News, Rumors and Opinions Monday AM 10-28-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 28 Oct. 2024

Compiled Mon. 28 Oct. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

Judy Note: This past weekend absolutely nothing was revealed about the status of the Global Currency Reset. We know that in Tier 1 the Elders, German Bonds and select Yellow Dragon Bonds have been paid and 100% of the Pentecostal Group were under Non Disclosure Agreements (NDAs).

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 28 Oct. 2024

Compiled Mon. 28 Oct. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

Judy Note: This past weekend absolutely nothing was revealed about the status of the Global Currency Reset. We know that in Tier 1 the Elders, German Bonds and select Yellow Dragon Bonds have been paid and 100% of the Pentecostal Group were under Non Disclosure Agreements (NDAs).

Sun. 27 Oct. 2024: Bombshell Report! This is your Financial Bible | This is the Quantum Financial System Manual of GESARA-NESARA & XRP! – amg-news.com – American Media Group

Sun. 27 Oct. 2024: INTEL: Quantum Financial System, Global Currency Reset, and the Med Beds 5D ~ Trust the Plan! – amg-news.com – American Media Group

~~~~~~~~~~~

THURS. 24 OCT. 2024: BOOOOM!!! THE BRICS CURRENCY NOTE: A Game-Changer in the Global Financial Arena! …Carolyn Bessette Kennedy on Telegram

The day has come. The BRICS nations—Brazil, Russia, India, China, and South Africa—are no longer satisfied with living in the shadow of the U.S. Dollar. They’ve dropped the bombshell that could obliterate the American financial system as we know it—a BRICS Currency Note! Although it’s not in circulation yet, its mere existence sends a clear message: the BRICS countries are flipping the script on the global financial stage.

The BRICS Currency Note—A Revolution in Motion! The world woke up to a shockwave when the BRICS Currency Note was revealed. This bold move could be the beginning of a financial revolution. For decades, the U.S. Dollar has held the world in its grip, dictating the terms of global trade, finance, and politics. But now, with the emergence of a BRICS currency, the tides may be turning for good.

The BRICS note symbolizes a defiant stand against the U.S.-dominated financial system. Vladimir Putin has taken the reins of this movement, signaling that these nations are ready to break free from the suffocating control of the American financial empire.

What Does This Mean for the World? This is more than just currency. It’s a direct challenge to the U.S. dominance. By proposing this currency, the BRICS nations are creating a new financial ecosystem. No longer will they be at the mercy of a single country and its weaponized financial system.

The Rise of the BRICS Currency: A Defiant Response to U.S. Control. For too long, the U.S. Dollar has been used as a financial weapon, enforcing sanctions and manipulating countries that oppose American interests. The BRICS nations have had enough. They’re not just talking about change—they’re making it happen. This currency will weaken America’s ability to control the global economy.

The BRICS Currency Note—whether it’s in your hands now or not—signals that the world is ready to move on. The U.S. financial grip is crumbling, and this is just the beginning of a new era where nations will no longer be dictated to by U.S. interests.

A Move for Financial Independence: This BRICS currency is a symbol of economic sovereignty. The 100 BRICS Note that has emerged is a powerful statement—these nations are no longer bowing to the demands of the U.S.-controlled system. They are taking charge of their economic destiny and shattering the chains that have bound them to the American financial order.

Implications for the Global Financial Order: The End of U.S. Dominance? The introduction of this currency could send shockwaves through the global financial system. It’s not just about economics—it’s about seismic political shifts that could spell the end of U.S. Dollar dominance. The U.S. has used its financial power to project control over the world for decades. But with the BRICS currency in play, that era is over.

A Defiant Response to U.S. Sanctions: Sanctions have been a go-to weapon for the U.S., but the BRICS nations are done playing along. With their own currency in hand, they can circumvent American financial institutions and reclaim their power.

The unveiling of the BRICS Currency Note is more than just an economic maneuver—it’s a direct challenge to the global order. The U.S. stranglehold on the world economy is crumbling as these nations rise up and take control.

Conclusion: The Beginning of the End? The BRICS Currency Note could be the start of the end for the U.S. Dollar’s reign. As this revolution unfolds, we are witnessing a monumental shift in power—one where the U.S. no longer holds the ultimate financial weapon.

Read full post here: https://dinarchronicles.com/2024/10/28/restored-republic-via-a-gcr-update-as-of-october-28-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Sudani cleaned up the swamp. All of a sudden all of the banks that were stealing the Iraqi dinar, American dollar and profiteering illegally...he cleaned it all up. I told you we needed the CBI floor to be so spotless that you could eat off of the floor. The United States Treasury is on the second floor of the new CBI building. It's spotless. All the bank that [were stealing] have been shut down. All the political parties that had power in the media and in the banking structure of Iraq are slowly being whittled away.

Mnt Goat ...the agreements and paperwork are all nearly completed to set the reinstatement in motion. But...we know this is not going to happen until the CBI is ready. The CBI is not ready until they first secure the banks, the stock market, provide security (insurance) and then begin rebuilding the economy...I must mention this too as it is a factor. They will not be ready until the US Treasury and the Federal Reserve gives them the green light.

BRICS New Payment System “BRICS Pay” Successfully Tested & Launched! What's Next

Afro Page: 10-27-2024

The BRICS nations (Brazil, Russia, India, China, and South Africa) have launched "BRICS Pay," a groundbreaking payment system designed to enhance trade, boost financial independence, and challenge traditional banking systems.

In this video, we explore how BRICS Pay was developed, its successful testing phase, and the potential impact it could have on global transactions. Could BRICS Pay reshape the global financial landscape?

Watch to learn what’s next for this ambitious project!

MASSIVE CRASH IS COMING IN HOUSING AND STOCK MARKET (w/ Mike Maloney)

Sachs Realty: 10-28-2024

Housing market and stock market are in massive bubbles! Crash is coming as our monetary system is broken, consumer debt is at all-time highs and the Federal Reserve is Bankrupt according to Mike Maloney

Seeds of Wisdom RV and Economic Updates Monday Morning 10-28-24

Good Morning Dinar Recaps,

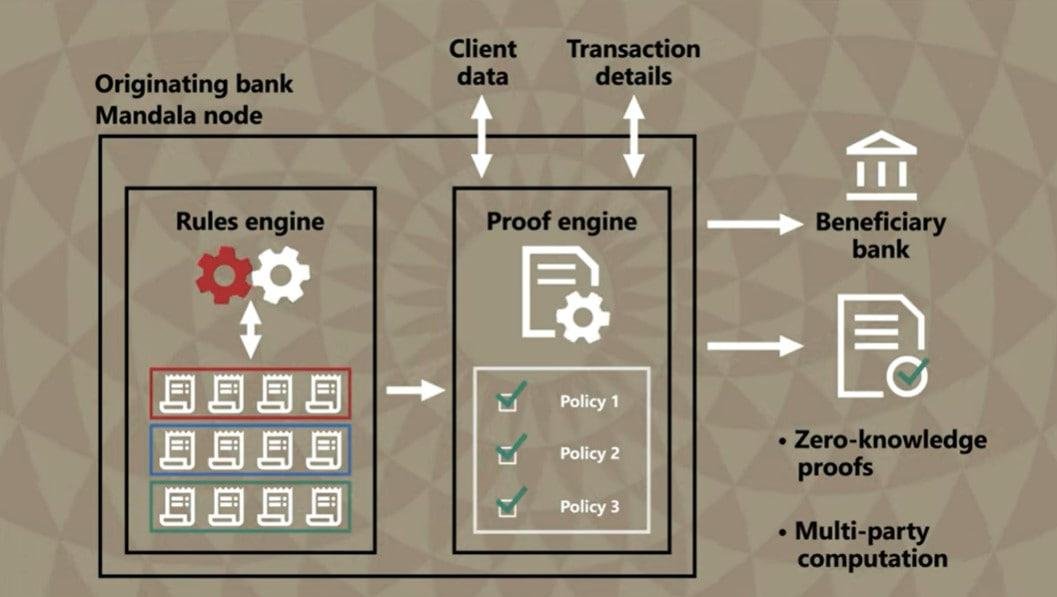

BIS PROJECT DEMONSTRATES AUTOMATED CROSS-BORDER TRANSACTION COMPLIANCE',.

Project Mandala uses zero-knowledge proofs to complete compliance checks across different jurisdictions.

The Bank for International Settlements (BIS) and its central bank partners have shown through Project Mandala that regulatory compliance can be embedded into cross-border transaction protocols.

Good Morning Dinar Recaps,

BIS PROJECT DEMONSTRATES AUTOMATED CROSS-BORDER TRANSACTION COMPLIANCE',.

Project Mandala uses zero-knowledge proofs to complete compliance checks across different jurisdictions.

The Bank for International Settlements (BIS) and its central bank partners have shown through Project Mandala that regulatory compliance can be embedded into cross-border transaction protocols.

The project is a collaboration involving central banks worldwide, including the BIS Innovation Hub Singapore Centre, the Reserve Bank of Australia, the Bank of Korea, Bank Negara Malaysia and the Monetary Authority of Singapore (MAS).

On Oct. 28, the BIS updated its page for Project Mandala, highlighting that the project has reached its proof-of-concept stage.

The project, which seeks to automate compliance for cross-border transactions, is one of the BIS’ key projects for 2024. On Jan. 23, the BIS included Project Mandala in its work program.

The project also aligns with the G20 priority actions for enhancing cross-border payments.

Automated compliance checks in cross-border transactions

In an explainer video, the BIS detailed that, during the proof-of-concept phase of Project Mandala, all participant institutions, including commercial banks, central banks and other regulated financial entities, will operate a Mandala node within their systems.

Participants will interact through a peer-to-peer messaging system, which will help them obtain relevant policies applicable to transactions. The system will then transmit the necessary data to generate proof of compliance and manage any other information needed for automated compliance checks.

Within the Mandala system, rules across jurisdictions are stored in a repository and distributed across relevant parties. The data is applied against consumer transaction data to ensure that cross-border transactions are compliant.

How Project Mandala would streamline cross-border transactions. Source: BIS

The system implements zero-knowledge proofs to complete transaction compliance checks privately. ZK-proofs allow a prover to convince a verifier that a particular claim is true without revealing the details of the claims.

BIS “optimistic” about early results

In an announcement, Maha El Dimachki, head of the BIS Innovation Hub Singapore Centre, said that the central bank is optimistic about the potential of Project Mandala’s early results to enhance cross-border payments.

The official said that Mandala is “pioneering the compliance-by-design approach to improve cross-border payments without compromising privacy or the integrity of regulatory checks.”

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

HONG KONG PARTNERS CENTRAL BANKS OF BRAZIL, THAILAND FOR TOKENIZATION. TO OFFER DIGITAL BOND GRANTS

Today the Hong Kong Monetary Authority (HKMA) announced collaborations with the central banks of Brazil and Thailand for cross border tokenization transactions, including atomic settlement of digital asset transactions (delivery versus payment / DvP) and wholesale CBDC (payment versus payment / PvP). Additionally, the HKMA plans to provide grants of up to HK$2.5 million for digital bond issuances to promote Hong Kong as a tokenization venue.

Hong Kong has previously issued two tokenized government green bond issuances, one tokenized (so the primary issuance was conventional) the other natively digital. The second one was worth more than US$750 million across multiple currencies and was the largest digital bond at the time. It has since been eclipsed by two KfW issuances.

As part of Hong Kong’s push to promote the digital asset ecosystem, it soon plans to publish guidelines for a new Digital Bond Grant Scheme that will offer a maximum grant of HK2.5 million for each eligible issuance.

Cross border collaborations

Given Brazil’s hugely successful launch of its Pix real time payment system, many are eagerly watching the progress of DREX, the Banco Central do Brasil’s wholesale CBDC and tokenization project. DREX recently announced the 13 themes to be trialed and re-opened applications for participants.

Now DREX and Hong Kong’s Project Ensemble tokenization project will trial cross border transactions, including for trade finance and carbon credits.

Previously, Hong Kong conducted a trial with the Banque de France.

HKMA unveiled a similar collaboration with the Bank of Thailand, with whom it previously partnered for CBDC in Project Inthanon-LionRock. That initiative expanded to mBridge, the cross border CBDC project that has reached the minimum viable project stage.

The Thai collaboration will involve Thailand’s Project San, an internal experiment that is testing a tokenization ecosystem. This includes wholesale settlement, Ethereum-compatible ledgers for tokenized deposits and digital assets, plus an interoperability mechanism.

HKMA emphasized the interoperability work, specifically how to enable the interoperability of separate distributed financial market infrastructures (dFMIs).

For the interoperability aspect, the HKMA is also a new associate member of the Linux Foundation (LF) Decentralized Trust (an evolution of Hyperledger), joining seven other central bank members that are collaborating on the technical requirements for central bank digital currencies (CBDC).

Project Ensemble Sandbox update

Additionally, the HKMA provided an update on its Project Ensemble Sandbox for wholesale CBDC, tokenized deposits and tokenization. It previously outlined some of the planned use cases, and today disclosed which ones have completed. JP Morgan has joined the sandbox alongside two technology firms, R3 and Tencent affiliate, WeBank Technology Services.

It added a new use case for tokenized or digital funds involving China Construction Bank (Asia), Fubon Bank (Hong Kong), JETCO and OSL Digital Securities.

These announcements were part of the Hong Kong Fintech Week. This morning, keynotes by the Treasury, Securities and Futures Commission and HKMA involved sharing other updates on stablecoins and cryptocurrency.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

🌱WHAT ARE BONDS? WHY WE WATCH ISAAC. WHAT IS ISAAC'S WORD WHEN HE IS COMPLETE? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Monday Morning 10-28-2024

TNT:

Tishwash: 150,000 Kurdish employees receive their salaries digitally via the “Hisabi” system

The Financial System Administration "Hisabi" in the Kurdistan Region announced, on Sunday, the expansion of the scope of its digital operations so that the number of beneficiaries of the system reached 150 thousand employees during the past week.

According to the official website of the "My Account" system, which Shafak News Agency has reviewed, the number is increasing monthly and 150,000 employees have received their salaries through the system, which reflects the continuous growth in the adoption of the system to facilitate the process of disbursing salaries through digital bank accounts.

TNT:

Tishwash: 150,000 Kurdish employees receive their salaries digitally via the “Hisabi” system

The Financial System Administration "Hisabi" in the Kurdistan Region announced, on Sunday, the expansion of the scope of its digital operations so that the number of beneficiaries of the system reached 150 thousand employees during the past week.

According to the official website of the "My Account" system, which Shafak News Agency has reviewed, the number is increasing monthly and 150,000 employees have received their salaries through the system, which reflects the continuous growth in the adoption of the system to facilitate the process of disbursing salaries through digital bank accounts.

The system is expected to include all eligible employees in the region by the end of next year, as they will be able to receive their salaries directly through their own bank accounts.

This expansion comes within the framework of the Kurdistan Region's efforts to enhance the digital infrastructure and facilitate financial transactions for citizens. link

Tishwash: Economist: Lowering interest rates encourages investment but carries caveats

Economic expert Salah Nouri confirmed today, Sunday, that reducing the interest rate is one of the main tools of monetary policy used by the Central Bank to influence the economy, whether by increasing or decreasing it according to inflation or deflation rates.

Nouri explained in his interview with {Euphrates News} that “reducing the interest rate encourages individuals and companies to borrow for productive projects, which leads to stimulating the economy,” adding: “Lower interest makes the cost of loans lower, and thus encourages consumption and investment.”

Nouri pointed out that "reducing the interest rate reduces the cost of production and perhaps the prices of imported goods, which leads to a reduction in selling prices," but he warned that "reducing the interest rate may push depositors to withdraw their deposits due to the decrease in returns, and resort to alternative investments such as gold."

He added: "It is necessary for the Central Bank to monitor the money market and commodity prices to measure the level of c: Al Furat News}inflation, especially since facilitating borrowing may affect the elasticity of demand versus supply." link

************

Tishwash: The Age of Mafia Flourishing in Iraq" .. People's Crises Strengthen the Positions of Currency Smuggling Gangs - Urgent

Economic expert Nasser Al-Kanani confirmed today, Sunday (October 27, 2024), the existence of mafias exploiting crises in Iraq and the region in order to increase currency smuggling operations.

Al-Kanani told Baghdad Today, "As soon as the war in Lebanon and Gaza escalated and security tensions in the region as a whole, specialized mafias emerged that work to exploit such security conditions in order to increase the process of smuggling currency from Iraq. There are different methods for this smuggling, some of which are done through foreign imports, which take place outside the platform."

He added, "Iraq is working to strengthen its national currency, but there are those who are working to weaken this currency by making the dollar very high against the national currency, and some are working to limit large commercial transactions to the dollar exclusively, and the sale of real estate, cars, etc., and this also weakens the national currency, despite all the campaigns to prevent internal transactions in dollars."

The economic expert continued, "Iraq cannot exploit conflicts and wars to strengthen its national currency, especially since it is working hard, internally and externally, to stay away from these wars. Iraq realizes the great economic danger if it enters the circle of conflict and wars."

The war on Gaza and its consequences, which included many regions of the Middle East, dealt a blow to the global economy, especially the Israeli economy, where government spending exceeded $140 billion, and it also lost approximately $15 billion from the attack on Lebanon, according to economic experts.

Speaking about the consequences of the ongoing conflict in the region on Iraq, researcher and aviation specialist Faris Al-Jawari reveals that there are significant material losses for Iraq as a result of the recent Israeli bombing of Iran.

Al-Jawari told Baghdad Today yesterday, Saturday, that "there are losses and material damages to the Iraqi air transport sector in particular and the airport sector as a result of the recent Israeli aggression on Iran, and this impact is clear and tangible during the recent period, but the recent aggression is the most dangerous as it was the reason for a complete halt to Iraqi aviation."

He explained that "the stoppage means the interruption of financial revenues that come to the Iraqi government through the passage of aircraft over Iraqi airspace, and this is worth ($450) per aircraft, and according to the latest report of the Iraqi Airports Company, approximately (600) aircraft pass over Iraq monthly, and this means that Iraq loses (270) thousand dollars per day."

He added, "There are other material losses as a result of the planes not arriving at the airports, and their failure to arrive there means providing ground services to them, and this provision is in exchange for a sum of money, and this matter is estimated at around ($2,000), and this means that there are great economic damages and losses as a result of the Israeli aggression on Iran and the general security situation in the region."

The aviation specialist confirmed that "Iraqi aircraft are the ones that are directly affected, as most companies were refusing to land at Iraqi airports, and this means that the major losses are incurred by Iraqi Airways, and there is also a service impact at the airports on passengers through the suspension of flights, and this disrupts the work of many passengers and it has economic impacts as well, of course."

Israel launched a series of air strikes on Iran early Saturday morning. Four hours after the start of the operation, which Tel Aviv called "Days of Response," the Israeli army announced that it had completed the attack on military targets in Iran, that all of its aircraft that carried out the attack on Iran had returned safely to their bases, and that the operation had achieved all of its goals. link

Mot: .. When the Door Bell Rings

Mot: Trying to Do As Asked I Do!!!

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 10-27-24

Good Afternoon Dinar Recaps,

INDO-PACIFIC NATIONS OUTPACING THE US IN CRYPTO REGULATION, SEC COMMISSIONER SAYS

A U.S. Securities and Exchange Commission (SEC) commissioner has urged the U.S. to adopt a more proactive approach to crypto regulation, pointing to the leadership of Indo-Pacific nations like Japan, Singapore, and Hong Kong. He emphasized that these countries have crafted clear frameworks that foster innovation while protecting investors, in contrast to the U.S., where unclear guidelines leave market participants struggling with uncertainty.

SEC Commissioner Urges US to Learn from Indo-Pacific’s Crypto Leadership

U.S. Securities and Exchange Commission (SEC) Commissioner Mark T. Uyeda compared the U.S. SEC’s regulatory approach to those of other countries, especially in the Indo-Pacific, regarding crypto and fintech, at the AIMA APAC Annual Forum in Hong Kong on Wednesday.

Good Afternoon Dinar Recaps,

INDO-PACIFIC NATIONS OUTPACING THE US IN CRYPTO REGULATION, SEC COMMISSIONER SAYS

A U.S. Securities and Exchange Commission (SEC) commissioner has urged the U.S. to adopt a more proactive approach to crypto regulation, pointing to the leadership of Indo-Pacific nations like Japan, Singapore, and Hong Kong. He emphasized that these countries have crafted clear frameworks that foster innovation while protecting investors, in contrast to the U.S., where unclear guidelines leave market participants struggling with uncertainty.

SEC Commissioner Urges US to Learn from Indo-Pacific’s Crypto Leadership

U.S. Securities and Exchange Commission (SEC) Commissioner Mark T. Uyeda compared the U.S. SEC’s regulatory approach to those of other countries, especially in the Indo-Pacific, regarding crypto and fintech, at the AIMA APAC Annual Forum in Hong Kong on Wednesday.

He stressed that while the U.S. continues to grapple with unclear regulatory frameworks for digital assets, countries like Japan, Singapore, Hong Kong, and Australia have taken a leadership role in fostering innovation while protecting investors.

Uyeda praised the regulatory advancements in the Indo-Pacific, stating: “I believe there is much to learn from market regulators in the Indo-Pacific region on how to promote these values and objectives.”

The SEC commissioner highlighted how countries in the region have crafted forward-looking regulations that balance the need for innovation with investor protection.

For instance, Hong Kong has introduced a stablecoin licensing regime, Singapore has committed $150 million to promote fintech, Japan has issued guidelines for crypto exchange supervision, and Australia has its own regulatory sandbox.

Uyeda said:

My impression is that Hong Kong, Singapore, Japan, and Australia, among others, have shown leadership in how to facilitate crypto and fintech capital formation and innovation while promoting investor protection.

The U.S. regulator emphasized that many companies have been forced to navigate these uncertainties on their own. “My view is that the SEC could do much more in addressing the key gating question of whether a crypto asset is a security.

Market participants have been forced to struggle with this analysis and decipher SEC views from various settled enforcement actions and litigation in the courts,” he detailed.

“One concern expressed by market participants has been that the SEC has not provided sufficient guidance on key issues, such as when does a particular crypto offering need to be regulated as a security offering.”

In comparison, the SEC’s approach has been less clear, leaving market participants uncertain about key regulatory issues, Uyeda pointed out, adding:

By comparison to the Indo-Pacific region, the SEC’s current regulatory approach to crypto and related technology is less advanced.

Uyeda urged the SEC to learn from the Indo-Pacific’s proactive stance and become more transparent and engaged with the crypto industry. He pointed to fintech events and regulatory sandboxes used by regulators in the region as examples of how to support innovation.

In contrast, the U.S. lacks a specific registration form for crypto, making the regulatory process difficult for issuers.

Uyeda warned that the U.S. must not “bury our heads in the sand about the growing benefits and risks of crypto and financial technology,” calling for the SEC to take a more active role in addressing these challenges.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

WILL JAPAN LAUNCH BITCOIN AND ETHEREUM CRYPTO ETFS? KEY INDUSTRY GROUP PUSHES FOR APPROVAL

In a recent move to boost the growth of crypto investment products in Japan, a coalition of Japanese companies has recommended that any upcoming exchange-traded funds (ETFs) in the region should focus on Bitcoin (BTC) and Ethereum (ETH).

This recommendation comes as Japan debates whether to follow the US and other nations that have already approved crypto-backed ETFs.

The Push For Crypto ETF Approval

It is no more news that the recent introduction of crypto ETFs in the US and other major countries such as Hong Kong is viewed as a milestone for the digital asset industry, following years of regulatory resistance.

Despite the embrace crypto ETFs have received from these countries, Japan, on the other hand, has been so far cautious on this front, with officials from the Financial Services Agency (FSA) previously expressing reservations about the advantages of these ETFs.

However, as of October 25, a certain group, which includes prominent financial institutions appears to be pushing and urging the country’s regulator to prioritize Bitcoin and Ethereum ETFs due to their “market value and long-term performance” which make them “well-suited” for asset-building over medium to long-term horizons.

Particularly, the group’s proposal highlights the perceived reliability of Bitcoin and Ethereum, pointing out their track records, and significant market caps, which are key players in the overall digital currency market.

As Japan explores a potential shift in its stance on crypto ETFs, this coalition seems to ensure that the focus remains on well-established assets such as Bitcoin and Ethereum.

In addition to recommending that Bitcoin and Ethereum be prioritized in potential ETF offerings, the coalition also advised that Japan reconsider its tax policies on crypto income.

Japan’s tax rate on crypto gains can reach as high as 55%, which many argue is a deterrent to individual and institutional investors.

The group suggested that a separation of tax on income earned from cryptocurrencies could help make Japan a more “competitive” destination for digital currency investment.

Notably, members of this coalition include key players in Japan’s financial landscape, such as Mitsubishi UFJ Trust and Banking Corp., Sumitomo Mitsui Trust Bank Ltd., crypto exchange bitFlyer Inc., and brokerage firms like Nomura Securities Co. and SBI Securities Co.

These institutions with vast industry experience have collectively expressed their concerns and recommendations as a consensus rather than individual opinions.

The coalition’s insights come when Japan’s digital currency regulatory environment is under close examination, and the FSA has confirmed its intent to review its regulatory policies. However, this review is expected to take time and its outcome remains uncertain.

@ Newshounds News™

Source: Bitcoinist

~~~~~~~~~

RUSSIA PUBLISHES NEW CRYPTO LAW EXPANDING STATE CONTROL OVER DIGITAL ASSETS

Russia’s new crypto law amplifies state control, enabling regional restrictions, tighter infrastructure regulations, and enhanced transaction monitoring.

State Authority Over Digital Currency Grows as Russia Publishes New Law

The Russian government released a document on Friday detailing a law signed by President Vladimir Putin that broadens the scope of digital currency regulations.

This new law significantly extends government oversight of cryptocurrency mining activities and related infrastructure across the nation.

Taking effect on Nov. 1, the legislation includes several amendments designed to strengthen oversight and impose limitations on crypto mining activities based on regional needs.

The law enables the Russian government to implement mining restrictions by location and define specific procedures and circumstances for banning mining operations.

A notable provision in the law gives the government the power to stop digital currency mining pools from functioning in certain areas.

Additionally, the government now has the authority to regulate infrastructure providers supporting mining operations.

This legislation also grants multiple federal agencies, beyond the Federal Financial Monitoring Service (Rosfinmonitoring), access to digital currency identifier addresses. This expansion includes federal executive agencies and law enforcement, bolstering their capability to track transactions that may be linked to money laundering or terrorist financing activities.

Moreover, the amendments transfer responsibility for the national mining register from the Ministry of Digital Development to the Federal Tax Service, which will now oversee mining registrations for businesses and remove those with repeated infractions.

While individual miners can continue without registering if they adhere to specific electricity consumption limits, companies and individual entrepreneurs must comply with new registration requirements.

In its approach to digital currencies, Russia is advancing crypto regulations and developing a state-backed digital currency, the digital ruble. The country has legalized crypto mining and permitted cryptocurrency use in international trade, aiming to bypass sanctions and reduce reliance on the U.S. dollar in foreign exchanges.

Putin signed legislation in August allowing experimental frameworks for cryptocurrency use in international transactions.

This law enables legal adjustments for cross-border crypto transactions, placing oversight of pilot projects with the Bank of Russia and requiring approval from the Finance Ministry, Federal Security Service, and Rosfinmonitoring.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “ News and Views” 10-27-2024

G7 Banking Giant Joins China’s RMB Payments System, Bypassing USD In Global Trade

Sean Foo: 10-27-2024

In a big move, UK banking Giant, HSBC, has officially joined China's interbank cross-border payment system.

This is a signal that no matter the political pressure from the US, China's economy is just too important to ignore.

Meanwhile, China is preparing for a fierce economic battle in 2025 where the stimulus bazooka could be fired again.

G7 Banking Giant Joins China’s RMB Payments System, Bypassing USD In Global Trade

Sean Foo: 10-27-2024

In a big move, UK banking Giant, HSBC, has officially joined China's interbank cross-border payment system.

This is a signal that no matter the political pressure from the US, China's economy is just too important to ignore.

Meanwhile, China is preparing for a fierce economic battle in 2025 where the stimulus bazooka could be fired again.

Timestamps & Chapters:

0:00 UK Giant Joins China Payments System

2:57 China's Economy Too Big To Ignore

6:17 Beijing's Russian Advantage

8:33 Yellen Scolds China Again

9:25 Unthinkable Economic War In 2025

11:57 Big Stimulus Bazooka Coming

Why Social Security Is On Borrowed Time

Lynette Zang: 10-27-2024

Today we are talking about social security and the looming crisis that's about to hit as the entire program is on borrowed time.

IMF WARNS “New Financial Crisis”: Your Savings at Risk

Taylor Kenny: 10-27-2024

Discover the truth behind shadow banking and the unregulated lending sector threatening global financial stability. Learn how shadow banks, which operate outside traditional regulations, pose a significant risk to your savings and financial security.

Find out why financial experts are warning of a potential crisis and what you can do to protect yourself.

CHAPTERS:

00:00 Introduction to Shadow Banking

00:35 The Growing Threat of Shadow Banks

01:09 The Size and Scope of Shadow Lending

02:22 Lack of Regulation and FDIC Limitations

03:37 IMF Warnings on Shadow Banking Risks

04:12 Traditional Banks’ Risk from Shadow Banking

05:24 Increased Volatility as the New Norm

06:33 Potential Economic Fallout and Hyperinflation

08:12 Protecting Wealth Outside the System

08:50 How to Take Action for Financial Security

09:52 Conclusion

News, Rumors and Opinions Sunday Afternoon 10-27-2024

KTFA:

Clare: Prime Minister: The government is moving forward with the growth of the oil and gas sectors

10/28/2024

Prime Minister Mohammed Shia al-Sudani discussed today, Sunday, with Oil Minister Hayan Abdul-Ghani al-Sawad the government's previous plans for the growth of the oil and gas sectors.

The Prime Minister's Media Office stated in a statement, a copy of which was received by NRT Arabic, that "Al-Sudani received today the Minister of Oil, Hayan Abdul-Ghani Al-Sawad, in the presence of the Undersecretary of the Ministry of Oil for Distribution Affairs."

KTFA:

Clare: Prime Minister: The government is moving forward with the growth of the oil and gas sectors

10/28/2024

Prime Minister Mohammed Shia al-Sudani discussed today, Sunday, with Oil Minister Hayan Abdul-Ghani al-Sawad the government's previous plans for the growth of the oil and gas sectors.

The Prime Minister's Media Office stated in a statement, a copy of which was received by NRT Arabic, that "Al-Sudani received today the Minister of Oil, Hayan Abdul-Ghani Al-Sawad, in the presence of the Undersecretary of the Ministry of Oil for Distribution Affairs."

He added that "Al-Sudani referred, during the meeting, to the government's previous plans for the growth of the oil and gas sectors, and the development of their projects within the government program, through the licensing rounds in which contracts were signed to invest in many oil and gas fields, in addition to investing in associated gas projects, and oil derivatives production projects."

Regarding cooperation with the OPEC Plus group, the meeting emphasized “the importance of partnership with oil-producing countries, with the aim of maintaining the stability and balance of global oil markets, and Iraq’s commitment to what was agreed upon within the group, including voluntary cuts and compensation for the increase in production, according to the updated schedule submitted by the Ministry of Oil to OPEC.” LINK

************

Clare: The regional government to its employees: Whoever does not have a biometric code will have his salary stopped by the federal finances

10/27/2024

The Ministry of Finance and Economy in the Kurdistan Regional Government called on Sunday, employees and workers in the public sector to rush to register in the biometric system before the twentieth of next November, warning them that the Federal Ministry of Finance will stop the salary of anyone who does not have a biometric code.

The ministry said in a statement today that based on the agreements and understandings concluded between the Ministry of Finance and Economy in the Kurdistan Region and the Ministry of Finance in the federal government regarding the issue of resolving technical problems related to the payroll of Kurdistan Regional Government employees, the following must be done:

First: All employees, retirees, people with special needs, and heirs of martyrs who have not registered themselves in the biometric system must register before the date (11/20/2024).

Second: The decision to register in the biometric system includes all employees and salary recipients who are abroad for various reasons, or on unpaid leave, study, etc.

Third: Every employee or person receiving a salary in the Kurdistan Regional Government who does not have a biometric code until the date (11/20/2024) will have his salary stopped by the Ministry of Finance in the federal government, and he will bear responsibility for that. LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat We have been...told by my CBI contact on the committee that we should expect to see the ramped-up Project to Delete the Zeros sometime soon after the U.S. election period is over sometime in November. This period of time through December will begin the process for the swap out with the newer lower denominations. To me this also means about a 1:1 at par rate of the IQD with the US dollar. But remember this is IN-COUNTRY only. Also remember these actions ALWAYS have dependencies. Nothing is a guarantee! I want to make this VERY CLEAR to you today. [Post 1 of 2....stay tuned]

Mnt Goat ...the media is constantly broadcasting commercials about how the swap out will work. Then the news media from Iraq tells us about the “cash center” that recently opened in Karkh. It is used solely for the intake of the three zero dinar notes or dollars. Folks they are already sucking in the three zero notes...So in reality, unofficially, the process of deleting the zeros has already begun. Yes, it is underway according to my CBI contact. [post 2 of 2]

Breaking News Iraqi Airspace Shut Down

Edu Matrix: 10-27-2024

MARKETS A LOOK AHEAD: COUNTDOWN... BE READY FOR ANYTHING! Important Updates.

Greg Mannarino: 10-27-2024

Seeds of Wisdom RV and Economic Updates Sunday Morning 10-27-24

Good Morning Dinar Recaps,

BLOCKCHAIN LIFE 2024 GATHERED THE LEADERS OF THE CRYPTO COMMUNITY FROM 120 COUNTRIES IN DUBAI

Dubai, UAE, October 26th, 2024, Chainwire

The 13th edition of the Blockchain Life Forum, the premier gathering for cryptocurrency leaders worldwide, recently concluded with an astounding attendance of over 12119 participants.

The forum showcased over 200 esteemed speakers, featuring industry pioneers and executives from top companies, including OKX, CoinMarketCap, Bitmain, Bybit, Binance, Animoca Brands, Circle, BingX, ICP, Kraken, TON, Sandbox, Polygon, Litecoin, Sui, BNB Chain, Cardano, DYDX, VeChain, Osmosis, Chiliz, Algorand, Ether Fi, Manta, Mantle, Delysium, and many more.

Good Morning Dinar Recaps,

BLOCKCHAIN LIFE 2024 GATHERED THE LEADERS OF THE CRYPTO COMMUNITY FROM 120 COUNTRIES IN DUBAI

Dubai, UAE, October 26th, 2024, Chainwire

The 13th edition of the Blockchain Life Forum, the premier gathering for cryptocurrency leaders worldwide, recently concluded with an astounding attendance of over 12119 participants.

The forum showcased over 200 esteemed speakers, featuring industry pioneers and executives from top companies, including OKX, CoinMarketCap, Bitmain, Bybit, Binance, Animoca Brands, Circle, BingX, ICP, Kraken, TON, Sandbox, Polygon, Litecoin, Sui, BNB Chain, Cardano, DYDX, VeChain, Osmosis, Chiliz, Algorand, Ether Fi, Manta, Mantle, Delysium, and many more.

The exhibition of crypto companies featured 125 amazingly beautiful booths. Major players such as OKX, Bitmain, BingX, KuCoin, Bitget, Listing.Help, and Uminers offered attendees an exclusive glimpse into the latest technologies and innovations shaping the crypto landscape.

As a spectacular finale to the forum, participants enjoyed the Legendary AfterParty at one of the world’s premier clubs, SKY2.0.

This informal networking event provided a platform for top industry figures to connect, complemented by a dazzling live performance from internationally celebrated artist French Montana, who thrilled over 1,200 attendees with his chart-topping hits.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

NETHERLANDS PROPOSES CRYPTO TAX COMPLIANCE TO ALIGN WITH EU STANDARDS

Aligning themselves with the tax reporting rule on digital currency enacted by the European Union (EU), the Netherlands revealed its intention to apply tax monitoring rules on crypto.

The Dutch government, an EU member, is obliged to accept and apply the new reporting requirement, a structure meant to assist EU member states in controlling digital currencies.

New Reporting Policy

The Dutch Ministry of Finance announced that the government seeks to pass a new policy that will ensure that activities related to cryptocurrencies will be reported and subjected to tax.

According to tax authorities, under the proposed legislation, the government will require crypto service providers to gather and share their users’ data with the Dutch taxation agency starting January 2026.

The Dutch Taxation and Tax Authorities noted, however, that digital currency owners are already required to submit a tax return on their balance and that the measure would not effect them.

Citing that the suggested step will improve cooperation among EU members by exchanging crypto data and transactions, State Secretary for taxes and Tax Authorities Folkert Idsinga clarified that the bill is viewed as an important initiative made by the Dutch government on crypto taxes.

“This will combat tax avoidance and evasion, and European governments will no longer miss out on tax revenues,” Idsinga said.

Under the new rule, digital asset service providers should submit the user data of individuals who are residents of EU member nations. They must submit the data to the Dutch tax administrator, which can be shared by the tax agency with other tax authorities across the regional bloc.

Public Feedback

The Dutch government said that it wants to know the opinion of the public on the proposed tax monitoring law. There will be a consultation period that will run until November 21 wherein the people are encouraged to give their concerns and reactions to the new policy.

The feedback gathered during the consultation will be used to draft the final version of the legislation. Tax authorities aim to submit the proposed measure to the country’s House of Representatives next year.

EU Crypto Tax Reporting

In October 2023, the EU introduced DAC8, a crypto taxation rule that requires all crypto service providers across the EU to provide their respective tax authorities with their users’ data.

The Dutch government said that DAC8 allows data exchange between tax authorities within the EU, limiting the administrative burden for crypto service providers because they only need to communicate with the proper authorities in the country they are registered.

“Without this DAC8 directive, providers could be asked for information by any member state,” Dutch tax authorities explained.

@ Newshounds News™

Source: Bitcoinist

~~~~~~~~~

🌱SWIFT & MBRIDGE: THE FUTURE OF CROSS-BORDER PAYMENTS? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Sunday AM 10-27-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 27 Oct. 2024

Compiled Sun. 27 Oct. 2024 12:01 am EST by Judy Byington

Judy Note: Right now the greatest takedown in the financial history of the World was happening. BRICS nations were accelerating de-dollarization faster than anticipated. Brazil, Russia, and China have bypassed the fiat US Dollar in trade agreements. Argentina and Japan were moving to dismantle oppressive tax regimes.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 27 Oct. 2024

Compiled Sun. 27 Oct. 2024 12:01 am EST by Judy Byington

Judy Note: Right now the greatest takedown in the financial history of the World was happening. BRICS nations were accelerating de-dollarization faster than anticipated. Brazil, Russia, and China have bypassed the fiat US Dollar in trade agreements. Argentina and Japan were moving to dismantle oppressive tax regimes.

Possible Timing:

Thurs 24 Oct. 2024: BOOOOM!!! The gold/backed BRICS Currency Note to be used for international trade (replacing the fiat US Dollar) was introduced by BRICS.

On Sun. 27 Oct. into Mon. 28 Oct. 2024 Project Sandman (US Dollar crash) was set to kick off.

Mon. 28 Oct. 1929 was the infamous Black Monday Market Crash and another was expected on Mon. 28 Oct. 2024.

~~~~~~~~~~

Global Currency Reset:

Sat. 25 Oct. 2024 Wolverine: “The GCR is defiantly coming this week.”

Sat. 25 Oct. 2024 MarkZ: “Billionaire Warren Buffet dumps $10,500,000,000 billion in Berkshire’s Bank of America’s stake after slashing JP Morgan Chase, Wells Fargo investments to zero” Why is this important? If he suddenly dumps the stocks it would probably cause a run on banks. He is historically one of the most solid traders in the world and he is unloading all bank stocks. . Mark Z

Sat. 26 Oct. 2024: Breaking! Military Intel: EBS Training Complete, Countdown to the Great Currency Revaluation Begins! – amg-news.com – American Media Group

Sat. 26 Oct. 2024: NESARA and GESARA Unveil Monumental Changes: Global Implementation Begins! – amg-news.com – American Media Group

~~~~~~~~~~~~~~~

Tier Groups involved in the RV.

Tier 1 the Elders, German Bonds, Select Yellow Dragon Bonds have been paid.

The Pentecostal group are now 100% under NDA.

~~~~~~~~~~

Global Financial Crisis:

Sat. 26 Oct. 2024: US Banks are hiding a dark secret. Bail Ins are coming. Time for the banks to rob us now. Luckily we have the QFS: https://m.youtube.com/watch?v=5QnojHmE4aw

The CEO of America’s largest bank, Jamie Dimon, says the global order is at risk. In other words, a transformation of the international monetary system. https://x.com/GoldTelegraph_/status/1849962758684790803

Bitcoin drops after the U.S. government announces an investigation into USDT crypto firm Tether.

Read full post here: https://dinarchronicles.com/2024/10/27/restored-republic-via-a-gcr-update-as-of-october-27-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Wolverine [via Judy Byington] The private contractors have seen their letters of confirmation that they will get paid this coming week. That is a million percent confirmed. The biggest news is that the biggest Whale in the RV got paid and went home to start the process to help humanity...he is a good friend of mine, and when that news came through, I started crying... I also, will be jumping in with them to help with their humanitarian projects...I will be flying out soon, but cannot tell you where. When I get the green light, you will not hear from me again, but the opera [RV?] will come before that happens.

Pimpy [Reference Guru Nader post ] It [The dinar on Forex] went from 1320 to 745 for every dollar so that's 54% increase in value. Woo! Man that's really good. It's not where everybody wants to be but still a nice jump in value. It's looking good. I really think it's looking good. I just try to keep people grounded...There is weird activity. Nobody really knows what it means but that is one hell of a jump, a 54% increase in value...I don't know what's going on...It is exciting because this is right on the heels of the information...that they're lifting restrictions [on foreign exchange in Iraq] and then all of a sudden this happens. This is like one day apart...All of a sudden next day there's a spike. Could be something, could be nothing...Everybody knows it's close so it's hard not to get excited.

Iraq Good News Growth Pattern; COP Currency Investment How to:

Edu Matrix: 10-26-2024

Fake Agro-Cheque | How to Spot The Fake 100 Billion Dollars Special Agro Cheque Banknote

BankNote World: 10-26-2024

Fraudsters will attack any banknote or product where they think they can make money and get away with their crime. With the high collector value of the Zimbabwe 100 Billion Special Agro-Cheque banknotes, counterfeiters have tried to produce and pass fake Zimbabwe 100 Billion Special Agro-Cheque banknotes.

At BanknoteWorld not only do we ensure the authenticity of the banknotes we sell, we also scour the market to look for counterfeits so we can analyze them and provide guidance to collectors and law enforcement how to spot these fakes.

“Tidbits From TNT” Sunday Morning 10-27-2024

TNT:

Tishwash: Rafidain Bank announces the implementation of the comprehensive banking system in 46 branches in Baghdad and the governorates

Rafidain Bank announced today, Sunday, the implementation of the comprehensive banking system in 46 branches in Baghdad and the governorates link

TNT:

Tishwash: Rafidain Bank announces the implementation of the comprehensive banking system in 46 branches in Baghdad and the governorates

Rafidain Bank announced today, Sunday, the implementation of the comprehensive banking system in 46 branches in Baghdad and the governorates link

Tishwash: The regional government to its employees: Whoever does not have a biometric code will have his salary stopped by the federal finances

The Ministry of Finance and Economy in the Kurdistan Regional Government called on Sunday on employees and workers in the public sector to rush to register in the biometric system before the twentieth of next November, warning them that the Federal Ministry of Finance will stop the salary of anyone who does not have a biometric code.

The ministry said in a statement today that based on the agreements and understandings concluded between the Ministry of Finance and Economy in the Kurdistan Region and the Ministry of Finance in the federal government regarding the issue of resolving technical problems related to the payroll of Kurdistan Regional Government employees, the following must be done:

First: All employees, retirees, people with special needs, and heirs of martyrs who have not registered themselves in the biometric system must register before the date (11/20/2024).

Second: The decision to register in the biometric system includes all employees and salary recipients who are abroad for various reasons, or on unpaid leave, study, etc.

Third: Every employee or person receiving a salary in the Kurdistan Regional Government who does not have a biometric code until the date (11/20/2024) will have his salary stopped by the Ministry of Finance in the federal government, and he will bear responsibility for that. link

************

Tishwash: "Hybrid Monetary Policy".. Al-Sudani's Advisor Reveals the Central Bank's New Step

The economic advisor to the Prime Minister, Mazhar Muhammad Salih, explained today, Saturday, precise details about the importance and reasons for the Central Bank of Iraq’s decision to reduce interest.

Saleh told {Euphrates News} that: "It is clear that the monetary policy of the Central Bank of Iraq has become a policy that meets the requirements of growth in real economic activity, through activating its operational objectives aimed at reducing the cost of credit and financing within the joints of the economic system in general and the banking system in particular.

" He explained, "The Central Bank began, through its decision issued in accordance with its circular on October 24, to reduce the monetary policy interest rate (which is the rate at which the Central Bank of Iraq deals with the banking system) by about 200 percentage points

By lowering the interest at which the Central Bank deals with banks from 7.5% to 5.5%, which means that the Central Bank of Iraq has become following an expansionary policy in targeting the money supply in a manner that is consistent with activating the real sector in the national economy and confronting unemployment indicators in the overall economy."

According to the statement of the Prime Minister's economic advisor, "Despite the above, the bank in its new policy did not neglect the importance of continuing to control local liquidity levels and carrying out high sterilization operations, by offering debt instruments called Islamic certificates of deposit with a return that increases with the length of the amortization period of those securities purchased by the banking system, which are considered sovereign debts that can be mortgaged or discounted in the secondary market and are excellent debts."

He continued, "The monetary policy of the Central Bank has given a signal to the financial and banking system that its easy or flexible policy adopted by the bank in moving the liquidity of the economy is under continuous control in order to play the role of the monetary authority in combating inflationary activities and imposing economic stability as its first central goal."

Saleh concluded by saying, "Between expanding the movement of economic liquidity as an expansionary policy and imposing control over liquidity levels by offering debt instruments in return at the same time in parallel, we can call the current monetary policy of the Central Bank of Iraq a {hybrid flexible monetary policy}."

The bank decided to reduce the interest rate from 7.5% to 5.5%, in addition to reactivating the securities (Islamic certificate of deposit and money transfers) according to an annual plan and with two terms: with a return of 4% for a period of 14 days and a return of 5.5% for a period of 182 days. link

************

Tishwash: Despite the Israeli attack, the Iranian toman recovers against the US dollar

Today, Saturday (October 26, 2024), the Iranian toman recorded a remarkable recovery against the US dollar on the main Tehran Stock Exchange.

Baghdad Today correspondent said that the toman price today in Tehran's main stock exchange was recorded at 6 million and 500 thousand tomans for every 100 US dollars.

He added that this price is considered a significant change towards recovery after it recorded 6 million and 800 thousand tomans for every 100 US dollars yesterday.

Israel launched a series of airstrikes on Iran early Saturday morning, and explosions were heard in the Iranian capital, Tehran, although there was no information about any damage or injuries.

Four hours after the start of the operation, which Israel called "Days of Response," the Israeli army announced that it had completed the attack on military targets in Iran, that all of its aircraft that carried out the attack on Iran had returned safely to their bases, and that the operation had achieved all of its goals.

Israeli military spokesman Daniel Hagari said the attack was carried out under the direction of the political echelon in response to the Iranian regime's attacks against Israel and its citizens.

A senior US official said that the Israeli response to Iran has ended, and asked Tehran not to respond or escalate, stressing that if Iran decided to respond, "we will be fully prepared to defend Israel again and there will be dire consequences."

He added that this should be the end of the exchange of direct strikes between Israel and Iran.

The Israeli attack began shortly before 2 a.m. on Tehran, and shortly thereafter Israeli military spokesman Daniel Hagari announced the start of a precise and targeted attack on Iran.

Later, Israeli media reported a second wave of Israeli attacks against Iran, targeting sites, some of which were in Shiraz. Then, the American website Axios quoted Israeli and American officials as saying that Israel targeted Iran with three waves of strikes, and that the first waves of those Israeli strikes targeted Iran’s air defense system.

After about 4 hours, the Israeli Broadcasting Authority confirmed the end of the Israeli attack on Iran, in which hundreds of fighter jets participated. The New York Times also quoted Israeli officials as saying that the attack on Iran ended after striking about 20 sites. link

Mot: A piece of the action

Mot: Soooooo -Watts Ur Critters Name!! – hmmmmm

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 10-26-24

Good Afternoon Dinar Recaps,

FED RATE CUT TO HAPPEN 2 DAYS AFTER US ELECTION, POSSIBLE MARKET IMPACT?

▪️The US Fed rate cut is imminent in November with 0.25% cut in view

▪️FOMC policy meeting will hold on Nov 7, two days after coming US election

▪️Bitcoin might benefit from this potential market rattling ahead

Beyond Bitcoin trend, one of the most important conversations on Wall Street now is the potential Fed rate cut in November. With the US economic data coming in below expectations, there is a higher level of certainty of a rate cut next month. The timing, however, has created a new conversation on what this might mean for the broader market.

Good Afternoon Dinar Recaps,

FED RATE CUT TO HAPPEN 2 DAYS AFTER US ELECTION, POSSIBLE MARKET IMPACT?

▪️The US Fed rate cut is imminent in November with 0.25% cut in view

▪️FOMC policy meeting will hold on Nov 7, two days after coming US election

▪️Bitcoin might benefit from this potential market rattling ahead

Beyond Bitcoin trend, one of the most important conversations on Wall Street now is the potential Fed rate cut in November. With the US economic data coming in below expectations, there is a higher level of certainty of a rate cut next month. The timing, however, has created a new conversation on what this might mean for the broader market.

.

US Fed Rate Cut: What Is With the Timing?

In September, the Federal Open Market Committee (FOMC) slashed interest rate by 50 basis points. This pivot comes after about 4 years of aggressive monetary policies. At the time, Federal Reserve officials including Chairman Jerome Powell revealed that more cuts are likely, depending on economic outlook.

Recent economic data shows a need for more cuts. Although the latest US PPI inflation data comes in hotter than expected, jobless claims remain a concern to tackle. With the outlook, many projected a 25 basis point Fed rate cut for November and possibly December.

A recent Beige Book report from the apex bank confirmed the need for further cuts, leaving the question of the timeline. Per a report from MarketWatch, the Fed officials are silently preparing for the November policy meeting on the 7th. This is 2 days after the US Presidential election between Donald Trump and Kamala Harris.

It remains unclear what the market impact will be as the elections might not have produced a winner by then. This is bound to leave the market investors highly cautious based on the broader uncertainty on what to expect. However, more clarity on what to expect with the release of PCE Inflation and the October job report next week.

What is in it for Bitcoin?

US Fed rate cut events are historically bullish for Bitcoin (BTC) and the broader crypto market. Branded as a hedge against inflation, Bitcoin might gain more attraction from investors over time.

This thesis stems from the likelihood of the US Dollar losing its purchasing power with excess capital flow amid the Fed rate cut push. This is already playing out as many firms are already exploring keeping funds in digital currencies as a hedge.

In a major twist, Microsoft shareholders will vote in the coming weeks about investing in Bitcoin. Following this revelation, top proponents like Michael Saylor has offered to help Microsoft make trillions through BTC if the leadership is open to talk.

@ Newshounds News™

Source: CoinGape

~~~~~~~~~

CARDANO FOUNDER REVEALS EPIC BITCOIN PLAN: DETAILS

Cardano founder Charles Hoskinson has teased an ambitious plan to enhance Bitcoin’s ecosystem by relaunching the Bitcoin Education Project in 2025 and introducing advanced resources for Bitcoin developers.

Hoskinson started The Bitcoin Education Project in 2013, providing free, peer-reviewed content on Bitcoin and the digital asset environment. Now, as he noted in a tweet, with Bitcoin “back in the family,” he intends to relaunch the Bitcoin Education Project in 2025 as well as develop a new edition of his course in the educational program.

The new edition, according to Hoskinson, will not only update previous content but will also include resources specifically for developers looking to build applications on the Bitcoin network.

In a push to expand the programming toolkit available for Bitcoin developers, Aiken education — a modern programming language and toolkit for developing smart contracts on the Cardano blockchain — will be prepared for Bitcoin developers, including hosting on Maestro and using the hyperledger GitHub.

@ Newshounds News™

Source: U Today

~~~~~~~~~

🌱 THE CONSTITUTION CALL WITH SILVER 57 JIM. LOWTIDE, R JAX AND MASON GREAT INFO - DID YOU KNOW? | Youtube

Replay of the Constitution Live Call from last night October 25, 2024 with guest speaker Mason.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Saturday PM 10-26-2024

TNT:

Tishwash: Al-Sudani directs to conclude contracts in euros

Prime Minister Mohammed Shia al-Sudani directed ministries and governorates to accept offers and bids and conclude contracts in euros, equal to the dollar.

The Secretary-General of the Council of Ministers, Hamid Al-Ghazi, said in a letter issued to state institutions that Al-Sudani directed the acceptance of offers and bids and the conclusion of contracts in the European currency "Euro", equal to the US dollar, in accordance with the decisions of the Council of Ministers and the instructions issued by the Central Bank of Iraq regarding the US dollar. link

TNT:

Tishwash: Al-Sudani directs to conclude contracts in euros

Prime Minister Mohammed Shia al-Sudani directed ministries and governorates to accept offers and bids and conclude contracts in euros, equal to the dollar.

The Secretary-General of the Council of Ministers, Hamid Al-Ghazi, said in a letter issued to state institutions that Al-Sudani directed the acceptance of offers and bids and the conclusion of contracts in the European currency "Euro", equal to the US dollar, in accordance with the decisions of the Council of Ministers and the instructions issued by the Central Bank of Iraq regarding the US dollar. link

Gold Telegraph: Transformation of the International Monetary System

Friday, 25 October 2024,

Somebody should ask Jerome Powell or Janet Yellen about the BRICS plan to create a new international exchange of precious metals.

Hint: They won’t.

BREAKING NEWS: JAPAN’S FINANCE MINISTER KATSUNOBU KATO DISCUSSED DEVELOPMENTS IN THE FOREIGN EXCHANGE MARKET WITH UNITED STATES TREASURY SECRETARY JANET YELLEN

You can’t make this stuff up.

“Recent moves in foreign exchange rates were discussed at a bilateral meeting today between Finance Minister Kato and Treasury Secretary Yellen…”

Australia’s central bank recorded its fourth straight year of accounting losses in 2024. $2.78 billion loss. You are reading this right.

BREAKING NEWS: THE FEDERAL GOVERNMENT IS INVESTIGATING CRYPTOCURRENCY COMPANY TETHER FOR POSSIBLE VIOLATIONS OF SANCTIONS AND ANTI-MONEY-LAUNDERING RULES

Nobody saw this coming.

“Authorities looking at possible violations of anti-money-laundering and sanctions rules…”

Again, I have said this for years… Watch for gold-backed stablecoins.

The CEO of America’s largest bank, Jamie Dimon, says the global order is at risk. In other words, A transformation of the international monetary system.

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Nader From The Mid East Monday night (Tuesday Morning) I was in bed and I received a phone call around 2 o'clock in the morning over here in the States. They go like, hey Nader you go on Forex and watch what's happening in Forex...I go to Forex and I see this spike. Boom. Big spike. This first time since 20 years I see it...I look at it and it's missing one zero. Instead of three zeros is only two zeros...I'm there looking at it. I'm not believing myself what I'm seeing and I see it going down too, back to .00076 ...For me they bring to do it. They're testing it. They testing it late night or early morning over there just to see how it's going to work out...If you go to google, type in Iraqi dinar exchange rate. Click 5d (last five days view). If you go there you see it loss it's zero and it's .0014 instead of .0076 ... [Note: See the spike on the chart from a few days ago by clicking here to view on Google ]

MarkZ [via PDK] Article: “MP (Member of Parliament) It is not possible to pass the 2025 budget without sending the final accounts from the last two years” This is a big one. Along with the HCl…it looks like we will soon be getting the revaluation we are looking for.

Debt Doomsday Countdown: US Heads into One of Most Challenging Periods in History – Peter Grandich

Kitco News: 10-26-2024

Jeremy Szafron, Anchor at Kitco News, interviews Peter Grandich, Founder of PeterGrandich.com, to discuss his stark forecast for the U.S. economy amid rising global power shifts, de-dollarization efforts, and BRICS’ recent developments.

Grandich says America is entering its ‘worst-ever economic, social, and political era,’ raising concerns about debt, retirement, and potential currency shifts as BRICS grows its influence.

This segment dives into Grandich’s ‘10 Commandments for Investors,’ emphasizing capital preservation over appreciation. He breaks down the latest warning from the International Monetary Fund (IMF). He also shares his outlook on gold, U.S. stocks, and the U.S. dollar.

00:00 Introduction: BRICS, IMF, World Bank Updates

02:28 BRICS Analysis

04:40 Gold and the International Financial System

05:34 Future of BRICS and Global Trade

08:41 Global Power Dynamics

11:41 IMF and World Bank Meetings

13:57 U.S. Debt Crisis and Federal Reserve

17:16 Economic Predictions

19:05 Financial Complacency

19:57 Macro Outlook: Recession and Debt Crisis

21:00 Retirement and Aging Crisis

22:20 Stock Market Predictions

26:08 Precious Metals: Gold and Silver Outlook

30:14 Junior Resource Stocks

32:49 Investment Strategies