Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Good evening Dinar Recaps,

Finance ministers discuss BRICS Bridge digital currency payments

"Specifically, the Ministry said, 'We are talking about creating a multilateral digital settlement and payment platform.' However, Sputnik International one of Russia’s English propaganda networks, went further. It said Finance Minister Anton Siluanov was ready to test digital currencies with China, the Eurasian Economic Union (EAEU) and the Gulf countries."

Another news outlet quoted Siluanov as saying, “The first thing to do is to create a connection to the existing central bank digital currency systems that are already operating in a number of countries. In parallel with this, national financial messaging systems need to be connected.”

Here, we have information with specific guidance on what has to be done in Russia and the BRICS system to see their local currencies onboarded to the new QFS. They give us a direct message in the last sentence of the above article.

Here it is again separated from the paragraph, "...national financial messaging systems need to be connected."

Goldilocks' Comments and Global Economic News Tuesday Evening 3-5-24

Good evening Dinar Recaps,

Finance ministers discuss BRICS Bridge digital currency payments

"Specifically, the Ministry said, 'We are talking about creating a multilateral digital settlement and payment platform.' However, Sputnik International one of Russia’s English propaganda networks, went further. It said Finance Minister Anton Siluanov was ready to test digital currencies with China, the Eurasian Economic Union (EAEU) and the Gulf countries."

Another news outlet quoted Siluanov as saying, “The first thing to do is to create a connection to the existing central bank digital currency systems that are already operating in a number of countries. In parallel with this, national financial messaging systems need to be connected.”

Here, we have information with specific guidance on what has to be done in Russia and the BRICS system to see their local currencies onboarded to the new QFS. They give us a direct message in the last sentence of the above article.

Here it is again separated from the paragraph, "...national financial messaging systems need to be connected."

Meanwhile, Russia will be testing their new digital currency this year. Remember, Putin is the chair of the BRICS System this year, and many of the currencies we are looking to revalue have already joined this group. BRICS Nations are formulating a digital gold token for trade, this will change everything.

Do you remember ISO 20022 messaging system? It is still important.

(https://sputnikglobe.com/20240226/russia-ready-to-test-payments-in-digital-currencies-with-china-eaeu---finance-minister-1116982914.html),

Watch the water.

© Goldilocks

Ledger Insights

Federal Reserve

~~~~~~~~~~

Fedwire is a real-time gross settlement system of central bank money used by Federal Reserve banks to transfer funds electronically between member institutions. Banks, businesses, and government agencies use Fedwire for large, same-day transactions. Investopedia

~~~~~~~~~~

When factoring in currency trades, it is the first currency in a currency pair that represents how much currency is needed to purchase a single unit of the corresponding currency beside it. Investopedia

© Goldilocks

~~~~~~~~~~

Freedom Fighter ©

A currency pair is the quoting of 2 different currencies, with the currency on the left of the slash

( / ) being exchanged FOR the currency on the right of the slash ( / )

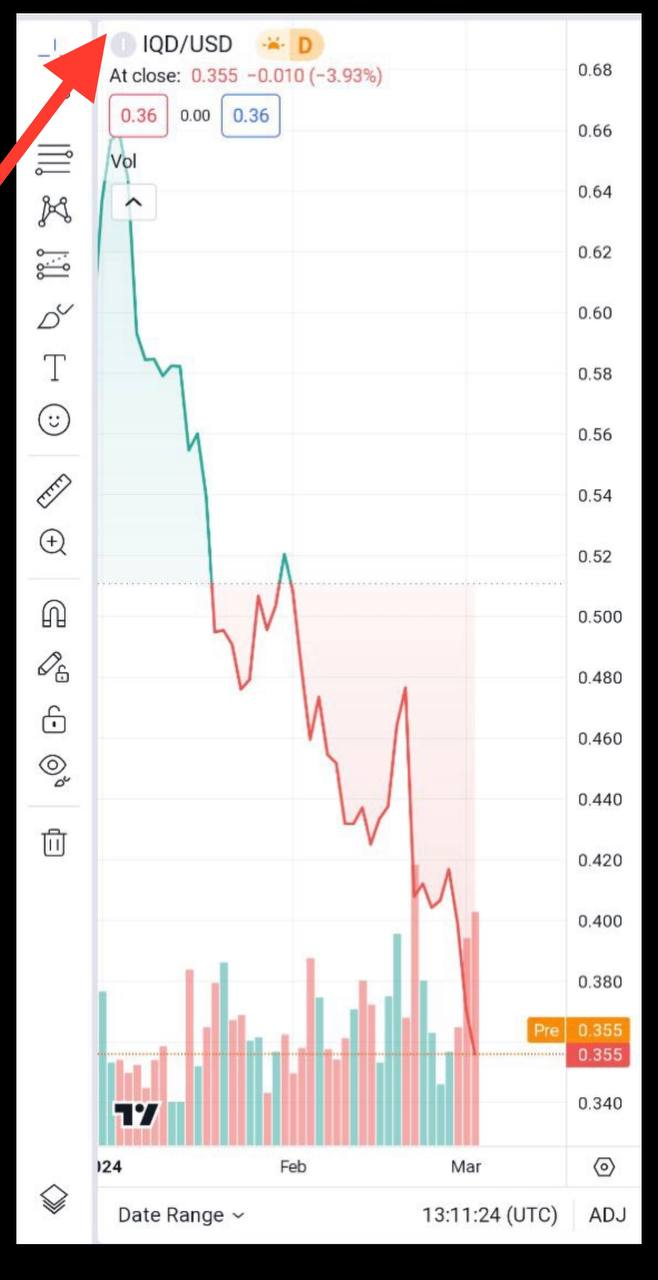

Our exchange will be IQD/USD

AKA we are exchanging

✅DINAR for USD (IQD/USD)

NOT ❌USD for DINAR

(USD / IQD )

Hear Freedom Fighter's Explanation here: https://t.me/c/1545617426/75146

~~~~~~~~~~

Freedom Fighter ©

✅Another example

~~~~~~~~~~

Thank you Freedom Fighter for a wonderful explanation in detail.

~~~~~~~~~~

Iraq confirms it has completed the requirements to join the World Trade Organisation | Zawya News

~~~~~~~~~~

Official: Iraq's accession to the World Trade Organization is imminent | Shafaq

~~~~~~~~~~

RBI Expects Launch Of Interoperable Internet Banking In 2024: Shaktikanta Das | NDTV Profit

~~~~~~~~~~

Analyzing the latest updates and advancements in Stellar (XLM) | CryptoNewsz

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Why Gold Might (Weirdly) Be A Contrarian Investment Right Now

Why Gold Might (Weirdly) Be A Contrarian Investment Right Now

Notes From the Field By Simon Black/James Hickman March 5, 2024

[Important Reminder: (Simon Black) has dropped the pen name and is now writing under his real name, James Hickman.]

It’s hard to say with a straight face that an asset hovering near its all-time high could be a “contrarian” investment. But I’m going to say it anyhow-- I think gold may be a contrarian play right now.

Now, it would be easy to assume that gold is near its all-time high because everyone is buying. And normally that would be true; typically, whenever an asset soars to a record high, it’s because individual investors are piling into the market.

We’ve seen this countless times, from Bitcoin to meme stocks; once something becomes the hot thing to own, small investors-- and occasionally professionally managed funds-- drive the price higher.

But that’s not happening with gold. In fact, investors have been abandoning gold for years.

Why Gold Might (Weirdly) Be A Contrarian Investment Right Now

Notes From the Field By Simon Black/James Hickman March 5, 2024

[Important Reminder: (Simon Black) has dropped the pen name and is now writing under his real name, James Hickman.]

It’s hard to say with a straight face that an asset hovering near its all-time high could be a “contrarian” investment. But I’m going to say it anyhow-- I think gold may be a contrarian play right now.

Now, it would be easy to assume that gold is near its all-time high because everyone is buying. And normally that would be true; typically, whenever an asset soars to a record high, it’s because individual investors are piling into the market.

We’ve seen this countless times, from Bitcoin to meme stocks; once something becomes the hot thing to own, small investors-- and occasionally professionally managed funds-- drive the price higher.

But that’s not happening with gold. In fact, investors have been abandoning gold for years.

Publicly available data from more than 100 gold ETFs (all of which are conveniently aggregated by the World Gold Council) show that western investors have been selling off their gold ETFs for most of the past few years.

WGC data show that North American and European investors dumped over 700 metric tons of gold since May of 2022, equivalent to nearly 20% of ETF holdings.

In fact, outflows for the month of January alone (the most recent month of published data) totaled more than 50 metric tons-- the second highest outflow in a year.

Most notably, however, North American, and European investors dumped 179.6 metric tons of gold September 2023 through January 2024.

This is important, because during that time period, the price of gold surged from $1820 per ounce to nearly $2100.

Strange, right? If investors were selling off substantial quantities of gold, it seems like the price should have fallen. Instead, it rose 15%. How is that possible?

Well, the reason that gold keeps going higher is because, while individual investors are selling, there’s another group that’s buying.

In fact, this group of buyers is completely price insensitive. They don’t care how much they pay per ounce. They are not even looking for a return on investment. And they have mountains of cash to spend.

The group of buyers I’m talking about is central banks and governments.

And not just the usual suspects like China and Russia either (though China did buy more than 200 metric tons in 2023). Others like Poland, India, Singapore, Czech Republic, Philippines… and even Iraq.

To me this is an obvious signal that the global financial system is probably going to change sooner rather than later. And long-time readers know we have been writing about this for years.

Reserve currencies throughout history have always come and gone.

There was a time when the Greek drachma dominated trade and commerce in the Mediterranean (due in large part to the conquests of Alexander the Great). It was displaced by the Roman denarius, then the Byzantine gold solidus, then the Venetian ducat.

Reserve currencies rise to prominence because people have confidence in the issuer, i.e. the Roman Empire, or the Republic of Venice, or the Spanish Empire.

But eventually that confidence wanes-- especially as the empire debases its currency and runs up massive debts.

That’s the situation the United States is in right now.

The national debt is already $34.4 trillion. And the Congressional Budget Office expects it to rise by at least $20 trillion over the next decade.

The dollar became the global reserve currency back in 1944 when there were no other nations to rival the US.

The US was the only country that hadn’t been completely obliterated by war. It boasted the largest, freest, most productive economy. It possessed the best technology and manufacturing capacity. It had the largest pool of savings.

And it also had one of the world’s largest and most rapidly growing populations.

Yet even with such an impressive socioeconomic resume, the rest of the world wasn’t willing to blindly trust the US government with the world’s reserve currency… not without first putting some critical checks and balances in place.

First, while other nations agreed to fix their currencies to the US dollar, the US agreed to fix the dollar to gold at a rate of $35 per troy ounce.

And second, the US government had to guarantee that the dollar would be freely convertible to gold; that way, if any nation ever lost confidence in the Treasury Department or Federal Reserve, they could easily redeem their dollars for gold.

This is a pretty critical point to understand: immediately following World War II, the US was at the peak of its power. Every other developed nation on earth had been devastated by the war. Farms and factories had been destroyed. Chaos and hunger were rampant. Entire governments had been toppled.

Yet even with such a tremendous power imbalance (i.e. the US was in pristine condition compared to Europe), allied nations still weren’t willing to go all-in on the US dollar. And they demanded the gold convertibility as a guarantee.

That was 80 years ago. And it’s safe to say that the US is nowhere near the peak of its geopolitical power anymore. Adversary nations are everywhere, and the US government’s finances are an embarrassing catastrophe.

When I see central banks buying up gold at record high prices, this suggests to me that they are preparing for a new global financial system-- one that is based on gold instead of the US dollar.

After all, this is the most logical scenario.

It would be naive (and deliberately ignorant of history) to believe that the dollar will go on indefinitely as the world’s dominant reserve currency, given the pitiful trend of US government finances. Even the IMF has called for a reset in the global financial system.

It’s also hard to believe that any new financial system would be centered on a Chinese currency; no one trusts the CCP, nor should they.

Gold is the most viable option to replace the dollar as the global reserve currency because it doesn’t require any convincing. Governments and central banks all over the world already own gold, just as they have for thousands of years.

And it’s a lot easier for everyone to have confidence in an asset class that no single nation controls.

Given the trend of their large-scale gold purchases, it appears that foreign governments and central banks may be preparing for this potential new financial system.

I’ve argued before that a gold-based financial system could send prices beyond $10,000 or more.

So, yes, even though gold is near a record high, it’s important to remember that individual investors are selling at a time when central banks are gobbling it up even more quickly.

And it’s possible they’re buying for a very deliberate reason.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

"Tidbits From TNT" Tuesday 3-5-2024

TNT:

Tishwash: Central: We spend millions of dollars on electronic payment, and Iraqis prefer cash

The Central Bank confirmed, on Monday, March 4, 2024, that Iraqi society prefers to deal with cash, pointing out that millions of dollars are spent annually by the bank on electronic payment.

Iraqis prefer cash in their transactions, while the Central Bank spends millions of dollars on electronic payments

Deputy Governor Ammar Khalaf said in a speech followed by “Ultra Iraq” that “Iraqi society prefers to rely on cash in daily transactions,” noting that “the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank during the year.” the past".

TNT:

Tishwash: Central: We spend millions of dollars on electronic payment, and Iraqis prefer cash

The Central Bank confirmed, on Monday, March 4, 2024, that Iraqi society prefers to deal with cash, pointing out that millions of dollars are spent annually by the bank on electronic payment.

Iraqis prefer cash in their transactions, while the Central Bank spends millions of dollars on electronic payments

Deputy Governor Ammar Khalaf said in a speech followed by “Ultra Iraq” that “Iraqi society prefers to rely on cash in daily transactions,” noting that “the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank during the year.” the past".

According to experts , the Iraqi government, through attempts to implement electronic payment, aims to withdraw the monetary mass in circulation in Iraq, which amounts to 84 trillion dinars.

Khalaf pointed out that “the Central Bank spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for the development of electronic payment in Iraq,” explaining that “the digital financial transformation in Iraq began when the salaries of state employees were localized and bank accounts were opened” to use electronic payment .

The Deputy Governor stated that the Ministry of Oil, gas stations, and some ministries “quickly responded to the directives of the Central Bank and the Iraqi government,” in addition to “the Passport Directorate, which required that payment be electronic, and the General Traffic Directorate.”

Ten days ago, the regional president of Visa, in Central and Eastern Europe, the Middle East and Africa, Andrew Torrey, revealed “the company’s readiness to bring expertise, in addition to employing more Iraqis in its office in Baghdad, with the aim of reaching 500,000 acceptance points from points of sale with electronic payment.” in Iraq link

************

Tishwash: Central Bank: Iraqi society prefers to use cash in daily transactions

3/4/2024 - Baghdad

The Central Bank of Iraq announced today, Monday, the use of the best internationally approved systems and standards in the field of electronic payment, while indicating that it spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for the development of electronic payment in Iraq.

Deputy Governor of the Central Bank, Ammar Khalaf, said in a speech at the first Iraqi Digital Economy Forum, “The digital financial transformation in Iraq began with the localization of state employee salaries and the opening of bank accounts, the primary purpose of which is to use electronic payment in daily transactions, whether inside Iraq.” Or outside it.”

Khalaf added, “Iraqi society prefers to rely on cash in daily transactions, but the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank over the past year and it continues to encourage and activate electronic payment in Iraq by issuing many Among the laws, controls and instructions that encourage the use of electronic payment in Iraq.

He pointed out that "some ministries responded quickly to the directives of the Central Bank and the Iraqi government, especially the Ministry of Oil by making collections at gas stations and others via electronic payment, as well as the Passports Directorate, which obligated payment to be electronic, in addition to the General Traffic Directorate and other ministries." Stressing that "all this support gives a very strong and significant impetus to electronic payment."

He pointed out that "the Central Bank has been the only influential player for many years, as it has embraced the importance of digital transformation in most of its transactions, and spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for developing electronic payment in Iraq through the use of the best internationally approved systems and standards in this field." ". LINK

************

Tishwash: Central Bank: Using the best internationally approved systems and standards in the field of electronic payment

The Central Bank of Iraq announced today, Monday, the use of the best internationally approved systems and standards in the field of electronic payment, while indicating that it spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for the development of electronic payment in Iraq.

The Deputy Governor of the Central Bank, Ammar Khalaf, said in a speech at the first Iraqi Digital Economy Forum, attended by an Earth News correspondent, that “the digital financial transformation in Iraq began with the localization of the salaries of state employees and the opening of bank accounts, the primary purpose of which was to use electronic payment in daily transactions.” Whether inside or outside Iraq.”

Khalaf added, “Iraqi society prefers to rely on cash in daily transactions, but the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank over the past year and it continues to encourage and activate electronic payment in Iraq by issuing many Among the laws, controls and instructions that encourage the use of electronic payment in Iraq.”

He pointed out that “some ministries responded quickly to the directives of the Central Bank and the Iraqi government, especially the Ministry of Oil by making collections at gas stations and others via electronic payment, as well as the Passports Directorate, which obligated payment to be electronic, in addition to the General Traffic Directorate and other ministries.” He stressed that “all this support gives a very strong impetus to electronic payment.”

He pointed out that “the Central Bank has been the only influencer for many years, as it has embraced the importance of digital transformation in most of its transactions, and spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for developing electronic payment in Iraq through the use of the best internationally approved systems and standards in this field.” link

Mot: . HUH??? --- Did I Realy Read what I Just Read!!????

Mot: and YES!! Yet another Great ""Dieting Tip"" frum ole Mot of Course!!

News, Rumors and Opinions Tuesday AM 3-5-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Restored Republic via a GCR: Update as of Tues. 5 March 2024

Compiled Tues. 5 March 2024 12:01 am EST by Judy Byington

Judy Note:

Banking Collapse Imminent. Banks cannot sustain Bank Runs. The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act allows the banks to confiscate assets, so they are. At Risk: 401Ks (currently there are $27T in retirement accounts) and people with cash positions in banks will have their money taken. The banks have already started this by limiting how much money you can take out, transfer on Zelle, or move in general. Effective March 11, 2024 there will be no more money to loan out.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Restored Republic via a GCR: Update as of Tues. 5 March 2024

Compiled Tues. 5 March 2024 12:01 am EST by Judy Byington

Judy Note:

Banking Collapse Imminent. Banks cannot sustain Bank Runs. The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act allows the banks to confiscate assets, so they are. At Risk: 401Ks (currently there are $27T in retirement accounts) and people with cash positions in banks will have their money taken. The banks have already started this by limiting how much money you can take out, transfer on Zelle, or move in general. Effective March 11, 2024 there will be no more money to loan out.

Global Currency Reset:

Mon. 4 March MarkZ: “I have a lot of sources expecting it to break loose in the next two days. I would not be surprised to see it before we reach the weekend as of right now. …Anne Vandersteele said that the banking collapse was imminent – the reset has begun and effective March 26, 2020 the Federal Reserve board reduced requirement ratios on all net transaction accounts to zero percent eliminating reserve requirements for all depository institutions. The term ‘bank financing’ disappears in seven days on March 11th, or midnight on the 10th is when those things cease to exist. On March 11th there will be no more money to loan out and the Fed gets to pick and choose who gets to loan out money and who will collapse.”

Sat. 2 March Frank26: “To be clear, yes, the IQD is trading on the private side of Forex, the institutional side, trading in futures. The trading chart has been climbing steadily and closed yesterday at $2.70.This may or may not be a precursor to what we see on the PUBLIC side. We could see more, we could see less. We don’t know, but the point is…before we can go to the bank as investors, the IQD must be trading on the public side of Forex. That’s the number the CBI will post on their website when the IQD becomes tradable. Everywhere. The time for that to happen is now upon us, but they have to show it. By all indications, they’re about to!”

Sat. 2 March Wolverine: “Coming on Monday, Tuesday and Wednesday 4, 5, 6 March we will be having an awesome week. This is no rumor. The Dinar is in the Forex and soon to be tradable. When it does, we will get our Green Light!”

25 Countries on Wait List to join BRICS: https://watcher.guru/news/25-countries-on-the-waitlist-to-join-brics

Global Financial Crisis:

Effective March 26, 2020, the Federal Reserve Board reduced reserve requirement ratios on all net transaction accounts to zero percent, eliminating reserve requirements for all depository institutions

In the Spring of 2023 the Banking Collapse started with smaller regional banks.

In the Spring of 2024 the next wave of Banking Collapse will continue.

In Nov 2023 the CEOs of Bank of America, Wells Fargo and JP Morgan told Congress they could not go from 0% reserves to be held to a 3% reserve balance. The current Deposit to Loan Ratios means the banks cannot sustain any type of run on the banks. When the people realize what is happening there will be a run on the banks.

Effective March 11, 2024 there will be no more money to loan out and the Fed will pick and choose who gets to loan out money

Congress passed the bail in provision with 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act which allows the banks to confiscate assets. The bail-in relief was legalized in the U.S. following the 2007–2008 financial crisis in which banks deemed “too big to fail” were bailed out by the U.S. government. The specific section of Dodd-Frank that deals with bail-ins is Title II: Orderly Liquidation Authority (OLA).

At Risk: 401Ks (currently there are $27T in retirement accounts) and people with cash positions in banks will have their money taken. The banks have already started this by limiting how much money you can take out, transfer on Zelle or move in general.

This will be the demise of the middle class leading to a recession and then depression. People will be left with nothing if they do not diversify their cash into paying off loans, buying gold, silver, crypto or other hard assets.

As BRICS comes more online, you are going to see the transfer to asset backed transactions.

Read full post here: https://dinarchronicles.com/2024/03/05/restored-republic-via-a-gcr-update-as-of-march-5-2024/

***************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff Iraq has already revealed to you they'll be revaluing their currency specifically within the month of March. It's not even a secret.

Frank26 [Iraq boots-on-the-ground report] FIREFLY: Parliament Finance is calling in the CBI to open bank branches outside of Iraq. FRANK: Too late, That's been going on a while! All last year we already told about the private banks of the CBI - They're going to retrieve the 3-zeros outside of Iraq because 97% or more is already been retrieved inside...The satellite banks are all over the world right now are ready to collect the 3-zero notes...All of these actions are to introduce the new exchange rate and the new national sovereignty to you, Iraqi citizens.

US SENATOR EXPOSES Government: US Is DEAD BROKE & Govt Spending Is a SCAM, Says Sen. T. Tuberville

Lena Petrova: 3-5-2024

It’s Happening: Wells Fargo, Bank Of America and More Announce New Banks CLOSING!

Atlantis Report: 3-4-2024

The American banking landscape is undergoing a significant transformation, with a clear trend towards fewer physical branches and a greater emphasis on digital banking options.

This trend is reflected in the recent announcements by major banks like Wells Fargo, Bank of America, and Citibank, who have all confirmed plans to close additional branches across the country.

Today, we will examine the reasons behind these closures, their potential impact on consumers, and the evolving future of banking in the United States.

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Good Evening Dinar Recaps,

I am aware that we have a back screen rate people have been sharing on the dinar indicating movement in the IQD. It is good to know that there is one.

Now, you can stop doubting that this is real.

Keep your eyes on gold, silver, and oil to solar sections of the Debt Clock. These numbers will be the foundation assets to the new economy, and they are numbers we need to see in order to formulate real values across all market sectors.

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Late Monday 3-4-24

Good Evening Dinar Recaps,

I am aware that we have a back screen rate people have been sharing on the dinar indicating movement in the IQD. It is good to know that there is one.

Now, you can stop doubting that this is real.

Keep your eyes on gold, silver, and oil to solar sections of the Debt Clock. These numbers will be the foundation assets to the new economy, and they are numbers we need to see in order to formulate real values across all market sectors.

All roads lead to gold, and gold will set us free.

© Goldilocks

~~~~~~~~~~

U.S. National Debt Clock : Real Time | US Debt Clock

~~~~~~~~~~

Monday Night Team call with

Texas Snake and Bob Lock: Focus on Planning

Time: 9 pm ET, 8 pm CT, 6pm PT Team Call Live Link

The calls are recorded and in the Archive room Link

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Good Evening Dinar Recaps,

"Glassnode on Wednesday reported that major US OTC platforms have run out of bitcoins, with only 40 coins remaining. This development shows an imminent supply shortage which directly signals the potential for a big price pump shortly."

Yes, Bitcoin is 15 years old and running out of supply. There are only 40 bitcoins left as of 3 days ago. At this point, the demand for Bitcoins are outpacing their supply.

When demand outpaces supply, the corresponding response for an asset is to rise in its value.

Historically, Bitcoin tends to lead the rally for all the crypto space. An upward movement is expected going forward inside our new digital economy.

A bull run in the crypto space will encourage digital adoption as this new asset class begins to form new price pressures going forward.

Remember, everything is being tokenized including Forex. Remember.... Coin Market Cap

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday Evening 3-4-24

Good Evening Dinar Recaps,

"Glassnode on Wednesday reported that major US OTC platforms have run out of bitcoins, with only 40 coins remaining. This development shows an imminent supply shortage which directly signals the potential for a big price pump shortly."

Yes, Bitcoin is 15 years old and running out of supply. There are only 40 bitcoins left as of 3 days ago. At this point, the demand for Bitcoins are outpacing their supply.

When demand outpaces supply, the corresponding response for an asset is to rise in its value.

Historically, Bitcoin tends to lead the rally for all the crypto space. An upward movement is expected going forward inside our new digital economy.

A bull run in the crypto space will encourage digital adoption as this new asset class begins to form new price pressures going forward.

Remember, everything is being tokenized including Forex. Remember.... Coin Market Cap

© Goldilocks

~~~~~~~~~~

"Bitwise anticipates a surge in institutional investment into Bitcoin ETFs in the coming months as major financial institutions, known as “wirehouses,” start offering Bitcoin ETF trades to their clients."

A wirehouse is a full-service broker-dealer of any size. Although many broker-dealers are "independent" firms involved in broker-dealer services, others are subsidiaries of commercial banks, investment banks, or investment companies. They sell Securities such as spot Bitcoin ETFs for their clients leveling the playing field between the retail Market and Institutional Financing.

For this reason, the competition for gold through digital assets can now be obtained through anyone desiring to become a part of the new Financial System through these new additions to their portfolios.

This is expected to create a gold rush into the next economy for well over a decade. We are simply beginning a process of transformation that will change values in every sector of our Global markets going forward. Crypto News CoinTelegraph

© Goldilocks

~~~~~~~~~~

"Russia is testing digital asset payment technology as groundwork for a potential BRICS digital currency.

The move aims to reduce global dependency on the US Dollar, aligning with BRICS’ de-dollarization efforts.

Digital currency trials are starting with China and Eurasian Economic Union countries, under Russia’s initiative."

Russia is making a move inside the new digital economy. They are testing their new payment system with digital assets formulating a pre BRICS currency launch.

Vladimir Putin is the current chairman for the BRICS Nations. One of the qualifications in belonging to the BRICS Nations is that countries have to back their economy by gold or other commodities. These new global economic initiatives are what is leading the drive towards a Global Currency Reset.

A new trading currency with a backing by gold for the BRICS Nations is rapidly becoming more than just a simple threat to the current Global Monetary System.

Russia is currently taking practical steps in lowering their dependence on the US dollar in trade among nations. And, these changes are affecting the current ratings of their currency. Enough so, that the FATF is currently re-rating their currency.

When a countries' currency is re-rated, it means they are currently in process of a revaluation inside their new currency values and mechanisms for the dissemination of these new values in trade. Yes, new exchange rates.

"The Financial Action Task Force (FATF) is the global money laundering and terrorist financing watchdog. It sets international standards that aim to prevent these illegal activities and the harm they cause to society."

Look for the FATF to get more involved in the BRICS Nations as they set forth new trading mechanisms designed to enhance their group's local currency values through their new digital asset-based trading system.

This is a move from a pegged currency with the dollar to a free floating exchange rate determined by the markets. Gold adds value to currencies that have been devalued over the years and equalizes the playing field for each country involving themselves inside free-floating mechanisms.

Watch the water.

© Goldilocks

CryptoPolitan

FATF

Investopedia

Regulation Asia

Times of India

~~~~~~~~~~

What is The Dodd Frank Act? | YouTube

~~~~~~~~~~

Dodd-Frank Act Update:

The National Institute of Standards and Technology released a revised version of its Cybersecurity Framework guidance detailing steps organizations can take to reduce cybersecurity risks, placing a greater priority on the role of corporate governance and supply chains in protecting sensitive data.

Dodd Frank Update

~~~~~~~~~~

China and Russia have almost completely abandoned the US dollar in bilateral trade as the push to de-dollarize intensifies | Business Insider

~~~~~~~~~~

The U.S. national debt is rising by $1 trillion about every 100 days | CNBC

~~~~~~~~~~

ZTX Ushers in Digital Real Estate Era | InvestorsObserver

~~~~~~~~~~

Ripple offers a fast, and cost-effective cross-border payment solution for banks and financial institutions globally. Ripple’s platform, Ripple Net, facilitates instant and transparent transactions, positioning itself as a more efficient alternative to traditional financial services.

Ripple is a blockchain-based digital payment network working to facilitate the transfer of value between different fiat currencies for its customers. XRP is the native cryptocurrency of Ripple.

CrowdWisdom

~~~~~~~~~~

Great Reset Watch: EU Parliament Approves 'Digital Identity Wallet' | Breitbart

~~~~~~~~~~

Tether’s USDT stablecoin hits historic $100B market cap | CoinTelegraph

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Monday Afternoon 3-4-2024

BRICS Will Devastate US Dollar & Economy – Bo Polny

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Biblical cycle timing expert, geopolitical and financial analyst Bo Polny predicted last year to “expect the US dollar to go lower and gold, silver and Bitcoin to trend higher, much higher in 2024.” What have we seen so far? Bitcoin and Gold are, once again, flirting with all-time highs, and silver is starting to turn up, too.

What about the dollar? So far, it is holding steady, but Polny contends the BRICS (Brazil, Russia, India, China and South Africa) are about to put a hurting on the buck. Polny explains, “The game changer is . . . the BRICS are about to attack the US dollar. I don’t care what anybody says, this is going to happen.

The dollar will be dethroned as the world reserve currency. When it is dethroned as the world reserve currency, the bond market will collapse, interest rates will spike and the real estate market will collapse. It will be absolutely devastating to the US economy.

BRICS Will Devastate US Dollar & Economy – Bo Polny

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Biblical cycle timing expert, geopolitical and financial analyst Bo Polny predicted last year to “expect the US dollar to go lower and gold, silver and Bitcoin to trend higher, much higher in 2024.” What have we seen so far? Bitcoin and Gold are, once again, flirting with all-time highs, and silver is starting to turn up, too.

What about the dollar? So far, it is holding steady, but Polny contends the BRICS (Brazil, Russia, India, China and South Africa) are about to put a hurting on the buck. Polny explains, “The game changer is . . . the BRICS are about to attack the US dollar. I don’t care what anybody says, this is going to happen.

The dollar will be dethroned as the world reserve currency. When it is dethroned as the world reserve currency, the bond market will collapse, interest rates will spike and the real estate market will collapse. It will be absolutely devastating to the US economy.

This will fulfill the prophecy of Kim Clement. He said the brothers of Goliath, those are the BRICS nations, ‘we will stand in glee, we will cripple you.’ What does that mean, ‘we will stand in glee’? Didn’t we just see Putin slapping high fives in the United Arab Emirates (UAE) and with everybody over there? . . .

We could see a high probability of a war beginning this March. Why? If you attack the supremacy of the US dollar, it’s an act of war. . . . The dollar will be dethroned as the world reserve currency. It will lose roughly 30% of it’s value, and that will take the USD index down to around the 70’s. Here’s the problem. This is not on millions of dollars of debt like the 1970’s.

We now have leverage, upon leverage, upon leverage with derivative contracts. So, a 30% haircut on derivative contracts (in the quadrillions of dollars) is devastating, devastating to the economy. I have said this before, and I am going to say it again, when the US dollar is dethroned as the world reserve currency, you are going to see Bitcoin blow vertical. This is why even at $60,000 (per unit), it is still a deal. Bitcoin is going six digits. I write this in my newsletter. We have a $100,000 price coming on Bitcoin, and that is just a warmup.

Polny goes on to say, “When the US dollar is dethroned as the world reserve currency, there are three things you want to hold. It’s everything opposite the US dollar. The first thing is God’s money. Number one would be silver, number two would be gold. The third thing is not God’s money, it is Bitcoin. It is going to go absolutely crazy because other countries will not accept the dollar as payment. . . . People are going to want to be paid in something that is real like gold, silver and crypto currencies.”

How high will gold and silver go? Polny says, “Right now, an ounce of gold should equal a Bitcoin. We could see gold and silver blow vertical soon. Gold is not allowed to go above $2,100 per ounce, and silver is not allowed to go above $26. . . . As long as the dollar is the world reserve currency . . . the control mechanism stands. When the dollar loses its world reserve currency status, gold and silver are going to blow vertical. Silver could go up three-fold in a single day, and that only starts the biggest bull market with gold and silver in history.”

In closing, Polny predicts, “You cannot stop what is coming. You cannot stop what is coming. The US dollar will be dethroned as the world’s reserve currency. Billionaires are front-running this trade. You can see it visually with Bitcoin. . . . Bitcoin is front-running what gold and silver are about to do this year. It will be much sooner than later. I think it could begin in March and into April. We are going to see gold and silver do a huge catchup game to what Bitcoin has been doing for years.”

Polny points out, “Keep in mind, when Bitcoin first started, it sold for less than a dollar per unit, and now, it is near all-time highs at around $62,000.”

There is much more in the 50-minute interview.

https://rumble.com/v4gwfrx-brics-will-devastate-us-dollar-and-economy-bo-polny.html

****************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Willie Wonka...you get that golden ticket. I think we got a golden ticket here. I'm not too sure because it looks like something is going on.

Sandy Ingram 10 weakest currencies in the world: The value of a currency depends on supply and demand while some are pegged, meaning the currency is valued at an agreed rate. The foreign exchange rate is an indicator of a country's economic wealth. #10 The Iraqi dinar - inflation and political instability are the given reasons. #9 Ugandan shilling (USH)... #8 Paraguayan Guarani (PYG)...land locked in South America #7 Guinean Franc (GNF)... #6 Uzbekistani Som (UZS) 1 USD = 12,501 UZS #5 Indonesian Rupiah (IDR) #4 Laotian Kip (LAK)...only land locked country in Southeast Asia. #3 Sierra Leonean Leone (SLL). #2 Vietnam Dong (VND) #1 Iranian Rial (IRR)

Sana gave his advice about the dollar in the dinar

Nader: 3-4-2024

PHYSICAL SILVER! Remains THE MOST UNDERVALUED Financial Asset ON EARTH.

Greg Mannarino: 3-4-2024

Potential Implications of Mexico’s Interest in Joining BRICS

Potential Implications of Mexico’s Interest in Joining BRICS

How Mexico’s Admission to BRICS Could Impact National Security

By JJ Davis, Danish Zia Sunday, 3 March 2024,

THE RUNDOWN

Recent proposals by Republicans in the US Congress for military intervention in Mexico’s cartel war have created controversy between the two countries. Mexican President Andres Obrador has stated that foreign intervention will not be welcome and called such suggestions “irresponsible.” As a result, the Mexican government has renewed its interest in joining BRICS, which could lead to trade and diplomatic complexities with the US in the future.

Potential Implications of Mexico’s Interest in Joining BRICS

How Mexico’s Admission to BRICS Could Impact National Security

By JJ Davis, Danish Zia Sunday, 3 March 2024,

THE RUNDOWN

Recent proposals by Republicans in the US Congress for military intervention in Mexico’s cartel war have created controversy between the two countries. Mexican President Andres Obrador has stated that foreign intervention will not be welcome and called such suggestions “irresponsible.” As a result, the Mexican government has renewed its interest in joining BRICS, which could lead to trade and diplomatic complexities with the US in the future.

THE BACKGROUND

Mexico is the second-largest economic power in Latin America, with a significant GDP and purchasing power that make it a crucial gateway to the North American market. Despite having differences regarding immigration and trade, both Mexico and the US have maintained a cordial relationship, which has been mutually beneficial. In December 2022, the two countries celebrated 200 years of diplomatic relations that have encompassed commercial, cultural, and educational ties.

However, recent cartel killings of American citizens near the US border have strained the relationship between Mexico and the US. Some Republican members of the US House of Representatives have used this tragedy to call for US military intervention, including the option of invading Mexico to attack the cartels. In response, Mexican President Andres Orbrador deemed the proposal “irresponsible” and stated that Mexico would not permit a foreign power to intervene.

As a result of these repeated calls for US military intervention, Mexico has expressed renewed interest in joining BRICS, an economic partnership between Brazil, Russia, India, China, and South Africa. Although the partnership with BRICS would mainly be economic, it could make the US Congress more cautious in its dealings and statements towards Mexico diplomatically, as well as diversify Mexico’s foreign relations and increase its global influence. Although the BRICS organization does not have any formal criteria for processing or admitting new members, it has stated that it could expand by five countries in 2023. Mexico has previously participated in several BRICS summits as an observer and a guest, putting the country in prime position to be one of the potential five expansion countries.

While joining BRICS could be positive for Mexico economically and globally, it may cause concerns for the US. Having economic and power rivals such as Russia and China with close economic and political ties with Mexico could influence how the US has to deal with Mexico in the future and could provide these rivals with easier access to the US market.

MEXICO – CHINA RELATIONS

Mexico and China have a strong trade relationship, with China making significant investments in Mexico over the past five years. Chinese exports to Mexico rose by 28% between January 2022 and August 2022, making China Mexico’s second-largest import partner after the US. More than 1,200 Chinese companies have invested in Mexico, including Ganfeng Lithium, which was granted access to a lithium mine in Sonora.

Initially, President Obrador wanted to review concessions to the mine’s lithium deposits in favor of a nationalized company, but he chose to relax the review process for Ganfeng, creating a mutually beneficial solution. In 2021, over 50% of the $9.08 billion of exports from Mexico to China were ores, and if Mexico were to be admitted to BRICS, the value of ore exports could increase further.

While the trade relationship between Mexico and China has been positive, Mexico has maintained a neutral political stance towards China. However, Mexico has expressed concern about China’s human rights practices, specifically with regards to the treatment of Uighur Muslims in Xinjiang. In 2020, Mexico was among 39 countries that signed a joint statement at the United Nations expressing concerns about the treatment of Uighur Muslims and urging independent observers to investigate the situation in Xinjiang. Despite this, Mexico has maintained a positive relationship with China, and trade has not been impacted.

MEXICO – RUSSIA RELATIONS

Mexico and Russia have developed a strong economic relationship, with Mexico ranking as Russia’s third-largest trading partner in Latin America. The relationship is mainly based on cooperation in the oil and gas sectors. Russian multinational companies such as Gazprom Marketing and Trading Mexico and Rusatom International have invested in Mexico. Gazprom is a state-owned energy company involved in natural gas sales and distribution, while Rosatom is a state-owned nuclear energy company involved in nuclear power plant development and construction in Mexico.

Unlike the US, Mexico has not imposed any sanctions on Russia. The two countries have maintained a positive diplomatic relationship since 1924, when Mexico became the first country in the Americas to establish relations with the Soviet Union. The focus of their relationship has always been on cooperation and advancement of energy and technology.

The positive diplomatic and economic relationship between Mexico and Russia has helped Russia establish a strong presence in Latin America, second only to Brazil. Gazprom’s and Rosatom’s investments in Mexico have strengthened the countries’ economic ties and led to cooperation in the development of energy and technology.

MEXICO RELATIONS WITH OTHER BRICS NATIONS

Mexico has strong trade relationships with China and Russia, but it is also expanding its ties with the other BRICS nations.

India and Mexico have a positive diplomatic relationship and a bilateral trade partnership that covers multiple sectors, including sustainable energy, climate change, and international security.

Mexico also has a bilateral trade relationship with South Africa, but it is smaller than its relationships with other BRICS nations. The two countries have a positive diplomatic relationship and have cooperated on peacekeeping missions and plans to combat climate change.

Brazil and Mexico are the two most economically powerful nations in Latin America and have a long-standing trade and diplomatic relationship. They have even explored the possibility of a free trade agreement to boost their economic vitality. While the two nations have had diplomatic disagreements about globalization, particularly in relation to Venezuela and Colombia, they have always worked together to maintain economic stability.

THE TAKEAWAY

Mexico has had long-standing relationships with all of the BRICS nations, but primarily relies on Brazil, China, and Russia as its economic trade partners. Joining BRICS would further solidify these partnerships and potentially lead to one of these nations overtaking the US as Mexico’s primary trade partner.

China and Russia have been increasing their investments in Mexico, particularly in minerals, energy, and technology. Russia’s state-owned Rusatom International is helping develop nuclear power capabilities in Mexico, which could be of growing concern if Mexico joins BRICS. Having a Russian entity with nuclear power access so close to the US would raise questions for the US government.

China has been slowly attempting to devalue the dollar by having Brazil and India trade in their native currencies, cutting the dollar out as an intermediary currency. With a BRICS membership, China could try to persuade Mexico to do the same, increasing the value of their own currency while impacting the USD’s economic vitality.

However, the US is Mexico’s largest trade partner, and Mexico would not want to risk ruining that relationship. A BRICS membership could potentially guarantee that the US Congress would be more calculated in their statements against Mexico, especially any statements that suggest invasion to dismantle the cartels. A US invasion would harm Mexico’s economy, which would subsequently impact China and Russia. Joining BRICS would provide an extra layer of security for Mexico to ensure the US treats it respectfully, as long as the US does not immediately feel that such an alliance poses an immediate threat to national security.

Source: Strike Source

https://dinarchronicles.com/2024/03/03/potential-implications-of-mexicos-interest-in-joining-brics/

"Tidbits From TNT" Monday Morning 3-4-2024

TNT:

Tishwash: UrgentAl-Sudani directs to reduce official working hours (by one hour) during the holy month of Ramadan

The Prime Minister, Muhammad Shiaa Al-Sudani, directed to reduce official working hours (one hour) in all government departments during the holy month of Ramadan.

A government source said in a press statement, “Prime Minister Muhammad Shiaa Al-Sudani directed to reduce official working hours (by one hour) in all government departments during the holy month of Ramadan.” link

TNT:

Tishwash: UrgentAl-Sudani directs to reduce official working hours (by one hour) during the holy month of Ramadan

The Prime Minister, Muhammad Shiaa Al-Sudani, directed to reduce official working hours (one hour) in all government departments during the holy month of Ramadan.

A government source said in a press statement, “Prime Minister Muhammad Shiaa Al-Sudani directed to reduce official working hours (by one hour) in all government departments during the holy month of Ramadan.” link

Tishwash: Integrity: We will reveal big names accused of corruption soon

The head of the Integrity Commission, Haider Hanoun, announced that the commission will reveal major names accused of corruption in the coming days, noting that the government program has given us a great moral boost in the fight against corruption.

Hanoun said, during a meeting within the activities of the Al-Rafidain Forum, that “the government program gave us a strong motivation in the field of combating corruption,” stressing that “major breakthroughs and achievements have been achieved based on the directives of the government program.”

He pointed out, "The Commission launched a campaign (Where did you get this from?), which focused on illicit gain and the sources of funds and their legitimacy. It also directed to activate the national anti-corruption strategy with the ministries, in addition to working with the private sector and civil society organizations."

Hanoun stressed, “We achieved great achievements during the past year, achievements that the Arab and national regions could not achieve.”

He explained, “The work of the Integrity Commission is to diagnose corruption and send corruption files to the judiciary,” adding, “We have not left any case presented to the media without it being verified.”

He pointed out, "Since we assumed responsibility, we have not tolerated political pressure, and we have not responded to any political interference."

Hanoun stressed that “government support gave space to the Integrity Commission,” noting that “the Commission will reveal big names in the coming days.” link

***************

Tishwash: Iraq offers itself as a bridge to connect Asia with Europe and Africa via Internet transit

The Ministry of Communications announced, on Sunday, the approval of a number of transit projects linking the continent of Asia to the continents of Europe and Africa via Iraq, as it is a shortcut and safer route in the region.

The ministry’s media said, in a statement received by Shafaq News Agency, that “in order to enhance the vision and direction of the Ministry of Communications to invest in Iraq’s geographical location in international communications traffic, the Ministry’s opinion committee approved in its 139th session a new transit project linking the continent of Asia to the continent of Europe via Iraq, passing through Turkey, while Another transit project linking the continent of Asia to the continent of Africa via Iraq via Jordan was discussed and approved.

According to the statement, Minister of Communications Hiyam Al-Yasiri affirmed “the approach of the Iraqi government and the Ministry of Communications to benefit from Iraq’s strategic location and enter it on the official global map in a way that competes with communications traffic through other international corridors.”

Al-Yasiri stated that "the diversity of transit projects will enhance Iraq's ability to attract international companies to pass their buses through Iraqi territory as it is a shortcut and safer route in the region, as the Ministry worked to create a competitive environment and prepare the technical requirements necessary for the success of these projects and build confidence with international companies to attract them to adopt Iraq as a corridor." For its international communications, especially with the current security challenges that the region is going through.” link

Tishwash: Bloomberg”: Oil is approaching its fair price and may jump to $100 per barrel

Bloomberg said in a report published today, Sunday, that Brent crude prices are close to the fair value of about $85 per barrel, while any escalation of the conflict in the Middle East may push the price to above $100, according to recent estimates issued. According to Bloomberg Intelligence, which previously estimated that the average price this year would reach $80.

The agency stated in its report that this increase is the latest, as several investment banks raised their price expectations this year, the most prominent of which was Goldman Sachs, which estimates peak prices at $87 per barrel in the summer, which is $2 more than its previous estimate.

She pointed out that oil prices have been trading in a narrow range near $80 per barrel since the beginning of 2024, as inflation in supplies from the United States and other producers compensated for OPEC+ cuts, amid fears that the conflict in the Middle East may disrupt crude shipments.

At the beginning of this year, Fitch raised its forecast for the price of Brent crude to $80 per barrel from $75 in its previous forecast, compared to an expected average of $82 in 2023.

Bloomberg Intelligence said that tensions in the Middle East and a rise in the geopolitical risk premium, with Houthi militants continuing to attack ships in the Red Sea, may have begun to slowly impact oil prices after the effects of weak economic prospects and a bleak demand picture were overtaken in the past few months.

She explained that hawkish signals from the Federal Reserve, weaker demand indicators in all major regions and declining sentiment were factors that pressured the price, despite limited supplies from the Organization of the Petroleum Exporting Countries (OPEC) amid continued production cuts.

Bloomberg Intelligence also indicated that its expectations for the fair value of the oil price are based on a set of variables that include - but are not limited to - geopolitical risks, inflation expectations, refining margin, inventory and sentiment.

Concerns about recession and slowing demand in the largest oil consuming countries dominated sentiment, despite the risk of further disruption to Russian flows after sanctions imposed by the European Union. Also, "near-term expectations remain unclear, although the gradual recovery in Asian consumption could boost demand and provide support for oil prices."

It is likely that any decrease in spare production capacity - once the OPEC + alliance begins to reduce production cuts - will eventually lead to a rise in oil prices due to panic. OPEC+'s spare production capacity (including Iran) stood at about 6.4 million barrels per day in January, based on Bloomberg data. Excess production capacity is concentrated in Saudi Arabia and the United Arab Emirates, with many other OPEC+ members seeking to increase production when necessary. Saudi production remains at about 9 million barrels per day.

It is estimated that the oil alliance will continue to extend production cuts during the second quarter of 2024, after which they will be gradually and partially canceled starting from the third quarter. This view is in line with Bloomberg's expectations in an attempt to avoid surpluses and support prices. link

Mot: .... Can Ya Relate!!!! Siiggghhhhhhh!!!!

Mot: .. So True – LOL

News, Rumors and Opinions Monday AM 3-4-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Restored Republic via a GCR: Update as of Mon. 4 March 2024

Compiled Mon. 4 March 2024 12:01 am EST by Judy Byington

Judy Note: It was my opinion, and I could be wrong, that on Thurs. 22 Feb the Cabal Financial System imploded.

That way everything would be done by Fri. 15 March when it was expected they would announce to the General Public, the Global Currency Reset and return to a gold/asset-backed currencies across the Globe.

Tier4b (us, the Internet Group) could very likely go during that ten days of Exposure. So, doing some deductions on the above information, I expect Tier4b to have notification to set exchange/ redemption appointments at least by next Tues. 5 March.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Restored Republic via a GCR: Update as of Mon. 4 March 2024

Compiled Mon. 4 March 2024 12:01 am EST by Judy Byington

Judy Note: It was my opinion, and I could be wrong, that on Thurs. 22 Feb the Cabal Financial System imploded.

That way everything would be done by Fri. 15 March when it was expected they would announce to the General Public, the Global Currency Reset and return to a gold/asset-backed currencies across the Globe.

Tier4b (us, the Internet Group) could very likely go during that ten days of Exposure. So, doing some deductions on the above information, I expect Tier4b to have notification to set exchange/ redemption appointments at least by next Tues. 5 March.

On Mon. 11 March the Federal Reserve will quit giving loans to the banks, which would close any bank across the Globe not Basel 3 compliant and in the BRICS new Financial System.

“They wanted the 10 days of darkness and RV/GCR done by Fr. 15 March. Agreements have been made. All electronics, WiFi, ATMs will go down. Businesses will be closed. Planes, Trains, Buses will be grounded. We had all better stock up on food and supplies, …777 Time Traveler on X and Telegram Sun. 3 March 2024

Global Financial Crisis:

Thurs. 29 Feb. Putin: “The West is discrediting its own currencies and banking system, while established monopolies in the global economy are crumbling,” Russian President Vladimir Putin said in his annual address to the Federal Assembly on Thursday. https://www.rt.com/business/593419-west-destroying-financial-system-putin/

Sat. 2 March: Fitch Ratings cut NYCB’s credit rating to junk, marking its second downgrade of the bank over the past month. The firm said NYCB’s recent disclosures “prompted a reconsideration” around how adequately it has prepared for potential commercial real-estate losses. https://www.wsj.com/finance/banking/new-york-community-bancorp-names-new-risk-and-audit-executives-10d6b9cc

Fri. 1 March New York Community Bancorp’s stock plunges nearly 30% as CEO exits, bank admits “material weaknesses” in loan oversight. https://www.disclose.tv/id/mi08w2ezzw/

Who holds US financial assets? While the U.S. national debt becomes increasingly domestic (with the main holders being the Federal Reserve, pension funds, and private American investors), the American stock market is becoming more internationalized. Foreigners hold 57% of the shares. This redirection of foreign money is very convenient for the U.S. authorities – in the event of a stock market crash, all risks will be borne not by the American government but by the investors themselves.

Sat. 2 March: The US commercial real estate crisis just got worse with a pension fund selling its Manhattan building for one dollar! As interest rates continue to hammer on commercial property, more banks and funds are at huge financial risk. The commercial real estate market collapse isn’t over and banks might be taking a brutal hit soon.

Sat. 2 March: Americans now owe $1.13 trillion on their credit cards, according to a new report from the Federal Reserve Bank of New York on household debt. Serious credit card delinquencies, or payments 90 days or more late, rose more than 50% in 2023. This is the highest level since 2009. (NBC News)

Sat. 2 March It’s Happening – Operation Storm: https://beforeitsnews.com/opinion-conservative/2024/02/situation-update-its-happening-operation-storm-2024-more-cabal-bankers-oligarchs-disappearing-or-dying-systems-being-exposed-death-rates-continue-to-skyrocket-solar-flash-impending-wt-3686697.html

Read full post here: https://dinarchronicles.com/2024/03/04/restored-republic-via-a-gcr-update-as-of-march-4-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

PompeyPeter Yeah, Iraq could come out at 1310 internationally on Forex. A man could land on the sun or pigs could fly. In other words the odds are slightly better than those two scenarios but in the opinion of most people it will not happen. Here's why: Sudani stated clearly that the dinar was worth more than the dollar and the value of the dinar would be higher than the value of the dollar. That ain't 1310 to $1. Secondly, Sudani said Iraqi's dinar would be the solution to the world's financial and economic problems. Not at 1310 it's not. Three, if they come out at 1310 it's impossible for the tripartite budget to work.

Militia Man Merchants will now be able to use the dinar to pay for foreign currency to buy international products...I would imagine there will be changes to Iraq's currency that will be reflective of the real value of the IQD...They haven't been using Iraq dinar at 1310 to purchase other foreign currencies. They've never done that before at 1310. Now they're saying they can do that...1310 exchange rate has never been an international exchange rate...That's coming from the Central Bank of Iraq so obviously something is happening because they've never done it before. I think it's really good.

BRICS R5 Project: BRICS currency explained

Fastepo: 3-3-2024

The BRICS R5 project aims to create a common currency for the 5 initial BRICS nations, all whose national currencies' names start with the letter "R". The inclusion of Iran, Saudi Arabia, UAE, Egypt, and Ethiopia as new members of BRICS could significantly impact the R5 project, potentially shaping its feasibility, scope, and global economic implications.

The expansion of BRICS, recognized for its geopolitical, geostrategic, and geo-economic implications, particularly with a focus on energy-centric considerations, highlights the diversification and strengthening of the bloc's economic and political influence.

The expanded BRICS group, now including significant states from the Middle East and Africa, introduces a new dynamic to the discussions on de-dollarization and the use of local currencies for international trade. The presence of key energy producers like Saudi Arabia, Iran and the UAE could enhance the group's leverage in global oil markets, potentially influencing the pricing and trading mechanisms of energy products, which might support the development and implementation of the R5 project.

Goldilocks' Comments and Global Economic News Sunday Evening 3-3-24

Goldilocks' Comments and Global Economic News Sunday Evening 3-3-24

Good Evening Dinar Recaps,

"India’s forex reserves experienced a notable increase, rising by $2.975 billion to reach $619.072 billion for the week ending February 23, as reported by the Reserve Bank of India (RBI). This surge follows a previous week where reserves had slightly decreased by $1.132 billion.

Major Components

1. Foreign Currency Assets:

Increased by $2.405 billion to $548.188 billion.

Foreign currency assets encompass various currencies such as the euro, pound, and yen, reflecting their valuation against the US dollar.

Goldilocks' Comments and Global Economic News Sunday Evening 3-3-24

Good Evening Dinar Recaps,

"India’s forex reserves experienced a notable increase, rising by $2.975 billion to reach $619.072 billion for the week ending February 23, as reported by the Reserve Bank of India (RBI). This surge follows a previous week where reserves had slightly decreased by $1.132 billion.

Major Components

1. Foreign Currency Assets:

Increased by $2.405 billion to $548.188 billion.

Foreign currency assets encompass various currencies such as the euro, pound, and yen, reflecting their valuation against the US dollar.

2. Gold Reserves:

Rose by $472 million to $47.848 billion during the week.

3. Special Drawing Rights (SDRs):

Witnessed an uptick of $89 million to $18.197 billion.

4. Reserve Position with the IMF:

Expanded by $9 million to $4.839 billion."

There would be absolutely no reason for India to be increasing their revenue like this unless it had something to do with the UPI or Unified Payments Interface.

The UPI powers several bank accounts in one application. This can happen with any bank globally that wants to participate in their payment transaction system through trade and more.

It is an instant payment service that operates 24/7 and 365 days a year. Their foreign currency, special drawing rights, and gold reserves continue to grow.

This enables them to service the needs of foreign currency exchanges in trade from around the world near and far. They can even enable people to do these transactions over a mobile phone application.

It's been a while back, but Iraq was one of the countries along with Vietnam and Indonesia that piloted this new International Payment System. Current Affairs

© Goldilocks

~~~~~~~~~~

The IMF is recognizing Iraq to be a financially inclusive banking system. This means they have become an open banking system allowing free trade agreements to be made with them near and far.

The CBI article that goes with this writing indicates that the IMF has recognized Iraq to be a compliant, safe, and trustworthy institution for trade. It is well and it's way to digitizing products for trade beyond the oil sector and on the local level.

These new monetary mechanisms will shield them from money laundering that has plagued them for so many years, and it will enable them to move forward with the full confidence of a Global Economy.

© Goldilocks

https://cbi.iq/news/view/2527

~~~~~~~~~~

Iraqi Customs launches automation system at Umm Qasr Port - Shafaq News

👆Watch the Water!

~~~~~~~~~~

"An ACH transfer is completed through a clearing house — a network of financial institutions — and is used most often for processing direct deposits or payments.

A wire transfer is typically used for high-value transactions and is completed through a bank, which makes it faster, but it does have a fee."

We are currently transitioning from Clearing House Transactions to Wire Transfer Services that can be done through a bank. Wire transfer services will make this new digital payment system much faster. In fact, the transfer of payments will be done in seconds.

As Protocol 20 expands and integrates Quantum Technologies from around the world, this shift into digital processing of money transfers will significantly increase the demand for the new digital economy. These new demands will bring in new values across the board and from country to country.

Money velocity will enhance faster trades that will allow the movement of products around the world to operate seamlessly and efficiently. Faster movement of products will create more profits and increase more opportunities for companies producing their items for sale across many sectors of the market and on an even playing field no matter their size. Tipalti

© Goldilocks

~~~~~~~~~~

Hong Kong Sees Surge in Crypto Exchange License Applications as Regulatory Landscape Evolves | The Currency Analytics

👆 Goldilocks pointed to this article

~~~~~~~~~~

Crypto Council comments on Hong Kong’s stablecoin regulation | CryptoPolitan

~~~~~~~~~~

Special Drawing Rights

Pacific Exchange Rate Service: Current Exchange Rates; Database

https://fx.sauder.ubc.ca/SDR.php

~~~~~~~~~~

UPI: Unified Payments Interface - Instant Mobile Payments | NPCI

~~~~~~~~~~

Bloomberg -- Eurex Clearing AG plans to start clearing repo trades for hedge funds directly by the middle of the year, a key step toward improving liquidity in a market that has been constrained over the years by tighter financial regulation.

The firm, one of the leading global clearinghouses, aims to have hedge funds up and running on their platform “by the summer,” executive board member Matthias Graulich said on the sidelines of the Derivatives Forum in Frankfurt on Thursday.

~~~~~~~~~~

Prominent figures in the XRP community have argued that the XRP tokens locked in escrow by Ripple have a fundamental role in turning the asset into a global reserve currency. | The Crypto Basic

~~~~~~~~~~

Blockchain is one step away from mainstream adoption - Blockworks

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps