“Tidbits From TNT” Thursday 5-16-2024

TNT:

Tishwash: A license for brokerage companies to trade in shares on international stock exchanges

The Securities Commission is studying the possibility of licensing brokerage companies to trade in shares on international stock exchanges.

The head of the authority, Faisal Al-Haims, said in a statement: “The authority has begun studying the licensing of brokerage companies to trade in shares on global stock exchanges through a technical committee within it.”

He added, “The Authority is working seriously to support and develop the stock market by studying the licensing of brokerage companies to enable them to trade in shares on international stock exchanges for the first time in Iraq.”

He explained, “This step comes in the context of protecting the rights of citizens to trade through brokerage companies that practice this activity without an official license from the Securities Commission, which seeks to develop the financial markets in the country,” noting that “the Commission is working to provide a stimulating and regulated investment environment.” “It contributes to enhancing confidence among investors and raising Iraq’s position in global financial markets.” link

TNT:

Tishwash: A license for brokerage companies to trade in shares on international stock exchanges

The Securities Commission is studying the possibility of licensing brokerage companies to trade in shares on international stock exchanges.

The head of the authority, Faisal Al-Haims, said in a statement: “The authority has begun studying the licensing of brokerage companies to trade in shares on global stock exchanges through a technical committee within it.”

He added, “The Authority is working seriously to support and develop the stock market by studying the licensing of brokerage companies to enable them to trade in shares on international stock exchanges for the first time in Iraq.”

He explained, “This step comes in the context of protecting the rights of citizens to trade through brokerage companies that practice this activity without an official license from the Securities Commission, which seeks to develop the financial markets in the country,” noting that “the Commission is working to provide a stimulating and regulated investment environment.” “It contributes to enhancing confidence among investors and raising Iraq’s position in global financial markets.” link

CandyKisses: Iraq confirms its keenness to achieve energy self-sufficiency

Economy News – Baghdad

Today, Wednesday, Prime Minister Muhammad Shiaa Al-Sudani affirmed the government’s keenness to implement its executive approach within the axis of achieving energy self-sufficiency, while indicating that the memorandums of understanding that were signed during his visit to the United States of America last April are being implemented on the ground.

The Prime Minister’s Media Office stated in a statement received by Al-Iqtisad News, “Al-Sudani received the US Assistant Secretary of State for Energy Resources Affairs, Jeffrey Payette, in the presence of the US Ambassador to Iraq,” noting that “the most prominent files of cooperation in the field of energy, in all its forms, were reviewed.” And ways to develop it, in a way that contributes to achieving common interests.”

During the meeting, the Prime Minister stressed, “The government’s keenness to implement its executive approach within the axis of achieving energy self-sufficiency, in the areas of exploiting locally produced natural and associated gas, generating electricity, providing petroleum derivatives, and producing chemical fertilizers and petrochemical materials,” explaining that the memorandums of understanding that were signed during His visit to the United States of America last April is being implemented on the ground.”

Al-Sudani pointed to “the government’s efforts and steps in the field of economic and financial reform, especially in the areas of tax, customs, and the banking sector, and completing the elements of the ideal investment environment,” calling on “American companies to work and invest in Iraq.”

For his part, Payet praised “the efforts of the Iraqi government to develop the energy sector,” pointing to “the joint statement of the Prime Minister and US President Joseph Biden, which represents a road map and framework for fruitful work and cooperation.”

He stressed “the desire of American companies to invest and expand their activities inside Iraq.”

************

CandyKisses: US negotiations to supply Iraq’s electricity with 3,000 megawatts

Shafaq News / Iraqi Minister of Electricity Ziad Ali Fadel discussed with the US Assistant Secretary of State for Energy Affairs Jeffrey Payat on Wednesday that the electrical system was supplyed by about 3,000 thousand new megawatts through the implementation of new energy projects.

This came during the reception of the Iraqi Minister of Electricity, of the US Assistant Secretary of State for Energy Affairs, in the presence of the US Ambassador in Baghdad, Alena Romanoski, according to a statement received by Shafaq News.

During the meeting, the two sides discussed cooperation between the two countries in the field of energy, where Fadel reviewed the projects it is implementing by the ministry in the production, distribution and transport sectors, and its plans to diversify energy supply sources through a package of projects for electrical connection and other projects in the field of clean energy.

The meeting touched on the role of American and foreign companies in contributing to the modernization of the infrastructure of the electricity sector in Iraq. The Minister of Electricity referred to the contracts concluded with (GE) to qualify and maintain production plants for 5 years, as well as the conversion of gas stations from simple cycles to the complex cycles currently implemented by the American company in more than one location in Iraq.

The two sides discussed, according to the statement, accelerating the implementation of the terms of the memorandum of cooperation concluded during the recent visit of Prime Minister Mohammed Shiaa Al-Sudani to Washington, including the supply of the electrical system by about 3,000 thousand new megawatts through the implementation of new energy projects.

The Iraqi Minister of Electricity called on American companies to submit their offers for the smart transformation project in the electrical system, which the ministry is implementing in selected areas of Baghdad and the provinces as a first stage, expecting that this project will contribute to improving the performance of the electrical network and securing processing hours for citizens 24 hours a day.

For his part, the US official stressed Washington's interest in supporting the Iraqi government's steps in enhancing the performance of its electrical system, and moving towards investment in clean energy projects suitable for the environment

Mot: ......... Just So Ya Knows!!!

Mot: .. not to brag

News, Rumors and Opinions Thursday AM 5-16-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 16 May 2024 Compiled Thurs. 16 May 2024 12:01 am EST by Judy Byington

Global Currency Reset: (RUMORS)

Wed. 15 May 2024 Wolverine: “I hope you guys are excited. I know it has been very stressful for all of us. Yesterday’s call was not the call I wanted to say to you, because I have been told not to say anything. But what I can tell you tell you that Brazil was to go around 12 pm today, but unfortunately, the World Bank had it postponed, but they will go tomorrow Thurs. 16 May.

I will get the call when Brazil starts. A lot of things are happening. A huge, huge whale in Zurich whom I spoke of is looking fine, and I got the Green Light from that person, and it is looking phenomenal.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 16 May 2024

Compiled Thurs. 16 May 2024 12:01 am EST by Judy Byington

Global Currency Reset: (RUMORS)

Wed. 15 May 2024 Wolverine: “I hope you guys are excited. I know it has been very stressful for all of us. Yesterday’s call was not the call I wanted to say to you, because I have been told not to say anything. But what I can tell you tell you that Brazil was to go around 12 pm today, but unfortunately, the World Bank had it postponed, but they will go tomorrow Thurs. 16 May.

I will get the call when Brazil starts. A lot of things are happening. A huge, huge whale in Zurich whom I spoke of is looking fine, and I got the Green Light from that person, and it is looking phenomenal.

Bond Holders will probably get blessed this week. Remember, the bond holders go first, and then the currencies holders.

Tier4B will actually be “golden” in a few days, in my own opinion, as soon as Bond Holders are paid, the Tier4B should go straight away.

I have a feeling that this is what’s happening. I think this will be sporadic with no announcement – Just going to happen. The announcement will come from your platform, from your whale, or maybe lawyers you are working with, saying you need to go to a redemption center.

In terms of the public -there will be no public announcement. It all depends on what the notifications actually tell you, if they tell you to be quiet or whatever else there is. All is discrete right now.

After signing NDAs no one will know who has been paid. I think that is the best way to go, so no one knows who got paid, this way we are protected.

There are a lot of bad apples out there waiting to know if people they DO know got paid or not, and obviously, they do not want people to get harmed. This in my opinion of course.

I have not received real confirmation on that. If this is the case, I cannot release the opera as it would be seen as an announcement by me. The main thing is that we all want the blessing and the Med Beds. And, if it is that way, I will sing the opera for you all at the get together.

I might be wrong, remember, I am just a messenger.

This may be a shotgun and we go at the same time – we are that close right now, and I hear wonderful news coming from certain people I know in Zurich and Miami. I am praying that this tine Bruce gets it right today.

I have been wrong so many times. We do not do this on purpose. All Intel providers work hard. Things keep changing – Today, We thought Brazil would happen, and now it is tomorrow. Take care guys, Wolverine.”

Global Financial Crisis:

Wed. 15 May 2024: Credit Crisis Hits Worst Level Since Great Recession As Millions Of Americans Go Bankrupt – Epic Economist Video – American Media Group (amg-news.com)

Read full post here: https://dinarchronicles.com/2024/05/16/restored-republic-via-a-gcr-update-as-of-may-16-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man I think they're at the stage where they just got to jump and do it. They have to interlink with the region and...the world so it's going to be a timed event. I don't have the time, the date for that but I think we're going to see it shortly...

Jeff The rate change is here... Article: "Sudanese directs to hold an extraordinary session next Sunday to discuss the 2024 budget schedules" The reason council of Ministers which normally meet on Tuesday are meeting on Sunday is they can only meet after the rate changes...They are reducing the deficit. To reduce the deficit you have to reduce your expenses, cost and figures. The only way they can do that is revaluing the currency...This step is contingent upon the rate change.

The Derivatives Market Is Starting To Crack...Again!!

George Gammon: 5-15-2024

Fireworks In Gold & Silver Ahead? | Andy Schectman

Liberty and Finance: 5-14-2024

Andy Schectman, CEO of Miles Franklin Precious joins Dunagun Kaiser, founder of LibertyAndFinance to discuss breaking new analyses released by analyst Bill Holter which signal an imminent breakout to the upside for both gold & silver.

Andy also answer your questions LIVE in tonight’s livestream!

Goldilocks' Comments and Global Economic News Wednesday Evening 5-15-24

Goldilocks' Comments and Global Economic News Wednesday Evening 5-15-24

Good Evening Dinar Recaps,

"The European Securities and Markets Authority (ESMA) recently revealed that four applications are pending. One of those is from Germany’s 21X (https://www.21x.eu/), the only one of the quartet that has applied for a DLT trading and settlement systems (DLT TSS) license.

If approved, this would allow it to both operate a secondary market (DLT MTF) and run the settlement systems (DLT SS). We were the first DLT TSS applicant in Europe. We do have a first mover advantage that we are hoping to realize,” 21X CEO Max Heinzle told Ledger Insights."

A secondary market allows investors and traders the ability to exchange with each other when a primary Market adds an item for sale. Securities can be directly traded between two entities without having to go through the primary issuer.

This allows the actual price of an item to be driven by supply and demand. An actual value begins to surface over several trades.

Goldilocks' Comments and Global Economic News Wednesday Evening 5-15-24

Good Evening Dinar Recaps,

"The European Securities and Markets Authority (ESMA) recently revealed that four applications are pending. One of those is from Germany’s 21X (https://www.21x.eu/), the only one of the quartet that has applied for a DLT trading and settlement systems (DLT TSS) license.

If approved, this would allow it to both operate a secondary market (DLT MTF) and run the settlement systems (DLT SS). We were the first DLT TSS applicant in Europe. We do have a first mover advantage that we are hoping to realize,” 21X CEO Max Heinzle told Ledger Insights."

A secondary market allows investors and traders the ability to exchange with each other when a primary Market adds an item for sale. Securities can be directly traded between two entities without having to go through the primary issuer.

This allows the actual price of an item to be driven by supply and demand. An actual value begins to surface over several trades.

It is a system that allows large and small traders to invest in Market transactions such as stock markets and over-the-counter markets.

Foreign currency exchanges are traded on the secondary Market. Examples of stock markets (or secondary markets) include:

* the NYSE and Nasdaq in the U.S.

* the London Stock Exchange

* the Hong Kong Stock Exchange

* the Bombay Stock Exchange

* the Frankfurt Stock Exchange

(https://www.ledgerinsights.com/esma-explains-why-dlt-pilot-regime-hasnt-taken-off/)

When Stablecoins and Tokenized Assets become law on June 30th, 2024, we will have a Digital Ledger System capable of recording these transactions going forward. Germany’s 21X (https://www.21x.eu/),

Ledger Insights Investopedia 1 Banking Frontiers Soft Serve Inc Investopedia 2

© Goldilocks

~~~~~~~~~

"Deutsche Bank today announced it has joined the Monetary Authority of Singapore’s (MAS) Project Guardian (as part of the asset and wealth management workstream). The collaborative initiative is dedicated to testing the feasibility of asset tokenization applications in regulated financial markets.

Project Guardian is a multi-year project involving global policymakers (including the United Kingdom’s FCA, Switzerland’s FINMA, and Japan’s FSA) and financial services industry representatives.

As part of the asset and wealth management workstream, the bank will test an open architecture and interoperable blockchain platform to service tokenized and digital funds. It will then propose protocol standards and identify best practice to contribute to industry progress."

The Deutsche Bank connects to all banks around the world, and their proposed "protocol standards" from this project test will move us towards Global unification inside the new digital asset economy. Deutsche Bank The Block Fintech Futures

© Goldilocks

~~~~~~~~~

The Monetary Authority of Singapore is finalizing their rules for their new over-the-counter derivatives reporting regimen.

These final regulations come into operation on October 21, 2024. It will introduce the Unified Payments Interface, Unique Transaction Identifier or swaps transaction identifier, cardholder data environment, and ISO 20022 in reporting.

These new developments just so happen to be taking place in the same month of the next BRICS summit. Exchange Protocols and Regulations are clearly being interfaced onto the QFS during this time. Traction Fintech DowJones

© Goldilocks

~~~~~~~~~

How Trading Works on OTC Markets | Youtube

~~~~~~~~~

What are Secondary Markets? | Youtube

~~~~~~~~~

Philippines Central Bank Launches Peso-Linked Stablecoin Trials | Bitrue FAQ

Philippines Stablecoin Announcement:

The Philippines will now test a peso-backed stablecoin in payments, trading, hedging, and DeFi applications.

~~~~~~~~~

Finastra certifies multiple solutions for ISO 20022 compliance | The Paypers

Tuesday 14 May 2024 15:05 CET | News

Global provider of financial software applications Finastra has announced the completion of testing and certification for ISO 20022. (https://thepaypers.com/search/index.aspx?search=Finastra)

This achievement positions Finastra as one of the early vendors in the industry to complete the certification process for multiple solutions. The certification pertains to four of Finastra’s payment processing solutions, allowing financial institutions across the United States to enhance their innovation capabilities.

The certified solutions include Payments To Go, Global PAYplus, PAYplus USA, and PAYplus Connect, offering a range of options for financial institutions to comply with ISO 20022 standards for FedWire. Financial institutions are required to conduct their own testing to meet ISO 20022 compliance standards by the end of 2024, emphasizing the importance of selecting a suitable payment processor with the necessary technology.

👆 Goldilocks pointed to this article

~~~~~~~~~

Digital ID Regulations Start THIS MONTH mandatory by 2026. | TheNationalPulse

The Digital Identity Regulation (eIDAS 2.0), the European Union’s latest set of digital ID rules, will take effect on May 20. Big Tech firms and EU member nations must now comply in supporting the EU Digital Identity (EUDI) Wallet, though work on the project remains ongoing, with pilot programs scheduled for 2025.

According to recently published standards by the European Council, the EUDI Wallet must be fully implemented across the continent by 2026. Initial usage will encompass scenarios such as accessing government services and age verification.

~~~~~~~~~

Financial Services and Markets Act Announcement:

Singapore has commenced its second phase of implementing the Financial Services and Markets Act (FSMA). The Act was passed into law in April 2022 to give the Monetary Authority of Singapore (MAS) additional powers to address misconduct, technology, and virtual asset risks. 20 hours ago

~~~~~~~~~

Andrei Belousov: The Economist in Charge of Russia’s Army | The Moscow Times

n economist and technocrat with no military background, Russia's new Defense Minister Andrei Belousov has been tasked with deploying his number-crunching skills and bureaucratic oversight to secure Russian victory against Ukraine.

~~~~~~~~~

China considers local government purchases of unsold homes, Bloomberg News says | Yahoo News

~~~~~~~~~

Government Acquisition, Regulation of Private Property. Initiative Constitutional Amendment. | LAO CA Gov

~~~~~~~~~

The Unseen Battles in Iraq USD IQD Ex Rate Value Up | Youtube

~~~~~~~~~

Silver Price Hasn't Done This In Over A Decade ($30 BREAKOUT Imminent) | Youtube

~~~~~~~~~

Yesterday, the Oesterreichische National Bank participated in the first trial of wholesale DLT settlement transactions as part of the Eurosystem experiments. As reported last month, 16 institutions (https://www.ledgerinsights.com/ecb-wholesale-dlt-trials-first-participants/) were onboarded to participate in the first wave of DLT trials, which use real central bank money. In addition, there are experiments involving simulations. LedgerInsights

~~~~~~~~~

09 May 2024 (BIS):

BIS added 37 entities to the Entity List under the destination of the PRC for the following reasons:

Supporting the High Altitude Ballon that overflew the United States in February 2023;

Having connections to companies that provided such support;

Acquiring and attempting to acquire U.S.-origin items, applicable to unmanned aerial vehicles, to be used by Chinese military entities;

Being involved in the shipment of controlled items to Russia since its invasion of Ukraine in February 2022;

Acquiring and attempting to acquire U.S.-origin items in support of advancing China’s quantum technology capabilities; and Being involved in advancing China's nuclear program development. https://overruled.com/china/

~~~~~~~~~

The essential metals for humans: a brief overview - PubMed

~~~~~~~~~

S&P Global Rankings Urges Asset Managers To Embrace Tokenization | TheDefiant

~~~~~~~~~

The DCSA Digital Trade initiative was designed to facilitate universal acceptance and adoption of a standards-based electronic Bill of Lading, applicable to both original Bill of Ladings and Seaway Bills.

Using open source Application Programming Interfaces (APIs), DCSA BL standard enables straight-through processing of BL data, eliminating paper and manual intervention from BL processes.

Standardised digitalisation of BL data and processes will help create a more secure, agile and sustainable supply chain ecosystem. DCSA is also working closely with eBL solution providers on technical and legal interoperability to enable seamless digital transfer of original BLs across different platforms and stakeholders, which will facilitate the global uptake of BL standards. DCSA

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s Thoughts and Opinions 5-15-2024

U.S. Stock Market And Banks Are About To Be Devastated By Black Swan Event!

Atlantis Report: 5-15-2024

U.S. Stock Market And Banks Are About To Be Devastated By Black Swan Event!

The U.S. financial sector is experiencing severe problems. Our stock market and banking sector are bracing for an imminent black swan event.

Energy prices are unstable, with oil prices fluctuating wildly while shipping costs remain stubbornly high.

As these prices fluctuate wildly, a new trading phenomenon is gaining traction on Wall Street.

These ultra-short-term bets are gaining popularity and could trigger a black swan event.

U.S. Stock Market And Banks Are About To Be Devastated By Black Swan Event!

Atlantis Report: 5-15-2024

U.S. Stock Market And Banks Are About To Be Devastated By Black Swan Event!

The U.S. financial sector is experiencing severe problems. Our stock market and banking sector are bracing for an imminent black swan event.

Energy prices are unstable, with oil prices fluctuating wildly while shipping costs remain stubbornly high.

As these prices fluctuate wildly, a new trading phenomenon is gaining traction on Wall Street.

These ultra-short-term bets are gaining popularity and could trigger a black swan event.

These issues could initiate a domino effect, leading to a major financial crisis that could devastate the U.S. stock market and banks.

Fiscal Future: 'Rubicon Crossed' with Soaring U.S. Government Spending - Peter Boockvar

Kitco News: 5-14-2024

Jeremy Szafron, Anchor at Kitco News, interviews Peter Boockvar, Chief Investment Officer of Bleakley Financial Group and editor of The Boock Report.

In this interview Peter shares his latest insights on the U.S. economy, examining the implications of recent fiscal pressures like the soaring costs of U.S. government spending and the shifts from a 40-year bond bull market to a bear market.

Boockvar also analyzes how these factors might influence the Federal Reserve's policies and the broader financial markets. Additionally, he offers strategic investment advice in light of the current economic landscape, including his perspective on utility stocks and sectors poised for growth.

0:00 - Introduction and Welcome

1:15 - U.S. Economic Pressures Discussed

3:00 - Impact of Fiscal Trends on Economy

5:10 - Shift from Bond Bull to Bear Market

7:25 - Significance of Rising Debt Costs

9:50 - Government Spending and Economic Impact

12:15 - Dependence on Domestic Funding

15:00 - Exploring High Debt Figures

18:00 - Global Bond Market and U.S. Economy

21:00 - Inflation Trends and Debt Sustainability

23:00 - Closing Remarks and Future Outlook

On The Ledge' Of Systemic Financial Crisis, Fed Is Giving Life Support | Mehrsa Baradaran

David Lin: 5-15-2024

Mehrsa Baradaran, Professor of Law at UC Irvine, discusses the risks facing our financial system

0:00 – Intro

0:40 - Evolution of banking regulations

7:00 - Should banks fail?

13:20 - Another financial crisis

17:00 - Insuring crypto firms

21:11 - Capitalism and neoliberalism

26:42 - Wealth gap

35:10 - CEO pay

38:15 - Gold standard

Accelerating Collapse of Fiat Regime Paving the Way For Gold: Peter St Onge

Accelerating Collapse of Fiat Regime Paving the Way For Gold: Peter St Onge

Commodity Culture: 5-15-2024

Peter St Onge has a view that gold's return to the monetary system could fix a lot of the problems we have with corruption in politics, out-of-control government deficits, wars being waged, and much more.

Peter argues that the BRICS nations introducing a gold-backed currency for trade would be a big step in the right direction to setting humanity back on a path of sound money.

Accelerating Collapse of Fiat Regime Paving the Way For Gold: Peter St Onge

Commodity Culture: 5-15-2024

Peter St Onge has a view that gold's return to the monetary system could fix a lot of the problems we have with corruption in politics, out-of-control government deficits, wars being waged, and much more.

Peter argues that the BRICS nations introducing a gold-backed currency for trade would be a big step in the right direction to setting humanity back on a path of sound money.

00:00 Introduction

01:23 Who Really Controls the World?

04:00 Lust For Profits and Power

06:01 Biden's Economic Advisor

09:48 Can a Gold Standard Fix Our Problems?

13:56 Is Silver a Monetary Metal?

16:01 BRICS Gold-Backed Currency

23:14 Commodity Supercylce

27:57 Finding Value in Markets Today

30:59 How Will This Debt-Based System End?

34:47 Brazen Corruption

“Tidbits From TNT” Wednesday 5-15-2024

TNT:

Tishwash: Will the volume of trade exchange between Iraq and China increase to about 55 billion dollars?

Today, Wednesday, the Iraqi-Chinese Business Council expected the volume of trade exchange between Iraq and China to rise to about 55 billion dollars, calling for the necessity of financial regulation of this trade.

Council member Sabah Al-Daraji said in an interview followed by Al-Iqtisad News, “The development of relations between Iraq and China in various sectors is leading to a noticeable increase in the volume of trade exchange to more than last year, which amounted to 53 billion dollars, with the increase in projects and agreements as well as the proximity of... “Working on the path of development,” expecting that “the volume of trade exchange will exceed about 55 billion dollars.”

Al-Daraji added, "The volume of trade between Iraq and China requires finding financial solutions to regulate it," pointing out that "many Iraqi merchants are still in a spiral of routine with Iraqi banks and the requirements of the electronic platform."

TNT:

Tishwash: Will the volume of trade exchange between Iraq and China increase to about 55 billion dollars?

Today, Wednesday, the Iraqi-Chinese Business Council expected the volume of trade exchange between Iraq and China to rise to about 55 billion dollars, calling for the necessity of financial regulation of this trade.

Council member Sabah Al-Daraji said in an interview followed by Al-Iqtisad News, “The development of relations between Iraq and China in various sectors is leading to a noticeable increase in the volume of trade exchange to more than last year, which amounted to 53 billion dollars, with the increase in projects and agreements as well as the proximity of... “Working on the path of development,” expecting that “the volume of trade exchange will exceed about 55 billion dollars.”

Al-Daraji added, "The volume of trade between Iraq and China requires finding financial solutions to regulate it," pointing out that "many Iraqi merchants are still in a spiral of routine with Iraqi banks and the requirements of the electronic platform."

The Chinese Deputy Ambassador, Xu Haifeng, had revealed in previous press statements that “China has a great interest in developing trade and economic relations with Iraq because of its economic weight in the world and the Middle East region,” adding that “the volume of trade exchange between the two countries reached in 2023.” It reached 53.37 billion dollars, an annual increase of 43.1 percent, while the volume of China’s imports from Iraq reached 39.38 billion dollars, an annual increase of 47.8 percent,” stressing, “China is the largest buyer of Iraqi oil.” link

CandyKisses: Iraq can add 75,000 barrels per day of oil to its OPEC+ quota

Kazakhstan opened a thorny debate on OPEC+ production levels later on Tuesday, saying it believes it should be allowed to pump more oil in 2025, when all current production cuts for the group of producers end.

OPEC+ has tasked three companies – IHS, Wood Mackenzie and Rystad Energy – to assess the capabilities of all members to use in benchmark production – figures by which production cuts or increases are calculated – from 2025. Reviews are scheduled to take place by 2025. End of June.

Five OPEC+ sources said that as a result, the issue will not be raised at the June 1 meeting, allowing the group to decide on policy for the rest of 2024 more easily. But it also means that the June meeting won't give the market much policy guidance for 2025, when all the current cuts are over.

"Figures on production capacity will not be presented at the June meeting," said one OPEC+ source, who asked not to be identified, adding that "the reason is that some countries have not fully concluded their discussions with secondary sources."

The UAE is expected to gain up to 180,000 bpd of additional capacity until 2027, while Kazakhstan is expected to reach 80,000 bpd of new capacity, according to JPMorgan estimates. Iraq could add another 50,000 to 75,000 bpd.

The IMF estimates that Saudi Arabia needs the oil price of $96.20 this year to balance its budget, then drop to $84.70 in 2025.

Iraq's budget needs a price of $90 for oil next year, and Algeria and Kazakhstan need prices well above $100.

************

Tishwash: After implementing electronic systems, Customs announces a “historic” increase in its revenues

The General Authority of Customs announced today, Tuesday, achieving what it described as a historic increase in its revenue rate during the first quarter of this year, while it expected a doubling of revenues once the automation project is completed.

The head of the General Authority for Customs, Hassan Al-Ugaili, told the Iraqi News Agency (INA): “During the years 2022 and 2023, the General Authority for Customs achieved an increase in the percentage of its revenues, and last year it reached 28%.”

He added, "In the first quarter of this year, the Authority achieved an increase of 120% over the first quarter of last year, as the first quarter of this year is the highest revenue since the founding of the Customs."

He continued, "The increase came as a result of a set of measures by the authority through simplifying procedures, in addition to monitoring and implementing some electronic systems," pointing out that "the authority is in the process of generalizing the application of electronic systems in all ports of the Iraqi state, and we hope in the middle of next year to end automation in all Customs centers.

He pointed out that “the authority is looking forward to achieving an increase in revenues this year to more than 100% over the previous year,” expecting that “if automation is completed and fully disseminated, the increase may reach three times.” link

************

Tishwash: Al-Sudani told an American official: The memorandums of understanding concluded between the two countries are being implemented on the ground

Today, Wednesday, Prime Minister Muhammad Shiaa Al-Sudani, with US Assistant Secretary of State for Energy Resources Affairs Jeffrey Payette, in the presence of the US Ambassador to Iraq, reviewed the most prominent files of cooperation in the field of energy, in all its forms, and ways to develop it, in a way that contributes to Achieving common interests.

During the meeting, Al-Sudani stressed, according to a statement from the Prime Minister’s Office, a copy of which {Al-Furat News} received, “the government’s keenness to implement its executive approach within the axis of achieving energy self-sufficiency, in the areas of exploiting locally produced natural and associated gas, generating electricity, providing oil derivatives, and producing chemical fertilizers.” And petrochemical materials,” referring to “the memorandums of understanding that were signed during his visit to the United States of America last April, and which are being implemented on the ground.”

Al-Sudani pointed to "the government's efforts and steps in the field of economic and financial reform, especially in the areas of tax, customs, and the banking sector, and completing the elements of the ideal investment environment, calling on American companies to work and invest in Iraq."

For his part, the American official praised the efforts of the Iraqi government in developing the energy sector. He also referred to the joint statement of the Prime Minister and US President Joseph Biden, which represents a road map and framework for fruitful work and cooperation, stressing the desire of American companies to invest and expand their activities inside Iraq. link

Mot: The Angry Ghost

Mot: Sooooon to Change - Right!!!!

News, Rumors and Opinions Wednesday AM 5-15-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 15 May 2024 Compiled Wed. 15 May 2024 12:01 am EST by Judy Byington

NESARA/GESARA: The Dawn of a New World

“The End of Poverty, The End of Debt, The Beginning of a New Golden Age!” Prepare for a world where poverty, hunger, and debt are relics of the past, replaced by global prosperity and lasting peace for all!

NESARA Joins Forces with GESARA: In a monumental shift, NESARA, a comprehensive economic reform plan for the United States, has united its destiny with GESARA, its global counterpart. This momentous announcement heralds a profound transformation that will impact not only the United States but also a coalition of 206 sovereign nations worldwide. The linchpin of this transformation is the new financial system enshrined within GESARA.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 15 May 2024

Compiled Wed. 15 May 2024 12:01 am EST by Judy Byington

NESARA/GESARA: The Dawn of a New World

“The End of Poverty, The End of Debt, The Beginning of a New Golden Age!” Prepare for a world where poverty, hunger, and debt are relics of the past, replaced by global prosperity and lasting peace for all!

NESARA Joins Forces with GESARA: In a monumental shift, NESARA, a comprehensive economic reform plan for the United States, has united its destiny with GESARA, its global counterpart. This momentous announcement heralds a profound transformation that will impact not only the United States but also a coalition of 206 sovereign nations worldwide. The linchpin of this transformation is the new financial system enshrined within GESARA.

A Global Gold-Standard Monetary System: Once GESARA takes center stage, the International Monetary Fund (IMF) will declare the inception of a “global gold-standard monetary system.” In this new era, all remaining fiat currencies will be exchanged for gold-backed currency, a significant step away from paper money. The march toward digital currencies will gain momentum under this revitalized financial system.

A Transition Rooted in Simplicity: To ensure a seamless transition, meticulous preparations have been made. The new financial system has been operational for months, securely hosted on a quantum server impervious to hacking or unauthorized access. Crucially, wealth proliferation is a cornerstone of this transformation. Newly minted wealth holders are more inclined to contribute to humanitarian efforts, ultimately fostering wealth for all.

Wealth-Building Mechanisms: This transformation might witness a shortage of skilled workers, which, paradoxically, is a wealth-building catalyst. The resulting surge in wages and salaries counterbalances the price drop stemming from tax reductions, sometimes up to 80% of final product costs, thus ushering in deflation. Lower energy costs, thanks to free-energy technologies, further contribute to this financial renaissance.

The Future: A Glorious Reality: Our future is poised to be a grand tapestry of innovation and abundance. Technologies once suppressed by the cabal, some dating back centuries, are finally being unleashed. For instance, the pristine waters of Antarctica will revitalize arid regions and infuse life into all flora and fauna. A world with personalized credit cards, Replicators that produce everything, and newfound awareness of the power of the mind to manifest our desires awaits. Real healthcare capable of rejuvenating our bodies, re-growing limbs or organs, and even reversing the aging process by decades is on the horizon.

Liberation from Financial Chains: Money and traditional banking, tools historically employed by the cabal to manipulate and control us within a debt-based economy, are slated for obsolescence. Coinage, however, will endure. With the elimination of national debts globally, taxes will be lowered for individuals and corporations. Instead, a flat sales tax of approximately 15% on new items will be implemented.

The Dissolution of the Global Elite’s Pyramid: The current pyramid structure dominated by the global elite, governments, and corporations has reached its limit. This structure perpetuates class divisions and scarcity. True spiritual evolution arises when one’s identity transcends material attachments. With the advent of free energy, advanced transportation, and Replicators accessible to all, true equality emerges. No one will be enslaved, people will pursue their passions with ample free time for reflection and creativity. Hoarding becomes unnecessary.

A Vision of Advanced Civilization: In advanced civilizations, concerns about food, shelter, and transportation are relics of the past. As NESARA and GESARA unfurl, we stand on the brink of a world where prosperity, freedom, and innovation thrive, and the human spirit soars unburdened by material concerns.

The Critical GESARA Teachings Every American Needs to Learn Before the Financial Reset!

~~~~~~~~~~~~~

Global Currency Reset:

Tues. 14 May 2024 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#

Bruce’s US Space Force contact indicated Tier4b (Us, the Internet Group) would have a window to receive notification between tonight Tues. 14 May and Wed. night 15 May.

An Iraqi source said there was an in-country Dinar Rate at over $8. The Dong was just below $8.

The Dinar went on a CBI platform to trade (not on the Forex).

On Sun. 12 May the PM of Iraq made two of the three announcements he was supposed to make, with the third announcement made on Mon. 13 May.

Our banking accounts have been mirrored on the QFS. Those accounts were made live on the QFS yesterday Mon. 13 May.

Tues. 14 May 2024: The Ancient Frequency Powering the Quantum Financial System Revealed: Setting Up the QFS Accounts!

Read full post here: https://dinarchronicles.com/2024/05/15/restored-republic-via-a-gcr-update-as-of-may-15-2024/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat ...Iraq is always much farther ahead than it seems in these articles, as they can read a bit gloomy at times like there is a ton more of work to be done. But in reality, they are much, much closer to accomplishing most of the goals to the Pillars of Financial Reform as we realize as needed to progress forward into the international arena and play ball with the big guys… Folks, it is coming...we can’t stop it now. It is just a matter of time.

Walkingstick [Information from Iraq bank owner #1 friend] Ever since Sudani came back from Washington DC the government of Iraq...has been in the process of making...videos, commercials, advertising. Sudani has been doing this on behalf of the executive level of all the private banks...These videos will soon be released and shown on Iraqi television

and the big screens. Suandi and the GOI are making these videos with the executive branch of each bank to teach the Iraqi citizens about the new national currency...and the process of the new exchange rate...There will be a primary video, a spearhead video. The videos will be with the head of the private banks, the governor of the Central Bank of Iraq, the whole of the board members, the government of Iraq, Sudani himself, the Minister of Planning, the Minister of Finance, the Minister of Oil. It will encompass all of the GOI of Sudani because the GOI encompasses the entire executive branch...These videos will explain to the Iraqi citizens the process of the monetary reform and where it is at that moment... [Post 2 of 2]

************

DISASTER. Inflation Report Comes In WORSE THAN EXPECTED! AND ITS NOT GOING TO STOP.

Greg Mannarino: 5-14-2024

Economist’s “News and Views” Tuesday 5-14-2024

Peter Schiff: “US and EU will have Argentina-type inflation”

Reinvent Money: 5-14-2924

Paul Buitink talks to Peter Schiff, founder of Schiffgold, about the increasing global debt levels.

When Paul asks which currency is in the most trouble, Peter responds that's it looking bad for all and especially for the US dollar.

It's just because of its world reserve status that on the surface the dollar still doesn't look as bad as the others. He believes that debt will increase in both the U.S. and the EU, with politicians prioritizing reelection over the economic and public well-being.

This unsustainable trajectory, he warns, may lead to Argentina-style inflation, because politicians won't dare to default.

Peter talks about the endgame for the current financial system and the role the dollar and gold will play going forward.

Peter Schiff: “US and EU will have Argentina-type inflation”

Reinvent Money: 5-14-2924

Paul Buitink talks to Peter Schiff, founder of Schiffgold, about the increasing global debt levels.

When Paul asks which currency is in the most trouble, Peter responds that's it looking bad for all and especially for the US dollar.

It's just because of its world reserve status that on the surface the dollar still doesn't look as bad as the others. He believes that debt will increase in both the U.S. and the EU, with politicians prioritizing reelection over the economic and public well-being.

This unsustainable trajectory, he warns, may lead to Argentina-style inflation, because politicians won't dare to default.

Peter talks about the endgame for the current financial system and the role the dollar and gold will play going forward.

Peter remains skeptical about the value of cryptocurrencies like bitcoin. In his view, a cryptocurrency only has real value when backed by a tangible asset such as gold.

Without such backing, he argues, cryptocurrencies lack inherent value. Peter says you have tot protect yourself with gold and other non-printable assets.

My Favorite Chart: What Happens When Purchasing Power Becomes ZERO?

Lynette Zang: 5-14-2024

SHOCKING $8.9 Trillion US Debt Due THIS SUMMER

5-14-2024

The U.S. banking sector is at a crossroads as over $400 billion in unrealized losses loom large, exacerbated by unyielding interest rates, setting the stage for a potential crisis of epic proportions.

With multiple bank failures already a reality, tensions rise as the looming maturity of $8.9 trillion in government debt threatens to tip the scales of financial stability.

CHAPTERS:

00:00 $8.9 Trillion US Debt Due

01:22 Unrealized Bank Losses

02:36 Debt Maturity 2024

05:23 Banks In Limbo

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible." It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS © Goldilocks ~~~~~~~~~

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible."

It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS

© Goldilocks

~~~~~~~~~

"UAE: Liv Digital Bank enters tokenization deal targeting Gen Zs" | CoinGeek

We are moving at a rapid pace at this point in the tokenization of our assets around the world.

You are going to notice the word digital added to many banking titles and companies going forward. Old traditional assets have been reformed into digital assets.

Hong Kong is leading the way in the digital asset transformation, and the innovation of our new banking system on a global scale is in its final stages there.

Hong Kong is presently finishing up many of their pilot programs, and their movement forward will lead our way into the new digital age.

© Goldilocks

~~~~~~~~~

Franklin Templeton CEO: All Investment Funds Going Blockchain | Crypto Times

"Jenny Johnson, CEO of the $1.6 trillion asset management giant Franklin Templeton, stated that all exchange-traded funds (ETFs) and mutual funds will eventually migrate to blockchain technology."

I know we have gone over this several times, but this gives you an idea of how much money is transferred into blockchain technology.

This is just one of many companies that are doing the same as we speak.

Institutional money and institutional integration are beginning to take place on the blockchain at larger magnitudes indicating that the new digital economy is moving towards mass adoption.

© Goldilocks

~~~~~~~~~

U.S. banks undertake blockchain experiment | Investment Executive

"The U.S. financial sector is exploring the idea of tokenizing various financial instruments, including U.S. Treasuries, wholesale central bank money, and commercial bank money, which would enable transactions in these instruments to settle on a single shared ledger.

Currently, transactions in various components of the wholesale financial system all take place on separate systems. A new project will examine the concept of tokenizing these instruments to facilitate settlement on a single platform, under existing legal frameworks.

SIFMA is serving as project manager, with participation from several large financial institutions including Citi, J.P. Morgan, Mastercard, Swift, TD Bank N.A., U.S. Bank, USDF, Wells Fargo, Visa, and Zions Bancorp.

Other project contributors include the Bank of New York Mellon, Broadridge, DTCC, the International Swaps and Derivatives Association, Tassat Group, and the MITRE Corp"

I want to point out that this article is sharing with us how this new experiment is being conducted on the Swift System and the new Digital Ledger Transmission System (DLT) Ledger.

This indicates that the movement of foreign currency exchange services is transitioning from wire services that can take days for transmissions to occur to electronic exchange services that are done in a matter of seconds and far more cost-efficient.

This is what my banker friend was referring to yesterday as to why her friend was going through foreign exchange services training.

© Goldilocks

~~~~~~~~~

Tokenizing assets on a scalable blockchain | Naeem Aslam, Antonino Sardegno, Stas Trock | Youtube

~~~~~~~~~

Swarm Markets (SMT) Price Today, News & Live Chart | Forbes Crypto Market Data

~~~~~~~~~

...by the Securities and Exchange Commission

H.J. Res. 109 would invalidate SEC Staff Accounting Bulletin 121 (SAB 121), which reflects considered SEC staff views regarding the accounting obligations of certain firms that safeguard crypto-assets. 6 days ago

~~~~~~~~~

SEC issues SAB 121 on digital asset custodial obligations | KPMG

~~~~~~~~~

👆The US is still working on who has governing power over these digital assets. This is why many Governments are moving ahead of the United States in the mobilization of the new digital economy.

This is why the MICA regulations are so important for us to finish. It will give more clarity and government power to authentic leaders in government to facilitate the movement of our new digital economy. House Financial Services

© Goldilocks

~~~~~~~~~

US Department of Treasury, Pacific Northwest National Laboratory, and Cloudflare Partner to Share Early Warning Threat | CoudFlare

San Francisco, CA, May 9, 2024 – Cloudflare, Inc (NYSE: NET), the leading connectivity cloud company, today announced a partnership with the United States Department of Treasury and Pacific Northwest National Laboratory (PNNL) under the Department of Energy to improve the cyber resilience of the financial services industry by sharing an advanced threat intelligence feed through Cloudflare. With this new offering, financial services institutions that are using Cloudflare Gateway now have privileged access to Custom Indicator Feeds that share threat indicators and enable direct action to be taken, to better defend against ransomware, phishing, and other threats.

~~~~~~~~~

Ranking Member Waters Statement on Resolution to Overturn SEC’s Guidance on Crypto Assets: H.J. Res. 109 “Would Have Broad and Negative Consequences for All Public Companies and Their Investors, with Implications for the Entire Securities Market, Not Just Crypto.” | U.S. House Committee on Financial Services Democrats

~~~~~~~~~

May 9, 2024

Tokenized Real-World Assets: Pathways to SEC Registration

By: Ryan Mitteness, Ryan M. McRobert, Andrew T. Albertson

What You Need to Know

Global demand for Tokenized Real-World Assets (RWAs) is growing rapidly in the decentralized finance (DeFi) community and traditional finance industry.

Tokenized RWAs allow legal ownership or rights to traditionally illiquid assets to be digitalized and traded on digital platforms, leading to expedited settlements and potentially reduced operating costs.

Regulatory hurdles have slowed adoption in U.S. markets where companies have to navigate existing securities laws and often lengthy review processes by the Securities Exchange Commission (SEC).

While a clear preferred registration pathway through the SEC for tokenized RWAs has yet to emerge, there are various potential approaches issuers of RWAs may explore for broadly marketed offerings in the United States. Fenwick

~~~~~~~~~

ETFs and mutual funds are all going to be on blockchain, says Franklin Templeton CEO - Ledger Insights - blockchain for enterprise | LedgerInsights

~~~~~~~~~

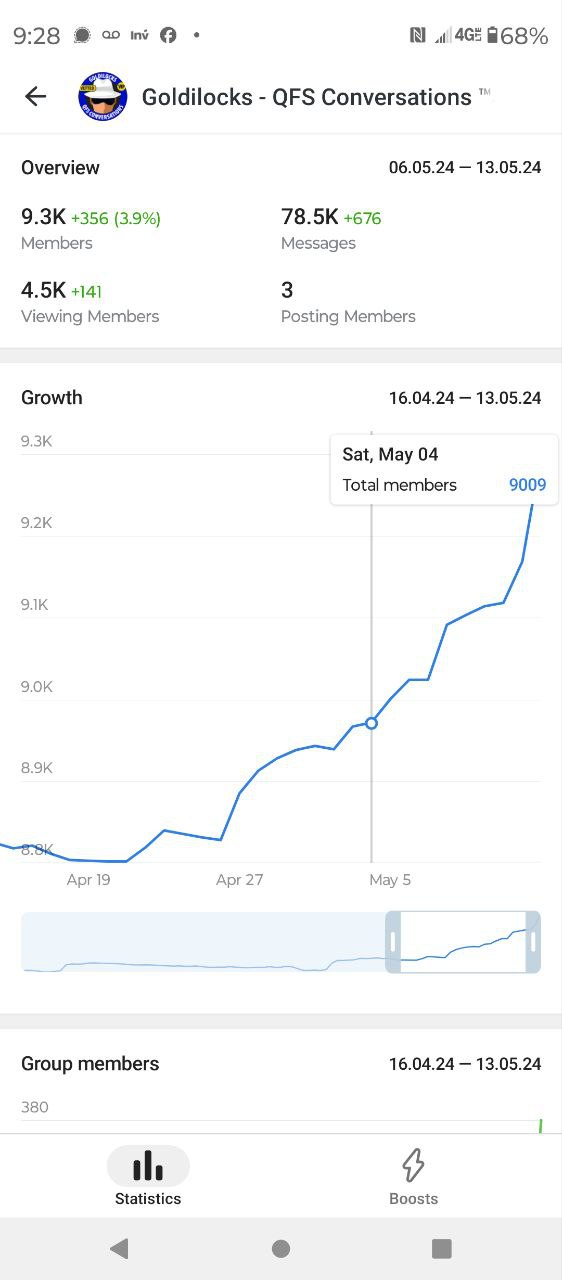

Thank you everyone for your participation in this room. I thought I would give you an idea of the statistics that actually take place in this room. This is the current total.

It is important to note that almost 50% of the people in this room actually come to it every day. This is very rare due to the fact that most people join rooms and then move on to others.

What you are looking at above is an active room where people realize and know that the information being shared is important, and I take this room and the lives of the people within it as an important piece instilled within my heart of prayer each and every day as I write to support and encourage all of us to move forward in faith, hope, and love.

© Goldilocks

~~~~~~~~~

ECB conducts first DLT trials for wholesale central bank money settlement | FinExtra

~~~~~~~~~

Report on OTC derivatives data reporting and aggregation requirements

The final regulations come into operation on 21 October 2024, introducing the UPI, UTI, CDE and ISO 20022 in reporting.10 hours ago

~~~~~~~~~

Miami Federal Court Orders Multiple Individuals and Entities to Pay Over $225 Million for Foreign Currency Fraud and Misappropriation Scheme | CFTC

~~~~~~~~~

May 14, 2024

Washington, D.C. — The Commodity Futures Trading Commission today announced the Honorable Darrin P. Gayles of the U.S. District Court for the Southern District of Florida issued an order of default judgment against four individuals and five companies (nine defendants): Jase Davis of Brandon, Mississippi; Borys Konovalenko of Ukraine; Anna Shymko of Duluth, Georgia; Alla Skala of Grand Island, New York and/or Fort Erie, Canada; Easy Com LLC d/b/a ROFX, a New Hampshire LLC; Global E-Advantages LLC a/k/a Kickmagic LLC d/b/a ROFX, a Delaware LLC and New York foreign LLC; Grovee LLC d/b/a ROFX, a Delaware LLC; Notus LLC d/b/a ROFX, a dissolved Colorado LLC; and Shopostar LLC d/b/a ROFX, a Colorado LLC.

The default judgment order stems from the CFTC’s August 31, 2022 amended complaint charging the nine defendants and defendant Timothy F. Stubbs with fraud, misappropriation, and registration violations in connection with a fraudulent foreign currency (forex) scheme. [See CFTC Press Release Nos. 8486-22 and 8790-23]

~~~~~~~~~

DTCC Comments on Industry’s Affirmation Progress | DTCC

~~~~~~~~~

H.R.4766 - 118th Congress (2023-2024): Clarity for Payment Stablecoins Act of 2023 | Congress Gov

~~~~~~~~~

Using MRI, engineers have found a way to detect light deep in the brain | MIT News | Massachusetts Institute of Technology

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Tuesday PM 5-14-2024

R. Kiyosaki warns US dollar to crash as ‘BRICS gold crypto’ emerges Ana Zirojevic May 13, 2024

Amid warnings of a major financial crash, famous investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has shared his views on why the United States dollar, in particular, might suffer as a new currency threatens its global domination.

Specifically, Kiyosaki was visiting South Africa, “watching and listening to rumors of what will happen when BRICS nations, Brazil, Russia, India, China, South Africa produce BRICS crypto, possibly backed by gold,” as he told his followers in an X post published on May 12.

R. Kiyosaki warns US dollar to crash as ‘BRICS gold crypto’ emerges

Ana Zirojevic May 13, 2024

Amid warnings of a major financial crash, famous investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has shared his views on why the United States dollar, in particular, might suffer as a new currency threatens its global domination.

Specifically, Kiyosaki was visiting South Africa, “watching and listening to rumors of what will happen when BRICS nations, Brazil, Russia, India, China, South Africa produce BRICS crypto, possibly backed by gold,” as he told his followers in an X post published on May 12.

Hyperinflation on horizon

Indeed, according to the renowned finance educator, if the rumors are true, this would mean a loss of value to the US dollar and a hyperinflation in the US, and he recommended investing money in alternative assets instead, including gold, silver, and Bitcoin (BTC) to protect oneself against this crash:

“If BRICS gold crypto happens, trillions in fake money, fiat US dollars will come rushing back to home to America causing hyperinflation in America, ultimately destroying US dollar. Best buy real gold, silver, and Bitcoin now, and protect yourself from the crash of US dollar.”

As a reminder, Kiyosaki has lately intensified his doomsday warnings, stressing the crash has already started, signaling the end of the US dollar, and that the dire situation is only worsening “because our debt keeps going up,” with the dollar’s demise the primary reason to accumulate the above assets.

More recently, he said that most people were living in “Disneyland” instead of preparing for the crisis using a strategy he considers the best – starting their own business, using debt as money to buy cash-flowing assets like rental properties, and saving gold, silver, and the maiden cryptocurrency.

Robert Kiyosaki and Bitcoin

Interestingly, the ‘Rich Dad Poor Dad’ author has also admitted to being a latecomer to the crypto industry and not knowing much about the flagship decentralized finance (DeFi) asset, but he has been a fan nonetheless, including Bitcoin in most of his recommendations.

On top of that, he has agreed with the founder and CEO of ARK Invest, Cathie Wood, and her extremely bullish prediction that Bitcoin price in USD could hit $2.3 million. For now, Bitcoin is trading at $61,639, gaining 1.55% on the day, but declining 4.57% in the past week, and losing 8.58% on its monthly chart.

Source: Finbold

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Article: "Floating the dinar" returns to the forefront.. Will the Central Bank of Iraq resort to it and what are its risks?" Floating the dinar, oh my goodness, they are talking to the Iraqi citizens about the monetary reform...Floating the dinar is what they're going to do...

Mnt Goat ...the US Treasury needs to recognize that Iraq still has tremendous value in the dinar as the country sits right now with its oil revenues and out paces Kuwait in all aspects of its economy and so why is Kuwait 1 KWD = $3.40 USD? ...the IQD is being intentionally suppressed now after 20 years already and that is at the heart of the problem Iraq now faces. In reality they are more than ready and the Dr Shabibi attempt in 2012 tells it all...

Deflation As Economy Comes To A Halt | Michael Pento

Liberty and Finance: 5-13-2024

Disinflation is coming, says portfolio manager Michael Pento and even a short period of deflation is likely.

Amid the economy coming to a halt, the Fed will have no other option than to inflate the currency supply.

At that point, stagflation will become the new normal, he says. And stagflation - high inflation with a weak economy - has proven to be the ideal environment for gold.

INTERVIEW TIMELINE:

0:00 Intro

1:20 Japan's economy

10:00 Dedollarization

18:21 What's the Fed's real goal?

The Year Of Giving Dangerously

The Year Of Giving Dangerously

White Hats Briefing # 203

We will once again center some attention on the post-BTC halving, and provide a suggested short list of some very, very speculative crypto plays that could yield big numbers (perhaps 1,000% to 10,000%) by being swept up in post-halving winds.

With the approaching and ever-present realities of a new multi-polar world and the possibility of fiscal impact on the US dollar, some strategic moves into this high-risk/high-reward corner of the digital asset realm may be prudent for some of your disposable risk dollars. With the current consolidation at just-below recent market highs, it may be an opportune time to consider such a move.

We will not go into a lengthy explanation of the ideas, and would suggest that any who wish to partake of these ideas must take the time to review the details of each themselves. There are adequate details available on each product via their respective websites, or via the Internet where no site exists for a project.

The Year Of Giving Dangerously

White Hats Briefing # 203

We will once again center some attention on the post-BTC halving, and provide a suggested short list of some very, very speculative crypto plays that could yield big numbers (perhaps 1,000% to 10,000%) by being swept up in post-halving winds.

With the approaching and ever-present realities of a new multi-polar world and the possibility of fiscal impact on the US dollar, some strategic moves into this high-risk/high-reward corner of the digital asset realm may be prudent for some of your disposable risk dollars. With the current consolidation at just-below recent market highs, it may be an opportune time to consider such a move.

We will not go into a lengthy explanation of the ideas, and would suggest that any who wish to partake of these ideas must take the time to review the details of each themselves. There are adequate details available on each product via their respective websites, or via the Internet where no site exists for a project.

Let us proceed.

Pyrin (PYR-USD): PYRIN strategically integrates Layer 1 technology, enhances decentralization, introduces smart contracts, and pioneers innovative resource management which not only boost miner revenues but also contribute to more environmentally friendly blockchain protocols.

More information about where and how to by this idea can be found here.

Banano (BAN-USD): This meme coin with real utility allows you to earn rewards for contributing computing power to medical research. Banano describes itself as a feeless, instant, rich in potassium cryptocurrency powered by directed acyclic graph (DAG) technology that aims to disrupt the meme economy. Banano was a hard fork of Nano coin in 2018.

Banano is fully decentralized, with no central development team, a rarity in today’s crypto landscape. This aspect arguably makes Banano one of the safest meme cryptos. Interestingly, you can sell computing power to the medical sector in exchange for Banano, a process termed “folding.”

This use case alone arguably makes it the most useful meme coin, surpassing even some utility projects that barely see any activity on their networks.

More information on this project can be found here.

Blue Kirby (KIRBY-USD): A pure meme crypto on the Fantom (FTM-USD) blockchain has a tiny market cap and potential for explosive gains.

The Blue Kirby is what helped Andre’s other protocol (yearn.finance) reach $1B, it is here to help $FTM become a leader again. Liquidity comes from the top down, we will change the game and make it come from bottom up. Just a simple humble character, that's what the Blue Kirby symbolizes.

This crypto can deliver multi-bagger gains if Fantom (FTM-USD) takes off during the next alt season or if it finds enough attention from crypto whales. Regardless, it is a gamble, much like the other two cryptos on this list, and you should treat it as such.

Now we move on to the Global...eh, sorry...the Selective Global Refunding Project.

I always do my best to request (not demand) as much up-to-date information on this esoteric, highly-sensitive, sovereign-level, disruptive, multi-trillion-dollar, quasi-amorphous potential transaction as possible for you.

A complete, end-to-end full-on summary of its entire workings is not possible, because you can all imagine that current holders of the monopolized sacred keys of nation-busting vigorish would be driven berserk at any notion that financial resources should be designed to directly SERVE, and not EXPLOIT the nation-state.

Of course, the SGRP would serve no purpose, nor deserve any support, if it were the same three-card-monte merely served up by the Gentile of our species.

And hence, this project has as its natural enemy, a very dangerous external element; a threatening element that rises to provoke entire world-wars into existence, in part to protect their craps game and prevent the spread of any proven, nationally-owned funding alternative that shows, without any doubt, what a project like the SGRF can do for mankind.

Germany once rose from a banking clique quagmire with a similar effort, and the world saw that bloodsucking, usurious, central-banking abattoirs were not only unnecessary, but were "serving" mankind alright...as a quartered steer!

Here is the response from Londinium to my latest present-time request for information. This is as complete as it can be, for now:

We live in a declining Western civilization where standards have gone. For many, economic hope is lost.

How to survive first, beyond thrive is the new dilemma. The West needs a Rethink fast. Geo politically it's happening daily. Money for sure. Standards will take time and Leaders even more so.

The hardest lesson of all is a complex one. Making money, creating wealth is not the hardest dilemma you will face. But keeping it, is!

Wealth creation in a stagnating nation. Plan B fast is what? The West is sleepwalking to disaster. CBDCs will ring fence the lot. Enslaved. Accounts blocked or locked.

As economies, Industries and standards risk nosediving. This new perception of what's best to invest in next, is a Chancers Starter Opportunity. To affect Self-Help. You must. As nations decline, address how to side-step sinking with coagulated Swine. The Fed is dead. Fake Jewish racketeering money is done. BRICS will break this Camel's back. Asset-backed or fake Jewish crap? America is Usury bonded. Enslaved.

The petrodollar is in irreversible decline. Swerve the backlash gate as the mass Goyim are assembled, to meet the Usury Herding fate.

All State-planning algorithms for capital needs are defaulting. They all grossly underassessed age living projections. Taxes too.

They grossly underassessed illness, disease and consequential fallout of geriatric ageing problems. COVID, too, and what's still to come. They lost the plot. An actuarial nightmare.

Reserves are non-existent, the system was never designed to empathize with how to meet needs, just to filter skim.

It can't meet escalating shortfall needs. It has no reserves. All was taken. To default the insolvent dollar now unleashes War. Wrath and Fury.

As bank systems stand, American nationals in particular are prohibited from many emerging markets, if they can't be US regulated or at will. US sequestrated, Americans can only play in a Federal rigged game.

As we debate how to asset back and audit emerging BRICS currencies, it directly challenges the only hype-backed, worthless USD, opening a dichotomy. What are the volumes we can asset back for BRICS, leverage and trade freely? There is only one remaining vast balance of AU, and that carries war risks.

How did Yamashita fare? All know the risks. But if America tries to steal this from South Korea, China will engage. Right up to WWIII. As they did with North Korea. North Korean armaments would be unleashed. Lives are cheap.

There are deeply sensitive discussions in play with multi-tier Eurasian parties. Game changing if accomplished. American greed and maleficence derailed the last opportunities. Death by Duplicity. BRICS AU backed by real AU will face down and take the Face off the Fed Jews. Debasing and neutering them. Stepping on the Rodents' nest. Uniting Eurasia as one.

As with the Zim and Dinars, in parallel with the then Weimar Republic Marks, if the Dollar tanks, you too? They are scrambling.

But, in the meantime what to do, as possible options for you?

And that, my friends, is that.

The Prime Directive to all remains: be ready for anything. There is no way to predict any economic, natural or man-made disaster affecting the general population. Always ask, "What if...?", and be ready to provide a solution to the best degree possible.

And thank you, once again, for the many varied and inciteful comments and discussions taking place. We have so many very accomplished and talented contributors that I am quite certain you will find information within that many are probably paying for to obtain elsewhere.

I will skip the general house-keeping updates for now, but be advised that the site may go down at short notice for such to be implemented. I will give as much pre-notice as possible to prevent you being unable to post a comment as the site goes offline while doing so.

The Empire thanks you for your service.

WHA

S*P*Q*R*

SI VIS PACEM PARA BELLVM