good Evening Dinar Recaps,

Breaking: Ripple CEO Brad Garlinghouse on SEC Lawsuit, Crypto Predictions, XRP Victory | CoinGape

If you think that cryptocurrency is not part of the Presidential race this year, you might want to think again. The population is watching very closely on how Congress deals with our new digital economy.

At the end of June, our Markets in Crypto Assets and Stablecoins are about to become law. We have some coins that just simply won't cut the mustard after that date.

These new regulations becoming law will set directives on their use and their value going forward. Gold and other Commodities will back these tokenized assets and stablecoins that are going to be backed with enough gold and other commodities to keep these digital currencies at a stable value to represent their countries' currency.

Quite simply, unless you hold a digital asset that is part of the new QFS, you may find some of your assets being either banned or just simply going away.

Goldilocks' Comments and Global Economic News Sunday Evening 5-12-24

Good Evening Dinar Recaps,

Breaking: Ripple CEO Brad Garlinghouse on SEC Lawsuit, Crypto Predictions, XRP Victory | CoinGape

If you think that cryptocurrency is not part of the Presidential race this year, you might want to think again. The population is watching very closely on how Congress deals with our new digital economy.

At the end of June, our Markets in Crypto Assets and Stablecoins are about to become law. We have some coins that just simply won't cut the mustard after that date.

These new regulations becoming law will set directives on their use and their value going forward. Gold and other Commodities will back these tokenized assets and stablecoins that are going to be backed with enough gold and other commodities to keep these digital currencies at a stable value to represent their countries' currency.

Quite simply, unless you hold a digital asset that is part of the new QFS, you may find some of your assets being either banned or just simply going away.

At the end of June, utility case digital assets will begin to drive the market over speculation, and the cryptocurrencies that survive going forward will have a purpose.

This could cause a Black Swan Event temporarily in the markets as new Tokenized Assets become adopted on a massive scale. Every sector of the market will begin feeling the pressures of movement into a real value in the second half of this year.

Ripple will begin to move assets across borders near and far. It will begin creating a level of competition with the dollar and other currencies, but the ability to level off Currency Market opportunities will commence at that time.

Ripple will be the common currency used to make currencies around the world have a real chance at going to a real value based on demand and supply backed by commodities. CoinGape

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

US House Committee set to address regulatory issues over digital assets through review of FIT21 Act | FX Street

The House Committee on Rules publicly announced intentions to address digital asset regulatory issues.

Financial Innovation and Technology for the 21st Century Act would be reviewed to better address the state of digital assets.

Billionaire Mark Cuban says that crypto is the way to win the votes of younger and independent Americans.

~~~~~~~~~

Vietnam welcomes US consideration of market economy's status for VN | VietnamNet

~~~~~~~~~

Vietnam: Market-economy status shouldn’t require a ‘perfect score’ | InsideTrade

~~~~~~~~~

📈 Facing Today's #stagflation Reality | Youtube

~~~~~~~~~

Uphold CEO On XRP, ODL & Mass Adoption! | Youtube

~~~~~~~~~

FYI: I only post in this room, and people are welcome to take any information out of this room to other places.

I do not post outside of dinar land, but I have seen this information throughout the internet inside professional business venues.

This is a free gift to the group of people that I am a part of and always will be.

© Goldilocks

~~~~~~~~~

Leading European bank to halve oil and gas exposure by 2025 | Offshore Technology

~~~~~~~~~

Standard Chartered Bank to fund green Chinese firms in Africa-Xinhua | English News

~~~~~~~~~

Scaling AML compliance with AI to prepare for the next black swan event | BAI

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Evening 5-11-24

Goldilocks' Comments and Global Economic News Saturday Evening 5-11-24

Good Evening Dinar Recaps,

EUROPEAN BANKING AUTHORITY MICA ANNOUNCEMENT:

"The EBA publishes final draft technical standards under the Markets in Crypto-Assets Regulation (MICA)"

Specifically, stablecoins and tokenized assets are currently in the comment stage and ready for the white papers.

A white paper is a final document ready for implementation for business owners in an industry to utilize as a reference guideline. In this case, this particular white paper is for countries around the world to use these stablecoin and asset regulations as a guideline for creating a standardized stablecoins and digital assets they can use Globally.

Remember, Stablecoins and Market assets are a digital representation of a country's currency and the assets they pay for going forward. The standardization process of our Global currencies is currently in their final phases. EBA Europa CorporateFinanceInstitute

© Goldilocks ~~~~~~~~~

Goldilocks' Comments and Global Economic News Saturday Evening 5-11-24

Good Evening Dinar Recaps,

EUROPEAN BANKING AUTHORITY MICA ANNOUNCEMENT:

"The EBA publishes final draft technical standards under the Markets in Crypto-Assets Regulation (MICA)"

Specifically, stablecoins and tokenized assets are currently in the comment stage and ready for the white papers.

A white paper is a final document ready for implementation for business owners in an industry to utilize as a reference guideline. In this case, this particular white paper is for countries around the world to use these stablecoin and asset regulations as a guideline for creating a standardized stablecoins and digital assets they can use Globally.

Remember, Stablecoins and Market assets are a digital representation of a country's currency and the assets they pay for going forward. The standardization process of our Global currencies is currently in their final phases. EBA Europa CorporateFinanceInstitute

© Goldilocks

~~~~~~~~~

"On May 7, 2024, the European Banking Authority (EBA) published three final drafts of technical standards developed under Regulation (EU) 2023/1114 on crypto-assets, the so-called Market in Crypto-Assets Regulation (MICA), published in the Official Journal of the European Union on June 9, 2023.

With reference to the timeline for applicability of the MICA Regulation, it will be applicable in its entirety from December 30, 2024; however, the requirements set for asset-referenced tokens and e-money tokens will be applicable starting from June 30, 2024."

I know some of you look for dates and rates only, so I'm going to make the above articles more specific to those looking for important dates.

On June 30th, the digital markets and the e-money used to pay for those assets through the banking system are to be done by June 30th, 2024. PwC TLS

© Goldilocks

~~~~~~~~~

MICA activating new laws on June 30th, 2024 regarding our digital assets and stablecoins will begin the process of institutional money being moved across borders.

This will begin the process of putting price pressures on foreign currency exchange rates going forward. This does not mean we'll see those changes right away, but we will begin seeing movements of money in ways we have not seen before.

Credit valuation adjustments will be happening across the board throughout the second half of this year. Some assets will go up and others will go down. In the end all assets will be in process of finding their equilibrium inside the new digital economy.

© Goldilocks

~~~~~~~~~

5 Major Banks Closing Many Locations in Idaho and Washington State | LiteOnline

~~~~~~~~~

Treasury and IRS Release Final Regulations on Credit Transferability | JD Supra

On April 25, 2024, the U.S. Department of the Treasury (Treasury) and the Internal Revenue Service (IRS) issued final regulations (the Final Regulations) regarding the election to transfer energy tax credits under Section 6418 of the Internal Revenue Code of 1986, as amended (the Code), pursuant to changes authorized by the Inflation Reduction Act of 2022 (IRA). The Final Regulations update the initial proposed regulations issued on June 14, 2023 (the Proposed Regulations), discussed by Wilson Sonsini, relating to the transfer of eligible credits.

~~~~~~~~~

JPMorgan Chase Implements Quantum-Secured Network | IOT World Today

JPMorgan Chase researchers have successfully implemented a high-speed, quantum-secured crypto-agile network (Q-CAN), connecting two data centers over existing fiber optic cables.

The demonstration was conducted in an air-gapped environment over 29 miles of deployed telecom fiber across Singapore and achieved 45 days of continuous operation.

Quantum-safe communication is an increasingly pressing issue as large-scale quantum computers could break the cryptography used to secure transmissions.

~~~~~~~~~

This Week in AI: Digital Agents, Quantum AI and Spy Chatbots | Pymnts

~~~~~~~~~

Banking Giant Wells Fargo Holds Spot Bitcoin ETF on Behalf of Clients, According To New SEC Filing - The Daily Hodl

~~~~~~~~~

Senate Urged to Swiftly Overturn SEC's 'Misguided' Crypto Rules – Regulation | Bitcoin News

~~~~~~~~~

US Elections: Stand With Crypto forms committee to support pro-crypto candidates | FinExtra

~~~~~~~~~

🚨*Ripple CEO Brad Garlinghouse Warns About A Blackswan Coming*🚨 | Twitter

He Discusses How The US Government Is Coming After Tether.

~~~~~~~~~

Goldilocks Posts are Broken Down Weekly on Saturday Nights!

TONIGHT! Saturday Night Live Call with Freedom Fighter breaking down Goldilocks Posts from this Week, with Jester too! Come join the call and learn what is happening with the new QFS!

SNL Call Link Freedom Fighter's Bio

9 pm EDT / 8 pm CDT / 6 pm PDT

The Saturday Night Q & A room will be open an hour before the call and remain open during the call for Questions to be answered during the call at the end!

The calls are recorded and will be posted in the Archive room after the call

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Evening 5-10-24

Goldilocks' Comments and Global Economic News Friday Evening 5-10-24

Good evening Dinar Recaps,

"The U.S. is in a dilemma about whether to upgrade the non-market economy status of Vietnam to that of a market economy."

The U.S. Department of Commerce has until late July to complete this review and decision. A market economy would bring with it significant trade relationship opportunities.

Vietnam would become a country where supply and demand would determine prices on their goods and services.

A shift in a monetary policy such as this would bring more power back to the people and less to the government.

It would move from government intervention powers for the stabilization of their currency to incentives toward supply and demand determined by the people and the industries they promote.

Goldilocks' Comments and Global Economic News Friday Evening 5-10-24

Good evening Dinar Recaps,

"The U.S. is in a dilemma about whether to upgrade the non-market economy status of Vietnam to that of a market economy."

The U.S. Department of Commerce has until late July to complete this review and decision.

A market economy would bring with it significant trade relationship opportunities.

Vietnam would become a country where supply and demand would determine prices on their goods and services.

A shift in a monetary policy such as this would bring more power back to the people and less to the government.

It would move from government intervention powers for the stabilization of their currency to incentives toward supply and demand determined by the people and the industries they promote.

A move like this tends to put price pressures on a country's currency. One of the hallmarks of a market economy would be a stronger Vietnamese Dong.

This would make imports cheaper for them and exports more expensive for other countries determining new exchange rates for all parties involved in trade. Vietnam Briefing HickmanMills

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

EU Basel 3 Standards Announcement:

"The legislative package to implement the International Basel III Standards is now adopted by the European Parliament Plenary and Council."

This is the signal for banks to move urgently towards CRR3 compliance deadlines. These mandates include Credit Risk, Market Risk, Output floor, ESG Pillar III and Reporting rules.

The new regulations will begin to shift their economy affecting trade relations around the world by these decisions.

The full implementation of EU's Basel 3 has to be completed by January 1st, 2025. This will begin to shift all economies around the world into new price pressures on everything.

"The European Union collectively has $8.1T in circulation, making it the fourth largest in the world, behind Japan ($8.9T)."

As you can see, the changes currently being made by the above two countries will have a significant impact on money flow going forward. These new changes will be in fluctuation for the rest of this year determining new price pressures on all economies around the world. Wolters Kluwer 1 Wolters Kluwer 2 Bank of America Linkedin

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

Hong Kong Market Tokenization Announcement:

"Project Ensemble is the HKMA’s new wholesale central bank digital currency (wCBDC) project to render support to the development of the tokenization market in Hong Kong."

Project Ensemble is another digital currency initiative. It is one of many pilot programs that are currently being executed in Hong Kong.

mBridge and Genesis are currently being executed inside Hong Kong. These projects will support the underlying infrastructure of the Hong Kong economy.

Project Genesis and mBridge will provide liquidity and a multi-CBDC platform developed to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions using CBDCs. AFP Bitcoin News BIS 1 BIS 2

© Goldilocks

~~~~~~~~~

Hong Kong’s Monetary Authority to replace ‘Virtual Bank’ with ‘Licensed Digital Bank’ to Boost Public Confidence | South China Morning Post

~~~~~~~~~

Russia court allows seizure of $13 million of JPMorgan and Commerzbank assets | MSN

~~~~~~~~~

Ripple and XRPL Labs Join Alliance to Develop Blockchain Recovery Standards – Bitcoin News

~~~~~~~~~

Project Genesis 2.0 | Youtube

~~~~~~~~~

Project mBridge | Youtube

~~~~~~~~~

HK launches Project ‘Ensemble’ to support tokenization with wCBDC | Web3 | 3.0 TV | Youtube

~~~~~~~~~

The Global Digital Currency Market is currently in pilot programs that will transition us and our currencies into real values.

This is a digital process and not a date. Stay tuned as new information develops.

© Goldilocks

~~~~~~~~~

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation - The Daily Hodl

~~~~~~~~~

Research and Analysis - working paper: Evolution of Asia's outward-looking economic policies: Some lessons from trade policy reviews | WTO

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Evening 5-9-24

Goldilocks' Comments and Global Economic News Thursday Evening 5-9-24

Good Evening Dinar Recaps,

"Based on the decision of the Board of Directors of this bank No. (191) of 2023, it was decided to give the mediation companies that buy and sell foreign currencies under category (C) to merge to be classified as (A) or (B) until 3/31/2024."

Do you remember this article from the CBI? I remember talking with you about this particular article and how it was a reclassification of the Iraqi dinar. There is more information that is important for us to know at this time, so I have saved it to share with you now.

Moving to an A/B from a C classification essentially means that holders of the Iraqi Dinar is now a registered security. Registered Securities are freely tradable, and they can be sold to public investors on a much more broader scale.

Banks are generally owned by stockholders. This is what forms most of the Equity Capital that comes into a bank. Our foreign currency exchange with banks helps to build liquidity for them and the markets.

Since banks are privately owned for-profit institutions, this makes our foreign currency exchange with them a private exchange.

Goldilocks' Comments and Global Economic News Thursday Evening 5-9-24

Good Evening Dinar Recaps,

"Based on the decision of the Board of Directors of this bank No. (191) of 2023, it was decided to give the mediation companies that buy and sell foreign currencies under category (C) to merge to be classified as (A) or (B) until 3/31/2024."

Do you remember this article from the CBI? I remember talking with you about this particular article and how it was a reclassification of the Iraqi dinar. There is more information that is important for us to know at this time, so I have saved it to share with you now.

Moving to an A/B from a C classification essentially means that holders of the Iraqi Dinar is now a registered security. Registered Securities are freely tradable, and they can be sold to public investors on a much more broader scale.

Banks are generally owned by stockholders. This is what forms most of the Equity Capital that comes into a bank. Our foreign currency exchange with banks helps to build liquidity for them and the markets.

Since banks are privately owned for-profit institutions, this makes our foreign currency exchange with them a private exchange.

Jester and Freedom Fighter do a "Saturday Night Live" call each week to explain the importance of getting to know your "Relationship Managers" whom will participate in your exchange at some level, and they will continue to participate in your banking success through periodic reviews of your account.

Each week, Freedom Fighter and Jester have live conversations with people who are going out to establish banking relationships that will guide them in the exchange process, and they come back to tell people what they found.

You do not want to miss these calls.

© Goldilocks

SEC

CBI

Westlaw

Connecticut Portal Department of Banking

Wise - Foreign Currency

Investopedia - Capital Markets

~~~~~~~~~

"A federal-covered security can be legally sold in a state once the proper documents and filing fee are submitted. Sales may occur on the day SEC registration is effective or when the notice filing was filed, whichever occurred last."

In other words, the Iraqi Dinar can be bought and sold as a "registered security" close to the end of May.

This article is a continuation of the first one printed today. I just simply wanted to be clear about a particular point that is of interest to all of us who hold the Iraqi Dinar.

It does not mean that we are going to exchange any foreign currencies at the end of this month, especially the Iraqi Dinar, but it will become possible. Achievable - Finra-Series SEC Archives

© Goldilocks

~~~~~~~~~

Freedom Fighter Breaks Down Goldilocks Posts today with Q & A

Freedom Figjter breaksw down Goldilocks Posts from today 5.9.24.mp3

LISTEN HERE:

The world’s economic order is breaking down | Economist

~~~~~~~~~

How is Currency Valued - Overview, History, Measurement | Corporate Finance Institute

~~~~~~~~~

Central bank business models are being forced to change as the economy digitalizes, Joachim Nagel, Deutsche Bundesbank governor, said on May 6.

“If you would have asked me 20 years ago, is the central bank model destroyable?” Nagel told the Bank for International Settlements (BIS) Innovation Summit in Basel, “I would have said no.” But, now: “I’m not so sure anymore.” Central Banking

~~~~~~~~~

Best states for taxes | Fidelity

~~~~~~~~~

Lloyds collaborates with Red Hat on InnerSource engineering programme | Finextra

~~~~~~~~~

Mastercard, Citi, JPMorgan Test Ledger for Settling Bank Money | Bloomberg Law

~~~~~~~~~

SEC Labels Upcoming Ripple Stablecoin Unregistered Crypto Asset | The Crypto Basic

~~~~~~~~~

A/B Exchange Offer Definition | Law Insider

An A/B exchange offer involves the exchange of unregistered, privately placed securities for SEC-registered securities. The original restricted securities, which are typically debt securities, would likely have been issued to holders in a private placement transaction. 1 day ago

~~~~~~~~~

Silver Price Analysis: Silver is now probably in an uptrend | FXStreet

Silver price has probably reversed its short-term downtrend and begun a new uptrend.

It has broken above the May 7 highs – a key sign the short-term trend has reversed.

The possibility now exists for the precious metal to rise back up towards the $30.00 mark.

~~~~~~~~~

IBM Expands its Software Availability to 92 Countries in AWS Marketplace | DQ

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday Evening 5-8-24

Goldilocks' Comments and Global Economic News Wednesday Evening 5-8-24

Good Evening Dinar Recaps,

A Regulated Settlement Network | LedgerInsiights

A Regulated Settlement Network is the practical use of tokenized deposits, wholesale Central Bank money, U.S. Treasuries and other tokenized assets.

This project is being done on a shared ledger as part of the Regulated Settlement Network (RSN). "Citi, J.P. Morgan, Mastercard, Swift, TD Bank N.A., U.S. Bank, USDF, Wells Fargo, Visa, and Zions Bancorp are participating in this pilot program."

The goal is to test payment settlements on a common regulated network. It is to witness the efficiency of coordinating existing laws through the use of simulating USD delivery versus payment transactions.

The Federal Reserve Bank of New York will be assessing this DLT Digital Ledger Technology System for incorporation inside the new digital economy. © Goldilocks

~~~~~~~~~

Goldilocks' Comments and Global Economic News Wednesday Evening 5-8-24

Good Evening Dinar Recaps,

A Regulated Settlement Network |

A Regulated Settlement Network is the practical use of tokenized deposits, wholesale Central Bank money, U.S. Treasuries and other tokenized assets.

This project is being done on a shared ledger as part of the Regulated Settlement Network (RSN).

"Citi, J.P. Morgan, Mastercard, Swift, TD Bank N.A., U.S. Bank, USDF, Wells Fargo, Visa, and Zions Bancorp are participating in this pilot program."

The goal is to test payment settlements on a common regulated network. It is to witness the efficiency of coordinating existing laws through the use of simulating USD delivery versus payment transactions.

The Federal Reserve Bank of New York will be assessing this DLT Digital Ledger Technology System for incorporation inside the new digital economy. Ledgerinsights

© Goldilocks

~~~~~~~~~

👆I do believe our new tokenized asset regulations through MICA and new Stablecoins will fit well inside the new regulated payment system above.

© Goldilocks

~~~~~~~~~

Capital gains tax rates under Joe Biden's plan: Twitter

Georgia - 50.09%

Iowa - 50.3%

Kansas - 50.3%

Idaho - 50.4%

Nebraska - 50.44%

Maine - 51.75%

Oregon - 54.5%

Minnesota - 55.45%

New York - 55.5%

New Jersey - 55.5%

California - 57.9%

~~~~~~~~~

Big money has already moved in and bought gold - Brien Lundin says investors aren't waiting | Youtube

~~~~~~~~~

Ripple Vs. SEC: Sealed Remedies Reply Filed, What's Next? | Bitcoinist

~~~~~~~~~

BRICS is planning to establish its own central bank to issue a new common currency.

Russia’s Deputy Foreign Minister, Sergei Ryabkov, emphasized that creating a central bank is crucial for the currency’s launch.

The project has faced challenges and complexities, especially after BRICS doubled in size. Cryptopolitan

~~~~~~~~~

Geopolitics and Its Impact on Global Trade and the Dollar - Gita Gopinath | Youtube

~~~~~~~~~

The Global Solar Power Boom Is Driving a Surge in Silver Demand - WSJ

~~~~~~~~~

BRICS Brace for Potential International Monetary System Collapse | CoinTribune

~~~~~~~~~

IQD 60-Second Iraqi News Update 5/8/24 #iraq #iqd Rate | Youtube

~~~~~~~~~

CFTC Chair Predicts Tsunami Of Crypto Enforcement Actions In Next 2 Years | Bitcoinist

The CFTC Chair acknowledges the challenges of getting legislation passed but notes the momentum and desire from lawmakers to close regulatory gaps, particularly in stablecoin legislation.

~~~~~~~~~

Is Ripple's XRP the Key to BRICS' New Monetary Project to Finally Ditch the US Dollar in 2024? | Crypto News Flash

Following the confirmation that the BRICS alliance is developing a stablecoin, the community is speculating that Ripple’s XRP could be leveraged. Russian Minister of Foreign Affairs confirmed that the alliance will launch a stablecoin to facilitate international transfers.

With its reputation for instant cross-border payments, Ripple could be a major player if the BRICS countries move forward with their de-dollarization stablecoin project, as hinted at by Sergei Ryabkov’s announcement.

~~~~~~~~~

Will Central Bank Digital Currencies Undermine Gold's Value? | Oil Price

CBDCs pose a threat to gold's traditional role as a store of value and hedge against inflation due to their potential for increased centralization and control over individual finances.

As CBDCs are rolled out and cash is phased out, gold and silver may emerge as the primary means of transacting outside the centralized digital currency system, leading to a potential surge in their value.

Legislators are divided on the issue, with some recognizing the threat posed by CBDCs and advocating for the protection of precious metals holders, while others believe CBDCs may become inevitable despite concerns about individual freedoms and financial privacy.

~~~~~~~~~

Currently, we have regulations taking place for Stablecoins, Tokenized Assets, and a Regulated Settlement System.

Think of this as paying for assets to go into your portfolio (Tokenized Assets) inside of a Banking System capable of making transactions (Settlement System) for you with the Dollar (soon to be XRP Stablecoin).

The entire QFS is now currently going through the Regulation process as we speak.

© Goldilocks

~~~~~~~~~

The worst thing we could do if stablecoins are being misused around the world is to step away and not regulate them," says @SenLummis, who together with @SenGillibrand | Twitter

~~~~~~~~~

👀 This is Yuge!

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

The US Dollar Is So Strong That China's Central Bank, Among Others, Just Keeps Loading Up On Gold

The US Dollar Is So Strong That China's Central Bank, Among Others, Just Keeps Loading Up On Gold

Huileng Tan Wed, May 8, 2024,

China's economy is struggling, leading to a surge in gold purchases as a safe-haven asset.

Central banks are on a gold-buying spree, contributing to record-high spot gold prices.

Other central banks are also snapping up gold to diversify their assets on the back of a strong greenback.

China's economy is in a funk and people are rushing out to buy gold as a safe-haven asset to hedge against economic uncertainties, sending prices of the precious metal to record highs.

The country's central bank has also gotten into the act, adding 60,000 troy ounces of gold to its stash in April, according to official data released on Tuesday. It marked the 18th straight month the People's Bank of China was piling in on gold.

But it's not just about economic uncertainty. The heightened interest in gold is also a pushback to the strong US dollar, which is making it too expensive for emerging nations like China to import goods.

The US Dollar Is So Strong That China's Central Bank, Among Others, Just Keeps Loading Up On Gold

Huileng Tan Wed, May 8, 2024,

China's economy is struggling, leading to a surge in gold purchases as a safe-haven asset.

Central banks are on a gold-buying spree, contributing to record-high spot gold prices.

Other central banks are also snapping up gold to diversify their assets on the back of a strong greenback.

China's economy is in a funk and people are rushing out to buy gold as a safe-haven asset to hedge against economic uncertainties, sending prices of the precious metal to record highs.

The country's central bank has also gotten into the act, adding 60,000 troy ounces of gold to its stash in April, according to official data released on Tuesday. It marked the 18th straight month the People's Bank of China was piling in on gold.

But it's not just about economic uncertainty. The heightened interest in gold is also a pushback to the strong US dollar, which is making it too expensive for emerging nations like China to import goods.

The Dollar Index — which measures the value of the green against a basket of six other currencies — has risen 4% this year and 10% since the start of 2022. This is due to the Federal Reserve's interest-rate hikes since March 2022, which tend to strengthen the dollar.

The Chinese yuan has lost 1.6% against the dollar this year to date. It's down 4% over the past 12 months and about 12% lower against the greenback since the start of 2022.

Other central banks are also loading up on gold. Big gold buyers include China, Turkey, and India, the World Gold Council, or WGC, wrote in a report last week.

"Accounting for almost a quarter of annual gold demand in both those years, many have attributed central banks' ongoing voracious appetite for gold as a key driver of its recent performance in the face of seemingly challenging conditions: namely, higher yields and US dollar strength," wrote the council.

In all, the world's central banks bought 290 tons of gold in the first quarter of this year — the strongest start to any year on record, per the WGC.

Central banks are not done buying gold

Even though central banks have bought a whole lot of gold since 2022, they may not be done yet, said the WGC.

"Not only is the long-standing trend in central bank gold buying firmly intact, it also continues to be dominated by banks from emerging markets," the WGC added.

To Read More:

https://finance.yahoo.com/news/us-dollar-strong-chinas-central-173902306.html

Goldilocks' Comments and Global Economic News Tuesday Evening 5-7-24

Goldilocks' Comments and Global Economic News Tuesday Evening 5-7-24

Good Evening Dinar Recaps,

For the last three and a half years, we have been talking about the new digital economy. We have talked about legislative bills and infrastructure Networks being built to support the new digital banking system.

Currently, we are witnessing several legislative bills moving through Congress today. And, we are witnessing regulations this month formulate new guidelines for this new digital economy.

Earlier this year, we witnessed Protocol 20 begin the process of expansion of networks connecting to each other inside Quantum Technological Protocols.

Payment systems will begin emerging onto the scene as each of these new tokenized assets is currently in the regulation process along with discussions in Congress to push them forward.

At this point, credit valuation adjustments will begin to occur inside the new digital asset-based trading system. The time for price discovery through the movement of supply and demand is about to make itself known.

© Goldilocks

~~~~~~~~~

Goldilocks' Comments and Global Economic News Tuesday Evening 5-7-24

Good Evening Dinar Recaps,

For the last three and a half years, we have been talking about the new digital economy. We have talked about legislative bills and infrastructure Networks being built to support the new digital banking system.

Currently, we are witnessing several legislative bills moving through Congress today. And, we are witnessing regulations this month formulate new guidelines for this new digital economy.

Earlier this year, we witnessed Protocol 20 begin the process of expansion of networks connecting to each other inside Quantum Technological Protocols.

Payment systems will begin emerging onto the scene as each of these new tokenized assets is currently in the regulation process along with discussions in Congress to push them forward.

At this point, credit valuation adjustments will begin to occur inside the new digital asset-based trading system. The time for price discovery through the movement of supply and demand is about to make itself known.

© Goldilocks

~~~~~~~~~

HEARING

Hearing Entitled: SEC Enforcement: Balancing Deterrence with Due Process | Youtube

Tuesday, May 7, 2024 10:00 AM in 2128 Rayburn House Office Building

Capital Markets Subcommittee

Click here to view the Committee Memorandum.

Click here to view the LIVESTREAM of this hearing.

Witnesses

Mr. Andrew Vollmer, Senior Affiliated Scholar at the Mercatus Center and former SEC Deputy General Counsel

Mr. Nick Morgan, President and Founder, Investor Choice Advocates Network

Professor Paul Eckert, Professor of the Practice of Law, College of William & Mary Law School

Mr. John Reed Stark, President, John Reed Stark Consulting Legislation

H.R. 6695, the "Due Process Restoration Act of 2023, to authorize private parties to compel the Securities and Exchange Commission to seek sanctions by filing civil actions, and for other purposes"

H.R. ____, to clarify what constitutes a violation of the federal securities laws for purposes of determining penalty amounts

H.R. ____, to clarify the Securities and Exchange Act of 1934 with respect to civil money penalties and the authority to seek disgorgement

H.R. ____, to repeal the policy of the Securities and Exchange Commission set forth in 17 C.F.R. § 202.5(e)

H.R. ____, to clarify that, like with actions brought under the Securities Exchange Act of 1934, certain actions filed under the Securities Act of 1933 are required to be heard in federal court

H.R. ____ to codify the process to obtain waivers from certain disqualifications under the federal securities laws

H.J.Res. ____ , providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Reporting of Securities Loans”

H.J.Res. ____, providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Short Position and Short Activity Reporting by Institutional Investment Managers”

H.J.Res. ____, providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Further Definition of ‘As a Part of a Regular Business’ in the Definition of Dealer and Government Securities Dealer in Connection With Certain Liquidity Providers”

H J Res. ____ , providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Form PF; Reporting Requirements for All Filers and Large Hedge Fund Advisers”

--------------------

Take a look at this long list of legislative bills that are getting ready to be run through Congress today.

Each in some way deals with all the legislative bills we've been talking about on this channel regarding large hedge funds accounts, Exchange Act procedures, and more.

© Goldilocks

~~~~~~~~~

Central banks must revise business model, embrace CBDCs — ECB member | CoinTelegraph

~~~~~~~~~

RAISE-1 AI Robot Demos 49 Axes Humanoid Using This New Tech (“AGI-BOT” ANDROID, EL BRAIN) | Youtube

~~~~~~~~~

The following keeps you from having to open multiple accounts up to the $250,000 limit FDIC insures.

Here is a way to protect your accounts beyond the normal FDIC caps of coverage.

Look at the following site and see what you think…LINK

If you look at their “participating banks” list, all the major players are there - WF, BofA, Chase, etc...

You can break down a list of participating banks in your state.

Your bank may just already have this available to you, check your state and bank.

Again, you don't know what you don't know.

Building relationships is key when managing wealth.

Always be in learning mode to new opportunities when talking to those in this arena. IntraFi

*Hint - Listen, Check, Validate and Act.

~~~~~~~~~

{Economic: Al-Furat News} The Ministry of Commerce announced the holding of the meetings of the third session of the Trade and Investment Framework Agreement between Iraq and the United States of America in Washington, D.C., after a break of more than nine years, headed by the Iraqi side, the economic agent Ghassan Farhan Hamid, and from the American side, the Office of Trade Representation.

The Economic Agent for Trade said in a statement to the Ministry that received a copy of it {Euphrat News} that “the meeting discussed many axes, the most important of which are the agricultural sector, standardization, qualitative control, financial system, customs, company registration, intellectual property rights, Iraq’s accession to the World Trade Organization, the health sector and government contracts.”

He pointed out “the confirmation during the meetings that the Iraqi government is open to all parties and that economic reform and diversifying the economy are among the priorities to be worked on, and that Iraq is ready to discuss any proposal that leads to strengthening relations between the two countries.” Search4Dinar

WATCH THE WATER

~~~~~~~~~

Why Are Central Banks Buying So Much #Gold? | Youtube

~~~~~~~~~

Learn about the Federal Reserve Bank of New York's gold vault | NewYorkFed

~~~~~~~~~

Stellar Development Foundation Q1 2024 Report: Initiatives and Achievements Propel Growth | Crypto News

By Zoran Spirkovski

As 2024 unfolds, the Stellar Development Foundation (SDF) has released a comprehensive report detailing its accomplishments in the first quarter. The period was marked by significant milestones, including the launch of smart contracts on the network and a remarkable growth in asset value, reflecting Stellar’s increasing influence in the blockchain sector.

The year began with Stellar implementing smart contracts through its new platform, Soroban. This move is poised to revolutionize Stellar’s ecosystem by enhancing functionality and developer engagement. Moreover, the total value of real-world assets held on Stellar reached an impressive $533 million, underpinned by a substantial $1.6 billion in total payments volume processed this quarter. Stellar continues to offer extremely low transaction costs, averaging $0.000065, maintaining its position as a leader in cost efficiency.

Smart Contracts on Stellar: The Soroban Era

Soroban represents a significant leap forward for Stellar, providing a robust, Rust-based environment tailored for developing scalable and sensible smart contracts. This platform not only advances Stellar’s technological framework but also significantly expands its utility and appeal to developers.

The surge to $533 million in assets highlights Stellar’s growing role in financial services, especially through the tokenization of assets. This process enhances liquidity and market efficiency, presenting new opportunities for investment and asset management within the financial sector.

SDF’s efforts have been pivotal in enhancing financial inclusion, with a particular focus on facilitating access to financial services globally. The forthcoming Meridian 2024 conference, scheduled for October 15-17 in London, is set to celebrate these achievements and unveil future initiatives.

In its quest for global expansion and improved security, SDF has been actively engaging with the global community and strengthening its technological stack. A notable initiative is the Soroban Audit Bank (https://stellar.org/blog/developers/the-soroban-audit-bank-fostering-a-secure-smart-contract-ecosystem), which supports security audits for projects on Stellar, ensuring that Stellar remains a secure and reliable platform for all users.

Why It Matters: Stellar’s Strategic Vision

Stellar’s strategic initiatives are shaping a financial landscape that is more inclusive, efficient, and secure. The deployment of smart contracts and the expansion of asset tokenization are just examples of how Stellar is unlocking the potential of blockchain technology to foster a more connected and accessible financial world.

In conclusion, Stellar Development Foundation’s first quarter of 2024 has set a robust pace for the year. With smart contracts live and assets growing, Stellar is poised to further its mission of transforming the global financial landscape, making it more inclusive and efficient through blockchain technology.

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps