More News, Rumors and Opinions Wednesday PM 6-12-2024

KTFA:

Clare: Saudi Arabia's petro-dollar exit: A global finance paradigm shift

10 Jun 2024

The financial world is bracing for a significant upheaval following Saudi Arabia's decision not to renew its 50-year petro-dollar deal with the United States, which expired on Sunday, 9 June, 2024.

The lapsed security agreement - signed by the United States and Saudi Arabia on 8 June 1974 - establishes two joint commissions, one on economic co-operation and the other on Saudi Arabia's military needs, and was said to have heralded an era of increasingly close co-operation between the two countries.

American officials at the time expressed optimism that the deal would motivate Saudi Arabia to ramp up its oil production. They also envisioned it as a blueprint for fostering economic collaboration between Washington and other Arab countries.

KTFA:

Clare: Saudi Arabia's petro-dollar exit: A global finance paradigm shift

10 Jun 2024

The financial world is bracing for a significant upheaval following Saudi Arabia's decision not to renew its 50-year petro-dollar deal with the United States, which expired on Sunday, 9 June, 2024.

The lapsed security agreement - signed by the United States and Saudi Arabia on 8 June 1974 - establishes two joint commissions, one on economic co-operation and the other on Saudi Arabia's military needs, and was said to have heralded an era of increasingly close co-operation between the two countries.

American officials at the time expressed optimism that the deal would motivate Saudi Arabia to ramp up its oil production. They also envisioned it as a blueprint for fostering economic collaboration between Washington and other Arab countries.

The crucial decision to not renew the contract enables Saudi Arabia to sell oil and other goods in multiple currencies, including the Chinese RMB, Euros, Yen, and Yuan, instead of exclusively in US dollars. Additionally, the potential use of digital currencies like Bitcoin may also be considered.

This latest development signifies a major shift away from the petrodollar system established in 1972, when the US decoupled its currency from gold, and is anticipated to hasten the global shift away from the US dollar.

Cross-border CBDC transactions

In a more recent move, Saudi Arabia has announced its involvement in Project mBridge, a project which explores a multi-central bank digital currency (CBDC) platform shared among participating central banks and commercial banks. It is built on distributed ledger technology (DLT) to enable instant cross-border payments settlements, and foreign-exchange transactions.

The project has more than 26 observing members including the South African Reserve Bank, which was greenlighted as a member this month.

The better known observing members of mBridge are those of the Bank of Israel, Bank of Namibia, Bank of France, Central Bank of Bahrain, Central Bank of Egypt, Central Bank of Jordan, European Central Bank, the International Monetary Fund, the Federal Reserve Bank of New York, the Reserve Bank of Australia, and the World Bank.

In tandem, the project steering committee has created a bespoke governance and legal framework, including a rulebook, tailored to match the platform's unique decentralised nature.

Evolution of Project mBridge

Project mBridge is the result of extensive collaboration starting in 2021 between the BIS Innovation Hub, the Bank of Thailand, the Central Bank of the United Arab Emirates, the Digital Currency Institute of the People's Bank of China and the Hong Kong Monetary Authority.

In 2022, a pilot with real-value transactions was conducted. Since then, the mBridge project team has been exploring whether the prototype platform could evolve to become a Minimum Viable Product (MVP) – a stage now reached.

As it enters the MVP stage, Project mBridge is now inviting private-sector firms to propose new solutions and use cases that could help develop the platform and showcase all its potential. LINK

**************

Clare: The Minister of Communications announces a campaign to turn off towers in preparation for switching to fiber optics

6/11/2024 Baghdad

On Tuesday, Minister of Communications Hiyam Al-Yasiri announced the imminent launch of a campaign to extinguish towers in residential areas in preparation for the transition to the fiber optic system.

Al-Yasiri said in a statement, reported by the official news agency, and seen by Al-Iqtisad News, that “the Ministry intends to implement a campaign to extinguish the towers in coordination with the relevant security authorities, and according to the schedules set for them, after which it will switch to the fiber-optic system.”

She added, "There will be no losses to tower owners or unplanned extinguishing, as the companies operating on FTTH lines have completed their work in dozens of Iraqi regions in preparation for extinguishing those towers, and there is a detailed scheduled plan that will be announced in advance to extinguish the Wi-Fi towers." Fi) and converting it to FTTH service, which will be with the consent of the citizen and not compulsory.”

Al-Yasiri continued, “The prices that FTTH will offer will be lower or equal to the prices of Wi-Fi, despite its high cost, but we bear these costs with the companies in order to provide good service to citizens.” LINK

BuckEyeTree: Iraq continues to transform into the modern era with banking and now fiber optics. With security and stability and safety (banking laws against terrorism and corruption), investors / companies will find a good environment to do business.

If I remember correctly from UB2B, "in the coming days" phrase could potentially mean "anyrime." Praying with the blessings to be realized that this will be in the coming "days" or sooner. Big plans for an improved Iraq and for ministries.

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat If you step outside of Iraq, when they finally do reinstate the dinar, the exchange of the three zero notes...will exchange to whatever the currency exchanges i.e. FOREX rate is at the time.

Frank26 [Iraq boots-on-the-ground report] FIREFLY: Parliament is saying we're going to pass the investment law. You're going to see it very soon...

UPDATE: Iraq's Expected Growth by the End of 2024/2025 (MENA)

Nadeer: 6-12-2024

BREAKING: BRICS Says 59 Nations Plan to Join, New Financial System, Dedollarization Priorities

Lrena Petrova: 6-12-2024

Goldilocks' Comments and Global Economic News Wednesday Afternoon 6-12-24

Goldilocks' Comments and Global Economic News Wednesday Afternoon 6-12-24

Good evening Dinar Recaps,

"BASEL COMMITTEE MUST STOP GLOBAL BANKS FROM CONTINUING TO CHEAT ON KEY REGULATORY TESTS AND ENDANGERING FINANCIAL STABILITY" | BetterMarkets

These tests include examinations of the bank's capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to systemic risk.

The above sentence is otherwise known as stress tests. A stress test determines how well a bank is capable of handling a liquidity crisis.

The OCC and FDIC conduct several tests to measure a bank's capacity to withstand transitional periods like we are in at the present time.

Goldilocks' Comments and Global Economic News Wednesday Afternoon 6-12-24

Good evening Dinar Recaps,

"BASEL COMMITTEE MUST STOP GLOBAL BANKS FROM CONTINUING TO CHEAT ON KEY REGULATORY TESTS AND ENDANGERING FINANCIAL STABILITY" | BetterMarkets

These tests include examinations of the bank's capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to systemic risk.

The above sentence is otherwise known as stress tests. A stress test determines how well a bank is capable of handling a liquidity crisis.

The OCC and FDIC conduct several tests to measure a bank's capacity to withstand transitional periods like we are in at the present time.

These tests are conducted to prevent crisis interventions and collapse situations that could become a contagion to other Banks.

Tighter controls on the new digital banking system are not only expected, but they will determine the compliance level a bank has in their standing going forward. BetterMarkets

© Goldilocks

~~~~~~~~~

BRICS: BRICS calls for enhanced use of local currencies in trade between member countries - The Economic Times

~~~~~~~~~

Joint Statement of the BRICS Ministers of Foreign Affairs/International Relations, Nizhny Novgorod, Russian Federation, 10 June 2024 - The Ministry of Foreign Affairs of the Russian Federation | Ministry of Foreign Affairs

~~~~~~~~~

Call to Action: ISSB Global Adoption

"The International Sustainability Standards Board (ISSB) is an independent, private-sector organization that develops and approves IFRS Sustainability Disclosure Standards."

The International Financial Reporting Standards are intended to make financial statements consistent, transparent, and comparable around the world.

The IFRS S1 and IFRS S2 are climate standards on an economy looking to be accepted on a world wide basis by 2025.

"IFRS S1 requires companies to disclose material information on all sustainability-related risks and opportunities that could reasonably be expected to affect their prospects. IFRS S2 sets out the requirements for climate-related disclosures."

Sustainability-related risks deal primarily with liquidity issues surrounding the banking system such as Governmental risks and economic factors.

Greenhouse gas (GHG) emissions is a climate-related risk. It is a climate related disclosure being proposed, and how, the banking system will be a part of managing those risks ie car loans.

Many compliance rules are expected to shift inside the new digital economy along with climate risks that will affect banking operations. This is one of the new adaptations that is being called for to help us adjust to our changing world.

As you can see from the previous article, new changes are being developed and governed by the ruling bodies above and beyond the banking system to recommit their International compliance standards inside this new digital banking system. CorpGovLaw EY IFRS PWC Zurich

© Goldilocks

~~~~~~~~~

National and International governing bodies are starting to get involved with their new policies that will govern the new digital banking system.

This gives us an indication that the governing bodies of our new banking system are beginning to shift their attention to new rules and regulations that will move our money going forward.

© Goldilocks

~~~~~~~~~

How will Europe's elections impact digital euro legislation? - Ledger Insights - blockchain for enterprise

~~~~~~~~~

Russia intends to perform its first cross-border payments using the digital ruble in the second half of 2025. Central bank digital currency (CBDC) transactions with China or Belarus are on the cards. That’s according to Anatoly Aksakov, who chairs the Financial Markets Committee of Russia’s State Duma. | LedgerInsights

~~~~~~~~~

Panel perspectives: Navigating the new waves of supply chain finance | TradeFinanceGlobal

~~~~~~~~~

Project Cedar, Explained (Wholesale Central Bank Digital Currency Prototype). How the 7 trillion dollar a day Forex Market will move its money. | Youtube

~~~~~~~~~

We are moving from a World Reserve Asset transaction to Central Bank Digital Ledger Technological (blockchain) transactions.

© Goldilocks

~~~~~~~~~

~~~~~~~~~

🚨BREAKING: BRICS Says 59 Nations Plan to Join, New Financial System, Dedollarization Priorities | Youtube

~~~~~~~~~

A Distributed Systems Reading List | Ferd CA

~~~~~~~~~

Putin Says BRICS Developing Independent Payment System Free From Political Pressure – Featured Bitcoin News

~~~~~~~~~

Ripple Completes Acquisition of Standard Custody & Trust Company – News Bytes Bitcoin News

~~~~~~~~~

Saudi Arabia's petro-dollar exit: A global finance paradigm shift | The Business Standard

~~~~~~~~~

Russia’s Moscow Exchange to stop trading in dollars after latest US sanctions | ARA TV

~~~~~~~~~

~~~~~~~~~

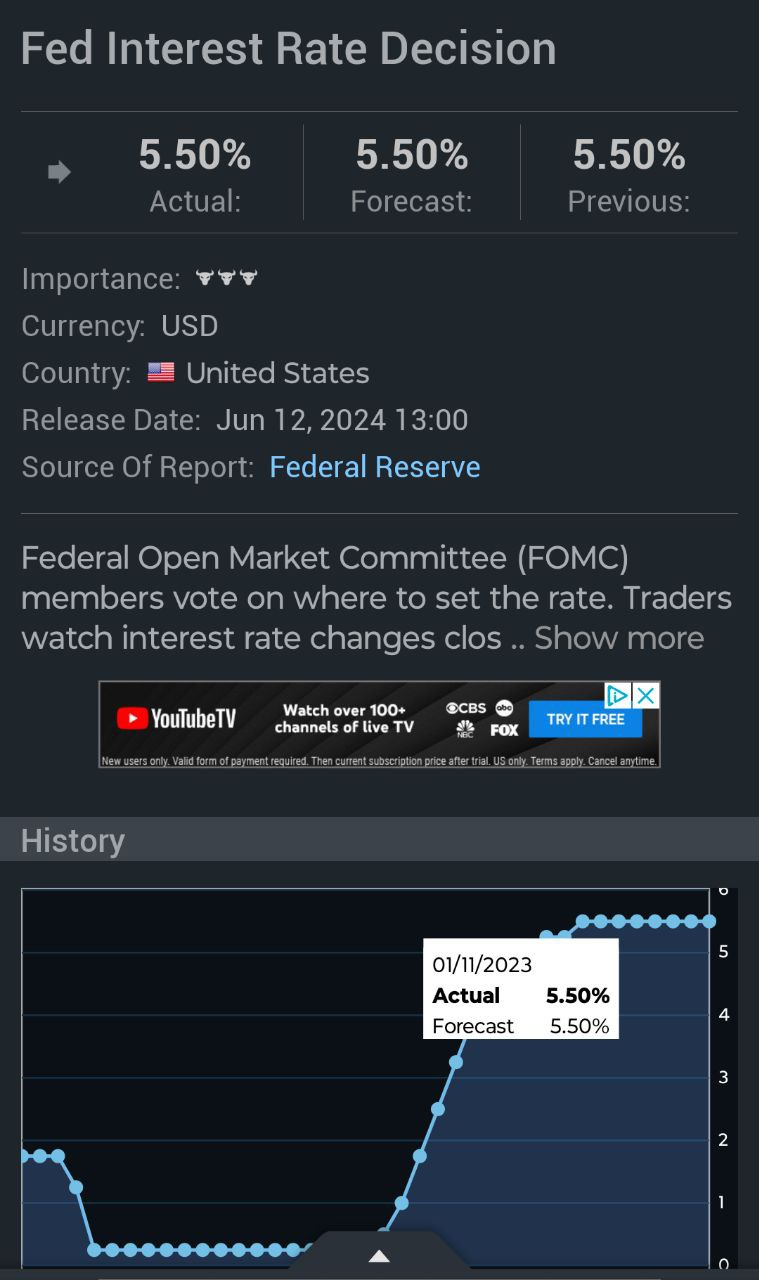

FOMC Press Conference June 12, 2024 | Youtube

~~~~~~~~~

~~~~~~~~~

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

America is in “A Bad Place”; Gold Can Restore Its Prosperity Says Judy Shelton

America is in “A Bad Place”; Gold Can Restore Its Prosperity Says Trump Fed Nominee

Daniella Cambone: 6-12-2024

“You can't have sound money without sound finances,” says Judy Shelton, monetary economist, author of “Money Meltdown,” and former economic advisor to Donald Trump.

In an exclusive interview with Daniela Cambone, Shelton explains the rationale behind a gold standard argument, detailing how issuing a gold-backed bond may be the pathway to it.

“I don't know how people talk about free trade without addressing currency gyrations and how they impact trade,” she says.

Additionally, she warns that the fate of the U.S. may be similar to what happened to the Soviet Union with insurmountable debt. “Is the US still going to be here in 50 years? At the rate of the unsustainability in terms of the fiscal and monetary situation that you opened with, I don't see how.”

Tune in for this insightful discussion on the future of the U.S. economy and the potential return to a gold standard.

America is in “A Bad Place”; Gold Can Restore Its Prosperity Says Trump Fed Nominee

Daniella Cambone: 6-12-2024

“You can't have sound money without sound finances,” says Judy Shelton, monetary economist, author of “Money Meltdown,” and former economic advisor to Donald Trump.

In an exclusive interview with Daniela Cambone, Shelton explains the rationale behind a gold standard argument, detailing how issuing a gold-backed bond may be the pathway to it.

“I don't know how people talk about free trade without addressing currency gyrations and how they impact trade,” she says.

Additionally, she warns that the fate of the U.S. may be similar to what happened to the Soviet Union with insurmountable debt. “Is the US still going to be here in 50 years? At the rate of the unsustainability in terms of the fiscal and monetary situation that you opened with, I don't see how.”

Tune in for this insightful discussion on the future of the U.S. economy and the potential return to a gold standard.

“Tidbits From TNT” Wednesday 6-12-2024

TNT:

Tishwash: Kuwait connects its “Fiber” network to Iraq

The Kuwaiti telecommunications company Zajil, revealed that its “Fiber” network had been delivered to the borders of the two countries with Iraq. The advisor to the company’s board of directors, Engineer Walid Saleh Al-Qallaf, told “Al-Sabah”: “The company is currently working on connecting from Kuwait to Al-Faw directly,” indicating “the operation of the Safwan port, which will be followed by the operation of the Al-Faw port, so that Iraq will be a major corridor for passing the network, not only in the Gulf.” But for the countries of East Asia, it will be synonymous with the Egyptian corridor.”

He added, "The Iraqi corridor needs full encouragement and government support to make it successful, as it is necessary and fundamental to the completion of these projects," noting that "Iraq has become the focus of attention of countries and major international companies due to the incidents that took place in the Red Sea and the fear of the cessation of communications through this corridor."

TNT:

Tishwash: Kuwait connects its “Fiber” network to Iraq

The Kuwaiti telecommunications company Zajil, revealed that its “Fiber” network had been delivered to the borders of the two countries with Iraq.

The advisor to the company’s board of directors, Engineer Walid Saleh Al-Qallaf, told “Al-Sabah”: “The company is currently working on connecting from Kuwait to Al-Faw directly,” indicating “the operation of the Safwan port, which will be followed by the operation of the Al-Faw port, so that Iraq will be a major corridor for passing the network, not only in the Gulf.” But for the countries of East Asia, it will be synonymous with the Egyptian corridor.”

He added, "The Iraqi corridor needs full encouragement and government support to make it successful, as it is necessary and fundamental to the completion of these projects," noting that "Iraq has become the focus of attention of countries and major international companies due to the incidents that took place in the Red Sea and the fear of the cessation of communications through this corridor."

Al-Qallaf stated that “the incidents that took place in the Red Sea are a warning bell to search for a backup corridor for the Suez Canal, as heading towards Iraq was to be a successful corridor for these projects.” link

Tishwash: Iraqis resort to “gold bullion” instead of money, and the banking system is dying

Today, Wednesday (June 12, 2024), financial affairs expert Mustafa Hantoush revealed the reason why Iraqis are resorting to purchasing gold bullion in abundance during the current period.

Hantoush said in an interview with "Baghdad Today" that "recently, the demand for buying gold bullion has increased significantly by citizens, especially those with large sums of money. They have begun to save that money through these bullion instead of depositing their money in banks."

He stated that "the reason why citizens resort to buying gold bullion to save their money is as a result of the weakness of the banking system, lack of confidence in this system, and fear for their money due to American sanctions. This is why we see the majority of Iraqis turning towards gold bullion, especially in light of the high prices of the yellow metal and the stability of this price and its lack of fluctuation like the dollar." .

From mid-December 2022 until now, the Iraqi dinar has continued to fall against the US dollar, until it reached the level of 1,610 dinars against one dollar at a time when the official price of the dollar is 1,300 dinars.

With the decline of the national currency and the rise in poverty and unemployment rates, Iraqi gold markets recorded a large demand from customers to buy the yellow metal amid warnings against buying counterfeit ones.

According to data from the specialized website “Bloomberg” , Iraq bought 33.9 tons of gold in the year 2022, while the Turkish Consul General in Erbil Hakan Karaçay revealed that Iraq imported Turkish gold worth $1.5 billion during the year 2021.

Iraq's gold reserves witnessed a noticeable increase during the month of February 2024, as International Monetary Fund data showed that Iraq had increased its possession of the precious metal by 3,079 tons, bringing the total to 145,661 tons.

This increase indicates Iraq's continued strategy to diversify its foreign reserves and enhance financial and monetary stability in the long term.

This step by Iraq comes at a time when the world is witnessing a rise in gold prices, as the price reached its highest level in its history last month above $2,400 per ounce.

Many simultaneous factors are strengthening the record levels of gold, especially in light of the escalation of geopolitical tensions around the world, and in light of the state of “uncertainty” surrounding the global economy, which supports the trend towards the precious metal as a traditional safe haven in the face of market fluctuations and dire scenarios that impose themselves on the market. the scene.

Iraq is among the countries that possess large amounts of gold reserves in the Arab region, as it ranks fourth after the Kingdom of Saudi Arabia, Algeria, and Morocco link

************

Tishwash: Beijing: Iraq is the third largest Arab trading partner with China

Today, Wednesday, the representative of the Chinese Embassy, the Commercial Counselor of the People's Republic of China in Iraq, Xu Chun, revealed cooperation between the Ministry of Higher Education and Huawei to build the Information Technology Academy, while noting that Iraq is China's third largest trading partner among Arab countries.

During the conference on smart education, in cooperation with Huawei Technology, and attended by the Iraqi News Agency (INA) correspondent, Chun expressed his "happiness to attend the smart education event organized by the Ministry of Higher Education and Scientific Research in Iraq in cooperation with Huawei."

He added, "Iraq is one of the first Arab countries to establish diplomatic relations with China," noting that "the Iraqi government worked to actively manage governance and achieved remarkable results in maintaining social stability, advancing economic reform, and improving infrastructure and public services."

He pointed out that "China is Iraq's largest trading partner and China's third largest trading partner among Arab countries," noting that "the support from the two governments has led to progress in some projects of commercial and social value and a continuous deepening of cooperation in the fields of energy, infrastructure, and others." .

He added, "With the continuous development of information technology and its in-depth application, the demand for digital transformation in Iraq has increased. Since the end of last year, the Iraqi government has given great importance to accelerating the digital transformation process, and there have been a series of developments in the field of electronic passports and other government services."

He continued, "We are pleased to see cooperation between Huawei, the Ministry of Higher Education and Scientific Research, and local universities to build the ICT Academy, which aims to provide online lessons, provide a global exchange and competition platform for teachers and students, encourage students to obtain Huawei's professional and technical certificate, and develop talents." Innovation and technology applied to society and the ICT industry chain.”

He explained, "President of the People's Republic of China, Xi Jinping, stressed in his speech during the opening session of the tenth session of the ministerial meeting of the China-Arab Cooperation Forum, deepening cooperation, following up on the work of the past, paving the way for the future, and accelerating the pace of building the Chinese-Arab community for a common future."

He continued, "The digital age represents the key to accelerating the improvement of the digital infrastructure on a large scale, enhancing the infrastructure of networks, computing and applications in a coordinated manner and linking them with data for continuous economic and social development," expressing his "aspiration for more cooperation with Chinese companies." "To exchange experiences and cooperate with the Iraqi government and companies and actively participate in the digital transformation process in Iraq, in order to continue to advance the strategic partnership relations between China and Iraq to a higher level."

For his part, CEO of Huawei Iraq, William Yang, said: “We are keen to employ our global capabilities and expertise to develop and hone the skills of local talent and provide a full range of education digitization solutions designed for Iraq.”

He continued, "The partnership with the Ministry of Higher Education will provide Iraqi students with access to the latest technologies and recognized certificates in this field, instilling and strengthening a culture of innovation and entrepreneurship, as well as promoting the establishment of an effective smart campus by strengthening the basic education network and simplifying cloud platforms." And implementing smart classroom applications.

He added, "Given our confidence in the excellence of Iraqi talent at the regional and global levels, we are convinced that this cooperation will have a positive and sustainable transformative impact on the information and communications technology sector in Iraq, leading to bridging the digital gap, creating more job opportunities, and driving economic and social growth in Iraq." "The country."

He pointed out that “the Huawei ICT Competition, which is held annually, focuses on developing scientific and technological talent by highlighting realistic practices and needs in the technology sector, as well as urging participants to design innovative solutions that contribute to creating social and commercial value using modern technologies.”

The “Seeds for the Future” program also provides young talents with training courses and participation in international competitions that enhance the presence of intercultural exchange and the transfer of knowledge and experiences,” pointing out that “the programs include activities for graduates that focus on adopting the use of digital technology, in a way that enhances entrepreneurship and supports paths of development and growth.” Various sectors and industries.

He stressed, "Huawei, as a leading global company in providing infrastructure and smart devices for information and communications technology, is committed to putting its capabilities and expertise to develop the information and communications technology sector in the countries in which it operates, and its business strategy aims to harness technology to advance social and economic sustainability in the long term." link

Mot .. Bet Ya Didn't Knows This Stuff!!!

Mot: . oooooooooooh - What a cute little baby porcupine

RV/GCR Heading to the Launchpad: Prepare for a Currency Reset

RV/GCR Heading to the Launchpad: Prepare for a Currency Reset

On June 10, 2024 By Awake-In-3D

BRICS’ new currency will launch a global REVALUATION and challenge RESET the financial system once and for all.

The fiat currency financial landscape stands on the edge of a major shift with the potential for a significant revaluation (RV) and a global currency reset (GCR).

This transformative change is closely tied to the ongoing initiative by the BRICS Alliance to introduce a new gold-backed common trade currency.

RV/GCR Heading to the Launchpad: Prepare for a Currency Reset

On June 10, 2024 By Awake-In-3D

BRICS’ new currency will launch a global REVALUATION and challenge RESET the financial system once and for all.

The fiat currency financial landscape stands on the edge of a major shift with the potential for a significant revaluation (RV) and a global currency reset (GCR).

This transformative change is closely tied to the ongoing initiative by the BRICS Alliance to introduce a new gold-backed common trade currency.

ALSO READ: BRICS Now Dominates Global Oil, Gold and Energy Supplies

The BRICS bloc is increasingly seeking to reduce its reliance on Western G7 currencies, particularly the US dollar, for international trade. The quest for economic sovereignty and financial stability drives these nations to consider a common trade currency.

A significant revaluation of currencies will be a key result of this initiative, profoundly impacting the global financial system.

In This Article

Reducing Reliance on G7 Currencies

The Inadequacy of Existing BRICS Currencies

The Need for a Globally Acceptable Currency

Integration into the Forex Market

Benefits of Gold Backing

Reducing Reliance on G7 Currencies

The dominance of the US dollar and the euro in international trade presents significant challenges for BRICS nations.

Dependence on these currencies exposes BRICS economies to the monetary policies and economic fluctuations of Western nations. This dependence often results in economic instability, as decisions made by the Federal Reserve or the European Central Bank can have far-reaching, negative effects on BRICS economies.

For instance, interest rate hikes in the US can lead to capital outflows from BRICS nations, causing currency devaluations and economic turmoil.

A common trade currency would mitigate these vulnerabilities, providing BRICS members with greater control over their economic destinies and reducing the influence of G7 monetary policies on their economies.

The Inadequacy of Existing BRICS Currencies

None of the individual BRICS currencies—the Chinese yuan, Russian ruble, Indian rupee, Brazilian real, or South African rand—have the global acceptance or liquidity of the US dollar or euro. Each of these currencies has its own set of challenges, including limited international use, lower levels of liquidity, and susceptibility to domestic economic issues.

Relying solely on a basket of these currencies would not solve the problem, as these currencies lack the widespread use and trust needed for efficient international trade.

Additionally, the volatility and varying economic policies of the BRICS nations can lead to instability in the value of these currencies, making them less reliable for international transactions.

The Need for a Globally Acceptable Currency

For BRICS to enhance trade efficiency and efficacy, a new, globally acceptable currency is essential.

This common trade currency (CTC) would be used by all BRICS members for trade among themselves and potentially accepted by many non-BRICS countries, promoting smoother and more reliable cross-border transactions. The CTC would serve as a stable and reliable medium of exchange, reducing transaction costs and exchange rate risks associated with using multiple currencies.

This stability would encourage more countries to engage in trade with BRICS nations, fostering economic growth and cooperation.

Establishing a New Central Bank and Clearing House

To manage the new currency, BRICS would need to establish a central bank facility dedicated to the CTC. This institution would oversee the issuance and regulation of the currency, ensuring its stability and trustworthiness.

The central bank would implement monetary policies to maintain the value of the CTC and manage its reserves of gold and BRICS currencies.

Additionally, a central clearing house similar to the Bank for International Settlements (BIS) would be necessary to facilitate efficient and secure transactions. This clearing house would act as a financial intermediary, ensuring that cross-border transactions are settled smoothly and reducing the risk of fraud and financial mismanagement.

The Structure of the Common Trade Currency

To ensure high fungibility and acceptance, the proposed CTC would be backed by 40% gold and a basket of major BRICS member currencies. This backing would lend stability and credibility to the CTC, making it an attractive option for international trade partners.

Gold, a universally recognized store of value, would enhance the currency’s stability, while the inclusion of BRICS currencies would reflect the economic strengths of the member nations.

The 40% gold backing would provide a solid foundation for the CTC, reducing the risk of inflation and currency devaluation.

The remaining 60% would be backed by a diversified basket of BRICS currencies, ensuring that the CTC reflects the collective economic power of the member nations.

Attracting Non-Member Nations

The gold-backed CTC would appeal to many countries outside the BRICS bloc, except for G7 nations like the US, EU, England, and Canada, which may resist such a shift.

The stability and value offered by gold backing would make the CTC an attractive medium for trade, enhancing its acceptance and use worldwide.

Non-member nations, particularly those in developing regions, would find the CTC to be a reliable alternative to the volatile G7 currencies, fostering economic ties with BRICS nations and reducing their reliance on Western financial systems.

Integration into Forex Markets

The CTC would soon find its way into the Forex market, further solidifying its acceptance and convertibility.

As a stable and reliable currency, it would offer an alternative to the volatile and inflation-prone fiat currencies of the G7 nations.

The integration of the CTC into Forex markets would provide traders and investors with a new instrument for hedging and investment, increasing its liquidity and global acceptance.

Over time, the CTC would become a significant player in the global currency market, challenging the dominance of the US dollar and euro.

Benefits of Gold Backing

Backing the CTC with gold would provide significant advantages.

Gold is a stable store of value, which would reduce inflation and offer superior stability compared to major G7 fiat currencies. The gold backing would make the CTC a reliable hedge against economic uncertainty, attracting international confidence and FDI (Foreign Direct Investment).

Historically, gold has been seen as a safe haven asset during times of economic turmoil. By backing the CTC with gold, BRICS nations can ensure that their currency remains stable and retains its value even during global financial crises.

Stronger BRICS Member Currencies Drives the RV/GCR

A crucial benefit of the Common Trade Currency (CTC) is the significant revaluation (RV) and global currency reset (GCR) it would trigger for BRICS member currencies.

By linking their currencies to a gold-backed CTC, BRICS nations would experience a substantial appreciation (RV) in their exchange rates against G7 fiat currencies.

This revaluation would be driven by the intrinsic value and stability provided by the gold backing, enhancing the global standing of BRICS currencies.

The RV and GCR process would logically unfold as follows:

Gold-Backed Stability: The gold component would provide a stable foundation, reducing inflation and increasing confidence in BRICS currencies. Investors and global markets would recognize the inherent value of a currency backed by a tangible asset like gold.

Increased Demand: As the CTC gains acceptance in international trade, demand for BRICS currencies would rise. This increased demand would naturally lead to an appreciation of their values.

Market Adjustments: Forex markets would adjust to the new reality of a stable, gold-backed currency. Traders and investors would shift their portfolios to include more BRICS currencies, further driving up their values.

Global Acceptance: The widespread acceptance of the CTC would reduce the dominance of the US dollar and euro. As more countries and businesses start using the CTC, the reliance on G7 currencies would diminish, causing a shift in global currency dynamics.

Economic Benefits: The strengthened exchange rates would lead to lower import costs for BRICS nations. This reduction in costs would increase the purchasing power of BRICS citizens and businesses, fostering economic growth and development.

Long-Term Stability: The consistent value provided by the gold backing would ensure long-term stability for BRICS currencies. This stability would attract further investment and trade, reinforcing the positive cycle of currency revaluation and economic growth.

Overall, the introduction of a gold-backed CTC would not only stabilize and strengthen BRICS currencies but also initiate a broader RV and GCR across the global financial system against all purely fiat currencies.

ALSO READ: BRICS Now Dominates Global Oil, Gold and Energy Supplies

This strategic move would reduce dependence on G7 fiat currencies, enhance the economic sovereignty of BRICS nations, and contribute to a more balanced and multipolar global economy.

The Bottom Line

Introducing a common trade currency backed by 40% gold and a basket of BRICS member currencies is a strategic move that could transform international trade for BRICS nations. It would provide economic stability, reduce reliance on G7 currencies, and enhance the global standing of BRICS economies.

The creation of this new currency, supported by robust financial institutions, would mark a significant step towards a more balanced and multipolar global financial system.

The resulting RV of BRICS currencies would have far-reaching implications, including the rapid adoption of gold-backed currencies and the hyperinflation of any remaining fiat currencies – a planet wide GCR.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/how-brics-will-drive-a-global-rv-gcr-explained-in-simple-steps/

News, Rumors and Opinions Wednesday AM 6-12-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 12 June 2024

Compiled Wed. 12 June 2024 12:01 am EST by Judy Byington,

Global Currency Reset: Rumors/Opinions

Tues. 11 June 2024 Wolverine: “It’s official. Brazil has already started. On Wed. 12 June Reno should be releasing the funds. On Thurs. 13 June the Pentecostal Group will shut down.”

Mon. 10 June 2024 MarkZ: “Many of my Bond people are expecting payment Tues or Wed. 11,12 June. Most sources say we will go within three days of when the Bonds go.”

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 12 June 2024

Compiled Wed. 12 June 2024 12:01 am EST by Judy Byington,

Global Currency Reset: Rumors/Opinions

Tues. 11 June 2024 Wolverine: “It’s official. Brazil has already started. On Wed. 12 June Reno should be releasing the funds. On Thurs. 13 June the Pentecostal Group will shut down.”

Mon. 10 June 2024 MarkZ: “Many of my Bond people are expecting payment Tues or Wed. 11,12 June. Most sources say we will go within three days of when the Bonds go.”

Sun. 9 June 2024 Anon: “We learned from our call this afternoon that the PM of Iraq has announced that Iraq has revalued their currency and the rate is over $4.00. We expect to be at the bank by Mon. or Tues. – which may be too early because we have to wait 10 days after they announced the HCL (on June 3) according to today’s info. (which would take it to Thurs. 13 June).”

Tues. 11 June 2024 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#, 667-770-1865

Two sources expect notification tomorrow Wed. 12 June 2024

A connection to the Bond Holders says they should receive their emails tomorrow Wed. 12 June 2024.

~~~~~~~~~~~~~

Wolverine on Mon. 10 June 2024:

According to the intel I am receiving it looks like we are really definitely close.

I have spoken to the director of Mauricio’s platform. They are ecstatic and will have a special announcement soon. His platform is purely humanitarian, Nesara/Gesara.

Last night the intel that came in said: Yesterday I confirmed Paymaster number one to our USA holders. Mon. 10 June he delivers the release codes and keys.

We are very close guys, and what we are hearing that is might be happening actually midweek, probably Wed. or Thurs. 12, 13 June.

Mauricio group has a meeting with someone very important, and they said it is actually going to happen this week. They are not going to mention a date, but it is that close now.

The Pentecostal Group sent a confirmed announcement saying that all platforms will be closed – they will not be selling anymore of the Yellow Dragons. They will close up operations and they are getting ready now.

But we have received notifications for private groups, and these people are more than likely customers of these banks. There was a lot of Intel coming through for notifications.

I heard some people got paid. I cannot confirm that. I received an audio from Brazil that one contact got paid, got it in Spanish. I would need someone to translate it other than me. For if I translate it, people would say I was inventing stuff, so it is better than someone from the audience that speaks Spanish translates it. It is about a minute audio saying that they got paid 1% and they expect the rest during this month to get paid.

Read full post here: https://dinarchronicles.com/2024/06/12/restored-republic-via-a-gcr-update-as-of-june-12-2024/

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Article: "Al-Sudani: Iraq's interest in developing gas projects will provide job opportunities and give the economy added value"

I HAVE ALWAYS SAID THE MOMENT YOU SEE THE HCL, SECONDS LATER YOU WILL SEE THE NEW EXCHANGE RATE!

Walkingstick [Iraqi Bank friend Aki update] In the coming days means at any moment now...the articles are going to be showing pictures of the lower notes. It's also going to give descriptions in the articles of the lower notes...

Militia Man When you drop three zeros it creates value. It's that simple. And when you add a real effective exchange rate to that value that's created from dropping the three zeros, that's when the fireworks begin.

Iraq Seeks $2.5 Billion Missile System NEW EXCHANGE RATES

Edu Matrix: 6-12-2024

Iraq Seeks $2.5 billion Missile System from South Korea - Right now, Iraq has NO air missile system to protect itself or its citizens. Exchange Rates for IQD VND HTG ZiG

BRICS Officially END The Petrodollar: What next?

Fastepo: 6-11-2024

- On June 9th, 2024, Saudi Arabia announced it would not renew the Petro Dollar agreement. This decision reflects a broader trend of de-dollarization, where countries are increasingly seeking to reduce their dependence on the US Dollar for international trade.

This shift is part of Saudi Arabia's strategic move to diversify its economic partnerships and align more closely with emerging economic powers like China and the BRICS nations. In this video, we discuss this breaking news and how it could impact the US economy and dollar valuation.

More News, Rumors and Opinions Tuesday PM 6-11-2024

MikeCristo8: Why the Fiat Dollar Could Suddenly Begin Collapsing

June 10, 2024

MikeCristo8: If you want to understand why the fiat Dollar could begin to suddenly collapse starting tomorrow is…

Turkey (and the rest of the world, poor countries) will be offered a better exchange rate to replace their dollar reserves with China’s RMB digital gold token in the oil trade.

Luke Gromen recently posted a tweet that Gold would replace the U.S. Treasury bond in oil trade settlement.

It’s strictly business for the reason why the dollar may suddenly collapse.

BRICS News @BRICSinfo

JUST IN: Turkey’s foreign minister to travel to Russia on Monday for a meeting with BRICS representatives.

MikeCristo8: Why the Fiat Dollar Could Suddenly Begin Collapsing

June 10, 2024

MikeCristo8: If you want to understand why the fiat Dollar could begin to suddenly collapse starting tomorrow is…

Turkey (and the rest of the world, poor countries) will be offered a better exchange rate to replace their dollar reserves with China’s RMB digital gold token in the oil trade.

Luke Gromen recently posted a tweet that Gold would replace the U.S. Treasury bond in oil trade settlement.

It’s strictly business for the reason why the dollar may suddenly collapse.

BRICS News @BRICSinfo

JUST IN: Turkey’s foreign minister to travel to Russia on Monday for a meeting with BRICS representatives.

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat ...the IMF is not going “lop” the Iraqi dinar. A “lop” is a tool the IMF uses to restart a currency from massive inflation. ...We also have articles for Iraq telling us they WILL NOT lop the dinar. They do not have massive inflation and so this tool of a lop is not necessary. That is why they call it the “project to delete the zeros” and not a ”lop”.

Clare IN 2023 THERE WAS AN APPEAL ON THE ACTUAL BUDGET... BUT WAS RULED OUT THROUGH THE COURTS. THE TRIPARTE BUDGET WAS LEGALLY PASSED, SENT TO THE PRES. WHO SIGNED IT AND WAS PUBLISHED IN THE GAZETTE. Today's Article Quote: "I do not think there will be an appeal, and even if there is an appeal, the budget will be spent, because it was voted on and its issue was decided legally." THERE IS NO APPEAL ON THE BUDGET SCHEDULES THAT WERE JUST PASSED BY PARLIAMENT AND IT WAS NOT NECESSARY TO BE SIGNED BY PRES. BECAUSE THE BUDGET WAS ALREADY PASSED...THE MOJ HAS IT NOW AND WILL PUBLISH WHEN READY.

************

TNT:

CandyKisses: After OPEC’s decision to reduce cuts… Iraq increases its production by 40 thousand barrels per day

Economy News _ Baghdad

Iraq increased its production by 40,000 barrels per day during the month of May, after OPEC’s decision to reduce cuts, according to a survey conducted by S&P Global Commodity Insights on June 10.

The nine OPEC members subject to quotas boosted crude oil production by 100,000 bpd in May, led by Nigeria and Iraq, pushing the group 320,000 bpd above their collective targets, while the bloc's allies led by Russia cut production.

Iraq increased its production by 40,000 barrels per day to reach 4.28 million barrels per day, which is 280,000 barrels per day more than its current target, despite its agreement in May to compensate for the surplus production. The Platts survey estimates current oil production in the Kurdistan Region of Iraq at 210,000 barrels per day.

Iraq's production reached 4.28 million barrels per day, up from the previous month, which reached 4.24 million barrels per day.

LIVE! The Fed's NEXT MOVE Is Going To Be EPIC! "Inflate BY ANY MEANS POSSIBLE."

Greg Mannarino: 6-10-2024

IMPORTANT: US Banking Crisis Will Start Soon As 50%+ Commercial Property Fire Sale Begins

Lena Petrova: 6-11-2024

Five Predictions For The Coming Decade Of Decline

Five Predictions For The Coming Decade Of Decline

Notes From the Field By James Hickman (Simon Black) June 11, 2024

There is a well-known modern proverb (often attributed to the novelist G. Michael Hopf) that goes, "Weak men create hard times, hard times create strong men, strong men create good times, good times create weak men."

The saying sums up the cyclical nature of the rise and fall of societies– and it’s a topic in which I have tremendous personal interest.

Having recently reached middle age, I can comfortably say with the benefit of hindsight that I was born and grew up during the American prime time– the time at which the wealthiest and most powerful country in the history of the world was at its peak.

Five Predictions For The Coming Decade Of Decline

Notes From the Field By James Hickman (Simon Black) June 11, 2024

There is a well-known modern proverb (often attributed to the novelist G. Michael Hopf) that goes, "Weak men create hard times, hard times create strong men, strong men create good times, good times create weak men."

The saying sums up the cyclical nature of the rise and fall of societies– and it’s a topic in which I have tremendous personal interest.

Having recently reached middle age, I can comfortably say with the benefit of hindsight that I was born and grew up during the American prime time– the time at which the wealthiest and most powerful country in the history of the world was at its peak.

The US is still an incredible country with so much prosperity and opportunity. But it would be completely naive and ignorant to claim that America is not in substantial decline.

Its standing in the world has waned, much of it just over the past few years. It’s hard for adversary nations to take you seriously when your President shakes hands with thin air and embassy employees in Kabul have to be evacuated by helicopter.

Financial challenges keep piling up– from the insolvency of Social Security to the $35 trillion national debt to the inflation problem that just won’t go away.

And social divisions, many of which have been bizarrely self-inflicted, seem to grow more tense by the day.

Fortunately, America’s decline began from a historically high peak. So even in its diminished state, again, it is still wealthy and powerful.

But the real concern isn’t where the country is today. It’s the trend, i.e. where the country will end up in ten years’ time if it stays on current course.

I’ve spent the past fifteen years studying similar cases throughout history– the US is far from alone as the only nation that has ever peaked and declined.

And one of the best works on the subject I’ve ever read is The Collapse of Complex Societies, by anthropologist Joseph Tainter.

“Collapse” is a strong word and conjures images of anarchy and death. But Tainter’s definition is more precise; “collapse” doesn’t mean that a society or nation ceases to exist, but that it experiences a steep decline in political, social, and economic stability.

This is what (I believe it’s clear) the US is going through right now, and the trend is accelerating.

Tainter’s book examines the common factors of how different societies throughout history declined– from ancient Mesopotamia to Western Rome. And his analysis shows that one of the key culprits in collapse is the inability of a government to recognize problems… or to solve them.

Many ancient Roman emperors were legendary for failing to recognize the horrible problems brought on by their policies and incompetence– inflation, invasion, etc.

This pretty much describes the US federal government in a nutshell.

Politicians can barely talk about problems in a civil and rational manner. And quite often they refuse to even acknowledge them.

We’ve seen this over and over again with issues such as inflation, the southern border, crime, and social security.

For example, the Social Security trustees publish a report each year stating plainly that the program is going to run out of money by 2033. But no one in Washington wants to talk about it. Joe Biden has even pledged to veto ANY efforts to reform the program.

Biden’s top officials also repeat the bold-faced lie that “the border is secure”, while actively encouraging illegal immigration. The federal government even sued Texas to stop the state from securing the border on its own.

The people in charge demonize and defund police, decriminalize theft, and elect progressive prosecutors who let violent criminals go free.

It’s the same dysfunction with federal spending. These people can’t even acknowledge that a $35 trillion national debt is catastrophic. Most politicians happily ignore it, and others come up with more outrageous spending to further the debt spiral.

They cannot acknowledge the problem, let alone discuss it rationally. Merely passing a budget now routinely devolves into a crisis.

Our view of where this trend leads is clear:

1. Inflation is coming.

There is little hope of responsible spending. The government’s own projections forecast an extra $20 trillion in new debt over the coming decade, and frankly that’s optimistic.

History shows that explosions in national debt are financed by the Federal Reserve creating new money– which ultimately causes inflation.

When the Fed created $5 trillion of new money during the pandemic, we got 9% inflation. How much inflation will $20+ trillion cause?

And the worse inflation becomes, the more urgency the rest of the world will have to replace the dollar as the global reserve currency… which will result in even MORE inflation in the US.

It’s a vicious cycle in which inflation will create more inflation. We project this is 5-7 years away.

2. Social Security is not going to be there for you.

Social Security is not a political problem; it’s an arithmetic problem. And the math just doesn’t add up.

Every year the US Secretary of Treasury signs the report saying plainly that, by 2033, Social Security’s trust funds will run out of money. Benefits will have to be permanently cut by 25% and then become worse over time.

3. Higher taxes are virtually guaranteed.

Politicians love claiming that people should pay their “fair share” but can never quite define how much that means.

And they have already moved the goalposts on who exactly owes society more— the “billionaires” became the top 1%, then quickly shot up to the top 5%, then 10% and soon it will be the top 25%.

Higher taxes won’t just be federal. State and local taxes— from sales tax to property tax— are very likely to cost more, while your governments provide much less.

4. Continued social chaos.

Every time it feels like the lack of civility and unity across Western Civilization can’t get any worse, something new erupts.

The latest is university students screaming “from the river to the sea” and “Just Stop Oil” while defacing artwork and public monuments. Rising tides of socialism and racial animosity never seem to ebb, and idiotic wokeness just won’t go away.

These social divisions will likely continue to grow.

5. Maybe most importantly, major geopolitical disruptions.

As the financial and social decline of the US becomes increasingly obvious to the rest of the world, adversaries are becoming more emboldened.

Nations like China, Russia, North Korea, and Iran are likely to grow more assertive, and there will be significant calls to replace the dollar as the global reserve currency.

Soft war incidents like spy balloons, manufactured pandemics, cyberattacks, etc. will persist— and if we’re very lucky, there won’t be a shooting war. I give it 50/50.

It’s exasperating. Anybody over the age of about 35 remembers a time when it wasn’t like this.

Yet now chaos is the norm. I’m not saying this to be dramatic– it’s important to be intellectually honest.

Part of being intellectually honest means acknowledging that, again, the US is still a great country with an incredibly powerful economy, boasting some of the most valuable businesses in the world.

And Americans still enjoy an extremely high standard of living— albeit one that has been disrupted in recent years by the combination of inflation, crime, and social chaos.

The most exasperating part is that these problems are fixable.

The US government could spend responsibly, encourage capitalism and innovation to grow the economy, and its debt problems would melt away. The dollar would remain valuable. US leadership might even earn back global trust.

But with the current people in charge, I wouldn’t hold my breath. And I also wouldn’t put all my hopes and dreams on the voters smartening up anytime soon.

Yet there are still plenty of solutions that independent-minded individuals can execute without relying on the government.

For example:

Problem: Future inflation will pose a major problem to one’s savings.

Solution: Invest in assets which do well during, or even benefit from, inflation— real assets such as energy, mining, and productive technology. Right now many of these are selling for record low prices, yet poised for substantial growth.

Problem: An overrun border and rising crime rates threaten cities and living standards.

Solution: Obtain a second residency in a foreign country where you really enjoy spending time, or even obtain a second passport. This way you and your family will always have a place to go if the need ever arises.

Problem: Social Security’s trust funds will run out of money within a decade.

Solution: Maximize contributions to retirement accounts— including a special type of 401k which could allow you to double contributions and direct where funds are invested. This lowers your taxable income, puts more money away for retirement, and allows the investments to grow tax-free.

There are solutions for people who, unlike the government, are willing to recognize the problems and actually do something about it.

https://www.schiffsovereign.com/trends/five-predictions-for-the-coming-decade-of-decline-151037/

If you’re feeling a bit overwhelmed and unsure how to get started, I want to take a moment and introduce you to our newest product called Schiff Sovereign Premium.

To Read More: Click here to find out more.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

Goldilocks' Comments and Global Economic News Tuesday Evening 6-11-24

Goldilocks' Comments and Global Economic News Tuesday Evening 6-11-24

Good Evening Dinar Recaps,

"Project mBridge continues its development and has reached the minimum viable product (MVP) stage, while broadening its international reach."

This project has reached its minimum requirements that will allow it to work with early adopters on this Digital Ledger Technology enabling instant payments through cross-border International (CBDC) trades. This system will allow foreign currency exchanges through local currencies.

There are now over 26 observing members and Saudi Arabia has just recently joined as a full participant. This DLT will allow payments to be settled in local currencies of those who are early adopters of this new digital payment system.

Goldilocks' Comments and Global Economic News Tuesday Evening 6-11-24

Good Evening Dinar Recaps,

"Project mBridge continues its development and has reached the minimum viable product (MVP) stage, while broadening its international reach."

This project has reached its minimum requirements that will allow it to work with early adopters on this Digital Ledger Technology enabling instant payments through cross-border International (CBDC) trades. This system will allow foreign currency exchanges through local currencies.

There are now over 26 observing members and Saudi Arabia has just recently joined as a full participant. This DLT will allow payments to be settled in local currencies of those who are early adopters of this new digital payment system.

"Project mBridge is the result of extensive collaboration “starting in 2021 between the BIS Innovation Hub, the Bank of Thailand, the Central Bank of the United Arab Emirates, the Digital Currency Institute of the People’s Bank of China, and the Hong Kong Monetary Authority.”

In 2022, real value transactions took place on a pilot program and were successful. This project has been coordinated with the Bank of International Settlements, and it is expected to be available by mid-2024.

Since mbridge has reached its minimum viable product stage, it is now able to invite the International community to begin interfacing onto this section of the QFS.

© Goldilocks

Crowdfund Insider

As of June 2024, the observing members to Project mBridge include: Asian Infrastructure Investment Bank, Bangko Sentral ng Pilipinas; Bank Indonesia; Bank of France; Bank of Israel; Bank of Italy; Bank of Korea; Bank of Namibia; Central Bank of Bahrain; Central Bank of Chile; Central Bank of Egypt; Central Bank of Jordan; Central Bank of Malaysia; Central Bank of Nepal; Central Bank of Norway; Central Bank of the Republic of Türkiye; European Central Bank; International Monetary Fund; Magyar Nemzeti Bank; National Bank of Cambodia; National Bank of Georgia; National Bank of Kazakhstan; New York Innovation Centre, Federal Reserve Bank of New York; Reserve Bank of Australia; South African Reserve Bank; and World Bank. BIS Ledger Insights Product Plan

~~~~~~~~~

According to this report, supply and demand issues in trade are currently in an imbalanced state. The demand for goods and services has steadily grown since the Covid-19 pandemic, and first quarter numbers show a significant growth for the United States and for China. Yet, we are not out of the woods, and supply and demand need to be brought into equilibrium.

High demand is good for traders, and it looks good on the Markets. It is the supply side that is lacking at the present moment due to inflated prices on goods and services. In order to balance the economy and make it grow steadily and forward, there needs to be more attention on moving the products across the country. This will increase money flow and demands on our Stablecoins that in turn gives more purchasing power to our currencies.

Here is where monetary policies come into play. As we move into a tokenized asset and gold token regimen for payment, this will stimulate the process of deflating the economy. A shift in interest rate reduction or remaining steady will give our suppliers liquidity capable of catching up to the demands of companies across the United States and China.

We are at a wait-and-see approach on the FOMC meeting. The changes made at this meeting and the next one are critical to the transition of our economy and it's moving back into profitable status. Supply Chain Brain Investopedia

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

When will the next fed rate cut be? Look ahead to future FOMC meetings | Investopedia

~~~~~~~~~

Mastercard Launches Open Banking Solutions in Partnership With Atomic to ‘Enhance User Experiences’ | The Fintech Times

Payments giant Mastercard has integrated Deposit Switch and Bill Pay Switch into its open banking platform, in a move that enables consumers to automatically switch their direct deposits and update their recurring bill payments, when opening a digital account or when updating information on an existing account.

~~~~~~~~~

XRP COULD BECOME THE WORLD'S RESERVE CURRENCY - RIPPLE XRP NEWS | Youtube

~~~~~~~~~

Iraq Seeks $2.5 Billion Missile System from South Korea #iqd #vnd #htg #ZiG Rates | Youtube

~~~~~~~~~

Central Bank of Saudi Arabia Teams Up with Ripple to Transform Cross-Border Settlements | Coin Trust

~~~~~~~~~

Italian Banking Association trials two styles of wholesale CBDC - Ledger Insights - blockchain for enterprise

~~~~~~~~~

Fidelity Intl tokenizes fund on JPM Tokenized Collateral Network - Ledger Insights - blockchain for enterprise

~~~~~~~~~

Solar-Powered Planes Are Ready to Take Off (And Fly for Months at a Time) - WSJ

~~~~~~~~~

BREAKING NEWS:

Apple unveils "tap to pay" between iPhones! 📲

Apple is interconnected with Ripple's Interledger Protocol! 🤝🏼

All the roads lead to one destination and the destination is called #XRP 💎 Crypto Barbie on Twitter

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Will Texas Exit the United States and Join BRICS? Awake-In-3D

Will Texas Exit the United States and Join BRICS?

On June 9, 2024 By Awake-In-3D

Could Texas and BRICS Create A Gold-Backed Financial Future Beyond the Fiat Currency System?

If Texas were to secede, an intriguing possibility is that it might only accept gold-backed dollars for cross-border trade, rejecting fiat currency – including the US Dollar – entirely.

This stance could align Texas with the BRICS Alliance, which is currently developing a new gold-backed common trade currency and sovereign financial system.

Will Texas Exit the United States and Join BRICS?

On June 9, 2024 By Awake-In-3D

Could Texas and BRICS Create A Gold-Backed Financial Future Beyond the Fiat Currency System?

If Texas were to secede, an intriguing possibility is that it might only accept gold-backed dollars for cross-border trade, rejecting fiat currency – including the US Dollar – entirely.

This stance could align Texas with the BRICS Alliance, which is currently developing a new gold-backed common trade currency and sovereign financial system.

Also Read: Texas Takes the Lead: A Gold-Backed Future for Sovereign Digital Currency

Joining the BRICS Alliance could bolster Texas’ economic independence and offer a robust alternative to traditional financial systems dominated by fiat currencies.

This potential alignment with BRICS nations would significantly impact global geopolitics and economics, positioning Texas as a key player in a shifting international monetary landscape.

In This Article

Texas GOP’s call for a secession vote and state sovereignty

Historical context of Texas’ independence movement

Key arguments and criticisms of the TEXIT movement

Economic and political implications of potential secession

The Texas Republican Party’s recent convention has reignited discussions about the state’s potential secession from the United States.

With the adoption of platform planks advocating for a secession referendum and stronger resistance to federal overreach, the question of Texas’ independence is gaining renewed attention.

Texas GOP Advocates for State Sovereignty

At the 2024 Republican Party of Texas Convention in San Antonio, the party adopted two significant platform planks.

The first asserts that the federal government has overstepped its bounds, infringing on powers reserved to the states. It calls for the Texas government to oppose, refuse, and nullify unwarranted federal laws, affirming Texas’ right to secede. The second plank directs the Texas Legislature to schedule a secession referendum for the next general election.

“This historic vote at the 2024 Republican Party of Texas Convention represents a substantial shift towards enhancing state sovereignty and exploring the potential for Texas to operate as an independent nation,” stated the Texas Nationalist Movement (TNM).

Historical Context of Texas’ Independence Movement

The location of the convention, San Antonio, holds historical significance as the site of the Alamo, a key chapter in Texas’ fight for independence from Mexico.

The 1836 Battle of the Alamo, though a setback, played a crucial role in Texas becoming a self-governing republic. From 1836 to 1845, Texas was an independent nation before joining the United States.

The first plank of the new platform cites Article 1, Section 1, of the Texas Constitution, claiming federal government actions have impaired Texas’ right to local self-government. It calls for a referendum on secession and the passing of the Texas Sovereignty Act.

Arguments and Criticisms of the TEXIT Movement

Supporters of the TEXIT movement argue that secession would protect Texas’ rights against federal overreach.

They believe that greater autonomy would allow Texas to better manage its resources and address its residents’ needs without federal interference. The Texas Nationalist Movement’s Nate Smith defended the platform at the convention, countering claims of treason and emphasizing the right to self-determination.

Critics, however, argue that secession is unconstitutional and impractical.

They point to the Pledge of Allegiance’s reference to “one nation…indivisible” as evidence against the legitimacy of secession.

Brian McGlinchey, in making a case against the pledge, argues that the concept of indivisibility contradicts the foundational human right to political divisibility, as demonstrated by the United States’ own secession from the British Empire.

Economic and Political Implications

Texas’ potential secession poses significant economic and political implications.

As the largest oil producer in the United States, Texas accounts for 42% of American production, with extensive agriculture, deep-water ports, and a burgeoning high-tech industry. These resources position Texas well for economic independence.

Also Read: Calls for Gold-backed Dollar on the Rise Across USA

The recent decision by BlackRock, Citadel Securities, and other investors to back the Texas Stock Exchange further underscores the state’s economic potential. Rising dissatisfaction with federal regulations and compliance costs has fueled this move, highlighting Texas’ attractiveness as an independent economic entity.

The Bottom Line

The Texas GOP’s call for a secession vote and increased state sovereignty marks a significant shift in the state’s political landscape.

While the TEXIT movement faces substantial legal and practical challenges, its growing support reflects a deepening desire for autonomy and local governance.

As Texans continue to explore the growing desire for sovereign independence, the question of whether it will actually secede from the United States remains open, with significant implications that could reshape the state’s future and its relationship within the global financial and geopolitical landscape.

Supporting article: https://www.zerohedge.com/political/new-texas-gop-platform-calls-secession-vote-resistance-federal-infringements

Full text of Texas HB 384 Texas Sovereignty Act: https://capitol.texas.gov/tlodocs/88R/billtext/pdf/HB00384I.pdf

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/will-texas-exit-the-united-states-the-answer-may-surprise-you/

Some “BRICS News” Tuesday 6-11-2024

42 Countries Joining BRICS: What Next

Fastepo: 6-10-2024

Delegates from 22 countries are gathering for the BRICS foreign ministers meeting in Nizhny Novgorod, Russia, taking place on June 10 and 11, 2024.

This significant event and one of the largest ones in BRICS history is set to discuss various topics related to global economic governance, multilateralism, and the ongoing development of BRICS cooperation.

This represents another step towards the further expansion of the BRICS bloc in the near future.

42 Countries Joining BRICS: What Next

Fastepo: 6-10-2024

Delegates from 22 countries are gathering for the BRICS foreign ministers meeting in Nizhny Novgorod, Russia, taking place on June 10 and 11, 2024.

This significant event and one of the largest ones in BRICS history is set to discuss various topics related to global economic governance, multilateralism, and the ongoing development of BRICS cooperation.

This represents another step towards the further expansion of the BRICS bloc in the near future.

BRICS Beyond Borders: Dedollarization, Common Currency, and Global Expansion

Think BRICS: 6-11-2024

Discover the latest BRICS news and developments in financial matters, expansion, and cooperation. In this insightful video, Clive Ettia from Think BRICS and Rhod Mackenzie from @SCOBRICSInsight discuss pivotal topics such as dedollarization, BRICS common currency, and digital currency initiatives. In the opening segment, we dive into Russia's push for dedollarization in Latin America trade.

Understand the geopolitical implications and the benefits and challenges this brings to Latin American countries. We then explore the broader BRICS strategy for economic sovereignty and mitigating dollar dependency.

Next, we cover the ambitious move towards a BRICS common currency. Learn about the feasibility, timeline, and potential economic and political implications of this initiative. We compare it with digital currency projects involving Saudi Arabia, China, and the UAE, highlighting how these efforts align with BRICS' financial sovereignty goals and global trade strategies.

We also touch upon regional security issues, focusing on the tensions in the Horn of Africa over a naval base in Somaliland. This discussion outlines the strategic importance of the region, BRICS interests in Africa, and potential diplomatic solutions. Lastly, the video reviews the recent BRICS Foreign Ministers' meeting in Nizhny Novgorod, discussing strategic alignments and the growing influence of BRICS.

With around 30 countries showing interest in joining or cooperating with BRICS, we analyze the strategic advantages and the future growth potential of this powerful alliance.

While this video provides an in-depth analysis of BRICS financial matters, expansion, cooperation, and the specific geopolitical and economic implications of de-dollarization and a common currency, it does not cover the technical details of implementing a BRICS digital currency or the exact strategies behind each country's involvement in these initiatives.

The discussion on regional security and naval base conflicts in the Horn of Africa is thorough, but it does not delve into the specific military strategies or detailed political negotiations taking place behind the scenes.