Economist’s “News and Views” Tuesday 5-14-2024

Peter Schiff: “US and EU will have Argentina-type inflation”

Reinvent Money: 5-14-2924

Paul Buitink talks to Peter Schiff, founder of Schiffgold, about the increasing global debt levels.

When Paul asks which currency is in the most trouble, Peter responds that's it looking bad for all and especially for the US dollar.

It's just because of its world reserve status that on the surface the dollar still doesn't look as bad as the others. He believes that debt will increase in both the U.S. and the EU, with politicians prioritizing reelection over the economic and public well-being.

This unsustainable trajectory, he warns, may lead to Argentina-style inflation, because politicians won't dare to default.

Peter talks about the endgame for the current financial system and the role the dollar and gold will play going forward.

Peter Schiff: “US and EU will have Argentina-type inflation”

Reinvent Money: 5-14-2924

Paul Buitink talks to Peter Schiff, founder of Schiffgold, about the increasing global debt levels.

When Paul asks which currency is in the most trouble, Peter responds that's it looking bad for all and especially for the US dollar.

It's just because of its world reserve status that on the surface the dollar still doesn't look as bad as the others. He believes that debt will increase in both the U.S. and the EU, with politicians prioritizing reelection over the economic and public well-being.

This unsustainable trajectory, he warns, may lead to Argentina-style inflation, because politicians won't dare to default.

Peter talks about the endgame for the current financial system and the role the dollar and gold will play going forward.

Peter remains skeptical about the value of cryptocurrencies like bitcoin. In his view, a cryptocurrency only has real value when backed by a tangible asset such as gold.

Without such backing, he argues, cryptocurrencies lack inherent value. Peter says you have tot protect yourself with gold and other non-printable assets.

My Favorite Chart: What Happens When Purchasing Power Becomes ZERO?

Lynette Zang: 5-14-2024

SHOCKING $8.9 Trillion US Debt Due THIS SUMMER

5-14-2024

The U.S. banking sector is at a crossroads as over $400 billion in unrealized losses loom large, exacerbated by unyielding interest rates, setting the stage for a potential crisis of epic proportions.

With multiple bank failures already a reality, tensions rise as the looming maturity of $8.9 trillion in government debt threatens to tip the scales of financial stability.

CHAPTERS:

00:00 $8.9 Trillion US Debt Due

01:22 Unrealized Bank Losses

02:36 Debt Maturity 2024

05:23 Banks In Limbo

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible." It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS © Goldilocks ~~~~~~~~~

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible."

It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS

© Goldilocks

~~~~~~~~~

"UAE: Liv Digital Bank enters tokenization deal targeting Gen Zs" | CoinGeek

We are moving at a rapid pace at this point in the tokenization of our assets around the world.

You are going to notice the word digital added to many banking titles and companies going forward. Old traditional assets have been reformed into digital assets.

Hong Kong is leading the way in the digital asset transformation, and the innovation of our new banking system on a global scale is in its final stages there.

Hong Kong is presently finishing up many of their pilot programs, and their movement forward will lead our way into the new digital age.

© Goldilocks

~~~~~~~~~

Franklin Templeton CEO: All Investment Funds Going Blockchain | Crypto Times

"Jenny Johnson, CEO of the $1.6 trillion asset management giant Franklin Templeton, stated that all exchange-traded funds (ETFs) and mutual funds will eventually migrate to blockchain technology."

I know we have gone over this several times, but this gives you an idea of how much money is transferred into blockchain technology.

This is just one of many companies that are doing the same as we speak.

Institutional money and institutional integration are beginning to take place on the blockchain at larger magnitudes indicating that the new digital economy is moving towards mass adoption.

© Goldilocks

~~~~~~~~~

U.S. banks undertake blockchain experiment | Investment Executive

"The U.S. financial sector is exploring the idea of tokenizing various financial instruments, including U.S. Treasuries, wholesale central bank money, and commercial bank money, which would enable transactions in these instruments to settle on a single shared ledger.

Currently, transactions in various components of the wholesale financial system all take place on separate systems. A new project will examine the concept of tokenizing these instruments to facilitate settlement on a single platform, under existing legal frameworks.

SIFMA is serving as project manager, with participation from several large financial institutions including Citi, J.P. Morgan, Mastercard, Swift, TD Bank N.A., U.S. Bank, USDF, Wells Fargo, Visa, and Zions Bancorp.

Other project contributors include the Bank of New York Mellon, Broadridge, DTCC, the International Swaps and Derivatives Association, Tassat Group, and the MITRE Corp"

I want to point out that this article is sharing with us how this new experiment is being conducted on the Swift System and the new Digital Ledger Transmission System (DLT) Ledger.

This indicates that the movement of foreign currency exchange services is transitioning from wire services that can take days for transmissions to occur to electronic exchange services that are done in a matter of seconds and far more cost-efficient.

This is what my banker friend was referring to yesterday as to why her friend was going through foreign exchange services training.

© Goldilocks

~~~~~~~~~

Tokenizing assets on a scalable blockchain | Naeem Aslam, Antonino Sardegno, Stas Trock | Youtube

~~~~~~~~~

Swarm Markets (SMT) Price Today, News & Live Chart | Forbes Crypto Market Data

~~~~~~~~~

...by the Securities and Exchange Commission

H.J. Res. 109 would invalidate SEC Staff Accounting Bulletin 121 (SAB 121), which reflects considered SEC staff views regarding the accounting obligations of certain firms that safeguard crypto-assets. 6 days ago

~~~~~~~~~

SEC issues SAB 121 on digital asset custodial obligations | KPMG

~~~~~~~~~

👆The US is still working on who has governing power over these digital assets. This is why many Governments are moving ahead of the United States in the mobilization of the new digital economy.

This is why the MICA regulations are so important for us to finish. It will give more clarity and government power to authentic leaders in government to facilitate the movement of our new digital economy. House Financial Services

© Goldilocks

~~~~~~~~~

US Department of Treasury, Pacific Northwest National Laboratory, and Cloudflare Partner to Share Early Warning Threat | CoudFlare

San Francisco, CA, May 9, 2024 – Cloudflare, Inc (NYSE: NET), the leading connectivity cloud company, today announced a partnership with the United States Department of Treasury and Pacific Northwest National Laboratory (PNNL) under the Department of Energy to improve the cyber resilience of the financial services industry by sharing an advanced threat intelligence feed through Cloudflare. With this new offering, financial services institutions that are using Cloudflare Gateway now have privileged access to Custom Indicator Feeds that share threat indicators and enable direct action to be taken, to better defend against ransomware, phishing, and other threats.

~~~~~~~~~

Ranking Member Waters Statement on Resolution to Overturn SEC’s Guidance on Crypto Assets: H.J. Res. 109 “Would Have Broad and Negative Consequences for All Public Companies and Their Investors, with Implications for the Entire Securities Market, Not Just Crypto.” | U.S. House Committee on Financial Services Democrats

~~~~~~~~~

May 9, 2024

Tokenized Real-World Assets: Pathways to SEC Registration

By: Ryan Mitteness, Ryan M. McRobert, Andrew T. Albertson

What You Need to Know

Global demand for Tokenized Real-World Assets (RWAs) is growing rapidly in the decentralized finance (DeFi) community and traditional finance industry.

Tokenized RWAs allow legal ownership or rights to traditionally illiquid assets to be digitalized and traded on digital platforms, leading to expedited settlements and potentially reduced operating costs.

Regulatory hurdles have slowed adoption in U.S. markets where companies have to navigate existing securities laws and often lengthy review processes by the Securities Exchange Commission (SEC).

While a clear preferred registration pathway through the SEC for tokenized RWAs has yet to emerge, there are various potential approaches issuers of RWAs may explore for broadly marketed offerings in the United States. Fenwick

~~~~~~~~~

ETFs and mutual funds are all going to be on blockchain, says Franklin Templeton CEO - Ledger Insights - blockchain for enterprise | LedgerInsights

~~~~~~~~~

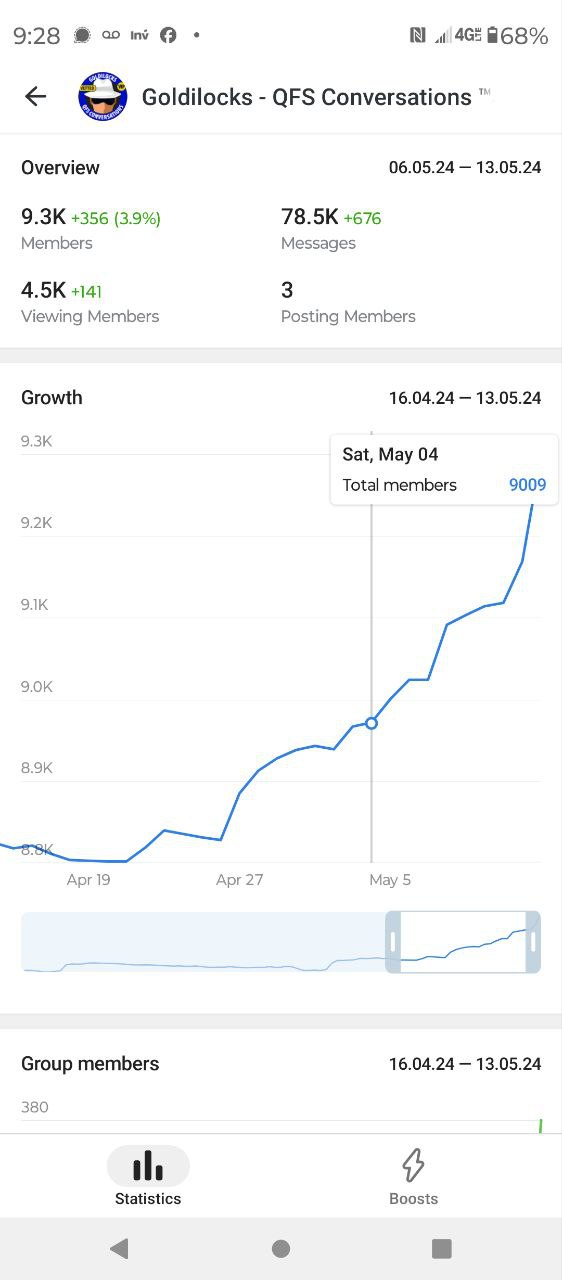

Thank you everyone for your participation in this room. I thought I would give you an idea of the statistics that actually take place in this room. This is the current total.

It is important to note that almost 50% of the people in this room actually come to it every day. This is very rare due to the fact that most people join rooms and then move on to others.

What you are looking at above is an active room where people realize and know that the information being shared is important, and I take this room and the lives of the people within it as an important piece instilled within my heart of prayer each and every day as I write to support and encourage all of us to move forward in faith, hope, and love.

© Goldilocks

~~~~~~~~~

ECB conducts first DLT trials for wholesale central bank money settlement | FinExtra

~~~~~~~~~

Report on OTC derivatives data reporting and aggregation requirements

The final regulations come into operation on 21 October 2024, introducing the UPI, UTI, CDE and ISO 20022 in reporting.10 hours ago

~~~~~~~~~

Miami Federal Court Orders Multiple Individuals and Entities to Pay Over $225 Million for Foreign Currency Fraud and Misappropriation Scheme | CFTC

~~~~~~~~~

May 14, 2024

Washington, D.C. — The Commodity Futures Trading Commission today announced the Honorable Darrin P. Gayles of the U.S. District Court for the Southern District of Florida issued an order of default judgment against four individuals and five companies (nine defendants): Jase Davis of Brandon, Mississippi; Borys Konovalenko of Ukraine; Anna Shymko of Duluth, Georgia; Alla Skala of Grand Island, New York and/or Fort Erie, Canada; Easy Com LLC d/b/a ROFX, a New Hampshire LLC; Global E-Advantages LLC a/k/a Kickmagic LLC d/b/a ROFX, a Delaware LLC and New York foreign LLC; Grovee LLC d/b/a ROFX, a Delaware LLC; Notus LLC d/b/a ROFX, a dissolved Colorado LLC; and Shopostar LLC d/b/a ROFX, a Colorado LLC.

The default judgment order stems from the CFTC’s August 31, 2022 amended complaint charging the nine defendants and defendant Timothy F. Stubbs with fraud, misappropriation, and registration violations in connection with a fraudulent foreign currency (forex) scheme. [See CFTC Press Release Nos. 8486-22 and 8790-23]

~~~~~~~~~

DTCC Comments on Industry’s Affirmation Progress | DTCC

~~~~~~~~~

H.R.4766 - 118th Congress (2023-2024): Clarity for Payment Stablecoins Act of 2023 | Congress Gov

~~~~~~~~~

Using MRI, engineers have found a way to detect light deep in the brain | MIT News | Massachusetts Institute of Technology

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Tuesday PM 5-14-2024

R. Kiyosaki warns US dollar to crash as ‘BRICS gold crypto’ emerges Ana Zirojevic May 13, 2024

Amid warnings of a major financial crash, famous investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has shared his views on why the United States dollar, in particular, might suffer as a new currency threatens its global domination.

Specifically, Kiyosaki was visiting South Africa, “watching and listening to rumors of what will happen when BRICS nations, Brazil, Russia, India, China, South Africa produce BRICS crypto, possibly backed by gold,” as he told his followers in an X post published on May 12.

R. Kiyosaki warns US dollar to crash as ‘BRICS gold crypto’ emerges

Ana Zirojevic May 13, 2024

Amid warnings of a major financial crash, famous investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has shared his views on why the United States dollar, in particular, might suffer as a new currency threatens its global domination.

Specifically, Kiyosaki was visiting South Africa, “watching and listening to rumors of what will happen when BRICS nations, Brazil, Russia, India, China, South Africa produce BRICS crypto, possibly backed by gold,” as he told his followers in an X post published on May 12.

Hyperinflation on horizon

Indeed, according to the renowned finance educator, if the rumors are true, this would mean a loss of value to the US dollar and a hyperinflation in the US, and he recommended investing money in alternative assets instead, including gold, silver, and Bitcoin (BTC) to protect oneself against this crash:

“If BRICS gold crypto happens, trillions in fake money, fiat US dollars will come rushing back to home to America causing hyperinflation in America, ultimately destroying US dollar. Best buy real gold, silver, and Bitcoin now, and protect yourself from the crash of US dollar.”

As a reminder, Kiyosaki has lately intensified his doomsday warnings, stressing the crash has already started, signaling the end of the US dollar, and that the dire situation is only worsening “because our debt keeps going up,” with the dollar’s demise the primary reason to accumulate the above assets.

More recently, he said that most people were living in “Disneyland” instead of preparing for the crisis using a strategy he considers the best – starting their own business, using debt as money to buy cash-flowing assets like rental properties, and saving gold, silver, and the maiden cryptocurrency.

Robert Kiyosaki and Bitcoin

Interestingly, the ‘Rich Dad Poor Dad’ author has also admitted to being a latecomer to the crypto industry and not knowing much about the flagship decentralized finance (DeFi) asset, but he has been a fan nonetheless, including Bitcoin in most of his recommendations.

On top of that, he has agreed with the founder and CEO of ARK Invest, Cathie Wood, and her extremely bullish prediction that Bitcoin price in USD could hit $2.3 million. For now, Bitcoin is trading at $61,639, gaining 1.55% on the day, but declining 4.57% in the past week, and losing 8.58% on its monthly chart.

Source: Finbold

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Article: "Floating the dinar" returns to the forefront.. Will the Central Bank of Iraq resort to it and what are its risks?" Floating the dinar, oh my goodness, they are talking to the Iraqi citizens about the monetary reform...Floating the dinar is what they're going to do...

Mnt Goat ...the US Treasury needs to recognize that Iraq still has tremendous value in the dinar as the country sits right now with its oil revenues and out paces Kuwait in all aspects of its economy and so why is Kuwait 1 KWD = $3.40 USD? ...the IQD is being intentionally suppressed now after 20 years already and that is at the heart of the problem Iraq now faces. In reality they are more than ready and the Dr Shabibi attempt in 2012 tells it all...

Deflation As Economy Comes To A Halt | Michael Pento

Liberty and Finance: 5-13-2024

Disinflation is coming, says portfolio manager Michael Pento and even a short period of deflation is likely.

Amid the economy coming to a halt, the Fed will have no other option than to inflate the currency supply.

At that point, stagflation will become the new normal, he says. And stagflation - high inflation with a weak economy - has proven to be the ideal environment for gold.

INTERVIEW TIMELINE:

0:00 Intro

1:20 Japan's economy

10:00 Dedollarization

18:21 What's the Fed's real goal?

The Year Of Giving Dangerously

The Year Of Giving Dangerously

White Hats Briefing # 203

We will once again center some attention on the post-BTC halving, and provide a suggested short list of some very, very speculative crypto plays that could yield big numbers (perhaps 1,000% to 10,000%) by being swept up in post-halving winds.

With the approaching and ever-present realities of a new multi-polar world and the possibility of fiscal impact on the US dollar, some strategic moves into this high-risk/high-reward corner of the digital asset realm may be prudent for some of your disposable risk dollars. With the current consolidation at just-below recent market highs, it may be an opportune time to consider such a move.

We will not go into a lengthy explanation of the ideas, and would suggest that any who wish to partake of these ideas must take the time to review the details of each themselves. There are adequate details available on each product via their respective websites, or via the Internet where no site exists for a project.

The Year Of Giving Dangerously

White Hats Briefing # 203

We will once again center some attention on the post-BTC halving, and provide a suggested short list of some very, very speculative crypto plays that could yield big numbers (perhaps 1,000% to 10,000%) by being swept up in post-halving winds.

With the approaching and ever-present realities of a new multi-polar world and the possibility of fiscal impact on the US dollar, some strategic moves into this high-risk/high-reward corner of the digital asset realm may be prudent for some of your disposable risk dollars. With the current consolidation at just-below recent market highs, it may be an opportune time to consider such a move.

We will not go into a lengthy explanation of the ideas, and would suggest that any who wish to partake of these ideas must take the time to review the details of each themselves. There are adequate details available on each product via their respective websites, or via the Internet where no site exists for a project.

Let us proceed.

Pyrin (PYR-USD): PYRIN strategically integrates Layer 1 technology, enhances decentralization, introduces smart contracts, and pioneers innovative resource management which not only boost miner revenues but also contribute to more environmentally friendly blockchain protocols.

More information about where and how to by this idea can be found here.

Banano (BAN-USD): This meme coin with real utility allows you to earn rewards for contributing computing power to medical research. Banano describes itself as a feeless, instant, rich in potassium cryptocurrency powered by directed acyclic graph (DAG) technology that aims to disrupt the meme economy. Banano was a hard fork of Nano coin in 2018.

Banano is fully decentralized, with no central development team, a rarity in today’s crypto landscape. This aspect arguably makes Banano one of the safest meme cryptos. Interestingly, you can sell computing power to the medical sector in exchange for Banano, a process termed “folding.”

This use case alone arguably makes it the most useful meme coin, surpassing even some utility projects that barely see any activity on their networks.

More information on this project can be found here.

Blue Kirby (KIRBY-USD): A pure meme crypto on the Fantom (FTM-USD) blockchain has a tiny market cap and potential for explosive gains.

The Blue Kirby is what helped Andre’s other protocol (yearn.finance) reach $1B, it is here to help $FTM become a leader again. Liquidity comes from the top down, we will change the game and make it come from bottom up. Just a simple humble character, that's what the Blue Kirby symbolizes.

This crypto can deliver multi-bagger gains if Fantom (FTM-USD) takes off during the next alt season or if it finds enough attention from crypto whales. Regardless, it is a gamble, much like the other two cryptos on this list, and you should treat it as such.

Now we move on to the Global...eh, sorry...the Selective Global Refunding Project.

I always do my best to request (not demand) as much up-to-date information on this esoteric, highly-sensitive, sovereign-level, disruptive, multi-trillion-dollar, quasi-amorphous potential transaction as possible for you.

A complete, end-to-end full-on summary of its entire workings is not possible, because you can all imagine that current holders of the monopolized sacred keys of nation-busting vigorish would be driven berserk at any notion that financial resources should be designed to directly SERVE, and not EXPLOIT the nation-state.

Of course, the SGRP would serve no purpose, nor deserve any support, if it were the same three-card-monte merely served up by the Gentile of our species.

And hence, this project has as its natural enemy, a very dangerous external element; a threatening element that rises to provoke entire world-wars into existence, in part to protect their craps game and prevent the spread of any proven, nationally-owned funding alternative that shows, without any doubt, what a project like the SGRF can do for mankind.

Germany once rose from a banking clique quagmire with a similar effort, and the world saw that bloodsucking, usurious, central-banking abattoirs were not only unnecessary, but were "serving" mankind alright...as a quartered steer!

Here is the response from Londinium to my latest present-time request for information. This is as complete as it can be, for now:

We live in a declining Western civilization where standards have gone. For many, economic hope is lost.

How to survive first, beyond thrive is the new dilemma. The West needs a Rethink fast. Geo politically it's happening daily. Money for sure. Standards will take time and Leaders even more so.

The hardest lesson of all is a complex one. Making money, creating wealth is not the hardest dilemma you will face. But keeping it, is!

Wealth creation in a stagnating nation. Plan B fast is what? The West is sleepwalking to disaster. CBDCs will ring fence the lot. Enslaved. Accounts blocked or locked.

As economies, Industries and standards risk nosediving. This new perception of what's best to invest in next, is a Chancers Starter Opportunity. To affect Self-Help. You must. As nations decline, address how to side-step sinking with coagulated Swine. The Fed is dead. Fake Jewish racketeering money is done. BRICS will break this Camel's back. Asset-backed or fake Jewish crap? America is Usury bonded. Enslaved.

The petrodollar is in irreversible decline. Swerve the backlash gate as the mass Goyim are assembled, to meet the Usury Herding fate.

All State-planning algorithms for capital needs are defaulting. They all grossly underassessed age living projections. Taxes too.

They grossly underassessed illness, disease and consequential fallout of geriatric ageing problems. COVID, too, and what's still to come. They lost the plot. An actuarial nightmare.

Reserves are non-existent, the system was never designed to empathize with how to meet needs, just to filter skim.

It can't meet escalating shortfall needs. It has no reserves. All was taken. To default the insolvent dollar now unleashes War. Wrath and Fury.

As bank systems stand, American nationals in particular are prohibited from many emerging markets, if they can't be US regulated or at will. US sequestrated, Americans can only play in a Federal rigged game.

As we debate how to asset back and audit emerging BRICS currencies, it directly challenges the only hype-backed, worthless USD, opening a dichotomy. What are the volumes we can asset back for BRICS, leverage and trade freely? There is only one remaining vast balance of AU, and that carries war risks.

How did Yamashita fare? All know the risks. But if America tries to steal this from South Korea, China will engage. Right up to WWIII. As they did with North Korea. North Korean armaments would be unleashed. Lives are cheap.

There are deeply sensitive discussions in play with multi-tier Eurasian parties. Game changing if accomplished. American greed and maleficence derailed the last opportunities. Death by Duplicity. BRICS AU backed by real AU will face down and take the Face off the Fed Jews. Debasing and neutering them. Stepping on the Rodents' nest. Uniting Eurasia as one.

As with the Zim and Dinars, in parallel with the then Weimar Republic Marks, if the Dollar tanks, you too? They are scrambling.

But, in the meantime what to do, as possible options for you?

And that, my friends, is that.

The Prime Directive to all remains: be ready for anything. There is no way to predict any economic, natural or man-made disaster affecting the general population. Always ask, "What if...?", and be ready to provide a solution to the best degree possible.

And thank you, once again, for the many varied and inciteful comments and discussions taking place. We have so many very accomplished and talented contributors that I am quite certain you will find information within that many are probably paying for to obtain elsewhere.

I will skip the general house-keeping updates for now, but be advised that the site may go down at short notice for such to be implemented. I will give as much pre-notice as possible to prevent you being unable to post a comment as the site goes offline while doing so.

The Empire thanks you for your service.

WHA

S*P*Q*R*

SI VIS PACEM PARA BELLVM

“Tidbits From TNT” Tuesday 5-14-2024

TNT:

Tishwash: International Monetary Fund: We do not rule out the collapse of the global monetary system

The Executive Director of the International Monetary Fund for Russia, Alexei Mugin, said that he does not rule out the possibility of the collapse of the current global monetary system.

In an interview with the "Novosti" agency, Mogin asked: "Is there a possibility of the collapse of the global monetary system? It seems to me that such a possibility actually exists."

The expert stated that the currently existing system relies on confidence that dollar assets are safe, but central banks, institutions, and even families have already begun to sell dollar assets and buy gold, due to growing lack of confidence in their safety.

Mogin warned of chaos in the global economy, and said: “Once this confidence is lost, a period of chaos will occur in the global economy.”

TNT:

Tishwash: International Monetary Fund: We do not rule out the collapse of the global monetary system

The Executive Director of the International Monetary Fund for Russia, Alexei Mugin, said that he does not rule out the possibility of the collapse of the current global monetary system.

In an interview with the "Novosti" agency, Mogin asked: "Is there a possibility of the collapse of the global monetary system? It seems to me that such a possibility actually exists."

The expert stated that the currently existing system relies on confidence that dollar assets are safe, but central banks, institutions, and even families have already begun to sell dollar assets and buy gold, due to growing lack of confidence in their safety.

Mogin warned of chaos in the global economy, and said: “Once this confidence is lost, a period of chaos will occur in the global economy.”

Last April, the International Monetary Fund warned, in its financial monitoring report, that the debts of the United States and China pose a threat to global finances.

The rise in US public debt and the dependence of global trade on the dollar raises concerns among experts and a number of countries around the world.

Data issued by the Treasury Department, earlier this month, revealed that the US budget deficit exceeded one trillion dollars in the first six months of the fiscal year, partly paid for by the rise in interest on public debt. link

Tishwash: Iraq increases its gold holdings by more than three tons, bringing its reserves to more than 145 tons

Iraq’s gold reserves witnessed a noticeable increase during the month of February 2024, as International Monetary Fund data showed that Iraq had increased its possession of the precious metal by 3,079 tons, bringing the total to 145,661 tons.

This increase indicates Iraq's continued strategy to diversify its foreign reserves and enhance financial and monetary stability in the long term.

Gold is a traditional safe haven for investors, especially during periods of economic and geopolitical uncertainty.

This step by Iraq comes at a time when the world is witnessing a rise in gold prices, as the price reached its highest level in its history last month above $2,400 per ounce.

Iraq is among the countries that possess large amounts of gold reserves in the Arab region, as it ranks fourth after Saudi Arabia, Algeria, and Morocco.

In general, this increase in Iraq's gold reserves is considered a positive indicator of the health and strength of the Iraqi economy. link

************

Tishwash: Chinese companies are delving into the field of exploration in Iraq.. What about American and European companies?

Iraq aspires to increase oil reserves to more than 160 billion barrels, and to do so it has launched a group of projects to increase production, opening the door to more investments in the field of exploration.

In this context, Chinese companies have emerged as a major player, after a number of companies won more new investments to explore oil and gas fields in Iraq as part of a licensing round to develop the oil and gas sector in the country launched by the Ministry of Oil.

The licensing round included 29 projects, aiming to increase production for local consumption. More than 20 companies qualified for the licensing round, including European, Chinese, Arab and Iraqi groups. The only Chinese companies among the participating foreign companies were able to obtain investments in the licensing round that began on Saturday, and this This means that there are no major American oil companies participating.

The list of Chinese companies that recently won the new bids, according to what was announced by Iraqi Oil Minister Hayan Abdul Ghani on Sunday, included: the Chinese company “CNOOC Iraq” , which won the investment to develop Block 7 for oil exploration, extending over an area of 6,300 square kilometers across the provinces of Diwaniyah. Babil, Najaf, Wasit, and Muthanna in the center and south of the country.

Zhenhua , Anton, and Sinopec also won investments to develop the Abu Khaimah fields in Muthanna, Al Dhafriya in Wasit, and Sumer in Muthanna, respectively.

*Support competition

In turn, the director of the Iraqi Center for Studies, Ghazi Faisal, confirms in a press statement that “China is in fact in a state of widespread economic competition with America, the European Union countries, Britain, and with various international economic powers,” noting that “China enjoys broad economic influence in the fields of Investment, loans and financing, with the aim of ensuring energy security and covering its daily needs - which are estimated at about 11 million barrels per day, the volume of China’s imports - other than gas.”

He added, "The Middle East and the Arabian Gulf region is one of the strategic regions for China... and therefore competes with American and regional companies in the field of gas, energy, and manufacturing industries," noting that "the Middle East region possesses enormous wealth, especially Iraq, which alone possesses more than $20 worth of wealth." A trillion dollars in minerals are still uninvested, and major companies can compete to enter into large-scale investments, in addition to gas and oil reserves, as Iraq is the second largest oil reserve after Saudi Arabia.”

He explains that "this Chinese activity in Iraq comes within the framework of the current international economic competition," noting that "China is competing in particular with American and European companies to provide the best."

Faisal adds, "China's activity comes within the framework of legitimate competition in international economic relations, to obtain the best gains and to guarantee China's interests and needs for minerals and energy in light of its possession of the best advanced technology in various industries."

According to official Chinese data, issued by the General Administration of Customs, Beijing’s imports of crude oil reached their highest levels ever in 2023 as demand for fuel recovered after the decline resulting from the Corona pandemic, despite the economic headwinds.

Imports increased by 11 percent compared to 2022 to 563.99 million tons, or the equivalent of 11.28 million barrels per day, an increase from the previous record level recorded in 2020, which reached 10.81 million barrels per day.

*Strategic objectives

For his part, the professor of economics in Iraq, Nabil Al-Marsoumi, explains in a press statement that “It is noted that China has broad control over the fields offered within the current licensing round for exploration that was put forward by the Ministry of Oil, and that most of the Chinese companies that won contracts are already present in Iraq.” ", adding that "the most important areas and fields that were awarded were owned by Chinese companies in particular."

He explained that "China's interest in Iraq is due to the presence of Baghdad as a global energy center and as one of the largest producers," adding that "China is a large importer of oil, and therefore it needs to secure energy supplies on a regular basis, and Iraq achieves this."

He stressed that "Iraq is a suitable place for China in light of the ability of Chinese companies to harmonize with the Iraqi environment, thus supporting their ability to achieve strategic goals."

On Saturday (May 11, 2024), the Iraqi Minister of Oil, Hayan Abdul Ghani, expressed his hope that the country’s oil reserves would exceed 160 billion barrels, during the launch of two rounds of new licenses to invest in 29 fields, in addition to exploratory patches of oil and gas.

The two tours included exploration fields and areas in 12 governorates and areas located in Iraqi territorial waters.

*An important investment environment

In addition, the Iraqi economic expert, Dr. Jaafar Al-Husseinawi, pointed out in a press statement that “There is no doubt that Iraq represents an important investment environment for all international companies because of its enormous natural resources of crude oil, major untapped gas reservoirs, large quantities of phosphate and sulfur, and so on.” that".

He added, "Companies are flocking to Iraq - including Chinese companies - driven by the desire to achieve economic returns and real investment opportunities, from an economic standpoint."

On the political level, Iraq's location is of particular importance in the region, and therefore China is trying to be present there and remove American control (influence).

The Iraqi Prime Minister, Muhammad Shiaa Al-Sudani, said during the launch of the licensing round, “Iraq expects to obtain more than 3,459 million standard cubic feet per day of gas, and more than one million barrels of oil per day, through these two rounds.”

He added: "These strategic projects will contribute to increasing investments in these governorates, which will help improve their economic and service reality."

*Developed relationships

Mustafa Al-Bazarkan, an advisor on energy affairs, points out that “commercial and political relations between China and Iraq are “developed,” and there is popular support for the government’s steps to strengthen and develop bilateral relations, especially in light of popular positions opposed to strengthening relations with Washington and London. This was in the interest of the developed relations with China.” .

He continues: “During the past two years, there has been more than one departure of American and Western oil companies from Iraq, which prompted Chinese companies to direct their investments and technical expertise to Iraq, the most recent of which was last Monday when a Chinese company won oil investments in the Jabal Sanam region on the border with Kuwait.”

Crude oil sales constitute 90 percent of Iraqi budget revenues. But despite its enormous oil wealth, the country still depends on imports to meet its energy needs, especially gas to power electricity.

Iraq, a founding member of OPEC, has announced its commitment, along with other countries, to voluntarily reduce production to support prices affected by economic uncertainty.

Iraqi Oil Minister Hayan Abdul Ghani said on Sunday (May 12, 2024) that Baghdad will adhere to the voluntary production cuts reached by the OPEC+ alliance at its next meeting on June 1.

The coalition includes the Organization of the Petroleum Exporting Countries (OPEC) and producers from outside it, led by Russia.

The minister amends these statements from others he made on Saturday, saying that Iraq has made enough voluntary cuts and will not agree to any new cuts in production. link

Mot: ... When Enough is Enough! -- Just Loves Karma I Do!

Mot: . and da Word of da Day!! -- Spuddle !!!

News, Rumors and Opinions Tuesday AM 5-14-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 14 May 2024 Compiled Tues. 14 May 2024 12:01 am EST by Judy Byington

Global Currency Reset Judy Note:

Mon. 13 May 2024 Wolverine: “I confirm this. Like I said the live call is going to be very emotional. Get those tissues ready everyone. Received information from a Bond Banker in Brazil today. A large Tier 3 Platform in Brazil has been authorized for receiving liquidity now by Central Bank and Notifications going out with Payments happening! Other news: Mike Bara has said that a Tier 3 bond holder on the U.S. East coast has received his notification. Waiting to hear if he has been paid. Expecting a wire any time.”

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 14 May 2024

Compiled Tues. 14 May 2024 12:01 am EST by Judy Byington

Global Currency Reset Judy Note:

Mon. 13 May 2024 Wolverine: “I confirm this. Like I said the live call is going to be very emotional. Get those tissues ready everyone. Received information from a Bond Banker in Brazil today. A large Tier 3 Platform in Brazil has been authorized for receiving liquidity now by Central Bank and Notifications going out with Payments happening! Other news: Mike Bara has said that a Tier 3 bond holder on the U.S. East coast has received his notification. Waiting to hear if he has been paid. Expecting a wire any time.”

WOW US Bank Accepted 25,000 Dinar Equal $25,000 Dollar – 2:56 Chase Bank RV Started Wells Fargo And JP Morgan Date & Time of IQD Fixed – 3:23 100 % Revaluation Confirmed – 3:14 Congratulations Revaluation Done Go And Your Dinar & Dong On New Rate – 3:36 Really It is Very Good Rate For All Investors $4.66 USD – 2:04 https://www.youtube.com/watch?v=5VuEk9ofnZ4

Chase Bank RV Started Wells Fargo And JP Morgan Date & Time of IQD Fixed – 3:23 https://www.youtube.com/watch?v=BATt0WPIolg

100 % Revaluation Confirmed – 3:14 https://www.youtube.com/watch?v=4vfd8xXI64A

Congratulations Revaluation Done Go And Your Dinar & Dong On New Rate – 3:36 https://www.youtube.com/watch?v=5QUqxkiHK8o

Really It is Very Good Rate For All Investors $4.66 USD – 2:04 https://www.youtube.com/watch?v=EblzGtikRTw

Global Financial Crisis:

Mon. 13 May 2024: US Dollar To Collapse, BRICS https://beforeitsnews.com/eu/2024/05/brics-just-announced-the-u-s-dollar-is-about-to-collapse-for-good-2717774.html

Sun. 12 May 2024: US Debt Clock: New Money Incoming! The Power of Precious Metals – Know What You Hold!!! – American Media Group (amg-news.com)

Read full post here: https://dinarchronicles.com/2024/05/14/restored-republic-via-a-gcr-update-as-of-may-14-2024/

************

Goldilocks: Global Banking Announcement:

This is a note to follow up on the banker who went into foreign currency exchange training last week.

She shared that Banks are "currently" exchanging their currencies using native currencies.

There will be much faster settlement times utilizing a country's own currencies for the exchange.

Presently, this applies to all currencies around the world except for the IQD.

This makes sense to me due to the fact that Dee and I have been told that the IQD would not float. It will be given a revalued rate.

This bank will go unnamed to protect it from being bombarded with phone calls.

What is important to take from this piece of Intel is, for this Bank, these new procedures began today.

This does not mean that all Banks have started these protocols yet, but it does mean that expectations are high that they begin.

© Goldilocks

Courtesy of Dinar Guru: https://www.dinarguru.com/

Fnu Lnu There are several regiments to float a currency: FREE FLOAT - The currency's value is determined solely by supply and demand in the market...MANAGED FLOAT - Similar to a free floating...but a government intervenes by buying or selling its own currency to minimize fluctuations. CURRENCY PEG - The currency's value is pegged to a basket of currencies or to another country's currency. EUROPEAN SNAKE [In The Tunnel] - Beginning in mid-1972...Each country agreed not to allow its currency to fluctuate more than 1 1/8% up or down from an agreed central exchange rate. [Post 1 of 2....stay tuned]

Fnu Lnu I doubt they still call it "The Snake" but that is the method used to if one wishes to participate in the IMF baskets...The Dinar will use the European Snake method of floating the currency because it only allows for a 1 1/8% fluctuation up or down thus providing the maximum stability. The currency will open with it's permanent value, more or less, and then over time, it may be allowed to adjust one and one-eighth percent either way... [Post 2 of 2]

************

Gold is up Iraq

Nader: 5-13-2024

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Good Evening Dinar Recaps,

"The End Of The World Order And The Rise Of Trade Regulation" Throughout the world, the US has been in process of signing Free Trade Agreements with countries.

These FTAs eliminate barriers to trade significantly. This includes tariffs, improving intellectual property rights, and more.

In addition, they improve laws protecting intellectual property rights, open up government procurement opportunities, and easing investment rules.

The world of trade between countries are changing rapidly at this point. These new trade agreements require credit valuation adjustments across the board including foreign currency exchange rates. Mondaq Trade Cornell Law

WATCH THE WATER.

© Goldilocks.

~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Good Evening Dinar Recaps,

"The End Of The World Order And The Rise Of Trade Regulation"

Throughout the world, the US has been in process of signing Free Trade Agreements with countries.

These FTAs eliminate barriers to trade significantly. This includes tariffs, improving intellectual property rights, and more.

In addition, they improve laws protecting intellectual property rights, open up government procurement opportunities, and easing investment rules.

The world of trade between countries are changing rapidly at this point. These new trade agreements require credit valuation adjustments across the board including foreign currency exchange rates. Mondaq Trade Cornell Law

WATCH THE WATER.

© Goldilocks.

~~~~~~~~~*

"The network value-to-transaction ratio, or NVT ratio, is a proposed approach that is determined by dividing the market capitalization of a digital asset by the transaction value during a certain time period. These are the important metrics that help in the valuation of digital assets."

The above information is exactly what will begin happening at some level when our new regulated digital assets become law on June 30th.

We will go through a process of credit valuation adjustments based on demands for their use and corresponding underlying assets that support what used to stand alone in the traditional markets.

Backing traditional assets with gold and other commodities will change the way we look at the price of these assets going forward.

During this time, we can expect to see caps on gold released for many of these new digital assets to find a real value as we approach January 1st, 2025.

The first of next year is when the expectation for Basel 3 compliant measures to be fully complete. At that time, solid rates will become possible for many of the assets a trader will hold.

Price fluctuations across the board between now and then are expected including Forex. Our markets will be in process of finding real values. Eqvista MoodysAnalytics

© Goldilocks

~~~~~~~~~

Crypto Regulations Act update for the US:

"Today, the House Committee on Rules publicly noticed its intent to consider the Financial Innovation and Technology for the 21st Century (FIT21) Act, clearing a pathway for a floor vote later this month.

The FIT for the 21st Century Act is an important first step towards achieving regulatory clarity for digital assets. FIT21 provides the robust, time-tested consumer protections and regulatory certainty necessary to allow the digital asset ecosystem to flourish in the United States."

After this vote, you can expect movement towards the Senate to come soon after in order to meet those deadlines for June 30th, 2024 for the European Union.

China is already in the regulatory process, and expected to coordinate with a global efforts of Europe and the US. House Financial Services DailyCryptoNews

© Goldilocks

~~~~~~~~~

Global Banking Announcement:

This is a note to follow up on the banker who went into foreign currency exchange training last week.

The banks now have the capability to send wires in every currency around the world with the exception of the Iraqi dinar.

There will be much faster settlement times utilizing a country's own currencies for the exchange.

This makes sense to me due to the fact that Dee and I have been told that the IQD would not float. It will be given a revalued rate.

What is important to take from this piece of Intel is, for this Bank, these new procedures began today.

This does not mean that all Banks have started these protocols yet, but it does mean that expectations are high that they begin.

© Goldilocks

~~~~~~~~~

"Navigating the New Frontier: Updates to Federal Onshore Oil and Gas Leasing Rules and Regulations" | JD Supra

These new rules and regulations for the oil sector have reached their final stages. And now, the transition into the energy sector of our markets that includes solar power and electric cars will proceed.

© Goldilocks

~~~~~~~~~

SAN FRANCISCO, May 9, 2024 — WisdomTree Prime Launches to 41 States, Leveraging Stellar Network for Enhanced Digital Asset Services | Crypto News

WisdomTree, a notable asset management firm, has launched its innovative financial app, WisdomTree Prime, to cover 75% of the U.S. population across 41 states despite shareholder wishes.

This strategic extension is powered by the Stellar Development Foundation, which supports the app’s robust digital asset services. (https://www.crypto-news.net/tokenization-government-money-fund/)

WisdomTree has integrated Stellar’s efficient transaction platform to power WisdomTree Prime, aligning with its goal to streamline financial operations for its users.

~~~~~~~~~

WisdomTree Digital Trust Company, LLC. | Wisdom Tree Inc

~~~~~~~~~

ASEAN - The key Player in the Indo-Pacific Region - Indian Defence Review

~~~~~~~~~

Dow Gold Ratio: Stocks vs Gold Charts | SD Bullion

~~~~~~~~~

Hong Kong and Saudi Arabia Consider Establishing ETF - Claps

~~~~~~~~~

Alternative Trading Systems (ATSs) | Investor Gov

~~~~~~~~~

Zimbabwe set to be invited to join BRICS | The Zimbabwe Mail

👆 Goldilocks pointed to this article

~~~~~~~~~

Currently, indications are pointing at Zimbabwe, together with Argentina and Saudi Arabia, being officially announced as new members of the NDB at the BRICS summit to be held in South Africa this August. | Herald

~~~~~~~~~

Institutions Coming In! Pivotal Moment For XRP! | Youtube

~~~~~~~~~

RIPPLE VS. SEC

Tomorrow on May 13th:

Parties and any third parties file omnibus letter motions and also file proposed redactions to such materials!

As @attorneyjeremy1 said: We‘re just waiting for the judge now! #Ripple Twitter

~~~~~~~~~

BREAKING NEWS Iraq at Odds w/OPEC Over Oil Production Cuts | Youtube

~~~~~~~~~

When You Put Money in the Bank annnddd It's Gone - SOUTH PARK | Youtube

~~~~~~~~~

Crash Landing Ahead? Fed May Cut Rates but We’ve Run Out of Time | Youtube

~~~~~~~~~

The Gold Team Breaking down Goldilocks. Their backgrounds is why Goldilocks gave them all the Gold Seal of approval. Goldilocks QFS Goldilocks Q A Saturday Night Live Call

~~~~~~~~~

The Association of Private Banks praises the direction of the Iraqi Central Bank to establish digital banks | Search 4 Dinar

Economy News – Baghdad

The Executive Director of the Association of Iraqi Private Banks, Ali Tariq, praised the Central Bank’s direction to establish digital banks to keep pace with the great development in the global banking sector.

In an interview with “Economy News”, Tariq said that “the world is moving towards digitizing banking services, and Iraq has started its first steps in establishing digital banks, as so far there is a licensed digital bank inside Iraq, and provides its services naturally to the public.”

~~~~~~~~~

Why is Crude oil price crashing? | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Why The Dollar Will Lose Its Status As The Global Reserve Currency

Why The Dollar Will Lose Its Status As The Global Reserve Currency

Notes From the Field By James Hickman (Simon Black) May 13, 2024

By the early 400s, the Roman Empire was coming apart at the seams and in desperate need of strong, competent leadership. In theory, Honorius should have been the right man for the job.

Born into the royal household in Constantinople, Honorius had been groomed to rule, practically since birth, by the finest experts in the realm. So even as a young man, Honorius had already accumulated decades of experience.

Yet Rome’s foreign adversaries rightfully believed Honorius to be weak, out of touch, divisive, and completely inept.

He had entered into bonehead peace treaties that strengthened Rome’s enemies. He paid vast sums of money to some of their most powerful rivals and received practically nothing in return. He made virtually no attempt to secure Roman borders, leaving the empire open to be ravaged by barbarians.

Why The Dollar Will Lose Its Status As The Global Reserve Currency

Notes From the Field By James Hickman (Simon Black) May 13, 2024

By the early 400s, the Roman Empire was coming apart at the seams and in desperate need of strong, competent leadership. In theory, Honorius should have been the right man for the job.

Born into the royal household in Constantinople, Honorius had been groomed to rule, practically since birth, by the finest experts in the realm. So even as a young man, Honorius had already accumulated decades of experience.

Yet Rome’s foreign adversaries rightfully believed Honorius to be weak, out of touch, divisive, and completely inept.

He had entered into bonehead peace treaties that strengthened Rome’s enemies. He paid vast sums of money to some of their most powerful rivals and received practically nothing in return. He made virtually no attempt to secure Roman borders, leaving the empire open to be ravaged by barbarians.

Inflation was high. Taxes were high. Economic production declined. Roman military power declined. And all of Rome’s foreign adversaries were emboldened.

To a casual observer it would have almost seemed as if Honorius went out of his way to make the Empire weaker.

One of Rome’s biggest threats came in the year 408, when the barbarian king Alaric invaded Italy; imperial defenses were so non-existent at that point that ancient historians described Alaric’s march towards Rome as unopposed and leisurely, as if they were “at some festival” rather than an invasion.

Alaric and his army arrived to the city of Rome in the autumn of 408 AD and immediately positioned their forces to cut off any supplies. No food could enter the city, and before long, its residents began to starve.

Historians have passed down horrific stories of cannibalism-- including women eating their own children in order to survive.

Rather than send troops and fight, however, Honorius agreed to pay a massive ransom to Alaric, including 5,000 pounds of gold, 30,000 pounds of silver, and literally tons of other real assets and commodities.

(The equivalent in today’s money, adjusted for population, would be billions of dollars… similar to what the US released to Iran in a prisoner swap last year.)

Naturally, Honorius didn’t have such a vast sum in his treasury… so Romans were forced to strip down and melt their shrines and statues in order to pay Alaric’s ransom.

Ironically, one of the statues they melted was a monument to Virtus, the Roman god of bravery and strength… leading the ancient historian Zosimus to conclude that “all which remained of Roman valor and intrepidity was totally extinguished.”

Rome had spent two centuries in the early days of the empire-- from the rise of Augustus in 27 BC to the death of Marcus Aurelius in 180 AD-- as the clear, unrivaled superpower. Almost no one dared mess with Rome, and few who did ever lived to tell the tale.

Modern scholars typically view the official “fall” of the Western Roman Empire in the year 476. But it’s pretty clear that the collapse of Roman power and prestige took place decades before.

When Rome was ransomed in 408 (then sacked in 410), it was obvious to everyone at the time that the Emperor no longer had a grip on power.

And before long, most of the lands in the West that Rome had once dominated-- Italy, Spain, France, Britain, North Africa, etc. were under control of various Barbarian tribes and kingdoms.

The Visigoths, Ostrogoths, Vandals, Franks, Angles, Saxons, Burgundians, Berbers, etc. all established independent kingdoms. And for a while, there was no dominant superpower in western Europe. It was a multi-polar world. And the transition was rather abrupt.

This is what I think is happening now-- we’re experiencing a similar transition, and it seems equally abrupt.

The United States has been the world’s dominant superpower for decades. But like Rome in the later stage of its empire, the US is clearly in decline. This should not be a controversial statement.

Let’s not be dramatic; it’s important to stay focused on facts and reality. The US economy is still vast and potent, and the country is blessed with an abundance of natural resources-- incredibly fertile farmland, some of the world’s largest freshwater resources, and incalculable reserves of energy and other key commodities.

In fact, it’s amazing the people in charge have managed to screw it up so badly. And yet they have.

The national debt is out of control, rising by trillions of dollars each year. Debt growth, in fact, substantially outpaces US economic growth.

Social Security is insolvent, and the program’s own trustees (including the US Treasury Secretary) admit that its major trust fund will run out of money in just nine years.

The people in charge never seem to miss an opportunity to dismantle capitalism (i.e. the economic system that created so much prosperity to begin with) brick by brick.

Then there are ubiquitous social crises: public prosecutors who refuse to enforce the law; the weaponization of the justice system; the southern border fiasco; declining birth rates; extraordinary social divisions that are most recently evidenced by the anti-Israel protests.

And most of all the US constantly shows off its incredibly dysfunctional government that can’t manage to agree on anything, from the budget to the debt ceiling. The President has obvious cognitive disabilities and makes the most bizarre decisions to enrich America’s enemies.

Are these problems fixable? Yes. Will they be fixed? Maybe. But as we used to say in the military, “hope is not a course of action”.

Plotting this current trajectory to its natural conclusion leads me to believe that the world will enter a new “barbarian kingdom” paradigm in which there is no dominant superpower.

Certainly, there are a number of rising rivals today. But no one is powerful enough to assume the leading role in the world.

China has a massive population and a huge economy. But it too has way too many problems… with the obvious challenge that no one trusts the Communist Party. So, most likely China will not be the dominant superpower.

India’s economy will eventually surpass China’s, and it has an even bigger population. But India isn’t even close to the ballpark of being the world’s superpower.

Then there’s Europe. Combined, it still has a massive economic and trade union. But it has also been in major decline… with multiple social crises like low birth rates and a migrant invasion.

Then there are the energy powers like Russia, Iran, Saudi Arabia, and Indonesia; they are far too small to dominate the world, but they have the power to menace and disrupt it.

The bottom line is that the US is no longer strong enough to lead the world and keep adversarial nations in check. And it’s clear that other countries are already adapting to this reality.

Earlier this month, for example, China successfully launched a rocket to the moon as part of a multi-decade mission to establish an International Lunar Research Station.

By 2045, China hopes to construct a large, city-like base along with several international partners including Russia, Pakistan, Thailand, South Africa, Venezuela, Azerbaijan, Belarus, and Egypt. Turkey and Nicaragua are also interested in joining.

This is pretty remarkable given how many nations are participating, even if just nominally. Yet the US isn’t part of the consortium.

This would have been unthinkable a few decades ago. But today the rest of the world realizes that they no longer need American funding, leadership, or expertise.

e can see similar examples everywhere, most notably in Israel and Ukraine. And I believe one of the next shoes to drop will be the US dollar.

After all, if the rest of the world doesn’t need the US for space exploration, and they can ignore the US when it comes down to World War 3, then why should they need the US dollar anymore?

The dollar was the clear and obvious choice as the global reserve currency back when America was the undisputed superpower. But today it’s a different world.

Foreign nations continuing to rely on the dollar ultimately means governments and central banks buying US government bonds. And why should they take such a risk when the national debt is already 120% of GDP?

In addition, Congress passed a new law a few weeks ago authorizing the Treasury Department to confiscate US dollar assets of any country it deems an “aggressor state.”

While people might think this is a morally righteous idea, the reality is that it will only turn off foreign investors. Why should China, Saudi Arabia, or anyone else buy US government bonds when they can be confiscated in a heartbeat?

All of this ultimately leads to a world in which the US dollar is no longer the dominant reserve currency. We’re already starting to see signs of that shift, and it could be in full swing by the end of the decade.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

More News, Rumors and Opinions Monday Afternoon 5-13-2024

KTFA:

Clare: The Iraqi Parliament decides to elect its new president next Saturday

5/13/2024

The Iraqi Parliament has set next Saturday as the date for electing its new president.

The media of the Iraqi House of Representatives said in a brief statement received by Shafaq News Agency, that the Presidency of the Council decided to hold a session on Saturday, May 18, 2024, to elect the Speaker of the House of Representatives.

An informed political source told Shafaq News Agency that the “Taqaddum” Party and the “Sadara” Bloc decided to present Mahmoud Al-Mashhadani as a candidate for the presidency of Parliament.

Al-Mashhadani, (75 years old), headed the Iraqi Council of Representatives from 2006 to 2009.

KTFA:

Clare: The Iraqi Parliament decides to elect its new president next Saturday

5/13/2024

The Iraqi Parliament has set next Saturday as the date for electing its new president.

The media of the Iraqi House of Representatives said in a brief statement received by Shafaq News Agency, that the Presidency of the Council decided to hold a session on Saturday, May 18, 2024, to elect the Speaker of the House of Representatives.

An informed political source told Shafaq News Agency that the “Taqaddum” Party and the “Sadara” Bloc decided to present Mahmoud Al-Mashhadani as a candidate for the presidency of Parliament.

Al-Mashhadani, (75 years old), headed the Iraqi Council of Representatives from 2006 to 2009.

According to the source, the nomination was supported by Muhammad al-Halbousi, with the withdrawal of Talal al-Zubaie, leaving al-Mashhadani to remain a solo candidate, facing Salem al-Issawi.

The "Sadara" parliamentary bloc announced, after midnight on Saturday, joining the "Taqaddum" coalition led by Muhammad al-Halbousi, in a decision that would advance a candidate for the presidency of the Iraqi parliament. LINK

Clare: A deficit exceeding 75 trillion, and this is the date of its arrival.. Parliament’s finances talk about the 2024 budget

5/13/2024 Baghdad

Today, Monday, the Parliamentary Finance Committee expected the schedules of the general budget law from the government to reach the House of Representatives this week, while it determined the expected deficit percentage.

Committee member Faisal Al-Naeli said, in an interview followed by Al-Iqtisad News, that “the House of Representatives is awaiting the arrival of the budget schedules and the start of discussing its provisions and making the necessary amendments to them by the Finance Committee to ensure the proper implementation of the government curriculum.”

He pointed out that "indicators confirm that the schedules will reach the House of Representatives this week in order to proceed with their approval as quickly as possible."

In turn, a member of the Parliamentary Finance Committee, Moin Al-Kadhimi, revealed the expected deficit in the current year’s budget, indicating that it may exceed 75 trillion dinars.

Al-Kadhimi said, “The current year’s budget amounts to 228 trillion dinars, with a planned deficit of up to 75 trillion.”

He added, "The budget included total revenues and spending in the amount of 150 trillion dinars, indicating that the government seeks for actual spending to be 228 trillion."

He pointed out that "the committee will amend the budget schedules during the second reading." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat ...the IQD must be put back on FOREX for Iraq to progress to the desired goals as they themselves proclaim they want to accomplish...know that progress is moving along and much more quickly now...Oh…just wait until Iraq gets back on FOREX…WOW, things are really going to explode.

Paulette It is great to see more articles regarding the "Float"...I strongly believe this is the early stages of the last push by the CBI to educate the Citizens prior to implementing the "Delete the Zeros" project...Patience all...this is slowly coming together...

DOLLAR COLLAPSE: IMF Warns of Global Fragmentation Along Geopolitical Lines & Dedollarization

Lena Petrova: 5-12-2023

BANKS ARE GOING TO FALL LIKE DOMINOS! Important Updates.

Greg Mannarino: 5-13-2024

“Tidbits From TNT” Monday 5-13-2024

TNT:

CandyKisses: Minister of Commerce stresses the importance of creating a state of balance in the economy and enhancing financial stability

Economy News _ Baghdad

Trade Minister Atheer Dawood Al-Gheriri stressed on Monday the importance of creating a balance in the economy and enhancing financial stability.

According to a statement of the ministry received by "Economy News", that "Minister of Trade Atheer Dawood Al-Gheriri, headed the delegation of the Republic of Iraq in the meetings of the Economic and Social Council at the level of ministers that began in Manama under the umbrella of the League of Arab States in preparation for the holding of the 33rd session of the Arab Summit in Bahrain."

TNT:

CandyKisses: Minister of Commerce stresses the importance of creating a state of balance in the economy and enhancing financial stability

Economy News _ Baghdad

Trade Minister Atheer Dawood Al-Gheriri stressed on Monday the importance of creating a balance in the economy and enhancing financial stability.

According to a statement of the ministry received by "Economy News", that "Minister of Trade Atheer Dawood Al-Gheriri, headed the delegation of the Republic of Iraq in the meetings of the Economic and Social Council at the level of ministers that began in Manama under the umbrella of the League of Arab States in preparation for the holding of the 33rd session of the Arab Summit in Bahrain."

This meeting comes in light of many important and accelerated changes and developments in the world and our region, especially in light of the economic and social crises and their repercussions, which requires strengthening our Arab environment by coordinating our national policies to deal with international challenges positively and effectively in accordance with the developments of the global economy," Al Ghuriri added in his speech during the meetings.

He added that "the files on the agenda are of great importance, especially those related to the Greater Arab Free Trade Area and the establishment of the Arab Customs Union, in addition to files related to the health sector and financial security, which constitute basic pillars to support sustainable development and economic integration."

Al Ghurairi stressed the importance of supporting all efforts and cooperation in order to achieve the desired goals and enhance economic integration, stressing the importance of creating a state of balance in our economy and enhancing financial and economic stability.

************

Tishwash: 5/11 Iraq , Tunisia sign bilateral agreements in several areas

The Iraqi government signed ,on Sunday, bilateral agreements with Tunisia in several areas.

The agreements and understanding memorandums included the following:

- The Ministry of Education signed an executive program memorandum for educational cooperation for the years 2024, 2025 and 2026, with the Tunisian Ministry of Education.

- The signing of the annex to the amendment of the memorandum of understanding in the fields of youth and sports between the minister of youth and sports Ahmed Al-Mubarqa, and the Tunisian Minister of Foreign Affairs and immigration Nabil Ammar .

- A memorandum of understanding in the field of pharmaceutical and health cooperation between the Iraqi and Tunisian ministries of Health, represented by the Iraqi Ministry of Health, Minister Saleh Al-Hasnawi, and the Tunisian Ministry of Health, Tunisian Foreign Minister Nabil Ammar.

- A memorandum of understanding in the security field between the Iraqi Ministry of Interior and the Tunisian Ministry of Interior, on the Iraqi side, minister Abdul Amir al-Shammari and the Tunisian side, Tunisian Foreign Minister Nabil Ammar.

- A memorandum of understanding in the field of Labor and social affairs between the Ministry of Labor and Social Affairs, represented by Minister Ahmed Al-Assadi and the Tunisian Ministry of Social Affairs represented by Tunisian Foreign Minister Nabil Ammar.

- Memorandum of understanding for technical cooperation between the Iraqi Ministry of Labor and Social Affairs and the Tunisian Ministry of Social Affairs.

- A memorandum of understanding in the field of vocational training and employment between the Iraqi Ministry of Labor and Social Affairs and the Tunisian Ministry of Social Affairs.

- A memorandum of understanding in the field of traditional industries between the Ministry of industry and minerals represented by its minister Khaled Batal and the Tunisian Ministry of industry and energy represented by Tunisian Foreign Minister Nabil Ammar.

- A memorandum of cooperation in the field of religious affairs between the Iraqi Ministry of Culture, Tourism and antiquities represented by Minister of Culture Ahmed Fakak Al-Badrani, and the Tunisian Ministry of Tourism represented by Tunisian Foreign Minister Nabil Ammar.

- A memorandum of understanding in the field of civil protection between the Iraqi Civil Defense Directorate, represented by its director, Major General Mohsin Kadhim Alak, and the Tunisian civil defense and protection service, represented by the Tunisian ambassador in Baghdad.

- A memorandum of understanding between the Baghdad Secretariat, represented by Secretary Ammar Moussa, and the municipality of Tunis, represented by the notary of the municipality of Tunis.

- A memorandum of understanding in the field of Archives between the Iraq National Library and Archive represented by the director general of the Department of cultural relations and the Tunisian National Archives represented by the Tunisian ambassador in Baghdad.

- Memorandum of understanding between the Union of Iraqi chambers of Commerce and the Union of Tunisian chambers

- Memorandum of understanding between the Union of Iraqi contractors and the Chamber of Tunisia.

- Signing the minutes of the meeting of the Joint Committee between Iraqi foreign ministers Fuad Hussein and Tunisian Foreign Minister Nabil Ammar.

- Memorandum of understanding in the field of developing trade exchanges between the Republic of Iraq and the Ministry of trade and export development of the Republic of Tunisia.

- Memorandum of understanding on the environmental side on the Iraqi side minister Nizar Mohammed and the Tunisian side Foreign Minister Nabil Ammar.

- Memorandum of understanding between the Iraqi federation of industries and the Tunisian Federation. link

*************

CandyKisses: Iraq signs MoU with Honeywell to support energy sector

Baghdad today - follow-up

Today, Monday (May 13, 2024), Iraq signed a memorandum of understanding with the American company "Honeywell" to support the energy sector in the country.

Honeywell CEO Ken West said in a press statement, followed by Baghdad Today, that "these agreements allow the company to explore opportunities for strategic cooperation in Iraqi oil and gas fields, including stopping the burning of gas associated with production operations and providing development, automation and control services." Remote monitoring.

He added, "The memorandums of understanding were signed during a meeting hosted by the American Chamber of Commerce, accompanied by members of his team, with the participation of Prime Minister Muhammad Shiaa Al-Sudani, along with an elite group of high-level officials in the government and prominent companies in the private sector."

"Honeywell has made significant achievements in Iraq, and we look forward to bringing these agreements into effect," West said, stressing that "there is huge potential for growth and cooperation to enhance the levels of reliability and sustainability of the energy sector for Iraqis across the country."

"These agreements come as part of Honeywell's commitment to provide the best global solutions and expertise to help raise the levels of efficiency and sustainability within the country's energy sector. It also reflects the company's efforts to align and strengthen its portfolio with three mega trends, including the energy transition."

Mohammed Shabout, president of Honeywell in Iraq, said, "These agreements reflect the firm commitment of Honeywell and the private and public sectors in Iraq to continue working on modernizing and developing the local industry."

"The focus is increasing on the energy sector where we all have to invest in the necessary technology and work to provide a better energy future for the entire region," he said.

Honeywell has been operating in Iraq since the seventies and recently appointed Mohammed Shabout as the company's regional head of Iraq.

Mot: .. uh oh

Mot: ... tough being a mum

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Good Morning Dinar Recaps,

The link below provides information on Vietnam's review by the US Department of Commerce regarding Vietnam's ability to move into a Market Economy.

My understanding from the previous article on Vietnam reviewed is that this is not a graded review. It is simply a valuation of the types of goods and services they can provide comprehensively.

Vietnam is showing steady growth in several areas of their Market. Their potential to increase National Capital Investment opportunities on a Global scale is evident.

Clearly, hurdles are being cleared for Vietnam to move into a Market Economy. A Market Economy will allow them to freely move their money through supply and demand.

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Good Morning Dinar Recaps,

The link below provides information on Vietnam's review by the US Department of Commerce regarding Vietnam's ability to move into a Market Economy.

My understanding from the previous article on Vietnam reviewed is that this is not a graded review. It is simply a valuation of the types of goods and services they can provide comprehensively.

Vietnam is showing steady growth in several areas of their Market. Their potential to increase National Capital Investment opportunities on a Global scale is evident.

Clearly, hurdles are being cleared for Vietnam to move into a Market Economy. A Market Economy will allow them to freely move their money through supply and demand.

******************************

Credit Valuation Adjustments on their currency will be determined by Vietnam's ability to move their goods and services near and far at competitive rates.

© Goldilocks

https://vietnamnet.vn/en/vietnam-business-news-may-12-2024-2279536.html

~~~~~~~~~

Vietnam's Foreign Exchange Rate Review:

HCMC (Saigon) inspects authorized foreign exchange agents.