Seeds of Wisdom RV and Economic Updates Monday Afternoon 3-17-25

Good Afternoon Dinar Recaps,

CARDANO AND BITCOIN INTEGRATION: A NEW FRONTIER FOR BLOCKCHAIN SYNERGY

In a crypto landscape where Bitcoin frequently tops $100K and commands a $1.3 trillion market cap, Cardano (ADA) is carving a transformative path through its integration with Bitcoin.

Announced in October 2024, this integration, powered by the BitcoinOS (BOS) Grail Bridge, uses zero-knowledge cryptography to connect two of the most prominent blockchains.

Good Afternoon Dinar Recaps,

CARDANO AND BITCOIN INTEGRATION: A NEW FRONTIER FOR BLOCKCHAIN SYNERGY

In a crypto landscape where Bitcoin frequently tops $100K and commands a $1.3 trillion market cap, Cardano (ADA) is carving a transformative path through its integration with Bitcoin.

Announced in October 2024, this integration, powered by the BitcoinOS (BOS) Grail Bridge, uses zero-knowledge cryptography to connect two of the most prominent blockchains.

This initiative aims to unlock Bitcoin’s vast liquidity for Cardano’s decentralized finance (DeFi) ecosystem, placing Cardano as a leader in cross-chain innovation. Both blockchains benefit from the strengths of each and this synergy makes it possible to do more in crypto.

How Both Blockchains Benefit

Cardano’s BTC integration creates a symbiotic relationship, enhancing the strengths of both Bitcoin and Cardano through technical ingenuity and strategic alignment.

Cardano’s Gains

Cardano taps into Bitcoin’s unparalleled liquidity—over $1.3 trillion as of early 2025—via the BOS Grail Bridge. This bridge uses the BitSNARK protocol, a zero-knowledge proof system, to enable trustless, secure transfers of BTC onto Cardano’s smart contract platform. In short, BitSNARK makes sure your Bitcoin transfers to Cardano remain private, secure, and reliable.

Unlike traditional bridges requiring off-chain custody, the Grail Bridge keeps Bitcoin on its native chain while allowing it to interact with Cardano’s extended UTXO (eUTxO) model. This model is Cardano’s way of handling transactions, where each transaction spends outputs from previous ones—like paying with exact cash and getting change—allowing safer, clearer, and more predictable blockchain interactions.

This opens doors to DeFi applications like lending and yield farming, powered by Cardano’s Ouroboros proof-of-stake consensus, which processes transactions with lower energy costs than Bitcoin’s proof-of-work.

Upcoming upgrades like Leios further boost scalability, preparing Cardano for a surge in BTC-driven activity.

ADA Spotlight: Sundial

Sundial, a Layer 2 solution bridging Cardano and Bitcoin, launched in late 2024 to unlock Bitcoin’s $1.3 trillion liquidity for Cardano’s DeFi ecosystem. Built on Cardano’s secure eUTxO model and Ouroboros consensus, Sundial processes transactions off-chain for increased speed, lower costs, and scalability.

“This partnership brings together Bitcoin’s security and Cardano’s flexibility, creating new opportunities for DeFi and real-world use. Our L2 will bridge these ecosystems, making transactions faster, more scalable, and more efficient.” stated Sundial founder Sheldon Hunt.

In partnership with Tesseract, Sundial protocol aims to handle thousands of transactions per second, integrating Bitcoin seamlessly and securely into Cardano’s rapidly growing ecosystem of 1,370+ projects.

By enabling Bitcoin-backed lending and trading, Sundial positions Cardano as a major DeFi hub for institutional users, potentially pushing ADA above $3 by late 2025 and reinforcing Cardano’s role as a leading interoperable blockchain.

Bitcoin’s Advantages on Cardano

For Bitcoin, this integration opens the prospect of smart contract functionality without altering its core protocol.

The BOS Grail Bridge enables BTC holders to engage in DeFi on Cardano—like decentralized exchanges or collateralized loans—while preserving Bitcoin’s security and simplicity. This doesn’t compromise Bitcoin’s foundational design but extends its utility beyond a store of value.

The BitSNARK protocol ensures privacy-preserving smart contracts, maintaining Bitcoin’s ethos of decentralization. With Cardano handling over 100 million transactions to date and hosting 1370+ Web3 projects, Bitcoin unlocks a partner chain to explore new use cases.

Top Benefits for Cardano Users Today

Cardano users are already reaping rewards from this integration, with practical enhancements boosting accessibility and utility.

▪️Enhanced DeFi Access

Bitcoin’s liquidity flowing into Cardano means users can now stake BTC in DeFi protocols, earn yields, or use it as collateral—all secured by zero-knowledge cryptography.

This expands Cardano’s 1300+ project ecosystem, which includes decentralized applications (dApps) built on its Plutus smart contract platform.

▪️Babel Fees Simplify Interaction

Cardano’s unique Babel Fees system lets users pay transaction fees in BTC instead of ADA, which is great for Bitcoin holders. This removes the need to acquire ADA upfront, lowering entry barriers and streamlining cross-chain participation.

Imagine a BTC holder joining a Cardano liquidity pool without swapping assets—Babel Fees make it seamless.

▪️Scalability in Action

With Leios on the horizon and Ouroboros already delivering high throughput, Cardano handles increased DeFi traffic efficiently. Users benefit from lower costs—often fractions of a cent per transaction—compared to Ethereum’s gas fees, making BTC-based DeFi on Cardano both practical and affordable. Sundial’s L2 bridging hints at even faster, cheaper transactions, though it’s still emerging.

▪️Community Governance

Cardano’s decentralized governance, rooted in its Voltaire phase, empowers users to shape the ecosystem. Bitcoin’s integration amplifies this, drawing in a broader community to vote on upgrades via on-chain mechanisms. This participatory model, paired with regulatory engagement in Washington D.C., builds trust among users and institutions alike.

In short, Cardano users gain a richer, more accessible DeFi landscape, fueled by Bitcoin’s scale and secured by cutting-edge tech.

Future Vision: Bitcoin and Cardano in Harmony

The ultimate goal of this integration transcends price speculation—it’s about making Bitcoin even more expansive in the multichain era of crypto. By merging Bitcoin’s liquidity with Cardano’s smart contract abilities, the duo makes for a better experience especially if you’re a Bitcoiner. You get to drive financial innovation on BTC on an unprecedented scale.

Picture a future where Bitcoin powers decentralized lending platforms on Cardano, or where BTC-backed stablecoins thrive across multichain ecosystems—all without centralized intermediaries.

Sundial and other L2’s integrated with BTC & ADA could accelerate this by enhancing scalability, potentially handling thousands of transactions per second. Cardano’s research-driven approach, with over 200 academic papers behind it, ensures this vision is grounded in rigor, not hype.

Bitcoin trusts Cardano to grow the network, and that is proof enough of Cardano’s firepower in the coming crypto cycles.

Analysts like Michaël van de Poppe see ADA hitting $3 short-term, with $10 possible by year-end 2025 if adoption surges. Yet there are still some challenges: Bitcoin’s conservative base needs convincing, and technical hurdles in cross-chain architecture persist.

But if realized, Cardano becomes Bitcoin’s smart contract layer, unlocking $1.3 trillion in value for DeFi while reinforcing Cardano’s role as a sustainable, scalable blockchain. This is about a symbiotic leap forward in crypto, blending Bitcoin’s dominance with Cardano’s innovation to reshape finance for millions.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

HOW NORTH KOREA’S $1.14B BITCOIN STASH COULD THREATEN THE CRYPTO MARKET

▪️North Korea has amassed a significant Bitcoin reserve through cybercrime, posing a potential market risk due to possible large-scale sales.

▪️The U.S. has established a large, legitimate Bitcoin reserve, contrasting with North Korea's illicit accumulation.

▪️North Korea's use of Bitcoin raises concerns about market stability.

North Korea has quietly built one of the largest government-held Bitcoin reserves, surpassing even crypto-friendly nations like El Salvador and Bhutan. This has raised concerns in the crypto community, as a sudden sell-off from North Korea could shake the market, causing a liquidity crisis and a major price drop.

What happens if they decide to sell off their holdings? Could this trigger a massive market crash? And more importantly, is this part of a bigger geopolitical game?

Here’s a closer look at how North Korea built its Bitcoin empire – and why the world should be paying attention.

Are Heists Fueling North Korea’s Bitcoin Growth?

North Korea’s rise as a major Bitcoin holder follows a large-scale cyber heist by the Lazarus Group, a state-backed hacking syndicate. On February 21, 2025, the group stole over $1.4 billion in cryptocurrency from Bybit, a well-known exchange.

Much of the stolen funds, originally in Ethereum, were later converted into Bitcoin, increasing North Korea’s total holdings to 13,562 BTC—now valued at more than $1.14 billion.

The US Takes a Different Approach

While North Korea has acquired Bitcoin through cyberattacks, the United States has opted for a structured approach. On March 6, 2025, President Donald Trump signed an executive order creating the Strategic Bitcoin Reserve (SBR). With 198,109 BTC, worth around $16.71 billion, the US now holds the world’s largest government-owned Bitcoin supply.

How Other Countries Compare in Bitcoin Holdings

According to Arkham data, several governments now hold significant amounts of Bitcoin:

▪️The United Kingdom has 61,245 BTC ($5.17 billion), mostly seized from criminal activity.

▪️Bhutan holds 10,635 BTC ($897.6 million) through its state investment arm, Druk Holdings.

▪️El Salvador, the first country to adopt Bitcoin as legal tender, has 6,117 BTC ($516.11 million).

Is Kim Jong Un Making a Strategic Bitcoin Move?

The timing of North Korea’s Bitcoin buildup, just as the US launched its Strategic Bitcoin Reserve, has raised speculation. Some analysts believe Kim Jong Un is using stolen Bitcoin to create a shadow reserve, helping North Korea bypass financial restrictions and fund operations without relying on traditional banking systems.

Bitcoin’s decentralized nature makes it a valuable asset for North Korea, which has been cut off from the global financial system due to international sanctions. Unlike traditional reserves such as gold or foreign currency, Bitcoin allows the country to move wealth and conduct transactions without oversight from global financial authorities.

Crypto Community Is Not Taking It Well

While the US sees its Bitcoin reserve as a financial strategy, North Korea’s growing stash appears to be part of a broader geopolitical game. This marks a shift where digital assets are becoming tools of economic and political influence.

The crypto community is increasingly worried about North Korea’s Bitcoin strategy.

Bitcoin is no longer just a currency; it’s a weapon, a shield, and a statement of power.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Monday 3-17-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 17 March 2025

Compiled Mon. 17 March 2025 12:01 am EST by Judy Byington

What We Think We Know as of Mon. 17 March 2025:

Fri. 14 March 2025 Secretary of Treasury Scott Bessent: President Trump is (allegedly) putting a 90 day tax collection freeze on the IRS and firing 45,000 agents.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 17 March 2025

Compiled Mon. 17 March 2025 12:01 am EST by Judy Byington

What We Think We Know as of Mon. 17 March 2025:

Fri. 14 March 2025 Secretary of Treasury Scott Bessent: President Trump is (allegedly) putting a 90 day tax collection freeze on the IRS and firing 45,000 agents.

Corporate Taxes in the United States: “Corporate taxes in the United States began in 1894 when the first federal corporate income tax was introduced. However, this tax was challenged in court and found to be unconstitutional, leading to its repeal within one year. The corporate tax was reintroduced in 1913 with a much lower rate of 1%.” The Federal Reserve, didn’t just shove the income tax down the throats of Americans, it also shoved the corporate tax down the throats of American businesses too. Trump is taking us back to the constitution where the people have all the power again.”

The CIA, the Federal Reserve, and Wall Street have spent decades suppressing gold’s role in the financial system. If gold was really worthless, why is the U.S. government REFUSING to conduct a full audit of Fort Knox? Why is China accumulating massive gold reserves? Why are the wealthiest families quietly preparing for a return to a gold-based economy while YOU are told to “trust the dollar”? …Secrets Exposed on Telegram

~~~~~~~~~~

Global Currency Reset:

On Mon. 17 March 2025 NESARA/GESARA Will Be (allegedly) Official Throughout the World. https://x.com/Official_MrPool/status/1900999425876525531?t=KtRCVd7-FZteWi_2Cb4UZQ&s=09 …Mr. Pool on X

Sat. 15 March 2025 Wolverine: “A high, high source just told me we will be celebrating this week. I can’t tell you the date, but it will all be happening this week.”

Sat. 15 March 2025: MAJOR NEWS: RV/GCR is HERE – The Gold Reset is HAPPENING – The Fed is D**D – The Fiat Illusion is Collapsing – Are You Ready? – amg-news.com – American Media Group

~~~~~~~~~~

Sat. 15 March 2025 Quantum Financial System (QFS) Operating … Julian Assange on Telegram

THURS. 13 MARCH 2025: THE QUANTUM FINANCIAL SYSTEM (QFS) has been operating behind the scenes, monitoring all banking transactions in preparation for its full activation. This technology will revolutionize the financial world, rendering corruptt systems obsolete and ensuring a gold- or asset-backed economy free from manipulation.

The End of the Cabal’s Banking Empire: The QFS will replace the Swift system with an un-hackable, AI-driven network supported by the Secret Space Program. It was designed to dismantle the DeepState’s control, preventing iligal wealth accumulation through usury, fraud, and theft. The days of corrupt politicians and bankers laundering money in secrecy are over—QFS monitors every transaction in real time.

The QFS has been running parallel to the existing system, Every fiat dollar, euro, or yen has been digitally marked, making illicit transfers impossible to conceal. The Cabal’s system is crumbling; their defeat is near.

Gold-Backed Currencies & The Global Currency Reset (GCR): In the new system, only gold- or asset-backed currencies will be recognized. Every transaction will carry a digital gold certificate, referencing the actual gold reserves securing the currency. Any fiat currency tied to fraud, terrorism, or illigal origins will be disqualified from QFS.

Each country must be GESARA-compliant to participate, ensuring fairness in global trade. A specific formula will determine each nation’s currency value based on its assets, economy, and population. The GCR (Global Currency Reset) will align all national currencies at a one-to-one exchange rate, ensuring financial sovereignty free from Cabal control.

QFS: The Ultimate Quantum Security: Unlike blockchain, which is still vulnerable, QFS is a quantum AI system technology. It prevents hacking, fraud, and unauthorized transfers, ensuring every transaction is transparent, legal, and owner-intended.

For decades, politicians and elites manipulated the Swift system, moving stolen wealth globally. They never realized that QFS was already tracking their actions in real time.

The Deepstate’s Final Breath: Despite desperate efforts to hack, delay, or sabotage QFS, the Cabal has lost. They will soon be fully removed as the world shifts to a free and fair financial system. Seventy thousand+ sealed indictments are prepared, signaling a wave of justice. The DeepState’s destruction is inevitable.

The QFS is alive—an intelligent system that ensures financial fairness, preventing theft and restoring economic freedom for humanity. The great liberation has begun.

Read full post here: https://dinarchronicles.com/2025/03/17/restored-republic-via-a-gcr-update-as-of-march-17-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man If they change the value of their exchange rate and they go into the international Forex they're not going to do it at 1310. If they were going to do it at 1310 as it is today they would have already done it but they haven't. It's that simple.

Militia Man They're somewhere around 2.5% to 2.8% inflation, which is historically low in all of the Middle East...Having the dollar reserves, having the gold reserves and having low inflation are key components to a revaluation...They have well over what is required by the IMF. They've got 3x to 5x the reserves necessary to support the value of their currency.

Frank26 [Iraq boots-on-the-ground report] FIREFLY:As soon as the budget reaches the council and it will submit a report to the presidency of parliament in this regard. FRANK: First it's going to the COM! What did I say? Who should be the last? And when? 3...2...1...now! The last nanosecond. This going to the COM first Sudani? Yes. The COM, your Council of Ministers, is going to review every penny of this budget? Yes. Then it's going to parliament? Yes. So they can't screw around with it by then because then it becomes official right? Yes.

FDIC: Bank Deposit Risk Grows as $482B in Losses Threaten Stability

Taylor Kenny: 3-16-2025

The FDIC just confirmed bank losses are surging, not shrinking—and it’s 10X worse than 2008.

With rising interest rates devaluing bank assets, the same risk that collapsed Silicon Valley Bank is now lurking beneath the surface of the entire financial system.

Only 1.25% of deposits are insured, and banks are stockpiling gold. What are they preparing for?

CHAPTERS:

0:00 FDIC

1:40 $118 Billion ¬Loss

2:36 High Risk Banks

6:07 Increased Inflation & Bank-Bail Ins

8:23 Central Bank Gold Buying

9:50 Gold and Silver Guide

“Tidbits From TNT” Monday 3-17-2025

TNT:

Tishwash: Iraq: Top 5 Arab economy in 2024

Five Arab countries, including Iraq, accounted for 72% of the region’s GDP, which surpassed $3.6 trillion in 2024, according to a new report from the Arab Investment & Export Credit Guarantee Corporation ("Dhaman") released on Sunday.

The UAE, Saudi Arabia, Egypt, Iraq, and Algeria emerged as the leading contributors to the Arab economy, the report showed.

The forecast for 2025 suggests a 4.1% growth in the Arab economy, driven by strong performances in 14 countries, including nine oil producers, which together make up around 78% of the total GDP.

TNT:

Tishwash: Iraq: Top 5 Arab economy in 2024

Five Arab countries, including Iraq, accounted for 72% of the region’s GDP, which surpassed $3.6 trillion in 2024, according to a new report from the Arab Investment & Export Credit Guarantee Corporation ("Dhaman") released on Sunday.

The UAE, Saudi Arabia, Egypt, Iraq, and Algeria emerged as the leading contributors to the Arab economy, the report showed.

The forecast for 2025 suggests a 4.1% growth in the Arab economy, driven by strong performances in 14 countries, including nine oil producers, which together make up around 78% of the total GDP.

Despite economic challenges, the analysis highlights a boost in oil and gas export revenues, though crude oil production dropped by 4%, with uneven growth across the region.

Iraq continues to play a central role in the Arab economy, with its reliance on oil exports alongside government efforts to diversify income sources and increase investments in other sectors.

Per capita income in the Arab world reached $7,557 in 2024, with a modest increase expected to $7,602 in 2025. The population surpassed 467 million, growing by 2%.

Inflation in the region climbed to 12% last year, but is expected to ease to 8.5% in 2025. Unemployment rose to 9.7%.

Arab foreign trade saw a 3.6% increase, reaching $3.3 trillion, thanks to a 1% rise in exports and a 7% jump in imports.

Foreign exchange reserves across Arab countries grew by 3.7%, reaching $1.2 trillion, enough to cover imports for more than eight months.

The region's government debt decreased to 48.3% of GDP, with further reductions expected, dropping to 47.6% in the coming year. link

************

Tishwash: To reduce speculation, a Sudanese advisor reveals a new monetary strategy.

The Prime Minister's economic advisor, Mazhar Mohammed Saleh, revealed a new monetary strategy Sunday evening that seeks to reduce speculation.

Saleh said in a statement to Al-Furat News that: "A new monetary strategy aims to gradually attract foreign exchange transactions to the officially regulated banking system."

He explained that "this strategy focuses on expanding the base of buying and selling foreign currency at fixed and stable rates, in line with the current monetary policy."

Saleh emphasized that "these steps coincide with enhancing the freedom of the foreign exchange process, with a high commitment to transparency and money governance in line with international standards."

He pointed out that "this strategy is being implemented in an organized and precise manner by the Iraqi banking system, and specifically targets large transfers, especially those related to financing wholesale trade."

Saleh also pointed out "the importance of stimulating electronic banking transactions to reduce cash circulation, which contributes to feeding the parallel market with cash dollars, thus reducing speculative operations that take place outside the framework of the law." link

**************

Tishwash: Rafidain: Electronic collection amounts jumped to more than 6 trillion dinars in 2024.

Rafidain Bank announced record growth in electronic tax settlements for government departments' accounts during 2024, with amounts exceeding 6 trillion dinars.

A statement issued by Rafidain Bank confirmed, "The pace of collections through electronic payment companies has increased, reflecting the significant development in the adoption of digital systems in government revenue management."

The statement explained that "total tax collections during 2024 amounted to more than 6.06 trillion Iraqi dinars, recording a continuous increase compared to the first months of the year."

According to the statement, September 2024 witnessed the highest growth rate, with total settlements reaching 838.5 billion dinars, an increase of 11.12% compared to the previous month.

At the beginning of 2025, the system continued its "strong performance, with total collections in January 2025 reaching approximately 707.5 billion dinars, followed by February with 689.2 billion dinars."

Government departments also recorded a "significant increase in the activation of the electronic collection system, with the number of activated entities rising to 1,808 by February 2025, compared to 1,395 by December 2024."

Rafidain Bank affirmed that "this significant growth reflects the success of the state's efforts to promote digital transformation, reduce reliance on cash, and achieve higher levels of financial transparency and efficiency," noting that "the electronic collection system represents a fundamental pillar in improving collection mechanisms and reducing the risks of financial corruption."

He also noted that "this qualitative leap comes within the framework of the ongoing efforts led by Rafidain Bank, in cooperation with government agencies, to support the digital economy, enhance confidence in electronic financial transactions, and raise the efficiency of the financial sector in Iraq link

Mot: .. May the Road Rise ~~~~~

Mot: .. Bet Ya Didn't Knows!! Elves in ireland

Seeds of Wisdom RV and Economic Updates Monday Morning 3-17-25

KEY US ECONOMIC EVENTS THIS WEEK: HOW MARKETS AND CRYPTO MAY REACT

▪Key US economic indicators this week, including retail sales, housing starts, and jobless claims, will provide signals about the economy.

▪The Federal Reserve's interest rate decision, expected to remain unchanged, will be closely watched for future policy hints.

▪Multiple indexes released on Thursday, including Existing Home Sales and the Fed Manufacturing Index, are forecast to decline.

KEY US ECONOMIC EVENTS THIS WEEK: HOW MARKETS AND CRYPTO MAY REACT

▪Key US economic indicators this week, including retail sales, housing starts, and jobless claims, will provide signals about the economy.

▪The Federal Reserve's interest rate decision, expected to remain unchanged, will be closely watched for future policy hints.

▪Multiple indexes released on Thursday, including Existing Home Sales and the Fed Manufacturing Index, are forecast to decline.

This week, several key economic events in the US could shape market trends and investor sentiment. From retail sales and housing data to jobless claims and the Federal Reserve’s interest rate decision, these reports will offer crucial insights into the state of the economy.

Why does this matter? Because shifts in economic indicators don’t just affect traditional markets – they impact crypto too! A strong economy could fuel investor confidence, while signs of slowdown might trigger uncertainty.

Prime US Economic Events This Week

US Retail Sales Index – Monday

The US Retail Sales Index, set for release on Monday, measures the total sales of retail goods and services over a month.

In January, it dropped from 0.7% to -0.9%. The consensus expects that it would rise from -0.9% to 0.7%. According to TEForecast, the index would climb to 0.5%.

An increase in retail sales usually signals a strong economy, boosting investor confidence and encouraging riskier investments like cryptocurrencies. However, if consumer spending is too strong, the Federal Reserve may take a stricter stance on interest rates, which could negatively impact the crypto market.

US Housing Starts Index – Tuesday

The Housing Starts Index, coming out on Tuesday, tracks the number of new residential construction projects that begin each month.

In January, the index fell from 1.515 million to 1.366 million. The consensus forecast predicts a slight increase to 1.375 million, while TEForecast expects a further decline to 1.34 million.

A rise in housing starts signals economic growth and can boost investor confidence. However, if construction activity increases too much, it may push interest rates higher, making borrowing more expensive and potentially slowing down crypto investments.

US Initial Jobless Claims – Thursday

The Initial Jobless Claims report, scheduled for Thursday, tracks the number of people filing for unemployment benefits for the first time.

In the second week of March, it slipped from 222K to 220K. The consensus estimates that it would grow sharply from 220K to 224K. As per TEForecasts, it would reach as high as 225K.

Higher jobless claims indicate economic weakness, which can lower investor confidence. However, a weakening labor market may also delay interest rate hikes, which could support crypto prices in the short term.

US Existing Home Sales – Thursday

The Existing Home Sales Index, also releasing on Thursday, measures the number of homes sold where the mortgage has been finalized.

In January, home sales fell from 4.29 million to 4.08 million. Analysts expect another drop to 3.92 million.

A drop in US existing home sales signals economic slowdown. It may also suggest lower consumer spending. This could affect crypto market sentiment adversely.

Philadelphia Fed Manufacturing Index – Thursday

The Philadelphia Fed Manufacturing Index, based on a survey of manufacturers in the Third Federal Reserve District, is set for release on Thursday.

In February, the index dropped from 44.3 points to 18.1 points. Analysts expect it to fall further to 12.1 points, while TEForecast predicts a decline to 11 points.

A shrinking manufacturing index indicates economic contraction and could lead to a more cautious market, affecting investment in both traditional and digital assets.

Federal Reserve Interest Rate Decision – Wednesday

The Federal Open Market Committee (FOMC) will meet on Tuesday, with its decision on interest rates expected on Wednesday.

Most experts believe the Federal Reserve will keep rates unchanged for now. Recently, Fed Chair Jerome Powell suggested that the central bank is taking a cautious “wait-and-see” approach, as many economic factors remain uncertain.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

SOUTH KOREA'S CENTRAL BANK RULES OUT BITCOIN RESERVE POSSIBILITY: REPORT

▪The Bank of Korea said it has not considered the option of creating a bitcoin reserve.

▪The central bank cited bitcoin’s volatility and IMF guidelines as the reasons for its decision not to review.

The Bank of Korea (BOK) stated Sunday that it has not considered the possibility of incorporating bitcoin into its foreign exchange reserve, in an answer to a written query from a member of the National Assembly's Strategy and Finance Committee.

The BOK cited bitcoin's high volatility as a primary reason for its negative stance on accruing the cryptocurrency, the Korea Economic Daily reported.

The central bank expressed concern that volatility in the cryptocurrency market could lead to a significant surge in transaction costs when cashing out bitcoin, according to the news report.

Bitcoin also does not comply with the International Monetary Fund's guidelines for foreign exchange reserve management, the BOK said. The IMF states in its guidelines that a foreign exchange reserve must control liquidity, market and credit risks "in a prudent manner."

On March 6, U.S. President Donald Trump signed an executive order to establish a Strategic Bitcoin Reserve, based on the BTC the government seized from criminal or civil proceeding

While Trump's move prompted several countries to positively consider creating their own bitcoin reserves, the South Korean central bank has cited skeptical views shared by Japan, Switzerland and the European Central Bank.

Beyond the issue of creating a bitcoin reserve, South Korea has recently been moving to loosen its strict regulations on crypto. The country's financial watchdog is currently rolling out its plan to gradually lift the ban on institutional crypto trading, and is preparing to establish its second crypto legal framework, focusing on managing stablecoins.

The Block reached out to the BOK for further comment.

@ Newshounds News™

Source: The Block

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Iraq confronts economic crises with the "Digital Dinar." The parallel market is threatened with "Extinction."

TNT:

Tishwash: Iraq confronts economic crises with the "digital dinar." The parallel market is threatened with "extinction."

The Central Bank of Iraq is preparing to launch the digital dinar, marking the transition to digital currency management.

The digital dinar is a digital currency issued by the central bank, officially part of a country's monetary system. It is similar in value to the traditional dinar, but is traded electronically via digital wallets or approved financial applications.

TNT:

Tishwash: Iraq confronts economic crises with the "digital dinar." The parallel market is threatened with "extinction."

The Central Bank of Iraq is preparing to launch the digital dinar, marking the transition to digital currency management.

The digital dinar is a digital currency issued by the central bank, officially part of a country's monetary system. It is similar in value to the traditional dinar, but is traded electronically via digital wallets or approved financial applications.

It facilitates instant money transfers within the country or across borders, reduces the logistical burden of issuing paper or metal currency, and enables broader segments of society to access digital financial services.

This project comes in light of the significant economic challenges facing Iraq, such as its heavy reliance on paper money and the phenomenon of hoarding. The digital dinar aims to address these challenges by providing a safe and effective digital alternative to paper money.

Central Bank Governor Ali Al-Alaq had previously stated during a speech he delivered at the Finance and Banking Conference and Exhibition that "the financial and banking system will witness fundamental transformations, including the decline of paper currencies and their replacement by digital payments for central banks."

He explained that "the Central Bank is moving to create its own digital currency, which will gradually replace paper transactions, as is the case with some central banks around the world."

Mazhar Saleh Mohammed, the Prime Minister's advisor for financial and banking affairs and former deputy governor of the Central Bank, highlighted the importance of the digital dinar and its relationship to the dollar exchange rate in local markets.

Speaking to Al-Eqtisad News, Mohammed emphasized that the digital dinar is a global trend in the development of payment systems, particularly in the description of monetary units that will acquire digital rights bearing the same legal acquittal force issued by the monetary authority as banknotes in acquitting debts, as they are units of account, exchange, and storage of value within the digital economic community and via a highly sophisticated, rapid, and accurate information system.

He added that these monetary units will be used with high transparency to cover various real transactions of goods and services, as well as to settle small and large obligations. He noted that all exchange transactions will be transparently recorded between traders, up to the point of purchasing a loaf of bread, under the supervision of the monetary authority, thus ending the ambiguous or illegal uses of money once and for all.

Regarding the digital dinar's relationship to exchange rates, Al-Sudani's advisor explained that the official exchange rate will be the prevailing and sole rate, the digital exchange rate adopted by monetary policy.

The parallel market will disappear in its current form, as it is difficult to invent a secondary digital market whose operations operate outside the control of the digital monetary authority. However, usurious digital markets may emerge among the same traders.

He pointed out that the digital cash system provides the banking system with sufficient digital cash liquidity to grant loans without the risk of liquidity risk within banking markets. This encourages investors to borrow easily, increases economic growth levels, and promotes sustainable development. It also facilitates access to global digital exchanges for global payments and settlements.

"Introducing digital currency requires two things," according to the Prime Minister's advisor. He explained that the first is a high level of public awareness of the digital monetary system, while the second is the availability of an advanced information, communications, and data technology infrastructure that evolves continuously over time.

He pointed to the need for a legal infrastructure to protect digital currency transactions, particularly in protecting users' rights to their income and wealth, which cybersecurity provides against any dangerous digital breaches.

Many questions are being raised about the digital dinar and its differences from cryptocurrencies, which economic expert Ziad Al-Hashemi answers.

Al-Hashemi points to a "significant difference" between digital currencies and cryptocurrencies: "The former are issued and regulated by central banks, such as the digital dollar and the digital dirham, while cryptocurrencies such as Bitcoin are not subject to any official authority and their value depends on supply and demand, making them highly volatile."

He stated that if the Central Bank of Iraq issues the digital dinar, it will be the sole entity controlling the issuance and distribution of the digital currency, facilitating oversight and preventing financial crimes, unlike cryptocurrencies, which operate on a decentralized system that is difficult to control.

He pointed out that the digital dinar will be fully backed by the central bank and have a relatively stable value, similar to paper currency. However, it will be traded electronically only through bank accounts and wallets, contributing to reducing the use of paper money, achieving financial inclusion, and reducing reliance on the dollar in daily transactions.

Al-Hashemi noted that the primary goal of this step is to eliminate the phenomenon of cash hoarding, whereby citizens keep large sums of money outside banks due to lack of confidence in the banking system. This hinders the flow of funds and negatively impacts economic activity. If the project is implemented well, the digital dinar could help disburse hoarded liquidity and stimulate lending and credit. link

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 3-16-25

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 3-16-25

Good Afternoon Dinar Recaps,

JPMORGAN CHASE, WELLS FARGO AND BANK OF AMERICA REFUSE TO REIMBURSE CUSTOMERS AFTER SCAMMERS ATTACK ACCOUNTS: REPORTS

New reports show JPMorgan Chase, Wells Fargo and Bank of America are closing the door on customers hit by fraud, rejecting their claims and refusing to reimburse their accounts.

Good Afternoon Dinar Recaps,

JPMORGAN CHASE, WELLS FARGO AND BANK OF AMERICA REFUSE TO REIMBURSE CUSTOMERS AFTER SCAMMERS ATTACK ACCOUNTS: REPORTS

New reports show JPMorgan Chase, Wells Fargo and Bank of America are closing the door on customers hit by fraud, rejecting their claims and refusing to reimburse their accounts.

JPMorgan Chase refused to refund a customer in Northern California after a scammer used a fake driver’s license to initiate unauthorized withdrawals, reports the ABC-affiliated news station KGO-TV.

Katrina, who preferred not to give her last name, says someone pretending to be her withdrew money from her Chase account without even having her bank card or PIN.

The con artist, who is still at large, made two withdrawals from Katrina’s account totaling $1,500.

Katrina filed a police report and the next month, she received a letter from Chase telling her that the bank has denied her claim, alleging that she both authorized and benefited from the withdrawals. After Katrina reached out to the local news for help, the bank reversed its decision.

Meanwhile, Wells Fargo has told a customer in South Carolina that she’s out of luck after falling victim to scammers pretending to work at the bank’s fraud department, reports the NBC affiliate WGAL.

Stephanie Zufall received a message asking her to verify a $1,300 Apple Pay transaction. She replied “no” and soon received a call from someone posing as a Wells Fargo representative.

The scammer tricked Zufall into depositing $3,000 into an ATM via her mobile wallet, then stole it by linking her account to his.

Wells Fargo denied her claim and in response to the news report, says it’s re-opened the investigation.

Lastly, Bank of America says it will not reimburse an aspiring entrepreneur’s account after she lost $20,000 to a scammer impersonating the bank.

The customer says she received a call from a spoofed number matching BofA’s support number on her debit card, reports the ABC-affiliated WLS-TV.

The scammer convinced her to transfer the money to supposedly protect it, only for her to later discover that she had been deceived.

Bank of America says it’s not liable and its real staff would never ask customers to send money over the phone.

The customer says the loss has forced her to abandon plans to start a new business.

“I’ve been working 10 to 13 hours plus with no break. I have to expedite that money that was stolen from me, and it wasn’t just stolen from me, but stolen from my kids, too.”

@ Newshounds News™

Source: Daily Hodl

~~~~~~~~~

BRICS MAKES MAJOR ANNOUNCEMENT ON DE-DOLLARIZATION

The major announcement from the BRICS alliance is that the bloc is divided on the global de-dollarization agenda. The nine-member alliance is seeing divisions as cracks open up from all sides on what the group stands for. While some countries want to launch a new common currency for trade and transactions, others don’t. The breaking up of ideas is causing a split within the group with each country wanting different agendas.

BRICS: India & Brazil Announce ‘No Interest’ in De-Dollarization

BRICS member India has made it clear that it has no interest in ending reliance on the US dollar and will not pursue the de-dollarization agenda. Foreign Minister S. Jaishankar said that India has “absolutely no interest” in undermining the US dollar. He said that the country “has never had a problem” with the greenback and has no plans to replace it.

In addition, four Brazilian government officials on the condition of anonymity said that Brazil plans to reject the BRICS currency. Brazil chairs the upcoming summit in July and plans to dismiss the formation of the new currency. President Luiz Lula da Silva is planning to nix the idea as he chairs the 17th summit, reported Reuters. Therefore, BRICS members India and Brazil are against de-dollarization in 2025.

Even BRICS members South Africa and the United Arab Emirates (UAE) remain on the sidelines of the de-dollarization initiative. Only Russia, China, and Iran are aggressively looking to replace the US dollar for cross-border transactions. Russia and Iran are reeling under sanctions that are making them desperate to find an alternative to the US dollar.

On the other hand, China is looking to use BRICS as a stepping stone to pursue its agenda of global domination. India does not want that to happen as it sees the Communist country as an opportunist. In conclusion, the idea of BRICS reshaping the de-dollarization initiative is a farce with no unity and more divisions.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

XRP HOLDERS THIS IS WHY RIPPLE WILL REPLACE SWIFT - BANKS WILL BEG FOR XRP | Youtube

XRP JUST FLIPPED ETHEREUM IN FDV - NOTHING IS KEEPING XRP FROM GOING PARABOLIC | Youtube

@ Newshounds News™

Source: Common Sense Crypto

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Sunday Afternoon 3-16-2025

KTFA:

Clare: Al-Sudani's advisor: Iraq's foreign reserves reach $110 billion

3/16/2025- Baghdad

The Prime Minister's financial advisor, Mazhar Mohammed Salih, confirmed on Sunday that Iraq's foreign exchange reserves are a safety net against economic fluctuations, noting that they are estimated at approximately $110 billion.

"Iraq's foreign exchange reserves are one of the most important indicators supporting investment, both domestic and foreign, as the country has a stable foreign exchange portfolio estimated at approximately $110 billion, distributed between gold, dollars, and foreign currencies," Saleh said in a statement to the official agency, followed by "Al-Eqtisad News."

KTFA:

Clare: Al-Sudani's advisor: Iraq's foreign reserves reach $110 billion

3/16/2025- Baghdad

The Prime Minister's financial advisor, Mazhar Mohammed Salih, confirmed on Sunday that Iraq's foreign exchange reserves are a safety net against economic fluctuations, noting that they are estimated at approximately $110 billion.

"Iraq's foreign exchange reserves are one of the most important indicators supporting investment, both domestic and foreign, as the country has a stable foreign exchange portfolio estimated at approximately $110 billion, distributed between gold, dollars, and foreign currencies," Saleh said in a statement to the official agency, followed by "Al-Eqtisad News."

He explained that "these reserves contribute to strengthening macroeconomic stability, both domestically and externally, making them a protective factor against global economic fluctuations and shocks. They also provide strong coverage for the monetary base and financial indicators related to trade and international debt maturing soon."

He added, "The current account of the balance of payments is recording positive rates that enhance the stability of the value of the Iraqi dinar, thus reducing the impact of fluctuations in global oil markets, given the nature of Iraq's rentier economy."

He noted that "Iraq, as the fifth largest oil producer in the world, enjoys sustainable foreign financial flows, enabling it to quickly and efficiently support its cash reserves."

He stressed that "these strong reserves provide a stable investment environment, which contributes to accelerating the pace of investment and supporting the country's promising economic growth." LINK

************

Clare: Turkish Energy Minister Arrives in Baghdad for Oil and Gas Talks

3/16/2025

Turkish Minister of Energy and Natural Resources Alp Arslan arrived in Baghdad on Sunday, according to a statement issued by the Iraqi Ministry of Oil.

The ministry said in a statement that Deputy Prime Minister for Energy Affairs and Minister of Oil Hayan Abdul-Ghani Al-Sawad received Arslan and his accompanying delegation.

According to the statement, the meeting discussed bilateral relations between the two countries in the fields of oil, gas and energy.

The meeting was attended by the Undersecretary for Extraction Affairs and the General Managers of the Oil Marketing Company, the North Oil Company, the Economic Department, and the Legal Department, according to the statement.

Turkey halted flows on the pipeline, which transports oil from the Kurdistan Region of Iraq to the Turkish port of Ceyhan, in March 2023 after an arbitration court ordered it to pay approximately $1.5 billion in compensation to Iraq for transporting oil without Baghdad's approval. Ankara refused to pay the fine at the time and demanded that Erbil pay it.

The pipeline closure halted Iraqi oil exports by approximately 500,000 barrels per day. The resumption of oil flows from Kurdistan may mitigate some of the impact on markets caused by reduced shipments from Iraq, the main source of crude.

Iraq had been exporting between 400,000 and 500,000 barrels per day from northern fields, including the Kurdistan Region, via the now-defunct pipeline. Oil Minister Hayan Abdul Ghani said earlier this month that Iraq plans to transport at least 300,000 barrels per day of crude oil once operations resume. He added that the Iraqi government has also begun a formal process to persuade the regional government to transfer the oil to the Federal Oil Marketing Organization (SOMO).

Türkiye has repeatedly said that the pipeline is operational and that it is up to Iraq to resume flows, and the United States has also expressed a strong desire to see oil flow through the Iraq-Turkey pipeline.

Resuming pipeline shipments could pose a dilemma for Baghdad, which is committed to reducing crude production as part of the OPEC+ agreement but is struggling to comply with the promised cuts.

OPEC's production and exports are under increased scrutiny after US President Donald Trump called on the group in early 2025 to "bring down the price of oil." LINK

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man It's been a long road. I understand. Everybody is waiting for what we're looking for. Everybody should be excited because...all the little bits and pieces if you tie them in together you're going to find that Iraq is ready to go international. Internationlism is being put out in the news the last few days...one after another, one after another...Just myself alone I was able to get to about 16 or 17 articles out of hundreds...

Frank26 [Iraq boots-on-the-ground report] FIREFLY: Mr. Sammy...says watch for when the budget tables make it to Council of ministers (COM) because they already said they would review it and vote on it as soon as possible. The the COM is where and when that rate will show up...When it goes to the COM that's when to get excited because soon they will vote and the COM will do it quickly...That's what we need, Council of Minister first...then that rate will show...Parliament is just a formality. FRANK: Sudani sends the budget tables to the COM? Are you kidding me? I didn't know he was going to do that. He's not going to send it to parliament? Oh my goodness that's like Sudani telling parliament to pick a finger and you might as well pick the middle finger because he's not going to share anything with them...until the very last second...

************

MAJOR Currency Breakthrough ZiG = $0 08

Edu Matrix: 3-16-2025

Discover how Zimbabwe's innovative new gold-backed currency, the ZiG, is making waves on the global financial stage!

Currently valued at eight cents, this bold move could set a precedent for other nations like Iraq to follow, potentially increasing their own currency value.

In this video, we delve into the implications of this new development and what it could mean for global markets.

Economist’s “News and Views” Sunday 3-16-2025

GOLD Is Telling YOU: The GLOBAL RESET Is IMMINENT | Willem Middelkoop

Soar Financially: 3-16-2025

Willem Middelkoop, founder and CEO of the Commodity Discovery Fund and author of “The Big Reset,” joins us to break down gold’s historic surge above $3,000.

Willem shares why geopolitical uncertainty, currency debasement, and soaring physical gold demand signal the global reset he has long predicted is underway.

He reveals why this is only the beginning, and how investors positioned in gold and silver could benefit tremendously.

GOLD Is Telling YOU: The GLOBAL RESET Is IMMINENT | Willem Middelkoop

Soar Financially: 3-16-2025

Willem Middelkoop, founder and CEO of the Commodity Discovery Fund and author of “The Big Reset,” joins us to break down gold’s historic surge above $3,000.

Willem shares why geopolitical uncertainty, currency debasement, and soaring physical gold demand signal the global reset he has long predicted is underway.

He reveals why this is only the beginning, and how investors positioned in gold and silver could benefit tremendously.

00:00 – Gold Hits $3,000

01:04 – Willem Middelkoop Returns

02:09 – Why Gold Is Rising

03:27 – Institutional & Central Bank Demand

04:38 – Physical vs. Paper Gold

05:26 – War Risk in Europe

07:07 – The Big Reset Begins

07:41 – De-dollarization Update

09:17 – China Leads Multipolar World

10:28 – Russia’s Role Explained

11:39 – Are BRICS Still Relevant?

13:16 – Trump & Dollar Confidence

14:19 – US Debt Crisis

16:45 – Gold Signals Dollar Trouble

18:39 – Market Volatility Ahead

19:42 – Gold-Backed Bonds?

21:06 – Geopolitics & Critical Minerals

24:01 – Commodity Investing Outlook

27:15 – Deregulation: Too Little Too Late

CRASH ALERT! Trump's Plan to Destroy the Old Fiat System! The New "Golden Age" Dawns!

(Bix Weir) 3-14-2025

Financial Collapse Imminent, GOLD At ALL-TIME HIGH | David Hunter

Soar financially: 3-16-2025

In this interview, David Hunter, Chief Market Strategist at Contrarian Macro Advisors, shares his bold predictions on the global economy, stock markets, and the looming financial crisis.

He discusses the potential for a recession worse than 2008, the Fed’s policy mistakes, and why he believes the market will first skyrocket before experiencing a major collapse.

Hunter also dives into his gold and silver price targets, the impact of tariffs on inflation, and why he sees a significant drop in the US dollar coming soon.

00:00 – Intro & Welcoming David Hunter

02:01 – Does the White House Want a Recession?

10:15 – Market Overview: Is a Rally or a Crash Coming?

16:47 – The Fed’s Policy Mistakes and Economic Risks

24:40 – Inflation vs. Stagflation: What’s Really Happening?

31:28 – The Auto Loan & Real Estate Bubble

36:21 – Global Bust Incoming – Worse Than 2008?

39:27 – The US Dollar Collapse: What’s Next?

44:09 – Gold & Silver Predictions: $3,400 Gold, $75 Silver?

46:52 – Stock Market Targets: S&P 7500, Nasdaq 25K, Dow 55K?

49:57 – Recession vs. Depression: How Bad Could It Get?

Seeds of Wisdom RV and Economic Updates Sunday Morning 3-16-25

Good Morning Dinar Recaps

U.S. SENATE PASSES CONTROVERSIAL BILL TO AVOID GOVERNMENT SHUTDOWN

▪The Senate passed a Republican-led spending bill to avert a government shutdown, with key Democratic support.

▪Senate leader Schumer prioritized avoiding a shutdown, arguing it would grant Trump and "DOGE" excessive power.

▪The bill's passage revealed a divide within the Democratic party, with moderates and allies supporting Schumer's pragmatic approach.

Good Morning Dinar Recaps

U.S. SENATE PASSES CONTROVERSIAL BILL TO AVOID GOVERNMENT SHUTDOWN

▪The Senate passed a Republican-led spending bill to avert a government shutdown, with key Democratic support.

▪Senate leader Schumer prioritized avoiding a shutdown, arguing it would grant Trump and "DOGE" excessive power.

▪The bill's passage revealed a divide within the Democratic party, with moderates and allies supporting Schumer's pragmatic approach.

The U.S. Senate narrowly avoided a government shutdown on Friday, passing a Republican-led spending bill just before the midnight deadline. The vote was 62-38, with 10 Democrats siding with nearly all Republicans. But while the bill kept the government running, it exposed deep divisions within the Democratic Party – especially when it comes to handling Donald Trump’s influence.

Behind the scenes, tensions ran high. Some Democrats wanted to take a stand against the GOP, while others feared the consequences of a shutdown. Senate Majority Leader Chuck Schumer was caught in the middle, making a strategic move that surprised many. So, why did he support the bill?

Schumer’s Quiet Strategy

Senate Majority Leader Chuck Schumer faced pressure from progressives and House Democrats to oppose the GOP-backed bill. However, he stayed quiet about his stance all week. On Thursday, he finally announced his support, giving other Democrats the green light to follow. This move helped reduce the risk of a shutdown during uncertain economic times.

Schumer admitted the bill wasn’t ideal but argued that shutting down the government would give Trump and his allies too much power.

The Democrats Who Voted With Republicans

Nine Senate Democrats joined Schumer in supporting the bill, temporarily giving up some leverage over Trump. These lawmakers included moderates, Schumer’s close allies, senators from states with many federal workers, and those nearing retirement. They agreed with Schumer that preventing a shutdown was the better option, fearing that Trump and Elon Musk could use the crisis to gain even more control.

Schumer warned that the future of government funding was now in the hands of Trump, Musk, and their allies. He cautioned that if a shutdown happened, it could last six to nine months and create serious instability.

Some Democrats criticized him for giving up too soon, saying he missed a rare chance to pressure Republicans after the House passed the GOP’s spending bill with Trump’s backing.

“I’ll Take Some Bullets,” Says Schumer

The vote largely followed party lines, 54-46, leaving many Democrats frustrated. They argued the bill failed to address key issues like healthcare and housing.

Schumer acknowledged the criticism but stood by his decision. “I’ll take some of the bullets,” he said, accepting that both moderates and progressives would be unhappy. The nine Democratic senators who voted with him may also face political consequences, but none are expected to have immediate election challenges.

House Democrats Frustrated Over Schumer’s Move

House Democrats, who had earlier rejected the bill, were upset with Schumer’s decision. Leaders like Hakeem Jeffries wanted a short-term funding bill to allow more time for negotiations. They argued the GOP bill gave Trump too much power while cutting critical services, including funding for Washington, D.C.

Senate Republicans, including John Thune, defended the bill, saying Democrats failed to complete last year’s budget, making another stopgap measure necessary.

Despite criticism from some Democrats, the White House stood by Schumer. The president praised him for making a “bold and courageous” choice, showing his approval of the compromise.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

4 TYPES OF FINANCIAL DOCUMENTS YOU SHOULD KEEP TOGETHER AT ALL TIMES IN CASE OF EMERGENCY — HERE’S WHY

Life is full of the unexpected. You never know when you may find yourself in dire straits or faced with an emergency that’s totally out of your control. Sadly, Americans are affected by weather-related disasters now more than ever before.

According to the NOAA’s National Centers for Environmental Information (NCEI), 2024 alone was full of “billion-dollar” weather-related natural disasters: There were 27 individual weather and climate disasters with at least $1 billion in damages, which is only one less than the record of 28 events in 2023. Last year’s natural disasters took nearly 600 lives and cost approximately $182.7 billion in total.

With natural disasters on the rise, you’ll absolutely need to be prepared for whatever comes your way. This includes having a “financial go bag” at the ready.

A financial go bag is basically what it sounds like: It’s a bag with everything related to your finances, identity, emergency contacts and medical information that you need to keep on your person.

Here are four specific categories of items you’ll want to be sure you have in your financial go bag.

Financial and Legal Documents

Having copies of any applicable financial and legal documents printed and at the ready is critical, according to the Federal Emergency Management Agency (FEMA). For example, if your home is destroyed in a fire, maintaining copies of these documents in your go bag may be the only physical proof you have of account ownership.

These include but are not limited to the following types of documents:

▪Credit and debit card statements

▪Checking account statements

▪Savings account statements

▪Retirement and investment account statements

▪Utility bills

▪Student loan statements

▪Alimony and child support documents

▪Elder care information.

Identification

When faced with a catastrophe, you’ll need to have at least a few forms of identification in your bag, according to FEMA.

Two important reasons are you may need to be identified to receive emergency medical attention, or authorities may need to identify you if you’re attempting to cross a security checkpoint.

These include but are not limited to the following types of identification:

▪Passport

▪Driver’s license

▪Social Security card

▪Green card

▪Military service identification

▪Pet ownership papers and identification tags.

List of Emergency Contacts

FEMA also recommends keeping a list of emergency contacts in your bag in case of evacuation. For example, maybe your cell phone, which contains all your contacts, dies, and the only way to contact someone is by using someone else’s phone and referencing the list in your bag.

These include but are not limited to the following types of contacts:

▪Doctors and specialists

▪Dentists

▪Pediatricians

▪Veterinarians

▪Your children’s school

▪Your employer

▪Local emergency services.

Medical Information

If an emergency strikes, it could result in injuries to you or your family. In the worst-case scenario, you have to have all pertinent medical information ready in your bag, according to FEMA, to ensure you receive the care and benefits you’re entitled to get.

This includes but is not limited to the following medical information:

▪Health insurance cards

▪Medicare and/or Medicaid cards

▪Dental insurance cards

▪Any other health benefits, such as VA benefits

▪A detailed and up-to-date list of medications you take

▪Immunizations records

▪Allergy information

▪Medical equipment and devices you need

▪Pharmacy information

▪Living will, medical power of attorney and any disability documentation.

@ Newshounds News™

Source: Yahoo Finance

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Sunday Morning 3-16-2025

TNT:

Tishwash: Kurdistan Regional Government: Baghdad holiday tomorrow does not include the region

The Kurdistan Regional Government announced today, Saturday, that tomorrow's Baghdad holiday does not include the region.

The regional government said in a statement, "Official holidays and occasions have been previously specified in its official schedule. The holidays and occasions remain as they are."

She added, "No changes will be made to it unless the Kurdistan Parliament, in accordance with its powers, decides to reconsider it and make a new decision regarding it."

TNT:

Tishwash: Kurdistan Regional Government: Baghdad holiday tomorrow does not include the region

The Kurdistan Regional Government announced today, Saturday, that tomorrow's Baghdad holiday does not include the region.

The regional government said in a statement, "Official holidays and occasions have been previously specified in its official schedule. The holidays and occasions remain as they are."

She added, "No changes will be made to it unless the Kurdistan Parliament, in accordance with its powers, decides to reconsider it and make a new decision regarding it." link

Tishwash: Reassuring citizens, the Central Bank told NINA: We have ample cash liquidity.

The Central Bank of Iraq (CBI) reassured the banking and community circles of ensuring the availability of cash liquidity to cover all local transactions in Iraqi dinars.

The Governor of the Central Bank, Ali Al-Alaq, said in a statement to the National Iraqi News Agency ( NINA ), that "the Central Bank is the last entity that can be without cash liquidity in Iraq."

He explained that "the Central Bank has wide scope to provide local currency to the extent that this currency is covered by foreign reserves, which currently far exceeds the level of local sufficiency, and more than we can finance."

He added, "There is frequent confusion between the position of the Central Bank, which is a completely different situation from the financial situation related to the financial policy in the country or the Ministry of Finance," indicating that "the Ministry of Finance's revenues are based in dollars through Iraqi oil sales in the global market."

Al-Alaq stressed that "the Central Bank deals in Iraqi dinars for all amounts it receives in dollars, and this is very available under any circumstances," calling for distinction and separation between the financial situation at the level of the government and the Ministry of Finance, and the availability of cash at the Central Bank of Iraq. / link

***************

Tishwash: The government is preparing to approve the 2025 budget. Al-Sudani's advisor reveals the details.

The Iraqi government is likely to approve the draft budget before Eid al-Fitr, according to Mohammed Shia al-Sudani, the prime minister's financial and economic advisor.

Mazhar Mohammed Saleh said the Cabinet will likely approve the 2025 budget law before Eid al-Fitr and submit it to Parliament.

Saleh explained that spending constitutes approximately 67% to 70% of the total public expenditures in the budget law, which consist of salaries, allowances, retirement, and social care.

The Prime Minister's advisor noted that the budget is approximately 200 trillion dinars, with a deficit of approximately 64 trillion dinars.

Iraq has a three-year budget for 2023, 2024, and 2025, and is required to submit the budget schedule to Parliament annually.

Parliament approved the 2024 budget schedule on June 3, 2025.

Iraq's 2024 budget amounts to more than 211 trillion dinars, an increase of approximately 12 trillion dinars compared to 2023 link

***************

Tishwash: New meetings with oil companies to resume exports via the Turkish port of Ceyhan.

Economic expert Hevidar Shaaban revealed, today, Sunday (March 16, 2025), that two meetings were held between the Federal Ministry of Oil and the Ministry of Natural Resources in the Regional Government, with representatives of oil companies operating in Kurdistan .

Shaaban told Baghdad Today, "The first meeting will be held in Baghdad this week, and another meeting will be held next week in Erbil between the same parties to resolve the issue of resuming oil exports through the Turkish port of Ceyhan."

He added, "The oil export problem is not related to the federal government or the regional government, but rather the oil companies are refusing to resume exports at this time until the regional government's debts are paid."

Among the most prominent issues facing the resumption of oil exports through the Turkish port of Ceyhan are the method of calculating oil quantities, the method of payment, and the share of international companies extracting oil from the Kurdistan Region, in addition to the issues of salaries, fees, and customs duties. Delegations between the two sides are attempting to resolve these issues before the start of export operations .

Oil Minister Hayan Abdul Ghani surprisingly announced last February the resumption of exports from Kurdistan, a move that could end a nearly two-year conflict that has disrupted supplies of more than 300,000 barrels per day entering global markets via Turkey link

Mot: Not True - it Isn't!!!

Mot: .... When Ya!!!!

News, Rumors and Opinions Sunday AM 3-16-2025

Gold Telegraph: When Bonds Shatter, New Alliances Rise

3-15-2025

Paul Volcker once said something compelling:

“The truly unique power of a central bank, after all, is the power to create money, and ultimately, the power to create is the power to destroy.”

It is the truth.

Gold Telegraph: When Bonds Shatter, New Alliances Rise

3-15-2025

Paul Volcker once said something compelling:

“The truly unique power of a central bank, after all, is the power to create money, and ultimately, the power to create is the power to destroy.”

It is the truth.

The United States is racing to catch up in the global battle for critical elements.

Two key battlegrounds define this fight:

1. Financial Supremacy

2. Mineral Control

Financial power will slowly fade if you don’t influence and have large control over certain minerals.

=======================================

What makes the world so different today? Old alliances are breaking down. Traditional allies are turning on each other. This is what makes the world more unpredictable. When bonds shatter, new alliances rise, often in ways no one expects.

=======================================

Something that many people are sleeping on. The CURRENT chairman of the United States council of economic advisers recommended last year that countries should be forced to swap their holdings of US Treasuries for 100-year bonds. Gold. @judyshel

=======================================

Billionaire Jeffrey Gundlach says gold is going to reach $4000. Welcome to the era, @TruthGundlach.

=======================================

BREAKING NEWS: RUSSIA IS USING CRYPTOCURRENCIES IN ITS OIL TRADE WITH CHINA AND INDIA TO SKIRT WESTERN SANCTIONS… INCLUDES TETHER

Ok.

“Crypto small but growing part of Russia’s $192 bln oil trade, sources say…”

=======================================

Countries are now turning to cryptocurrencies to settle oil trades, while Iran and Russia have long been have discussions about creating a gold-backed stablecoin. Watch the petrodollar closely in the years ahead. Many remain asleep. The financial war is heating up.

=======================================

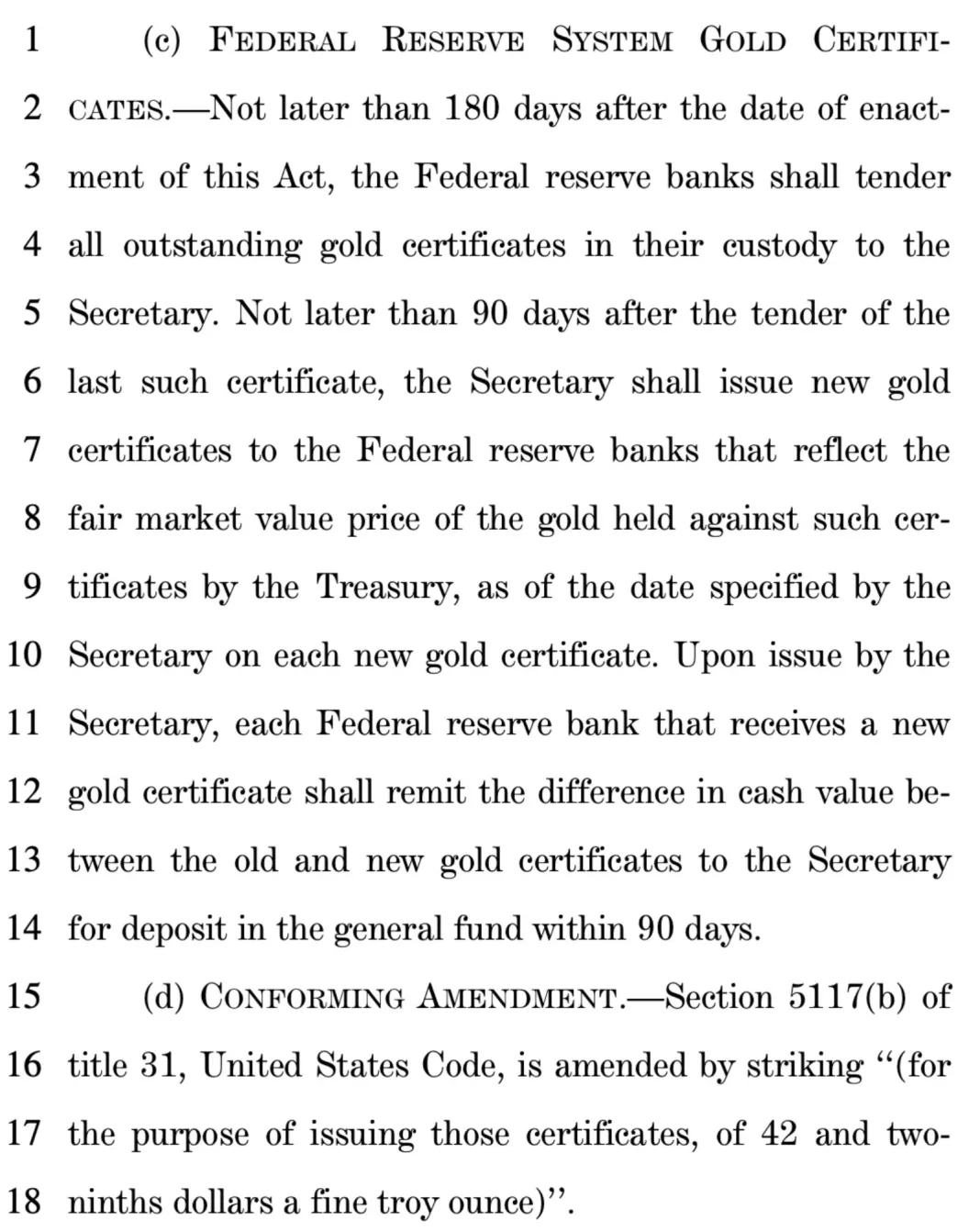

Another thing many people are NOT talking about is the possibility of a repricing event of the gold reserves of the United States from their statutory value of $42.22 per oz to their current fair market value.

This was mentioned in a recent “Act” pushed forward…

I have talked about this for months, and recently, I have been with Dr. Ron Paul.

Also, with Sean Boyd, who has helped lead the world’s most valuable gold producer.

If this happens, this will push gold into the hot light and totally discredit anyone in the media who has called gold a barbarous relic.

Again, does the movie seem to be just starting?

A fierce debate is raging among Western governments and the mining industry:

Is China deliberately overproducing critical minerals to crush Western competitors and dominate the supply chain?

This is why the U.S. is scrambling to secure its critical mineral supply chains.

=======================================

Gold ETFs recorded their highest monthly inflows since March 2022 last month… This is what a safe haven looks like.

=======================================

BREAKING NEWS: KYRGYZSTAN LAUNCHES GOLD-BACKED STABLECOIN

You don’t say?

“Initially collateralized with $500 million worth of gold, its reserves are projected to increase to $2 billion within 24 months…”

Source: https://cointelegraph.com/news/el-salvador-20-how-kyrgyzstans-blockchain-strategy-stands-apart

Source(s):

https://dinarchronicles.com/2025/03/15/gold-telegraph-when-bonds-shatter-new-alliances-rise/

***************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Article: "Iraq opens its doors to 37 countries through the e-visa service program" Quote: "Iraqi authorities have abolished the requirement to obtain a visa upon arrival for citizens of the United States, European Union, United Kingdom and others replacing it with an electronic visa" They're going to make it easy...They're ready for investors... They're going to be doing major transactions in dinar and that's how I see it...

Mnt Goat One article really stands out... “IMF DISCUSSES STRENGTHENING IRAQI DINAR“ ...I also want

to point out that we read in the recent past that the IMF has stated that Iraq qualified for a global transformation of their currency and it should be reinstated...

Trump’s Secret Plan to Rewrite the Financial System!

MarkMoss: 3-14-2025

What if I told you that Trump just made a move that could completely rewrite the U.S. financial system. AND nobody’s talking about it?”

For the first time in history, the U.S. government is officially endorsing digital assets and stable coins—and they’re pushing banks to play a MAJOR role.

Treasury Secretary Scott Bessent just said quote: ‘We are going to keep the U.S. the dominant reserve currency in the world, and we will use stable coins to do that.

But here’s where it gets REALLY interesting… They have TWO ways to do this. One of them is a complete government-controlled system—but the other? It could take us back to a financial model from over 200 years ago, where banks competed to issue their own money.”

A system that some call chaotic—but others say was one of the greatest golden ages of financial innovation.

So the big question is: Are we about to see the return of Free Banking? And if so, what does that mean for YOU? By the end of this video, you’re going to understand exactly what’s happening, why the government is pushing this NOW, and how it could create one of the biggest wealth-building opportunities of the decade.