Goldilocks' Comments and Global Economic News Late Wednesday Evening 4-17-24

Goldilocks' Comments and Global Economic News Late Wednesday Evening 4-17-24

Good Evening Dinar Recaps,

Gold Standard Announcement:

"Russian gold exports have stopped since the start of this year after new exchange-rate-linked duties, Danil Volkov, director of the finance ministry’s tax policy department, told the Federation Council, the upper chamber of parliament."

This year, Russia is in process of abolishing their export duty on gold. This is a government tax on goods leaving the exporting country. It is collected by the customs authorities.

A gold-exchange rate-linked duty is a monetary system where a nation's gold can be converted into bills of exchange such as the Ruble. Such moves open the door to a Gold Standard.

Citizens in Russia are already making currency to gold and vice versa exchanges at their local bank.

Goldilocks' Comments and Global Economic News Late Wednesday Evening 4-17-24

Good Evening Dinar Recaps,

Gold Standard Announcement:

"Russian gold exports have stopped since the start of this year after new exchange-rate-linked duties, Danil Volkov, director of the finance ministry’s tax policy department, told the Federation Council, the upper chamber of parliament."

This year, Russia is in process of abolishing their export duty on gold. This is a government tax on goods leaving the exporting country. It is collected by the customs authorities.

A gold-exchange rate-linked duty is a monetary system where a nation's gold can be converted into bills of exchange such as the Ruble. Such moves open the door to a Gold Standard.

Citizens in Russia are already making currency to gold and vice versa exchanges at their local bank.

When this is fully implemented, we will begin to see a ripple effect of other countries seeing the advantages of such a trade especially as countries begin to form free trade agreements fully putting an end to tariffs and aligning their gold with local currencies. This will go a long way to leveling the playing field.

Is Bretton Woods 3 about to make an announcement?

WATCH THE WATER.

© Goldilocks

Mining Wikipedia Study Smarter Book Airfreight Britannica

~~~~~~~~~

Gold Exchange Standard: Definition, Impact & History | Study Smarter

~~~~~~~~~

LUMMIS, GILLIBRAND INTRODUCE BIPARTISAN LANDMARK LEGISLATION TO CREATE REGULATORY FRAMEWORK FOR STABLECOINS

Below is a link to the full version of what is being voted on... Lummis Senate

~~~~~~~~~

UPDATE MESSAGE FROM SAM OLIVER

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Zimbabwe and Iraq News Posted by TNT Members 4-17-2024

TNT:

Harambe: IMF ready to work with Zimbabwe | PE News 4-17-24

International Monetary Fund (IMF) managing director Ms Kristalina Georgieva yesterday said they remain committed to working with Zimbabwe to ensure economic stability and the success of the re-engagement with the international community.

She said this in a post on X after participating in a discussion on Zimbabwe’s economic developments and update on the arrears clearance and debt resolution process in Washington DC ahead of the IMF-World Bank Spring Meetings that start today, ending Friday.

“Productive discussion at the Zimbabwe roundtable with donor partners,” she said.

“The IMF stands ready to work with the Zimbabwean authorities to restore macroeconomic stability and re-engage with the international community, which are essential for accessing external financing.”

TNT:

Harambe: IMF ready to work with Zimbabwe | PE News 4-17-24

International Monetary Fund (IMF) managing director Ms Kristalina Georgieva yesterday said they remain committed to working with Zimbabwe to ensure economic stability and the success of the re-engagement with the international community.

She said this in a post on X after participating in a discussion on Zimbabwe’s economic developments and update on the arrears clearance and debt resolution process in Washington DC ahead of the IMF-World Bank Spring Meetings that start today, ending Friday.

“Productive discussion at the Zimbabwe roundtable with donor partners,” she said.

“The IMF stands ready to work with the Zimbabwean authorities to restore macroeconomic stability and re-engage with the international community, which are essential for accessing external financing.”

The roundtable was attended by a number of top officials, including African Development Bank (AfDB) president Dr Akinwumi Adesina, who is also the champion of Zimbabwe’s Arrears Clearance and Debt Resolution process and former Mozambique President Joachim Chissano, who is the high-level facilitator of the process.

In his address, Finance, Economic Development and Investment Promotion Minister, Professor Mthuli Ncube said Zimbabwe’s total public and publicly guaranteed debt stock is estimated at US$21,1 billion, comprising external debt of US$13 billion and domestic debt of US$8,1 billion.

“Zimbabwe is currently in debt distress due to the accumulation of external debt payment arrears amounting to US$6,7 billion,” said Prof Ncube.

“The external debt overhang is weighing heavily on the country’s development needs due to lack of access to international financial resources to finance Zimbabwe’s economic recovery and priority projects and programmes, under the National Development Strategy 1: (2021-2025) (NDS1).”

In December 2022, Government established a Structured Dialogue Platform as part of it’s Arrears Clearance, Debt Relief and Resolution Strategy, with all creditors and development partners in order to institutionalise structured dialogue on economic and governance reforms to underpin the Arrears Clearance and Debt Resolution process.

Prof Ncube told delegates that since then, there has been commendable progress with the Structured Dialogue Platform, with growing consensus and confidence in the process, promoted by a transparent and inclusive consultative process.

Since December 2022, five Structured Dialogue Platform meetings were held in Harare, including a High-Level Debt Resolution Forum.

Prof Ncube said the meetings have been focusing on the following strategic three pillars; economic growth and stability reforms; governance reforms; and land tenure reforms, compensation of former farm owners and the resolution of Bilateral Investment Protection and Promotion Agreements (BIPPAs).

Prof Ncube said as a sign of commitment to the engagement and re-engagement process, Government was making quarterly token payments to International Financial Institutions.

The World Bank Group has received US$1 million, taking cumulative payments made to date to US$70 million.

The AfDB Group has received US$500 000, taking cumulative payments to date US$37,4 million, while the European Investment Bank has received US$100 000, taking the cumulative payments made so far to US$5,6 million.

“Government is also making quarterly token payments of US$100 000 to each of the 16 Paris Club bilateral creditors (cumulative token payments made to date are US$12,7 million,” said Prof Ncube.

Turning to the economy, he said Zimbabwe has successfully implemented an IMF Staff Monitored Programme, established a competitive foreign exchange rate regime, ended quasi-fiscal operations at the central bank, brought macroeconomic stability, tight monetary policy and sound fiscal management and ensured availability of social protection for all, among others.

Prof Ncube said negotiations were underway for a broad Staff Monitored Programme framework, adding that the programme is “critical for Government to establish a track record of policy implementation and pave the way for Arrears Clearance and Debt Resolution, including an IMF financial arrangement”.

In terms of the food situation, he said developments during the first three months suggest a difficult year ahead owing to a severe drought attributed to EI-Nino, with serious implications on the agriculture and energy sectors, as well as the rest of the economy.

Prof Ncube said Zimbabwe has already declared the drought a National Disaster and is seeking support of the international community, including from the World Bank and the AfDB, among others.

https://positiveeyenews.co.zw/2024/04/17/imf-ready-to-work-with-zimbabwe/

************

Tishwash: Al-Sudani stresses the necessity of dialogue with the US Treasury, the Federal Bank, and the International Monetary Fund

Shafaq News/ The Iraqi Prime Minister, Muhammad Shiaa Al-Sudani, stressed on Wednesday the necessity of continuing the dialogue with the US Treasury, the Federal Reserve, and the International Monetary Fund.

This came while Al-Sudani received, at his residence in the American capital, Washington, the Chairman of JP Morgan Bank, Masha Klovksi, and his accompanying delegation, according to a statement received by Shafaq News Agency.

The meeting witnessed a discussion of the Iraqi government’s efforts to implement financial and banking reforms, in light of the path it is taking towards improving the economic reality and achieving development, as well as discussing the government’s measures in developing the government banking sector, through its contracts with major international consulting companies specialized in banking reform and encouraging banks. To open accounts with foreign banks; To be correspondent banks, according to a plan aimed at dispensing with the electronic platform at the end of this year.

Al-Sudani stressed that it is not possible to work in any development sector without reform steps for the banking sector, stressing the need to continue dialogue with the US Treasury, the US Federal Reserve, the International Monetary Fund, and other international financial institutions.

************

CandyKisses: Political praise for Sudanese’s visit to Washington: It will improve the atmosphere and improve relations

Mawazine News - Baghdad,

A researcher in political affairs, Atheer Al-Sharaa, today, Wednesday, praised the visit of Prime Minister Muhammad Shiaa Al-Sudani to Washington, pointing out that this visit will improve the atmosphere and improve relations between the two countries.

Al-Sharaa said in an interview with Mawazine News: "This visit is a ray of hope and a glimmer of success that is relied upon by rational people inside and outside Iraq, and that it will turn the political situation upside down."

Al-Sharaa condemned, "Some politicians obstructing the government's steps, considering these actions to stop the process of government success that is to be achieved."

He stressed that “foreign policies are working seriously to improve and improve the type of relationship between them and America and neighboring countries, indicating that America considers that it was the one who liberated Iraq, noting that “there is a media trying to put an end to the American presence in the country.”

He continued, “There must be a necessity Dealing with the United States and its allies from other countries according to the priority of the national interest, forgetting all other considerations, pointing out that this visit will succeed according to the agenda and will improve the type of relationship between Baghdad and Washington, considering the birth of a new phase.”

Tishwash: Parliament welcomes American support for Iraqi banks by dealing directly with international banks

Today, Wednesday, the Parliamentary Finance Committee welcomed American support for Iraqi banks licensed to deal directly with international banks.

Committee Chairman Atwan Al-Atwani said in a statement received by Al-Rabaa: “We are following with great satisfaction the results of the discussions of the Iraqi delegation currently visiting Washington, headed by Prime Minister Muhammad Shiaa Al-Sudani,” stressing “full support for the positive understandings that resulted from Al-Sudani’s meeting with the American President within the framework of the transformation in the relationship.” "Between the two countries, from the security and military aspects to the areas of development, reconstruction, economy and investment."

He added, "We welcome the US President's announcement of the United States of America's commitment to supporting Iraq to reform and develop its financial and banking system and paving the way for licensed Iraqi banks to deal directly with accredited international correspondent banks, in a way that contributes to linking Iraq to the international economic system."

He continued, "We are all confident and proud of the Iraqi negotiating delegation, and we hope that these discussions will be a new beginning to achieve a true partnership between the two countries in various political, security and economic fields in a way that achieves well-being, prosperity and stability for our country." link

*************

Tishwash: Al-Sudani receives in Washington the Chairman of JPMorgan

On Wednesday, Prime Minister Muhammad Shiaa Al-Sudani stressed the necessity of carrying out reforms in the banking sector in order to achieve development in the country, while pointing out that the government is implementing projects that will achieve sustainable development.

The Prime Minister’s media office said in a statement, seen by Al-Iqtisad News, that “Al-Sudani received, at his residence in the American capital, Washington, the President of JPMorgan Bank, Mr. Masha Klovoksy, and his accompanying delegation, and during the meeting, the government’s efforts in implementing financial and banking reforms were discussed.”

In light of the path it is taking towards improving the economic situation and achieving development, in addition to discussing the government’s measures to develop the government banking sector, through its contracts with major international consulting companies specialized in banking reform, and encouraging private banks to open accounts with foreign banks to be correspondent banks, according to A plan aims to dispense with the electronic platform at the end of this year.”

Al-Sudani stressed, according to the statement, that “it is possible to work in any development sector without reform steps for the banking sector, and the need to continue dialogue with the US Treasury, the US Federal Reserve, the International Monetary Fund, and other international financial institutions.”

For his part, Klovsky praised "the efforts of the Iraqi government to activate, develop and rehabilitate government and private banks, and its procedures in the field of providing assistance to private Iraqi banks," stressing "its support for the activities of the Iraq Fund for Development and its readiness to provide expertise and assistance in the field of training, cooperation and partnership link

Goldilocks' Comments and Global Economic News Wednesday Evening 4-17-24

Goldilocks' Comments and Global Economic News Wednesday Evening 4-17-24

Good Evening Dinar Recaps,

Banking Announcement:

"HKEX Confirms Decision to Allow Issuers to Hold Treasury Shares. Allowing Hong Kong-incorporated issuers to hold treasury shares will give them 'greater flexibility in managing their capital structure.'"

These changes will take effect on June 11th, 2024. It will give Hong Kong companies more control over their capital.

During down times for their company, this will enable them to have an asset that will neutralize some of the capital flows needed during times of great economical challenges such as the one going on now.

© Goldilocks

Goldilocks' Comments and Global Economic News Wednesday Evening 4-17-24

Good Evening Dinar Recaps,

Banking Announcement:

"HKEX Confirms Decision to Allow Issuers to Hold Treasury Shares. Allowing Hong Kong-incorporated issuers to hold treasury shares will give them 'greater flexibility in managing their capital structure.'"

These changes will take effect on June 11th, 2024. It will give Hong Kong companies more control over their capital.

During down times for their company, this will enable them to have an asset that will neutralize some of the capital flows needed during times of great economical challenges such as the one going on now. Morgan Lewis

© Goldilocks

~~~~~~~~~

The tokenization and expansion of tokenized assets is well underway. Currently, we are seeing the expansion of Regulations on a Global scale. Along with this movement, payment structures and laws are being established for them.

Support mechanisms are being added two companies and various other institutions that will increase the net worth of companies going forward through Government issuance of assets backed by gold.

The new QFS is unlike any Financial System we have had before. This one is more comprehensive and inclusive of support mechanisms used by Governments to help sustain our economies during a crisis.

Of course, the backing of gold will supply the needed support going forward for the execution of this new set of Quantum Financial Technologies.

Perhaps, this is the reason why Governments are buying so much gold, and the certainty of a bull market in Commodities such as gold have never been more needed than it is now.

We are simply at the beginning stages of a bull run in gold, gold is a World Reserve Asset that is recognized by all countries. And, the need for it in use case scenarios appears to have no end. Gold Avenue

"All roads lead to gold, and digital gold will set us free."

© Goldilocks

~~~~~~~~~

Government Announcement:

"Top U.S. House Lawmakers Meet on Stablecoin Bill"

The House Financial Services Committee are currently meeting on what the next steps are going to be for pushing the legislative process forward on Stablecoins.

The Stablecoins will enable the world to pay for tokenized assets through digital mechanisms going forward.

There is an urgency to push these bills forward. Once MICA is complete at the end of May, countries around the world will have a working regulation process to finish their own testing of protocols and interface them on the Quantum Financial System.

At that point, we will witness the transition of our Global Economy transition into a Digital Financial System. This will reset many of the price actions on the markets and their correlating protocols with the banks. It will include all sectors of the market. Youtube Coindesk

© Goldilocks

~~~~~~~~~

Markup of H.R. 5535, H.R. 802, H.R. 7437, H.R. 7440, H.R. 7428, H.R. 4206, H.R. 4116. | Youtube

~~~~~~~~~

"There’s no plan for one massive ledger. Instead, there will be multiple unified ledgers. Tokenization reduces the need for messaging, cutting transaction delays, costs and reconciliations. By using smart contracts, programmability can enable automation, transforming the role of intermediaries to governance."

What is the concept of unified ledger?

"A Unified ledger brings together central bank digital currencies (CBDC), tokenized deposits, and tokenized assets onto common platforms." Ledger Insights

~~~~~~~~~

UK Finance announced that the Regulated Liability Network (RLN) has entered a new phase of experimental trials in the UK. The RLN aims to create a common ‘platform for innovation’ including tokenized deposits (https://www.ledgerinsights.com/tokenized-deposits/) alongside conventional deposits using a shared ledger. All of the largest British banks are participating: Barclays, Citi, HSBC, Lloyds, NatWest, Nationwide, Santander, Standard Chartered, Virgin Money as well as card firms Mastercard and Visa. Ledger Insights

~~~~~~~~~

World Economic Forum Announcement:

Today the World Economic Forum published a report on wholesale central bank digital currencies (wCBDC). The paper briefly summarizes many of the wCBDC initiatives and hones in on top level use cases and how a wholesale CBDC could address long standing industry challenges. Ledger Insights

~~~~~~~~~

Transcript of Global Financial Stability Report April 2024 Press Briefing | IMF

~~~~~~~~~

BRICS Announcement:

“More than 40 states are applying for membership in BRICS. And every month the number of such countries increases. This indicates that such a free, flexible form of interaction within the BRICS is very attractive ,” the politician said. | TV Brics

~~~~~~~~~

PayPal's Stablecoin For Cross-Border Payments Is Big News | Payments Journal

~~~~~~~~~

The Powerful AI Shaping the World: Meet Aladdin | Thinkpol News

~~~~~~~~~

Liquidity from global equity markets fuelling fresh investment in gold | Siasat Daily

~~~~~~~~~

~~~~~~~~~

“We expect the market to consolidate prior to the halving and then expect the overall bull markets to continue,” they added. Bitcoin halvings are programmed to occur automatically every 210,000 blocks — roughly every four years. Mar 19, 2024 | The Block

~~~~~~~~~

"Bundesbank partners MIT for CBDC privacy research." | Ledger Insights

👆 More on this tomorrow...

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Wednesday Afternoon 4-17-2024

KTFA:

Don961: : Attempts to reduce dollarization

Economical 2024/04/17 Muhammad Sharif Abu Maysam

We often witness a state of monetary instability in the economies of developing countries that suffer from structural imbalances, or countries that are going through stages of adaptation as they move from the state economic system to the market economy in light of economic globalization, which contributes to the emergence of informal currency exchange markets. Foreign exchange, and the US dollar is usually the most traded in those markets as a suitable haven for price value from exchange rate fluctuations.

Because of the dominance of the dollar in all global commodity and service market exchanges, demand for it increases with the aim of financing foreign trade in countries that suffer from the inability to meet the needs of the local market for basic goods. Monetary and financial disruptions usually contribute to the adoption of the dollar alongside the local currency, and then it replaces it.

KTFA:

Don961: : Attempts to reduce dollarization

Economical 2024/04/17 Muhammad Sharif Abu Maysam

We often witness a state of monetary instability in the economies of developing countries that suffer from structural imbalances, or countries that are going through stages of adaptation as they move from the state economic system to the market economy in light of economic globalization, which contributes to the emergence of informal currency exchange markets. Foreign exchange, and the US dollar is usually the most traded in those markets as a suitable haven for price value from exchange rate fluctuations.

Because of the dominance of the dollar in all global commodity and service market exchanges, demand for it increases with the aim of financing foreign trade in countries that suffer from the inability to meet the needs of the local market for basic goods. Monetary and financial disruptions usually contribute to the adoption of the dollar alongside the local currency, and then it replaces it.

Little by little, it will take up more space in exchanges and trades unless the matter is remedied and the imbalances are addressed.

Otherwise, the country’s currency will lose its usefulness as a means of exchange, so it becomes dollarization that contributes to perpetuating inflation, economic instability, and the difficulty of addressing imbalances as a phenomenon supported by the data of globalization.

Here, the relevant authorities, while they are in the process of searching for solutions that will restore life to the local currency and maintain its protection, may be concerned with searching for procedural tools to curb dollarization as a phenomenon that threatens economic sovereignty

Because it appears to be a natural result of the circumstances and data of the state of transformation in the form of the economic system, as it usually The adaptation phase occurs when moving from a state economy to a market economy, but here we are looking for solutions according to the available ideas.

In economic tradition, the demand for the local currency increases if it is adopted in trade exchanges with other countries, and thus the level of demand for foreign currencies in the local market decreases.

To finance foreign trade, this matter seems difficult at first glance, but according to what was announced by some BRICS countries, it seems possible, and the rate of demand for the local currency also increases if the contribution of the local product increases in satisfying the market’s need for goods and in a way that ensures a decrease in the rate of demand for the dollar as a result of the decline.

The rate of flow of hard currency abroad, and it also occurs in cases of relying on the local currency to deliver remittances coming from abroad, and it may occur when the demand for locally produced goods for export purposes increases, especially when the cost of the unit produced locally decreases compared to those produced in other countries

As increasing rates contribute Export increases financial transactions locally through the inflow of foreign currencies, which are converted through banking channels into the equivalent of the local currency upon exchange, which contributes to supporting the attractiveness of the local currency and the stability of its value, thus increasing the demand for it. link

************

Driving America into a Brick Wall – Bill Holter

By Greg Hunter’s USAWatchdog.com

Back in February, when everyone was predicting a Fed rate cut, precious metals expert and financial writer Bill Holter said rates would be going up and not down. Since that call, the 10-Year Treasury is up more than 30 basis points. It closed today at 4.67%. Now, Holter is still calling for higher interest rates that will coincide with higher gold and silver prices. Why? It’s called inflation, and it’s not temporary.

Holter explains, “Foreigners are backing away from buying Treasuries. That is the only thing that has kept the doors open, so to speak, is the fact we are able to borrow an unlimited amount of money because we are the world reserve currency. Foreigners backing away from our debt is going to lead the Federal Reserve to be the buyer of last, and then, only resort.

So, you will have direct monetization between the Fed and the Treasury. What that will cause is a currency that declines in purchasing power. It will decline in a big way, and it will decline rapidly. So, what I am describing is inflation that turns into hyperinflation.”

But that is not the end of our problems. Holter points out, “I do think it is going to get worse, and that means interest rates will go higher, and that will put on much more pressure. We are at 4.65% on the 10-Year Treasury now. We went from 3.75% to 4.65% (in a short amount of time). We run through 5% on the 10-year Treasury, and everything blows up. . . .

The bottom line here is we are at the end game of a fiat currency.

Young people have never experienced high inflation. . . . Where we are this time around, Paul Volker (Fed Head in 1979) was able to raise rates to 16% or 17% and crush inflation. He was able to do that because there was not a ton of debt. The U.S. debt back in 1980 was 35% of GDP. Now, it is 125% plus debt to GDP. If you raise rates to 6% to 8%, you will blow up the entire system because much of this debt was put on during the 1% to 3% interest rate time. . . . The inflation is going to push rates higher no matter what the Fed says.”

Gold is hitting one new record high after another. It’s not greed, but fear, and Holter says, “Big money is buying gold because they are looking for protection.” The other wild card is war, and Holter says, “War is a way to keep the system propped up.”

In closing, Holter contends, what you are seeing is not a series of mistakes by incompetent people. Holter says, “This is too stupid for it not to be the plan. . . .This is not a Republican or Democrat thing. We are being steered directly into a brick wall because the globalists can’t take over the world with the US standing. They have to take the US down, and if they take the US down, so will the western financial system fall. If that happens, the globalists can have their way.”

There is much more in the 46-minute interview.

Join Greg Hunter as he goes One-on-One with financial writer and precious metals expert Bill Holter for 4.16.24.

https://rumble.com/v4pvkh6-driving-america-into-a-brick-wall-bill-holter.html

https://dinarchronicles.com/2024/04/17/greg-hunter-w-bill-holter-driving-america-into-a-brick-wall/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat I was told by my CBI contact that the currency swap out will happen as they will not hide this event and must inform the citizens (education process...). Yes, they also have to explain the exchange swap-out process and how it will work along with descriptions of the newer lower denominations. The CBI will then post those pictures of the lower denominations my contact told me were taken weeks ago. So, just wait and watch it all play out...You should be excited...with FACTUAL knowledge...

Militia Man The final provisions of the SFA are on the table...Security is set. The economic aspect is underway. We're going to watch al-Sudani finish up his signing of contracts... I can't imagine ...how are you going to fund all this with an exchange rate of 1310 IQD to the USD? And how is it that that you've said the Iraqi dinar, Mr Al-Sudani, is stronger than the dollar?

************

ALERT! ITS GAME OVER IF THE DEBT MARKET GOES "NO BID." VERY IMPORTANT UPDATES.

Greg Mannarino: 4-17-2024

BRICS Expansion: 40 New Members joining BRICS

BRICS Expansion: 40 New Members joining BRICS

Fastepo: 4-16-2024

More than 40 countries have expressed their interest in joining BRICS, with this number steadily increasing over time, according to an interview by Grigory Karasin, a senior Russian politician on April 16th, 2024.

Karasin emphasized the attractiveness of BRICS' flexible cooperation model, citing the ongoing rise in potential member nations as evidence.

Following the recent addition of new members—Saudi Arabia, Iran, the United Arab Emirates, Egypt, and Ethiopia—the total GDP (PPP) of the BRICS bloc is approximately $58.5 trillion USD.

BRICS Expansion: 40 New Members joining BRICS

Fastepo: 4-16-2024

More than 40 countries have expressed their interest in joining BRICS, with this number steadily increasing over time, according to an interview by Grigory Karasin, a senior Russian politician on April 16th, 2024.

Karasin emphasized the attractiveness of BRICS' flexible cooperation model, citing the ongoing rise in potential member nations as evidence.

Following the recent addition of new members—Saudi Arabia, Iran, the United Arab Emirates, Egypt, and Ethiopia—the total GDP (PPP) of the BRICS bloc is approximately $58.5 trillion USD.

This enhanced economic size underscores the bloc's growing influence in global economic affairs. The expanded BRICS now aims to be a more inclusive representation of the Global South and is positioning itself to have greater influence in global economic and political affairs.

The bloc is focused on enhancing trade and investment among its members in local currencies to reduce dependency on the dollar and other major reserve currencies.

This de-dollarization move is intended to strengthen economic ties within the bloc and with other developing countries.

BRICS leaders have reiterated their commitment to reforming international governance structures like the United Nations and other multilateral organizations to ensure more equitable representation of emerging and developing economies.

The group is also keen on promoting sustainable development, climate action, and addressing issues like poverty and hunger, consistent with the Sustainable Development Goals (SDGs).

The bloc faces challenges related to its expansion strategy. The lack of a formal institutional structure and the diverse interests of its members make consensus-building difficult, which could dilute the group’s effectiveness in achieving its goals.

The inclusion of countries with significant geopolitical and economic differences, such as Iran and Saudi Arabia, adds complexity to internal dynamics.

While the BRICS bloc is set to continue its expansion, this may further challenge the group’s cohesion. However, the collective economic weight of its members, particularly in areas like oil production, provides a substantial platform to influence global economic trends.

The group’s focus remains on creating a counter-narrative to Western economic and political dominance, positioning itself as a key player in global affairs.

In this video, we will delve into several topics including: Why does BRICS strategy not resemble European Union?, BRICS currency and financial system, BRICS nations moving toward complete de-dollarisation and last but not the least, we also explain Collective power of the blocs as of April 2024.

"Tidbits From TNT" Wednesday Morning 4-17-2024

TNT:

Tishwash: US Supports Iraq in joining WTO

At a meeting on Monday between Iraq's Minister of Planning, Mohammed Tameem, and US Secretary of State Antony J. Blinken, Iraq renewed its commitment to joining the World Trade Organization (WTO) and to protect intellectual property rights.

The United States has pledged support for a series of projects under the International Visitor Leadership Program aimed at developing expertise in these areas among Iraqis.

Both parties have recognized the importance of strategic projects and infrastructure development in Iraq, which will support regional integration and enhance international trade. ink

TNT:

Tishwash: US Supports Iraq in joining WTO

At a meeting on Monday between Iraq's Minister of Planning, Mohammed Tameem, and US Secretary of State Antony J. Blinken, Iraq renewed its commitment to joining the World Trade Organization (WTO) and to protect intellectual property rights.

The United States has pledged support for a series of projects under the International Visitor Leadership Program aimed at developing expertise in these areas among Iraqis.

Both parties have recognized the importance of strategic projects and infrastructure development in Iraq, which will support regional integration and enhance international trade. ink

CandyKisses: Meetings at the American Chamber of Commerce between the Iraqi private sector and the American banking sector

Wednesday, April 17, 2024 8:06

Baghdad (NINA) - On the sidelines of Prime Minister Mohammed Shia Al-Sudani's visit to the United States of America, meetings were held in Washington at the American Chamber of Commerce between the Iraqi private sector and the American banking sector to support long-term projects in Iraq.

This is the first time that the Iraqi government has supported the private sector with bonds to qualify it in negotiations with the American side./

************

Tishwash: A new government position regarding the 2024 budget schedules.. Have they been completed?

On Wednesday, the Prime Minister’s Advisor for Financial Affairs, Mazhar Muhammad Salih, considered the presentation of the financial tables for the fiscal year 2024 by the executive authority for parliamentary approval, “a flexible legislative path as an integral part of the financial constants and principles” of the tripartite budget law.

Saleh said in a statement followed by Al-Eqtisad News, “These tables include revenues, public expenditures, and the estimated hypothetical deficit, and they are within the law that was originally legislated by the House of Representatives and published in the Official Gazette last year.”

He added: "The proposed financial schedules, which are being prepared by the executive authority today and which have become almost complete, are based on the financial legislation in force and approved under the aforementioned tripartite budget law."

He continued, "The financial schedules prepared for the year 2024 will take into account the urgent economic and social conditions and changes required by the need for economic development in the year 2024, especially new investment projects, and financial commitments and pledges during the current year, with a view to implementing them as an annual financial plan within the framework of the principles of the tripartite general budget itself." In letter and spirit link

************

Tishwash: Al-Sudani: The issue of ending the presence of the international coalition represents an Iraqi demand

Prime Minister Muhammad Shiaa Al-Sudani confirmed, on Tuesday, that the transition to bilateral relations with the coalition countries is a desire and a departure from Iraq's national interests, while he indicated work to remove Iraq from the arena of conflict in the region.

The Prime Minister’s Media Office stated in a statement received by “Al-Ma’louma” that “the most prominent thing in the press interview conducted by Prime Minister Muhammad Shia’ Al-Sudani with the American CNN news network is that he said: “My visit to Washington comes at a sensitive and important time for our relations.” bilateral relations and what is happening in the region, and we agreed on the importance of stopping the escalation and not engaging in further mutual retaliatory actions; Because it affects the security and safety of the peoples of the region.”

He added, "Iraq, since the beginning of the events of October 7, was one of the first to warn of the danger of the continuation of this conflict and its dangerous repercussions," pointing out that "international navigation in the Red Sea is being obstructed and what is happening in Lebanon and Syria and the recent escalation is one of the repercussions of this conflict." ".

He pointed out that "the region cannot bear these events and everyone must put pressure to stop this escalation," stressing that "we will not be lax in enforcing the law and maintaining security and stability in Iraq, and we have taken immediate and practical measures in this matter."

He continued: "We are working to remove Iraq from the arena of conflict, while maintaining our principled position regarding the aggression taking place against Gaza and the Palestinian territories, because this is the root of the problem," indicating that "the region cannot be reduced to reactions. Rather, there is a process of genocide to which the Palestinians are being subjected." In front of the eyes of the world and the international community, which, along with its systems and laws, has failed to protect innocent civilians.”

He pointed out that "the casualties of women and children are unacceptable, and it is the root of the problem, because once this war stops, the region will witness a breakthrough and stability," noting that "the difference in positions between us and the United States regarding events in the region is not small in describing the events. But we agree that there is international law, general principles, humanitarian law, the laws of war, and the principle of protecting diplomatic missions.”

He explained: “We want to implement these values and principles called for by the international community, so where are the UN Security Council resolutions and the recommendations of international conferences regarding the Palestinian issue? Since the Oslo, Madrid and Sharm El-Sheikh conferences, as well as the recent Security Council resolution,” he added, adding: “I do not think that President Biden He disagrees with me on these principles, nor does any country that calls for an international order that respects humanity.”

He stated that “the attack that took place on the Iranian mission in Damascus is a clear violation and contradicts international law, which prompted Iran to respond, even though we made an effort to contain this situation,” adding: “We are facing a real problem with what is happening in Gaza, which affects the stability of the region and the world.” “Ignoring the root of this problem means more repercussions and the expansion of the arena of conflict in a sensitive area for the world.”

He continued: "We have not received reports or indications of the launch of missiles or drones from Iraq during the Iranian attack, and our position is clear that we will not allow Iraq to be thrown into the arena of conflict, and we are committed to this matter," explaining that "Iran cannot be involved in every issue related to the Iraqi situation." “The issue of ending the coalition is an Iraqi demand, and it is part of the government program that the House of Representatives voted on, and these are facts that must not be overlooked.”

He stressed that "there has been a discussion about the mission of the coalition between the Iraqi government and the United States since August 2023, and Iraq today is different from what it was ten years ago when the coalition was formed," noting that "ISIS today does not represent a threat to the security of the Iraqi state, and it is natural for the government to take the initiative to organize The topic of the international alliance.

He pointed out that “our security services have reached the highest levels of efficiency, readiness, control, and maintenance of security and stability in Iraq,” stressing, “According to the data on the ground, we initiated dialogue with the United States, which was achieved through the approval of the Supreme Military Committee, which meets continuously to present proposals.” About the timetable for ending the international coalition’s mission.”

He pointed out that "the transition to bilateral relations with the coalition countries is a desire and based on Iraq's national interests and not from the desires of specific countries or positions," noting that "we have understandings and committees for joint security cooperation between Iraq and the United States, which hold their meetings on an ongoing basis and establish a sustainable relationship and bilateral security partnership." In accordance with what was stipulated in the Constitution and the Strategic Framework Agreement.” link

Mot: .. OUCHIE!!!!

Mot: .... Yeppers... me Latest INternet Learning Lesson!! ~~~

News, Rumors and Opinions Wednesday AM 4-17-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 17 April 2024

Compiled Wed. 17 April 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors)

Mon. 15 April MarkZ: The Bond Folks have expectations of things starting from between Mon. 15 April to Mon. 22 April. We were told from day one that bonds need to be close to completion or well underway before they pull the trigger. We will know by tomorrow from European contacts if the Bonds have kicked off. Tues. 16 April Update MarkZ: Mark couldn’t get hold of any of his Bond Holder contacts. The calls went to voicemail, while another said he was in “Blackout.”

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 17 April 2024

Compiled Wed. 17 April 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors)

Mon. 15 April MarkZ: The Bond Folks have expectations of things starting from between Mon. 15 April to Mon. 22 April. We were told from day one that bonds need to be close to completion or well underway before they pull the trigger. We will know by tomorrow from European contacts if the Bonds have kicked off. Tues. 16 April Update MarkZ: Mark couldn’t get hold of any of his Bond Holder contacts. The calls went to voicemail, while another said he was in “Blackout.”

Tues. 16 April Bruce: Bond Holders were expecting their emails to exchange tomorrow Wed. 17 April or Thurs. 18 April. Tier4b (us, the Internet Group) should go around the same time. Yesterday a lower Tier Bank told us that they expected liquidity Wed. 17 April or Thurs. 18 April. The Iraqi Dinar rate has not yet been made public, but the Dinar is on the back screens of the Forex and trading upward with a Contract Rate that is very high. The Dong Rate is also trading upward in a good direction.

Mon. 15 April TNT Tony: The Three Letter Agencies were saying that the RV could go anytime after 5pm Mon. 15 April through Wed. 17 April. Banks were looking for it into tomorrow morning Tues. 16 April. But Tony thinks we won’t see it until next week.

Tues. 16 April Wolverine: “My Contact confirmed that there was a “pause” on everything because of our safety. But it was lifted. She said this is the closest we have ever been. She doesn’t want to give dates. But things can go any moment. Keep watching Iraq – big announcement coming soon.” Ginger: “I shared late last week that the “Pause” had indeed been lifted and things were set in motion again.”

Global Financial Crisis:

Tues. 16 April Frank 26:There are many Chief Executive Officers of many banks around the world at the US Treasury meeting right now with Sudani, Alaq and Barzani…Also…CEOs of CitiBank, Chase Bank and Bank of America are there. We also have all of the JP Morgan representatives, Merril Lynch, all investment companies you can think of, all of them are meeting…The meetings are going on now…This [Iraqi] entourage is here in the United States to meet with their counter parts.

Black Swan Events Have Begun:

Tues. 16 April: Copenhagen Denmark’s historic 17th-century Børsen Stock Exchange building in Copenhagen is on fire. The famous spire of the world’s oldest stock exchange, Börsen, collapsed as a result of a strong fire, reports Reuters. The building is 400 years old. The 54-meter spire was made in the shape of the twisted tails of dragons.

Read full post here: https://dinarchronicles.com/2024/04/17/restored-republic-via-a-gcr-update-as-of-april-17-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 We are now in position IMO that the banks that are going to exchange the Iraqi dinar are now on alert.

Walkingstick [Walkingstick's former Iraqi bank partner Number One Update] Number One is with Sudani. That's why Number One is in DC right now. He owns 6 banks and 4 of them are in Iraq. Those banks are playing a part of the monetary reform inside of Iraq. Also, outside with the private bank satellite banks that are representing the Central Bank of Iraq. They're going to Michigan because Aki [Iraqi Bank Manager] is in Michigan.

Nader From The Mid East I believe it's going to happen. I believe it's going to change. I believe it's going to change, happen when it's ready to happen. That's it. When you see the coalition leave...the government of Iraq sovereign and nobody control it and when you see a new dinar that's when the exchange rate will change. Simple as that.

Inflation To 'Rebound', Crash Markets And Send Interest Rates Soaring | Louis Gave & David Hay

David Lin: 4-17-2024

Louis Gave, CEO of Gavekal, and David Hay, Co-CIO of Evergreen Gavekal, join forces to discuss the coming rebound of inflation and all the market implications that come with it.

0:00 - Intro

1:36 - Rebound of inflation

7:37 - Fed policy

16:13 - 8% interest rate?

23:07 - Inflation and spending

33:14 - Invasion of Taiwan?

37:11 - Market bubble

46:00 - Market outlook

48:34 – Gold

51:53 - Asset allocation

Goldilocks' Comments and Global Economic News Tuesday Evening 4-16-24

Goldilocks' Comments and Global Economic News Tuesday Evening 4-16-24

Good Evening Dinar Recaps,

Yesterday, Hong Kong regulators adopted both spot Bitcoin ETF and spot Ether ETF. In 2021, mainland China and cryptocurrency trading was banned. Since that time, China has been working diligently to regulate this industry.

And now, China's largest family is in process of funding the above projects. "ChinaAMC, Harvest Global and Bosera International are among those that have been given the green light to issue ETFs."

China AMC is the first Exchange Traded Fund manager in China, and they are the investment manager of the Asian Bond Fund China Fund.

ETFs track a specific set of index assets allowing you to invest in many Assets in that particular sector. ETFs allow you to invest in a grouping of companies and digitize them in a group fund.

This process allows sectors of the market to be joined together in a single asset group class bringing the new digital economy inside the marketplace.

Goldilocks' Comments and Global Economic News Tuesday Evening 4-16-24

Good Evening Dinar Recaps,

Yesterday, Hong Kong regulators adopted both spot Bitcoin ETF and spot Ether ETF. In 2021, mainland China and cryptocurrency trading was banned. Since that time, China has been working diligently to regulate this industry.

And now, China's largest family is in process of funding the above projects. "ChinaAMC, Harvest Global and Bosera International are among those that have been given the green light to issue ETFs."

China AMC is the first Exchange Traded Fund manager in China, and they are the investment manager of the Asian Bond Fund China Fund.

ETFs track a specific set of index assets allowing you to invest in many Assets in that particular sector. ETFs allow you to invest in a grouping of companies and digitize them in a group fund.

This process allows sectors of the market to be joined together in a single asset group class bringing the new digital economy inside the marketplace.

Inside a Global Market, this allows Trading to take place between our Eastern countries and Western countries at the push of a button in a matter of seconds.

The Clearing House Interbank Payments System (CHIPS) is now ISO 20022 compliant allowing this Global messaging system to clarify trades between the East and the West going forward.

For large banking transactions in the US, CHIPS is the most used for trades in cross-border International trading.

This is why the Markets in Crypto Assets regulatory process ending by the end of May is so important. MICA will become the standard by which many countries formulate their own regulatory process in trade.

Ripple and the SEC are currently involved in final negotiations. It is expected that they will come up with an agreement to settle this week.

Ripple would allow settlement of trades to take place within seconds between the East and West through their Network.

So much is coming together at once. It is important that we put the pieces together to see how close we are to the ability to transact on the new QFS. Nothing can happen until all moving parts are working together.

Ripple has agreed to implement a new Stablecoin that represents the US dollar. This coordinated effort will allow Global trading systems to fulfill payment transactions through the XRP settlement coin within seconds.

The SEC has put Ripple through rigorous scrutiny for the last few years. It is basically a coin that has gone through the regulatory process already and awaiting it's approval to move forward on the International stage.

Stablecoin laws are already on the table in Congress to clarify new protocols inside the new digital asset based trading system. As we witness all of these coordinated efforts move into their implementation stage, it is important for us to recognize and acknowledge the work that has been done globally for the last decade or so to make this possible.

For the last 3 years, this room has witnessed our new QFS being built from the ground up. Our baby has grown up and getting ready to move out into the world. CNBC Esma Europa Investopedia Sortly Linkedin Wikipedia

© Goldilocks

~~~~~~~~~

Currently, our markets are moving into what is called a reflation trade. This happens when price actions begin to reflect more correlations with inflation prices than true fundamentals.

This is why we're having to realign or reset our markets along with banking system to synchronize our new Quantum Financial System with authentic values only Gold can provide.

When our new tokenized assets begin to reflect values based on gold prices, it will move our markets into authentic price actions going forward. Barons

© Goldilocks

~~~~~~~~~

During Iraq's visit to the US, they talked about a comprehensive economic relationship. In essence, this is a free trade agreement.

A free trade agreement is cooperation between two countries that develops trade relations and investment opportunities on an International level.

Trade deals increase imports and exports between two countries. This has the ability to bring into line exchange rates accomplishing less risk on both parties normalizing their trade exchanges between each other.

In other words, a free trade agreement with Iraq would bring an equilibrium of exchange rates between our countries allowing this trade relationship to move our currencies into a real value between us. Youtube Carlson School Trade Small Business Investopedia Wikipedia

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

Next Bitcoin Halving 2024 Date & Countdown [BTC Clock]

~~~~~~~~~

Ripple Vs. SEC Update: Expert Says Both Parties Have Reached A Settlement Agreement | Bitcoinist

~~~~~~~~~

Iraq maintains its 30th rank with the largest gold reserves - Iraqi News

~~~~~~~~~

~~~~~~~~~

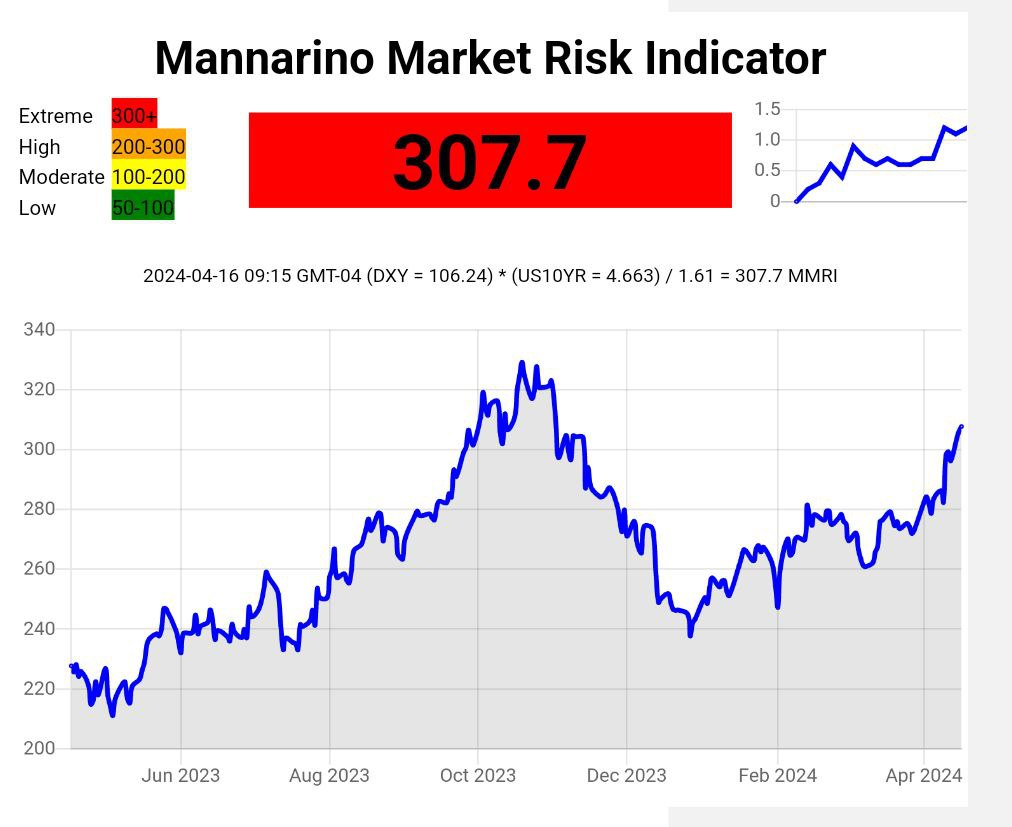

👆 If risk in this market is not contained, we are going to see a meltdown. Thus, the reason why I shared with you the next 3 to 5 weeks will be a challenge for the market in finding new price patterns.

It is important to not get so fixated on what's going on with the market except for the debt sectors of the market. The real action is going on behind the scenes, and we cover that each day.

~~~~~~~~~

What Is Bitcoin Halving?

The Bitcoin Halving is when Bitcoin's mining reward is split in half. It takes the blockchain network about four years to open 210,000 more blocks, a standard set by the blockchain's creators to continuously reduce the rate at which the cryptocurrency is introduced.

The first reward was 50 bitcoin. Previous halving dates were:

Nov. 28, 2012, to 25 bitcoins

July 9, 2016, to 12.5 bitcoins

May 11, 2020, to 6.25 bitcoins

The next halving is expected to occur in April 2024, when the block reward will fall to 3.125 BTC.

As of March 2024, about 19.65 million bitcoins were in circulation, leaving just around 1.35 million to be released via mining rewards. Investopedia

~~~~~~~~~

RIPPLE XRP EU & U.K. ARE GETTING READY⚠️🚨XRP HOLDERS WILL GET RICH | Youtube

~~~~~~~~~

You Won’t Believe What Nostradamus Predicted For 2024! | Youtube

~~~~~~~~~

The US Commitment to Iraq is Revealed Iraqi PM Visits the White House | Youtube

~~~~~~~~~

Hearing Entitled: Agency Audit: Reviewing CFPB Financial Reporting & Transparency | Youtube

~~~~~~~~~

Ripple Proposes Native Lending Protocol to Expand XRP Earning Opportunities - Times Tabloid - Latest Cryptocurrency News, Bitcoin (BTC) News, Ethereum (ETH) News, Shiba Inu (SHIB) News, Ripple's XRP News | Times Tabloid

~~~~~~~~~

RIPPLE XRP | BIS JUST ANNOUNCED THE NEW SYSTEM | PAY ATTENTION | Youtube

~~~~~~~~~

BIS Announcement of the new Financial System:

"Finternet: The BIS vision that underpins the Unified Ledger tokenization push" Ledger Insights

👆 more on this tomorrow...

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist's "News and Views" Tuesday 4-16-2024

Jim Willie: 'Gold's The Safe Haven When There's No Escaping The Debt Default'

Arcadia Economics: 4-16-2024

With gold and #silver rallying while there's been a selloff in the bond market, today Dr. Jim Willie checks in to share his view on what's happening. J

im talks about how Japan is selling US treasuries, which has added to the pressure in the debt market.

Meanwhile, the Fed continues walking an increasingly fine line of balancing whether to cut or raise interest rates, as inflation has continued to run at higher than desired rates.

All of which has contributed to what we're seeing in the gold and silver markets. And to hear from Dr. Jim Willie, click to watch the video now!

Jim Willie: 'Gold's The Safe Haven When There's No Escaping The Debt Default'

Arcadia Economics: 4-16-2024

With gold and #silver rallying while there's been a selloff in the bond market, today Dr. Jim Willie checks in to share his view on what's happening. J

im talks about how Japan is selling US treasuries, which has added to the pressure in the debt market.

Meanwhile, the Fed continues walking an increasingly fine line of balancing whether to cut or raise interest rates, as inflation has continued to run at higher than desired rates.

All of which has contributed to what we're seeing in the gold and silver markets. And to hear from Dr. Jim Willie, click to watch the video now!

This Report Is PROOF That An Economic Crisis Is Coming

Atlantis Report: 4-16-2024

The rising number of layoffs across various industries is a worrying trend. Despite the supposed economic growth, many people are losing their jobs. Even industries that were believed to be safe are not immune.

This is causing concern as it hasn't been seen in recent years. Moreover, the level of consumer debt is another alarming issue.

The fact that around one-third of Americans are struggling to pay their bills indicates that not everyone is benefiting from the so-called economic boom.

With the possibility of inflation and interest rate hikes, people already burdened by debt face an uncertain future.

"Indoeisia and Zimbabwe News" Posted by Harambe at TNT 4-16-2024

TNT:

Harambe: Indonesian rupiah hits 4-year low, prompts central bank intervention, Money News | AsiaOne 4-16-24

The Indonesian rupiah on Tuesday (April 16) slid to its weakest in four years as the market reopened after the Eid al-Fitr holidays, prompting the central bank to intervene.

The rupiah weakened as much as 2.27 per cent to 16,200 per US dollar, its weakest level since early April 2020, leading the decline among emerging Asia currencies.

While Indonesian markets were closed for the holidays, the US dollar had gained after strong US economic data and rising inflation led markets to push out expectations for when the Federal Reserve could start cutting interest rates.

"Bank Indonesia is taking steps to maintain rupiah stability by maintaining supply-demand balance in foreign exchange market, through triple interventions," Edi Susianto, the central bank's head of monetary department, told Reuters.

TNT:

Harambe: Indonesian rupiah hits 4-year low, prompts central bank intervention, Money News | AsiaOne 4-16-24

The Indonesian rupiah on Tuesday (April 16) slid to its weakest in four years as the market reopened after the Eid al-Fitr holidays, prompting the central bank to intervene.

The rupiah weakened as much as 2.27 per cent to 16,200 per US dollar, its weakest level since early April 2020, leading the decline among emerging Asia currencies.

While Indonesian markets were closed for the holidays, the US dollar had gained after strong US economic data and rising inflation led markets to push out expectations for when the Federal Reserve could start cutting interest rates.

"Bank Indonesia is taking steps to maintain rupiah stability by maintaining supply-demand balance in foreign exchange market, through triple interventions," Edi Susianto, the central bank's head of monetary department, told Reuters.

The central bank is intervening especially through the spot and domestic non-deliverable forwards, he added, while boosting attractiveness of rupiah-denominated assets.

The benchmark stock index also weakened, dropping as much as 3.02 per cent on Tuesday, before regaining some of the losses.

Yield of the benchmark 10-year bonds rose to 6.83 per cent, its highest since November 2023.

https://www.asiaone.com/money/indonesian-rupiah-hits-four-year-low-prompts-central-bank-intervention

************

Harambe: Zimbabwe’s New Central Banker Vows to Regain Investor Confidence | Bloomberg 4-16-24

Zimbabwe’s new central bank governor vowed to restore confidence in the institution that’s repeatedly failed to stabilize prices and the nation’s currency.

The Reserve Bank of Zimbabwe is rolling out a ‘Back to Basics’ plan that will initially focus on consolidating the introduction of the nation’s new national currency — the ZiG, John Mushayavanhu said in a circular to staff. It will also seek a “paradigm shift” in culture at the bank to rebuild its credibility and relevance, he said.

“The market has lost confidence and trust in the credibility and impact of the central bank’s policies over the years, and this calls for a focused re-orientation and change in the way we do things in pursuit of our statutory mandate,” Mushayavanhu said in the note.

Mushayavanhu’s first policy measure after taking over as governor was the introduction of the ZiG — short for Zimbabwe Gold — on April 5. The new unit backed by gold and a basket of foreign currencies is the southern African nation’s sixth attempt to create a functioning local currency since 2008. A single ZiG is worth about 7 US cents, the price of a milligram of gold.

The currency has strengthened 1.5% since its introduction and traded at 13.36 per US dollar on Tuesday, according to central bank data.

Dubbed by commercial bankers as “John the Second” after taking over from former Governor John Mangudya last month, Mushayavanhu said other reforms planned by the central bank include “identifying and plugging leakages and restructuring the Reserve Bank’s balance sheet from short-term pressures likely to undermine the efficacy of our policies.”

The bank will also seek to collate and disseminate credible data and appoint a panel to monitor the effectiveness of monetary policy. Along with the new currency, Mushayavanhu also introduced a new interest rate on April 5 — one set at 20%, compared with 130% previously, which was the highest central bank rate in the world.

The ZiG replaced the Zimbabwean dollar, which lost four-fifths of its value against the greenback this year before being replaced, fanning inflation and evoking bitter memories for citizens of the days of hyperinflation.

Zimbabwe stopped publishing local currency inflation data last year, after adopting a measure that better reflects the dominant role the US dollar plays in the economy. Under the measure inflation quickened to a seven-month high of 55.3% in March.

More News, Rumors and Opinions Tuesday Afternoon 4-16-2024

KTFA:

Clare: The Sudanese advisor expects the dollar to decline after the Washington discussions

4/16/2024 Baghdad,

The political advisor to the Prime Minister, Sobhan Mulla Jiyad, expected Iraq's readiness to transform the relationship with the "International Coalition" into bilateral relations, anticipating a relative decline in the "dollar" with the Sudanese visit to Washington.

Mullah Jiyad said in a televised interview followed by Mawazine News: “Iraq wants to transform the relationship with the International Coalition into bilateral relations.”

He added, "We expect the dollar to decline relatively with the Sudanese visit to Washington," noting that "Iraq wants to transform the relationship with the International Coalition into bilateral relations." LINK

KTFA:

Clare: The Sudanese advisor expects the dollar to decline after the Washington discussions

4/16/2024 Baghdad,

The political advisor to the Prime Minister, Sobhan Mulla Jiyad, expected Iraq's readiness to transform the relationship with the "International Coalition" into bilateral relations, anticipating a relative decline in the "dollar" with the Sudanese visit to Washington.

Mullah Jiyad said in a televised interview followed by Mawazine News: “Iraq wants to transform the relationship with the International Coalition into bilateral relations.”

He added, "We expect the dollar to decline relatively with the Sudanese visit to Washington," noting that "Iraq wants to transform the relationship with the International Coalition into bilateral relations." LINK

Economy / investigations and reports

Economists and political analysts unanimously agreed on the importance of the economic and financial aspect of PrimeMinister Muhammad Shiaa Al-Sudani's visit, noting that it will strengthen cooperation relations in banking reform and anti-corruption files and achieve significant financial and economic gains for Iraq.

Activating economic and financial cooperation.

Speaking to the Iraqi News Agency (INA), writer and political analyst Haitham Al-Khazali says, “The visit is of great importance because it will discuss activating the Strategic Framework Agreement and moving the relationship with the United States from the security framework to the rest of the frameworks stipulated in the Strategic Framework Agreement by activating cooperation.” In financial, economic, environmental, energy and anti-corruption aspects.”

He added, "We believe that this visit will be crowned with success and contribute to achieving great political and financial gains due to Iraq's increasing importance in the region, its openness to countries of the world, investment opportunities, existing economic resources, the possibility of establishing economic partnership relations with the United States, and cooperation in all other aspects, the most important of which are banking and economic reform, combating corruption, energy, and financial support."

Effects of climate change.

He continued, "The Prime Minister is expected to meet with officials in the US Treasury Department, and the meeting may contribute to lifting sanctions on some Iraqi banks and easing the conditions for financial transfers to Iraq, which will contribute to consolidating and strengthening the Iraqi dinar against the US dollar."

He added, "It is also hoped that the visit will witness the signing of agreements with companies investing in traditional energy, as well as in the field of clean energy, in cooperation with American companies, while strengthening cooperation in banking reform, activating anti-corruption laws and global transparency agreements, and supporting

Iraq's efforts to recover its wanted persons and money in the United States."

Addressing the issue of disabled banks.

The specialist in financial and banking affairs, Mustafa Akram Hantoush, said in his speech to the Iraqi News Agency (INA): “The visit carries economic goals at 50% of its agenda, especially from the banking side, and the Prime Minister is aware and fully oriented towards supporting the reform of the banking sector, which is what included in the ministerial programme.

He added, "The Prime Minister is supposed to meet with representatives of major American banks to request facilities for the Iraqi banking system. He will also meet with officials of the US Treasury Department and the Federal Reserve. We expect that there will be an official request to remove sanctions from some of the sanctioned banks that have not been proven to have committed violations."

Iraq has turned into a workshop.

Meanwhile, economic expert Abdul Hassan Al-Ziyadi confirmed in his speech to the Iraqi News Agency (INA) that “Iraq seeks to invest in the strategic framework agreement and the visit would remove the problems, especially the financial ones, that plagued the relationship between Baghdad and Washington in previous governments, and the current government moved to implement reforms.”

"Really to end it."

He added, "The government of Prime Minister Muhammad Shiaa Al-Sudani implemented actual and practical steps in the field of financial and banking reform, accompanied by an economic movement to implement important projects that turned Iraq into a workshop. It invested government work that strengthened political and security stability and provided the appropriate ground for the private sector and foreign investment to exploit the great opportunities in the fields of...

Construction, reconstruction and strategic projects.

He continued, "Activating the strategic framework agreement with its financial, economic, and i

nvestment aspects will contribute to the United States, as the world's first economy, playing an

important role in supporting the investment movement and the Iraqi economy," noting that "the Prime Minister accompanied with him a delegation representing the Iraqi Private Sector Council, and this is a precedent that occurs for the first time in Iraqi governments represent great support for this sector in establishing partnerships with American investors and companies to support the investment movement in Iraq.”

An important visit in light of the regional circumstances.

The economic expert, Nabil Al-Tamimi, said in his speech to the Iraqi News Agency (INA) that “the visit is one of the most important stations in formulating Iraq’s foreign policy in light of the current regional circumstances, and its main goal is to chart the future relationship between Baghdad and Washington through bilateral agreements, and in fact, the Prime Minister The ministers are working to draw up a framework for the relationship between Baghdad and Washington that is compatible with Iraqi ambitions to preserve sovereignty as well as enhance economic and trade cooperation and cooperation in combating corruption.” link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 There are many Chief Executive Officers of many banks around the world at the US Treasury meeting right now with Sudani, Alaq and Barzani...Also...CEOs of CitiBank, Chase Bank and Bank of America are there. We also have all of the JP Morgan representatives, Merril Lynch, all investment companies you can think of, all of them are meeting...The meetings are going on now...This [Iraqi] entourage is here in the United States to meet with their counter parts.

Militia Man Al-Sudani's visit to the White House...we know he's already done that...They brought about 130 different people with them. I think they said three planes worth...That [Large] motorcade yesterday in WDC was so very telling in just how important today and tomorrow will be. If you are not excited by now? Wake up!

The US Commitment to Iraq is Revealed Iraqi PM Visits the White House

Edu Matrix: 4-16-2024

The US Commitment to Iraq is Revealed: The Iraqi PM visits the White House. President Biden talks of commitment to Iraq's economics and energy. The opening statements made by Iraq's Prime Minister and the President of the United States.

RED ZONE MARKET RISK! AND WITHOUT DIRECT INTERVENTION EXPECT A FULL-ON MELTDOWN.

Greg Mannarino: 4-16-2024