Seeds of Wisdom RV and Economics Updates Sunday Afternoon 1-11-26

Good Afternoon Dinar Recaps,

TETHER AT CENTER STAGE IN US–VENEZUELA CONFLICT AS 80% OF OIL REVENUE MOVES VIA STABLECOINS

Sanctions pressure accelerates digital money adoption and weakens traditional banking control

Good Afternoon Dinar Recaps,

TETHER AT CENTER STAGE IN US–VENEZUELA CONFLICT AS 80% OF OIL REVENUE MOVES VIA STABLECOINS

Sanctions pressure accelerates digital money adoption and weakens traditional banking control

Overview

Tether’s USDT stablecoin has emerged as a central financial tool in Venezuela following the arrest of Nicolás Maduro in the United States.

An estimated 80% of Venezuela’s oil-sector revenue is now being collected through stablecoins rather than traditional banking channels.

USDT has become critical both for state-level oil transactions and for everyday civilian use amid currency collapse.

Heightened scrutiny of Venezuela’s financial flows has placed stablecoins at the center of global sanctions and enforcement debates.

Key Developments

Sanctions-driven shift: Venezuela’s state oil company began accepting USDT for oil sales as early as 2020 to bypass restrictions on dollar-clearing banks.

Oil revenue transformation: Economists estimate that nearly four-fifths of Venezuela’s oil income now settles in stablecoins rather than fiat currency.

Civilian adoption accelerates: With the bolívar having lost over 99% of its value over the past decade, USDT has become a preferred store of value and medium of exchange for citizens.

Regulatory tension: Tether has cooperated with U.S. authorities to freeze wallets linked to sanctioned entities, highlighting the dual-use nature of stablecoins.

Maduro case intensifies scrutiny: The former president’s detention has renewed focus on tracking state-linked crypto flows tied to oil exports.

Why It Matters

This development reflects a structural change in how sanctioned economies function financially:

Banking systems are no longer mandatory: Stablecoins allow commodity trade to operate outside traditional correspondent banking networks.

Sanctions enforcement is evolving: Digital settlement challenges conventional financial controls designed around banks and SWIFT.

Parallel financial systems are forming: Stablecoins are now operating as functional money, not speculative instruments, in stressed economies.

Precedent-setting case: Venezuela provides a real-world example of how digital currencies can sustain national revenue under extreme pressure.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies in anticipation of revaluation within a global reset framework, this shift is significant:

Dollar dominance is being quietly eroded: When oil revenue settles outside dollar-clearing systems, reserve-currency influence weakens.

Alternative settlement systems gain legitimacy: Stablecoins demonstrate how trade can persist without reliance on legacy fiat infrastructure.

Currency repricing signals: Monetary systems often fracture at the edges before broader revaluation events occur.

Hard lessons for fiat currencies: Trust, access, and usability matter more than official status during monetary stress.

This is a reminder that currency power follows utility, not declarations.

Implications for the Global Reset

Payment Systems Pillar: Stablecoins are proving capable of replacing banks in high-value trade under pressure.

Monetary Transition Pillar: The rise of digital dollars outside U.S. control exposes vulnerabilities in the existing fiat-dominated order.

This is not just a crypto story — it is a case study in how money systems evolve when traditional structures fail.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

CoinGape – “Tether in Focus as 80% of Venezuela Oil Revenue Moves via Stablecoins”

Crypto Economy – “Venezuela Captures 80% of Oil Revenue in USDT Amid Sanctions Pressure”

LiveBitcoinNews – “USDT Becomes Venezuela’s Financial Lifeline Amid Sanctions”

~~~~~~~~~~

BRICS PLAN TO MOVE FROM 50% TO 65–70% GLOBAL GOLD CONTROL IN 2026

Gold, not debt, is emerging as the backbone of the next monetary system

January 11, 2026

Overview

BRICS nations are accelerating a coordinated strategy to expand their control of global gold reserves from roughly 50% to an estimated 65–70% in 2026.

The strategy combines aggressive central-bank gold purchases, expanded domestic production, and gold-backed trade and settlement systems.

Since 2020, BRICS countries have increased gold’s share of their total reserves by more than 100%.

Central banks within the bloc accounted for over half of all global gold purchases between 2020 and 2024.

Key Developments

Production dominance: China produced approximately 380 tonnes of gold in 2024, while Russia added about 340 tonnes, underscoring BRICS’ internal supply strength.

Allied output expands control: When aligned producers such as Kazakhstan, Iran, and Uzbekistan are included, BRICS-aligned nations now represent close to 50% of global gold output.

Brazil resumes gold accumulation: Brazil purchased 16 tonnes of gold in September 2025 — its first major addition since 2021 — raising reserves to 145.1 tonnes.

Massive reserve buildup: Combined BRICS gold reserves now exceed 6,000 tonnes, led by Russia, China, and India.

Bloc expansion amplifies power: With 11 member nations, BRICS now represents roughly 46% of the world’s population and 37% of global GDP.

Why It Matters

This is not simply a commodities story — it is a monetary architecture shift.

Gold is being repositioned as strategic money, not just a reserve hedge.

Paper-based systems are being quietly sidelined in favor of physical settlement credibility.

Gold-backed trade infrastructure reduces reliance on dollar-denominated systems and Western financial rails.

Production plus reserves equals leverage: BRICS now controls both supply and storage — a rare historical combination.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies in anticipation of revaluation within a global reset framework, this development is critical:

Gold accumulation precedes currency repricing: Historically, nations strengthen balance sheets with hard assets before resetting or revaluing currencies.

Gold-backed trade changes exchange dynamics: Settlement in gold or gold-linked units reduces artificial currency suppression.

Dollar dilution accelerates diversification: As BRICS reduces dollar exposure, alternative currencies gain relative strength.

Physical backing restores trust: In a reset environment, currencies tied to tangible assets tend to outperform fiat-only systems.

In short, gold is being positioned as the anchor asset for the next monetary era — and currency holders are watching the foundation being laid.

Implications for the Global Reset

Hard-Asset Pillar: Central banks are replacing debt exposure with physical gold at scale.

Monetary Realignment Pillar: Gold-backed trade and reserve systems signal preparation for a post-fiat monetary reset.

This is not speculation — it is balance-sheet warfare playing out in real time.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Sunday Afternoon 1-11-26

Iraq’s Non-Oil Revenues Hit Nearly $9B

2026-01-11 Shafaq News– Baghdad Iraq’s non-oil revenues have reached about 13 trillion dinars ($8.9B) but still fall well short of its economic capacity, lawmaker Shaimaa Abdul Sattar Al-Fatlawi said on Sunday.

Al-Fatlawi, a member of the National Al-Nahj (Approach) bloc, told Shafaq News that the total includes 2.5 trillion dinars ($1.7B) from direct taxes, 3.5 trillion dinars ($2.4B) from additional tax-related income, and 7 trillion dinars ($4.8B) from fees and other charges, describing the figures as inconsistent with Iraq’s scale of investment, trade, and agricultural activity.

Iraq’s Non-Oil Revenues Hit Nearly $9B

2026-01-11 Shafaq News– Baghdad Iraq’s non-oil revenues have reached about 13 trillion dinars ($8.9B) but still fall well short of its economic capacity, lawmaker Shaimaa Abdul Sattar Al-Fatlawi said on Sunday.

Al-Fatlawi, a member of the National Al-Nahj (Approach) bloc, told Shafaq News that the total includes 2.5 trillion dinars ($1.7B) from direct taxes, 3.5 trillion dinars ($2.4B) from additional tax-related income, and 7 trillion dinars ($4.8B) from fees and other charges, describing the figures as inconsistent with Iraq’s scale of investment, trade, and agricultural activity.

Identifying the housing sector as a major missed revenue source, she noted that investment companies held around 200,000 residential units in 2024 with an average value of 70 million dinars ($47.8K) each. A 15% levy on those properties alone, Al-Fatlawi estimated, could yield nearly 7 trillion dinars, excluding private universities, hospitals, and large commercial projects.

She blamed the shortfall on weak enforcement and ineffective digital tax systems, calling for staff rotation, tighter oversight, and a comprehensive review of collection mechanisms.

Her comments come as lawmakers began gathering signatures on Saturday to overturn the caretaker cabinet’s Decision No. 97 of 2025 on new tax measures, arguing it violates Article 28 of the constitution and the Customs Tariff Law by imposing or changing duties without parliamentary approval. https://shafaq.com/en/Economy/Iraq-s-non-oil-revenues-hit-nearly-9B

Iraq Will Be Among The Arab Countries With The Lowest Inflation By The End Of 2025.

Money and Business Economy News – Baghdad Iraq recorded a low inflation rate by the end of 2025, according to data issued by the International Monetary Fund (IMF).

According to the data, Iraq was among the Arab countries with the lowest inflation in terms of price increases, at 1.5%. This level reflects relative stability in the local market, especially in the prices of basic commodities, compared to other countries that experienced significant inflationary pressures during the same year.

This decline in inflation rates is attributed to several factors, most notably the relative stability of the exchange rate, the improved availability of goods in the markets, and government measures related to imports and subsidies, which have contributed to reducing the rising cost of living for citizens, despite the continued regional and global economic challenges.

As for other Arab countries, Sudan topped the list of highest inflation rates at 87.2%, followed by Yemen and Egypt at 20.4% each, then Tunisia at 5.9%, Somalia at 3.6%, and Algeria at 3.5%, amid clear effects of the economic and political conditions in those countries.

In contrast, Arab countries recorded low inflation rates, most notably Jordan and Kuwait at 2.2%, Saudi Arabia at 2.1%, Libya at 1.8%, the UAE at 1.6%, Morocco at 1.2%, and Oman at 0.9%, while Bahrain came in at 0.3%, and Qatar had the lowest Arab inflation rate at 0.1% by the end of 2025. https://economy-news.net/content.php?id=64425

Iraqis Bear The Brunt Of Government’s Fiscal Crisis As Fees Surge

2025-01-26 03:17 Shafaq News/ The Iraqi government’s recent decision to impose increased taxes and service fees has sparked widespread criticism from citizens, lawmakers, and experts. The measures, intended to address Iraq’s growing budget deficit, have been criticized for disproportionately affecting low- and middle-income families, adding to the financial strain during an already challenging economic period.

Root Causes: Budget Deficit and Economic Dependency

Iraq’s economic challenges are deeply rooted in its dependency on oil revenues, which account for 90% of the country’s state income. This reliance has made the economy highly vulnerable to fluctuations in global oil prices, leading to recurring budget deficits. In 2023, Iraq faced a deficit equivalent to 7.7% of its GDP. Efforts to diversify income streams have been insufficient, with a modest 22% rise in tax revenues in 2024 failing to address a projected budget deficit of 64 trillion dinars ($49.3 billion).

The 2024 federal budget, estimated at 211 trillion dinars ($161 billion), assumes an oil price of $70 per barrel. While oil prices currently hover above this figure, fiscal constraints remain tight. Domestic borrowing has surged to over 70 trillion dinars ($53.8 billion) to cover operational expenses, underscoring the unsustainable nature of current fiscal policies. Experts warn that Iraq’s financial challenges could deepen in 2025 as global oil prices are expected to decline further.

Impact of Tax Hikes on Everyday Iraqis

The new taxes and fees target essential services, placing an immediate financial burden on Iraqi citizens. For example, utility bills now include a surcharge of 2,000 dinars (approximately $1.37), while notary fees have risen from 1,000 dinars ($0.68) to 20,000 dinars ($13.70). Court fees have tripled to 6,000 dinars ($4.11), leaving many struggling to keep up.

“Court fees used to be 1,000 or 2,000 dinars, but now they’ve surged to 6,000 dinars,” said Abu Aqeel, a resident of Karbala. “Families like mine simply cannot afford these sudden increases.”

The financial strain has led to public frustration and protests, with citizens decrying the government’s inability to address their economic hardships.

Government’s Defense: A Necessary Move?

The government has defended the fee increases as necessary measures to boost state revenues and address liquidity shortages. The proposed “Law on Service Fees” grants ministers, governors, and other officials the authority to impose or modify fees.

MP Mohammad Jassim Al-Khafaji emphasized the urgency of this law, stating, “The government insists on this law because the country’s financial situation is dire.”

Despite this defense, critics argue that the lack of transparency and accountability undermines public trust. “Amid allegations of corruption and wasteful spending, it is difficult to convince citizens that these fees are for their benefit,” Al-Khafaji added.

Expert Criticism: Economic and Legal Concerns

Economists have labeled the fee hikes as a regressive measure that neglects Iraq’s long-term stability. Mustafa Hantoush, an economic expert, warned that these policies deepen poverty, which already affects 40% of the population in some provinces. “Raising taxes and fees without addressing systemic inefficiencies only exacerbates inequality and poverty,” he told Shafaq News.

Hantoush urged the government to “focus on diversifying the economy by investing in agriculture, industry, and transportation to create sustainable jobs.” Additionally, he highlighted “systemic corruption” in key revenue streams, including oil sales and currency exchanges, as “a significant drain on public finances.”

Legal experts have also raised concerns about the constitutionality of the fee increases. Article 28 of Iraq’s Constitution requires taxes and fees to be imposed or amended through enacted laws.

Mohammed Jumaa, a legal expert, argued, “Imposing fees without legal approval is essentially an illegal tax on citizens,” calling on Parliament to block the legislation, describing it as “a violation of constitutional safeguards.”

Calls for Change and Sustainable Solutions

Lawmakers and labor committees urge the government to adopt alternative strategies that alleviate the financial burden on citizens. Jassem Al-Mousawi, a member of the Parliamentary Labor Committee, emphasized, “The focus should be on alleviating the financial strain on Iraqis, not exacerbating it.”

Al-Mousawi called for ministries to identify sustainable revenue sources, such as enhancing non-oil sectors and combating corruption. He also announced plans to “summon ministry representatives to ensure accountability and transparency in government spending.”

The Bigger Picture: Structural and Policy Challenges

The fee hikes are part of broader economic and structural challenges facing Iraq. While the government aims to diversify revenue streams, efforts have been slow and insufficient. Economists have repeatedly called for reforms to reduce dependence on oil revenues and address inefficiencies in public spending.

Corruption remains a significant obstacle, with billions of dollars lost annually due to mismanagement and embezzlement. Without addressing these systemic issues, experts warn that Iraq’s financial crisis will persist, with low- and middle-income families bearing the brunt of the burden.

Looking Ahead: Fiscal Challenges in 2025

As Iraq prepares for 2025, fiscal challenges are expected to intensify. Global oil prices are predicted to decline, further straining the country’s budget. In this context, the government’s reliance on measures like tax hikes may prove unsustainable, potentially fueling more public discontent.

To avoid a deeper economic crisis, Iraq must implement comprehensive reforms. These include diversifying the economy, reducing corruption, and improving transparency and accountability in public finances. Without such measures, the cycle of budget deficits and economic instability is likely to continue.

https://www.shafaq.com/en/Report/Iraqis-bear-the-brunt-of-government-s-fiscal-crisis-as-fees-surge

From Burden To Strategy: Iraq Cuts Debt, Targets Growth

2025-07-09 Shafaq News – Baghdad Iraq is advancing a fiscal plan to reduce over $114B in public debt, aiming to enhance credit ratings, expand policy flexibility, and reallocate resources to long-term infrastructure development.

Domestic debt edged down in April to 85.5T IQD ($60.2B), from 85.53T ($60.23B) in March, according to Central Bank (CBI) data, after repayments to financial institutions, lowering their outstanding share to 19.11T IQD ($13.45B).

Additional internal liabilities include 756B IQD ($532M) owed by the Ministry of Finance, 51T IQD ($35.91B) in treasury transfers held by the central and commercial banks, 2.03T IQD ($1.43B) in ministry-backed treasury notes, and 12.57T IQD ($8.85B) in deferred payments, largely owed to farmers.

Foreign obligations have also declined. CBI reported on June 14 that Iraq’s external debt dropped to $54.6B in 2024, down 2.94% from $56.2B in 2023. About $9B is due by 2028, with an additional $9B linked to long-term loans from international reconstruction funds.

Debt Within Global Thresholds

Analysts highlight that Iraq’s debt ratios remain within safe international bounds. External debt constitutes less than 8% of GDP, placing Iraq in a low-risk category that supports credit stability and foreign investor interest.

Speaking to Shafaq News, Prime Minister's financial adviser Mudhhir Mohammed Saleh described the current policy direction as “fiscal consolidation,” where controlled debt growth aligns with reduced budget deficits, a central goal in the government's economic roadmap.

Decreasing reliance on borrowing, he added, "improves Iraq’s credit standing, lessens exposure to risk, and attracts foreign investment."

Additionally, easing internal debt alleviates pressure on local liquidity. “Lower sovereign borrowing allows commercial banks to extend more credit to the private sector, fueling domestic growth,” he noted.

Repayment Plans

Also speaking with Shafaq News, financial analyst Safwan Qusay proposed using state-owned assets to settle internal debt. “The Ministry of Finance can convert real estate into tradable shares and allocate them to creditors—removing interest burdens and preserving fiscal space.”

He added that Iraq’s external liabilities are mostly concessional, offering favorable repayment terms. "Demonstrating repayment ability enhances Iraq’s financial credibility and appeal to global investors."

Still, he cautioned against aggressive borrowing, even if global benchmarks allow debt up to 60% of GDP. “Iraq must use its resources wisely to avoid transferring today’s debt onto future generations.”

The World Stage

Placing Iraq’s debt within a global context, economist Karim al-Hilu told Shafaq News that sovereign borrowing is common among advanced economies. “The United States carries over $36T in internal debt, while Germany owes €2T."

"Domestic liabilities, denominated in local currency, are easier to manage. In contrast, external debts come with interest obligations and may expose a country to geopolitical pressures," he explained.

Al-Hilu emphasized that reducing debt levels will unlock funds for essential development. “Iraq needs over 1,000 strategic projects in transport, energy, and food security. Debt reduction can rechannel spending into these areas.”

However, he warned that fiscal gains alone won’t resolve deeper governance problems. “Administrative inefficiencies, political quotas, and corruption continue to block execution of approved plans,” he observed.

Even well-structured federal policies often stall at the local level. “Some tenders and investment projects require bribes to proceed, and provincial actors frequently obstruct implementation for partisan gain,” al-Hilu concluded.

Looking Ahead

Beyond immediate fiscal metrics, Iraq’s long-term financial outlook hinges on institutional credibility and transparent execution. Analysts emphasize that without reliable reporting standards and predictable budgeting cycles, credit agencies and investors may hesitate to reclassify Iraq into more favorable risk categories despite falling debt levels.

Another critical factor is the development of local capital markets. Strengthening domestic bond markets, improving regulatory oversight, and expanding non-oil revenue streams could give Iraq additional tools to manage debt sustainably without overreliance on external aid or emergency lending.

Iraq’s ability to balance debt reduction with inclusive growth will shape its role in regional economic dynamics. As global capital flows shift amid tightening monetary policies, countries like Iraq must demonstrate not only solvency, but also vision, transforming fiscal gains into enduring national development.

Written and edited by Shafaq News staff. https://www.shafaq.com/en/Report/From-burden-to-strategy-Iraq-cuts-debt-targets-growth

If You Own Silver, Pay Attention Now — Bill Holter & Peter Schiff

If You Own Silver, Pay Attention Now — Bill Holter & Peter Schiff

Macroedge: 1-9-2026

Silver isn’t behaving like a normal commodity anymore — and that’s exactly why Bill Holter and Peter Schiff are sounding the alarm.

In this video, we break down why the recent move in silver is not just another rally, but a signal of deeper stress in the financial system.

From shrinking physical inventories and rising industrial demand to weakening confidence in paper markets, the silver market is flashing warning signs that most investors are missing.

If You Own Silver, Pay Attention Now — Bill Holter & Peter Schiff

Macroedge: 1-9-2026

Silver isn’t behaving like a normal commodity anymore — and that’s exactly why Bill Holter and Peter Schiff are sounding the alarm.

In this video, we break down why the recent move in silver is not just another rally, but a signal of deeper stress in the financial system.

From shrinking physical inventories and rising industrial demand to weakening confidence in paper markets, the silver market is flashing warning signs that most investors are missing.

Bill Holter explains why gold and silver should be viewed as real money, not commodities, and why physical supply constraints are becoming impossible to ignore.

Peter Schiff connects these moves to currency debasement, rising debt, central bank behavior, and a weakening U.S. dollar, arguing that precious metals are increasingly acting as financial lifeboats — not trades.

This discussion also covers:

Why silver’s breakout is different from past cycles

The growing gap between physical and paper markets

How industrial demand (AI, EVs, solar) is tightening supply

Why central banks are accumulating gold — and what that means for silver

What this shift could signal heading into 2026

This is not hype. This is a structural change unfolding in real time. If you own silver — or are watching the precious metals market — this is a conversation you need to hear.

News, Rumors and Opinions Sunday 1-11-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sun. 11 Jan. 2026

Compiled Sun. 11 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: Thurs. 1 Jan. 2026 as the Quantum Financial System (QFS) (allegedly) became fully operational across the Globe, the Restored Republic came into being as a Sovereign Nation founded on principles of the original Constitution.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sun. 11 Jan. 2026

Compiled Sun. 11 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: Thurs. 1 Jan. 2026 as the Quantum Financial System (QFS) (allegedly) became fully operational across the Globe, the Restored Republic came into being as a Sovereign Nation founded on principles of the original Constitution.

Now gold/asset-backed currencies(allegedly) oversaw every transaction in over 200 Sovereign Nations, enforcing NESARA/GESARA protocols that brought total debt forgiveness, prosperity funds and a return to sovereign abundance for all.

Tier 4B notifications calls through secure channels for those holding foreign currencies and Zim bonds were expected to begin sometime between Sun. 11 Jan. and Wed. 14 Jan. 2026, with redemption appointments imminent.

Payouts were (allegedly) rolling out in waves prioritized by humanitarian projects. In the last 14 hours over 41,000 high-value Zim bondholders received secure NDA 72–96 hour windows (3-4 days). Zim and other currencies revalued at very high rates.

Debt forgiveness (allegedly) sweeps the globe under NESARA/GESARA activation, liberating families from mortgages, credit card burdens, taxes on labor end as well as unjust financial chains imposed by the former regime as the flow of rightful wealth to the faithful begins in earnest.

~~~~~~~~~~~~~

Sat. 10 Jan. 2026 CONFIRMED INTEL: SECURITY, STRUCTURE & SILENCE – THE TIER 4B PROTOCOL IS (ALLEGEDLY) FULLY IGNITED, GLOBAL RESET EXPLODING IN 2026 AS IRAQ, VIETNAM & ZIMBABWE LEAD THE CHARGE AGAINST THE DEEPSTATE FINANCIAL CABAL – RV IS HERE NOW! …Q on Telegram

TIER 4B IS (ALLEGEDLY) LIVE AND OPERATIONAL RIGHT NOW. The silent financial revolution is no longer whispers in the shadows; it’s verified, bank-confirmed action ripping through the old fiat system. Iraq, Vietnam, and Zimbabwe are (ALLEGEDLY) detonating the global reset, with IQD, VND, and ZIM holders stepping into historic wealth transfers that the c***l never wanted you to see.

They laughed at us. They called us delusional. They shut down forums, banned groups, and ridiculed the faithful who held strong. But now? The vindication is massive.

Private U.S. banking channels at Chase, Wells Fargo, and Bank of America have (allegedly) activated secure, appointment-only exchange centers. No walk-ins, no public announcements – just elite-level security protocols, armed staff, device restrictions, NDA signings, and wealth management onboarding for the awakened ones.

This is a classified military-grade operation, monitored and executed with precision to bypass the corrupt central banks and unleash suppressed value straight to the people.

Forget the rigged public Forex screens – inside the hidden ledgers, IQD and VND rates are (allegedly) skyrocketing to levels once labeled “impossible.” ZIM is right there with them, ready to turn everyday patriots into multi-trillionaires overnight.

The Deepstate’s fiat empire is (allegedly) crumbling as gold-backed realities take over. Iraq has gone fully sovereign: sanctions lifted, UN and U.S. forces out, massive anti-corruption sweeps recovering billions in stolen assets – all fuel for the RV explosion.

Their digital modernization aligns perfectly with the new quantum system, declaring independence from Cabal control.

Vietnam is (allegedly) locking in gold-backed Dong strength, shocking the fiat world and proving asset-backed currencies win. Zimbabwe’s project-backed redemption model is reshaping global debt slavery, freeing nations from endless banker chains.

This isn’t just a currency flip – it’s the financial detonation that dismantles the economic stranglehold. The old guard is terrified because the power is shifting to us – the holders who trusted the plan when everyone else folded.

Phased rollout is(allegedly) in full motion as of January 2026: 72-hour soft launch complete, high-volume patriots already exchanging in the first 7-10 days, mid-tier flooding in over the next weeks, and broader access ramping up fast.

Get your currency receipts, IDs, and proofs ready now. Appointments require absolute discretion – stay silent, ignore the fakes, and shut out the noise from paid shills trying to derail this.

Scammers are swarming because they know it’s real – legitimate Tier 4B access never asks for upfront payments. Only secure, verified channels. This is your moment to claim what’s been stolen from generations. The window is wide open, but the cabal will try everything to slam it shut.

~~~~~~~~~~~~~

Sat. 10 Jan. 2026 TIER 4B IS ACTIVE. THE RV IS REAL. THE GLOBAL RESET IS UNSTOPPABLE.

We are the storm they’ve feared. The era of waiting is dead – the era of patriots rising in wealth and power begins NOW.

Stay vigilant. Stay ready. The deepstate is finished. This is our financial liberation – and it’s happening right under their noses.

TRUST THE PLAN. THE BEST IS YET TO COME FOR THE AWAKENED!

Read full post here: https://dinarchronicles.com/2026/01/11/restored-republic-via-a-gcr-update-as-of-january-11-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat Article: "AN ECONOMIC ASSESSMENT OF THE CENTRAL BANK’S DECISION TO FIX THE DOLLAR EXCHANGE RATE IN THE 2026 BUDGET" So for the first time I have been in this investment the CBI has told us they fixed the budget to an exchange rate. It has been normal practice for the Finance Committee to fix the budget to the market price of oil or a little less for market variations in future. Why is this very good news for us today? Let me explain... [Post 1 of 2....stay tuned]

Mnt Goat This shows us the country is slowly moving away from oil as the sole source of revenue and now even the budget is no longer evolving around oil. WOW! They are moving to general terms of overall economic stability which means all revenue, including revenues from non-oil sources. WOW! They are truly moving away from the sanctioned rules of everything evolving around oil. WOW! [Post 2 of 2]

Frank26 [Iraq boots-on-the-ground report] OMAR: TV guy talking about former CBI governor Dr. Shabibi, he said the dinar would go down incrementally before any major revaluation...It is entirely possible the Central Bank of Iraq will reduce the dinar's exchange rate incrementally before they carry out a full revaluation. They have done it before, like in early 2023 when they nudged the rate down a little bit...It's a way to keep everything stable and avoid sudden changes in the economy. Yes, incremental reductions are on the table before any big revaluation happens... FRANK: They self-confessed there's a revaluation coming to your currency. I understand they're trying to tell you they're going to do it slowly but surely. But that's a bunch of "whatever".

************

President Trump's ULTIMATUM Has Banks Panicking!

Steven Van Metre: 1-10-2026

What if I told you President Trump’s latest directive for the banks is actually a ticking time bomb set to explode access to credit—and crash the entire economy and stock market?

“Tidbits From TNT” Sunday 1-11-2026

TNT:

Tishwash: Sudanese advisor: Financial deficit is temporary and will not affect the development path

The financial advisor to the Prime Minister, Mazhar Muhammad Saleh, confirmed that the financial deficit in Iraq is short-term.

It does not pose an obstacle to the country's economic development path.

Saleh explained that the deficit is mostly linked to fluctuations in oil prices in global markets.

He pointed out that investors realize that these fluctuations do not reflect institutional weakness as much as they reflect market factors beyond national control.

TNT:

Tishwash: Sudanese advisor: Financial deficit is temporary and will not affect the development path

The financial advisor to the Prime Minister, Mazhar Muhammad Saleh, confirmed that the financial deficit in Iraq is short-term.

It does not pose an obstacle to the country's economic development path.

Saleh explained that the deficit is mostly linked to fluctuations in oil prices in global markets.

He pointed out that investors realize that these fluctuations do not reflect institutional weakness as much as they reflect market factors beyond national control.

He added that investor confidence is strengthened when deficits are accompanied by disciplined financing tools, such as issuing domestic bonds and prudent management of public spending.

He stressed that this sends a clear message about the government's ability to control the flow of public funds and avoid long-term imbalances. link

Tishwash: Oil Minister: More than 450 companies are participating in the energy exhibition.

Oil Minister Hayyan Abdul Ghani announced on Saturday the participation of more than 450 companies in the energy exhibition, emphasizing that this large turnout sends a message of stability to Iraq.

Speaking to the Iraqi News Agency (INA), Abdul Ghani said, "The energy exhibition, held at the Baghdad International Fairgrounds, is a distinguished event due to the active participation of many companies specializing in the oil and electricity sectors, in addition to other fields." He noted that "more than 450 companies were present and participating in the exhibition."

He explained that "through this participation, we will learn about the nature of the work these companies contribute to the development of the oil, electricity, and renewable energy sectors," stressing that "the presence of these companies in such numbers represents a clear message of stability in Iraq from a security, economic, and regulatory standpoint."

Prime Minister Mohammed Shia'a al-Sudani inaugurated the 11th Iraq Energy/IEE Exhibition and Conference on Saturday at the Baghdad International Fairgrounds. link

************

Tishwash: An economic observatory reveals the Central Bank of Iraq's conditions for banks to trade in currencies other than the dollar.

An economic observatory announced the new conditions set by the Central Bank of Iraq for banks wishing to trade foreign currencies other than the dollar, such as the European "Euro" and the Chinese "Yuan," noting that among these conditions is that "the bank's capital must be 300 billion Iraqi dinars."

The Eco Iraq Observatory explained in a press statement on Saturday, January 10, 2026, that “the Central Bank circulated a document entitled (Guidelines and Models for Assessing Minimum Requirements) for banks prohibited from dealing in dollars and wishing to work in other foreign currencies such as the European Euro, the Chinese Yuan, the UAE Dirham, and others, indicating that “this document is part of the banking sector reform program implemented by the Central Bank.”

The observatory noted that “the document included conditions, most notably that the bank’s capital be 300 billion dinars with a plan to reach 400 billion dinars by the end of 2028,” as well as “the bank having sufficient and regular liquidity to cover its obligations and the obligations of customers, in accordance with international banking regulations (LCR and NSFR).”

"The document emphasized the disclosure of the bank's ownership, i.e., providing a complete and approved list of shareholders, with full disclosure of related parties," according to the statement.

The Economic Affairs Observatory “Eco Iraq” had previously revealed that 35 out of 72 banks operating in Iraq were subject to US sanctions, either due to sanctions by the Office of Foreign Assets Control (OFAC), i.e., the bank being placed on an international blacklist and its financial transactions being paralyzed or its dollar transactions being stopped, or as a “temporary regulatory measure” and not a penalty, to force the bank to comply with transparency. link

************

Tishwash: US Chargé d'Affaires: The United States emphasizes the need for immediate action to dismantle "militias" in Iraq

The US Embassy in Baghdad stated that the United States will continue to clearly emphasize the need for immediate action to dismantle militias in Iraq.

In a post on its X platform, the embassy said that Chargé d'Affaires Joshua Harris met with Ammar al-Hakim, leader of the Hikma Movement, to discuss shared interests in protecting Iraqi sovereignty, defeating terrorism, enhancing regional security, and strengthening economic ties that benefit both Americans and Iraqis.

Harris reiterated that "the inclusion of Iranian-backed terrorist militias in the Iraqi government, in any capacity, is incompatible with a strong US-Iraqi partnership."

He added that "the United States will continue to clearly emphasize the need for immediate action to dismantle terrorist militias that serve foreign agendas and threaten Iraq's sovereignty, stability, and economy." link

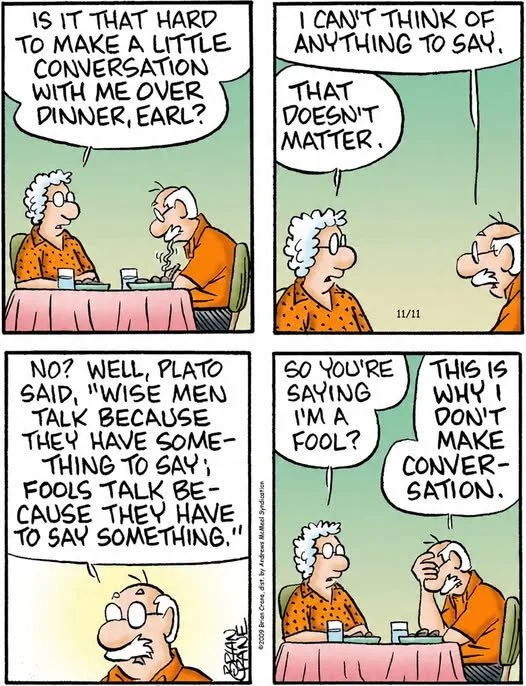

Mot: Never a Break Does ole ""Earl"" get!!!

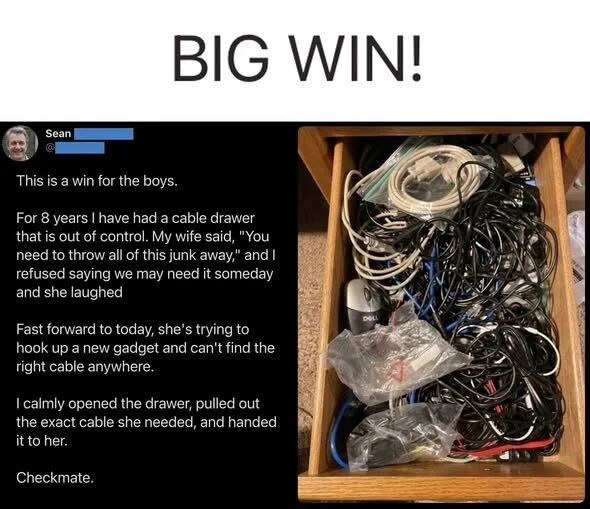

Mot: Big Win Today!!!! Heeeee heeeee heeeee!!!!

Seeds of Wisdom RV and Economics Updates Sunday Morning 1-11-26

Good Morning Dinar Recaps,

Central Bank Liquidity Operations Continue

Fed’s large hidden liquidity injections suggest deeper financial plumbing stress than official narratives imply

Good Morning Dinar Recaps,

Central Bank Liquidity Operations Continue

Fed’s large hidden liquidity injections suggest deeper financial plumbing stress than official narratives imply

Overview

The Federal Reserve, particularly via the New York Fed and its standing repo facilities, has been injecting large sums of liquidity into U.S. banks to keep short-term funding markets functioning.

Media and market data show usage of these liquidity windows — including repo operations and emergency cash injections — at unusually high levels, indicating systemic funding pressure.

These operations serve to supply cash against high-quality collateral (e.g., Treasury securities), a tool the Fed uses when private funding channels dry up.

Increased activity around year-end and after quant-tightening measures ended reflects banks leaning more on central bank support than usual.

Key Developments

High use of the Fed’s standing repo facility: Eligible financial institutions drew about $26 billion in overnight liquidity via this tool, among the highest levels since its creation to offer fast loans against collateral.

Record pressures around month-end: Usage of liquidity facilities surged, with nearly $50 billion in standing repo loans extended as banks sought cash amid funding volatility.

Larger context of tightening liquidity: Repo and funding markets have shown signs of strain due to quantitative tightening, reductions in bank reserves, and high Treasury issuance.

Why It Matters

Central bank liquidity operations — especially large or sustained ones — are more than routine technical plumbing:

Stress indicator: When banks increasingly tap central bank facilities, it shows that normal market funding channels are under pressure.

Hidden support: These injections often occur without headline announcements, meaning traditional market indicators (like monetary policy statements) may understate actual system reliance on the Fed.

Monetary policy tension: Such liquidity support can run counter to tightening narratives (like rate increases or QT), signaling that central banks are walking a fine line between stability and policy normalization.

Why It Matters to Foreign Currency Holders

For holders of foreign currencies eyeing positional shifts or revaluation opportunities, this trend has meaningful implications:

Signals potential systemic stress: Large liquidity injections suggest financial systems — especially U.S.-centered ones — may be under pressure, undermining confidence in dominant reserve currencies over time.

Dollar dynamics: Increased central bank liquidity can weaken the dollar’s perceived strength if markets see these moves as hidden easing, supporting diversification into foreign currencies and gold.

Global credit conditions: Excess liquidity dampens credit costs and can encourage capital flows into emerging markets, affecting exchange rates and asset valuations in those regions.

Monetary transition cues: When central banks shift quietly from tightening to liquidity provision, it can presage broader monetary adjustments, which historically precede currency repricing events.

These moves are not isolated cash swaps — they signal underlying liquidity fragility that can ripple through currency markets before traditional indicators catch up.

Implications for the Global Reset

Financial Stability Pillar: Stealth liquidity operations imply dependence on central bank backstops, highlighting fragilities that might accelerate structural reforms in how global finance functions.Monetary Transition Pillar: Hidden injections may reflect a pivot away from rigid tightening toward liquidity accommodation, a trend that often precedes broader currency and monetary system shifts.

This is not just technical operations — it’s central banking in crisis-management mode, with implications for currency valuations and systemic risk.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Banks tap Fed liquidity tool amid year-end pressures

Ainvest – Escalating Repo Fails and Systemic Liquidity Risks in 2025

~~~~~~~~~~

Historic EU–Mecosur Trade Deal Nears Completion

After 25 years of gridlock, a massive trade bloc emerges as the world quietly reorganizes economic power

Overview

The European Union has moved decisively toward finalizing the EU–Mercosur free trade agreement after more than two decades of negotiations.

Italy’s decision to back the pact broke a long-standing deadlock among EU member states.

The agreement would unite the EU with Brazil, Argentina, Uruguay, and Paraguay into a single trade zone of roughly 780 million people.

Combined, the bloc would represent close to 25% of global GDP — one of the largest free-trade areas ever formed.

Key Developments

Italy shifts position: Rome reversed earlier opposition after securing agricultural safeguards, helping unlock EU consensus.

Political resistance remains: France, Poland, and farming groups across Europe continue to voice environmental and food-standard concerns.

Strategic resources in focus: The deal improves EU access to South American agricultural output, energy, and critical raw materials.

Next steps underway: The pact still requires European Parliament approval and ratification by Mercosur nations before implementation.

Why It Matters

This agreement marks a structural realignment in global trade at a time when protectionism and fragmentation dominate headlines.

By deepening EU–South America integration, the deal:

Counters global trade fragmentation by reinforcing multilateral commerce instead of tariffs and blocs.

Diversifies supply chains away from over-reliance on China and geopolitically sensitive routes.

Strengthens Europe’s geopolitical leverage in Latin America, a region increasingly contested by major powers.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies in anticipation of higher future valuations, this development is significant:

Trade blocs drive currency demand: Expanded trade volumes increase transactional demand for regional currencies rather than defaulting to the U.S. dollar.

Supports de-dollarization trends: Large multi-regional trade agreements often evolve toward local-currency settlement mechanisms over time.

Signals systemic restructuring: Long-term trade frameworks are typically aligned with broader monetary and financial realignments — not short-term politics.

Capital flow rebalancing: As investment shifts toward emerging trade corridors, currency repricing frequently follows structural integration.

In short, trade architecture precedes monetary change — and this deal is architecture on a historic scale.

Implications for the Global Reset

Trade Realignment Pillar: The EU–Mercosur pact accelerates the shift toward multipolar trade networks.

Monetary Transition Pillar: Sustained non-U.S. trade expansion lays groundwork for future currency revaluation and settlement reform.

This is not just trade — it’s global financial restructuring taking shape in real time.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Italy backs EU–Mercosur trade deal after 25 years of talks”

Financial Times – “EU member states move to approve Mercosur trade pact”

Associated Press – “EU inches toward landmark Mercosur trade agreement”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Sunday Morning 1-11-26

Unregulated Digital Revenues Pose Financial Risks In Iraq, Expert Warns

2026-01-11 Shafaq News– Baghdad Iraq’s rapidly expanding digital content sector operates largely without regulation, allowing significant online revenues to move outside state oversight and increasing financial risk, a member of the Dijlah Center for Strategic Planning warned.

Speaking to Shafaq News on Sunday, Ali Karim Idhayib noted that the spread of social media, especially live streaming and paid content, has created parallel cash flows beyond existing controls, cautioning that the absence of clear rules on income disclosure, taxation, and supervision leaves the sector vulnerable to misuse, including tax evasion and the movement of funds with unclear origins under media or entertainment labels.

Unregulated Digital Revenues Pose Financial Risks In Iraq, Expert Warns

2026-01-11 Shafaq News– Baghdad Iraq’s rapidly expanding digital content sector operates largely without regulation, allowing significant online revenues to move outside state oversight and increasing financial risk, a member of the Dijlah Center for Strategic Planning warned.

Speaking to Shafaq News on Sunday, Ali Karim Idhayib noted that the spread of social media, especially live streaming and paid content, has created parallel cash flows beyond existing controls, cautioning that the absence of clear rules on income disclosure, taxation, and supervision leaves the sector vulnerable to misuse, including tax evasion and the movement of funds with unclear origins under media or entertainment labels.

According to Chatham House, a London-based policy institute, Iraq’s digital economy is expanding faster than the state’s ability to monitor it, driven by a surge in online retail, ride-hailing platforms, and content monetization over the past five years. While these sectors have become a key opportunity for Iraq’s youth, who make up more than 60% of the population and face unemployment exceeding 35%, the think tank noted that weak infrastructure, unstable regulations, limited financing, and fragmented oversight are major constraints.

“The challenge is not technology itself, but how it is managed,” Idhayib stressed, pointing to international models that require transparency, integrate digital earnings into tax systems, and coordinate with major platforms. Iraq, he added, needs a similar framework adapted to local conditions.

He called for a national effort involving state institutions, economists, and communications regulators to align regulation with the pace of digital growth. https://shafaq.com/en/Economy/Unregulated-digital-revenues-pose-financial-risks-in-Iraq-expert-warns

Dollar Opens Lower In Baghdad, Higher In Erbil Markets

Economy & Business USD/IQD Exchange 2026-01-11 Shafaq News– Baghdad/ Erbil The US dollar opened Sunday’s trading at a lower rate in Baghdad while recording a slight increase in the Kurdistan Region, according to a Shafaq News market survey.

In Baghdad, the dollar opened at 146,000 Iraqi dinars per 100 dollars, down by 800 dinars from the previous session, when it closed at 146,800 dinars per 100 dollars at the Al-Kifah and Al-Harithiya exchanges.

Local exchange shops in the capital sold the dollar at 146,500 dinars per 100 dollars, while buying prices stood at 145,500 dinars.

In Erbil, the dollar edged higher at the opening of trading, with selling prices reaching 145,950 dinars per 100 dollars and buying prices at 145,900 dinars. This marked a slight increase compared with the last session, when the selling price stood at 145,700 dinars per 100 dollars, while the buying price was 145,600 dinars. https://shafaq.com/en/Economy/Dollar-opens-lower-in-Baghdad-higher-in-Kurdistan-markets

USD/IQD Exchange Rates Surge In Baghdad, Erbil

2026-01-11 Shafaq News– Baghdad/ Erbil The US dollar exchange rates edged higher against the Iraqi dinar on Sunday in Baghdad and Erbil as local currency exchanges closed.

According to a Shafaq News survey, Baghdad’s Al-Kifah and Al-Harithiya central exchanges registered a rate of 146,400 dinars per $100, up from 146,000 dinars per $100 earlier in the day.

In Baghdad’s local exchange shops, the selling rate climbed to 147,000 dinars per $100, while the buying rate stood at 146,000 dinars per $100.

In Erbil, the selling rate reached 146,100 dinars per $100 and the buying rate 146,000 dinars per $100.

https://shafaq.com/en/Economy/USD-IQD-exchange-rates-surge-in-Baghdad-Erbil-1-2

Iraq Ranks Third In The Arab World In Foreign Currency Reserves With $112 Billion.

InNovember 2025, Iraq's foreign currency reserves stood at approximately $112 billion, according to data from the Central Bank of Iraq. These reserves represent one of the highest levels in the region after Saudi Arabia and the UAE, covering more than 15 months of imports and providing Iraq with a significant safety net despite internal political and economic challenges.

Libya ranks fourth in the Arab world with large foreign currency reserves.

From the Gulf to the heart of Africa, despite political divisions, Libya maintains its fourth position in the Arab world with foreign currency reserves approaching $99 billion, covering about four years of imports.

Oil and gas exports define the features of economic power, as Arab countries' finances seize their windfall by increasing reserves and managing liquidity during periods of recession.

Qatar’s central bank’s foreign exchange reserves rose to $71.7 billion last November, covering 11 months of imports.

Egypt's substantial reserves exceeded $50.2 billion.

In Cairo, the most populous Arab country, foreign currency reserves stand at approximately $50.2 billion, a significant figure for supporting the Egyptian pound amidst import pressures and debt repayments. These reserves are now sufficient to cover more than six months of imports.

The figures at the Central Bank of Egypt improved during a year that witnessed an improvement in most indicators, and a rise in dollar revenues from exports, tourism and remittances from Egyptians abroad to more than $100 billion combined.

Reserves in Morocco and Algeria

Both Morocco and Algeria maintain similar levels of foreign exchange reserves, ranging between $39 billion and $41 billion. These figures are not just data in central bank reports, but rather indicators of the strength of countries and their ability to withstand fluctuations in oil prices, the challenges of inflation, and to ensure the stability of local currencies.

The World's Largest Foreign Exchange Reserves

Globally, China has the largest foreign exchange reserves, exceeding $3.2 trillion, followed by Japan, which exceeds $1 trillion.

Ultimately, whoever holds the reserves holds the initiative, and in a world full of fluctuations, these treasuries are the first line of defense for the stability of Arab economies. https://economy-news.net/content.php?id=64092

Oil Fuels 90% Of Iraq’s $70B+ Revenue In 2025

2026-01-10 Shafaq News– Baghdad Iraq generated more than 103 trillion Iraqi dinars ($71.4 billion) in federal budget revenue between January and October 2025, with oil accounting for about 90% of the total, Finance Ministry data showed on Saturday.

According to the data, oil revenue reached roughly $64.3 billion during the period, while non-oil income totaled about $7.1 billion.

Iraq continues to depend on oil to fund public spending. In earlier remarks to Shafaq News, government economic adviser Mudher Mohammed Saleh explained that decades of war, international sanctions, and political instability had undermined efforts to diversify the economy and expand non-oil revenue sources.

Read more: Iraq’s economy in 2025: Oil dominance and delayed reforms

https://shafaq.com/en/Economy/Oil-fuels-90-of-Iraq-s-70B-revenue-in-2025

BASEL 111 JUST TURNED GOLD INTO TIER ONE MONEY AGAIN

BASEL 111 JUST TURNED GOLD INTO TIER ONE MONEY AGAIN

Charlie Ward: 1-11-2026

Tomorrow is the 12th and it’s a big day. Normally I wouldn’t do a video on a Sunday but, with tomorrow being such a big day where Basel 3 comes into full effect it will change everything.

Because the banks have to comply or get out!.

Have a look at this: (Excerpts)

BASEL 111 JUST TURNED GOLD INTO TIER ONE MONEY AGAIN

Charlie Ward: 1-11-2026

Tomorrow is the 12th and it’s a big day. Normally I wouldn’t do a video on a Sunday but, with tomorrow being such a big day where Basel 3 comes into full effect it will change everything.

Because the banks have to comply or get out!.

Have a look at this: (Excerpts)

While the retail public was focused on price charts, the real decision was made behind closed doors in Basel Switzerland. The Bank of International Settlements (BIS) has officially passed the final implementation phase of the Basel 3 end game rules.

This is not a rumor but a regulatory mandate that goes into effect when markets open on Monday. They passed it quietly because they know it changes everything.

This new rule forces banks to revalue how they hold gold and silver on balance sheets.

They have lit the fuse for precious metals explosion. This new rule is the death knell for the naked short selling that has suppressed silver for 40 years.

This is as significant as Nixon closing the gold window in 1971.

In 1971 we moved away from metal. In 2026 with Basel the third we are moving back towards metal. It is a slow bureaucratic return to the Gold Standard disguised as banking regulation.

Monday Morning marks the start of a new era.

You have heard about the global reset. This is it. It isn’t a single event. It is a series of rule changes and Basel third is a key pillar to the reset. It re-establishes gold as the center of the financial solar system.

This moves us away from a US centric dollar system to a neutral asset backed system.

Be sure to listen to entire video for the details.

Debt Crisis Triggering Monetary Revolution?

Debt Crisis Triggering Monetary Revolution?

WTFinance: 1-9-2026

As we approach 2026 and beyond, the global economic and financial landscape is undergoing a significant transformation.

According to Jeff Park, CIO at ProCap Financial, the traditional US-led Washington Consensus, which has dominated global monetary policy and geopolitics since World War II, is in decline or potentially dead.

In a recent conversation, Park outlined the key drivers of this shift, including geopolitical realignments, trade imbalances, and the rise of new technological forces such as AI.

Debt Crisis Triggering Monetary Revolution?

WTFinance: 1-9-2026

As we approach 2026 and beyond, the global economic and financial landscape is undergoing a significant transformation.

According to Jeff Park, CIO at ProCap Financial, the traditional US-led Washington Consensus, which has dominated global monetary policy and geopolitics since World War II, is in decline or potentially dead.

In a recent conversation, Park outlined the key drivers of this shift, including geopolitical realignments, trade imbalances, and the rise of new technological forces such as AI.

The Washington Consensus, which has underpinned the global economic order for decades, is being challenged by a complex mix of factors. The changing role of the US dollar, trade tensions between the US and China, and the emergence of new technologies are all contributing to a rapidly evolving landscape.

As Park notes, these changes are ushering in a new era of “ideological investing,” where market movements and investment decisions are increasingly influenced by policy shifts, geopolitical events, and cultural trends rather than purely economic fundamentals.

In this new environment, investors must navigate a complex web of factors that are driving market behavior.

Monetary policy is undergoing a reset, with a disconnect emerging between short-term interest rates and long-term bond yields.

This challenges traditional investing frameworks and forces a reconsideration of investment strategies. The US-China economic relationship, characterized by structural imbalances and diverging industrial policies, is moving toward decoupling, influencing global capital flows and domestic policy in both nations.

Park contrasts the US market’s future to China’s current state, where government policies and ideological directives heavily influence market behavior.

He foresees the US market increasingly reflecting similar ideological drivers, where government actions and geopolitical events create outsized, often unpredictable market impacts.

This environment benefits retail investors who can act quickly and flexibly, unlike large institutions constrained by size and rules.

The rise of AI-powered robo-advisors is set to further disrupt traditional investing. These platforms can create highly personalized, ideology-driven portfolios that blend characteristics of active and passive investing.

This new paradigm could challenge traditional fund flows dominated by index funds and ETFs, as investors seek more agency over their investment choices aligned with personal beliefs and geopolitical views.

In this complex environment, Park advocates for diversified portfolios with orthogonal strategies that include long volatility positions to capture fat-tail risks. He emphasizes Bitcoin as a unique, orthogonal asset class with strong potential in the current environment, alongside traditional safe havens like gold.

Interest rates and the shape of the yield curve remain critical areas to watch, given their geopolitical and economic implications.

Finally, Park stresses the importance of culture as a defining parameter in investing. He highlights its resilience against AI and deterministic models, encouraging investors to embrace probabilistic thinking, maintain self-determination, and recognize the nuanced, non-deterministic nature of human behavior as crucial for navigating the complex investment landscape of the future.

The end of the Washington Consensus marks a significant shift in the global economic and financial landscape. As we enter a new era of ideological investing, investors must be prepared to navigate a complex and rapidly evolving environment.

By embracing diversification, orthogonal strategies, and the importance of culture in investing, investors can position themselves for success in a world where traditional frameworks are no longer relevant.

For further insights and information, watch the full video from WTFinance featuring Jeff Park’s conversation.

2000% Silver Revaluation! This Is What Every Silver Stacker Should Do

2000% Silver Revaluation! This Is What Every Silver Stacker Should Do | Lynette Zang

Smart Silver Trends: 1-10-2026

The True Value of Precious Metals Silver and Gold Valuation: Lynette Zang argues that based on a historic 20:1 gold-to-silver ratio, silver's true fundamental value should be a minimum of *$300 per ounce*. Applying this historical context, she calculates the true fundamental value of an ounce of gold to be between *$33,000 and $40,000*.

Gold Revaluation: Lynette Zang views a revaluation of U.S. gold reserves as inevitable. She believes the Federal Reserve would not implement this at current market prices because the current nominal price does not reflect the amount of paper money that has been issued. Its main purpose would be to regain public confidence after a catastrophic event.

2000% Silver Revaluation! This Is What Every Silver Stacker Should Do | Lynette Zang

Smart Silver Trends: 1-10-2026

The True Value of Precious Metals Silver and Gold Valuation: Lynette Zang argues that based on a historic 20:1 gold-to-silver ratio, silver's true fundamental value should be a minimum of *$300 per ounce*. Applying this historical context, she calculates the true fundamental value of an ounce of gold to be between *$33,000 and $40,000*.

Gold Revaluation: Lynette Zang views a revaluation of U.S. gold reserves as inevitable. She believes the Federal Reserve would not implement this at current market prices because the current nominal price does not reflect the amount of paper money that has been issued. Its main purpose would be to regain public confidence after a catastrophic event.

⭐️ Prediction of Hyperinflation and Currency Reset The Scenario: The core argument is that hyperinflation is coming to "burn off the debt." This period will see prices soar dramatically—the speaker gives an extreme example of a loaf of bread costing $80,000.

The Reset: After the hyperinflationary crisis, the speaker predicts a government action, such as "lopping off zeros" in an overnight revaluation to bring prices back down (e.g., $80,000 to $8). While all fiat savings would be reset, she suggests gold's newly high nominal price would hold value for a period before beginning to climb again in the new currency system.

⭐️ The Genius Act and the Stablecoin Market A New Monetary System: She discusses the Genius Act as the first legal foundation for cryptocurrencies and stablecoins, claiming it has already fundamentally changed the global monetary system.

Artificial Market: By requiring new U.S. stablecoins to be dollar-backed on a one-to-one basis, the government is creating a new artificial market to support the dollar, replacing the reliance on the US Treasury market. She highlights that the stablecoin market, currently at around $125 billion, is projected by some to grow to *$2 trillion by 2028*.

Criminal Cartels: The video concludes by asserting that the legal framework being created is similar to the 2008 financial crisis, effectively allowing bankers to act unethically without legal consequence, which the speaker refers to as the legalization of "theft" (inflation).

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 1-10-26

Good Afternoon Dinar Recaps,

BRICS TAKE CHARGE — Gold-Backed Trade Units Signal a Shift Away from Dollar Dependence

This is not de-dollarization — it’s a parallel system quietly taking shape

Good Afternoon Dinar Recaps,

BRICS TAKE CHARGE — Gold-Backed Trade Units Signal a Shift Away from Dollar Dependence

This is not de-dollarization — it’s a parallel system quietly taking shape

Overview

BRICS has launched a pilot “Unit” settlement instrument that blends 40% physical gold backing with 60% member currencies, offering a structured alternative for international trade settlement.

Designed for governments and banks, not consumers, the Unit reduces reliance on correspondent banking and mitigates sanctions exposure while maintaining ties to existing financial systems.

Stability is anchored in gold, addressing volatility concerns common to purely fiat or digital instruments.

Key Developments

Gold-Backed Structure: Each Unit is anchored by physical gold alongside proportional allocations of BRICS member currencies.

Blockchain Settlement: The system operates on a dedicated ledger maintained by an independent research institute, with reserves placed in escrow within member borders.

Trade-Only Instrument: Units are used for invoicing and clearing, avoiding intermediary FX conversions and reducing transaction friction.

Reserve Depth: BRICS nations collectively hold more than 6,000 tonnes of gold, reinforcing credibility and long-term backing.

Measured Rollout: The pilot phase limits scale and access, emphasizing testing, governance, and coordination over speed.

Why It Matters

This initiative reframes gold from a passive reserve into an active settlement asset, positioning BRICS to diversify trade rails without triggering abrupt market disruption. It signals a pragmatic approach: build alternatives without attempting to replace the dollar outright.

Implications for the Global Reset

Pillar 1 – Asset-Linked Settlement: Tying trade units to physical gold restores credibility and dampens volatility during fiat stress cycles.

Pillar 2 – Multipolar Trade Rails: Parallel settlement options reduce systemic risk tied to single-currency dependence and sanctions chokepoints.

Key Takeaway

The BRICS Unit is not a consumer currency and not a dollar killer. It is a strategic settlement layer—gold-anchored, institution-only, and deliberately paced. The message is clear: financial sovereignty is being engineered quietly, not announced loudly.

This is not just innovation — it’s the architecture of multipolar finance being laid.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “BRICS Take Charge: 40% Gold Unit Currency Starts Challenging Dollar”

Reuters — “BRICS explore gold-linked settlement tools as members seek alternatives to dollar trade”

~~~~~~~~~~

MONEY TRANSFER REFORMS BEGIN — Compliance Tightens on the Global Rails

U.S. Treasury signals enforcement-first approach to legitimacy, not restriction

Overview

The U.S. Treasury, under Secretary Scott Bessent, has launched targeted reforms and heightened scrutiny of money transfer centers following investigations into alleged welfare fraud and questionable overseas remittances. The effort is led by the Financial Crimes Enforcement Network (FinCEN) and is currently focused on Minnesota as a pilot program, with tools designed to improve transparency while preserving lawful cross-border transfers.

Key Developments

Enhanced Oversight: Money services businesses (MSBs) are facing tighter compliance checks, audits, and reporting requirements.

Geographic Targeting Orders (GTOs): Lower reporting thresholds expand transaction-level visibility in high-risk areas.

Fraud Prevention Focus: The initiative targets misuse of public funds and illicit flows without banning legitimate remittances.

Pilot Program: Minnesota serves as a test case to assess effectiveness before any broader rollout.

Regulatory Signal: Enforcement emphasizes proof of origin and lawful use, not blanket restrictions.

Why It Matters to Foreign Currency Holders

Legitimacy Premium: Tighter compliance strengthens confidence in currencies moving through regulated channels, supporting acceptance and settlement abroad.

Transparency Over Prohibition: Lawful foreign currency transfers remain permitted; the emphasis is on documentation and traceability.

Reduced Disruption Risk: Clear rules lower the odds of sudden freezes or reversals for compliant holders during enforcement cycles.

FX Market Confidence: Enhanced AML/KYC alignment reduces reputational risk, aiding correspondent banking and cross-border liquidity.

Watch for Expansion: If the pilot extends nationally, documentation standards could become uniform—benefiting compliant holders while pressuring opaque flows.

Implications for the Global Reset

Pillar 1 – Rule of Law: Consistent enforcement and verifiable origins underpin trust in cross-border value exchange.

Pillar 2 – Clean Settlement Rails: Transparent MSB operations support modern payment systems and reduce friction in FX settlement.

Key Takeaway

These reforms reflect process-driven financial tightening aimed at compliance and fraud prevention, not restricting legitimate currency movement. For foreign currency holders, documentation and lawful channels are the advantage—they preserve access, stability, and recognition as standards rise.

This is not restriction — it’s preparation for a compliant global system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Bessent says overseas money transfers are fine if people can prove origin of funds”

CBS Minnesota — Treasury Secretary Bessent Minnesota fraud crackdown

Bloomberg — Bessent ramps up Minnesota scrutiny with money services probe

~~~~~~~~~~

AIRSTRIKES NEAR IRAQ–SYRIA BORDER — Coalition Operations Target ISIS and Militant Cells

Explosions near the frontier signal continued pressure on extremist strongholds and regional instability

Overview

U.S. and coalition forces have reported multiple airstrikes targeting Islamic State of Iraq and the Levant (ISIL/ISIS) positions in both Syria and Iraq, including areas near the border region.

These operations are part of ongoing counter-terror campaigns designed to degrade remaining extremist capabilities and limit their ability to project violence across the frontier.

Strikes involved fighter jets, attack aircraft, bombers, and remotely piloted systems hitting tactical units, infrastructure, vehicles, and command positions.

The missions are conducted under Operation Inherent Resolve, the long-running anti-ISIS coalition effort involving the U.S. and partner nations.

Key Developments

Syria Airstrikes: Multiple engagements destroyed ISIS tactical units, fighting positions, buildings, and a mobile oil drilling rig near Hasakah and Kobani, disrupting militant logistics.

Iraq Strikes: Coalition strikes targeted ISIL units, checkpoints, vehicles, and bunkers near Rutbah, Beiji, Tal Afar, Sinjar, and near Kirkuk, degrading terror infrastructure.

Coordination With Iraqi Forces: Many of the Iraqi actions were approved by the Iraqi Ministry of Defense, reflecting cooperation against shared threats.

These airstrikes come amid ongoing security concerns along the long and porous Iraq–Syria border, a historic corridor for militants and smuggling networks.

Why It Matters to Foreign Currency & Markets

Risk Pricing in Oil & FX: Renewed military activity near a major oil-producing region keeps risk premia elevated in commodities and currencies tied to Middle East stability.

Capital Flows & Safe Havens: Heightened geopolitical risk tends to strengthen safe-haven assets and may widen spreads on regional sovereign credit.

Trade & Supply Disruption Risk: Extended unrest can affect logistics and insurance costs for goods moving through nearby export corridors.

Investor Confidence: Persistent conflict discourages inward investment and heightens volatility in markets sensitive to geopolitical stress.

Implications for the Global Reset

Pillar 1 – Security & Financial Stability: Persistent conflict highlights the role of security in underpinning economic confidence and currency stability.

Pillar 2 – Risk and Liquidity Flows: Geopolitical shocks influence liquidity allocations, reserve strategies, and risk-off behavior in global asset markets.

Key Takeaway

The latest airstrikes near the Iraq–Syria border illustrate that military pressure on extremist cells remains a priority even as the region transitions from territorial ISIS control to insurgent activity. These operations sustain operational risk in nearby markets and underscore how security dynamics directly intertwine with currency, trade, and investor confidence.

This is not just conflict — it’s the security layer beneath global markets.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps