Goldilocks' Comments and Global Economic News Friday AM 3-8-24

Goldilocks' Comments and Global Economic News Friday AM 3-8-24

Good morning Dinar Recaps,

Starting today, China no longer trades the Yuan with the Dollar. Hong Kong launches their wholesale CBDC project to support digital tokenization and tokenized deposits. And, Hong Kong is advancing a privacy digital currency with Project Aurum 2.0.

As one door closes, another door opens. Hong Kong has a market capitalization of over 30 trillion dollars. While the United States has over 46 trillion dollars in market capitalization, the move to make trades in local currencies on a level playing field utilizing a gold standard protocol inside a digital economy backed by gold will go a long way in bringing more monetary value to the Eastern half of our world.

Goldilocks' Comments and Global Economic News Friday AM 3-8-24

Good morning Dinar Recaps,

Starting today, China no longer trades the Yuan with the Dollar. Hong Kong launches their wholesale CBDC project to support digital tokenization and tokenized deposits. And, Hong Kong is advancing a privacy digital currency with Project Aurum 2.0.

As one door closes, another door opens. Hong Kong has a market capitalization of over 30 trillion dollars. While the United States has over 46 trillion dollars in market capitalization, the move to make trades in local currencies on a level playing field utilizing a gold standard protocol inside a digital economy backed by gold will go a long way in bringing more monetary value to the Eastern half of our world.

Mainland China is Hong Kong's largest trading partner. The newly launched “HKD-RMB Dual Counter Model” will see an initial 24 companies start offering Yuan counters. This will allow investors in Hong Kong to trade in the Yuan.

The line in the sand has been drawn, and today, we are about to witness countries begin to cross them.

© Goldilocks

Digital Pound Foundation

Adleman.USC Edu

Ledger Insights

HKEX

CNBC

Investopedia

~~~~~~~~~~

What Happens To Gold If China Backs The Yuan With It? (GLD). The simple answer is that it will rise.

Our new digital economy backed by commodities through tokenized assets is giving countries like China and opportunity to forge new pathways into countries like Hong Kong never seen before in history.

New Hopes and New Visions in the trading world is creating an entrepreneurial spirit. The realization that new paths can be formed through a new digital economy is inspiring new moves in Global Trade not seen before.

Digital Gold is the bridge into these new bilateral relationships countries are beginning to form on the Eastern half of our world. Markets BusinessInsider Finance Yahoo

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

Update:

We have an update on Stellar Soroban Phase 2 test. It is complete.

Protocol 20 is about to move into high gear at this point.

* Upgrade on Pubnet March 12th

* Validator vote March 19th

* If all goes well, everything will move to public use

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps - www.DinarRecaps.com

Goldilocks' Comments and Global Economic News Thursday Evening 3-7-24

Goldilocks' Comments and Global Economic News Thursday Evening 3-7-24

Good Evening Dinar Recaps,

Our Global Economy is in process of redefining and recalculating currency values. Specifically, we are undergoing pilot programs to determine regulations on the use and the amount needed to level the playing field in trade among countries.

These are measured in units of account in the banking world. Each unit of account currently has a digital value and a commodity value inside what we are currently calling a tokenized asset going forward.

These new pending prices are what many are calling a Global Currency Reset. This is why new laws have been coming into effect on our new digital economy the last two and almost a half years to solidify real values going forward.

Goldilocks' Comments and Global Economic News Thursday Evening 3-7-24

Good Evening Dinar Recaps,

Our Global Economy is in process of redefining and recalculating currency values. Specifically, we are undergoing pilot programs to determine regulations on the use and the amount needed to level the playing field in trade among countries.

These are measured in units of account in the banking world. Each unit of account currently has a digital value and a commodity value inside what we are currently calling a tokenized asset going forward.

These new pending prices are what many are calling a Global Currency Reset. This is why new laws have been coming into effect on our new digital economy the last two and almost a half years to solidify real values going forward.

Real values are necessary for the new Quantum Financial System to calculate with precision and speeds we have never seen before in history, and not, artificial values controlled and determined by a single country.

This is the year to determine these new values going forward that will affect our Global Economy for generations to come. Finance Magnates

© Goldilocks

~~~~~~~~~~

In the future, you will hold "units of account" for the currencies you hold or one single currency. Each of these units of account (currency) will be instilled with values that come from a digital asset.

Are you beginning to see how power will be given back to the people? You will literally be holding a real asset in your hand(s) going forward. You will own gold, and gold belongs to the people.

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

The dollar is transitioning into a secular Bear Market. Let's watch what happens to Gold.

~~~~~~~~~~

"WHY ASSET AND LIABILITY MANAGEMENT SHOULD BE THE NERVE CENTER OF MODERN BANKS"

Current restrictions in credit is beginning to affect Banking liquidity opportunities that creates even less money to the banking system.

Many small Banks are vacant and creating more and more stress on the commercial real estate market. Banks are consolidating, and some are going out of business.

As Banks transition from a client-centered operation to a trading centered operation, it will be a profitable movement of the new digital economy that will bring in more liquidity going forward.

Asset and liability management are quickly becoming the new roles of the banking system.

Asset Management is the acquiring, trading, and maintaining of assets inside a Bank that has potential growth.

Yes, the new digital economy is digitally based and maintained in and through the banking system. Clients will be seen as investors holding assets of potential growth such as digital assets backed by gold and other commodities.

These assets will grow over time and be encouraged to solidify their growth potential through portfolios run by AI and other means.

The world of banking, and the lifestyle shift of our new GLOBAL ECONOMY is and will change the way we live. International Banker

© Goldilocks

~~~~~~~~~~

President Putin's Advisor Announcement:

"Russian President Vladimir Putin’s advisor on foreign policy issues said, ‘Work will continue to develop the Contingent Reserve Arrangement, primarily regarding the use of currencies different from the US dollar’"

The BRICS Nations are in process of creating an independent payment system based on digital technologies & blockchain.

Their intentions are to create a trading coin backed by gold. Remember, 70% of (digital) trade is done on the water from country to country. It will provide more strength to currencies who have been utilizing the dollar instead of their own countries' currencies going forward.

This will significantly shift the role of the dollar, as well as, empower Eastern countries gaining strength in their local currencies through these measures. First Post

Watch the water.

© Goldilocks

~~~~~~~~~~

China is withdrawing from the US Stock Market by way of US dollar to Yuan trades on Forex. The Yuan will no longer be able to buy US Dollars on Forex.

If you look closely, the Depository Trust Company will be closing these trades on March the 8th, 2024.

Are they about to back their currency by gold? If not, will their gold token become more accessible in the world of trade? Either way, you can expect a major shift like this to have a backup plan.

© Goldilocks

~~~~~~~~~~

~~~~~~~~~~

Essential to keeping the market liquid, broker-dealers can be firms, banks or individual people. And as you may be able to guess from the hyphenated name, they serve two distinct roles.

What Is a Broker-Dealer, and What Do They Do? - SmartAsset

~~~~~~~~~~

XRP Escrow: Foundation for XRP’s Transition to Global Reserve Currency, Experts Say | Crypto News Flash

~~~~~~~~~~

Instant Payments Regulation Announcement:

The Council of the European Union has, on the 26th of February of this year, adopted a regulation aimed at promoting instant payments within the European Union (EU), in accordance with the Union’s initiative to foster a capital markets union. The Instant Payments Regulation will allow individuals to transfer funds to another EU member state as well as within the same country in just 10 seconds, at any time of day. https://gvzh.mt/insights/new-regulation-on-instant-payments-adopted/

~~~~~~~~~~

In November 2000, the SEC adopted Exchange Act Rule 11Ac1-5. Rule 11Ac1-5 is aimed at improving public disclosure of order execution quality.

New SEC Rule 605 (formerly 11Ac1-5) requires FINRA to make available certain order execution information, facilitating the uniform public disclosure of order execution information by all market centers. SEC FINRA

~~~~~~~~~~

European Central Bank Holds Interest Rates Steady...Ira’s Morning Flash Video for 3 7 2024 | YouTube

~~~~~~~~~~

Arizona Senate considers Bitcoin and other digital asset ETFs for state pension investment | Crypto Briefing

~~~~~~~~~~

President Biden will address a Joint Session of Congress at the United States Capitol on Thursday, March 7, 2024 at 9 PM ET. | Whitehouse

~~~~~~~~~~

Qatar Central Bank is set to launch its new instant payment service this month as part of its Third Financial Sector strategy. | Fintech Futures

~~~~~~~~~~

Repost Reminder:

Take a look at the top listing on Credit Bank of Iraq bank rate inside Iraq. It is important to note that the US dollar conversion rate still remains the same, but it is listed as a currency that can be exchanged with the dinar.

Scroll all the way to the far right of the dinar listing at Credit Bank of Iraq, and you will find that one US dollar still buys 1,300 dinar.

You might want to save this page with the below article link to refer back to when checking currency rates inside Iraq. Credit Bank of Iraq

© Goldilocks

👆No changes yet.

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday Evening 3-6-24

Goldilocks' Comments and Global Economic News Wednesday Evening 3-6-24

Good evening Dinar Recaps,

Today, the Global Markets Advisory Committee Meeting subcommittee of the CFTC is meeting to make 3 recommendations for the markets going forward:

* The first-ever digital asset taxonomy. It is designed to promote regulatory clarity and international alignment.

* Basel 3 end game proposal.

* Transition to T+1 securities settlement and Treasury ETFs.

The role of this committee is to take a look at the legislative process and make recommendations for a bill to move it forward in Congress. Although committees only have the authority to advise, their recommendations go a long way in determining the contents of what goes on a legislative bill.

These three proposals are already in process. This committee is designed to focus attention on the details of what has already been introduced to Congress. These recommendations will provide more clarity for Congress to understand and work with current legislative bills already on the table.

The Financial Stability Board will be present at this meeting along with other prominent Global Financial Advisors. A vote will be taken today to move these legislative bills forward. CFTC

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Wednesday Evening 3-6-24

Good evening Dinar Recaps,

Today, the Global Markets Advisory Committee Meeting subcommittee of the CFTC is meeting to make 3 recommendations for the markets going forward:

* The first-ever digital asset taxonomy. It is designed to promote regulatory clarity and international alignment.

* Basel 3 end game proposal.

* Transition to T+1 securities settlement and Treasury ETFs.

The role of this committee is to take a look at the legislative process and make recommendations for a bill to move it forward in Congress. Although committees only have the authority to advise, their recommendations go a long way in determining the contents of what goes on a legislative bill.

These three proposals are already in process. This committee is designed to focus attention on the details of what has already been introduced to Congress. These recommendations will provide more clarity for Congress to understand and work with current legislative bills already on the table.

The Financial Stability Board will be present at this meeting along with other prominent Global Financial Advisors. A vote will be taken today to move these legislative bills forward. CFTC

© Goldilocks

~~~~~~~~~~

Take a look at the top listing on Citibank bank rate inside Iraq. It is important to note that the US dollar conversion rate still remains the same, but it is listed as a currency that can be exchanged with the dinar.

Scroll all the way to the far right of the dinar listing at Citibank, and you will find that one US dollar still buys 1,300 dinar.

You might want to save this page to look at currency rates inside Iraq along with cbi.iq. Credit Bank of Iraq

© Goldilocks

~~~~~~~~~~

Gold prices hit a record high. There’s a gold rush on Wall Street | CNN Business

~~~~~~~~~~

In simple terms, a unit of account is defined as a standard unit of measurement of market/economic value for an asset, goods, services, and other transactions. https://3commas.io/blog/unit-of-account

~~~~~~~~~~

Our Global Economy is in process of redefining and recalculating currency values. Specifically, we are undergoing pilot programs to determine regulations on the use and the amount needed to level the playing field in trade among countries.

These are measured in units of account in the banking world. Each unit of account currently has a digital value and a commodity value inside what we are currently calling a tokenized asset going forward.

These new pending prices are what many are calling a Global Currency Reset. This is why new laws have been coming into effect on our new digital economy the last two and almost a half years to solidify real values going forward.

Real values are necessary for the new Quantum Financial System to calculate with precision and speeds we have never seen before in history, and not, artificial values controlled and determined by a single country.

This is the year to determine these new values going forward that will affect our Global Economy for generations to come. Finance Magnates

© Goldilocks

~~~~~~~~~~

The Stellar Development Foundation (SDF) recently submitted a letter in response to a Request for Information on Financial Inclusion (RFI) issued by the U.S. Department of the Treasury (Treasury).

This response blends our work on financial access with our continued efforts to advocate for open systems. By combining these two focus areas, SDF aims to inform Treasury’s development of a national strategy for financial inclusion from a technological perspective – emphasizing that tools to further financial access and inclusion can benefit from open-source and transparent technology.

In our response, we address two key points: the importance of access when defining financial inclusion and how to leverage technology to advance financial inclusion efforts.

SDF defines access as a core tenet for the advancement of financial inclusion. Access to formal financial systems, such as bank accounts, is crucial for individuals, households, and small businesses to participate in the increasingly digital economy and unlock advanced services like savings and lending.

We propose that consumers should have access to free or low-cost products that support everyday financial transactions in today’s cashless economy. Services that leverage digital wallets and blockchain technology can address traditional barriers like minimum account balances and account fees that preclude participation in the formal economy.

As a public and freely accessible blockchain, the Stellar network provides a rich environment and set of technical tools for such everyday financial services. Stellar

👆 The Stellar Development Foundation is a Committee member of the Global Markets Advisory Committee Meeting subcommittee.

~~~~~~~~~~

A China-Russia geopolitical alignment was long the Kremlin’s dream

The war in Ukraine has brought the two autocratic powers much closer

The axis is emerging just as the West is preoccupied with domestic issues GIS Reports Online

~~~~~~~~~~

The United Arab Emirates demonstrated its commitment to financial sector innovation last week when it undertook the first cross-border transfer of its central bank digital currency (CBDC), the digital dirham.

On January 29, the chairman of the UAE Central Bank sent 50 million digital dirhams - the equivalent of approximately $13 million - from the UAE to China over mBridge, a platform that allows countries and financial institutions to experiment with using CBDCs for cross-border wholesale payments.

The transfer forms part of the UAE’s efforts on developing a CBDC that can drive the the country’s digital transformation, and is the first in a series of pilot programs the UAE intends to run with CBDCs, with future projects to focus on establishing CBDC bridges with India, and a proof of concept for a CBDCs use in domestic retail and wholesale payments. Jointly these efforts comprise part of the UAE’s CBDC Strategy, which the Central Bank announced in March 2023. Elliptic

~~~~~~~~~~

Fast payments have achieved mass adoption in some jurisdictions but not in others – with adoption likely depending on the design characteristics of different fast payment systems (FPS).

Adoption of fast payments tends to be more widespread when the central bank owns the FPS, when non-banks participate and when the number of use cases and cross-border connections is greater.

These insights can help inform the design and development of FPS and other payment infrastructures.

YouTube

~~~~~~~~~~

Digital Ruble Announcement:

At a meeting of the Association of Banks of Russia, both the central bank governor and deputy governor gave an update on the digital ruble. Trials for the central bank digital currency (CBDC) started in August last year after the passage of legislation. It started with a dozen banks, 600 end users and 30 merchants across 11 cities. The plan is to begin to roll out the CBDC next year.Ledger Insights

~~~~~~~~~~

Nikki Haley gives speech addressing her future in 2024 presidential race – watch live

👆 This speech will give you insight into what is about to happen the rest of this year. It is a short speech. Please listen carefully.

She talks about the transition of our economy in October, Term limits for politicians, a smaller Government, and more...

~~~~~~~~~~

Take a look at the top listing on Citibank bank rate inside Iraq. It is important to note that the US dollar conversion rate still remains the same, but it is listed as a currency that can be exchanged with the dinar.

Scroll all the way to the far right of the dinar listing at Citibank, and you will find that one US dollar still buys 1,300 dinar. Credit Bank of Iraq

© Goldilocks

👆 You might want to save this page to look at currency rates inside Iraq along with CBI.iq.

~~~~~~~~~~

What have we learned the last few days about the Iraqi Dinar?

Yes, a rate has been on the back screen for years, but it is not tradable until it goes to the front screen for you and me.

~~~~~~~~~~

In simple terms, a unit of account is defined as a standard unit of measurement of market/economic value for an asset, goods, services, and other transactions.

https://3commas.io/blog/unit-of-account

~~~~~~~~~~

In the future, you will hold "units of account" for the currencies you hold or one single currency. Each of these units of account (currency) will be instilled with values that come from a digital asset.

Are you beginning to see how power will be given back to the people? You will literally be holding a real asset in your hand(s) going forward. You will own gold, and gold belongs to the people.

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

UK regulations will allow stablecoins and CBDCs to coexist, says former BoE fintech lead

United Kingdom policymakers are adopting a coordinated approach to establish regulations allowing cryptocurrencies, stablecoins and CBDCs to coexist. CoinTelegraph

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Tuesday PM 3-5-2024

TNT:

CandyKisses: Joint with Iraq. Iran looks to create trade zone for access to the Mediterranean Sea

Haidar Hisham

The Secretary of the Supreme Council of Iran's Supreme Council of Commercial, Industrial and Special Economic Free Zones revealed that he negotiated with 21 countries to establish a joint free zone and reach a conclusion with five countries, including Syria and Iraq.

According to the official IRNA news agency, Hojatullah Abdul Maliki confirmed that Iran seeks to establish a joint free zone with other countries, but also seeks to establish a tripartite joint free zone by negotiating with Iraq and Syria.

He stressed: Through the establishment of a tripartite free zone between Iran, Syria and Iraq, we will witness a great investment leap as we follow this issue.

TNT:

CandyKisses: Joint with Iraq. Iran looks to create trade zone for access to the Mediterranean Sea

Haidar Hisham

The Secretary of the Supreme Council of Iran's Supreme Council of Commercial, Industrial and Special Economic Free Zones revealed that he negotiated with 21 countries to establish a joint free zone and reach a conclusion with five countries, including Syria and Iraq.

According to the official IRNA news agency, Hojatullah Abdul Maliki confirmed that Iran seeks to establish a joint free zone with other countries, but also seeks to establish a tripartite joint free zone by negotiating with Iraq and Syria.

He stressed: Through the establishment of a tripartite free zone between Iran, Syria and Iraq, we will witness a great investment leap as we follow this issue.

Abdul Malki pointed out that Iran is currently negotiating with 21 countries to establish a joint free zone, saying: "We have so far reached the stage of signing a document with five countries, which is either in the form of a memorandum of understanding or including the text of the approvals of the Joint Commission."

He added: "We have spoken with Iraq and Syria for the establishment of a joint free zone, and the negotiating parties have expressed their agreement in this regard, and we are waiting for a tripartite meeting.

The secretary of the Supreme Council of Iran's Supreme Council of Trade, Industrial Free and Special Economic Zones added: "The area being considered for this purpose is one of the last parts that got rid of ISIS, but now security has been established and transit is taking place smoothly.

The establishment of a common free zone would benefit the three countries and make Iran's access to the Mediterranean very easy.

************

CandyKissses: Economists urge expanded partnership with Europe

Economy News _ Baghdad

Specialists in economic and financial affairs called for expanding the country's openness to investments with the European side, especially after the exit of European companies from long-term Russian agreements, indicating that the Prime Minister's recent visit to the Netherlands represents a gateway to this openness.

Economist Dr. Mustafa Hantoush said in an interview with "Al-Sabah" followed by "Economy News", that there is a real opportunity for Iraq to partner with Europe, especially since the latter had long partnerships with Russia and Ukraine in the field of energy.

He pointed out that Europe is currently isolated due to recent events, noting that it is possible to exploit this partnership as an oil country and cooperate with European companies, especially as they are looking for countries to market their products, including animal products and seeds.

Hantoush pointed out that most countries in Europe are looking for partnerships to market their products, especially with oil countries, and Iraq is one of those countries, as it has huge oil wealth, and the country needs their expertise in the field of livestock and seeds.

For his part, economist Safwan Qusai said that the recent visit of Prime Minister Mohammed Shia al-Sudani to the Netherlands is key to convincing the European investor to partner with Iraq.

He added that the country needs investments from the European side and the exploitation of the Dutch port of Rotten-Dan, which is the largest port in Western Europe and is the gateway to the production of Germany, Britain, Paris and Belgium, and that about 500 million tons of goods are entered through this port annually.

He pointed out that linking the port of Faw with the port of Rotten Down through Turkey, which is a strategic partner for the transport of goods, goods and people, and that the Netherlands for Iraq will be the communication station, and that the European Union has begun looking for the import of alternative goods for gas and oil.

He pointed out that the presence of the Sudanese in the Netherlands is the key to convince the European investor to partner through the giant British insurance companies, pointing to the possibility of transferring part of the German and Italian production lines into Iraq as we have the production capacity.

For his part, Imad al-Fatlawi, who is interested in economic affairs, said that the state's recent directions to develop a roadmap to activate cooperation with the European side represent an important step on the road to economic integration, pointing out that there are intensive efforts to solve problems and challenges in this aspect, especially in the field of construction, industry and even in the aspect of agriculture and livestock.

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man They're going to have a very strong country...Iraq's foreign reserves are huge, historic in history, all-time high and they increased their gold supply another 10 tons. You can see the direction they're going and why they're getting praises...

Frank26 [Iraq boots-on-the-ground report] FIREFLY: Bank friend...in his opinion a new rate that will float. We're going to have gateway from Iraq to European side in trading. It will be amazing...The deletion of the zeros is near...Four different experts of the economy being sent to us by the CBI saying what is needed to be done with the zeros. It's no secret. FRANK: He's 100% correct. I keep telling you it's here.

A SUPER-MELTDOWN WILL OCCUR IN THE DEBT MARKET...AND IT CANNOT BE STOPPED.

Greg Mannarino: 3-5-2024

Andy Schectman: Gold Rallies Again After Clearing $2,100 Level

Arcadia Economics: 3-5-2024

The gold price has continued its rally again today, trading as high as $2,150 during the morning session. And as Andy Schectman of Miles Franklin notes in today's call, this is happening at the same time that interest rates are still elevated.

So in today's show, he talks about the $100 move we've just witnessed in the past 3 days, the reaction in the silver price, and how the physical premiums have responded to the move. To find out more, click to watch the video now!

Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Good evening Dinar Recaps,

Finance ministers discuss BRICS Bridge digital currency payments

"Specifically, the Ministry said, 'We are talking about creating a multilateral digital settlement and payment platform.' However, Sputnik International one of Russia’s English propaganda networks, went further. It said Finance Minister Anton Siluanov was ready to test digital currencies with China, the Eurasian Economic Union (EAEU) and the Gulf countries."

Another news outlet quoted Siluanov as saying, “The first thing to do is to create a connection to the existing central bank digital currency systems that are already operating in a number of countries. In parallel with this, national financial messaging systems need to be connected.”

Here, we have information with specific guidance on what has to be done in Russia and the BRICS system to see their local currencies onboarded to the new QFS. They give us a direct message in the last sentence of the above article.

Here it is again separated from the paragraph, "...national financial messaging systems need to be connected."

Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Good evening Dinar Recaps,

Finance ministers discuss BRICS Bridge digital currency payments

"Specifically, the Ministry said, 'We are talking about creating a multilateral digital settlement and payment platform.' However, Sputnik International one of Russia’s English propaganda networks, went further. It said Finance Minister Anton Siluanov was ready to test digital currencies with China, the Eurasian Economic Union (EAEU) and the Gulf countries."

Another news outlet quoted Siluanov as saying, “The first thing to do is to create a connection to the existing central bank digital currency systems that are already operating in a number of countries. In parallel with this, national financial messaging systems need to be connected.”

Here, we have information with specific guidance on what has to be done in Russia and the BRICS system to see their local currencies onboarded to the new QFS. They give us a direct message in the last sentence of the above article.

Here it is again separated from the paragraph, "...national financial messaging systems need to be connected."

Meanwhile, Russia will be testing their new digital currency this year. Remember, Putin is the chair of the BRICS System this year, and many of the currencies we are looking to revalue have already joined this group. BRICS Nations are formulating a digital gold token for trade, this will change everything.

Do you remember ISO 20022 messaging system? It is still important.

(https://sputnikglobe.com/20240226/russia-ready-to-test-payments-in-digital-currencies-with-china-eaeu---finance-minister-1116982914.html),

Watch the water.

© Goldilocks

Ledger Insights

Federal Reserve

~~~~~~~~~~

Fedwire is a real-time gross settlement system of central bank money used by Federal Reserve banks to transfer funds electronically between member institutions. Banks, businesses, and government agencies use Fedwire for large, same-day transactions. Investopedia

~~~~~~~~~~

When factoring in currency trades, it is the first currency in a currency pair that represents how much currency is needed to purchase a single unit of the corresponding currency beside it. Investopedia

© Goldilocks

~~~~~~~~~~

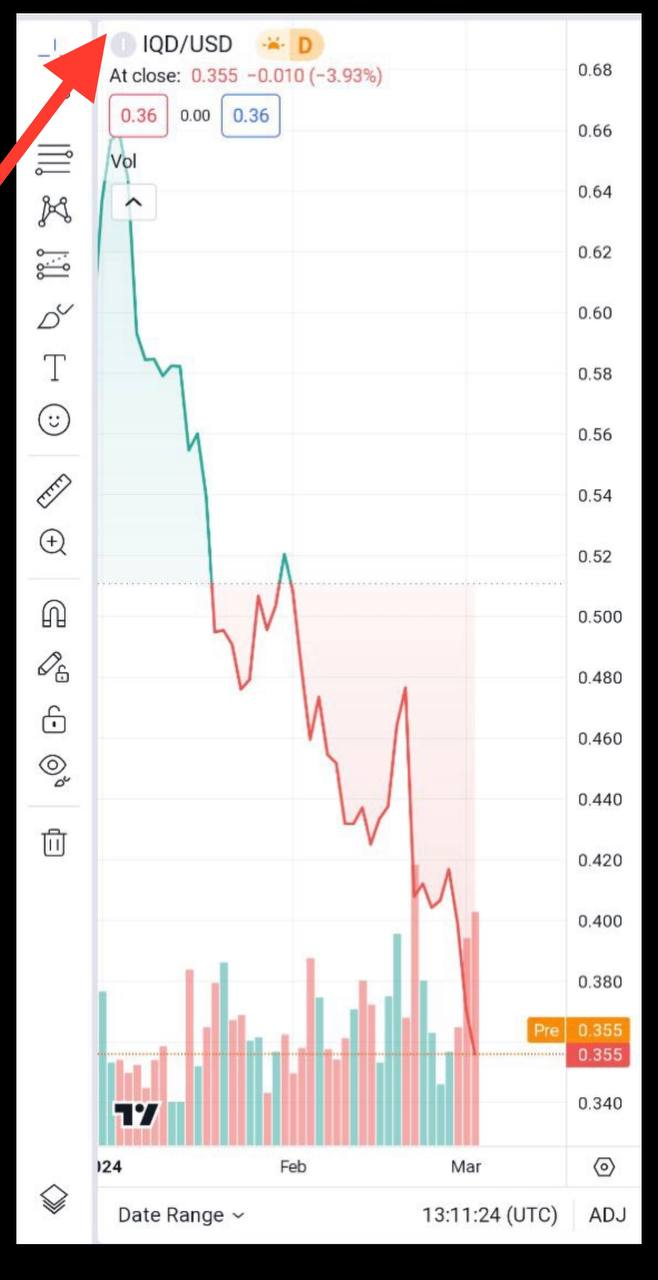

Freedom Fighter ©

A currency pair is the quoting of 2 different currencies, with the currency on the left of the slash

( / ) being exchanged FOR the currency on the right of the slash ( / )

Our exchange will be IQD/USD

AKA we are exchanging

✅DINAR for USD (IQD/USD)

NOT ❌USD for DINAR

(USD / IQD )

Hear Freedom Fighter's Explanation here: https://t.me/c/1545617426/75146

~~~~~~~~~~

Freedom Fighter ©

✅Another example

~~~~~~~~~~

Thank you Freedom Fighter for a wonderful explanation in detail.

~~~~~~~~~~

Iraq confirms it has completed the requirements to join the World Trade Organisation | Zawya News

~~~~~~~~~~

Official: Iraq's accession to the World Trade Organization is imminent | Shafaq

~~~~~~~~~~

RBI Expects Launch Of Interoperable Internet Banking In 2024: Shaktikanta Das | NDTV Profit

~~~~~~~~~~

Analyzing the latest updates and advancements in Stellar (XLM) | CryptoNewsz

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Why Gold Might (Weirdly) Be A Contrarian Investment Right Now

Why Gold Might (Weirdly) Be A Contrarian Investment Right Now

Notes From the Field By Simon Black/James Hickman March 5, 2024

[Important Reminder: (Simon Black) has dropped the pen name and is now writing under his real name, James Hickman.]

It’s hard to say with a straight face that an asset hovering near its all-time high could be a “contrarian” investment. But I’m going to say it anyhow-- I think gold may be a contrarian play right now.

Now, it would be easy to assume that gold is near its all-time high because everyone is buying. And normally that would be true; typically, whenever an asset soars to a record high, it’s because individual investors are piling into the market.

We’ve seen this countless times, from Bitcoin to meme stocks; once something becomes the hot thing to own, small investors-- and occasionally professionally managed funds-- drive the price higher.

But that’s not happening with gold. In fact, investors have been abandoning gold for years.

Why Gold Might (Weirdly) Be A Contrarian Investment Right Now

Notes From the Field By Simon Black/James Hickman March 5, 2024

[Important Reminder: (Simon Black) has dropped the pen name and is now writing under his real name, James Hickman.]

It’s hard to say with a straight face that an asset hovering near its all-time high could be a “contrarian” investment. But I’m going to say it anyhow-- I think gold may be a contrarian play right now.

Now, it would be easy to assume that gold is near its all-time high because everyone is buying. And normally that would be true; typically, whenever an asset soars to a record high, it’s because individual investors are piling into the market.

We’ve seen this countless times, from Bitcoin to meme stocks; once something becomes the hot thing to own, small investors-- and occasionally professionally managed funds-- drive the price higher.

But that’s not happening with gold. In fact, investors have been abandoning gold for years.

Publicly available data from more than 100 gold ETFs (all of which are conveniently aggregated by the World Gold Council) show that western investors have been selling off their gold ETFs for most of the past few years.

WGC data show that North American and European investors dumped over 700 metric tons of gold since May of 2022, equivalent to nearly 20% of ETF holdings.

In fact, outflows for the month of January alone (the most recent month of published data) totaled more than 50 metric tons-- the second highest outflow in a year.

Most notably, however, North American, and European investors dumped 179.6 metric tons of gold September 2023 through January 2024.

This is important, because during that time period, the price of gold surged from $1820 per ounce to nearly $2100.

Strange, right? If investors were selling off substantial quantities of gold, it seems like the price should have fallen. Instead, it rose 15%. How is that possible?

Well, the reason that gold keeps going higher is because, while individual investors are selling, there’s another group that’s buying.

In fact, this group of buyers is completely price insensitive. They don’t care how much they pay per ounce. They are not even looking for a return on investment. And they have mountains of cash to spend.

The group of buyers I’m talking about is central banks and governments.

And not just the usual suspects like China and Russia either (though China did buy more than 200 metric tons in 2023). Others like Poland, India, Singapore, Czech Republic, Philippines… and even Iraq.

To me this is an obvious signal that the global financial system is probably going to change sooner rather than later. And long-time readers know we have been writing about this for years.

Reserve currencies throughout history have always come and gone.

There was a time when the Greek drachma dominated trade and commerce in the Mediterranean (due in large part to the conquests of Alexander the Great). It was displaced by the Roman denarius, then the Byzantine gold solidus, then the Venetian ducat.

Reserve currencies rise to prominence because people have confidence in the issuer, i.e. the Roman Empire, or the Republic of Venice, or the Spanish Empire.

But eventually that confidence wanes-- especially as the empire debases its currency and runs up massive debts.

That’s the situation the United States is in right now.

The national debt is already $34.4 trillion. And the Congressional Budget Office expects it to rise by at least $20 trillion over the next decade.

The dollar became the global reserve currency back in 1944 when there were no other nations to rival the US.

The US was the only country that hadn’t been completely obliterated by war. It boasted the largest, freest, most productive economy. It possessed the best technology and manufacturing capacity. It had the largest pool of savings.

And it also had one of the world’s largest and most rapidly growing populations.

Yet even with such an impressive socioeconomic resume, the rest of the world wasn’t willing to blindly trust the US government with the world’s reserve currency… not without first putting some critical checks and balances in place.

First, while other nations agreed to fix their currencies to the US dollar, the US agreed to fix the dollar to gold at a rate of $35 per troy ounce.

And second, the US government had to guarantee that the dollar would be freely convertible to gold; that way, if any nation ever lost confidence in the Treasury Department or Federal Reserve, they could easily redeem their dollars for gold.

This is a pretty critical point to understand: immediately following World War II, the US was at the peak of its power. Every other developed nation on earth had been devastated by the war. Farms and factories had been destroyed. Chaos and hunger were rampant. Entire governments had been toppled.

Yet even with such a tremendous power imbalance (i.e. the US was in pristine condition compared to Europe), allied nations still weren’t willing to go all-in on the US dollar. And they demanded the gold convertibility as a guarantee.

That was 80 years ago. And it’s safe to say that the US is nowhere near the peak of its geopolitical power anymore. Adversary nations are everywhere, and the US government’s finances are an embarrassing catastrophe.

When I see central banks buying up gold at record high prices, this suggests to me that they are preparing for a new global financial system-- one that is based on gold instead of the US dollar.

After all, this is the most logical scenario.

It would be naive (and deliberately ignorant of history) to believe that the dollar will go on indefinitely as the world’s dominant reserve currency, given the pitiful trend of US government finances. Even the IMF has called for a reset in the global financial system.

It’s also hard to believe that any new financial system would be centered on a Chinese currency; no one trusts the CCP, nor should they.

Gold is the most viable option to replace the dollar as the global reserve currency because it doesn’t require any convincing. Governments and central banks all over the world already own gold, just as they have for thousands of years.

And it’s a lot easier for everyone to have confidence in an asset class that no single nation controls.

Given the trend of their large-scale gold purchases, it appears that foreign governments and central banks may be preparing for this potential new financial system.

I’ve argued before that a gold-based financial system could send prices beyond $10,000 or more.

So, yes, even though gold is near a record high, it’s important to remember that individual investors are selling at a time when central banks are gobbling it up even more quickly.

And it’s possible they’re buying for a very deliberate reason.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Good Evening Dinar Recaps,

I am aware that we have a back screen rate people have been sharing on the dinar indicating movement in the IQD. It is good to know that there is one.

Now, you can stop doubting that this is real.

Keep your eyes on gold, silver, and oil to solar sections of the Debt Clock. These numbers will be the foundation assets to the new economy, and they are numbers we need to see in order to formulate real values across all market sectors.

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Good Evening Dinar Recaps,

I am aware that we have a back screen rate people have been sharing on the dinar indicating movement in the IQD. It is good to know that there is one.

Now, you can stop doubting that this is real.

Keep your eyes on gold, silver, and oil to solar sections of the Debt Clock. These numbers will be the foundation assets to the new economy, and they are numbers we need to see in order to formulate real values across all market sectors.

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

U.S. National Debt Clock : Real Time | US Debt Clock

~~~~~~~~~~

Monday Night Team call with

Texas Snake and Bob Lock: Focus on Planning

Time: 9 pm ET, 8 pm CT, 6pm PT Team Call Live Link

The calls are recorded and in the Archive room Link

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Good Evening Dinar Recaps,

"Glassnode on Wednesday reported that major US OTC platforms have run out of bitcoins, with only 40 coins remaining. This development shows an imminent supply shortage which directly signals the potential for a big price pump shortly."

Yes, Bitcoin is 15 years old and running out of supply. There are only 40 bitcoins left as of 3 days ago. At this point, the demand for Bitcoins are outpacing their supply.

When demand outpaces supply, the corresponding response for an asset is to rise in its value.

Historically, Bitcoin tends to lead the rally for all the crypto space. An upward movement is expected going forward inside our new digital economy.

A bull run in the crypto space will encourage digital adoption as this new asset class begins to form new price pressures going forward.

Remember, everything is being tokenized including Forex. Remember.... Coin Market Cap

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Good Evening Dinar Recaps,

"Glassnode on Wednesday reported that major US OTC platforms have run out of bitcoins, with only 40 coins remaining. This development shows an imminent supply shortage which directly signals the potential for a big price pump shortly."

Yes, Bitcoin is 15 years old and running out of supply. There are only 40 bitcoins left as of 3 days ago. At this point, the demand for Bitcoins are outpacing their supply.

When demand outpaces supply, the corresponding response for an asset is to rise in its value.

Historically, Bitcoin tends to lead the rally for all the crypto space. An upward movement is expected going forward inside our new digital economy.

A bull run in the crypto space will encourage digital adoption as this new asset class begins to form new price pressures going forward.

Remember, everything is being tokenized including Forex. Remember.... Coin Market Cap

© Goldilocks

~~~~~~~~~~

"Bitwise anticipates a surge in institutional investment into Bitcoin ETFs in the coming months as major financial institutions, known as “wirehouses,” start offering Bitcoin ETF trades to their clients."

A wirehouse is a full-service broker-dealer of any size. Although many broker-dealers are "independent" firms involved in broker-dealer services, others are subsidiaries of commercial banks, investment banks, or investment companies. They sell Securities such as spot Bitcoin ETFs for their clients leveling the playing field between the retail Market and Institutional Financing.

For this reason, the competition for gold through digital assets can now be obtained through anyone desiring to become a part of the new Financial System through these new additions to their portfolios.

This is expected to create a gold rush into the next economy for well over a decade. We are simply beginning a process of transformation that will change values in every sector of our Global markets going forward. Crypto News CoinTelegraph

© Goldilocks

~~~~~~~~~~

"Russia is testing digital asset payment technology as groundwork for a potential BRICS digital currency.

The move aims to reduce global dependency on the US Dollar, aligning with BRICS’ de-dollarization efforts.

Digital currency trials are starting with China and Eurasian Economic Union countries, under Russia’s initiative."

Russia is making a move inside the new digital economy. They are testing their new payment system with digital assets formulating a pre BRICS currency launch.

Vladimir Putin is the current chairman for the BRICS Nations. One of the qualifications in belonging to the BRICS Nations is that countries have to back their economy by gold or other commodities. These new global economic initiatives are what is leading the drive towards a Global Currency Reset.

A new trading currency with a backing by gold for the BRICS Nations is rapidly becoming more than just a simple threat to the current Global Monetary System.

Russia is currently taking practical steps in lowering their dependence on the US dollar in trade among nations. And, these changes are affecting the current ratings of their currency. Enough so, that the FATF is currently re-rating their currency.

When a countries' currency is re-rated, it means they are currently in process of a revaluation inside their new currency values and mechanisms for the dissemination of these new values in trade. Yes, new exchange rates.

"The Financial Action Task Force (FATF) is the global money laundering and terrorist financing watchdog. It sets international standards that aim to prevent these illegal activities and the harm they cause to society."

Look for the FATF to get more involved in the BRICS Nations as they set forth new trading mechanisms designed to enhance their group's local currency values through their new digital asset-based trading system.

This is a move from a pegged currency with the dollar to a free floating exchange rate determined by the markets. Gold adds value to currencies that have been devalued over the years and equalizes the playing field for each country involving themselves inside free-floating mechanisms.

Watch the water.

© Goldilocks

CryptoPolitan

FATF

Investopedia

Regulation Asia

Times of India

~~~~~~~~~~

What is The Dodd Frank Act? | YouTube

~~~~~~~~~~

Dodd-Frank Act Update:

The National Institute of Standards and Technology released a revised version of its Cybersecurity Framework guidance detailing steps organizations can take to reduce cybersecurity risks, placing a greater priority on the role of corporate governance and supply chains in protecting sensitive data.

Dodd Frank Update

~~~~~~~~~~

China and Russia have almost completely abandoned the US dollar in bilateral trade as the push to de-dollarize intensifies | Business Insider

~~~~~~~~~~

The U.S. national debt is rising by $1 trillion about every 100 days | CNBC

~~~~~~~~~~

ZTX Ushers in Digital Real Estate Era | InvestorsObserver

~~~~~~~~~~

Ripple offers a fast, and cost-effective cross-border payment solution for banks and financial institutions globally. Ripple’s platform, Ripple Net, facilitates instant and transparent transactions, positioning itself as a more efficient alternative to traditional financial services.

Ripple is a blockchain-based digital payment network working to facilitate the transfer of value between different fiat currencies for its customers. XRP is the native cryptocurrency of Ripple.

CrowdWisdom

~~~~~~~~~~

Great Reset Watch: EU Parliament Approves 'Digital Identity Wallet' | Breitbart

~~~~~~~~~~

Tether’s USDT stablecoin hits historic $100B market cap | CoinTelegraph

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Sunday Evening 3-3-24

Goldilocks' Comments and Global Economic News Sunday Evening 3-3-24

Good Evening Dinar Recaps,

"India’s forex reserves experienced a notable increase, rising by $2.975 billion to reach $619.072 billion for the week ending February 23, as reported by the Reserve Bank of India (RBI). This surge follows a previous week where reserves had slightly decreased by $1.132 billion.

Major Components

1. Foreign Currency Assets:

Increased by $2.405 billion to $548.188 billion.

Foreign currency assets encompass various currencies such as the euro, pound, and yen, reflecting their valuation against the US dollar.

Goldilocks' Comments and Global Economic News Sunday Evening 3-3-24

Good Evening Dinar Recaps,

"India’s forex reserves experienced a notable increase, rising by $2.975 billion to reach $619.072 billion for the week ending February 23, as reported by the Reserve Bank of India (RBI). This surge follows a previous week where reserves had slightly decreased by $1.132 billion.

Major Components

1. Foreign Currency Assets:

Increased by $2.405 billion to $548.188 billion.

Foreign currency assets encompass various currencies such as the euro, pound, and yen, reflecting their valuation against the US dollar.

2. Gold Reserves:

Rose by $472 million to $47.848 billion during the week.

3. Special Drawing Rights (SDRs):

Witnessed an uptick of $89 million to $18.197 billion.

4. Reserve Position with the IMF:

Expanded by $9 million to $4.839 billion."

There would be absolutely no reason for India to be increasing their revenue like this unless it had something to do with the UPI or Unified Payments Interface.

The UPI powers several bank accounts in one application. This can happen with any bank globally that wants to participate in their payment transaction system through trade and more.

It is an instant payment service that operates 24/7 and 365 days a year. Their foreign currency, special drawing rights, and gold reserves continue to grow.

This enables them to service the needs of foreign currency exchanges in trade from around the world near and far. They can even enable people to do these transactions over a mobile phone application.

It's been a while back, but Iraq was one of the countries along with Vietnam and Indonesia that piloted this new International Payment System. Current Affairs

© Goldilocks

~~~~~~~~~~

The IMF is recognizing Iraq to be a financially inclusive banking system. This means they have become an open banking system allowing free trade agreements to be made with them near and far.

The CBI article that goes with this writing indicates that the IMF has recognized Iraq to be a compliant, safe, and trustworthy institution for trade. It is well and it's way to digitizing products for trade beyond the oil sector and on the local level.

These new monetary mechanisms will shield them from money laundering that has plagued them for so many years, and it will enable them to move forward with the full confidence of a Global Economy.

© Goldilocks

https://cbi.iq/news/view/2527

~~~~~~~~~~

Iraqi Customs launches automation system at Umm Qasr Port - Shafaq News

👆Watch the Water!

~~~~~~~~~~

"An ACH transfer is completed through a clearing house — a network of financial institutions — and is used most often for processing direct deposits or payments.

A wire transfer is typically used for high-value transactions and is completed through a bank, which makes it faster, but it does have a fee."

We are currently transitioning from Clearing House Transactions to Wire Transfer Services that can be done through a bank. Wire transfer services will make this new digital payment system much faster. In fact, the transfer of payments will be done in seconds.

As Protocol 20 expands and integrates Quantum Technologies from around the world, this shift into digital processing of money transfers will significantly increase the demand for the new digital economy. These new demands will bring in new values across the board and from country to country.

Money velocity will enhance faster trades that will allow the movement of products around the world to operate seamlessly and efficiently. Faster movement of products will create more profits and increase more opportunities for companies producing their items for sale across many sectors of the market and on an even playing field no matter their size. Tipalti

© Goldilocks

~~~~~~~~~~

Hong Kong Sees Surge in Crypto Exchange License Applications as Regulatory Landscape Evolves | The Currency Analytics

👆 Goldilocks pointed to this article

~~~~~~~~~~

Crypto Council comments on Hong Kong’s stablecoin regulation | CryptoPolitan

~~~~~~~~~~

Special Drawing Rights

Pacific Exchange Rate Service: Current Exchange Rates; Database

https://fx.sauder.ubc.ca/SDR.php

~~~~~~~~~~

UPI: Unified Payments Interface - Instant Mobile Payments | NPCI

~~~~~~~~~~

Bloomberg -- Eurex Clearing AG plans to start clearing repo trades for hedge funds directly by the middle of the year, a key step toward improving liquidity in a market that has been constrained over the years by tighter financial regulation.

The firm, one of the leading global clearinghouses, aims to have hedge funds up and running on their platform “by the summer,” executive board member Matthias Graulich said on the sidelines of the Derivatives Forum in Frankfurt on Thursday.

~~~~~~~~~~

Prominent figures in the XRP community have argued that the XRP tokens locked in escrow by Ripple have a fundamental role in turning the asset into a global reserve currency. | The Crypto Basic

~~~~~~~~~~

Blockchain is one step away from mainstream adoption - Blockworks

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Evening 3-2-24

Goldilocks' Comments and Global Economic News Saturday Evening 3-2-24

Good Evening Dinar Recaps,

"Hong Kong is currently pursuing an expansion of the digital yuan’s application. It is also approaching the second phase of its own CBDC pilot program and completing consultations for stablecoin issuance."

Do you remember a couple of months ago when we spoke of several global stablecoins that were being tested inside a sandbox with Hong Kong?

They are telling us that Hong Kong is in process of moving past the consultation process and ready to move into the implementation phase. This is the phase of regulatory development inside Global use case scenarios.

The e-HKD digital version of the Hong Kong dollar completed its first pilot testing phase in October 2023. Now, Hong Kong is telling us that they are moving into the retail sector. This will include programmable payments, offline payments, and tokenized deposits. Coin Speaker

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Saturday Evening 3-2-24

Good Evening Dinar Recaps,

"Hong Kong is currently pursuing an expansion of the digital yuan’s application. It is also approaching the second phase of its own CBDC pilot program and completing consultations for stablecoin issuance."

Do you remember a couple of months ago when we spoke of several global stablecoins that were being tested inside a sandbox with Hong Kong?

They are telling us that Hong Kong is in process of moving past the consultation process and ready to move into the implementation phase. This is the phase of regulatory development inside Global use case scenarios.

The e-HKD digital version of the Hong Kong dollar completed its first pilot testing phase in October 2023. Now, Hong Kong is telling us that they are moving into the retail sector. This will include programmable payments, offline payments, and tokenized deposits. Coin Speaker

© Goldilocks

~~~~~~~~~~

CBI Announcement:

Shafaq News / The Iraqi Central Bank (CBI) affirmed on Saturday that it has provided five alternative currencies to the dollar for traders to use in purchasing goods from abroad, using each country's currency through the bank.

CBI’s Deputy Governor Ammar Hamad told Shafaq News Agency that "CBI has made other foreign currencies available for Iraqi traders, including the euro, the Chinese yuan, the Turkish lira, the Emirati dirham, and the Indian rupee."

He added that "these currencies are now available to traders, aiming to facilitate foreign trade. When a trader imports goods from China, for instance, they can pay in Iraqi dinars to the Iraqi bank, which will then settle the amount with the Chinese company or factory in Chinese currency." Shafaq

👆 Goldilocks pointed to this article

~~~~~~~~~~

The Bank for International Settlements has set forth recommendations for Central Banks on supervision and legislative practices of Global Stablecoins.

Below is a link to a chart that you can read about these regulation recommendations. These recommendations will flow into the Central Bank's guidance for banks.

Here, we have the beginning stages of a top-to-bottom mandate of guidelines that will formulate new rules, regulations, and laws to govern Stablecoins. BIS

© Goldilocks

~~~~~~~~~~

Federal Register Announcement:

There is a proposed rule by the CFTC to extend a period of comments before execution of a new rule on April 22nd, 2024.

Proposed Rule: "The Commodity Futures Trading Commission (CFTC or Commission) is proposing to amend its regulations to permit a foreign board of trade (FBOT) registered with the Commission to provide direct access to its electronic trading and order matching system to an identified member or other participant located in the United States and registered with the Commission as an introducing broker (IB) for submission of customer orders to the FBOT's trading system for execution."

Foreign Board of Trade means any board of trade. This includes any exchanges or markets outside the United States. Federal Register

© Goldilocks

~~~~~~~~~~

“Most countries have said that settlement in national currencies is what the BRICS countries need. We are already a big BRICS family of 10 countries. Most countries supported the fact that it is necessary to build new mechanisms of settlements and shared the experience of developing digital currencies by central banks, the experience of building platforms, and participation in trials of various platforms,” Chebeskov said. Modern Diplomacy

~~~~~~~~~~

Moscow: The Russian Finance Ministry together with the Bank of Russia and BRICS partners will prepare a number of initiatives to improve the international monetary and financial system, which will focus in particular on the issue of creating the BRICS Bridge multisided payment platform, according to files published following the first meeting of BRICS finance ministers and central banks governors in Sao Paulo, Brazil. Times of Oman

~~~~~~~~~~

USDV - A Revolutionary Stablecoin Transparently Pegged To Tokenized T- Bills | Coin Telegraph

~~~~~~~~~~

As the name suggests, a reverse ATM, or a cash-to-card kiosk, is the opposite of a conventional cash machine. A reverse ATM is a machine into which customers deposit cash and are given a debit card with the amount they have deposited credited onto the card. The customer can then use this card to complete a transaction through the merchant’s payment gateway—either in-store or online.

Currently, consumers will most commonly see cash-to-card kiosks in venues or establishments that want to encourage their customers to use cards instead of cash for transactions in their establishments. In return for cash, kiosks dispense stored-value cards that can be used to purchase goods or services in that establishment. Unicorn Group

~~~~~~~~~~

Fed Chair mum on foreign nations’ evacuation of Gold from US | FX Street

~~~~~~~~~~

Bretton Woods 3:

Join LIDS and the Harvard International Law Journal for our Spring 2024 conference entitled “Bretton Woods 3.0? The Future of International Economic Law.”

The event will occur throughout the day of March 2, 2024 at Austin Hall on the Harvard Law School Campus.

This year’s conference features four panels and one keynote speech focusing on the changing nature of multilateral cooperation in international economic law.

Each discussion will cover key topics related to this theme, drawing on experts from the legal industry, academia, and intergovernmental organizations. Harvard Edu

~~~~~~~~~~

Inflation Saga Far from Over: Services Inflation in Euro Area Just as Stubborn as in the US, Makes Very Disconcerting Moves | Wolf Street

~~~~~~~~~~

US states are using gold & silver as money - are YOU? | YouTube

~~~~~~~~~~

RIPPLE XRP🚨IMF SHOCKING NEW ESDR RULES⚠️🚨XRP IS WAKING UP | YouTube

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Evening 3-1-24

Goldilocks' Comments and Global Economic News Friday Evening 3-1-24

Good Evening Dinar Recaps,

"Congress approves a short-term extension to avoid a shutdown and buy more time for final spending agreement"

This short-term extension lasts until the 22nd of March, 2024. At that time, a new fiscal budget is expected to be approved in the US.

This was supposed to be voted on last October the 1st of 2023, but many adjustments to the bill has been adjusted since that time to incorporate new needs and discarding ones no longer needed as we move into the new digital asset based trading system.

At that time, new liquidity forming the basis for our new digital economic framework projects (Protocol 20) will come into play as we incorporate new ways of living in this new world. AP News

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Friday Evening 3-1-24

Good Evening Dinar Recaps,

"Congress approves a short-term extension to avoid a shutdown and buy more time for final spending agreement"

This short-term extension lasts until the 22nd of March, 2024. At that time, a new fiscal budget is expected to be approved in the US.

This was supposed to be voted on last October the 1st of 2023, but many adjustments to the bill has been adjusted since that time to incorporate new needs and discarding ones no longer needed as we move into the new digital asset based trading system.

At that time, new liquidity forming the basis for our new digital economic framework projects (Protocol 20) will come into play as we incorporate new ways of living in this new world. AP News

© Goldilocks

~~~~~~~~~~

This is where we stand on our Tokenized Treasuries.

Currently, this is where we stand on tokenizing our treasuries that represent assets of the US Treasury Securities in digital format. It is our US Treasury Securities that becomes the foundation of building our new Financial Infrastructure.

These digital tokens become tradable assets on the blockchain. This gives you an idea of where we stand in the process of building the new digital economy. Unchained Crypto

© Goldilocks

~~~~~~~~~~

"Congress approves a short-term extension to avoid a shutdown and buy more time for final spending agreement"

This short-term extension lasts until the 22nd of March, 2024. At that time, a new fiscal budget is expected to be approved in the US.

This was supposed to be voted on last October the 1st of 2023, but many adjustments to the bill has been adjusted since that time to incorporate new needs and discarding ones no longer needed as we move into the new digital asset based trading system.

At that time, new liquidity forming the basis for our new digital economic framework projects (Protocol 20) will come into play as we incorporate new ways of living in this new world. AP News

© Goldilocks

~~~~~~~~~~

Euro Bank and India UPI Announcement:

"NPCI International Payments Limited (NIPL), a subsidiary of National Payments Corporation of India (NPCI), and Eurobank SA, a Greek bank, have signed a Memorandum of Understanding (MoU) towards enhancing cross-border payments using UPI rails."

The Euro Bank and and India's UPI has a Memorandum of Understanding (MoU) between them on cross border payments utilizing the Unified Payments Interface.

"The eurobank is a financial institution that accepts deposits (https://www.investopedia.com/terms/d/deposit.asp) and makes loans (https://www.investopedia.com/terms/l/loan.asp) in foreign currencies." What makes this connection so important lies in the fact of the payment systems between them.

"As the private bank of the largest financial group in the world, Frankfurter Bankgesellschaft is both at home in Zurich and in Frankfurt am Main, rooted in both countries – Switzerland and Germany – and closely connected with city and country, culture and society at both locations."

Cross border Euro payments to and from Switzerland go through the Swiss Euro Clearing Bank in Frankfurt. This acts as the link between the two systems. These connections are of prime importance in uniting foreign markets to one of the most influx of money that moves through the world each day.

This gives us more access to foreign markets and foreign currency trades. Each day, we are witnessing various pieces of our global economy unite into what makes up the Global Markets.

These new connections make up new digital building blocks inside the new QFS. Gaps are being closed rapidly, and the need for stablecoins to purchase tokenized assets from around the world is becoming more and more important.

As Protocol 20 continues to expand uniting Quantum Technologies, look for stablecoins to become more in the forefront going forward.

© Goldilocks

CNBCTV

BIS

Swiss Banking

Swiss-Banking-Lawyers

~~~~~~~~~~

ABU DHABI, March 1 (Reuters) – World Trade Organization (WTO) negotiators extended talks again in Abu Dhabi on Friday as they struggled to break a political deadlock after five days of high-level negotiations.

It was far from clear whether a consensus could be reached among the WTO’s 164 members before a new deadline of 10 p.m. local time (1800 GMT). Several delegates warned that countries remained far apart as organisers announced a fifth extension.

WTO talks run deep into overtime with no breakthrough in sight - CNBC Africa CNBC Africa

~~~~~~~~~~

IMPORTANT UPDATE: The #WTOMC13AbuDhabi closing session has been postponed. Follow our social media channels to stay updated.

More about MC13: wto.org/mc13 WTO Twitter

~~~~~~~~~~

CFTC Announcement:

Washington, D.C. — The Commodity Futures Trading Commission today announced it is extending the deadline for the public comment period on a proposed rule that makes certain modifications to the CFTC’s swap data reporting rules in Parts 43 and 45 related to the reporting of swaps in the other commodity asset class and the data element appendices to Parts 43 and 45 of the CFTC’s regulations. The deadline is being extended to April 11, 2024.

The proposed rule was published in the Federal Register on December 28, 2023, with a 60-day comment period scheduled to close on February 26, 2024. [See CFTC Press Release No. 8835-23]

The Commission provided the extension in response to a request by a commenter. Comments may be submitted electronically through the CFTC Comments online process. All comments received will be posted on CFTC.gov. CFTC

~~~~~~~~~~

CFTC Reporting (Dodd-Frank) | Kaizen Reporting

~~~~~~~~~~

FEDNOW Instant Payments Announcement:

The Federal Reserve’s FedNow Service is an instant payments infrastructure that allows participating banks and credit unions to send and receive transactions within seconds on behalf of their customers — 24 hours a day, seven days a week.

This page lists participating financial institutions that are currently live on the service, as well as financial institutions serving as settlement and liquidity providers. Financial institutions that have completed testing and certification will be added to the list once they are live on the service. FRB Services

~~~~~~~~~~

RBI Grants Payment Aggregator License to Amazon Pay in India - Fintech Singapore

~~~~~~~~~~

US says falling trade with China could be positive - BBC News

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps