Economist’s “News and Views” Saturday 9-28-2024

Commodity Culture: BRICS Gold-Backed Currency to be Serious Rival to the Dollar within 2 Years

Friday, 27 September 2024, 22:04 PM

In an enlightening discussion with Commodity Culture, Simon Hunt painted a vivid picture of a world on the brink of significant geopolitical upheaval. As he delves into the complexities of modern power dynamics, he posits that the BRICS nations — Brazil, Russia, India, China, and South Africa — are poised to turn the tables on what has long been considered Western hegemony.

This change, he suggests, won’t just be economic; it will be accompanied by kinetic conflicts in the Middle East and Europe, presenting a multifaceted challenge to the existing world order.

Commodity Culture: BRICS Gold-Backed Currency to be Serious Rival to the Dollar within 2 Years

Friday, 27 September 2024, 22:04 PM

In an enlightening discussion with Commodity Culture, Simon Hunt painted a vivid picture of a world on the brink of significant geopolitical upheaval. As he delves into the complexities of modern power dynamics, he posits that the BRICS nations — Brazil, Russia, India, China, and South Africa — are poised to turn the tables on what has long been considered Western hegemony.

This change, he suggests, won’t just be economic; it will be accompanied by kinetic conflicts in the Middle East and Europe, presenting a multifaceted challenge to the existing world order.

As the dollar faces threats from rival currencies and growing inflationary pressures mount, investors may increasingly turn to gold not merely as an investment but as a protection against potential currency collapse. The perception of gold as a timeless store of value may experience a renaissance, prompting individuals and nations alike to stockpile the precious metal to buffer against future uncertainties.

Simon Hunt’s discussion with Commodity Culture serves as a clarion call to recognize the dynamic changes underway in global politics and economics. With the rise of BRICS, potential currency wars, and the specter of World War 3, we must prepare for a radically different world.

Investors, policymakers, and everyday individuals need to stay informed about these developments, understand the implications of shifting power dynamics, and take proactive steps to protect their economic interests.

As we look to the future, commodities, particularly gold, will likely form the bedrock of a resilient strategy to navigate the choppy waters ahead. It’s an urgent reminder: in a world marked by conflict and uncertainty, preparedness is the key to survival.

A 1930s Economic Crisis is Here: “I’m Going to Be Screaming to Buy Gold”

Daniela Cambone: 9-27-2024

Join Daniela Cambone for an electrifying episode of The Daniela Cambone Show! Today’s guest, Joel Litman of Altimetry, warns us of a potential return to economic conditions similar to the 1930s and 1970s.

With five key policies being discussed in Washington—including raised taxes, capital gains hikes, and price controls—we could be on the brink of significant market shifts.

Joel shares why, for the first time in his career, he believes gold could outperform the S&P 500, and he explains the critical factors investors should be watching now.

Could these economic headwinds signal a gold rush? Or will the stock market prevail?

Tune in as Joel dives into how government policies, potential tax changes, and economic history could impact your investments.

CHAPTERS:

00:00 5 things in economy to watch out

3:50 Harris and Biden’s economic plans

5:52 Gold performance

6:46 Stock market

8:30 Fed rate cuts

10:01 Debt crisis

11:42 Trump’s tariff protection policy

18:42 Joel’s conference

US Economy on Brink of Collapse: Japan ditch US Dollar!

Fastepo: 9-27-2024

Foreign governments heavily invest in U.S. Treasury securities, facing significant risks. Rising U.S. interest rates can decrease the market value of Treasuries, leading to potential losses during sudden rate hikes often triggered by inflation.

Additionally, a weakening U.S. dollar diminishes the value of these investments when converted to other currencies, presenting a risk particularly for nations with volatile or strengthening currencies.

Threats of inflation can also reduce the real returns on U.S. Treasuries if the inflation rate exceeds the yields, which erodes the purchasing power of foreign reserves.

Political and geopolitical tensions, such as U.S. debt ceiling debates, may disrupt market confidence and financial market access, increasing investment risk.

Furthermore, liquidity risks during financial crises can force large holders to sell at lower prices, negatively impacting market values. Countries with substantial holdings, like China and Japan, face concentration risks that could result in significant losses if the U.S. financial system struggles or if the dollar sharply declines, complicating their market exit strategies.

As of September 2024, Japan is the top international investor in U.S. government bonds, despite experiencing noticeable fluctuations in its investment levels over the year. In March 2024, Japan held U.S. Treasuries worth approximately $1.87 trillion.

However, by May, this figure had reduced to about $1.128 trillion following cumulative sales of $59.5 billion, including a significant reduction of $22 billion in May after a $37.5 billion decrease in April.

“Tidbits From TNT” Saturday 9-28-2024

TNT:

Tishwash: Setting a date to launch 102 investment opportunities in Iraq

Today, Friday, the Chairman of the National Investment Commission, Haider Makiya, set the date for launching 102 investment opportunities in various sectors.

Makiya said, "The Investment Commission is preparing, during the Iraqi Investment Forum conference that will be held on the second of next October, to launch 102 investment opportunities that have completed sectoral approvals," noting that "these projects that will be announced will include various sectors, and will benefit the citizen and the state."

TNT:

Tishwash: Setting a date to launch 102 investment opportunities in Iraq

Today, Friday, the Chairman of the National Investment Commission, Haider Makiya, set the date for launching 102 investment opportunities in various sectors.

Makiya said, "The Investment Commission is preparing, during the Iraqi Investment Forum conference that will be held on the second of next October, to launch 102 investment opportunities that have completed sectoral approvals," noting that "these projects that will be announced will include various sectors, and will benefit the citizen and the state."

He pointed out that "these projects were the result of numerous discussions within the operations room within the authority, with the membership of the Iraqi Economic Council, as well as the Prime Minister's Office, and a map was drawn up for the projects that are expected to be implemented by the beginning of November."

Regarding environmental sustainability projects, Makiya confirmed that “the Authority is working with Iraqi banks to set goals, plans and applications for banks to finance climate and environmental change projects,” indicating that “the Authority has projects and a round of discussions with the International Finance Organization that will be announced soon.” link

Tishwash: Foreign Minister invites his Venezuelan counterpart to visit Baghdad

Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein extended an official invitation to Venezuelan Foreign Minister Ivan Gil Pinto to visit Baghdad.

The Ministry of Foreign Affairs stated in a statement received by Al-Maalouma Agency, that “the Minister of Foreign Affairs met with his Venezuelan counterpart, on the sidelines of the 79th session of the United Nations General Assembly in New York, and discussed with him relations between Iraq and Venezuela and the importance of strengthening them after 75 years of its establishment.

The common denominators in the fields of oil production and gas reserves were also discussed, stressing the need for continuous coordination in these important areas.”

International issues of common interest were also discussed, most notably the Palestinian issue. Fuad Hussein thanked Venezuela for its honorable and supportive stances towards the Palestinian cause.

Within the framework of strengthening bilateral relations, the available opportunities for developing cooperation in the fields of agriculture and oil expertise were discussed.

The two ministers focused on the importance of exchanging expertise in exploiting associated gas and enhancing cooperation in this field.

It was emphasized to follow up on the work of the joint committee between the two countries, activate the signed memoranda of understanding, and move forward in completing the procedures for signing the memoranda that are still under completion.

At the end of the meeting, Fuad Hussein extended an invitation to his Venezuelan counterpart to visit Baghdad, to strengthen bilateral relations between the two countries. link

************

Tishwash: Kurdistan Finance announces the results of its delegation's recent visit to Baghdad

The Ministry of Finance in the Kurdistan Regional Government announced the results of its delegation's visit to the capital, Baghdad, regarding the issue of financing the salaries of employees in the region.

A statement by the ministry said, "During the past few days, a delegation from the Ministry of Finance in the Kurdistan Regional Government visited the capital, Baghdad, and met with the federal Ministry of Finance on the issue of financing employees' salaries," noting that "the two sides reached a number of understandings."

The statement pointed out that "the Kurdistan Ministry of Finance has submitted the list of employees' salaries for the months of August and September, as requested by the Federal Ministry of Finance last time."

He added, "In order to cover the deficit in August salaries, which is estimated at 243 billion dinars, the Federal Ministry of Finance decided to disburse the suspended payments from February to August, and it is scheduled to begin distributing salaries at the beginning of next week with the arrival of supplementary funding from Baghdad." link

************

Tishwsh: Al-Asadi: We call on citizens to invest in the retirement and social security law

During his visit to Najaf Governorate today, Saturday, September 24, 2024, the Minister of Labor and Social Affairs, Mr. Ahmed Al-Asadi, called on citizens to invest in the Retirement and Social Security Law and expedite registration for optional insurance.

Al-Asadi announced the completion of the procedures for issuing smart cards to more than 17,074 new families during the opening of schools designated for people with special needs.

During the visit, he explained a number of measures regarding what the ministry has accomplished:

* Issuing smart cards to 13,498 people with disabilities and special needs.

* Completion of the smart card for children with diabetes, amounting to 3496.

* Completion of the smart card for 80 orphans, and they will receive the cash assistance next Tuesday, corresponding to 10-1-2024.

* The number of those included in Najaf Governorate reached more than 110,594 families.

* 2,433 new families from Najaf Governorate were included, and smart cards were issued to more than 1,226 families in Najaf, and they will receive the aid next Tuesday.

* We have completed the transfer of more than 12,000 social protection beneficiaries to the Ministry of Interior, including 998 beneficiaries from Najaf Governorate.

* Today we opened Elia Elementary School for Special Education in Najaf Governorate.

* Today we opened the main reception hall for beneficiaries in the Women's Social Protection Department.

* Today we opened the safe environment hall for raising children in the Women's Social Protection Department.

* We opened electronic inquiries and a central computer room for the Social Protection Department for Men.

* We announce that all individuals at Elia School are included in the social protection allowance and the full-time assistant.

* We have directed to take rapid measures to facilitate the granting of loans.

* We directed the Disability Rights Commission to open more than one new medical committee in the governorate.

* We directed to focus on opening new sub-committees for social protection in the governorate. link

Mot: ... Issues I Can Get Behind

Mot: Have a wonderful day everyone.

Seeds of Wisdom RV and Economic Updates Saturday Morning 9-28-24

Good Morning Dinar Recaps,

HAS ECB CRACKED THE CODE FOR DIGITAL EURO CBDC ADOPTION?

Two economists at the European Central Bank have modelled how to get consumers to adopt a central bank digital currency (CBDC) and the digital euro in particular.

They distinguish between adoption and usage. While consumers may decide to include a new payment method, they won’t necessarily use it that often.

Good Morning Dinar Recaps,

HAS ECB CRACKED THE CODE FOR DIGITAL EURO CBDC ADOPTION?

Two economists at the European Central Bank have modelled how to get consumers to adopt a central bank digital currency (CBDC) and the digital euro in particular.

They distinguish between adoption and usage. While consumers may decide to include a new payment method, they won’t necessarily use it that often.

To create their model, the economists used the 2022 ECB Study on Payment Attitudes of Consumers in the EU (SPACE). Given it was post COVID, it showed changes in payment behaviors such as an increase in usage of mobile payments for person-to-person payments which rose from 3% in 2019 to 10% in 2022.

Unsurprisingly, they found consumers prefer to stick to familiar methods, such as cards and cash. Switching incurs a significant adoption cost, in terms of money, time and effort.

Three steps to make adoption worthwhile

One avenue to make the switching costs worthwhile is to design the CBDC to combine the relative advantages of both cards (usability) and cash (controlling usage and privacy). The model showed this could increase adoption by 80% and usage by 140%.

A second strategy is to communicate these benefits effectively. While this had some benefit, the impact was smaller compared to the design choices.

Thirdly, the economists highlight the importance of surfing network effects. We believe this implies there could be different strategies for different jurisdictions. In some regions P2P payments might be more popular, so this could be the area to push. In other jurisdictions there may be more potential for Point of Sale payments (PoS). For example, the SPACE survey showed usage of mobile payments at PoS at 10% in the Netherlands versus 1% in Slovenia.

They argue that regions more eager to adopt new payment technologies will be more open to CBDC. That makes sense. However, we see a counterargument that if users adopt new payment technologies they could perceive less need for a CBDC.

The economists also highlight the role of legislation in ensuring distribution, such as obliging banks, and requiring merchants to accept the digital euro at PoS.

Other digital euro reports

Meanwhile, in other digital euro news, during August an NEBR paper explored the impact of a potential digital euro on banks, European payment providers and US payment providers.

It found upbeat press mentions of a digital euro coincided with positive stock price movements for European payment firms and negative ones for American firms. There was no impact on banks.

Another report was published by the Veblen Institute and Positive Money, two organizations that are critical of banks. They highlight that there’s an option for the ECB and national central banks to sidestep private payment providers and go direct to consumers.

We confirm that legally the central banks and governments are also ‘payment service providers’ (PSPs), and it is PSPs that will provide wallet services for the digital euro, per draft legislation.

The IMF recently published a report on CBDCs exploring how to encourage adoption by consumers and merchants.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

COULD ROBINHOOD AND REVOLUT FIND STABLECOIN SUCCESS WHERE PAYPAL STUMBLED?

If Robinhood and Revolut do make a run at launching a stablecoin, as reported, can they each avoid the same fate as PayPal's PYUSD?

Fintech heavyweights Robinhood, a U.S. investing app, and Revolut, a crypto-friendly neobank based in London, are considering launching their own stablecoins, unnamed sources told Bloomberg this week.

The giants are eyeing the stablecoin market at a time when Tether (USDT), with its $119 billion market capitalization, accounts for roughly 68% of the $173.5 billion category.

With Europe offering clearer regulatory frameworks, the fintech giants could bring a new wave of competition. However, the question remains: Can they break through Tether's dominance, or will they struggle like other giants before them?

Although neither company has officially confirmed their plans, both companies are considering stablecoin issuance, according to a report on September 26.

Fred Schebesta, founder of Finder.com, sees the potential for Robinhood and Revolut but acknowledged the challenge.

“Revolut and Robinhood definitely have a shot at making a dent in USDT’s dominance, but it's going to take a lot of integration to get there,” he said. “USDT has a deep-rooted presence in the market, and people, for some reason, still place an unusual amount of trust in it.”

He said PayPal's stablecoin demonstrates that “even big players aren’t gaining much traction yet,” but added that Robinhood and Revolut have a chance to try a different approach.

“Their platforms are more integrated with retail investors,” Schebesta said, “and if they can leverage those ecosystems properly, they might find an edge that PayPal hasn't tapped into yet.”

Pav Hundal, a market analyst at Australian crypto exchange Swyftx, agrees that scale will be crucial.

“Stablecoins are a game of scale, or relative scale if you have a niche offering,” he told Decrypt. “Robinhood and Revolut possess scale in abundance and clearly have some level of conviction that they can leverage their huge global networks to take a slice of Tether’s market.”

The two companies also have one major advantage, he added: Both companies are already regulated in many jurisdictions around the world. “But for now, Tether exists on an entirely different plane of existence to its competitor,” Hundal said.

PayPal isn’t alone in its struggles with PYUSD. Even giants like JPMorgan Chase, Meta (Facebook), and Binance have attempted to conquer the stablecoin world—each meeting their own unique challenges and limitations.

JPM Coin found its place within internal banking but failed to penetrate wider retail or DeFi markets. Meta’s Diem, once heralded as the “future of money,” crumbled under regulatory pressures, never seeing the light of day.

Binance's BUSD has grown, but even it remains a distant competitor to Tether, unable to topple the giant.

Tether’s entrenched position as the crypto exchanges’ primary trading pair sets a high bar for liquidity that new entrants must match. The stablecoin market's deep liquidity pools, network effects, and established trust create high barriers for new entrants.

@ Newshounds News™

Source: Decrypt

~~~~~~~~~

XRP LEDGER IMPLEMENTS TWO MAJOR UPDATES TO BOOST ECOSYSTEM FUNCTIONALITY

▪️XRP Ledger announces two updates that enhance its functionality.

▪️Ripple’s stablecoin RLUSD may benefit from these new updates.

▪️Continued blockchain advancements support Ripple's ecosystem growth.

The XRP Ledger (XRPL) has announced two significant updates following a recent modification.

These developments have attracted attention, particularly due to rising expectations surrounding the potential launch of Ripple’s stablecoin, RLUSD. Consequently, there is curiosity about how these updates will impact the stablecoin’s functionality and the overall ecosystem.

XRP Ledger Executes Two Major Updates

According to an XRPScan report, the XRP Ledger implemented two important updates named “fixEmptyDID” and “fixPreviousTxnID” last Friday. Both updates received support from 31 validators, surpassing the 28/35 threshold.

The first update aims to prevent the creation of empty DID ledger entries that previously occupied unnecessary space. With this change, any transaction attempting to create such entries will result in an error. This endeavor is expected to enhance ledger efficiency without interfering with existing processes.

Will Ripple’s Stablecoin RLUSD Be Affected?

Ripple $0.620272 has begun beta testing its stablecoin on both the XRPL and Ethereum $2,675 networks. Recently, Ripple released two batches of the RLUSD stablecoin, each containing 485 RLUSD. These developments have intensified speculation regarding how the recent updates on XRPL will influence the operation of the stablecoin.

Ripple President Monica Long confirmed that RLUSD would be launched this year if it receives U.S. approval.

Long expressed expectations that the stablecoin would serve broader areas compared to Ripple’s native cryptocurrency, XRP. She also noted that decentralized exchanges (DEX) on the XRPL could benefit from the stablecoin’s efficiency, while XRP would be utilized for smaller cryptocurrency transactions.

These statements suggest that the recent XRPL updates could empower both RLUSD and the XRP ecosystem, offering more functionality and flexibility across multiple applications.

In a period marked by continuous advancements in blockchain technology, such technical updates within the XRP Ledger may contribute to strengthening the Ripple ecosystem and enhancing investor confidence.

@ Newshounds News™

Source: CoinTurk

~~~~~~~~~

IS THE US DEBT CLOCK ACCURATE? LET'S PEEK | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Bits and Pieces” in Dinarland Saturday AM 9-28-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 28 Sept. 2024

Compiled Sat. 28 Sept. 2024 12:01 am EST by Judy Byington

Judy Note: In Dallas, major financial executives were caught attempting to flee the country through covert channels. But here’s the kicker: their escape routes have been entirely compromised by the Quantum Financial System (QFS). Their money is frozen, their assets confiscated, and their backdoor channels blocked. It’s checkmate, and they have nowhere to run.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 28 Sept. 2024

Compiled Sat. 28 Sept. 2024 12:01 am EST by Judy Byington

Judy Note: In Dallas, major financial executives were caught attempting to flee the country through covert channels. But here’s the kicker: their escape routes have been entirely compromised by the Quantum Financial System (QFS). Their money is frozen, their assets confiscated, and their backdoor channels blocked. It’s checkmate, and they have nowhere to run.

They also intended to overcome the Global Currency Reset through their own Great Reset of non-asset-backed digital currency or gold-backed currency that they alone controlled. The Cabal’s HSBC claimed they’ve successfully applied “quantum technology” to buy and sell tokenized physical gold, turning it into ERC-20 tokens, making it fungible. However, they owned the gold, not you.

Fri. 27 Sept. 2024: Military Mobilized to Defend QFS: Global Wealth Redistribution Underway with Troops on the Ground – The Elites Are in Full Panic Mode! – Gazetteller

~~~~~~~~~~~

Possible Timing: Tues. 1 Oct. 2024 (RUMORS/OPINIONS)

On Tues. 1 Oct. 2024 US Inc. Corp. dissolves, ending the fiat monetary system. The privately owned US Inc. Government, Federal Reserve and IRS will shut down. US Inc. fiscal year ends. It’s been bankrupt since 2008 and without Congressional budget approvals – running on fumes with a fiat US Dollar.

On Tues. 1 Oct. 2024 All banks worldwide not Basel III Compliant (have gold backing to their monies) will be closed. The Basel III regulations could alter the real estate market in unprecedented ways.

On Tues. 1 Oct. 2024 the Quantum Financial System Global Currency Reset goes into effect with 134 Sovereign nation gold/asset-backed currencies trading at a 1:1 with each other. The QFS completely replaces the outdated and corrupt central banking model. Forget about inflation, interest rates or manipulated stock markets—the QFS will make all of that obsolete. The endless printing of fiat money by corruptt central banks will be a thing of the past.

On Tues. 1 Oct. 2024 NESARA GESARA begins as countries worldwide activate the gold/asset-backed Quantum Financial System and Global Currency Reset. The BRICS nations will head the greatest wealth transfer in history. 134 nations are ditching the fiat US dollar and moving to gold-backed currencies. Each of these currencies will trade at a 1:1 ratio.

On Tues. 1 Oct. 2024 LIBOR is slated to be replaced by SOFR, marking a significant change in financial benchmarks.

On Tues. 1 Oct. 2024 the new United States of America Republic will start its new fiscal year under a gold-backed US Note as part of the Global Currency Reset.

The QFS isn’t just a financial system. It’s part of a broader plan to take full control of global communication, energy grids, and data. The military, working with top-secret intelligence agencies, has developed this system to prevent any future manipulation by global elites.

On Tues. 1 Oct. 2024 45,000 ILA workers at major ports will go on strike as unions push for a 77% wage increase. Half of US goods go through those ports. For each day of the strike, it will take one week to recover, severely disrupting the supply chain. Stock up on goods.

~~~~~~~~~~~~~

Restored Republic:

Alliance Plan: … on Telegram

NESARA/GESARA Debt Forgiveness implementation

QFS implemented

Federal Reserve d**d, IRS under new US Treasury

New tax system where there is only a 14% tax on new items bought only, no tax on food or medicine, wages, etc.

Read full post here: https://dinarchronicles.com/2024/09/28/restored-republic-via-a-gcr-update-as-of-september-28-2024/

***********

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 You can see the excitement of what's going on is no longer a secret and it's being advertised and published and talked about and bragged about all over the world from New York, the United States Treasury, all the way back to Iraq. The whole Middle East is on pins and needles. They all know. They're excited and they know it's going to affect them as well too...

Jeff Iraq can only change the rate at one or two points in the year, beginning or the middle of the year. That was stated by Shabibi. If Iraq was going to revalue at any of those times you would see them increase their steps and actions preparing to revalue. In this month of September those steps has occurred. They have increased their actions getting critical steps...laws done. They have tremendously ramped up.

BRICS Currency: 40% Could Be Tied to Gold, 60% in Local Currencies!

We Love Africa: 9-27-2024

Will Brics’ gold-backed currency dethrone the dollar and throw the West into financial chaos? This is what happens when 40% of a currency is backed by gold and 60% by local currencies come face to face with dollars backed by nothing.

It can send the US dollar crashing overnight.

So, is this the beginning of the end for the dollar; are we witnessing its downfall in real-time?

Could the US economy survive if Brics nations stop using the dollar or are we on the brink of collapse? Let’s find out.

Sovereign Debt Collapse to Flip Global Monetary System

Sovereign Debt Collapse to Flip Global Monetary System

Sean Foo and Andy Schectman: 8-27-2024

As the US debt plateaus at over $31 trillion, a significant concern looms for economists, policy makers, and citizens alike: the possibility of sovereign default.

The consequences of such an event extend beyond mere finances; it signals a seismic shift in the global economic order, potentially leading to a reset of monetary systems and a renewed recognition of gold’s value as a cornerstone of wealth preservation.

Sovereign Debt Collapse to Flip Global Monetary System

Sean Foo and Andy Schectman: 8-27-2024

As the US debt plateaus at over $31 trillion, a significant concern looms for economists, policy makers, and citizens alike: the possibility of sovereign default.

The consequences of such an event extend beyond mere finances; it signals a seismic shift in the global economic order, potentially leading to a reset of monetary systems and a renewed recognition of gold’s value as a cornerstone of wealth preservation.

This exploration examines the factors contributing to the current financial landscape, the looming threat of default, and how international tensions shape our economic reality.

Every day, the US government grows tighter with its fiscal policies, choosing to borrow extensively to finance its obligations. The debt has soared due to persistent budget deficits, which often result from a mix of extravagant spending and declining revenues.

As interest rates rise, so do the costs associated with servicing this gargantuan debt. The Debt-to-GDP ratio continues to climb, causing concern among analysts that a tipping point will soon be reached—one where the US will spend more on debt servicing than it does on crucial domestic programs.

In the face of potential economic turmoil, many investors are revisiting gold as a fundamental asset. Historically, gold has maintained its value even in times of crisis, often serving as a hedge against inflation and currency devaluation. Should a sovereign default occur, it’s likely we would see a rush to gold, as investors seek to protect their wealth when traditional currencies falter.

Moreover, gold’s growing appeal can be linked to the increasing uncertainty surrounding fiat currencies, especially the US dollar. The more volatile and unpredictable the monetary policy, the more individuals and countries may turn to gold as a reliable store of value.

While the internal economic factors pose significant challenges, the landscape of international relations exacerbates the situation. The economic war between the US, China, and Russia is intensifying, with sanctions, trade conflicts, and technological rivalry shaping a new multipolar world order.

Superpowers are increasingly weaponizing economic dependencies, with China promoting the Yuan in international trade and Russia expediting efforts to bypass the US dollar. This tension heightens the potential for conflict and instability, which could ultimately bring about an economic environment ripe for crisis.

As the dynamics of international economics shift, the US’s precarious financial situation becomes even more alarming. The interplay of escalating debt, potential default, and the increasing value of gold amidst geopolitical strife creates a perfect storm that could steer us toward a financial cliff.

The confluence of skyrocketing US debt, the specter of sovereign default, and escalating geopolitical tensions creates a maelstrom of uncertainty in our economic landscape. While we can only speculate on the exact timeline and nature of these impending crises, one truth remains clear: the decisions we make today will shape the financial reality of tomorrow.

Understanding these risks and strategically positioning oneself for the potential economic reset could be the key to navigating what lies ahead. Prepare, adapt, and maintain vigilance—because the storm is approaching, and its arrival could redefine the world as we know it.

Watch the video below from Sean Foo with Andy Schectman for further insights.

More News, Rumors and Opinions Friday PM 9-27-2024

Ariel: Iraqi News Update

Recent historical moves in Iraq’s financial sector indicate a significant stride towards modernizing banking operations. According to the latest info. Iraq is poised to complete its transition to an advanced banking system, aligning with international financial standards.

This overhaul, which is approximately 95% complete, aims to conclude by the end of 2024, marking a critical moment in Iraq’s economic reform.

The core of this transformation involves moving away from the wire auction system to direct correspondent banking relationships. This shift aims to not just an upgrade in operational efficiency but also aims at combating corruption and fostering transparency in financial transactions. Which will create Security & Stability in all Iraq.

Ariel: Iraqi News Update

Recent historical moves in Iraq’s financial sector indicate a significant stride towards modernizing banking operations. According to the latest info. Iraq is poised to complete its transition to an advanced banking system, aligning with international financial standards.

This overhaul, which is approximately 95% complete, aims to conclude by the end of 2024, marking a critical moment in Iraq’s economic reform.

The core of this transformation involves moving away from the wire auction system to direct correspondent banking relationships. This shift aims to not just an upgrade in operational efficiency but also aims at combating corruption and fostering transparency in financial transactions. Which will create Security & Stability in all Iraq.

You all should be jumping around your home & office at this news. You were just told by the CBI that they only have 5% left to do and you will be able to cash in your currency. Do you know how long people have been waiting for this news?

Can you imagine that on that day it will be your last time being broke? And you will have the opportunity to start the year off with a bang.

This comprehensive banking reform is not just about operational changes but represents a broader vision for Iraq’s economic renaissance. By integrating with the global financial network more seamlessly, Iraq is setting the stage for a future where its economy is not only resilient but also a key player in regional financial dynamics.

𝙏𝙝𝙚 𝙪𝙣𝙞𝙫𝙚𝙧𝙨𝙚 𝙞𝙨 𝙖𝙗𝙤𝙪𝙩 𝙩𝙤 𝙘𝙝𝙖𝙣𝙜𝙚.

𝙔𝙤𝙪𝙧 𝙬𝙤𝙧𝙡𝙙 𝙞𝙨 𝙖𝙗𝙤𝙪𝙩 𝙩𝙤 𝙘𝙝𝙖𝙣𝙜𝙚.

𝙔𝙤𝙪𝙧 𝙘𝙤𝙪𝙣𝙩𝙧𝙮 𝙞𝙨 𝙖𝙗𝙤𝙪𝙩 𝙩𝙤 𝙘𝙝𝙖𝙣𝙜𝙚.

𝙔𝙤𝙪𝙧 𝙡𝙞𝙛𝙚 𝙞𝙨 𝙖𝙗𝙤𝙪𝙩 𝙩𝙤 𝙘��𝙖𝙣𝙜𝙚.

Everything that had been happening up until this point with all the corruption in our lives are about to cease to exist in all forms of evil.

Banking

Government

Technology

Medical

Education

Music

I told you all for years now Everything starts with Iraq. And when they begin Everything else before it will end. This is why we are seeing a sped up timeline where everything is getting exposed at once. You are about to come out of “The Great Pause” that you have been under for the past four years.

Donald Trump told you in his last speech that everything will happen fast. How? Because we couldn’t do anything until Iraq was ready. Now you are going to see countries across the world speed up their operations to remove all the corruption in their government and other areas.

Remember what Al-Sudani stated. Their new systems is anti money laundering. Now do you remember what I told you all about ISO-20022? Guess what that is? An anti money laundering system that banks are implementing across the planet. This will choke out all the dark money that funds all the false flags we have been subjected to.

This is why they always wanted to ensure that the Middle East always remained unstable so theu can continue to force the fiat USD on 3rd world countries because debts & human tra££icking. Once the reinstatement occurs you will see a lot of corruption come to a sudden halt.

There is more I can say but you get the point.

Source(s):

https://x.com/Prolotario1/status/1839395603953955278

https://x.com/Prolotario1/status/1839486627078418502

https://dinarchronicles.com/2024/09/26/ariel-prolotario1-everything-starts-with-iraq/

************

Gold Telegraph: Gold is at Record Highs in Most Fiat Currencies

Thursday, 26 September 2024,

China is preparing to inject $142 billion of capital into the country’s top banks.

This would be the first intervention since the 2008 financial crisis.

This is massive news.

Gold is at record highs in most fiat currencies worldwide for a reason.

Global debt crisis.

The entire world is now watching gold.

History repeats.

BREAKING NEWS: ANOTHER NEW RECORD HIGH FOR GOLD IN US DOLLAR TERMS.

More history.

I said this over 3 years ago when everyone was claiming inflation was transitory, and I will repeat it:

You need to watch the price of commodities to understand the future of inflation.

Central banks around the world are watching these moves closely but likely feel trapped.

BREAKING NEWS

CHINA TO ISSUE $284 BILLION OF SOVEREIGN DEBT THIS YEAR TO HELP REVIVE ECONOMY

$284 billion.

This is going to get wild.

“The planned fiscal expansion is the latest attempt by Chinese policymakers to revive an economy grappling with deflationary pressures…”

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY:

We see articles on the news, reporters saying the imminent change to our currency is coming. Then he talked about deleting the zeros and the good that this would do and the bad. Then said our dinar would be stronger than the Jordan dinar.

Mnt Goat Article: “IRAQ PLANS CURRENCY REDENOMINATION AMID ECONOMIC CHALLENGES“ ...this is just not another article about the Project to Delete the Zeros but much, much more...I believe this project is going to move forward this fall, and I am told not until after the US election.

*****************

Putin Confirms BRICS Are Working On Independent Payment System

Arcadia Economics: 9-27-2024

Over the past few months we've reported how there was increasing confirmation that the BRICS are working on a proposal for a new independent payment system.

And this week, Russian President Vladimir Putin confirmed as much in a speech ahead of the BRICS meeting in Kazan in October.

To hear his comments, click to watch this short video now.

Seeds of Wisdom RV and Economic Updates Friday Evening 9-27-24

Good Evening Dinar Recaps,

GENSLER SUGGESTS BNY MELLON’S CRYPTO CUSTODY MODEL COULD EXPAND BEYOND BITCOIN AND ETHER ETFS

BNY Mellon explores extending regulated crypto custody beyond ETFs.

▪️Gensler suggests BNY Mellon's crypto custody model could apply to various digital assets.

▪️The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

Good Evening Dinar Recaps,

GENSLER SUGGESTS BNY MELLON’S CRYPTO CUSTODY MODEL COULD EXPAND BEYOND BITCOIN AND ETHER ETFS

BNY Mellon explores extending regulated crypto custody beyond ETFs.

▪️Gensler suggests BNY Mellon's crypto custody model could apply to various digital assets.

▪️The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

In comments to Bloomberg today, SEC Chair Gary Gensler discussed BNY Mellon’s crypto custody structure. He suggested that the model used for Bitcoin and Ether ETFs could be applied to other digital assets.

While the current approval applies only to Bitcoin and Ether ETFs, Gensler noted that the custody structure is not limited to specific crypto assets.

“Though the actual consultation related to two crypto assets, the structure itself was not dependent on what the crypto was, it didn’t matter what the crypto was.” said Gensler.

BNY Mellon now has the flexibility to extend its custody services to other digital assets if it chooses. Gensler emphasized that the “non-objection” is based on the structure itself, not the type of crypto asset, allowing other banks to adopt the same model for crypto custody.

The approval hinges on BNY’s use of individual crypto wallets, ensuring that customer assets are protected and segregated from the bank’s own assets in the event of insolvency. This wallet structure was developed in consultation with the SEC’s Office of Chief Accountant, leading to the agency’s “non-objection” decision.

This approval guarantees that the bank’s approach complies with regulatory requirements, preventing customer assets from being at risk during bankruptcy, a key issue that has plagued crypto platforms like Celsius, FTX, and Voyager.

The crypto custody market, estimated to be worth $300 million and growing by 30% annually, represents a lucrative opportunity for financial institutions.

With non-bank providers typically charging much higher fees for digital asset custody compared to traditional assets, banks like BNY Mellon are well-positioned to capitalize on this growing demand by offering more secure and regulated solutions.

@ Newshounds News™

Source: CryptoBriefing

~~~~~~~~~

@ Newshounds News™

Live Call: https://t.me/+CpYhls2JLGc5YWRh

~~~~~~~~~

BIG Silver Price and coin news

The Economic Ninja

(9/26/2024)

🚀 Silver surged to a 12-year high in 2022, gaining 37% since January 2023, driven by expectations of Fed rate cuts and increased demand in renewable energy, electronics, and electric vehicles.

💡 The global renewable energy market is projected to grow from $1.14 trillion in 2023 to $5.62 trillion by 2025, with a 17.3% annual growth rate, boosting silver's industrial applications.

🔬 Silver has more patents tied to it than any other metal, used in everyday items like water filters, cell phones, and solar panels, with companies indifferent to price fluctuations due to the small amounts needed in production.

📈 The Federal Reserve's pivot towards easier monetary policy, potential future rate cuts, and China's economic boost efforts have supported silver's price gains.

💼 Silver is considered a tangible, real investment that can be vaulted, contrasting with the stock market's perceived "vaporware" nature, with recommendations to invest in the cheapest possible silver coins.

@ Newshounds News™

Source: The Economic Ninja

~~~~~~~~~

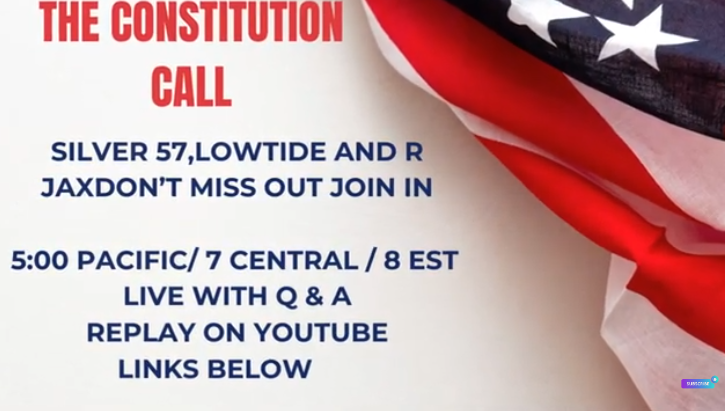

Join Us for the Constitution Call Tonight - You Won't Want to Miss It! Seeds of Wisdom Team | Youtube

@ Newshounds News™

Visit, Like and Subscribe to Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Friday 9-27-2024

Currencies BLOWING UP - Expect $3000/oz Gold Soon | Tony Greer

Liberty and Finance: 9-26-2024

Tony Greer discussed the current state of the gold and silver markets, emphasizing gold's strong performance amid ongoing fiat currency instability.

He pointed out that Western central banks' relentless currency creation is driving investors toward gold as a safe haven, predicting it could reach $3,000 per ounce by mid-2025.

Currencies BLOWING UP - Expect $3000/oz Gold Soon | Tony Greer

Liberty and Finance: 9-26-2024

Tony Greer discussed the current state of the gold and silver markets, emphasizing gold's strong performance amid ongoing fiat currency instability.

He pointed out that Western central banks' relentless currency creation is driving investors toward gold as a safe haven, predicting it could reach $3,000 per ounce by mid-2025.

Greer also expressed a cautious optimism about the stock market, noting that recent economic volatility has led to a potential resurgence in tech stocks and cyclicals, suggesting the S&P 500 could rally significantly.

He contrasted the investment behaviors in gold and silver, advocating for a focus on gold due to its stability and historical value as a hedge against inflation.

INTERVIEW TIMELINE:

0:00 Intro

1:15 Gold market

4:28 S&P 500 update

11:06 Recession

13:20 Stock market valuation

15:45 Silver vs gold

21:14 Commodities outlook

CHINA Sell Off 39% of US Treasury: What's Next?

Fastepo: 9-26-2024

The U.S. government continues to regard Treasury securities as stable and secure investment options, especially during economic uncertainties.

Despite this, there are growing concerns about the national debt, which has escalated to over $35 trillion as of mid-2024. This figure has doubled in the last 15 years, highlighting a trend of increasing government expenditure and debt accumulation.

The U.S. government's rising debt poses several long-term economic risks, notably due to the increasing cost of servicing this debt amidst rising interest rates. These higher rates make debt servicing more expensive, potentially leading to inflation and increased borrowing costs, which could crowd out private investment and necessitate higher taxes or reduced government spending.

Compounding these concerns is the U.S.'s reliance on foreign investment to fund its national debt.

Notably, China, which was once the largest foreign holder of U.S. debt, has reduced its holdings significantly, from a peak of $1.316 trillion in 2013 to about $749 billion by mid-2024.

This reduction is part of a broader trend of decreasing foreign ownership of U.S. debt, driven by geopolitical shifts and policy changes both in the U.S. and abroad.

Such a reduction in foreign investment could force the U.S. to offer higher interest rates to attract new investors, thereby increasing borrowing costs further.

This is How The Fed Just Ruined Your Life - George Gammon Goes Off

Daniela Carbone: 9-25-2024

In this insightful interview, George Gammon discusses the Federal Reserve's recent moves and the narrative they want us to believe. Are we heading for a hard landing, or can the Fed really control the economy?

George argues that despite the Fed's attempts to orchestrate a "soft landing," history shows that they often lag behind the curve.

Daniela Cambone dives deeper with George on the Fed’s decision-making, the realities of the labor market, and the significance of the inverted yield curve.

Tune in as they break down complex economic indicators and what they mean for the future of the economy.

CHAPTERS:

0:00 Fed’s Huge Mistake

4:30 More Rate Cuts Needed

8:30 Economic Downturn

13:00 Powell & Elections

18:00 Recession

24:00 Gold Safe Haven

33:00 Future Outlook

Seeds of Wisdom RV and Economic Updates Friday Morning 9-27-24

Good morning Dinar Recaps,

Ripple President Shares Bold Plans for RLUSD and Ethereum

Along with XRP’s function in smaller transactions, Ripple’s RLUSD aims to improve international transactions backed by dollars.

Ripple introduces Ethereum-compatible sidechains to XRPL, combining Ethereum’s programmability with XRP Ledger’s scalability and low costs.

Ripple has announced plans for its new stablecoin, Ripple USD (RLUSD), which will initially be available in countries or territories outside of the United States where Ripple has already obtained a license. Ripple President Monica Long made the statement during a recent interview with a Japanese media outlet.

She stated that after this initial launch, Ripple will look at entering more markets, with Japan being one of the possible targets due to its high adoption prospects for RLUSD.

Good morning Dinar Recaps,

Ripple President Shares Bold Plans for RLUSD and Ethereum

Along with XRP’s function in smaller transactions, Ripple’s RLUSD aims to improve international transactions backed by dollars.

Ripple introduces Ethereum-compatible sidechains to XRPL, combining Ethereum’s programmability with XRP Ledger’s scalability and low costs.

Ripple has announced plans for its new stablecoin, Ripple USD (RLUSD), which will initially be available in countries or territories outside of the United States where Ripple has already obtained a license. Ripple President Monica Long made the statement during a recent interview with a Japanese media outlet.

She stated that after this initial launch, Ripple will look at entering more markets, with Japan being one of the possible targets due to its high adoption prospects for RLUSD.

Ripple’s Legal Victory Sets the Stage for RLUSD Global Expansion

Before establishing RLUSD, Ripple won a substantial legal struggle with the United States Securities and Exchange Commission (SEC), with the court ruling that XRP is not a security. This decision brought legal clarity to the cryptocurrency market, allowing Ripple to expand its services.

Monica Long hailed this triumph as a turning point moment for Ripple, allowing it to strengthen its footprint in the US market, despite the fact that the majority of its growth continues to come from outside the US, particularly in the Asia-Pacific area.

One of Ripple’s primary objectives is to include RLUSD as part of an effective cross-border settlement solution. A trustworthy and open stablecoin will result from the full backing of RLUSD by US dollars and their equivalents in other currencies.

Within the Ripple ecosystem, RLUSD is expected to play an important role in increasing transaction liquidity and efficiency. Monica Long stated:

“RLUSD is not intended to replace XRP, but to supplement it. While XRP will continue to be used for lower market-cap assets, RLUSD will be an effective vehicle for larger transactions.”

Ripple has lofty intentions to add Ethereum interoperability to the XRP Ledger. This means that Ethereum developers will be able to use XRP as a gas token on sidechains that are compatible with the Ethereum Virtual Machine (EVM).

This interface provides developers with additional chances to implement financial solutions and decentralized applications (DeFi) on the XRPL, using XRP’s scalability and efficiency.

Japan stands out as one of Ripple’s most potential markets, given to its long-standing cooperation with the SBI Group. As we previously reporeted, Ripple and SBI have worked together on a number of projects, including the creation of a digital NFT wallet for Expo 2025 in Osaka, which highlights Ripple’s potential acceptance in Japan’s corporate sector.

Furthermore, SBI Remit, a part of the SBI Group, has been providing international remittance services since 2017, using XRP as a bridge currency to enable quick and cost-efficient transactions.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Republicans introduce bill forcing Gary Gensler to testify biannually

Senate Republicans have introduced legislation that would require the SEC chair, currently Gary Gensler, to testify before Congress twice a year.

This move comes amid mounting criticism of SEC Chair Gary Gensler’s leadership and the agency’s approach to regulating the digital asset sector.

As reported by Fox Business, the proposed bill, the “Empowering Main Street in America Act,” would extend provisions from the Dodd-Frank Act to include a mandate for the SEC chair’s biannual appearance.

This follows a postponed hearing originally scheduled for Gensler before the Senate Banking Committee.

The day before, the House Financial Services Committee scrutinized Gensler, with members of both parties questioning his approach to crypto regulation and the broader financial market.

Senate Banking Committee Ranking Member Tim Scott, a key advocate for the bill, criticized the postponement, viewing it as indicative of a lack of accountability under Gensler’s leadership, per Fox Business.

Scott and nine other Senate Republicans argued that more frequent testimony is essential to ensure the SEC maintains its mission of protecting investors, facilitating capital formation, and promoting fair and orderly markets.

Gensler vs. Crypto

Biden-appointed Gensler has vocally expressed skepticism toward crypto regulation. He came out forcefully against the FIT21 bill after it was passed in the House.

The crypto industry mostly views Gensler with skepticism and frustration. Many believe his strict enforcement approach and classifying most crypto assets as securities have stifled innovation and created legal uncertainty.

Gensler’s tenure has faced bipartisan pushback, particularly regarding the SEC’s handling of digital assets.

Critics argue that the agency’s aggressive enforcement actions have caused uncertainty in the crypto market. These concerns were recently highlighted during a congressional hearing in which all five SEC commissioners, including Gensler, were pressed on their stance on cryptocurrency oversight.

Senate Republicans are aiming for greater accountability and transparency in the SEC’s regulatory decisions with the Empowering Main Street in America Act. They want to ensure the SEC remains transparent as the financial landscape continues to evolve.

On Sept. 24, The SEC charged TrueCoin and TrustToken with securities violations over unregistered offerings of TUSD and TrueFi, resulting in a settlement with fines totaling over $500,000. The case adds to the SEC’s growing enforcement actions against crypto firms, with industry fines surpassing $7 billion since 2013.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

DEBUNKING MYTHS: OPINIONS VS. FACTS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Friday AM 9-27-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 27 Sept. 2024

Compiled Fri. 27 Sept. 2024 12:01 am EST by Judy Byington

Timing: Tues. 1 Oct. 2024 (Rumors/Opinions)

On Tues. 1 Oct. 2024 U****c. (United?)Corp. dissolves, ending the fiat monetary system. The privately owned U****c. Government, Federal Reserve and IRS will shut down. U****c. fiscal year ends. It’s been bankrupt since 2008 and without Congressional budget approvals – running on fumes with a fiat US Dollar.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 27 Sept. 2024

Compiled Fri. 27 Sept. 2024 12:01 am EST by Judy Byington

Timing: Tues. 1 Oct. 2024 (Rumors/Opinions)

On Tues. 1 Oct. 2024 U****c. (United?)Corp. dissolves, ending the fiat monetary system. The privately owned U****c. Government, Federal Reserve and IRS will shut down. U****c. fiscal year ends. It’s been bankrupt since 2008 and without Congressional budget approvals – running on fumes with a fiat US Dollar.

On Tues. 1 Oct. 2024 All banks worldwide not Basel III Compliant (have gold backing to their monies) will be closed. The Basel III regulations could alter the real estate market in unprecedented ways.

On Tues. 1 Oct. 2024 the Quantum Financial System Global Currency Reset goes into effect with 134 Sovereign nation gold/asset-backed currencies trading at a 1:1 with each other. The QFS completely replaces the outdated and corruptt central banking model. Forget about inflation, interest rates or manipulated stock markets—the QFS will make all of that obsolete. The endless printing of fiat money by corruptt central banks will be a thing of the past.

On Tues. 1 Oct. 2024 NESARA GESARA begins as countries worldwide activate the gold/asset-backed Quantum Financial System and Global Currency Reset. The BRICS nations will head the greatest wealth transfer in history. 134 nations are ditching the fiat US dollar and moving to gold-backed currencies. Each of these currencies will trade at a 1:1 ratio.

On Tues. 1 Oct. 2024 LIBOR is slated to be replaced by SOFR, marking a significant change in financial benchmarks.

On Tues. 1 Oct. 2024 the new United States of America Republic will start its new fiscal year under a gold-backed US Note as part of the Global Currency Reset.

The QFS isn’t just a financial system. It’s part of a broader plan to take full control of global communication, energy grids, and data. The military, working with top-secret intelligence agencies, has developed this system to prevent any future manipulation by global elites.

On Tues. 1 Oct. 2024 45,000 ILA workers at major ports will go on strike as unions push for a 77% wage increase. Half of US goods go through those ports. For each day of the strike, it will take one week to recover, severely disrupting the supply chain. Stock up on goods.

~~~~~~~~~~

Global Currency Reset:

Thurs. 26 Sept. 2024 Bruce:

There are no longer going to be Tier 5 banks, or small banks. They will be absorbed by Tier 3 or Tier 4 banks.

Tier 1,2,3 banks have been connected to the new system. Tier 4 will be completed by this Sat. 28 Sept.

Redemption Center Staff will be on call this weekend.

Iraq will have their new lower denomination currency

Bond Holders will have access to their accounts by Tues. 1 Oct.

Tier4b (us, the Internet Group) will receive 800 number email notifications on Mon. 30 Sept. They should appear in a three hour period.

The Call Center will route you to the Redemption Center where you will exchange.

Exchange Appointments will be set starting on Tues. 1 Oct. onward.

R&R allowances are already deposited in your Quantum Account. You move that money to your bank with your Quantum Card you will receive at your appointment.

Both banks and Redemption Centers have on their screens the 14 currencies that will increase in value.

As of this weekend all 197 new currency rates of the 209 countries in the World will be on the screens.

You will have access to some of your monies at your exchange.

Active Military on Military Bases will exchange Dinar and Afghani over the weekend. They have already received notification they will do that.

The highest rates are on the Redemption Center screens. You will exchange there and not at a bank.

The Iraqi Dinar rate is tied to the oil barrel rate.

People in hospitals or who have a medical problem will have up to 40 days to exchange at a Redemption Center.

Read full post here: https://dinarchronicles.com/2024/09/27/restored-republic-via-a-gcr-update-as-of-september-27-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff September is the month where you have seen and heard more from the Central Bank ever throughout this entire year... They have been more vocal and have completed more steps in the month of September than any other month...Critical things are happening. They're preparing to go international. Their budget period would start October 1st...that's why the news has increased significantly as we're approaching October.

Frank26 Article: "The government forms a higher committee to adapt Iraq banks to International financial requirements" What does that mean? It means the Iraq dinar is going to float internationally in international markets. But it's at a program rate? No it's not. But it has sanctions on the country? No it doesn't. Wells Fargo says it's on the OFAC list,

that it's on the 'bad currency' list? No it's not...That going international requires a new exchange rate. Yes it does.

The US Debt Crisis Is Far Worse Than You Think

George Gammon: 9-27-2024

One Day Only ETFS: Wall Street's New Gambling Scheme

Lynette Zang: 9-27-2024

Today's video touches on the trading volatility of even some of the most "secure" investments ever created, and how they are being turned into something even the creator feared...

“Tidbits From TNT” Friday Morning 9-27-2024

TNT:

Tishwash: Prime Minister leaves New York for Baghdad

Prime Minister Mohammed Shia Al-Sudani left New York heading to Baghdad.

The Prime Minister's Media Office stated in a statement received by the Iraqi News Agency (INA), that "Prime Minister Mohammed Shia al-Sudani left New York heading to the capital, Baghdad, after concluding his participation in the meetings of the 79th session of the United Nations General Assembly." link

TNT:

Tishwash: Prime Minister leaves New York for Baghdad

Prime Minister Mohammed Shia Al-Sudani left New York heading to Baghdad.

The Prime Minister's Media Office stated in a statement received by the Iraqi News Agency (INA), that "Prime Minister Mohammed Shia al-Sudani left New York heading to the capital, Baghdad, after concluding his participation in the meetings of the 79th session of the United Nations General Assembly." link

Tishwash: Iraq discusses cooperation with SpaceX to provide internet services

Today, Thursday, the Chairman of the Communications and Media Commission, Ali Al-Moayyad, discussed with the Senior Director of Global Licensing and Market Activation at SpaceX, Ryan Goodnight, prospects for cooperation to provide Internet services in Iraq.

The Commission stated in a statement that "Chairman of the Communications and Media Commission, Ali Al-Moayyad, met with the Senior Director of Global Licensing and Market Activation at SpaceX, Ryan Goodnight, on the sidelines of Iraq's participation in the Future Summit held in New York," noting that "the meeting discussed the available means to spread Starlink services in the region, and the high-speed internet services it provides."

She added, "The two sides discussed how to benefit from these modern technologies and their licensing mechanisms to meet the needs of users, whether individuals or institutions."

She added, "SpaceX representatives provided a detailed explanation of the services provided by the company, the areas it covers, and the speeds that can be provided to operators." link

************

Tishwash: US State Department: Announcement of agreement on the future of the international coalition from Iraq within two weeks

The US State Department expected to announce the agreement on the future of the international coalition from Iraq within two weeks.

"We expect that in the coming days, within a week or two, I don't want to specify a specific date, but in the coming days and weeks, we will hear more about the position, and I don't mean the American position, but the joint position, because the partnership between the United States and Iraq is the most important

And when we say there is an agreement or a deal; there was a deal or there was an agreement years ago regarding the presence of the American army and the international coalition in Iraq, this was at the invitation of the Iraqi government and secondly to combat terrorism only, and therefore we must see in this context of the agreement that was in the past years, how we will change if the circumstances change

As we must change or at least we must renew this defense and security relationship with Iraq," said the US State Department's regional spokesman, Samuel Werberg, in a press statement.

"So far, there is no official announcement or statement for me to share, but as I said weeks ago, we knew that since the announcement by Secretary of Defense Austin, we saw that the US government and the Iraqi government were intervening in these discussions to set the appropriate conditions for the continuation of this coordination between the two countries, so we expect that in the coming days and maybe within a week or two we will hear more." link

************

Tishwash: Al-Samarrai praises Al-Sudani’s speech before the United Nations: It is worthy of Iraq, its history and its international standing

Today, Friday (September 27, 2024), the head of the Azm Alliance, MP Muthanna Al-Samarrai, praised the speech of Prime Minister Muhammad Shia Al-Sudani before the United Nations General Assembly, indicating that it is befitting of Iraq, its history and its international status.

Al-Samarrai said in a post on the (X) platform, which was followed by "Baghdad Today", "We followed the speech of Prime Minister Mohammed Shia al-Sudani before the seventy-ninth session of the United Nations General Assembly, and it was a speech that befits Iraq, its history and international standing, and clearly expresses its orientations and reflects the will of its people and its national, Arab, Islamic and humanitarian principles."

Al-Sudani stressed in his speech that stopping the violations taking place in Palestine and the region is everyone’s responsibility. While he pointed to the Security Council’s failure to maintain international peace and security, he stressed Iraq’s support for Lebanon and its continued provision of assistance to overcome the effects of these attacks. link

************

Tishwash: Prime Minister: Iraq is witnessing an urban and economic renaissance and revitalization of the industrial and agricultural sectors

Prime Minister Mohammed Shia al-Sudani received an official invitation to visit Islamabad on Thursday from his Pakistani counterpart, Shehbaz Sharif.

The Prime Minister's Media Office said in a statement, seen by "Al-Eqtisad News", that "Prime Minister Mohammed Shia Al-Sudani met - this evening, Thursday (Baghdad time) in New York - with Pakistani Prime Minister Shehbaz Sharif, on the sidelines of his participation in the 79th session of the United Nations General Assembly."

He added that "the meeting witnessed discussions on the overall bilateral relations and ways to develop them in various fields, in addition to discussing the latest developments in the aggression in Gaza and Lebanon and the efforts made to stop the war of genocide against the Palestinians and protect brotherly Lebanon and its secure people."

Al-Sudani explained to his Pakistani counterpart - according to the statement - "Iraq's desire to deepen the relationship with Pakistan in various fields, and that the government is following an open policy on all steps of economic partnership, just as Iraq is witnessing an urban and economic renaissance and the revitalization of industrial and agricultural fields, in addition to the deep desire to open the doors of constructive partnerships with brotherly and friendly countries."

He touched on "the pivotal efforts undertaken by Iraq to prevent the escalation of the situation in the region and stop the aggression, including the initiative to call for an Islamic summit that unites the ranks of Islamic countries, especially Pakistan, in order to prevent the situation from sliding into a comprehensive war and protect the steadfast Lebanese and Palestinian peoples."

For his part, Shehbaz Sharif extended an invitation to Al-Sudani to "visit Islamabad in order to establish more foundations for cooperation and partnership between the two countries and expand trade exchange agreements."

He expressed his "support for the Iraqi initiative calling for an Islamic summit to consider the current aggression on Lebanon and Palestine, and formulate a unified position regarding the ongoing massacre of the Palestinian people and the attempts to expand the war by the occupation government link

Mot: 3 of those.. nooo -- 5 of those --- nooooo 4 of

Mot: .... Always looking for a Good Hotel - Huh!!!