Seeds of Wisdom RV and Economic Updates Monday AM 8-5-24

Good Morning Dinar Recaps,

Warren Buffett and Berkshire Hathaway now own 4% of all T-Bills issued to the public…

Buffett has ~$277 Billion. The Fed has $195 Billion.

Good Morning Dinar Recaps,

Warren Buffett and Berkshire Hathaway now own 4% of all T-Bills issued to the public…

Buffett has ~$277 Billion.

The Fed has $195 Billion.

Warren Buffett is now a larger holder of US Treasury Bills than the Federal Reserve.

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

JUST IN: 🇺🇸 The Strategic #Bitcoin Reserve bill has been officially introduced.

@ Newshounds News™

Read more: Bitcoin Magazine, Congress-Gov

~~~~~~~~~

So if it’s subject to REGULATORY APPROVAL and it’s supposed to come out in Q4 this YEAR, then REGULATIONS are COMING OUT before THEN.

@ Newshounds News™

Twitter

THIS IS AN OPINION PIECE BUT WORTH CONSIDERING

~~~~~~~~~

US Stocks tanking. Japanese stocks tanking. Cryptos tanking

@ Newshounds News™

Twitter

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Zimbabwe Gold ZiG Currency is Bringing Humanity Closer to the GCR

Zimbabwe Gold ZiG Currency is Bringing Humanity Closer to the GCR

On August 1, 2024 By Awake-In-3D

How the Zimbabwe Gold ZiG is Reshaping the Future Global Currency System Today

The resurgence of gold as a global currency is becoming a reality, with Zimbabwe leading the way. The introduction of the Zimbabwe Gold ZiG currency has sparked significant interest and marked a seminal shift in the global financial landscape.

Zimbabwe’s approach provides a glimpse into humanity’s promising financial future.

Zimbabwe Gold ZiG Currency is Bringing Humanity Closer to the GCR

On August 1, 2024 By Awake-In-3D

How the Zimbabwe Gold ZiG is Reshaping the Future Global Currency System Today

The resurgence of gold as a global currency is becoming a reality, with Zimbabwe leading the way. The introduction of the Zimbabwe Gold ZiG currency has sparked significant interest and marked a seminal shift in the global financial landscape.

Zimbabwe’s approach provides a glimpse into humanity’s promising financial future.

In This Article:

What is the Zimbabwe Gold ZiG?

Is the Zimbabwe Gold ZiG Currency Being Used?

How has the ZiG helped Zimbabwe’s Economy?

Will the Gold ZiG Replace the US Dollar in Zimbabwe?

Is the Zimbabwe Gold ZiG a Part of a GCR?

What is the Zimbabwe Gold ZiG?

The Zimbabwe Gold currency, or ZiG, launched in April 2024, is a gold-backed currency designed to replace the depreciated Zimbabwean dollar.

The ZiG is backed by foreign exchange reserves and precious metals, providing a stable and secure alternative to the previously volatile local currency.

This marks Zimbabwe’s sixth attempt to establish a reliable currency in the past 15 years.

Is the Zimbabwe Gold ZiG Currency Being Used?

Since its introduction, the adoption of the ZiG has been remarkable. Zimbabwean Central Bank Governor John Mushayawanha reported that the usage of ZiG has doubled, now representing 30% of all transactions in the country.

This rapid increase in acceptance indicates growing confidence among Zimbabweans in the new currency’s stability and value.

How has the ZiG helped Zimbabwe’s Economy?

The introduction of the ZiG has had a stabilizing effect on Zimbabwe’s economy. The gold-backed currency has helped to curb inflation and restore some confidence in the national monetary system.

Previously, hyperinflation and a depreciating local currency plagued the economy, but the ZiG’s success suggests a turning point.

The use of gold coins in 2022 laid the foundation for this success, proving effective in managing liquidity and preserving value.

Will the Gold ZiG Replace the US Dollar in Zimbabwe?

The Zimbabwean government has ambitious plans for the ZiG to become the sole legal tender by 2030.

Finance Minister Mthuli Ncube has introduced measures to increase demand for the ZiG, including requiring government departments to accept payments in the local currency.

President Emmerson Mnangagwa has indicated that the transition could be completed as early as 2026, aiming to reduce reliance on the US dollar.

Is the Zimbabwe Gold ZiG a Part of a GCR?

The ZiG’s introduction is seen as a significant step towards a Global Currency Reset (GCR), where gold re-emerges as the foundation for a fair and sovereign financial system open to all of humanity.

The success of the ZiG will lead other nations to adopt gold-backed currencies, fostering a more secure and equitable global economy.

The GCR envisions a future where gold and other real assets underpin global financial systems, reducing the debt, volatility and uncertainty associated with fiat currencies.

The Bottom Line

Zimbabwe’s introduction of the ZiG currency marks a pivotal moment in the global financial landscape. By embracing a gold-backed currency,

Zimbabwe is not only stabilizing its own economy but also paving the way for a broader global currency reset.

Zimbabwe’s success with the ZiG will bring a new era of financial stability and prosperity, driven by the strong properties and value of gold.

Contributing Source: https://eurasiabusinessnews.com/2024/07/29/in-zimbabwe-the-use-of-gold-backed-currency-zig-grows/

=======================================

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

More News, Rumors and Opinions Sunday PM 8-4-2024

KTFA:

Clare: WTO

@wto

Members welcomed on 18 July the resumption of #Iraq's accession process after a 16-year hiatus, commending Iraq for its renewed political commitment & engagement. Iraq reaffirmed its pledge to join the WTO, highlighting significant domestic reforms. More: http://bit.ly/3LCyu9e

https://x.com/wto/status/18196.....0213436553

(CLICK THE LINK TO WATCH THE VIDEO)

KTFA:

Clare: WTO

@wto

Members welcomed on 18 July the resumption of #Iraq's accession process after a 16-year hiatus, commending Iraq for its renewed political commitment & engagement. Iraq reaffirmed its pledge to join the WTO, highlighting significant domestic reforms. More: http://bit.ly/3LCyu9e

https://x.com/wto/status/18196.....0213436553

(CLICK THE LINK TO WATCH THE VIDEO)

Clare: US Treasury Takes Control of Iraq's Central Bank to Combat Money Laundering

8/3/2024

Three informed sources close to the political and parliamentary decision-making process in Baghdad revealed extremely dangerous information confirming that the US Treasury Department has taken a permanent headquarters in the Central Bank of Iraq building. They considered that this step came as a result of the great pressures on the Iraqi banking system with the aim of limiting money laundering and dollar smuggling, as the governor of the Central Bank was forced to allocate an entire floor for US Treasury departments to monitor money transfers and prevent any illegal activities.

The three sources confirmed that a team of American employees is working permanently at the Central Bank of Iraq, as part of intensive efforts to ensure Iraq's commitment to international standards for combating money laundering and terrorist financing.

The sources stressed that the Iraqi banking sector is suffering from increasing pressures exerted by the US Treasury to prevent the smuggling of dollars to countries such as Iran, Russia and Syria, which are facing economic sanctions.

One of the sources explained that the governor of the Central Bank of Iraq tried to resist these restrictions, but the American response was strict, as the Central Bank of Iraq was included among the institutions considered to support money laundering operations and failure to comply with sanctions.

In previous reports, the US Treasury imposed severe sanctions on several Iraqi banks, on charges of involvement in money laundering and dollar smuggling. The policy of the Central Bank of Iraq is characterized by randomness and the absence of a clear strategic plan to protect Iraq's money from smuggling, which prompted the US Treasury to impose strict and direct control over the Central Bank and Iraqi banks.

Iraqi banks are currently undergoing a rigorous evaluation process under the supervision of the US Treasury Department, which includes monitoring all banking operations and money transfers. This situation reflects the great challenges facing the Iraqi banking system in light of the ongoing efforts to reform it and improve its image before the international community.

On the other hand, Prime Minister Mohammed Shia al-Sudani has repeatedly sought to ease these measures, trying to reach understandings with the American side. But there is strong resistance from Washington, which insists on correcting the course of the economic process and reforming the banking system in Iraq. Al-Sudani finds himself in a difficult position, as he must balance internal pressures and international demands.

In a broader context, the current situation reflects the complexity of the relationship between Iraq and the United States in the financial and banking sphere. While Iraq seeks to preserve its sovereignty and the independence of its banking system, the United States continues to exert pressure to ensure that the Iraqi banking system is not used to finance illicit activities. LINK

AZPatriot: Why does this sound bad IMO??? I think President Reagan said is best of the 9 most feared words to Americans, "I'm from the government and I'm here to help"!

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man 'The Theft of The Century'...It's a big deal. It's in the forefront again...They're going to claw back a lot of money. A LOT of money. Why is that important to you and I? If they claw back a lot of money it all goes back to the treasury. Tens of billions of dinars or multiple billions of dollars. It's all clawed back from people that stole their money from the citizens...We'd have to pay out on that [988 billion dinars] if they were able to keep them...Finding this stuff is amazing. It's really good for the country...citizens and it's really good for you and I...

Frank26 You have to start getting ready for when they give you the new exchange rate...You know what's coming...I'm not saying I'm leaving but I'm saying there's going to be a major change very soon...Things are going to change dramatically very soon.

US ECONOMY RED FLAGS: Unemployment Rises, Warren Buffet Stockpiles Cash, National Debt Surges

Lena Petrova: 8-4-2024

LIVE! SPECIAL REPORT... MMRI FREEFALL.

Greg Mannarino: 8-4-2024

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 8-4-24

Good Afternoon Dinar Recaps,

Gold (XAU) Forecast: Dollar Weakness and Falling Yields Set Stage for Continued Rally

Key Points: ▪️ Gold surges 2.32% weekly despite Friday pullback, settling at $2442.50 amid geopolitical tensions and Fed rate cut expectations. ▪️ Middle East conflicts, including Hamas leader assassinations, boost safe-haven demand for gold as geopolitical hedge. ▪️ Powell's comments spark surge in trader bets for September rate cut, CME FedWatch tool shows 28.5% chance of 50-basis-point cut. ▪️ Weaker-than-expected U.S. jobs report strengthens case for gold: Only 114,000 jobs added, unemployment rises to 4.3% ▪️ Analysts eye $2,500 year-end target for gold, potentially arriving sooner if current bullish trends persist in the market.

@ Newshounds News™

Read more: FX Empire

Good Afternoon Dinar Recaps,

Gold (XAU) Forecast: Dollar Weakness and Falling Yields Set Stage for Continued Rally

Key Points:

▪️ Gold surges 2.32% weekly despite Friday pullback, settling at $2442.50 amid geopolitical tensions and Fed rate cut expectations.

▪️ Middle East conflicts, including Hamas leader assassinations, boost safe-haven demand for gold as geopolitical hedge.

▪️ Powell's comments spark surge in trader bets for September rate cut, CME FedWatch tool shows 28.5% chance of 50-basis-point cut.

▪️ Weaker-than-expected U.S. jobs report strengthens case for gold: Only 114,000 jobs added, unemployment rises to 4.3%

▪️ Analysts eye $2,500 year-end target for gold, potentially arriving sooner if current bullish trends persist in the market.

@ Newshounds News™

Read more: FX Empire

~~~~~~~~~

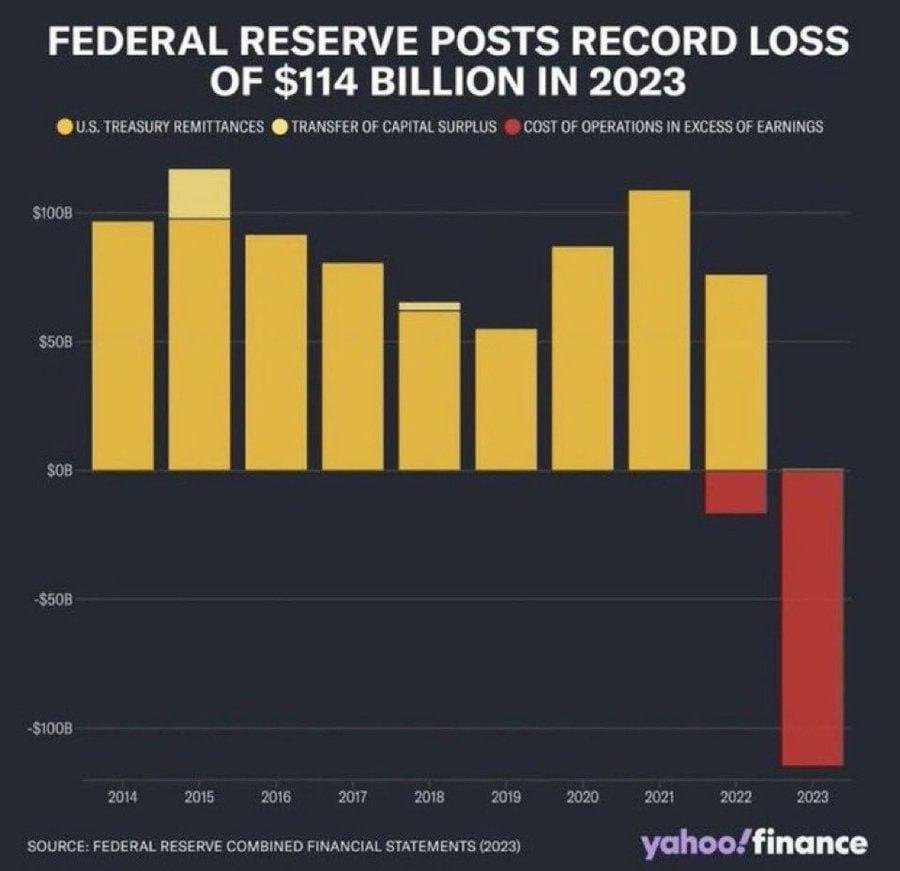

Federal Reserve posted its biggest loss in history last year of $114 Billion

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Ripple Unveils RLUSD Webpage: Set to Compete with Tether and USDC

▪️RLUSD aims to compete with major stablecoins like Tether and USD Coin.

▪️Ripple’s strategic initiatives enhance the interoperability and utility of RLUSD.

Ripple Labs Inc. has developed a new webpage for its next stablecoin, RLUSD. The release has aroused widespread interest, with blockchain researcher Collin Brown noting that RLUSD intends to compete with big players Tether (USDT) and USD Coin.

This step demonstrates Ripple’s determination to increase its presence in the stablecoin sector, despite the changing regulatory landscape.

RLUSD Stablecoin to Leverage Ripple’s Cross-Border Network and XRP Ledger

The RLUSD stablecoin is expected to improve Ripple’s business operations by leveraging its current cross-border settlement network and the well-known Layer 1 protocol, XRP Ledger.

The stablecoin will be released on both the XRP Ledger and Ethereum, providing access to different ecosystems. This dual issuance adds significant liquidity to important trading pairs on certain centralized exchanges, increasing its utility and adoption.

The publication of the RLUSD webpage has fueled this enthusiasm, despite the fact that the stablecoin’s release date remains unknown.

On the other hand, as we previously reported, Monica Long, Ripple’s President, stressed the company’s focus on the XRPL EVM sidechain in their Q2 report, citing a collaboration with Axelar to improve interoperability. This strategic move is intended to improve the sidechain’s functioning and expand its use cases.

Also, according to a prior CNF report, Ripple has released 500 million XRP from escrow to an unnamed wallet, reportedly to assist liquidity and potential future initiatives.

Beside that, El Salvador is investigating the usage of XRP and Bitcoin for international trade with Russia, demonstrating the growing interest in Ripple’s solutions. This exploration is consistent with Ripple’s objective of improving cross-border transactions and providing more efficient financial services.

Meanwhile, according to CoinMarketCap, the XRP price is currently around $0.5458, down 4.47% over the last 24 hours. This also reflects a bearish position of 9.58% for the last 7 days.

@ Newshounds News™

Read more: Crypto News Flash, XLRP-Sidechains, U Today, TimesTabloid

~~~~~~~~~

Nizhny Novgorod to Host 8th BRICS Industry Ministers’ Meeting

The BRICS Industry Ministers’ Meeting will take place on 16 August 2024 as part of Russia’s BRICS Chairship in 2024. The event will focus on the development of industrial cooperation between BRICS countries.

The programme will include a BRICS–EAEU–UNIDO roundtable devoted to the synergy of developing economies and international organizations in order to accelerate industrial development and improve competitiveness.

Russian Minister of Industry and Trade Anton Alikhanov will also be available to the media.

The meeting will take place at the Nizhny Novgorod Fair. There will be a press centre for media representatives with a broadcast of the main programme events.

@ Newshounds News™

Read more: BRICs-Rissia 2024

~~~~~~~~~

Important Cardano Update Related to the Network’s Security: Details

“The alpha v1 release is just the beginning of the journey,” the team stated.

▪️Input Output launched the alpha v1 release of the partner chains toolkit for Cardano to enhance network security by leveraging stake pool operators (SPOs).

▪️Despite the disclosure, Cardano’s native token ADA remained around $0.38, with no significant price change.

The Alpha V1 Release

Input Output – a technology company responsible for the research and development of the Cardano blockchain – launched the alpha v1 release of the partner chains toolkit.

The move aims to strengthen the network’s security by enabling developers to leverage Cardano’s extensive network of stake pool operators (SPOs).

“By leveraging SPOs, both new and existing networks can quickly increase their number of validators for a more robust and efficient security paradigm,” the announcement reads.

The process includes a toolkit that offers numerous innovations for developers, such as mixed validator committee, consensus model flexibility, SPO participation, opt-out capability, and more.

At the core of the initiative is “a unique committee selection algorithm” that uses Cardano data to create trusted committees. These innovations are responsible for generating a specified percentage of blocks, thereby improving security for new protocols.

The Input Output team added that the alpha v1 release is just the beginning of a long journey aimed at receiving feedback from the community.

“Stay tuned for some exciting new developments over the coming months, along with a detailed roadmap,” the team concluded.

@ Newshounds News™

Read more: CryptoPotato

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Are You Prepared for Currency Exchanges in a New Gold-Backed System?

Are You Prepared for Currency Exchanges in a New Gold-Backed System?

On August 3, 2024 By Awake-In-3D

New gold-backed digital currencies are coming and learning as much as we can about the future of GCR currency exchanges should be on everyone’s to-do list.

A new and promising financial system alternative is emerging—one that harnesses the intrinsic stability and value of gold-backed digital currency technology.

It has long been my view that a gold-backed component is what will create a significant revaluation (RV) of our GCR currencies and bonds.

Are You Prepared for Currency Exchanges in a New Gold-Backed System?

On August 3, 2024 By Awake-In-3D

New gold-backed digital currencies are coming and learning as much as we can about the future of GCR currency exchanges should be on everyone’s to-do list.

A new and promising financial system alternative is emerging—one that harnesses the intrinsic stability and value of gold-backed digital currency technology.

It has long been my view that a gold-backed component is what will create a significant revaluation (RV) of our GCR currencies and bonds.

Key Takeaways

Understand Gold-Backed Value: Grasp the concept of how gold-backed currencies tie value directly to gold, ensuring more stability compared to fiat currencies.

Learn Transaction Mechanics: Familiarize yourself with the process of direct peer-to-peer transactions in the new system, which bypass traditional banking methods.

Embrace Digital Tools: Utilize modern digital apps and platforms designed for managing and converting gold-backed currency units seamlessly.

Prepare for the Transition: Stay informed and ready for the shift to gold-backed currencies to gain a significant advantage in the evolving financial landscape.

As we all witness the logical conclusion to the Great Global Fiat Currency Debt System experiment, understanding and preparing for the introduction of a new gold-backed currency system alternative becomes essential.

This alternative financial framework, often referred to as the Global Currency Reset (GCR), offers a more stable and reliable store of value by tying currency directly to gold.

Unlike fiat currencies, which are backed only by government promises, gold-backed currencies ensure that the value of money is anchored in a tangible and historically trusted asset.

In the not-too-distant future, we may witness a shift where digital platforms facilitate direct peer-to-peer transactions using gold-backed currency units, bypassing traditional banks and reducing transaction fees.

This system promises greater transparency and security, making financial exchanges simpler and more efficient.

This article explores the mechanics of how GCR currency exchanges might work, providing you with information needed to help understand this impending change.

By familiarizing yourself with these concepts now, you can position yourself advantageously as this new financial paradigm takes shape.

The Basics of Gold-Backed Currencies

Gold-backed currencies are mediums of exchange where the value of the currency is directly tied to a specific amount (weight) of gold. Unlike fiat currencies, which are backed only by government promises, gold-backed currencies offer a tangible asset that provides an intrinsic store of value.

This shift is expected to bring greater stability and reduce the risk of manipulation that plagues our current global fiat currency system.

Why Gold?

Gold has been a symbol of wealth and stability for centuries. Its inherent value, rarity, and universal acceptance make it an ideal foundation for a new financial system. As fiat currencies face devaluation and economic uncertainties, gold offers a safe haven, ensuring that currency retains its value over time.

The Mechanics of Currency Exchange

In the emerging gold-backed system, currency exchanges will look quite different from what we are used to today. Instead of dealing in purely digital or paper money, transactions will involve units that represent a specific amount of gold.

For example, a unit might be equivalent to one gram of gold. This means that the value of your currency is directly tied to the market price of gold, providing a more stable and reliable store of value.

Imagine you have a substantial amount of new gold-backed currency units after an exchange, each based on 1/2 gram of gold. Today, one gram of gold is worth around $75.

As the new system values these units in terms of gold, they will have substantially higher purchasing power when exchanged for pure fiat currencies such as the US Dollar or Euro. This is how the GCR currency revaluation is realized, leading to significant gains in value, especially as the global economy adjusts to this new standard.

Practical Applications

How will this work in practice? Let’s say you want to buy a house. In the new system, you could transfer the gold-backed units directly to the seller without the need for traditional banks. This direct peer-to-peer transaction not only simplifies the process but also reduces fees and eliminates the need for middlemen.

Digital Integration

One of the most exciting aspects of this new system is its integration with modern digital technologies. Apps and desktop platforms will allow users to manage their gold-backed currency units seamlessly.

You can convert your units into local digital currencies, deposit them into your bank, and spend them as you would with any other form of money.

This blend of old-world value (gold) with new-world technology offers a compelling vision of the future of finance.

Future Implications

As the new gold-backed currency system gains traction, we may see a significant shift in how we perceive and use money.

Traditional fiat currencies like the dollar or euro might eventually adopt gold backing to remain competitive. For now, this system offers a robust alternative, promising greater security, transparency, and stability.

Are You Ready?

The transition to a gold-backed currency system is more than just a financial adjustment; it’s a paradigm shift. Understanding how this system works and preparing for its implementation can give you a significant advantage.

Stay tuned to the “Endgame GCR” podcast for more insights and updates on this transformative journey. The future of finance is golden, and now is the time to get prepared.

Many more details and examples of the new gold-backed currency system and RV/GCR exchanges are discussed in Episode 3 (links below).

Podcast on YouTube: Endgame GCR Episode 3 (YouTube)

Podcast on Rumble: Endgame GCR Episode 3 (Rumble)

=======================================

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Insiders Sell Billions In Stocks | David Morgan

Insiders Sell Billions In Stocks | David Morgan

Liberty and Finance: 8-3-2024

David Morgan expresses concerns about the stock market, noting that insiders like Warren Buffett and Jeff Bezos are selling stocks, potentially indicating a peak.

He suggests investors may want to consider reducing their stock market exposure. In the metals market, Morgan observes that gold and silver face challenges breaking past certain price points, anticipating more downward pressure due to seasonal trends but expecting a stronger performance in late 2024 and into 2025.

Insiders Sell Billions In Stocks | David Morgan

Liberty and Finance: 8-3-2024

David Morgan expresses concerns about the stock market, noting that insiders like Warren Buffett and Jeff Bezos are selling stocks, potentially indicating a peak.

He suggests investors may want to consider reducing their stock market exposure. In the metals market, Morgan observes that gold and silver face challenges breaking past certain price points, anticipating more downward pressure due to seasonal trends but expecting a stronger performance in late 2024 and into 2025.

Morgan also highlights the impact of economic conditions on crime rates, using In-N-Out Burger's closure in Oakland due to safety concerns as an example.

He suggests that rising crime rates reflect deteriorating economic conditions, especially in states like California. Additionally, Morgan discusses the potential impact of geopolitical conflicts on silver demand, emphasizing military and technological needs could consume the supply.

He also advocates for maintaining a constitutional republic in the U.S., arguing that preserving founding principles is crucial to prevent societal collapse.

INTERVIEW TIMELINE:

0:00 Intro

1:20 Gold & silver update

4:55 Recession ahead

9:00 Gold vs stock market

12:00 Silver & geopolitical conflicts

13:48 Industrial demand for silver

17:17 $50 Silver?

RV/GCR Currency Exchanges in the QFS: Awake-In-3D Podcast

RV/GCR Currency Exchanges in the QFS

On August 1, 2024 By Awake-In-3D

If you’ve ever wondered about currency exchanges in the QFS and how it could work, this episode is for you.

In this episode of the “Endgame GCR” Podcast, hosts Awake-In-3D and Marie G. discuss currency exchanges, gold currency revaluations and how it all could work in the QFS (Quantum Financial System ).

The conversation builds on previous podcast episodes, offering listeners a deeper understanding of how the Global Currency Reset (GCR) and related technologies might unfold in practical terms.

We present several, real-world scenarios in simple, easy to understand examples.

RV/GCR Currency Exchanges in the QFS

On August 1, 2024 By Awake-In-3D

If you’ve ever wondered about currency exchanges in the QFS and how it could work, this episode is for you.

In this episode of the “Endgame GCR” Podcast, hosts Awake-In-3D and Marie G. discuss currency exchanges, gold currency revaluations and how it all could work in the QFS (Quantum Financial System ).

The conversation builds on previous podcast episodes, offering listeners a deeper understanding of how the Global Currency Reset (GCR) and related technologies might unfold in practical terms.

We present several, real-world scenarios in simple, easy to understand examples.

IN THIS EPISODE:

GCR Gold, Digital Currencies, and the QFS

Dispelling QFS myths and sharing concrete, real-world developments

Explanation of FinTech (Finance Technology)

Importance of gold in backing in the QFS

The QFS alternative to the current fiat currency system

Clarifying misconceptions about QFS and quantum computing

QFS as a decentralized ledger system

Sovereign Digital Currencies vs. Central Bank Digital Currencies (CBDCs)

How exchanges and redemptions could work in the QFS

Bypassing traditional banks with security and transparency of the QFS

Example scenarios of using QFS Gold-backed Units for currency exchanges and spending RV/GCR funds in local currency

Valuation and backing of QFS Gold-backed Units by gold

Role of off-ledger gold in the GCR alternative currency system

Potential value appreciation of QFS Gold-backed Units

Digital and tokenized ownership transfers

Simplified, fee-free transactions without middlemen

Future implications for traditional banking and loans

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Podcast now available on the GCR Real-Time News YouTube Channel

Seeds of Wisdom RV and Economic Updates Sunday Morning 8-4-24

Good Morning Dinar Recaps,

OpenEden Introduces Tokenized US Treasury Bills onto the XRP Ledger

"Tokenization platform OpenEden has announced that it will bring tokenized US Treasury bills (T-bills), a short-term US government debt obligation backed by the US Department of the Treasury, to the XRP Ledger (XRPL) and its users for the first time."

"The tokenization of T-bills onto the XRPL is a demonstration of how institutional access to decentralized finance (DeFi) is being driven by the tokenization of traditional real-world assets (RWAs).

The assets backing OpenEden’s TBILL tokens are invested in short-dated US T-bills and reverse repurchase agreements collateralized by US Treasuries. Minters are subject to stringent KYC and AML screening to ensure the highest security and regulatory compliance standards."

Good Morning Dinar Recaps,

OpenEden Introduces Tokenized US Treasury Bills onto the XRP Ledger

"Tokenization platform OpenEden has announced that it will bring tokenized US Treasury bills (T-bills), a short-term US government debt obligation backed by the US Department of the Treasury, to the XRP Ledger (XRPL) and its users for the first time."

"The tokenization of T-bills onto the XRPL is a demonstration of how institutional access to decentralized finance (DeFi) is being driven by the tokenization of traditional real-world assets (RWAs).

The assets backing OpenEden’s TBILL tokens are invested in short-dated US T-bills and reverse repurchase agreements collateralized by US Treasuries. Minters are subject to stringent KYC and AML screening to ensure the highest security and regulatory compliance standards."

"Ripple, the leader in enterprise blockchain and crypto solutions, will also allocate USD$10 million into OpenEden’s TBILL tokens. This is part of a larger fund that Ripple will allocate to tokenized T-bills provided by OpenEden and other issuers."

"OpenEden’s tokenized US Treasury bills represent another exciting example of how all types of real-world assets are being tokenized to drive utility and new opportunities," said Markus Infanger, Senior Vice President, RippleX.

"Institutions are increasingly looking at where to tokenize their real-world assets and the arrival of T-bills on the XRPL powered by OpenEden reinforces the decentralized Layer 1 blockchain as one of the leading blockchains for real-world asset tokenization.”

"Bringing tokenized T-bills to the XRP Ledger is the next step in our exciting journey. Purchasers will be able to mint our TBILL tokens via STABLECOINS, including Ripple USD when it launches later this year.”

"Ripple also recently announced its work with Archax, the UK’s first Financial Conduct Authority regulated digital asset exchange, broker and custodian, that plans to bring hundreds of millions of dollars of tokenized real world assets (RWAs) onto the XRPL over the coming year."

@ Newshounds News™

Read more: Ripple

~~~~~~~~~

Earn 4.97%* U.S. Treasury yields on-chain

"The only tokenized U.S. Treasury product with an “A” rating from Moody’s."

Moody’s Credit Rating

OpenEden’s TBILL is the first and only tokenized product to receive an “investment grade” rating by Moody’s.

"Gain exposure to U.S. Treasuries without the constraints of U.S. trading hours. TBILL token holders enjoy 24/7 minting & redemption, thanks to smart contracts. DeFi projects can build on TBILL's ERC-20 tokens."

TBILL tokens are audited, transparent, and verifiable

"Like you, we live by “don’t trust, verify”. Which is why we launched the market’s first proof-of-reserves that combines off-chain and on-chain auditability. Here is how we open the books."

@ Newshounds News™

Read more: Open Eden

~~~~~~~~~

The OpenEden TBILL tokens are ETHEREUM-BASED ERC-20 standards that are TRANSFERABLE between different blockchain wallets.

"Former senior officials at the Gemini crypto exchange announced that OpenEden, a decentralized finance (DeFi) platform, had launched the first smart contract vault to offer access to US Treasury Bills (T-Bills). According to the announcement, OpenEden will enable stablecoins holders to mint Treasury Bills (T-BILL) tokens through the OpenEden T-BILL Vaul. "

"According to OpenEden, the TBILL tokens are Ethereum-based ERC-20 standards that are transferable between different blockchain wallets."

"There is around $130 billion worth of stablecoins sitting on the sidelines and not generating any meaningful yield. As DeFi yields continue to lag further behind traditional financial asset yields, there is a growing demand for institutional-grade DeFi products that offer low-risk, liquid, and transparent returns to stablecoin holders.”

"By tokenizing real-world assets, OpenEden hopes to open up the blockchain industry to a $300 trillion market that is yet to be tapped on a global scale. Moreover, the cryptocurrency market is about $1 trillion despite being in existence for the past 14 years."

@ Newshounds News™

Read more: Coin Speaker

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Sunday Morning 8-4-2024

TNT:

Tishwash: US Treasury Takes Control of Iraq's Central Bank to Combat Money Laundering

Three informed sources close to the political and parliamentary decision-making process in Baghdad revealed extremely dangerous information confirming that the US Treasury Department has taken a permanent headquarters in the Central Bank of Iraq building.

They considered that this step came as a result of the great pressures on the Iraqi banking system with the aim of limiting money laundering and dollar smuggling, as the governor of the Central Bank was forced to allocate an entire floor for US Treasury departments to monitor money transfers and prevent any illegal activities.

TNT:

Tishwash: US Treasury Takes Control of Iraq's Central Bank to Combat Money Laundering

Three informed sources close to the political and parliamentary decision-making process in Baghdad revealed extremely dangerous information confirming that the US Treasury Department has taken a permanent headquarters in the Central Bank of Iraq building.

They considered that this step came as a result of the great pressures on the Iraqi banking system with the aim of limiting money laundering and dollar smuggling, as the governor of the Central Bank was forced to allocate an entire floor for US Treasury departments to monitor money transfers and prevent any illegal activities.

The three sources confirmed that a team of American employees is working permanently at the Central Bank of Iraq, as part of intensive efforts to ensure Iraq's commitment to international standards for combating money laundering and terrorist financing.

The sources stressed that the Iraqi banking sector is suffering from increasing pressures exerted by the US Treasury to prevent the smuggling of dollars to countries such as Iran, Russia and Syria, which are facing economic sanctions.

One of the sources explained that the governor of the Central Bank of Iraq tried to resist these restrictions, but the American response was strict, as the Central Bank of Iraq was included among the institutions considered to support money laundering operations and failure to comply with sanctions.

In previous reports, the US Treasury imposed severe sanctions on several Iraqi banks, on charges of involvement in money laundering and dollar smuggling. The policy of the Central Bank of Iraq is characterized by randomness and the absence of a clear strategic plan to protect Iraq's money from smuggling, which prompted the US Treasury to impose strict and direct control over the Central Bank and Iraqi banks.

Iraqi banks are currently undergoing a rigorous evaluation process under the supervision of the US Treasury Department, which includes monitoring all banking operations and money transfers. This situation reflects the great challenges facing the Iraqi banking system in light of the ongoing efforts to reform it and improve its image before the international community.

On the other hand, Prime Minister Mohammed Shia al-Sudani has repeatedly sought to ease these measures, trying to reach understandings with the American side. But there is strong resistance from Washington, which insists on correcting the course of the economic process and reforming the banking system in Iraq. Al-Sudani finds himself in a difficult position, as he must balance internal pressures and international demands.

In a broader context, the current situation reflects the complexity of the relationship between Iraq and the United States in the financial and banking sphere. While Iraq seeks to preserve its sovereignty and the independence of its banking system, the United States continues to exert pressure to ensure that the Iraqi banking system is not used to finance illicit activities. link

************

Tishwash: Legal violations” in the work of the Central Bank prompt demands to replace its governor, Ali Al-Alaq

Today, Saturday, the economic expert, Abbas Al-Bassel, stressed the necessity of replacing the Governor of the Central Bank of Iraq, Ali Mohsen Al-Alaq, in light of the violations committed by the Central Bank against the constitution and the law.

Al-Basel told Al-Jarida, “When Al-Alaq was brought in, the work of the corrupt whales among the politicians became active, as they invested in dollars and the private sector was terminated, while the Central Bank imposed unnatural complications by launching a campaign against simple shops and kiosks in the markets of Shorja and Karrada, and preventing the sale of electrical and food supplies and even clothing in dollars, and taking pledges from shop owners to prevent dealing in dollars, and punishing them in the event of a violation, in procedures that have no legal ceiling or a judge’s decision, so the Central Bank violated the constitution and the law.”

Al-Bassel added, "The dollar is currently on the rise, at a time when there is no official announcement by the Central Bank about the volume of remittances leaving the country, so Ali Al-Alaq must be replaced with a professional, non-partisan figure." link

************

Tishwash: Al-Fath: Foreign banks in Iraq do not have cash value

Today, Saturday, member of the Al-Fatah Alliance, Mahmoud Al-Hayani, revealed the presence of large corruption files within the Iraqi banking business and the involvement of major figures, while confirming that foreign banks in Iraq do not have monetary value that benefits Iraq.

Al-Hayani said in a statement to the Maalouma Agency, “Foreign and Jordanian banks in particular do not have through which they can supply the Iraqi market funds with the monetary mass, and their presence inside Iraq does more harm than good,” noting that “The Central Bank of Iraq was unable to find solutions and did not rise to the level.” "Required".

He continued, "The reason for the entry of foreign banks into the country is due to American dictates exercised on the Central Bank in order to grant them licenses to operate in Iraq according to special privileges," pointing out that, "The Iraqi government needs support from the political forces and concerted efforts in order to distance the banking business from suspicion.” And corruption.”

The economic expert, Mustafa Akram Hantoush, had confirmed that the measure taken by the Central Bank of Iraq was to grant business licenses to Jordanian banks and operate in the country, indicating that it was the duty of the Central Bank to strengthen Iraqi banks instead of Jordanian ones. link

************

Repeated violations of sovereignty and the presence of the international coalition put Iraqi military leaders before two bitter choices

Academic Talib Mohammed commented on Wednesday on the repeated violation of national sovereignty with the escalation of demands to end the foreign military presence, especially the American one, in Iraq.

He pointed out that Iraqi military leaders are confused between declaring readiness and bearing the consequences of that, or confirming the need for the international coalition and bearing various charges, which requires strengthening trust between the government, political forces and military leaders in order to reach a decision that they will be held accountable for before the Iraqi people and history.

“The breach of Iraqi national sovereignty has become a common occurrence, considering that the last strike in Babylon came as part of a series of multiple and qualitative strikes in Iraq. Therefore, Iraqi sovereignty is breached through hostile strikes, whether from neighboring countries or the Zionist entity. The Israeli strikes are linked to an Israeli approach to control and change the nature of the region, meaning imposing force and continuing these strikes until a new political path is achieved in the region, and this path is controlled by Israel and America,” Mohammed told Al-Jarida.

He added, "As for the Iraqi military position, after the victory over terrorist organizations, the last of which was ISIS, it sent a message that the military institution is capable of leading itself, but on the condition of completing the logistical and technical matters, military equipment, and security and military liaison with the international coalition."

He continued, “In light of the presence of political blocs that want to end the foreign military presence in Iraq, especially the American one, the decision in this regard should be issued after studying the situation and the social, popular, economic and political reality to give a mature decision that we will not regret in the future, which requires the Iraqi military leaders to study the situation, whether the Iraqi forces are ready and do not need other countries, and if they are capable, they should announce this to the Iraqi public opinion and this issue depends on the Iraqi Council of Representatives.”

“But the Iraqi military leaders are confused about this aspect,” Mohammed added. “If they confirm readiness and do not need the international coalition, a security breach may occur and they may be blamed for confirming readiness. However, if the military leaders say the opposite, that they need the international coalition, they may be exposed to other accusations. Therefore, there is a need to strengthen trust between the government, political forces, and military leaders in order to reach a decision that they will be held accountable for before the Iraqi people and history.” link

Mot: ........ Planning Ahead

News, Rumors and Opinions Sunday AM 8-4-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 4 Aug. 2024

Compiled Sun. 4 Aug. 2024 12:01 am EST by Judy Byington,

As The Global Financial Bubble Popped

US Stock Market Collapsing

Banks Closing

It’s only wise to have at least a month’s supply of food, water, cash, medicine and essential items on hand for yourself, your family and to share with others in case of emergency.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 4 Aug. 2024

Compiled Sun. 4 Aug. 2024 12:01 am EST by Judy Byington,

As The Global Financial Bubble Popped

US Stock Market Collapsing

Banks Closing

It’s only wise to have at least a month’s supply of food, water, cash, medicine and essential items on hand for yourself, your family and to share with others in case of emergency.

Global Financial Crisis:

Sat. 3 Aug. 2024 CBDC: The GM of The Bank of International Settlements (top of the tree of global banking) explains they can’t control the use of cash, but they can control digital currency! CBDCs will give governments total power over citizens if cash is discontinued.

Sat. 3 Aug. 2024 BRICS calls on the Middle East to stop using the US dollar for oil trade.

Sat. 3 Aug. 2024 Are the fiat currency financial system Domino’s ready to fall this coming week?

Warren Buffett has recently sold approximately 50% of his Apple shares, signaling a significant shift in his investment strategy.

Meanwhile, the NASDAQ has entered a correction phase, and the S&P 500 is only 4% away from a similar correction.

In contrast, gold prices have surged to a record high, reflecting growing economic uncertainty.

The U.S. Economy is now officially in a recession according to the Sahm rule, and economic forecasts predict four interest rate cuts in 2024 to combat the downturn.

Market volatility has increased dramatically, doubling in the last three weeks, while inflation remains stubbornly high.

Unemployment rates are also on the rise, adding to the economic woes.

Despite these challenges, billionaires who sold their assets at market peaks are seemingly untroubled.

It’s going to be a turbulent week ahead for the fiat currency financial debt system…. so break out the popcorn! https://x.com/grdecter/status/1819865369885933976?s=46&t=P2Ls81hs8j9RD7M6kNgOvw

Thurs. 1 Aug. 2024:

On Thurs. 1 Aug. the US stock market took a three trillion dollar hit.

In the 21st century the Stock Market has crashed in the years 2000, 2008, 2020 (Dot Com Bubble, Housing Crisis, and Covid Recession) (These were all election years)

War and a global recession is not farfetched. Pray. Keep your eyes peeled. Watch these things, but don’t let it consume you.

Read full post here: https://dinarchronicles.com/2024/08/04/restored-republic-via-a-gcr-update-as-of-august-4-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Everybody's pretty much pumped, pretty much excited because the news that's been coming in is off the charts. Saleh has been out for the last couple of weeks educating everybody... reiterating why they do what they do...and how they do it. Economists coming out talking about what they believe the Central Bank of Iraq is dealing with with the Federal Reserve Bank, United States Treasury. You can see these guys are serious...

MarkZ & Militia Man [via PDK] MarkZ: Have you heard anything about Iraq’s ascension into the WTO? Militia Man: Iraq is going to need to trade cross-borders. The Iraqi dinar is not yet on the forex with a REER. (Real Effective Exchange Rate) With the Ayuscuda cross border system …I think it’s ready to go. MarkZ: I also think it’s ready to go. But how long can they go without a new rate? They have not published the budget tables yet…. I think they are hiding it because the new rate is in it to do all those new projects.

ShelbyMac2.0, [From Mike Bara]

Today, a contact went to the bank (Big 4) to buy more currency. He was told by the manager, who acknowledges the RV, not to bother, because he would return to exchange in "two days."

The same contact was also told that "this week" the market would drop "2,000 points." That's not enough to make an impact. I think he misheard and was told the market would drop TO 2,000 POINTS!! Don't forget, Andy Schectman predicted this in my interview with him two weeks ago. (link below

He said the US markets could drop to the value of Gold, which is around $2,454 an ounce.

Also hearing the Crowdstrike hackers got access to the crash protection algorithms, and that when the plunge begins, they won't be able to halt trading. This is how it will be portrayed anyway.

https://mikebara.blogspot.com/2024/07/the-new-gold-standard-with-mike-bara.html

************

The LAST Layer Of Consumer Confidence Is BREAKING

Lynette Zang: 8-3-2024

In today's video we are discussing consumer sentiment, the massive dip in consumer trust and what that means for the economy and you...

“Financial System and Market Crash “News and Views” 8-3-2024

Bank Reserves: The Ghost Of Bad Debt | Rafi Farber

Liberty and Finance: 8-2-2024

For more than a decade, the Federal Reserve has effectively been propping up banks by replacing their toxic debt with new currency. According to Rafi Farber these bank reserves are akin to "the ghost of bad debt."

Farber anticipates an imminent crisis within the banking sector, which he predicts will precipitate a financial calamity surpassing the severity of those seen in 2008 or 2020.

In his analysis, Farber outlines strategies for preparing for this potential financial upheaval. He emphasizes the importance of diversifying investments, safeguarding assets in tangible forms, and staying vigilant about shifts in the financial landscape.

Bank Reserves: The Ghost Of Bad Debt | Rafi Farber

Liberty and Finance: 8-2-2024

For more than a decade, the Federal Reserve has effectively been propping up banks by replacing their toxic debt with new currency. According to Rafi Farber these bank reserves are akin to "the ghost of bad debt."

Farber anticipates an imminent crisis within the banking sector, which he predicts will precipitate a financial calamity surpassing the severity of those seen in 2008 or 2020.

In his analysis, Farber outlines strategies for preparing for this potential financial upheaval. He emphasizes the importance of diversifying investments, safeguarding assets in tangible forms, and staying vigilant about shifts in the financial landscape.

‘Armageddon’ Here? Why Markets Are Crashing Right Now | Clem Chambers

David Lin: 8-2-2024

Clem Chambers, CEO of Online Blockchain, discusses the latest jobs report and the market response.

0:00 - Market reaction to jobs report

5:50 - Yen/USD vs. stocks

7:35 - Will market crash continue?

11:00 - VIX

13:11 - Russell 2000

14:50 - Market rotation

18:10 - How to play 'uncertainty'

19:40 - Rate cut vs. stocks

27:10 – Bitcoin

Ariel: Market Crash

People, Donald Trump has always stated for years that in order for emerging economies in the Middle East to thrive the artificial value of the fiat USD must come down. This is what is suppressing everything. A market crash will help facilitate the much needed reinstatement.

This is why countries around the world are waiting with bated breath for this event. Thus is why Saudi Arabia on June 9th no longer accepted oil contracts to be denominated in fiat USD.

Henry Kissinger was the one who flew over there to make that deal in exchange for military protection and other things.His death was a sign that the regime was coming to an end.

This is why Iraq is setting up their own trade routes to compete with the Suez Canal. Their market will have a robust trade connection to the Asian markets. Israel tried to prevent this at every turn. Which is why ISIS/DAESH was created to cause instability in Iraq.

Because in order for the monetary reforms to work certain conditions had to be met with IMF that required Security & Stability in Baghdad. This is why BRICS Nations must have a national currency in order to join. You guys have to understand how much the fiat USD have caused 3rd world countries who were forced to use it.

I’m getting off topic but you know what I am getting at. We need a market crash in order for Iraq to be able to afford to compete against 1st world countries. Luckily you have IQD where you will be able to participate in the reinstatement.

You already know what this means. I told you the fiat USD has to fall in order for developing economies to prosper. One of them is Iraq.

Ariel

************

Trillions Lost: Jobs Bombshell Triggers “Slow Motion Collapse” As US Recession Risk Escalates

Sean Foo: 8-3-2024

The US stock meltdown just got worse with over $3 trillion dollars destroyed. Investors are losing steam and the fundamentals of the US economy is cracking.

The recent jobs report, massive layoffs and unemployment data just smashed the soft-landing narrative. We are in for a slow-motion collapse.

Timestamps & Chapters:

0:00 Stocks $3 Trillion Sell-Off

2:39 Jobs Shock & Massive Layoffs

5:43 Fed Rate Cut Nightmare

8:54 Big Market Collapse Risk

12:03 The Risk Is Global