Seeds of Wisdom RV and Economic Updates Tuesday Evening 8-6-24

Good evening Dinar Recaps,

Google Pay, Walmart-backed PhonePe to join India’s CBDC pilot

In April, Reserve Bank of India Governor Shri Shaktikanta Das announced plans to expand its retail central bank digital currency (CBDC) pilot beyond banks. Last month the central bank said payment providers would join the digital rupee pilot this quarter.

Now Reuters reported that five payment providers have applied, citing sources. They are Google Pay, Walmart-backed PhonePe, Cred, Amazon Pay and Mobikwik.

PhonePe is India’s leading payments app, followed by GooglePay. Together they make up 85% of transactions and value for UPI, India’s successful instant payment solution, which processes almost 14 billion transactions monthly.

Good Evening Dinar Recaps,

Google Pay, Walmart-backed PhonePe to join India’s CBDC pilot

In April, Reserve Bank of India Governor Shri Shaktikanta Das announced plans to expand its retail central bank digital currency (CBDC) pilot beyond banks. Last month the central bank said payment providers would join the digital rupee pilot this quarter.

Now Reuters reported that five payment providers have applied, citing sources. They are Google Pay, Walmart-backed PhonePe, Cred, Amazon Pay and Mobikwik.

PhonePe is India’s leading payments app, followed by GooglePay. Together they make up 85% of transactions and value for UPI, India’s successful instant payment solution, which processes almost 14 billion transactions monthly.

Not mentioned among the digital rupee applicants is third ranked player PayTM, which has a 6% UPI market share. Cred is fourth, AmazonPay is sixth and Mobikwik is sixteenth, but the UPI figures drop off significantly beyond the big three.

If the CBDC follows UPI, then banks might end up playing second fiddle to the payment apps. Three banks rank in the top ten for UPI apps – Axis, ICICI and Kotak Mahindra – with the largest in the fifth spot. However, the three banks combined have a market share of less than one percent.

The percentages reference the user interface used to initiate payments. UPI is for interbank payments, so the money comes from bank accounts.

A Reuters source also stated that the erupee pilots are likely to stay in the pilot stage for a couple of years, which makes sense.

Advanced CBDC functionality takes time

From the early days, the central bank managed expectations, noting that the CBDC was unlikely to compete with the well-established UPI payment infrastructure.

Without more advanced functionality, there’s no incentive for consumers to switch. And if providers offer cash incentives, the switch could be temporary, as has happened in China with its digital yuan red envelope incentives.

Some of the distinguishing functionalities of India’s CBDC include offline payments and programmable payments, which are still in the early stages. Unlike rolling out the app, both may take a little time to come to fruition.

Plus, both the Ministry of Finance and central bank believe that the CBDC killer app will be cross border payments, especially for remittances. Even more so than the other two features, cross border payments take time to develop through collaboration with other jurisdictions.

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

Euro stablecoin market surges under MiCA

French and Irish fintech companies have partnered to introduce a euro-backed stablecoin. The coin will launch on the Stellar blockchain a month after MiCA stablecoin laws came into force.

The European Union’s Markets in Crypto-Assets Regulation (MiCA) framework is gradually coming into effect in line with its planned implementation timeline. The initial set of regulations, which took effect on July 1, focused on stablecoins and their issuers.

These clear guidelines have both cleaned out the market of players not able to meet regulatory requirements and created a favorable environment for stablecoins pegged to local currency.

One example is a new partnership between the France-based fintech company Next Generation and Ireland-based electronic money institution (EMI) Decta, which announced a plan to reintroduce a euro-pegged stablecoin, EURT, on the Stellar blockchain.

According to the involved parties, the initiative, which launched on Aug. 5, is fully MiCA compliant.

MiCA rebirth

Next Generation has strong ties to the renowned fintech player Tempo France. This company initially launched EURT in 2017 in collaboration with the Stellar Foundation, pioneering one of the first euro-pegged stablecoins.

However, the absence of a regulatory framework then led to the project’s suspension. However, under MiCA, stablecoins are classified as electronic money tokens (EMTs), aligning them with traditional e-money and necessitating that issuers possess an EMI license or be a credit institution.

This regulatory clarity has transformed the euro-backed stablecoin market, making it more predictable and attractive to investors.

Circle became the first global stablecoin issuer to comply with MiCA and chose France as its European headquarters, citing the country’s “forward-looking” stance on digital asset regulation.

The activation of MiCA is expected to drive substantial growth in the euro-backed stablecoin sector. Market predictions forecast a minimum market capitalization of 15 euros by 2025, reaching 70 billion euros by 2026 and potentially surpassing 2 trillion euros by 2028.

@ Newshounds News™

Read more: CoinTelegraph

~~~~~~~~~

UBS says ‘going into Japan now is like catching a falling knife,’ warns stock sell-off will continue

“The only reason why the Japanese market is up so strongly in the last two years is because the Japanese yen has been very, very weak.

Once it reverses, you got to get out right and I think they’re all getting out right now as a result of that,” Tay said.

"The yen, which weakened to a 38-year low of 161.99 against the U.S. dollar in June, reversed course during the run-up to the Bank of Japan’s policy meeting."

"It strengthened sharply after the BOJ raised its benchmark interest rate last week to around 0.25% and decided to trim its purchases of Japanese government bonds."

"Currently, the yen was last trading at 144.82, its lowest level against the greenback since January. A stronger yen pressurizes Japanese stock markets, which are heavily dominated by trading houses and export-oriented firms by eroding their competitiveness."

"Tay said the yen can indicate whether the Japanese market will do well. As the yen has strengthened, stocks have declined, “there is still a lot more pressure on the Japanese stock market, unfortunately,” he said.

"While Tay acknowledged that some gains made by the market were due to corporate restructuring efforts by the Tokyo Stock Exchange, “the main driver was the Japanese yen.”

"Now, with the U.S. Federal Reserve signaling rate cuts are on the table and the Bank of Japan raising rates, the interest differential between the two central banks will narrow, making a “carry trade” less attractive, potentially setting the stage for the yen to strengthen further."

EVERYONE IS WONDERING WHY DID THE MARKETS CRASH ON 8/5 AND THEN REBOUND. JAPAN SET THE STAGE WITH A WEAKING NIKKEI. THIS ARTICLE SHEDS LIGHT ON THE CURRENCY SIDE OF THIS EVENT AND HOW THE YEN NEEDS TO STRENGTHEN AGAINST THE DOLLAR

@ Newshounds News™

Read more: CNBC

~~~~~~~~~

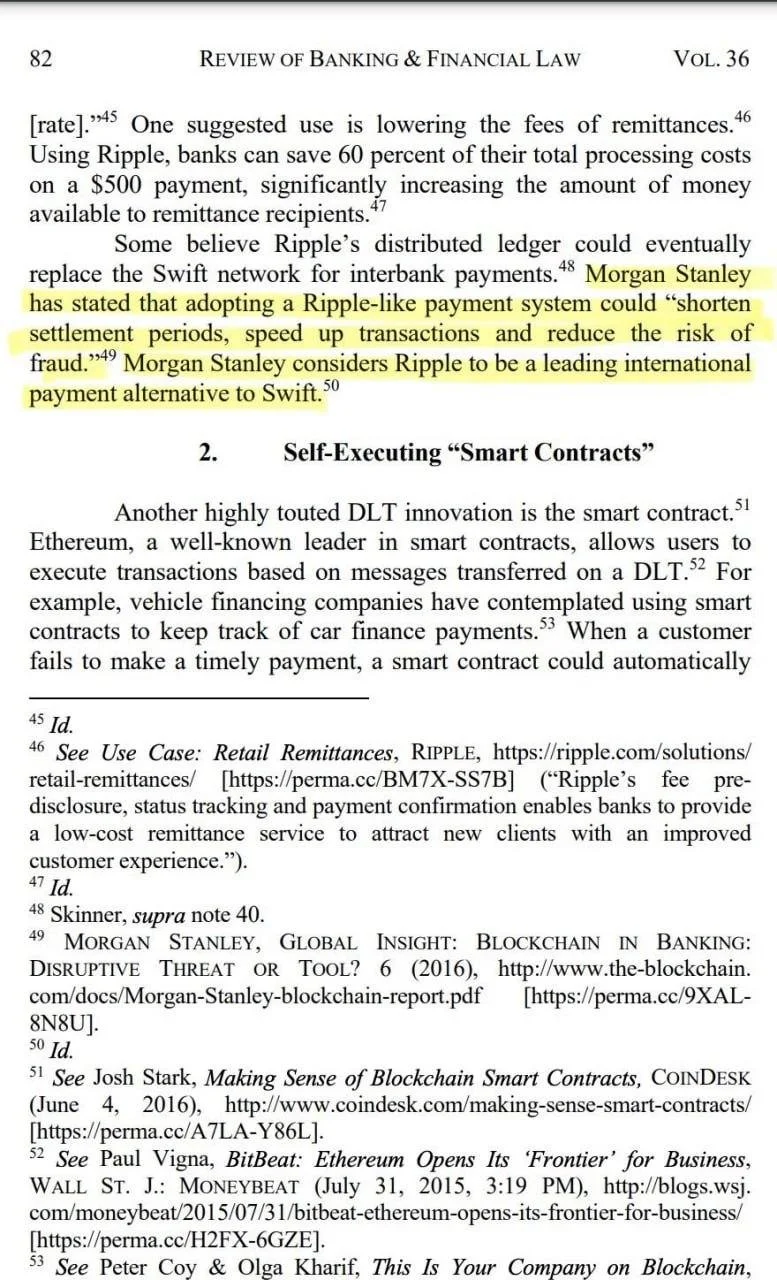

Morgan Stanley, one of the most important financial institutions in the world, has stated that CRYPTOCURRENCIES WILL DISRUPT THE GLOBAL FINANCIAL SYSTEM IN 2024.

In a Banking And Financial Law Journal, it is documented that Morgan Stanley has also stated that Ripple is a LEADING PAYMENT ALTERNATIVE TO SWIFT.

And their own research reports, Morgan Stanley notes that XRP is more efficient than BTC and is closer to what traditional banks do today.

@ Newshounds News™

https://x.com/SMQKEDQG/status/1820783189197017134

@ Newshounds News™

Read more:

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Tuesday PM 8-6-2024

TNT:

Tishwash: Central Bank Governor's Resignation: Admission of Failure or Escape from the Repercussions of the Financial Crisis?

The Governor of the Central Bank of Iraq, Ali Al-Alaq, submitted a request to relieve him of his post to Prime Minister Mohammed Al-Sudani, amid a series of issues and problems in the financial and banking sector in Iraq, which include the failure to control the dollar exchange rate on the black market.

An informed source revealed to Al-Mustaqilla today, Tuesday, that Al-Alaq decided to submit his resignation after facing multiple problems in the financial sector, in addition to his inability to fulfill his promises to control the exchange rate. This request comes at a sensitive time for the Iraqi economy, which suffers from severe fluctuations in exchange rates and direct impacts on the local economy.

TNT:

Tishwash: Central Bank Governor's Resignation: Admission of Failure or Escape from the Repercussions of the Financial Crisis?

The Governor of the Central Bank of Iraq, Ali Al-Alaq, submitted a request to relieve him of his post to Prime Minister Mohammed Al-Sudani, amid a series of issues and problems in the financial and banking sector in Iraq, which include the failure to control the dollar exchange rate on the black market.

An informed source revealed to Al-Mustaqilla today, Tuesday, that Al-Alaq decided to submit his resignation after facing multiple problems in the financial sector, in addition to his inability to fulfill his promises to control the exchange rate. This request comes at a sensitive time for the Iraqi economy, which suffers from severe fluctuations in exchange rates and direct impacts on the local economy.

The main reasons that prompted Al-Alaq to submit his resignation are related to the ongoing difficulties in managing the financial and banking sector, in addition to the major challenges in controlling the dollar exchange rate on the black market. Since taking office, Al-Alaq has made many promises to achieve financial stability, but he has faced great difficulties in implementing them, which has led to increasing pressure on him.

A document obtained by Al-Mustaqilla today, Tuesday, revealed that the Speaker of Parliament has agreed to host the Governor of the Central Bank, Ali Mohsen Al-Alaq, by the Parliamentary Integrity Committee. This hosting aims to discuss the challenges facing the Central Bank and investigate the reasons that led to the request for his resignation.

Al-Alaq’s resignation could raise questions about the future of financial policy in Iraq. The central bank is central to economic stability, and any change in its leadership could have a significant impact on financial markets and confidence in the banking system.

Iraq faces major economic challenges that require strong and qualified financial leadership. The most prominent of these challenges are:

Controlling the exchange rate: Iraq needs effective policies to control the dollar exchange rate and prevent speculation that leads to sharp fluctuations.

Banking system reform: Improving the efficiency and transparency of the banking system to keep pace with international standards.

Combating corruption: Promoting integrity and transparency in financial institutions to prevent corruption and restore investor confidence.

text:

To / Governor of the Central Bank / Office of the Governor

M/ Oral parliamentary question

good greeting.

Based on Article (61/Seventh (1) of the Constitution, and Articles (27) Second) and (29) of the House of Representatives and its Formations Law No. (13) of 2018, and based on Articles (50) and (51) of the internal regulations.

House of Representatives. We refer to you the parliamentary question addressed by Mr. Representative Dr. (Hadi Hassan Al-Salami) to answer it orally in the presence of the Governor of the Central Bank at the House of Representatives session, and the date will be determined later according to the period specified in the legal articles. Media

with respect link

************

Low oil prices threaten Iraq's economy: Does the government have a plan or will it wait and watch?

Economist Omar al-Halbousi confirmed that the drop in oil prices to $75 per barrel is putting Iraq under great pressure, especially since the 2024 budget was approved on the assumption that the price of a barrel of oil will be $80.

Al-Halbousi warned that the continued decline in oil prices will lead to a major collapse and the government’s inability to pay salaries and run the state’s work. link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY:

They're saying the US Treasury has taken over the Central Bank of Iraq...They have an entire floor at the CBI headquarters. It is reference to the CBI not getting the banks that were supposed to be sanctioned to cease and comply...The US Treasury is here to oversee and stop any money laundering that was preventing us from having our monetary reform... FRANK: Not the whole building just the second floor...This is ancient history...

Militia Man [ via PDK] The multi-currency practices are going to go away and ultimately they will apply a REER or Real Effective Exchange Rate to Iraq’s currency - Everything we are seeing is powerful evidence that the monetary reforms are on the table and they are knocking them out….

The IMF's Latest Report on Iraq's Economy

Edu Matrix: 8-6-2024

BRICS ALLIES: Malaysia and Russia Focus on Economic Ties as PM Anwar Ibrahim Plans to Visit Russia

Lena Petrova: 8-6-2024

Economist’s “Financial Crash News and Views” 8-6-2024

Decoding Economics: New Black Monday, Stock Markets Crash

Tuesday, 6 August 2024, 6:35 AM

On a day that will undoubtedly be etched in the annals of financial history, Japan’s Nikkei Index faced an unprecedented fall, plummeting 12.40% to 31,458.42 points. This remarkable downturn has been labeled the new “Black Monday,” a term that conjures images of financial chaos and market panic, reminiscent of previous stock market crashes. But what triggered this massive sell-off, and what does it imply for Japan and the global economy?

The catalyst behind this startling decline was an amalgamation of concerns centered on a potential global recession. Weak economic data emanating from the United States has heightened fears about the broader economic landscape. It isn’t merely the numbers that are alarming; it’s the narratives they weave, signifying a possible slowdown that could ripple through nations and continents.

Decoding Economics: New Black Monday, Stock Markets Crash

Tuesday, 6 August 2024, 6:35 AM

On a day that will undoubtedly be etched in the annals of financial history, Japan’s Nikkei Index faced an unprecedented fall, plummeting 12.40% to 31,458.42 points. This remarkable downturn has been labeled the new “Black Monday,” a term that conjures images of financial chaos and market panic, reminiscent of previous stock market crashes. But what triggered this massive sell-off, and what does it imply for Japan and the global economy?

The catalyst behind this startling decline was an amalgamation of concerns centered on a potential global recession. Weak economic data emanating from the United States has heightened fears about the broader economic landscape. It isn’t merely the numbers that are alarming; it’s the narratives they weave, signifying a possible slowdown that could ripple through nations and continents.

Prior to this downturn, the Nikkei 225 had been riding high, with a peak of approximately 42,400 points reached in mid-July. Investors were optimistic, buoyed by a robust recovery from the pandemic and strong export performance. However, as global sentiments shifted and indices began to display signs of volatility, the stage was set for a dramatic correction.

One of the critical factors contributing to the Nikkei’s downfall was the sudden and sharp appreciation of the yen, which, although typically a sign of strength, began to pose challenges for Japan’s export-driven economy. A stronger yen makes Japanese goods more expensive for foreign buyers, effectively hurting sales in international markets. Consequently, companies that thrive on export revenues found themselves caught in a tightening vise, resulting in a steep decline in stock prices across the board.

This situation not only affected domestic sectors but had a domino effect on markets in the region. Asian financial markets responded swiftly, with notable declines in Hong Kong, Shanghai, Mumbai, Bangkok, Manila, and Jakarta. Investors’ apprehension was palpable, creating a sense of uncertainty that cast a long shadow over market activities.

The fallout from the Nikkei’s plummet was global. European markets in Frankfurt, Paris, and London experienced significant declines, though they were less severe than their Asian counterparts. Such trends underline a growing interconnectedness within the global financial system, where turmoil in one major economy can lead to widespread unease elsewhere.

Social media platforms lit up with analysis and commentary, as traders, analysts, and economic pundits sought to make sense of the situation. Many expressed a deep concern for the prolonged health of the global economy and the interconnected nature of financial markets. The reactions varied from panic to caution, signaling that investors are weighing their options in a climate of heightened uncertainty.

As we move forward, the question remains: what does this mean for the future? Economists warn that before recovery can commence, stabilizing factors must be addressed. Central banks might need to reassess policy schemes to shield economies from volatility, while businesses might have to adapt their strategies to weather economic headwinds.

Investors will undoubtedly remain vigilant, watching for indicators of recovery in the U.S. and elsewhere. The road ahead could be tumultuous, but it is crucial for market players to recalibrate expectations and remain cautious of potential market overreactions.

In conclusion, Japan’s “Black Monday” serves as a stark reminder of the fragility of markets in the face of economic uncertainty. As we navigate through these turbulent times, vigilance, informed decision-making, and a keen understanding of underlying economic indicators will be essential for investors and businesses alike.

The path to recovery may be long, but one thing is clear: the world is watching, and the ramifications of this day will echo across markets for time to come.

Watch the video below from Decoding Economics for more information.

Is This The "Everything Bust" Of The "Everything Bubble"? | John Rubino

Liberty and Finance: 8-5-2024

The S&P 500 has declined by nearly 10% from its peak. John Rubino (https://rubino.substack.com) highlights the vulnerability of the stock and real estate markets.

He notes that almost all asset classes are experiencing bubble-like conditions. Recent market movements and financial crisis in Japan could signal the onset of a widespread downturn.

We may be witnessing the "everything bust" of the "everything bubble." This situation suggests significant challenges ahead for investors.

INTERVIEW TIMELINE:

0:00 Intro

1:55 Real estate

13:15 "Emergency" rate cuts

15:50 Fiat collapse

20:20 The "everything bust"

22:25 Preparedness

Global Market MELTDOWN (this is just the beginning)

Taylor Kenny: 8-5-2024

BREAKING NEWS: Dubbed Black Monday 2.0, the world is witnessing a dramatic global stock MELTDOWN.

With concerns escalating as the Federal Reserve faces calls for an emergency rate cut to prevent an even deeper recession.

Taylor Kenney is here to bring you the latest developments as they continue to unfold.

“Tidbits From TNT” Tuesday 8-6-2024

TNT:

Tishwash: Former MP: Iraq's financial autonomy is lost because of Washington

On Monday, former member of the Finance Committee, Muhammad Al-Shabki, accused Washington of dominating the oil revenues in the US Federal Bank.

Al-Shabki said in a statement to the “Al-Ma’louma” agency, “There are issues imposed on Iraq and domination of the Iraqi economy by the United States,” noting that “this policy that America placed on Iraq is the reason for the calamity in its economic situation.”

He added, “Iraq does not have autonomy over its money coming from oil exports in the US Federal Bank,” calling on the government to “be freed from this pressure and have a say in reformulating the relationship with the Americans.”

TNT:

Tishwash: Former MP: Iraq's financial autonomy is lost because of Washington

On Monday, former member of the Finance Committee, Muhammad Al-Shabki, accused Washington of dominating the oil revenues in the US Federal Bank.

Al-Shabki said in a statement to the “Al-Ma’louma” agency, “There are issues imposed on Iraq and domination of the Iraqi economy by the United States,” noting that “this policy that America placed on Iraq is the reason for the calamity in its economic situation.”

He added, “Iraq does not have autonomy over its money coming from oil exports in the US Federal Bank,” calling on the government to “be freed from this pressure and have a say in reformulating the relationship with the Americans.”

He stated that "Iraq is asking the American side for a lot of money, which represents the proceeds of the amounts in the Federal Bank."

Earlier, a member of the Al-Fatah Alliance, Ali Hussein, warned in a statement to the Al-Ma'louma Agency about the American control over the oil financial revenues in the Federal Bank, accusing Washington of exploiting this control to exert pressure on Iraq. link

Tishwash: The power of the "Federal Forces"... Iraq is moving to achieve financial autonomy

The United States of America still dominates the Iraqi economy through economic agreements concluded by Washington according to what primarily serves its interests, as the American administration seeks to block the way for those trying to rid the country of its control over Iraqi oil sales funds.

The United States of America continues to impose its influence on Iraq in many vital files, including depositing the funds from the sale of Iraqi oil in the US Federal Bank, amid clear blackmail by passing many files, most notably the dollar bill, which puts great pressure on the government.

Iraq seeks to get rid of this dominance by depositing the money in the Federal Bank and sending it directly to the Central Bank.

Speaking about this file, Al-Fatah Alliance member Ali Hussein calls on the government to seek to find alternatives and take the step of liberating the country from the dominance of the dollar and the continuing American sanctions, while stressing that Iraq's move towards lifting the restrictions of the US Federal Bank is a must.

Hussein said in an interview with the Maalouma Agency, “It will be a bold step, but it will succeed if the atmosphere is created and contracts are made with alternative international banks,” noting that “it is necessary to bring in companies from international countries.” that do not deal in the US dollar.”

He continues, “Entering into the Shanghai system and other global organizations will be the first stage of liberation from the dollar,” adding that “the movement to end the dollar’s hegemony over the world, led by major countries, has greatly succeeded.”

He adds, “Contracting from companies from Eastern countries and bringing them to work inside Iraq will avoid the economic blockade,” pointing out that “the government is required to seek to find alternatives and take the step of liberating the country from the dominance of the dollar and American sanctions." link

************

Harambe: Telegram: Reports of 2 American soldiers killed in the bombardment of 7 missiles by the Iranian proxy on the Ain Asad base in Iraq

🔸 Reports of 2 American soldiers killed in the bombardment of 7 missiles by the Iranian proxy on the Ain Asad base in Iraq.

🔸 Report on American military activity at the Arar border crossing between Saudi Arabia and Iraq. Possible US reinforcements on their way to Iraq.

Telegram Link:

https://t.me/beholdisraelchannel/37017

************

Tishwash: Iraq, EU discuss combating terrorism

Today, Monday, the head of the Counter-Terrorism Service, Karim Al-Tamimi, discussed the file of combating terrorism with the European Union Mission.

A statement by the service received by /Al-Youm Al-Akhbariya/ stated that "the head of the Iraqi Counter-Terrorism Service, Lieutenant General Karim Al-Tamimi, received the head of the European Union Mission and his accompanying delegation today, Monday, at the headquarters of the Counter-Terrorism Service in the capital, Baghdad."

The two sides discussed, according to the statement, "security cooperation in combating terrorism with regard to holding workshops and conferences and exchanging expertise and information with the European Union countries."

The statement indicated that "the discussion addressed the Iraqi national strategy to combat terrorism and the mechanisms of cooperation in its implementation in order to achieve the desired goal of reaching a secure and stable Iraq." link

Mot: .. Finally - Figured out da problem!!!!

Mot: ... Sooooooooo - Howd Ur Day Go!!!!!

Seeds of Wisdom RV and Economic Updates Tuesday Morning 8-6-24

Good Morning Dinar Recaps,

STELLAR Blockchain Chosen for New EURT Euro-Pegged STABLECOIN Initiative "Ireland-based electronic money institution (EMI) DECTA is partnering with French fintech company Next Generation to introduce a new Euro-pegged stablecoin, ‘EURT’.

The collaboration aims to create a fully compliant stablecoin that adheres to the Markets in Crypto-Assets (MiCA) regulations and operates on the Stellar blockchain, alongside three additional platforms."

Good Morning Dinar Recaps,

STELLAR Blockchain Chosen for New EURT Euro-Pegged STABLECOIN Initiative

"Ireland-based electronic money institution (EMI) DECTA is partnering with French fintech company Next Generation to introduce a new Euro-pegged stablecoin, ‘EURT’.

The collaboration aims to create a fully compliant stablecoin that adheres to the Markets in Crypto-Assets (MiCA) regulations and operates on the Stellar blockchain, alongside three additional platforms."

"Next Generation, which has close ties with Tempo France, previously launched EURT with the Stellar Foundation as one of the first stablecoins in 2017.

However, the project was suspended due to the lack of a regulatory framework. The implementation of MiCA now provides a structured environment, facilitating the relaunch of this project."

"As of 1 July 2024, the new MiCA regulations permit the issuance of Euro-pegged stablecoins exclusively by credit institutions or EMIs within the EU. With its EMI license from the Central Bank of Ireland, DECTA is well-positioned to be a pioneering issuer under these new regulations."

“The implementation of MiCA has ushered in a new era in the history of modern digital finance in Europe,” said Suren Hayriyan, president of Next Generation. “The demand for Euro stablecoins is extremely high. Companies, entrepreneurs, and private users today lose a lot on forced conversions.

"The firms plan to launch EURT in October, aligning with strategic goals and regulatory milestones. The partners emphasize the SIGNIFICANCE OF REGULATION, indicating that UNREGULATED Euro-denominated stablecoins will no longer have a place in the market"

@ Newshounds News™

Read more: Digital Pound Foundation

~~~~~~~~~

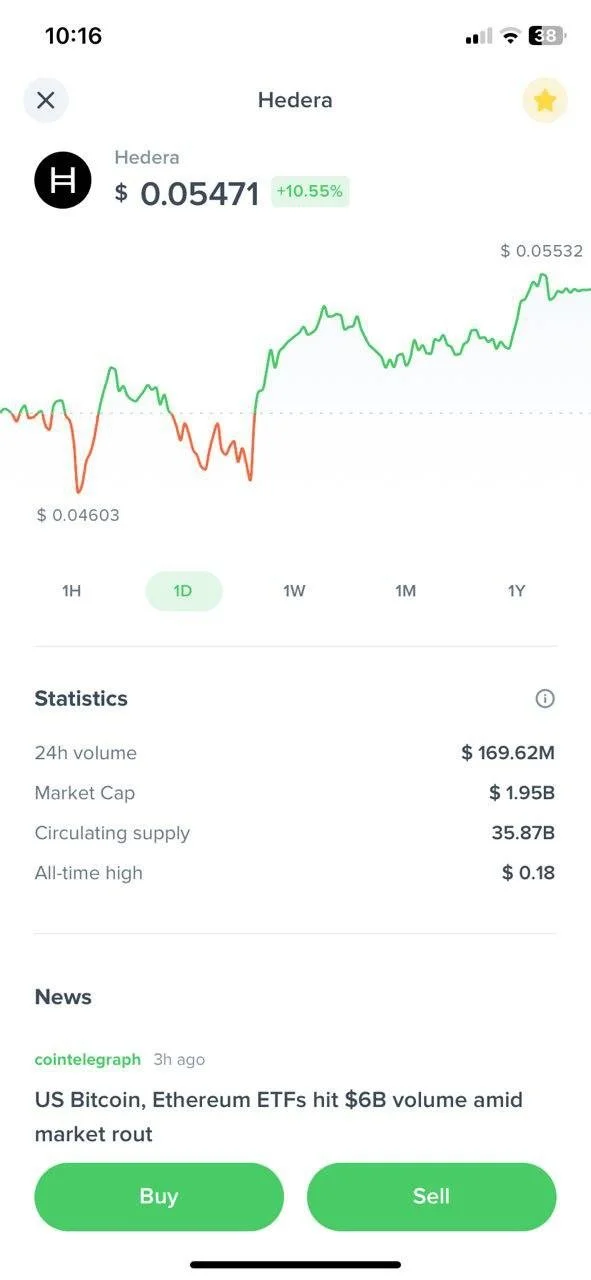

We’re excited to announce that #Hedera has officially joined the @IIF

(Institute of International Finance), joining the likes of @circle @coinbase, and @BlackRock, and other leading institutions to collaboratively foster global financial stability and sustainable economic growth.

@ Newshounds News™

Read more: Twitter, IIF

~~~~~~~~~

Hedera - HBAR

@ Newshounds News™

~~~~~~~~~

JUST IN: El Salvador bought more #Bitcoin today while everyone else is selling.

@ Newshounds News™

Read more: Bitcoin Magazine

~~~~~~~~~

ARE CBDC'S A FORM OF CRYPTOCURRENCY?

THIS ARTICLE IS VERY COMPREHENSIVE AND WE HIGHLY RECOMMEND CLICKING THE LINK TO THE FULL ARTICLE FOR REVIEW

"Although CBDCs are a form of digital currency, they are not a cryptocurrency. Compared to cryptocurrencies, CBDCs are centralized, meaning they’re issued and regulated by a monetary authority — in this case, a country’s government.

They’re also considered legal tender and hold the same status as any traditional fiat currency issued by a central bank. Finally, by virtue of the fact that CBDCs are based on fiat currency, they’re far less volatile than cryptocurrencies, whose value is determined by market forces and speculative activity."

"While both CBDCs and cryptocurrencies have their advantages and disadvantages, the general consensus is that they are two very different things, with different implications for the economy and society at large."

"The decentralized nature of cryptocurrencies has also accelerated innovation in cross-border payments — for example, RIPPLE, a Real-Time Gross Settlement system, has successfully built a global payment ecosystem with the XRP cryptocurrency at its core."

"The growing popularity of cryptocurrencies has created increased competition for central banks, which have realized that they need to offer instant, electronic payments to stay current and maintain market share."

"There’s been some confusion recently around the relationship between FedNow and CBDCs, with some wondering whether FedNow is a CBDC. To cut right to the chase: No, it is not, and the two are fundamentally different.

CBDCs are not a payment mechanism, but rather a form of currency and a digital means of storing value. FedNow, however, is a payment mechanism — in other words, it’s a means of moving funds from one bank account to another.

"To put things into perspective, the FedNow Service can be likened to a highway system, providing a fast and efficient infrastructure for the movement of payments between financial institutions.

CBDCs enable central banks to compete with private-sector offerings by providing a wider array of services to consumers, including a more stable, secure alternative to cryptocurrencies.

There’s also a cost-saving incentive to CBDCs, as electronic payments are less expensive to process — both for governments and financial institutions — than paper-based payments."

"Looking to the future, FedNow, digital payments, ISO 20022, and CBDCs will be transformational not only for businesses within the financial services industry but for anyone who uses financial services. In the long run, they will coexist with cryptocurrencies, providing consumers and businesses with a wide range of complementary mechanisms for the digital transfer of value."

@ Newshounds News™

Read more: Volantetech

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Tuesday AM 8-6-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 6 Aug. 2024

Compiled Tues. 6 Aug. 2024 12:01 am EST by Judy Byington

Welcome To Black Swan Monday

Markets Crashing Across the World

Federal Reserve Calls Emergency Meeting

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 6 Aug. 2024

Compiled Tues. 6 Aug. 2024 12:01 am EST by Judy Byington

Welcome To Black Swan Monday

Markets Crashing Across the World

Federal Reserve Calls Emergency Meeting

Withdraw all Funds From Your Banks Right Now!!!

By Mon. morning 5 Aug. 2024 looming World War III in the Middle East and US Recession fears had sparked sell outs in international Markets with Oil, Crypto and Stocks down across the Globe. The New York Stock Market 24 Hour Trading was halted even before the Market opened, and then at that opening, the Dow dropped 1,000 points. Japanese Stock losses exceeded $830 billion, the Aussie market lost $77 Billion in the Monday Morning Bloodbath and Taiwan’s Stock Market suffered it’s worst losses since 1967.

A World-Wide Call For Fast and Prayer:

Pray for a Restoration of Freedom for People of the World.

It’s only wise to have at least a month’s supply of food, water, cash, medicine and essential items on hand for yourself, your family and to share with others in case of emergency.

Travel Advisory: “Due to the unpredictable and volatile nature of the Global situation U.S citizens should shelter in a safe place, and strongly consider returning to the United States when safe to do so.”

Global Financial Crisis: Mon. 5 Aug. 2024 Current situation: https://nypost.com/2024/08/05/business/bloodbath-on-wall-street-as-dow-nasdaq-futures-plunge-amid-recession-fears/

On Mon. morning 5 Aug. 2024 New York Stock Market 24 Hour Trading was halted even before the Market opened, while at that Opening the Dow dropped 1,000 points. Japanese stock losses exceeded $570 billion. Japanese banks have lost $85 billion due to panic selling on Monday, Bloomberg reports. Taiwan’s stock market suffered it’s worst losses since 1967. Bitcoin has dropped below $50,000!

Mon. 5 Aug. 2024 Multiple brokerages, including Charles Schwab, Fidelity, Vanguard, TD Ameritrade, E-Trade, UPS, Century Link and Interactive Brokers, are currently down and reporting errors amid market crashes.

Everyone is confused right now as to why the stock market is recovering. Let me explain it to you. The Market Makers are manipulating the market as they always have, they are pushing blue chip stocks back up, killing options prices so people sell, pushing #Bitcoin as high as they can, and they are shorting #silver, #gold, #XRP, #ISO20022 tokens, and meme stocks like $AMC $DJT $GME just as they always have on any given day. BUT THIS IS FINANCIALLY CRIPPLING THEM.

That is where the BLACK SWAN comes in. Right now its manageable, it HURTS, but its do-able. BUT once the SWAN happens its NO longer MANAGABLE. They will turn the POWER OFF to protect their POWER. But when STARLINK turns us back on using QUANTUM power, the stock market and crypto markets will go into FREE FALL. Creating the largest stock market crash the world has ever seen.

They will no longer be able to manipulate fast enough or high enough to keep them from financial collapse and this is when the APES rise. We HODL for our number and when we sell, IF WE SELL, we take what money they still have left creating the BIGGEST WEALTH TRANSFER IN HISTORY. The powers that have unknowingly run this world keeping us systematically enslaved will be destroyed with the FLIP OF A SWITCH. While they become the next LEHMAN BROTHERS. The PERFECT STORM OF FINANCE creating a FINANCIAL REVOLUTION. Welcome to the GREAT AWAKENING.

Japan’s Stock Market is officially in correction territory

Ethereum and Bitcoin were down 25% and 15%, with Bitcoin value dropping below $50,000 for the first time since February and currently trading at $52,500.

Over $1,000,000,000 liquidated from the Crypto Currency Market in the past 24 hours.

The Nasdaq 100 is officially in correction territory

The 10-Year Note Yield is down 60 basis points in 1 week

The unemployment rate is at a 3-year high of 4.3%

The volatility index, $VIX, is up over 100% in 1 month

The following trading platforms were reportedly down:

Charles Schwab

TD Ameritrade

Vanguard

E-Trade

Fidelity

Google $GOOGL: -11%

Amazon $AMZN: -10%

Microsoft $MSFT: -9%

NVIDIA $NVDA: -11%

Apple $AAPL: -10%

Meta $META: -10%

Tesla $TSLA: -10%

Mon. 5 Aug. 2024 Tokyo Japanic Monday: Japanese Bonds, Stocks Halted After Plunging Into Bear Market As Everything Crashes Everywhere! Japan stocks plunge 7% as sell-off continues. Japan’s benchmark Nikkei Stock Average opened Monday trading down and soon extended losses to 7%, continuing its steep decline from the previous two sessions. The index at one point fell as much as 7.1%, or 2,540,33 points, from Friday’s close to 33,369.37 — its lowest intraday level since Jan. 5. The broader Tokyo Stock Price Index shed 7.8%. https://asia.nikkei.com/Business/Markets/Equities/Japan-stocks-plunge-7-as-sell-off-continues

Sun. 4 Aug. 2024 BREAKING: Wave of financial collapses in multiple markets spread across the world. Korean Stock Exchange Crashing. Suspends Trading.

Mon. 5 Aug. 2024: Bank RUNS! SMFG SHARES FALL AS MUCH AS 16%, TOUCHING DAILY LOWER LIMIT. And there goes Japan’s second largest bank. Next up: bank runs! https://x.com/zerohedge/status/1820261662760358240?s=46

Mon. 5 Aug. 2024: Markets now anticipating an emergency Fed rate cut before the scheduled September date.

Mon. 5 Aug. 2024 GLOBAL STOCK MARKET MADNESS!: The Japanese Stock Exchange Nikkei 225 is WAY DOWN at opening at over -4,100 POINTS. That number has since gone down further to over -4,600 POINTS. That translates to 13% DOWN. Just for scale…Japan’s largest bank (MUFG) is DOWN 21%, Mitsubishi Bank is the 9th LARGEST bank in the WORLD. The Taiwanese Stock Exchange has dropped over 1,800 points or 8%. The LARGEST points drop in their HISTORY. Also, the Korean Exchange is down 247 points or 9%. ALL trading has currently ceased. The US markets will NO DOUBT be greatly affected by this when the morning comes. THIS IS A TRULY HISTORIC CRASH OF EPIC PURPORTIONS. “Black Monday” is going to be an UNDERSTATEMENT.

Mon. 5 Aug. 2024 The Indian Express Stock Market Crash Today: Bloodbath on Dalal Street as Sensex crashes by nearly 2,400 points amid recession fears in US: https://indianexpress.com/article/business/market/sensex-crashes-india-shares-us-growth-fears-9495613/

Mon. 5 Aug. 2024 Black Monday: A wave of financial collapses in multiple markets is happening across the world. Stocks and crypto have plunged as investors start to panic while a global sell-off deepens. Absolute chaos in Japan as stocks are on track for their biggest decline in more than eight years, following a significant drop last Friday. This is an even larger drop than the Black Monday crash of 1987. South Korea has halted all sell orders as markets crash more than 5%. In the United States, the Magnificent 7 stocks have erased nearly $500 billion overnight. With rumors of World War III and Civil War across Europe, the markets are expecting an even deeper crash tomorrow.

~~~~~~~~~~

Restored Republic:

For those of you who are worried about our future, don’t be. …Mr. Pool,(JFK Jr.) Mon. 5 Aug. 2024

The Federal Reserve has been rolled into the US Treasury.

The IRS is no more.

The fiat dollar is backed by gold.

The oil market has been brought to zero to bring down Rockefeller.

Free Energy is on it’s way.

Our nation will be Sovereign and free.

Worldwide Peace will reign.

Read full post here: https://dinarchronicles.com/2024/08/06/restored-republic-via-a-gcr-update-as-of-august-6-2024/****

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff The news is now really starting to ramp up. Critical steps are coming forward...They're going to fall into place like clockwork. August through September is going to be the most critical period in this investment that we've ever witnessed.

Militia Man Looks like someone is not happy about their cash cow getting yanked out from them. Their magic carpet just got grounded. They're not being able to steal money anymore and they're upset about it. Whales, large financial people and politicians involved in the banks they got shut off. They're being vocal about it. Who runs some of the media in Iraq? We know some people that were at the top of the country have their fingers in the pot when it comes to media...

END GAME ALERT! Physical Silver & Good Cryptos Will THRIVE AFTER the Global Meltdown!!

(Bix Weir) 8-5-2024

90 days left before an election that may never happen! In this time frame BOTH the Good Guys and Bad Guys want to destroy the Global Fiat Monetary System so HANG ON TIGHT!

ECONOMIC BLOODBATH: $1.4 TRILLION LOST in a Day as Global Markets Panic & Major Indices Collapse

Lena Petrova: 8-5-2024

Seeds of Wisdom RV and Economic Updates Monday Evening 8-5-24

Good Evening Dinar Recaps,

Three-Quarters of Banks Face Digital Banking Infrastructure Issues

The banking industry is experiencing a seismic shift as agile, digital-native FinTechs capture an ever-growing share of the market.

Burdened by outdated technology, traditional financial institutions face mounting challenges in delivering modern digital services.

The growing dominance of FinTechs — securing nearly half of all new account openings — highlights the urgency for banks to modernize their infrastructure.

Good Evening Dinar Recaps,

Three-Quarters of Banks Face Digital Banking Infrastructure Issues

The banking industry is experiencing a seismic shift as agile, digital-native FinTechs capture an ever-growing share of the market.

Burdened by outdated technology, traditional financial institutions face mounting challenges in delivering modern digital services.

The growing dominance of FinTechs — securing nearly half of all new account openings — highlights the urgency for banks to modernize their infrastructure.

With consumer expectations rapidly evolving toward seamless digital experiences, banks must navigate the high costs and complexities of updating their core systems.

Exploring incremental modernization through application programming interfaces (APIs) may offer a viable path forward, enabling banks to enhance their digital capabilities and remain relevant in an increasingly competitive landscape.

A recent PYMNTS Intelligence Report, “Core Strength: FIs Must Modernize to Meet the FinTech Challenge,” in collaboration with Galileo, highlights the urgent need for traditional financial institutions to overhaul their outdated systems to keep pace with digital-native competitors.

The report reveals that 75% of banks struggle with implementing new digital solutions due to their legacy infrastructure, underscoring the critical nature of modernization efforts.

As FinTechs continue to capture a growing market share, banks face mounting pressure to adopt agile technologies and innovative approaches.

@ Newshounds News™

Read more: PYMNTS

~~~~~~~~~

The crypto market has just witnessed its largest three-day sell-off in 12 months amid weak jobs data in the US and revived fears of a recession.

The crypto market has just clocked its most significant three-day sell-off in almost a year, shedding as much as $510 billion from its total market capitalization since Aug. 2.

The sharp crypto sell-off arrived amid faltering equities performance, with the S&P 500 falling as much as 4.4% in the same time frame.

The market stumble has been led by weak employment data, slowed growth among major tech stocks and revived fears of a recession.

Several major companies, including Microsoft and Intel, posted lower-than-expected second-quarter results, and market leader Nvidia was battered by expectations of impending rate cuts in September, which has seen capital flow back into smaller, lagging companies.

The total crypto market capitalization fell by $314 billion on Aug. 5. Source: TradingView

The last time crypto sold off this sharply over a three-day period was in mid-August of 2023.

BTC and ETH are down 20% and 28%, respectively, in the last seven days.

Layer-1 network Solana’s has been the hardest-hit cryptocurrency among the top 10 largest tokens by market cap, falling 30.6% since July 30.

The Crypto Fear & Greed Index — an indicator that tracks market sentiment toward Bitcoin and crypto — has fallen back into “fear” and currently displays a score of 26 at the time of publication, according to Alternative.me.

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

Amazon Founder Jeff Bezos sold $1.65 billion worth of $AMZN at the exact top - man deserves a round of applause for these trades!

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Why do I hold $XRP? This video should make it clear.

WATCH THE VIDEO IMBEDDED IN THIS TWEET. WORTH 2 MINUTES.

@ Newshounds News™

Listen Here: Twitter

~~~~~~~~~

Japan's three largest financial companies have lost $85 billion in market value over the past two trading days.

Read that again.

History…

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

This Is Why We Can’t Have Nice Things.

This Is Why We Can’t Have Nice Things.

Notes From the Field By James Hickman / Simon Black August 5, 2024

Athenian general Miltiades was already a hero across ancient Greece when he set sail for the island of Paros in 489 BC.

Born into stardom as the son and nephew of famous Olympic champions, Miltiades made a name for himself as one of the most important and successful commanders in the Greek war against Persia.

In fact, Miltiades was responsible for devising the incredibly unique, surprise battle plan that confounded the Persian army at the Battle of Marathon in 490 BC. The Greeks were vastly outnumbered and outmatched... but they annihilated the Persians thanks to Miltiades’ tactical genius, making him an instant celebrity-hero throughout the region.

This Is Why We Can’t Have Nice Things.

Notes From the Field By James Hickman / Simon Black August 5, 2024

Athenian general Miltiades was already a hero across ancient Greece when he set sail for the island of Paros in 489 BC.

Born into stardom as the son and nephew of famous Olympic champions, Miltiades made a name for himself as one of the most important and successful commanders in the Greek war against Persia.

In fact, Miltiades was responsible for devising the incredibly unique, surprise battle plan that confounded the Persian army at the Battle of Marathon in 490 BC. The Greeks were vastly outnumbered and outmatched... but they annihilated the Persians thanks to Miltiades’ tactical genius, making him an instant celebrity-hero throughout the region.

So, when he approached the Athenian government the following year and requested to lead a special mission to reclaim lost Greek territory in the Aegean Sea, they approved his mission without question. And the Hero of Marathon set sail a few months later with a fleet of 70 ships.

Unfortunately for Miltiades, his voyage was a total disaster; his fleet was nearly vanquished, he lost a great number of men, and he was unable to take the island of Paros. So, when he returned to Athens, all of his former heroics were forgotten… and people wanted his head. Literally.

It was commonplace in ancient Greece for politicians and military leaders to be held accountable for their decisions; many were even put on trial at the end of their rule and had their administrations publicly scrutinized.

These weren’t political witch hunts; rather, they were a form of checks-and-balances whereby anyone found to have been truly incompetent, disloyal, or duplicitous would be severely punished.

Miltiades-- again, the Hero of Marathon-- was charged with treason for causing such severe and embarrassing losses in his ill-fated Paros expedition. He was tried, convicted, and ultimately sentenced to death… however this was eventually reduced to a fine of 50 talents (roughly $10 million in today’s money) and a lengthy prison sentence.

Sometimes I feel like the Greeks were really on to something.

Sure, the world is complicated, and there’s never any guarantee of success in warfare, business, life, politics, etc. Decision makers don’t have a crystal ball and rarely have perfect information… so there can never be any certainty about future outcomes.

But leaders have a moral and legal obligation to always do their best… and to make rational decisions and take sensible risks. Most importantly, whenever there’s new information, they have an obligation to challenge their own decisions and adjust course if necessary.

Failure to do so is arrogant, deliberate incompetence.

We saw this all throughout the pandemic; at first, there was very little information available, and politicians’ knee-jerk reaction was to enact the most extreme measures.

But six-months later there was plenty of data. And politicians had plenty of opportunity to review the updated information, summon their courage, and make better, more rational decisions.

Some places (Florida) did. Others (New York, California) stuck to their failed, idiotic, destructive policies. They kept people locked down, they kept the schools closed, and they exacted an incalculable toll on their citizens.

But they will never be held accountable for their incompetence. Instead, they end up on lucrative speaking tours, awarded highly paid consulting or board positions, or advanced outrageous sums for their memoirs.

And this leads me to what’s happening in England right now.

As you’re probably aware, a sick-o teenager in northern England stabbed a bunch of kids last week in a horrifying rampage. Nine children were wounded, and at least three have died.

Rumors quickly circulated that the attacker was a Muslim refugee who had arrived by boat to England’s shores, and violent riots quickly broke out across the country.

The government and media were quick to correct the rumor; the 17-year-old attacker (he turns 18 on Wednesday) was born in the UK and is the son of Rwandan immigrants.

Then they further denounced the rioters as “far right” and “racist”, and the Prime Minister threatened to use the full force of the law against them.

Look, it’s completely inexcusable for rioters to engage in violence and destruction of property. But it’s also inexcusable for politicians to run their country into the ground.

The media has been quick to condemn the rioters. But they are completely silent, and frankly complicit, regarding the destruction of their country.

To Read More: https://www.schiffsovereign.com/trends/this-is-why-we-cant-have-nice-things-151207/

Seeds of Wisdom RV and Economic Updates Monday Afternoon 8-5-24

Good Afternoon Dinar Recaps,

Blockchain and Nation-State Infrastructure: Why Bother? " Financial titans like JP Morgan, Standard Chartered, HSBC, and Goldman Sachs are diving deep into blockchain, spurred on by the SEC’s approval of spot Bitcoin and Ether ETFs and BlackRock’s tokenization initiatives.

However, participation from legacy organizations brings with it a growing risk of reproducing the same kinds of centralized structures that blockchain set out to dismantle.

Additionally, greater involvement from traditional finance attracts stronger regulatory frameworks and more regimented policy structures from nation-state institutions, which risks stifling innovation and limiting the autonomy of our blockchain networks. So, why bother?"

"Not long ago, these financial giants were the loudest critics of crypto’s credibility and efficacy. For context, in 2017, the CEO of JPMorgan Chase famously declared, “BITCOIN IS A FRAUD”.

Good Afternoon Dinar Recaps,

Blockchain and Nation-State Infrastructure: Why Bother?

" Financial titans like JP Morgan, Standard Chartered, HSBC, and Goldman Sachs are diving deep into blockchain, spurred on by the SEC’s approval of spot Bitcoin and Ether ETFs and BlackRock’s tokenization initiatives.

However, participation from legacy organizations brings with it a growing risk of reproducing the same kinds of centralized structures that blockchain set out to dismantle.

Additionally, greater involvement from traditional finance attracts stronger regulatory frameworks and more regimented policy structures from nation-state institutions, which risks stifling innovation and limiting the autonomy of our blockchain networks. So, why bother?"

"Not long ago, these financial giants were the loudest critics of crypto’s credibility and efficacy. For context, in 2017, the CEO of JPMorgan Chase famously declared, “BITCOIN IS A FRAUD”.

In this era of heavy skepticism, financial governance in the U.S. looked down its nose at this whole ecosystem—if it even dared to look at all.

Yet now, as the two start to realize the potential upside of Wall Street ETFs, we seem incredibly eager to shine a light on their arrival.

We need to ask ourselves if these major private and public players can be trusted with the future of blockchain ecosystems when they have, for years, continued to struggle with the provision of clear and feasible regulatory frameworks."

"It’s still unclear if digital assets are SECURITIES or COMMODITIES, leading to endless lawsuits and regulatory headaches for major exchanges in the US. These opaque rules and guidelines have fostered a mass jurisdictional exodus, as companies look for legal respite to innovate in other places. "

"To circumvent these centralized points of failure, we need to continue building permissionless and trustless systems that can’t be taken down by the state, regulator, or any one owner.

Decentralized, open-source zero-knowledge (zk) bridges may not be a silver bullet, but they offer a more promising and equitable future.

Distributed, anonymous, and autonomous, these bridges can operate with minimum governmental interference and therefore maximum freedom, empowering participants to move assets freely and generate proofs locally and economically."

"This allows for true interoperability, giving protocols sovereign control without the heavy hand of regulatory requirements. It also makes these bridges nation-state-resistant: if a given bridge provider is regulated out of existence or prosecuted, users can continue bridging using the decentralized infrastructure."

"In this vision, protocols would enjoy greater freedom, with no unnecessary requirements, no user flow restrictions, and no extra security vulnerabilities. Crypto would again become a space where no single country, company, or party has an unfair advantage, effectively returning to the decentralized spirit at the heart of blockchain."

"Imagine instead a world where thousands of blockchains communicate seamlessly—a future where fragmented liquidity becomes a cohesive, high-performance ecosystem.

This vision is within reach. We are on the cusp of making blockchain as efficient and interconnected as the internet itself.

Decentralized, horizontal scalability is the only way forward, making crypto truly useful for the wider global community."

@ Newshounds News™

Read more: Bitcoin

~~~~~~~~~

Cambodia’s Bakong DIGITAL CURRENCY helps address DOLLARIZATION

ANOTHER ARTICLE HIGHLIGHTING THE FACT THAT COUNTRIES ARE CONTINUING DOWN THE PATH TO DE-DOLLARIZE AND RETURN TO LOCAL CURRENCIES.

THIS TREND IS HAPPENING ALL AROUND THE WORLD AND SEEMS TO BE A STRATEGIC PLAN TO BRING IN A GLOBAL FINANCIAL SYSTEM.

"Cambodia has been a heavily dollarized country since it returned to civilian rule in the early nineties. Roughly 80% of transactions are in US dollars. Prior to becoming the Governor of the National Bank of Cambodia, Chea Serey spearheaded the launch of the Bakong digital currency payment system in 2020.

A key aim was to encourage a higher proportion of transactions in the local riel rather than dollars. Based on figures for the first half of 2024, that strategy looks like it’s working."

"Bakong has been a huge success. By the end of last year, the central bank said there were ten million wallets out of a 17 million population. While often described as a central bank digital currency (CBDC), Bakong is closer to a tokenized deposit initiative with the Bakong currency backed by balances at commercial banks."

"One of the key tactics to encourage use of the LOCAL CURRENCY is to only support cross border payments using riel. Bakong has existing cross border payment arrangements for Bakong with Thailand, Laos and Vietnam and is expanding its collaborations with China, Japan, India, Korea, Singapore and Malaysia.

Late last year it partnered with Alipay+, the international arm of the dominant Chinese wallet. Additionally, it’s encouraging local retailers to quote prices in riel."

"There’s another reason the strategy is working. With a prudently managed economy, the riel can hold its own in the foreign exchange markets. It has an unofficial peg of 4000 riel to the dollar, which it has managed to more or less hold for the past 20 years.

During the past ten years it has varied by less than 5%. Given the decline in the US dollar in the last few days, the riel has now slightly appreciated against the dollar over the past year. Other currencies in the region such as the Thai Baht, have depreciated a little."

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

USD/JPY Forecast – US Dollar Continues to Drop Against The Yen

The USD/JPY pair fell hard in the early hours on Monday, as the trading world continues to unwind the overall carry trade, and the Fed is looking more and more likely to cut rates later this year. Ultimately, this is a market that I think will continue to see more and more volatility.

@ Newshounds News™

Read more: FX Empire

~~~~~~~~~

IMPORTANT RIPPLE (XRP) UPDATE

“Ripple USD will be fully backed by a segregated reserve of cash and cash equivalents and redeemable 1:1 for US dollars,” the announcement reads.

▪️Ripple plans to launch a stablecoin called Ripple USD (RLUSD) by the end of 2024, available on XRP Ledger and Ethereum. It promises benefits like deep liquidity for certain trading pairs, instant settlements, and programmable finance.

▪️The SEC has criticized RLUSD as an “unregistered crypto asset,” continuing its ongoing legal battle with Ripple since 2020.

More Attention to RLUSD

Ripple made waves earlier this year when it revealed that it would introduce a stablecoin pegged to the American dollar. At the time, CEO Brad Garlinghouse stated that the product would serve as a bridge between traditional finance and the cryptocurrency industry.

Ripple’s team has still not provided an exact date for the stablecoin’s official release. However, they explained it will be available on the XRP Ledger and Ethereum and should go live before the end of 2024. The team also revealed that the stablecoin will be called Ripple USD (ticker RLUSD).

Most recently, the product was added to the company’s official website, meaning its launch could be just around the corner. “

Ripple USD (RLUSD) is being designed to maintain a constant value of one US dollar. Issued on XRP Ledger and Ethereum blockchains, Ripple USD will be fully backed by a segregated reserve of cash and cash equivalents and redeemable 1:1 for US dollars,” the section reads.

Ripple’s team argued that RLUSD would provide certain benefits, such as deep liquidity for selected trading pairs on centralized exchanges, instant settlements, and programmable finance.

The Clash With the SEC

The upcoming stablecoin has already become a subject of controversy, receiving criticism from the US Securities and Exchange Commission (SEC). Several months ago, the regulator labeled it an “unregistered crypto asset.”

This is not the first confrontation between Ripple and the SEC. The agency sued the firm in December 2020, accusing it and some of its executives of illegally raising more than $1.3 billion by selling XRP in an unregistered security offering.

The legal battle passed through multiple developments in the following years, becoming one of the hottest topics in the crypto space. It reached its trial stage in April 2024, meaning a resolution could be announced anytime.

Some industry participants view the SEC as the underdog in the dispute, pointing to Ripple’s three partial court wins secured throughout 2023. XRP’s price reacted positively to each of those, and it will be interesting to see how it performs once the case is officially closed.

@ Newshounds News™

Read more: Crypto Potato

~~~~~~~~~

Crypto Market Crash Aside: 3 Things to Watch This Week

Things couldn’t get much worse for crypto markets following their largest retreat for more than a year. However, this week’s economic calendar in the US is slow which could limit further volatility.

Crypto markets have fallen below $2 trillion total capitalization in a massive double-digit crash, the likes of which have not been seen for at least a year.

Stock markets in Asia are also reeling this Monday morning following a tech stock rout in the United States late last week.

Economic Calendar August 5 to 9

Monday, we will see July’s final S&P services PMI (purchasing managers index), which provides a snapshot of business conditions in the services sector in the United States.

The ISM services report is also due, which will provide economic indicators for service based on surveys of supply management professionals. Changes in ISM and PMI reports often precede changes in the wider economy.

Thursday has initial jobless claims data, which indicate employment and labor markets in the United States and have a wider impact on the economy.

This week’s light economic events calendar will not have much impact on markets as they are already in freefall.

Economists are forecasting more economic doom and gloom. “All in, we have an economic slowdown for sure, with a high probability that a recession is approaching,” reported Forbes over the weekend.

Crypto Markets Bleed $280B

Crypto markets have dumped a further $280 billion over the past 12 hours resulting in a daily slump of around 13%.

This has dropped total market capitalization back to $1.94 trillion, its lowest level since February. Digital asset markets have dumped more than 20% over the past week as sentiment shifts to bearish.

Bitcoin led the declines with a slump to under $50,000 during the Monday morning Asian trading session. The asset has lost 13% over the past 24 hours in its largest and fastest fall for more than a year.

Ethereum fared even worse, tanking a whopping 21% on the day to $2,200, its lowest level since January.

The altcoins are a sea of red this morning, with most dumping double digits as crypto markets wipe out nearly all gains made in 2024 in the space of a couple of days.

@ Newshounds News™

Read more: Crypto Potato

~~~~~~~~~

IRAQ Central Bank Governor comments on DOLLAR EXCHANGE and FOREIGN REMITTANCES

"Ali Al-Alaq, governor of the Central Bank, discussed the value of remittances sent abroad and the value of the dollar."

"Al-Alaq said in a proclamation got uninvolved of his facilitating in the Place of Delegates that “our unfamiliar cash holds are adequate to make balance on the lookout,” demonstrating that “the National Bank offers in excess of 250 million bucks everyday to meet the necessities of unfamiliar exchange.”

He added, “85% of unfamiliar exchanges are as of now occurring between Iraqi banks and reporter banks WITHOUT GOING THROUGH the US Central bank,” making sense of that “the lodging drive is vital to the bank.”

He explained that “the Central Bank is now heading to cover the financing of the construction of 32 thousand housing units” and that “the volume of loans granted within the real estate initiative amounts to 10 trillion dinars.”

@ Newshounds News™

Read more: Dinar Opinions

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “Market Crash News and Views” 8-5-2024

40% Stock Market Crash is Here with Simon Hunt

WTFinance: 8-5-2024

On this episode of the WTFinance podcast I had the pleasure of welcoming back Simon Hunt.

During our conversation we spoke about the risk of a market crash in 2024, BRIC's currency, Global Cold/Hot War, financial system crisis and more.

40% Stock Market Crash is Here with Simon Hunt

WTFinance: 8-5-2024

On this episode of the WTFinance podcast I had the pleasure of welcoming back Simon Hunt.

During our conversation we spoke about the risk of a market crash in 2024, BRIC's currency, Global Cold/Hot War, financial system crisis and more.

I hope you enjoy.

0:00 – Introduction

1:52 - Market crash in 2024?

9:01 - Control over the heartland?

13:13 - BRIC’s currency

19:30 - Republicans to cut spending?

21:16 - South China Sea

27:18 - Cold vs hot world war?

31:24 - Financial system correction?

34:09 - One message to takeaway from our conversation?

Bloodbath: US Economic Panic Begins As Japan’s Soaring Currency Detonates The Stock Market

Sean Foo: 8-5-2024

As Japan suffers a massive stock sell-off, the US economy is getting hit hard as the Yen carry trade begins to blow up.

US stocks is on the verge of a nasty sell-off and the recession risks are now getting frighteningly real. Here's what you must know.

Timestamps & Chapters:

0:00 Japan In Freefall Collapse

2:38 Economy Breaking, Massive Sell-Off

5:31 Carry Trade Blows Up & Collapses Markets

7:33 Sponsor: Indigo Precious Metals

8:58 USD Falling Hard

9:39 US Market Dump Big Risk

12:23 Recession Shock Risk

*‘Market Is Broken’: How To Survive When ‘All Hell Breaks Loose’ | Chris Vermeulen

David Lin: 8-5-2024

Chris Vermeulen, Chief Market Strategist of TheTechnical Traders.com, discusses Monday's market sell-off and what's next.

0:00 - Market reaction

3:00 - Buy the dip?

7:42 - Stage 3 Topping Phase

12:47 - Trading psychology

18:41 - Bear market indicators

21:35 - Repeat of 2022?

24:53 - Recession fears

27:45 - Safe haven

31:05 - Emergency rate cut?

32:20 - Yen

“Tidbits From TNT” Monday 8-5-2024

TNT:

Tishwash: Al-Alaq: The Central Bank is moving towards covering the financing of the construction of 23 thousand housing units

The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Sunday, that the priority of financing will be for residential complexes ready for housing. A statement by the bank received by / Al-Maalouma / said that "the Governor of the Central Bank visited the Real Estate Bank to study and process citizens' delayed loan requests."

The statement added that "the Governor of the Central Bank confirmed that the priority of financing will be for residential complexes ready for housing." link

TNT:

Tishwash: Al-Alaq: The Central Bank is moving towards covering the financing of the construction of 23 thousand housing units

The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Sunday, that the priority of financing will be for residential complexes ready for housing.

A statement by the bank received by / Al-Maalouma / said that "the Governor of the Central Bank visited the Real Estate Bank to study and process citizens' delayed loan requests."

The statement added that "the Governor of the Central Bank confirmed that the priority of financing will be for residential complexes ready for housing." link

Tishwash: Al-Sudani discusses with Allawi the government's efforts and serious steps to achieve economic reform

Prime Minister Mohammed Shia Al-Sudani received today, Sunday, former Prime Minister and head of the Iraqi National Accord Party, Iyad Allawi.

The government statement, a copy of which was received by {Euphrates News}, stated: “The meeting witnessed a discussion of the general conditions in the country, and a discussion of the government’s efforts and serious steps to achieve economic reform, which is the basis for developing all vital sectors, and improves the economic and living conditions of citizens in all parts of Iraq.”

He pointed out that "the meeting addressed the situation in the region and the challenges it faces in light of the increasing frequency of bloody attacks by the Zionist occupation authorities against the Palestinian people in Gaza, and the emphasis on Iraq's sovereignty and security, which is a gateway to the region's security and stability." link

************

Tishwash: Central Bank Governor: Our foreign exchange reserves are sufficient to create balance in the market

The Governor of the Central Bank, Ali Mohsen Al-Alaq, confirmed today, Sunday, that our foreign currency reserves are sufficient to create balance in the market. The media office of the head of the Finance Committee in the House of Representatives said in a brief statement received by Al-Mutalaa, that "the Governor of the Central Bank, Ali Mohsen Al-Alaq,

provided a full briefing during his hosting of the Finance Committee on the reasons for the fluctuation of the exchange rate, the mechanism of the electronic platform and its role in controlling internal and external trade, the housing initiative file, US sanctions on Iraqi banks, and the status of the cash reserve of hard currencies at the Central Bank of Iraq."

Al-Alaq stated, according to the statement, that "our reserve of hard currency is sufficient to create balance in the market," indicating that "the Central Bank sells more than $ 250 million daily to meet the requirements of foreign trade," indicating that "85 percent of foreign transfers are currently taking place between Iraqi banks and correspondent banks, without going through the US Federal Reserve."

He pointed out that "the housing initiative is of great importance to the bank, and that the volume of loans granted within the real estate initiative amounts to 10 trillion dinars," adding that "the Central Bank is now heading to cover the financing of the construction of 23,000 housing units, and priority will be given to completed residential complexes." link

************

Tishwash: Al-Atwani: Exchange rate stability is a central issue for the state

The head of the Finance Committee in the House of Representatives, Atwan Al-Atwani, confirmed on Sunday that the stability of the exchange rate is a central issue for the state, while he pointed out that the housing initiative achieved positive results.

The media office of the head of the Finance Committee in the House of Representatives stated in a statement, which was reviewed by "Al-Eqtisad News", that "Al-Atwani chaired the committee meeting that hosted the Governor of the Central Bank of Iraq, Ali Mohsen Al-Alaq, to discuss the monetary policy file in the country."

He added that "the meeting reviewed a number of issues, most notably the issue of the electronic platform and the procedures related to it in order to facilitate work and economic stability, in addition to the issue of banks and the mechanism for developing the money transfer process."

He continued that "the meeting witnessed important interventions by committee members on banks' initiatives to provide real estate and housing loans, and ways to facilitate procedures and ease conditions for citizens in the process of applying for housing units in complexes."

Al-Atwani stressed, according to the statement, that "the widening gap between the official price of selling the dollar and the parallel market price creates a state of economic and financial instability," stressing that "the stability of the exchange rate is a central issue for the state."

The head of the Finance Committee noted that "there is a duality in the issue of imposing US sanctions between Iraqi banks and correspondent banks, which requires the Central Bank of Iraq to move effectively and address this crisis, in addition to tightening control over the work of private banks, in a way that ensures the integrity of all their procedures and work."

Al-Atwani added that "the housing initiative has achieved positive results, and therefore we are pushing towards supporting and continuing it in order to expand the list of those covered by housing loans, and contribute to resolving this crisis."

He continued that "the stability of the monetary market has a direct impact on the general financial situation," adding that "the labor market is unstable in terms of selling currency, which casts a shadow over the general monetary situation." link

************

Mot: . Beeeeeeeeee Honest!! -- Ya Did!! - HUH!!!

Mot: Two Weeks Notice