Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Good Evening Dinar Recaps,

What Is a Private Wealth Manager?

A bank's ledger balance is a record of all transactions that have been processed and approved at the end of a business day, including deposits, withdrawals, interest income, and bill payments.

That being said, is it really a stretch to anyone's imagination that we are moving into a digital processing center on a Global scale, and the banking system is just simply one section interfaced onto a Quantum Technological Systematic set of protocols designed to run numbers on equations until a balance between two parties are cleared?

Yes, we are finding that many positions in the banking system and around the world can be automated. Still, the need for a personal touch remains.

This would account for why Personal Wealth Manager positions are on the rise and Banks are currently making these changes to meet the needs of a new society.

Goldilocks' Comments and Global Economic News Thursday Evening 5-23-24

Good Evening Dinar Recaps,

What Is a Private Wealth Manager?

A bank's ledger balance is a record of all transactions that have been processed and approved at the end of a business day, including deposits, withdrawals, interest income, and bill payments.

That being said, is it really a stretch to anyone's imagination that we are moving into a digital processing center on a Global scale, and the banking system is just simply one section interfaced onto a Quantum Technological Systematic set of protocols designed to run numbers on equations until a balance between two parties are cleared?

Yes, we are finding that many positions in the banking system and around the world can be automated. Still, the need for a personal touch remains. This would account for why Personal Wealth Manager positions are on the rise and Banks are currently making these changes to meet the needs of a new society.

The synchronization of human behavior and technological advances are currently being held at a balance. Where we go from here will be determined by the choices both AI and Human Nature co-create in this new world.

There will always be pros and cons to each choice we make going forward, but the integration of the Techno-Human Race is forging a new path. It is an experimentation beyond everything we have encountered so far in history.

Movement forward is both scary and filled with opportunity. Yet, inside each of us is an explorer of space and time. We are walking into new frontiers and decisions will have to be made by each of us how far we are willing to go.

The transition into digital money and sudden wealth is a much larger step than many realize. We will cross over into a dimension of life few have seen in this lifetime.

We are at a crossroads, and movement into a new digital world that moves our money and the choices we make is rapidly approaching.

True freedom will not be the result of sudden wealth. Freedom comes from a much deeper place. The more that is given to us, the more is required for us to reach into those places hands can no longer touch. Here, we ask for wisdom and guidance from a place of creativity. Our creative nature knows how to walk beside the presence of our Creator forming a relationship that always has, is, and will be with us to the end.

The time to evolve is right in front of us now, and the choice to become creative entrepreneurs exploring New Frontiers is calling on us to resonate with new vibrations capable of moving our attention into higher ground. | CFA Institute

© Goldilocks

~~~~~~~~~

"XRP Price Nears Major Converging Point: Analyst Predicts 3,600% Jump To $20" | Trading View

When you take a look at some of the technical analysis on the price of XRP, it currently has a Relative Strength Index potential of moving into a bull run.

"An RSI is a technical tool used to measure the speed and change of price movements in a cryptocurrency. It is also used to determine the short-term momentum of a cryptocurrency’s market."

Twenty dollars would be just a beginning point of reference to obtain on its way to integrating its full demand over time at much higher levels.

Remember, Ripple is the liquidity coin that allows the movement of our money to take place in the digital economy. Ripple uses its cryptocurrency, XRP, as a liquidity bridge for cross-border payments. Financial institutions can convert fiat currency into XRP, send it across the XRP Ledger blockchain, and then convert it back to the destination currency.

It is necessary for Ripple to have a much higher price range than it is currently displaying to bring in a catalyst for its movement.

Ripple is moving from a speculative investment to one that is based on demand. This shift in its purpose and its role in the new economy will raise it to much higher levels to meet these new demands inside the new digital asset-based economy.

From a trading perspective, the movement of Ripple in its price and demand will pull us into the next economy.

Watch Ripple.

© Goldilocks

~~~~~~~~~

Central banking: embracing change | BIS

~~~~~~~~~

ABCs of Banking - Banks and Our Economy | CT Department of Banking

~~~~~~~~~

Imaging a better climate future in China: Greenpeace-hosted climate change forum - Greenpeace East Asia

~~~~~~~~~

Lawmakers Push to Make IRS Direct File Program Permanent After Successful Pilot - Franklin County Free Press

~~~~~~~~~

US Debt Clock: Elon Musk’s Revolutionary Vision! Transforming the American Economy with Blockchain and AI, the New US Treasury Dollar, and Precious Metals Backing Currency! - American Media Group

~~~~~~~~~

#Ripple’s $XRP is a military operation. | Twitter

~~~~~~~~~

IMPORTANT IMF Report on Iraq's Economy GDP Prediction Good News | Youtube

~~~~~~~~~

Text - H.R.4763 - 118th Congress (2023-2024): Financial Innovation and Technology for the 21st Century Act | Congress.gov | Library of Congress

👆Now, we can move forward.

~~~~~~~~~

LIVE | FOMC Meeting Minutes Data Release - LIVE | 5/22/2024 | Youtube

👆 Goldilocks pointed to this article

~~~~~~~~~

(ZiG/USD) IMF Calls Zimbabwe Switch to Gold-Backed ZiG an ‘Important’ Step - Bloomberg

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Some “ASEAN and BRICS” News 5-23-2024

10 ASEAN Countries To Ditch the U.S. Dollar Vinod Dsouza May 20, 2024

The Association of Southeast Asian Nations (ASEAN) countries are looking to promote local currencies for trade and ditch the U.S. dollar for cross-border transactions. ASEAN consists of 10 countries and their economies are fast developing in the global sphere. This puts the USD under pressure, as several developing countries including the ASEAN bloc are looking to end reliance on the U.S. dollar.

Source: orfonline.org

10 ASEAN Countries To Ditch the U.S. Dollar

Vinod Dsouza May 20, 2024

The Association of Southeast Asian Nations (ASEAN) countries are looking to promote local currencies for trade and ditch the U.S. dollar for cross-border transactions. ASEAN consists of 10 countries and their economies are fast developing in the global sphere. This puts the USD under pressure, as several developing countries including the ASEAN bloc are looking to end reliance on the U.S. dollar.

Source: orfonline.org

ASEAN: 10 Countries Look To Stop Using the U.S. Dollar, Settle Trade Payments in Local Currencies Instead

The 10 ASEAN countries that are looking to stop using the U.S. dollar for trade are Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. According to the latest figures from the International Monetary Fund (IMF), commonly called the World Bank, the combined GDP of ASEAN nations currently stands at around $4 trillion.

If the ASEAN alliance completely starts using local currencies for trade, the U.S. dollar will be in jeopardy. In particular, Indonesia is the most aggressive among the lot in pushing the de-dollarization agenda ahead. Indonesian President Joko Widodo is urging the bloc to quickly move away from the U.S. dollar and start using local currencies.

The move will strengthen their native economies giving local currencies a boost in the global foreign exchange markets. Several developing countries fear the rising U.S. debt of $34.4 trillion can affect their native economies and businesses. Therefore, the only solution to American debt is to make ASEAN countries use local currencies and sideline the U.S. dollar.

The U.S. pressing sanctions on other developing countries is also among the reasons why ASEAN wants to ditch the dollar. A stronger local currency will have no adverse effects from U.S. sanctions making their economies safer. In conclusion, the next decade will be different for the U.S. dollar as many nations are looking to uproot it.

Source: Watcher Guru

https://dinarchronicles.com/2024/05/22/10-asean-countries-are-looking-to-ditch-the-us-dollar/

BRICS: America’s 4th Largest Bank Warns of Economic Crash

Joshua Ramos May 22, 2024

Amid the ongoing geopolitical shift brought about by the BRICS economic alliance, America’s 4th largest bank has warned of an impending economic crash. Specifically, Citigroup’s chief US economist, Andrew Hollenhorst, has spoken with CNBC regarding his concerns for the United States and its economic fragility.

Hollenhorst discussed his concerns, specifically regarding the labor market. He noted that the deterioration of the hiring sector could have dire implications for the country. Ultimately, he spoke on why a hard landing may be all but an inevitability for the nation.

Citigroup Warns of Potential Economic Crash

Over the last year, the BRICS economic alliance has observed significant growth. Not only has the bloc embraced its first expansion initiatives since 2001, but it has also embraced alliance-wide economic policies. These infrastructure developments hinder international reliance on the US dollar while promoting local currency use.

Now, the geopolitical shift that the BRICS bloc has orchestrated may be playing a part in America’s 4th largest bank warning of an impending economic crash. Specifically, Citigroup’s Andrew Hollenhorst noted that a hard landing is likely in the cards.

“Firms are hiring at a lower rate. Firms are having workers work less hours,” Hollenshorrts told CNBC. “So this gradual softening has already started. That tends to snowball and end up in something that looks more like a hard landing.”

Moreover, Hollenhorst noted that some reports have expressed a more concerning view of the economic circumstances. Additionally, he noted that a recession could be set to follow any hard landing that takes place. Specifically, he notes that small businesses have displayed the lowest levels of hiring intentions since 2016.

Furthermore, the hiring rate is at its lowest level since 2014, Hollenhorst stated. Therefore, the labor market’s reality coincides with the overall interest rate issue, inflation persists, and optimism does not appear to be a logical response.

All of this will also contend with the ongoing US dollar questions that have arisen in recent months. The BRICS alliance has driven a global shift toward gold and other assets. Therefore, ongoing debt concerns and de-dollarization initiatives will only increase pressure on the US in its most dire state.

Source: Watcher Guru

https://dinarchronicles.com/2024/05/23/americas-4th-largest-bank-warns-of-an-economic-crash/

“Tidbits From TNT” Thursday 5-23-2024

TNT:

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

HappyWelshGuy: RV Update - The Truth

Tony, is quite correct the RV will happen soon.......But not yet

This is what is really happening...

There is a carefully, orchestrated plan in effect, that is being meticulously monitored

Tier # 1 and Tier # 2 is currently being financially hydrated

When this is completed to the satisfaction of the Alliance then and only then will Tier # 3 be financially hydrated

TNT:

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

HappyWelshGuy: RV Update - The Truth

Tony, is quite correct the RV will happen soon.......But not yet

This is what is really happening...

There is a carefully, orchestrated plan in effect, that is being meticulously monitored

Tier # 1 and Tier # 2 is currently being financially hydrated

When this is completed to the satisfaction of the Alliance then and only then will Tier # 3 be financially hydrated

When this is completed to the satisfaction of the Alliance then and only then will Tier # 4 (US) the internet group be financially hydrated

Everything is currently "On Track" and moving to expectation

If everything continues to expectation, then Tier # 4 should be financially on or about JUNE 15th with a back wall of July 4th

It is "NOT" going to happen today, tomorrow or this month

However, Tony is right

It will be our time soon

Nothing will stop this except for a 911 type event

Remain positive and in anticipation

My source actually sits on a special committee formatted for the very specific purpose of the timing of the revaluation to take place

June 15th, is not that far away so remain patient and be in expectation

~~~~~~~~~~

Fuze: Don't get me wrong, it is possible this could extend to early June but the point is, it's suspicious for the reasons stated in this widely distributed all of a sudden mysterious source. There is legitimate Intel from literally the horses mouth that June was a best Target month of Dr. Shabibi (bless his sole) why?

Because he said " the "project to delete the zeros with the rate change should be done at the beginning or middle of Iraqs fiscal year" FOR ACCOUNTING purposes!

June is the middle of their fiscal year at present. In addition, one time in the past when the project was postponed in 2012 it was earmarked to go June 2013 according to a declassified MOF document and US Congressional Report.

These are well documented facts in video format and documents from non Maliki, non social media credible sources!!! So early to mid June would not be a surprise,

**************

Tishwash: Economist: We are experiencing a good financial year and the rise in salary expenses must be reconsidered

The economic expert, Safwan Qusay, considered Iraq’s fiscal year “good,” while stressing the need to reconsider the rise in salary expenses.

Qusay said, during his hosting of the program {Free Speech} broadcast by Al-Furat satellite channel this evening, that: “

The process of implementing the program of the government of Muhammad Shiaa Al-Sudani requires {operational and investment} spending, and there are priorities voted on by Parliament, and it is held accountable for achieving these goals, so the process of allocating financial allocations To achieve these goals, it requires scientific foundations and program costs. So far, the issue is items, not programs, costs, accounting, and the establishment of a unified treasury in order not to wait for schedules, and in order for it not to be repeated in 2025.

The government is required to set estimates by establishing a unified treasury and spending and collection units on a daily basis

Parliament is one case, as they both seek to achieve their goals.

- We are facing a good year, considering that oil prices are above $70, and zero oil and other imports will contribute to reducing expenses and increasing revenues.

- The government is seeking to establish investment projects parallel to oil revenues, and the increase in salary spending needs to be restored Consider

-The timetable determines the mechanism for disbursing expenditures as it tries to move from items to programs -

Government achievements for the year 2024 can raise cash revenues

- Federal ministries must be coherent and complementary to one another, as increasing non-oil revenues enhances the value of the dinar. Iraqi, and the need to reconsider the nature of contracts with foreign companies.

-International prices change, so if the financial foundations are understood by the government, it can certainly change them.

The Ministry of Finance is required to assume that the project that it cannot finance is a source of income that is subject to investment. link

************

CandyKisses: Sudanese arrives in Najaf to open projects

Iraqi Prime Minister Mohammed Shia al-Sudani arrived on Tuesday morning in Najaf province.

According to his media office, the visit is part of a series of field visits to the governorates.

In a subsequent statement, his office indicated that al-Sudani had launched the executive work on the upper threshold garage project, which is multi-layered (Najaf Grand Garage) in the center of the city.

Al-Sudani also launched the work of the tablet glass production project in Najaf Industrial City, the first project of the sovereign guarantees initiative for the private sector, with a production capacity of 800 tons per day.

Al-Sudani also launched the executive works in urban development projects for the southwestern side of the Haidari courtyard, during his visit to the city of Najaf.

Al-Sudani stressed that the visit to Najaf comes within the periodic visits to all our governorates to follow up on the progress of services and implement priorities in infrastructure projects and economic development, in addition to the province's privacy that necessitates attention and dedication to it.

The Prime Minister indicated that infrastructure projects have a great deal of attention, and there will be follow-up by specialized teams present in the governorate for the purpose of overcoming obstacles, noting the development of additional financial allocations to the governorate, and that there is a follow-up to the lagging projects that are being completed, as the focus is on infrastructure and service projects, because they are the basis of any development process.

He explained that the multi-storey garage project comes in line with the government's vision to alleviate urban problems in the center of Najaf, including improving infrastructure, using renewable energy, sustainability of the green environment, and facilitating and streamlining the movement of visitors and serving them.

Al-Sudani announced the approval of a package of important projects related to the threshold, which were included in the 2024 budget tables, namely:

- The project of expropriating buildings located on the southern side of the Holy Shrine, at a cost of 65 billion.

- The project of Al-Afaf Women's Hospital, at a cost of 10.312 billion.

- Carpet washing project for the Haidari plate, at a cost of 3.406 billion.

- A project of acquisitions for the development of the southern side of the Haidari courtyard, at a cost of 75 billion.

- The project of constructing the tunnel of the Prophet (PBUH) 12 billion.

- Tusi tunnel project, farewell square, at a cost of 16.4 billion.

- Adaptation of the Haram and Abu Talib Gallery, at a cost of 11 billion.

- Equipping Al-Afaf Hospital, at a cost of 11 billion.

It is noteworthy that the multi-storey garage project (Najaf Grand Garage) consists of eight floors and a capacity of 2,500 wheels, and includes 4 parts, and the standard of preserving the architectural identity of the city of Najaf was adopted, as it includes a tunnel linking the new Hajjah Street and the Haidari courtyard, in addition to tourist and recreational facilities.

************

CandyKisses: : Within the 2024 budget. Sudani announces a package of projects for the upper threshold

Baghdad Today - Baghdad

Prime Minister Mohamed Shia Al-Sudani announced on Thursday (May 23, 2024) the launch of executive works in urban development projects for the southwestern side of the Haidari Sahn.

The Sudanese Media Office said in a statement received by "Baghdad Today", that "Prime Minister Mohammed Shia Al-Sudani, launched the executive work in urban development projects for the southwestern side of the Haidari Al-Sharif courtyard, during his visit to the city of Najaf, which he arrived on Thursday morning."

According to the statement, Al-Sudani stressed that "the visit to Najaf within the periodic visits to all our provinces, to follow up on the progress of services and implement priorities in infrastructure projects and economic development, in addition to the province's privacy that necessitates attention and dedication to it."

The Prime Minister indicated that "infrastructure projects have a great deal of attention, and there will be follow-up by specialized teams present in the province for the purpose of overcoming obstacles," noting that "additional financial allocations are being made to the governorate, And that there is a follow-up to the lagging projects that are being completed, as the focus is on infrastructure and service projects, because they are the basis of any development process."

He explained that "the (multi-layered garage) project comes in line with the government's vision to alleviate urban problems in the city center of Najaf, including improving infrastructure, using renewable energy and sustainability for the green environment, and facilitating and streamlining the movement of visitors and serving them."

According to the statement, Al-Sudani announced "the approval of a package of important projects for the shrine, which were included in the 2024 budget tables, namely:

- The project of expropriating buildings located on the southern side of the upper holy shrine, at a cost of 65 billion.

- The project of the Afaf Women's Hospital, at a cost of 10.312 billion.

- Carpet washing project for the Haidari plate, at a cost of 3.406 billion.

- A project of acquisitions for the development of the southern side of the Haidari courtyard, at a cost of 75 billion.

- The project of constructing the tunnel of the Prophet (PBUH) at a cost of 12 billion.

- Tusi tunnel project, farewell square, at a cost of 16.4 billion.

- Adaptation of the Haram and Abu Talib Gallery, at a cost of 11 billion.

- Equipping Al-Afaf Hospital, at a cost of 11 billion.

It is noteworthy that the multi-storey garage project (Najaf Grand Garage) consists of eight floors with a capacity of 2,500 wheels, and includes 4 parts, in which the standard of preserving the architectural identity of the city of Najaf was adopted, as it It includes a tunnel linking the new Hajjah (Aj) Street and the Haidari courtyard, in addition to tourist and recreational facilities.

Mot: More Truisms from Earl and Opal

News, Rumors and Opinions Thursday AM 5-23-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR:

Update as of Thurs. 23 May 2024 Compiled Thurs. 23 May 2024 12:01 am EST by Judy Byington

Judy Note: It’s the end, and time for a New Beginning. Keep love for all humanity in your heart and God in your plans to help them.

Jamie Dimon, the CEO of JPMorgan Chase, has announced his plans to retire, while FDIC Chair Martin Gruenberg would also step down. The FDIC lacks sufficient funds to cover insured accounts.

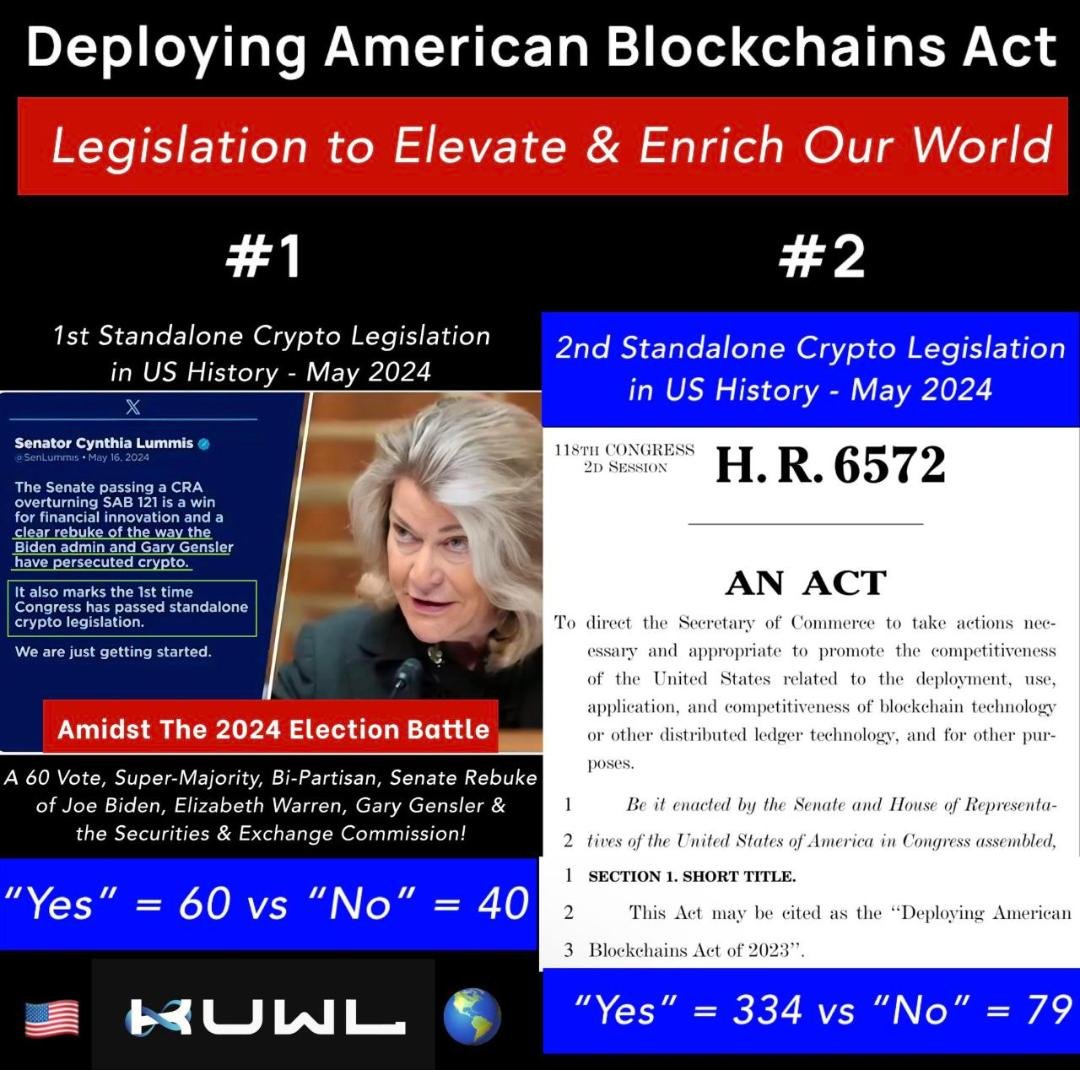

These developments, alongside the introduction of the “End the Fed” Bill and the passage of a Blockchain Bill, signal a shift in global economic and financial systems back to The People.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 23 May 2024

Compiled Thurs. 23 May 2024 12:01 am EST by Judy Byington

Judy Note: It’s the end, and time for a New Beginning. Keep love for all humanity in your heart and God in your plans to help them.

Jamie Dimon, the CEO of JPMorgan Chase, has announced his plans to retire, while FDIC Chair Martin Gruenberg would also step down. The FDIC lacks sufficient funds to cover insured accounts.

These developments, alongside the introduction of the “End the Fed” Bill and the passage of a Blockchain Bill, signal a shift in global economic and financial systems back to The People.

Global Currency Reset:

Judy Note: Apparently Tier4b (us, the Internet Group) has not yet been notified of how to set exchange and redemption appointments, although some Bond People are liquid and expectations are that things will start to explode this Memorial Day Weekend.

Wed. 22 May 2024 Wolverine Chat: “This will not be a long chat. There was a meeting last night in Reno. The topic was when to release the notifications. The notifications are coming out. The main bondholders are hopefully expecting notifications today. So hold on everyone!! We are on the very edge of this! Expecting notifications to come in today for the major bondholders. Tier4B, in my opinion, will hopefully come in on the weekend. Things are happening in the Pentecostal group. The leader will be having a get together in Bogota the first week of June, so then they will be ready to go. It was a very good audio that they put out yesterday. Hopefully they will be able to release it has been long time for that platform as the owner has been through so much. Not much other Intel coming through right now. Keep your fingers crossed and hopefully we will have good news very soon. Take care,” Wolverine

Wed. 22 May 2024 MarkZ: “I am confident that some Bond Holders such as those in Humanitarian Projects are being paid and bonds are moving today Wed. 22 May.”

Tues. 21 May 2024 Banker: “Well folks was advised we would have positive indications today but now am being told it should come on the 24th which is this coming Friday which would give the banks time to deal with their Fridays and Mondays and begin to schedule appointments later into next week. We can only hope that at some point these projections will be accurate.”

Tues. 21 May 2024 Unknown Source: “Banks in the USA will close on the 24th and until May 27th (Monday) they will be offline, without credit cards and without access to 24-hour banking. It will be the beginning of AES – EMERGENCY ALERT SYSTEM and on Tues. 28 May 2024, some banks and companies will no longer open.

~~~~~~~~~~

Tues. 21 May 2024 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#:

There was a meeting last night with 64 individuals in Reno to decide when the emails were going out for Tier 3, 4a,b. They were told to make the decision whether this was going on Tues. 21 May, or on Wed. 22 May.

A Metals Broker said that this could go overnight tonight Tues-Wed 21, 22.

Everyone left Reno either last night or at 6am this morning. That means they got things done and we should have this overnight tonight or tomorrow.

~~~~~~~~~~

Global Financial Crisis:

Tues. 21 May 2024 Congressman Tom Emmer calls to ban CBDC’s and says President Biden wants to trade Americans’ right to privacy for a CCP-style Central Bank Digital Currency surveillance tool.

Read full post here: https://dinarchronicles.com/2024/05/23/restored-republic-via-a-gcr-update-as-of-may-23-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man There's a lot of money going to to be made in Iraq and it's all starting to come together. When the World Bank is sitting at the table and they're working to finance projects, take a look at it. It doesn't smell of, 'oh, this is never going to happen, blah, blah, blah, we heard this two years ago.' No you didn't. I have to tease because I still get that on occasion.

Frank26 Question "What does your gut say the rate will be in the end?" Remember I said IMO the float would probably be between $3.36 and $4.25 would be a good place to cap it.

IMPORTANT IMF Report on Iraq's Economy GDP Prediction Good News

Edu Matrix: 5-23-3034

IMPORTANT IMF Report on Iraq's Economy GDP Prediction Good News - The International Monetary Fund's Latest Report on Iraq is Good News.

Currency News; Iraq: Iraqi Dinar, Vietnam Dong, ZiG Currency, Haiti's Currency, Gold, and BRICS Currency Plans.

China SELLS RECORD $53.5B in US Debt, Geopolitical Risks & Fear of Sanctions Shift Global Economies

Lena Petrova: 5-22-2024

Goldilocks' Comments and Global Economic News Wednesday Evening 5-22-24

Goldilocks' Comments and Global Economic News Wednesday Evening 5-22-24

Good Evening Dinar Recaps,

"Ripple CLO Claims The SEC Has a NODE on the XRP Ledger" A NODE offers ways to approve and process transactions without a centralized authority.

A node validates and authenticates blockchain transactions. A Blockchain node's primary job is to confirm the legality of network transactions.

Once a confirmation is made between two digital networks through a blockchain consensus, a transaction is validated on both sides of an exchange.

A protocol brings all nodes of a distributed blockchain network into agreement on a single data set or similar data confirming the right to move forward inside a blockchain connection. Then, a digital transaction can go through for both parties.

Goldilocks' Comments and Global Economic News Wednesday Evening 5-22-24

Good Evening Dinar Recaps,

"Ripple CLO Claims The SEC Has a NODE on the XRP Ledger"

A NODE offers ways to approve and process transactions without a centralized authority.

A node validates and authenticates blockchain transactions. A Blockchain node's primary job is to confirm the legality of network transactions.

Once a confirmation is made between two digital networks through a blockchain consensus, a transaction is validated on both sides of an exchange.

A protocol brings all nodes of a distributed blockchain network into agreement on a single data set or similar data confirming the right to move forward inside a blockchain connection. Then, a digital transaction can go through for both parties.

This is done electronically and without the need of someone mediating the transaction on the QFS.

It looks like XRP and the SEC have decided to play ball together. Times Tabloid Trade Marks Ledger

© Goldilocks

~~~~~~~~~

Okay. It is official. Ripple and the SEC are doing more than playing ball together. They are in business together.

"Ripple has filed a new trademark for the phrase “RLUSD,” suggesting the likely listing symbol for its proposed dollar-based stablecoin." Trade Mark

A trademark does three things:

* It identifies the source of your product

* It provides legal protection for your brand name and product

* It protects you against counterfeiting and fraud

This officially ties the SEC and Ripple together in a partnership. This new filing has given them intellectual property rights to copy and expand in a business together.

This love/hate relationship has certainly turned a corner. As the pages are turned on their past relationship in courts, it will certainly be interesting to read the next chapters of what they can do together. The Crypto Basic Maynardnexsen

© Goldilocks

~~~~~~~~~

Do you see why the XRP and SEC connection is so important? Yes, Ripple is ISO compliant. Now that changes things a little bit... 😉

© Goldilocks

~~~~~~~~~

ISO 20022 Crypto: Which Coins & Tokens are Compliant? - CoinCheckup

~~~~~~~~~

Iraq clears all debts to IMF | Iraqi News

Baghdad (IraqiNews.com) – The financial advisor to the Iraqi Prime Minister, Mazhar Salih, confirmed recently that Iraq has repaid all the loans it has taken from the International Monetary Fund (IMF) since 2003, a total of just under $8 billion.

Salih explained that the IMF provided several loans to Iraq, aiming to support macroeconomic stability and financial reforms, the Iraqi News Agency (INA) reported.

Between 2003 and 2021, Iraq obtained several financing programs from the IMF, including emergency loans and long-term financial assistance.

In 2016, the IMF approved a financial program worth $5.34 billion to support economic reforms in Iraq. Within five years, Iraq paid out the loan in full after obtaining two-thirds of the total.

Iraq sought a $6 billion emergency loan from the IMF in 2021; however, the loan was not granted because, at the time, it hadn’t been linked to any of the IMF’s initiatives.

Iraq’s engagement with the IMF was intended to assist in addressing the economic issues brought on by the drop in oil prices, which were connected to fluctuations in the balance of payments, as well as to promote government reforms.

~~~~~~~~~

The People’s Bank of China (PBOC) and the Bank of Thailand signed a memorandum of understanding (MOU) on Tuesday to enhance cooperation in facilitating bilateral transactions using local currencies. | Modern Diplomacy

~~~~~~~~~

The American Bankers Association urged House leaders to back a bill that would stop the Federal Reserve from creating a CBDC for individuals. | Crypto News

~~~~~~~~~

"Ripple believes in CBDCs seeing them as crucial for asset tokenization!"

Is Ripple about to be the CBDC alternative? Is Ripple quickly becoming the new CBDC? Will Ripple replace the dollar?

The answer to these questions are simply put, not likely. Yet, Ripple is what is going to move CBDCs and all assets inside the new digital economy.

Ripple respects your privacy and intends to keep your information secure. (See article below) Ripple will be the settlement token that will move your money.

This is the most likely scenario that will be seen going forward. It is an alternative option that may very well be what will take place.

Life is a Quantum Soup and the taste of the final product is and will be determined by the ingredients that make it up. Rich Turrin Substack Ripple Energy

© Goldilocks

~~~~~~~~~

👆Ripple is at the forefront of the CBDC revolution, engaging with governments globally to leverage its technology for digital currency development. In May 2023, Ripple launched a dedicated platform to assist central banks, governments, and financial institutions in issuing CBDCs and stablecoins. 2 days ago | Forbes

~~~~~~~~~

3 Unconventional Trends Reshaping The Business Landscape | Forbes

~~~~~~~~~

Todays House Bill removes the @SECGov entirely from crypto.

Puts all power in the hand of the Secretary of the Department of Commerce. Twitter Congress

Since 2021 this was Gina M. Raimondo. @SecRaimondo

~~~~~~~~~

Banking Announcement:

Spot Ethereum ETF approved. Ethereum is a smart contract. Here's what it does. ETHV is currently listed on DTCC.

The DTCC is the Depository Trust & Clearing Corporation. The DTCC clears and settles virtually all broker-to-broker equity markets. Yes, Forex is an equity Market.

"A smart contract is a computer program or a transaction protocol () that is intended to automatically execute, control or document events and actions according to the terms of a contract () or an agreement."

It ensures that both sides of a trade can be securely executed with enough funds to ensure all requirements are fulfilled. Reuters TheBlock

© Goldilocks

~~~~~~~~~

Swift Unveils New Cross-Border Payment Tracking Solution | PYMNTS

Swift Announcement:

Swift is extending ISO 20022 across the entire payment chain. 👇

"Swift has unveiled new ways for financial institutions to streamline cross-border payments for corporate customers.

The financial messaging service said it is doing this “by extending ISO 20022 across the entire payment chain and giving banks ready-to-use, white-labeled tracking services that can be activated for customers at the click of a button,” per a Tuesday (May 21) news release.

Swift plans to allow financial institutions (FIs) to capture rich data at its source by standardizing payments end-to-end with ISO 20022, according to the release.

In addition, Swift says it will also help banks offer customers payment tracking services by API or messaging channel, for complete transparency on the status of a payment as well as confirmation that it has been received."

So now, we have access to the ISO 20022 messaging system.

* Goldilocks

~~~~~~~~~

What a month to remember...

~~~~~~~~~

Expanding the cross-boundary e-CNY | Hong Kong Monetary Authority

The Hong Kong Monetary Authority (HKMA) and the People’s Bank of China (PBoC) have made further progress in the e-CNY pilot for cross-boundary payments, to expand the scope of e-CNY pilot in Hong Kong to facilitate the setup and the use of e-CNY wallets by Hong Kong residents, as well as the top-up of e-CNY wallets through the Faster Payment System (FPS).

The interoperability between the FPS and the e-CNY system operated by the Digital Currency Institute (DCI) of the PBoC also marks the first linkage of a faster payment system with a central bank digital currency system in the world. It provides an innovative use case which underscores interoperability, a key area set out in the G20 Roadmap for enhancing cross-border payments.

~~~~~~~~~

AI Is Taking Over Accounting Jobs As People Leave The Profession | Forbes

~~~~~~~~~

Asia Pacific Outshines Globally in Instant Payments Adoption - Blockchain News

~~~~~~~~~

Swift standardizes payments end-to-end and gives banks ready-to-use tracking services to enhance corporate | Swift

👆 this is going to change ISO20222 timelines a bit...😄

~~~~~~~~~

Brussels, 21 May 2024 - Swift has today set out plans to help financial institutions streamline the cross-border payments experience for their corporate customers, by extending ISO 20022 across the entire payment chain and giving banks ready-to-use, white-labelled tracking services that can be activated for customers ...1 day ago | Swift

👆 I will say more on this tomorrow. This changes the game quite a bit my friends.

~~~~~~~~~

VanEck's Ethereum ETF listed on DTCC ahead of SEC decision | ReadWrite

VanEck's spot Ethereum ETF listed on DTCC platform under "ETHV" ticker, awaiting SEC approval to become active.

SEC officials in contact with major exchanges to update and modify existing spot Ether ETF applications.

Crypto community divided as May 23 deadline for SEC's decision on VanEck's ETF application approaches.

~~~~~~~~~

A smart contract can execute an FX swap contract by locking the agreed rates and amounts on the blockchain, and transferring the funds automatically on the specified dates. This can reduce the need for intermediaries, such as banks or brokers, and lower the transaction fees and settlement time. | Linkedin

~~~~~~~~~

This Is Serious BRICS Nations Have Officially Set A Date To Ditch The US Dollar. | Twitter

~~~~~~~~~

Ripple Vs. SEC Lawsuit: Latest Filing Marks Beginning Of The End Of Historic Battle | Bitcoinist

~~~~~~~~~

IF THIS HAPPENS - CRYPTO WILL EXPLODE OVERNIGHT! MEGA CRYPTO NEWS! | Youtube

~~~~~~~~~

Secret Banking Crisis Looms; What the Fed Doesn’t Want You to Know – Insider Nomi Prins | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

The Fed Is Already Insolvent. Here’s How We Think This Plays Out

The Fed Is Already Insolvent. Here’s How We Think This Plays Out

Notes From The Field By James Hickman ( Simon Black ) 5-22-24

On Tuesday, September 15, 1992, the two most powerful financial officials in the British government held an urgent meeting that night to review their plan for when the markets opened the next morning.

The tone of the meeting must have felt frantic… even desperate… because the value of the British pound had been falling for weeks.

Investors and speculators were rapidly losing confidence in the UK government, mostly due to the ridiculous “Exchange Rate Mechanism” (ERM) which essentially pegged most European currencies to the German Deutschemark.

Rational investors viewed the ERM as an almost comical impossibility.

Germany’s economy was light years ahead of everyone else. Germany had vastly higher productivity, far greater savings, low inflation, high growth, and much more responsible monetary policy.

The Fed Is Already Insolvent. Here’s How We Think This Plays Out

Notes From The Field By James Hickman ( Simon Black ) 5-22-24

On Tuesday, September 15, 1992, the two most powerful financial officials in the British government held an urgent meeting that night to review their plan for when the markets opened the next morning.

The tone of the meeting must have felt frantic… even desperate… because the value of the British pound had been falling for weeks.

Investors and speculators were rapidly losing confidence in the UK government, mostly due to the ridiculous “Exchange Rate Mechanism” (ERM) which essentially pegged most European currencies to the German Deutschemark.

Rational investors viewed the ERM as an almost comical impossibility.

Germany’s economy was light years ahead of everyone else. Germany had vastly higher productivity, far greater savings, low inflation, high growth, and much more responsible monetary policy.

So, to even pretend that a country like Italy or even Britain could fix its exchange rate to the Deutschemark, i.e. to essentially mirror Germany’s economic performance-- was a total joke.

Britain joined the Exchange Rate Mechanism in October 1990. Prime Minister Margaret Thatcher had spent years trying to keep Britain out of the ERM, viewing it as giving up national sovereignty.

But Thatcher was about to retire. And the new batch of leaders insisted that pegging Britain’s economy to Germany was the way forward.

Their experiment didn’t even last two years. By the summer of 1992, inflation in Britain was more than 3x Germany’s. Plus, Britain had a major budget deficit.

Financial speculators correctly recognized, given the massive disconnect between the British and German economies, that Britain would not be able to maintain its fixed exchange rate with the Deutschemark.

So, traders began short selling the British pound, i.e. betting that the value of the pound would fall because the British government would devalue its currency.

The sell-off reached a crisis on September 15th, when the head of Germany’s central bank suggested to the Wall Street Journal that weaker countries (like Britain) would have to devalue their currencies.

That’s what led the British Chancellor of the Exchequer and head of the Bank of England-- the two most powerful policymakers in British government finance-- to meet that evening.

They knew that the German central bank’s comments would encourage even more traders to dump the British pound. So, the two men pledged to do ‘whatever it takes’ to defend the pound and defeat the speculators.

It didn’t work.

The following morning on September 16th, the Bank of England did everything it could. They raised interest rates, they bought back pounds, they bought government bonds, they made all sorts of outlandish promises.

But speculators didn’t believe any of it. They could see the numbers, and they knew that the Bank of England simply didn’t have the financial resources to maintain such an unrealistic exchange rate.

One of those speculators was George Soros, who famously bet $10 billion against the British pound… far exceeding the Bank of England’s financial resources

By the end of that day, the British central bank had exhausted its capital and was essentially bankrupt. The British government had to bail them out to the tune of 3 billion pounds, and then announce that they were formally leaving the ERM-- proving the speculators right.

This is an important story to understand, because it’s likely that something similar may happen to the Federal Reserve and US dollar over the next several years.

The Federal Reserve is already insolvent.

According to its most recent annual financial statements, the Fed has just $51 billion in equity, versus a whopping $948 billion in mark-to-market losses. This means the Fed is insolvent by roughly $900 billion.

This is a big problem. Remember that the Fed is still a bank, i.e. it has financial obligations, liabilities, and depositors that it needs to pay.

For example, commercial banks like JP Morgan and Bank of America have deposited a total of $3.4 trillion of their customers’ money, i.e. YOUR money, with the Fed. And the Treasury Department holds another $700 billion deposit at the Fed.

The Fed owes money to foreign governments. They owe trillions of dollars from repurchase agreements to banks and businesses across the global financial system.

So, yeah, the insolvency of the Federal Reserve is a pretty big deal. Yet, at least for now, no one is saying a word about it.

But just like the Bank of England in 1992, sooner or later, someone is finally going to say something… and do something… about the Fed’s insolvency.

There’s a good chance that means betting against the dollar… just like speculators bet against the pound three decades ago. And that would ultimately reduce the value of the dollar, increase inflation, and trigger a new ‘Bretton Woods’ agreement in which the US dollar is no longer the world’s reserve currency.

George Soros became known as “The Man Who Broke the Bank of England”. (Though given his malign proclivity to fund progressive activists, he is known by several other names in my household, none of them reverent).

Within the next several years there could be some Chinese or Russian financier who becomes known as “The Man Who Broke the Fed”.

This isn’t sensational. The Fed is already insolvent by $900+ billion, according to its own financial statements. Social Security is insolvent. The US government is insolvent by tens of trillions… and they further anticipate the national debt to grow by $20 trillion over the next decade.

These are facts, not fantasies.

And this is why it makes so much sense to hedge these risks by owning real assets which are scarce, valuable, and uncorrelated to the US dollar.

Gold is a great example. And as we’ve argued before, even though it’s already near its all-time high, we believe it can go much higher from here.

More on that soon.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

International Monetary Units: How SDRs Lead to Our GCR

International Monetary Units: How SDRs Lead to Our GCR

On May 21, 2024 By Awake-In-3D

The quest for a global currency reset leads us back to the origins of international monetary units, marking the SDR architecture as the critical starting point. This is Part 1 of a 2-Part examination of mapping the GCR Gold Monetary Unit

In This Article:

The Birth of Special Drawing Rights (SDRs)

Challenges Faced by SDRs

The Rise of Gold-Backed Stablecoins

The Future of International Monetary Units

Does GCR stand for Global Currency Reset or Golden Currency Reset?

Actually, it could stand for both.

International Monetary Units: How SDRs Lead to Our GCR

On May 21, 2024 By Awake-In-3D

The quest for a global currency reset leads us back to the origins of international monetary units, marking the SDR architecture as the critical starting point.

This is Part 1 of a 2-Part examination of mapping the GCR Gold Monetary Unit

In This Article:

The Birth of Special Drawing Rights (SDRs)

Challenges Faced by SDRs

The Rise of Gold-Backed Stablecoins

The Future of International Monetary Units

Does GCR stand for Global Currency Reset or Golden Currency Reset?

Actually, it could stand for both.

The concept of international monetary units has evolved significantly over time, reflecting changes in the global financial landscape.

From the introduction of the Special Drawing Rights (SDRs) by the International Monetary Fund (IMF) in 1969 to the advent of gold-backed digital stablecoins today, these units have undergone substantial transformation.

“At last… the elusive GCR is within reach!” Source: Disney Entertainment

The Birth of Special Drawing Rights (SDRs)

In 1969, the IMF introduced SDRs as a novel international monetary unit. The goal was to supplement gold and currency reserves of member countries.

The SDR was conceived as a potential global currency, aiming to stabilize the global economy and provide liquidity.

This international unit of value was designed for exchange between central banks and to act as a buffer against economic crises.

Challenges Faced by SDRs

Despite its promising start, the SDR faced several challenges.

The primary issue was that SDRs were not anchored by any tangible asset like gold, making them fiat in nature. This lack of real backing made it difficult for SDRs to establish a stable value against other fiat currencies.

Consequently, the SDR failed to gain widespread acceptance as a currency and became more of a tool for international debt management rather than a functional global currency.

The Rise of Gold-Backed Stablecoins

With advancements in financial technology (FinTech), the landscape of international monetary units began to shift.

Digital innovations have paved the way for the creation of gold-backed stablecoins, offering a more reliable and practical solution.

Unlike SDRs, these stablecoins are backed by physical gold, providing a tangible asset that helps maintain their value and stability in the international market.

The Future of International Monetary Units

The journey from SDRs to gold-backed stablecoins highlights the evolution of international monetary units in response to technological advancements and economic needs.

While SDRs represented a bold experiment, their shortcomings underscored the importance of backing currencies with tangible assets.

The emergence of digital, gold-backed stablecoins marks a significant advancement, offering a promising future for international trade and financial stability.

The Bottom Line

The evolution of international monetary units from SDRs to gold-backed stablecoins illustrates the continuous search for a stable and reliable global currency.

As technology advances, the possibility of a global currency reset becomes more attainable, with gold-backed stablecoins leading the charge towards a more stable and secure financial future.

The quest for a global currency reset finds its starting point in the SDR architecture, marking a significant milestone in the journey towards financial stability.

SDRs Explained: https://www.investopedia.com/terms/s/sdr.asp

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

More News, Rumors and Opinions Wednesday PM 5-22-2024

TNT:

CandyKisses: International group lifts Iraq from ‘bad’ financial list

Shafaq News / The Middle East and North Africa Financial Action Task Force (MENAFATF) on Wednesday ranked Iraq as a country highly committed to recommendations on combating money laundering and terrorist financing.

The Media Center of the Iraqi Supreme Judicial Council, in a statement received by Shafaq News, said that the organization decided at its general meeting held in the Kingdom of Bahrain for the period from May 19-23, to consider Iraq one of the countries that are highly committed to the recommendations of the Financial Action Task Force (FATF) in the field of combating money laundering and terrorist financing.

He pointed out that "the report of the residents on Iraq and the adeqency of the procedures followed by the Iraqi authorities in the field of combating money laundering and the financing of terrorism were accepted."

TNT:

CandyKisses: International group lifts Iraq from ‘bad’ financial list

Shafaq News / The Middle East and North Africa Financial Action Task Force (MENAFATF) on Wednesday ranked Iraq as a country highly committed to recommendations on combating money laundering and terrorist financing.

The Media Center of the Iraqi Supreme Judicial Council, in a statement received by Shafaq News, said that the organization decided at its general meeting held in the Kingdom of Bahrain for the period from May 19-23, to consider Iraq one of the countries that are highly committed to the recommendations of the Financial Action Task Force (FATF) in the field of combating money laundering and terrorist financing.

He pointed out that "the report of the residents on Iraq and the adeqency of the procedures followed by the Iraqi authorities in the field of combating money laundering and the financing of terrorism were accepted."

He pointed out that accepting the residents' report "means continuing not to include Iraq on the gray list, which is the list of high-risk countries in the field of combating money laundering and terrorist financing, after the Iraqi team succeeded in convincing the general meeting of MENA FATV of the adequacy of the measures taken by it in this field."

The media center explained that the two deputy presidents of the Karkh Court of Appeal, Judges Ali Hussein Jaffat, Lia Jafar, and the Deputy Chairman of the Russafa Court of Appeal, Judge Ayad Mohsen, participated in the meeting with a group of representatives of the Anti-Money Laundering Office of the Central Bank of Iraq, as well as representatives of the rest of the relevant Iraqi institutions.

************

Tishwash: US Extends State of Emergency in Iraq

United States President Joe Biden has extended the state of emergency in Iraq for another year, citing the ongoing instability in Iraq as a threat to US national security.

On Monday, the White House released the letter of President Biden’s notification to Congress regarding the extension of the state of emergency in Iraq for another year.

According to Biden’s letter to Congress, “to address the unusual and extreme threats to US national security and foreign policy posed by obstacles to the orderly reconstruction of Iraq, the restoration and maintenance of peace and security in the country, and the development of political administration and economic institutions,” the US president has extended the 2003 national emergency in Iraq for another year.

Resolution 13303 was issued by former US president George W. Bush after the Iraq war on May 22, 2003, to protect the Iraqi Development Fund for the reconstruction of Iraq, as well as to protect Iraqi oil products, US interests, and to lift sanctions on Iraq.

“It will allow the US president to take more steps in Iraq, including the use of emergency forces, the deployment of more troops, the imposition of economic sanctions, the suspension of certain laws and measures, or any other step to protect US national security and foreign policy in Iraq.”

The US president must notify Congress of the extension in a special letter 90 days before the expiration date.

In recent years, Iranian-backed Iraqi militia groups have called for US withdrawal from the country.

For future US and international coalition forces in Iraq, the US and Iraq have established a joint Higher Military Commission, which is a military-to-military dialogue between Iraqi and U.S. defense leaders and professionals.

Since its launch in January 2024, the three subcommittees established by the Higher Military Commission have conducted meetings in Baghdad supported by coalition members to discuss the threat of IS, the operational environment, and the capabilities of the Iraqi Security Forces.Link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Is Iraq a member of the WTO? 'Well, Frank you say they're a member of the WTO, they qualified for it.' But do you see any official paper that tells you they're a member of the WTO. 'No.' Why not? Until you see the new exchange rate. 'But you don't have to have a high exchange rate to join the WTO. Why do you say something like that?' Because commitments were made in contracts that were guaranteed by Sudani for all these people through the WTO investments for the economic reform of Iraq.

Mnt Goat The UN, IMF and World Bank all on one day, Thursday, noted significant progress that Iraq has made in recent years, despite ongoing challenges. The reinstatement spigot has been opened. The direction is now clear.

Commodities Have 'Never, Ever' Been More Undervalued Than Today: Leigh Goehring

Commodity Culture: 5-22-2024

Leigh Goehring brings his decades of experience as an investor in natural resources to send a message: now is the time to invest in commodities, as they have never been more undervalued in the history of markets. Leigh goes in-depth on his investment thesis for gold, silver, uranium, copper, energy, and agriculture, along with explaining the cyclical nature of commodities and why today is when you want to be invested in the sector.

ITS GETTING MUCH WORSE FASTER. NOW MORE THAN EVER! HOARD GOLD, SILVER, COMMODITIES.

Greg Mannarino: 5-22-2024

Zimbabwe Applies For ISO Code For ZiG Currency (5/22/24)

TNT:

Harambe: Zimbabwe Applies For ISO Code For ZiG Currency | Pindula (5/22/24)

Reserve Bank of Zimbabwe (RBZ) deputy governor Innocent Matshe said that the central bank is in the process of applying for an International Organisation for Standardisation (ISO) code for the Zimbabwe Gold (ZiG) currency as it moves to make the unit a stand-alone currency, reported.

ISO currency codes are three-letter alphabetic codes that represent various currencies used worldwide. These codes are essential for currency trading and international settlements.

When combined, they form the symbols and cross rates used in financial transactions. For instance, USD stands for the United States Dollar, EUR represents the Euro, and JPY denotes the Japanese Yen.

The ISO currency code for the defunct Zimbabwean dollar was ZWL.

TNT:

Harambe: Zimbabwe Applies For ISO Code For ZiG Currency | Pindula (5/22/24)

Reserve Bank of Zimbabwe (RBZ) deputy governor Innocent Matshe said that the central bank is in the process of applying for an International Organisation for Standardisation (ISO) code for the Zimbabwe Gold (ZiG) currency as it moves to make the unit a stand-alone currency, reported.

ISO currency codes are three-letter alphabetic codes that represent various currencies used worldwide. These codes are essential for currency trading and international settlements.

When combined, they form the symbols and cross rates used in financial transactions. For instance, USD stands for the United States Dollar, EUR represents the Euro, and JPY denotes the Japanese Yen.

The ISO currency code for the defunct Zimbabwean dollar was ZWL.

Speaking at a breakfast meeting hosted by the Zimbabwe Economics Society in Harare on Tuesday, Matshe said:

According to our economic strategy, we believed that the success of our currency, ZiG, would depend on a limited management system, maintaining a tight monetary policy stance, controlling money supply and creating demand for the domestic currency.

This would demonstrate policy consistency, build trust in ZiG and facilitate effective communication. Let me confirm that ZiG is indeed a standalone currency.

We are currently in the process of applying for an ISO code and we expect no deviation from our initial protection policies.

Matshe claimed that Zimbabwe’s economy has been growing despite exchange rate fluctuations and inflation. He said:

It is essential to have an affordable base currency. We cannot sustain a dual currency situation indefinitely. Zimbabwe’s economy has been growing despite past instabilities, including currency fluctuations, exchange rates and inflation. However, we need to address these issues.

Matshe also pointed out that it was critical to include all sectors in currency reform, including those outside the traditional financial and banking sectors. He said:

The introduction of ZiG aimed to end the instability and create a standardised currency. Without robust reforms, our economy would not have grown significantly.

We need a framework that harnesses the potential of all sectors, including those outside the traditional financial and banking sectors.

Inclusivity is crucial and we must understand that digital finance is essential for a 21st-century economy.

We have made progress in electronic financial activities, but we need to think seriously about digitalisation.

Certainty and stability in times of crisis allow for long-term planning and investment, which is key to industrialisation.

https://www.pindula.co.zw/2024/05/22/zimbabwe-applies-for-iso-code-for-zig-currency/

Why the Federal Reserve Fears This New Bill to End Its Power: Awake-In-3D

Why the Federal Reserve Fears This New Bill to End Its Power

On May 21, 2024 By Awake-In-3D

Opening the door for an American MONETARY AND CURRENCY RESET that ends the Fiat Financial System

In This Article

Ending the FED: This is the Way

H.R. 8421 and its Purpose

Representative Thomas Massie’s Motivations

Key Supporters and Historical Context

Potential Impact on the Economy

A strong argument can be made that the Federal Reserve Central Banking system has enabled every financial crisis since its creation in 1913.

Why the Federal Reserve Fears This New Bill to End Its Power

On May 21, 2024 By Awake-In-3D

Opening the door for an American MONETARY AND CURRENCY RESET that ends the Fiat Financial System

In This Article

Ending the FED: This is the Way

H.R. 8421 and its Purpose

Representative Thomas Massie’s Motivations

Key Supporters and Historical Context

Potential Impact on the Economy

A strong argument can be made that the Federal Reserve Central Banking system has enabled every financial crisis since its creation in 1913.

Initially established to stabilize the American monetary system, the Federal Reserve’s primary goal has been to control the U.S. dollar.

Over the years, the Federal Reserve has implemented strategies such as removing the dollar from the gold standard and monetizing the national debt issued by the U.S. Treasury.

Despite its significant monetary control, the Federal Reserve is not a government entity; it is a private bank owned by a collective of private board members and the largest banks in the United States.

This private ownership raises concerns about the Federal Reserve’s true motivations and accountability.

The introduction of the Federal Reserve Board Abolition Act faces formidable opposition from these powerful Banksters, who will undoubtedly fight to prevent this bill from becoming law.

This bill, sponsored by Representative Thomas Massie (R-KY), seeks to dismantle the Federal Reserve System, aiming to address the inflationary pressures that have plagued the American economy.

With substantial support in the House of Representatives, this legislation could significantly alter the nation’s financial landscape.

Introduction of H.R. 8421 and its Purpose

H.R. 8421 proposes the abolition of the Board of Governors of the Federal Reserve System and the Federal Reserve banks.

It also calls for the repeal of the Federal Reserve Act of 1913, the law that established the Federal Reserve System.

This significant move aims to dismantle the central bank, which Rep. Massie and his supporters argue has been responsible for severe economic issues, particularly inflation.

Representative Thomas Massie’s Makes His Case

Rep. Massie has been vocal about his concerns regarding the Federal Reserve’s role in the economy. He argues that the central bank’s policies during the COVID-19 pandemic, which included creating trillions of dollars and lending them to the Treasury Department, have led to unprecedented deficit spending.

According to Massie, this “monetizing of the debt” has devalued the dollar and fueled the inflation that is now impacting millions of Americans.

“Americans are suffering under crippling inflation, and the Federal Reserve is to blame,” said Massie.

He believes that ending the Federal Reserve is the most effective way to curb inflation and protect the financial well-being of retirees and savers.

Key Supporters and Historical Context

The Federal Reserve Board Abolition Act is backed by several prominent members of the House, including Rep. Andy Biggs (R-AZ), Rep. Lauren Boebert (R-CO), and Rep. Josh Brecheen (R-OK), among others.

This legislation echoes previous efforts by former Representative Ron Paul (R-TX), who first introduced a similar bill in 1999 and continued to champion the cause until 2013.

Rep. Massie’s reintroduction of this bill is also complemented by his Federal Reserve Transparency Act of 2023, which aims to audit the Federal Reserve.

This dual approach seeks to both dismantle and scrutinize the central bank, reflecting a broader movement among certain lawmakers to reduce the power and influence of the Federal Reserve.

Impact on the US Economy

If enacted, H.R. 8421 would initiate a one-year period during which the Federal Reserve System would be dismantled.

During this time, employees would receive compensation, and the assets and liabilities of the Federal Reserve would be managed and liquidated. The Director of the Office of Management and Budget would oversee this process, ensuring an orderly transition.

The abolition of the Federal Reserve could lead to significant changes in the U.S. financial system. Proponents argue that it would eliminate the inflationary policies that have eroded the value of savings and increased economic inequality.

Critics, however, warn that such a drastic move could destabilize financial markets and lead to economic uncertainty.

As if we are not already in unprecedented times of financial uncertainty?

The Bottom Line

The introduction of the Federal Reserve Board Abolition Act by Rep. Thomas Massie is a bold proposal aimed at fundamentally restructuring the U.S. financial system.

With significant support in the House, this legislation represents a critical juncture for economic policy and monetary independence in America.

We all need to support this Bill with passion. Let your congressional representatives know you want to END THE FED.

Read the full text of the Bill here: https://massie.house.gov/UploadedFiles/EndTheFed.pdf

Read Representative Massie’s Press Release here: https://massie.house.gov/news/documentsingle.aspx?DocumentID=395644

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

“Tidbits From TNT” Wednesday Morning 5-22-2024

TNT:

Tishwash: Biden's decision to extend the emergency in Iraq protects Baghdad's money - Iraqi expert

The expert in American affairs, Professor Aqeel Abbas, confirmed that the White House’s decision, which was issued yesterday, to extend the state of emergency in Iraq, stems from economic and financial reasons, and has no military or security aspect.

He said that the United States protects Iraqi funds from seizure in accordance with this decision, as There is an unknown number of companies and entities around the world that have sued Iraq over the invasion of Kuwait, and if this protection decision is cancelled, Iraqi funds outside the country will be subject to seizure.

TNT:

Tishwash: Biden's decision to extend the emergency in Iraq protects Baghdad's money - Iraqi expert

The expert in American affairs, Professor Aqeel Abbas, confirmed that the White House’s decision, which was issued yesterday, to extend the state of emergency in Iraq, stems from economic and financial reasons, and has no military or security aspect.

He said that the United States protects Iraqi funds from seizure in accordance with this decision, as There is an unknown number of companies and entities around the world that have sued Iraq over the invasion of Kuwait, and if this protection decision is cancelled, Iraqi funds outside the country will be subject to seizure.

Aqeel Abbas, in a statement:

Extending this decision is economic and financial, not military or security. It protects Iraq from judicial rulings issued by courts in several countries against Iraq, some of which we do not know yet, because the Iraqi state did not inventory the cases filed against the backdrop of the invasion of Kuwait. Many companies were harmed at that time and lawsuits were filed in different countries.

If the US decision is not extended, many Iraqi funds will be seized, and it will be difficult for Iraq to transfer oil money to the Central Bank.

Today, the United States is the protector of Iraqi funds. The funds go to an American bank in New York and then are transferred to Iraq.

Biden stated in a letter addressed to the US Congress:

Obstacles to the orderly reconstruction of Iraq, the restoration and maintenance of peace and security, and the development of Iraq's political, administrative, and economic institutions continue to pose an extraordinary threat to the national security and foreign policy of Iraq and to the United States.

The national emergency declared in Executive Order 13303 relating to Iraq will remain in effect after May 22, 2024 for another additional year. link

************

CandyKisses: Sudani arrives in Tehran to offer condolences on the death of the Iranian president and his companions

Shafaq News-Prime Minister Mohammad Shia al-Sudani arrived on Wednesday morning in Tehran to offer condolences on the death of President of the Islamic Republic of Iran Ebrahim Raisi, Foreign Minister Amir Hossein Abdollahian and their companions in the crash of the helicopter they were carrying them.

The Sudanese media office said in a statement today that the Sudanese is heading a high-level official delegation that includes the President of the Federal Court and a number of ministers and governors.

An informed source said on Tuesday that the Sudanese will participate in the funeral of the Iranian president in the capital, Tehran.

The source told Shafaq News Agency that "the Sudanese will head to the Iranian capital Tehran in order to participate in the official funeral of Iranian President Ibrahim Raisi on Wednesday."

On Monday, Iran officially announced the death of President Ebrahim Raisi along with Foreign Minister Hossein Amir-Abdollahian in the crash of a helicopter they were traveling with other officials in a rugged area near the border with Azerbaijan, in the northwestern province of East Azerbaijan.

Mourners began gathering in Tehran on Tuesday in preparation for days of funerals and processions for the late Iranian president, his foreign minister and other officials who died in the helicopter crash.

On Tuesday morning, a motorcade driven by a truck carrying coffins slowly moved through the narrow streets of central Tabriz, the closest major city to the crash site.

The bodies are due to be transported to Qom before being transported to Tehran, a funeral ceremony presided over by Iran's Supreme Leader Ayatollah Ali Khamenei on Wednesday, and a procession will be held in Birjand, Raisi's hometown, on Thursday, followed by a funeral and burial in the city of Mashhad.

************

CandyKisses: The Council of Ministers issues decisions on lagging projects and financial reform

Baghdad - Mawazine News

The Council of Ministers on Tuesday adopted new decisions related to the country's neglarizing projects and financial reform steps, while deciding to install 17 general managers in separate departments.

This came, during the presidency of Prime Minister Mohamed Shiaa Al-Sudani, the 21st regular session of the Council of Ministers, in which the general situation in the country was discussed, the topics on the agenda were discussed, and the necessary directives and decisions were issued thereon, according to a statement received by Mawazine News.

At the beginning of the session, the Sudanese touched on the painful incident that claimed the lives of the President of the Islamic Republic of Iran, the Minister of Foreign Affairs and their companions, stressing the solidarity of Iraq, the government and people, with the Iranian people and the Iranian leadership in these difficult times, and described the departure of the Iranian president as a great loss, because of his personality that loves peace, work and cooperation, referring to the joint files, whether between the two countries and with the countries of the region, which witnessed, during his presidency, further progress and achievement.

The session witnessed the review of the results of the report on the evaluation of the performance of ministries in the field of anti-corruption for 2023, and the Prime Minister directed all ministers to pay attention to the results of the report, and work to follow up on his recommendations and observations and remedy them in the results of the evaluation for 2024.

In the context of following up on infrastructure projects, the Prime Minister directed the preparation of a comprehensive vision and an integrated study on the Hally Road project in Basra Governorate, attracting sober companies in implementation, and coordinating with Basra Governorate on completion and implementation.

The Prime Minister also directed, within the framework of reforming the administrative structures of state institutions, to re-form a committee that is studying the merger of the General Company for Food Trading and the General Company for Central Markets, to present the results within a month.

The Council of Ministers continued to consider the file of lagging and suspended service projects, and put the processors to complete the work in them, as it approved the following:

1- Increasing the amount of the reserve for the project (processing and implementation of two treatment stations in Nasiriyah / Dhi Qar Governorate), and increasing the total cost of the Nasiriyah sewage project.

2- Increasing the total cost and amount of reserve for a construction (establishment of the second corridor of the Ghammas Junction Road - Al- Hamza 62 km).

3- Increasing the total cost and amount of reserve for a construction (establishment of a modern bridge and its approach).

With regard to evaluating the efficiency of general managers and follow-up performance, the Council of Ministers approved the installation of (17) Directors-General in various state ministries and institutions, distributed by (4) general managers in the Ministry of Water Resources, (3) in the Ministry of Agriculture, (3) in the Independent High Electoral Commission, (3) in the Military Industrialization Authority, and one Director-General in the ministries of electricity, industry, the Political Prisoners Foundation, and the Federal Financial Supervision Bureau.

In the context of following up the implementation and completion of traffic jam mitigation projects, the Council of Ministers approved what is confirmed in the book of the Ministry of Construction, Housing, Municipalities and Public Works, on the project to develop (front torm), provided that the Ministry bears the integrity of the procedures related to contracting. The project includes the expansion of the road from the front towards the Diyala Bridge, to improve traffic, and to ensure that the realization of the flow of integration with the project of the Mohammed Al-Qasim road connecting the road to the army canal road from the side of Rustama, in addition to the expansion of adjacent streets within the track, the establishment of two bridge intersections and the organization of the front.

The Council of Ministers voted to exclude the Italian company (GKSD) from the registration conditions set out in the amended Foreign Companies Branch Law (2 of 2017), and approve the financing of the preparation and management contract for the Internal Security Forces Hospital from the budget of the Directorate of Welfare Affairs of the Internal Security Forces, while ensuring the implementation of the restriction of all revenues, which the hospital receives from its operation, finally in favor of the budget of the aforementioned Directorate.

In the field of financial and administrative reform, the Council of Ministers approved the adoption of the (National Methodology for Good Governance Standards in Iraq), prepared by the Diwani Order Committee (84 of 2021), based on the provisions of the Constitution, taking into account the observation of the Legal Department in the General Secretariat of the Council of Ministers, not to create a section related to the follow-up of the implementation of the adoptions of good governance and administrative configurations, within the planning departments in ministries and entities not associated with the Ministry and governorates; to to conflict with the government's vision of reducing and rationalizing administrative structures. A specialized team, from the Ministry of Planning, the Board of Advisors and the Follow-up Committee of the Government Program, submits a report every (3) months, to the Prime Minister for decision.