Goldilocks' Comments and Global Economic News Monday Evening 2-12-24

Goldilocks' Comments and Global Economic News Monday Evening 2-12-24

Good Evening Dinar Recaps,

Viet Nam’s exports surge 42% in January

"Việt Nam’s exports reached nearly US$33.6 billion in January, a 42 percent surge over the same period last year and the highest level since April 2022.

According to a report by the Ministry of Industry and Trade, Việt Nam’s total imports and exports of goods in the first month they surpassed $64 billion, up 38 percent year-on-year.

The surge in exports was mainly driven by the agriculture-forestry-fisheries, and processing industries, which increased nearly 97 percent and 38 percent, respectively."

These numbers are significant increases, but the one number that is the most encouraging is coming from their "process industry."

Companies that extract, transport, and process raw materials for manufacturing semi-finished or high-quality end products such as physical, mechanical, and/or chemical processes are classified as process industries.

This significant increase in demand for this particular industry indicates an ongoing service that can be provided to the Global economy. The increase in their goods and services will begin to increase price pressures on their currency to meet these demands through digitized payment systems.

© Goldilocks

Source: VNA/SGT/VNS/VOV/Dtinews/SGGP/VGP/Hanoitimes

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday Evening 2-12-24

Good Evening Dinar Recaps,

Viet Nam’s exports surge 42% in January

"Việt Nam’s exports reached nearly US$33.6 billion in January, a 42 percent surge over the same period last year and the highest level since April 2022.

According to a report by the Ministry of Industry and Trade, Việt Nam’s total imports and exports of goods in the first month they surpassed $64 billion, up 38 percent year-on-year.

The surge in exports was mainly driven by the agriculture-forestry-fisheries, and processing industries, which increased nearly 97 percent and 38 percent, respectively."

These numbers are significant increases, but the one number that is the most encouraging is coming from their "process industry."

Companies that extract, transport, and process raw materials for manufacturing semi-finished or high-quality end products such as physical, mechanical, and/or chemical processes are classified as process industries.

This significant increase in demand for this particular industry indicates an ongoing service that can be provided to the Global economy. The increase in their goods and services will begin to increase price pressures on their currency to meet these demands through digitized payment systems.

© Goldilocks

Source: VNA/SGT/VNS/VOV/Dtinews/SGGP/VGP/Hanoitimes

~~~~~~~~~~

12:58 Baghdad – 964 The Securities Commission announced on Monday that the acceptance of cash payments is through electronic payment methods only, while revealing a trend to list electronic payment companies on the stock market. Search 4 Dinar

~~~~~~~~~~

It is the future demand for US Treasuries being used as a debt instrument by other countries that is the concern for the US dollar going forward.

The lower demand for the US dollar to be used as a World Reserve Asset will force the Federal Reserve to engage in quantitative easing or the lowering of interest rates to produce more purchasing power on our currency.

Current price distortions between the US dollar and other currencies utilizing their own resources and purchasing power through the use of their own local currencies will begin the process of leveling the playing field in a Global Currency Reset.

Through the use of tokenized assets utilizing gold/local currency opportunities for countries around the world will establish new demands inside the new digital asset-based trading system.

It is a process that is currently underway and about to shift into much higher gear as we approach the end of this month. WTOP Radio

© Goldilocks

~~~~~~~~~~

"The renewables bubble has burst | The Spectator"

The movement from oil to solar power and electronic vehicles has begun. This transition has redirected much monetary supply into new directions and towards clean energy.

This transition is ongoing, and it will take some time. It is causing distortions in oil prices and the redirecting of new local currencies aligning themselves with this transition is causing new speculation prices on oil and energy.

Look for free-floating rates to begin as we transition from oil to solar power and other energy sectors of the market paving the way into new developments inside a digital economy.

© Goldilocks

~~~~~~~~~~

A Goldilocks Economy represents an idea whose time has come. We are currently adjusting Payment Systems and Global Economies seeking out price patterns that will allow us to move into the future with systematic digital protocols that will align our Global Economy with numbers we can grow from going forward.

Just like the story of Goldilocks and the Three Bears, we are looking for value adjustments that are "just right." Our entire Financial System around the Globe is just simply looking for a home. As we journey through this transition, the place we live will be determined by real values and real numbers paved with streets of gold.

© Goldilocks

~~~~~~~~~~

The Chinese Yuan just replaced the US Dollar in foreign currency trades for Russia.

In just the last 2 years, the Yuan was used less than 1% to now over 34%.

© Goldilocks

https://www.youtube.com/shorts/peH0vxSfEg4

~~~~~~~~~~

The world needs more copper.

This will be one of the biggest stories in the years ahead.

Read: https://x.com/goldtelegraph_/status/1756382475276918961?s=46

👆 Goldilocks pointed to this article

~~~~~~~~~~

BREAKING NEWS

ZIMBABWE MAY BACK ITS CURRENCY WITH GOLD IN AN EFFORT TO END EXCHANGE-RATE INSTABILITY

Here it comes…

It always starts with one.

Read: https://x.com/goldtelegraph_/status/1757081932373062101?s=46

~~~~~~~~~~

Zimbabwe’s Government Considers Using Gold to Back Its Currency | Bloomberg

~~~~~~~~~~

Zimbabwe to link exchange rate to hard assets which includes gold.

People laugh at the country but don't grasp the blueprint.

It is starting…

Read: https://x.com/goldtelegraph_/status/1757135386110013612?s=46

~~~~~~~~~~

Ripple says it’s planning to expand its payments business in the U.S.

Right now, 90% of the blockchain company’s business is based outside the U.S., Ripple senior director and head of product marketing, W. Oliver Segovia, said on LinkedIn last week.

“After being relatively quiet for the past 3 years in the US for Ripple Payments, we’re geared up to announce new product updates powered by our money transmitter licenses (MTLs) that cover the majority of US states,” Segovia wrote. Pymnts

~~~~~~~~~~

Is a Recession Imminent? The Fed's Leading Indicator, Which Hasn't Been Wrong Since 1966, Offers a Clear Answer. | Fool Investing

~~~~~~~~~~

The $2 Trillion in Goods the US Exported in 2023: Led by Energy Products, Capital Goods, Pharmaceuticals, and Automotive | Wolf Street

~~~~~~~~~~

Even Banks in Asia-Pacific (APAC) on the Hook for US Office CRE: Fitch | Wolf Street

~~~~~~~~~~

Acting Comptroller Discusses Bank Mergers | YouTube

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist's "News and Views" Monday 2-12-2024

Dollar Needs to be Gold Backed for Chance of Survival and to Rival BRICS

Daniela Cambone: 2-12-2024

Daniela Cambone engages in a conversation with Eric Wade, the editor of Crypto Capital at Stansberry Research, also known for his authorship of "America Vs. Americans: How Capitalism Has Failed a Capitalist Nation and What We Can Do About It".

In their discussion, Wade delves into the central themes of his book, touching upon the U.S. dollar, bitcoin, gold, and strategies for reducing taxes.

He emphasizes a shift in the capitalist approach, advocating for valuing and enhancing the worth of people's labor.

“Capitalism is if we could respect labor more, if we could make people's labor worth more,” he says. Wade also talks about the prospect of offering free education without imposing burdensome tax hikes.

Dollar Needs to be Gold Backed for Chance of Survival and to Rival BRICS

Daniela Cambone: 2-12-2024

Daniela Cambone engages in a conversation with Eric Wade, the editor of Crypto Capital at Stansberry Research, also known for his authorship of "America Vs. Americans: How Capitalism Has Failed a Capitalist Nation and What We Can Do About It".

In their discussion, Wade delves into the central themes of his book, touching upon the U.S. dollar, bitcoin, gold, and strategies for reducing taxes.

He emphasizes a shift in the capitalist approach, advocating for valuing and enhancing the worth of people's labor.

“Capitalism is if we could respect labor more, if we could make people's labor worth more,” he says. Wade also talks about the prospect of offering free education without imposing burdensome tax hikes.

Concluding on a bold prediction, Wade forecasts a trajectory leading gold to soar to $3,500 an ounce within the coming years. Dive into the video to gain deeper insights into his compelling perspectives.

CHAPTERS:

00:00 America vs Americans

4:34 Free education

6:44 U.S. Dollar as hard currency

8:51 Bitcoin

10:13 BRICS currency

11:30 Goal of the book

13:16 What made Eric write the book?

17:49 Socialism

19:42 Healthcare

24:17 Bitcoin ETFs/Gold

29:14 Bitcoin ETF out of the system

32:13 CBDCs

Another Regional Bank Is In Big Trouble, Bank Runs Intensify

Atlantis Report: 2-12-2024

The US regional banking sector is facing a severe crisis, as three major banks have collapsed in the past six months, and another one is on the verge of failure.

The crisis has been triggered by a combination of factors, such as rising interest rates, high exposure to risky assets, and large withdrawals of uninsured deposits.

The crisis has also raised concerns about the stability and resilience of the US financial system and the adequacy and effectiveness of the regulatory and supervisory framework.

Today, we will examine the causes and consequences of the regional bank crisis and the challenges and opportunities for the surviving banks.

The Key Indicator For Recession, Credit Event, Market Meltdown | Michael Gayed

David Lin: 2-12-2024

Michael Gayed, Portfolio Manager of Tidal Financial Group, discusses the looming credit event, and what would cause the Fed to pivot.

0:00 – Intro

2:20 - Credit event

5:47 - Monetary policy

10:36 - Stock market momentum

13:17 - Lumber/gold ratio

14:55 - Utilities vs. gold

16:33 - Yield curve

19:13 - Bank of Japan

21:20 - Lead/Lag report

More News, Rumors and Opinions Monday PM 2-12-2024

TNT:

CandyKisses: Iraq is in first place. Iranian official: Our trade with neighboring countries amounted to $50 billion

Baghdad Today - Follow-up

An Iranian official revealed on Sunday (February 11, 2024) that the volume of non-oil trade between Iran and 15 neighboring countries amounted to $50 billion during the past ten months of the current Iranian year, which ends on March 20, adding that "Iraq occupied the first place in Iran's exports."

The spokesman for the Iranian Trade Development Committee, Ruhollah Latifi, told the news agency "Ilna", followed by "Baghdad Today": "The volume of non-oil trade between Iran and 15 neighboring countries amounted to $ 50 billion during the 10 months of the current Iranian year, which was accompanied by a growth of 1.8 percent compared to the same period last year."

TNT:

CandyKisses: Iraq is in first place. Iranian official: Our trade with neighboring countries amounted to $50 billion

Baghdad Today - Follow-up

An Iranian official revealed on Sunday (February 11, 2024) that the volume of non-oil trade between Iran and 15 neighboring countries amounted to $50 billion during the past ten months of the current Iranian year, which ends on March 20, adding that "Iraq occupied the first place in Iran's exports."

The spokesman for the Iranian Trade Development Committee, Ruhollah Latifi, told the news agency "Ilna", followed by "Baghdad Today": "The volume of non-oil trade between Iran and 15 neighboring countries amounted to $ 50 billion during the 10 months of the current Iranian year, which was accompanied by a growth of 1.8 percent compared to the same period last year."

He added: "From the beginning of March 2023 until January 2024, 79,982,360 tons of goods worth 49 billion 831 million 871 thousand dollars were exported between Iran and Iran's neighboring countries, and the share of Iran's exports to these countries amounted to 60 million 368 thousand 642 tons of goods worth 23 billion 150 million 483 thousand dollars, and the share of Iran's imports from neighboring countries amounted to 19 million and 613 thousand and 717 tons worth 26 billion and 681 million and 388 thousand and 465 dollars."

Regarding the export of Iranian food and agricultural products to neighboring countries, Latifi said: "In 10 months of this year, 6 and 151 million and 744 tons of livestock were exported, and fish, agricultural and food products worth three billion and 909 million And 648 thousand and 708 dollars were exported to Iran's neighboring countries."

According to Latifi, Iraq ranked first with $7.2 billion, followed by the UAE with $5.2 billion, Turkey with $3.5 billion, Pakistan with $1.7 billion, and Afghanistan with $1.5 billion, in exporting Iranian goods.

He pointed out that "the Sultanate of Oman ranked sixth with the purchase of $916 million, followed by Russia with $760 million, Azerbaijan with $499.5 million, Turkmenistan with $368 million, Armenia with $333 million, Kazakhstan with $163.5 million , Kuwait with $146 million, and Qatar with $146 million. Bahrain $8.3 million and Saudi Arabia $361,000."

On the volume of Iranian imports from neighboring countries, he said: "The UAE sold $17 billion, Turkey sold $6 billion, Russia sold $1.5 billion, Oman sold $778 million, Pakistan sold $527 billion dollars, and the first million five countries that exported their goods to Iran."

Source: Iranian "ILNA" news agency

****************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Iraq is moving towards going into a market economy...it's quite obvious...Tensions are the trade lines between Egypt and Jordan because of the Red Sea. There's been some chaos going on with different factions disrupting trade...Iraq's Development Road Project Article quote: "Iraq supports an alternative to the international transport lines that deliver good from the East to the West." Everything's coinciding at this time with the major international transport companies coming into play...

Frank26 [Iraq boots-on-the-ground report] FIREFLY: So far we are not seeing the lower notes but they talk to us about them every day. They just talk to us about them and why we'll need them. FRANK: They are talking to you about the lower notes and coins because they are about to show them to you next week or the week after. I believe your bank friend will show you something in the sense of pictures...Take as many pictures as you can.

****************

KTFA:

Clare: Al-Sudani cancels his visit to the Emirates and apologizes to its president

2/12/2024

An official source revealed that Iraqi Prime Minister Muhammad Shiaa Al-Sudani canceled his scheduled visit to the Emirates on Monday.

The source told Shafaq News Agency that Prime Minister Muhammad Shiaa Al-Sudani canceled his visit to the United Arab Emirates to participate in the World Government Summit, without knowing the reasons for canceling the visit. LINK

Harlequin3: Hmmm. Odd…..imo

FULL-BLOWN LIQUIDITY CRISIS WORSENING MUCH FASTER! This IS NOT An Accident.

Greg Mannarino: 2-12-2024

HERE WE GO: Fed Chair Powell Declares Certain Banks Must Go Amidst Commercial Real Estate Downturn

Taylor Kenny: 2-11-2024

Is the regional bank crisis ending or just starting? Recent developments, such as the sharp decline in New York Community Bancorp's stock from commercial real estate losses, signal potential trouble. With $500 billion in debt maturing this year and falling property values, small banks are bracing for a crisis.

CHAPTERS:

00:00 NYCB Collapse

01:30 Regional Bank Stakes

04:21 Office Loan Delinquencies 5-year High

06:00 Regional Bank Stocks Plummet

Part 1: The Grand Financial Plan and the Elder Guardians of Historical Wealth : Awake-In-3D

Part 1: The Grand Financial Plan and the Elder Guardians of Historical Wealth

On February 11, 2024 By Awake-In-3D

In RV/GCR

What you are about to read is, by far, not a comprehensive account of the complete RV/GCR

Nor is it intended to be.

While we are accustomed to using the acronym RV/GCR (Revaluations/Global Currency Reset), the acronym is actually backwards. It would be more accurate to type GCR/RV since the revaluations of currencies are a sub-function of the Global Currency Reset itself.

Taken even further, the GCR is a sub-function of a Global Financial Reset (GFR).

The article series to follow is focused on the GFR/GCR and not the Revaluation of Currencies (RV), yet they go hand in hand.

Part 1: The Grand Financial Plan and the Elder Guardians of Historical Wealth

On February 11, 2024 By Awake-In-3D

In RV/GCR

What you are about to read is, by far, not a comprehensive account of the complete RV/GCR

Nor is it intended to be.

While we are accustomed to using the acronym RV/GCR (Revaluations/Global Currency Reset), the acronym is actually backwards. It would be more accurate to type GCR/RV since the revaluations of currencies are a sub-function of the Global Currency Reset itself.

Taken even further, the GCR is a sub-function of a Global Financial Reset (GFR).

The article series to follow is focused on the GFR/GCR and not the Revaluation of Currencies (RV), yet they go hand in hand.

The origins of Our GCR have an interesting, if not compelling story to tell regarding its overall purpose and foundational structure.

At the heart of this epic plan stand the Dynastic Dragon Families, a coalition of Bloodline Principals and Trustees from across Asia. They represent China, Japan, the Philippines, Indonesia, and Vietnam.

While it may come off reading like a creative fiction worthy of an epic, big-budget movie, it also remains logically plausible given the mission, resources, and achievability within today’s financially interconnected world.

Besides, how could the plan and components for a complete makeover of the failing Fiat Currency Debt System not be made of the stuff that stirs our hearts and souls.

So, let’s begin…

The Royal/Dragon Families: Guardians of the World’s Wealth

The revelation of a Global Currency Reset (GCR) emerged at a pivotal time in our financial history.

Across the globe, nations grapple with unprecedented economic challenges. These range from ballooning debts to the instability of fiat currencies, which lack tangible backing.

In response, a transformative proposal surfaces, promising a radical overhaul of the global financial system. This plan, rooted in the wealth of a secretive alliance known as the “Elder/Royal Families,” aims to reset the monetary landscape.

This is a key element of the GCR, setting the stage for an exploration of humanity’s shift towards a more stable and equitable economic framework.

At the heart of this epic plan stand the Dynastic Dragon Families, a coalition of Bloodline Principals and Trustees from across Asia. They represent China, Japan, the Philippines, Indonesia, and Vietnam.

These stewards hold the keys to the largest gold reserves not listed in any public record. Known as “Off-Ledger Gold,” this treasure is more than a myth; it’s a vast repository of wealth, shrouded in secrecy and history.

See also: GCR Origins (Part 2): Project Hammer’s Secret Trading Platforms for WW2 Off-Ledger Gold

It is reported that the foundation of the Elders traces back to The Kong Family Bloodline, and the ancient Chinese philosopher Confucius (Kongzi), born in 551 B.C.

Confucius laid the philosophical foundations for what would become a system of thought and ethics that has profoundly shaped Chinese society and beyond for over two and a half millennia.

Confucius, the progenitor of the Kong family, represents a lineage that has continued unbroken to the present day and recognized as the longest family tree in history.

The King David Trust is said to represent an amalgamation of European Royal Bloodlines (but not all of them) who support the deployment of their inherited wealth for the benefit of humanity and economic prosperity.

On the Royal Families side, the Lurie family, distinguished by its claim to one of the oldest bloodlines in the world, traces its origins back to the biblical King David, who is said to have united the tribes of Israel and ruled in the 10th century BCE.

The Lurie bloodline originated in the ancient Levant area, historically, the region along the eastern Mediterranean shores, roughly corresponding to modern-day Israel, Jordan, Lebanon, Syria, and certain adjacent areas.

The Lurie family’s lineage is well-documented from the 13th century in France, where they emerged as a prominent Ashkenazi Jewish family. The name “Lurie” itself is believed to derive from the town of Loire, situated along the Rhone River, indicating a geographical origin of the family’s prominence.

The King David Trust is said to represent an amalgamation of European Royal Bloodlines (but not all of them) who support the deployment of their inherited wealth for the benefit of humanity and economic prosperity.

The significance of these gold troves cannot be overstated. They embody not just material wealth but a legacy spanning centuries.

The Elder/Royal Families have amassed this gold over generations, with the intent of using it for the greater good. Their proposition?

To back currencies, relieve debt, and fund humanitarian projects on a global scale.

Their role challenges the current financial paradigm, pushing against the tide of fiat money—a system where currency’s value is not backed by physical commodities but rather the government’s declaration. In advocating for a return to asset-backed currencies, the Elder/Royal Families aim to restore stability and trust in global economics.

This bold vision sets the stage for a confrontation with the entrenched interests of the Western banking cabal, marking a crucial juncture in the quest for financial reform.

To be continued in Part 2: The Foundation for Global Financial Reform and the GCR

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/part-1-the-grand-financial-plan-and-the-elder-guardians-of-historical-wealth/

"Tidbits From TNT" Monday 2-12-2024

TNT:

Tishwash: Iraqi ports participate in the Breakbulk Middle East 2024 exhibition in Dubai

The General Company for Iraqi Ports is participating in the (Break Bulk) Middle East 2024 exhibition, in Dubai, which continues until tomorrow, Tuesday.

The General Company for Ports stated in a statement: “The participation came with the aim of opening up to international companies, presenting investment opportunities in the Iraqi shipping sector, as well as introducing the large port of Al-Faw, and searching for competent international operators to cooperate in the field of shipping and unloading.”

She added: “The Breakbulk Middle East Exhibition is one of the most important occasions that brings together decision-makers and businessmen in the shipping and logistics services sector. It is a unique opportunity to communicate with major parties in the Middle East, East Asia and Africa and build cooperative relationships that support business growth.” .

TNT:

Tishwash: Iraqi ports participate in the Breakbulk Middle East 2024 exhibition in Dubai

The General Company for Iraqi Ports is participating in the (Break Bulk) Middle East 2024 exhibition, in Dubai, which continues until tomorrow, Tuesday.

The General Company for Ports stated in a statement: “The participation came with the aim of opening up to international companies, presenting investment opportunities in the Iraqi shipping sector, as well as introducing the large port of Al-Faw, and searching for competent international operators to cooperate in the field of shipping and unloading.”

She added: “The Breakbulk Middle East Exhibition is one of the most important occasions that brings together decision-makers and businessmen in the shipping and logistics services sector. It is a unique opportunity to communicate with major parties in the Middle East, East Asia and Africa and build cooperative relationships that support business growth.”

.She pointed out: “The exhibition will include discussion sessions and studies presented by the most prominent experts and regional and international companies in this sector.” link

CandyKisses: With the participation of 180 local and international companies. Launch of the "Energy of Iraq Nine" exhibition

Baghdad Today - Baghdad

Today, Monday (February 12, 2024), the activities of the Ninth Iraq Energy International Exhibition and Conference were launched on the grounds of the Baghdad International Fair with the participation of 180 local and international companies.

The media of the Ministry of Electricity said in a statement received by "Baghdad Today" that "in the presence of a high official, the activities of the ninth Iraq International Energy Exhibition and Conference were launched today on the grounds of the Baghdad International Fair, under the patronage of His Excellency Prime Minister Muhammad Shia Al-Sudani, and under the supervision of His Excellency Minister of Electricity Ziad Ali Fadel."

He explained that "more than 180 local and international companies specialized in energy affairs are participating in the exhibition, which will continue for the period from (12-14 / February / 2024).

He pointed out that "the Minister of Electricity, Ziad Ali Fadel, welcomed the companies participating in the exhibition in its ninth edition, and valued the efforts of those in charge of it," stressing "the Iraqi government's endeavor to build sustainable and reliable energy systems that take into account appropriate environmental standards."

According to the statement, the Minister of Electricity "presented a presentation of the Ministry's plans and projects within the government curriculum to raise the rates of electrical energy production by adding new production units, the efficiency of gas generating stations by switching from simple cycle to combined cycle, as well as improving the efficiency of the performance of gas stations by adding cooling systems, rehabilitation and long-term maintenance, as well as introducing renewable energy into the energy mix produced."

Fadel revealed "the Ministry's upcoming projects, the most important of which are the smart transformation in the electrical system, the application of smart networks and meters, and electronic payment systems for electricity use bills," noting that "the Ministry succeeded in achieving the highest production of electrical energy in its history during last summer, reaching (26,050) megawatts, and our technical teams are making great efforts to increase production during the next summer in the event that the stability of the required fuel supply is achieved."

The minister expressed his "optimism in completing the ministry's plans with the support and patronage of the Prime Minister, the rest of the ministries and cooperation with the national and foreign private sector."

************

Tishwash: For fear of sanctions”.. Iraq wants the Americans to leave “calmly”, and the Sudanese is eager to authorize the blocs and factions

Member of the House of Representatives, Ali Al-Lami, said today, Monday (February 12, 2024), that a comprehensive war is far from Iraq’s atmosphere at the present time, while indicating that containing the situation must include a consensus between the political blocs and the resistance factions to remove foreign forces.

Al-Lami explained to “Baghdad Today” that “the attacks launched by the armed factions on American targets in Iraq will not lead to a comprehensive war according to our vision, despite the presence of a reaction from time to time,” pointing out that “the events in Gaza have direct repercussions on the general situation, and the examples are not many.” In our country and other regions."

He added, "Our view of containing the situation includes a main point, which is the agreement of the political blocs and resistance factions in handing over the file of removing foreign forces, including American forces, to Prime Minister Muhammad Shiaa al-Sudani and authorizing him to proceed with implementing the agreement according to calm principles that preserve Iraq's sovereignty without any escalation."

Al-Lami pointed out that “the Sudanese has the ability to manage negotiations and succeed in ending tension, protecting the country’s sovereignty, and coming up with outcomes that serve Iraq and its prestige,” noting that “Washington has influence in Iraq and possesses many pressure cards, including economic ones, which it may resort to if its interests are directly targeted.” This is what we must pay attention to and strive to remove its forces according to paths through the government.”

Yesterday, Sunday (February 11, 2024), the spokesman for the Commander-in-Chief of the Armed Forces, Major General Yahya Rasoul, revealed that the Supreme Iraqi Military Committee had resumed its meetings with the international coalition forces.

Rasoul said in a statement received by "Baghdad Today", "The Iraqi Supreme Military Committee resumed its meetings with the international coalition forces in Baghdad today, Sunday, to assess the military situation, the level of danger, the operational environment, and the capabilities of the Iraqi armed forces."

He stated, "Based on these meetings, a timetable will be formulated for a deliberate and gradual reduction, leading to the end of the mission of the international coalition forces to fight ISIS and the transition to a bilateral relationship."

Rasoul noted that "as long as nothing disturbs the peace of the talks, the meetings will occur periodically to complete the committee's work as quickly as possible."

A source familiar with the Iraqi-American military negotiations reported earlier on Sunday to “Baghdad Today” that 3 committees had been formed between Baghdad and Washington to complete the withdrawal of the coalition from Iraq during the round of negotiations held today between the two countries.

The source said, "The second round of negotiations between Baghdad and Washington regarding the withdrawal of the international coalition from Iraq ended this evening, after agreeing to continue meetings between Baghdad and Washington during the next two weeks link

Mot: hee hee hee - They wont see it coming ~~~

Mot: Loving Quietly! ~~~

Goldilocks' Comments and Global Economic News Monday AM 2-12-24

Goldilocks' Comments and Global Economic News Monday AM 2-12-24

Good morning Dinar Recaps,

"The changes to operations in the country’s FX market imply that Nigeria has eased its control of the Naira, allowing the local currency to float freely."

Nigeria is moving to a free-floating exchange rate. In other words, Nigeria is allowing their currency to be determined by supply and demand inside the market.

Here, the Central Bank will not be influencing the external value of their currencies' exchange rate.

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday AM 2-12-24

Good morning Dinar Recaps,

"The changes to operations in the country’s FX market imply that Nigeria has eased its control of the Naira, allowing the local currency to float freely."

Nigeria is moving to a free-floating exchange rate. In other words, Nigeria is allowing their currency to be determined by supply and demand inside the market.

Here, the Central Bank will not be influencing the external value of their currencies' exchange rate.

© Goldilocks

Gatekeepers News

Investing in Gold: Is Gold Still a Good Inflation Hedge in a Recession? | Bloomberg

~~~~~~~~~~

CURRENT SITUATION

1. Stocks are trading like the Fed already cut rates

2. Bonds are trading like rate cuts aren't happening

3. Gold is trading like we are on track for a "soft landing"

4. Oil prices are trading like we are entering a recession

5. Housing markets are trading like nothing is happening

Nothing adds up here.

@KobeissiLetter

~~~~~~~~~~

MC Explains: All you need to know about programmability and offline functionality proposed in CBDC pilot. | Moneycontrol

During monetary policy review, Reserve Bank of India (RBI) Governor Shaktikanta Das on February 8 proposed additional use cases for central bank digital currency (CBDC) pilot projects.

To make it attractive and increase the adoption of CBDC, Das said that the digital currency would be programmed to help cater to specific end uses and also make it usable in areas with poor or no internet.

~~~~~~~~~~

15 Strongest Currencies in the World in 2024 - Insider Monkey

~~~~~~~~~~

Bidenomics is failing, the people know it now. The farmers are now feeling the pain. When Trump was in the WH he gave the tariffs to the farmers to help them. Now the farmers are in trouble. Putin is now letting everyone know the world is moving away from the Federal Reserve note. | X22report

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Monday AM 2-12-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 12 Feb. 2024

Compiled Mon. 12 Feb. 2024 12:01 am EST by Judy Byington

Global Currency Reset (RUMORS)

Sun. 11 Feb. Chance Mcfadden: “Today Sun. 11 Feb. the Bank was told there may be an event following the Super Bowl, which would be 10:00 pm Eastern. They are also being told there is most likely an announcement early next week. They don’t mention (or know) the specific content of both of these events. The Iraqi RV is finally posted and (allegedly) set for Sun. 11 Feb. and the Global Redemption Program (allegedly) starts Mon. 12 Feb. Buyers, Paymasters have funds just (allegedly) waiting to be liquid. Iraqi banks in the US began paying Iraqi citizens living in the US who are exchanging their old Dinar for US Dollars but rate is not known. The Federal Reserve says the rate is (allegedly) $4.81, which is the rate agreed to at Davos in January.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 12 Feb. 2024

Compiled Mon. 12 Feb. 2024 12:01 am EST by Judy Byington

Global Currency Reset (RUMORS)

Sun. 11 Feb. Chance Mcfadden: “Today Sun. 11 Feb. the Bank was told there may be an event following the Super Bowl, which would be 10:00 pm Eastern. They are also being told there is most likely an announcement early next week. They don’t mention (or know) the specific content of both of these events. The Iraqi RV is finally posted and (allegedly) set for Sun. 11 Feb. and the Global Redemption Program (allegedly) starts Mon. 12 Feb. Buyers, Paymasters have funds just (allegedly) waiting to be liquid. Iraqi banks in the US began paying Iraqi citizens living in the US who are exchanging their old Dinar for US Dollars but rate is not known. The Federal Reserve says the rate is (allegedly) $4.81, which is the rate agreed to at Davos in January.

Chance McFadden: “Was told the paperwork was just completed. The Iraq Government will (allegedly) reveal the new ‘lower denomination’ notes this week

Sun. 11 Feb. Rod Steel: “I’ve spoken with some bond people and they have (allegedly) received funds. I was told the paperwork was just completed and the Admiral is going to release everything on Mon. 12 Feb. The Iraq Government will (allegedly) reveal the new ‘lower denomination notes to their citizens this week then the Dinar Rate to be published in the Gazette, FOREX this Monday February 12th.

Sat. 10 Feb. MarkZ: “I got some great stuff from Rod steal this morning about groups in Reno and expectations of an announcement that he thinks could happen early this week. This certainly fits with what my banking contacts are saying. I expect updates mid day on Monday 12 Feb. I will keep an ear out because there is a sudden flurry of activity on the Reno side. Geo political stuff is lining up just what we expected to see at the end. They look to be 100% following the playbook. I am still getting a lot of calls to expect something big tomorrow evening Sun. 11 Feb. And I hear sheriffs are on alert….many threats around the country…so everybody be sure to stay safe. I did not details as to the “when” Just to be prepared now for a possible emergency. Some gave reports to watch threats to the infrastructure and cyber attacks.”

Sat. 10 Feb. Mike Bara: Exchanges are (allegedly) taking place at major banks with branch managers and wealth managers. Dinar, Dong and Rupiah are (allegedly) being exchanged. Zim and Bolivar can only be exchanged at Redemption centers. The rates on Dinar are $2.93 as of today, (allegedly) $2.21 on Dong. No rate on Rupiah. Exchange has taken place, and 10% of monies are spendable today. Currencies were set up in separate accounts. New debit card issued for new funds. No NDA. Recipient will return in “72 hours” (Monday) to finish the process. This implies rates will be public when Forex goes live or shortly thereafter. Also implies funds released on Monday will be gold backed. We are very, very close.

Sat. 10 Feb. Brazil Rubem Baz: “Because the Imperial Family of the Ancient Chinese Golden Dragon is the one that puts up all the gold necessary for the Ransom payments, they decided that the deposits for the holders. They will begin on the day they begin to celebrate the Chinese year (year 4722 for them), which is this Saturday, February 10, 2024 (in different countries in Asia there are different start dates, from early January to mid-February). This money has already been received by the main Financial Institutions and the 50 Best Banks in the World and they are passing it on to Paymasters who will contact the clients. Liquidity will be from Monday, February 12, because in the West normally people do not work on Sundays. Among the 12 different animals to which each of their years corresponds, this one corresponds to the Dragon, which for them is not an evil monster, but a just and benevolent creature that brings prosperity. Over the next two weeks, large holders who have already completed their paperwork and submitted SKRs will be paid.”

On Thurs. 15 Feb. 2024. Tier4b exchanges and bond redemption (allegedly) will wrap up.

Global Financial Crisis:

Five Months before his Assassination, President John F. Kennedy issued this executive order that would give the American currency back to the People by printing Money based on a Silver Standard, Taking away the power of the Federal Reserve Banking cartel. Many argue this is the Reason that JFK was assassinated.

Sun. 11 Feb. Australia’s economic future is in the balance as the $532 billion collapse of China’s mega real estate developer Evergrande takes hold. https://www.news.com.au/finance/economy/world-economy/devastating-impact-of-evergrandes-532-billion-collapse/news-story/eeea622b054dfa56d020cd516fba6a42

The Great Reset is the battle of our lifetime. If the elites that control this world succeed, we will all be living like slaves in digital concentration camps. If we win, we will FOREVER change the world for the better.

$201 Billion piled onto US Debt in one month as Black Swan Author warns America facing Financial Death Spiral: https://dailyhodl.com/2024/02/10/201000000000-piled-onto-us-national-debt-in-one-month-as-black-swan-author-warns-america-facing-financial-death-spiral/

Sat. 10 Feb. BRICS Allies Downsizing US Dollar in Central Banks: https://watcher.guru/news/brics-us-allies-are-downsizing-the-dollar-in-central-banks

Read full post here: https://dinarchronicles.com/2024/02/12/restored-republic-via-a-gcr-update-as-of-february-12-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Nader From The Mid East Here's what I can tell you. When the dinar changes everybody will know. Everybody in the whole world, everybody knows about. It will be all over the news. When Iraq will be sovereign again, when somebody declare the end of war and everything, that's what's going to happen...

Sandy Ingram Vietnam is making major financial news. Vietnam factory activity returns to growth status after the pandemic, tourist arrivals increased by 73.6% in January and retail sales are still growing for the 26th straight month. The inflation rate is at a five month low of 3.7%. Overall Vietnam has green lights on all growth patterns...Vietnam knows precisely what to do to bring the value of its currency back into the line of profit...

Goldilocks' Comments and Global Economic News Sunday Evening 2-11-24

Goldilocks' Comments and Global Economic News Sunday Evening 2-11-24

Good Evening Dinar Recaps,

I have been watching several countries from around the world going through Article 4 consultations with the IMF. Many of these were held last year to determine new fiscal plans for the coming year that we are now living in at this time.

Article 4 meetings with the IMF happen every year, but this time is different. They are discussing inclusion of Commodities and Digital Assets to implement.

I noticed several articles this past week and yesterday talking about revealing and implementing new fiscal sustainability plans. These new plans will govern the economy of their people.

These new fiscal sustainability plans are indicators the countries are preparing to move forward with our new digital economy. It's getting out in the open my friends.

Below are just a few articles from countries that are beginning to inform their people about monetary policy changes that are coming.

© Goldilocks

Goldilocks' Comments and Global Economic News Sunday Evening 2-11-24

Good Evening Dinar Recaps,

I have been watching several countries from around the world going through Article 4 consultations with the IMF. Many of these were held last year to determine new fiscal plans for the coming year that we are now living in at this time.

Article 4 meetings with the IMF happen every year, but this time is different. They are discussing inclusion of Commodities and Digital Assets to implement.

I noticed several articles this past week and yesterday talking about revealing and implementing new fiscal sustainability plans. These new plans will govern the economy of their people.

These new fiscal sustainability plans are indicators the countries are preparing to move forward with our new digital economy. It's getting out in the open my friends.

Below are just a few articles from countries that are beginning to inform their people about monetary policy changes that are coming.

© Goldilocks

Cabin Radio

Politico

European Commission

China Daily

IMF

~~~~~~~~~~

"From Coal to Clean: The Economic Challenge of Shifting Energy Paradigms"

Our world is transitioning into clean energy paradigms. It is causing some of our fossil fuel communities to be vulnerable. People will be moving into new companies leaving old ones behind during this process. There will be many adjustments that will need to be done on so many levels inside our new economy.

This will cause a shift in monetary policies and prices on energy sectors of the market. Commodities are expected to go into a bull market for several years when this transition is fully complete due to the fact of this change in the way we work and live.

This is another reason why it is important to watch The Debt Clock. Watch for a resetting of prices in gold, silver, and oil. What used to be the oil sector now reads "from oil to solar." Interesting don't you think?

Each week, my friend Freedom Fighter spends time with people going over the debt clock. I hope you seek out this room through "Seeds of Wisdom." It is both fun and enlightening for the people who are working together to understand the changes taking place on the debt clock. Oil Price

© Goldilocks

~~~~~~~~~~

BRICS: 159 Countries Eyeing Russia's New Payment System | Watcher Guru

~~~~~~~~~~

RBI Tests Asset Tokenization in Wholesale CBDC Pilot | Crypto Times

~~~~~~~~~~

ARTICLE 19 contributed to ‘Voices for the DMA’, a call in video format from 20+ stakeholders in the Coalition for App Fairness for effective enforcement of the Digital Markets Act (DMA) ahead of the 6 March 2024 deadline for compliance. Article 19

~~~~~~~~~~

Instant payments are finally here: Milestone vote by European Parliament | Worldline

"Marking a pivotal moment in European payments, the European Parliament has endorsed the regulation mandating instant payments, requiring credit transfers to be executed within ten seconds across the EU. This endorsement paves way to the approval by EU Finance Ministers in Council, with the final text anticipated to be published in the Official Journal of the European Union (OJEU) by March 2024."

~~~~~~~~~~

Devastating impact of Evergrande’s $532 billion collapse | News AU

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

US Commercial Real Estate Contagion Spreads to Germany and Japan : Awake-In-3D

US Commercial Real Estate Contagion Spreads to Germany and Japan

On February 8, 2024 By Awake-In-3D

The commercial real estate (CRE) sector in the United States continues facing significant losses, marking a crisis that experts are calling the worst since the financial crisis of 2008.

I don’t believe that the CRE meltdown will be the trigger of the fiat currency debt system collapse, but it will certainly play a role in contributing to the final event.

This downturn has not only destabilized the US regional banking sector but has also spread as a contagion to Europe and Japan, showcasing the interconnected nature and instability risks of global fiat financial markets.

US Commercial Real Estate Contagion Spreads to Germany and Japan

On February 8, 2024 By Awake-In-3D

The commercial real estate (CRE) sector in the United States continues facing significant losses, marking a crisis that experts are calling the worst since the financial crisis of 2008.

I don’t believe that the CRE meltdown will be the trigger of the fiat currency debt system collapse, but it will certainly play a role in contributing to the final event.

This downturn has not only destabilized the US regional banking sector but has also spread as a contagion to Europe and Japan, showcasing the interconnected nature and instability risks of global fiat financial markets.

The Epicenter: The US CRE Crisis

The US CRE sector is currently experiencing unprecedented stress, primarily due to the seismic shifts in work culture brought on by the government’s response to COVID-19.

The transition to remote work has left office buildings vacant, causing a steep decline in rental incomes and property values.

According to a report by Forexlive, Goldman Sachs estimates that $1.2 trillion in mortgages are due by the end of next year, with much of it underwater.

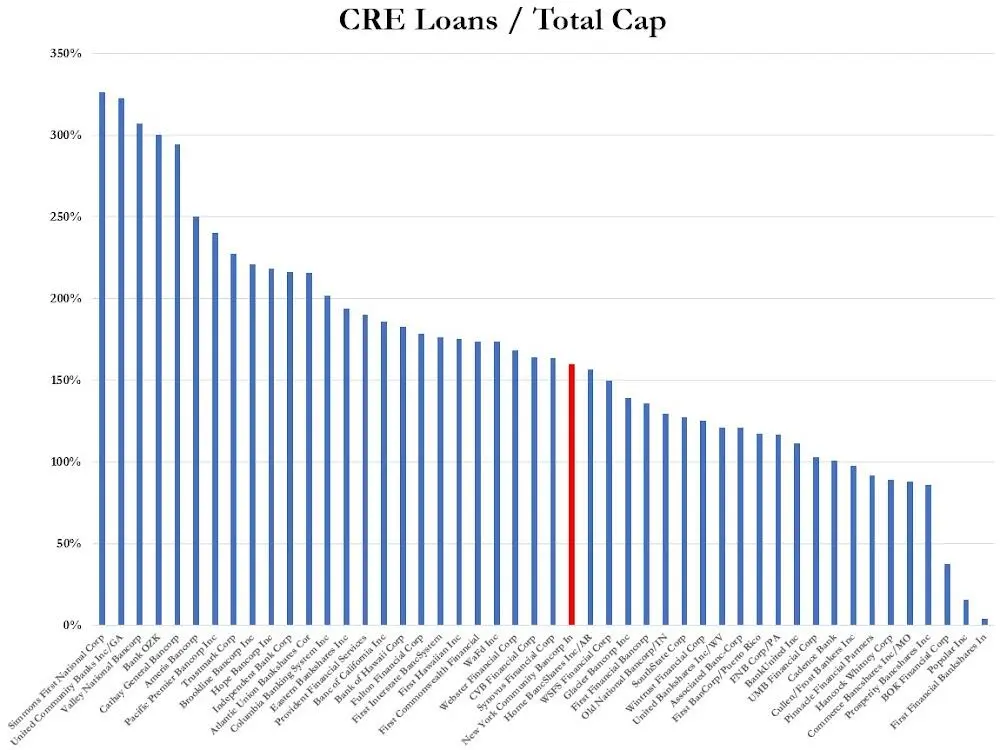

US Regional Banks with the largest CRE loans relative to capital

This situation has led to significant losses for regional banks and financial institutions heavily invested in commercial real estate loans.

More Bad News for Germany: Multiple Banks

Germany, Europe’s largest economy, has not been immune to the repercussions of the US CRE crisis.

Deutsche Pfandbriefbank (PBB), a German lender with a focus on real estate, has had to increase its provisions for bad debts significantly, bracing itself for what it describes as the worst decline in commercial property values in 15 years.

The bank has set aside as much as €215 million ($231.7 million) for potential losses on loans, highlighting the “persistent weakness of the real estate markets”.

Similarly, Deutsche Bank has allocated €123 million ($133 million) to cover potential defaults on its US commercial real estate loans, indicating the far-reaching impact of the US crisis on European banks.

The Situation in Japan: Aozora Bank’s Unexpected Losses

Aozora Bank, based in Tokyo, Japan, has encountered significant financial distress due to its exposure to the U.S. commercial real estate market, marking a dramatic shift in the bank’s balance sheet health.

This situation has led Aozora Bank to report its first annual net loss in 15 years, a stark reversal from its previous net profit projections.

The bank has been compelled to take massive loan-loss provisions for U.S. commercial property as valuations have plummeted in the wake of rising borrowing costs and a decrease in demand exacerbated by the shift to remote work.

This financial turmoil resulted in a projected net loss of 28 billion yen ($190.5 million) for the fiscal year ending March 31, significantly deviating from an initially expected net profit of 24 billion yen. Consequently, Aozora Bank has decided to forgo dividends for the remainder of the financial year.

The ongoing CRE crisis in the US serves as a stark reminder of the global fiat financial system’s interconnectedness and risk of contagions spreading worldwide.

Banks and financial institutions worldwide are now facing the ripple effects of this downturn, with the full extent of potential losses and their distribution across the financial sector still unfolding.

Contributing sources:

https://ai3d.blog/us-commercial-real-estate-contagion-spreads-to-germany-and-japan/

More News, Rumors and Opinions Sunday PM 2-11-2024

TNT:

Tishwash: Expectations of the date of Ramadan in Iraq

After the Sunni Endowment Office in Iraq and the Supreme Religious Authority in Najaf announced the start dates for the month of Shaban for the Hijri year 1445, it has become almost certain to know the date of the next month of Ramadan, which follows Shaban in the lunar months.

The crescent of the month of Shaaban was seen at sunset this evening, Sunday (February 11, 2024), with the naked eye in Najaf Al-Ashraf and Kirkuk.

The Sunni Endowment Office announced yesterday that today, Sunday, is the first day of the month of Shaban, and considering that this month will have 30 days, the beginning of the month of Ramadan will be next March 12, and if the month of Shaban has 29 days, then the first of Ramadan will be on March 11.

TNT:

Tishwash: Expectations of the date of Ramadan in Iraq

After the Sunni Endowment Office in Iraq and the Supreme Religious Authority in Najaf announced the start dates for the month of Shaban for the Hijri year 1445, it has become almost certain to know the date of the next month of Ramadan, which follows Shaban in the lunar months.

The crescent of the month of Shaaban was seen at sunset this evening, Sunday (February 11, 2024), with the naked eye in Najaf Al-Ashraf and Kirkuk.

The Sunni Endowment Office announced yesterday that today, Sunday, is the first day of the month of Shaban, and considering that this month will have 30 days, the beginning of the month of Ramadan will be next March 12, and if the month of Shaban has 29 days, then the first of Ramadan will be on March 11.

On the other hand, the Office of the Supreme Religious Authority announced yesterday that tomorrow, Monday, is the first day of the month of Shaban, and considering that this month will have 30 days, the beginning of the month of Ramadan will be next March 13, and if the month of Shaban has 29 days, then the first of Ramadan will be on March 12.

This year, Sunnis and Shiites may fast on the same day if the Sunni Endowment and the Supreme Authority in Najaf announce that March 12 is the first day of the month. Otherwise, the difference will be one day, and the Sunnis will fast a day earlier than the Shiites. link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY: A representative from the CBI is talking to us in great detail about the new coins they will be giving us with the new currency notes...He said to us once again, the process to delete the zeros is in the process. It made us smile. He said this process is occurring because the lower notes will not be needed if the rate wasn't increasing. He said if the CBI didn't come out with these lower notes the monetary reforms would be a disaster. He said that's why we need a change in our rate...

Goldilocks Article: "Vietnam's Rise as a Global Manufacturing Hub in the Era of Resilience and ESG Compliance" Quote: "Vietnam's cost-competitive manufacturing capabilities, expanding consumer market, and supportive policies make it an attractive destination for foreign investment. Despite challenges, Vietnam is well-positioned to capitalize on this trend and cement its position as a key player in the global economy."

**************

KTFA:

2/11/2024 Baghdad -

Today, Sunday, Minister of Finance, Taif Sami Muhammad, participated in the activities of the Eighth Arab Public Finance Forum in Dubai.

The Ministry said in a statement received by the Iraqi News Agency (INA): “Minister of Finance, Taif Sami Muhammad, participated in the activities of the Eighth Public Finance Forum for Arab Countries under the title of designing more efficient financial policies to address challenges related to debt and future financial issues in light of more stringent financing restrictions and tax management.” and reform of public sector institutions.

She added that “the forum discusses financial policy issues and the prospects for economic and financial developments, with the aim of exchanging experiences and expertise and identifying the challenges facing economic policy makers and reform priorities in Arab countries,” noting that “the forum is held in cooperation with the International Monetary Fund, and in the presence and participation of Arab finance ministers and governors.” Central banks and Arab monetary institutions, along with a number of heads, senior officials and experts from international and regional financial institutions.”

She continued, "The forum also addresses the challenges of reforming and supporting energy and strengthening social safety networks, with the aim of achieving a future characterized by sustainability and social solidarity. The forum also addresses the balance sheet-based approach to creating value from public assets in order to enhance the ability of governments to achieve their goals, in addition to the importance of Enhancing domestic revenue mobilization to confront spending pressures and achieve comprehensive and sustainable economic growth, by improving tax administration, while evaluating the progress achieved in the Arab region.” LINK

MARKETS A LOOK AHEAD: IMPORTANT UPDATES! Expect MASSIVE DISTORTIONS TO WORSEN FASTER.

Greg Mannarino: 2-11-2024

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

On February 7, 2024 By Awake-In-3D

How to discuss the Fiat Currency System Scam with friends and family without sounding like a conspiracy theory nut.

The lifeblood of the global fiat currency debt system is the powerhouse of currency creation: Fractional Reserve Lending.

This mechanism not only fuels the economy but also amplifies the “Currency Creation Scam” as I will explain in this article.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting, but within the banking system itself.

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

On February 7, 2024 By Awake-In-3D

How to discuss the Fiat Currency System Scam with friends and family without sounding like a conspiracy theory nut.

The lifeblood of the global fiat currency debt system is the powerhouse of currency creation: Fractional Reserve Lending.

This mechanism not only fuels the economy but also amplifies the “Currency Creation Scam” as I will explain in this article.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting, but within the banking system itself.

Fractional Reserve Lending: Massive Leveraging of Your Bank Deposits

Fractional Reserve Lending operates on a principle as simple as it is brilliant.

Banks are required to keep only a fraction of your deposit in reserve, lending out the rest.

With a 10 percent reserve ratio, for example, a $100 deposit can magically transform into $90 of loanable funds.

This leaves us with a peculiar situation: your bank account still shows that you have a $100 balance, yet actually $90 is now elsewhere, in the hands of borrowers.

How?

Through the creation of “bank credit,” a digital mirage replacing real dollars.

Astonishingly, 92 to 96 percent of all fiat currency in existence is created (out of thin air) through multiplied cycles of bank credit.

Bank Credit: The True Secret of an Invisible Currency

This bank credit, while lacking the tangible form of cash, functions as currency within our economy. It emerges from a simple yet profound act: banks typing numbers into a computer.

This fabricated currency, stemming from your initial deposit, multiplies via loans as it moves through the banking system from one bank, to another and another.

A $100 deposit can balloon into $1,000 of bank credit, all while being backed by a mere $100 from the original deposit.

As loans are made and the currency circulates, each recipient re-deposits the funds, enabling further lending.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting but within the banking system itself.

Astonishingly, 92 to 96 percent of all fiat currency in existence is created (out of thin air) through this cycle of bank credit.

The Real Cost of These Digital Currency Dollars Numbers

What does this mean for you, the everyday person? Let’s think this through step-by-step.

When you or your business takes out a loan, the proceeds of the loan simply go into another bank account, which creates more deposits (digital numbers) that are then re-loaned out again via fractional reserve lending, and then multiplied via the same process again and again.

This mechanism of currency multiplication underpins a system where the majority of our money supply is not real ‘money’ but a web of IOUs.

Every unit of fiat currency is an IOU created through fraction reserve lending that multiplied and expanded from one loan to the next and one bank to another.

While it fuels economic activity, it also represents a precarious balance, reliant on everyone’s continued faith and participation in the banking system.

The implications become obvious … a system built on fractional reserves is a system built on a foundation of trust, not real, tangible value.

In the next article, I will explain how this fabricated ‘wealth’ affects inflation, interest rates, and ultimately, the transfer of wealth from the many to the few.

Peeling back the layers of the fiat currency system and understanding these unsound mechanisms is the first step toward recognizing the potential true workings of our current financial infrastructure.

The fiat system has a finite self-life leading to an inevitable global financial reset based on more tangible, asset-based systems.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D